Abstract

The development of digital finance represents a new paradigm for the delivery of financial services that has exerted an external shock on the off-balance sheet (OBS) activities of traditional commercial banks. In response, commercial banks have embarked on a digital transformation to mitigate the challenges posed by digital finance. However, the impact of external shocks and internal responses on banks’ OBS activities, especially the effect of internal responses, needs to be further clarified in order to inform commercial banks’ decision-making. Using a dataset consisting of 42 Chinese commercial banks’ operating data from 2013 to 2022, this paper employs a two-way fixed effects model and a moderation analysis to conduct an empirical analysis. The results show that digital finance has a significant inhibitory effect on OBS activities; furthermore, digital transformation of commercial banks strengthens this inhibitory effect, indicating that its benefits are outweighed by costs of investment and competitive losses. Additionally, the net interest margin significantly amplifies the inhibitory effect, suggesting a trade-off between income from core business activities and OBS activities under external competitive pressure. Based on these research findings, it is recommended that commercial banks seek differentiated competitive strategies and optimize the product structure of their OBS activities. Furthermore, digital transformation strategies should take into account the overall interests of the bank and strike a balance between long-term and short-term benefits.

1. Introduction

The emergence of digital finance, epitomized by third-party internet payment platforms, has introduced a new paradigm of financial services, including payment, settlement, and agency services, characterized by low costs, convenience, and rapidity. Alipay’s online payment system was spun off from Taobao in 2004 and became the earliest independent online payment system in China, marking the beginning of the digital finance in China. In less than ten years, it amassed one billion users. In 2013, Alipay launched Yu’ebao, integrating online payment with money market fund management, enlightening the public on financial awareness and practices. This year was also seen as the first year of China’s digital finance development [,]. Since then, digital finance has rapidly flourished in China, including innovations such as mobile payments, P2P lending, online lending, and supply chain finance. Along with the digital transformation of commercial banks, digital finance has been deeply impacting and reshaping the operational mode of China’s financial system. In recent years, the government has actively promoted digital finance by issuing many policies. In December 2021, the State Council released the “14th Five-Year Plan for Digital Economy Development”, aiming to accelerate the digital transformation of financial services to promote ongoing innovation and efficient development in the financial industry.

Due to dual drivers of technological innovation and policy support, financial institutions have achieved breakthroughs in handling massive data and modeling of fine-grained scenarios, gradually driving digital transformation (DT) of financial services and products. This has effectively expanded the scale of services, improved service experiences, enhanced service efficiency, reduced costs, controlled risks, and extended the boundaries of financial products.

Commercial banks play a vitally important role in the Chinese financial system, with their income primarily originating from net interest margin (NIM), OBS activities, and investment returns from traditional banking operations. OBS activities refer to business that does not constitute a commercial bank’s on-sheet assets and liabilities but that generates non-interest income for the bank. Since joining the WTO, market interest rates have fluctuated downwards, leading to fierce competition in deposit and loan businesses, resulting in narrowed the NIM income. Commercial banks have been seeking to diversify their business and income structures; hence, OBS activities have seen their income proportion gradually increase due to their diverse and flexible nature, special cost structures, extensive coverage, low risks, and stable income. The 2018 Guotai Junan report [] pointed out that the proportion of commercial banks’ OBS income rose 5% year-by-year since 2000, peaking at 25% and with a growth rate higher than the growth rate of banks’ interest income, gradually becoming an important source of banks’ income. However, the growth rate of OBS income has gradually slowed since 2011 [].

The slowdown in the growth rate of the proportion of the OBS income in commercial banks seems to coincide with the rapid development of digital finance, represented by Alipay (including Yu’ebao). Is this merely a coincidence? Zheng [] believes that internet finance has disrupted commercial banks’ OBS activities, while Guan and Sun [] points out that the development of third-party payment has had some substitution effect on the intermediate business of commercial bank, affecting the profitability of commercial banks. Teng and Ye [] states that third party-payment platform and internet-based sales investment products reduce commission charges. Faced with these challenges, commercial banks have adopted digital transformation as a new growth driver, leveraging digital technologies to upgrade business processes to achieve intelligence and online capabilities in payment settlement, investment management, and other businesses, with the aim of enhancing operational efficiency, reducing costs, attracting more potential customers, and boosting OBS income []. While the existing literature acknowledges that digital finance affects commercial banks’ OBS activities, the magnitude and direction of this impact are not empirically supported. Furthermore, the role of banks’ digital transformation in moderating this relationship remains unexplored.

Interest income from core business and non-interest income from OBS activities are the most important sources of profit for commercial banks. The narrowing of net interest margins has forced commercial banks to actively expand their OBS activities and adjust their business structure correspondingly []. Williams and Rajaguru [] believes that declines in net interest income are associated with increased non-interest income. The existing studies show that commercial banks seek to balance their core and OBS activities; however, it is unclear whether this balance persists in cases where digital finance impacts OBS activities, as this issue has yet to be explored in the literature.

To address the above-mentioned issues, this paper conducts an empirical analysis of the impact of digital finance on commercial banks’ OBS income by utilizing the Peking University Digital Inclusive Finance Index [] and the operational data of 42 Chinese commercial banks from 2013 to 2022 from Wind.com (Accessed on 30 April 2024). In addition, it examines whether the digital transformation of commercial banks and the net interest margin of core businesses have a moderating effect on this impact. The study aims to explore the external shocks of digital finance on traditional commercial banks’ OBS activities as well as the moderating effects of digital transformation and core businesses amid the ongoing integration of digital technology and financial services and the emergence of new financial formats. Ultimately, this research seeks to understand the future changes in commercial banks’ income structures and provide a basis for operational decision-making.

2. Literature Review

As of now, there is no consensus on the definition of digital finance. It is widely believed that digital finance extends from the digital economy to the financial sector and transforms the way in which financial activities are conducted and delivered by leveraging digital technologies such as the internet, big data, AI, cloud computing, and blockchain to deliver financial services [] such as fund transfers, settlements, payments, agency sales of financial products, small loans, credit cards, and other financial services. It involves the digitalization of financial products, transactions, and services [], and exhibits distinctive advantages such as convenience, rapidity, and low costs [,]. With the convergence of the internet, digital technologies, and finance services, digital finance encompasses various financial services, including internet finance, third-party financial platforms, and online banking, among others. According to the classification in [] and guided by our research objectives, this paper distinguishes the above general definition into two distinct components. One is the provision of financial products, transactions, and services by internet platforms or third-party institutions by leveraging digital technologies, which we continue to term ‘digital finance’ in the following text. The other is the integration of digital technologies and the internet into traditional commercial banking operations to deliver various financial activities, including their typical services, which is referred to as ‘digital transformation’. The ongoing convergence of digital technologies and financial services is profoundly reshaping China’s financial institutions and market systems [,,].

From a market competition perspective, some of the literature suggests that digital finance can facilitate the development of commercial banks’ OBS activities. Wei [] and Koont [] believe that digital finance has intensified both the competitive pressures on commercial banks and inter-bank competition, resulting in market share losses [], which in turn affect the profitability and performance of commercial banks [,,]. Banks can augment their non-interest income by expanding into diversified non-traditional products and services [,,]. The increase in non-interest income from OBS activities has enhanced banks’ profitability []. Consequently, under competitive pressure, developing OBS activities has become a strategy-driven approach for commercial banks [].

Meanwhile, by examining the effects of digital finance on interest rates, the literature suggests that digital finance can have an indirect positive impact on the growth of OBS activities. Qiu et al. [] believe that within the context of interest rate regulation, fintech products, such as Yu’ebao leverage internet platforms to enable residents to indirectly participate in the interbank market with idle funds, thereby gaining market-based returns and promoting the marketization of interest rates in China. Saunders and Schumacher [] argued that interest rate marketization should intensify competition, leading to a decrease in banks’ loan–deposit interest rate spreads. Interest rate spread income and OBS income are key revenue streams for commercial banks; consequently, fluctuations in these areas inevitably impact a bank’s revenue structure, prompting adjustments and changes in its OBS structure. Hu et al. [] provide supporting evidence for this, pointing out that digital finance has compressed the profitability of banks’ traditional on-sheet business, prompting commercial banks to seek new growth opportunities in the OBS area, which in turn strengthens their incentives to expand their OBS activities.

Nevertheless, the positive impact of digital finance on OBS activities is tempered by risk considerations. Research has shown that OBS activities can have a significant impact on commercial banks’ risk profile [,], increasing their exposure to specific risks, particularly foreign exchange risk [,]. Accordingly, as banks navigate the profitability pressures brought about by digital finance, opting to expand OBS activities to increase their income still necessitates a judicious assessment of risk–reward tradeoffs, underscoring the need for a cautious and informed approach. Consequently, as evidenced by the aforementioned literature, it remains uncertain whether the competitive pressure brought about by digital finance can be transformed into a driving force for the development of OBS activities, thereby leading to an increase in OBS income.

Notably, digital finance can also pose a direct threat to the OBS activities of commercial banks, leading to a decline in their OBS income. Third-party payments play a vital role in the advancement of digital finance and significantly influence commercial banks’ OBS activities. In 2023, mobile payment transactions in China were completed 185.147 billion times, and their value soared to CNY 555.33 trillion []. The rapid expansion of internet-based third-party payment platforms such as Alipay and WeChat Pay has notably reduced reliance on physical cash []. Additionally, online lending platforms such as Ant Credit Pay and JD Credit have diverted traditional banks’ credit card businesses. Digital economic platforms have advantages such as high customer stickiness, rapid transactions, diverse functionalities, and low transaction fees []. All of these factors have impacted the profitability and operational efficiency of commercial banks [,], squeezing their OBS activities [,]. As a result, commercial banks have become the mainstay of fintech investment by increasing their technology investment, advancing their own fintech development, and accelerating their digital transformation [,,,]. Commercial banks are not only conducting online business through the internet, but are also undergoing multidimensional digital transformation, including basic support systems, organizational structure, risk control, customer management, etc. (for example, “internet + financial” services, smart retail banking, and cloud payments) [,,]. This digital transformation can significantly enhance banks’ liquidity creation [] as well as individual transactions and net commission income [] while improving overall performance and promoting channel transformation [].

This literature review reveals that digital finance has a dual impact on commercial banks’ OBS activities. On the one hand, digital finance directly competes with commercial banks’ OBS activities while also incentivizing commercial banks to upgrade their OBS activities through digital transformation. On the other hand, digital finance exacerbates competition, undermines the profitability of commercial banks’ core business, and encourages them to explore OBS activities, while also necessitating a balance between the growth of OBS activities and their impact on operational risk. As a result, in the current era of profound convergence between digital technology and financial services, the exact nature of the impact of digital finance on commercial banks’ OBS activities remains unclear. Additionally, whether the digital transformation of commercial banks and changes in net interest margins have a moderating effect on this impact is also uncertain. The following work focuses on these issues.

3. Research Hypothesis

OBS activities of commercial banks can be broadly categorized into types such as bank card services, transaction and settlement services, advisory services, guarantees and commitments, agency services, and custodial services. Bank incomes are primarily derived from fees and commissions. The impact of digital finance on these activities can be analyzed in terms of two dimensions, namely, external shocks and internal responses.

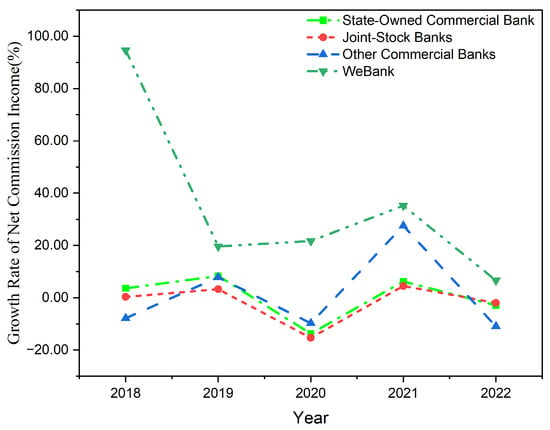

External shocks from digital finance on traditional commercial banks are primarily reflected in three areas. One source of shock is from the convenience provided by digitalized third-party payment platforms. Mobile payment providers such as Alipay have become the mainstream payment method due to their convenience and speed, which are offered free of charge. Unlike the traditional bank card payment model, in which transaction handling fees are apportioned among clearing agencies, card-issuing banks, and acquiring banks, the third-party payment model introduces an additional participant in the handling fee distribution1, thereby reducing the income of traditional card-issuing banks. Furthermore, the advantages of low online operating costs and free services have led to loss of bank transfer and settlement customers, further resulting in a squeeze on their transaction handling fees and commission income []. A second source of shock is the disruption of traditional commercial banks’ agency services by financial services on digital platforms []. For example, Alipay offers a range of financial products, such as funds, insurance, and financial products. These services, based on online interaction scenarios, are characterized by low entry barriers and instant feedback, making them popular among mobile users and putting competitive pressure on traditional banks’ agency services. The third source of shock to traditional commercial banks is the impact of internet banks based on digital technology []. WeBank, established at the end of 2014, has become an important market supplier by utilizing the internet and big data to focus on addressing the financial needs of long-tail customers. Based on data from the annual report of WeBank, the average annual growth rate of its OBS activities, including fees and commissions from settlements, agencies, and bank cards from 20182 to 2022, was close to 35%, accounting for 34% of total operating income on average, while the average growth rate of fees for state-owned commercial banks during the same period was only 0.32% and for commercial banks in the shareholding system it was −1.83% []. As shown in Figure 1, these three aspects indicate that the development of digital finance poses an external challenge to traditional commercial banks which reduces their OBS income.

Figure 1.

Comparison of the growth rates of commission income in commercial banks from 2018 to 2022. Note: The data are from the WeBank annual report and Xing [].

Based on the above analysis, Hypothesis 1 is proposed.

Hypothesis 1.

Digital finance imposes external impacts on the OBS activities of commercial banks and exerts a restraining effect on their OBS income.

Faced with external competitive pressures from digital finance, traditional commercial banks are responding through active digital innovation, which is referred to as the internal response of commercial banks to digital transformation. This internal response mainly affects banks’ OBS activities in three ways.

One key strategy is to accelerate the digital transformation of traditional banking businesses, thereby reducing the impact of external shocks from third-party platforms. In recent years, all traditional commercial banks have increased investment in digital technology and development to promote the digitization, onlineization, mobilization, and intelligence transformation of banking businesses, including OBS activities. By utilizing financial technology, customers can access OBS services anytime and anywhere at low cost. Currently, all commercial banks have launched mobile banking apps; in order to enhance customer engagement and retention, they also provide pan-financial services such as consumption, payment, overdraft, wealth management, and other services for high-frequency application scenarios such as “clothing, food, housing, and transportation”. Additionally, they leverage data-driven applications to promote cross-industry synergies, accelerate development OBS activities. Such innovations have effectively increased the competitiveness of traditional commercial banks against third-party payment platforms and internet banks in settlement, agency, and other businesses.

A second strategy is to leverage digital technology to provide OBS activities such as consulting-style services. The “China Banking Industry Non-Credit Business Development Report” [] states that one large commercial bank has developed an intelligent investment consultant service system catering to enterprise users’ investment and financing transaction needs. This system integrates data resources to implement the digitalization of various conventional functions, including information research reports, financial diagnosis, risk warnings, matchmaking transactions, and investment and financing guidance. This meets users’ diversified needs for intelligent financial services such as browsing investment research reports, querying industry data, evaluating corporate credit, analyzing business finance, making investment and financing decisions, and tracking risk information. Through digital technology innovation, commercial banks can provide innovative service modes with their OBS activities involving investment banking consulting and promote the development of these OBS activities.

The third strategy is to reduce OBS service costs and revenues through digitization. By leveraging digital technology for transaction processing, the consumption of human and material resources can be reduced, as can intermediate approval and transaction links, thereby reducing both the tangible and management costs of OBS activities. Digital financial platforms have strong data analysis capability, which can improve the efficiency of customer acquisition and reduce the cost of customer acquisition while enabling more accurate risk identification and risk assessment of customers to reduce the risk of the OBS activities. Meanwhile, the ubiquity of internet and mobile devices enables individuals to access financial services anywhere and anytime, which reduces the demand for traditional bank OBS services and can potentially lead to a decline in commercial banks’ OBS income.

In summary, internal responses by commercial banks, such as digital transformation, will reduce the negative impact of external shocks on OBS income, but will also reduce the total OBS income due to the lower fees and demand for the OBS activities. With the strength of both factors taken into consideration, Hypothesis 2 is proposed as follows.

Hypothesis 2.

Digital transformation in commercial banks enhances the suppressive effect of digital finance on their OBS income.

The core business of commercial banks consists of deposit and loan business. Interest rate regulation, macroeconomic changes, and market competition cause fluctuations in commercial banks’ net interest income. The net interest margin exerts significantly negative impacts [,]. When the deposit and loan spreads of commercial banks become narrow and the profit of their traditional deposit and loan business decreases, commercial banks are prompted to expand their OBS activities in order to seek new growth opportunities; thus, they turn to development of their OBS activities as a way to increase their income [,]. With the development of digital finance, and facing negative impacts from the external shock of digital finance on banks’ OBS activities, changes in the deposit and loan spreads of commercial banks influence their approach to OBS activities. When interest rate spreads are widened and the profitability of core business is improved, banks’ inclination to expand their OBS activities to augment the overall income will decrease; on the contrary, when the spreads are narrowed and the profit of core business declines, commercial banks become more active in developing OBS activities to offset the profit loss.

Based on the above analysis, Hypothesis 3 is proposed.

Hypothesis 3.

The net interest income from deposits and loans at commercial banks will moderate the impact of digital finance on the OBS income; an increase in the spread between deposit and loan rates will enhance the suppressive effect of digital finance on banks’ OBS income.

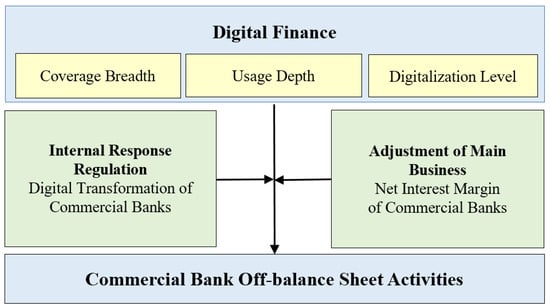

Figure 2 shows the model which schematically expresses the relationship between the variables in the hypothesis. All the variables are provided in detail in Section 4.

Figure 2.

Research model.

4. Research Design

4.1. Data Sources and Selection of Variables

There are 43 commercial banks in the monetary financial service categorized by the China Securities Regulatory Commission. Among these, one financial leasing company was excluded and the remaining 42 commercial banks were selected as the research samples in this study, including six state-owned large commercial banks, nine joint-stock commercial banks, seventeen city commercial banks, and ten rural commercial banks. An empirical analysis was conducted based on the annual data of the proportion of the OBS income and other major indicators of these banks from 2013 to 2022. The sample data were primarily from the Peking University Digital Finance Research Center, the Tonghuashun Database, commercial banks’ annual reports, and the RESSET Database.

4.1.1. Dependent Variables

OBS activities refer to activities that do not constitute the on-sheet assets and liabilities of commercial banks and that generate non-interest income for banks. The income from the OBS activities is usually represented by the collection of fees and commission income. Referring to the literature by Shen and Zhao [] and Shi and Zhang [], this paper uses non-interest income as a proxy variable for income from the OBS activities of commercial banks. To eliminate the effect of the scale of bank revenues and reflect the development level of the OBS activities of commercial banks, in this study the proportion of OBS income () to total operating revenue is treated as the dependent variable.

4.1.2. Explanatory Variables

The Digital Financial Inclusion Index () and its sub-indicators compiled by the Institute of Digital Finance at Peking University, including Digital Financial Coverage Breadth (), Digital Finance Use Depth (), and Digital Finance Digitization Level (), are used as the core explanatory variables. This index is based on Alipay’s transaction data and has been used to construct a digital finance index that reflects the development of digital finance in China as well as three-dimensional sub-indicators of digital financial coverage, usage depth, and digitalization level []. This is currently the most comprehensive and accurate indicator of the level of development of digital finance in China, and is widely used [,,,].

4.1.3. Control Variables

According to the literature by Zheng [], Batrancea [], Xie and Wang [], Wang and Xie [], the OBS activities of commercial banks are influenced by factors such as the macro-level economic environment, market competition, industry development, and asset–liability status of banks at both the macro- and micro-levels. The control variables in this study include the Size (), Return on Equity (), Loan–Deposit Ratio (), Cost–Income Ratio (), and GDP Cumulative Year-on-Year Growth Rate () of commercial banks.

4.1.4. Moderating Variables

The moderating variables in this study are Digital Transformation () and Net Interest Margin (). The digital innovation of commercial banks involves three dimensions: strategies, businesses, and management system; these reflect the degree of attention to digital technology at banks on the strategic level, the digitalization of channels, products, and R&D, and the digitalization of organizational and talent management [], respectively. The Institute of Digital Finance at Peking University has calculated the Digital Transformation Index () of Chinese Commercial Banks for 221 commercial banks in China from these three dimensions, comprehensively reflecting the internal response degree of banks in terms of the external impact of digital finance. is employed as a moderator to capture the moderating role of banks’ digital innovation and the transformation between digital finance and OBS activities.

The net interest margin () is the ratio of a bank’s net interest income to its total interest-generating assets, and serves as an important indicator for measuring the profitability of commercial banks’ interest-bearing assets and the cost of financing their liabilities. is considered as a moderator to capture the impact of commercial banks’ asset–liability management and profitability on the inhibitory effect of digital finance upon OBS activities.

All of the variables are provided as listed in Table 1.

Table 1.

Definitions of variables.

4.1.5. Descriptive Statistics

The descriptive statistics of the variables are shown in Table 2. The descriptive statistical results show that the maximum value of is 432.2, which means that the highest ratio of OBS income to operating income in the sample is 43.22%. The lowest ratio result is 0.025%, indicating that there are large differences in the percentage of OBS income among different commercial banks. The values of are substantial, underscoring pronounced regional disparities in digital finance development. Furthermore, the control variables are all within a reasonable range and no extreme outliers are present.

Table 2.

Descriptive statistics.

4.2. Model Selection

Because panel regression models usually involve three models, namely, the mixed ordinary least squares (OLS) model, random effects (RE) model, and fixed effects (FE) model, a series of tests including the F-test, Lagrange multiplier test (LM), and Hausman test were sequentially applied to the panel data. The test results are shown in Table 3. The results reveal that the F-test presents significance at the 1% level, which shows that the FE model should be chosen relative to the OLS model. The LM test presents significance at the 1% level, implying that the RE model is superior to the OLS model. The Hausman test presents significance at the 10% level; thus, the FE model should be chosen as opposed to the RE model. Based on these test results, the FE model was finally chosen for the regression analysis, which also helps to alleviate the endogeneity problem due to omitted variables to an extent.

Table 3.

Results of the F-test, Lagrange multiplier test, and Hausman test.

4.3. Model Design

A two-way fixed effects model was employed to analyze the impact of digital finance on the development of commercial banks’ OBS activities:

where the subscripts i, j, and t denote the variables of bank, province, and year, respectively, represents the proportion of the OBS income in year t for commercial bank i headquartered in province j, is the digital finance index of the bank’s province j in year t, are control variables, is the bank fixed effect, is the year fixed effect, and is the disturbance term.

To further explore the mechanism of the impact of digital finance on the OBS activities of commercial banks, and are introduced as moderators based on the above benchmark regression model and the significance of the empirical results is used to determine whether they have a moderating effect on the impact of the digital finance on the OBS activities. The constructed model is as follows.

In Model (2), is the moderator, denoting digital transformation of commercial bank i in the t year, while is the interaction item of the digital finance index and digital transformation . In Model (3), is the moderator, representing the commercial bank net interest margin, while is the interaction term of the digital financial index and commercial bank net interest margin. If the coefficients and are positive, then the impact of digital finance on the OBS development of commercial banks increases with the advancement of both commercial bank digital transformation and net interest margin. Conversely, if the coefficients and are negative, then the impact of digital finance on the development of OBS activities of commercial banks diminishes as these moderators strengthen. The meanings of the other variables are consistent with Model (1).

5. Analysis of the Empirical Results

5.1. Pre-Benchmark Regression Tests

5.1.1. Multicollinearity Test

To ensure the accuracy of the results, the model was tested for multiple covariance using the variance inflation factor test (VIF) and tolerance test (TOL). Table 4 shows the results of the multicollinearity test. The results indicate that the mean VIF of the variables is well below 10 and the tolerance is above 0.2, suggesting that multicollinearity is not a significant concern.

Table 4.

Multicollinearity test results.

5.1.2. Cross-Sectional Dependence Test

In this study, the Pesaran CD, Pesaran scaled LM, Breusch–Pagan LM, and Frees tests were employed to test the cross-sectional correlation of the data. Table 5 shows that all four tests are significant at the 1% level. This provides evidence of the cross-sectional correlation of the data.

Table 5.

Cross-sectional dependence results.

5.1.3. Panel Unit Root Test

As shown above, the existence of cross-sectional correlation in the data was confirmed. To ensure the stationarity of the data, the Harris–Tzavalis (HT) test and Im–Pesaran–Shin (IPS) test were employed as the panel unit root tests in this study. The results are presented in Table 6, wherein D(0) denotes the result for the raw data and D(1) represents the result for the first-order difference data. The p-values for D(1) are all statistically significant at the 1% level, indicating that the data are stationary.

Table 6.

Panel unit root test results.

5.1.4. Cointegration Test

The results of the unit root tests on the panel data indicate that the data are integrated at order one, i.e., they become stationary after the first difference. Therefore, the Pedroni test was employed for cointegration testing []. The results are shown in Table 7. At the 1% significance level, the null hypothesis of no cointegration among the variables is rejected. This suggests that there exists a long-run cointegration relationship among the variables.

Table 7.

Cointegration test results.

5.2. Benchmark Regression and Analysis of Results

Table 8 shows the benchmark regression results for the impact of digital financial development on the proportion of OBS income. Columns (1)–(5) all include individual and year fixed effects; Column (1) does not include control variables, while Column (2) includes them. The results for digital finance are significant at the 10% and 5% levels with a negative regression coefficient, indicating that the development of digital finance suppresses commercial banks’ OBS income. This finding lends support to Hypothesis 1, which posits that the continued development of digital finance has a negative impact on the growth of commercial banks’ OBS activities, thereby contributing to a decrease in the proportion of non-interest income. Columns (3) to (5) show the regression of OBS income against sub-indices of digital finance. The result for the coverage breadth is significant and positive at the 1% level. The result for the penetration depth is significantly negative at the 1% level, and the result for digitalization degree is significantly negative at the 1% level. This indicates that the main reason for digital finance inhibiting the development of commercial banks’ OBS business is its extensive usage and higher degree of digitalization. This is primarily due to the fact that digital finance reduces transaction costs, offers efficient services, and provides a diverse range of products, thereby increasing competitive pressure on traditional commercial banks and constraining the development of their OBS activities.

Table 8.

Benchmark regression results.

5.3. Robustness Test

5.3.1. Adjusting the Time Window for Verification

To ensure the stability and reliability of the benchmark regression results, the sample time window was narrowed by excluding the period impacted by the COVID-19 pandemic. The regression was conducted using the data from 2013 to 2019. The test results are shown in column (1) of Table 9, indicating that the inhibitory effect of digital finance on the development of commercial banks’ OBS activities remains robust. In addition, the absolute value of the coefficient increased, suggesting that the inhibitory effect was more pronounced in the non-pandemic years.

Table 9.

Robustness test results.

5.3.2. Lagged Period Test

Regressions were conducted using digital finance data lagged by one period and two periods. The results are presented in Columns (2) and (3) of Table 9, respectively, demonstrating consistent robustness.

5.3.3. Replacing the Dependent Variable

Following [], the dependent variable was replaced with the ratio of non-interest income to assets (). characterizes the relative development scale of banks’ OBS business, and can help to verify the impact of digital finance on the development of commercial banks’ OBS business. The results shown in Column (4) of Table 9 remain significant.

5.4. Endogeneity Test

The data used in this part come from the Statistical Report on the Development Status of the Internet in China published by the China Internet Network Information Center (CNNIC). To address the interference of endogeneity in the identification process, the provincial internet penetration rate () was used as an instrumental variable and the two-stage least squares (2SLS) method was applied to mitigate the endogeneity problem and ensure more robust estimates. serves as a proxy for the development of digital financial inclusion infrastructure, thereby satisfying the relevance criterion with respect to digital financial inclusion. Upon controlling for variables related to commercial banks’ OBS income (), it is found that does not exert a direct influence on , thereby meeting the exogeneity criterion.

Thus, can be deemed a suitable instrumental variable for digital financial inclusion due to its relevance and exogeneity. The first-stage regression results, reported in Table 10, Column (1), yield an F-statistic of 68.082, which suggests that the concern of a weak instrumental variable can be mitigated. The second-stage regression results presented in Table 10, Column (2) indicate that the coefficient of the digital financial inclusion index is −6.723 and is highly statistically significant at the 1% level. This finding implies that despite controlling for potential endogeneity, the advancement of digital financial inclusion continues to exert a constraining influence on the expansion of commercial banks’ OBS activities.

Table 10.

Endogeneity test results.

5.5. Mechanism Analysis

5.5.1. The Moderation Effect of Digital Transformation

Based on Hypothesis 2, it is necessary to verify whether the digital transformation of commercial banks has a mitigating effect on the inhibition of OBS activities by digital finance. The moderation effect analysis was conducted using Model (2), and the results are shown in Table 11. Column (2) shows the moderation effect results after incorporating . It is found that the coefficient of the interaction term is significantly negative at the 10% level, indicating that exacerbates the inhibitory effect of digital finance on the development of OBS activities by commercial banks, thereby validating Hypothesis 2.

Digital transformation of commercial banks requires a large amount of resources and capital investment. The “2023 China Banking Industry Digital Transformation Research Report” [] shows that the capital investment of Chinese commercial banks in the IT construction and service fields has been increasing year-by-year. From 2019 to 2022, the annual compound growth rate of IT investment in the banking industry reached 24%, far exceeding the average growth rate of 6% in operating income of commercial banks in the same period3. This may reduce resource allocation to traditional OBS activities, thereby dampening the growth of these traditional businesses. While digital transformation brings about enhancements in digital technology, it also incurs complex regulatory and compliance requirements. Banks need to invest resources to ensure security, privacy protection, and compliance in their digital services; these additional costs and challenges can impact investments and growth in their traditional OBS activities.

5.5.2. The Moderation Effect of Net Interest Margin

Based on Hypothesis 3, is employed as a moderation indicator to test the moderation effect of the deposit and loan business spread in the process of digital finance inhibiting the development of the OBS activities of commercial banks. The moderation effect analysis was conducted using Model (3), and the test results are shown in Column (2) of Table 11. This column presents the results incorporating the moderation effect and interaction terms. From the moderation effect test results in Table 11, it is found that the coefficient of the interaction term is significantly negative at the 5% level, indicating that the moderation variable reinforces the dampening effect of digital finance on the development of commercial banks’ OBS activities; that is, the relationship between digital finance and the development of OBS activities are negatively moderated by such that a larger net interest margin exacerbates the inhibiting effect of digital finance, whereas a smaller net interest margin mitigates this effect, thereby confirming Hypothesis 3.

Table 11.

Moderating effects test results.

Table 11.

Moderating effects test results.

| (1) | (2) | (3) | |

|---|---|---|---|

| −1.609 ** | −1.252 * | −1.141 ** | |

| (0.660) | (0.698) | (0.551) | |

| 0.212 | |||

| (0.171) | |||

| −0.003 *** | |||

| (0.001) | |||

| −100.201 *** | |||

| (11.737) | |||

| −0.317 *** | |||

| (0.075) | |||

| constant | 112.018 | −2.948 | 84.058 |

| (162.670) | (182.311) | (176.506) | |

| Observations | 420 | 420 | 420 |

| R-squared | 0.767 | 0.771 | 0.813 |

| Control | Yes | Yes | Yes |

| id | Yes | Yes | Yes |

| year | Yes | Yes | Yes |

Note: Robust standard errors in parentheses; *, **, *** indicate significance at 10%, 5%, and 1%, respectively.

5.6. Heterogeneity Analysis

The ownership nature of Chinese commercial banks varies, which leads to different development levels in terms of their digital finance and OBS activities. In addition, there are large differences in economic development between the eastern, central, and western regions of China, resulting in variations in the development of the primary business and the OBS activities of commercial banks. The following provides a heterogeneity analysis from each of these two perspectives.

5.6.1. Heterogeneity Analysis of Different Types of Banks

Chinese commercial banks can be categorized into state-owned commercial banks, joint-stock commercial banks, and urban and rural commercial banks according to their ownership structures. The development speed, business structure, and management systems of OBS activities are different among the different types of commercial banks []. In terms of development speed, state-owned commercial banks show a stable growth rate of OBS income, with an average compound annual growth rate of 2.6% for service fee and commission income during 2011–2022. The OBS income of joint-stock commercial banks is growing rapidly, with the non-interest net income of eight sample banks increasing from CNY 11.9 billion to CNY 461 billion during 2006–2022 and the proportion of non-interest net income to operating net income rising from 9.8% to 30%. In terms of business structure, state-owned commercial banks mainly rely on bank card and settlement business income in their OBS activities, which together account for about 40% of their service fee and commission income, while joint-stock commercial banks and city commercial banks primarily engage in agency business. Notably, urban commercial banks’ agency business income accounts for a significant 50–70% of their total fee and commission income. In terms of management systems, a “unified management and tiered authorization” system for OBS business pricing is present in state-owned commercial banks. The head office of a state-owned commercial bank establishes rules and regulations for OBS business fees and exemptions, and branches are not allowed to exceed the pricing projects and standards set by the headquarters. Shareholding commercial banks focus on strategic coordination and resource integration in their OBS business management, paying attention to the growth of residents’ wealth management needs and the synergy effects of their agency service and asset management businesses. All commercial banks emphasize the application of financial technology and digitalization in OBS business management.

Due to differences in the development speed, business structure, and management of state-owned commercial banks’ OBS activities, the extent to which the development of digital finance inhibits their OBS activities may vary. Therefore, the sample was divided into two categories for heterogeneity analysis: state-owned commercial banks and non-state-owned commercial banks.

The regression results are shown in Table 12, with Columns (1)–(2) showing the regression results for state-owned banks and non-state-owned banks, respectively. It is found that digital finance has a significant inhibitory effect on the OBS activities of state-owned commercial banks. This may be related to the differences in the OBS activities between the two types of banks mentioned above. First, the pricing and management of service fees for OBS activities are more stringent in state-owned commercial banks; in cases where business growth is stable or even declining, the external impact of digital finance is more likely to result in a decline in their revenues. Second, the card and settlement businesses of state-owned commercial banks account for a much higher market share, and are more easily replaced by third-party payment platforms and other digital financial models, whereas the OBS businesses of non-state-owned commercial banks, which are mainly agency-based, are less affected by digital finance. Third, state-owned commercial banks have a larger scale and stronger financial resources, and their higher investment in financial technology amplifies the inhibiting effect of digital finance on their OBS businesses, as stated in Hypothesis 2 in the previous empirical test, which is another reason for this phenomenon.

5.6.2. Heterogeneity Analysis of Banks in Different Regions

There are large differences in the economic development of the eastern, central, and western regions of China, which are reflected in the divergent development of commercial banks’ core businesses and OBS activities. Thus, the sample was divided into three categories representing the eastern, central, and western regions for heterogeneity analysis. The regression results are shown in Columns (3)–(5) of Table 12. The results show that the development of commercial banks’ OBS activities in the western region is significantly inhibited by the impact of digital financial development.

This may be due to the lack of digital infrastructure in these regions, including limited network coverage and underdeveloped electronic payment systems, which restrict commercial banks’ ability to develop digital non-banking businesses. In contrast, the eastern and central regions have more mature urban development, more complete digital infrastructure, and easier access to digital finance technologies, enabling commercial banks to utilize these technologies to expand their businesses. Commercial banks in the eastern and central regions have more experience and are better equipped to face the challenges of digital finance, whereas those in the western region are relatively weaker in this regard. Furthermore, the vast territory and dispersed population of the western region make it more costly for commercial banks to operate. In contrast, the more concentrated geography and higher population density of the eastern and central regions allow commercial banks to more effectively utilize digital finance technologies to reduce costs and increase efficiency. This may be due to the relative lack of digital infrastructure on the part of commercial banks in the western region, including network coverage, electronic payment systems, and other developments that restrict their development of digital OBS activities.

Table 12.

Heterogeneity test results.

Table 12.

Heterogeneity test results.

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| State-Owned | Non-State-Own | Eastern | Central | Western | |

| −1.802 *** | −0.469 | −1.139 | 4.092 | −3.259 ** | |

| (0.683) | (1.436) | (1.089) | (2.632) | (1.494) | |

| 13.598 | 0.218 | 17.384 | −29.975 | −117.365 ** | |

| (11.612) | (22.120) | (11.372) | (37.873) | (50.981) | |

| −2.271 | 9.306 *** | 6.986 *** | −9.402 ** | −7.341 * | |

| (2.174) | (3.042) | (2.232) | (4.505) | (3.903) | |

| 0.937 | −0.649 | 0.781 | −3.963 ** | −0.297 | |

| (0.600) | (0.572) | (0.494) | (1.885) | (1.139) | |

| 0.165 | 1.703 | 0.936 | −3.538 | −9.039 | |

| (1.362) | (1.865) | (1.260) | (3.694) | (6.382) | |

| 7.489 | 28.945 ** | 13.463 ** | 13.552 | 24.642 *** | |

| (5.084) | (11.145) | (5.394) | (9.160) | (6.056) | |

| constant | 85.945 | −115.119 | −68.511 | −5247.717 | 1629.312** |

| (147.071) | (315.957) | (226.941) | (5107.295) | (619.614) | |

| Observations | 270 | 150 | 340 | 40 | 40 |

| R-squared | 0.772 | 0.827 | 0.783 | 0.886 | 0.792 |

| id | Yes | Yes | Yes | Yes | Yes |

| year | Yes | Yes | Yes | Yes | Yes |

Note: Robust standard errors in parentheses; *, **, *** indicate significance at 10%, 5%, and 1%, respectively.

6. Conclusions and Future Work

This paper has conducted an empirical analysis using the Peking University Digital Financial Inclusion Index and the operating data of 42 Chinese commercial banks from 2013 to 2022. The findings reveal that digital finance has a significant suppressive effect on the OBS income of commercial banks. Moreover, the study confirms that the digital transformation of commercial banks and the net interest margin of their core business have a moderating influence on this impact. The study reached the following main conclusions.

First, the empirical test results show that the development of digital finance has a dampening effect on the OBS income of commercial banks. Specifically, both digital finance usage and degree of digitalization significantly inhibit commercial banks’ OBS income, while the coverage of digital finance promotes commercial banks’ OBS income at 5% significance. These results remain robust after replacing the explanatory variable, adjusting the time window, and lagging the test.

Second, commercial banks have proactively responded to the impact of digital finance by taking digital transformation initiatives in three aspects: digitalization strategies, digitalized businesses, and digitalized management. While this digital transformation can mitigate the external impact of digital finance on commercial banks’ OBS activities, the large amount of resources and capital invested in the transformation process may also squeeze out investments in the OBS activities, thereby intensifying the inhibitory effect of digital finance on commercial banks’ OBS income. By taking as a moderator for mechanism analysis, the results show that commercial banks’ digital transformation has indeed strengthened the inhibitory effect of digital finance on banks’ OBS income during this period. Digitalization is an internal and external business environment that commercial banks have to face; however, the advantages brought by digital transformation, such as convenience, cost reduction, and fee savings, cannot significantly increase banks’ OBS income under intense market and price competition.

Third, by taking as a regulatory variable for mechanism analysis, the results show that the net interest margin of commercial banks’ deposit and loan business plays a reinforcing role in the inhibitory effect of digital finance on their OBS activities. As expands, the profit pressure of commercial banks is alleviated and the inhibitory effect of digital finance on their OBS activities is strengthened. Conversely, as narrows, the profit pressure of commercial banks increases and their motivation to improve profitability through the OBS activities is enhanced, thereby weakening the inhibitory effect of digital finance on their OBS activities.

Fourth, compared with other types of commercial banks, the OBS income of state-owned commercial banks is significantly restrained by digital finance. From a regional perspective, commercial banks’ OBS income in the western region is more significantly affected by digital finance.

Based on the above, the following policy recommendations are put forward.

First, optimizing product structure for competitive edge. Our empirical analysis reveals that the digital transformation of commercial banks has exacerbated the suppressive effect of digital finance on OBS activities while suggesting that this transformation has failed to mitigate the market share losses incurred by commercial banks due to the rise of digital finance. Consequently, digital transformation does not necessarily lead to a revival of traditional OBS activities. In a fiercely competitive and fee-driven market, commercial banks must proactively prioritize the challenges posed by digital finance, develop innovative products based on differentiated strategies, and leverage digital technology to gain a competitive edge, thereby achieving growth in OBS income. More specifically, the following three measures are proposed:

Configuring OBS Product Structures Based on Banks’ Innate Resource Endowments. For state-owned commercial banks, card businesses and payment processing services are major contributors to their fee and commission income. Despite experiencing revenue pressures due to market competition and fee compression, these banks can capitalize on their large scale, extensive branch networks, and highly credible reputation to launch low-risk and wealth management products with stable returns, including agency and custody services, as a way to diversify their OBS activities. Joint-stock commercial banks can leverage their flexible business model and customer-centric development philosophy to integrate investment, research, and private banking capabilities, thereby creating a comprehensive product suite that spans the customer lifecycle while achieving differentiation and specialization. As an example, banks could develop trust-based services such as will trusts and pension trusts in response to the aging population.

Market segmentation by scenario enables the delivery of high-quality solutions that meet customer needs. Commercial banks need to undergo a paradigm shift, transitioning from a product-centric approach to a demand-driven strategy. They can utilize data-driven innovation to develop scenario-based financial services in a bundled way, integrating insurance, investment, and other products to meet customers’ frequent financial needs in everyday life such as consumption, travel, and living expenses. Commercial banks are also encouraged to adopt a comprehensive bundled service approach, integrating payment and settlement, collection, advisory, and other related services to provide a holistic platform for corporate clients. This approach can promote the utilization of in-house settlement accounts and employee salary card services while satisfying the multifaceted needs of enterprises, including payment, advisory, custody, and wealth management services as well as the advisory, agency, and wealth management needs of their employees. Finally, these banks should enhance the bank–customer relationship and promote customer stickiness.

Service model shifts towards ‘Human + Digitalization’. The advent of the internet era has precipitated a paradigm shift in consumer behavior in which the traditional ‘brick-and-mortar + face-to-face interaction’ model is being supplanted. The emergence of data-driven and internet-based consumption and decision-making patterns is significantly impacting the development of commercial banks’ OBS activities. Taking wealth management as an example, the entire value chain, from client acquisition to product promotion, risk management, and customer service, is being increasingly digitized. Commercial banks should integrate their distinctive products and services with digital technologies, leveraging the advantages of digitalization to expand their service radius, enrich their service content, and enhance their service efficiency.

Second, digital transformation with a holistic approach. The above empirical evidence suggests that digital transformation amplifies the suppressive effect of digital finance on OBS activities. However, this finding does not imply that commercial banks’ digital transformation should be restricted; rather, its impact should be evaluated holistically while considering the tradeoffs across different business lines. When assessing digital finance externalities and their digital transformation, banks should integrate a holistic evaluation of overall profitability, especially considering potential synergies with other business lines, in order to ensure alignment with strategic goals and maximization of shareholder value. In fact, the above empirical evidence reveals that net interest margins amplify the suppressive effect of digital finance on OBS income, reflecting a tradeoff between interest income and fee-based revenue in commercial banking.

Third, digital transformation with a tradeoff between the long-term and short-term benefits. The digital economy has become a predominant force, and commercial banks must undergo a digital transformation that harnesses digital technologies in order to revolutionize their traditional business models and unlock new digital opportunities. Commercial banks’ digital transformation involves a multifaceted overhaul, extending beyond traditional business lines such as lending and deposit-taking to include sales, customer experience, risk management, operations, and governance. This renders digital transformation a capital-intensive and intricate systemic project, necessitating a trade-off between short-term investment and long-term returns. Commercial banks should select a digital transformation model based on their strategic plans, resource endowments, and external environment. There are several possible approaches, including the following.

All-purpose Model. This model achieves comprehensive digitalization by establishing a fintech arm, effectively reconstituting the bank as a digital entity. This model is characterized by high upfront investment, complex processes, and even organizational transformation, yielding enhanced customer experience and robust financial services capabilities. This model is suited for large commercial banks with abundant capital, extensive customer bases, diverse business lines, and multiple branches, allowing them to leverage economies of scale and amortize high upfront investments over a shorter period.

Service outsourcing model. This model, involving cooperation with professional fintech companies, leverages purchased services for digital transformation. Characteristics include low initial investment, high service efficiency, and affordable business process digitization, making it more suitable for medium- and small-sized commercial banks.

Hybrid Model. In addition to the all-purpose model and service outsourcing model, various hybrid options exist depending on the degree of cooperation with external fintech companies. Commercial banks should select a digital transformation model based on their short-term capital investment capacity, business structure, service convenience requirements, and long-term benefits in order to avoid blind investment and mitigate adverse impacts on profitability and the development of OBS activities.

Overall, this paper has investigated the impact on OBS activities of external shocks from digital finance and from the digital transformation of Chinese commercial banks, which is a critical internal environmental factor. Notably, commercial banks’ OBS activities exhibit structural heterogeneity. The sensitivity of different OBS activities to exogenous shocks from digital finance may vary; however, this paper has not explored the heterogeneous effects of digital finance on these activities. Additionally, this study was conducted against the backdrop of China’s rapidly developing digital finance sector; the effects of cross-country variations in digital financial policies and the development trajectories of banks’ OBS activities mean that they may exhibit heterogeneous outcomes in other countries. Hence, from a deeper and more comprehensive perspective, future research will need to explore the following topics: (1) a thorough analysis of the heterogeneous effects resulting from structural differences among OBS activities; (2) further validating and extending the model based on data from different countries; and (3) investigating how commercial banks optimize their business portfolio in terms of profitability in the face of external shocks from digital finance, especially business strategies between loan and deposit business and OBS activities when the loan–deposit spread narrows under the expectation of low interest rates and how this decision-making relates to banks’ competitive advantages and regulatory constraints. These topics can help banks to make operational decisions in the context of digital finance development and digitalization.

Author Contributions

Conceptualization, Y.W. and H.W.; methodology, Y.W.; software, Y.W.; validation, Y.W. and H.W.; formal analysis, Y.W.; investigation, Y.W.; resources, Y.W. and H.W.; data curation, Y.W.; writing—original draft preparation, Y.W. and H.W.; writing—review and editing, Y.W. and H.W.; visualization, Y.W.; supervision, H.W.; project administration, H.W. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Innovation and Entrepreneurship Training Programs for College Students of Nanchang University (Grant Nos.2023CX231).

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors on request to wangyibing@email.ncu.edu.cn.

Conflicts of Interest

The authors declare no conflicts of interest.

Notes

| 1 | https://www.21jingji.com/article/20230616/herald/38ec484bc3e899b5d5dbdcb900fb13a7.html (accessed on 30 May 2024). |

| 2 | Due to a growth rate as high as 304% in 2017, which is ignored, the calculation begins from 2018. |

| 3 | https://www.thepaper.cn/newsDetail_forward_27433954 (accessed on 10 May 2024). |

References

- Huang, Y.; Huang, Z. The Development of Digital Finance in China: Present and Future. China Econ. Q. 2018, 17, 1489–1502. [Google Scholar] [CrossRef]

- Wang, X.; Huang, Y.; Gou, Q.; Qiu, H. How Digital Technologies Change Financial Institutions: China’s Practice and International Implications. Int. Econ. Rev. 2022, 157, 6, 70–85. [Google Scholar]

- Qiu, G.; Yuan, Z.; Guo, C. A Complete Analysis of the Off-Balance Sheet Business of Commercial Banks: Concepts, Logic, and Experience; Technical Report; Guotai Junan Securities: Shanghai, China, 2018. [Google Scholar]

- Xing, W. 2023 Interim Measures for Business Outside the Balance Sheet of Commercial Banks. 2024. Available online: https://www.china-cba.net/Uploads/ueditor/file/20240207/65c2e2bc50635.pdf (accessed on 30 June 2024).

- Zheng, Z. The Influence of Internet Finance of Commercial Banks—Based on the Perspective of the Influence of “Internet+” on the Retail Industry. Financ. Econ. 2015, 326, 34–43. [Google Scholar]

- Guan, Y.M.; Sun, W.Q. Analysis on Bank Performance Based on Channel Transition. In Proceedings of the 2016 International Conference on Management Science and Management Innovation, Guilin, China, 13–14 August 2016; AEBMR-Advances in Economics Business and Management Research. Xu, Y., Zhao, S., Xie, H., Eds.; Volume 10, pp. 323–325. [Google Scholar]

- Teng, C.; Ye, S. The Impacts of Internet Finance on Commercial Bank Business. In Proceedings of the Third International Symposium—Management, Innovation & Development, Bks One & Two, Beijing, China, 10–11 December 2016; Kuek, M., Zhang, W., Zhao, R., Eds.; pp. 958–962. [Google Scholar]

- Meng, T.; Sun, M.; Zhao, Y.; Zhu, B. Analysis of the Impact of Interest Rate Liberalization on Financial Services Management in Chinese Commercial Banks. Sci. Program. 2020, 2020, 8860076. [Google Scholar] [CrossRef]

- Williams, B.; Rajaguru, G. The Evolution of Bank Revenue and Risk in the Asia-Pacific Region. Pac.-Basin Financ. J. 2022, 71, 101693. [Google Scholar] [CrossRef]

- Guo, F.; Wang, J.; Wang, F.; Kong, T.; Zhang, X.; Cheng, Z. Measuring China’s Digital Financial Inclusion: Index Compilation and Spatial Characteristics. China Econ. Q. 2020, 19, 1401–1418. [Google Scholar] [CrossRef]

- Ozili, P.K. Impact of Digital Finance on Financial Inclusion and Stability. Borsa Istanb. Rev. 2018, 18, 329–340. [Google Scholar] [CrossRef]

- Chima, A.L.N.; Chikasanda, V.K. The Impact of Internet Banking on Service Quality Provided by Commercial Banks. In Proceedings of the E-Infrastructure and E-Services for Developing Countries, Africomm 2013, Blantyre, Malawi, 25–27 November 2013; Lecture Notes of the Institute for Computer Sciences Social Informatics and Telecommunications Engineering. Bissyande, T., VanStam, G., Eds.; EAI; ICST. Volume 135, pp. 248–259. [Google Scholar] [CrossRef]

- Buchak, G.; Hu, J.; Wei, S.J. FinTech as a Financial Liberator; Working Paper 29448; National Bureau of Economic Research: Cambridge, MA, USA, 2021. [Google Scholar] [CrossRef]

- Thakor, A.V. Fintech and banking: What do we know? J. Financ. Intermediation 2020, 41, 100833. [Google Scholar] [CrossRef]

- Li, K.; Kim, D.J.; Lang, K.R.; Kauffman, R.J.; Naldi, M. How Should We Understand the Digital Economy in Asia? Critical Assessment and Research Agenda. Electron. Commer. Res. Appl. 2020, 44, 101004. [Google Scholar] [CrossRef]

- Wei, M. Explorations on Influence of Internet Finance on Traditional Commercial Bank. In Proceedings of the 2018 4th International Conference on Economics, Management and Humanities Science (ECOMHS 2018), Kunming, China, 27–28 August 2018; Liu, S., Ed.; pp. 467–470. [Google Scholar]

- Koont, N.K. Essays on Digital Banking. Ph.D. Thesis, Columbia University, New York, NY, USA, 2024. [Google Scholar]

- Shcherbina, T.A. Digital Transformation of the Banking Sector. In Proceedings of the International Scientific Conference Global Challenges and Prospects of the Modern Economic Development (GCPMED 2018), Samara, Russia, 6–8 December 2018; Mantulenko, V., Ed.; Samara State University of Economics: Samara, Russia, 2018; Volume 57, pp. 987–989. [Google Scholar] [CrossRef]

- Xiang, X.; Jiang, L. Digitalisation and Commercial Bank Performance: A Test of Heterogeneity from Chinese Commercial Banks. Financ. Res. Lett. 2023, 58, 104303. [Google Scholar] [CrossRef]

- Dong, J.; Yin, L.; Liu, X.; Hu, M.; Li, X.; Liu, L. Impact of Internet Finance on the Performance of Commercial Banks in China. Int. Rev. Fianncial Anal. 2020, 72, 101579. [Google Scholar] [CrossRef]

- Chen, Z.; Li, K.; He, L.Y. Has Internet Finance Decreased the Profitability of Commercial Banks? Evidence from China. Emerg. Mark. Financ. Trade 2020, 56, 3015–3032. [Google Scholar] [CrossRef]

- Nguyen, Q.T.T.; Ho, L.T.H.; Nguyen, D.T. Digitalization and Bank Profitability: Evidence from an Emerging Country. Int. J. Bank Mark. 2023, 41, 1847–1871. [Google Scholar] [CrossRef]

- Batrancea, L.; Rathnaswamy, M.K.; Batrancea, I. A Panel Data Analysis on Determinants of Economic Growth in Seven Non-BCBS Countries. J. Knowl. Econ. 2022, 13, 1651–1665. [Google Scholar] [CrossRef]

- Batrancea, L.M. An Econometric Approach on Performance, Assets, and Liabilities in a Sample of Banks from Europe, Israel, United States of America, and Canada. Mathematics 2021, 9, 3178. [Google Scholar] [CrossRef]

- Nguyen, J.; Parsons, R.; Argyle, B. An Examination of Diversification on Bank Profitability and Insolvency Risk in 28 Financially Liberalized Markets. J. Behav. Exp. Financ. 2021, 29, 100416. [Google Scholar] [CrossRef]

- Zhou, H.; Peng, Q.; Chen, L. Off-Balance Sheet Activities, Strategy-driven and Bank NIM-Based on the Chinese Evidence. Syst. Eng. 2015, 33, 24–31. [Google Scholar]

- Qiu, H.; Huang, Y.; Ji, Y. How does FinTech Development Affect Traditional Banking in China? The Perspective of Online Wealth Management Products. J. Financ. Res. 2018, 461, 17–29. [Google Scholar]

- Saunders, A.; Schumacher, L.B. The Determinants of Bank Interest Rate Margins: An International Study. J. Int. Money Financ. 2000, 19, 813–832. [Google Scholar] [CrossRef]

- Hu, L.; Dou, Q.; Liu, C. Does Digital Finance Help Reduce Commercial Bank Risk? Evidence from the Banks in China. New Financ. 2022, 396, 32–41. [Google Scholar]

- Haq, M.; Tripe, D.; Seth, R. Do Traditional Off-balance Sheet Exposures Increase Bank Risk? J. Int. Financ. Mark. Inst. Money 2022, 80, 101627. [Google Scholar] [CrossRef]

- Gao, S.; Gu, H.; Buitrago, G.A.; Halepoto, H. Will Off-Balance-Sheet Business Innovation Affect Bank Risk-Taking under the Background of Financial Technology? Sustainability 2023, 15, 2634. [Google Scholar] [CrossRef]

- Aktan, B.; Chan, S.G.; Zikovic, S.; Evrim-Mandaci, P. Off-Balance Sheet Activities Impact on Commercial Banks Performance: An Emerging Market Perspective. Ekon.-Istraz.-Econ. Res. 2013, 26, 117–132. [Google Scholar] [CrossRef]

- Wang, L.; Huang, Y.; Hong, Z. Digitalization as a Double-edged Sword: A Deep Learning Analysis of Risk Management in Chinese Banks. Int. Rev. Financ. Anal. 2024, 94, 103249. [Google Scholar] [CrossRef]

- The People’s Bank of China. Overall Situation of Payment System Operation in 2023; Operation Report; The People’s Bank of China: Beijing, China, 2024. [Google Scholar]

- Wang, Z. Empirical Study on the Substitution Effect of Electronic Currency for Cash from the Perspective of Third-Party Payment. Shanghai Financ. 2018, 4557, 87–92. [Google Scholar] [CrossRef]

- Sutherland, W.; Jarrahi, M.H. The Sharing Economy and Digital Platforms: A Review and Research Agenda. Int. J. Inf. Manag. 2018, 43, 328–341. [Google Scholar] [CrossRef]

- Chao, N.; Zhou, Y.; Yang, H. How does Digital Transformation Affect the Profitability of Rural Commercial Banks? Heliyon 2024, 10, e29412. [Google Scholar] [CrossRef]

- Liu, Z.; Feng, Q.; Li, H. Digital Finance, Bank Competition Shocks and Operational Efficiency of Local Commercial Banks in Western China. Pac.-Basin Financ. J. 2024, 85, 102377. [Google Scholar] [CrossRef]

- Csiszarik-Kocsir, A. The Present and Future of Banking and New Financial Players in the Digital Space of the 21st Century. Acta Polytech. Hung. 2022, 19, 143–160. [Google Scholar] [CrossRef]

- Yang, W.; Sui, X.; Qi, Z. Can Fintech Improve the Efficiency of Commercial Banks?—An Analysis based on Big Data. Res. Int. Bus. Financ. 2021, 55, 101338. [Google Scholar] [CrossRef]

- Versal, N.; Erastov, V.; Balytska, M.; Honchar, I. Digitalization Index: Case for Banking System. Stat.-Stat. Econ. J. 2022, 102, 426–442. [Google Scholar] [CrossRef]

- Filipovska, O. General Aspects of Bank Strategy on the Digital Transformation in North Macedonia. Zagreb Int. Rev. Econ. Bus. 2023, 26, 203–214. [Google Scholar] [CrossRef]

- Santoso, W.; Sitorus, P.M.; Batunanggar, S.; Krisanti, F.T.; Anggadwita, G.; Alamsyah, A. Talent Mapping: A Strategic Approach toward Digitalization Initiatives in the Banking and Financial Technology (FinTech) Industry in Indonesia. J. Sci. Technol. Policy Manag. 2021, 12, 399–420. [Google Scholar] [CrossRef]

- Guo, P.; Zhang, C. The Impact of Bank FinTech on Liquidity Creation: Evidence from China. Res. Int. Bus. Financ. 2023, 64, 101858. [Google Scholar] [CrossRef]

- Svitlana, K.; Tvaronaviciene, M.; Dovgal, O.; Levkovich, O.; Vodolazska, O. Impact of Selected Factors on Digitalization of Financial Sector. Entrep. Sustain. Issues 2022, 10, 358–377. [Google Scholar] [CrossRef]

- Diener, F.; Spacek, M. Digital Transformation in Banking: A Managerial Perspective on Barriers to Change. Sustainability 2021, 13, 2032. [Google Scholar] [CrossRef]

- Xu, C.; Yang, L. The Level of Digitalization in Commercial Banks and Bank Liquidity Creation. Financ. Res. Lett. 2024, 63, 105280. [Google Scholar] [CrossRef]

- Potapova, E.A.; Iskoskov, M.O.; Mukhanova, V.N. The Impact of Digitalization on Performance Indicators of Russian Commercial Banks in 2021. J. Risk Financ. Manag. 2022, 15, 452. [Google Scholar] [CrossRef]

- Khattak, M.A.; Ali, M.; Azmi, W.; Rizvi, S.A.R. Digital Transformation, Diversification and Stability: What do We Know about Banks? Econ. Anal. Policy 2023, 78, 122–132. [Google Scholar] [CrossRef]

- Wang, X. Commercial Banks’ Competitive Countermeasures under the Background of Internet Finance. In Proceedings of the 2017 3rd International Conference on Economics, Social Science, Arts, Education and Management Engineering (ESSAEME), Huhhot, China, (ESSAEME 2017), Huhhot, China, 29–30 July 2017; Advances in Social Science Education and Humanities Research. Hou, Y., Zheng, W., Eds.; Volume 119, pp. 1530–1534. [Google Scholar]

- Guo, P.; Cheng, M.; Gao, Z. Internet Finance, Net Interest Margin and Noninterest Activities in China’s Banking Sector. Singap. Econ. Rev. 2022, 67, 1987–2022. [Google Scholar] [CrossRef]

- Nguyen, J. The Relationship between Net Interest Margin and Noninterest Income Using a System Estimation Approach. J. Bank. Fiance 2012, 36, 2429–2437. [Google Scholar] [CrossRef]

- Zhang, G. Analysis on the Driving Factors of Intermediary Business Development of Commercial Banks in China: Empirical Test based on 16 Commercial Banks. J. Tech. Econ. Manag. 2021, 301, 73–77. [Google Scholar]

- Shen, C.; Zhao, S. Research on the Impact of Internet Finance on the Earnings of Commercial Banks–Based on the Analysis of 101 Commercial Banks in China. Mod. Econ. Res. 2017, 426, 32–38+55. [Google Scholar] [CrossRef]

- Shi, Y.; Zhang, M. Difference Analysis of Influence of Internet Financial Form on China’s Commercial Banks. J. Beijing Technol. Bus. Univ. Sci. 2018, 33, 105–115. [Google Scholar]

- Xie, X.; Wang, S. Digital Transformation of Commercial Banks in China: Measurement, Progress and Impact. China Econ. Q. 2022, 22, 1937–1956. [Google Scholar] [CrossRef]

- Wang, S.; Xie, X. Economic Pressure or Social Pressure: The Development of Digital Finance and the Digital Innovation of Commercial Banks. Economist 2021, 100–108. [Google Scholar] [CrossRef]

- Liu, M.; Huang, X.; Sun, J. Impact of Digital Finance on China’s Green Development and Its Mechanism. China Popul. Resour. Environ. 2022, 32, 113–122. [Google Scholar]

- Chen, X.; Wang, H.; Wang, G. Research on the Common Wealth Effect of Digital Inclusive Finance—Test According to Inflection Point Effect. Econ. Probl. 2024, 53–60. [Google Scholar] [CrossRef]

- Pedroni, P. Critical Values for Cointegration Tests in Heterogeneous Panels with Multiple Regressors. Oxf. Bull. Econ. Stat. 1999, 61, 653–670. [Google Scholar] [CrossRef]

- Huang, L.; Tang, P.; Xia, Z. Off-Balance Sheet Business, Risk Inputs and Operating Performance of Banks: An Empirical Analysis Based on Balanced Panel Data of Chinese Listed Banks from 2007 to 2011. Financ. Econ. Res. 2013, 28, 44–54. [Google Scholar]

- The iResearch Research Institute. The 2023 Research Report on Digital Transformation of China’s Banking Industry; Operation Report; iResearch Inc.: Shanghai, China, 2024; Available online: https://report.iresearch.cn/report_pdf.aspx?id=4175 (accessed on 15 June 2024).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).