Abstract

Since 2014, China has been actively promoting the transformation of manufacturing servitization, clarifying the importance of manufacturing servitization. This paper investigates the correlation between manufacturing servitization and cost stickiness, supplementing the research on the economic consequences of manufacturing servitization and the influencing factors of cost stickiness. This paper launches an empirical study with a sample of A-share manufacturing companies from 2014 to 2022. The research results show that, first, manufacturing servitization can inhibit enterprise cost stickiness; second, manufacturing servitization affects enterprise cost stickiness through the path of reducing enterprise adjustment costs, reducing managers’ optimistic expectations and reducing enterprise agency costs; third, the negative relationship between manufacturing servitization and cost stickiness is stronger among firms with a low level of internal control, a strong degree of financing constraints, a good quality internal information environment, a strong degree of competition in the market, and firms that are in capital-intensive manufacturing industries; fourth, the role of embedded servitization on enterprise cost stickiness is not significant, while hybrid servitization can have a significant negative effect on enterprise cost stickiness; and fifth, the impact of manufacturing servitization on enterprise cost stickiness mainly lies in the cost of material resources rather than the cost of human resources.

1. Introduction

The manufacturing industry plays a pivotal role in China’s economy, building a solid foundation for national development and social progress. However, with the continuous development of China’s manufacturing industry, a lot of dilemmas come along with it, and the competition between enterprises is becoming more and more intense. If manufacturing companies want to be more competitive, it is inevitable to reduce costs and improve efficiency.

In order to realize cost reduction and efficiency improvement, cost management is indispensable at all stages of the business management process. Cost stickiness shows the phenomenon of asymmetric change of cost and business volume that widely exists in enterprises, and it is a key point that cannot be ignored in cost management. Anderson, Banker, and Janakiraman firstly put forward the concept of “cost stickiness” in 2003. They called the phenomenon of asymmetry between cost and sales change “cost stickiness”, i.e., the magnitude of cost increase when sales increase is greater than the magnitude of cost decrease when sales decrease by the same amount [1]. Banker, Byzalov, and Chen found that the phenomenon of cost stickiness exists globally and is widespread at the firm level [2]. Meanwhile, Sun Zheng and Liu Hao analyzed that cost stickiness also exists in Chinese enterprises [3].

Scholars’ research on the factors affecting cost stickiness focuses on four aspects, which are management characteristics, firm characteristics, firm behavior, and external environment. In terms of management characteristics, managers’ overconfidence; ability level; and overseas, academic, and political backgrounds all have an impact on cost stickiness [4,5,6,7] with respect to firm characteristics, equity structure, the stage of development of the firm, and supplier/customer relationships affect cost stickiness [8,9,10,11]. In terms of firm behavior, the firm’s competitive strategy, financial strategy, and transformation strategy will have an impact on firm cost stickiness [12,13,14,15]. In terms of external environment, firm cost stickiness is influenced by economic development, competitive environment, and policies [1,16,17].

In the manufacturing industry, cost stickiness exists widely, and manufacturing enterprises should pay attention to cost stickiness and make effective adjustments and controls [18]. As an important transformation strategy for manufacturing enterprises, manufacturing servitization will have a great impact on the production and operation decisions of enterprises, so this paper hopes to explore the impact of manufacturing servitization on cost stickiness and hopes to find ways to control cost stickiness in manufacturing enterprises from the perspective of manufacturing servitization.

Manufacturing servitization refers to the integration of services and products by manufacturing firms, shifting from product sellers to function providers. Manufacturing servitization can affect firm performance, competitiveness, innovation, and green performance [19,20,21,22]. However, there is still a lack of research on the impact of manufacturing servitization on firms’ cost stickiness. Therefore, this paper takes manufacturing servitization as the entry point of research to explore the impact of manufacturing servitization on cost stickiness, supplementing the research on the economic consequences of manufacturing servitization and the perspective of transformation strategy in the factors affecting cost stickiness.

This paper uses the data of China’s A-share listed manufacturing companies from 2014 to 2022 for the empirical analysis to test the impact of manufacturing servitization on cost stickiness with a fixed-effects model, and the results of the study found that there is a significant negative correlation between manufacturing servitization and cost stickiness. In order to verify the robustness of the regression conclusions, this paper uses a variety of ways to carry out the robustness test. Then, in further analysis, this paper first conducted mechanism tests from the perspectives of adjustment costs, managers’ optimistic expectations, and agency costs; subsequently, it conducted a heterogeneity analysis from the five aspects of internal control, financing constraints, quality of the internal information environment, the degree of market competition, and the manufacturing industry in which the firms are located; finally, it also differentiated between the types of servitization and the types of cost elements.

The contribution of this paper lies in the following: First, this paper enriches the related research in the fields of manufacturing servitization and cost stickiness. This paper takes manufacturing servitization as an entry point, explores the impact of manufacturing servitization on business management from the perspective of cost stickiness by studying the impact of manufacturing servitization on cost stickiness, and opens up new perspectives for the study of the impact effect of manufacturing servitization. At the same time, this paper also enriches the research on the influence factors of cost stickiness. Although scholars at home and abroad have conducted a lot of research on cost stickiness influencing factors, the research direction of scholars is relatively scattered, which can be roughly divided into four aspects: management characteristics, enterprise characteristics, enterprise behavior, and external environment. Corporate behavior, strategic behavior, innovative behavior, surplus management behavior, etc. will have an impact on cost stickiness. The research on strategic behavior direction can be divided into competitive strategy, financial strategy, transformation strategy, strategic differentiation, and many other perspectives. Manufacturing servitization is one of the transformation strategies of enterprises, as combining it with cost stickiness can supplement the research on the impact of enterprise strategic behavior on cost stickiness.

Secondly, this paper can help enterprises to better carry out the transformation decision of manufacturing servitization. As the impact of manufacturing servitization on manufacturing enterprises is still unclear, manufacturing enterprises in the transformation of decision-making are inevitably hesitant, and in this context, the impact of manufacturing servitization on the utility of the investigation is particularly important. Therefore, from the perspective of cost control, analyzing the impact of manufacturing servitization on enterprise cost stickiness helps manufacturing enterprises to make the impact of manufacturing servitization more clear, provides a new perspective for the transformation of enterprise servitization decision-making, and helps enterprises to understand manufacturing servitization more.

Finally, this paper can help companies to master another way to control cost stickiness. Manufacturing enterprises have strong cost stickiness, and the existence of cost stickiness will have an impact on enterprise performance, enterprise value, enterprise risk, and many other aspects. Therefore, manufacturing enterprises should control cost stickiness. This paper concludes that manufacturing services can significantly reduce the cost of enterprise stickiness, which indicates that manufacturing enterprises can achieve the control effect of cost stickiness through manufacturing service, so as to achieve the goals of cost reduction, efficiency improvement, and high-quality development.

2. Theoretical Analysis and Research Hypotheses

2.1. Literature Review

The more widely recognized views on the causes of cost stickiness focus on the following three perspectives: adjustment costs, managerial optimistic expectations, and agency costs.

Adjustment costs are the costs incurred in adjusting factor inputs in the production area when a firm faces a change in business volume. According to the direction of adjustment, adjustment costs can be categorized into upward adjustment costs, i.e., the costs of increasing factor inputs when the business volume rises, and downward adjustment costs, i.e., the costs of decreasing factor inputs when the business volume falls. The impact of adjustment costs on cost stickiness is twofold. On the one hand, the existence of adjustment costs brings about a delayed reduction of resources by managers, which, in turn, leads to cost stickiness. For firms, if there is uncertainty about future demand and, at the same time, firms need to bear adjustment costs when cutting or reinvesting resources, then managers are not willing to reduce resources immediately when there is a decline in business. Only when managers believe that the decline in demand will continue for a period of time will they be willing to reduce the level of resource inputs, which will lead to a delay in the reduction of resources by managers when the business volume declines and the costs will fall more slowly, bringing about cost stickiness [1]. On the other hand, the asymmetry between upward and downward cost adjustments will also affect management’s business management decisions, resulting in cost stickiness. In the process of labor force adjustment, the cost of hiring new employees will be lower than the cost of dismissing old employees, which results in the downward adjustment cost being higher than the upward adjustment cost, and the number of employees dismissed by the manager when the business volume declines is lower than the number of new employees hired by the manager when the business volume rises, which brings about asymmetric changes in costs [23,24].

From the perspective of managers’ optimistic expectations, if managers hold an optimistic view of the future development of the enterprise when they face a decline in business volume, they will be more inclined to think that this situation is short-term and temporary, and due to the existence of adjustment costs, cutting resource inputs and later the restoration of inputs need to pay the corresponding costs. This results in optimistic managers preferring to maintain the status quo rather than reduce resource inputs, which leads to the phenomenon of sticky costs. Scholarly research has also confirmed the impact of optimistic expectations on cost stickiness from various perspectives. Macroeconomic conditions affect cost stickiness by influencing managers’ optimistic expectations. When the economy is growing, managers are more likely to have more optimistic expectations about market conditions, which leads to a weaker willingness to cut resource inputs when the business volume declines, and this is reflected in stronger cost stickiness in the firm [1]. When sales are growing in the previous period, managers are more likely to be optimistic about future sales, thus exacerbating cost stickiness [25,26]. The cost stickiness is exacerbated by optimism about future sales. Li and Zhao found that the more optimistic managers are about future business volume, the more sticky is the cost of the firm [27].

Cost management is an important part of the daily operation of an enterprise, and managerial decision-making has a great impact on this part. Managers, in their pursuit of self-interest, may consider not only the business situation but also their own self-interest when making decisions on cost and expense management. Thus, when the business volume rises, managers may have strong optimistic expectations to increase their own benefits and compensation and may invest more resources in order to build a business empire and have more dominant power over resources. When the business volume declines, managers may be reluctant to reduce their compensation or give up control of the resources they already have. Due to managers’ opportunistic motives, the asymmetric relationship between firms’ resource holdings and business volume brings about cost stickiness. Many scholars have used corporate free cash flow, CEO tenure, CEO change, and CEO fixed compensation as proxy variables to directly explore the relationship between agency costs and cost stickiness. The findings show that there is a positive correlation between agency costs and cost stickiness [28,29,30,31].

2.2. Theory Analysis and Research Hypotheses

From the perspective of adjustment costs, studies have shown that cost stickiness is higher in the manufacturing sector than in the service sector, and Weidenmier and Subramaniam’s study, based on a sample of U.S. firms, concluded that the manufacturing sector has the worst cost stickiness problem among all industries. The reason for the highest cost stickiness in the manufacturing industry is the high proportion of fixed assets and inventories in the manufacturing industry [32]. A high proportion of fixed assets increases the level of cost stickiness of a firm [33]. The reason is that the fixed assets of the enterprise will bring rigid costs, and the higher the proportion of fixed assets, the higher the fixed costs of the enterprise, which makes the enterprise more reluctant to make downward adjustments in the face of declining performance, resulting in higher cost stickiness [34]. From this perspective, manufacturing servitization can reduce the cost stickiness of enterprises from two aspects. On the one hand, manufacturing service is beneficial to enterprises to be “soft”; that is, in previous manufacturing enterprises, the proportion of hardware such as equipment was relatively high, and manufacturing servitization will introduce services and other software, reducing the proportion of hardware in manufacturing enterprises [35]. At the same time, the servitization of manufacturing introduces a service sector element to the original manufacturing production, and the service sector is able to withstand the economic cycles that drive investment and equipment purchases [36]. It can be seen that the transformation of manufacturing services can reduce the proportion of fixed assets and other heavy assets, as fixed assets and other heavy assets can reduce the proportion of adjustment costs and, further, reduce cost stickiness. On the other hand, service-oriented manufacturing enterprises have more service industry elements, and providing services to customers brings the distance between enterprises and customers closer, forming a closer connection with customers. When enterprises need to conduct product design or predict future demand, they can rely on closer relationships with customers to obtain relevant information about them in order to facilitate communication and reduce the adjustment costs brought about by communication and customer maintenance between enterprises and customers.

From the perspective of management optimistic expectations, on the one hand, manufacturing servitization is the extension of the manufacturing industry to the service industry, which can integrate the manufacturing industry and the service industry, which was in a state of separation before, relying on the manufacturing industry and the service industry to contact the integration between the manufacturing industry and the service industry to eliminate the boundaries between the manufacturing industry and the service plate, so that the information can be traded more efficiently in the flow of information to reduce the asymmetry of the information and to eliminate the mismatch of resources caused by the information fragmentation [37]. Since the servitization of the manufacturing industry provides services to customers, enterprises can more effectively obtain relevant information on customer demand, which helps them to obtain and circulate information at the grassroots level, which is helpful for enterprises to adjust the supply situation in a timely manner based on more direct and accurate information on demand and brings about better cost control [38]. On the other hand, compared to the manufacturing industry, the service industry in the long-term service provision has accumulated high-quality human resources and rich management experience. If manufacturing enterprises can introduce high-quality human resources and the management level condensed in the service industry through service-oriented transformation, it can help them improve their management ability and decision-making efficiency [39]. Therefore, compared to traditional manufacturing enterprises that are only engaged in the production and sale of products, enterprises that undergo the transformation of manufacturing services are more capable of establishing close and long-term relationships with their customers and thus managing information more efficiently. The management can obtain relevant information about the production and operation of the enterprise from the customer level, reduce the wrong judgment of the enterprise, and have a more accurate judgment of the enterprise’s situation, which enables the management to reduce the expectation of the enterprise when the business volume level drops and cut down the cost of the enterprise relatively quickly, and the cost of the enterprise will be less sticky.

From the point of view of agency costs, manufacturing servitization can optimize the relationship between enterprises and customers; through the provision of services to customers, enterprises are more able to have in-depth contact with customers, so as to reach a closer long-term cooperative relationship; and compared to the previous single transaction, customers are more likely to reach long-term cooperation with enterprises [40]. From the perspective of the enterprise, on the one hand, the customer is an important stakeholder in the enterprise, and the enterprise in the development of strategic decision-making is essential to consider the customer’s demands. If the enterprise and the customer reach a closer long-term cooperation relationship, the customer is more likely to require the enterprise to disclose more production and operation information; the disclosure of this information will not only help the customer to supervise the production and operation of the enterprise but the shareholders can also be based on the more transparent information to deepen the understanding of the production and operation of the enterprise and more accurately and conveniently supervise the management to reduce the self-interested behavior of the management to alleviate the principal–agent problem and reduce the agency cost. This reduces management’s self-interested behavior, alleviates the principal–agent problem, and lowers the agency cost. On the other hand, customers will consider the performance ability of the enterprise when entering into a transaction with the enterprise, so if the management wants to enter into more long-term and stable cooperation with the customers, it is necessary to show that the enterprise has a good performance ability to the customers. As a result, management will pay more attention to the operation of the enterprise, reduce personal self-interest, minimize the infringement of the interests of other related subjects, and better fulfill their fiduciary responsibilities. Therefore, in the context of the service-oriented manufacturing industry, the agency problem of the enterprise will be suppressed due to the pursuit of longer-term customer relationships [41].

In summary, the following hypotheses are proposed in this paper.

H1.

Manufacturing servitization is negatively related to firm cost stickiness.

3. Materials and Methods

3.1. Sample Selection and Data Source

In this paper, with reference to the Guidelines for Industry Classification of Listed Companies, China’s A-share listed companies in the manufacturing industry are selected to be analyzed, and the research period is 2014–2022, the internal control data are from Shenzhen DIB Enterprise Risk Management Technology Co., Ltd. (Shenzhen, China), the GDP growth rate data are from the National Bureau of Statistics, and the rest of the data are from the database of CSMAR. Since 2014, China has started to promote the process of manufacturing servitization, so this paper selects 2014 as the starting year of the data.

On this basis, this paper screens the data as follows: (1) delisted companies are excluded; (2) ST, as well as ST* types of the listed companies, are excluded; (3) abnormal data, as well as data with missing key variables, are excluded; (4) companies with major asset reorganizations implemented during the study period are excluded; and (5) companies with a proportion of service revenue higher than 50% are excluded. According to the Guidelines for Industry Classification of Listed Companies, the criterion for classifying an industry is that the proportion of operating income from a certain type of business of a listed company is higher than or equal to 50%; therefore, this paper excludes the data where the proportion of service income in the operating income of a company is higher than 50%. Finally, 17,249 valid samples are obtained. In addition, in order to reduce the impact of extreme data, this paper has carried out 1% Winsorize shrinkage for all continuous variables.

3.2. Variable Definitions

3.2.1. Cost Stickiness

In this paper, the Anderson, Banker, and Janakiraman (ABJ) model is selected to measure the cost stickiness, synthesizing the research of related scholars; the constructed model is shown in Equation (1) [1,42,43]:

where i and t denote firm and year, respectively; , where Cost denotes the firm’s operating costs; , where Rev denotes the firm’s operating revenue; and D denotes the dummy variable for revenue decline, which takes 1 when the revenue declines from period t − 1 to period t and vice versa takes 0. If costs are sticky, the magnitude of the change in costs when the revenue declines will be lower than the magnitude of the change in costs when the revenue rises, i.e., < 0.

3.2.2. Manufacturing Servitization

In this paper, we measure the level of manufacturing servitization of enterprises from the perspective of output servitization, referring to the research of Weng Zhigang and other scholars, and take the proportion of servitization revenue to the total operating revenue as a proxy variable [44,45,46,47]. The service-oriented revenue is obtained from the details of the notes to the financial statements in the annual reports of enterprises. According to the details of the operating revenue, the revenue containing the keywords of “service, maintenance/repair, testing/certification, upgrading/rehabilitation, design/research and development, consulting, installation/implementation, software/information system, solution, trading/distribution, logistics, procurement, finance/leasing, abandonment, real estate/property, and hotel/restaurant, tourism” is filtered, and manually delete the revenue from the mix of products and services.

3.3. Model Design

In this paper, the ABJ model is selected to measure the cost stickiness of enterprises; where < 0, there is cost stickiness, and the smaller is, the higher the degree of cost stickiness. In order to study the relationship between enterprise manufacturing servitization and cost stickiness, this paper constructs the model (2):

where i and t denote company and year, respectively. is the degree of cost stickiness, Serv is the core variable of this paper, manufacturing servitization, and Controls are the nine control variables selected in this paper, including four economic variables and five company characteristic variables. The economic variables include (1) asset intensity, (2) labor intensity, (3) two consecutive years of revenue decline, and (4) economic growth. The other control variables include (1) firm size, (2) financial leverage, (3) firm age, (4) profitability level, and (5) percentage of independent directors, all of which are commonly used control variables in the cost stickiness research field.

To test the relationship between manufacturing servitization and cost stickiness, model (3) is obtained by substituting Equation (2) into Equation (1) while controlling for year and industry fixed effects:

A detailed description of the variables used in this paper is shown in Table 1.

Table 1.

Description of the variables.

4. Results

4.1. Descriptive Statistics

This paper carries out descriptive statistics on the main variables, and the results are shown in Table 2. From the results of the descriptive statistics, it can be seen that both the cost change and the business volume change have sample data that are less than 0, the extreme difference between the cost change and the business volume change between different samples is large, and the research data can better support the research of this paper. The mean value of the core explanatory variable, the degree of servitization of the manufacturing industry (Serv), is 0.0306, and the median is 0, indicating that the number of samples that include service income in the revenue of the enterprise has not reached half, while the average level of servitization of the manufacturing industry of the enterprises within the sample is at 3.06%. The mean value of the dummy variable (D) representing the decline in business volume is 0.271, indicating that there is a 27.1% portion of the sample that has experienced an annual decline in sales; the mean value of the dummy variable (SD) representing the continuous decline in business volume for two consecutive years is 0.0984, indicating that the sample has experienced a decline in sales for two consecutive years in 9.84% of the sample.

Table 2.

Descriptive statistics of the main variables.

4.2. Main Regression Results

To explore the correlation between servitization and cost stickiness in manufacturing, it is first necessary to investigate whether there is cost stickiness in manufacturing firms. Therefore, this paper first examines whether cost stickiness exists in the manufacturing sample. As can be seen in column 1 of Table 3, the coefficient of ΔlnRev is 0.954, which is significant at the 1% significance level, and this coefficient represents that a 1% rise in the volume of business will result in a 0.954% increase in the corresponding cost, while the coefficient of ΔlnRev*D is −0.059, which is significantly negative at the 1% significance level, and it indicates that a 1% reduction in the volume of business will result in a reduction of the cost by only 0.895% (0.954–0.059). It can be seen that the cost change caused by a 1% decrease in the business volume is significantly lower than the cost change caused by a 1% increase in the business volume in manufacturing firms, and there is a significant cost stickiness problem in manufacturing firms.

Table 3.

Main regression empirical test results.

Based on the research on the existence of cost stickiness, this paper tests the correlation between servitization and cost stickiness in manufacturing. As can be seen from the results in column 2 of Table 3, without adding control variables, the coefficient of ΔlnRev*D*Serv is 0.224, which is significantly positive at the 1% significance level. As can be seen from the results in column 3 of Table 3, with the addition of the control variables, the coefficient on ΔlnRev*D*Serv is 0.198, which is significantly positive at the 5% level of significance. The smaller the coefficient of cost stickiness, the greater the cost stickiness. Therefore, the significant positive coefficient shows the negative correlation between manufacturing servitization and cost stickiness, and the transformation of manufacturing servitization by enterprises is beneficial to alleviate the cost stickiness problem of manufacturing enterprises.

4.3. Robustness Tests

4.3.1. Instrumental Variables Method

Drawing on the research of scholars, this paper selects the lagged one period of manufacturing servitization (Serv_t1) to construct an instrumental variable [48,49,50,51]. The endogenous variable in this paper is manufacturing servitization (Serv), and the endogenous variable is located in the ΔlnRev*D*Serv term in the main regression equation, so the endogenous variable in this regression equation is ΔlnRev*D*Serv. According to the actual situation of the research, this paper uses the cross-multiplication term of the one-period lag of manufacturing servitization and the dummy variable of income change and whether income is declining or not, i.e., Δ lnRev*D*Serv_t1 as an instrumental variable, and uses two-stage least squares (2SLS) for endogeneity testing.

The estimation results are shown in Table 4, where column (1) shows the estimation results of the first stage. From the estimation results of the first stage, the correlation coefficient between the instrumental variable ΔlnRev*D*Serv_t1 and the endogenous variable ΔlnRev*D*Serv is 0.472, which is significantly positive at the 1% significance level, indicating that there is a significant positive correlation between the lagged term of the manufacturing servitization and the current term.

Table 4.

Regression results of the instrumental variables method.

In addition, for instrumental variable rationality, the paper conducts further tests. In the instrumental variable rationality test, the Kleibergen–Paap Wald rk F statistic is 103.02, which is higher than the critical value of 16.38 at the Stock–Yogo 10% level, rejecting the weak instrumental variables hypothesis, and the relationship between the instrumental variables and the endogenous variables is strong. The p-value of the Kleibergen–Paap rk LM statistic is 0.000, rejecting the underidentification hypothesis. In conclusion, the choice of the instrumental variable is reasonable.

Column (2) of Table 4 shows the second-stage estimation results. The second-stage estimation results show that, after the introduction of instrumental variables, the negative effect of manufacturing servitization on firms’ cost stickiness is still able to be significant at the 1% level of significance and thus can prove the robustness of the regression results in this paper.

4.3.2. Propensity Score Matching Analysis (PSM)

In order to mitigate the bias of a possible nonlinear relationship between the control variables and the dependent variable, this paper employs the Propensity Score Matching (PSM) method for robustness testing.

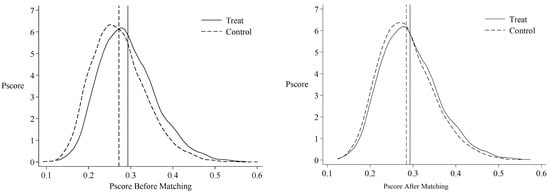

First, this paper divides the sample into a treatment group (with manufacturing servitization) and a control group (without manufacturing servitization) according to whether the firms are engaged in manufacturing servitization or not. Referring to Lixian Chen’s study, enterprise Tobin’s Q (TBQ), total return on assets (ROA), current ratio (FIN), gearing ratio (LEV), enterprise size (SIZE), and total number of employees (EMP) were selected as the covariates, and the regression method used logit regression to obtain the propensity regression value, trying to equalize the differences of variables except for manufacturing servitization in the samples of the processing group and the control group [52]. This paper adopts the matching method of nearest-neighbor matching with a matching ratio of 1:2. The matching results show that, among 16,997 observations, 16,983 observations are within the common range of values.

Then, the paper conducted a balance test. As can be seen from Table 5, compared to the pre-matching period, the standardized mean deviation of each covariate between the two groups is significantly reduced after matching, and the deviations are all lower than 5%. At the same time, the t-test results show that the p-value of the t-test of each covariate after matching is greater than 10%, and there is no systematic bias in the values of the covariates taken by the two groups.

Table 5.

Balance test results table.

Meanwhile, Figure 1 shows the kernel density plots of the two sets of propensity score values before and after matching. Before matching, the curves are more deviated, and after matching, the two curves are closer, and the distance between the two sets of mean values is reduced.

Figure 1.

Comparison of kernel density maps before and after matching.

Finally, the paper pools the samples of firms in the matched processing and control groups to form a new sample set and reperforms the main regression test, and the final regression results obtained are shown in Table 6. The regression results for the full sample are shown in column 1, and the regression results for the 10,550 samples in the matched processing and control groups are shown in column 2. In column 2, the coefficient of ΔlnRev*D*Serv is 0.193, which is significantly positive at the 5% significance level, so it can be seen that, after matching with PSM, manufacturing servitization still has a significant negative impact on cost stickiness, and the main regression conclusions are robust.

Table 6.

PSM matching regression results.

4.3.3. Other Robustness Tests

In order to ensure the robustness of the main regression conclusions, this paper also employs other robustness tests. First, controlling for firm fixed effects. This paper replaces controlling for industry fixed effects with controlling for firm fixed effects for the robustness test and, by doing so, cuts down on the endogeneity problem caused by omitting firm-level variables. Second, add control variables. Referring to the studies of Luo Hong et al. and Zhang Bo et al., this paper adds control variables that may have an impact on cost stickiness such as Dual, the proportion of shares held by the first largest shareholder (Lrghldrt), and the proportion of shares held by the management (Msshare) in the main test [43,53]. Third, the anti-stickiness sample is removed. The main regression conclusions of this paper were retested by removing 1357 pieces of data that do not vary in the same direction as costs and revenues, leaving 15,892 pieces of data to form a new research sample. Fourth, replace the manufacturing servitization metrics. Referring to Chenyu Zhao’s approach, the breadth of a firm’s manufacturing servitization is used as a substitute indicator to test whether the main regression is robust or not [54]. The breadth of manufacturing servitization (Serv_num) means the number of service businesses carried out by manufacturing enterprises and the specific practice is to retrieve whether there is the corresponding type of service revenue in the business revenue details in the notes to the financial statements of the enterprises according to the relevant service keywords mentioned above, and if there is a service business with the corresponding keywords in the revenue details of the enterprises, it will be recorded as 1. After that, the number of service businesses of the enterprise is summed up, and if there is no service business in the enterprise, it is recorded as 0, thus obtaining the variable of the breadth of servitization of the enterprise’s manufacturing industry. The conclusions of the main regression in this paper remain unchanged after various robustness tests.

5. Further Analysis

5.1. Mechanism Analysis

5.1.1. Adjustment Costs

From the perspective of cost adjustment, studies have shown that the cost stickiness of the manufacturing industry is lower than that of the service industry, and the reason is that the manufacturing industry has a higher proportion of fixed assets and inventory. Therefore, the service-oriented transformation of manufacturing enterprises through the introduction of services to achieve the integration of manufacturing and service industries can realize the “softening” of enterprise assets and reduce the proportion of heavy assets, thereby reducing the cost stickiness of the enterprise. Williamson pointed out that, if an asset is highly specialized, it will lose more value when it faces a liquidation situation, and therefore, it will be more costly to restructure it [55]. The cost of adjusting such assets is therefore higher. The negative correlation between manufacturing servitization and firm cost stickiness is stronger when asset specialization is high. The regression results, as shown in Table 7, show that the effect of manufacturing servitization on cost stickiness is more significant in the high asset specialization group. Therefore, it can be concluded that manufacturing servitization alleviates the problem of cost stickiness of firms by reducing their adjustment costs.

Table 7.

Adjustment cost mechanism test regression results.

5.1.2. Managers’ Optimistic Expectations

From the perspective of managers’ optimistic expectations, compared to manufacturing enterprises engaged in production, enterprises adopting the manufacturing servitization strategy are more closely connected with customers, can obtain more information, and can manage information more efficiently, and management can obtain relevant information about the production and operation of the enterprise from the customer level, reduce the erroneous judgment of the enterprise, and have a more accurate judgment of the enterprise’s situation, thus reducing the cost stickiness of the enterprise. According to related scholars, as the degree of environmental uncertainty increases, enterprises face higher information asymmetry and the possibility of information distortion, and it is more difficult for managers to obtain business information, so it is easy to generate optimistic expectations [56,57]. The manager will have more difficulty in obtaining business information and will be prone to optimistic expectations. The negative correlation between manufacturing servitization and firms’ cost stickiness is stronger when the environmental uncertainty is high. The regression results, as shown in Table 8, show that the effect of manufacturing servitization on cost stickiness is stronger in the high environmental uncertainty group. Therefore, it can be concluded that manufacturing servitization alleviates the problem of firm cost stickiness by reducing managers’ optimistic expectations and thus easing the problem of firm cost stickiness.

Table 8.

Regression results of the managerial optimistic expectations mechanism test.

5.1.3. Agency Costs

From an agency cost perspective, the servitization of manufacturing will bring about a change in the relationship between firms and their customers, and the introduction of services will help firms to extend their relationships, as well as to establish more long-term cooperation with their customers rather than single transactions [40]. For customers as one of the important stakeholders of the enterprise, if the enterprise and the customer reach a closer cooperative relationship, the customer is more likely to require the enterprise to disclose information, which will increase the transparency of the enterprise disclosure, thereby alleviating the enterprise principal–agent problem and reducing the agency cost. At the same time, in order to eliminate the customer’s skepticism about the enterprise’s ability to fulfill the considerations, it is more likely to show customers a good business situation; in this case, the formation of invisible constraints between the customer and the enterprise will play a supervisory role in the managers making rational decisions. When a company has abundant free cash flow, managers, driven by self-interest, are more likely to consume the cash held by the company and build a business empire by expanding production scale and other means when the business volume increases, but when faced with a decline in business volume, managers are reluctant to downsize the production scale of the enterprise. When the enterprise free cash flow is high, manufacturing servitization is more able to alleviate cost stickiness by reducing agency costs, and the negative correlation between manufacturing servitization and enterprise cost stickiness is stronger. The regression results are shown in Table 9, and the effect of manufacturing servitization on cost stickiness is stronger in the high free cash flow group. Therefore, it can be concluded that manufacturing servitization mitigates the problem of corporate cost stickiness by reducing corporate agency costs, thus mitigating the problem of corporate cost stickiness.

Table 9.

Regression results of the agency cost mechanism test.

5.2. Heterogeneity Analysis

5.2.1. Internal Control

The impact of internal control on firms’ cost stickiness can be analyzed from two perspectives. From the perspective of agency costs, internal control is an important governance mechanism within the firm that inhibits the possible opportunistic behavior of management and reduces agency costs. From the perspective of managers’ optimistic expectations, if there are problems with the company’s internal control, it will affect the quality of the accounting information within the company. If the quality of the internal accounting information is low, management will not be able to make decisions based on reliable and effective information, and it will be more difficult to accurately adjust the inputs of production resources in a timely manner in the face of changes in the business volume, which will lead to more serious cost stickiness problems [58]. In summary, in enterprises with more imperfect internal control, manufacturing servitization is more effective in reducing managers’ optimistic expectations and agency costs, and the negative correlation between manufacturing servitization and cost stickiness is stronger. The regression results, as shown in Table 10, show that the effect of manufacturing servitization on cost stickiness is stronger in the low internal control level group. Therefore, it can be concluded that manufacturing servitization is more effective in mitigating cost stickiness in firms with imperfect internal control levels.

Table 10.

Regression results of the internal control heterogeneity analysis.

5.2.2. Financing Constraints

If firms face strong financing constraints, they will need to pay more in external financing costs when they expand, and when they expand, they will need to spend more on financing costs in exchange for new resources to satisfy the demand created by rising business volumes. The cost of adjustment in the face of a higher business volume is also higher, so the willingness of enterprises to adjust costs upwards when the business volume rises is weak. At the same time, in the case of a decline in business volume in an enterprise with high financing constraints, the retention of redundant resources in the current situation will, on the one hand, lead to higher opportunity costs for the enterprise and, on the other hand, make the enterprise with high financing constraints face more difficult financial difficulties. Therefore, in the case of high financing constraints, the willingness of firms to adjust upward decreases and the willingness to adjust downward increases [59]. In the case of high financing constraints, firms are less willing to adjust upward and more willing to adjust downward. On the contrary, in an enterprise with weak financing constraints, the enterprise has more abundant funds, it has more confidence to invest when the business volume increases, and it can delay the reduction of resources when the business volume decreases; therefore, in an enterprise with weak financing constraints, the effect of manufacturing serviceization to reduce the downward adjustment cost of the enterprise will be more significant, and the negative correlation between the manufacturing serviceization and the cost stickiness will be stronger. The regression results, as shown in Table 11, show that the effect of manufacturing servitization on cost stickiness is stronger in the low financing constraint group. Therefore, it can be concluded that manufacturing servitization is more effective in reducing downward adjustment costs and alleviating the problem of cost stickiness in enterprises with weak financing constraints.

Table 11.

Regression results of the financing constraint heterogeneity analysis.

5.2.3. Quality of the Internal Information Environment

The management of an enterprise needs to make accurate judgments on the situation between the enterprise and the external environment based on a lot of internal and external information and then make decisions related to production and operation. Therefore, high-quality information is indispensable for management to make accurate and reasonable decisions. A good internal information environment of the enterprise can help the information to be transmitted efficiently and accurately within the company so that the managers can obtain more timely, accurate, and high-quality information so that the managers can be more accurate and confident when they need to make predictions about a future development situation [60]. In a better information environment within a company, the information is transmitted efficiently and accurately. When the internal information environment is good, the additional information obtained from customers can reach the management more smoothly, so that the management can have more effective information when making decisions. Therefore, in firms with a good internal information environment, the additional information that manufacturing servitization obtains from customers can better help management make decisions, and the negative relationship between manufacturing servitization and cost stickiness is stronger. The regression results, as shown in Table 12, show that the effect of manufacturing servitization on cost stickiness is stronger in the better internal information environment group. Therefore, it can be concluded that manufacturing servitization is more effective in reducing managers’ optimistic expectations and alleviating the problem of cost stickiness in firms with better internal information environments.

Table 12.

Regression results of the internal information environment heterogeneity analysis.

5.2.4. Degree of Market Competition

If the enterprise is in an intensely competitive environment, the customer’s requirements for the enterprise will be placed in a more important position, and the management will take more account of all aspects of the customer’s needs, which will make the customer’s supervision of the management more important, and the self-interested behavior of the management can be effectively curbed. In order to stabilize the customers and help the long-term development of the enterprise, the management will reduce the infringement of the interests of other stakeholders under the supervision of the customers, reduce agency costs, and thus alleviate the problem of cost stickiness. In enterprises with a high degree of market competition, the management will consider customers’ opinions more for the consideration of maintaining competitive advantages, thus strengthening the effect of manufacturing servitization to reduce agency costs, and the negative relationship between manufacturing servitization and cost stickiness will be more significant. The regression results, as shown in Table 13, show that the effect of manufacturing servitization on cost stickiness is stronger in the group with a high degree of market competition. Therefore, it can be concluded that manufacturing servitization is more effective in reducing agency costs and alleviating the problem of cost stickiness in enterprises with a high degree of market competition.

Table 13.

Regression results of the heterogeneity analysis of the degree of competition in the market.

5.2.5. Manufacturing Industry Classification

According to the different intensities of the input factors, manufacturing industries are usually classified as labor-intensive, capital-intensive, and technology-intensive. These three types of manufacturing enterprises show different characteristics. Capital-intensive manufacturing enterprises are more dependent on capital, with a larger proportion of fixed assets in the enterprise, and the assets in the enterprise have a high degree of specialization and limited use; if such assets are to be adjusted, it will bring higher adjustment costs for the enterprise [61]. Therefore, compared to the other two types of manufacturing enterprises, if capital-intensive manufacturing enterprises carry out service-oriented transformation, it can more effectively play its advantage of reducing the adjustment cost and alleviate the cost stickiness problem of the enterprise. Referring to the research of Nie Fei et al., this paper classifies manufacturing enterprises into different types according to the industries in which the companies are located [62]. Labor-intensive industries include Agricultural and Food Processing Industry (C13); Food Manufacturing (C14); Alcohol, Beverage, and Refined Tea Manufacturing (C15); Textile Industry (C17); Textile clothing and apparel industry (C18); Leather, fur, feather, and its products and footwear industry (C19); Wood Processing and Wood, Bamboo, Rattan, Palm, and Grass Products Industry (C20); Furniture Manufacturing (C21); Paper and paper products industry (C22); Printing and recording media reproduction industry (C23); and Literary, Educational, Industrial, Sports, and Recreational Goods Manufacturing Industry (C24), whereas capital-intensive include Petroleum processing, coking, and nuclear fuel processing industry (C25); Chemical raw materials and chemical products manufacturing (C26); Pharmaceutical Manufacturing (C27); Chemical Fiber Manufacturing (C28); Rubber and plastic products industry (C29); Non-metallic mineral products industry (C30); Ferrous metal smelting and rolling processing industry (C31); Non-ferrous metal smelting and rolling processing industry (C32); and Metal Products (C33); and technology-intensive include General Equipment Manufacturing (C34); Specialty Equipment Manufacturing (C35); Automobile Manufacturing (C36); Railroad, Shipbuilding, Aerospace, and Other Transportation Equipment Manufacturing Industry (C37); Electrical machinery and equipment manufacturing (C38); Computer, communication, and other electronic equipment manufacturing (C39); Instrumentation Manufacturing (C40); Other manufacturing industries (C41); and Comprehensive utilization of waste resources (C42). The regression results, as shown in Table 14, show that the effect of manufacturing servitization on cost stickiness is stronger in capital-intensive enterprises. Therefore, it can be concluded that manufacturing servitization is more effective in alleviating the cost stickiness problem in capital-intensive firms.

Table 14.

Regression results of the heterogeneity analysis of manufacturing industries in which firms are located.

5.3. Distinguishing Types of Servitization

Further, according to whether the services developed by the enterprise are associated with the products and whether the degree of integration with the enterprise value chain is high or low, the manufacturing servitization can be divided into embedded servitization and hybrid servitization, which represent two different directions of the manufacturing servitization, respectively. Embedded servitization refers to the fact that the services developed by enterprises will be embedded in the enterprise value chain, associated with the core products of the enterprise, and is an extension and value-added extension of the core products of the enterprise. In contrast, hybrid servitization is not related to the enterprise’s products but is just a way for manufacturing enterprises to develop services to obtain additional income beyond the production and sale of products. For these two different types of manufacturing servitization, this paper will further explore their impact on firms’ cost stickiness.

Referring to Zhang J. et al.’s study, this paper distinguishes between two types of servitization: embedded servitization and hybrid servitization, which are categorized in Table 15 [63]. Based on this classification standard, this paper combines the revenue information disclosed in the notes with the financial statements of enterprises, labels the revenue details as embedded service and hybrid service, respectively, constructs the variable embedded servitization degree (Em_serv) as the proportion of embedded service revenue to the total revenue, and constructs the variable hybrid servitization degree (Hy_serv) as the proportion of hybrid service revenue to the total revenue.

Table 15.

Classification criteria for manufacturing servitization.

The regression results, as shown in Table 16, show that hybrid servitization has a stronger impact on firms’ cost stickiness compared to embedded servitization. This may be due to the fact that embedded servitization is a service that relies on the firm’s own products and is able to draw on the resources of the products it combines in its development, whereas, on the contrary, hybrid servitization is not related to the products that the firm originally produces and sells and therefore cannot draw on the resources or capabilities that the firm previously used in manufacturing its core products. Embedded servitization and hybrid servitization symbolize two different capabilities of a firm. Embedded servitization can be viewed as a firm’s ability to use existing resources to continually extend the value of its products, while hybrid servitization is a firm’s ability to develop new resources. Therefore, hybrid servitization requires new resource inputs from the enterprise, which, in turn, can “soften” the enterprise’s assets to a greater extent, resulting in a decrease in the enterprise’s adjustment costs and a mitigating effect on the enterprise’s cost stickiness.

Table 16.

Regression results for distinguishing between types of servitization.

5.4. Distinguishing Cost Elements

This paper further distinguishes between different cost elements, categorizing costs into material resource costs and human resource costs. According to the previous theoretical analysis, the impact of manufacturing servitization on the adjustment costs of enterprises mainly lies in the “softening” of enterprise assets. Therefore, compared to human resource costs, the impact of manufacturing servitization on material resource costs should be stronger. Referring to the study of Can Zhao et al., this paper adopts cash paid to employees minus executive compensation to measure the human resource cost of enterprises (ΔlnPay), and the material resource cost (ΔlnInvest) is the operating cost minus the human resource cost, and then replaces the explanatory variable ΔlnCost in Equation (2) with these two variables [57].

The regression results, as shown in Table 17, show that the phenomenon of cost stickiness exists in manufacturing firms in both human resource costs and material resource costs, and the effect of manufacturing servitization on the stickiness of firms’ material resource costs is stronger compared to the stickiness of human resource costs. The result implies that enterprises adjust the material resource cost of enterprises more than the human resource cost when they carry out the transformation of manufacturing servitization.

Table 17.

Regression results for differentiated cost elements.

6. Discussion

There is a lack of previous research by scholars on the correlation between manufacturing servitization and cost stickiness, and the research in this paper fills this part of the research gap. This paper complements research on the economic consequences of servitization in manufacturing while identifying another transformational strategy that affects firms’ cost stickiness. Based on the epochal background of promoting the construction of a strong manufacturing country, this paper conducts an in-depth analysis of the impact utility of manufacturing servitization transformation on enterprises and explores the impact of manufacturing servitization on cost stickiness from the perspective of cost control. Secondly, based on the three major causes of cost stickiness, namely adjustment cost, managers’ optimistic expectations, and agency cost, the impact path of manufacturing servitization on cost stickiness is further explored. Then, based on this, the paper also conducts a heterogeneity analysis, which covers five elements: firms’ internal control, financing constraints, the quality of the internal information environment, the degree of market competition, and the manufacturing industry in which the firms are located. Finally, this paper also further distinguishes the types of enterprise manufacturing servitization, as well as the cost elements to be analyzed, to obtain more complete research content.

2014 is the year that China promoted the transformation of manufacturing servitization, so this paper selects China’s A-share listed enterprises in the manufacturing industry from 2014 to 2022 as the research sample, and a total of 17,249 data are obtained, and the regression obtains the following conclusions. First, in line with the conclusions obtained by previous scholars, cost stickiness exists widely in manufacturing enterprises [18], and manufacturing servitization has a significant inhibiting effect on cost stickiness. Second, manufacturing servitization alleviates the cost stickiness problem of enterprises through three paths: reducing the adjustment cost of enterprises, lowering the optimistic expectation of managers, and suppressing the agency problem of enterprises. Third, the inhibitory effect of manufacturing servitization on cost stickiness is stronger in firms with poor levels of internal control, strong degrees of financing constraints, good quality of the internal information environment, strong degree of competition in the market, and firms in capital-intensive manufacturing industries. Fourth, when the types of servitization are differentiated, embedded servitization does not have a significant effect on firms’ cost stickiness, while hybrid servitization can have a significant negative effect on firms’ cost stickiness. Fifth, the effect of manufacturing servitization on firms’ cost stickiness mainly lies in material resource costs rather than human resource costs.

Therefore, the following recommendations are made in this paper:

First, manufacturing enterprises can alleviate their cost stickiness problem through manufacturing servitization. Since manufacturing servitization has an inhibitory effect on cost stickiness, the transformation of servitization will help manufacturing enterprises make better cost decisions, thus realizing a more benign control of costs and helping enterprises realize cost reduction and efficiency. Among them, manufacturing enterprises with poor levels of internal control, a strong degree of financing constraints, and a high degree of market competition and those in capital-intensive industries are more suitable for reducing cost stickiness through manufacturing servitization, because these enterprise characteristics will make the mitigating effect of manufacturing servitization on cost stickiness stronger.

Second, firms can strengthen the inhibitory effect of manufacturing servitization on cost stickiness by improving the quality of their internal information environment, since the impact of manufacturing servitization on cost stickiness is stronger in enterprises with good information environment quality. Therefore, enterprises should enhance their internal information environment to make information transmission more transparent and efficient, so as to amplify the effectiveness of manufacturing servitization in suppressing cost stickiness.

Third, firms can inhibit cost stickiness through hybrid servitization. According to the findings of this paper, compared to embedded servitization, hybrid servitization is more effective in suppressing cost stickiness. Therefore, when choosing the way of servitization transformation, enterprises can choose the hybrid servitization to play the effect of reducing cost stickiness.

Author Contributions

Conceptualization, M.B.; resources, M.B. and H.G.; data curation, H.G. and H.S.; writing—original draft preparation, Y.H.; writing—review and editing, H.S.; project administration, M.B.; funding acquisition, M.B. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Complex Product Service Key Technology and Public Service Platform, Science and Technology Department of Zhejiang Province grant number 2023C01213 and the APC was funded by Support for the project “Service Revenue Measurement for Manufacturing Enterprises” at the Service-oriented Manufacturing Research Institute of the Ministry of Industry and Information Technology (MIIT).

Data Availability Statement

The information about the DIB Internal Control Information Index can be found at the following weblink: http://www.ic-erm.com/pro2-6.html, accessed on 29 May 2024.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| CEO | Chief Executive Officer |

| GDP | Gross Domestic Product |

| CSMAR | China Stock Market and Accounting Research Database |

| ST | Special Treatment |

| ABJ | Anderson, Banker, and Janakiraman |

| FE | Fixed Effects |

| PSM | Propensity Score Matching |

| HHI | Herfindahl–Hirschman Index |

References

- Anderson, M.C.; Banker, R.D.; Janakiramanj, S.N. Are Selling, General, and Administrative Costs “Sticky”? J. Account. Res. 2003, 41, 47–63. [Google Scholar] [CrossRef]

- Banker, R.D.; Byzalov, D.; Chen, L. Employment protection legislation, adjustment costs and cross-country differences in cost behavior. J. Account. Econ. 2013, 55, 111–127. [Google Scholar] [CrossRef]

- Sun, Z.; Liu, H. Study on the “Sticky” Expense Behavior of Chinese Listed Companies. Econ. Res. 2004, 12, 26–34+84. [Google Scholar]

- Zhang, Z. Political Affiliation, Managerial Overconfidence and Cost Stickiness—Empirical Evidence Based on GEM Listed Companies. Financ. Econ. Ser. 2016, 10, 67–75. [Google Scholar]

- Zhang, L.; Li, J.; Zhang, H.; Wang, H. Does Managerial Competence Affect Corporate Cost Stickiness? Account. Res. 2019, 3, 71–77. [Google Scholar]

- Zhao, X.; Yang, S.Z. Executive academic experience and corporate cost stickiness. Soft Sci. 2021, 35, 35–41. [Google Scholar]

- Zhou, Y.; Zhang, Y.; Zhu, L. Executives’ overseas experience, long-term decision-making and cost stickiness. Account. Newsl. 2023, 2, 44–48. [Google Scholar]

- Yan, H.; Zhu, M. Will state-owned equity participation change the cost stickiness of enterprises. Friends Account. 2023, 13, 9–18. [Google Scholar]

- He, D.P. Equity mix, accounting surplus comparability and corporate cost stickiness. Account. Newsl. 2022, 5, 65–69. [Google Scholar]

- Wei, L.; Zhang, L.; Xu, L.W. Property Rights Nature, Supplier Relationship Closeness and Cost Stickiness—Based on the Perspective of Relational Capital. Friends Account. 2018, 15, 65–71. [Google Scholar]

- Wang, X.Y.; Gao, K.J. Customer relationship and corporate cost stickiness: Knockout or cooperation. Nankai Manag. Rev. 2017, 20, 132–142. [Google Scholar]

- Zhou, B.; Zhong, T.; Xu, H.; Ren, Z. Corporate Strategy, Managerial Expectations and Cost Stickiness—Based on Empirical Evidence from Chinese Listed Companies. Account. Res. 2016, 7, 58–65+97. [Google Scholar]

- Hsu, H.; Lu, Y.; Zhao, Y. Does financial sharing implementation affect corporate cost stickiness? Financ. Account. Newsl. 2020, 2, 33–39. [Google Scholar]

- Yue, Y.; Gu, M. Research on the impact of intelligence on cost stickiness of manufacturing enterprises. Financ. Econ. Res. 2021, 36, 91–106. [Google Scholar]

- Zhao, L.; Huang, H. Enterprise digital transformation, supply chain collaboration and cost stickiness. Contemp. Financ. Econ. 2022, 5, 124–136. [Google Scholar]

- Liu, J.; Zhao, L. An empirical study on the impact of the degree of market competition on cost stickiness—Based on the data of Shenzhen and Shanghai main board listed enterprises. Friends Account. 2015, 11, 36–41. [Google Scholar]

- Jiang, W.; Yao, W.T.; Hu, Y.M. The implementation of the Minimum Wage Regulations and the cost stickiness of enterprises. Account. Res. 2016, 10, 56–62+97. [Google Scholar]

- Zhou, M.; Liu, Z.; Gao, M.B. Empirical study on cost stickiness of manufacturing enterprises—Based on A-share data of Shanghai manufacturing industry. Friends Account. 2019, 10, 10–14. [Google Scholar]

- Chen, L.X.; Shen, H. How manufacturing servitization affects firm performance and factor structure—An empirical analysis of PSM-DID based on listed company data. Econ. Dyn. 2017, 5, 64–77. [Google Scholar]

- Neely, A. Exploring the financial consequences of the servitization of manufacturing. Oper. Manag. Res. 2009, 1, 103–118. [Google Scholar] [CrossRef]

- Johnstone, S.; Dainty, A.; Wilkinson, A. Integrating products and services through life: An aerospace experience. Int. J. Oper. Prod. Manag. 2009, 29, 520–538. [Google Scholar] [CrossRef]

- Wang, J.; Wang, W.; Liu, Y.; Wu, H. Exploring the effects of manufacturing servitization on enterprise energy conservation and emissions reduction moderated by digital transformation. Energy Econ. 2023, 122, 106760. [Google Scholar] [CrossRef]

- Jaramillo, F.; Schiantarelli, F.; Sembenelli, A. Are adjustment costs for labor aysmmetric? An econometric test on panel data for Italy. Rev. Econ. Stat. 1993, 75, 640–649. [Google Scholar] [CrossRef]

- Pfann, G.A.; Palm, F.C. Asymmetric Adjustment Costs in Non-linear Labor Demand Models for the Netherlands and U.K. Manufacturing Sectors. Rev. Econ. Stud. 1993, 60, 397–412. [Google Scholar] [CrossRef]

- Banker, R.; Ciftci, M.; Mashruwala, R. Managerial Optimism and Cost Behavior. Soc. Sci. Electron. Publ. 2011. [Google Scholar]

- Kim, S.Y. A Study on the Effects of managerial Optimism on the Cost Behavior. Korean Int. Account. Rev. 2013, 51, 193–212. [Google Scholar]

- Li, L.; Zhao, X. Research on the effect of optimistic expectations of corporate executives on expense stickiness. J. Beijing Inst. Technol. Soc. Sci. Ed. 2013, 15, 64–69+76. [Google Scholar]

- Chen, C.; Sougiannis, T.; Lu, H. The Agency Problem, Corporate Governance, and the Asymmetrical Behavior of Selling, General, and Administrative Costs. Contemp. Account. Res. 2012, 29, 252–282. [Google Scholar] [CrossRef]

- Xie, Y.B.; Hui, L. Agency Problems, Corporate Governance and Firms’ Cost Stickiness-Empirical Evidence from China’s Manufacturing Firms. Manag. Rev. 2014, 26, 142–159. [Google Scholar]

- Jiang, W.; Yao, W. Ownership nature, executive tenure and corporate cost stickiness. J. Shanxi Univ. Financ. Econ. 2015, 37, 45–56. [Google Scholar]

- Zhang, P.; Wang, X. Research on the influencing factors of cost stickiness under the perspective of principal-agent. Friends Account. 2016, 16, 33–37. [Google Scholar]

- Weidenmier, M.L.; Subramaniam, C. Additional Evidence on the Sticky Behavior of Costs. Soc. Sci. Electron. Publ. 2003. [Google Scholar] [CrossRef]

- Kong, Y.; Zhu, N.; Kong, Q. Cost stickiness study: Empirical evidence from Chinese listed companies. Account. Res. 2007, 11, 58–65+96. [Google Scholar]

- Zhang, T.; Song, Q. Research on cost stickiness of China’s science and technology-based listed companies—Analysis from the perspective of asset structure. Transp. Financ. Account. 2017, 5, 35–40. [Google Scholar]

- Sun, L.; Li, G.; Jiang, Z.; Zheng, L.; He, Z. Service-oriented manufacturing as an advanced manufacturing model in the 21st century. China Mech. Eng. 2007, 19, 2307–2312. [Google Scholar]

- Oliva, R.; Kallenberg, R. Managing the transition from products to services. Int. J. Serv. Ind. Manag. 2003, 14, 160–172. [Google Scholar] [CrossRef]

- Liu, X.; Hou, J. Value Creation and Resource Allocation Effect of Manufacturing Servitization. Jianghan Forum 2023, 10, 22–29. [Google Scholar]

- Golara, S.; Dooley, K. The Influence of Manufacturing Services on Innovation. Acad. Manag. Annu. Meet. Proc. 2016, 1, 17418. [Google Scholar] [CrossRef]

- Lv, Y.; Chen, Y.; Hua, Y. Manufacturing servitization and corporate emission reduction. Econ. Rev. 2023, 2, 139–155. [Google Scholar]

- Sjödin, D.; Parida, V.; Kohtamäki, M. Relational governance strategies for advanced service provision: Multiple paths to superior financial performance in servitization. J. Bus. Res. 2019, 101, 906–915. [Google Scholar] [CrossRef]

- Lin, Z.; Qiu, Y. Supplier-customer relationship and agency cost. J. Beijing Technol. Bus. Univ. Soc. Sci. Ed. 2020, 35, 28–41+55. [Google Scholar]

- Li, H.; Sun, J.; An, N. ERP system implementation and corporate cost stickiness. Account. Res. 2020, 11, 47–59. [Google Scholar]

- Luo, H.; Huang, W.; Wang, Z. Trade policy uncertainty and corporate cost stickiness. Account. Res. 2023, 2, 149–162. [Google Scholar]

- Pan, R.; Luo, J.; Yang, Z. Servitization, front- and back-office digitization and firm performance in manufacturing firms. J. Syst. Manag. 2022, 31, 988–999. [Google Scholar]

- Weng, Z.; Wang, H.; Wang, P. Research on the Impact of Service Expansion on Firm Value. Financ. Trade Econ. 2010, 2, 117–123+137. [Google Scholar]

- Chen, C.; Jia, C. A study on the relationship between the degree of servitization and enterprise performance in manufacturing industry. Soc. Sci. Front. 2021, 10, 252–257. [Google Scholar]

- Xiao, T. Examination of the synergistic effect of manufacturing enterprises’ servitization business model and product innovation investment—An explanation of the “servitization paradox”. Manag. Rev. 2019, 31, 274–285. [Google Scholar]

- Huang, Y.; Xie, J. Manufacturing Input Servitization and Carbon Emission Intensity—An Empirical Analysis Based on WIOD Cross-Country Panel. Financ. Trade Econ. 2019, 40, 100–115. [Google Scholar]

- Qian, X.; Wang, S.; He, J. Servicification of Manufacturing and China’s Exports—Entering the Era of Service Dividend. Res. Financ. Issues 2020, 5, 111–120. [Google Scholar]

- Li, F. Manufacturing input servitization and enterprise innovation. Res. Manag. 2020, 41, 61–69. [Google Scholar]

- Yang, R.; Zheng, Y. Impacts of manufacturing servitization on energy efficiency: Moderate range and breakthrough path. Bus. Res. 2023, 3, 39–48. [Google Scholar]

- Chen, L. Manufacturing servitization, staffing composition and wage gap—An empirical analysis of PSM-DID based on data of listed manufacturing companies. J. Nanjing Univ. Financ. Econ. 2022, 6, 29–39. [Google Scholar]

- Zhang, B.; Yang, L.; Tao, T. Population aging and labor cost stickiness. Account. Res. 2022, 1, 59–69. [Google Scholar]

- Zhao, C. Digital Development and Service-oriented Transformation-Empirical Evidence from Listed Manufacturing Companies. Nankai Manag. Rev. 2021, 24, 149–163. [Google Scholar]

- Williamson, O.E. Economic Institutions of Capitalism; The Commercial Press: Beijing, China, 2020; pp. 58–144. [Google Scholar]

- Xu, H.; Gao, Y. Green technology innovation and corporate cost stickiness. Account. Newsl. 2023, 16, 29–34. [Google Scholar]

- Zhao, C.; Cao, W.; Yao, Z.; Wang, Z. Is “Internet Plus” conducive to reducing cost stickiness of enterprises? Financ. Res. 2020, 46, 33–47. [Google Scholar]

- Kim, J.B.; Lee, J.J.; Park, J.C. Internal Control Weakness and the Asymmetrical Behavior of Selling, General, and Administrative Costs. Electron. Publ. 2016. [Google Scholar]

- Jiang, W.; Hu, Y.; Zeng, Y. Financing constraints and firms’ cost stickiness—Empirical evidence based on industrial firms in China. Financ. Res. 2015, 10, 133–147. [Google Scholar]

- Dorantes, C.A.; Li, C.; Peters, G.F.; Richardson, J. The Effect of Enterprise Systems Implementation on the Firm Information Environment. Contemp. Account. Res. 2013, 30, 1427–1461. [Google Scholar] [CrossRef]

- Li, W.; Wang, F. Intelligent Transformation, Cost Stickiness and Firm Performance—An Empirical Test Based on Traditional Manufacturing Firms. Sci. Res. 2022, 40, 91–102. [Google Scholar]

- Nie, F.; Li, J.; Mao, H. Can servitization of manufacturing firms inhibit financialization? Econ. Rev. 2021, 6, 3–18. [Google Scholar]

- Zhang, J.; Sun, X.; Yuan, F.; Liu, X. Which type of servitization promotes firm performance: Embedded or hybrid? Econ. Model. 2023, 126, 106396. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).