Digitalization as a Factor of Production in China and the Impact on Total Factor Productivity (TFP)

Abstract

1. Introduction

2. Literature Review

2.1. Digitalization as an Input in Production Systems

2.2. The Measurement of Digitalization

2.3. The Socioeconomic Dividends of Digitalization

3. Methodology

3.1. Stochastic Frontier Analysis (SFA) with Transcendental Logarithmic Production Function Model

3.2. Calculation of Elasticity

3.3. Decomposition of TFP Change (TFPC)

- (1)

- Technological Efficiency Change (TEC)

- (2)

- Technological Change (TC)

- (3)

- scale efficiency change (SEC)

4. Data Source and Variable Selection

4.1. Data Source

4.2. Variable Selection

4.3. Descriptive Statistics of the Data

4.3.1. Descriptive Statistics of Input-Output Variables

4.3.2. Comparison of Input-Output Elements between 2011 and 2019

5. Estimation of Parameters and Elasticity

5.1. Results of the SFA

5.2. Elasticity of Factors

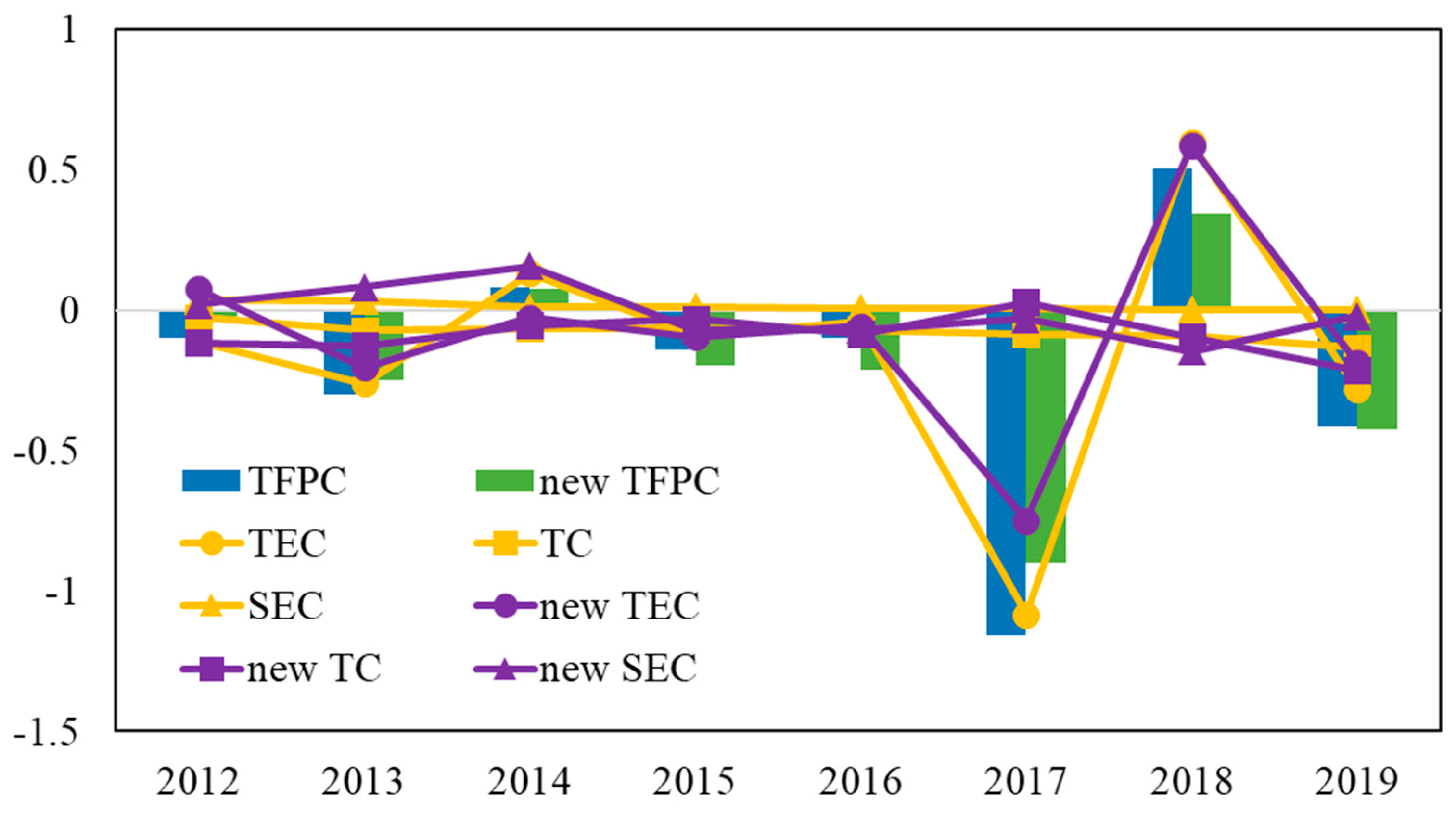

6. Decomposition of TFPC and Comparative Analysis

6.1. TFPC and Decomposition

6.2. Comparison with TFPC without Digitalization

7. Conclusions and Implications

- The study identified a U-shaped trajectory in the impact of digitalization on economic growth. Initially, the integration of digital technologies might lead to productivity setbacks due to adaptation challenges and investment costs. However, over time, as firms adjust and synergies begin to materialize, digitalization significantly enhances productivity, resulting in long-term economic benefits. This U-shaped impact underscores the transformative role of digitalization in reshaping economic outputs.

- This analysis reveals the complex interplay of substitution and complementarity among digitalization, labor, and capital within the production function. Digitalization not only substitutes for labor and capital in certain cases but also exhibits dependency on both. These relationships underscore that digitalization is no longer just an adjunct to traditional production factors; rather, it highlights its role as a production factor in its own right, dynamically interacting with other factors in both complementary and substitutive manners.

- By recalculating total factor productivity (TFP) to include digitalization, the study demonstrated that TFP assessments that fail to consider digital inputs underestimate economic outputs. The comparison between TFP calculations with and without digitalization inputs revealed that ignoring digital inputs could lead to a significant underestimation of productivity levels and potential economic growth.

- Policymakers and business leaders should anticipate initial productivity dips following digital investments. Supportive measures, such as training programs for workforce adaptation and phased implementation strategies, can mitigate these early stage challenges. Recognizing the long-term benefits, continued investments in digital infrastructure and technologies are crucial, even if immediate gains appear modest.

- The dual substitutive and complementary roles of digitalization necessitate a balanced approach in policy and business strategy formulation. Firms should leverage digital technologies to optimize labor and capital use, potentially reducing costs and enhancing output quality. Economic policies should facilitate this integration by supporting digital skills development and encouraging R&D in digital technologies.

- Economic analysts and policymakers should include digital inputs in productivity analyses to avoid underestimations of economic potential. The significant difference in TFP with and without digital inputs underscores the need for modernizing existing economic models to reflect the reality of digital impacts. This includes revising economic indicators and growth forecasts to integrate digitalization’s effects accurately.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Brennen, J.S.; Kreiss, D. Digitalization. In The International Encyclopedia of Communication Theory and Philosophy; Wiley: Hoboken, NJ, USA, 2016; pp. 1–11. [Google Scholar]

- Zaki, M. Digital transformation: Harnessing digital technologies for the next generation of services. J. Serv. Mark. 2019, 33, 429–435. [Google Scholar] [CrossRef]

- Jin, X.; Wah, B.W.; Cheng, X.; Wang, Y. Significance and Challenges of Big Data Research. Big Data Res. 2015, 2, 59–64. [Google Scholar] [CrossRef]

- Crary, J. Scorched Earth: Beyond the Digital Age to a Post-Capitalist World; Verso Books: London, UK, 2022. [Google Scholar]

- Fromhold-Eisebith, M.; Marschall, P.; Peters, R.; Thomes, P. Torn between digitized future and context dependent past—How implementing ‘Industry 4.0’production technologies could transform the German textile industry. Technol. Forecast. Soc. Chang. 2021, 166, 120620. [Google Scholar] [CrossRef]

- Attaran, M. The impact of 5G on the evolution of intelligent automation and industry digitization. J. Ambient. Intell. Humaniz. Comput. 2023, 14, 5977–5993. [Google Scholar] [CrossRef] [PubMed]

- Loebbecke, C.; Picot, A. Reflections on societal and business model transformation arising from digitization and big data analytics: A research agenda. J. Strat. Inf. Syst. 2015, 24, 149–157. [Google Scholar] [CrossRef]

- Bergmann, M.; Brück, C.; Knauer, T.; Schwering, A. Digitization of the budgeting process: Determinants of the use of business analytics and its effect on satisfaction with the budgeting process. J. Manag. Control 2020, 31, 25–54. [Google Scholar] [CrossRef]

- Nikmehr, B.; Hosseini, M.R.; Martek, I.; Zavadskas, E.K.; Antucheviciene, J. Digitalization as a Strategic Means of Achieving Sustainable Efficiencies in Construction Management: A Critical Review. Sustainability 2021, 13, 5040. [Google Scholar] [CrossRef]

- Xu, X. Research prospect: Data factor of production. J. Internet Digit. Econ. 2021, 1, 64–71. [Google Scholar] [CrossRef]

- Humby, C. Data is the new oil. In Proceedings of the ANA Senior Marketer’s Summit, Evanston, IL, USA, 3 November 2006; Volume 1. [Google Scholar]

- Luo, S.; Yimamu, N.; Li, Y.; Wu, H.; Irfan, M.; Hao, Y. Digitalization and sustainable development: How could digital economy development improve green innovation in China? Bus. Strat. Environ. 2023, 32, 1847–1871. [Google Scholar] [CrossRef]

- Chaisse, J. ‘The Black Pit:’Power and Pitfalls of Digital FDI and Cross-Border Data Flows. World Trade Rev. 2023, 22, 73–89. [Google Scholar] [CrossRef]

- Pan, W.; Xie, T.; Wang, Z.; Ma, L. Digital economy: An innovation driver for total factor productivity. J. Bus. Res. 2022, 139, 303–311. [Google Scholar] [CrossRef]

- Papadopoulos, T.; Singh, S.P.; Spanaki, K.; Gunasekaran, A.; Dubey, R. Towards the next generation of manu-facturing: Implications of big data and digitalization in the context of industry 4.0. Prod. Plan. Control 2022, 33, 101–104. [Google Scholar] [CrossRef]

- Parviainen, P.; Tihinen, M.; Kääriäinen, J.; Teppola, S. Tackling the digitalization challenge: How to benefit from digitalization in practice. Int. J. Inf. Syst. Proj. Manag. 2017, 5, 63–77. [Google Scholar] [CrossRef]

- Dicuonzo, G.; Galeone, G.; Zappimbulso, E.; Del’Atti, V. Risk management 4.0: The role of big data analytics in the bank sector. Int. J. Econ. Financ. Issues 2019, 9, 40–47. [Google Scholar] [CrossRef]

- Kamble, S.S.; Gunasekaran, A. Big data-driven supply chain performance measurement system: A review and framework for implementation. Int. J. Prod. Res. 2020, 58, 65–86. [Google Scholar] [CrossRef]

- Sheng, J.; Amankwah-Amoah, J.; Khan, Z.; Wang, X. COVID-19 Pandemic in the New Era of Big Data Analytics: Methodological Innovations and Future Research Directions. Br. J. Manag. 2021, 32, 1164–1183. [Google Scholar] [CrossRef]

- Cappa, F.; Oriani, R.; Peruffo, E.; McCarthy, I. Big data for creating and capturing value in the digitalized envi-ronment: Unpacking the effects of volume, variety, and veracity on firm performance. J. Prod. Innov. Manag. 2021, 38, 49–67. [Google Scholar] [CrossRef]

- Monino, J.L. Data value, big data analytics, and decision-making. J. Knowl. Econ. 2021, 12, 256–267. [Google Scholar] [CrossRef]

- Habibi, F.; Zabardast, M.A. Digitalization, education and economic growth: A comparative analysis of Middle East and OECD countries. Technol. Soc. 2020, 63, 101370. [Google Scholar] [CrossRef]

- Lee, C.-C.; He, Z.-W.; Yuan, Z. A pathway to sustainable development: Digitization and green productivity. Energy Econ. 2023, 124, 106772. [Google Scholar] [CrossRef]

- Supriya, M.; Deepa, A. Machine learning approach on healthcare big data: A review. Big Data Inf. Anal. 2020, 5, 58–75. [Google Scholar] [CrossRef]

- Chen, C.; Wang, S.; Yao, S.; Lin, Y. Does digital transformation increase the labor income share? From a perspective of resources reallocation. Econ. Model. 2023, 128, 106474. [Google Scholar] [CrossRef]

- Acharya, R.C. ICT use and total factor productivity growth: Intangible capital or productive externalities? Oxf. Econ. Pap. 2016, 68, 16–39. [Google Scholar] [CrossRef]

- Crespi, G.; Zuniga, P. Innovation and Productivity: Evidence from Six Latin American Countries. World Dev. 2012, 40, 273–290. [Google Scholar] [CrossRef]

- Edeh, J.N.; Acedo, F.J. External supports, innovation efforts and productivity: Estimation of a CDM model for small firms in developing countries. Technol. Forecast. Soc. Chang. 2021, 173, 121189. [Google Scholar] [CrossRef]

- Gaglio, C.; Kraemer-Mbula, E.; Lorenz, E. The effects of digital transformation on innovation and productivity: Firm-level evidence of South African manufacturing micro and small enterprises. Technol. Forecast. Soc. Chang. 2022, 182, 121785. [Google Scholar] [CrossRef]

- Crépon, B.; Duguet, E.; Mairesse, J. Research, innovation and productivity: An econometric analysis at the firm level. Econ. Innov. New Technol. 1998, 7, 115–158. [Google Scholar] [CrossRef]

- Wang, M.; Zhu, C.; Wang, X.; Ntim, V.S.; Liu, X. Effect of information and communication technology and electricity consumption on green total factor productivity. Appl. Energy 2023, 347, 121366. [Google Scholar] [CrossRef]

- Gërguri-Rashiti, S.; Ramadani, V.; Abazi-Alili, H.; Dana, L.; Ratten, V. ICT, Innovation and Firm Performance: The Transition Economies Context. Thunderbird Int. Bus. Rev. 2017, 59, 93–102. [Google Scholar] [CrossRef]

- Chedrawi, C.; Harb, B.; Saleh, M. The E-banking and the adoption of innovations from the perspective of the transactions cost theory: Case of the largest commercial banks in Lebanon. In ICT for a Better Life and a Better World: The Impact of Information and Communication Technologies on Organizations and Society; Springer: Berlin/Heidelberg, Germany, 2019; pp. 149–164. [Google Scholar]

- Nakatani, R. Total factor productivity enablers in the ICT industry: A cross-country firm-level analysis. Telecommun. Policy 2021, 45, 102188. [Google Scholar] [CrossRef]

- Le, T.D.Q.; Ngo, T.; Ho, T.H.; Nguyen, D.T. ICT as a Key Determinant of Efficiency: A Bootstrap-Censored Quantile Regression (BCQR) Analysis for Vietnamese Banks. Int. J. Financ. Stud. 2022, 10, 44. [Google Scholar] [CrossRef]

- Kiiski, S.; Pohjola, M. Cross-country diffusion of the Internet. Inf. Econ. Policy 2002, 14, 297–310. [Google Scholar] [CrossRef]

- Kotarba, M. Measuring digitalization–key metrics. Found. Manag. 2017, 9, 123–138. [Google Scholar] [CrossRef]

- Ragnedda, M.; Ruiu, M.L.; Addeo, F. Measuring Digital Capital: An empirical investigation. New Media Soc. 2020, 22, 793–816. [Google Scholar] [CrossRef]

- Russo, V. Digital Economy and Society Index (DESI). European guidelines and empirical applications on the territory. In Qualitative and Quantitative Models in Socio-Economic Systems and Social Work; Springer: Berlin/Heidelberg, Germany, 2020; pp. 427–442. [Google Scholar]

- Pratipatti, S.; Gomaa, A. A Longitudinal Analysis of the Impact of the Indicators in the Networked Readiness Index (NRI). J. Int. Technol. Inf. Manag. 2019, 28, 17–50. [Google Scholar] [CrossRef]

- Mengova, E.; Green, D. The Role of Innovation and Technology in Renewable Energy. Int. J. Environ. Sustain. 2023, 19, 17. [Google Scholar] [CrossRef]

- Li, F. Sustainable Competitive Advantages via Temporary Advantages: Insights from the Competition between American and Chinese Digital Platforms in China. Br. J. Manag. 2022, 33, 2009–2032. [Google Scholar] [CrossRef]

- Li, J.; Wu, Y.; Xiao, J.J. The impact of digital finance on household consumption: Evidence from China. Econ. Model. 2020, 86, 317–326. [Google Scholar] [CrossRef]

- Chen, S.; Zhang, H. Does digital finance promote manufacturing servitization: Micro evidence from China. Int. Rev. Econ. Financ. 2021, 76, 856–869. [Google Scholar] [CrossRef]

- Yan, B.; Wang, F.; Chen, T.; Liu, S.; Bai, X. Digital finance, environmental regulation and emission reduction in manufacturing industry: New evidence incorporating dynamic spatial-temporal correlation and competition. Int. Rev. Econ. Financ. 2023, 83, 750–763. [Google Scholar] [CrossRef]

- Aleksandrova, A.; Truntsevsky, Y.; Polutova, M. Digitalization and its impact on economic growth. Braz. J. Politi. Econ. 2022, 42, 424–441. [Google Scholar] [CrossRef]

- Bouwman, H.; Nikou, S.; Molina-Castillo, F.J.; De Reuver, M. The impact of digitalization on business models. Digit. Policy Regul. Gov. 2018, 20, 105–124. [Google Scholar] [CrossRef]

- Wu, H.; Hao, Y.; Geng, C.; Sun, W.; Zhou, Y.; Lu, F. Ways to improve cross-regional resource allocation: Does the development of digitalization matter? J. Econ. Anal. 2023, 2, 1–30. [Google Scholar] [CrossRef]

- Bührer, C.; Hagist, C. The effect of digitalization on the labor market. In The Palgrave Handbook of Managing Con-Tinuous Business Transformation; Springer: Berlin/Heidelberg, Germany, 2017; pp. 115–137. [Google Scholar]

- Schislyaeva, E.R.; Saychenko, O.A. Labor Market Soft Skills in the Context of Digitalization of the Economy. Soc. Sci. 2022, 11, 91. [Google Scholar] [CrossRef]

- Glocker, C.; Piribauer, P. Digitalization, retail trade and monetary policy. J. Int. Money Financ. 2021, 112, 102340. [Google Scholar] [CrossRef]

- Seoane, M.F.V. Alibaba’s discourse for the digital Silk Road: The electronic World Trade Platform and ‘inclusive globalization’. In China’s Globalizing Internet; Routledge: London, UK, 2022; pp. 67–82. [Google Scholar]

- Feng, S.; Chong, Y.; Yang, Y.; Hao, X. Digitization and total factor productivity: Evidence from China. In The Singapore Economic Review; World Scientific Publishing: Singapore, 2022; pp. 1–33. [Google Scholar] [CrossRef]

- Li, S.; Tian, Y. How Does Digital Transformation Affect Total Factor Productivity: Firm-Level Evidence from China. Sustainability 2023, 15, 9575. [Google Scholar] [CrossRef]

- Li, G.; Liao, F. Input digitalization and green total factor productivity under the constraint of carbon emissions. J. Clean. Prod. 2022, 377, 134403. [Google Scholar] [CrossRef]

- Aigner, D.; Lovell, C.A.K.; Schmidt, P. Formulation and estimation of stochastic frontier production function models. J. Econom. 1977, 6, 21–37. [Google Scholar] [CrossRef]

- Kumbhakar, S.C.; Horncastle, A.P. A Practitioner’s Guide to Stochastic Frontier Analysis Using Stata; Cambridge University Press: Cambridge, UK, 2015. [Google Scholar]

- Kumbhakar, S.C.; Denny, M.; Fuss, M. Estimation and decomposition of productivity change when production is not efficient: A paneldata approach. Econ. Rev. 2000, 19, 312–320. [Google Scholar] [CrossRef]

- Zhang, J. Estimation of China’s provincial capital stock (1952–2004) with applications. J. Chin. Econ. Bus. Stud. 2008, 6, 177–196. [Google Scholar] [CrossRef]

- Tian, X.; Yu, X. The Enigmas of TFP in China: A meta-analysis. China Econ. Rev. 2012, 23, 396–414. [Google Scholar] [CrossRef]

- Xiang, X.; Yang, G.; Sun, H. The Impact of the Digital Economy on Low-Carbon, Inclusive Growth: Promoting or Restraining. Sustainability 2022, 14, 7187. [Google Scholar] [CrossRef]

- Wach, K.; Maciejewski, M.; Głodowska, A. U-shaped relationship in international entrepreneurship: Entrepreneurial orientation and innovation as drivers of internationalisation of firms. Technol. Econ. Dev. Econ. 2022, 28, 1044–1067. [Google Scholar] [CrossRef]

- Xia, F.; Xu, J. Green total factor productivity: A re-examination of quality of growth for provinces in China. China Econ. Rev. 2020, 62, 101454. [Google Scholar] [CrossRef]

- Chen, X.; Liu, X.; Zhu, Q. Comparative analysis of total factor productivity in China’s high-tech industries. Technol. Forecast. Soc. Chang. 2022, 175, 121332. [Google Scholar] [CrossRef]

- Ren, X.; Liu, Z.; Jin, C.; Lin, R. Oil price uncertainty and enterprise total factor productivity: Evidence from China. Int. Rev. Econ. Financ. 2023, 83, 201–218. [Google Scholar] [CrossRef]

| Primary Dimension | Secondary Dimension | Specific Indicators |

|---|---|---|

| Breadth of coverage | Account coverage | Number of Alipay accounts per 10,000 people |

| Percentage of Alipay-tied card users | ||

| Average number of bank cards tied to each Alipay account | ||

| Depth of use | Payment business | Number of payments per capita |

| Amount paid per capita | ||

| The number of active users with a high amount (50 or more annual activities) as a percentage of annual activities 1 or more times | ||

| Credit business to individual users | Number of Internet consumer loans per 10,000 adult Alipay users | |

| Number of loans per capita | ||

| Loan amount per capita | ||

| Credit business for micro and small operators | Number of Internet micro and small business loans per million adult Alipay users | |

| Average number of loans per household for micro and small operators | ||

| Average loan amount for small and micro operators | ||

| Insurance business | Number of insured users per 10,000 Alipay users | |

| Number of insurance strokes per capita | ||

| Amount of insurance per capita | ||

| Investment business | Number of Alipay users per 10,000 people involved in Internet investment and wealth management | |

| Number of investments per capita | ||

| Investment amount per capita | ||

| Credit business | Number of people using credit-based lifestyle services (including finance, accommodation, travel, social, etc.) per 10,000 Alipay users | |

| Number of calls per capita for natural person credit | ||

| Degree of digital support services | Convenience | Percentage of mobile payment transactions |

| Percentage of mobile payment amount | ||

| Financial services costs | Average loan interest rate for small and micro operators | |

| Average personal loan interest rate |

| Mean | Std.Dev | Min | Max | |

|---|---|---|---|---|

| GDP | 2414.766 | 3502.174 | 34.953 | 38,156.010 |

| D | 165.261 | 65.429 | 17.020 | 321.646 |

| L | 60.104 | 90.076 | 5.691 | 986.872 |

| K | 6092.681 | 6867.597 | 289.685 | 72,423.381 |

| lngdp | 7.280 | 0.972 | 3.554 | 10.549 |

| lnD | 5.003 | 0.513 | 2.834 | 5.774 |

| lnL | 3.647 | 0.849 | 1.739 | 6.895 |

| lnK | 8.301 | 0.887 | 5.669 | 11.190 |

| lngdp | lnD | lnL | lnK | |

|---|---|---|---|---|

| lngdp | 1 | |||

| lnd | 0.548 | 1 | ||

| lnl | 0.872 | 0.209 | 1 | |

| lnk | 0.793 | 0.389 | 0.266 | 1 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| lnD | −1.382 * | 4.847 *** | 3.041 *** | |

| (0.661) | (0.450) | (0.491) | ||

| lnL | 0.602 | 0.470 | -0.791 * | 0.065 |

| (0.371) | (0.259) | (0.376) | (0.214) | |

| lnK | 0.876 * | 0.687 | 1.399 ** | 0.500 |

| (0.442) | (0.364) | (0.458) | (0.265) | |

| t | 2.161 *** | −0.191 *** | 0.0875 | |

| (0.227) | (0.055) | (0.165) | ||

| t2 | 0.122 *** | 0.029 *** | 0.0371 *** | |

| (0.010) | (0.003) | (0.006) | ||

| lnD2 | 0.273 ** | −0.540 *** | −0.389 *** | |

| (0.090) | (0.064) | (0.066) | ||

| lnL2 | −0.031 | −0.018 | −0.055 | −0.021 |

| (0.028) | (0.025) | (0.029) | (0.023) | |

| lnK2 | −0.019 | −0.017 | −0.0204 | 0.007 |

| (0.031) | (0.031) | (0.033) | (0.027) | |

| lnD*lnL | −0.081 | 0.537 *** | 0.280 *** | |

| (0.138) | (0.135) | (0.073) | ||

| lnD*lnK | −0.075 | −0.420 ** | −0.045 | |

| (0.129) | (0.132) | (0.080) | ||

| lnK*lnL | 0.061 | 0.044 | 0.152 | −0.007 |

| (0.097) | (0.094) | (0.104) | (0.083) | |

| lnD*t | −0.544 *** | −0.0271 | ||

| (0.049) | ||||

| lnL*t | 0.027 | 0.014 | −0.042 ** | |

| (0.014) | (0.007) | (0.013) | ||

| lnK*t | 0.0221 (0.014) | −0.004 | 0.051 *** | |

| (0.009) | (0.015) | |||

| _cons | 2.992 | 2.598 | −7.668 *** | 1.418 |

| (1.861) | (11.341) | (1.693) | (3.926) | |

| μ | 2.446 *** | 1.589 | 2.008 *** | 6.809 |

| (0.458) | (11.566) | (0.352) | (3.571) | |

| η | −0.060 *** | −0.003 | −0.027 *** | −0.024 ** |

| (0.008) | (0.010) | (0.007) | (0.009) | |

| σ2 | 0.320 *** | 0.187 ** | 0.258 * | 0.209 ** |

| (0.034) | (0.010) | (0.226) | (0.012) | |

| γ | 0.700 *** | 0.396 * | 0.596 ** | 0.486 ** |

| (0.035) | (0.034) | (0.039) | (0.039) | |

| σ2u | 0.224 *** | 0.074 *** | 0.154 ** | 0.101 ** |

| (0.035) | (0.010) | (0.023) | (0.015) | |

| σ2v | 0.096 *** | 0.113 *** | 0.104 *** | 0.107 *** |

| (0.003) | (0.003) | (0.003) | (0.003) | |

| Breusch–Pagan/Cook–Weisberg test for heteroskedasticity | ||||

| chi2 | 0.371 | 4.120 | 0.611 | 6.852 |

| Prob > chi2 | 0.541 | 0.042 | 0.436 | 0.009 |

| Year | Input Elasticity | Elasticity of Substitution | ||||

|---|---|---|---|---|---|---|

| Digitalization | Labor | Capital | Digitalization and Labor | Digitalization and Capital | Labor and Capital | |

| 2011 | 0.4301 | 0.5678 | 0.4104 | 0.1399 | 1.2987 | 0.1779 |

| 2012 | 0.5646 | 0.5454 | 0.4518 | −0.4762 | 1.6381 | 0.0299 |

| 2013 | 0.6290 | 0.5722 | 0.4342 | −2.4564 | 0.9826 | 0.1546 |

| 2014 | 0.6522 | 0.5882 | 0.4234 | 0.8302 | 1.0550 | 0.1922 |

| 2015 | 0.6887 | 0.5995 | 0.4199 | −1.1001 | 1.2114 | 0.2099 |

| 2016 | 0.7128 | 0.6151 | 0.4120 | −0.6615 | 1.0561 | 0.2552 |

| 2017 | 0.7334 | 0.6385 | 0.3983 | 3.0075 | 0.5801 | 0.3065 |

| 2018 | 0.7342 | 0.6700 | 0.3755 | −0.0552 | 1.1150 | 0.3846 |

| 2019 | 0.7322 | 0.7095 | 0.3451 | −0.9825 | 1.2260 | 0.4675 |

| mean | 0.6530 | 0.6118 | 0.4079 | −0.1949 | 1.1292 | 0.2420 |

| Year | TFPC | TEC | TC | SEC |

|---|---|---|---|---|

| 2011 | - | - | - | - |

| 2012 | −0.0993 | −0.1112 | −0.0258 | 0.0377 |

| 2013 | −0.2981 | −0.2603 | −0.0709 | 0.0331 |

| 2014 | 0.0799 | 0.1333 | −0.0641 | 0.0107 |

| 2015 | −0.1388 | −0.0889 | −0.0636 | 0.0137 |

| 2016 | −0.1013 | −0.0398 | −0.0703 | 0.0088 |

| 2017 | −3.1595 | −3.0825 | −0.0858 | 0.0088 |

| 2018 | 0.5074 | 0.5972 | −0.0918 | 0.0020 |

| 2019 | −0.4120 | −0.2816 | −0.1337 | 0.0033 |

| mean | −0.4527 | −0.3917 | −0.0757 | 0.0148 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, P.; Liu, J.; Lu, X.; Xie, Y.; Wang, Z. Digitalization as a Factor of Production in China and the Impact on Total Factor Productivity (TFP). Systems 2024, 12, 164. https://doi.org/10.3390/systems12050164

Li P, Liu J, Lu X, Xie Y, Wang Z. Digitalization as a Factor of Production in China and the Impact on Total Factor Productivity (TFP). Systems. 2024; 12(5):164. https://doi.org/10.3390/systems12050164

Chicago/Turabian StyleLi, Pei, Jinyi Liu, Xiangyi Lu, Yao Xie, and Ziguo Wang. 2024. "Digitalization as a Factor of Production in China and the Impact on Total Factor Productivity (TFP)" Systems 12, no. 5: 164. https://doi.org/10.3390/systems12050164

APA StyleLi, P., Liu, J., Lu, X., Xie, Y., & Wang, Z. (2024). Digitalization as a Factor of Production in China and the Impact on Total Factor Productivity (TFP). Systems, 12(5), 164. https://doi.org/10.3390/systems12050164