Abstract

This paper investigates how historical inter-firm syndication networks influence venture capitalists’ (VCs) propensity to invest in startups pursuing novel, uncertain technologies, with a focus on artificial intelligence (AI). We theorize that VCs’ positional attributes within cumulative syndication networks determine their access to external expertise and intelligence that aid AI investment decisions amidst informational opacity. Specifically, reachability to prior AI investors provides referrals and insights transmitted across short network paths to reduce ambiguity. Additionally, VC brokerage between disconnected industry clusters furnishes expansive, non-redundant information that is pivotal for discovering and assessing AI opportunities. Through hypotheses grounded in social network theory, we posit network-based mechanisms that equip VCs to navigate uncertainty when engaging with ambiguous innovations like AI. We test our framework, utilizing comprehensive historical records of global venture capital investments. Analyzing the location information of VC firms in this database, we uncovered a history of 14,751 investments made by Korean and Japanese firms. Using these data, we assembled an imbalanced panel dataset from 1984 to 2022 spanning 230 Korean and 413 Japanese VCs, with 4508 firm-year observations. Negative binomial regression analysis of this dataset reveals how historical relational patterns among venture capital firms foster readiness to evaluate unfamiliar innovations.

1. Introduction

Venture capitalists (VCs) are influential financial intermediaries who provide critical early-stage capital to promising startup companies, enabling the commercialization and diffusion of innovations [1,2]. Their investments in fledgling ventures, amidst pronounced risks and uncertainties, play a seminal role in transforming novel technologies and business ideas into realities [3,4]. However, VCs face an enduring predicament stemming from the inherent information asymmetries shrouding entrepreneurial startups [5]. Despite the due diligence processes of screening, evaluating, and selecting promising startups, VCs often lack insights into the startups’ businesses, such as their operations, managerial capabilities, and market potential [6]. Navigating the informational challenges is even more crucial when assessing startups pursuing highly novel, unproven technologies where uncertainty abounds [7,8,9].

A prime example is artificial intelligence (AI), which has undergone multiple cycles of hype and disillusionment over the decades [10]. While recent breakthroughs in machine learning and neural networks have catalyzed its growing mainstream adoption, AI-focused startups still exhibit technological uncertainty [11], market unpredictability [12,13,14], and regulatory ambiguity [15]. AI’s opaqueness exacerbates the dilemmas confronting VCs as they attempt to decipher which startups legitimately merit investment amidst inflated claims. The escalating significance of AI, coupled with persisting uncertainties surrounding AI-related startups, underscores the necessity of scrutinizing the mechanisms that enable certain VCs to more effectively navigate the complexity of the AI landscape.

Our research employs social network theory to explore how VCs’ embeddedness within syndication networks influences their propensity to finance AI startups. In discussing how VCs navigate informational challenges, the existing literature has examined various types and sources of information used to evaluate startups’ quality [16,17] or highlighted the facilitative role of geographic clusters for accessing such information [18,19]. The social network perspective has introduced a new dimension to this discussion by highlighting syndication relationships among VCs, forged through their joint investments in startups, as key informational channels for accessing external intelligence, expertise, and resources [20,21,22]. Indeed, the prior literature has scrutinized how syndication networks benefit VCs, particularly in contexts marked by significant uncertainties, such as investments during the nascent stages of entrepreneurial ecosystems [23], as well as investments in new geographical regions [24] and industries [25].

However, limited research has delved into the role of syndicate networks amidst the emergence of novel, ambiguous technological areas like AI. This research gap is particularly unfortunate, given the exponential growth in VC investments in AI-related startups [26,27]. Our study addresses this gap by elucidating how network embeddedness aids VCs in overcoming AI’s uncertainty, subsequently shaping their engagement with AI startups. The central premise of our research is that VCs’ positions within historically constructed syndication networks influence their ability to overcome information barriers when pursuing novel opportunities in AI [28,29,30,31].

Specifically, we theorize that network reachability and brokerage represent key positional attributes that enhance information and knowledge flows. First, reachability captures how readily the focal VC can leverage connections throughout the syndication network to exchange resources and expertise [32,33]. Reachability is higher when the focal VC has the shortest paths, linking them to other VCs. These efficient linkages enable timely knowledge transfers across network boundaries [33,34], granting reachability benefits even in the absence of direct syndication ties. Our second key construct, brokerage, builds on Burt’s [29] theory of structural holes. VCs bridging disconnected clusters in the syndication network gain advantages from expansive, non-redundant information access. Such brokerage aids the discovery and assessment of AI startups amid unfamiliarity.

Together, we posit that a VC’s network positions, characterized by reachability and brokerage, determine its capacity to garner external insights about opaque domains like AI, subsequently influencing its rate of investments in AI-related startups. We test and confirm our ideas with an empirical analysis of AI investments made by 230 Korean and 413 Japanese VCs between 1984 and 2022.

Investigating the relationship between VCs’ syndication networks and their tendency to invest in AI startups has several practical and theoretical implications. First, AI has ascended into a general-purpose technology with an expanding, cross-sectoral footprint [35,36]. AI startups now pursue wide-ranging applications encompassing fields as diverse as finance [37], healthcare [38], transportation [39], agriculture [40], entertainment [41], and more [42]. However, successfully building commercially viable ventures around nascent technologies like AI remains an arduous entrepreneurial journey fraught with obstacles, resource constraints, and coordination challenges [12,13]. VCs adept at navigating this ambiguous terrain can provide much-needed financing and support to promising AI startups through the perilous early stages [27]. Our study reveals network-related attributes that potentially enhance VCs’ readiness to engage with AI startups amidst prevailing skepticism, thereby expanding the availability of early-stage capital in this strategically important domain. These insights carry valuable practical implications regarding how the VC ecosystem can scale funding and engagement with frontier technologies like AI that will shape future markets.

Second, while prior entrepreneurial finance research has analyzed various mechanisms that aid VCs in surmounting information asymmetries [5,6,43], limited scholarly attention has delved into network-related remedies in the context of uncertain, rapidly evolving technologies like AI. Syndication networks represent a conduit through which VCs can tap into distributed knowledge and expertise, illuminating the merit of unfamiliar startups [24,44,45]. Our research addresses this gap in the extant literature by revealing how historical syndication networks influence VCs’ aptitude for assessing opaque AI startups. Beyond direct ties, we highlight how indirect network connectivity and structural positioning transmit valuable intelligence that shapes VC behavior within ambiguous, complex technological environments.

Third, most prior studies exploring VC syndication networks have examined the role of direct ties in the syndicate networks on VCs’ performance and behaviors [46,47]. Our research focuses on the broader structure of historically accumulated syndicate networks encompassing the direct and indirect ties of VCs. In addition, our study further incorporates the recent changes in AI investment behaviors among VCs to capture the dynamic landscape of AI-related information that is accessible through networks. An evolutionary perspective centered on historical network development enables a deeper comprehension of how syndication networks equip VCs with cognitive and informational tools to tackle uncertainty when pursuing uncharted technological terrain like AI.

Finally, our focus on VCs within two major Asian economies, Japan and South Korea, imparts geographic diversity to the literature. Despite representing a vital nexus of technological innovation and entrepreneurship, Asia-located VCs have received limited scholarly attention thus far [48,49]. Our multi-country dataset encompasses investments in AI startups by VCs from 1984 to 2022, providing a foundation to advance contextual insights into Asian VCs’ syndication dynamics and engagement with frontier technologies.

In the subsequent sections, we first provide theoretical rationales for each of our hypotheses. Next, we detail our methodology, followed by the results from our hypothesis testing. We end by discussing our study’s contributions and suggestions for future research.

2. Theoretical Background and Hypothesis Development

2.1. VC Network Reachability and AI Startup Investments

Venture Capitalists (VCs) serve as crucial financial intermediaries, tasked with the diligent evaluation of startups to identify and channel funds towards the most promising ventures [50]. Central to this evaluation is a thorough examination encompassing the startup’s technological innovation, the competency of the founding team, the distinctiveness of the value proposition and business model, an analysis of the market environment, and the prevailing regulatory framework, among other factors that are indicative of potential success [11,12,13,14,15,16,17]. The nature of startups often embeds them with inherent uncertainties, necessitating a significant volume of information for an accurate assessment [5,6].

The predicament of information asymmetry significantly challenges VCs, particularly when navigating complex and rapidly evolving domains like AI [5,51]. Founders typically possess a deeper understanding of their ventures than external investors, creating a discernible information imbalance that hampers the VCs’ ability to identify genuinely promising startups. Despite this, VCs must meticulously evaluate the viability of the technology, the capabilities of the team, market dynamics, regulatory considerations, and other pertinent factors to ascertain the potential of novel technology-based startups to yield returns.

One viable strategy to mitigate the information asymmetry issue is to rely on prior syndication. The existing literature underscores the benefits VCs accrue from syndication networks, including enhanced deal flow access, risk mitigation, decision validation, and information sharing [21,50]. Sorenson and Stuart [45] further elucidate that syndication networks foster efficient knowledge transfer between partners, as exemplified when a VC gains a superior understanding of a startup’s potential from insights shared by a syndicate partner invested in the startup. Meuleman and colleagues [24] demonstrate how VCs utilize different types of network embeddedness, relational embeddedness (direct ties) and structural embeddedness (indirect ties) when participating in cross-border investments associated with startups located in countries with different degrees of institutional uncertainty.

Extending these insights, we posit that not only direct, ongoing ties, but also the extent of a VC’s reachability within their historical syndication network, particularly to other VCs with prior AI investments, can significantly augment the expertise available to them, thus increasing their propensity to finance AI startups. Network reachability refers to the existence of connections, both direct and indirect, between a focal venture capital firm (VC) and other VCs within the broader syndication network [33]. It measures how readily the focal VC can access and interact with other VCs across the network. A higher degree of reachability is indicated by the number and lengths of the shortest paths connecting the focal VC to others, facilitating faster and more efficient knowledge and resource exchange across the network [33,34,52].

For instance, VC A has high reachability to VC B if they have directly collaborated on deals (direct ties) or if they have a chain of other syndicate partners who can act as efficient conduits of information (indirect ties). The ability to tap into VC B’s expertise through short, low-friction network connections increases VC A’s reachability. Conversely, reachability is limited if VC A and B are not directly or indirectly linked; in such cases, knowledge from VC B is less likely to diffuse to VC A, increasing isolation. Low reachability often entails reliance on longer intermediary chains to exchange knowledge, a process that tends to be slower and less reliable.

In the context of AI startup investment, high network reachability to incumbent AI startup investors broadens the channels through which a VC can acquire nuanced intelligence, referrals, and other benefits that enhance their ability to evaluate AI deals. Such robust connectivity provides access to external AI expertise. We argue that a VC’s network reachability, especially to established AI investors through historical syndicates, is likely to increase their likelihood of investing in AI startups. These channels offer access to expertise that is critical for overcoming information barriers.

Network reachability confers several informational benefits: it provides technology alerts, validation, referrals, and clarifications about market hype, aiding VCs in navigating uncertainties when evaluating AI startups. We maintain that a VC’s network reachability to former AI investors via historical syndicates significantly increases their likelihood of engaging with and investing in AI startups. These connections reveal expertise that is vital for addressing information asymmetries. This argument is supported from two perspectives. First, multiple studies have shown that indirect, third-party connections convey invaluable tacit knowledge about startup quality and technological viability, thereby guiding investment decisions amid uncertainty [30,31]. Sullivan and Tang [22] found that small-world networks, which combine local clustering with short path lengths, had a positive impact on the performance of US venture capital firms from 1995 to 2003, but this effect varied with the firms’ absorptive capacity to recognize and assimilate external information and knowledge. Schilling and Phelps [33] highlight that shorter network path lengths enable a smoother knowledge transfer across network boundaries, offering a wealth of diverse information that spurs innovation. These factors suggest that VCs are likely to make extensive use of both direct and indirect connections of varying path lengths when evaluating innovative, unproven ventures where information asymmetries are substantial.

The significance of network reachability is particularly pronounced in the uncertain and complex realm of AI, characterized by pronounced information asymmetries. The dynamics of network connections and the subsequent information flow are vital in enhancing investors’ abilities to assess quality and mitigate risks, especially in uncertain environments. This reasoning supports our theory that the web of relationships, enabling potential access to seasoned AI investors through a VC’s historical syndication network, is likely to act as a source of insights and expertise on the AI landscape, even without direct syndication in a specific deal.

For example, interactions with veteran AI investors, either directly or through shortened network paths, yield nuanced intelligence that is crucial for precise evaluations. The expanded range of information provided by syndicate network connectivity could significantly alter perceptions of AI investment potential. Positive insights could alleviate the skepticism often associated with previous cycles of AI hype. Assertions of significant progress in AI technologies, like deep learning with unmatched predictive accuracy, might prompt a reassessment of the AI sector. Moreover, seasoned AI investors might facilitate access to prospective deals and entrepreneur referrals, thus ensuring a steady flow of attractive, under-the-radar AI startups. Additionally, experienced partners may validate a VC colleague’s initial interest in a particular AI deal.

In essence, network reachability to established AI startup investors offers numerous informational benefits—insights into technology, referral streams, validation, and the mitigation of hype—all of which collectively heighten the propensity to pursue AI deals. These relationships, even in the absence of actual syndication, act as a pivotal mechanism to overcome information barriers while assessing unfamiliar AI ventures, conveying nuanced intelligence that enables accurate evaluations under conditions of uncertainty. We, therefore, hypothesize the following:

Hypothesis 1 (H1):

VCs with higher network reachability to syndicate partners with a history of investing in AI startups are more inclined to invest in AI startups themselves.

2.2. VC Network Brokerage and AI Startup Investments

We contend that a VC with elevated betweenness centrality is predisposed towards investing in AI startups. Rooted in social network theory, betweenness centrality measures the extent to which a node acts as a bridge or intermediary among other nodes in a network [28]. In the VC syndication network milieu, a VC’s betweenness centrality reflects their strategic positioning in connecting disparate investor cohorts or entrepreneurial ventures. This positional advantage not only broadens a VC’s access to diverse and non-redundant information but also enhances their control over resource flow, including financial capital and expertise, across the network [29].

Central to our hypothesis is the notion that a VC’s structural position within the syndication network profoundly influences their aptitude and willingness to engage with emerging technological realms, notably AI startups. The theory of structural holes postulates that entities (here, VCs) bridging gaps in a network—structural holes—gain unique informational advantages [29]. They are privy to a wider spectrum of information and innovations traversing the network, enriching their situational awareness and enabling them to seize emerging investment opportunities. This aspect gains prominence in the AI domain, known for its rapid technological advancements and marked market uncertainty [53]. VCs with higher betweenness centrality, by bridging structural holes, are positioned to grasp evolving AI trends and technologies earlier, rendering the AI domain more salient to them.

Our assertion that VC betweenness centrality will foster AI startup investments is undergirded by theoretical insights into the strategic boons of network brokerage. Specifically, the bridging of structural holes avails VCs of expansive informational access, expediting the discovery of innovative AI ventures and timely knowledge acquisition regarding AI’s evolving technological readiness. Moreover, the broker’s selective exposure capacity can magnify positive narratives surrounding AI, overshadowing outdated, negative perceptions among skeptical investors. The recombinative potential inherent in bridging enables VCs to discern synergies between AI startups and incumbents positioned to leverage AI capabilities. Furthermore, ecosystem cultivation denotes VCs utilizing brokerage to interlink fragmented activity pockets around AI entrepreneurs, researchers, customers, and other stakeholders. This system-building role diminishes coordination costs, fostering AI experimentation. Lastly, the reputational merits of betweenness centrality may increase the AI deal flow to broker VCs while bolstering the credibility of their upbeat AI assessments among peers. Such bridging positions also hone pattern recognition faculties concerning AI’s burgeoning ubiquity. Collectively, these multidimensional boons of brokerage provide information, vision, referral pipelines, combination potential, ecosystem orchestration, and cognitive advantages, enabling VCs to avidly pursue and secure promising AI startup deals.

Venturing into domains like AI is laden with uncertainties stemming from technological volatility, market unpredictability, and regulatory ambiguity. Nonetheless, network positioning, as depicted by betweenness centrality, can significantly allay these uncertainties [54]. A high betweenness centrality emboldens VCs to form connections among previously unconnected or loosely connected entities intrigued by the new domain. By fostering these connections, VCs cultivate a conducive ecosystem for knowledge exchange, risk sharing, and the collaborative exploration of emerging opportunities in the AI domain. This, in turn, curtails the coordination costs and information asymmetries, usually characterizing entrepreneurial entry into emerging technological domains.

From the outlined theoretical framework, we derive several rationales supporting our assertion that a VC with higher betweenness centrality is more likely to invest in AI startups. First, the informational advantages associated with high betweenness centrality enhance the VC’s insight into the AI domain, bridging the perceptual gap between their existing knowledge base and this novel domain. This narrowed perceptual distance is crucial in overcoming the cognitive biases and inertia that typically deter investors from venturing into unfamiliar technological domains.

Second, the ability to establish connections and facilitate exchanges of knowledge and resources across the network enhances the VC’s ability to navigate the uncertainties and complexities inherent in the AI domain. This not only strengthens their risk assessment and decision-making processes but also boosts their capacity to identify, evaluate, and engage with promising AI startups.

Third, the strategic advantages of a high betweenness centrality extend beyond the individual VC to benefit the broader venture capital ecosystem [21]. By serving as conduits, VCs with high betweenness centrality foster a conducive environment for the cross-pollination of ideas, resources, and expertise across the network. This triggers a collective learning process, where the insights and experiences garnered from engaging with AI startups are shared across the network, reducing collective uncertainty and elevating the collective propensity to invest in AI startups.

Fourth, the bridging role of VCs with high betweenness centrality aids in aggregating the complementary resources and expertise essential for nurturing and accelerating the growth of AI startups. This not only heightens the likelihood of successful entrepreneurial outcomes but also amplifies the positive externalities for the broader innovation ecosystem. Taken together, these factors create a conducive milieu for VCs with high betweenness centrality to actively engage with and invest in AI startups, thereby contributing to the vibrancy and evolution of the AI entrepreneurial ecosystem. Thus, we hypothesize the following:

Hypothesis 2 (H2):

A VC endowed with higher betweenness centrality is more inclined to invest in AI startups.

3. Methods

3.1. Data and Sample

We gathered extensive data detailing the investment activities of venture capital firms in Korea and Japan, particularly focusing on investments in artificial intelligence startups. Our main data source was Thomson Reuters’ Eikon database, referred to as Eikon hereafter, which provided comprehensive historical records of VC investments around the globe. The database offers detailed information about VC firms and their target startups. Analyzing the location data of these VC firms, we uncovered a history of 14,751 investments made by Korean and Japanese VC firms. Utilizing this information, we assembled an imbalanced panel dataset spanning 230 Korean and 413 Japanese VCs from 1984 to 2022, encompassing 4508 observations at the firm-year level.

3.2. Dependent Variable and Model Specification

The dependent variable of the current study is the number of investments a VC firm made in AI startups in a year. We identified a set of startups that incorporate AI technologies in their business models. From the Eikon database, we obtained the business description texts of the startups and searched for a subset of startups that contained AI-related keywords in their descriptions. We carefully constructed a set of AI-related keywords by consulting the previous works that identified AI-related patents using textual descriptions of their technology [55,56]. The list comprised general keywords related to AI and more specific keywords describing the techniques used in AI. Table 1 provides the list of the keywords we used in screening AI-related startups. In the end, we identified a total of 970 investments (587 unique investment rounds) made to 418 AI-related startups by our sample firms during the sample period. For each VC firm in a year, we counted the number of investments the firm had made in AI startups.

Table 1.

List of keywords used in the identification of AI startups.

The dependent variable of the current study, a VC firm’s annual number of investments in AI startups, is a count variable with overdispersion. Therefore, we employed negative binomial regression to estimate the models testing our hypotheses. The current analysis involves repeated observations from the same VC firms over different years, raising potential concerns of correlations in the errors within firms. To address this, we estimated the models with standard errors clustered at the VC firm level in order to draw more accurate and robust inferences. Formally, we estimated the following model:

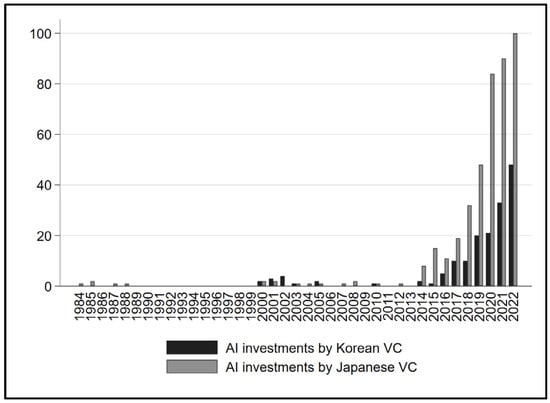

We provide more detailed insights into the investments in AI startups made by our sample VCs. Figure 1 shows the yearly distribution of the AI investments made by sample firms during the study period. Investments in AI startups started as early as the mid-1980s, with a slight increase in the number around the dotcom bubble in 2001. Investments in AI startups have gained momentum starting from 2014 and have grown exponentially in recent years after the outbreak of COVID-19 in 2019. In terms of the absolute number of investments, investments by Japanese VCs surpass those of their Korean counterparts, but the numbers become comparable once we take into consideration the fact that the number of Japanese VCs making investments is about 1.8 times larger than their Korean counterparts.

Figure 1.

Annual distribution of investments in AI startups by Korean and Japanese VCs.

Table 2 presents how investments are spread across different countries and industries of AI startups. Regarding geographical distribution, the majority of investments by Korean and Japanese VC firms are concentrated in their own domestic markets (Korea: 64.69%; Japan: 67.25%), as well as in the U.S. (Korea: 23.08%; Japan: 18.13%). As expected, a significant portion of these AI startups are in the prepackaged software industry. However, there are noticeable differences in focus: Korean VCs show a preference for AI startups in the semiconductor sector, whereas Japanese VCs lean towards investments in industries related to computer programming services and computer-integrated systems design. Table 3 showcases the list of top VC firms in terms of the number of investments in AI startups during the study period.

Table 2.

Distribution of investments by AI startup country and industry.

Table 3.

Top VC firms in terms of AI investments.

3.3. Independent Variables

We constructed two independent variables capturing sample VC firms’ positions in the VC syndicate networks to test our hypotheses. In order to do so, we first constructed annually updated syndicate networks of VC firms appearing in the Eikon database, comprised of VC firms that appear in the VC investments made around the globe within the past five years. Specifically, we defined a relationship between a pair of VCs as being present if the VCs had invested in the same startup company in the same round.

The first independent variable of interest is network reachability. Specifically, we utilized the operationalization of “distance-weighted reach” used in the previous works [33,34] to measure how our sample VCs are in close proximity to other VC firms that recently invested in AI startups. In each annual syndicate network, we first identified AI-investing VCs, a set of VCs that invested in AI startups in the same five-year window period. For each VC firm in our sample, we then calculated the VC firm’s distance-weighted reach to these other AI-investing VCs. Specifically, the distance-weighted reach is defined as the sum of reciprocal distances from a focal VC to all other AI-investing VCs that are reachable from the focal VC, where the distance corresponds to the shortest path length between the pair in the network. We then normalized the distance-weighted reach by the total number of AI-investing VCs observed in a given year in order to make the measure comparable across years. This takes the following form:

where denotes a focal VC firm, is other VC firms investing in AI startups, is the shortest path length between and observed in the syndicate network at time , and denotes the total number of other VC firms investing in AI startups at time .

The resulting variable ranges between 0 and 1 and captures the extent to which a focal VC stands in close proximity to other VC firms that have invested in AI startups in a given year. Hypothetically, the variable takes the maximum value of 1 if a VC collaborated with all AI-investing VCs in the network. The variable is further discounted if the VC firm cannot reach other AI-investing VCs or can only reach other AI-investing VCs via multiple steps through the network. Therefore, a lower value is assigned to a VC in a more distant network location from other AI-investing VCs.

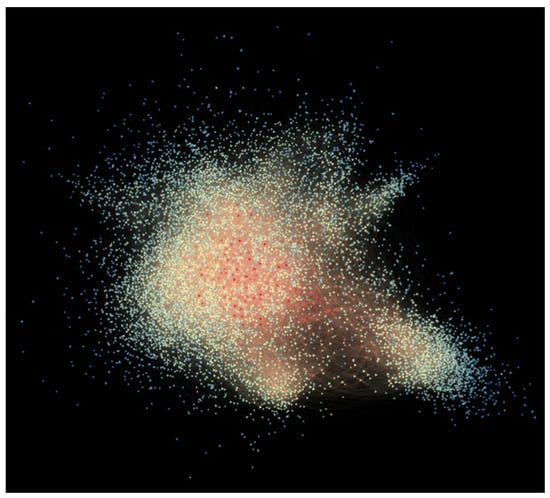

Figure 2 visualizes the networks of VCs observed in 2022. VC firms are represented as the nodes, and the syndicate relationships between two VCs in the past five years correspond to the edges in the graph. Triangle-shaped nodes denote VCs that made investments in AI startups in the past five years, while circle-shaped ones indicate those without such investments. The level of reachability to other AI-investing VCs is color-coded in a spectrum where red (blue) color represents greater (less) proximity to other AI-investing VCs.

Figure 2.

Visualization of syndication network in 2022.

The second independent variable of interest is betweenness centrality. Betweenness centrality, in this context, refers to the extent to which a VC firm occupies a strategic position within the VC syndicate networks, acting as a bridge or connector between other VC firms [28]. This measure quantifies the accessibility to diverse sets of information that are available in the VC community when they are positioned on the shortest paths between other pairs of VC firms. For a given VC firm, the betweenness centrality is calculated as the sum of the shortest paths between all pairs of other VC firms that pass through the focal VC firm. This can take the following form:

where is the focal VC firm, refers to a set of VCs found in the syndicate network at time , and denote other VC firms in the network, corresponds to the number of shortest paths between and , and counts the number of shortest paths between and that pass through the focal VC firm .

3.4. Control Variables

Following the previous studies on VCs’ performance [21] and investment behaviors [44,57,58], we included a set of control variables in the baseline models to account for other factors that may affect VC firms’ rate of investing in AI startups. We included VC age, based on the years elapsed since the sample VCs’ founding years. Older VCs may have developed organizational inertia [59,60], characterized by entrenched processes and structures in investment, leading them to become more reluctant to invest in emerging technologies such as AI. We controlled for VC track record, the number of investments a VC firm made in the past five years, as VCs with stronger track records may have better access to investment opportunities and the ability to discern the potential of AI startups [58,61]. A VC’s number of startup exits counts the number of startups in the VC’s investment portfolio that successfully exited through initial public offerings (IPO) in the past five years [62]. A higher number of exits indicates a VC’s proficiency in identifying and nurturing successful startups. VC portfolio diversity, measured by the complement of the Herfindahl index based on the distribution of past investments in startups across different industries, indicates a VC’s past investments in broader sectors [63], which may enhance the firm’s ability to identify the potential of AI across diverse applications. The percentage of a VC firm’s investments in the first round could signify the firm’s risk preference for early investments [64], which may correlate with their tendency to invest in emerging technologies [65].

We created a binary variable denoting whether a firm is a corporate VC or not. The investments of corporate VCs may have different investment motives, such as alignment with the existing businesses, from traditional VCs [66]. We also indicated whether a firm is a Korean VC or not to control for possible differences in the investment preferences between VCs of different nationalities. We controlled for the annual number of investments in AI in a country to capture the broader country-level investment climate toward AI technology in a given year. Finally, we included four-period dummy variables, indicating the periods between 1991 and 2000, 2001 and 2010, 2011 and 2015, and 2016 and 2022, to control for idiosyncratic period effects, such as the advancement of key AI technologies or investment trends, in testing our hypotheses.

3.5. Robustness Checks

One of the concerns associated with the dependent variable is excessive zeros in the distribution, which accounts for almost 87% of the data. To test the robustness of our findings against this concern, we employed a zero-inflated negative binomial model. The excessive zeros in the number of AI startups may not only stem from VCs’ lack of interest in AI startups but also their volume of investment activities in general. Hence, we included VCs’ track records for the number of investments in the past five years as the inflation factor, predicting zeros in the dependent variable. The model was also estimated with standard errors clustered at the firm level. The results remained unchanged to this specification.

4. Results

Table 4 reports the descriptive statistics and correlation coefficients of the variables used in the current study. The correlations among the variables were all below 0.6, and the variance inflation factor across all models was below 10.

Table 4.

Descriptive statistics and correlation coefficients.

Table 5 presents the results of the negative binomial regression predicting the annual number of investments in AI startups by Korean and Japanese VCs. Model 1 enters the baseline model, including the control variables. The results indicate that VCs with a higher track record (Model 1: b = 0.917, p-value < 0.001) tend to invest more in AI startups. A country’s annual number of investments in AI also positively predicts a VC firm’s investment in AI (Model 1: b = 0.368, p-value < 0.001).

Table 5.

Negative binomial regression predicting # of investments in AI startups.

Model 2 enters the first independent variable of interest, network reachability to other AI-investing VCs. The positive and significant coefficient (Model 2: b = 3.601, p-value < 0.001) lends support to H1. The result indicates that a VC firm’s level of network reachability, which critically determines its ease and speed in accessing information related to AI investments, significantly increases its subsequent rate of investments in AI startups. Model 3 introduces the second independent variable of interest, betweenness centrality. The result confirms H2, that VCs occupying a more information-rich network position prone to bridging diverse connections are more likely to invest in AI startups (Model 3: b = 3.143, p-value < 0.001). Model 4 simultaneously includes the two main variables in the model. We still find that effect of network reachability (Model 4: b = 3.309, p-value < 0.001) and betweenness centrality (Model 4: b = 2.475, p-value < 0.01) persist in the full model specification.

To provide a more nuanced understanding of the economic significance of the hypothesized variables, we computed the parametric estimates of the coefficients. The calculation reveals that one standard deviation increase in network reachability and betweenness centrality, respectively, increase a VC firm’s subsequent rate of investing in AI-related startups by multiplicative factors of 1.568 (1.568 = exp(3.309 × 0.136) and 1.109 (1.109 = exp(2.475 × 0.042). While the size of the economic effects of these variables is not as large as that of track records (a multiplicative factor of 2.072), the results showcase not only how well VCs performed in the past but also how well-connected they are within the VC syndicate networks, which significantly influences their investment decisions in AI-related startups.

While we did not explicitly formulate a hypothesis, we conducted an additional analysis to compare the effects of the two hypothesized network variables on the subsequent rate of AI-related investments between VCs located in Korea and Japan. Model 5 introduces two interaction terms based on the two independent variables’ interaction with a dummy variable denoting Korean VCs. The insignificant coefficient of the interaction term for network reachability indicates that Korean and Japanese VCs equally benefit from their level of network reachability when it comes to their subsequent rate of AI-related investments (Model 5:b = 1.145, insig.). However, the negative and significant interaction term for network betweenness centrality showcases that the positive impact of betweenness centrality on AI-related investments is less pronounced for Korean VCs than their Japanese counterparts. This prompts speculation that the strategic advantage derived from acting as a bridge within the network, facilitating diverse connections and information flow, may face unique challenges or operate differently within the context of Korean venture capital. Cultural intricacies, regulatory frameworks, or industry-specific practices could contribute to this observed divergence, warranting further exploration into the intricate factors shaping the role of betweenness centrality in influencing AI-related investments within the Korean venture capital landscape.

In Table 6, we report the results of zero-inflated negative binomial regression testing of the robustness of our findings. The positive effects of network reachability (Model 7: b = 3.469, p-value < 0.001) and betweenness centrality (Model 8: b = 3.874, p-value < 0.001) remain unchanged. Hence, we find robust support for our hypotheses.

Table 6.

Zero-inflated negative binomial regression predicting # of investments in AI startups.

5. Discussion

Our proposed research offers several prospective contributions to the literature at the intersection of entrepreneurial finance, social networks, and technology strategy. First, we address a notable gap in the literature concerning how historical inter-firm networks aid in engagement with new technologies amidst uncertainty. Prior studies largely adopted a static perspective, focusing narrowly on direct ties in the syndicate networks [46,47]. By elucidating how cumulative network development, encompassing both direct and indirect ties, shapes VCs’ technology strategy over time, we respond to calls for an evolutionary, dynamic view of inter-organizational networks [20,67]. Our findings will reveal network-based mechanisms that cultivate organizational preparedness to navigate technological change.

Second, we delineate key network properties—reachability and brokerage—that transmit external knowledge, foster learning, and reduce ambiguity about opaque technologies’ potential. Examining heterogeneous network positions contributes nuanced insights into how structure engenders informational and cognitive advantages. Beyond well-studied constructs like centrality, constraints, and tie strength, our focus on reachability and brokerage provides a finer-grained perspective into the performance implications of network locational attributes [68].

Third, our investigation of VCs within Japan and South Korea imparts geographic diversity and enhances contextual insights into Asian VCs’ syndication practices and technology strategy. Despite extensive research on American VCs, scholars have noted the need to advance the understanding of Asian VC ecosystems, which differ institutionally from their Western counterparts [48,49]. Our empirical analysis helps address this gap through a novel investigation into how syndication networks shape Asian VCs’ participation in emerging technologies.

Fourth, our historically anchored dataset encompassing VC investments in AI startups from 1984 to 2022 provides both depth and breadth to empirically assess theoretical mechanisms. The burgeoning studies on VCs’ investments in AI rely on relatively limited samples covering short time periods [26,27]. The expansive span of our dataset across five decades enhances robustness and illuminates long-term dynamics in VCs’ reliance on syndication networks when engaging with new technologies like AI.

In summary, exploring the intersection of networks, uncertainty, and technology strategy in the context of VCs’ AI investments presents significant possibilities to advance scholarly comprehension of how historical relational ties shape firms’ technology orientation. Our proposed integrative framework, drawing from diverse theoretical bases, responds to calls for greater pluralism in entrepreneurial finance research [69].

Future research can expand our work in several ways. First, our approach can be used to examine how VCs use syndicate networks to navigate through various types of technological changes that spur the boom and burst of investments in the entrepreneurial domains. For instance, the emergence of blockchain technologies [70] and imperatives for cleantech startups amidst climate changes [71] have led to a series of hype and disenchantment in the investment communities. Future research can elucidate how VCs’ position in the syndicate network might have aided them in capturing the investment opportunities in these domains during the early stages of the hype. Additionally, our approach can also be employed to investigate how venture capitalists can leverage the syndicate networks to strategically withdraw from hype prior to its eventual burst.

Second, subsequent work can examine how the effects of syndicate networks vary across different contexts. While the current study posits that VCs’ network positions will largely determine the level of information available to the VCs, it does not take into consideration that not all VCs are equally motivated to rely on such information. One possibility is that VCs located in different institutional contexts may exhibit differing levels of reliance on syndicate networks due to varying regulatory frameworks, cultural norms, technological developments, and market conditions. Also, VCs’ prior experiences, risk preferences, and past performance may differently shape their propensity to utilize the information gained from the syndicate networks.

Finally, future research could delve into whether VCs occupying different network positions can effectively translate their investments in artificial intelligence (AI) into successful ventures. While the current study focuses on the role of syndicate networks in influencing VCs’ propensity to invest in AI, it does not explore the performance implications of these investments. Therefore, an exploration of the different mechanisms that mediate the relationship between VC network positions and investment success in AI ventures is warranted. Together, we look forward to empirically evaluating the posited network mechanisms and engaging in insightful scholarly dialogues to enrich the collective understanding of VC strategy and cognition amidst technological change.

Author Contributions

Both authors equally contributed to the research. Conceptualization, B.T.-S.K. and E.-j.H.; methodology, B.T.-S.K. and E.-j.H.; software, B.T.-S.K.; validation, B.T.-S.K. and E.-j.H.; formal analysis, B.T.-S.K.; investigation, E.-j.H.; resources, B.T.-S.K. and E.-j.H.; data curation, B.T.-S.K. and E.-j.H.; writing—original draft preparation, B.T.-S.K. and E.-j.H.; writing—review and editing, B.T.-S.K.; visualization, B.T.-S.K.; supervision, E.-j.H.; project administration, E.-j.H.; funding acquisition B.T.-S.K. and E.-j.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported by Waseda University and 2023 Hongik University Innovation Support Program Fund.

Data Availability Statement

Data available upon request.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Gompers, P.; Lerner, J. The Venture Capital Revolution. J. Econ. Perspect. 2001, 15, 145–168. [Google Scholar] [CrossRef]

- Samila, S.; Sorenson, O. Venture Capital as a Catalyst to Commercialization. Res. Policy 2010, 39, 1348–1360. [Google Scholar] [CrossRef]

- Hellmann, T.; Puri, M. Venture Capital and the Professionalization of Start-up Firms: Empirical Evidence. J. Financ. 2002, 57, 169–197. [Google Scholar] [CrossRef]

- Fraser, S.; Bhaumik, S.K.; Wright, M. What Do We Know about Entrepreneurial Finance and Its Relationship with Growth? Int. Small Bus. J. 2015, 33, 70–88. [Google Scholar] [CrossRef]

- Amit, R.; Brander, J.; Zott, C. Why Do Venture Capital Firms Exist? Theory and Canadian Evidence. J. Bus. Ventur. 1998, 13, 441–466. [Google Scholar] [CrossRef]

- Bollazzi, F.; Risalvato, G.; Venezia, C. Asymmetric Information and Deal Selection: Evidence from the Italian Venture Capital Market. Int. Entrep. Manag. J. 2019, 15, 721–732. [Google Scholar] [CrossRef]

- Kerr, W.R.; Nanda, R.; Rhodes-Kropf, M. Entrepreneurship as Experimentation. J. Econ. Perspect. 2014, 28, 25–48. [Google Scholar] [CrossRef]

- Haessler, P.; Giones, F.; Brem, A. The Who and How of Commercializing Emerging Technologies: A Technology-Focused Review. Technovation 2023, 121, 102637. [Google Scholar] [CrossRef]

- Rotolo, D.; Hicks, D.; Martin, B.R. What Is an Emerging Technology? Res. Policy 2015, 44, 1827–1843. [Google Scholar] [CrossRef]

- Strickland, E. The Turbulent Past and Uncertain Future of AI: Is There a Way out of AI’s Boom-and-Bust Cycle? IEEE Spectr. 2021, 58, 26–31. [Google Scholar] [CrossRef]

- Ameye, N.; Bughin, J.; van Zeebroeck, N. How Uncertainty Shapes Herding in the Corporate Use of Artificial Intelligence Technology. Technovation 2023, 127, 102846. [Google Scholar] [CrossRef]

- Kaggwa, S.; Akinoso, A.; Dawodu, S.O.; Uwaoma, P.U.; Akindote, O.J.; Osawaru, S.E. Entrepreneurial Strategies for AI Startups: Navigating Market and Investment Challenges. Int. J. Manag. Entrep. Res. 2023, 5, 1085–1108. [Google Scholar] [CrossRef]

- Lee, B.; Kim, B.; Ivan, U.V. Enhancing the Competitiveness of AI Technology-Based Startups in the Digital Era. Adm. Sci. 2024, 14, 6. [Google Scholar] [CrossRef]

- Weber, M.; Moritz, B.; Jörg, W.; Böhm, M.; Helmut, K. AI Startup Business Models. Bus. Inf. Syst. Eng. 2022, 64, 91–109. [Google Scholar] [CrossRef]

- Buiten, M.C. Towards Intelligent Regulation of Artificial Intelligence. Eur. J. Risk Regul. 2019, 10, 41–59. [Google Scholar] [CrossRef]

- Hoenig, D.; Henkel, J. Quality Signals? The Role of Patents, Alliances, and Team Experience in Venture Capital Financing. Res. Policy 2015, 44, 1049–1064. [Google Scholar] [CrossRef]

- Colombo, O. The Use of Signals in New-Venture Financing: A Review and Research Agenda. J. Manag. 2021, 47, 237–259. [Google Scholar] [CrossRef]

- Chen, H.; Gompers, P.; Kovner, A.; Lerner, J. Buy Local? The Geography of Venture Capital. J. Urban Econ. 2010, 67, 90–102. [Google Scholar] [CrossRef]

- Cumming, D.; Dai, N. Local Bias in Venture Capital Investments. J. Empir. Financ. 2010, 17, 362–380. [Google Scholar] [CrossRef]

- Gulati, R.; Gargiulo, M. Where Do Interorganizational Networks Come From? Am. J. Sociol. 1999, 104, 1439–1493. [Google Scholar] [CrossRef]

- Hochberg, Y.V.; Ljungqvist, A.; Lu, Y. Whom You Know Matters: Venture Capital Networks and Investment Performance. J. Financ. 2007, 62, 251–301. [Google Scholar] [CrossRef]

- Sullivan, B.N.; Tang, Y. Small-World Networks, Absorptive Capacity and Firm Performance: Evidence from the US Venture Capital Industry. Int. J. Strateg. Chang. Manag. 2012, 4, 149–175. [Google Scholar] [CrossRef]

- Khavul, S.; Deeds, D. The Evolution of Initial Co-Investment Syndications in an Emerging Venture Capital Market. J. Int. Manag. 2016, 22, 280–293. [Google Scholar] [CrossRef]

- Meuleman, M.; Jääskeläinen, M.; Maula, M.V.J.; Wright, M. Venturing into the Unknown with Strangers: Substitutes of Relational Embeddedness in Cross-Border Partner Selection in Venture Capital Syndicates. J. Bus. Ventur. 2017, 32, 131–144. [Google Scholar] [CrossRef]

- Antretter, T.; Sirén, C.; Grichnik, D.; Wincent, J. Should Business Angels Diversify Their Investment Portfolios to Achieve Higher Performance? The Role of Knowledge Access through Co-Investment Networks. J. Bus. Ventur. 2020, 35, 106043. [Google Scholar] [CrossRef]

- Mou, X. Artificial Intelligence: Investment Trends and Selected Industry Uses. IFC EMCompass Emerg. Mark. 2019, 71, 1–8. [Google Scholar]

- Tricot, R. Venture Capital Investments in Artificial Intelligence: Analysing Trends in VC in AI Companies from 2012 through 2020; OECD Publishing: Paris, France, 2021. [Google Scholar]

- Freeman, L.C. A Set of Measures of Centrality Based on Betweenness. Sociometry 1977, 40, 35–41. [Google Scholar] [CrossRef]

- Burt, R.S. Structural Holes and Good Ideas. Am. J. Sociol. 2004, 110, 349–399. [Google Scholar] [CrossRef]

- Valente, T.W.; Foreman, R.K. Integration and Radiality: Measuring the Extent of an Individual’s Connectedness and Reachability in a Network. Soc. Netw. 1998, 20, 89–105. [Google Scholar] [CrossRef]

- Doreian, P. On the Connectivity of Social Networks. J. Math. Sociol. 1974, 3, 245–258. [Google Scholar] [CrossRef]

- Borgatti, S.P. Centrality and Network Flow. Soc. Netw. 2005, 27, 55–71. [Google Scholar] [CrossRef]

- Schilling, M.A.; Phelps, C.C. Interfirm Collaboration Networks: The Impact of Large-Scale Network Structure on Firm Innovation. Manag. Sci. 2007, 53, 1113–1126. [Google Scholar] [CrossRef]

- Schilling, M.A. Technology Shocks, Technological Collaboration, and Innovation Outcomes. Organ. Sci. 2015, 26, 668–686. [Google Scholar] [CrossRef]

- Crafts, N. Artificial Intelligence as a General-Purpose Technology: An Historical Perspective. Oxf. Rev. Econ. Policy 2021, 37, 521–536. [Google Scholar] [CrossRef]

- Rasskazov, V. Financial and Economic Consequences of Distribution of Artificial Intelligence as a General-Purpose Technology. Financ. Theory Pract. 2020, 24, 120–132. [Google Scholar] [CrossRef]

- Königstorfer, F.; Thalmann, S. Applications of Artificial Intelligence in Commercial Banks—A Research Agenda for Behavioral Finance. J. Behav. Exp. Financ. 2020, 27, 100352. [Google Scholar] [CrossRef]

- Jiang, F.; Jiang, Y.; Zhi, H.; Dong, Y.; Li, H.; Ma, S.; Wang, Y.; Dong, Q.; Shen, H.; Wang, Y. Artificial Intelligence in Healthcare: Past, Present and Future. Stroke Vasc. Neurol. 2017, 2, 230–243. [Google Scholar] [CrossRef] [PubMed]

- Abduljabbar, R.; Dia, H.; Liyanage, S.; Bagloee, S.A. Applications of Artificial Intelligence in Transport: An Overview. Sustainability 2019, 11, 189. [Google Scholar] [CrossRef]

- Jha, K.; Doshi, A.; Patel, P.; Shah, M. A Comprehensive Review on Automation in Agriculture Using Artificial Intelligence. Artif. Intell. Agric. 2019, 2, 1–12. [Google Scholar] [CrossRef]

- Han, S. AI, Culture Industries and Entertainment. In The Routledge Social Science Handbook of AI; Routledge: London, UK, 2021; pp. 295–312. [Google Scholar]

- Bughin, J.; Hazan, E.; Ramaswamy, S.; Chui, M.; Allas, T.; Dahlström, P.; Henke, N.; Trench, M. Artificial Intelligence the Next Digital Frontier; McKinsey Global Institute: New York, NY, USA, 2017. [Google Scholar]

- Yang, Y.; Fang, Y.; Wang, N.; Su, X. Mitigating Information Asymmetry to Acquire Venture Capital Financing for Digital Startups in China: The Role of Weak and Strong Signals. Inf. Syst. J. 2023, 33, 1312–1342. [Google Scholar] [CrossRef]

- Zhelyazkov, P.I. Interactions and Interests: Collaboration Outcomes, Competitive Concerns, and the Limits to Triadic Closure. Adm. Sci. Q. 2018, 63, 210–247. [Google Scholar] [CrossRef]

- Sorenson, O.; Stuart, T.E. Syndication Networks and the Spatial Distribution of Venture Capital Investments. Am. J. Sociol. 2001, 106, 1546–1588. [Google Scholar] [CrossRef]

- Wang, D.; Pahnke, E.C.; Mcdonald, R.M. The Past Is Prologue? Venture-Capital Syndicates’ Collaborative Experience and Start-up Exits. Acad. Manag. J. 2022, 65, 371–402. [Google Scholar] [CrossRef]

- Bellavitis, C.; Rietveld, J.; Filatotchev, I. The Effects of Prior Co-Investments on the Performance of Venture Capitalist Syndicates: A Relational Agency Perspective. Strateg. Entrep. J. 2020, 14, 240–264. [Google Scholar] [CrossRef]

- Bruton, G.D.; Ahlstrom, D. An Institutional View of China’s Venture Capital Industry: Explaining the Differences between China and the West. J. Bus. Ventur. 2003, 18, 233–259. [Google Scholar] [CrossRef]

- Bruton, G.; Ahlstrom, D.; Yeh, K.S. Understanding Venture Capital in East Asia: The Impact of Institutions on the Industry Today and Tomorrow. J. World Bus. 2004, 39, 72–88. [Google Scholar] [CrossRef]

- Lerner, J. Venture Capitalists and the Decision to Go Public. J. Financ. Econ. 1994, 35, 293–316. [Google Scholar] [CrossRef]

- Piacentino, G. Venture Capital and Capital Allocation. J. Financ. 2019, 74, 1261–1314. [Google Scholar] [CrossRef]

- Lyu, Y.; Zhu, Y.; Han, S.; He, B.; Bao, L. Open Innovation and Innovation “Radicalness”—The Moderating Effect of Network Embeddedness. Technol. Soc. 2020, 62, 101292. [Google Scholar] [CrossRef]

- Hargadon, A.B. Brokering Knowledge: Linking Learning and Innovation. Res. Organ. Behav. 2002, 24, 41–85. [Google Scholar] [CrossRef]

- Ahuja, G. Collaboration Networks, Structural Holes, and Innovation: A Longitudinal Study. Adm. Sci. Q. 2000, 45, 425–455. [Google Scholar] [CrossRef]

- Cockburn, I.M.; Henderson, R.; Stern, S. The Impact of Artificial Intelligence on Innovation: An Exploratory Analysis. In The Economics of Artificial Intelligence: An Agenda; University of Chicago Press: Chicago, IL, USA, 2018; pp. 115–146. [Google Scholar]

- Giczy, A.V.; Pairolero, N.A.; Toole, A.A. Identifying Artificial Intelligence (AI) Invention: A Novel AI Patent Dataset. J. Technol. Transf. 2022, 47, 476–505. [Google Scholar] [CrossRef]

- Aggarwal, R.; Kryscynski, D.; Singh, H. Evaluating Venture Technical Competence in Venture Capitalist Investment Decisions. Manag. Sci. 2015, 61, 2685–2706. [Google Scholar] [CrossRef]

- Petkova, A.P.; Wadhwa, A.; Yao, X.; Jain, S. Reputation and Decision Making Under Ambiguity: A Study of U.s. Venture Capital Firms’ Investments in the Emerging Clean Energy Sector. Acad. Manag. J. 2014, 57, 422–448. [Google Scholar] [CrossRef]

- Le Mens, G.; Hannan, M.T.; Pólos, L. Age-Related Structural Inertia: A Distance-Based Approach. Organ. Sci. 2015, 26, 756–773. [Google Scholar] [CrossRef]

- Le Mens, G.; Hannan, M.T.; Pólos, L. Founding Conditions, Learning, and Organizational Life Chances: Age Dependence Revisited. Adm. Sci. Q. 2011, 56, 95–126. [Google Scholar] [CrossRef]

- Lee, P.M.; Pollock, T.G.; Jin, K. The Contingent Value of Venture Capitalist Reputation. Strateg. Organ. 2011, 9, 33–69. [Google Scholar] [CrossRef]

- Bacon-Gerasymenko, V. When Do Organisations Learn from Successful Experiences? The Case of Venture Capital Firms. Int. Small Bus. J. 2019, 37, 450–472. [Google Scholar] [CrossRef]

- Matusik, S.F.; Fitza, M.A. Diversification in the Venture Capital Industry: Leveraging Knowledge under Uncertainty. Strateg. Manag. J. 2012, 33, 407–426. [Google Scholar] [CrossRef]

- Elango, B.; Fried, V.H.; Hisrich, R.D.; Polonchek, A. How Venture Capital Firms Differ. J. Bus. Ventur. 1995, 10, 157–179. [Google Scholar] [CrossRef]

- Wang, S.; Wareewanich, T.; Chankoson, T. Factors Influencing Venture Capital Performance in Emerging Technology: The Case of China. Int. J. Innov. Stud. 2023, 7, 18–31. [Google Scholar] [CrossRef]

- Anokhin, S.; Wincent, J.; Oghazi, P. Strategic Effects of Corporate Venture Capital Investments. J. Bus. Ventur. Insights 2016, 5, 63–69. [Google Scholar] [CrossRef]

- Madhavan, R.; Koka, B.R.; Prescott, J.E. Networks in Transition: How Industry Events (Re) Shape Interfirm Relationships. Strateg. Manag. J. 1998, 19, 439–459. [Google Scholar] [CrossRef]

- Burt, R.S.; Kilduff, M.; Tasselli, S. Social Network Analysis: Foundations and Frontiers on Advantage. Annu. Rev. Psychol. 2013, 64, 527–547. [Google Scholar] [CrossRef] [PubMed]

- Zacharakis, A.L.; Meyer, G.D. The Potential of Actuarial Decision Models: Can They Improve the Venture Capital Investment Decision? J. Bus. Ventur. 2000, 15, 323–346. [Google Scholar] [CrossRef]

- Park, G.; Shin, S.R.; Choy, M. Early Mover (Dis)Advantages and Knowledge Spillover Effects on Blockchain Startups’ Funding and Innovation Performance. J. Bus. Res. 2020, 109, 64–75. [Google Scholar] [CrossRef]

- Gaddy, B.E.; Sivaram, V.; Jones, T.B.; Wayman, L. Venture Capital and Cleantech: The Wrong Model for Energy Innovation. Energy Policy 2017, 102, 385–395. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).