Abstract

Although previous studies have predominantly dealt with innovation ambidexterity, they have only focused on a single innovation activity and overlooked the interaction of innovation activities. Drawing on organizational ambidexterity theory, this study established four types of innovation configurations: dual exploration (technology exploration and business model exploration), business model leveraging (technology exploration and business model exploitation), technology leveraging (technology exploitation and business model exploration), and dual exploitation (technology exploitation and business model exploitation). Using the panel data of 613 listed manufacturing firms in China, this study examined whether and how configurations of ambidextrous innovation affect firm performance in the context of digital transformation. Empirical results provide evidence that a dual exploration and technology leveraging strategy has a positive impact on firm performance, while a dual exploitation and business model leveraging strategy has the opposite effect and is subject to the moderating influence of the level of digitalization. Under high levels of digitalization, the positive effect of the dual exploration strategy on firm performance becomes more significant, while the effects of others are weakened. This study contributes to the organizational ambidexterity literature by providing a finer-grained understanding of the effect of ambidextrous innovation from a configurational perspective. This study also contributes to the digitalization transformation literature by revealing the moderating role of digitalization.

1. Introduction

Successful innovation plays a pivotal role in enabling firms to attain superior performance within a fiercely competitive market landscape [1,2]. Among the myriad forms of innovation, technological innovation has garnered heightened attention [3]. However, the process of innovation-driven industrial transformation and upgrading is a comprehensive engineering endeavor. The developmental trajectory of the manufacturing firms necessitates the synergistic integration of multiple innovation methodologies. Singularly emphasizing one form of innovation inevitably leads to a lack of driving force [4,5]. Addressing the “black box” of innovation development to elucidate the effectiveness of utilizing innovation for performance enhancement is a pressing concern. Technological innovation must be intricately linked to business models to propel firm success [6]. Serving as a crucial tool for enhancing business performance, technological innovation facilitates the sustainable and robust growth of firms by refining existing processes and products or creating novel, more advantageous ones. Business model innovation (leveraging mechanisms such as value network expansion and business model adjustments) serves as a pivotal conduit for commercializing the outcomes of technological innovation, yielding economic benefits [7,8]. Nevertheless, navigating the critical dilemma of aligning these two forms of innovation is particularly challenging, and is contingent upon the diverse allocation of resources [9].

The integration of innovative approaches remains an ongoing process of dynamic refinement, intricately linked to the concurrent processes of exploration and exploitation. Scholars contend that “ambidexterity” literature offers a valuable theoretical foundation when addressing the diverse modes of innovation within a company [10]. In mature technologies and stable markets, emphasis on efficiency, control, and incremental improvement is crucial. Innovation must leverage existing resources. However, an exclusive focus on this developmental path may result in capability traps and hinder organizational change. Conversely, in the realm of new technologies and volatile markets, flexibility, initiative, and experimentation become imperative, necessitating the exploration of novel ideas for innovation [11]. Yet, an excessive emphasis on exploration can lead to endless search cycles, unfruitful change, and a heightened risk of failure [12]. In the long run, firms must possess the dual capabilities of exploration and exploitation to effectively respond to environmental changes. Consequently, striking a balance between exploration and utilization presents a significant challenge for firms. Notably, in the domains of technological innovation and business model innovation, attention should be given to the trade-off between exploration and exploitation. However, existing literature predominantly focuses on technological innovation, and often neglects business model innovation or the interplay between these two complementary innovation activities. This oversight overlooks the potential benefits of cross-domain ambidexterity [13,14]. Similarly, prior research on the trade-offs between exploitation and exploration, as these two complementary yet contradictory activities, has been inconsistent due to variations in organizational requirements, structures, practices, and management behaviors [15,16,17,18].

The impact of digitalization extends significantly across both upstream and downstream aspects of businesses, networks, and ecosystems [19,20]. The dynamic functionality of information technology (IT) can enhance firms’ competitiveness by facilitating a rapid understanding of market needs and fostering increased flexibility and agility [21]. However, the existence of the “IT paradox” implies that only a portion of firms can truly benefit from digitalization, highlighting a potential divide in its impact [22]. The development of digitalization places heightened demands on the technological and business model aspects of firms [23]. On the one hand, transitioning towards digitalization, smart products, the internet of things, and the industrial internet has reshaped the capability requirements for manufacturing firms [24]. On the other hand, beyond altering capability requirements, digitalization may also profoundly impact inter-firm transactions, power dynamics between companies, and strategic identities. For instance, manufacturing companies may increasingly resemble software companies [25]. This presents an additional dilemma for companies navigating the challenges of the new business environment.

Henceforth, to address the dilemma, this study employs the configuration theory, which posits that firm performance hinges on the amalgamation of innovations [26]. It extends the organizational ambidexterity theory by delineating the dimensions of technological innovation and business model innovation [27,28] and formulates four distinct configuration models. These models are systematically elucidated, outlining their respective merits and drawbacks concerning their capacity to achieve ambidexterity across domains [29]. The study delves into these models extensively within varied digital transformation contexts. Through this innovative approach, the paper elucidates how manufacturing firms can strategically align technological innovation and business model innovation amidst the backdrop of digital transformation. It introduces a fresh perspective on enhancing firm performance through the lens of organizational ambidexterity, contributing valuable insights to the intersection of technological and business model innovations in the evolving digital landscape.

This study offers several noteworthy contributions. Firstly, it contributes to the systematic organization of ambivalence research by examining the role of research exploration–exploitation across diverse fields. Diverging from previous singular-field studies on ambivalence [30,31,32], this paper investigates the impact of exploration and exploitation within technology- and business-model-related innovation domains. It introduces a novel approach to address the ongoing debate on organizational ambidexterity [15], aligning with Lavie et al.’s (2011) perspective that companies can effectively coordinate exploration and exploitation across distinct organizational domains [15]. Secondly, in contrast to prior studies predominantly centered on technology-related innovation [13,14], this study elucidates the strategic allocation of innovation related to both technology and business models. It systematically explains how to mitigate tensions between these two types of innovation and comprehensively outlines the internal logic of the influence exerted by various forms of configuration models formed through technology and business model innovation on firm performance. This comprehensive analysis provides a solid theoretical foundation for understanding how innovation configuration contributes to the enhancement of firm performance. Thirdly, this paper delves into the impact of organizational ambidexterity within the context of China’s digital transformation, a unique contribution considering most studies on digitalization and ambidexterity are situated in Western contexts with stable institutional environments and ample market resources [16,33]. Given China’s emerging markets characterized by a volatile institutional environment and limited access to market resources, the complexity of organizational ambidexterity may pose some particular challenges [34,35,36,37]. This paper offers a novel research perspective by applying cross-domain ambidexterity in the context of China’s digital transformation, thereby enriching the understanding of organizational dynamics in this setting. Secondly, as the world’s largest emerging market, China has greater development opportunities and has always attracted a continuous stream of enterprises to enter the Chinese market. The research conducted in this study has important implications for Chinese business operators and managers planning to enter the Chinese market.

2. Theoretical Background and Hypotheses

2.1. Organizational Ambidexterity and Configuration Strategies

The enhancement of firm performance hinges on the adept configuration of innovation elements [38]. This involves the judicious selection and optimization of various components, encompassing activities, policies, structural elements, and resources. The amalgamation of these elements in different forms can yield varying effects on the company’s resource utilization [26,39,40]. Consequently, this study extends the innovation configuration theory to scrutinize how the effective configuration of technology- and business-model-based innovation can be orchestrated to attain superior performance.

Ambidexterity is acknowledged as a dynamic capability inherent in firms, where the attainment of optimal performance relies on striking a dynamic balance between exploration and exploitation [41,42]. In the realm of innovation operations, a well-structured configuration has the potential to enhance the efficiency of current operations while concurrently bolstering the organization’s adaptability and flexibility to environmental changes [43]. In the sphere of innovation decision-making, maintaining a balance between ambidextrous decision-making modes empowers large and complex organizations to sustain flexibility and achieve success in both short- and long-term perspectives [44]. This equilibrium promotes the realization of firm financial goals and sustainability objectives, establishing a positive correlation between organizational performance and ambidexterity [45,46]. Drawing from the resource-based view, it is posited that in the absence of a well-orchestrated configuration, a pure innovation strategy emphasizing either operational excellence or product leadership may outperform a mixed strategy, highlighting the significance of strategic alignment [47]. Guided by ambidexterity theory and innovation configuration theory, this article constructs four innovation configuration strategies (Table 1), explores the impact of different configuration strategies on firm performance, and conducts an in-depth analysis in the context of digital transformation.

Table 1.

Configuration strategies.

2.2. Configuration Strategies and Firm Performance

2.2.1. Dual Exploration and Business Model Leveraging Strategy

Exploratory technological innovation places a distinct emphasis on the creativity and novelty inherent in new products. Grounded in the theory of innovation configuration, the research and development efforts directed towards any new products and processes necessitate a harmonious alignment with an appropriate business model for value realization. Otherwise, the outcomes of technological innovation may not yield any substantial value for the firm [48]. Numerous instances of unsuccessful innovation underscore that the root cause of failure often lies not in the shortcomings of technological innovation per se, but rather in entrepreneurs failing to discern a business logic capable of identifying the potential value embedded in the innovation [49,50].

Previous empirical studies have revealed that engaging in simultaneous exploration across multiple domains empowers firms to sidestep the rigidity entrenched in prevailing practices within the innovation process. This, in turn, fortifies differentiation and yields superior innovation performance [51]. Beginning with technological innovation as a focal point, it becomes apparent that exploratory technological innovation significantly fosters activities related to business model design [52]. In instances where firms embark on the creation of novel products through radical technological shifts, the pursuit of additional market opportunities necessitates a concurrent exploration of business models centered around these innovations. This strategic approach transforms technical products into tangible market value, thereby enhancing Schumpeter’s rent [50,53]. To elaborate, exploratory innovation predominantly accomplishes product differentiation and uniqueness, elevating market demand and instilling a willingness among consumers to pay a higher premium. Nevertheless, following a triumphant product innovation, the market often witnesses a proliferation of imitators grappling with the challenges posed by truncated product life cycles and elevated costs. In response, constructing an unparalleled business model, intricately aligned with market demands and feedback within the business model subsystem, becomes imperative. This initiative extends the competitive advantage of firms by introducing a temporal lag for imitators and provides enduring protection for the firm in the long run [54,55].

Commencing with business model innovation, the synergy between business model exploration and technology exploration proves to be mutually reinforcing. Firms strategically determine the primary trajectory of business model evolution, propelling the development of products and the introduction of novel functionalities through fundamentally distinct technological foundations [46,56]. Employing business model innovation serves as a means of securing competitive advantages in the market, while the pursuit of exploratory technology innovation strategies works to establish absolute core competitiveness. This strategic alignment, driven by the continuous integration of technology and market dynamics, engenders the creation of new business models, catalyzing a cyclical evolution of technological innovation. Ultimately, this dynamic process contributes to the long-term performance of the firm [57]. Illustratively, the mutual propulsion of business model innovation and breakthrough technology innovation has the dual effect of reducing firm costs and enhancing innovation efficiency [58]. Conversely, an exploitative business model may result in the squandering and failure of firm technological innovation to some extent. This occurs because the business model required for the commercialization of emerging and disruptive technologies often conflicts with the firm’s existing business model. Faced with unpredictable outcomes, firms may opt to relinquish the development of new technologies. In contrast, exploratory technological innovation emphasizes the exploration of new technologies, yielding pioneering products with extended cycles and substantial changes. This misalignment poses a challenge to the efficiency-focused logic of business model innovation and may lead to conflicts [59]. Consequently, achieving synergy between exploitative business model innovation and exploratory technology innovation proves challenging and often exerts a negative impact on the performance of manufacturing firms. Building upon this understanding, the paper advances the following hypotheses:

H1.

The adoption of a dual exploration strategy exerts a positive influence on firm performance.

H2.

The business model leveraging strategy has a negative impact on firm performance.

2.2.2. Dual Exploitation and Technology Leveraging Strategy

From a sustainability perspective, progressive technological innovation involves a systematic integration characterized by gradual and subtle improvements, building on the existing product market experience of the firm with minimal deviation [6]. In terms of resource capability, the concept of domain separation suggests that tension in resources may be alleviated by conducting exploration in one domain while simultaneously exploiting another domain [16,29]. On the one hand, exploratory business model innovation accentuates resource concentration to establish new collaborative networks with stakeholders or explore novel market segments by expanding connections with various network members. Considering resource constraints, exploitative technological innovation (which demands relatively lower investments) is chosen to complement this strategy [60]. On the other hand, given the scarcity of technical resources, manufacturing firms must integrate resources into the operational process and explore innovative solutions based on existing knowledge and resources. The introduction of a new business model contributes to enhancing the knowledge absorption capacity of firms, facilitating the discovery of new knowledge and its commercialization [61].

From a value acquisition standpoint, the introduction or creation of new business models revitalizes and actively utilizes existing technical resources, paving the way for the discovery of novel value propositions for current products. This approach provides opportunities for firms to realign products and technical resources with fresh value propositions, leading to enhanced benefits [62,63]. However, the design of an efficient business model can intensify the negative impact of exploitative innovations on firm performance growth, and concurrently, weaken the positive impact of exploratory innovations on firm performance growth. When exploitation takes precedence as the primary activity, short-term success may elevate the risk of stagnation, leaving firms ill-prepared for environmental changes. Firms may inadvertently fall into a “success trap” where their core competence transforms into core rigidity [64]. Consequently, the more emphasis firms place on coupling progressive innovation with exploitative business model innovation, the more likely they are to adhere to stable and standardized existing systems, solidifying their developmental and business behaviors. This rigidification makes it challenging for them to adapt to the complex and dynamic business environment. Hence, this paper proposes the following hypotheses:

H3.

Technology leveraging strategy has a positive impact on firm performance.

H4.

Dual exploitation strategy hurts firm performance.

2.3. The Moderating Role of Digitalization

As industries embrace the fourth industrial revolution (Industry 4.0) through digital transformation, an entirely new era is being witnessed. The manufacturing industry is evolving into a more intelligent landscape, characterized by extensive data exchange and predictive analytics technologies driven by the internet of things (IoT) [65]. In the realm of technological innovation, digital manufacturing plays a pivotal role in minimizing scrap rates and equipment losses by monitoring operational data, ultimately enhancing the success rate of technological advancements [66,67]. Concerning business model innovation, digital technologies act as transformative agents, converting available data into valuable insights and actionable instructions. This is achieved through the optimization and storage of knowledge in the cloud, supporting the continuous development of sustainability functions, spanning from product design to predictive maintenance and product tracking [68,69,70]. A Price Waterhouse Coopers (PWC) report underscores the potential impact of digitalization, noting that at high levels of digitalization, manufacturing efficiency is anticipated to increase by 15–20%, with a concurrent generation of over 20% in revenue over the next five years [71].

In accordance with the innovation configuration theory, the advantages of digital transformation hinge on the harmonious collaboration between business model innovation and technological innovation. Digitalization has engendered an escalated demand for novel technologies, skills, and processes, therefore revolutionizing the creation of value in the industrial value chain. This transformation is realized through the adoption of IoT technologies, intensive data exchange, and predictive analytics capabilities [72,73] The actualization of digital value creation is anticipated to extend beyond firm boundaries and traverse networks, manifesting in the guise of collaborative value creation [74,75]. The utilization of digital technology holds immense potential for technological innovation, mitigating the risks associated with such innovation and rendering technological exploration both inevitable and feasible. Simultaneously, these functionalities amplify opportunities for firms to deliver and capture value while adapting to a volatile environment, mitigating conflicts between new technology and the existing business model. In doing so, it opens new avenues for value creation [76].

From the standpoint of value creation, two primary methods—incremental and radical—directly influence the economic performance of firms. In the case of radical value creation, numerous firms, in a bid to capitalize on the advantages ushered in by digitalization, are meticulously constructing entirely novel business models revolving around digital technologies such as artificial intelligence, digital platforms, and big data analytics. This is facilitated by a more visionary and creative mindset, with technological innovation serving as the primary driver of value [77,78]. Leveraging real-time changes in digital operational data, firms (through exploratory technological innovation) introduce more flexible or customized products and services. Additionally, this approach grants customers the autonomy to choose, fostering enhanced value creation [79,80]. Consequently, at elevated levels of digitalization, both new technology and business model innovation wield the potential to fundamentally alter the profit-making paradigm of firms. The positive impact of aligning exploitative technology with a new business model on firm performance becomes challenging to demonstrate. Firms adopting a strategy based solely on exploitation may encounter the risk of regression in the face of this changing landscape.

In the realm of incremental value creation, it becomes evident that matching new technologies with new business models is equally crucial. Firstly, the impetus from digital technology and business model innovation is to propel continuous technological innovation, ensuring firms stay abreast of competitors and furnish enduring value to customers [81,82]. While leveraging digital solutions to consistently gauge customer needs and accelerate business model revenue generation, firms must concurrently undertake technological exploration in response to changing demands. A systematic alignment is imperative, as merely introducing new products or services in a non-systematic manner might not guarantee market success. Without continuous product and service innovation, firms risk missing out on new market shares. Thus, evaluating market needs in the context of ongoing technological innovation is critical [83], underscoring the importance of precisely defining and quantifying value creation. This aids in communicating the benefits of a specific business model, preventing the provision of features that are no longer sought after by the target customer and curbing unnecessary utilization waste [84,85]. Secondly, digitalization is intricately linked with business model innovation in the long run. Business models enabled by digital technologies have the potential to redefine how the value of new products and processes is created, delivered, and captured among providers, customers, and other participants in the value chain. This dynamic facilitates dual-domain exploratory innovation, engendering long-term performance value. In the short term, adhering to the resource-based view, explorative innovation in a single domain takes on a transitional form at lower levels of digitalization, with a constrained impact on performance improvement [86]. Therefore, this paper posits the following hypotheses:

H5.

At an advanced level of digitalization, the dual exploration strategy exhibits a more pronounced positive impact on firm performance.

H6.

At an advanced level of digitalization, the detrimental effect of the business model leveraging strategy on firm performance is mitigated.

H7.

At an advanced level of digitalization, the positive impact of the technology leveraging strategy firm performance is mitigated.

H8.

At an advanced level of digitalization, the dual exploitation innovation strategy exerts a more notable negative impact on firm performance.

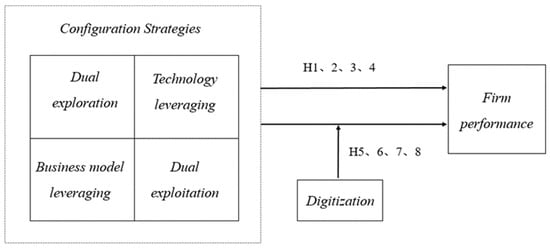

Draw a conceptual model diagram for this study, as shown in Figure 1.

Figure 1.

Conceptual model.

3. Research Method

3.1. Research Setting and Data Collection

This study focuses on manufacturing firms listed on the Shanghai and Shenzhen A-share stock exchanges in China, covering the period 2018–2020. The independent variables (four innovation methods) were selected from the 2018–2019 annual report data, and the dependent variable (firm performance) and other variables were selected from the 2019–2020 annual report data. This study follows the following three principles to screen and process data:

- ①

- Excluding ST, *ST, and other specified firms.

- ②

- Using technological innovation variables as the standard to delete firms with missing data and abnormal numerical values. These firms have not disclosed research and development investment capitalization, expense amount, research and development expenses, or digital information that cannot be crawled.

- ③

- Deleting firms with industry codes D, F, H, J, K, and L (sustainable operation even if not engaged in innovation activities).

After screening, 613 sample observations were obtained.

The data used to test the proposed hypotheses were obtained from the China Stock Market and Accounting Research (CSMAR) database and JUCHAO information network. Specifically, this study obtained technological innovation and control variables data from CSMAR database. Based on the annual report disclosure information of firms on the JUCHAO information network, the data on business model innovation was organized, and other data information was verified to ensure the accuracy of the data collected.

The data analysis was mainly completed using Stata15.0 software, and ChatGPT 3.5 was employed to polish sentence structure and improve readability.

3.2. Measures

3.2.1. Firm Performance

Following previous research [66,87], firm performance is measured by return on total assets (ROA).

3.2.2. Technological Innovation

Technological innovation in this context is defined based on the guidelines outlined in Accounting Standard for Business Firms No. 6—Intangible Assets (2006) in China. The investment in internal research and development projects is categorized into two stages: research stage investment and development stage investment. The research stage investment is considered more exploratory, involving higher risks and greater uncertainty of outcomes compared to the development stage investment. Following the approach established by Bi et al. (2017) [88], the research expenditure of research and development activities, treated as expensed expenditure, is utilized to measure exploratory technological innovation (RTI). Additionally, the capitalized expenditure of firms is employed as utilization expenditure to measure exploitative technological innovation (TTI). The data used for these measurements are extracted from the information on research and development activities expensed, as disclosed in the Board’s report. To account for innovation lag, data from the previous period are utilized.

3.2.3. Business Model Innovation

Business model innovation is assessed using the content analysis method inspired by the work of Albertini (2014) and Xie et al. (2019) [1,89]. This involves quantitatively assigning scores to the information about changes in firm strategy, operation, profitability, and other relevant aspects disclosed in the business status section of a firm’s annual report. The variables of exploratory business model innovation (RBMI) and exploitative business model innovation (TBMI) are then scored on a scale of 0 to 2. The scoring criteria are as follows: 0 for no related description, 1 for a simple description lacking implementation details (e.g., a detailed plan, implementation process, or quantitative terms indicating actual innovation), and 2 for a detailed description. To account for innovation lag, data from the preceding period are utilized. The evaluation criteria are shown in Table 2 and Table 3.

Table 2.

Example of evaluation criteria for exploratory business model innovation.

Table 3.

Example of evaluation criteria for exploitative business model innovation.

3.2.4. Digitalization

Digitalization (DI) is quantified using the text mining method, employing the frequency of occurrence of specific digital keywords as metrics—the higher the frequency, the more attention is paid to the meaning represented by the keyword [90]. The selection of keywords is based on the work of Li et al. (2021) [91]. A Python algorithm involving automatic word segmentation and manual sorting is utilized to determine the total frequency of each keyword in the firm’s annual report. The resulting data undergoes a 1% processing to mitigate the impact of extreme values, following the approach outlined by Mallin et al. (2013) [92]. The processed data is then dichotomized into high and low levels of digitalization. If the value exceeds the overall average, it is classified as 1; otherwise, if it is below the overall average, it is categorized as 0. For example, the overall average is 4.05 and Midea’s digitalization frequency is 20, it will be assigned a value of 1. The keywords included digital, big data, cloud, industrial Internet, artificial intelligence, data analysis, analyze data, data acquisition, data collection, visualization, information system, intelligence, knowledge graph, machine learning, internet of things, MES, Industry 4.0, and BI.

3.2.5. Control Variables

Additionally, considering the multifaceted nature of firm behavior and performance, seven control variables are identified based on a comprehensive review of the relevant literature. These variables encompass firm size, firm age, asset–liability ratio, property right nature, firm growth, and liquidity capital flows. The inclusion of these control variables aims to account for influences on firm behavior, decisions, and performance. All variables and their measurements are shown in Table 4.

Table 4.

Symbols and measurements of variables.

3.3. Model Design

Based on theoretical analysis results and hypothesis logic, this study refers to existing literature and constructs the following regression model. Firstly, we construct Model 1 to verify the impact of seven control variables on firm performance. Secondly, four innovation variables are added to Model 1 to construct Model 2, which can be used to verify the impact of different innovation methods on firm performance.

ROAi,t = β0 + β1SIZEi,t + β2AGEi,t + β3LEVi,t + β4PRi,t + β5INDi,t + β6GRi,t + β7LCFi,t + εi,t

ROAi,t = β0 + β1SIZEi,t + β2AGEi,t + β3LEVi,t + β4PRi,t + β5INDi,t + β6GRi,t + β7LCFi,t + εi,t

+ β8RTIi,t−1 + β9TTIi,t−1 + β10RBMIi,t−1 + β11TBMIi,t−1 + εi,t

+ β8RTIi,t−1 + β9TTIi,t−1 + β10RBMIi,t−1 + β11TBMIi,t−1 + εi,t

Thirdly, when examining the impact of different innovation matching strategies on firm performance, the interaction terms of four innovation methods can be constructed. Based on Model 2, the interaction terms are added to construct Model 3 to test the hypotheses H1–H4.

ROAi,t = β0 + β1SIZEi,t + β2AGEi,t + β3LEVi,t + β4PRi,t + β5INDi,t + β6GRi,t + β7LCFi,t + εi,t

+ β8RTIi,t−1 + β9TTIi,t−1 + β10RBMIi,t−1 + β11TBMIi,t−1 + β12TLi,t−1 + β13BLi,t−1

+ β14DRi,t−1 + β15DTi,t−1 + εi,t

+ β8RTIi,t−1 + β9TTIi,t−1 + β10RBMIi,t−1 + β11TBMIi,t−1 + β12TLi,t−1 + β13BLi,t−1

+ β14DRi,t−1 + β15DTi,t−1 + εi,t

Finally, we use Model 4 and 5 to analyze the moderating effect of digitalization on the impact of innovative configuration strategies on firm performance, and then verify hypotheses H5–H8. Model 4 represents the effect of a high digitization level group, while Model 5 represents the effect of low digitization level group.

ROAi,t = β0 + β1SIZEi,t + β2AGEi,t + β3LEVi,t + β4PRi,t + β5INDi,t + β6GRi,t + β7LCFi,t + εi,t

+ β8RTIi,t−1 + β9TTIi,t−1 + β10RBMIi,t−1 + β11TBMIi,t−1 + β12TLi,t−1 + β13BLi,t−1

+ β14DRi,t−1 + β15DTi,t−1 + εi,t

+ β8RTIi,t−1 + β9TTIi,t−1 + β10RBMIi,t−1 + β11TBMIi,t−1 + β12TLi,t−1 + β13BLi,t−1

+ β14DRi,t−1 + β15DTi,t−1 + εi,t

ROAi,t = β0 + β1SIZEi,t + β2AGEi,t + β3LEVi,t + β4PRi,t + β5INDi,t + β6GRi,t + β7LCFi,t + εi,t

+ β8RTIi,t−1 + β9TTIi,t−1 + β10RBMIi,t−1 + β11TBMIi,t−1 + β12TLi,t−1 + β13BLi,t−1

+ β14DRi,t−1 + β15DTi,t−1 + εi,t

+ β8RTIi,t−1 + β9TTIi,t−1 + β10RBMIi,t−1 + β11TBMIi,t−1 + β12TLi,t−1 + β13BLi,t−1

+ β14DRi,t−1 + β15DTi,t−1 + εi,t

4. Analyses and Results

4.1. Statistical Description and Correlation Analysis

The article selects five statistical indicators, namely sample size, mean, standard deviation, minimum, maximum, skewness, and sharpness, to conduct statistical analysis on the samples. The specific statistical results are shown in Table 5. From the results, it can be seen that there are no cases where the standard deviation is greater than the mean. The stability of the sample data is good and there is not much change in the numerical values compared to previous studies. The difference between the maximum and minimum values of the four innovation variables is significant, indicating that there are significant differences in the choices of different innovation methods among firms. Similarly, there are significant differences in the firm performance (dependent variable). From the description of the control variables, it can be seen that there is a significant difference between the two indicators of firm size and growth, but the overall difference is small. Therefore, the sample distribution is relatively uniform, indicating that the data collection is effective. In addition, it can be seen from the statistical results that the skewness of all sample data is between −2 and 2, and the kurtosis is between −3 and 3. The values of skewness and kurtosis are within an acceptable range, which indicates that the data distribution conforms to the characteristics of the Gaussian distribution. Therefore, it can be considered that these data are in line with the Gaussian distribution and further data analysis and processing can be carried out. Furthermore, the percentage of state-owned firms is 30.8%, and the percentage of firms from high-tech industries is 65.3%. When we use text analysis assignment to measure RBMI (TBMI), missing data accounts for 30.3% (26.0) of the sample, simple description accounts for another 35.7% (49.1), and detailed description represents the remaining 34.0% (24.9).

Table 5.

Statistical description of relevant variables.

This study employs the Pearson correlation coefficient to assess the correlation between variables. The findings are presented in Table 6. The correlation coefficients across variables are all below 0.65, indicating a lack of significant covariance issues between them. Analyzing the correlation results, it is observed that the correlation coefficients between the four types of innovations and firm performance are consistently positive and statistically significant. This preliminary finding suggests that all four types of innovations may have an impact on firm performance, affirming the viability of the study’s conceptual framework.

Table 6.

Results of correlation analysis.

4.2. Hypotheses Testing

This article uses Stata15.0 software to conduct regression analysis on 613 collected panel data. Before constructing the interaction term, variables have been standardized and centralized to eliminate the influence of dimensional differences and multicollinearity as much as possible. The regression model is also subjected to the Hausman test to determine the choice of fixed or random effects model. In all the test results of this article, the p-value is less than 0.1, meaning that a fixed effects model is chosen. The detailed regression analysis results are presented in Table 7.

Table 7.

Results for effects of configuration strategies on firm performance.

In addition, to further investigate whether there is a significant difference in the impact of various configuration strategies on firm performance between the two groups of samples, this paper uses a Fischer test based on Bootstrap to conduct inter-group coefficient difference tests. Specifically, the regression coefficient differences between the two groups of variables in the high digitalization level group and the low digitalization level group are compared. The test results are shown in Table 8.

Table 8.

Results of inter-group coefficient test.

In Model 2, it is evident that various innovation strategies exert a significant positive impact on firms’ performance levels. Moving to Model 3, the DR is found to significantly influence firm performance (β = 0.136, p < 0.05), exhibiting a positive promoting effect, thereby supporting Hypothesis H1. Similarly, TL also exhibits a significant effect on firm performance (β = 0.164, p < 0.05), showing a parallel positive promoting effect and supporting Hypothesis H3. Conversely, BL demonstrates a significant negative effect on firm performance (β = −0.109, p < 0.05), and the DT shows a significant negative effect as well (β = −0.127, p < 0.05), confirming the support for Hypotheses H2 and H4.

The moderating impact of digitalization on the relationship between distinct innovation allocation strategies and firm performance, along with the test outcomes of inter-group coefficients, are detailed in Table 4 and Table 5. Examining Model 4 and Model 5, it becomes apparent that the regression outcomes for the DR and firm performance are significantly positive at a high level of digitalization (β = 0.362, p < 0.05), whereas, at a low digitalization level, these effects are not significant (β = 0.106, p > 0.1). Moreover, the empirical p-value in the inter-group coefficient difference test is less than 0.1, signifying a noteworthy difference between the regression coefficients of the two groups. This suggests that with increased digitalization, the impact of the DR on firm performance becomes more pronounced. Meanwhile, at a high level of digitalization, the regression between TL and firm performance is not significant (β = 0.180, p > 0.1), and the regression results of BL and firm performance are also not significant (β = −0.046, p > 0.1). Conversely, at a low digitalization level, both regression results are significant (β = 0.210, p < 0.05, β = −0.113, p < 0.1). The test results of inter-group coefficients in Table 5 demonstrate that the p-values are all less than 0.1, indicating significant differences between the regression results of the two leveraging strategies and firm performance in the two groups. Therefore, it can be concluded that at a high level of digitalization, the impact of leveraging strategies on firm performance will be weakened. Consequently, hypotheses H6 and H7 are supported. Moreover, under both high and low digitalization levels, the regression outcomes of the DT on firm performance are significantly negative (β = −0.293, p < 0.05; β = −0.138, p < 0.1). Despite β = −0.138 > β = −0.293, the p-value of the inter-group coefficient is greater than 0.1, indicating no significant difference in the impact of DT on firm performance at different digitalization levels. Hence, hypothesis H8 is not supported.

4.3. Robustness Tests

We employed the approach of substituting the dependent variable—net profit on total assets (ROA)—with return on net assets (ROE) and isolating non-state-owned firm sub-samples to examine the primary impact of the four configuration strategies on firm performance. The frequency of occurrences of digital-related information (DRI) serves as an indicator of the importance firms attribute to digitalization. Substituting the digital technology classification (DI) with DRI can validate the stability of the adjustment effect. The results reveal that the significance level of each variable and the sign of the regression coefficients exhibit no significant changes from the original findings, confirming the research hypotheses of this paper (Table 9).

Table 9.

The results of the robustness test.

5. Discussion

5.1. Research Finding

This study diverges from prior research primarily centered on technological innovation [13,14] by adopting the organizational ambidexterity theory to explore the impact of cross-domain innovation configuration on firm performance [31,32]. The paper categorizes technological innovation and business model innovation into exploration and exploitation, leading to four distinct configuration strategies. The specific hypothesis testing results are shown in Table 10. Empirical research results align with the research hypotheses, confirming the significant influence of different configuration strategies on firm performance. Regarding the examination of the relationship between digitalization and various configuration strategies and firm performance, the empirical findings indicate that at a high level of digitalization, the positive impact of DR (dual exploratory strategy) on firm performance is more pronounced than at a low digitalization level. The positive effect on firm performance becomes increasingly apparent with higher levels of digitalization. Moreover, as the digitalization level rises, the influence of leveraging strategy on firm performance diminishes. This suggests that digitalization weakens the positive impact of TL (technology leveraging strategy) on firm performance and diminishes the negative relationship between BL (business model leveraging) and firm performance, aligning with the theoretical hypotheses of this paper.

Table 10.

Research hypothesis testing results.

Regarding the impact of DT (dual exploitation strategy) on firm performance at different digitalization levels, the results indicate that both are negative and significant, with no notable difference. This indicates that digitalization does not have a significant moderating effect on the impact of DT (dual exploitative innovation) on firm performance, which is inconsistent with the research hypotheses of this article. This can be interpreted in several ways. Firstly, based on the configuration theoretical approaches, and in particular external alignment perspective, the dual exploitation strategy may no longer be suitable for the swiftly evolving market environment. This fundamental mismatch likely results in a negative effect on firm performance, irrespective of the level of digitalization. Secondly, from the perspective of organizational ambidexterity theory, the dual nature of innovation necessitates firms to possess both exploitation and exploration capabilities. Relying solely on exploitation capabilities may not yield substantial returns for firms. Lastly, even though digitalization presents a “double-edged sword” that imposes higher demands on firms’ innovation strategies, it concurrently provides increased profit opportunities through advanced technology dissemination and rapid information flow, to some extent offsetting the negative outcomes stemming from the misalignment of innovation approaches. Therefore, there is no significant difference in the impact of an exploitation strategy on firm performance at different levels of digitalization.

5.2. Theoretical Implications

The findings of this study can contribute to the innovation ambidexterity and digital transformation literature, and further offer the following theoretical implications and a fresh pathway to future studies.

Firstly, this study makes a noteworthy contribution to the organizational ambidexterity literature by concurrently investigating the equilibrium between exploration and exploitation in both technological innovation and business model innovation realms. In response to the call for cross-domain research on ambidexterity [29,32], this paper introduces a fresh perspective to address the ongoing debate about the impacts of organizational ambidexterity. Specifically, this study underscores the importance of aligning strategic goals or behaviors within closely related domains while maintaining a balance between exploitation and exploration [15].

Secondly, in line with the theoretical proposition that the configuration of various organizational elements and activities (such as function, structure, and attribute) is pivotal for achieving firm performance [26], this study diverges from previous research that solely concentrates on technological innovation. Instead, it uncovers the internal dynamics between two distinct innovation activities. This study presents empirical evidence concerning the allocation of diverse innovation activities within firms for the first time, establishing a conceptual framework that addresses the innovation dilemma by strategically distributing technological innovation and business model innovation following organizational ambidexterity perspectives [30,93]. This strategic allocation aims to alleviate the tension between technological and business model innovation ambidexterity. The research findings affirm the significance of a suitable configuration, unveil the interactive effects of different configuration strategies, and provide a novel insight into the mechanisms through which these configuration pathways influence firm performance.

Thirdly, this paper explores the impact of two types of innovation model configuration and organizational ambidexterity in the context of a more rapid digital transformation in China, making further contributions to the literature relevant to this topic [36]. This study reveals that in a nascent dynamic institutional environment, the positive effect of DR (dual exploration strategy) is more pronounced with a higher level of digitalization. Conversely, the diverse effects of leveraging strategies, which concentrate on ambidexterity for firm performance, are attenuated. This underscores the importance of applying pertinent theories to emerging markets and introduces a fresh research perspective. In addition, China has become the world’s second-largest economy and is closely related to the global economic situation. As the world’s largest emerging market, China shares many common characteristics with other emerging markets [37]. Digital transformation and innovation are the inevitable paths for all manufacturing enterprises in the world to adapt to the trend of intelligent manufacturing transformation and gain competitive advantages. Therefore, the results of this study can provide a reference for other research situations.

5.3. Practical Implications

The findings of this study may have important implications for managers.

Firstly, this paper’s research establishes that the exploration of ambidextrous innovation in both technology and business model dimensions holds significant implications for the transition of manufacturing firms from a singularly focused innovation mode to a collaborative innovation approach. In the innovation journey of manufacturing firms, various innovations coexist that are constrained by resource limitations and the innovation configuration effect, emphasizing that more innovation does not necessarily equate to better outcomes [4,5]. Hence, manufacturing firms must explore innovation configuration models that align with market demands, responding to changes in the internal and external environment and their needs.

Secondly, the insights gained from this research in the Chinese market hold substantial implications for operators of Chinese firms and those planning to enter this market. As the world’s largest emerging market, China has greater development opportunities and has always attracted a continuous stream of enterprises. The results of this study can help them adapt to the Chinese market environment and reduce unnecessary resource waste. The findings suggest that managers should concurrently explore and exploit, avoid pure strategies, and achieve this balance across different functional areas. To attain innovation success and superior performance, adopting dual exploration and technology leveraging strategies is appropriate as they can foster competitive advantages through differentiated operations or relatively low costs.

Moreover, as the firm’s digitalization level improves, the more pronounced the positive impact of dual exploratory strategy on firm performance becomes, while the negative effect weakens. Consequently, manufacturing firms are advised to enhance their investment in digital technology and align with digital macro policies based on their available resources, establishing a connection between digital transformation and the innovation pace [94,95]. Supported by a high digital level, actively exploring business model innovation and technological innovation enables firms to achieve long-term development. In scenarios with limited resources, leveraging strategies can be strategically chosen during the transitional period, building ambidexterity capabilities, and gradually transitioning towards a more competitive dual exploratory strategy. This approach allows firms to keep pace with market development, ensuring their long-term and sustainable growth.

5.4. Limitations and Research Directions

There are limitations to this study that need to be acknowledged. Firstly, due to sample constraints, not all manufacturing firm samples were fully disclosed, potentially impacting the research results. Secondly, variable measurement faces limitations, particularly in cases where data encoding relies on text mining, introducing the possibility of coding errors that might affect result validity. In future research endeavors, ongoing exploration of the intricate relationships between diverse forms of innovation, continuous improvement in sample representation, and the incorporation of innovative research methods can enhance the credibility and effectiveness of studies, ultimately providing more robust insights for the development of the manufacturing industry.

6. Conclusions

In the process of transformation and upgrading in the manufacturing industry, both technological and business model innovation plays a very important role. Starting from the organizational ambidexterity theory, this article focuses on the phenomenon of innovation configuration and extracts the mechanisms and relationship models of four innovation configuration strategies. Based on data from 613 listed manufacturing companies, the impact of business model innovation and technological innovation configuration on firm performance under the digital background is analyzed. This further improves the research on innovation configuration and organizational duality, opening up the “black box” of innovation development to explain the effectiveness of using innovation to achieve performance improvement, and providing suggestions for the deployment of innovation strategies and digital transformation of manufacturing firms.

Author Contributions

Conceptualization, P.G.; methodology and formal analysis, J.Z.; writing—original draft preparation, J.Z.; writing—review and editing, P.G. All authors have read and agreed to the published version of the manuscript.

Funding

This study was supported by the National Natural Science Foundation of China (grant number 72172041) and the Humanities and Social Sciences Project of the Ministry of Education in China (grant number 20YJC630022).

Institutional Review Board Statement

Not Applicable.

Informed Consent Statement

Not Applicable.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the corresponding authors on reasonable request.

Acknowledgments

Declaration of generative AI and AI-assisted technologies in the writing process. During the preparation of this work, the author(s) used ChatGPT 3.5 to polish sentence structure and improve readability. After using this tool/service, the authors reviewed and edited the content as needed and take full responsibility for the content of the publication.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Xie, X.M.; Huo, J.G.; Zou, H.L. Green process innovation, green product innovation, and firm financial performance: A content analysis method. J. Bus. Res. 2019, 101, 697–706. [Google Scholar] [CrossRef]

- Zheng, L.; Iatridis, K. Friends or foes? A systematic literature review and meta-analysis of the relationship between eco-innovation and firm performance. Bus. Strategy Environ. 2022, 31, 1838–1855. [Google Scholar] [CrossRef]

- Casadesus-masanell, R.; Zhu, F. Business model innovation and competitive imitation: The case of sponsor-based business models. Strateg. Manag. J. 2013, 34, 464–482. [Google Scholar] [CrossRef]

- Zhang, F. Configurations of Innovations across Domains: An Organizational Ambidexterity View. J. Prod. Innov. Manag. 2017, 34, 821–841. [Google Scholar] [CrossRef]

- Codini, A.P.; Abbate, T.; Messeni, P.A. Business Model Innovation and exaptation: A new way of innovating in SMEs. Technovation 2023, 119, 102548. [Google Scholar] [CrossRef]

- Teece, D.J. Business models, business strategy and innovation. Long Range Plann. 2010, 43, 172–194. [Google Scholar] [CrossRef]

- Hahn, R.; Spieth, P.; Ince, I. Business model design in sustainable entrepreneurship: Illuminating the commercial logic of hybrid businesses. J. Clean. Prod. 2018, 176, 439–451. [Google Scholar] [CrossRef]

- Nathan, M.; Rosso, A. Innovative events: Product launches, innovation and firm performance. Res. Policy 2022, 51, 104373. [Google Scholar] [CrossRef]

- Dilan, E.; Aydin, M.N. An integrated framework for examining innovation alignment in organizations. Int. J. Innov. Technol. Manag. 2019, 16, 1950039. [Google Scholar] [CrossRef]

- Markides, C. Business model innovation: What can the ambidexterity literature teach us? Acad. Manag. Perspect. 2013, 27, 313–323. [Google Scholar] [CrossRef]

- Bernal, O.V.; Toro-jaramilo, I.D. Organizational Ambidexterity: Exploration and Exploitation. Int. J. Innov. Technol. 2019, 16, 1950033. [Google Scholar] [CrossRef]

- Latifi, M.A.; Nikou, S.; Bouwman, H. Business model innovation and firm performance: Exploring causal mechanisms in SMEs. Technovation 2021, 107, 102274. [Google Scholar] [CrossRef]

- Aspara, J.; Tikkanen, H.; Pöntiskoski, E.; Järvensivu, P. Exploration and exploitation across three resource classes: Market/customer intelligence, brands/bonds, and technologies/processes. Eur. J. Mark. 2011, 45, 596–630. [Google Scholar] [CrossRef]

- Liu, Y.; Collinson, S.; Cooper, C.; Baglieri, D. International business, innovation and ambidexterity: A micro-foundational perspective. Int. Bus. Rev. 2022, 31, 101852. [Google Scholar] [CrossRef]

- Clauss, T.; Kraus, S.; Kallinger, F.L.; Bican, P.M.; Brem, A.; Kailer, N. Organizational ambidexterity and competitive advantage: The role of strategic agility in the exploration-exploitation paradox. J. Innov. Knowl. 2021, 6, 203–213. [Google Scholar] [CrossRef]

- Voss, G.B.; Voss, Z.G. Strategic ambidexterity in small and medium-sized firms: Implementing exploration and exploitation in product and market domains. Organ. Sci. 2013, 24, 1459–1477. [Google Scholar] [CrossRef]

- Osiyevskyy, O.; Shirokova, G.; Ritala, P. Exploration and exploitation in crisis environment: Implications for level and variability of firm performance. J. Bus. Res. 2020, 114, 227–239. [Google Scholar] [CrossRef] [PubMed]

- Santa-Maria, T.; Vermeulen, W.J.V.; Baumgartner, R.J. Framing and assessing the emergent field of business model innovation for the circular economy: A combined literature review and multiple case study approach. Sustain. Prod. Consump. 2021, 26, 872–891. [Google Scholar] [CrossRef]

- Kohtamäki, M.; Parida, V.; Oghazi, P. Digital servitization business models in ecosystems: A theory of the firm. J. Bus. Res. 2019, 104, 380–392. [Google Scholar] [CrossRef]

- Di, V.A.; Palladino, R.; Pezzi, A. The role of digital innovation in knowledge management systems: A systematic literature review. J. Bus. Res. 2021, 123, 220–231. [Google Scholar]

- Kaur, N.; Sood, S.K. Dynamic resource allocation for big data streams based on data characteristics (5Vs). Int. J. Netw. Manag. 2017, 27, 55–69. [Google Scholar] [CrossRef]

- Ekata, G.E. The IT Productivity Paradox: Evidence from the Nigerian Banking Industry. J. Inf. Sys. Dev. 2012, 51, 1–25. [Google Scholar] [CrossRef]

- Broccardo, L.; Zicari, A.; Jabeen, F. How digitalization supports a sustainable business model: A literature review. Technol. Forecast. Soc. 2023, 187, 122–146. [Google Scholar] [CrossRef]

- Bresciani, S.; Huarng, K.H.; Malhotra, A. Digital transformation as a springboard for product, process and business model innovation. J. Bus. Res. 2021, 128, 204–210. [Google Scholar] [CrossRef]

- Ancillai, C.; Sabatini, A.; Gatti, M. Digital technology and business model innovation: A systematic literature review and future research agenda. Technol. Forecast. Soc. 2023, 188, 122307. [Google Scholar] [CrossRef]

- Zhu, X.; Xiao, Z.; Dong, M.C.; Gu, J. The fit between firms’ open innovation and business model for new product development speed: A contingent perspective. Technovation 2019, 86, 75–85. [Google Scholar] [CrossRef]

- O’Cass, A.; Heirati, N.; Ngo, L.V. Achieving new product success via the synchronization of exploration and exploitation across multiple levels and functional areas. Ind. Market. Manag. 2014, 43, 862–872. [Google Scholar] [CrossRef]

- Kaulio, M.; Thoren, K.; Rohrbeck, R. Double ambidexterity: How a Telco incumbent used business-model and technology innovations to successfully respond to three major disruptions. Creat. Innov. Manag. 2017, 26, 339–352. [Google Scholar] [CrossRef]

- Lavie, D.; Kang, J.; Rosenkopf, L. Balance within and across domains: The performance implications of exploration and exploitation in alliance. Organ. Sci. 2011, 22, 1517–1538. [Google Scholar] [CrossRef]

- Božič, K.; Dimovski, V. Business intelligence and analytics use, innovation ambidexterity, and firm performance: A dynamic capabilities perspective. J. Strateg. Inf. Syst. 2019, 28, 101578. [Google Scholar] [CrossRef]

- Vorhies, D.W.; Orr, L.M.; Bush, V.D. Improving customer focused marketing capabilities and firm financial performance via marketing exploration and exploitation. J. Acad. Mark. Sci. 2011, 39, 736–756. [Google Scholar] [CrossRef]

- Zhang, D.L.; Linderman, K.; Schroeder, R.C. The moderating role of contextual factors on quality management practices. J. Oper. Manag. 2012, 30, 12–23. [Google Scholar] [CrossRef]

- Fang, E.; Palmatier, R.W.; Grewal, R. Effects of customer and innovation asset configuration strategies on firm performance. J. Market. Res. 2011, 48, 587–602. [Google Scholar] [CrossRef]

- Marquis, C.; Qian, C. Corporate social responsibility reporting in China: Symbol or substance? Organ. Sci. 2014, 25, 127–148. [Google Scholar] [CrossRef]

- Heras, H.A.; Estensoro, M.; Larrea, M. Organizational ambidexterity in policy networks. Compet. Rev. 2020, 30, 219–242. [Google Scholar]

- Sheng, S.; Zhou, K.Z.; Li, J.J. The effects of business and political ties on firm performance: Evidence from China. J. Mark. 2011, 75, 1–15. [Google Scholar] [CrossRef]

- Genin, A.L.; Tan, J.; Song, J. State governance and technological innovation in emerging economies: State-owned firm restructuration and institutional logic dissonance in China’s high-speed train sector. J. Int. Bus. Stud. 2021, 52, 621–645. [Google Scholar] [CrossRef]

- Chen, B.T. Service innovation performance in the hospitality industry: The role of organizational training, personal-job fit and work schedule flexibility. J. Hosp. Mark. Manag. 2017, 26, 474–488. [Google Scholar] [CrossRef]

- Parker, S.C.; Witteloostuijn, A.V. A General Framework for Estimating Multidimensional Contingency Fit. Organ. Sci. 2010, 21, 540–553. [Google Scholar] [CrossRef]

- Koufteros, X.; Vonderembse, M.; Jayaram, J. Internal and External Integration for Product Development: The Contingency Effect of Uncertainty, Equivocality, and Platform Strategy. Decis. Sci. 2010, 36, 97–133. [Google Scholar] [CrossRef]

- Hu, B.; Chen, W. Business model ambidexterity and technological innovation performance: Evidence from China. Technol. Anal. Strateg. 2016, 28, 583–600. [Google Scholar] [CrossRef]

- Khanagha, S.; Volberda, H.; Oshri, I. Business model renewal and ambidexterity: Structural alteration and strategy formation process during transition to a cloud business model. R&D Manag. 2014, 4, 322–340. [Google Scholar]

- Maletič, M.; Maletič, D.; Gomišček, B. The impact of Sustainability-Basel exploration and Sustainability-Basel exploitation practices on the organisational performance: A cross-country comparison. J. Clean. Prod. 2016, 138, 158–169. [Google Scholar] [CrossRef]

- Egelhoff, W.G. How a Flexible Matrix Structure Could Create Ambidexterity at the Macro Level of Large, Complex Organizations Like MNCs. Manag. Int. Rev. 2020, 60, 459–484. [Google Scholar] [CrossRef]

- Chen, D.N.; Liang, T.P. Knowledge evolution strategies and organizational performance: A strategic fit analysis. Electron. Commer. Res. Appl. 2011, 10, 75–84. [Google Scholar] [CrossRef]

- Dranev, Y.; Izosimova, A.; Meissner, D. Organizational Ambidexterity and Performance: Assessment Approaches and Empirical Evidence. J. Knowl. Econ. 2020, 11, 676–691. [Google Scholar] [CrossRef]

- Solís-Molina, M.; Hernández-Espallardo, M.; Rodríguez-Orejuela, A. Performance implications of organizational ambidexterity versus specialization in exploitation or exploration: The role of absorptive capacity. J. Bus. Res. 2018, 91, 181–194. [Google Scholar] [CrossRef]

- Guo, H.; Guo, A.; Ma, H. Inside the black box: How business model innovation contributes to digital start-up performance. J. Innov. Knowl. 2022, 7, 100188. [Google Scholar] [CrossRef]

- Souto, J.E. Business model innovation and business concept innovation as the context of incremental innovation and radical innovation. Tourism Manag. 2015, 51, 142–155. [Google Scholar] [CrossRef]

- Zhou, X.; Cai, Z.; Tan, K.H. Technological innovation and structural change for economic development in China as an emerging market. Technol. Forecast. Soc. 2021, 167, 120671. [Google Scholar] [CrossRef]

- Coccia, M. Theorem of not independence of any technological innovation. J. Econ. Bibliogr. 2018, 5, 29–35. [Google Scholar]

- Burström, T.; Parida, V.; Lahti, T. AI-enabled business-model innovation and transformation in industrial ecosystems: A framework, model and outline for further research. J. Bus. Res. 2021, 127, 85–95. [Google Scholar] [CrossRef]

- Leppänen, P.; George, G.; Alexy, O. When do novel business models lead to high performance? A configurational approach to value drivers, competitive strategy, and firm environment. Acad. Manag. J. 2023, 66, 164–194. [Google Scholar] [CrossRef]

- Randhawa, K.; Wilden, R.; Gudergan, S. How to innovate toward an ambidextrous business model? The role of dynamic capabilities and market orientation. J. Bus. Res. 2021, 130, 618–634. [Google Scholar] [CrossRef]

- Suchek, N.; Fernandes, C.I.; Kraus, S. Innovation and the circular economy: A systematic literature review. Bus. Strateg. Environ. 2021, 30, 3686–3702. [Google Scholar] [CrossRef]

- Ferreras-Méndez, J.L.; Olmos-Penuela, J.; Salas-Vallina, A. Entrepreneurial orientation and new product development performance in SMEs: The mediating role of business model innovation. Technovation 2021, 108, 102325. [Google Scholar] [CrossRef]

- Zott, C.; Amit, R. The business model: A theoretically anchored robust construct for strategic analysis. Strateg. Organ. 2013, 11, 403–411. [Google Scholar] [CrossRef]

- Wells, P. Degrowth and techno-business model innovation: The case of River simple. J. Clean. Prod. 2018, 197, 1704–1710. [Google Scholar] [CrossRef]

- Chesbrough, H. Business model innovation: Opportunities and barriers. Long Range Plann. 2010, 43, 354–363. [Google Scholar] [CrossRef]

- Gronum, S.; Steen, J.; Verreynne, M.L. Business model design and innovation: Unlocking the performance benefits of innovation. Aust. J. Manag. 2016, 41, 585–605. [Google Scholar] [CrossRef]

- Limaj, E.; Bernroider, E.W. The roles of absorptive capacity and cultural balance for exploratory and exploitative innovation in SMEs. J. Bus. Res. 2019, 94, 137–153. [Google Scholar] [CrossRef]

- Agnihotri, A. Low-cost innovation in emerging markets. J. Strateg. Mark. 2015, 23, 399–411. [Google Scholar] [CrossRef]

- Hang, C.; Garnsey, E.; Ruan, Y. Opportunities for Disruption. Technovation 2015, 39, 83–93. [Google Scholar] [CrossRef]

- Khan, S.J.; Mir, A.A. Ambidextrous culture, contextual ambidexterity and new product innovations: The role of organizational slack and environmental factors. Bus. Strat. Environ. 2019, 28, 652–663. [Google Scholar] [CrossRef]

- Sjjödin, D.R.; Vinit, P.; Markus, L. Smart Factory Implementation and Process Innovation. Res. Technol. Manag. 2018, 61, 22–31. [Google Scholar] [CrossRef]

- Lin, W.L.; Yip, N.; Ho, J.A. The adoption of technological innovations in a B2B context and its impact on firm performance: An ethical leadership perspective. Ind. Mark. Manag. 2020, 89, 61–71. [Google Scholar] [CrossRef]

- Chatterjee, S.; Chaudhuri, R.; Vrontis, D. Does data-driven culture impact innovation and performance of a firm? An empirical examination. Ann. Oper. Res. 2021, 11, 1–26. [Google Scholar] [CrossRef]

- Leen, G.; Karl, V.; Saskia, M. Transition Thinking and Business Model Innovation Towards a Transformative Business Model and New Role for the Reuse Centers of Limburg, Belgium. Sustainability 2016, 8, 112–122. [Google Scholar]

- Heiskala, M.; Jokinen, J.P.; Tinnilae, M. Crowdsensing-based transportation services-An analysis from business model and Sustainability-Basel viewpoints. Res. Transp. Bus. Manag. 2016, 18, 38–48. [Google Scholar]

- Mostaghel, R.; Oghazi, P.; Parida, V. Digitalization driven retail business model innovation: Evaluation of past and avenues for future research trends. J. Bus. Res. 2022, 146, 134–145. [Google Scholar] [CrossRef]

- Parida, V.; Sjödin, D.; Reim, W. Reviewing Literature on Digitalization, Business Model Innovation, and Sustainable Industry: Past Achievements and Future Promises. Sustainability 2019, 11, 391. [Google Scholar] [CrossRef]

- Liu, J.; Chang, H.; Forrest, J.Y.L.; Yang, B. Influence of artificial intelligence on technological innovation: Evidence from the panel data of China’s manufacturing sectors. Technol. Forecast. Soc. 2020, 158, 120–142. [Google Scholar] [CrossRef]

- Benitez, G.B.; Ferreira-Lima, M.; Ayala, N.F. Industry 4.0 technology provision: The moderating role of supply chain partners to support technology providers. Supply. Chain. Manag. 2022, 27, 89–112. [Google Scholar] [CrossRef]

- Ehret, M.; Wirtz, J. Unlocking value from machines: Business models and the industrial internet of things. J. Mark. Manag. 2017, 33, 111–130. [Google Scholar] [CrossRef]

- Paiola, M.; Agostini, L.; Grandinetti, R. The process of business model innovation driven by IoT: Exploring the case of incumbent SMEs. Ind. Market. Manag. 2022, 103, 30–46. [Google Scholar] [CrossRef]

- Cheah, S.; Wang, S.; Ma, J. Big data-driven business model innovation by traditional industries in the Chinese economy. J. Chin. Econ. Foreign. 2017, 10, 229–251. [Google Scholar] [CrossRef]

- Krotov, V. The Internet of Things and new business opportunities. Bus. Horizons 2017, 60, 831–841. [Google Scholar] [CrossRef]

- Martin-pena, M.L.; Diaz-garrido, E.; Sanchez-lopez, J.M. The digitalization and servitization of manufacturing: A review on digital business models. Strateg. Chang. 2018, 27, 91–99. [Google Scholar] [CrossRef]

- Mathias, H.; Tuomas, H.; Marko, K. Modeling manufacturer’s capabilities for the Internet of Things. J. Bus. Ind. Mark. 2018, 33, 822–836. [Google Scholar]

- Trunk, A.; Birkel, H.; Hartmann, E. On the current state of combining human and artificial intelligence for strategic organizational decision making. Bus. Res. 2020, 20, 875–919. [Google Scholar] [CrossRef]

- Story, V.M.; Raddats, C.; Burton, J. Capabilities for advanced services: A multi-actor perspective. Ind. Market. Manag. 2017, 60, 54–68. [Google Scholar] [CrossRef]

- Paschou, T. Digital servitization in manufacturing: A systematic literature review and research agenda. Ind. Market. Manag. 2020, 89, 278–292. [Google Scholar] [CrossRef]

- Gerpott, T.J.; May, S. Integration of Internet of Things components into a firm’s offering portfolio—A business development framework. Information 2016, 18, 53–63. [Google Scholar] [CrossRef]

- Kiel, D.; Arnold, C.; Voigt, K.I. The influence of the Industrial Internet of Things on business models of established manufacturing companies-A business level perspective. Technovation 2017, 68, 4–19. [Google Scholar] [CrossRef]

- Hanafizadeh, P.; Nik, M.R. Configuration of Data Monetization: A Review of Literature with Thematic Analysis. Glob. J. Flex. Syst. Manag. 2020, 21, 17–34. [Google Scholar] [CrossRef]

- Kohtamäki, M.; Parida, V.; Pankaj, C. The relationship between digitalization and servitization: The role of servitization in capturing the financial potential of digitalization. Technol. Forecast. Soc. 2020, 151, 119–134. [Google Scholar] [CrossRef]

- Jia, J.; Bradbury, M.E. Risk management committees and firm performance. Aust. J. Manage. 2021, 46, 369–388. [Google Scholar]

- Bi, X.F.; Zhai, S.P.; Jiang, B.Q. The Impact of Government Subsidies and Financial Redundancy on Dual Innovation of High-tech Firms. J. Account. Res. 2017, 4, 46–52. [Google Scholar]

- Albertini, E.A. Descriptive Analysis of Environmental Disclosure: A Longitudinal Study of French Companies. J. Bus. Ethics 2014, 121, 233–254. [Google Scholar] [CrossRef]

- Yan, J.; Tsinopoulos, C.; Xiong, Y. Unpacking the impact of innovation ambidexterity on export performance: Microfoundations and infrastructure investment. Int. Bus. Rev. 2021, 30, 101766. [Google Scholar] [CrossRef]

- LI, D.; Shen, W. Can Firm Digitalization Promote Green Innovation? The Moderating Roles of Internal Control and Institutional Ownership. Sustainability 2021, 13, 13983. [Google Scholar] [CrossRef]

- Mallin, C.; Michelon, G.; Raggi, D. Monitoring Intensity and Stakeholders’Orientation: How does Governance Affect Social and Environmental Disclosure? J. Bus. Ethics 2013, 114, 29–43. [Google Scholar] [CrossRef]

- Anzenbacher, A.; Wagner, M. The role of exploration and exploitation for innovation success: Effects of business models on organizational ambidexterity in the semiconductor industry. Int. Entrep. Manag. J. 2020, 16, 571–594. [Google Scholar] [CrossRef]

- Tian, J.; Coreynen, W.; Matthyssens, P. Platform-based servitization and business model adaptation by established manufacturers. Technovation 2022, 118, 102222. [Google Scholar] [CrossRef]

- Paiola, M.; Schiavone, F.; Grandinetti, R. Digital servitization and Sustainability-Basel through networking: Some evidences from IoT-based business models. J. Bus. Res. 2021, 132, 507–516. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).