1. Introduction

Individual investors face various obstacles that can hinder their success in the stock market. These barriers include emotional decision-making, difficulty understanding market trends, lack of professional expertise, and challenges in making real-time trading decisions [

1]. To overcome these obstacles, quantitative automated trading systems are often employed, offering several advantages that enhance the investment experience for individual investors. These benefits encompass eliminating emotional bias, precise trade execution through data and algorithmic analysis, and adapting swiftly to real-time market fluctuations. Moreover, as highlighted by Arribas et al. [

2], these automated systems can effectively integrate investors’ preferences, particularly concerning ESG objectives for diverse stocks. By leveraging these advantages, investors can optimize their investment processes, manage risks effectively, and increase their potential for sustained success in the stock market [

3,

4,

5].

Despite these advantages, automated stock trading systems provided by various companies also come with a range of limitations, including potentially misleading advertisements, risks to personal information security, steep minimum investment requirements, and skepticism regarding the legitimacy of advertised returns without back-testing validation. Additionally, users often encounter significant fees when using these systems. Furthermore, there is a lack of studies that explore automated stock trading systems beyond these limitations [

6]. Therefore, more studies are needed to propose methodologies that utilize deep learning models to analyze a selected set of stocks identified through technical analysis methods, followed by the implementation of automated trading [

7]. These gaps in the literature emphasize the significance and potential contribution of this study.

In most previous studies, the dominant approach for predicting stock prices has been the use of Artificial Intelligence (AI) or deep learning models alone [

8]. However, individual stock investors who rely solely on deep learning models for analysis and decision-making may face challenges, especially if their personal laptop’s Graphics Processing Units (GPUs) have subpar performance. This is attributed to the extensive computational processing time required by deep learning models, which heavily depend on large-scale datasets. Consequently, it may be impractical to analyze all stock prices using a personal laptop GPU. On an average computer, it would take approximately three minutes to analyze a single stock for 100 epochs. Considering that there are 2546 stocks listed on the Korea Composite Stock Price Index (KOSPI), the Korea Securities Dealers Automated Quotations (KOSDAQ), and the Korean New Exchange (KONEX) markets, it would take roughly 7638 min or approximately 127 h to predict the prices of all stocks. This renders it virtually impossible to analyze all stock items and make buying and selling decisions within a single day.

To address the performance limitations of personal laptop GPUs, it is recommended to combine deep learning models with technical analysis methods. This hybrid approach can significantly reduce the required analysis time, allowing individual investors to quickly identify stocks that may yield potential gains or losses in the upcoming trading day. Therefore, this method can effectively overcome limitations associated with personal laptop GPU performance, resulting in more reliable outcomes for investment decision-making.

In this study, we propose a comprehensive buy-and-sell algorithm designed to be compatible with the performance of an average laptop GPU. This allows individual investors to implement an AI-based automated trading system across all stocks, enhancing their investment strategies and increasing efficiency. Additionally, by integrating deep learning models with technical analysis methods, investors can navigate the complexities of financial markets more adeptly and strengthen their investment strategies, ultimately achieving a stable rate of return. As a result, this approach provides a lightweight analysis method that focuses on stocks identified through technical analysis methods, rather than a large-scale analysis method that relies solely on deep learning to evaluate all stocks. This streamlined methodology saves a significant amount of time, enabling the analysis of stock items and the execution of buying and selling decisions, even with the performance capabilities of an average laptop GPU.

Despite utilizing high-speed GPUs for stock price predictions, AI-driven automated trading systems companies are marred by disadvantages, such as misleading advertising and exorbitant fees [

9]. Therefore, creating a personalized automated trading system can enhance trustworthiness and provide greater autonomy, empowering individual investors to implement their preferred investment methodologies. In response to this need, we introduce a customized automated trading system tailored to investors of all scales. This system operates within the computational capacities of an average laptop GPU to execute buy and sell orders. Given the demand for an affordable and reliable stock prediction system capable of generating steady profits within a standard laptop GPU environment, this proposal aims to deliver such a system.

Therefore, the objective of this study is to develop a system that can accurately anticipate stock market trends and yield consistent returns without relying on expensive high-performance GPUs. By leveraging the computational capabilities of average laptop GPUs, this innovative system aspires to offer individual investors a cost-effective and accessible tool for achieving their investment goals. By combining deep learning models with technical analysis methods and optimizing the system for average laptop GPUs, the findings of this study are expected to contribute valuable insights to the field of automated stock trading systems and provide practical guidance to individual investors.

3. Research Context

3.1. Research Procedure

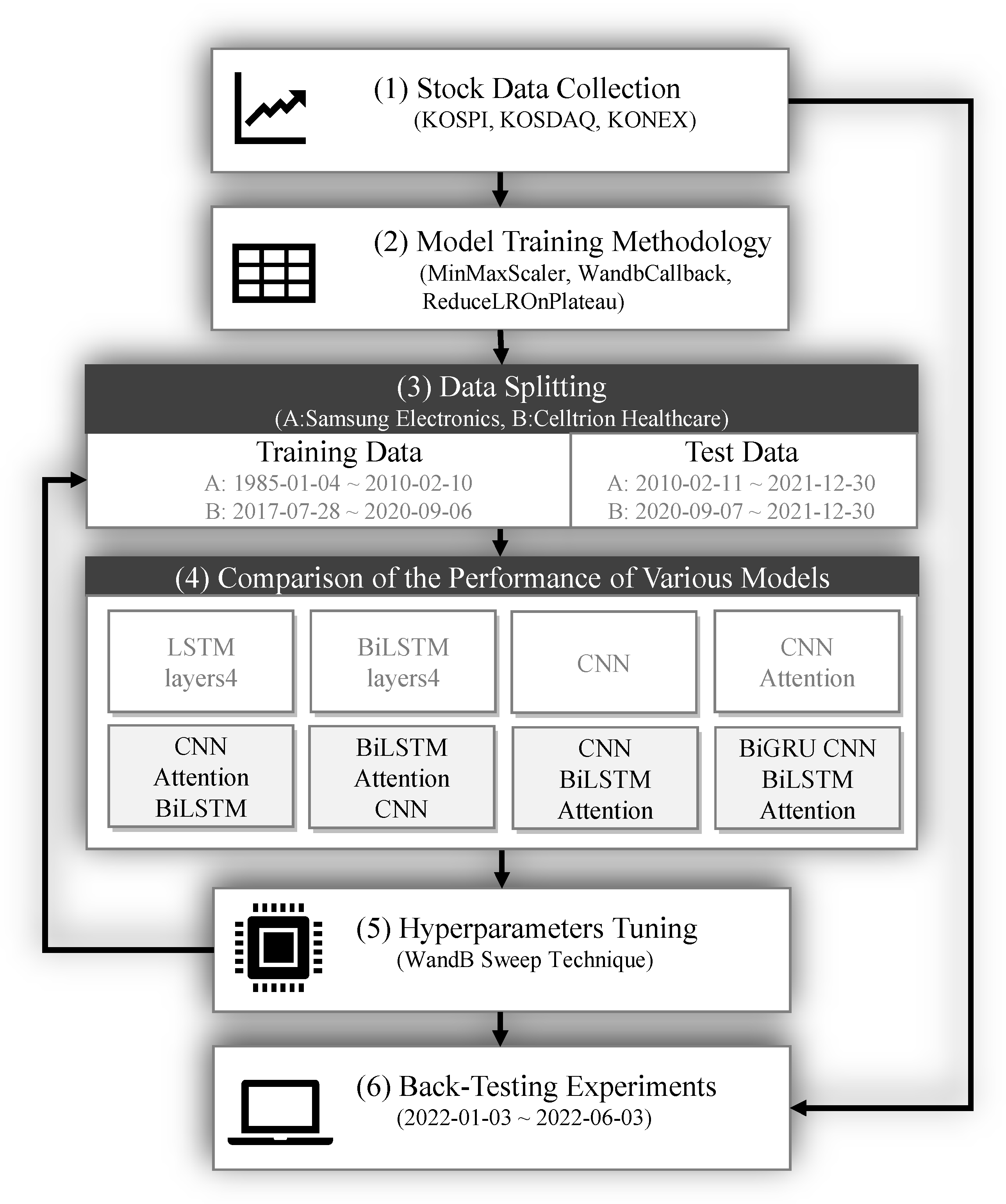

The research process in this study, as outlined in

Figure 2, commences with the collection of stock data and proceeds. Subsequently, the performance of different models is compared to determine the most effective model. This study continues with the optimization of model performance through hyperparameter tuning. Lastly, a back-testing rate of return validation is performed, utilizing individual deep learning models.

3.2. Experimental Environmental

We set an experimental environment composed of an AMD Ryzen 7 4800H with Radeon Graphics (2.90 GHz processor), 8.00GB RAM, and an NVIDIA GeForce GTX 1650 Ti GPU as personal laptop GPUs. The research was conducted within the VScode programming environment, Keras 2.4.3, TensorFlow 2.3.0, and Python 3.7.13. These tools allowed for multi-NVIDIA GPU support and distributed training.

Stock data were gathered using a 32-bit Anaconda virtual environment. On the other hand, experiments involving deep learning models and research comparing profitability through back-testing methods were executed in a 64-bit Anaconda virtual environment.

Database management was accomplished with MySQL 8.0. JetBrains DataGrip was chosen as the SQL query execution tool over MySQL Workbench due to its greater versatility and user-friendliness.

3.3. Stock Data Collection

In this study, we utilized the Kiwoom Securities (hereafter “K”) OpenAPI to collect daily stock data from approximately 2546 stocks listed on the KOSPI, KOSDAQ, and KONEX, explicitly focusing on daily data instead of minute-level data. In addition, the K OpenAPI was employed to gather closing prices, and all subsequent experiments were conducted based on these collected data.

The dataset has eight columns: date, code, stock name, closing price, 5-day simple moving average, 10-day simple moving average, 20-day simple moving average, and 40-day simple moving average. In addition, for the comparative analysis of deep learning models and back-testing strategies, a dataset containing five columns—close, open, high, low, and volume—was utilized for implementing buying and selling decisions with deep learning models.

In addition, data regarding managed stocks, non-compliant disclosure stocks, investment caution stocks, investment warning stocks, and investment risk stocks were scraped from the Korea Investor Network Disclosure Channel (KIND) website.

4. Methodology

4.1. Model Training

We used 9780 data points from Samsung Electronics stock data from 4 January 1985 to 30 December 2021. In addition, 1088 data points from Celltrion Healthcare stock data, covering the period from 28 July 2017 to 30 December 2021, were also employed in the experiments. Samsung Electronics and Celltrion Healthcare are well-established companies with solid reputations in their respective industries. This means their stock data reflects mature market behavior, which can be beneficial when making predictions.

Moreover, the reason for choosing these two items was because at the time of data collection, they were each at the top in terms of market capitalization in the KOSPI and the KOSDAQ, respectively.

For model performance validation experiments, input data were extracted from five column features: closing price (close), trading volume (volume), opening price (open), highest price (high), and lowest price (low). In this study, only the close, volume, open, high, and low columns were extracted as features from the Samsung Electronics and Celltrion Healthcare stock data, and all five columns were normalized to values using MinMaxScaler [

24].

Deep learning models were trained using the fit function in the model class API, leveraging the TensorFlow.keras.callbacks library, wandb.keras, and WandbCallback. To monitor the internal state and statistical data of the deep learning models during training, we employed two callback functions: WandbCallback and ReduceLROnPlateau. These callback functions facilitated more effective and precise training of the deep learning models [

25].

We employed the WandbCallback function from the wandb.keras library to save the best-performing model and weights based on the lowest validation data loss, as well as to record the performance metrics of the model at each epoch. The validation_steps parameter was set to “5”, enabling the full validation dataset to be used every five steps. Due to its significant benefits, we chose the WandbCallback function over the TensorBoard callback function. To optimize model performance, we used the ReduceLROnPlateau callback function, which lowers the learning rate (lr) if there is no improvement or decrease in validation data loss over one generation. Notably, in this study, the default value for the min_lr variable, which establishes the lower limit for the learning rate, was adjusted from “0” to “0.0001” [

26].

We also used the train_test_split function from the Sklearn library to divide the training and testing data at a ratio of 7:3. The experiments were performed with EPOCHS set to 100 and BATCH_SIZE to 32. In this research, we made a concerted effort to implement the AngularGrad optimizer [

27] in various deep learning models. Therefore, we meticulously configured the parameters, setting the method angle to “cos,” the learning rate to 1 × 10

−4, beta_1 to 0.9, beta_2 to 0.999, and eps to 1 × 10

−7. The intent behind this arrangement is to augment the optimization process, thus improving both the performance and generalization capability of the models.

4.2. Window Sliding

The window sliding technique is popular in stock price prediction using deep learning models [

28]. This method segments a time series of stock prices into smaller, equal-sized windows or segments, which are slid across the data. The primary goal of employing the window-sliding method in deep learning models is to detect key patterns and trends in the data that can be used to generate accurate predictions. Moreover, the window sliding method allows deep learning models to discern temporal dependencies within the data, which is vital in forecasting stock prices [

29].

In this study, experiments were carried out using a window size of 1. This strategy divided the time series of stock prices into consecutive, non-overlapping windows of size 1, enabling daily analysis of the stock price data and capturing short-term trends and market fluctuations. Utilizing a window size of 1 allowed us to grasp the daily volatility of the stock prices and detect patterns and trends that might not be observable with other techniques. This approach also facilitated the optimization of predictive models by analyzing the performance of various models.

4.3. Deep Learning Models Comparison

We conducted an in-depth evaluation of multiple models to facilitate a comprehensive comparison, encompassing primary and hybrid configurations. The basic models assessed in this research comprised four-layer LSTM networks, CNNs, and four-layer BiLSTM networks. Furthermore, the hybrid models assessed in the study included the CNN Attention hybrid model, the BiLSTM Attention CNN hybrid model, the CNN BiLSTM Attention hybrid model, the CNN Attention BiLSTM hybrid model, and the Bidirectional Gated Recurrent Unit (BiGRU) CNN BiLSTM Attention, hybrid model. We used the same values for the hyperparameters to compare the models.

We utilized the BiGRU CNN BiLSTM Attention model, an innovative deep learning architecture integrating the BiGRU, CNN, and BiLSTM alongside an Attention mechanism. This architecture aims to improve time series data’s prediction performance and interpretability by selectively concentrating on relevant parts of the input sequence.

The model starts with an input layer of shape (5, 1), symbolizing a one-time step with five features. Next, a bidirectional GRU layer is implemented to capture both forward and backward dependencies within the input sequence. Next, the BiGRU layer comprises two GRU layers, one processing the input sequence in the forward direction and the other in the reverse direction. Finally, the outputs of the two GRU layers are combined to produce a comprehensive representation of the input sequence.

Next, a 1D convolutional layer with Exponential Linear Unit (ELU) activation is applied to the output of the BiGRU layer. This convolutional layer is designed to identify local patterns and features within the input sequence, thereby extracting relevant temporal information. A batch normalization layer is then used to enhance the model’s training stability and convergence speed by normalizing the output of the convolutional layer. Following the normalization, a max pooling layer is employed to reduce the spatial dimensions of the feature maps, thereby enhancing the model’s ability to identify and extract robust, reliable features from the data. Following this, a bidirectional LSTM layer is introduced to further refine the temporal information captured by the model. Like the BiGRU layer, the BiLSTM layer comprises two LSTM layers processing the input sequence in both forward and reverse directions, with their outputs combined. It is applied to the output of the dropout to incorporate the Attention mechanism into the model. The input tensor dimensions are rearranged using the Permute function in this Attention mechanism. A dense layer with a SoftMax activation computes attention weights for each time step, signifying their importance in the sequence.

The second Permute function reshuffles the dimensions of the input tensor (42, 1) based on a specified pattern. The tensor’s form is effectively reshaped by rearranging the dimensions, offering flexibility in processing the tensor. The output of the dropout layer, which represents the temporal sequence of input features before the Attention mechanism, then undergoes an element-wise multiplication with these attention weights using the multiply function. The result is a new sequence where each feature is scaled according to its calculated weight or significance. After implementing the Attention mechanism, a Flatten layer is utilized to reshape the output tensor into a 2D tensor. This reshaped tensor is then fed into a dense layer with a linear activation function in the model’s final output.

A novel deep learning model, CNN Attention BiLSTM, is proposed in this study, combining a CNN, an Attention mechanism, and BiLSTM for time series prediction. This model seeks to address the complexities associated with deciphering intricate patterns and dependencies in sequential data, especially within the context of financial market applications. The architecture of the proposed model is detailed as follows. (1) Input Layer: The input layer takes in data with a shape of (5, 1), where 5 represents the five input features, including closing, volume, opening, highest, and lowest prices, and 1 signifies the number of time steps. (2) Convolutional Layer: A 1D convolutional layer is implemented to extract local features from the input time series data. The “filters” parameter in the conv1 function represents the dimensionality of the output space. Each filter in a CNN is responsible for a specific type of feature extraction by convolving with the input data. This 1D convolutional layer has filters of 21, a kernel size of 1, and strides of 30. The layer employs the ELU activation function and valid padding. (3) Batch Normalization Layer: Batch normalization is a technique aimed at enhancing the training process and attaining quicker convergence by normalizing the input to each layer. A batch normalization layer is added with an axis of 1 and a momentum of 0.9. (4) Max Pooling Layer: A 1D max pooling layer with a pool size of 1 and strides of 2 is implemented to reduce the spatial dimensions of the input data. This layer aids in decreasing the number of trainable parameters. (5) Attention Mechanism: Proven effective in stock prediction tasks, the Attention mechanism is an integral part of this architecture. It assigns importance to different input time steps. Following the implementation of a 1D max pooling layer, the Attention mechanism comes into play. This mechanism reshapes the input tensor dimensions using the Permute function and calculates attention weights for each timestep. These weights reflect the importance of each timestep within the sequence. This is executed using a dense layer that employs a SoftMax activation function. Then, another Permute function rearranges the input tensor according to a pre-set pattern, allowing for flexible tensor processing. Lastly, the output from the 1D max pooling layer undergoes an element-wise multiplication with these attention weights, yielding a new sequence where each feature’s magnitude is adjusted according to its computed significance. (6) Bidirectional LSTM Layer: A BiLSTM layer processes sequential data in both forward and backward directions, enabling the model to capture patterns from past and future data. This layer has 21 units and uses a kernel initializer set to its default value. (7) Dropout Layer: To prevent overfitting and enhance the model’s generalization capabilities, a dropout layer with a rate of 0.3 is introduced. This layer randomly omits neurons during the training phase. (8) Flatten Layer: The output tensor from the preceding layer is reshaped into a two-dimensional tensor using a Flatten layer. (9) Output Layer: A dense output layer with a single neuron and a linear activation function is employed for regression tasks. It predicts the target value based on the learned features.

In conclusion, the proposed CNN Attention BiLSTM model integrates the strengths of a CNN, Attention mechanism, and BiLSTM network to predict time series data effectively. As a result, this model is anticipated to offer valuable insights and enhance prediction performance across various financial market applications. Additionally, this streamlined architecture provides an efficient solution for stock price prediction within automated stock trading systems.

4.4. Hyperparameter Tuning

This study employed the Sweep methodology from Weights and Biases (WandB), providing a robust and efficient method for hyperparameter optimization specifically designed for deep learning models [

30].

The process involves exploring various hyperparameter values to find the most effective combination, which can be time-consuming. To expedite this process, we utilized Bayesian optimization, a method known for its speed in identifying optimal solutions. Moreover, we conducted hyperparameter tuning experiments on four distinct hybrid models. These models included CNN Attention BiLSTM, BiLSTM Attention CNN, CNN BiLSTM Attention, and BiGRU CNN BiLSTM Attention. Each model was analyzed and optimized to ensure the most effective and efficient performance.

Within the BiLSTM layers of these models, the initial default values were replaced with alternative settings:

recurrent_initializer = tf.random_normal_initializer(mean = 0.2, stddev = 0.05);

bias_initializer = tf.keras.initializers.HeUniform();

kernel_initializer = tf.keras.initializers.GlorotNormal().

Employing these parameters in place of the default settings in the BiLSTM layer could enhance model performance and learning efficiency. In deep learning models, selecting suitable weigh properties can significantly influence the attainment of optimum performance. Commonly, the following weight initializations are employed in designing neural networks. (1) Recurrent Initializer: The recurrent_initializer sets up the initial weights of the recurrent layers within a neural network. Using a random normal initializer with specified mean and standard deviation demands a comprehension of these parameters’ implications on the initial weights’ distribution. The mean = 0.2 parameter determines the center of the normal distribution from which the initial weights are derived. Typically, the mean is set near 0, but in this scenario, it has been set to 0.2, slightly shifting the range of initial weights. By doing so, the model can examine a broader set of initial weight values, potentially facilitating quicker convergence and preventing the model from falling into local minima during training. The stddev = 0.05 parameter defines the breadth or dispersion of the normal distribution employed for generating the initial weights. A lower standard deviation value leads to a tighter distribution of initial weights around the mean. The initial weight values will be nearer to the mean of 0.2. A minor standard deviation, such as 0.05, allows the model to explore a regulated range of initial weight values, helping to avoid issues like vanishing or exploding gradients during training.

In summary, using a random normal initializer with mean = 0.2 and stddev = 0.05 means the initial weights are drawn from a normal distribution centered around 0.2 with a spread of 0.05. This setting could result in more diverse initial weight values, possibly enhancing model convergence and alleviating common training challenges [

31].

This study conducted hyperparameter tuning experiments on three models: CNN Attention BiLSTM, BiLSTM Attention CNN, and CNN BiLSTM Attention. A Sweep Configuration approach was used, encompassing five key parameters. (1) BiLSTM_units was tested with three unique values: 11, 16, and 21. (2) Conv1D_activation investigated three activation functions: ReLU, SeLU, and ELU. (3) Conv1D_filters were evaluated with two distinct values: 21 and 31. (4) Conv1D_strides were examined with two stride values: 30 and 40. (5) Dropout was scrutinized with three different settings: 0.2, 0.3, and 0.4.

In addition, the BiGRU CNN BiLSTM Attention model underwent Sweep Configuration with six parameters. The parameters for BiLSTM_units, Conv1D_activation, Conv1D_filters, Conv1D_strides, and dropout were set identically to those in the Sweep Configuration of the CNN Attention BiLSTM, BiLSTM Attention CNN, and CNN BiLSTM Attention models. However, the distinguishing feature of this model was the introduction of an additional parameter, BiGRU_units, into the Sweep Configuration. Hyperparameter optimization experiments were conducted with the BiGRU_units parameter assigned the values 11, 16, and 21.

4.5. Back-Testing with Technical Analysis Methods

We designed a back-testing system that primarily targets acquiring stocks at the opening price at 9 AM on the specified “d” date. This method emphasizes the daily trading of stocks, initiating transactions at the start of the trading day.

Technical analysis methods were applied by firstly excluding stocks classified as administrative issues, unfaithful corporations, investment caution stocks, investment warning stocks, and investment risk stocks from all KOSPI, KOSDAQ, and KONEX stocks. Then, stocks were selected based on a complex formula involving the 5-day, 10-day, 20-day, and 40-day average closing prices and the Bollinger Bands method [

32]. Stocks were further filtered based on the “d-1” date closing price’s position relative to the lower Bollinger Band. In the last phase of extraction, stocks that satisfied the condition of having an average absolute momentum percentage more significantly throughout 1 to 12 months prior were chosen.

The buying and selling techniques involved using hybrid models with the five-column data (closing price, trading volume, opening price, highest price, and lowest price) from each stock’s listing date up to the “d-1” date.

The buying technique involved using four individual hybrid deep learning models with hyperparameters determined through WandB Sweep. These hyperparameters were determined based on the most common values from the top three results with the lowest val_mae values, obtained through WandB Sweep experiments using data from Celltrion Healthcare and Samsung Electronics stocks.

First, the models were used to purchase stocks with the predicted closing price rise by exceeding “1” percent on the “d” date compared to the predicted closing price on the “d-1” date. Then, starting with a capital investment of 10 million KRW, a daily allocation of 2 million KRW was distributed across a range of stocks to promote diversification.

The selling technique involved using the same four individual hybrid deep learning models. Stocks were sold when the predicted closing price for the “d” date was expected to decline by less than “-1” percent compared to the predicted closing price on the “d-1” date. The same deep learning models were used for buying and selling techniques to establish a cohesive trading strategy. Moreover, the hyperparameter values of hybrid models used for selling techniques were the same as those used in the buying techniques.

6. Discussion

6.1. Discussion of Findings

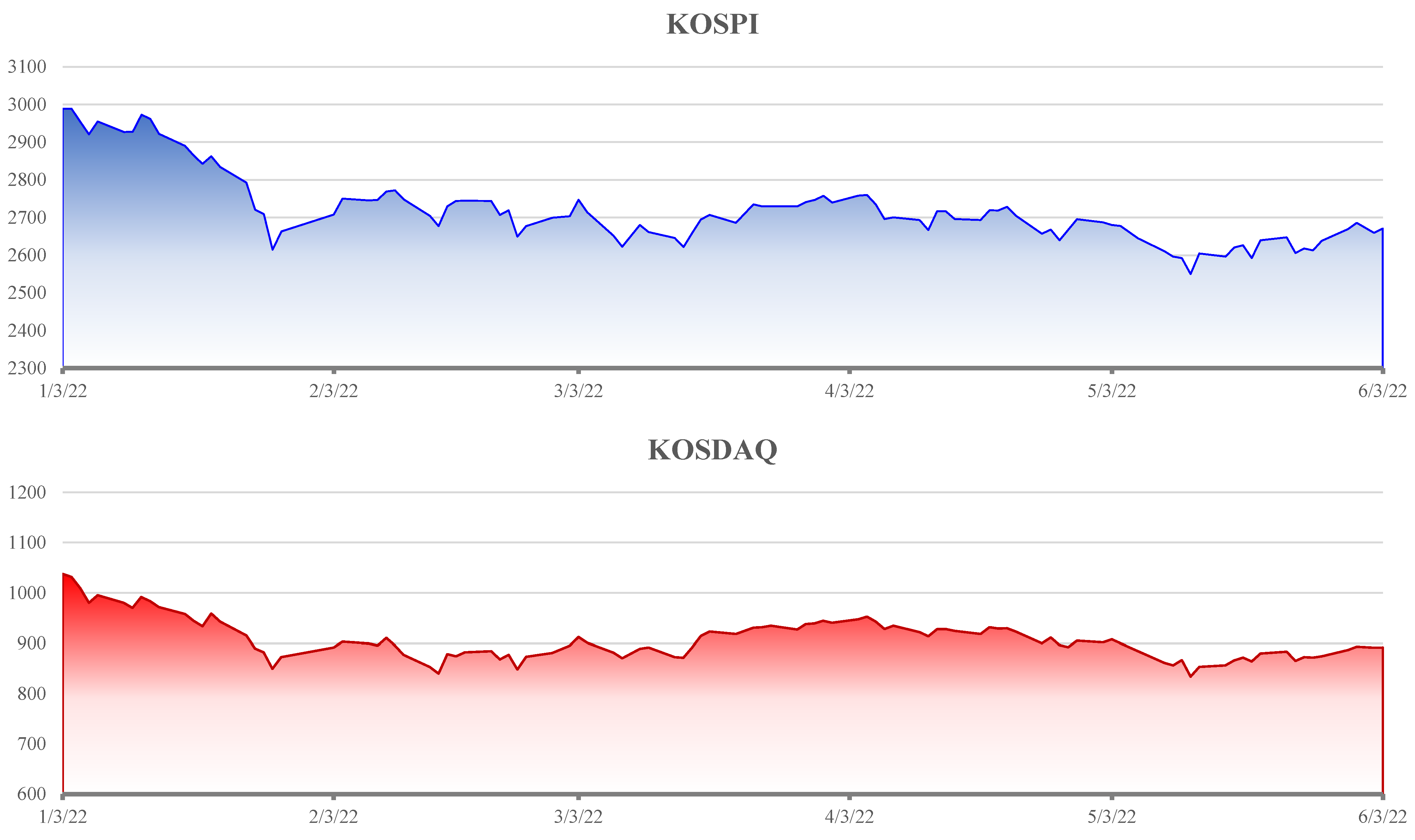

This study examined Samsung Electronics and Celltrion Healthcare stock data using eight deep learning models, among which the CNN Attention BiLSTM outperformed the others. Furthermore, by implementing a back-testing method to verify returns, the CNN Attention BiLSTM model displayed the highest prediction accuracy and returns among the four hybrid models considered. This finding underscores the efficacy of the CNN Attention BiLSTM model in accurately predicting stock market trends and consistently generating profits, emphasizing the value of leveraging advanced deep learning techniques. In this study, utilizing the back-testing method over five months resulted in the following projected timelines. When analyzing the collected data for approximately 2546 stocks from KOSPI, KOSDAQ, and KONEX solely using deep learning techniques, the anticipated time frame was roughly 800 days. In contrast, integrating technical analysis with deep learning analysis significantly reduced the time required, with experimental results indicating a timeline of approximately 2–3 days. Hence, solely analyzing all stocks through deep learning methods proves to be impractical. It becomes necessary to incorporate technical analysis to facilitate feasible back-testing methods, enabling the purchase of potentially rising stocks on the following day.

Theoretically, this study contributes to the existing literature using domestic stock data concerning automated trading systems, an area with relatively few studies [

5]. Moreover, it introduced a lightweight technical analysis method that allows conducting analyses using deep learning models and executing buy and sell orders, even in an average GPU environment. This approach effectively addresses the temporal limitations of algorithms that rely solely on deep learning models.

From a practical standpoint, this research offers a cost-efficient and highly accessible approach to developing automated stock trading systems that use machine learning and deep learning. For example, some larger investment companies or institutions use high-priced, ultra-fast GPUs to handle the rapid fluctuations of the stock market by performing complex calculations in a very short time. However, while these systems offer fast response times and high processing capabilities, they also entail considerable costs, increasing the initial investment cost.

In contrast, the system proposed in this study can function effectively on an average laptop, significantly reducing the initial investment cost and widening the range of potential participants in its development and operation. Its flexible design allows the application of various technical analysis techniques, catering to individual investor preferences and objectives. In addition, the back-testing feature enables investors to make informed, rational investment decisions that align with their unique investment styles and risk tolerances.

6.2. Limitations and Future Research

In this study, we have identified several limitations. First, our approach primarily relied on lightweight analysis methods for stock price prediction. Incorporating a wider spectrum of data sources, from stock prices to sentiment analysis, could further enhance accuracy and potential returns on investment. Second, the quantitative strategies we proposed represent only one dimension of available investment methods. Their efficacy might be influenced by individual investor characteristics, such as risk tolerance and time horizons. Thus, a diversified portfolio that merges quantitative with other investment strategies is advisable. Third, our study’s exclusive focus on the Korean stock market might limit its generalizability to other major markets, such as Japan and Hong Kong. Broader comparative research across different markets is essential to validate our findings’ applicability. Fourth, we explored specific configurations of the machine learning frameworks: LSTM, BiLSTM, and CNN. Describing these as distinct models might be misleading, and other prominent machine learning frameworks were not included in our focus. Future research might benefit from a broader exploration of other machine learning architectures. In conclusion, while this study offers an efficient approach to automated stock trading, a more holistic strategy encompassing diverse techniques, extensive data sources, and risk management is recommended. Future studies should consider these factors to stay adaptive and effective in the dynamic world of stock trading.