1. Introduction

A country or region is made up of many cities, which are different in many ways. Cities largely differ not only in their size, but also in their function and in the characteristics of the agents forming each city. Since the development of a country or region is highly dependent on the formation of various cities and their interactions, understanding the heterogeneous and diverse urban formation and interaction mechanisms in whole economic systems should be at the core of concerns of the policy makers for sustainable economic development and growth.

To understand such heterogeneity of cities and their formation and interaction mechanisms, the field of urban economics has been developed, and many systematic links have been uncovered. Above all, cities are largely different in their productivity. In general, large cities are more productive than small cities. Such urban productivity premiums are affected by various externality effects, as well as by various geographical characteristics. Among others, the previous literature in urban economics has highlighted the positive externality coming from agglomeration economies as the main driver for urban productivity premiums [

1]. As more firms and workers flow into the city, more competitions and more opportunities for idea exchange are created, and such positive externalities lead to an improvement of the overall city productivity. To explain such basic mechanisms, traditional models in urban economics have assumed homogeneous representative agents. Under the simplifying assumption of homogeneous agents, the larger the size (population) of the city, the more the total product of the city increases proportionately through positive externality effects [

2]. Consequently, models that take such approaches do not take account of the heterogeneity of agents, and only the total population (size) of the city determines the urban productivity premiums (see, e.g., [

3,

4]).

Though traditional models have provided many important basic insights concerning city formations and the links between the city size and the productivity, recent studies using individual firm and worker level microdata highlight the heterogeneity of cities in many aspects and much more complex interactions between heterogeneous cities, as well as between heterogeneous agents inside the cities. Above all, individual agents forming a city are largely heterogeneous, particularly regarding their individual productivity level, and such individual heterogeneity and its interactions play a key role in the aggregate output of heterogenous cities.

The highlighted stylized facts of recent empirical studies particularly emphasize such heterogeneity of agents and its implications [

5]. The share of qualified workers increases with the size of the city, which implies a sorting effect between heterogeneous workers and heterogeneous locations. Recent evidence shows that the worker quality differences across cities may explain up to 40–50% of the measured size productivity relationship [

6]. In addition to the soring effect, a selection effect has also been highlighted: the heterogeneous characteristics of the cities influence the occupational choices of the heterogeneous individual workers, as well as the entry/exit decisions of the heterogeneous individual firms and entrepreneurs. Various agglomeration effects have also been highlighted: the externality effects of each city are affected not only by the size of the city, but also by the heterogeneity of the agents forming the city and their interactions. Another branch of recent works in this line has focused on inequality. The average earnings of the workers are positively correlated to the size of the city, and the urban productivity premium increases proportionately with the average education level of the workers in the city. In addition, a large part of the overall income inequality is explained by the within-city income inequality as well as by the between-city income inequality. Not surprisingly, the size distribution of cities is not uniform. It is now widely documented that the size distribution of cities displays Zipf’s law (see, e.g., [

7,

8,

9]).

The above recent stylized facts based on heterogeneous agents cannot be explained by traditional modeling approaches in urban economics that assume homogeneous representative agents. Addressing heterogeneous agents and their interactions requires the introduction of heterogeneous agents in the model and the explicit consideration of the linkage between them. In particular, we need a framework that make it possible to analyze how heterogeneous agents flow into different city types (the sorting effect) and choose different tasks/occupations (the selection effect), as well as how the agglomeration effects coming from the heterogenous agents affect the overall productivity of the city (the productivity effect). Though recently, there have been several theoretical attempts to address such heterogeneous agents and their interactions in urban systems, their implications seem to still be limited in many ways due the complexity of the model when introducing various heterogeneity factors [

10]. Mainly, one-sided heterogeneity has been assumed, such as heterogeneous workers and homogeneous firms or heterogeneous firms and homogeneous workers, which would limit the analyses on the possible direct and indirect effects through the interactions of heterogeneities.

Another branch of recent studies focuses on the composition of cities. As modern cities specialize in different functions according to the value chain of the whole economy, large cities tend to attract high-value-added headquarter activities, while small cities tend to host relatively low-value-added simple production functions [

11,

12]. Moreover, cities are also different in their skill composition: relatively more-qualified workers flow into large cities, while small cities host more less-qualified workers (see, e.g., [

6,

13]). Such a compositional effect should be one of the main drivers of urban productivity premiums.

The aim of this paper is to analyze heterogenous city evolutions and the resulting implications on the labor market, as well as the overall productivity within a unified theoretical general equilibrium framework. For this, I developed a model in which heterogeneous workers were sorted into different cities based on their comparative advantage. Cities are heterogeneous in their function in the overall value chain and have different city-specific productivities, wherein the productivity of a worker depends not only on the individual ability, but also on the overall productivity of the city where the worker is located. Firms are also heterogeneous: two types of firms, using high or low technology, respectively, compete in the market and employ different workers. In doing so, I attempt to address recent new stylized facts coming from various heterogeneity factors in modern cities.

In terms of the theoretical modeling of heterogeneous agents, this model is related to the recent literature in international trade. By modeling heterogeneous firms and/or workers, recent papers highlight the aggregate productivity effect of globalization and the new gains from trade, which could not be captured by traditional models assuming a representative agent (see, e.g., [

14,

15,

16,

17,

18,

19,

20]). In a similar vein, this paper investigates how a reduction in the monitoring costs to produce in peripheral areas or a reduction in the trade costs in international trade contexts may differently affect the cities, as well as the heterogeneous workers and firms.

In particular, this paper focuses on the two countervailing effects of agglomeration and congestion. Traditional theoretical models in the literature have simply assumed that the congestion economies would dominate the agglomeration economies. It is because the derived equilibrium city size can be stable only when the marginal utility of workers decreases in city size. Such a theoretical condition should, however, be required in a particular environment where workers are homogeneous and all cities perform the same function and/or produce the same homogeneous goods. It is, however, widely documented that today’s modern cities are functionally specialized in many cases, and heterogeneous workers sort into different cities. In addition, as Behrens and Robert-Nicoud [

5] point out, though the relative magnitude of urban costs (congestion economies) and of agglomeration economies are important for understanding a variety of positive and normative properties of the spatial equilibrium, the empirical literature on the estimation of the urban costs is still scarce.

Given our heterogeneous worker–firm–city framework, in this paper, I investigate the different implications depending on the relative dominance of the two countervailing effects of agglomeration and congestion. As will be shown, given the same exogenous shocks, the city evolutions and the resulting labor market implications are crucially dependent on the relative dominance between the agglomeration and congestion effects. It is also shown that such relative dominance may affect the trading partner and generate the co-movement of city evolution in each country. When trading countries are asymmetric, overall city evolutions may be synchronized and follow the evolution of the country characterized that is by stronger dominance of one of the two effects of agglomeration and congestion.

As will be shown, by explicitly considering the linkage between functionally differentiated cities, as well as the interactions between heterogeneous agents, our integrated framework overcomes the limitations of traditional models. Since the 1960s, urban economists have focused on the problem of the optimal city size. Based on simple cost-benefit analyses, the optimal city size theory has sought the optimal city population which maximizes the net benefits [

21]. As pointed out by various authors, however, the dynamics and development patterns of urban systems in the real world can be explained by many other factors other than the population size [

22]. In particular, urban economists began to underline the concept of efficient city size. which is determined by the functional heterogeneity of cities and its linkage within the urban systems. Two paradigms have emerged, which are referred to as the neoclassical Christallerian city paradigm and the network city paradigm. Though Christaller’s central place theory has provided important insights on the pattern of a nested hierarchy in urban systems [

23], it has been widely highlighted that modern city systems are much more complex and function as networks [

24]. In the network theory, cities are functionally specialized within the whole urban system and closely interrelated through such features as the production linkages of local and global firms. In this regard, our paper contributes to the city network theory literature by explicitly modeling worker and firm heterogeneity and by studying the possible outcomes coming from their interactions. In particular, it is shown that cities may develop and co-evolve through their interactions within global networks. Though, in this paper, we do explicitly model the strategic behaviors of city developers, our unified theoretical framework may shed some interesting light on the city development process. In their influential work, Henderson and Thisse [

25] developed a model to determine the number and sizes of communities when consumers/residents are heterogeneous in their income levels and when communities adopt strategic behaviors to attract residents. In our study, workers are heterogenous in their talents, and individual incomes are determined endogenously by interactions with the overall productivity of the city, which were determined endogenously through the sorting of heterogeneous workers. Such compositional effects should be at the core of concerns about the issue of optimal and/or efficient city size. Fujita and Krugman [

26] emphasized the increasing returns, imperfect competition, and transport costs in the new economic geography literature. In an environment where heterogeneous workers and firms endogenously sort into different city types, and the overall productivity of cities is, in turn, determined by such endogenous compositional effects, previous key terms, such as increasing returns, imperfect competition, and transport costs, should play much more important roles and generate even stronger direct and indirect effects in the general equilibrium framework of the spatial economy.

The rest of the paper is organized as follows. In

Section 2, I present the basic setup of a model where only one firm type exists. In

Section 3, I study the effects of a fall in the monitoring costs to produce in peripheral areas. In

Section 4, we extend the basic model by introducing another technologically different firm type, and I investigate the effects of a fall in the monitoring costs when the two heterogeneous firm types compete in the market. In

Section 5, I further extend the model to include international trade between two countries and investigate the effects of a fall in trade costs.

Section 6 supplements the theoretical discussions by providing numerical simulation results with a parameterized version of the model.

Section 7 concludes with some concluding remarks.

2. Setup of the Model

In this section, we first construct a basic model where only one firm type exists. Workers are differentiated by their individual ability, and their productivity is determined by their interactions with the overall productivity of the city, while cities are exposed to externalities from agglomeration and urban costs. Cities perform specialized functions in the total production chain of firms. Workers then sort into different cities and tasks according to their comparative advantage so that city-specific wage rates and the overall productivity of cities are endogenously determined by the resulting compositional effects. In such a setting, we analyze the impacts of a reduction in the monitoring costs to produce outside peripheral areas. We will later extend the model to incorporate different firm types and study the implications from their competition.

2.1. Preferences

Households have Dixit–Stiglitz preferences over a continuum of differentiated varieties:

where

represents the mass of available varieties, and

is the elasticity of substitution between varieties. A consumer’s optimization yields a demand schedule for each variety:

which is associated with an aggregate price index:

2.2. Heterogeneous Workers and Cities

There is a continuum of workers with a unit mass, differentiated by their talent

. The talent distribution is given by

with density

with a support of

. The productivity of a worker depends not only on the individual talent

, but also on the overall productivity of the city where the worker is located. Let

denote the productivity (the efficiency units of labor) of a worker with talent

when located in a city

. For simplicity, we assume linear productivity schedules:

where

is a city-specific productivity parameter, and

is a vertical shift parameter. For expositional purpose, we assume, for the moment, that

. This assumption will be relaxed later. Without the loss of generality, we index cities in increasing order of their productivity:

. More formally, any functional form satisfying

can be adopted. Since we have no strong evidence concerning

, we assume a linear productivity functional form for the sake of simplicity. This also allows for the potential introduction of worker talent distribution (see Jung [

20]).

Apart from the differentiated city-specific productivities, cities are exposed to externalities from agglomeration

and urban costs from congestion

. Workers can increase their productivity by interacting and exchanging ideas with others in the city (thus positive learning externalities from larger cities), while larger cities suffer higher urban costs from more congestion. An individual worker has one unit of time that can be divided between producing (

) and interacting (

):

. The output of a worker with talent

in city

is given by:

where

, and

.

The learning externality

depends on the city-wide total time allocation for interacting

(a scale effect) and the average productivity of the workers in the city

(a composition effect). We assume:

where

is a scale parameter.

Workers allocate time optimally to maximize their total output. From Equation (5), maximizing

with respect to

yields

. Substituting

into Equations (6)–(8), Equation (5) then leads to the following:

where

, and

, which represents the city size in terms of the efficiency units of labor.

Finally, Equation (9) shows that at a given talent , individual real output level is determined by the basic city-specific productivity and the relative dominance between agglomeration and congestion effects governed by and at a given city size.

2.3. Firms and Production

There is a continuum of firms, each producing a differentiated variety

. The production of any variety requires combining managerial (headquarter) inputs

and intermediate (repetitive) inputs

. We assume a Leontief production function with units that are conveniently chosen so that one unit of

and one unit of

are required to produce one unit of product

:

Cities are differentiated in their functions and productivities, and firms’ production functions are vertically differentiated in their required technologies so that more productive cities host higher value-added headquarter activities, while less productive ones host lower value-added repetitive activities. Given the two functions in the total value chain of firms, for now we consider two cities: . Technological speaking, and are thus associated with and , respectively.

Here, we consider the firms’ outsourcing strategies. Recent revolutionary advances in transportation and ICT technologies have provided firms with strong new incentives to extensively adopt outsourcing strategies and transfer more production activities to new locations with cheap labor. We assume that firms have the possibility to outsource some part of their intermediate input production to outside peripheral areas. That is, while can be produced only in , can be produced in and in peripheries. Peripheral areas should be understood more broadly as including any new locations outside the existing core urban areas. They may also be located abroad so that the firms engage in offshore outsourcing. On the other hand, producing in peripheries is associated with monitoring costs per unit.

By assuming a Cobb–Douglas production function for

,

, we obtain the following demand system:

where

and

are the wage rates in

and the outside peripheries, respectively. We can of course adopt a more general CES function, where the elasticity of substitution between the two inputs is different from unity. However, in this framework, that would yield qualitatively identical results without adding insight.

Labor forces are cheaper in undeveloped peripheral areas; we assume an exogenously given relative wage rate , with and . Alternatively, we may endogenize with a strictly fixed supply of labor in peripheral areas. This, however, would not change our main results qualitatively. Henceforth, we will use the subscript to indicate the variables of outside peripheral areas.

Firms are free to enter the market, and entering the market incurs a fixed cost

, which is expressed in terms of the variety-specific foregone output. We assume monopolistic competition to prevail so that firms charge a constant markup over the marginal production cost. From the technology Equation (10), we have the following:

where

is the wage rate in

.

2.4. Sorting and Wage Distribution

Equation (4) indicates that there is a complementarity between worker talent and city-specific productivity. In a given city, a worker’s productivity increases with individual talent level , and also at a given individual talent level , a worker’s productivity increases with a higher city-specific productivity level . That is, workers with higher are relatively more efficient when matched with higher city-specific productivities.

In the spirit of Roy [

27], workers will sort based on their respective comparative advantage. Let

be the equilibrium talent threshold between the two cities. Then, less talented workers with

will sort into

and produce intermediate inputs, while more talented ones with

will sort into

, where they perform higher value-added managerial activities. In each city, workers are paid their marginal product. From Equation (9), we then have the following:

where

and

are, respective, the city sizes in terms of the efficiency units of labor:

City-specific wage rates

and

will be determined by labor market equilibrium conditions.

Figure 1 illustrates the equilibrium talent allocation to different cities and the resulting equilibrium wage distribution. In

Figure 1, it is shown clearly that higher-talented workers are paid higher in the higher-productivity city (city 2), while lower-talented workers are paid higher in the lower-productivity city (city 1).

Though the concepts and definitions might be different, our multi-city framework may be related to the polycentric city models in the literature [

28]. Modern economic activities tend to cluster in several interacting centers of activity rather than to be monocentric. In our model, cities are technologically defined and perform different functions along the total production chain of firms. In such a functionally defined urban system, we seek to find the equilibrium regarding how heterogeneous workers sort into different cities based on their comparative advantages and what the resulting market implications would be.

2.5. Equilibrium

Now, we turn to derive the long-run general equilibrium solutions of this framework.

Free entry ensures zero profits for firms so that markup revenue exactly covers the fixed cost:

From Equation (9) and at a given equilibrium threshold

, the total output of each city is given by the following:

From Equations (10), (11), and (17) and from our characterization of the fixed costs as a foregone output, labor market equilibrium requires that the following be met:

where

and

denote the number of firms and the total output produced in the peripheries, respectively.

In a perfectly competitive labor market, having no arbitrage condition for the threshold worker would pin down the city-specific wage rates,

and

. The city-specific wage rates would adjust so that the marginal worker would be indifferent between the cities. From Equation (14) and by choosing

as our numeraire, we obtain the following:

Among others, Equation (20) shows that and are crucial for the determination of the wage rates. If , then the relative wage rate is negatively related to the relative city size , while if , the opposite result appears. Intuitively, if the agglomeration effect dominates the congestion effect (), the city-specific efficiency wage rate should fall as the city becomes larger, since the city-specific labor supply increases in the labor market. On the other hand, if the congestion effect dominates the agglomeration effect (), the city-specific labor supply would decrease as the city grows more so that the city-specific efficiency wage rate rises. In the following section, we will study the different implications in depth.

Finally, the labor incomes from employment are given by:

To avoid the unnecessary balance of payment complication, we conveniently assume that labor costs for peripheral workers are paid in units of the consumption basket (1):

3. Effects of a Fall in (One-Firm-Type Case)

Recent revolutionary technological advances have provided firms with strong new incentives to extensively adopt outsourcing strategies. In particular, recent advances in information and communication technologies have drastically reduced the required monitoring costs when some production activities are performed in new and distant locations, and new peripheral areas are being increasingly included into firms’ production chains. We now investigate the effects of such changes.

From markup pricing (13) and the free-entry Condition (16), it follows immediately that

. By substituting this expression into Equation (19), the number of firms can be expressed as follows:

From Equations (17), (18), and (23), we then obtain the following:

From Equations (11) and (12), we know that a fall in increases the demand for while it decreases that of . Then, from Equations (15) and (24), it can be easily checked that a decrease in due a fall in leads to a decrease in the threshold , since . Not surprisingly, a fall in makes the production in the peripheries more profitable so that the demand for decreases, which consequently results in a contraction of city 1: decreases. A decrease of implies, at the same time, an expansion of city 2: the most talented workers in city 1 now move to city 2 and perform higher value-added managerial activities. It is also straightforward that an increase in induces more entry of the firms from Equation (23).

On the other hand, the impact on the city-specific wage rates would be dependent on the relative magnitude of and . From Equation (20), we obtain the following: (i) if , then ; (ii) if ; then . That is, the impact of a fall in on the relative wage rate between cities is crucially dependent on the relative dominance of the two countervailing effects of agglomeration and congestion. If agglomeration economies dominate congestion economies () the city’s relative wage would decrease as the city grows, since the city-specific labor supply increases in the labor market, while, in the case of , the opposite result would appear. If , the two effects are exactly offset so that there is no change in , since is fixed to with from Equation (4). In this simple model with only one firm type, the model is solvable even with the assumption of . This assumption, however, should be relaxed when different firm types coexist and compete in the final good market. This will be discussed in the subsequent section, where we extend the basic model by introducing other firm types.

Concerning this issue, canonical models in the literature assume that congestion economies dominate agglomeration economies at the margin (see, e.g., Henderson [

2]). The reason is that the equilibrium city size is stable only if the marginal utility is decreasing in city size, that is, when urban costs rise faster than urban productivity as urban population grows. Canonical models in the spirit of Henderson [

2], however, crucially depend on the simplistic assumption that all cities produce the same homogeneous final good. In such a particular environment, the optimal size can be solved only if the marginal utility from moving into the city falls with the city size. It is, however, widely documented that today’s modern cities are functionally specialized; there exist functionally separate labor markets. In such an environment,

is no longer a necessary condition for the equilibrium stable city size to be solved. On the empirical side, there have been many studies to measure agglomeration and congestion economies. The estimates are, however, largely diverse depending on the used data and methodology, and there seems to be no consensus yet on the relative dominance between the agglomeration and congestion effects. Those effects should be city-specific issues.

Lemma 1 summarizes the results.

Lemma 1. When there exists only one firm type in the market, a fall in decreases the talent threshold so that more workers are attached to higher value-added managerial activities. This reallocation leads to two possible outcomes depending on the relative magnitude of and : (i) if , then ; and (ii) if , then .

Thus, an exogeneous shock of a fall in may change the basic urban structure. Lower monitoring costs to produce in the outside peripheral areas induce firms to increasingly adopt the outsourcing strategy. The city 2 where firms are headquartered expands, while the city 1 also produces the intermediate input contracts. Workers’ movement between cities changes city size in terms of both efficiency units of labor and total output. Though we do not explicitly model the labor market of the outside peripheral areas for the sake of simplicity, an increased outsourcing of firms obviously implies developments and the urbanization of those areas. Also, movements of more workers from city 1 to city 2 imply an improvement of overall productivity, since more workers are now attached to higher technology. The impact on the relative wage rates would be different depending on the relative dominance of the two countervailing effects of agglomeration and congestion. If the agglomeration effects are dominant, the relative wage rate of city 2 for one efficiency labor unit would decrease due to more abundant managerial inputs. On the other hand, if the congestion effects are dominant, the opposite result would appear. The main insight from this result may be that the optimal city size and the resulting urban structure are not determined simply by the cost-benefit analysis of the homogenous population as in the traditional optimal city size theory. Various heterogeneities and their interactions in the urban systems do matter. Having this basic mechanism in mind, we now proceed to include different firm types.

4. Heterogeneous Firms and Competition

4.1. Two Firm Types

So far, firms have been defined as homogeneous in their organizational structure and used technologies. All firms can have access to the intermediate inputs produced in peripheries. Though such a modeling approach makes things much simpler and easier to analyze, there is now ample evidence that firms are highly heterogeneous, even within narrowly defined industries. To study the possible implications for the city evolution when firms are heterogeneous and compete in the market, this section extends the previous base model to include different firm types.

We distinguish two different technologies for the managerial (headquarter) activities: a high (

) and a low (

) technology. Using

technology is cheaper to operate by enabling the use of cheaper labor in the peripheries (

), but more expensive to set up (

). Thus, we assume that the marginal production costs are lower in the peripheral areas even after paying the unit monitoring costs, but having the access to the outside peripheries firms means incurring a higher fixed setup cost for high technology. From our functional and technological distinction of cities, this implies an emergence of a city associated with

technology. Accordingly, we assume:

where

, and

.

Thus, the most talented workers are now allocated to city 3, which has the highest productivity. To sum up, the lowest-talented workers produce intermediate inputs in city 1 with the lowest technology (productivity), while the workers in city 2 and 3 perform managerial activities; the middling workers perform managerial activities in city 2 that are associated with

technology, while the highest-talented workers perform managerial activities in city 3 associated with

technology.

Figure 2 illustrates such specification with the resulting sorting of the workers.

Firms’ organizational structures require specific technologies. There are two types of firms, which we denote by the used technologies: and . Without the loss of generality, we assume that only firms using technology are profitable enough to meet the higher fixed setup cost to have access to the peripheries. More specifically, the following condition ensures such a case: . When this condition is satisfied, firms produce in the peripheries, while firms do this in city 1. The previous equations are adjusted accordingly.

Given the two firm types, the pricing Equation (13) and the zero-profit Condition (16) now lead to the following:

Throughout the paper, we assume , thus implying that the essential price advantage of firms comes from employing cheap labor in the peripheries.

Equations (18) and (19) are adjusted to yield the following:

where

The workers of the three cities are paid their marginal product:

The city-specific wage rates are determined by a no-arbitrage condition for the threshold workers:

which can be rewritten using the fact that

, thereby implying that

:

where

is our numeraire.

Now, the total labor incomes are given by the following:

4.2. Effects of a Fall in (Two-Firm-Type Case)

As before, we now investigate the effects of a fall in the peripheral monitoring costs. If both firm types appear in equilibrium, their competition in the final goods market can be summarized by the revenue ratio between them:

. From Equations (2), (26), and (27), we obtain the following:

To investigate the effects of a fall in

, we start by showing

. By totally differentiating the equilibrium condition

in Equation (28) and by using Equations (30) and (31), we obtain a positive relationship between

and

:

Recall that firms are based in city 1 and 2. Intuitively, if firms expand, then the two cities should expand too—increases in both and —while, if firms contract, then the two cities should contract too—decreases in both and .

Now consider a fall in . Intuitively, a fall in the monitoring costs would benefit firms who produce their intermediate inputs in the peripheral areas after incurring the high fixed setup costs. Since the two firm types ( and ) are competing in the final good market, a fall in would generate negative impacts for firms, which would finally lead to an expansion of firms and a contraction of firms. How would such changes affect the allocation of workers between cities and the relative wage rates? To see this, we investigate the revenue ratio between and firms. Since the equilibrium Condition (35) should always be satisfied as long as the two firm types exist in the market, it is straightforward that a fall in should lead to an increase in the wage ratio : . Recall that is our numeraire, with .

From Equations (31) and (33), we have the following:

As before, the consequences are highly dependent on the relative dominance of the two countervailing effects of agglomeration and congestion, which are measured by and , to simplify the analysis and to focus on the two city-wide effects. Let us first assume that in Equation (25) as before so that . We can characterize three cases depending on the relative magnitude of and .

First, when the agglomeration effects are dominant (), it can be shown easily from Equations (36) and (37) that an increase in due to a fall in would induce increases in both and . If we allow for , those effects would be mitigated to some extent, since from Equation (25), but, as long as the agglomeration effects remain dominant, the effects on the two talent thresholds would not be reversed. If , then we also obtain due to an increase in .

Second, when the congestion effects are dominant (), the inverse effects are yielded. An increase in due to a fall in would induce decreases in both and . On the other hand, in this case, allowing for enforces those effects, since the two terms on the RHS of Equation (37) move in the same direction: increases too as decreases. Additionally, a decrease in leads to an increase in .

Third, when the agglomeration and congestion effects are almost offset (), the impact of a fall in would be adjusted mostly on the first term of the RHS of Equation (37). As an extreme case, if we impose , then Equation (37) becomes: . Note that we cannot impose both and simultaneously. In the equilibrium Condition (35), when there is a competition between different firm types, something should be adjusted, followed by a change in . This could not the case when only one firm type exists in the market. More formally, the assumption of ensures that . An increase in due to a fall in would induce decreases in both and . A decrease in also induces an increase in .

Lemma 2 summarizes the results.

Lemma 2. When two firm types compete in the market, a fall in yields three possible outcomes: (i) If the agglomeration effects are dominant, (), we obtain the following: , , and . (ii) If the congestion effects are dominant, (), we obtain the following: , , and . (iii) If the agglomeration and congestion effects are almost offset, (), wet obtain the following: , , and .

5. International Trade and City Evolution

Our model can easily be extended to include international trade. Let us assume two symmetric countries where two previous firm types compete. Now, there is ample evidence that exporting firms are more productive and use higher technologies. In addition, entering the foreign market requires an additional fixed setup cost, which we denote by . Thus, we assume that firms export, while firms only serve the domestic market.

Assuming iceberg trade costs

, the import demands for individual

varieties are given by the following:

and the aggregate price index adjusts is given as the following:

where asterisks indicate foreign variables.

As before, we can consider the revenue ratio between the exporting firms (

) and domestic firms (

). By removing the asterisks from the symmetry between the countries, the total revenue of each firm type can be written as:

From (26), (27), and (40), we obtain the revenue ratio as follows:

where

.

Note that a decrease in the trade cost would induce very similar effects as a decrease in the monitoring cost . Given that high technology () firms have access to peripheral areas to produce more cheaply and enter the foreign market after incurring high fixed setup costs, decreases in either or benefit firms. From Equation (41), it can be shown that a fall in induces an increase in as the impacts of a fall in . A fall in leads to a rise in the RHS of Equation (41). Then, should increase so that the equilibrium Condition (41) remains satisfied. Also, note that a fall in leads to the same qualitative results.

Thus, similarly to Lemma 2, the following Lemma 3 is immediately established under international trade.

Lemma 3. When trading countries are symmetric, a freer trade yields three possible outcomes: (i) If the agglomeration effects are dominant, (), we obtain the following: , , and . (ii) If the congestion effects are dominant, (), we obtain the following: , , and . (iii) If the agglomeration and congestion effects are almost offset, (), we obtain the following: , , and .

The above results indicate again that the consequences of freer trade may crucially depend on the relative dominance of the two countervailing effects of agglomeration and congestion. This implies that when countries are asymmetric in terms of the magnitude of the two effects, trade may yield quite different effects. We now turn to the case of asymmetric countries.

Allowing for asymmetric countries in their city-wide dominance between agglomeration and congestion effects should make the basic mechanism more complicated. First of all, the revenue ratio between the two firm types would not be simplified as in Equation (41). Since exporting firms have revenue from two asymmetric countries, the revenue ratio between domestic and exporting firms in the home country leads to the following:

Furthermore, the competition of the two firm types in the two asymmetric countries requires more equilibrium conditions to be satisfied. That is, all the other possible competition pairs should be considered simultaneously:

,

,

,

,

. Note that even domestic firms, which do not enter the foreign market, in each country compete with each other indirectly under international trade.

All of the above Equations (42)–(47) should be satisfied simultaneously as long as each firm type exists in the market. This implies that when countries are interrelated through international trade, the city evolution in each country also becomes highly interrelated. That is, even though one country might be neutral in the two effects of agglomeration and congestion, if its trading partner is highly dominated by one of the two effects, then the country would follow its trading partner’s city evolution pattern. Suppose, for example, that is strongly higher than in the foreign country so that a fall in generates increases in both and , which leads to an overall decrease in income in the foreign country. Such contraction in the foreign country negatively affects the exporting firms in the home country too, which leads to a contraction of exporting firms and an expansion of domestic firms in the home country. Thus, international trade generates the comovement of city evolution in each country.

Lemma 4. When trading countries are asymmetric, overall city evolutions are synchronized and follow the evolution of the country characterized by a stronger dominance of one of the two effects of agglomeration and congestion.

To get a feeling for the different quantitative effects involved, the following section provides numerical simulation results with a parameterized version of the model.

6. A Numerical Appraisal

In this section, we complement our theoretical discussion with numerical simulations. From our development of the theoretical model, the two-country general equilibrium model consists of 29 equations and 29 endogenous variables, which should be solved simultaneously. To solve the numerical general equilibrium model, the GAMS (General Algebraic Modeling System) software has been used. Starting from a benchmark parameterization of the model, we resolve the model by changing a parameter value such as trade costs.

The chosen (and/or calibrated) parameter values and initial benchmark equilibrium values for the endogenous variables are reported in the

Appendix A (

Table A1). As a benchmark, we set

so that the two countervailing effects of agglomeration and congestion are exactly offset. The base model parameter values are configured so that, initially, the three cities are similar in size in terms of the efficiency units of labor:

,

, and

They are also similar in terms of outputs:

,

, and

. The associated technological parameter values (

,

, and

) and the resulting variable values satisfy all the basic assumptions made in the text. We assume a uniform talent distribution with a support of

, and the two countries are completely symmetric. We set

as our numeraire:

.

To complement our previous theoretical results and to contrast the impacts of some parameter changes, we start from a situation where the economies are as neutral as possible and symmetric. The key parameters of this model are the technological parameters , , and . Since we have no strong evidence for these values, we calibrate these parameters so that initially the three cities are almost the same. In doing so, we simulate how the same cities and countries may evolve differently depending on the relative dominance of the two countervailing effects of congestion and agglomeration.

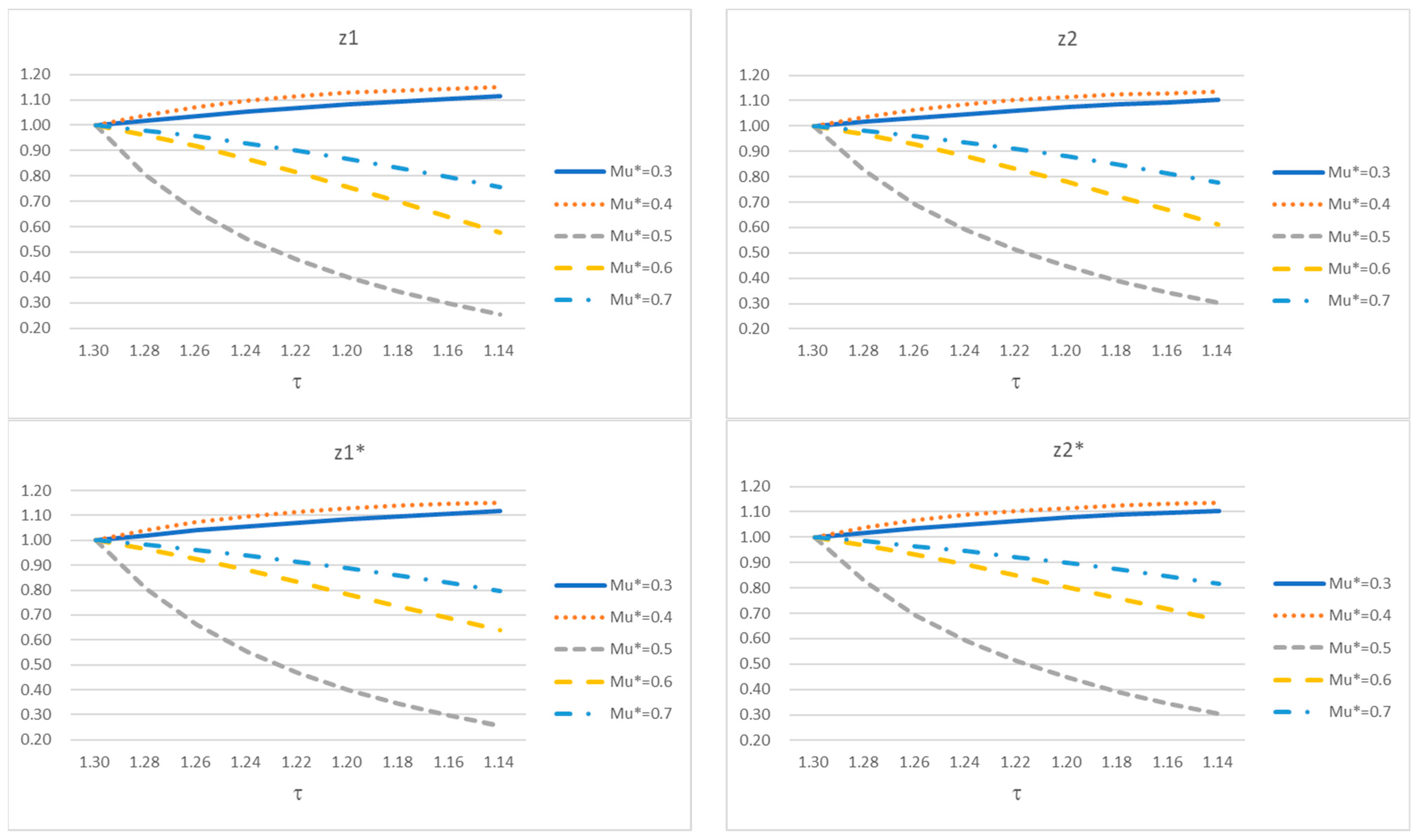

Table 1,

Table 2 and

Table 3 show the simulated effects of falls in

for different values of

and

. For comparison purposes, we maintain

and

, and we adjust

,

and

. For each case of

, the adjusted parameter values are

,

, and

, respectively, which lead to very similar values. In

Table 1,

Table 2 and

Table 3, the initial variable values when

are normalized to one.

Table 1,

Table 2 and

Table 3 confirm our theoretical results (Lemma 3). When the agglomeration and congestion effects were offset (

Table 1:

), a fall in

decreased both

and

and increased both

and

; when the agglomeration effects were dominant (

Table 2:

), a fall in

increased both

and

, and

decreased while

increased; when the congestion effects were dominant (

Table 3:

), a fall in

decreased both

and

and increased both

and

.

The workers’ movement between cities changes the city size in terms of both the efficiency units of labor and total output. Decreases in both

and

imply a contraction of cities associated with the low-tech domestic firms and an expansion of a city associated with the high-tech exporting firms:

decreased, while

increased (

Table 1 and

Table 3). The opposite result applied when

(

Table 2).

In our heterogeneous worker framework, the movements of threshold workers changed the talent composition of each city. A decrease in

implies that the most talented workers previously located in city 2 moved to city 3. These workers are, however, less talented compared to the existing workers in city 3. The city-wide average wage per worker should be dependent on both

and

. We measured the average wage per capita in each city:

The changes in these measures are reported at the last three columns of each table, which are also highly related to the city-wide agglomeration and congestion effects.

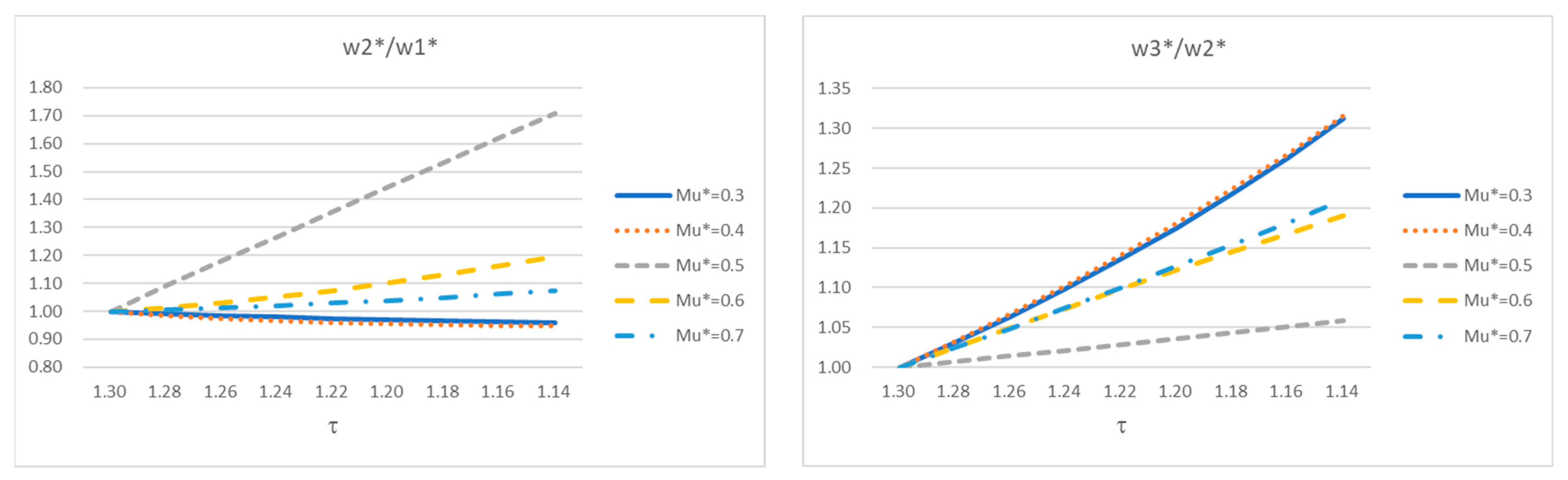

Figure 3 shows the comovements of

and

of the two asymmetric countries. Given

and

, we assumed a different

:

. For some comparison purposes as before, we adjusted

,

and

by maintaining

and

. Following a fall in

, the two talent thresholds

and

movd in the same direction, and the magnitude of changes were also very close. Both

and

increasd in both countries when

, while they decreased in both countries when

. In other words, the movement of

and

in the home country, that is, being neutral regarding the two effects of agglomeration and congestion with

, is influenced by the trading partner’s characteristic. If the agglomeration effects are dominant in the foreign country (

),

and

increase, even in the home country. Inversely, if the congestion effects are dominant in the foreign country (

),

and

decrease in the home country as well. In our parameterization, the critical value of

which turns the direction of the movements of

and

was found around 0.4834. This result indicates that city evolutions are interrelated through international trade, and they are highly influenced by the trading partner’s characteristic in terms of the two effects of agglomeration and congestion.

Figure 4 shows the resulting changes in the relative wage ratios. From Equations (4) and (33), we know that

, which was confirmed for all cases. On the other hand, the effects on

were largely different between the two countries. Note that, by keeping

as the numeraire,

was totally endogenous in this case of asymmetric countries. In our configuration, a fall in

led to a fall in

, except when

(the case where two countries are completely symmetric), which yields the different effects on

and

.

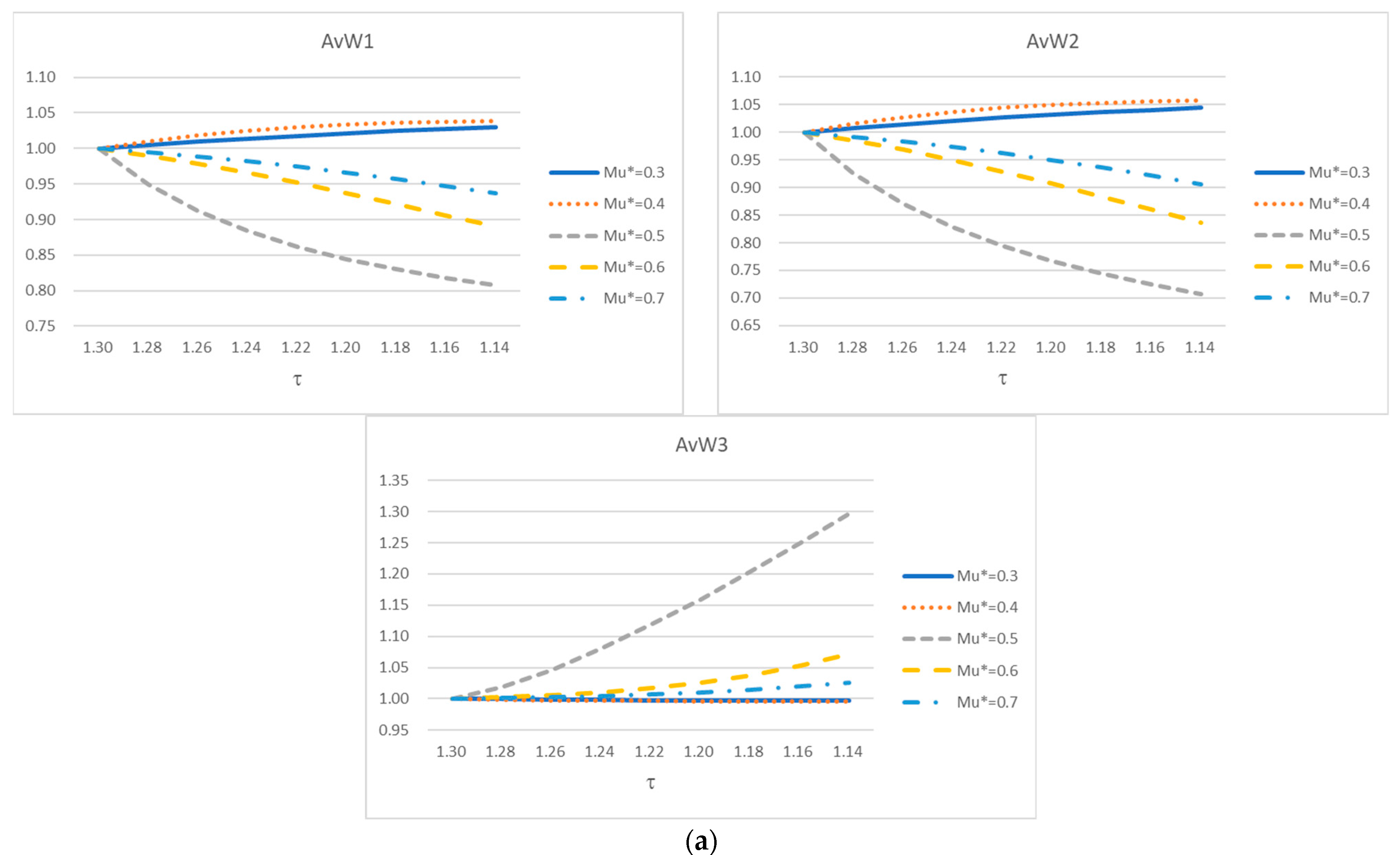

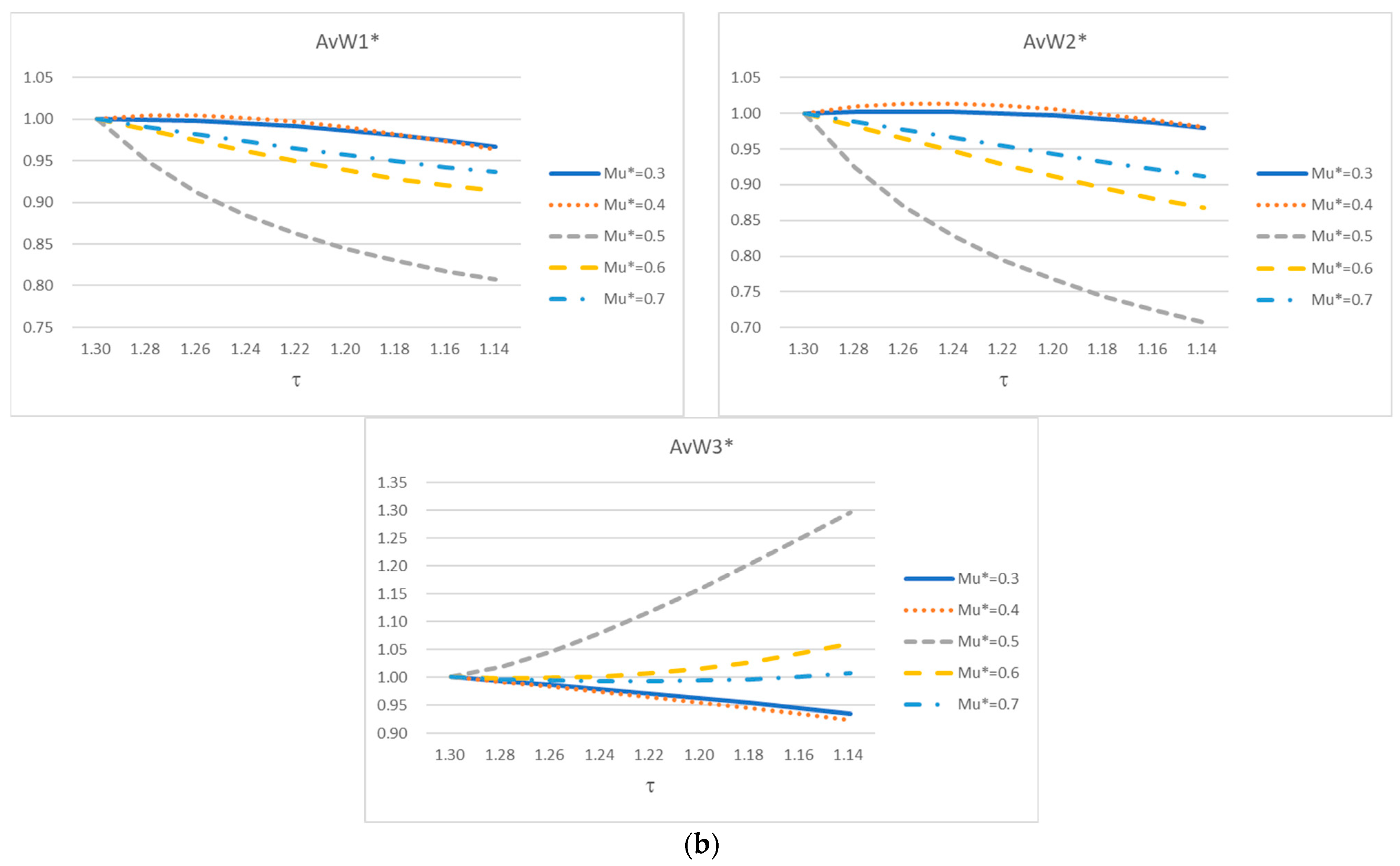

Finally,

Figure 5 shows the resulting effects on the average wage per capita in each city and in each country. We find more or less similar changes in the two countries, except when

. Note that, in terms of the movement of

and

the home country was influenced by the foreign country, especially when the agglomeration effects were dominant in the foreign country: when

;

and

increased in the home country as well, although the home country was neutral in the two effects. Once again, it can be noticed that city and income inequality evolutions are interrelated through international trade and influenced by the characteristics of the trading partners.

Given the importance of the elasticity of substitution for the results in these types of monopolistic competition models, in the

Appendix A, we report the results for alternative values of

:

, which confirmed our main qualitative results.

7. Conclusions

Though many important mechanisms regarding city formation and expansion have been uncovered, traditional theories in urban economics have limitations in explaining the recent stylized facts of modern city evolutions. Recent evidence highlights various heterogeneity factors in the composition of cities and much more complex interactions among the heterogeneous agents and heterogeneous cities, which cannot be addressed by traditional models assuming a homogeneous representative agent.

In line with the recent empirical evidence, in this paper, I developed a unified theoretical general equilibrium model, which incorporates the various aspects of heterogeneity in the modern city evolutions. Workers are heterogeneous in their basic abilities, and firms are heterogeneous in their technologies. Furthermore, cities are functionally differentiated in the total value chain and have different city-specific productivities. Consequently, workers endogenously sort into different tasks and cities based on their comparative advantage, and the interaction between heterogeneities plays a key role in the heterogeneous city evolutions.

Among others, our heterogeneous worker–firm–city framework has highlighted the importance of the relative magnitude of congestion economies and agglomeration economies as pertains to the equilibrium outcomes. It was shown that the same exogenous shocks might lead to completely different consequences depending on the relative dominance of the two countervailing effects of congestion and agglomeration, which could not be captured by traditional models in the literature. Such analyses have also yielded a new and interesting, empirically testable, prediction in an extended open economy setting. The relative dominance of the two countervailing effects of congestion and agglomeration may affect the trading partner and generate the comovement of city evolution in each country: that is, when trading countries are asymmetric, overall city evolutions may be synchronized and follow the evolution of the country characterized by the stronger dominance of one of the two effects of agglomeration and congestion.

Though the terminology might be different depending on the fields, the optimal allocation of resources and their efficient circularity have been at the core of sustainable development. As an economic concept linked to sustainable development, the circular economy has gained important attention in recent years. Though the original concept and models may be more related to environmental issues in a narrow sense, the circular economy also aims to increase the sustainability of the economic systems by improving resource efficiency. On the other hand, in the urban economics, the optimal allocation of resources between cities and their interactions, as well as efficient circularity, have been at the core of sustainable economic development. By making a bridge between the two fields, this paper extends the paradigm of the circular economy in the context of the city evolutions within the urban systems. In particular, by developing a new unified theoretical framework, this paper highlights the role of various heterogeneity factors in modern cities, which should be at the core of the circular economy and sustainable development.

There has been rising literature as pertains to new urban economics, which has been attempting to focus on the various heterogeneity and transportation costs in urban systems. As the literature is new and emerging, many directions of future research would be interesting and promising. First of all, the theoretical predictions of this paper may be tested empirically. In particular, precise estimates of both the congestion economies and agglomeration economies and the assessment of their differential impacts on the aggregate outcomes in urban systems should be of great interest to understand diverse urban mechanisms. As a first attempt, our model abstracts from various labor market imperfections in the real world. Needless to say, further elaboration and extension of the basic setup of this paper may yield further new insights into the various mechanisms in the modern urban systems. As argued by many researchers, some important drivers of the urban growth of modern cities may include innovation and different amenities. And as Moretti [

29] identifies, brain hubs or innovation clusters have been emerging, and highly specialized innovation workers are generating more kinds of service jobs in these hubs and clusters. Such a dynamic perspective of innovation should be an important factor to explain the evolution of modern cities. This paper has provided a new theoretical general equilibrium framework in which the technology–skill matchings are endogenous and heterogeneous workers sort into different cities based on their comparative advantages. Endogenizing the given technologies in this framework and analyzing the dynamic perspective of innovation more explicitly would be a promising direction for future work. Also, the parameterized version of the model in this paper might be extended and adapted to develop a large-scale computable general equilibrium (CGE) model to derive various real-world policy implications. Since the literature on new urban economics is new, currently, no equivalent simulation models are to be found. This paper’s new theoretical framework may be enriched in various directions to incorporate various other real-world complex heterogeneity factors and to be applied to real-world datasets. I leave them for future research.