Digital Revolution and Digitization Process to Promote AIS as a Vector of Financial Performance

Abstract

1. Introduction

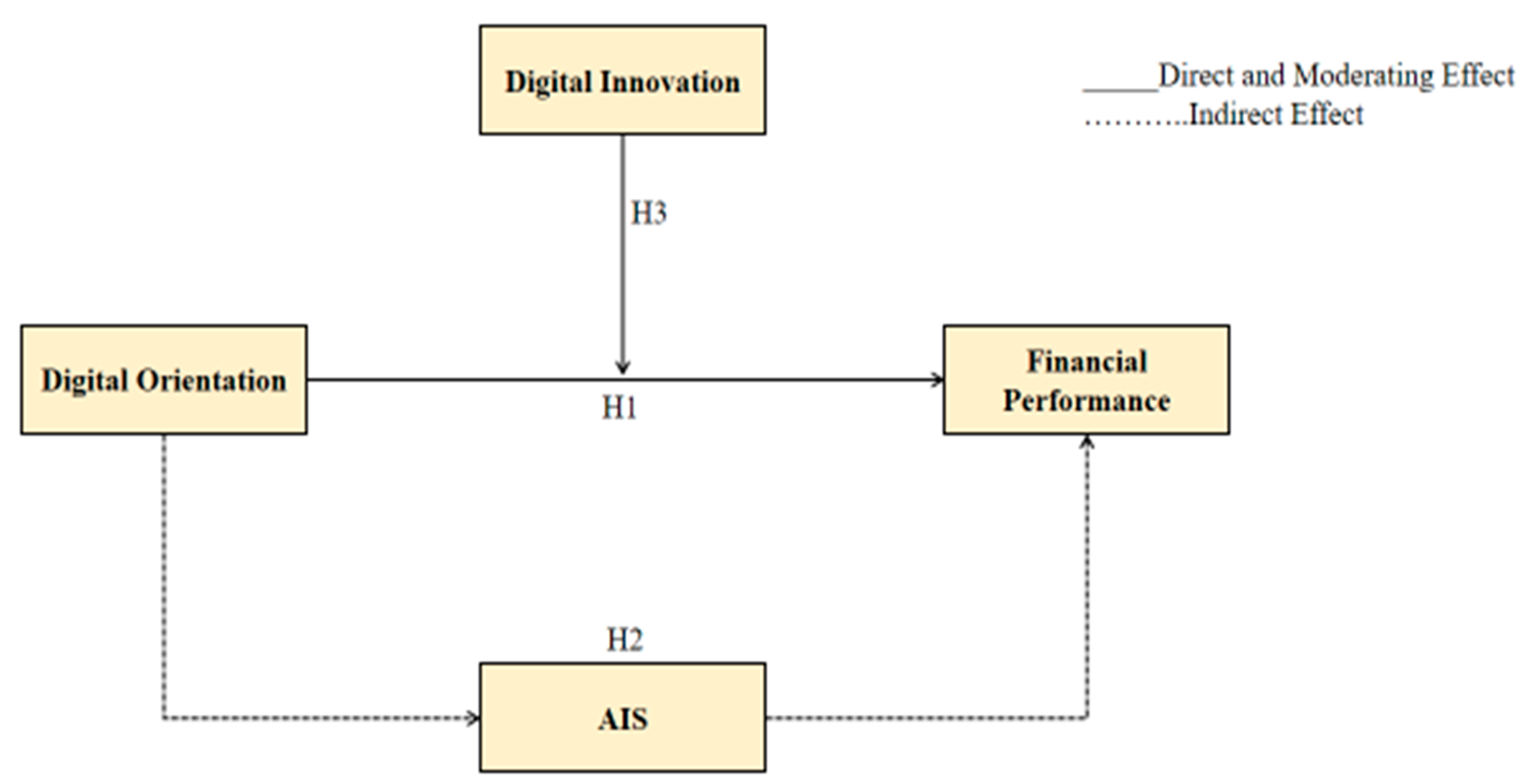

- How does digital orientation positively influence financial performance?

- How does the accounting information system mediate this relationship?

- What is the moderating role of digital innovation in the relationship between digital orientation and financial performance?

2. Literature Review and Substantiation of Hypotheses

2.1. Digital Orientation and Financial Performance

2.2. Mediating Role of AIS

2.3. Digital Innovation Moderates

3. Research Methodology

3.1. Digital Orientation

3.2. Accounting Information System

3.3. Financial Performance

3.4. Digital Innovation

4. Results

4.1. Analysis

4.2. Reliability and Validity

4.3. Descriptive Statistics

4.4. Hypothesis Testing

5. Discussion

5.1. Theoretical Implications

5.2. Practical Implications

5.3. Limitations and Further Research

6. Conclusions

- Data Accuracy and Reliability: AIS helps ensure accurate and reliable financial data by automating data entry and reducing the risk of human errors. Accurate financial information is essential for making informed business decisions, setting financial goals, and assessing financial performance accurately.

- Timely Financial Reporting: AIS facilitates the timely generation of financial reports, such as balance sheets, income statements, and cash flow statements. Timely financial reporting provides management with up-to-date information to evaluate the financial health of the organization, identify areas of improvement, and take necessary corrective actions.

- Streamlined Financial Processes: AIS automates various financial processes, such as recording transactions, generating invoices, processing payments, and reconciling accounts. By streamlining these processes, AIS enhances operational efficiency, reduces manual workloads, and minimizes the likelihood of errors. This, in turn, improves overall financial performance.

- Decision Support: AIS generates financial information and reports that help management make strategic and operational decisions. For instance, AIS can provide real-time insights into revenue, expenses, profitability, and cash flow, enabling managers to identify profitable product lines, cost-saving opportunities, and potential financial risks. Informed decision making based on accurate financial information can positively impact financial performance.

- Compliance and Risk Management: AIS assists in ensuring compliance with financial regulations and reporting standards. It helps maintain proper internal controls, identify potential fraud or irregularities, and mitigate financial risks. Compliance and risk management measures supported by AIS contribute to maintaining financial stability and protecting the organization’s performance.

- Enhanced Financial Analysis: AIS provides tools and capabilities for financial analysis, including financial ratios, trend analysis, and variance analysis. These analytical capabilities enable deeper insights into financial performance, profitability, liquidity, and efficiency. By analyzing financial data more effectively, organizations can identify areas for improvement and take action to enhance financial performance.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Parviainen, P.; Tihinen, M.; Kääriäinen, J.; Teppola, S. Tackling the digitalization challenge: How to benefit from digitalization in practice. Int. J. Inf. Syst. Proj. Manag. 2017, 5, 63–77. [Google Scholar] [CrossRef]

- Abou-Foul, M.; Ruiz-Alba, J.L.; Soares, A. The impact of digitalization and servitization on the financial performance of a firm: An empirical analysis. Prod. Plan. Control 2021, 32, 975–989. [Google Scholar] [CrossRef]

- Quinton, S.; Canhoto, A.; Molinillo, S.; Pera, R.; Budhathoki, T. Conceptualising a digital orientation: Antecedents of supporting SME performance in the digital economy. J. Strat. Mark. 2018, 26, 427–439. [Google Scholar] [CrossRef]

- Almeida, F.; Santos, J.D.; Monteiro, J.A. The Challenges and Opportunities in the Digitalization of Companies in a Post-COVID-19 World. IEEE Eng. Manag. Rev. 2020, 48, 97–103. [Google Scholar] [CrossRef]

- Molina-Azorín, J.F.; Claver-Cortés, E.; López-Gamero, M.D.; Tarí, J.J. Green management and financial performance: A literature review. Manag. Decis. 2009, 47, 1080–1100. [Google Scholar] [CrossRef]

- Nasiri, M.; Saunila, M.; Ukko, J. Digital orientation, digital maturity, and digital intensity: Determinants of financial success in digital transformation settings. Int. J. Oper. Prod. Manag. 2022, 42, 274–298. [Google Scholar] [CrossRef]

- Rupeika-Apoga, R.; Petrovska, K.; Bule, L. The Effect of Digital Orientation and Digital Capability on Digital Transformation of SMEs during the COVID-19 Pandemic. J. Theor. Appl. Electron. Commer. Res. 2022, 17, 669–685. [Google Scholar] [CrossRef]

- Kindermann, B.; Beutel, S.; de Lomana, G.G.; Strese, S.; Bendig, D.; Brettel, M. Digital orientation: Conceptualization and operationalization of a new strategic orientation. Eur. Manag. J. 2021, 39, 645–657. [Google Scholar] [CrossRef]

- Al-Hiyari, A.; Al-Mashregy, M.H.H.; Mat, N.K.; Alekam, J.E. Factors that affect accounting information system implementation and accounting information quality: A survey in University Utara Malaysia. Am. J. Econ. 2013, 3, 27–31. [Google Scholar]

- Fitrios, R. Factors that influence accounting information system implementation and accounting information quality. Int. J. Sci. Technol. Res. 2016, 5, 192–198. [Google Scholar]

- Gofwan, H. Effect of Accounting Information System on Financial Performance of Firms: A Review of Literature; 2nd Departmental Seminar Series with the Theme–History of Accounting Thoughts: A Methodological Approach; Department of Accounting (Bingham University): Karu, Asarawa State, Nigeria, 2022; Volume 2, pp. 57–60. [Google Scholar]

- Bendig, D.; Schulz, C.; Theis, L.; Raff, S. Digital orientation and environmental performance in times of technological change. Technol. Forecast. Soc. Chang. 2023, 188, 122272. [Google Scholar] [CrossRef]

- Thennakoon, S.T.M.M.; Rajeshwaran, N. Accounting information system and financial performance: Empirical evidence on Sri Lankan firms. Int. J. Account. Bus. Financ. 2022, 8, 15–32. [Google Scholar] [CrossRef]

- Astuti, W.A.; Augustine, Y. The Effect of Digital Technology and Agility On Company Performance with Management Accounting System as Mediation. Int. J. Res. Appl. Technol. 2022, 2, 11–29. [Google Scholar] [CrossRef]

- Salehi, M.; Rostami, V.; Mogadam, A. Usefulness of Accounting Information System in Emerging Economy: Empirical Evidence of Iran. Int. J. Econ. Financ. 2010, 2, 186–195. [Google Scholar] [CrossRef]

- Spilnyk, I.; Brukhanskyi, R.; Yaroshchuk, O. Accounting and Financial Reporting System in the Digital Economy. In Proceedings of the 2020 10th International Conference on Advanced Computer Information Technologies (ACIT), Deggendorf, Germany, 16–18 September 2020; pp. 581–584. [Google Scholar]

- Hinings, B.; Gegenhuber, T.; Greenwood, R. Digital innovation and transformation: An institutional perspective. Inf. Organ. 2018, 28, 52–61. [Google Scholar] [CrossRef]

- Scott, S.V.; Van Reenen, J.; Zachariadis, M. The long-term effect of digital innovation on bank performance: An empirical study of SWIFT adoption in financial services. Res. Policy 2017, 46, 984–1004. [Google Scholar] [CrossRef]

- Arias-Pérez, J.; Vélez-Jaramillo, J. Ignoring the three-way interaction of digital orientation, Not-invented-here syndrome and employee’s artificial intelligence awareness in digital innovation performance: A recipe for failure. Technol. Forecast. Soc. Chang. 2022, 174, 121305. [Google Scholar] [CrossRef]

- Ionascu, I.; Ionascu, M.; Nechita, E.; Sacarin, M.; Minu, M. Digital Transformation, Financial Performance and Sustainability: Evidence for European Union Listed Companies. Amfiteatru Econ. 2022, 24, 94–109. [Google Scholar] [CrossRef]

- Fabian, N.E.; Broekhuizen, T.; Nguyen, D.K. Digital transformation and financial performance: Do digital specialists unlock the profit potential of new digital business models for SMEs? In Managing Digital Transformation; Routledge: London, UK, 2021; pp. 240–258. [Google Scholar]

- Abd Razak, S.N.A.; Noor, W.N.B.W.M.; Jusoh, Y.H.M. Embracing Digital Economy: Drivers, Barriers and Factors Affecting Digital Transformation of Accounting Professionals. Int. J. Adv. Res. Econ. Financ. 2021, 3, 63–71. [Google Scholar]

- Tungpantong, C.; Nilsook, P.; Wannapiroon, P. A Conceptual Framework of Factors for Information Systems Success to Digital Transformation in Higher Education Institutions. In Proceedings of the 2021 9th International Conference on Information and Education Technology (ICIET), Okayama, Japan, 27–29 March 2021; pp. 57–62. [Google Scholar] [CrossRef]

- Melović, B.; Jocović, M.; Dabić, M.; Vulić, T.B.; Dudic, B. The impact of digital transformation and digital marketing on the brand promotion, positioning and electronic business in Montenegro. Technol. Soc. 2020, 63, 101425. [Google Scholar] [CrossRef]

- Rosamartina, S.; Giustina, S.; Domenico, D.F.; Pasquale, D.V.; Angeloantonio, R. Digital reputation and firm performance: The moderating role of firm orientation towards sustainable development goals (SDGs). J. Bus. Res. 2022, 152, 315–325. [Google Scholar] [CrossRef]

- Abbu, H.R.; Gopalakrishna, P. Synergistic effects of market orientation implementation and internalization on firm performance: Direct marketing service provider industry. J. Bus. Res. 2021, 125, 851–863. [Google Scholar] [CrossRef]

- Ivashchenko, A.; Britchenko, I.; Dyba, M.; Polishchuk, Y.; Sybirianska, Y.; Vasylyshen, Y. Fintech platforms in sme’s financing: Eu experience and ways of their application in Ukraine. Invest. Manag. Financ. Innov. 2018, 15, 83–96. [Google Scholar] [CrossRef]

- Kim, G.; Shin, B.; Kim, K.K.; Lee, H.G. IT capabilities, process-oriented dynamic capabilities, and firm financial performance. J. Assoc. Inf. Syst. 2011, 12, 1. [Google Scholar] [CrossRef]

- Ikramuddin, I.; Matriadi, F.; Iis, E.Y.; Mariyudi, M. Marketing Performance Development: Application of the Concept of Digital Marketing and Market Orientation Strategy in the Msme Sector. Int. J. Educ. Rev. Law Soc. Sci. (IJERLAS) 2021, 1, 181–190. [Google Scholar] [CrossRef]

- Liu, J.; Zhou, K.; Zhang, Y.; Tang, F. The Effect of Financial Digital Transformation on Financial Performance: The Intermediary Effect of Information Symmetry and Operating Costs. Sustainability 2023, 15, 5059. [Google Scholar] [CrossRef]

- Payne, E.H.M.; Dahl, A.J.; Peltier, J. Digital servitization value co-creation framework for AI services: A research agenda for digital transformation in financial service ecosystems. J. Res. Interact. Mark. 2021, 15, 200–222. [Google Scholar] [CrossRef]

- Scardovi, C. Digital Transformation in Financial Services; Springer International Publishing: Cham, Switzerland, 2017; Volume 236. [Google Scholar]

- Shen, L.; Zhang, X.; Liu, H. Digital technology adoption, digital dynamic capability, and digital transformation performance of textile industry: Moderating role of digital innovation orientation. Manag. Decis. Econ. 2022, 43, 2038–2054. [Google Scholar] [CrossRef]

- Fang, M.; Liu, F.; Xiao, S.; Park, K. Hedging the bet on digital transformation in strategic supply chain management: A theoretical integration and an empirical test. Int. J. Phys. Distrib. Logist. Manag. 2023. ahead-of-print. [Google Scholar] [CrossRef]

- Niemand, T.; Rigtering, J.C.; Kallmünzer, A.; Kraus, S.; Maalaoui, A. Digitalization in the financial industry: A contingency approach of entrepreneurial orientation and strategic vision on digitalization. Eur. Manag. J. 2021, 39, 317–326. [Google Scholar] [CrossRef]

- Saleh, Q.Y.; Al-Nimer, M.B. The mediating role of the management accounting information system in the relationship between innovation strategy and financial performance in the Jordanian industrial companies. Cogent Bus. Manag. 2022, 9, 2135206. [Google Scholar] [CrossRef]

- Hutahayan, B. The mediating role of human capital and management accounting information system in the relationship between innovation strategy and internal process performance and the impact on corporate financial performance. Benchmarking Int. J. 2020, 27, 1289–1318. [Google Scholar] [CrossRef]

- Ironkwe, U.; Nwaiwu, J. Accounting Information System on Financial and Non-Financial Measures of Companies in Nigeria. Int. J. Adv. Acad. Res.|Bus. Dev. Manag. 2018, 4, 39–55. [Google Scholar]

- Ali, B.J.; Bakar, R.; Omar, W.A.W. The critical success factors of accounting information system (AIS) and it’s impact on organisational performance of Jordanian commercial banks. Int. J. Econ. Commer. Manag. 2016, 4, 658–677. [Google Scholar]

- Rehm, S.-V. Accounting Information Systems and how to prepare for Digital Transformation. In The Routledge Companion to Accounting Information Systems; Routledge: London, UK, 2017; pp. 69–80. [Google Scholar] [CrossRef]

- Chen, Y.; Hu, X. The Empowerment and Subversion of Financial Technology to Accounting Information System. In Proceedings of the 2nd International Conference on Internet, Education and Information Technology (IEIT 2022), Online, 27 December 2022; pp. 33–38. [Google Scholar] [CrossRef]

- Zhavoronok, A.; Popelo, O.; Shchur, R.; Ostrovska, N.; Kordzaia, N. The Role of Digital Technologies in the Transformation of Regional Models of Households’ Financial Behavior in the Conditions of the National Innovative Economy Development. Ingénierie des Systèmes d’Information 2022, 27, 613–620. [Google Scholar] [CrossRef]

- Asmuni, I. Reliability Implementation of Accounting Information Systems in Improving Small and Medium Enterprises Financial Performance. Test Eng. Manag. 2020, 83, 798–811. Available online: https://www.researchgate.net/publication/341423378_Reliability_Implementation_of_Accounting_Information_Systems_in_Improving_Small_and_Medium_Enterprises_Financial_Performance (accessed on 20 March 2023).

- Chmutova, I.; Simon Kuznets Kharkiv National University of Economics; Vovk, V.; Bezrodna, O. Analytical tools to implement integrated bank financial management technologies. Econ. Ann.-XXI 2017, 163, 95–99. [Google Scholar] [CrossRef]

- Khin, S.; Ho, T.C. Digital technology, digital capability and organizational performance: A mediating role of digital innovation. Int. J. Innov. Sci. 2018, 11, 177–195. [Google Scholar] [CrossRef]

- Soudani, S.N. The Usefulness of an Accounting Information System for Effective Organizational Performance. Int. J. Econ. Financ. 2012, 4, 136–145. [Google Scholar] [CrossRef]

- Xu, G.; Hou, G.; Zhang, J. Digital Sustainable Entrepreneurship: A Digital Capability Perspective through Digital Innovation Orientation for Social and Environmental Value Creation. Sustainability 2022, 14, 11222. [Google Scholar] [CrossRef]

- Anderson, J.C.; Gerbing, D.W. Structural equation modeling in practice: A review and recommended two-step approach. Psychol. Bull. 1988, 103, 411. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Structural equation models with unobservable variables and measurement error: Algebra and statistics. J. Mark. Res. 1981, 18, 382–388. [Google Scholar] [CrossRef]

- Zhao, L.; Liu, Z.; Vuong, T.H.G.; Nguyen, H.M.; Radu, F.; Tăbîrcă, A.I.; Wu, Y.-C. Determinants of Financial Sustainability in Chinese Firms: A Quantile Regression Approach. Sustainability 2022, 14, 1555. [Google Scholar] [CrossRef]

| Variables Details | Items | Cronbach’s Alpha | Factor Loading | Composite Reliability | AVE |

|---|---|---|---|---|---|

| Digital Orientation | 04 | 0.76–0.84 | 0.84 | 0.92 | 0.78 |

| Accounting Information System | 06 | 0.78–0.82 | 0.88 | 0.94 | 0.76 |

| Digital Innovation | 08 | 0.72–0.86 | 0.82 | 0.96 | 0.74 |

| Financial Performance | 04 | 0.74–0.88 | 0.86 | 0.98 | 0.72 |

| Variable-Detail | Mean | SD | Alpha | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|---|---|---|

| Respondent Education | 1.65 | 0.46 | 0.88 | 1.00 | |||||

| Respondent Experience | 1.44 | 0.65 | 0.84 | 0.058 | 1.00 | ||||

| Digital Orientation | 3.21 | 0.48 | 0.89 | 0.102 ** | 0.012 | 1.00 | |||

| Accounting Information System | 3.28 | 0.36 | 0.82 | −0.036 | 0.048 * | 0.64 ** | 1.00 | ||

| Digital Innovation | 3.47 | 0.72 | 0.86 | 0.014 | 0.52 | 0.26 ** | 0.36 ** | 1.00 | |

| Financial Performance | 0.18 | 0.34 | 0.84 | 0.016 | 0.01 | 0.28 ** | 0.32 ** | 0.38 ** | 1.00 |

| Model Detail | Hypothesis Description | Β | F | T | Sig | Remarks |

|---|---|---|---|---|---|---|

| Model No.1 | Digital Orientation → Financial Performance | 0.34 | 12.065 | 0.148 | 0.000 | Accepted |

| Model Detail | Data | Boot | Bias | SE | Lower | Upper | Sig |

|---|---|---|---|---|---|---|---|

| DO → AIS → FP | 0.18 | 0.14 | 0.002 | 0.46 | 0.2458 | 0.3672 | 0.0001 |

| Detail | Beta | T Value | Beta | T Value | Beta | T Value |

|---|---|---|---|---|---|---|

| Step-1 | ||||||

| Resp.educat | 0.18 | 0.24 | 0.14 | 0.16 | 1.04 | 1.36 |

| Respondent experience | 0.16 | 0.26 | 0.14 | 0.68 | 0.06 | 0.18 |

| Step 2 | ||||||

| Digital Orientation | 0.38 * | 7.65 | 0.34 * | 3.74 | ||

| Digital Innovation | 0.24 * | 5.85 | 0.36 * | 4.52 | ||

| Step 3 | ||||||

| DO x DI | 0.32 ** | 2.26 | ||||

| F | 4.16 ** | 18.34 * | 16.46 * | |||

| R2 | 0.02 | 0.26 | 0.26 | |||

| ∆ R2 | 0.26 | 0.04 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

BinSaeed, R.H.; Yousaf, Z.; Grigorescu, A.; Radu, V.; Nassani, A.A. Digital Revolution and Digitization Process to Promote AIS as a Vector of Financial Performance. Systems 2023, 11, 339. https://doi.org/10.3390/systems11070339

BinSaeed RH, Yousaf Z, Grigorescu A, Radu V, Nassani AA. Digital Revolution and Digitization Process to Promote AIS as a Vector of Financial Performance. Systems. 2023; 11(7):339. https://doi.org/10.3390/systems11070339

Chicago/Turabian StyleBinSaeed, Rima Hassan, Zahid Yousaf, Adriana Grigorescu, Valentin Radu, and Abdelmohsen A. Nassani. 2023. "Digital Revolution and Digitization Process to Promote AIS as a Vector of Financial Performance" Systems 11, no. 7: 339. https://doi.org/10.3390/systems11070339

APA StyleBinSaeed, R. H., Yousaf, Z., Grigorescu, A., Radu, V., & Nassani, A. A. (2023). Digital Revolution and Digitization Process to Promote AIS as a Vector of Financial Performance. Systems, 11(7), 339. https://doi.org/10.3390/systems11070339