Supply Chain Finance Business Model Innovation: Case Study on a Chinese E-Commerce-Centered SCF Adopter

Abstract

1. Introduction

1.1. Background

1.2. Research Aims

- RQ1: Does the business model innovation benefit from JD SCF’s practice keep sustainable strategic development?

- RQ2: How does JD SCF practice acquire a long-lasting competitive advantage in the financial providing market (consider the influence of business model innovation)?

1.3. Paper Layout

2. Theoretical Background

2.1. Supply Chain Finance (SCF)

2.2. Financial “Blue Ocean” Market

2.3. Business Model Innovation

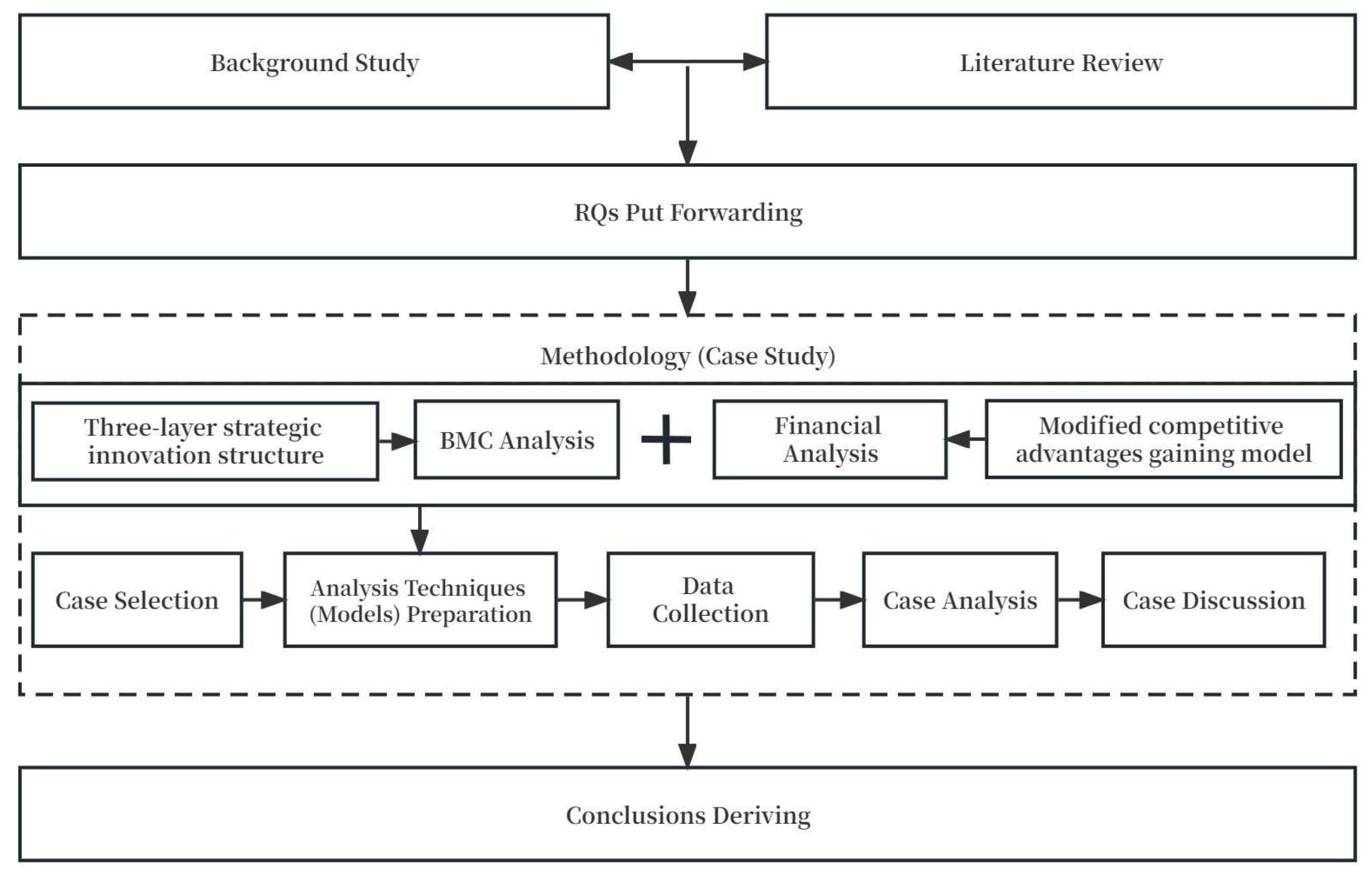

3. Methodology

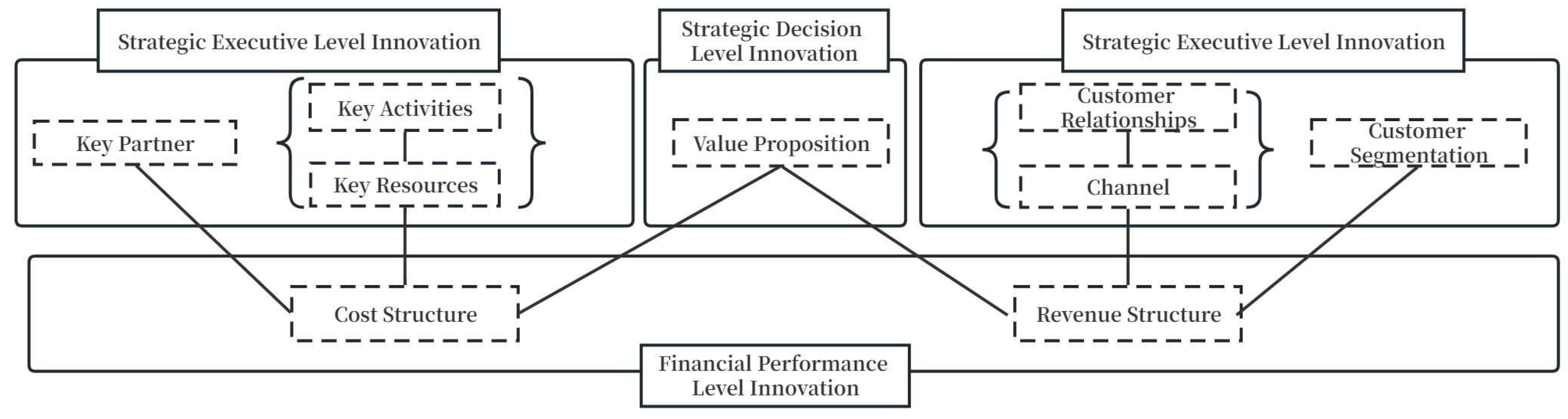

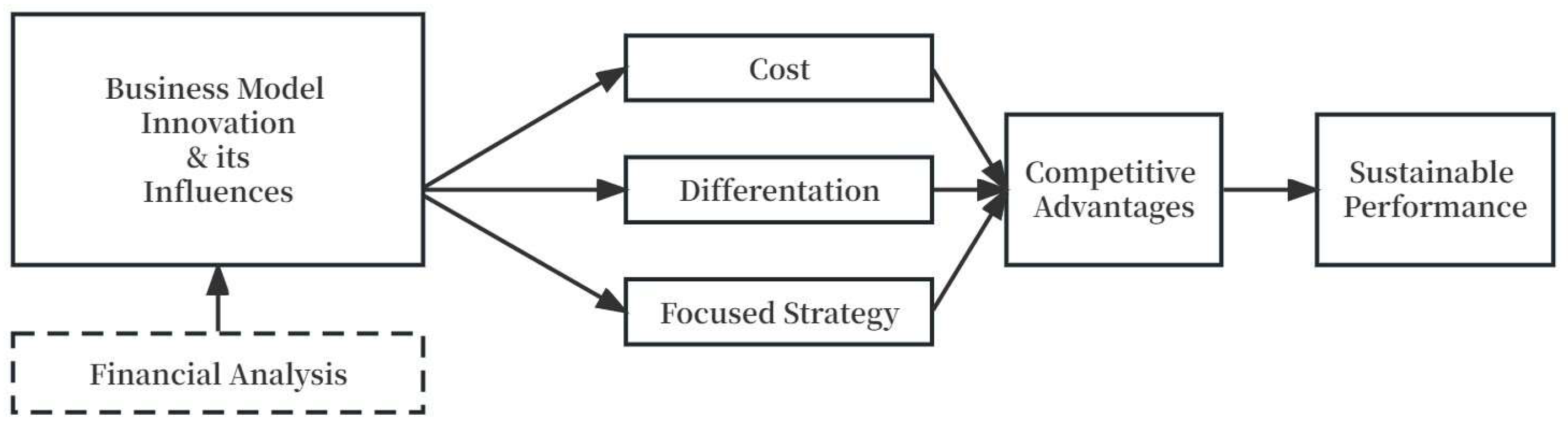

3.1. Research Framework

3.2. Case Selection

3.3. Analysis Techniques (Models) Preparation

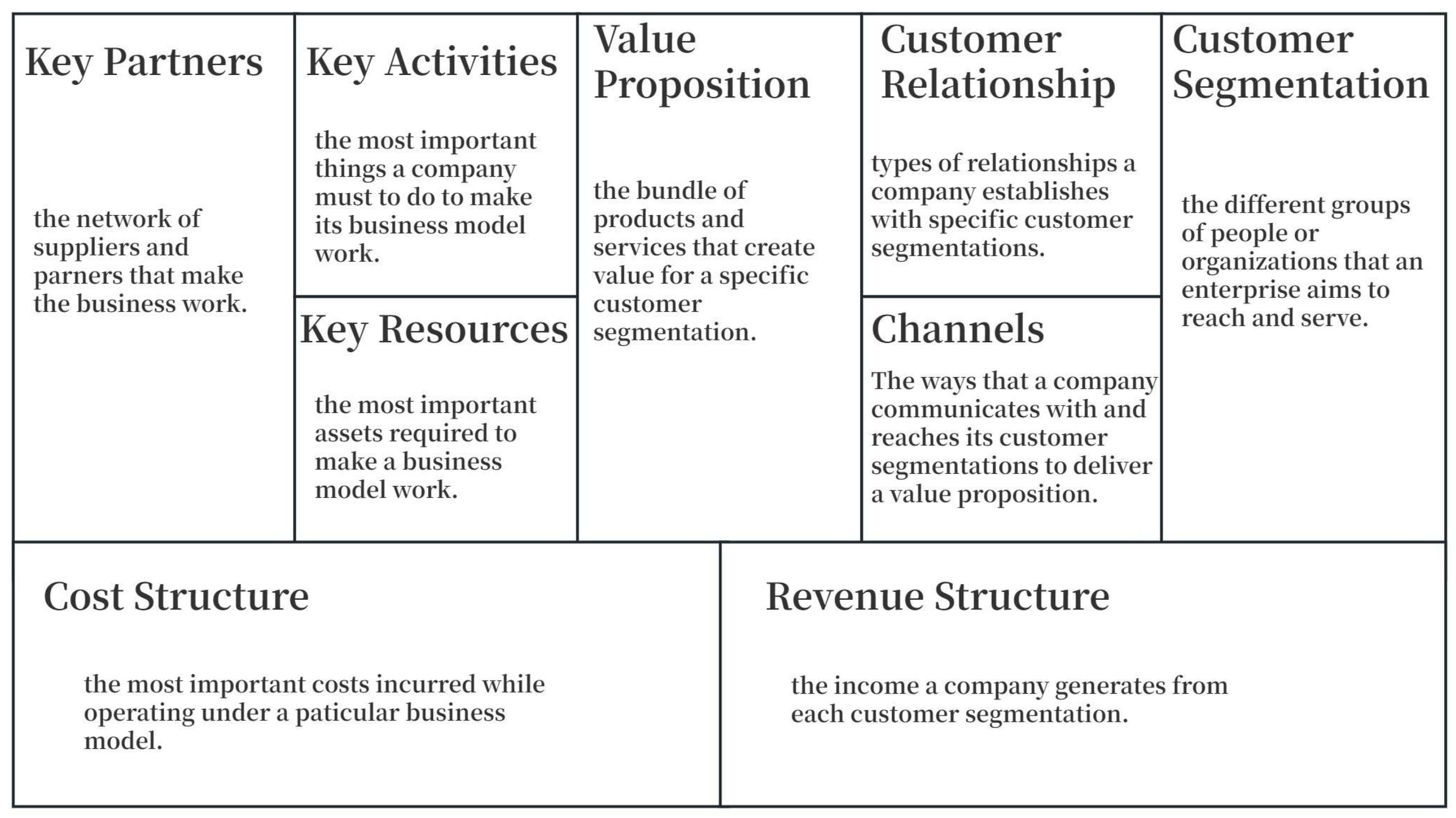

3.3.1. Business Model Canvas (BMC) Analysis

3.3.2. Financial Analysis

3.4. Data Collection

4. Case Study

4.1. Case Description

4.2. BMC Analysis

4.2.1. Value Proposition

4.2.2. Customer Relationship

4.2.3. Channels

4.2.4. Customer Segmentation

4.2.5. Revenue Structure

4.2.6. Key Resource

4.2.7. Key Activities

4.2.8. Key Partners

4.2.9. Cost Structure

4.3. Financial Analysis

4.3.1. Net Revenue and GMV

4.3.2. Liquidity: Inventory and Accounts Payable

4.3.3. Profits Related to SCF Practice

5. Case Discussion

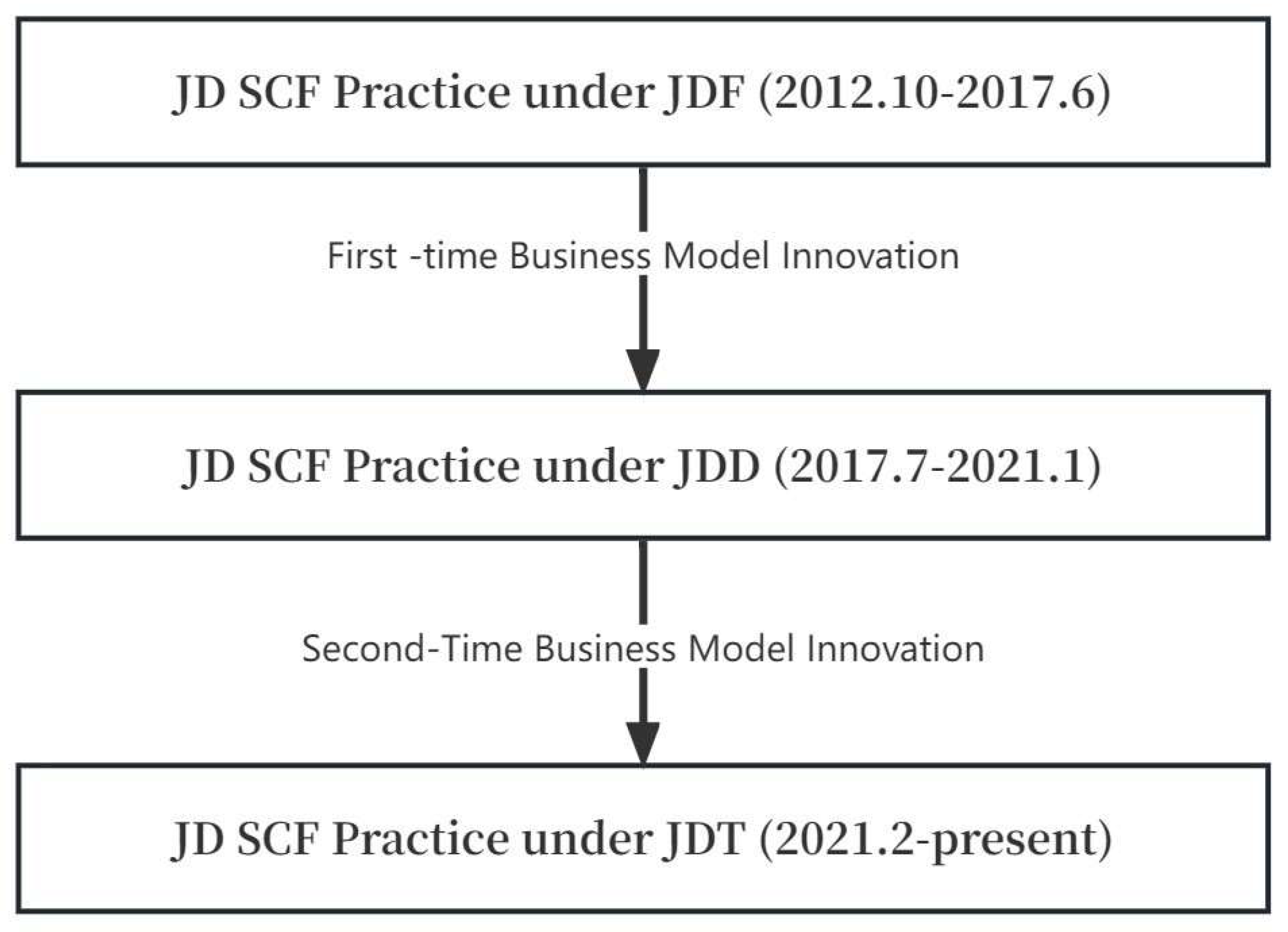

5.1. Does the Business Model Innovation Benefit from JD SCF Practice Keeping Sustainable Strategic Development?

5.2. How JD SCF Practice Acquires a Long-Lasting Competitive Advantage in the Financial Providing Market (Consider the Influence of Business Model Innovation)

5.2.1. Before Business Model Innovation, JDF (October 2012~June 2017): Cost Advantage Based on Accounts Payable Turnover Days

5.2.2. First-Time Business Model Innovation, JDD (July 2017~January 2021): Differentiation Advantage Based on the Business Expansion to “T2F”, “T2B” and “T2G”

5.2.3. Second-Time Business Model Innovation, JDT (February 2021~Present): Focused Strategy Based on “Technology + Industry + Understanding”

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Shen, Y.; Chen, C.; Gu, J. Research on the Design of Supply Chain Financial Ecology Model and Risk Management. Ekoloji 2019, 28, 3653–3660. [Google Scholar]

- Cronie, G.; Sales, H. ING Guide to Financial Supply Chain Optimisation. Available online: http://web.utk.edu/~jwachowi/INGpart1.pdf (accessed on 21 August 2022).

- Kristofik, P.; Kok, J.; de Vries, S.; van Sten-van’t Hoff, J. Financial supply chain management–Challenges and obstacles. ACRN J. Entrep. Perspect. 2012, 1, 132–143. [Google Scholar]

- Gelsomino, L.; Mangiaracina, R.; Perego, A.; Tumino, A. Supply chain finance: A literature review. Int. J. Phys. Distr. Log. Manag. 2016, 46, 348–366. [Google Scholar] [CrossRef]

- Omran, Y.; Henke, M.; Heines, R.; Hofmann, E. Blockchain-driven supply chain finance: Towards a conceptual framework from a buyer perspective. In Proceedings of the IPSERA 2017: 26th Annual Conference of the International Purchasing and Supply Education and Research Association, Budapest, Hungary, 9–12 April 2017. [Google Scholar]

- Chen, X.; Liu, C.; Li, S. The role of supply chain finance in improving the competitive advantage of online retailing enterprises. Electr. Commerce Res. Appl. 2019, 33, 100821. [Google Scholar] [CrossRef]

- Bloomenthal, A. Supply Chain Finance: What It Is, How It Works, Example. Available online: https://www.investopedia.com/terms/s/supply-chain-finance.asp (accessed on 23 August 2022).

- Lin, C.S.; Lin, C.Y. Constructing a network evaluation framework for improving the financial ecosystem in small-medium size firms. Technol. Econ. Dev. Econ. 2018, 24, 893–913. [Google Scholar] [CrossRef]

- BCR. World Supply Chain Finance Report 2021. Available online: https://bcrpub.com/world-supply-chain-finance-report-2021 (accessed on 31 July 2022).

- Iresearch. 2023 China Supply Chain Finance Digital Industry Research Report. Available online: http://k.sina.com.cn/article_1796217437_6b101a5d019015tx8.html#/ (accessed on 23 August 2022).

- Chan Kim, W.; Mauborgne, R. Value innovation: A leap into the blue ocean. J. Bus. Strategy 2005, 26, 22–28. [Google Scholar] [CrossRef]

- Kim, C.; Yang, K.H.; Kim, J. A strategy for third-party logistics systems: A case analysis using the blue ocean strategy. Omega 2008, 36, 522–534. [Google Scholar] [CrossRef]

- Citnews. Ministry of Commerce: In 2022, China’s E-Commerce Transaction Volume Reached 43.83 Trillion Yuan, A Year-on-Year Increase. Available online: http://www.citnews.com.cn/news/202304/158886.html (accessed on 30 July 2022).

- Gupta, D.; Chen, Y. Retailer-direct financing contracts under consignment. Manuf. Serv. Oper. Manag. 2020, 22, 528–544. [Google Scholar] [CrossRef]

- Cramer-Flood, E. Global Ecommerce 2020: Despite Decline, China will Become the World’s Largest Retail Market This Year. Available online: https://www.insiderintelligence.com/content/china-ecommerce-2020 (accessed on 30 July 2022).

- Wang, W. Research on supply chain financial risk management of JD.COM company under the background of “internet plus”. Market. Manag. Rev. 2019, 8, 36–37. [Google Scholar]

- Guo, C. Financial risk and risk control of online supply chain in JD.COM. China Storage Transp. 2019, 7, 97–99. [Google Scholar]

- He, M. Research on the Operation Mode of Supply Chain Finance in JD. COM. Front. Econ. Manag. 2023, 4, 161–168. [Google Scholar]

- Porter, M.E. Competitive Strategy; Harvard Business Press: Harvard MA, USA, 1980. [Google Scholar]

- Supply Chain Finance Community. SCF Community: Bridging Physical and Financial Supply Chains. Available online: http://www.scfcommunity.org/ (accessed on 21 August 2022).

- Camerinelli, E. Supply chain finance. J. Paym. Strategy Syst. 2009, 3, 114–128. [Google Scholar]

- Pfohl, H.-C.; Gomm, M. Supply chain finance: Optimizing financial flows in supply chains. Log. Res. 2009, 1, 149–161. [Google Scholar] [CrossRef]

- Petr, P.; Sirpal, R.; Hamdan, M. Post-crisis emerging role of the treasurer. Eur. J. Sci. Res. 2012, 86, 319–339. [Google Scholar]

- Walters, D. Effectiveness and efficiency: The role of demand chain management. Int. J. Log. Manag. 2006, 17, 75–94. [Google Scholar] [CrossRef]

- Hofmann, E. Supply chain finance: Some conceptual insights. Beiträge Zu Beschaff. Und Logist. 2005, 16, 203–214. [Google Scholar] [CrossRef]

- Wuttke, D.A.; Blome, C.; Foerstl, K.; Henke, M. Managing the innovation adoption of supply chain finance—Empirical evidence from six European case studies. J. Bus. Log. 2013, 34, 148–166. [Google Scholar] [CrossRef]

- Lin, C.-Y. Optimal core operation in supply chain finance ecosystem by integrating the fuzzy algorithm and hierarchical framework. Int. J. Comput. Intell. Syst. 2020, 13, 259–274. [Google Scholar] [CrossRef]

- Zhao, X.; Yeung, K.; Huang, Q.; Song, X. Improving the predictability of business failure of supply chain finance clients by using external big dataset. Ind. Manag. Data Syst. 2015, 115, 1683–1703. [Google Scholar] [CrossRef]

- Fellenz, M.R.; Augustenborg, C.; Brady, M.; Greene, J. Requirements for an evolving model of supply chain finance: A technology and service providers perspective. Commun. IBIMA 2009, 10, 227–235. [Google Scholar]

- Soni, G.; Kumar, S.; Mahto, R.V.; Mangla, S.K.; Mittal, M.L.; Lim, W.M. A decision-making framework for Industry 4.0 technology implementation: The case of FinTech and sustainable supply chain finance for SMEs. Technol. Forecast. Soc. Chang. 2022, 180, 121686. [Google Scholar] [CrossRef]

- Carnovale, S.; Rogers, D.S.; Yeniyurt, S. Broadening the perspective of supply chain finance: The performance impacts of network power and cohesion. J. Purch. Supply Manag. 2019, 25, 134–145. [Google Scholar] [CrossRef]

- Wan, X.; Qie, X. Poverty alleviation ecosystem evolutionary game on smart supply chain platform under the government financial platform incentive mechanism. J. Comput. Appl. Math. 2020, 372, 112595. [Google Scholar] [CrossRef]

- Lamoureux, J.-F.; Evans, T.A. Supply chain finance: A new means to support the competitiveness and resilience of global value chains. Available at SSRN 2179944 2011. [Google Scholar] [CrossRef]

- Jia, F.; Blome, C.; Sun, H.; Yang, Y.; Zhi, B. Towards an integrated conceptual framework of supply chain finance: An information processing perspective. Int. J. Prod. Econ. 2020, 219, 18–30. [Google Scholar] [CrossRef]

- Ma, H.-L.; Wang, Z.X.; Chan, F.T.S. How important are supply chain collaborative factors in supply chain finance? A view of financial service providers in China. Int. J. Prod. Econ. 2020, 219, 341–346. [Google Scholar] [CrossRef]

- Chen, X.; Wu, J. Supply Chain Finance; Posts and Telecom Press: Beijing, China, 2018. [Google Scholar]

- Yeepay Research. Research Report on the Development Trend of Supply Chain Finance Industry in 2018. Available online: https://www.headscm.com/Fingertip/detail/id/507.html (accessed on 18 July 2022).

- Björkdahl, J.; Holmén, M. Business model innovation–the challenges ahead. Int. J. Product Dev. 2013, 18, 213–225. [Google Scholar] [CrossRef]

- Amit, R.; Zott, C. Creating value through business model innovation. MIT Sloan Manag. Rev. 2012, 53, 41. [Google Scholar]

- Demil, B.; Lecocq, X. Business model evolution: In search of dynamic consistency. Long Range Plan. 2010, 43, 227–246. [Google Scholar] [CrossRef]

- Pohle, G.; Chapman, M. IBM’s global CEO report 2006: Business model innovation matters. Strategy Leadersh. 2006, 34, 34–40. [Google Scholar] [CrossRef]

- Baden-Fuller, C. Strategic innovation, corporate entrepreneurship and matching outside-in to inside-out approaches to strategy research. Br. J. Manag. 1995, 6, S3–S16. [Google Scholar] [CrossRef]

- Simanis, E.; Hart, S.L. Innovation from the inside out. MIT Sloan Manag. Rev. 2009, 50, 77–86. [Google Scholar]

- Bocken, N.M.P.; Short, S.W.; Rana, P.; Evans, S. A literature and practice review to develop sustainable business model archetypes. J. Clean. Prod. 2014, 65, 42–56. [Google Scholar] [CrossRef]

- Joyce, A.; Paquin, R.L. The triple layered business model canvas: A tool to design more sustainable business models. J. Clean. Prod. 2016, 135, 1474–1486. [Google Scholar] [CrossRef]

- Eisenhardt, K.M. Building theories from case study research. Acad. Manag. Rev. 1989, 14, 532–550. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Graebner, M.E. Theory building from cases: Opportunities and challenges. Acad. Manag. J. 2007, 50, 25–32. [Google Scholar] [CrossRef]

- Baxter, P.; Jack, S. Qualitative case study methodology: Study design and implementation for novice researchers. Qual. Rep. 2008, 13, 544–559. [Google Scholar] [CrossRef]

- Pratt, M.G. From the Editors: For the Lack of a Boilerplate: Tips on Writing Up (and Reviewing) Qualitative Research; American Society of Nephrology: Briarcliff Manor, NY, USA, 2009; Volume 52. [Google Scholar]

- Rowley, J. Using case studies in research. Manag. Res. News 2002, 25, 16–27. [Google Scholar] [CrossRef]

- Stuart, I.; McCutcheon, D.; Handfield, R.; McLachlin, R.; Samson, D. Effective case research in operations management: A process perspective. J. Oper. Manag. 2002, 20, 419–433. [Google Scholar] [CrossRef]

- Simons, H. Towards a Science of the Singular: Essays about Case Study in Educational Research and Evaluation; Centre for Applied Research in Education University of East Anglia: Norwich, UK, 1980. [Google Scholar]

- Yin, R.K. Case Study Research; Sage Publications: Beverly Hills, CA, USA, 1984. [Google Scholar]

- Stake, R.E. The Art of Case Study Research; Sage: Newcastle upon Tyne, UK, 1995. [Google Scholar]

- Meyer, C.B. A case in case study methodology. Field Meth. 2001, 13, 329–352. [Google Scholar] [CrossRef]

- JD.COM Group. 2020 Annual Report. Available online: https://ir.jd.com/static-files/e5d705b1-3089-4247-8b12-a4fb69fc025a (accessed on 24 August 2022).

- Cramer-Flood, E. Global Ecommerce 2020: Ecommerce Decelerates Amid Global Retail Contraction but Remains a Bright Spot. Available online: https://content-na1.emarketer.com/global-ecommerce-2020 (accessed on 24 August 2022).

- Sun, S. Liu Qiangdong on JD Finance: Alipay Is Ten Years Earlier than Us, but It Will Not Become a Business with 100 Billion Profit. Available online: https://www.01caijing.com/finds/details/11919.htm (accessed on 25 August 2022).

- Osterwalder, A. The Business Model Ontology a Proposition in a Design Science Approach. Doctoral Dissertation, Université de Lausanne, Faculté des Hautes Études Commerciales, Lausanne, Switzerland, 2004. [Google Scholar]

- Keane, S.F.; Cormican, K.T.; Sheahan, J.N. Comparing how entrepreneurs and managers represent the elements of the business model canvas. J. Bus. Ventur. Insights 2018, 9, 65–74. [Google Scholar] [CrossRef]

- Jing, Y.; Zhang, B. Analysis of LETV’s business model based on business model canvas. Commer. Account. 2017, 29–33. [Google Scholar] [CrossRef]

- Kesenwa, A.; Oima, D.O.; Oginda, M. Strategy formation, execution capability, and innovation-performance relationship to farms’ strategic orientation: A study of Safaricom, Nairobi, Kenya. Int. J. Bus. Soc. Sci. 2015, 6, 146–158. [Google Scholar]

- Jurevicius, O. Competitive Advantage. Available online: https://strategicmanagementinsight.com/topics/competitive-advantage.html (accessed on 4 August 2022).

- Baskarada, S. Qualitative case study guidelines. Qual. Rep. 2014, 19, 1–25. [Google Scholar] [CrossRef]

- JD.COM Group. 2017 Annual Report. Available online: https://ir.jd.com/static-files/fddad3a2-58bc-4c89-b119-320b9e773640 (accessed on 20 September 2022).

- JD.COM Group. 2019 Annual Report. Available online: https://ir.jd.com/static-files/fc93d5dd-9437-4141-9191-f960ba46874b (accessed on 20 September 2022).

- Liyan Research Institute. Advancing the Digital Transformation of Finance with Quality—The Example of Supply Chain Finance. Available online: https://www.sohu.com/a/543991527_99978243 (accessed on 5 October 2022).

- Sohu Finance. Liu Qiangdong: JD Has Been Doing Finance All the Time, Which Will Soon Exceed 10 Billion Yuan. Available online: https://business.sohu.com/20131224/n392309731.shtml (accessed on 12 October 2022).

- TechWeb. JDD-2017 JD Financial Global Data Explorer Conference ‘JD Financial Cloud’ Launched. Available online: https://baijiahao.baidu.com/s?id=1583294446155908201&wfr=spider&for=pc (accessed on 3 November 2022).

- Tianyancha.com. Overview of JD Digits Holding Co., Ltd. Available online: https://www.tianyancha.com/company/3448504655/shangshi (accessed on 6 November 2022).

- Tianyancha.com. Overview of JD Technology Holding Co., Ltd. Available online: https://www.tianyancha.com/brand/b1c58120788 (accessed on 7 November 2022).

- JD Digits Holding Limited Liability Company. JD Digits Prospectus. Available online: https://www.jrwenku.com/43924.html (accessed on 6 December 2022).

- JD.COM Group. 2014 Annual Report. Available online: https://ir.jd.com/staticfiles/7799577e-688a-4ee1-ae0b-9dfb91fb6909 (accessed on 20 September 2022).

- JD.COM Group. 2016 Annual Report. Available online: https://ir.jd.com/static-files/2b0685dc-63d2-4f49-b16f-c6d7ce0846f8 (accessed on 20 September 2022).

- JD.COM Group. 2018 Annual Report. Available online: https://ir.jd.com/staticfiles/d4d1ee39-164d-4adb-9805-39f105d91eae (accessed on 20 September 2022).

- JD.COM Group. 2021 Annual Report. Available online: https://ir.jd.com/static-files/9055f603-d2df-49ed-a4fe-ead80039d803 (accessed on 20 September 2022).

- JD Digits Holding Limited Liability Company. JD Tech. Prospectus. Available online: https://wenku.baidu.com/view/8e66f9b275a20029bd64783e0912a21615797f19.html?_wkts_=1685462666073 (accessed on 17 December 2022).

- Internet Analysis Salon. Liu Qiangdong’s Yale Speech Disclosed for the First Time that all the Strategic Layout of JD Revolves around Value. Available online: http://sohu.com/a/30112043_118540 (accessed on 17 October 2022).

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | Increase 2021 vs. 2020 | |

|---|---|---|---|---|---|---|---|---|

| Asia | 55 | 71 | 99 | 128 | 168 | 227 | 324 | 43% |

| Africa | 5 | 7 | 11 | 12 | 16 | 21 | 29 | 40% |

| Europe | 100 | 135 | 162 | 203 | 257 | 337 | 455 | 35% |

| America | 170 | 235 | 290 | 400 | 530 | 726 | 995 | 37% |

| TOTAL | 330 | 448 | 562 | 743 | 971 | 1311 | 1803 | 38% |

| Scope | Selected Representative References | Definition Quotes (Exemplary) |

|---|---|---|

| optimization | Camerinelli [21], Supply Chain Finance Community [20] | “SCF benefits capital flows optimization and liquidity value modification by offering various products or services to facilitate the management of physical and information flows by financial institutions in the SC” [21]. |

| integration | Pfohl and Gomm [22] | “SCF as the inner-company optimization of financing through integrating financing processes with customers, suppliers, and service providers to increase the value of all participating companies” [22]. |

| cost reduction | Petr et al. [23], Omran et al. [5] | “SCF is an interesting approach used by many focal firms to optimize the flows and allocation of financial resources in the supply chain, leading to higher profits and cost reduction in company financing” [5]. |

| value creation | Hofmann [25], Walters [24], Wuttke et al. [26] | “SCF is an approach for two or more organizations in a SC, including external service providers, to jointly create value through means of planning, steering, and controlling the flow of financial resources on an inter-organizational level” [25]. |

| ecological system/model | C. S. Lin and Lin [8], Shen et al. [1], C.-Y. Lin [27] | “The SCF ecosystem is a fresh type of financial provider that has the potential to make the SC more efficient by offering cheaper prices or credit to SMEs in the system” [8]. |

| SC risk management | X. Chen et al. [6], X. Zhao et al. [28] | “SCF necessitates financial institutions to carry out a thorough assessment of SCF clients, taking into account the risk dimensions, the environmental dimension, and the operational dimension” [28]. |

| financial technology | Fellenz et al. [29], Soni et al. [30] | “Financial technology (FinTech) innovation has also contributed to the adoption of SCF by delivering financial services using information technologies (IT) and simplifying loan and transaction processes for SMEs” [30]. |

| global supply chain network | X. Wan and Qie [32], Carnovale et al. [31] | “In the global SC network, SCF platforms have become an important means of precise poverty alleviation” [32]. |

| 2014 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|

| Suppliers | ≥7200 | ≥12,000 | ≥15,000 | ≥19,000 | ≥24,000 | ≥30,000 |

| Third-party merchants | ≥60,000 | ≥120,000 | ≥170,000 | ≥210,000 | ≥270,000 | ≥300,000 |

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|---|---|

| Annual Active Customer Accounts | 29.3 | 47.4 | 96.6 | 155 | 226.6 | 292.5 | 305.3 | 362 | 471.9 |

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Net Revenue | 41.38 | 69.34 | 115 | 181.3 | 258.3 | 362.3 | 462 | 576.9 | 745.8 | 951.6 |

| GMV | 73.3 | 125.5 | 242.5 | 590.6 | 939.2 | 1294.5 | 1676.9 | 2085.4 | 2612.5 | 3334.8 |

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Inventories | 4.75 | 6.39 | 12.19 | 20.54 | 28.91 | 41.7 | 44.03 | 57.93 | 58.93 | 75.60 |

| Inventory Annual Turnover Days | 34.1 | 34.2 | 34.8 | 36.4 | 37.6 | 38.1 | 37.3 | 35.8 | 33.3 | 30.3 |

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Accounts Payable | 8.10 | 11.02 | 16.41 | 31.20 | 46.01 | 74.36 | 80.07 | 90.42 | 106.53 | 140.51 |

| Annual Accounts Payable Days | 42.5 | 42.2 | 40.9 | 44.0 | 52.0 | 60.3 | 58.1 | 54.5 | 47.1 | 45.3 |

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|

| Interest income in relation to nonrecourse securitization debt charged to JD Digits (JDD) | 26.02 | 371.58 | 702.15 | 527.03 | 37.65 | - |

| Interest income in relation to loans provided to JD Digits (JDD) | 85.7 | 161.6 | 569.4 | 119.05 | 40.63 | 31.01 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhou, L.; Lee, H. Supply Chain Finance Business Model Innovation: Case Study on a Chinese E-Commerce-Centered SCF Adopter. Systems 2023, 11, 278. https://doi.org/10.3390/systems11060278

Zhou L, Lee H. Supply Chain Finance Business Model Innovation: Case Study on a Chinese E-Commerce-Centered SCF Adopter. Systems. 2023; 11(6):278. https://doi.org/10.3390/systems11060278

Chicago/Turabian StyleZhou, Lele, and Hyangsook Lee. 2023. "Supply Chain Finance Business Model Innovation: Case Study on a Chinese E-Commerce-Centered SCF Adopter" Systems 11, no. 6: 278. https://doi.org/10.3390/systems11060278

APA StyleZhou, L., & Lee, H. (2023). Supply Chain Finance Business Model Innovation: Case Study on a Chinese E-Commerce-Centered SCF Adopter. Systems, 11(6), 278. https://doi.org/10.3390/systems11060278