Abstract

It is of great value to study the stickiness of enterprise cost for reducing enterprise cost and improving enterprise performance. This paper selected all A-share non-financial listed companies from 2014 to 2019 to study the impact of executive power and employee stock ownership plans on cost stickiness. The study found that the higher the executive power, the stronger the cost stickiness of the enterprise. By reducing the adjustment costs and optimistic expectations of management and improving the performance sensitivity of executive compensation and quality of information disclosure, an employee stock ownership plan plays a role in suppressing the cost-stickiness effect of executive power. The larger the scale and the more times the employee stock ownership plan is implemented, the stronger the inhibition effect is. An employee stock ownership plan has a stronger inhibiting effect on the cost-stickiness effect of executive power in enterprises with a large proportion of state-owned and institutional shares and high employee status. Combining the research themes of management accounting and financial accounting, this study discusses the economic consequences of ESOP from the perspective of enterprise cost control, which is helpful for internal and external stakeholders of enterprises to understand the characteristics and effects of ESOP in the new era, and also provides new evidence for enterprise cost control while enlightening policy makers and listed companies to explore the feasible mechanism of enterprise cost control from the staff level. It is of great value to study the stickiness of enterprise cost for reducing enterprise cost and improving enterprise performance. This paper selected all A-share non-financial listed companies from 2014 to 2019 to study the impact of executive power and an employee stock ownership plan on cost stickiness. It is found that the higher the executive power, the stronger the cost stickiness. An employee stock ownership plan has a stronger inhibiting effect on the cost-stickiness effect of executive power in enterprises with a large proportion of state-owned and institutional shares and high employee status. This study provides new evidence for corporate cost control.

1. Introduction

With the deepening of supply-side structural reform, the significance and importance of cost reduction in the real economy have been highlighted by the national proposal of “three to go, one to drop and one to make up” in 2015. However, the existence of cost stickiness [1] makes it difficult for enterprises to reduce costs during the economic downturn, thus hindering the realization of cost reduction goals. Analyzing the factors and formation mechanism of cost stickiness, determining the constraints, and effectively guiding enterprises to reduce costs is a powerful tool for micro-enterprise cost management [2] and real economy cost reduction target realization under the new normal.

There are three causes of corporate cost stickiness: Adjustment costs, management optimistic expectations, and agency problems [3]. From the viewpoint of adjustment cost, the employment contract constraints signed between executives and employees make it difficult to reduce the human capital of the enterprise, thus giving rise to cost stickiness; from the viewpoint of management optimistic expectations, executives’ actions of increasing investment rather than reducing expenditure due to optimistic expectations of future economic forms will intensify enterprise cost stickiness; from the viewpoint of the agency problem, executives’ self-interest motive of building an enterprise empire willfully increases cost expenditure, resulting in enterprise cost. In terms of agency problems, executives’ self-interest in building a corporate empire increases cost expenditures and leads to cost stickiness. Thus, the behavior of executives is closely related to cost stickiness. The existing literature has not explored the impact of executive power on cost stickiness. This paper explores the cost-stickiness effect of executive power based on this innovative point.

Employees, similar to executives, are the creators of corporate value, and both are important human resources that need to be motivated [4]. In 2014, the Securities and Regulatory Commission promulgated the “Guidance on the Implementation of Employee Stock Ownership Plans in Listed Companies on a Pilot Basis” (hereinafter referred to as “Guidance”), which makes Employee Stock Ownership Plans (ESOPs) at this stage in China be ESOPs are mentioned and implemented. Employee stock ownership plans are considered an important means to improve corporate productivity and performance by reducing agency conflicts [5]. Employees become “shareholders” of the company through stock ownership plans (Song and Liu, 2018) and actively monitor the behavior of executives, thus regulating the power and cost stickiness of executives. After the implementation of an employee stock ownership plan in the new era of listed companies, the effect of employee participation in corporate governance is controversial. This paper takes cost stickiness as the research object and tries to investigate whether the implementation of an employee stock ownership plan can make up for the lack of corporate supervision mechanisms and play a restraining role in the cost-stickiness effect of executive power from the perspective of corporate operation.

The lack of employee ownership is related to the concentration of equity in the firm, which directly affects the firm’s performance and thus indirectly affects the firm’s cost stickiness. Gaur et al. [6] found that the lack of ownership concentration can lead to agency problems and thus poor returns for the firm. Wang’s study showed that the equity concentration can significantly improve the efficiency of energy companies’ investments in China [7]. However, Balsmeier and Czarnitzki [8] found a non-linear relationship between ownership concentration and firm performance, suggesting that too much concentration can lead to a significant reduction in the chances of attracting external investment, or even the loss of access to external investment, which may lead to slower growth due to a lack of capital availability. Not coincidentally, Guerrero-Villegas et al. [9] also argue that the improvement of firm performance is easier at low levels of equity concentration than at high levels. When equity is more dispersed, managers have more freedom to make decisions and usually prefer to favor short-term and low-risk decisions. However, when equity concentration exceeds a certain value, the positive effects of equity concentration become progressively worse and even have a curbing effect on firm performance. Yin et al. [10] found that the equity concentration has a positive effect on a firm’s earnings and an inverse effect on a firm’s market performance through the theoretical logic of “power-decision-performance”. The increase in equity concentration will lead to slower diversification, but the diversification will improve the firm’s performance. Therefore, employee shareholding will reduce the concentration of equity to some extent, which will enhance the diversification of the company and thus promote the performance of the company. Moreover, with the increase in employee shareholding, the resources of employees will be used for the development of the enterprise, which will reduce the cost of the enterprise to a certain extent and further promote the reduction of cost and efficiency of the enterprise.

The research contributions of this paper include the following three points. First, this paper is an innovative study of the economic consequences of employee stock ownership plans from the perspective of corporate operations at the intersection of management accounting and financial accounting, which enriches the literature on employee stock ownership plans and cost stickiness. At the present stage of the employee stock ownership plan in China, which was implemented in 2014, there are few relevant studies, and most of them focus on the impact of the employee stock ownership plan on corporate output [11,12,13], information disclosure [14], and innovation activities [15,16,17,18], and fewer scholars have focused on the impact of the employee stock ownership plan at the cost operation level, and this paper fills this literature gap. Second, this paper innovatively demonstrates the impact of executive behavior on corporate cost stickiness from the perspective of executive power and quantitatively examines the constraining effect of employee participation in corporate governance (the employee stock ownership plan) on executive power from the perspective of cost stickiness by using the agency problem between shareholding employees and executives as a new perspective, while extending the relevant research literature on corporate cost stickiness governance mechanisms. Third, the findings of this paper can provide a basis for micro enterprises’ cost management and macro regulators to understand the barriers to cost reduction in the real economy, assist micro cost management decisions and macro real economy cost reduction policies, and inspire policy makers and micro enterprises to explore feasible mechanisms for corporate cost control from the employee level. This paper first analyzes the institutional background and theory between cost reduction, employee stock ownership plan, executive power, and cost stickiness. Next, the data in the database were screened and selected, and a model involving employee stock ownership, executive power, and cost stickiness was constructed. Then, descriptive statistics were conducted for the independent variables, and a regression analysis was conducted for the dependent variables. Further, the adjustment cost mechanism path, management optimistic expectation mechanism path, executive compensation performance sensitivity mechanism path, and information disclosure quality mechanism path were obtained by the influence mechanism test method. On this basis, the moderating effects of different factors on cost stickiness are analyzed, primarily including the moderating effect of ESOP once vs. multiple times, the moderating effect of equity nature, the moderating effect of the ESOP_ratio, the moderating effect of institutional investors’ shareholding, and the moderating effect of employee turnover. Finally, the research conclusions and insights of this paper are obtained.

2. Institutional Background and Theoretical Analysis

2.1. Cost Reduction and Cost Stickiness

The traditional theory of cost nature assumes that the total variable cost varies positively with the change in business volume in the relevant range. With the deepening of this theory, scholars have found through empirical research that the marginal variation ratio of cost exists asymmetrically in the direction of different changes in business volume, i.e., there is cost stickiness. The research results of Anderson, Banker, and Janakiraman show that the level of cost stickiness is positively correlated with the capital and labor intensity of enterprises, which is primarily since high levels of capital intensity and labor intensity lead to higher adjustment costs [19]. Subramaniam and Weidenmier argued that the presence of cost stickiness is related to the magnitude of change in the firm’s sales. When the sales change is small, the adjustment cost is small and the firm does not have cost stickiness; while when the sales adjustment exceeds the firm’s available resources, the firm may need to change the original cost structure, which makes the adjustment cost increase significantly and the firm has cost stickiness [20]. Banker and Chen conducted an in-depth analysis of the relationship between the structural characteristics of the firm’s labor market and the firm’s cost stickiness in nineteen OECD countries. Regarding this relationship, they found that the adjustment costs of corporate human resources are positively related to the degree of legal protection of corporate employees and the bargaining power of corporate unions. Therefore, they concluded that cost stickiness is greater in countries with more robust legal systems for employees and stronger bargaining power of corporate unions [21]. The findings of Calleja, Steliaros, and Thomas also support the adjustment cost theory, and they concluded that both capital intensity and labor intensity at the firm level increase the cost of contract renegotiation and increase the level of cost stickiness [22]. There are many studies by domestic scholars that also support the adjustment cost viewpoint. Gong Qihui et al. and Cui Yanan showed that a higher level of marketization is conducive to higher factor mobility, more efficient resource allocation, and lower adjustment costs of factors. State-owned enterprises are subject to more government intervention, have less autonomy in acquiring and disposing of factors, have higher adjustment costs, and have higher cost stickiness; non-state-owned enterprises have more autonomy in acquiring and disposing of factors, have lower adjustment costs, and have less cost stickiness [23,24]. Yuanyuan Liu and Bin Liu took the implementation of the Labor Contract Law as an entry point to study the law of labor cost stickiness. The empirical results showed that the implementation of the Labor Contract Law in China increased the labor costs of enterprises and also raised the adjustment costs of enterprises, leading to the generation of cost stickiness [25]. Using the implementation of China’s Minimum Wage Regulation as an entry point, Jiang Wei et al. verified that the implementation of the Minimum Wage Regulation made the cost of adjusting committed resources downward higher than the cost of adjusting committed resources upward, which resulted in cost stickiness [26].

From 2016 to 2021, China’s State Council continued to issue the Notice on the Work Program for Reducing Enterprise Costs in the Real Economy (hereinafter referred to as the Notice), stating that effectively reducing enterprise costs in the real economy will not only improve the operational efficiency of enterprises but also remove the ineffective or backward production capacity of enterprises, optimize the environment for enterprise development, and further enhance industrial competitiveness. It is important to improve the quality of the supply system of the real economy, continue to enhance the quality advantages of our economy, and enhance the ability for sustainable economic development.

The objective of the Notice regarding cost reduction in the real economy is to reduce the comprehensive cost of the real economy, not to reduce the unit cost. However, there is the problem of cost stickiness in the cost theory of micro enterprises, and if we do not see the cost stickiness, it may be counterproductive to ask enterprises to reduce costs. Not only can the cost of enterprises not be reduced but it will also intensify the risk of enterprises in the economic downturn [27]. This will run counter to the original purpose of the macroeconomic cost reduction policy and seriously affect the effect of cost reduction policy implementation. Therefore, before conducting research on macroeconomic cost reduction, the problem of enterprise cost stickiness needs to be carefully studied.

2.2. Executive Power and Cost Stickiness

The significant influence of executives on cost stickiness has been confirmed by scholars from the perspectives of executive tenure [28], compensation performance [29], and personal characteristics and experiences [30,31,32], which are important for the management and decision making of corporate cost expenditures. Executive power is related to their influence on various activities of the firm, and Quan [33] and Zhang [34] show that excessive executive power can make executives disregard shareholders’ interests in the decision-making process and show strong personal will in their own compensation contract signing and corporate investment decisions. Thus, executive power representing executive influence is bound to affect corporate cost stickiness.

Banker et al. [3] attribute three causes of firm cost stickiness: Adjustment costs, management optimistic expectations, and agency problems. The adjustment cost view argues that there is an asymmetry between upward or downward adjustment of firm resources, and downward adjustment of resources is usually subject to greater friction. The resistance to adjusting costs downward stems from the employment contracts signed between companies and their employees. The contractual constraints make it difficult to adjust labor costs downward in a short period of time, thus creating cost stickiness in companies. Executives are in charge of the company’s affairs, and they have the power to make decisions on employment contracts and pay and performance. Powerful corporate management will pay higher salaries to employees out of personal self-interest [35,36], which makes it difficult to adjust corporate costs downward based on contractual constraints. Thus, under the adjustment cost view, executive power exacerbates firm cost stickiness.

Management’s optimistic expectation view holds that managers often believe that the firm’s future sales will show an increasing trend, and if current sales rise, they will invest additional resources; if current sales decline, managers will also consider the situation as transient and are reluctant to curtail spending. This behavioral tendency of executives to only increase costs rather than reduce them eventually gives rise to corporate cost stickiness [37]. The greater the power of executives, the less impeded and the easier it is to achieve the behavior of increasing corporate resource investment and unwillingness to curtail costs under management’s optimistic expectations. Thus, based on the management’s optimistic expectation view, executive power exacerbates firm cost stickiness.

The agency problem view suggests that executives and shareholders have both cooperative and competing interests in the pursuit of maximizing their own interests. Compared with shareholders, management has more first-hand information about corporate operations, and therefore management has a certain degree of dominant control over corporate resources. Due to the existence of the principal–agent problem, when the interests of management and shareholders are contrasting and the internal governance and supervision mechanisms of the firm cannot effectively restrain management, management will act more egoistically with an information advantage and its own power, and executives usually build corporate empires by over-employing employees and expanding the size of the firm [38], thus increasing the cost stickiness of the firm. In the agency problem of corporate cost stickiness, the longer the tenure of executives, the greater the perceived power of executives and the greater the impact on corporate cost stickiness may be [39]. Based on the above analysis, this paper proposes:

Hypothesis H1.

The greater the power of executives, the greater the cost stickiness of the firm.

2.3. Employee Stock Ownership Plan, Executive Power, and Cost Stickiness

The original policy intention of the employee stock ownership plan is to make employees become the same carrier of capital and labor, so that employees and enterprises “share the same honor and disgrace, and share the same interests”, and motivate employees to participate in corporate governance, which in turn improves enterprise productivity and performance [5,6,7]. It has been found that the implementation of employee stock ownership plans gives employees more value attributes [40], effectively promotes corporate innovation [15,16,17,18], improves the quality of information disclosure [14], and enables companies implementing employee stock ownership plans to enjoy higher share price returns [41]. However, the literature has also found certain drawbacks of employee stock ownership plans at this stage in China [42,43], resulting in low corporate productivity [44] and underutilization of due potential [45,46]. This literature on the implementation of employee stock ownership plans to play a role in corporate governance is based on stakeholder theory and agency theory.

From the perspective of stakeholder theory, employee stock ownership plans give employees the status of “shareholders of the company” and their interests are tied to corporate performance. After the implementation of the employee stock ownership plan, with the increase in shared information, employees have enough motivation and ability to participate in the management activities of the company, actively monitor the behavior of executives, restrain the behavior of executives to build corporate empires and expand the size of the company at will, force executives to make decisions in the interests of owners, and to a certain extent inhibit the occurrence of opportunistic behavior of executives in cost control.

From the perspective of agency theory, management will buy employees through the implementation of an employee stock ownership plan, so that employees will give up as “whistle blowers”. After the implementation of the employee stock ownership plan, the interests of employees are closely related to the share price, and combined with the characteristics of the short duration of China’s employee stock ownership plan and the lock-up period of no more than three years, employees may tend not to reveal bad news about the management in order to avoid the decline in the share price due to the disclosure of bad news, so as to ensure the short-term benefits [47]. In this case, the degree of concealment of negative news by executives or major shareholders may be higher in listed companies that implement employee stock ownership plans, and the cost-stickiness effect of executive power may be exacerbated. Based on the above analysis, the moderating effect on executive power and cost stickiness may exist in both positive and negative directions after the ESOP is implemented again. This paper proposes:

Hypothesis H2a.

The implementation of an employee stock ownership plan inhibits the effect of executive power on cost stickiness.

Hypothesis H2b.

The implementation of an employee stock ownership plan promotes the effect of executive power on cost stickiness.

3. Study Design

3.1. Sample Selection

The China Securities Regulatory Commission issued the Guidance in 2014, and this paper selected A-share non-financial industry listed companies from 2014 to 2019 as the initial research sample, eliminating the data of ST, *ST, and PT companies, and excluding data samples with missing cost stickiness and other control variables. In the final sample, a total of 467 listed companies have successfully implemented employee stock ownership plans using different methods, 346 companies have implemented employee stock ownership plans only once in the sample interval, and 121 companies have implemented employee stock ownership plans multiple times. Consistent with the treatment of Shen Hongbo et al. [48] and Zhou Donghua et al. [17], we retain only the initial employee stock ownership plan data for listed companies that have implemented multiple employee stock ownership plans. The data in this paper are obtained from the Wind Financial Research Database and the CSMAR database, and all continuous variables are tail-shrunk at 1% and 99% divided to eliminate the effect of outliers on the regression results.

3.2. Model Selection

3.2.1. Model of the Effect of Executive Power on Cost Stickiness

Before proceeding with the modeling, the variables in the model need to be defined. The definitions of the main variables involved in the model constructed in this paper are shown in Table 1.

Table 1.

Definition of main variables.

Referring to Anderson et al. [1], the following model (1) is extended and constructed to test the effect of executive power on firm cost stickiness.

is the natural logarithm of the ratio of a company’s SG&A expenses in year t to its SG&A expenses in year t − 1, calculated as . SG&A expenses are calculated by drawing on the sum of selling expenses and administrative expenses of listed companies by Anderson et al. [1] and Liang [31]. is the natural logarithm of the ratio of the company’s sales revenue in year t to sales revenue in year t − 1, which is calculated as . is a dummy variable for whether the sales revenue decreases. If the sales revenue of a company in year t is less than the sales revenue in year t − 1, the value is 1. Otherwise, it is 0. indicates the degree of cost stickiness. If the coefficient of is significantly less than 0, it means the enterprise has cost stickiness. Otherwise, there is no cost stickiness. The smaller the coefficient of , the stronger the enterprise cost stickiness.

is the power of executives. Referring to the measurement method of Chip Fu et al. [49], three dummy variables are selected to measure executive power: Whether the general manager and the chairman of the board are united in two positions, whether the chairman’s term of office is more than four years, and whether the degree of equity checks and balances is less than one. Among them, : If the general manager and the chairman are held by the same person, the value is 1. Conversely, it takes the value of 0. : If the chairman’s tenure exceeds four years, the value is 1. Conversely, it takes the value of 0. : If equity dispersion is less than 1 (the ratio of the shareholding ratio of the first largest shareholder to the sum of the shareholding ratio of the second to tenth largest shareholders), the value is 1. Conversely, it takes the value of 0. The power of executives is calculated by continuous integration.

are the control variables in this paper. Referring to the study of Andersonde et al. (2003), the economic growth (), capital intensity (), labor intensity (), whether consecutive (), and the cross product of the above four variables and are selected as control variables in year t. In addition, the firm size (), return on total assets (), gearing ratio (), sole director ratio (), and total asset turnover () are also introduced as control variables. Meanwhile, this paper controls for time-fixed effects and firm-fixed effects.

Under the premise that firms have cost stickiness ( is significantly negative), if the coefficient of is significantly positive, it indicates that the greater the power of executives, the less prominent the cost stickiness of firms, and conversely, if the result is significantly negative, it indicates that the greater the power of executives, the heavier the cost stickiness of firms, supporting hypothesis H1.

3.2.2. Testing the Moderating Effect of Employee Stock Ownership Plan on the Power Cost Effect of Executives

In this paper, the dummy variable of employee stock ownership plan implementation () and the share of the employee stock ownership plan in the total share of the company’s equity () are selected as the variables to measure the degree of employee stock ownership plan implementation. Based on model (1), the following model (2) is constructed to test the moderating effects of and on the stickiness of executive power and cost by setting the cross-product term.

is the dummy variable of employee stock ownership plan implementation, which takes the value of 1 if the company implements an employee stock ownership plan in year t. Conversely, it takes the value of 0. is the ratio of the share of equity of the company’s employee stock ownership plan implementation in year t to the share of all A shares of the company in year t. Other variables are defined above. The model continues to control for time-fixed effects and firm-fixed effects. If the coefficient is significantly positive, it indicates that employee stock ownership plan implementation (size of implementation) suppresses the effect of executive power on cost stickiness and hypothesis H2a holds. If the coefficient of is significantly negative, it indicates that employee stock ownership plan implementation (implementation size) promotes the effect of executive power on cost stickiness, and hypothesis H2b holds.

4. Empirical Results

4.1. Descriptive Statistics

4.1.1. Sample Distribution Statistics of Employee Stock Ownership Plans

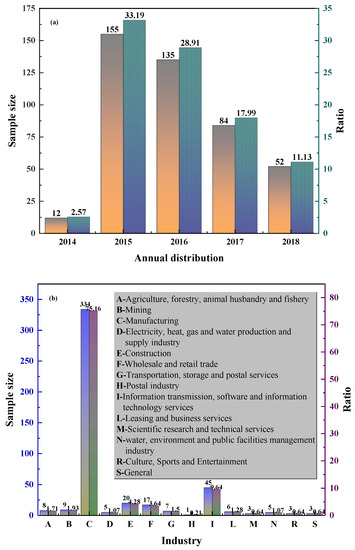

Figure 1 counts the distribution of employee stock ownership plans implemented and completed from 2014–2019 (including employee stock ownership plans implemented multiple times).

Figure 1.

Distribution of employee stock ownership plans: (a) By year; (b) by industry.

Figure 1a shows the annual distribution of employee stock ownership plans. The number of samples implementing employee stock ownership plans was the largest in 2015, reaching 155, and the number of samples implementing employee stock ownership plans decreased year by year from 2016–2019. From the industry distribution in Figure 1b, manufacturing is the industry with the largest number of employee share ownership plans implemented, accounting for 75.16% of the total sample, followed by information transmission, software, and information services, accounting for 9.64% of the total sample.

4.1.2. Descriptive Statistics of the Main Variables

The results of descriptive statistics for the main variables involved in this paper are shown in Table 2.

Table 2.

Descriptive statistics of main variables.

As can be seen from Table 2, the maximum value of measured by this paper is 3, the minimum value is 0, and the standard deviation is 0.8631, indicating that executive power varies widely across firms, and this variation is the focus of this paper’s research. The mean value of is 0.1456, indicating that a total of 14.56% of the companies in the sample year have implemented employee stock ownership plans, which is a low proportion, reflecting that the coverage of employee stock ownership plans in China in the new period is small and still in the early stage of development. The mean value of is 0.2314, which indicates that the share of equity of the employee stock ownership plan accounts for 23.14% of the share of equity of all A-share listed companies, which still does not reach the highest ratio (30%) required by relevant documents, reflecting the fact that many companies have a wait-and-see attitude towards the implementation effect of the employee stock ownership plan and are less active in implementing it. In addition, the descriptive statistics of other indicators are also logical.

4.2. Analysis of Regression Results

The results of hypotheses H1 and H2a/H2b are shown in Table 3.

Table 3.

Regression results.

Column 1 in Table 3 shows the regression results of model (1), and the coefficient of is −0.8520, which is significant at the 10% statistical level, indicating the existence of cost stickiness in the sample firms. The coefficient of is −0.0511, which is also significant at the 10% statistical level, indicating that the greater the power of executives, the greater the cost stickiness of firms, and hypothesis H1 is argued. Columns 2 and 3 show the regression results of model (2). From the results of the employee stock ownership plan implementation () reconciliation test in column 2, the coefficient of is significantly negative at the 5% statistical level, and hypothesis H1 holds, is significantly positive at the 1% statistical level, indicating that the implementation of an employee stock ownership plan will significantly suppress the influence of executive power on cost stickiness, and the conclusion supports H2a, that after the implementation of an employee stock ownership plan in listed companies, employees participate in corporate governance and effectively play a role in monitoring and restraining the behavior of executives, which suppresses the influence of executive power on cost stickiness; from the results of the adjustment test of the ratio of the share of equity in the implementation of an employee stock ownership plan to the share of all equity in the company () in the third column, under the conclusion of hypothesis H1. The coefficient of is statistically significantly positive at the 5% level, which indicates that the more the share of equity acquired by employees through the employee stock ownership plan, the higher the proportion of the company’s total share of equity, the greater the voice of employee participation in corporate governance, the stronger the restraining effect on executive behavior, and the stronger the effect of inhibiting the sticky effect of executive power costs, at which point the conclusion also supports H2a and does not support H2b.

5. Testing the Impact Mechanism

Based on the previous empirical results, this paper continues to examine the impact mechanism of the implementation of employee stock ownership plans on the stickiness effect of executive power costs, drawing on the ideas of Meng [18] and using group regressions to test the mechanism.

5.1. Adjustment Cost Mechanism Path

High adjustment costs are an important cause of cost stickiness in enterprises, and assets with high specialization have a higher loss of value when they are realized, leading to higher adjustment costs for firms [50]. In this paper, we measure the adjustment cost of enterprises by asset specificity (ASI) and draw on the method of Wang [51] to calculate asset specificity as the sum of net fixed assets, construction in progress, intangible assets, and long-term amortization costs as a percentage of total assets, and divide the sample into two groups with strong ASI and weak ASI. If the inhibitory effect of employee stock ownership plan implementation on executive power and cost stickiness is more pronounced in the sample group with high adjustment cost, it indicates that the mechanism path to reduce the adjustment cost holds, and the test results are shown in Table 4.

Table 4.

Mechanism path test.

From Table 4, it is easy to see that in the sample group with strong asset specificity, the regression coefficient of is 0.1676 and is significant at the 1% level. In the sample group with weaker asset specificity, the coefficient of is 0.0470 and is significant only at the 10% statistical level. The empirical results indicate that the suppression effect of employee stock ownership plan implementation on the sticky effect of executive power cost is more significant in the sample group with high adjustment costs. Therefore, the mechanism path in which the implementation of the employee stock ownership plan reduces the adjustment cost and thus suppresses the cost-stickiness effect of executive power is valid.

5.2. Management Optimistic Expectation Mechanism Path

Management’s optimistic expectation is another important factor that generates cost stickiness in enterprises. The higher the degree of environmental uncertainty, the greater the effect of the role of management’s optimistic expectations about the future operating conditions of the firm. Drawing on the approach of Shen [52], environmental uncertainty is used to measure management’s optimistic expectations, and the specific formula is as follows:

where Sale is the sales revenue and Year is the annual variable, and the residual term obtained from the above formula is the abnormal sales revenue. The standard deviation of abnormal sales revenue in the past 5 years is calculated and then divided by the average value of sales revenue in 5 years to obtain the value of the environmental uncertainty index, and the sample is divided into two groups with higher and lower environmental uncertainty values. If the inhibitory effect of employee stock ownership plan implementation on executive power and cost stickiness is more pronounced in the sample group with high environmental uncertainty, it indicates that the mechanism path of inhibiting managers’ optimistic expectations holds, and the test results are shown in Table 4.

The results show that in the sample group with high environmental uncertainty, has a regression coefficient of 0.1078 and is significant at the 1% level. In the sample group with low environmental uncertainty, the coefficient of is only 0.0458 and insignificant. The possible reason for the insignificant coefficient is that when the future economic situation is clearer, employees are more certain about their benefits from the increase in corporate value, resulting in insufficient motivation to participate in corporate governance and monitor the self-interest behavior of executives, and the effect of regulating the stickiness of executive power costs becomes insignificant. The empirical results show that the inhibitory effect of employee stock ownership plan implementation on the cost-stickiness effect of executive power is more significant in the sample group with high environmental uncertainty. Therefore, the mechanism path of employee stock ownership plan implementation suppressing management’s optimistic expectations holds.

5.3. Executive Compensation Performance Sensitivity Mechanism Path

Linking executive compensation to company performance is considered an important means to alleviate principal–agent conflicts. The higher the performance sensitivity of executive compensation, the more executives will pursue higher corporate performance in order to obtain higher compensation, which is also in the interest of shareholders, and the agency cost between them can be reduced. From the perspective of reducing agency costs, we examine whether employees, as “shareholders” of the company, can achieve consistency between the interests of executives and shareholders by increasing the performance sensitivity of executives’ compensation after the implementation of employee stock ownership plans, thus reducing the occurrence of executives’ self-interest-motivated behavior that increases the stickiness of corporate costs. The regression results are shown in Table 5 below, which shows that in the group with weak executive compensation sensitivity, the implementation of an employee stock ownership plan has a greater inhibitory effect on the cost stickiness of executive power [53]. The regression results show that in the group with weak performance sensitivity of executive compensation, the implementation of an employee stock ownership plan has a greater inhibitory effect on the cost-stickiness effect of executive power (0.1141 > 0.0847), and the significance level is stronger (significant vs. insignificant at the 1% statistical level). In addition, in the group with strong performance sensitivity of executive compensation, executive decisions are in the interest of shareholders, and the lack of employee-monitoring motivation makes the implementation of an employee stock ownership plan ineffective at inhibiting the cost-stickiness effect of executive power. Based on the above analysis, the mechanism path of employee stock ownership plan implementation to enhance the performance sensitivity of executive compensation and thus suppress the cost-stickiness effect of executive power holds.

Table 5.

Group test results.

5.4. Mechanism Path of Information Disclosure Quality

Information disclosure can reflect the business activities of enterprises on the one hand and assist management in performance evaluation on the other hand [54]. While firms fully disclose accounting information to promote transparency of accounting information, ensuring high disclosure quality can reduce information asymmetry between management and shareholders [55]. When the quality of information disclosure is high, the company’s employees can obtain more realistic and complete information about the company and achieve effective monitoring of the company’s business, which to some extent reduces the occurrence of behaviors that are detrimental to the development of the company such as blindly investing additional resources for self-interest motives by management, and the problem of executives using their authority to exacerbate the stickiness of corporate costs can be curbed. Referring to the study of Yi [56], the sample was grouped based on the rating of the Shenzhen Stock Exchange on the quality of information disclosure of listed companies. The assessment results of the Shenzhen Stock Exchange are divided into four grades: Excellent, good, qualified, and unqualified; when the disclosure quality rating is excellent and good, the disclosure quality is high, and when the disclosure quality rating is qualified and unqualified, the disclosure quality is poor. The results of the sub-group test are shown in Table 5. The regression results show that in the group with higher disclosure quality, the suppression coefficient of the cost-stickiness effect of employee stock ownership plan implementation on executive power is 0.0108 and is not significant. Meanwhile, in the group with a low quality of information disclosure, the coefficient of suppression of the cost-stickiness effect of employee stock ownership plan implementation on executive power is 0.2099 and is significant at the 1% statistical level. The regression results suggest that the mechanism path of employee stock ownership plan implementation to improve the quality of information disclosure holds.

6. Subgroup Test Results

6.1. Moderating Effect of ESOP Once vs. Many Times

In the previous section, if a company implements an employee stock ownership plan multiple times, only the initial implementation data are retained, but the more times a company implements an employee stock ownership plan, the greater the number of employees who receive company shares and participate in corporate governance. The growth of the “employee coalition” will further increase the voice of employees in corporate governance, thus affecting the role of executive power in cost stickiness. The results are shown in Table 5, which tests whether there is a difference in the moderating effect of the number of times the employee stock ownership plan is implemented by separating the sample of employees who implemented the plan once from those who implemented it multiple times.

The regression results show that in the single implementation of an employee stock ownership plan group, the coefficient of inhibition of employees’ control over executive cost is 0.0720 compared to the non-implemented employee stock ownership plan companies, and the coefficient is not significant. In the group of multiple employee stock ownership plans, the coefficient of inhibition of employee control over executive costs is greater at 0.1529 and is statistically significant at the 1% level compared to the companies without employee stock ownership plans. The regression results indicate that the more employee stock ownership plans are implemented, the more employees acquire the amount of company share capital, and the increase in voice increases their participation in corporate governance, leading to a greater restraining effect on the behavior of executives, which is reflected in a stronger inhibitory effect on the cost-stickiness effect of executive power.

6.2. Equity Nature Regulation Effect

The employee stock ownership system was first proposed in China to assist in the reform of state-owned enterprises, and based on the nature of the equity of listed companies, the grouping studied whether there is a difference in the inhibitory effect of an employee stock ownership plan, and the empirical results are shown in Table 5. The coefficient of is significant in both the sample group of state-owned enterprises and the sample group of private enterprises. However, the regression coefficient in the SOE sample group is 0.3237, which is larger than the regression coefficient in the private enterprise sample group of 0.0743. The results indicate that the introduction of an employee stock ownership plan, as an important means of introducing non-controlling shareholders in the mixed reform of SOEs, has a greater impact on the corporate governance of SOEs and significantly improves the problem of corporate cost stickiness caused by the power of executives.

6.3. ESOP_ratio Moderation Effect

The sample was divided into two groups according to higher and lower scales of employee stock ownership plan implementation to examine whether the moderating effect of an employee stock ownership plan is affected by the scale of implementation, and the regression results are presented in Table 5. The coefficient of is greater in the sample group of employee stock ownership plan implementation above the industry average compared to the sample group of employee stock ownership plan implementation below the industry average (0.1283 > 0.0730). The regression results indicate that the implementation of an employee share ownership plan will increase the motivation of employees to monitor the behavior of executives and increase the voice of employees in corporate governance when the company gives them more shares in the company, and also significantly increase the inhibitory effect on the self-interest-motivated behavior of executives.

6.4. Moderating Effect of Institutional Investors’ Shareholding

Compared with retail investors, institutional investors have more professional knowledge, and their financial strength and scale advantages give them stronger ability and motivation to supervise management, improve corporate governance, and motivate management to maximize corporate value [57], which has a suppressive effect on corporate cost stickiness [58]. The sample is divided into two groups according to the percentage of institutional investors’ shareholding to examine whether there is a difference in the inhibitory effect of employee share ownership plans, and the regression results are presented in Table 5. In the mean sample group where the percentage of institutional investors’ shareholding is greater than the industry, the coefficient of is 0.1090 and is significant at the 1% statistical level. The coefficient of is slightly smaller at 0.0723 and significant only at the 10% statistical level in the sample group of institutional investors with shareholding less than the industry mean. The regression results indicate that the presence of institutional investors can assist employees in monitoring the behavior of executives, and the higher the shareholding ratio of institutional investors, the stronger their power to assist employees in restraining the self-interested behavior of executives after the implementation of corporate employee stock ownership plans, and the more significant the inhibitory effect of employees in the cost-stickiness problem of executive power plays.

6.5. Employee Turnover Regulation Effect

One of the motivations for the implementation of employee stock ownership plans is to attract and retain talent, and in companies where human capital is more important, there is a tendency to grant more equity to employees [59]. The higher the status of the employee, the higher the benefits given by the company and their own job satisfaction, the lower the willingness to leave, and the greater the participation in corporate governance discourse. Referring to Wei’s [60] study, employee stability is measured by the employee turnover rate (the difference between the current year’s employee size and the previous year’s employee size divided by the average employee size over two years), and the willingness of employees to stay with the company can also reflect the treatment of employees and their status in the company from the side. The results of the subgroup tests are presented in Table 5. The empirical results indicate that the higher the status of employees in the firm (the lower the turnover rate), the greater the binding effect of the cost-stickiness effect of executive power (0.0681 and significant at the 1% statistical level), as firms give their employees a greater voice in corporate governance to retain them. The higher employee turnover rate in the firm indicates that the lower the relatively low position of employees in the firm, the weaker the binding influence of their smaller voice power on the cost-stickiness effect of executive power (0.0025 and insignificant).

In the previous paper, referring to the measurement method of Fu et al. [49], a total of three dummy variables are selected to measure executive power, including the combination of the two positions of general manager and chairman, the chairman’s tenure, and the degree of equity checks and balances. Here, the continuous variable of the chairman’s tenure is regressed as the measurement variable of executive power. The results show that executive power measured by the chairman’s tenure continues to significantly exacerbate corporate cost stickiness, and the main test in this paper is robust. The results of the regressions show that executive power still significantly contributes to firm cost stickiness, and the main test in this paper is robust.

The endogeneity issues arising from the omission of firm-related characteristic variable selection and the presence of time and firm-specific effects are eliminated in the previous paper by controlling for firm- and year-fixed effects and clustering the standard errors of all regression coefficients at the firm level. In addition, there may be some endogeneity issues in model (2), i.e., there are some omitted variables that affect both employee stock ownership plan implementation and firm cost stickiness. For this reason, the two-stage least squares (2SLS) method is used in this paper to deal with this endogeneity problem.

Employee stock ownership plan implementation is initially motivated by corporate financing motives (Zhang, 2006) and market value management motives (Sun and Liu, 2021). When firms face financing constraints, they are bound to adjust their cost expenditures as well, and the level of cash holdings is used as an instrumental variable for the analysis. The results in the first stage indicate that the level of corporate cash holdings is significantly correlated with the implementation of employee stock ownership plans. In the second stage of the test, after controlling for endogeneity, the employee stock ownership plan implementation dummy variable still significantly suppresses the cost-stickiness effect of executive power at the 5% level, which further confirms the validity of this paper’s research hypothesis H2a.

Corporate market capitalization management behavior affects both the implementation of employee stock ownership plans and corporate cost expenditures and total market capitalization is selected as an instrumental variable for analysis. The results of the first stage indicate that the total market capitalization of the firm is significantly correlated with the implementation of an employee stock ownership plan. In the second stage of the test, after controlling for endogeneity, the employee stock ownership plan implementation dummy variable still significantly suppresses the cost-stickiness effect of executive power at the 5% level, which further confirms the validity of this paper’s research hypothesis H2a.

7. Conclusions

In the context of cost reduction in China’s real economy, micro-enterprise cost stickiness plays an obstructive role in achieving cost reduction goals to a certain extent. Executives are in charge of the decision-making power of enterprise cost management. From the three perspectives of the causes of cost stickiness, the greater the power of executives, the more serious the enterprise cost stickiness is. An employee stock ownership plan is considered an important means to alleviate the agency problem between executives and shareholders, restrain the behavior of executives, and improve corporate governance. The cost and power of executives are regulated. Currently, on the issue of corporate cost stickiness, academics primarily focus on the existence and governance of cost stickiness, while the economic effects of cost stickiness have not been studied in depth, leading to a negative impression of corporate cost stickiness in academia and practice, which is considered detrimental to corporate growth and corporate value, thus blindly reducing corporate costs and expenses when corporate revenues decline [61,62]. State-owned firms, which hold more GCA than non-state-owned firms, are more cost sticky than non-state-owned firms, even though both types of firms use differentiation strategies more often [63]. At the same time, managers’ expectations of the future can influence firms’ investment decisions and costs. Specifically, optimistic expectations of management strengthen cost stickiness, while pessimistic expectations weaken cost counter stickiness. This complements the findings of this paper and provides additional directions for thinking about firm decisions. Prabowo et al. [64] found that SOEs exhibit greater cost stickiness than private firms due to the greater influence of socio-politics on SOEs. This explains the higher cost stickiness of SOEs from the perspective of the social responsibility of SOEs and provides new ideas for the reform of SOEs.

This paper examines the effect of executive power on cost stickiness using data from A-share non-financial listed companies from 2014 to 2019 as the research sample. The empirical results show that the greater the executive power, the more severe the cost stickiness of the firm, and the three formation theories of cost stickiness (adjustment cost, management optimistic expectation, and agency problem) hold. The results show that the implementation of an employee stock ownership plan can significantly suppress the positive effect of executive power on cost stickiness, and the larger the scale of employee stock ownership plan implementation, the more significant the suppression effect is, which supports the explanation of stakeholder theory for employee stock ownership plan. This paper argues that employee stock ownership plans inhibit the cost-sticking effect of executive power by reducing adjustment costs and management’s optimistic expectations, and by enhancing the performance sensitivity of executive compensation and the quality of information disclosure. Furthermore, this paper finds that the implementation of multiple employee stock ownership plans by firms allows employees to acquire more equity shares and increase their voice in corporate governance, and has a more significant dampening effect on the cost-stickiness effect of executive power; as an important institution to assist in SOE reform, after distinguishing the property rights attributes of firms, we find that employee stock ownership plans in SOEs have a more significant dampening effect on the cost-stickiness effect of executive power. Institutional investors with specialized knowledge can assist employees in suppressing the cost-stickiness effect of executive power, and the scale of implementation of employee stock ownership plans and the stability and status of employees can also lead employees to gain a greater voice in monitoring the self-interested behavior of executives and enhance the suppression of the cost-stickiness effect of executive power. To ensure the robustness of the empirical results, we replace the calculation indices and models of executive power and cost stickiness, respectively, and use the instrumental variables method to solve the endogeneity problem in the model and conclude that the empirical results of this paper are robust.

The selected topic of this paper is at the intersection of management accounting and financial accounting and innovatively explores the effect of employee discipline on executive behavior and participation in corporate governance after the implementation of an employee stock ownership plan in the new era from the perspective of corporate costs. First, this paper enriches the literature related to both the economic consequences of employee stock ownership plans in the new era and the cost-sticky governance mechanisms of firms. Second, no scholars have yet explored the issue of corporate cost stickiness from the perspective of executive power, and fewer scholars have explored the effectiveness of corporate governance based on executive–employee agency issues. The research in this paper fills this gap in the literature and provides ideas for quantifying the agency problem between the two, while also bringing to the fore the importance of employees in corporate governance. Finally, the research in this paper can be used as a theoretical guide for internal and external stakeholders to understand the characteristics and roles of employee stock ownership plans in the new era, as well as a basis for decision-making on corporate cost management, and likewise as an important basis for regulators and policy makers to understand the obstacles to achieving cost reduction goals in the real economy and to formulate scientific regulations. In addition, the variables involved in this paper are still not comprehensive, such as company performance, liquidity, cash flow, dividend policy, taxation, and other indicators, but these variables involve many company secrets, so most companies do not release these data to the outside world. This makes the amount of data available for the study small, so one of the priorities of the subsequent work is to continuously increase the sample size of the data and increase the impact factors of the model, so as to make the research findings closer to reality and grant the study more general and reference value.

Author Contributions

Conceptualization, D.Z. and D.W.; methodology, D.Z.; software, X.Z.; validation, D.Z., D.W. and Y.B.; formal analysis, D.Z.; investigation, D.Z., X.Z. and Y.B.; resources, D.Z.; data curation, X.Z.; writing—original draft preparation, D.Z. and X.Z.; writing—review and editing, D.W. and Y.B.; visualization, D.Z., D.W., X.Z. and Y.B.; supervision, D.W.; project administration, D.Z.; funding acquisition, D.W. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Natural Science Foundation of China Grant (71702196) and the Shenzhen Humanities and Social Sciences Key Research Base Grant (KP191001, KP191002, KP191003).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Cunningham, L.X. SMEs as motor of growth: A review of China’s SMEs development in thirty years (1978–2008). Hum. Syst. Manag. 2011, 30, 39–54. [Google Scholar] [CrossRef]

- Wang, J.H.; Mao, N. A study of economic policy uncertainty and firm cost stickiness in risk perspective. Manag. Sci. 2021, 34, 82–96. [Google Scholar]

- Banker, R.D.; Ciftci, M.; Mashruwala, R. Managerial optimism, prior sales changes, and sticky cost behavior. Working Paper 2008. [Google Scholar] [CrossRef]

- Chen, Y. A study on the implementation motivation and economic consequences of employee equity incentives. Manag. Rev. 2015, 27, 163–176. [Google Scholar]

- Song, F.X.; Liu, L. Employee stock ownership plans of listed companies: Implementation motivation, scheme design and its influencing factors. Reform 2018, 88–98. [Google Scholar]

- Gaur, S.S.; Bathula, H.; Singh, D. Ownership concentration, board characteristics and firm performance: A contingency framework. Manag. Decis. 2015, 53, 911–931. [Google Scholar] [CrossRef]

- Wang, J.; Wang, H.; Wang, D. Equity concentration and investment efficiency of energy companies in China: Evidence based on the shock of deregulation of QFIIs. Energy Econ. 2021, 93, 105032. [Google Scholar] [CrossRef]

- Balsmeier, B.; Czarnitzki, D. Ownership concentration, institutional development and firm performance in Central and Eastern Europe. MDE Manag. Decis. Econ. 2017, 38, 178–192. [Google Scholar] [CrossRef]

- Guerrero-Villegas, J.; Giráldez-Puig, P.; Pérez-Calero, S.L.; Hurtado-González, J.M. Ownership concentration and firm performance: The moderating effect of the monitoring and provision of resources board roles. Spanish J. Financ. Account. 2018, 47, 464–484. [Google Scholar]

- Yin, H.; Zhang, L.; Zhang, Y. The effect of ownership concentration and related diversification strategy of entrepreneurial enterprises on enterprise performance. Eurasia J. Math. Sci. Technol. Educ. 2017, 13, 8073–8087. [Google Scholar] [CrossRef]

- Ginglinger, E.; Megginson, W.; Waxin, T. Employee ownership, board representation, and corporate financial policies. J. Corp. Financ. 2011, 17, 868–887. [Google Scholar] [CrossRef]

- Kim, E.H.; Ouimet, P. Broad-based Employee Stock Ownership: Motives and Outcomes. J. Financ. 2014, 69, 1273–1319. [Google Scholar] [CrossRef]

- Fang, H.; Nofsinger, J.R.; Quan, J. The effects of employee stock option plans on operating performance in Chinese firms. J. Bank Financ. 2015, 54, 141–159. [Google Scholar] [CrossRef]

- Bova, F.; Dou, Y.; Hope, O.K. Employee Ownership and Firm Disclosure. Contemp. Account. Res. 2015, 32, 639–673. [Google Scholar] [CrossRef]

- Chang, X.; Fu, K.; Low, A.; Zhang, W. Non-executive Employee stock Options and Corporate Innovation. J. Financ. Econ. 2015, 115, 168–188. [Google Scholar] [CrossRef]

- Chen, C.; Chen, Y.; Hsu, P.H.; Podolski, E.J. Be nice to your innovators: Employee treatment and corporate innovation performance. J. Corp. Financ. 2016, 39, 78–98. [Google Scholar] [CrossRef]

- Zhou, D.H.; Huang, J.; Zhao, Y.J. Employee stock ownership plan and corporate innovation. Account. Res. 2019, 63–70. [Google Scholar]

- Meng, Q.B.; Li, X.Y.; Zhang, P. Can employee stock ownership plans promote corporate innovation?—Empirical evidence based on the perspective of corporate employees. Manag. World 2019, 35, 209–228. [Google Scholar]

- Anderson, M.C.; Banker, R.D.; Janakiraman, S.N. Are Selling, General, and Administrative costs sticky? J. Account. Res. 2003, 41, 47–63. [Google Scholar] [CrossRef]

- Subramaniam, C.; Weidenmier, M.L. Additional Evidence on the Sticky Behavior of Costs. Adv. Manag. Account. 2016, 26, 275–305. [Google Scholar]

- Banker, R.D.; Mack, C.J. Labor Market Characteristics and Cross-Country Differences in Cost Stickiness. SSRN Electron. J. 2006, 11, 102139. [Google Scholar] [CrossRef]

- Calleja, K.; Steliaros, M.; Thomas, D.C. A note on cost stickiness: Some international comparisons. Manag. Account. Res. 2006, 17, 127–140. [Google Scholar] [CrossRef]

- Gong, Q.F.; Liu, H.L.; Shen, H.H. Regional factor market development, state ownership and cost and expense stickiness. China Account. Rev. 2010, 8, 431–446. [Google Scholar]

- Cui, Y. Marketization, ownership nature and cost stickiness: Empirical data from A-share listed companies in China. Financ. Account. Monthly 2012, 11, 18–21. [Google Scholar]

- Liu, Y.; Liu, B. Labor protection, cost stickiness and firm response. Econ. Syst. Res. 2014, 5, 63–76. [Google Scholar]

- Jiang, W.; Yao, W.T.; Hu, Y.M. Implementation of Minimum Wage Regulation and Cost Stickiness of Enterprises. Account. Res. 2016, 10, 56–62. [Google Scholar]

- Geng, Y.; Wang, L. Cost stickiness, internal control quality and firm risk-empirical evidence from Chinese listed companies. Account. Res. 2019, 5, 75–81. [Google Scholar]

- Zhou, L.; Liu, H.; Zhang, H. How does board retention of former general managers affect firm resource alignment?—An empirical analysis based on cost stickiness perspective. Financ. Res. 2019, 2, 169–187. [Google Scholar]

- Yu, H.Y.; Wang, M.; Huang, B. Performance volatility, executive change and cost stickiness. Manag. Sci. 2019, 32, 135–147. [Google Scholar]

- Zhang, L.; Li, J.; Zhang, H.; Wang, H. Do managerial competencies affect firm cost stickiness? Account. Res. 2019, 3, 71–77. [Google Scholar]

- Liang, S. Managerial overconfidence, debt constraints and cost stickiness. Nankai Manag. Rev. 2015, 18, 122–131. [Google Scholar]

- Zhao, X.; Yang, S.C. Executive academic experience and corporate cost stickiness. Soft Sci. 2021, 35, 35–41. [Google Scholar]

- Quan, S.F.; Wu, S.N.; Wen, F. Management power, private earnings and compensation manipulation. Econ. Res. 2010, 45, 73–87. [Google Scholar]

- Zhang, L.P.; Yang, X.Q. Managerial power, management incentives and overinvestment. Soft Sci. 2012, 26, 107–112. [Google Scholar]

- Fang, J. Asymmetry of executive power and corporate compensation changes. Econ. Res. 2011, 4, 107–120. [Google Scholar]

- Bertrand, M.; Mullainathan, S. Enjoying the Quiet Life? Corporate Governance and Managerial Preferences. J. Polit. Econ. 2003, 111, 1043–1075. [Google Scholar] [CrossRef]

- Hope, O.K.; Thomas, W.B. Managerial Empire Building and Firm Disclosures. J. Account. Res. 2008, 46, 591–626. [Google Scholar] [CrossRef]

- Sun, H.; Wang, B. Management power, internal control and cost stickiness. Ind. Tech. Econ. 2021, 40, 71–76. [Google Scholar]

- Zhang, H.; Zhao, J.; Lu, Z. Employee compensation competitiveness and employee stock ownership in listed companies. Financial Res. 2021, 169–187. [Google Scholar]

- Edmans, A. Does the stock market fully value intangibles? Employee satisfaction and equity prices. J. Financ. Econ. 2011, 101, 621–640. [Google Scholar] [CrossRef]

- Chen, D.; Shi, X.; Lu, Y.; Li, Z. Employee stock ownership plan and financial information quality. Nankai Manag. Rev. 2019, 22, 166–180. [Google Scholar] [CrossRef]

- Song, C.; Wang, L.; Wang, M. Employee stock ownership plans and audit fees—Empirical evidence based on A-share listed companies in China. Audit. Res. 2020, 51–58, 67. [Google Scholar]

- Faleye, O.; Mehrotra, V.; Morck, R. When labor has a voice in corporate governance. JFQA 2006, 41, 48–510. [Google Scholar] [CrossRef]

- Meng, R.; Ning, X.; Zhou, X.; Zhu, H. Do ESOPs Enhance Firm Performance? Evidence from China’s Reform Experiment. J. Bank. Financ. 2011, 35, 1541–1551. [Google Scholar] [CrossRef]

- Pugh, W.N.; Oswald, S.L.; Jahera, J.S., Jr. The Effect of ESOP Adoptions on Corporate Performance: Are There Really Performance Changes. MDE Manag. Decis. Econ. 2000, 21, 167–180. [Google Scholar] [CrossRef]

- Hao, Y.L.; Jin, X.; Zhang, Y.J. Employee stock ownership plans under the fog of shareholding reduction--a comparative analysis based on equity incentives. Manag. Rev. 2019, 31, 164–177. [Google Scholar]

- Shen, H.; Hua, L.; Xu, J. Business performance of state-owned enterprises implementing employee stock ownership plans: Incentive compatibility or incentive insufficiency. Manag. World 2018, 34, 121–133. [Google Scholar]

- Fu, C.; Wang, X.; Lu, J. Analysis of management power, executive compensation changes and corporate M&A behavior. Account. Res. 2014, 11, 30–37. [Google Scholar]

- Williamson, O.E. Corporate finance and corporate governance. J. Financ. 1988, 43, 567–591. [Google Scholar] [CrossRef]

- Wang, Z.; Duan, B.; Wang, Y.; Chen, G. Capital mismatch, asset specificity and firm value—A perspective based on reclassification of business activities. China Ind. Econ. 2017, 3, 120–138. [Google Scholar]

- Shen, H.; Wu, L. The nature of equity, environmental uncertainty and the governance effect of accounting information. Account. Res. 2012, 8, 8–16, 96. [Google Scholar]

- Xia, D. Fiduciary responsibility, decision usefulness and investor protection. Account. Res. 2015, 1, 25–31, 96. [Google Scholar]

- Zhou, X.; Wu, X. A study on the influence of robustness on corporate disclosure behavior-based on the perspective of accounting information transparency. Nankai Manag. Rev. 2013, 16, 89–100. [Google Scholar]

- Yi, Z.; Jiang, F.; Qin, Y. Product market competition, corporate governance and information disclosure quality. Manag. World 2010, 1, 133–141, 161, 188. [Google Scholar]

- Yang, H.; Wei, D.; Sun, J. Can institutional investors’ shareholding improve the quality of accounting information of listed companies?—Discussing the differences of different types of institutional investors. Account. Res. 2012, 9, 16–23. [Google Scholar]

- Liang, S. Does institutional investors’ shareholding affect the stickiness of corporate expenses? Manag. World 2018, 34, 133–148. [Google Scholar]

- Lin, Y.P. What Drives Employee Stock Options Programs? Safeguarding Human Capital and Recruiting Wanted Skills. J. Appl. Bus. Econ. 2013, 14, 53–69. [Google Scholar]

- Wei, C. A study on the influencing factors of equity incentives in GEM companies. Account. Res. 2019, 7, 51–58. [Google Scholar]

- Zhang, G. Market Valuation and Employee Stock Options. Manag. Sci. 2006, 52, 1377–1393. [Google Scholar] [CrossRef]

- Sun, X.; Liu, Y. Equity pledges, employee stock ownership plans and self-interest of major shareholders. Account. Res. 2021, 4, 117–129. [Google Scholar]

- Kalantonis, P.; Schoina, S.; Kallandranis, C. The impact of corporate governance on earnings management: Evidence from Greek listed firms. Corp. Ownership Control 2021, 18, 140–153. [Google Scholar] [CrossRef]

- Ibrahim, A.E.A.; Ali, H.; Aboelkheir, H. Cost stickiness: A systematic literature review of 27 years of research and a future research agenda. J. Int. Account 2022, 46, 100439. [Google Scholar] [CrossRef]

- Zhong, T.; Sun, F.; Zhou, H.; Lee, J.Y. Business Strategy, State-Owned Equity and Cost Stickiness: Evidence from Chinese Firms. Sustainability 2020, 12, 1850. [Google Scholar] [CrossRef]

- Prabowo, R.; Hooghiemstra, R.; Van Veen-Dirks, P. State ownership, socio-political factors, and labor cost stickiness. Eur. Account Rev. 2018, 27, 771–796. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).