Abstract

In the context of China’s rural revitalization and expanding digital economy, this study aims to elucidate how digital financial inclusion technologies can better allocate financial resources across newly evolved agricultural entities—such as family farms, farmers’ cooperatives, and agricultural enterprises. By employing structural equation modeling (SEM) based on the Unified Theory of Acceptance and Use of Technology (UTAUT), we identify key determinants affecting farmers’ credit availability. Our results emphasize the overwhelming role of Digital Financial Inclusion Technology Applications (DAs) in a wide range of financial variables, particularly credit availability (CA). Notably, performance expectation did not exert a significant impact on credit availability, while variables like effort expectation, facilitating conditions, and especially social influence were significant contributors. As for social impacts, social influence emerged as a multifaceted enabler, encouraging collective support within farmer communities and thereby facilitating credit accessibility. In conclusion, our study reinforces the critical influence of DAs in molding the financial landscape and recommends targeted interventions that leverage these technologies and social dynamics to boost financial inclusion and drive rural prosperity.

1. Introduction

As we stand at the threshold of the Fourth Industrial Revolution, an unparalleled wave of technological innovations—ranging from artificial intelligence and the Internet of Things to digital financial systems—is sweeping across the globe, signaling a transformative shift in the economic landscape. In alignment with the principles of sustainable development in the digital economy, China has launched initiatives aimed at rural revitalization and the achievement of shared prosperity. These endeavors necessitate a focus on amplifying employment opportunities, boosting income, and increasing wealth in rural communities. However, such rural economies often face significant challenges, such as high costs of financial services and pronounced information asymmetry, which hampers the pursuit of inclusive growth for low- and middle-income individuals and small-scale enterprises [1]. Consequently, identifying market-oriented, sustainable strategies to cater to fragmented financial needs and extend financial services to the underserved populations is an urgent imperative [2].

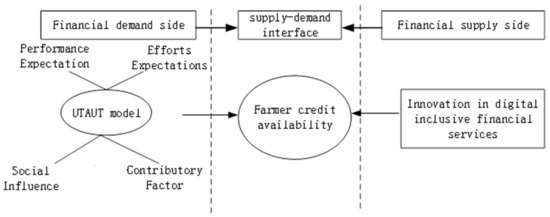

While policy-based microfinancing and subsidized credit schemes have somewhat ameliorated these issues, they offer only a palliative solution and fail to address the root causes [3]. In the grander scheme of rural revitalization and collective prosperity, financial inclusivity in rural settings becomes a topic of paramount importance [4]. This study addresses a notable gap in the existing literature by concentrating its inquiry on the demand side of rural financial services. While extensive research has been conducted on supply-side elements, the demand side remains relatively underexplored. Employing the User Technology Acceptance and Use Model (UTAUT) as the analytical framework (See Figure 1), this investigation aims to furnish both theoretical insights and actionable guidelines for the widespread implementation of advanced financial technologies in rural settings. Through a combination of theoretical evaluation and empirical investigation, this study will scrutinize the influence of key factors, such as performance expectations, effort expectations, societal influences, and facilitative conditions, on the rural populace’s adoption of emerging financial technologies.

Figure 1.

Research on farmers’ credit availability with a focus on financial needs. Source: figure adapted by authors (2023).

Digital financial inclusion has the transformative potential to usher marginalized communities into the mainstream economic fabric [5]. By creating an open, equitable, and comprehensive financial services architecture, it stands as a cornerstone for the sustainability of rural financial ecosystems [6]. Via lowering transactional and operational barriers, digital platforms offer unparalleled convenience, especially to rural residents, who often find traditional banking infrastructures geographically and logistically inaccessible [7]. Mobile payments and digital banking transcend these physical constraints, enabling around-the-clock financial transactions from any geographical locale [8]. More crucially, the digital financial ecosystem operates on an economy of scale, reducing operational overheads compared to traditional brick-and-mortar institutions [9]. This scalability allows financial service providers to pass on these savings in the form of low-interest loans and high-return savings products [10]. Leveraging big data analytics and artificial intelligence, these platforms can carry out sophisticated credit risk assessments, thereby including those without a conventional credit history in the credit market—enabling them to secure the capital required for growth and investments [11].

However, the caveat lies in the actual adoption and utilization of these digital platforms by the end-users, mainly rural farmers. To probe deeper into the drivers and barriers affecting this uptake, our study applies the Unified Theory of Acceptance and Use of Technology (UTAUT). This framework elucidates four key constructs, performance and effort expectations, community influence, and enabling factors, providing a robust paradigm with which to dissect the multifaceted nature of user acceptance [12]. To delve into the nuanced interplay of these variables, our study will employ structural equation modeling (SEM). SEM unearths complex relationships, particularly latent variables. Integrating micro-level individual behavior with macro-level innovation in digital financial inclusion, our multi-methodological approach aims to demystify the complex web of factors affecting rural users’ financial behavior. This research not only advances the application of the UTAUT model in the realm of rural finance but also introduces novel analytical lenses that could reshape our understanding of farmers’ credit availability, laying the foundation for policy recommendations that could redefine sustainable rural financial landscapes.

1.1. Innovation in Digital Inclusive Financial Services

China’s focus on innovation in inclusive rural financial services serves multiple interconnected objectives, creating a complex but highly strategic policy landscape. By promoting economic equity, the government aims to balance development between urban and rural regions, recognizing that inclusive financial services can catalyze rural economies by enabling access to credit, insurance, and other financial instruments. This effort dovetails with the national rural revitalization initiative, which seeks to make rural areas more attractive for both living and economic ventures, positioning enhanced financial services as a pivotal component that facilitates investment and development [13]. Moreover, there is a concerted push to modernize agriculture; inclusive financial services offer farmers the financial leeway necessary to invest in new technologies and practices, leading to increased yields and sustainability [14]. The reach of these services extends to previously underserved populations, aligning with goals of financial inclusion by leveraging digital technology to break down geographical and logistical barriers [15]. This innovation plays a significant role in boosting the socioeconomic mobility of rural residents, allowing them to save, invest in education, and improve their living standards, thus contributing to China’s overarching poverty alleviation goals [16]. On the technological front, the use of fintech, AI, and big data allows for targeted, efficient services, aligning with China’s broader ambitions to be a global leader in technology and innovation [17]. Furthermore, financial innovation does not occur in a vacuum; it creates synergy with other policies like ecommerce development and supply chain modernization in rural settings. Success in deploying inclusive financial services not only fortifies systemic resilience by providing a diversified base for economic growth but also establishes China’s reputation as a global leader in utilizing fintech for social welfare [18]. Lastly, these services offer a valuable channel for data collection, which can then be used to refine governance models, shape policies, and target other social services more effectively [19].

Digital finance is having a profound impact on farmers’ credit, changing its function and form and thereby increasing its reach and improving its efficiency [20]. Digital finance has significantly increased the financial reach of farmers by providing mobile payments and online lending platforms [21]. Under the influence of digital finance, farmers have been able to access a wider range of credit services and sources of finance without having to physically travel to a bank or other financial institution [22]. This has significantly reduced the transaction costs of credit for farmers and changed their passivity in accessing financial services [23]. With the help of big data and artificial intelligence technologies, financial institutions are able to more accurately analyze and assess the credit status of farmers in order to customize credit products and services that suit them [24]. By analyzing farmers’ consumption behavior, stable income, and social credibility through big data, financial institutions can more fairly assess farmers’ credit risks, thereby reducing loan rejection rates and borrowing costs [25]. Cloud computing and blockchain technology can improve the security and transparency of farmers’ credit [26]. Through cloud computing, financial institutions can process large amounts of credit data securely and efficiently; meanwhile, through blockchain technology, financial institutions can build an open and transparent credit system to prevent fraud and default [27]. Smart financial services such as financial inclusion apps and social media finance can provide farmers with more convenient and personalized credit services [28]. Digital financial development can significantly contribute to intermediary product innovation, as financial institutions can recommend the most suitable credit products and services to farmers through smart recommender systems, increasing their credit satisfaction [29]. Digital finance is revolutionizing the accessibility and efficiency of credit services for farmers. Leveraging technologies like big data, AI, cloud computing, and blockchain, it reduces transaction costs and risks while increasing customization and transparency. This innovation in digital inclusive financial services significantly enhances farmers’ financial reach and satisfaction.

1.2. The Unified Theory of Acceptance and Use of Technology

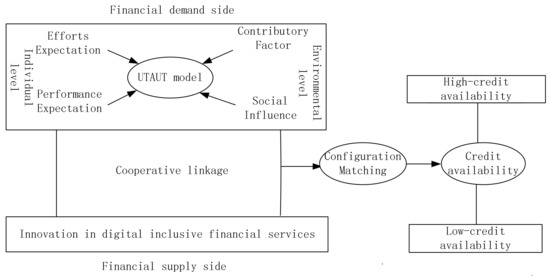

In the landscape of digital financial inclusion, the Unified Theory of Acceptance and Use of Technology (UTAUT) serves as a robust framework for dissecting individual micro-decision making among farmers. It identifies four critical constructs—performance expectations, effort expectations, community influence, and enabling factors [30]—that shape a farmer’s willingness and ability to adopt digital financial systems. Performance expectations directly impact a farmer’s perception of how effective and profitable the technology could be, while effort expectations gauge its ease of use. Community influence functions as a social multiplier, where adoption by innovative agricultural entities, as noted in Figure 2, encourages broader individual adoption. Enabling factors, like infrastructure and regulatory support, set the stage for practical implementation. By aligning these micro-level constructs with the macro-level objectives of digital financial inclusion, the UTAUT model offers a nuanced, integrated perspective that connects individual choices with systemic variables, thus informing strategies for expanding financial inclusivity in rural settings.

Figure 2.

A research framework that combines the individual micro level with the macro level of digital financial inclusion innovation.

Performance expectation is defined in the UTAUT model as a user’s expectation that the use of a particular system or technology will improve his or her job performance, and users are more likely to adopt a technological system if it meets their needs and helps them perform their tasks better [31]. Applying performance expectations to the relationship between digital financial inclusion and credit availability implies that farmers demand easier application processes, faster approval times, and more flexible repayment schedules from digital finance as a way to improve their credit availability. Digital finance facilitates the market participation behavior of farmers, thereby alleviating their relative poverty [32]. Farmers who find that using digital financial inclusion applications for credit applications saves them time, reduces processing fees, and increases their chances of being approved will have higher performance expectations and thus be more willing to accept and use these applications [33]. Conversely, if they find that these applications do not meet their needs or improve their credit access efficiency, then they may choose not to use these applications in favor of more traditional credit routes. Thus, from the perspective of the UTAUT model, raising farmers’ performance expectations is key to driving their acceptance and use of digital financial inclusion applications. To achieve this, financial service providers need to ensure that their applications provide substantial benefits, such as faster service, lower fees, and higher credit approval rates, in order to meet farmers’ credit needs and increase their credit availability.

Effort expectations are defined as the ease of use or level of effort that a user expects a new technology to require to use it, and users are more likely to accept and use a system or application if it is perceived to be easy to use and understand [34]. Effort expectations reflect the effort required for farmers to use these applications to access credit services, and there are differences in the effects of community levels of digital finance on household income growth among heterogeneous farmers, with the “digital divide” and “knowledge divide” leading to the ineffectiveness of digital finance in increasing the incomes of poor farmers’ households. The “digital divide” and the “knowledge divide” lead to the ineffectiveness of digital finance on poor farmers’ household income growth [35]. If an application has a complex design, requires high digital literacy from farmers, or has a cumbersome application and operation process, farmers may perceive that using the application requires greater effort, thus reducing their willingness to use it [36]. In contrast, if a digital financial inclusion app has an intuitive interface with easy-to-use instructions and clear guidance, then farmers may perceive that using the app requires less effort to access credit services, thus increasing the likelihood that they will use the app [37]. An app with concise step-by-step instructions and a clear feedback mechanism makes it easier for loan applicants to understand how to apply for credit, so they are more likely to use the app, thus increasing their credit availability [38]. Thus, from the perspective of the UTAUT model, reducing farmers’ effort expectations, i.e., making it less difficult for them to use digital financial inclusion apps, is an important way to increase their acceptance and use of these apps, and thus credit availability [39]. In order to achieve this, financial service providers need to design applications that are easy to use and understand and provide adequate guidance and technical support for their use.

Social influence refers to the influence of the people around an individual on his or her adoption and use of new technology. When individuals observe that the people around them are using a new technology and it is recognized and recommended by them, then they themselves are more likely to adopt and use it [40]. In rural communities, farmers’ credit behavior may be influenced by the people around them, and the sharing of experiences and recommendations from the people around them may increase their credit availability [41]. Social influences may also affect farmers’ credit availability by shaping the community’s financial culture and behavioral norms; if the community’s culture tends to support and promote the use of digital technologies for financial transactions, then farmers are more likely to accept and use digital financial inclusion applications, which in turn increases their credit availability [42]. In the rapidly transforming agricultural landscape of China, the rise of innovative agricultural management entities—such as technologically advanced family farms, highly organized farmers’ cooperatives, and forward-thinking agricultural enterprises—holds considerable implications for rural social dynamics, particularly in the realm of digital financial inclusion. These entities, which now control an impressive 36% of China’s total arable land contracted by households, serve as beacons of modernization and financial inclusion, potentially catalyzing widespread adoption of digital inclusive financial technologies in rural areas. In line with the Unified Theory of Acceptance and Use of Technology (UTAUT), the social impact of these pioneering entities is particularly potent. Their success in adopting and implementing digital financial technologies influences community perceptions and norms. When farmers see these entities thriving due to digital financial applications, they too are encouraged to shift their financial behaviors [43]. Essentially, these new agricultural management entities become social validators whose adoption of technology reinforces communal trust and willingness to innovate. The ripple effect extends beyond just increased productivity and efficiency; it influences the community’s financial culture, rendering it more conducive to adopting digital financial systems. As these behaviors gain traction, they invariably amplify credit availability for individual farmers, essentially democratizing financial inclusion across rural communities. This form of social influence, empowered by the entities’ organizational sophistication and technological acumen, drives a broader shift towards digital literacy and financial empowerment in rural China. It necessitates a multi-pronged approach from policymakers and financial service providers, including targeted educational initiatives and community outreach efforts that leverage these entities as case studies of successful digital adoption.

Contributing factors are the likelihood that individuals will actually use the new technology, depending on the technological environment and organizational resources they face [44]. Enabling conditions are in two main areas: whether farmers have the ability to access and use digital devices (e.g., smartphones, computers, etc.) and whether they have a stable internet connection [45]. If farmers do not have these resources or are unable to access them, they will not be able to use digital financial inclusion applications and thus will not be able to access credit from them [46]. Farmers’ digital literacy, network coverage, and the compatibility and ease of use of financial apps all affect whether farmers are able to accept and use these apps, which in turn affects their credit availability [47]. An app that is compatible with a wide range of devices and has a clean and easy-to-use interface will lower the threshold of use and thus increase usage. From the perspective of the UTAUT model, increasing farmers’ enablers, i.e., ensuring that they have adequate technological resources and network environments to use digital financial inclusion applications, is an important way to increase their credit availability [48]. To achieve this, financial service providers, policymakers, and technology companies need to work together to improve network coverage in rural areas, provide easier-to-use and compatible applications, and also improve farmers’ digital literacy through education and training.

1.3. Theoretical Framework

This research aims to understand farmers’ decision-making processes in rural China concerning the adoption of digital financial technologies. It is anchored in several interconnected theories and models. The primary framework employed is the Unified Theory of Acceptance and Use of Technology (UTAUT). This model serves as this study’s theoretical backbone, elucidating how effort expectancy, performance expectancy, social influence, and facilitating conditions influence farmers’ willingness to adopt new technologies. Studies on the UTAUT model in digital banking and finance primarily focus on constructs like effort expectancy, performance expectancy, and social influence, adding variables such as trust, satisfaction, and usability. Specific demographics, like older generations and New Zealand consumers, are examined, with age often serving as a moderating factor [49,50,51,52]. Research has extended the UTAUT model to fintech and mobile payments, introducing factors like perceived risk and credibility while also considering gender and regional variables, such as urban Indian women [53,54,55,56]. Specialized applications include niche financial technologies like agriculture finance and microfinance, where performance expectancy and financial cost are significant [57,58]. Behavioral moderators like age discrimination and lifestyle compatibility are introduced, with a focus on different social groups, including rural women and older people [55,59,60]. Cross-model approaches blend the UTAUT with other frameworks like TAM and ServPerf, examining the nuanced relationships between technical attributes and user intentions [52,53,56]. Lastly, the impact of government policy and perceived cost are studied in contexts like e-cash and agricultural finance [57,61,62].

In addition to the Unified Theory of Acceptance and Use of Technology (UTAUT), this research introduces another critical layer to its framework by integrating the theory of financial inclusion. While the UTAUT provides insights into the behavioral aspects of technology adoption—like effort and performance expectancy—the theory of financial inclusion broadens the scope to include the economic outcomes of such adoption, particularly in the context of rural China. This fusion of theories is significant for a more comprehensive understanding of farmers’ decision-making processes. The constructs of “credit availability” and “resource allocation” are central to this added layer. In rural settings, traditional financial services often fall short in meeting the needs of marginalized populations, such as farmers, due to factors like distance from financial institutions, lack of documentation, and high operational costs. Digital financial technologies can disrupt this status quo by making financial services more accessible and affordable. Here, “credit availability” refers to the ease with which farmers can access credit facilities through digital platforms, a crucial element for investment in agricultural activities and community development. Meanwhile, “resource allocation” pertains to how efficiently resources—both financial and non-financial—are distributed within the rural community, ensuring that even the most remote farmers can benefit from digital financial services.

Incorporating these constructs into the research framework allows this study to examine not just whether farmers are willing to adopt digital technologies (as gauged by the UTAUT) but also whether these technologies can tangibly improve their financial wellbeing and contribute to economic equality. This is essential for understanding the holistic impact of digital financial technologies and providing a compelling argument for their implementation in rural settings. By examining how these technologies can bridge economic divides, this research aspires to show how digital financial technologies could democratize access to essential financial resources, thereby empowering rural communities in ways that were not previously possible.

Adding another dimension to the research framework, theories of rural revitalization are integrated to provide a macro-level perspective on community development and economic prosperity in rural China. While the UTAUT and the theory of financial inclusion focus more on individual and economic aspects, rural revitalization theories expand the scope to community and regional development. These theories assert that the integration of technology, particularly digital financial services, can be a potent catalyst for rejuvenating rural areas that have been left behind in the rush toward urbanization. The inclusion of rural revitalization theories allows this research to take into account broader socioeconomic variables. For instance, how does the adoption of digital financial technologies influence rural employment rates, access to education, or even the migration patterns between rural and urban areas? Such macro-level impacts are integral for painting a complete picture of the transformative potential of these technologies. Resource allocation, a construct also considered in the financial inclusion theory, gains an additional layer of complexity here: it is not just about how individual farmers allocate resources but how these digital technologies could affect the allocation of community or even regional resources, leading to more equitable and sustainable development.

Rural revitalization theories can also provide insights into the mechanisms by which technological adoption can lead to economic prosperity. For example, they can explain how the introduction of digital financial services can attract further investment in rural infrastructure or enable more efficient supply chain management for agricultural products. These are essential aspects for long-term sustainability and growth in rural areas. By contextualizing this study within rural revitalization theories, this research gains a multidimensional approach to understanding the adoption and impact of digital financial technologies. This aids in comprehending not only individual behaviors and economic empowerment but also community-wide effects, making the findings more robust and applicable for policymakers and stakeholders interested in rural development.

Incorporating the broader context of the digital economy into the research framework allows for a more comprehensive understanding of the transitions taking place in financial systems, particularly in rural China. While the UTAUT offers an understanding of individual adoption behaviors and financial inclusion and rural revitalization theories focus on economic and community-level variables, respectively, the digital economy perspective brings into focus systems-level changes. It provides a lens to explore how digital technologies, beyond their immediate utility, are restructuring economic systems for enhanced efficiency and productivity. Here, the notion of the digital economy dovetails neatly with the focus on credit availability and resource allocation from the financial inclusion theory, as well as community development aspects from the rural revitalization theories. For instance, digital transactions can make the credit market more transparent and competitive, facilitating better rates and terms for farmers. This, in turn, impacts resource allocation and community development, affecting broader economic conditions and, eventually, the pace and scale of rural revitalization.

Structural equation modeling (SEM) was chosen to bring analytical rigor to this multidimensional framework. SEM allows for the simultaneous examination of multiple relationships and can handle complex interplays between observed and latent variables. In this specific study, SEM will be used to validate how factors from the UTAUT framework influence credit availability among farmers in rural China. Furthermore, SEM can assess how community and socioeconomic variables from the rural revitalization and financial inclusion theories serve as moderators in these relationships.

The inclusion of digital financial technologies as enablers plays a significant role here. These technologies are not just tools but catalysts that influence the relationships between various constructs, like effort expectancy, performance expectancy, and social influences, from the UTAUT model and broader economic and community variables. SEM will facilitate understanding this complex interplay, offering empirical validation for the integrated research framework that spans from individual behaviors to system-level transformations in the digital economy.

In summary, this study offers a comprehensive exploration of farmers’ decision-making processes in rural China regarding the adoption of digital financial technologies. By leveraging an integrative framework that combines the Unified Theory of Acceptance and Use of Technology (UTAUT) with financial inclusion and rural revitalization theories, as well as insights from the broader digital economy, this research provides a nuanced understanding that transcends individual behavioral patterns to include economic and community-level impacts. The use of structural equation modeling (SEM) lends analytical rigor, validating the complex interrelationships among these multidimensional constructs. This integrated approach not only enhances our understanding of technology adoption in rural settings but also provides actionable insights that are critical for both academic inquiry and policy formulation.

This article is structured as follows: Section 1 introduces the digital inclusive financial services and the guiding UTAUT framework. The more extensive Section 2 outlines our data and methodologies, detailing variables and the use of SEM. Section 3, the heart of the paper, presents comprehensive results including statistical analyses and SEM outcomes. Section 4 offers an in-depth discussion of these findings, their theoretical implications, and identifies future research directions. This layout was designed to deeply investigate the role of emerging agricultural entities in optimizing financial resources in rural China, as detailed in the Abstract.

2. Data and Methods

2.1. Data

In a monumental shift in China’s agricultural landscape, new types of agricultural management entities have revolutionized traditional paradigms of farming and resource management. Rooted in the concept of family contract management, these entities have emerged as avant-garde models, being acutely responsive to market dynamics and escalating agricultural productivity demands. Exhibiting specialized and intensive production techniques, they operate with a notable degree of organizational sophistication and social interconnectedness. These entities prominently include cutting-edge family farms, highly organized farmers’ cooperatives, and forward-thinking agricultural enterprises. The report of the 18th National Congress of the Communist Party of China (CPC) in 2013 proposed the construction of new types of agricultural management entities system. Notably, these revolutionary agricultural management entities began proliferating across China and amassed a significant presence, with an astounding 3 million such entities operational as of the end of 2019. These new entities command a considerable 36% of China’s total arable land that is contracted by households, representing a significant shift in agricultural management and land utilization.

This groundbreaking study, generously funded by the General Project of Guangdong Social Science Planning Fund, unfolded between 2019 and 2022 across various cities and counties in Guangdong Province, a region pivotal to China’s economic vitality. Employing a hybrid research methodology, this study incorporated face-to-face interviews facilitated through carefully structured paper questionnaires. When the pandemic imposed its challenges, the research team prudently transitioned to online survey mechanisms, ensuring the continuity, rigor, and relevance of data collection efforts in a rapidly changing environment. The survey sample’s representativeness of family farms, farmers’ cooperatives, and agricultural enterprises in China is substantiated through a comprehensive, multidimensional approach. Spanning diverse geographic regions within Guangdong Province, the sample size is statistically robust enough to neutralize errors and offer a reliable cross-section of the agricultural sector. It captures a wide economic range, from small family farms to large cooperatives, ensuring inclusivity. Methodological rigor is maintained by employing both paper questionnaires and online surveys, mitigating any internet accessibility bias. Conducted from 2019 to 2022, this study captures the changing landscape of agriculture, both pre-pandemic and during the pandemic. Validity checks, including demographic analysis and data cross-referencing, further bolster the sample’s integrity. Funded by the Guangdong Social Science Planning Fund, this study had the resources to adopt a systematic and thorough approach to sampling, making it a credible, authoritative representation of China’s family farms and farmers’ cooperatives.

The importance of examining their financial behaviors and needs cannot be overstated, as this provides invaluable insights into the current dynamics and future trends of rural financing [63]. Furthermore, these agricultural entities have an amplified need for financial resources to channel into various agricultural endeavors, such as production, equipment acquisition, and infrastructure development, thereby presenting a heightened demand for credit options [64]. As primary beneficiaries of agricultural financial services, these new business entities have elevated access to a diverse range of financial products and services [65]. Their likelihood of adopting digital inclusive financial technologies is considerably higher compared to other groups. Moreover, these new agricultural business entities wield a substantial influence over their respective rural communities. Their business operations and financial decisions reverberate beyond their individual scope, affecting neighboring farm households as well [66]. Their acceptance and usage of digital inclusive financial technologies can serve as a catalyst for widespread adoption in rural areas, further accentuating the utility of this research. Given the tight alignment between the respondent profile and the research subject matter, this dataset serves as a reliable foundation for conducting subsequent reliability tests and ascertaining the validity of the questionnaire results.

The dataset for this investigation is derived from questionnaires disseminated among new types of agricultural management entities, specifically family farms and farmers’ cooperatives. A total of 600 questionnaires were circulated, of which 547 were returned, yielding a high recovery rate of 91.1%. This robust response rate contributes to this study’s credibility and underscores the relevance of the respondent pool to the research topic at hand. These new agricultural business entities are emblematic of the evolving economic landscape in rural agriculture, characterized by a more contemporary, market-oriented scale of operation and business model. In the context of our research, which aims to optimize financial resource allocation in rural China by investigating farmers’ adoption of digital financial technologies, Table 1 offers compelling insights into the sample characteristics. Predominantly male participants (69.84%) affirm the male-centric nature of the agricultural sector, echoing traditional norms yet suggesting areas for gender-based policy interventions. The age demographic, leaning towards individuals aged 30–39, represents an experienced yet agile workforce poised to adapt to cutting-edge farming methodologies. Interestingly, the majority of participants possess primary-level education (58.68%), highlighting the inclusive nature of the emerging agricultural models and their capability to integrate a workforce of varied educational backgrounds into a structured, advanced operational framework. The income data, showing a significant portion of farmers have the financial capacity for larger purchases (38.94%), serve as a robust indicator of the economic viability of these new farming paradigms in a digital economy. The majority of operations are above average in size (35.10%), aligning well with this study’s focus on specialized and intensive agricultural techniques. The mean value of 3.38 suggests that the sample leans towards larger operations. The high standard deviation (6.14) indicates a wide range of operation sizes, which confirms this study’s claim of capturing a diverse economic range from small family farms to large cooperatives. These insights are especially relevant when viewed through the lens of the Integrated Technology Acceptance and Use Model (UTAUT) and structural equation modeling (SEM). They reveal that performance expectations are particularly influential in driving credit availability for these agricultural entities. This aligns with the broader objective of our study: to demonstrate that advancing technological acceptance among farmers is pivotal for both financial inclusion and rural revitalization. By marrying these demographic details with our SEM-based findings, this study outlines a nuanced, multifaceted strategy to promote digital financial technologies as a lever for enhancing rural credit availability and overall prosperity.

Table 1.

Characteristics of the sample.

2.2. Variables

In the current study, we employed a 5-point Likert scale to quantify the research variables, a methodological choice often favored in social science investigations for its ability to capture the nuances of respondents’ attitudes or emotional responses towards specific issues or statements. In our measurement system, a score of 1 signifies “strongly disagree”, while a score of 5 represents “strongly agree”. This scaling approach effectively transforms abstract psychological or attitudinal concepts into quantifiable metrics. These tangible numerical values then enable sophisticated analyses through methods such as structural equation modeling (SEM). This ensures a robust and interpretable dataset that lends itself well to comprehensive scrutiny, thereby adding empirical rigor to this study.

2.2.1. Outcome Variable

In this subsection, we delve into the outcome variables, specifically focusing on credit availability (CA) as a key indicator for farmers. To gain a multifaceted understanding of this variable, four critical questions were devised. The first question, “Frequency of access to credit”, serves not only as a straightforward metric of how often farmers are utilizing digital financial services but also as an indirect measure of their acceptance and comfort with these technologies. A high frequency of credit access would signal a strong foothold for digital financial services within the rural community, demonstrating their practical utility and broad-based acceptance. The second question, “Ease of access to credit”, aims to probe the user-friendliness and accessibility of digital financial services. This question is crucial because ease of use can significantly sway farmers’ likelihood of adopting these services, subsequently affecting their overall credit availability. Essentially, if digital financial platforms are straightforward and convenient, they stand a better chance of being integrated into the financial behaviors of the rural farming community. The third question focuses on “Credit terms”, such as interest rates and repayment periods. This metric helps elucidate whether the terms offered through digital financial services are advantageous compared to traditional avenues of credit. The attractiveness of these terms directly correlates with farmers’ willingness to use digital platforms. Favorable terms could serve as a strong incentive, enhancing farmers’ openness to these digitally inclusive financial services. Finally, the fourth question examines the “Likelihood of accessing credit in the future”, aiming to gauge farmers’ long-term expectations and confidence in digital financial platforms. Positive expectations for future credit accessibility can indicate a deeper, sustained trust in these digital services, and such optimism could lead to greater receptivity and usage over time.

Together, these four questions create a comprehensive framework with which to examine credit availability, taking into account both current behaviors and future expectations, thereby providing a rich, layered analysis that goes beyond mere surface-level insights.

2.2.2. Conditional Variables

In the realm of conditional variables, this study dissects multiple key factors that could potentially influence the adoption and efficacy of digital inclusive financial technology among farmers as it pertains to credit availability.

Digital Financial Inclusion Technology Applications (DAs). This study deploys five probing questions that range from the difficulty level to satisfaction in using digital financial services. These metrics aim to offer a 360-degree view of farmers’ awareness, acceptance, and usage patterns of digital technologies. Understanding these factors not only reveals the issues that could be obstacles but also illuminates the technology’s tangible impact on credit availability.

Performance expectation (PE). This variable comprises four main questions aimed at discerning farmers’ expectations of digital financial services in problem solving, time saving, financial literacy, and credit management. The goal here is to measure the perceived added value that digital platforms bring to the financial lives of farmers, affecting their willingness to use these platforms in the long run.

Effort expectations (EEs). Under this variable, four questions were crafted to gauge the ease and effort required in adopting new technologies. Elements such as self-learning capability, user-friendly interfaces, and the need for external help are explored to understand the mental and physical “effort cost” tied to these technologies, directly affecting their acceptability among farmers.

Social influence (SI). Three questions delve into the community-driven factors that could encourage or inhibit the uptake of digital financial technologies. Whether the community views it as a necessary skill, or if there are local role models to learn from, influences farmers’ behavioral attitudes toward these services.

Contributory Factor (CF). Three questions were designed to identify the impact of technical and external factors such as device limitations, network stability, and prior training. These are pivotal for understanding the feasibility of using digital services, as any shortcomings in these areas could be critical deterrents to adoption.

Collectively, these conditional variables provide a comprehensive framework for examining the multifaceted factors that affect the acceptance and successful integration of digital inclusive financial services among farmers. This, in turn, informs the understanding of how these factors influence credit availability, filling an important gap in the existing literature.

2.2.3. Control Variables

In the structural equation modeling (SEM) framework deployed for this study, meticulous attention has been given to selecting gender, age, and education as control variables, a decision rooted in the premise that these demographic factors could potentially skew the observed impact of digital financial inclusion technologies on farmers’ access to credit. Gender, as backed by the existing literature, is known to significantly influence the adoption of new technologies, with males being generally more inclined to assimilate such innovations [67,68,69]. Incorporating gender as a control variable thus allows this study to dissect gender-specific nuances that could impact the utilization of digital financial services among farmers and their consequent access to credit [70,71]. Similarly, age serves as another critical control variable because it is often directly correlated with the willingness to adopt technological advancements [72,73]. Younger farmers, who are generally more comfortable with digital interfaces, are presumed to be more experimental and willing to incorporate new digital financial services [74,75]. Education further augments this trio of control variables, given its positive correlation with the cognitive ability to understand and utilize complex technologies [76,77,78,79]. Those with higher levels of educational attainment are likely to have an easier time navigating new technological tools, making education a pivotal variable to control for. By rigorously controlling for these demographic influences, this study achieves a nuanced and accurate measurement of the UTAUT model’s four core constructs—performance expectations, effort expectations, community influences, and enablers—in relation to farmers’ credit availability. This methodological rigor enhances the credibility of this study’s findings, providing more precise insights into the adoption patterns of digital financial technologies among farmers and how such adoption interfaces with their credit availability, thereby enriching this study’s academic and practical contributions.

2.2.4. Modeling Structural Equations

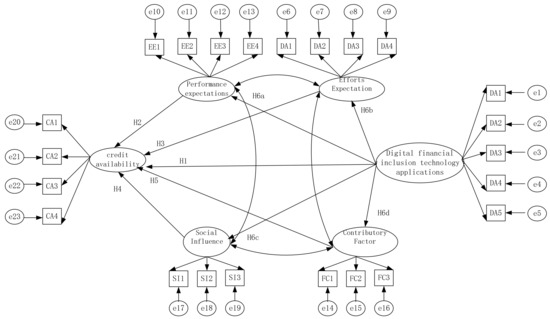

Figure 3 elucidates the relationships between variables in a structural equation model framed by the Unified Theory of Acceptance and Use of Technology (UTAUT). The model partitions the effects on farmers’ access to credit into direct and indirect impacts, thereby offering a more granular understanding of the causal pathways involved. Five central hypotheses further sharpen the focus of the model on the availability of credit to farmers.

Figure 3.

UTAUT-based structural equation modeling for designing farmers’ decisions in applying digital financial inclusion systems. Source: figure adapted by authors (2023).

Hypothesis 1.

There is a direct and beneficial impact of digital inclusive financial technologies on the availability of credit to farmers. By minimizing red tape and slashing transactional overheads, these digital solutions substantially enhance the likelihood of farmers securing essential credit, fortifying their overall financial resilience.

Hypothesis 2.

Performance expectations have a direct and beneficial impact on the availability of credit to farmers. The rationale is that when farmers hold the belief that digital financial services will efficaciously address their monetary needs, they display a heightened propensity to adopt these technologies. This heightened engagement can catalyze their ability to both obtain and manage credit, thereby buttressing their financial stability.

Hypothesis 3.

Effort expectations are expected to have a direct and beneficial impact on the availability of credit to farmers. The underlying argument here is that user-friendly, intuitive platforms incite greater adoption among farmers. The ease of navigation and operation in these digital systems prompts farmers to engage in financial transactions, such as credit applications, more readily.

Hypothesis 4.

Social impacts have a direct and beneficial effect on the availability of credit to farmers. This projection is substantiated by the tight-knit nature of agricultural communities, where shared opinions and lived experiences wield substantial sway over individual choices. A communal endorsement of digital financial services can thus act as a catalyst, inspiring farmers to take the digital plunge and consequently augmenting their access to credit resources.

Hypothesis 5.

Contributing factors have a direct and beneficial impact on the availability of credit to farmers. These auxiliary elements, when favorable, diminish the obstacles to effective adoption and use of digital financial platforms. This streamlined process subsequently optimizes the efficiency of credit acquisition and management, thereby widening the financial avenues available to farmers.

In this investigation, nuanced assumptions are made about the indirect influences of digital financial inclusion technology on farmers’ credit availability. The framework identifies multiple mediating pathways through which these indirect effects are believed to manifest.

Hypothesis 6 contends that the adoption of digital financial inclusion technology generates a ripple effect, influencing other variables that in turn positively affect farmers’ access to credit. For instance, embracing these digital solutions can elevate farmers’ income levels by reducing transaction costs and opening new revenue channels. This uptick in income enhances their creditworthiness, setting off an indirect yet potent boost to their ability to secure credit.

Hypothesis 6a focuses on performance expectations as the mediating factor. The supposition is that when farmers anticipate tangible benefits—such as expedited loan approvals or favorable interest rates—from using digital financial systems, they are more inclined to adopt these technologies. Once these performance expectations are validated, they propel sustained usage and heightened user satisfaction. Over time, this satisfaction translates into a more stable and attractive credit profile, engendering an indirect improvement in credit availability.

Hypothesis 6b addresses the mediating role of effort expectation. This hypothesis posits that a user-friendly and intuitive digital interface promotes higher utilization rates among farmers. This elevated usage indirectly augments their financial literacy and management acumen. Enhanced financial capabilities, in turn, fortify their credit profiles, increasing the likelihood of loan approvals.

Hypothesis 6c introduces social influence as a key mediator. The idea is that in tight-knit farming communities, the endorsement of digital financial systems by respected community members can catalyze broader adoption rates. This collective shift toward digital financial inclusivity elevates community-wide creditworthiness, indirectly amplifying each farmer’s probability of securing credit.

Hypothesis 6d earmarks contributing factors like device capability, network stability, and targeted educational initiatives as indirect influencers. Favorable conditions in these contributing factors can streamline the technology adoption process, lowering barriers to entry. As larger segments of the farming community become adept users, the aggregate data are expected to indicate a surge in responsible financial behavior and, consequently, improved creditworthiness.

By meticulously exploring these hypotheses, this study aims to render a nuanced, high-resolution portrait of how digital financial technologies intersect with farmers’ credit availability. This in-depth analytical focus not only enriches the academic discourse but also holds pragmatic implications for the broader adoption of digital financial services in agricultural settings.

3. Results

3.1. Descriptive Statistics and Correlation Analysis

Table 2 offers a comprehensive statistical overview, illustrating the correlations between key variables—digital financial inclusion technology adoption, performance expectations, effort expectations, community influence, and contributing factors—alongside their mean values and standard deviations. Remarkably, the Pearson’s correlation coefficients among these variables are not only significant but also predominantly exceed 0.7. This robust correlation strength underscores the interconnectedness of these variables, furnishing a solid foundation for more intricate empirical scrutiny. The means for each variable surpass the value of 2 on a 5-point Likert scale. In this context, a score of 2 generally signifies a neutral stance or an absence of any marked inclinations. Hence, higher mean scores reflect that participants’ evaluations veer more towards the positive end of the spectrum, or at the very least, do not demonstrate significant negativity. Further, the standard deviations for all the variables are confined within the 1.5 range, implying that the sample data are not widely dispersed but instead tightly clustered. This limited dispersion of data adds an extra layer of confidence to the validity of subsequent empirical steps.

Table 2.

Results of descriptive statistics and correlation analysis.

As an extension of these foundational results, structural equation modeling (SEM) will be employed for a nuanced path analysis. Through SEM, not only can the direct relationships between credit availability and the aforementioned variables be rigorously tested but so can any interaction effects that may exist between these variables. This multifaceted analytical approach aims to generate a sophisticated understanding of the specific mechanisms through which these interconnected variables impact farmers’ access to credit. By doing so, this research aspires to contribute both theoretically and practically to the broader discourse on financial inclusivity in agricultural settings.

3.2. Reliability and Validity Analysis

Prior to delving into the intricacies of structural equation modeling (SEM), it is imperative to rigorously evaluate the reliability and validity of the variables in focus. Cronbach’s alpha serves as the chosen metric for gauging the internal consistency of the scales or tests utilized in this study. Examination of Table 3 reveals that all variables boast Cronbach’s alpha values exceeding the threshold of 0.7, thereby attesting to the commendable internal consistency of the measurement instruments. This robust alpha score also implies a higher degree of correlation among the items within each scale, reinforcing the reliability of our data. In addition to Cronbach’s alpha, the Kaiser–Meyer–Olkin (KMO) values of all the variables are also noteworthy, surpassing the 0.7 benchmark. This elevated KMO value affirms that the sample is indeed well suited for an ensuing factor analysis, bolstering the structural validity of our model. Further amplifying this point is the factor analysis deployed to assess construct validity.

Table 3.

Results of reliability and validity tests.

From Table 3, it is discernible that the Average Variance Extracted (AVE) for all variables surpasses 0.5, signifying excellent convergent validity. This high AVE score suggests that the proportion of the variance accounted for by the constructs of each latent variable markedly surpasses the error variance, adding another layer of credibility to the measurement model. Simultaneously, factor loadings for all items are well above the 0.7 criterion. This indicates that each item not only has a high loading on its corresponding factor but also measures the latent variable to which it belongs in an exceptionally accurate manner. This strong factor loading further corroborates the convergent validity of the constructs, ensuring that the upcoming SEM analysis rests on a robust empirical foundation.

3.3. Structural Equation Modeling Results

3.3.1. Structural Equation Model Fitting Results

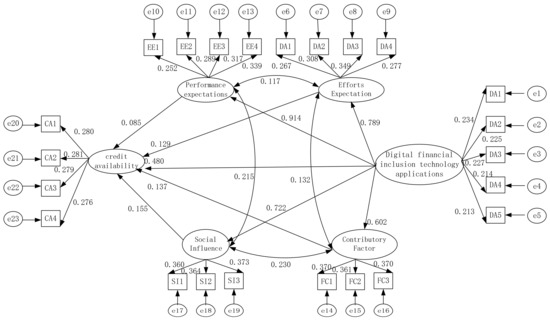

Figure 4 offers an illuminating depiction of the structural equation modeling (SEM) results, revealing a complex yet instructive interplay between digital financial inclusion technology and credit availability, mediated through four key variables: effort expectation (EE), facilitating conditions (FCs), social influence (SI), and performance expectation (PE). One plausible explanation for this intricate network lies in the transformative role that digital financial inclusion technologies play in elevating farmers’ financial literacy and operational skills. By making the navigation and utilization of financial products more accessible, these technologies in essence act as a catalyst for enhancing credit availability. Simultaneously, technological adoption also exerts a ripple effect on the broader community ecosystem. It provides essential infrastructural support, thus creating an enabling environment that further facilitates credit access for farmers. The SEM fitting results underscore these dynamics via the path coefficients.

Figure 4.

Structural equation model fitting results. Source: figure adapted by authors (2023).

The path coefficient for effort expectation provides quantifiable evidence that the willingness of farmers to invest effort in understanding and utilizing digital financial tools has a direct bearing on credit availability. Higher effort expectations are indicative of a greater propensity among farmers to actively engage with these digital platforms, thereby amplifying their chances of securing credit. Similarly, the path coefficient for facilitating conditions elucidates the undeniable impact of technological and equipment support on farmers’ access to credit. When farmers are equipped with the requisite tools and technical assistance, they are inherently better positioned to leverage digital financial technologies successfully, which in turn boosts credit availability. The role of social influence within the community is also accounted for, as reflected in its corresponding path coefficient. In communities where the mastery of digital financial technologies is considered a vital competency, farmers are more likely to receive collective encouragement and support, thereby enhancing their credit accessibility. Interestingly, performance expectation did not exhibit a significant impact on credit availability in this particular study. While elevated performance expectations could indeed drive a willingness to engage with digital platforms, this willingness may not necessarily translate into improved credit access, or its impact may be eclipsed by other dominant variables like effort expectation, facilitating conditions, and social influence.

In summary, these findings not only shed light on the myriad of factors that come into play in shaping credit availability for farmers but also furnish empirical evidence that can be instrumental in devising strategies to uplift farmers’ financial inclusivity.

3.3.2. Path Coefficient Analysis

The robustness of the structural equation modeling (SEM) results was rigorously scrutinized via the Bootstrap method, with a total of 5000 sample tests conducted. The ensuing data, meticulously tabulated in Table 4, afford both an overarching and nuanced view into how various variables either directly or indirectly impinge upon credit availability to farmers.

Table 4.

Results of testing path coefficients using the Bootstrap method.

Direct effects represent the potency of a single predictor variable influencing the dependent outcome, irrespective of other intervening variables. Upon sifting through these direct effects in Table 4, compelling evidence emerges. Digital financial inclusion technology exerts a profound and statistically significant positive impact on credit availability, quantified by a beta value (β) of 0.480 and an associated p-value of less than 0.01. Likewise, other predictor variables, such as effort expectation, facilitating conditions, and community influence, manifest significant positive impacts, as evidenced by their respective β-values and p-values, which fall beneath the 0.01 threshold. Performance expectation exhibits a statistically significant impact on credit availability, as evidenced by its β-value of 0.085 and corresponding p-value of less than 0.01. Moving to indirect effects, which cascade through one or more mediating variables, the analysis unveils that the influence of digital inclusive financial technology on credit availability is not merely direct but also percolates through other variables—effort expectation (EE), facilitating conditions (FCs), social influence (SI), and performance expectation (PE). These mediating variables, in turn, have downstream effects on credit availability (CA). Thus, the overall effect of Digital Inclusion (DI) on credit availability (CA) is synthesized through a combination of these direct and indirect pathways. Notably, the negligible impact of performance expectations on credit availability merits attention. This could suggest that within the confines of this particular model, the influence of performance expectation on credit availability is either inconsequential or is effectively counterbalanced by the more potent forces exerted by the other variables under scrutiny.

This layered analysis, therefore, not only corroborates the multifaceted nature of the factors that drive credit availability but also furnishes a statistical foundation for targeted interventions that aim to ameliorate farmers’ access to credit by leveraging digital financial inclusion technologies.

3.3.3. Analysis of the Impact on the Availability of Credit to Farmers

In this comprehensive structural equation modeling study aimed at unraveling the intricate relationships among variables in the financial ecosystem, Digital Financial Inclusion Technology Applications (DAs) stood out as a dominant player. Table 5 shows the total impact of the variables on farmers’ decision to apply the digital financial inclusion system. The total effects of DA on credit availability (CA), effort expectations (EEs), Contributory Factor (CF), performance expectation (PE), and social influence (SI) all exceeded 0.89, with p-values indicating extreme statistical significance and confidence intervals further confirming the robustness of these relationships. This paints a clear picture of DA as a pivotal force that molds various aspects of the financial environment. On the other end of the spectrum, effort expectation (EE) exhibited moderate total effects on CA and FC, signaling its lesser but still noteworthy role in the system. Similarly, performance expectation (PE) and social influence (SI) showed moderate total effects on multiple variables, reinforcing the idea that while they may not be as impactful as DA, they cannot be overlooked in the broader financial context. Interestingly, all paths in the analysis were statistically significant, albeit with varying effect sizes and confidence intervals. This complex tapestry of relationships underscores the nuanced interplay among these multiple factors, each contributing in its unique way to shape the financial landscape.

Table 5.

Total effects of variables on farmers’ decision to apply digital financial inclusion system.

As shown in Table 6, in an analysis aimed at understanding specific indirect effects within the financial sector, Digital Financial Inclusion Technology Application (DA) emerged as a formidable variable. It exhibited high total indirect effects on credit availability (CA) and Contributory Factor (CF), supported by highly significant p-values and robust confidence intervals. This central role of DA suggests its overarching influence in shaping financial systems. In contrast, effort expectations (EEs) showed a much smaller total indirect effect on CA but was still statistically significant, highlighting its subtler role in influencing credit availability. Performance expectation (PE) and social influence (SI) displayed moderate-to-low total indirect effects on CA and FC but were highly significant, indicating that while they may not be as dominant as DA, their influence is significant and operates through complex pathways. For instance, PE’s total indirect effect on CA was 0.057 and was highly statistically significant, underlining the importance of performance expectations in this financial context. Collectively, these results present a nuanced picture of the financial landscape, where each variable, despite its varying degree of influence, plays a statistically significant role, thereby contributing to the multifaceted nature of financial systems.

Table 6.

Total indirect effects of variables on farmers’ decision to apply digital financial inclusion system.

Table 7 shows the specific indirect effects of the variables on farmers’ decision to apply the digital financial inclusion system. In the structural equation modeling analysis conducted to unravel the complex web of specific indirect effects within the financial sector, Digital Financial Inclusion Technology Application (DA) emerged as an unequivocal linchpin. Its effects on credit availability (CA) and Contributory Factor (CF) spanned a broad spectrum, ranging from low to high, and were predominantly highly statistically significant. This underscores the central role DA plays in shaping and influencing financial outcomes. On the other end of the spectrum, performance expectation (PE) and effort expectations (EEs) yielded lower yet statistically significant effects, thereby highlighting their more nuanced but nonetheless important roles. Specifically, PE’s path through social influence (SI) to FC and ultimately to CA, although less impactful, held statistical significance, emphasizing the subtler ways in which performance expectations can influence financial variables. Among the pathways with high effect sizes were those involving DA, particularly the ones connecting DA through SI and EE to FC. These paths were highly significant, amplifying the integral role of DA in the financial ecosystem. Remarkably, the analysis revealed just one statistically insignificant path, further underscoring the coherence in how each variable contributes to the financial landscape. Overall, the findings paint a nuanced yet statistically robust picture of the financial sector, where each variable exerts a distinct level of influence, thereby contributing to its complex structure.

Table 7.

Specific indirect effects of the variables on farmers’ decision to apply the digital financial inclusion system.

3.3.4. Analysis of Hypothesis Testing

The structural equation modeling analysis provides robust evidence supporting all six hypotheses concerning the role of various factors in enhancing the availability of credit to farmers (See Table 8). Digital Financial Inclusion Technology Applications (DAs) emerge as a significant force with a high specific indirect effect on credit availability (CA), corroborating the idea that digital technologies have a direct and beneficial impact on farmers’ access to credit. Performance expectations (PE) also contribute positively, albeit to a lesser extent than DA, affirming their direct and beneficial role in credit availability. Meanwhile, effort expectations (EEs), though demonstrating a lower impact, are statistically significant, substantiating the hypothesis that they also positively affect credit availability. Social influence (SI) has a confirmed role as well, with its significant indirect effect on CA, thereby endorsing the idea that social factors are instrumental in enhancing credit availability. While the Contributory Factor (CF) itself is not directly measured against CA, its presence in multiple significant paths suggests its pivotal role in the financial ecosystem, thereby supporting its hypothesized beneficial impact on credit availability. Lastly, the widespread influence of DA on various other factors, which in turn have significant effects on CA, validates the hypothesis that the adoption of digital financial technologies sets off a ripple effect that positively impacts farmers’ access to credit. Overall, the analysis paints a comprehensive and nuanced picture, where each variable, despite its varying degree of impact, plays a distinct and statistically significant role in shaping farmers’ access to credit.

Table 8.

Hypothesis testing for upgrading smart hog farming decisions.

4. Discussion

4.1. Discussion of Findings

4.1.1. Digital Financial Inclusion Technology Applications Directly and Indirectly Influence Farmers’ Credit Availability

Digital Financial Inclusion Technology Applications (DAs) exert a multifaceted impact on farmers’ credit availability in Guangdong Province, China. Directly, these digital platforms simplify and expedite the credit application and approval processes, thereby boosting farmers’ ability to secure necessary funding [80]. Indirectly, the technology interacts with various influential variables, as per the UTAUT model, creating a complex web of factors that contribute to credit accessibility. For instance, effort expectation (EE) becomes a mediator when digital platforms are user-friendly, encouraging farmers to invest the time and effort required to navigate these systems, thereby indirectly influencing their credit access [81]. Similarly, Facilitating Conditions (FCs), such as technical support and necessary tools, enhance farmers’ utilization of digital services, which in turn indirectly elevates their credit availability [82]. Social influence (SI) within communities also plays an intermediary role; when digital financial literacy is considered valuable, collective support and encouragement indirectly improve farmers’ chances of securing credit [83]. Though performance expectation (PE) did not show a strong direct correlation with credit availability, it serves as a mediator when combined with other factors, subtly influencing credit outcomes. Overall, DA serves as a pivotal catalyst that both directly streamlines and indirectly enriches the credit acquisition process through a symbiotic relationship with other significant variables like EE, FC, SI, and PE.

4.1.2. Variables Such as Effort Expectation, Facilitating Conditions, and Social Influence Have Significant Positive Impacts on Credit Availability

Effort expectation, facilitating conditions, and social influence have high beta values and p-values less than 0.01, signifying their strong positive impact on credit availability. Effort expectation implies that farmers who are willing to invest the effort to understand and use digital financial systems are more likely to secure credit. Facilitating conditions represent the technical and logistical support that eases the use of these financial platforms, thereby boosting farmers’ chances of accessing credit. Social influence encapsulates the role of community encouragement and social norms, suggesting that in environments where digital financial literacy is valued, farmers are more likely to successfully obtain credit. The high beta values and low p-values for these variables confirm their statistically significant roles in enhancing credit accessibility for farmers.

4.1.3. Performance Expectation, Contrary to Expectations, Did Not Show a Significant Impact on Credit Availability

Performance expectation did not show a significant impact on credit availability, possibly because its influence is overshadowed by more potent variables, like effort expectation, facilitating conditions, and social influence. While high performance expectations may drive willingness to engage with digital financial platforms, this willingness does not necessarily translate to better credit access. This could be due to various reasons, like a disconnect between what the technology promises and actual user experience, or because other factors take precedence in the credit evaluation process. Therefore, the influence of performance expectation on credit availability may be either inconsequential or effectively counterbalanced by other variables.

4.1.4. The Role of Social Influence in New Agricultural Management Entities’ Adoption of Digital Financial Systems: A Multifaceted Enabler of Rural Credit Availability

The conclusion on the role of social influence within this study’s framework can be elaborated as follows: social influence manifests as a significant, albeit less dominant, factor in farmers’ decision to engage with digital financial systems for obtaining credit. It holds statistical significance with a p-value under 0.01, corroborating its substantial role in shaping financial behaviors among rural farming communities. The reason for this significance may lie in the collective nature of social norms and peer influence. In rural settings, where individual farmers may lack comprehensive information or confidence in navigating digital financial platforms, community opinion and shared experiences serve as a form of social proof. This essentially means that when digital financial technologies are valued within a community, farmers are more likely to receive collective encouragement and support to adopt them, thereby enhancing their access to credit. Additionally, social influence may act as a mediating factor between other variables like effort expectations or facilitating conditions and the end goal of credit availability. For example, a community that places high value on technological adoption may provide a more fertile ground for initiatives that improve facilitating conditions, like providing better internet connectivity or digital literacy programs. This, in turn, can have a cascading positive impact on credit availability.

Therefore, while social influence may not be the most dominant force, its role as both a direct and indirect enabler of financial inclusion is essential and complex. This insight should encourage policymakers and stakeholders to consider community-based approaches as part of comprehensive strategies aimed at enhancing rural financial inclusivity.

4.1.5. Digital Financial Inclusion Technology Applications (DAs) Have an Overarching Influence, Significantly Affecting Various Aspects of the Financial Environment, including Credit Availability (CA), Efforts Expectations (EEs), Contributory Factor (CF), Performance Expectation (PE), and Social Influence (SI)

Digital Financial Inclusion Technology Applications (DAs) have an overarching influence because they serve as the foundational infrastructure enabling multiple financial transactions and behaviors. First, DA directly impacts credit availability (CA) by providing an efficient, transparent platform for credit evaluation and disbursement, reducing traditional barriers. Second, DA influences effort expectations (EEs) by simplifying the user interface and transaction processes, encouraging users to invest effort in engaging with the platform. Third, DA affects facilitating conditions (FCs) by providing necessary tools and technical support, making it easier for users to adapt. Fourth, DA can set performance expectations (PE), shaping how users perceive the benefits of using the platform. Finally, DA plays a role in social influence (SI) by becoming a normative tool in the community, encouraging collective adoption. Its central role is substantiated by high p-values and beta values, showing its statistical significance across multiple variables, making DA a pivotal force shaping the financial landscape.

4.2. The Influence of Gender, Age, and Educational Attainment on Farmers’ Adoption of Digital Financial Services: Insights for Targeted Policy Interventions

Using gender as a control variable unveils significant gender-based disparities in the adoption of new digital financial technologies among farmers. This can be attributed to a range of factors: Men often have higher risk tolerance, better access to information, and greater financial literacy, which make them more inclined to adopt new technologies. Sociocultural norms often position men as the financial decision-makers, reinforcing their early adoption behavior. Furthermore, men may have more time and economic resources to invest in learning and using new financial technologies. By controlling for gender, this study provides a nuanced understanding of how variables like social influence or facilitating conditions impact farmers’ utilization of digital financial services and credit access, allowing for targeted policy interventions that address the unique needs and limitations of each gender.

By using age as a control variable, this study demonstrates a direct relationship between age and willingness to adopt technological innovations in the financial domain. Younger farmers are typically more tech-savvy, comfortable with digital interfaces, and open to experimentation, making them more receptive to adopting new digital financial services. This age-dependent receptivity is influenced by factors such as familiarity with digital tools, exposure to technological education, and an inherent willingness to adapt to changing methodologies. Understanding the impact of age enables a more nuanced analysis of farmers’ behaviors and barriers to adopting digital financial services, thereby allowing for more effective, age-targeted interventions.

By incorporating educational attainment as a control variable, this study finds a positive correlation between educational levels and the cognitive capacity to understand and employ complex digital financial technologies. Individuals with higher educational attainment are generally better equipped to grasp the nuances of new technological tools, increasing the likelihood of their adoption and effective use. This study therefore identifies education as a critical variable, suggesting that educational interventions could significantly improve the uptake and effective utilization of digital financial services among farmers.

4.3. Research Gaps and Prospects

While this study significantly advances our understanding of digital financial inclusion’s role in augmenting farmers’ access to credit, it also opens up numerous pathways for future scholarly inquiry. This research is narrowly tailored to a specific demographic—farmers—limiting the broader applicability of its findings. This calls for subsequent investigations that could adapt the model for other marginalized groups to determine if the observed dynamics are universally applicable. In terms of methodology, although this study utilizes a structural equation model, it does not incorporate more advanced analytical techniques like machine learning or predictive analytics, which could provide a deeper understanding of the influential variables. This study’s framework can also be ex-tended to include other socioeconomic and psychological factors like trust, behavioral economics, and political stability, which could enrich our comprehension of technology adoption and creditworthiness. Qualitative methodologies, such as interviews or case studies, could provide a fuller picture of the human factors driving these statistical outcomes. Additionally, this study was conducted in various cities and counties within Guangdong Province, China. This research is geographically confined, creating an imperative for cross-cultural analyses that could assess the global scalability and adaptability of digital financial inclusion initiatives. In summary, this study both enlightens and challenges—shedding new light on the complexities of financial inclusion while simultaneously uncovering gaps that could be the epicenter of future academic endeavors and policy refinements.

5. Conclusions