1. Introduction

PPP mode refers to the establishment of a cooperative relationship between government departments and private sectors to jointly provide public goods and services [

1]. While improving the supply efficiency of public goods and services, it forms a new investment and financing mode of sharing interests and risks between government and social capital. With the development of China’s society, the water pollution problem has become one of the crucial factors restricting China’s economic and social development [

2]. Water environment treatment PPP projects are gaining more and more attention due to their advantages such as relieving the financial pressure on the government and effectively improving the efficiency of the treatment. Most water environment treatment PPP projects are characterized by a long cooperation period, large investment scale, high technical requirements, large number of stakeholders, and complex transaction structure [

3,

4]. In the long investment period and operation period of PPP projects, there will be many uncertain factors [

5] whose complexity will lead to low interest of social capital, unclear risk allocation, and complex risk factors. Appropriate risk management is important to ensure that desired objectives are achieved [

6]. However, many PPP projects fail to achieve their project objectives due to improper risk management [

7]. Identifying the risks that may exist in water environmental treatment PPP projects and identifying the key risk points is particularly important to achieve the objectives of water environmental treatment PPP projects.

The difficulty in water environment treatment PPP projects is how to achieve reasonable and effective risk management. However, in the process of project implementation, there are still problems such as unclear responsibilities for multi-departmental “separate management” [

8] and emphasis on construction rather than operation [

9]; especially in risk management, the government often does not know the risks faced by the project and simply focuses on reducing project inputs [

9], project managers lack effective solutions and control measures for common problems and risks and do not combine the project itself to carry out targeted risk management and prevention [

10]. The identification of project risks, the identification of risks prone to occur according to project characteristics, and the targeted development of appropriate management plans and preventive measures are issues that need to be addressed urgently. At present, most of the research on the PPP project risk of water environmental treatment focuses on a single risk index or a stage of the project but does not pay attention to all aspects of the whole project risk. For example, Santandrea et al. [

11] addresses the financing risks of healthcare PPP projects; Xiong et al. [

12] focuses on ex-post risk management of PPP projects, starting with risk impact assessment and proposing measures such as renegotiation and early termination, focusing only on the post-management phase.

As a very important safety and reliability analysis tool, FMEA has been widely used to make risk management decisions, such as aerospace, automotive, nuclear, and healthcare industries [

13,

14,

15,

16]. It has also been widely used in risk management [

17,

18]. Unlike other critical analysis tools, the purpose of FMEA is to find out all possible failure modes and effects within the system, determine the cause of the failure mode, and then eliminate or reduce the specific failure, rather than finding a solution after the failure occurs [

19]. In FMEA, risk assessment can be carried out by the O, S, and D of risk indicators. In FMEA, risk assessment is carried out by developing risk priorities, which are determined by multiplication of risk factor scores. Although there are many attractions, in practice, FMEA risk assessment is often affected by uncertainty, and it is easy to appear that the same priority of risk is difficult to rank the problem. Fuzzy set theory is a suitable tool to solve such problems.

Multi-objective optimization method of proportional analysis (MOORA) is a multi-objective optimization method. By constructing the alternative objective decision matrix, the ratio system and the reference point method are combined to determine the most suitable objective [

20]. In 2010, Brauers and Zavadskas [

21] improved MOORA to MULTIMOORA by adding Full Multiplicative Form and employing Dominance Theory to obtain a final integrative ranking based on the results of these triple subordinate methods. It is more perfect and accurate than the traditional decision-making method. As a multi-objective decision method, MULTIMOORA has been widely used in various multi-scheme decision problems due to its advantages such as short operation time, low decision complexity and strong robustness [

22]. For example, Zavadskas et al. (2017) [

23] applied MULTIMOORA to the selection of building materials; Geetha et al. (2019) [

24] applied the MULTIMOORA decision-making method based on intuitionistic hesitant fuzzy sets to the selection of medical waste treatment methods. MULTIMOORA is also widely used in risk assessment [

25,

26]. However, multi-objective problems often involve uncertainty, while the ordinary MULTIMOORA method uses clear numbers, which cannot express the uncertainty of information well. In order to enable it to solve more complex decision problems, scholars have improved MULTIMOORA [

27]. Zhang et al. [

28] used a single triangular fuzzy number to represent expert opinions, and then used MULTIMOORA for evaluation. Liang et al. [

29] used Hesitant Fuzzy Linguistic Term Set (HFLTS) to study the evaluation information in MULTIMOORA, which could well reflect the hesitating-decision makers. This paper also follows the fuzzy idea and uses the IF-MULTIMOORA method to rank risk indicators. It solves the problem that it is difficult for experts to use accurate data to evaluate indicators and can deal with the uncertainty of information better.

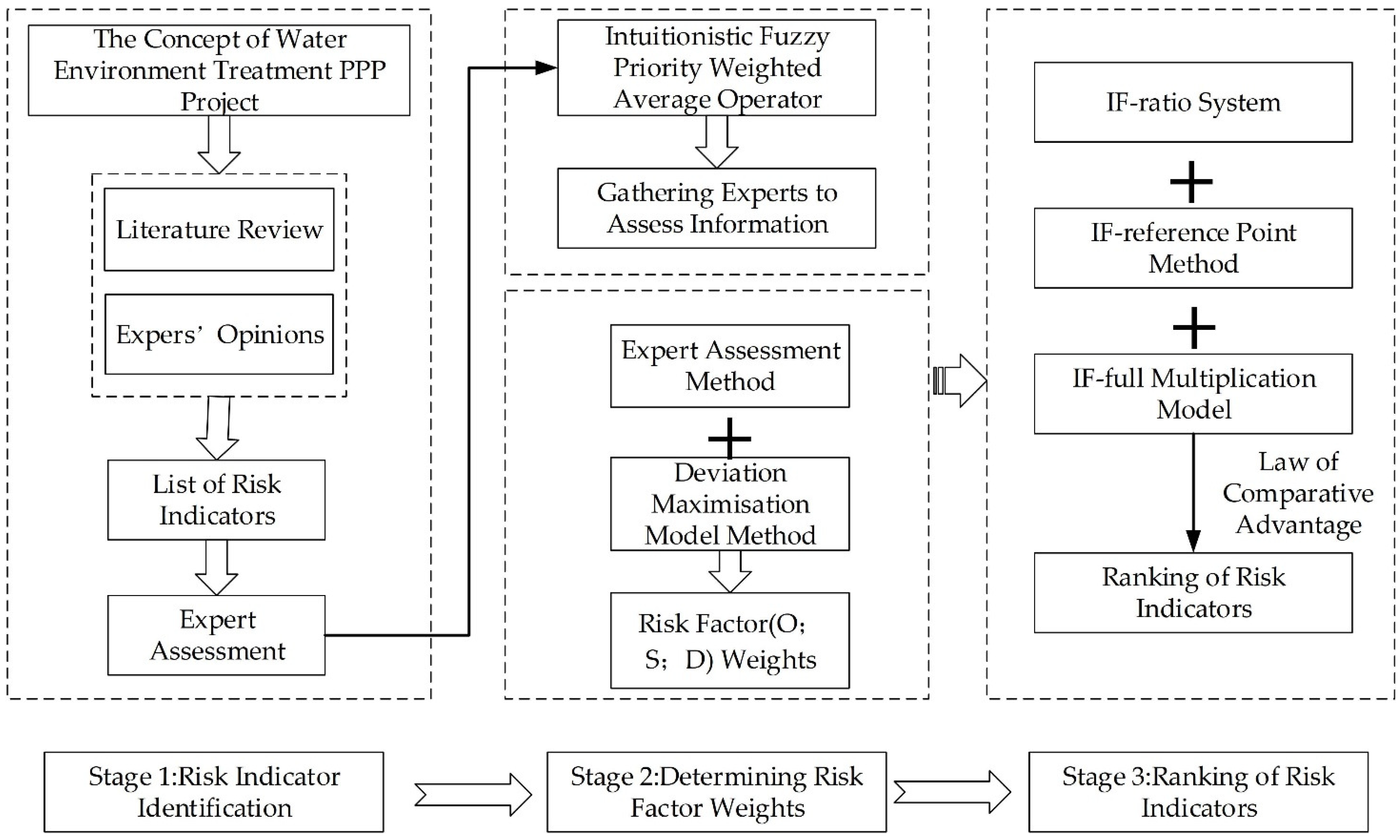

In this paper, a risk assessment model of water environmental treatment PPP project based on IF-MULTIMOORA improved FMEA method is established. The whole life cycle risk assessment indicator system of water environmental treatment PPP projects is established, which covers a variety of risk types and is more comprehensive. Intuitionistic fuzzy FMEA method was used to determine the O, S, and D of risk three risk factors and determine the weights, starting from these three aspects, using fuzzy ideas to assess the risk indicators, the different characteristics of risk indicators into consideration, improving the accuracy of the assessment; at the same time, the IF-MULTIMOORA method is used to avoid the determination of risk indicator weights and directly rank the risk indicators to determine the key risk indicators and focus the risk management on the risk issues that are prone to the project and carry out targeted risk management.

The second part of the paper is a literature review; the third part is the research methodology, which constructs a risk evaluation model for water environmental treatment PPP projects; the fourth part is an example study, which applies the developed model to practice; and the fifth part is the conclusion, which summarizes the theoretical contributions and limitations of the paper.

2. Literature Review

Establishing an objective and reliable risk indicator system is essential for the risk evaluation of water environmental treatment PPP projects [

30]. Jin and Cui [

31] combined with the characteristics of current water environment treatment PPP projects, based on literature reading method, collated, and summarized four first-level indicators of financing risk, project technology and management risk, government regulation risk, and environmental risk. Commonly used risk identification methods are the literature review method [

32], brain storming method [

33], etc. The risk identification of water environment treatment PPP projects cannot simply rely on a risk identification method but need to use a combination of several of these risk identification methods, play the advantages of multiple identification methods, make up for the disadvantages of a single identification method, comprehensive and systematic identification of risk factors.

There are also different approaches to risk assessment by domestic and international scholars. Song et al. [

34] proposed a risk evaluation model based on the group analytic hierarchy process (GAHP), rough set theory, and cloud model theory. Zhai et al. [

35] used a project scoring tool to design and score questions on 23 evaluation indicators in their study of investment risk in PPP projects, applied analytic hierarchy process (AHP) to determine the weights of each risk indicator, and finally used mixed center-point triangular winterization weight function to determine the investment risk evaluation level.

Most of the current research on PPP project risk assessment starts from a single project phase or a single risk indicator such as investment and financial risk, and the evaluation indicators used are often very similar to those of general PPP projects; and most of the studies on risk evaluation focus on the probability of risk occurrence, project risk level, etc., and do not consider the differences in different aspects of risk such as frequency and severity. The FMEA method assesses the risk level of an indicator by calculating the risk priority number (RPN = O × S × D) from three risk factors: O, S, and D. However, the traditional FMEA method has many shortcomings; expert assessment information is difficult to quantify accurately in practical applications [

36,

37]; it also does not consider the relative weights of risk factors, which is unreasonable; and it is easy to have the same RPN and difficult to sort [

19]. At the same time, the RPN calculated by the traditional FMEA method cannot reflect the real situation when the scores of the two risk factors are at opposite ends [

38]. How to establish a whole life cycle risk indicator system with the characteristics of water environmental treatment PPP projects, starting from the various characteristics of the risk, more effective identification, prevention of risk, and improve the efficiency of water environmental treatment PPP project governance needs to be studied in depth.

4. Case Study

4.1. Project Overview

Pingyu County is located in the east of Zhumadian City, Henan Province, China (as shown in

Figure 2). It is located in the Huaihe River system, with more than 3400 large and small channels, a total length of 4140 km. Xiaohong River and Ruhe River, tributaries of Huaihe River, flow through the county. The length of Xiaohonghe County is 50.2 km, with a watershed area of 939 square kilometers, accounting for 73% of Pingyu County. The length of Ruhe County is 20.54 km, with a watershed area of 290 square kilometers, accounting for 22% of Pingyu County. With the economic development in Pingyu County, the water quality has deteriorated, and the ecological environment has been degraded. In 2017, Henan Water Conservancy Investment Group Limited won the tender to undertake the PPP project’s design, construction, and operation for the water environment treatment and ecological restoration project in Pingyu County. This section takes the water environment treatment PPP project in Pingyu County as an example for risk evaluation.

4.2. Risk Indicator Assessment and Information Aggregation

4.2.1. Risk Indicator Assessment Based on Intuitive Fuzzy FMEA

Three experts familiar with the Pingyu project were selected to assess the project risk factors and risk indicators. The detailed information of experts is shown in

Table 4. The information table for the assessment of linguistic variables is shown in

Table 5.

4.3. Risk Factor Weighting

4.3.1. Determination of Subjective Weights Based on the Expert Assessment Method

The expert evaluation information for the three risk factors O, S, and D are shown in

Table 4. Firstly, the expert information is assembled using Equation (2). The steps are the same as 4.2.2 to obtain the intuitive fuzzy comprehensive evaluation matrix of risk factor weights. The results are shown in

Table 6. Using the corresponding score function values, the subjective weight values of the risk factors are obtained according to Equation (4) as

.

4.3.2. Objective Weighting Based on Deviation Maximization

Based on the intuitionistic fuzzy comprehensive evaluation matrix of risk factors in

Table 6, the deviation maximization optimization model is constructed according to Equations (5) to (9), and the objective weight vector of risk factors is obtained as

; the objective and subjective weights are taken to be the same, i.e.,

; the total weight of risk factors is determined as

.

The weights for the three risk factors O, S, and D are calculated in the table shown in

Table 7.

4.4. Ranking of Risk Indicators

According to the risk indicator ranking steps of IF-MULTIMOORA, the combined utility value, Tchebycheff distance and multiplicative utility value of the risk factors were obtained using Equations (10)–(12), respectively, as shown in

Table 8, which resulted in the ranking of the risk indicators under the IF-ratio system, IF-reference point method, and IF-full multiplicative model.

The final ranking of risk indicators based on the IF-MULTIMOORA method is shown in

Table 9, which gives the following ranking of risk indicators for the PingYu project.

4.5. Discussion

Using the improved FMEA method based on intuitionistic fuzzy MULTIMOORA proposed in this paper, the top five risk levels of the water environment treatment PPP project in Pingyu are financing risk (changing financing conditions/high costs), market changes, government intervention and credit problems, imperfect legal and regulatory systems, and inflation. Combined with the research results, in-depth interviews were conducted with project experts and the following insights were summarized:

Combined with the research results, in-depth interviews were conducted with project experts and the following insights were summarized:

Financing risk is the most common risk problem in PPP water environment treatment projects. Due to the public welfare nature of water environment treatment PPP projects, the project income is unstable, and the government is prone to financing risk if it simply seeks to reduce the project cost. Managers need to improve their ability to identify risks, understand the development prospects of the industry in the field of PPP projects, collect the data of similar projects, analyze the characteristics of their own projects, and formulate targeted preventive measures. Constantly broadening the financing channels, and thus changing the single financing method, through multi-channel financing can reduce the risks caused by the single financing method, and it can especially reduce some high-risk financing channels.

Market changes and inflation are market risks. Water environment treatment PPP projects are of strong public welfare nature, and their benefits are difficult to guarantee. Market changes can easily affect the projects. Project managers should always be familiar with the market situation, conduct scientific and sufficient market investigation, and do a good job of market risk emergency filing. A corresponding compensation mechanism may be specified in the relevant contract or agreement to ensure that the project has sufficient funds to ensure a reasonable return and the corresponding debt service capacity.

Government intervention and credit problems, and imperfect legal and regulatory systems are political risks. Since the government plays a dominant role in public welfare projects, and the government is less sensitive to changes in the market environment than social capital parties, the risk of government intervention will also have a significant impact on the implementation of projects. The government’s functions and powers at each stage of a PPP project should be clarified. The government must do what the law authorizes it to do. The establishment of a common governance system with project participants as the main body can promote the healthy development of PPP model. At the same time, since water environment treatment projects generally use feasibility gap subsidy and other ways to ensure the income of social capital, the government credit risk has an important impact on the operation of the project. To solve the trust-breaking problem, all the participants should help the spirit of the contract and cooperate sincerely to form a virtuous circle. Within the organization, managers should improve management systems and eliminate opportunism. In view of the risk of imperfect legal and regulatory systems, it is necessary to sort out the laws and regulations faced by the development, construction, and specific operation of the project, and strengthen the reasonable prevention of legal risks. When necessary, professional legal personnel should be used to ensure that the project construction and other activities are carried out legally and in compliance. Managers should improve the PPP supervision system, clarify the regulatory agencies, and distinguish the ownership of regulatory power, so as to solve the problem of social capital’s inappropriateness caused by excessive and insufficient supervision in PPP practice. Improving the PPP supervision system should also increase the transparency of PPP project information, reduce the information asymmetry, reduce the cost of supervision, and ensure the efficiency of supervision.

These measures are of great help to the risk management of Pingyu water environmental treatment PPP project and contribute to the sustainable development of the project. The risk assessment model proposed in this paper is suitable for most water environment treatment PPP project. Through the project risk assessment, the risk ranking can be clarified, so that the project manager can focus on the possible risks and allocate resources reasonably. Furthermore, they can make reasonable use of limited resources for the risks that are easy to occur and improve the utilization rate of resources. It helps project managers make correct decisions when facing risks and improve their ability to cope with risks.

This paper uses literature frequency statistics to synthesize risk indicators from fifteen papers. It combines semi-structured interviews to screen and supplement the indicator system. It also establishes a risk assessment system that covers the whole project life cycle and the possible occurrence of multiple types of risk indicators, which is more comprehensive. The improved FMEA method with the intuitive fuzzy concept still relies on expert judgment. However, it is reasonable to use this method to identify risk indicators from various aspects of the risk such as its O, S, and D. The results turn out to be more accurate than the previous way of risk assessment. The IF-MULTIMOORA method adopted in this paper solves the problem that the traditional MULTIMOORA method is only applicable to the real number background, and introduces the intuitionistic fuzzy priority weighted average operator (IFWA) and intuitionistic fuzzy weighted geometric operator (IFWG) into the ratio system and the whole model to avoid information loss, simple operation and robustness. It is possible to identify those risks that are prone to occur in a project so that targeted measures can be taken in advance and develop risk prevention strategies.