4.2. Hypothesis Test

- (1)

Direct effects test

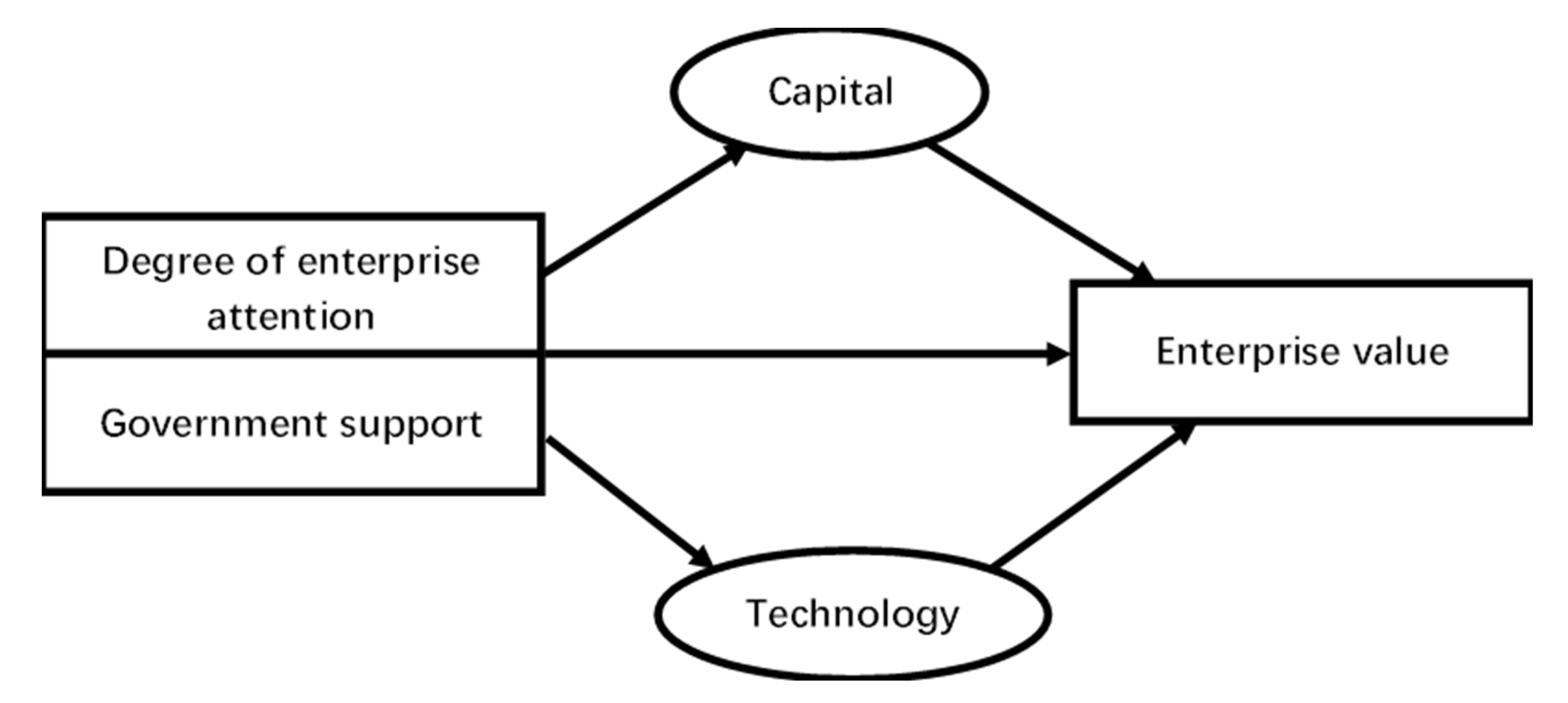

The results of the firm’s internal and external support and the financial and technology-related variables on firm value are shown in

Table 3. Models 1–10 are the results of the regression of firm value on all variables separately. There was a significant positive effect of the degree of enterprise attention on the firm value in model 2 (β = 0.047,

p < 0.01), which suggested that the more importance is attached to the development of AI within the firm, the more the value of the firm can be enhanced. There was a significant positive effect of physical capital on firm value in model 3 (β = 12.481,

p < 0.01). There was a significant positive effect of structural capital on firm value in model 4 (β = 0.664,

p < 0.01). There was no significant effect of human capital on firm value in model 5 (β = 0.002,

p > 0.1). On the one hand, human capital is an essential productive asset and factor as far as enterprises are concerned. However, differences in the quality of internal personnel and the differentiation of knowledge levels can lead to the alienation of the quality of this asset, and some enterprises consider poor-quality human capital to be a heavy or inefficient asset and include it in their divestment strategies [

46]. On the other hand, the path of human capital to firm value in R&D companies is influenced by the external environment. At the beginning of a new industry or technology, human capital is essential to drive firm value through the mediated path of R&D investment [

47], but when R&D companies are marketed, redundant human capital or divided human teams can lead to barriers to the firm value. Model 6 had a significant positive effect of financial capital on firm value (β = 1.225,

p < 0.01). Model 7 had a significant positive effect of government support on firm value with a strong effect (β = 24.151,

p < 0.01). Model 8 had a significant positive effect of investment in R&D personnel on firm value (β = 0.307,

p < 0.01). Model 9 had a significant positive effect of R&D capital investment on firm value (β = 0.550,

p < 0.01). The investment of R&D personnel can bring sufficient nutrients to the enterprise’s technology research and development and provide talent reserves for the enterprise to develop various new technologies and products. In contrast, the investment of R&D funds can provide fertile soil for the enterprise’s technology research and development, support various R&D activities, improve the welfare treatment of R&D personnel, and motivate the R&D enthusiasm of R&D personnel. The two complement each other, laying a solid foundation for the enterprise’s technology research and development and innovation, thus promoting the enterprise’s value. The results of model 10 showed that the ability to innovate positively affects firm value (β = 0.003,

p < 0.01). A comparison of the regression coefficients shows that government support and physical capital investment have a more significant impact on the value of AI firms, while the impact of independent innovation capability on firm value is less prominent. The reason for this is that AI companies belong to strategic emerging industries. Therefore, the marginal contribution of independent innovation capability at the beginning of the enterprise life cycle is relatively weak. The turnover of innovation results is complex, the R&D breakthroughs are significantly blocked, and the transformation of innovation results on the ground is complex, making it difficult for enterprises to form a rapid value path through innovation power in the short term [

48]. For the private sector AI industry, political connections and government subsidies are important ways to obtain value in the early stage of the enterprise, which is also the beginning of forming a “new type of government–business relationship.” With the multi-dimensional integration of government, industry, academia, and research, the enterprise realizes the construction of a value network, laying a good foundation for later development and value enhancement [

26]. In general, the impact of capital variables on the value of AI firms is stronger than the impact of technology variables, as capital is the basis for rapid growth in the early stages of a firm, and AI firms, especially start-ups, require large amounts of capital to purchase the resources needed for the business, including the plant and various equipment needed to develop the technology.

The results of the regression analysis of the degree of enterprise attention on capital and technology-related variables are shown in

Table 4. The independent variable in models 11–17 is the degree of enterprise attention, and the dependent variables are physical capital, structural capital, human capital, financial capital, R&D staff input, R&D fund input, and independent innovation capability. The results of models 11 to 14 show that the coefficients on the degree of enterprise attention were positive and had

p-values less than 0.01 (β > 0,

p < 0.01). The degree of enterprise attention significantly and positively affects the variables of each dimension of capital. Companies that attach sufficient importance to AI invest sufficient physical, structural, human, and financial capital to support AI development and use the capital investment to build a solid material foundation for the development and application of AI. The regression coefficients of the degree of enterprise attention in models 15 to 17 are positive, and the

p-values are less than 0.01 (β > 0,

p < 0.01). The degree of enterprise attention significantly and positively affects the variables of each dimension of technology. Companies that attach importance to AI also show their investment in technology. Companies that attach importance to AI strive to improve their soft power, invest in professional R&D staff and sufficient R&D funds in the field of AI, and at the same time improve their ability to innovate independently, develop their own patented technology, achieve independent development, and reduce the costs incurred by companies using external patents.

The results of the regression analysis of government support on capital and technology-related variables are shown in

Table 5. The independent variable in models 18–23 is government support, and the dependent variables are physical capital, structural capital, human capital, financial capital, R&D staff input, R&D fund input, and independent innovation capability. The coefficients of government support in models 18 to 23 were above 15, and the

p-values were less than 0.01 (β > 15,

p < 0.01). Government support positively affected physical capital, structural capital, human capital, financial capital, R&D staff input, and R&D fund input. With government funding support and a favorable policy environment during AI development, companies can strengthen their determination to develop AI and invest more in capital and technology to provide comprehensive support for AI development. The regression coefficient of government support in model 24 was enormous, but the

p-value was less than 0.01, indicating no direct effect of government support on independent innovation capability. This is because external forces do not achieve the improvement of an enterprise’s independent innovation capability except through the training of R&D personnel, the development of R&D activities, the improvement of the quality of business operators, etc. Therefore, government support does not have a direct impact on an enterprise’s independent innovation capability. The coefficients for government support in each model in

Table 5 are more significant than the coefficients for the degree of enterprise attention in each model in

Table 4. Artificial intelligence in China is still in the early stages, relying on government support. Enterprises for developing artificial intelligence are always in a wait-and-see state, and only the government strongly supports the development of artificial intelligence. Artificial intelligence can cause enough attention to enterprises, and enterprises have the confidence to develop artificial intelligence, so the government support for the development of artificial intelligence is stronger than the degree of enterprise attention.

- (2)

Intermediary effects test

The mediating role of capital variables in the impact of the degree of enterprise attention on firm value is shown in

Table 6. A stepwise regression test revealed that the

p-value for the degree of enterprise attention was more significant than 0.1 and became insignificant when physical capital was added to model 27. The physical capital variable remained significant and physical capital produced a full mediation effect, and hypothesis H1 was tested. With the addition of structural capital in models 28 to 29, the degree of enterprise attention became insignificant, while structural capital was significant and structural capital produced a full mediation effect, with hypothesis H3 being tested. The

p-values for the human capital variables in models 31 to 33 were all greater than 0.1, and none of the human capital variables was significant, indicating that human capital does not have a mediating effect, and with hypothesis H5 not being tested. With the inclusion of financial capital in models 34 to 36, the degree of enterprise attention was insignificant but financial capital was significant: Financial capital produced a full mediation effect, and hypothesis H7 was tested. The results of the mediating role of capital variables in the process of the impact of government support on firm value are shown in

Table 7. After adding physical capital and structural capital to models 46 to 51, respectively, the regression coefficients of government support became smaller but still significantly affected firm value (

p < 0.01).

Moreover, physical capital and structural capital also had a significant effect on firm value (p < 0.01), indicating that physical capital and structural capital play a partially mediating role in the effect of government support on firm value, and hypotheses H2 and H4 were tested. The coefficients on the human capital variables in models 52 to 54 were insignificant: human capital did not mediate government support, and hypothesis H6 was not tested. The coefficients of financial capital and government support in models 55 to 57 were significant (p < 0.01), with financial capital playing a partially mediating role, and hypothesis H8 was tested.

In general, capital had a solid mediating effect in the interaction between the degree of enterprise attention, government support, and corporate value enhancement. It is a practical manifestation of the degree of enterprise attention and government support, and a crucial mediating resource for value transformation. In terms of the internal structure of capital, the role of human capital in driving value to AI firms is minimal. On the one hand, artificial intelligence enterprises are high-tech industries. The demand for human resources makes the cost of capital investment rise, and the marginal utility of human capital decreases rapidly, making it less creative in radiating enterprise value and driving innovation.

On the other hand, the late start of the AI industry and the small size of the average company’s workforce and its entire sector make it difficult to demonstrate the human capital effect. Moreover, this paper refers to existing research paradigms that portray human capital in terms of payroll size, where redundant capital undoubtedly becomes a burden on firm value enhancement. Of the remaining categories of capital elements, physical capital is the most vital driver, followed by the utility of financial capital and the limited contribution of structural capital. Indicating a solid reliance on natural physical capital, the combination of descriptive statistics of the data reveals a lower demand for structured capital and a correspondingly smaller scale of structured capital in the early stages of development. As development evolves and the company matures, structural capital gradually adjusts to the company’s internal environment, and its share increases year by year, providing support for the company’s ability to plan and transform itself later on, and its usefulness increases.

The mediating role of technology variables in the impact of the degree of enterprise attention on firm value is shown in

Table 8. The coefficients on the degree of enterprise attention became insignificant (

p > 0.1) with the addition of R&D staff input and R&D fund input in models 37 to 42. In contrast, R&D staff input and R&D fund input remained significant, suggesting that R&D staff input and R&D fund input produced fully mediating effects in the influence of the degree of enterprise attention on firm value, and hypotheses H9 and H10 were tested. Models 43 to 45 show different results from the other two variables, with a partial mediating effect of the independent innovation capability in the impact of the degree of enterprise attention on firm value, testing hypothesis H10. The results of the mediating role of technology variables in the process of the impact of government support on firm value are shown in

Table 9. The coefficients of government support and the coefficients of the three mediating variables were significant when the three variables of R&D staff input, R&D fund input, and independent innovation capability were added to models 58 to 66, indicating that the technology variables play a partially mediating role in the influence of government support on firm value, and hypotheses H11, H12, H13, and H14 were tested. By comparing the coefficients of the models, it can be found that the coefficients of R&D staff input and R&D fund input were 0.245 and 0.484, respectively, while the coefficient of independent innovation capability was only 0.002, indicating that the mediating effect of both R&D staff and R&D fund input was significantly greater than that of independent innovation capability.

Technology is the primary resource for building the core competitiveness of an AI enterprise. An enterprise’s innovative technology is a significant mark that distinguishes it from other enterprises. Innovative technology that is difficult to imitate and replicate can help an enterprise form a unique competitive advantage in the industry, which plays an essential role in enhancing its value. Investment in R&D staff and R&D fund, as well as the development of independent innovation capabilities, are concrete signs of the importance companies attach to technology and the government’s focus on developing artificial intelligence in companies. The investment of R&D staff and funds are the necessary innovation input resources for enterprises to carry out R&D activities, and are the essential elements of an enterprise’s technological innovation system. The investment in R&D by enterprises is mainly used to support enterprises to carry out technological research and development, product design, and transformation of results, which in turn effectively contribute to the enhancement of enterprise value. Independent innovation capability is the catalyst for enterprises to develop new technologies. The research and development cycle of an enterprise’s independent patent technology depends on its independent innovation capability, and enterprises with solid capability can develop more competitive new patents in a shorter period, thus occupying more market share in the artificial intelligence industry. The market value of the enterprise can be substantially increased. The reason why the effect of the innovation capability is weaker than that of the investment in R&D staff and fund is that the innovation capability is the result of the long-term cultivation and accumulation of the enterprise, while the investment in R&D staff and the fund can be replenished in a short period. Thus, the effect of the enterprise’s investment in R&D is better than that of the innovation capability in only four years of data.

A comparison of the models in

Table 7 and

Table 8 reveals that the coefficients of all the capital dimension variables were above 0.5, while the coefficients of all the technology dimension variables were at the level of 0.5 and below with a mediating effect arising from the capital variables being more significant than that arising from the technology variables. The effect of capital investment in the short term was significantly better than that of technology investment. The physical, structural, and financial capital invested by companies in the short term can be used directly to purchase the infrastructure and facilities for the development of AI and a range of infrastructure and equipment can provide a solid physical foundation for companies to enter the AI industry and address the urgent need for companies to develop AI technology in the short term rapidly. However, in the long run, the effect of capital is diminishing, and companies need to rely on technology rather than capital to achieve long-term sustainable development in the field of artificial intelligence. A higher level of investment in research and development is conducive to forming a robust technological innovation capability in manufacturing companies. Constantly innovative technology can bring a constant stream of innovative breakthrough points for companies, breaking the spell of diminishing marginal effects. Technological innovation results from a firm’s accumulation over a long period, and therefore technology is not visible in the short term compared to capital.

After empirical analysis, the hypothesis test results proposed in this paper are as follows in

Table 10.