1. Introduction

Structural models of credit risk have faced several difficulties in explaining both the level and changes of bond and CDS spreads observed in the data since its pioneering introduction by [

1]. The early empirical work by [

2] shows that the Merton model for callable coupon bonds overprices such bonds. This findings have motivated a variety of extensions, such as allowing for default before the bond maturity, stochastic interest rates, jumps, and strategic default. Despite these extensions, the structural approach is still questioned regarding its ability to explain the level of credit spreads ([

3]).

This work attempts at giving an alternative explanation to the (alleged) lack of accuracy by structural models of default to explain credit spreads. In particular, the most important finding of the paper is that the documented inability by such models to describe both the cross-section and the time-series components of the spreads lies first in the type of default model chosen for the analysis, but mostly in the econometric tools employed for assessing the goodness to fit of the former.

Given the recent findings in [

4] documenting the need of a time-varying volatility of the asset in order to explain the level of credit spread over medium- and long-term maturities, a novel estimation technique of a time-varying volatility of the assets is introduced herein. However, the novel structural model proposed here as well as the related estimation technique are much simpler than the one in [

4]. As a matter of fact, their calibration methodology relies on the Fortet’s lemma, maximum likelihood and Chebychev interpolation in the case of stochastic diffusive asset volatility (and, on top of those, on simulated maximum likelihood when jumps are introduced). They have 9 parameters, over a total of 12, to estimate. In this paper, even though the asset value process is assumed to follow a geometric Brownian motion (thus asset volatility is not stochastic), the proposed estimation methodology allows to retrace the time series of the asset volatility for a given firm. Hence, the time series of the equity volatility can be also estimated accordingly.

To help the reader navigate throughout the paper, a brief roadmap of the steps and findings is provided:

- (a)

A new structural model is developed along the lines of [

1,

5]. The model developed here is an extension of the Merton’s model in which the firm’s equity is priced as an

n-fold compound call option instead of a vanilla call option; this allows to account for more than one debt maturing at only one future date, which surely is one of the most evident limitations of the Merton’s model.

- (b)

A new estimation technique is implemented for those variables which structural models of default predict to be the drivers for the spreads. More specifically, a simple estimation which relies only on the joint calibration on the price of the equity and CDS spreads (and, indirectly, by the book value of the firm’s debt) is proposed to estimate the value of the firm’s assets alongside its volatility, which are both unobservable quantities.

- (c)

Once the asset volatility and the market leverage are estimated, the goodness of these estimates is tested as their own ability to predict the one-period ahead CDS spreads. Different combinations of the model parameters are tested in order to obtain a satisfying calibration.

- (d)

Finally, an econometric analysis of the determinants of the credit spreads is conducted using an error correction mechanism (ECM).

The findings in (d) are the most interesting, as, to the best of my knowledge, the inability of structural models to explain the level of credit spreads has never been addressed via cointegration analysis. In fact, previous works such as [

6,

7,

8,

9] investigated the link between credit spreads and their determinants via simple linear regressions. There, a set of variables (usually leverage, equity volatility and characteristics of the term structure of interest rates) is regressed onto the spreads in order to explain their level and changes. This paper shows that use of such regressions to explain the level of the spreads (either bonds or CDS) is intrinsically flawed. As shown later in the paper, the level of credit spreads, as well as other variables entering the regressions, display a unit root. Therefore, any regression analysis based on these variables would detect spurious correlations. Hence, the only consistent way to tackle this problem is investigating the presence of a long-run equilibrium equation between these variables using an error correction mechanism (ECM), as introduced by [

10]. If these variables are cointegrated (that is, if there exists a linear combination of them which is stationary), an ECM can be estimated and the economic relationship between them can be further investigated. If the variables are not cointegrated, only the changes in spreads can be explained by regressing the first differences those variables onto the former (alternatively, a stationary VAR can be used). The use of an ECM, when possible, is more desirable, as it allows to shed light on the economic, and not only statistical, relationship between the variables.

It still appears surprising how previous works fully ignore a possible cointegration, despite [

11] developing a VECM to investigate the cointegration of bond and CDS spreads. Such analysis is possible only if the time-series component of the spreads is non-stationary. Here, instead, a cointegration analysis is conducted between the CDS spreads and their determinants as predicted by the structural models of default. This leads to a cointegrated system, where credit spreads, financial leverage and the firm’s riskiness comove, adjusting to a long-run equilibrium. Empirical results discussed in this paper support the existence of a cointegrating relationship between these variables

In the following analysis, CDS rather than bond spreads are used, as the former constitute a more direct and clean signal for the underlying default risk. In fact, CDS spreads provide relatively pure pricing of the default event of the underlying entity, as they are typically traded on standardized terms. In fact, unlike bonds, CDSs have a constant maturity, the underlying instrument is always par valued, they concentrate liquidity in one instrument, and are not affected by different taxation regimes; also, bond spreads are more likely to be affected by differences in contractual arrangements, such as differences in seniority, coupon rates, embedded options, and guarantees. Secondly, many corporate bonds are bought by investors who simply hold them to maturity, and the secondary market liquidity is therefore often poor. Furthermore, shorting bonds is even more difficult in the cash market, as the repo market for corporate bond is often illiquid, and the tenor of the agreement is usually very short. CDS contracts instead allow investors to implement trading strategies to hedge credit risk over a longer period of time at a known cost. Moreover, as shown by [

11], CDS spreads tend to respond more quickly than bond spreads to changes in credit conditions in the short run.

The rest of the paper is organized as follows.

Section 2 provides a short literature review of the works connected to the paper.

Section 3 introduces the compound option structural model of default alongside the estimation methodology for the firm’s asset value and volatility.

Section 4 models the cointegration relationship between the variables, and the short-term adjustment is estimated. Finally,

Section 5 discusses the main findings and performs some robustness checks.

Section 6 concludes.

2. Literature Review

Academic research has taken mainly three routes in analyzing the quite surprising lack of accuracy of structural models in explaining the observed credit spreads.

Firstly, attempts to empirically implement models on individual corporate bond spreads have failed ([

12]). Mixed evidence supporting the structural approach is instead documented for CDS spreads ([

8,

9]), thus suggesting liquidity and tax arguments for the lack of success in case of bonds ([

13,

14]). Ref. [

15] finds that expected losses account for a low fraction of spreads for investment grade bonds. Ref. [

6] documents that proxies for credit risk explain only a small portion of changes in yield spreads and that the unexplained portion is driven mainly by factors that are independent of both credit-risk and standard liquidity measures.

Secondly, efforts to calibrate models to observable moments, including historical default rates and Sharpe ratios, have been unable to match average credit spreads levels (the so-called credit spread puzzle). Ref. [

3], testing over an extensive class of structural models, shows that credit risk accounts for only a small fraction of yield spreads for investment-grade bonds of all maturities, with the fraction lower for bonds of shorter maturities, but it accounts for a much higher fraction of yield spreads for high-yield bonds. They calibrate each of the models on the historical default loss experienced and equity risk premia, and demonstrate that different models (under)predict similar credit risk premia.

Thirdly, models have been unable to jointly explain the dynamics of credit spreads and equity volatilities. Within this framework of research, ref. [

16] finds that idiosyncratic volatility can explain one-third of yield spreads for investment grade bonds rated below Aaa. An important recent development which examines potential links between the credit spread puzzle and macroeconomic conditions using consumption-based asset-pricing is [

17]. The authors show that the [

18] pricing kernel combined with some mechanism to match the countercyclical nature of defaults is able to capture the level and time variation of Baa-Aaa spreads. However, they also show that a pricing kernel that explains the equity premium with a constant Sharpe ratio cannot explain the credit spread.

A recent paper which tries to address all the above-mentioned failures of structural models of default in explaining credit spreads is [

4]. In their paper, the authors use the framework in [

19] (i.e., the firm has issued a consol bond) in which the unlevered asset process is modeled as in [

20]. Thus allowing for stochastic volatility in firm value process and calibrating the variance risk premium consistently with reasonable firm-level Sharpe ratios, they are first able to resolve the credit spread puzzle for medium- to longer-term maturities for representative Baa- and Aa-rated firms. Secondly, introducing jumps in the asset value process allows to fit shorter term credit spreads as well. Moreover, their model succeeds at explaining the joint dynamics of credit spreads and equity volatilities, and allows them to identify economically significant variance risk premia, which explain an important part of spread levels.

To summarize, this works hopes to fill some theoretical, methodological and empirical gaps detected in this literature, more specifically, the following:

Provide a novel and richer, though still tractable, structural model of default which removes one of the most stringent restriction of the Merton’s model, namely clustering the firm’s debt at one single point in time (theoretical);

Develop a new estimation technique for some crucial unobservable variables, such as the value of the firm’s assets and volatility (methodological);

Conduct a cointegration analysis on a large panel of US CDS spreads (using the estimated variables) to show that large part of the empirical failure of structural models is more apparent than real as it was largely due to an omitted variable problem (empirical).

4. Estimating the Cointegration

When regressing credit spread changes on the changes of the variables, which structural models of default would predict to influence the spread (as in [

6]), if the levels the selected variables are non-stationary and cointegrated, these regressions are misspecified. Moreover, regressions on non-stationary levels (as in [

7,

8,

9]) may lead to spurious correlations. Therefore, it should not be surprising that the regressions on the levels work ‘better’ than the ones on the changes: despite the OLS estimators being super consistent, the

s and

t-statistics are likely to be large, even if the underlying variables are not truly correlated. As a consequence, reliable inference cannot be made.

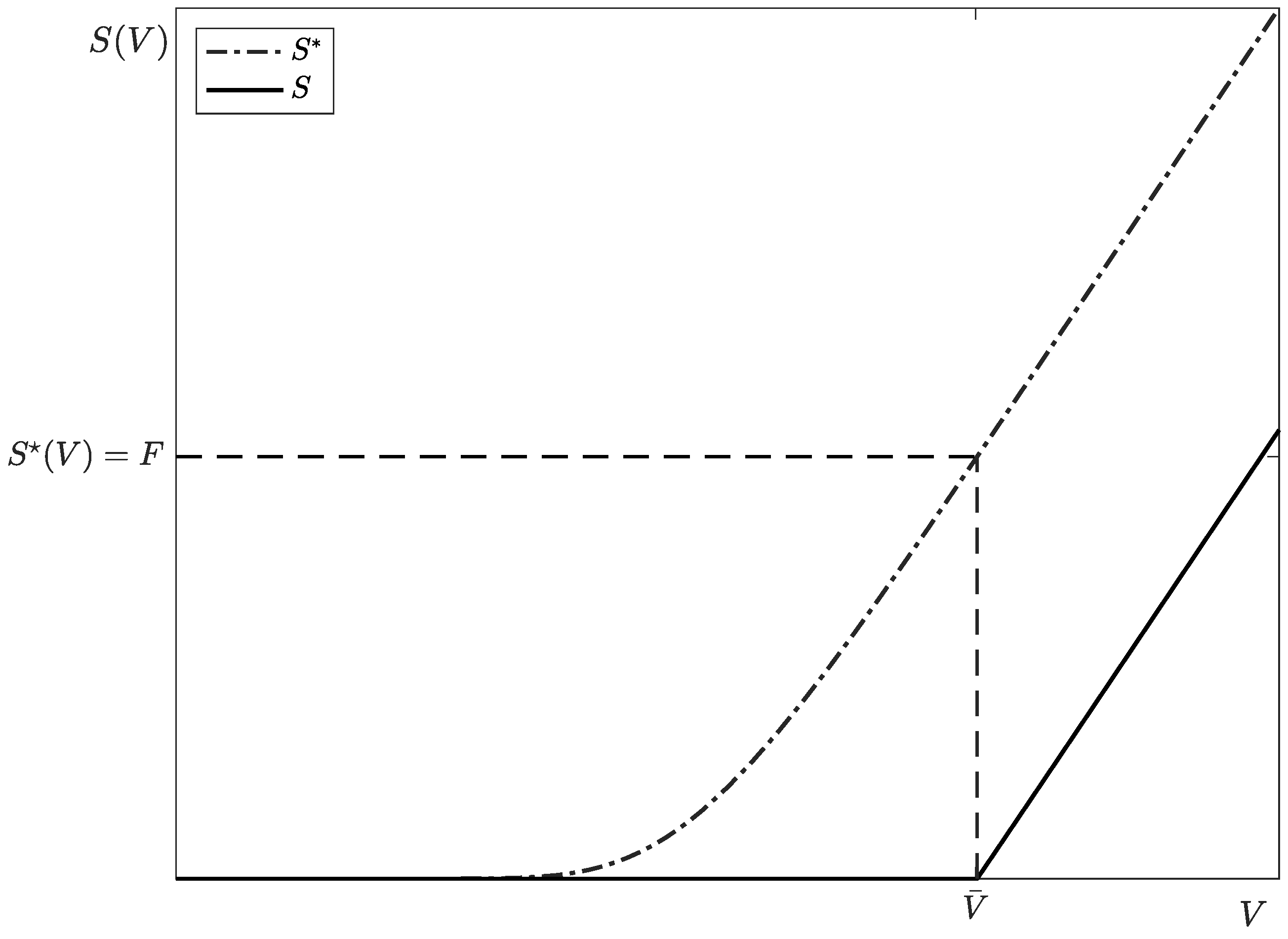

For illustration purposes,

Figure 2 shows the 5-year CDS spreads, financial leverage and equity volatility (estimated as in (

9)) for four companies operating in different industries. These variable are evidently non-stationary, also hinting at strong comovements. Unit root tests confirm the non-stationarity of all the variables. Identical conclusions are drawn for the other companies in the sample also if the model-implied market leverage is replaced by book leverage.

Despite the estimation technique for the equity volatility is new, the other variables still display stochastic trends. Hence, if cointegration is present, the appropriate way to model the level of credit spreads is an error correction mechanism. Based on the structural approach of default, the spread is likely to follow upon chances on the firm’s financial leverage () and riskiness () and not vice versa. Therefore, the model is implemented à la Engle–Granger instead of using a VECM (that is, only one cointegrating vector is estimated).

Assume the long-run equilibrium equation to be

in which

are, respectively, the CDS spread (for a given maturity), model-implied market leverage (

) and equity volatility (

) of firm

i at time

t. CDS is observed, whist LEV and VOL are estimated as in (

9). Unreported results, available upon request, show that the same conclusions discussed below are obtained using firms’ book leverage. As default times are driven by the value of the equity at reimbursement dates, the volatility of the equity is used in the cointegration equation.

These are the variables that structural models of default predict as determinants of default probabilities and, therefore, credit spreads. If the variables are random walks and cointegrated, then the error term

is stationary for all

i.

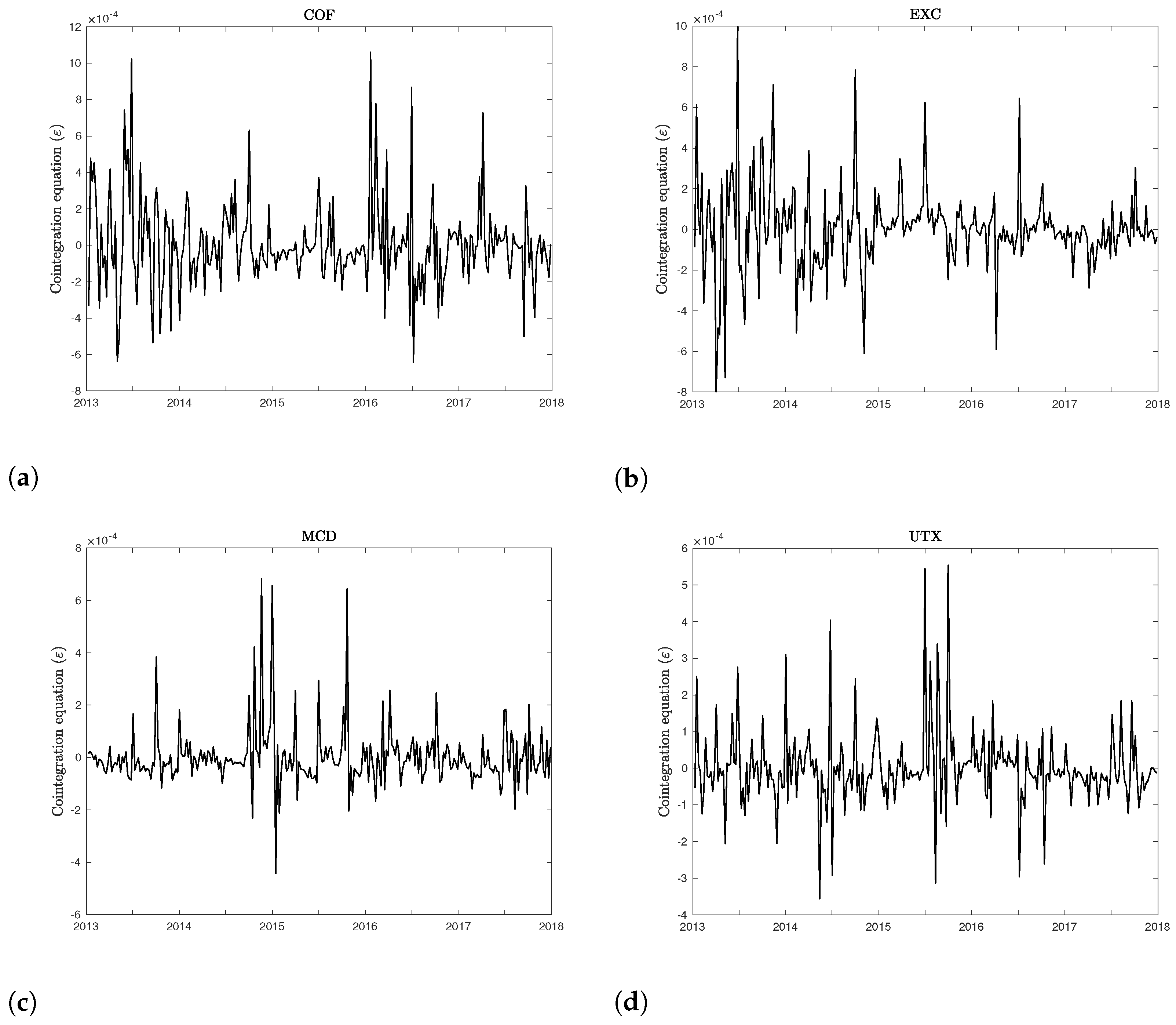

Figure 3 plots the residuals of the regressions (

11) for the same four companies taken into consideration in

Figure 2. Visual inspection, supported by unit root tests, confirms the presence of cointegration between the CDS spreads, leverage, and volatility. The same conclusions regarding the existence of a cointegrating vector apply to the whole sample of firms, as well as to CDS spreads for different maturities.

The autoregressive distributive lag, ARDL

, dynamic panel specification of (

11) (with exogenous variables,

) is defined as

and the error correction reparameterization of (

12) is

where

,

,

, and

. The parameter

is the error-correcting speed of adjustment term. If

, then there would be no evidence for a long-run relationship. This parameter is expected to be significantly negative under the prior assumption that the variables show a return to a long-run equilibrium. Of particular importance is the vector

, which contains the long-run relationships between the variables driving the spreads.

Following [

6], exogenous variables, in changes (

), are also added. These are the change in level, slope and curvature of the term structure of interest rates, the log-return on the S&P500, and the change in the CBOE SKEW Index.

The level of interest rates is defined as the treasury yield for 5-year maturity. The slope of the term structure is defined as the difference between between 5-year and 1-year treasury yields. Although the spot rate is the only interest-rate-sensitive factor that appears in the firm value process, the spot rate process itself may depend upon other factors as well. For example, ref. [

30] finds that the two most important factors driving the term structure of interest rates are the level and slope of the term structure. To capture potential nonlinear effects due to convexity, the squared level of the 5-year spot rate is also added as proxy for the curvature.

Similarly, the return on the S&P500 is used to proxy for the state of the economy. In fact, even if the probability of default remains constant for a firm, changes in credit spreads can occur due to changes in the expected recovery rate. The expected recovery rate in turn should be a function of the overall business climate.

Lastly, adding the changes in the CBOE SKEW Index aims at capturing the changes in the probability and magnitude of a large negative systematic jump, which ultimately would affect the firm value. Recent research ([

4,

9,

31]) has in fact shown the crucial importance of allowing for jumps in the firm value process in order to explain short-term credit spreads. The CBOE SKEW Index is a strike-independent measure of the slope of the implied volatility curve that increases, as this curve tends to steepen. The index is calculated from the price of a tradable portfolio of out-of-the money S&P 500 options, similar to the VIX Index.

The choice of the variables (both endogenous and exogenous) mirrors the ones in [

6]. However, three major differences need to be highlighted. First, here an ECM is estimated thus adding an additional stationary variable (the long-run equilibrium equation) to the regression in the spread changes. Secondly, the proposed calibration allows to estimate a firm-specific volatility (of both assets and equity), whilst they need to rely on a market-wide measure of volatility, namely the changes in the VIX index. Finally, the proxy for the downward jump risk employed here is different, as they calculate their own measure of skew based on the implied volatilities of options on the S&P 5000 futures. Here, the CBOE SKEW Index is used instead.

The estimation of the coefficients in (

13) is carried through using the PMG estimator proposed by [

32], which allows for heterogeneous short-run dynamics and common long-run equilibrium.

Table 6,

Table 7 and

Table 8 report the estimates of the long-run equilibrium equation in (

11) and the short-term adjustment in (

13). All the coefficients have the predicted sign and are highly statistically significant.

Most of the results are qualitatively identical when 1-, 5- and 10-year spreads are used. For what concerns the long-run equilibrium, both volatility and leverage display a positive and statistically significant loading: an increase in either VOL or LEV lead to a larger level of the spread in the long run. Focusing on the short-term adjustment, changes in both the firm’s equity volatility and its financial leverage increase the change in the spread. In terms of economic significance, an increase of 1% in the firm’s volatility increases the CDS spread of 0.7, 2.5 and 4 bps for 1-, 5- and 10-year maturity, respectively. Similarly, an identical change in the firm’s financial leverage induces the spread to undergo increases of 0.4, 1.1 and 1.7 bps, ceteris paribus. Thus, when considering the short-term adjustment, changes in the variable driving the long-equilibrium have an impact on the spreads, which increase with the maturity of the CDS contract.

For what concerns the set of exogenous variables, all the variables display significant coefficients. First, the changes in the level of interest rates have a negative impact on the credit spread: as pointed out by [

33], the static effect of a higher spot rate is to increase the risk-neutral drift of the firm value process. A higher drift reduces the probability of default, and in turn, reduces the credit spreads. Ref. [

34] obtains similar results. Likewise, the positive coefficients of the changes on the slope and curvature of the term structure are consistent with the findings of previous studies. As a decrease in yield curve slope may imply a weakening economy, it is reasonable to believe that the expected recovery rate might decrease in times of recession. Therefore, this would further decrease the credit spreads. Additionally, positive returns in the S&P500—which accounts for the growing economy and therefore an increasing expected recovery rate—have the effect of reducing the spread as suggested by economic intuition.

Finally, the coefficient reflecting the effect of systematic downward jumps (proxied as changes in the CBOE SKEW Index) is the only estimate whose sign differs between short- versus medium- and long-term spreads. As shown in [

4,

9,

31], jumps are necessary to explain the level of short-term spreads: structural models which account only for diffusive shocks in the asset value process imply zero instantaneous probability of default and therefore cannot meet the observed levels of 6-month and 1-year spreads. Hence, the coefficient of

Skew is positive for 1-year spread changes as expected.

An increase in the probability of a negative systematic jump translates into larger shot-term spreads. However, for longer maturities, the coefficient is negative. This apparently counterintuitive result can be easily explained by how systematic negative jumps affect firms. If such an event occurs, the ability of firms to repay its debt affects those liabilities expiring in the immediate future. This is what is observed for spreads with 1-year maturity. Conversely, if the firms survive the shot-term shock, they are more likely to be able to survive the futures shocks. Thus, the medium- and long-term spreads lower. Additionally, it is worth highlighting that, in the case of 5-year spreads, the impact of negative jumps is only marginally significant.

To conclude, a further analysis of the cointegration mechanism between spreads, volatility and financial leverage is discussed. As expected, the estimated coefficient of the long-run equation () is negative, within the unit circle and statistically significant. The closer the estimate is to zero, the slower the adjustment. Conversely, the closer to , the faster the adjustment. If , there is full correction in 1 period, and if there is overshooting, that is an oscillatory adjustment dynamic. If , there is not cointegration, that is the disequilibrium expands. As expected, the size of the coefficient is larger, in absolute value, for shorter maturities: short-term spreads adjust faster to shocks in the firm’s volatility and leverage. The associated t-statistic is also larger for 1-year spread changes. Conversely, the degree of cointegration becomes stronger at longer horizons: the t-statistics of the long-run equilibrium equation increase with the maturity of the CDS.

To quantify the speed of convergence towards the long-run equilibrium, half-life statistics can be considered. The estimated negative loading of the cointegrating equation,

, in (

13) signifies that

of that disequilibrium is dissipated before the next time period and

remains. It is often of interest to estimate how long it will take for an existing disequilibrium to be reduced by 50% (half-life of disequilibrium), that is

The estimated half-lives are 6.5, 23.3 and 24.9 weeks for the 1-, 5- and 10-year CDS spread, respectively. This highlights a significantly different behavior of the short- versus the medium- and long-term spreads: the short 1-year spreads reacts about four time faster than the 5- and 10-year spreads in order to realign to equilibrium. This finding is not surprising, as, given the shorter maturity, the spread should be expected to vary as quickly as possible with the changes in the firm’s leverage and volatility.

5. Discussion on the Main Results and Robustness Checks

In this section, we first examine how the compound option performs in terms of pricing errors (compared to other structural models); then, we compare our results on the cointegration analysis with those reported in other studies which document the inability of the proposed variables to explain the level and changes in credit spreads.

In order to compare the ability of the compound option model to price credit spreads, the results reported by [

3] are used. There, the authors calibrate seven different structural models of default with different desirable features. More specifically, they analyze the performance of the following models: a baseline simple model with and without stochastic interest rates ([

33]), a model with endogenous default barrier ([

23]), a model with strategic default ([

35,

36]), a model with mean-reverting leverage ratios ([

37]), a model with countercyclical market risk premium, and a jump-diffusion model. All the models underpredict credit spreads. Average absolute mean errors are reported in

Table 9. Similarly, the compound option model (

and LGD =

) generally underpredicts the spread. However, the extent of the underpricing is much smaller: the proposed model is able to reduce the underpricing to 9.58 bps, whist the pricing errors of other structural models range from 83.19 to 105.67 bps.

Given the extent of the reduction in the pricing error, it is worth stressing further how the model implied spreads are calculated. In terms of market variables, the model spread depends (via the risk-neutral probabilities) on the equity value, the leverage of the company, the level of interest rates and the asset volatility. The proposed methodology is able to estimate the asset volatility and value at time t, using the known capital structure as well as the stock price. Once this volatility is estimated, say , it is then used one week ahead to predict the spread. Therefore the spread at time is essentially a function such as , where the listed variables are the contemporaneous stock price, level of interest rates, leverage and the previous-week asset volatility, respectively. As r and LEV are unlikely to vary substantially from week to week, the proposed estimation shows how the equity, alongside the past volatility, is a sufficient statistic for predicting spreads in a compound option model.

However, it may be argued that what is being shown is simply predicting the credit spread at time

with the credit spread at time

t. This issue might be very impactful on the analysis, as the CDS data do show a significant autoregressive component (which is indeed modeled in the next section). In order to address this concern, the following variables are calculated:

where CDS is the observed market spread, and

is the spread estimated with the proposed methodology. Given the results discussed in the previous sections, the test is conducted setting LGD = 50% and

. If this analysis is actually using the past spread to predict the current one, the distributions of

X and

Y should be, if not identical, relatively similar.

Thus, the two-sample Kolmogorov–Smirnov test is conducted on X and Y for each company in the dataset. Under the null hypothesis, X and Y are drawn from the same distribution. For brevity, the results of the test are omitted but available upon request. In the case of 1- and 5-year spreads, the null hypothesis is always rejected; for the 10-year spread, there are only two companies for which the test fails to reject the null hypothesis at 5% significance level. Given these results, it can be fairly concluded that the proposed model and estimation technique do not price the contemporaneous spread as the spread realized in the previous period.

To conclude, the sensible reduction in terms of underpricing may suggest that the compound option mechanism is better able to capture the default dynamics. Unfortunately [

3] do not analyze the compound option model in [

5], as it is not analytically tractable for their calibration approach. Better fits are only obtained by [

4]; however, their model with stochastic asset volatility and jumps is far more complicated to calibrate than the proposed compound option model of default.

Regardless of the better ability of the compound option model to produce credit spreads, the use of a cointegration mechanisms is also able to enhance the fit of the regressions on the spreads as compared with [

6] and other studies. For each firm

i, the adjusted-

s of the short-term adjustment is calculated and reported in

Table 10. Average adjusted-

s of 69%, 45% and 30% are obtained for 1-, 5- and 10-year spread changes. These numbers are significantly larger that the 26% (shot-maturity) and 21% (long-maturity) obtained by [

6]. The results in [

7] are not directly comparable, as the authors opt for regressing credit spread levels instead of changes onto similar sets of variables (still in levels). As the goodness to fit of the ECM model is evidently superior to the ones of a simple regression on changes, this provides extra evidence of the importance of a long-run equilibrium dynamic, which must be taken into account to correctly identify how credit spreads change.

Even when the implied volatility is used, the triplet spread, leverage, volatility still shows a statistically significant cointegration. However, using the average implied volatility of put options has a significant impact in the short-term adjustment dynamics: changes in the implied volatility are significant (at 10% significance level) only for the 1-year spread. Considering that most of equity options available in the market have maturity less than one year, the loss of significance for the 5- and 10-year spread should not surprise: the changes in the (short-term) implied volatility do not explain the reversion to the long-run equilibrium of medium- and long-term spreads. Nonetheless, the cointegration among the variables is still present, even though the model-implied volatility is replaced by the option-implied volatility.

These results, alongside the good pricing errors obtained via a compound option model of default, support the importance and ability of structural models in modeling the default as well as in explaining the level and changes of credit spreads.

Robustness Checks

Despite the proposed cointegration displaying much larger adjusted

s than previous works, the goodness of this approach is further investigated via principal components analysis (PCA), in a similar fashion to [

7]. However, it is worth highlighting that the PCA conducted herein is on the CDS spread changes, whilst [

7] do so on the levels. Based on the same arguments on the non-stationary of credit spreads discussed in the previous section, PCA should always be implemented on independent and identically distributed data (the changes) and not on random walks (the levels). Additionally, they look at raw credit spreads, whilst PCA requires demeaned variables to be used.

PCA aims at studying the extent to which the selected set of variables in (

13) captures systematic credit-spread variations. PCA is, in fact, an effective tool for analyzing the cross-sectional variation of the spread changes, thereby searching for common ‘factors’ (the components) which should affect credit spread changes regardless of firm-specific characteristics.

First, the first 10 principal components (PCs) from the demeaned credit spreads changes are extracted for both the 1-, 5-, and 10-year maturities.

Figure 4 shows the scree plots for the first 10 components. The spread changes for different maturities have similar principal components and display the kink around the 3rd/4th component. Overall, the first component explains 25–35% of the total variance of the spread changes; the second component explains around 15%; the third component explains around 10%; and the fourth component explains less then 10%. That is, in total, the first four components explain only about 60% of the total variance of the CDS spread changes. The fact that the first four component explain relatively little of the total variance points toward the possibility that variables influencing spread changes are firm-specific (as leverage and firm’s volatility) rather than systematic. This, alongside the successful cointegrating analysis, further supports the validity of the structural model of default to explain credit spreads.

These promising results could be, however, driven by over-fitting: as the volatility is obtained using the compound option model so to match the other market variables, the cointegrating mechanism could have been induced by the estimation methodology. In order to address this potential issue, the volatility estimated from the spread and the stock price is replaced by the option-implied volatility. More specifically, for each date, the option implied volatility surface is obtained from the most liquid out-of-the-money put options (i.e. out-of-the-money put options with daily trading volume above the annual mean volume), and their average is used. Option data are obtained from the OptionMetrics. The rational for focusing on put options is due to the fact part of the option skew displayed by equity option is attributable to the leverage effect ([

38]). Therefore, the information conveyed by the implied volatility in the put region may have some relevance for the pricing of credit risk ([

39]). Results are reported in

Table 11,

Table 12 and

Table 13.

Secondly, credit spread changes for each company are regressed on an increasing set of PCs. For each set of PCs, the average adjusted-

(and its standard deviation) are reported in

Table 14. Ref. [

7] reports simple

instead of its adjusted correction for the number of regressors. This is incorrect, as adding an extra regressor is likely to increase the

, but not the adjusted-

, even when the variable (here, the PC) is not statistically significant. Then, the same set of PCs is regressed onto the residuals of (

13). If the variables used to explain credit spread changes are not capturing systematic variations, large incremental adjusted-

should be found from the regression of the residuals.

In general, the average adjusted-

s of the regressions of PCs on both the spread changes and on the residual of the short-term adjustment (

13) are around 10%, thus signaling a very modest impact of systematic factors in explaining the cross-sectional variation of spread changes. The presence of a systematic factor related to the first principal components appears to be slightly more important for the medium- and long-term spreads. This could relate to how jump risk affect CDS spread changes for longer maturities. Perhaps using the change in the CBOE SKEW as a proxy for large jumps in the firms’ asset value is appropriate only when considering short-term spreads. This conjecture is based on the fact the average adjusted

of the regression of the first component onto the 5-year residuals is actually larger than the average adjusted

of the regression on the changes. Somehow, the short-term adjustment regression induces systematic risk in the residuals: the main difference between regression (

13) estimated on the 5- and 10-year spread changes is the impact of the jumps, whose estimated coefficients also display the opposite sign. Alternatively, there is a systematic factor which the model is ignoring. This could be a liquidity factor for the CDS market; however, it would account only for a very small fraction of the cross-sectional variation of the CDS spread changes of longer maturities.

As last robustness check, the error correction parametrization in (

13) is re-estimated for different values of the loss given default (60% and 80%). For the sake of brevity, the estimates are not reported but are available upon request. All the conclusions obtained in the previous section remain valid.

6. Conclusions

This paper develops a new estimation technique for the unobservable firm’s asset value and volatility which relies only on the observable equity value, risk-neutral probability of default and the face value of the firm’s debt.

The estimated parameters are first used to test the ability of model to reprice CDS spreads, out of sample. The pricing errors produced by the compound option model of default are then compared with those generated by the structural models in [

3]. The compound option model sensibly outperforms the other models, being able to reduce the pricing error by almost 90%.

Secondly, the estimated parameters are used to investigate the existence of cointegration between credit spreads and those variables which structural models of default predict as driving their level. Estimations confirm the presence of an error-correction mechanism which leads to a long-equilibrium between the level of the spreads, financial leverage and the volatility of the firm’s equity. Once the cointegration equation is accounted for, the goodness to fit of the regressions on the changes improves substantially compared to previous studies. Finally, principal component analysis is employed to study the cross-sectional variation of credit spread changes.

Moreover, this work is the first to document the cointegration between CDS spreads, financial leverage and the firm’s risk in a large panel of US firms. Once the cointegration equation is added to the regressions on credit spread changes, the selected variables do explain quite well their variation. Consistently with previous findings and the economic intuition, it is shown that short-term spreads react more quickly to shocks to the long-run equilibrium, and that jumps affect short- and long-term spreads differently. Additionally, most of the variation in the cross-section appears to be driven by firm-specific characteristics rather than systematic factors.

One of the clear limitation of this work is related to the assumptions of the compound option model. In particular, the reference firm is assumed to default only at known discrete times which coincide with the reimbursement dates of the bonds outstanding. Furthermore, the exact amount of debt due at these future dates must be known (or sensibly approximated). As explained in

Section 3.4, the maturities of the firm’s debt, as well as the aggregation scheme of the firm’s liabilities, had to be calibrated. The proposed calibration, though based on the ability of the compound option model to price the spreads, is somehow arbitrary, even though other calibration schemes were tested, showing that the results are robust. Finally, it would be interesting to relax the model assumption on the static capital structure: in fact, the firm is not allowed to modify its leverage throughout its lifetime. In the interests of brevity, these extensions are best left for future research.