Insurance Premium Determination Model and Innovation for Economic Recovery Due to Natural Disasters in Indonesia

Abstract

:1. Introduction

2. Materials and Methods

2.1. Research Methods and Data

2.2. Statistical Analysis

2.3. Basic Model of Disaster Insurance with Subsidies

3. Results and Discussion

3.1. Development of a Disaster Insurance Model with Subsidies

- (a)

- countableThus, for obtained .

- (b)

- can be calculated byIt can be calculated for the left limit, i.e.,Meanwhile, the right limit is

- (c)

- On the basis of the results obtained in terms (a) and (b), it can be seen that

- (a)

- countableThus, for obtained .

- (b)

- can be calculated byIt can be calculated for the left limit, i.e.,Meanwhile, the right limit is

- (c)

- On the basis of the results obtained in terms (a) and (b), it can be seen that

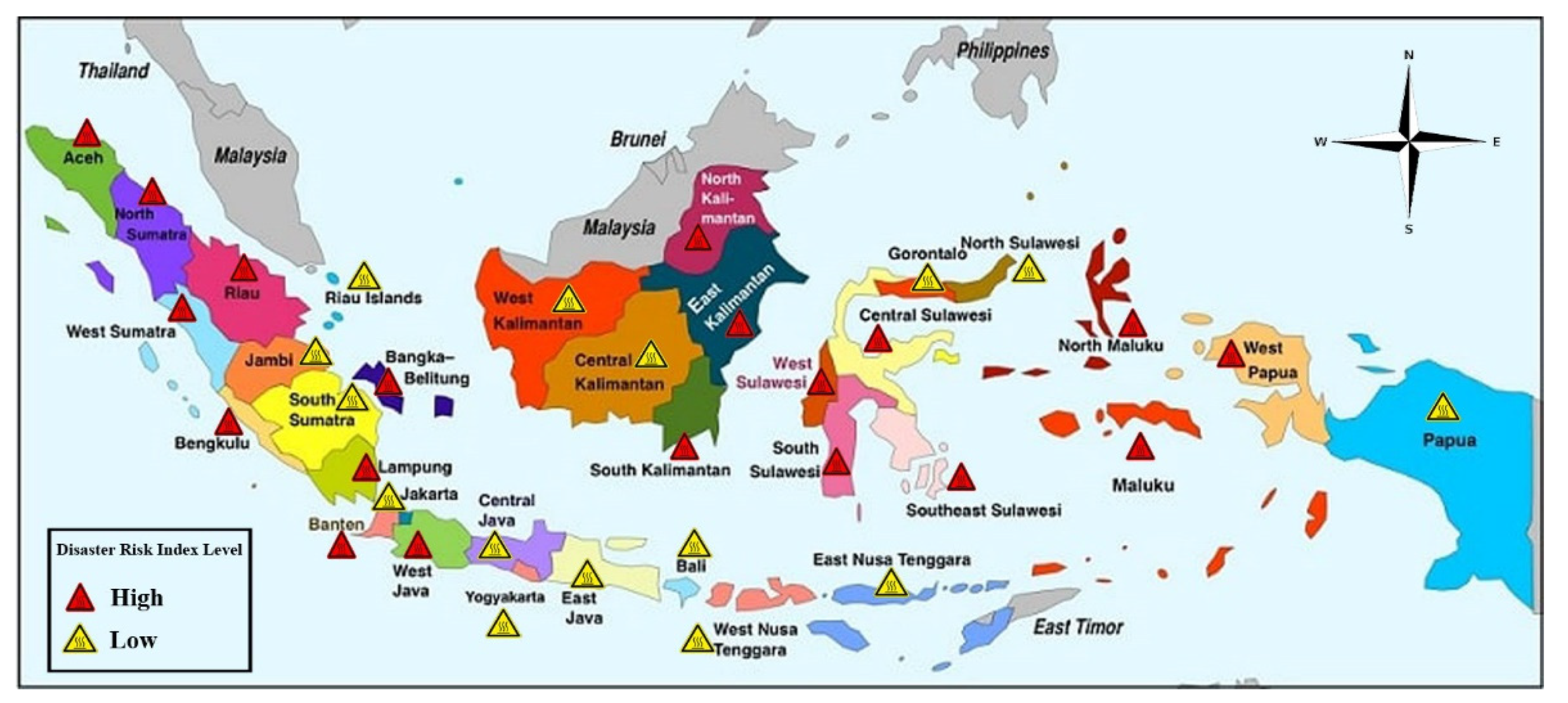

3.2. Disaster Insurance Data Analysis with Subsidies

4. Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Rosenberg, H.; Errett, N.A.; Eisenman, D.P. Working with disaster-affected communities to envision healthier futures: A trauma-informed approach to post-disaster recovery planning. Int. J. Environ. Res. Public Health 2022, 19, 1723. [Google Scholar] [CrossRef] [PubMed]

- Kalfin; Sukono; Supian, S.; Mamat, M. Insurance as an Alternative for Sustainable Economic Recovery after Natural Disasters: A Systematic Literature Review. Sustainability 2022, 14, 4349. [Google Scholar] [CrossRef]

- Chaudhary, M.T.; Piracha, A. Natural Disasters—Origins, Impacts, Management. Encyclopedia 2021, 1, 1101–1131. [Google Scholar] [CrossRef]

- Rivera, D.Z. Disaster colonialism: A commentary on disasters beyond singular events to structural violence. Int. J. Urban Reg. Res. 2022, 46, 126–135. [Google Scholar] [CrossRef]

- Munyai, R.B.; Chikoore, H.; Musyoki, A.; Chakwizira, J.; Muofhe, T.P.; Xulu, N.G.; Manyanya, T.C. Vulnerability and Adaptation to Flood Hazards in Rural Settlements of Limpopo Province, South Africa. Water 2021, 13, 3490. [Google Scholar] [CrossRef]

- Uddin, M.S.; Haque, C.E.; Khan, M.N.; Doberstein, B.; Cox, R.S. Disasters threaten livelihoods, and people cope, adapt and make transformational changes”: Community resilience and livelihoods reconstruction in coastal communities of Bangladesh. Int. J. Disaster Risk Reduct. 2021, 63, 102444. [Google Scholar] [CrossRef]

- Bhowmik, J.; Irfanullah, H.; Selim, S.A. Empirical evidence from Bangladesh of assessing climate hazard-related loss and damage and state of adaptive capacity to address them. Clim. Risk Manag. 2021, 31, 100273. [Google Scholar] [CrossRef]

- Parven, A.; Pal, I.; Witayangkurn, A.; Pramanik, M.; Nagai, M.; Miyazaki, H.; Wuthisakkaroon, C. Impacts of disaster and land-use change on food security and adaptation: Evidence from the delta community in Bangladesh. Int. J. Disaster Risk Reduct. 2022, 78, 103119. [Google Scholar] [CrossRef]

- Guo, J.; Liu, H.; Wu, X.; Gu, J.; Song, S.; Tang, Y. Natural disasters, economic growth and sustainable development in china―an empirical study using provincial panel data. Sustainability 2015, 7, 16783–16800. [Google Scholar] [CrossRef]

- Noy, I.; Yonson, R. Economic vulnerability and resilience to natural hazards: A survey of concepts and measurements. Sustainability 2018, 10, 2850. [Google Scholar] [CrossRef] [Green Version]

- Tesselaar, M.; Botzen, W.J.W.; Aerts, J.C. Impacts of climate change and remote natural catastrophes on EU flood insurance markets: An analysis of soft and hard reinsurance markets for flood coverage. Atmosphere 2020, 11, 146. [Google Scholar] [CrossRef]

- Adeagbo, A.; Daramola, A.; Carim-Sanni, A.; Akujobi, C.; Ukpong, C. Effects of natural disasters on social and economic well being: A study in Nigeria. Int. J. Disaster Risk Reduct. 2016, 17, 1–12. [Google Scholar] [CrossRef]

- Xie, W.; Rose, A.; Li, S.; He, J.; Li, N.; Ali, T. Dynamic economic resilience and economic recovery from disasters: A quantitative assessment. Risk Anal. 2018, 38, 1306–1318. [Google Scholar] [CrossRef]

- Zhang, H.; Dolan, C.; Jing, S.M.; Uyimleshi, J.; Dodd, P. Bounce forward: Economic recovery in post-disaster Fukushima. Sustainability 2019, 11, 6736. [Google Scholar] [CrossRef]

- Cheng, L.; Zhang, J. Is tourism development a catalyst of economic recovery following natural disaster? An analysis of economic resilience and spatial variability. Curr. Issues Tour. 2020, 23, 2602–2623. [Google Scholar] [CrossRef]

- Nugroho, A.; Takahashi, M.; Masaya, I. Village fund asymmetric information in disaster management: Evidence from village level in Banda Aceh City. In IOP Conference Series: Earth and Environmental Science; IOP Publishing: Bristol, UK, 2021; Volume 630, p. 012011. [Google Scholar]

- Winarni, L.N.; Dewi, C.I.D.L.; Raka, A.A.G.; Widanti, N.P.T. The Legal Politic in Countermeasure the Crime in Funding and Management of Disaster Assistance. Sociol. Jurisprud. J. 2021, 4, 31–38. [Google Scholar] [CrossRef]

- Boediningsih, W.; Afdol, S.H.; Winandi, W.; Suwardi, S.H.; Hum, M. Appropriate Natural Disaster Management Policy in Guarantee Accuracy of Target Post Disaster Assistance. Prizren Soc. Sci. J. 2019, 3, 79–87. [Google Scholar] [CrossRef]

- Scholz, W.; Stober, T.; Sassen, H. Are urban planning schools in the global South prepared for current challenges of climate change and disaster risks? Sustainability 2021, 13, 1064. [Google Scholar] [CrossRef]

- Kawasaki, H.; Yamasaki, S.; Yamakido, M.; Murata, Y. Introductory Disaster Training for Aspiring Teachers: A Pilot Study. Sustainability 2022, 14, 3492. [Google Scholar] [CrossRef]

- Lestari, F.; Paramitasari, D.; Kadir, A.; Firdausi, N.A.; Fatmah, A.; Hamid, A.; Suparni, Y.; El-Matury, H.J.; Wijaya, O.; Ismiyati, A. The Application of Hospital Safety Index for Analyzing Primary Healthcare Center (PHC) Disaster and Emergency Preparedness. Sustainability 2022, 14, 1488. [Google Scholar] [CrossRef]

- Rizqillah, A.F.; Suna, J. Indonesian emergency nurses’ preparedness to respond to disaster: A descriptive survey. Australas. Emerg. Care 2018, 21, 64–68. [Google Scholar] [CrossRef] [PubMed]

- Izumi, T.; Shaw, R.; Djalante, R.; Ishiwatari, M.; Komino, T. Disaster risk reduction and innovations. Prog. Disaster Sci. 2019, 2, 100033. [Google Scholar] [CrossRef]

- Meilani, N.L.; Hardjosoekarto, S. Digital weberianism bureaucracy: Alertness and disaster risk reduction (DRR) related to the Sunda Strait volcanic tsunami. Int. J. Disaster Risk Reduct. 2020, 51, 101898. [Google Scholar] [CrossRef]

- Priyono, A.; Moin, A.; Putri, V. Identifying digital transformation paths in the business model of SMEs during the COVID-19 pandemic. J. Open Innov. Technol. Mark. Complex. 2020, 6, 104. [Google Scholar] [CrossRef]

- Gao, W.; Guo, Y.; Jiang, F. Playing for a resilient future: A serious game designed to explore and understand the complexity of the interaction among climate change, disaster risk, and urban development. Int. J. Environ. Res. Public Health 2021, 18, 8949. [Google Scholar] [CrossRef]

- Tuhkanen, H.; Boyland, M.; Han, G.; Patel, A.; Johnson, K.; Rosemarin, A.; Mangada, L.L. A typology framework for trade-offs in development and disaster risk reduction: A case study of typhoon Haiyan recovery in Tacloban, Philippines. Sustainability 2018, 10, 1924. [Google Scholar] [CrossRef]

- Sukono, S.; Kalfin, K.; Riaman, R.; Supian, S.; Hidayat, Y.; Saputra, J.; Mamat, M. Determination of the natural disaster insurance premiums by considering the mitigation fund reserve decisions: An application of collective risk model. Decis. Sci. Lett. 2022, 11, 211–222. [Google Scholar] [CrossRef]

- Marchal, R.; Piton, G.; Lopez-Gunn, E.; Zorrilla-Miras, P.; van der Keur, P.; Dartée, K.W.J.; Pengal, P.; Matthews, J.H.; Tacnet, J.-M.; Graveline, N.; et al. The (Re)Insurance Industry’s Roles in the Integration of Nature-Based Solutions for Prevention in Disaster Risk Reduction—Insights from a European Survey. Sustainability 2019, 11, 6212. [Google Scholar] [CrossRef]

- Luu, C.; von Meding, J.; Mojtahedi, M. Analyzing Vietnam’s national disaster loss database for flood risk assessment using multiple linear regression-TOPSIS. Int. J. Disaster Risk Reduct. 2019, 40, 101153. [Google Scholar] [CrossRef]

- Chen, Y.; Li, J.; Chen, A. Does high risk mean high loss: Evidence from flood disaster in southern China. Sci. Total Environ. 2021, 785, 147127. [Google Scholar] [CrossRef]

- Daly, P.; Mahdi, S.; McCaughey, J.; Mundzir, I.; Halim, A.; Srimulyani, E. Rethinking relief, reconstruction and development: Evaluating the effectiveness and sustainability of postdisaster livelihood aid. Int. J. Disaster Risk Reduct. 2020, 49, 101650. [Google Scholar] [CrossRef]

- Alfieri, L.; Dottori, F.; Betts, R.; Salamon, P.; Feyen, L. Multi-model projections of river flood risk in Europe under global warming. Climate 2018, 6, 6. [Google Scholar] [CrossRef]

- Sloggy, M.R.; Suter, J.F.; Rad, M.R.; Manning, D.T.; Goemans, C. Changing climate, changing minds? The effects of natural disasters on public perceptions of climate change. Clim. Chang. 2021, 168, 25. [Google Scholar] [CrossRef]

- Bao, X.; Zhang, F.; Deng, X.; Xu, D. Can trust motivate farmers to purchase natural disaster insurance? Evidence from earthquake-stricken areas of Sichuan, China. Agriculture 2021, 11, 783. [Google Scholar] [CrossRef]

- Lo, A.Y. The role of social norms in climate adaptation: Mediating risk perception and flood insurance purchase. Glob. Environ. Chang. 2013, 23, 1249–1257. [Google Scholar] [CrossRef]

- Atreya, A.; Ferreira, S.; Michel-Kerjan, E. What drives households to buy flood insurance? New evidence from Georgia. Ecol. Econ. 2015, 117, 153–161. [Google Scholar] [CrossRef]

- Xu, D.; Liu, E.; Wang, X.; Tang, H.; Liu, S. Rural households’ livelihood capital, risk perception, and willingness to purchase earthquake disaster insurance: Evidence from southwestern China. Int. J. Environ. Res. Public Health 2018, 15, 1319. [Google Scholar] [CrossRef]

- Terdpaopong, K.; Rickards, R. Thai non-life insurance companies’ resilience and the historic 2011 floods: Some recommendations for greater sustainability. Sustainability 2021, 13, 8890. [Google Scholar] [CrossRef]

- Hanson, S.G.; Sunderam, A.; Zwick, E. Business Continuity Insurance in the Next Disaster. University of Chicago, Becker Friedman Institute for Economics Working Paper. 2021, pp. 52–77. Available online: http://ww.ericzwick.com/bci_aspen/bci_aspen.pdf (accessed on 2 June 2022).

- Kalfin; Sukono; Supian, S.; Mamat, M. Mitigation and models for determining premiums for natural disaster insurance due to excessive rainfall. J. Phys. Conf. Ser. 2021, 1722, 012058. [Google Scholar] [CrossRef]

- Dubelmar, D.; Kartini, M.A.D.; Mareli, S.; Soedarno, M. Natural Disaster Insurance Policy in Indonesia: Proposing an Institutional Design. In Asia-Pacific Research in Social Sciences and Humanities Universitas Indonesia Conference (APRISH 2019); Atlantis Press: Amsterdam, The Netherlands, 2021; pp. 277–284. [Google Scholar]

- Kovacevic, R.M.; Semmler, W. Poverty traps and disaster insurance in a bi-level decision framework. In Dynamic Economic Problems with Regime Switches; Springer: Cham, Switzerland, 2020; pp. 57–83. [Google Scholar]

- Picard, P. Natural Disaster Insurance and the Equity-Efficiency Trade-Off. J. Risk Insur. 2008, 75, 17–38. [Google Scholar] [CrossRef]

- Wang, M.; Liao, C.; Yang, S.; Zhao, W.; Liu, M.; Shi, P. Are people willing to buy natural disaster insurance in China? Risk awareness, insurance acceptance, and willingness to pay. Risk Anal. 2012, 32, 1717–1740. [Google Scholar] [CrossRef] [PubMed]

- Oktora, S.I.; Wulansari, I.Y.; Siagian, T.H.; Laksono, B.C.; Sugiandewi, N.N.R.; Anindita, N. Identifying the potential participation in natural disaster insurance: First attempt based on a national socio-economic survey in Indonesia. International Journal of Disaster Resilience in the Built Environment. Int. J. Disaster Resil. Built. Environ. 2022. ahead-of-print. [Google Scholar] [CrossRef]

- Aidi, Z.; Farida, H. Natural disaster insurance for Indonesia disaster management. Adv. Environ. Sci. 2020, 12, 137–145. [Google Scholar]

- Badan Nasional Penanggulangan Bencana (BNPB). Geoportan Data Bencana Indonesia. Available online: https://gis.bnpb.go.id/ (accessed on 21 May 2022).

- Badan Nasional Penanggulangan Bencana (BNPB). Indeks Risiko Bencana Indonesia. Available online: https://inarisk.bnpb.go.id/ (accessed on 1 June 2022).

- Đurić, Z. Collective risk model in non-life insurance. Ekon. Horiz. 2013, 15, 15–163. [Google Scholar]

- Bulut, H. Managing catastrophic risk in agriculture through ex ante subsidized insurance or ex post disaster aid. J. Agric. Resour. Econ. 2017, 42, 406–426. [Google Scholar]

- Cai, J.; Alain, J.; Elisabeth, S. Subsidy Policies and Insurance Demand. Am. Econ. Rev. 2020, 110, 2422–2453. [Google Scholar] [CrossRef]

- McAneney, J.; McAneney, D.; Musulin, R.; Walker, G.; Crompton, R. Government-sponsored natural disaster insurance pools: A view from down-under. Int. J. Disaster Risk Reduct. 2016, 15, 1–9. [Google Scholar] [CrossRef]

- Weiss, M.A.; Tennyson, S.; Regan, L. The effects of regulated premium subsidies on insurance costs: An empirical analysis of automobile insurance. J. Risk Insur. 2010, 77, 597–624. [Google Scholar] [CrossRef]

- Liu, F.; Xu, E.; Zhang, H. An improved typhoon risk model coupled with mitigation capacity and its relationship to disaster losses. J. Clean. Prod. 2022, 357, 131913. [Google Scholar] [CrossRef]

- Santos, F.P.; Pacheco, J.M.; Santos, F.C.; Levin, S.A. Dynamics of informal risk sharing in collective index insurance. Nat. Sustain. 2021, 4, 426–432. [Google Scholar] [CrossRef]

- Sidi, P.; Mamat, M.; Sukono; Supian, S. Supply and demand analysis for flood insurance by using logistic regression model: Case study at Citarum watershed in South Bandung, West Java, Indonesia. In IOP Conference Series: Materials Science and Engineering; IOP Publishing: Bristol, UK, 2017; Volume 166, p. 012002. [Google Scholar]

- Gignoux, J.; Menéndez, M. Benefit in the wake of disaster: Long-run effects of earthquakes on welfare in rural Indonesia. J. Dev. Econ. 2016, 118, 26–44. [Google Scholar] [CrossRef] [Green Version]

| High-Risk Area | Low-Risk Area | ||

|---|---|---|---|

| Province | Proportion | Province | Proportion |

| West Sulawesi | 0.58670645 | DI Yogyakarta | 0.496598432 |

| Bengkulu | 0.570883806 | East Southeast Nusa | 0.496492713 |

| Bangka Belitung Islands | 0.569262778 | North Sulawesi | 0.49148867 |

| Maluku | 0.565738804 | South Sumatra | 0.490678156 |

| South Sulawesi | 0.562038631 | Jambi | 0.488563771 |

| Southeast Sulawesi | 0.555801197 | West Kalimantan | 0.488035175 |

| Banten | 0.545757871 | East Java | 0.473586881 |

| East Kalimantan | 0.542762493 | Central Java | 0.468653317 |

| North Kalimantan | 0.541352903 | Central Kalimantan | 0.467631365 |

| Aceh | 0.541211944 | Bali | 0.45610797 |

| West Sumatra | 0.526939849 | West Southeast Nusa | 0.451244885 |

| Riau | 0.518975668 | Gorontalo | 0.446276082 |

| Lampung | 0.51724892 | Papua | 0.433096419 |

| West Java | 0.513830666 | Riau Islands | 0.410190587 |

| North Maluku | 0.51319635 | DKI Jakarta | 0.225604823 |

| North Sumatra | 0.511610562 | ||

| Central Sulawesi | 0.510835288 | ||

| South Kalimantan | 0.510800048 | ||

| West Papua | 0.510796524 | ||

| Disaster Risk Index | Expectation | Std. Deviation | Variance |

|---|---|---|---|

| Occurrence frequency (N) | 2562.0000 | 1587.41120 | 2562.0000 |

| Economic loss (X) | 42,066,867,692 | 47,804,880,752.85 | 2.28531 × 1021 |

| High-Risk Area Insurance Premium | Low-Risk Area Insurance Premium | ||

|---|---|---|---|

| Province | Premium (IDR) | Province | Premium (IDR) |

| West Sulawesi | 63,240,023,161,914 | DI Yogyakarta | 53,574,174,368,079 |

| Bengkulu | 61,535,398,353,842 | East Southeast Nusa | 53,562,775,998,193 |

| Bangka Belitung Islands | 61,360,759,732,080 | North Sulawesi | 53,023,253,156,946 |

| Maluku | 60,981,110,554,336 | South Sumatra | 52,935,865,654,491 |

| South Sulawesi | 60,582,478,917,705 | Jambi | 52,707,898,256,781 |

| Southeast Sulawesi | 59,910,499,873,097 | West Kalimantan | 52,650,906,407,353 |

| Banten | 58,828,499,716,526 | East Java | 51,093,129,189,669 |

| East Kalimantan | 58,505,797,915,444 | Central Java | 50,561,205,261,679 |

| North Kalimantan | 58,353,938,244,346 | Central Kalimantan | 50,451,021,019,453 |

| Aceh | 58,338,752,277,236 | Bali | 49,208,598,701,934 |

| West Sumatra | 56,801,173,107,372 | West Southeast Nusa | 48,684,273,687,201 |

| Riau | 55,943,165,965,670 | Gorontalo | 48,148,550,302,583 |

| Lampung | 55,757,137,868,576 | Papua | 46,727,553,523,525 |

| West Java | 55,388,878,166,164 | Riau Islands | 44,257,906,715,001 |

| North Maluku | 55,320,541,314,170 | DKI Jakarta | 24,356,352,894,928 |

| North Sumatra | 55,149,699,184,185 | ||

| Central Sulawesi | 55,066,176,365,081 | ||

| South Kalimantan | 55,062,379,873,304 | ||

| West Papua | 55,062,000,224,126 | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kalfin; Sukono; Supian, S.; Mamat, M. Insurance Premium Determination Model and Innovation for Economic Recovery Due to Natural Disasters in Indonesia. Computation 2022, 10, 174. https://doi.org/10.3390/computation10100174

Kalfin, Sukono, Supian S, Mamat M. Insurance Premium Determination Model and Innovation for Economic Recovery Due to Natural Disasters in Indonesia. Computation. 2022; 10(10):174. https://doi.org/10.3390/computation10100174

Chicago/Turabian StyleKalfin, Sukono, Sudradjat Supian, and Mustafa Mamat. 2022. "Insurance Premium Determination Model and Innovation for Economic Recovery Due to Natural Disasters in Indonesia" Computation 10, no. 10: 174. https://doi.org/10.3390/computation10100174

APA StyleKalfin, Sukono, Supian, S., & Mamat, M. (2022). Insurance Premium Determination Model and Innovation for Economic Recovery Due to Natural Disasters in Indonesia. Computation, 10(10), 174. https://doi.org/10.3390/computation10100174