Research on Price Prediction of Stock Price Index Based on Combination Method with Introduction of Options Market Information

Abstract

1. Introduction

2. Theoretical Framework

2.1. Logical Framework of Combination Method

2.2. Technical Approaches Within the Logical Framework of the Combination Method

2.2.1. Options Pricing Formula

2.2.2. CEEMDAN

2.2.3. BP Neural Network

3. Price Prediction Based on Combination Method

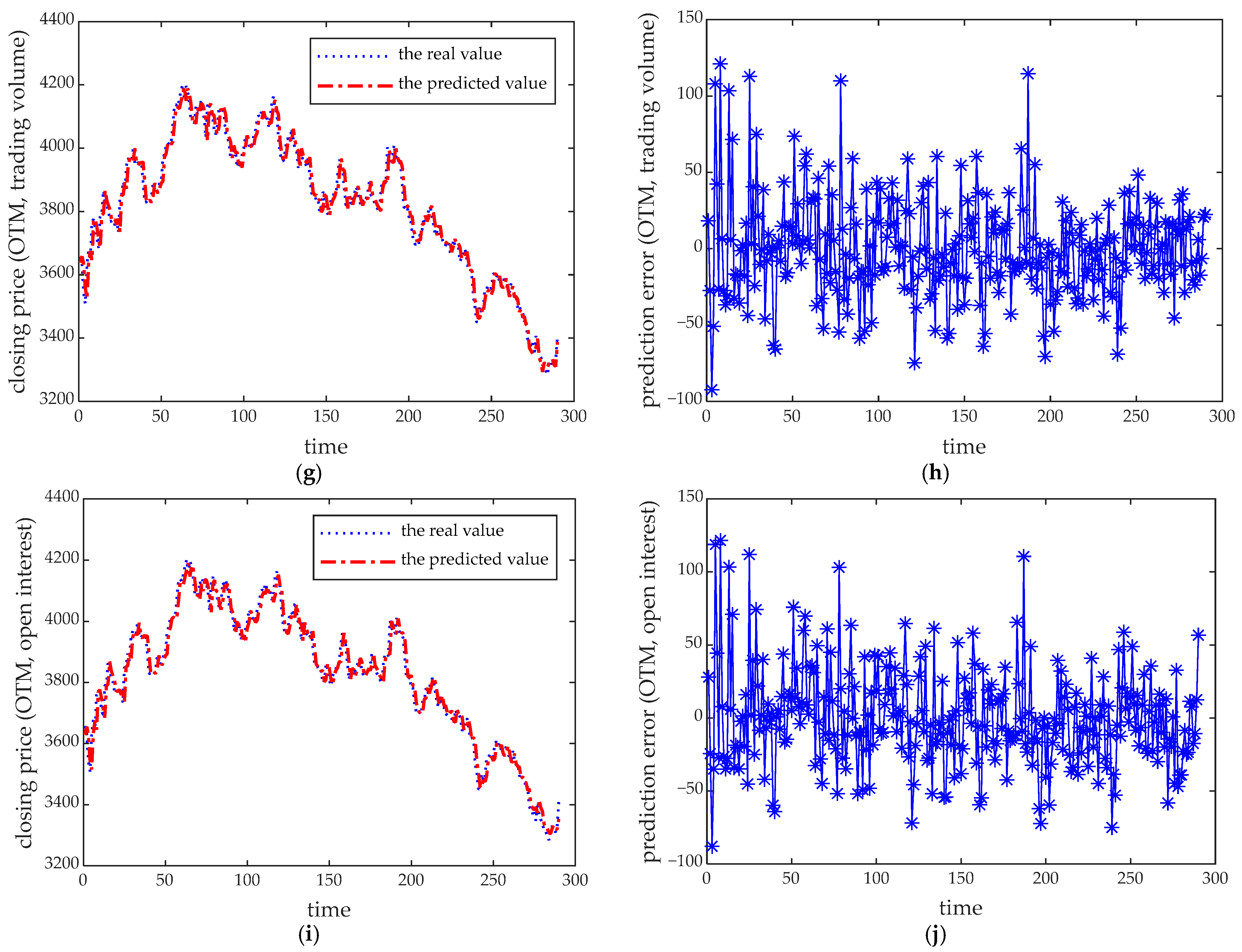

3.1. Price Prediction Based on the Original Time Series with Options Market Information

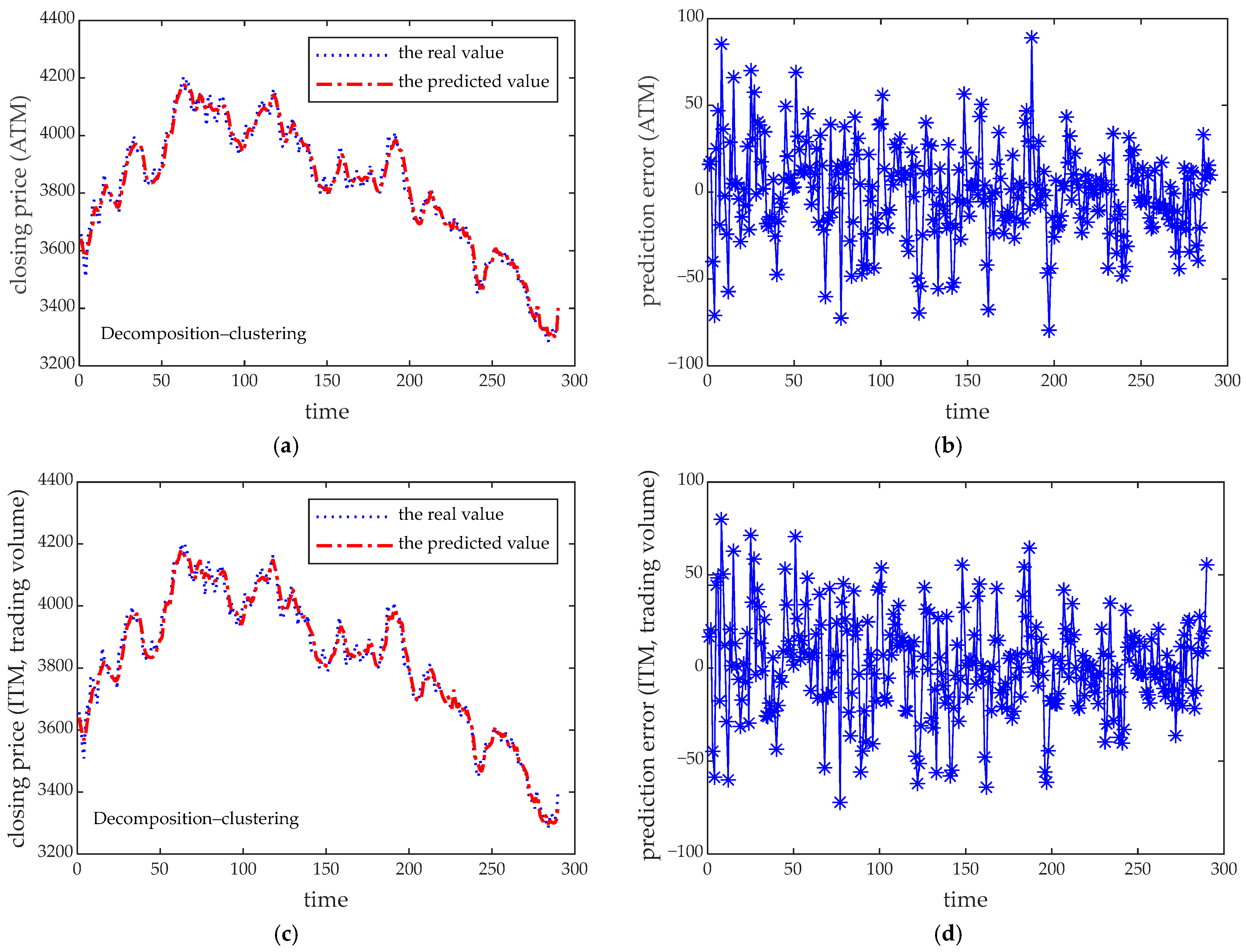

3.2. Optimization of Prediction Effect Based on Decomposition–Clustering Method

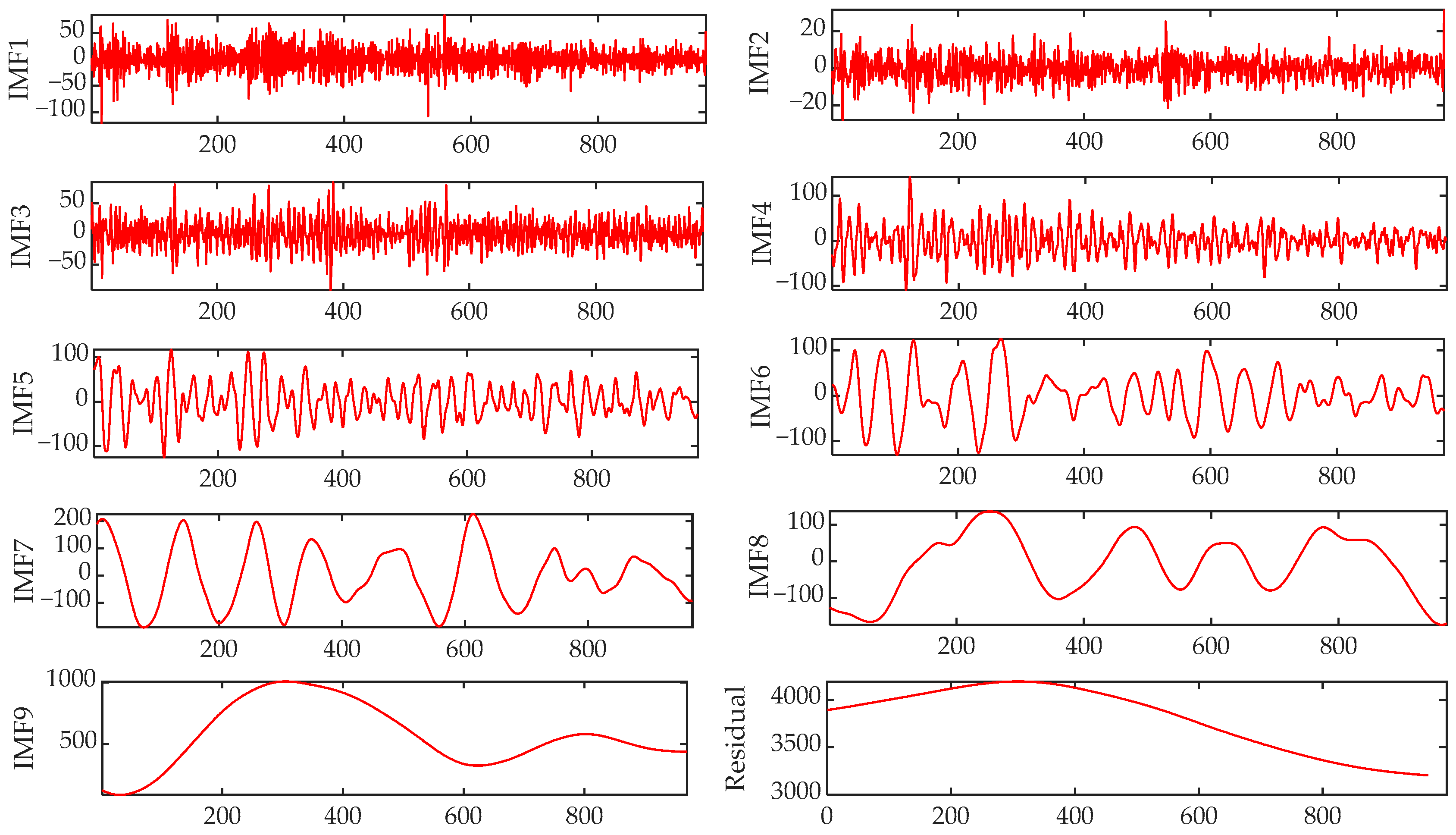

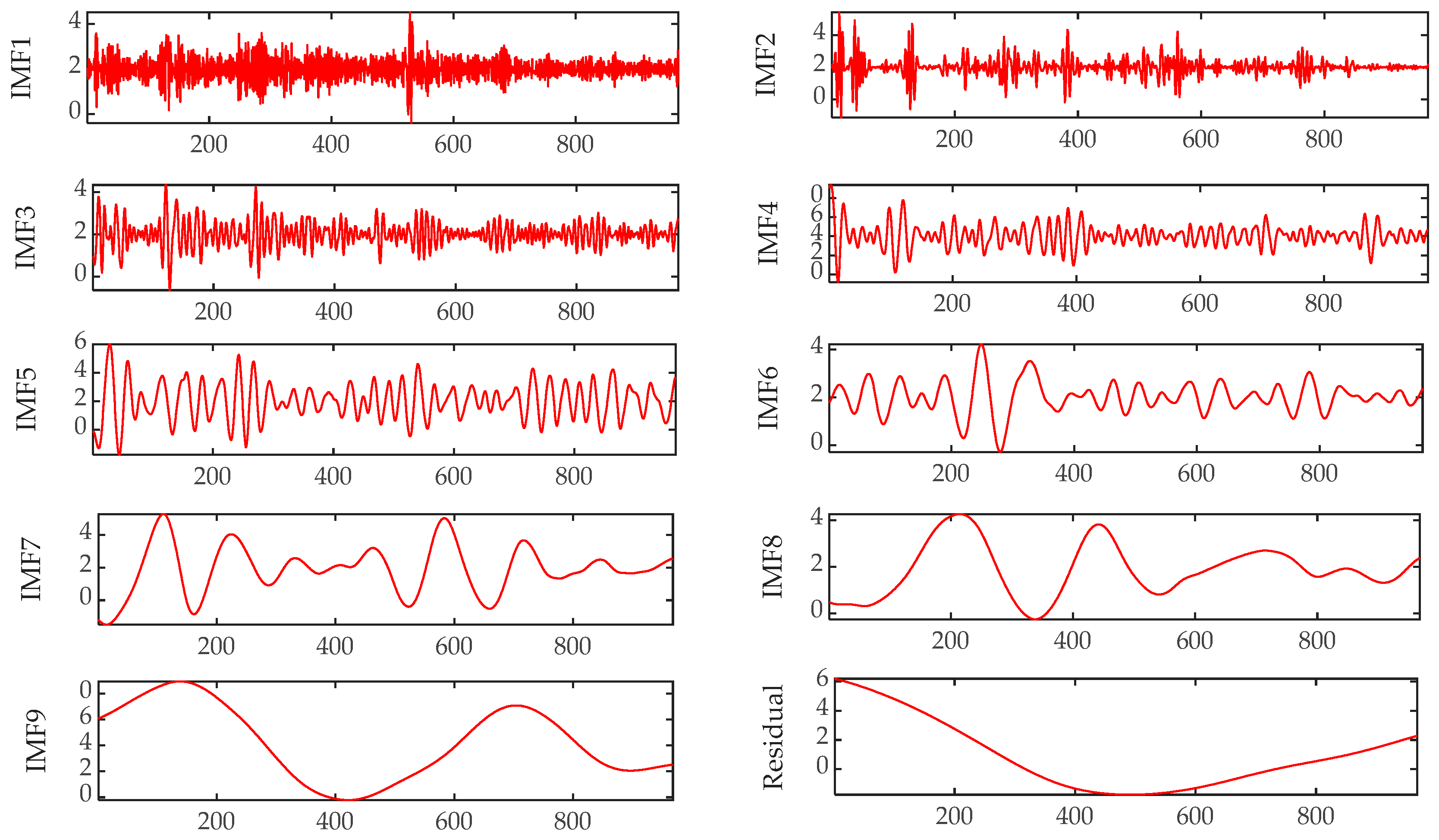

3.2.1. Decomposition and Clustering of Time Series

3.2.2. Optimization Results and Comparative Analysis Based on the Decomposition–Clustering Method

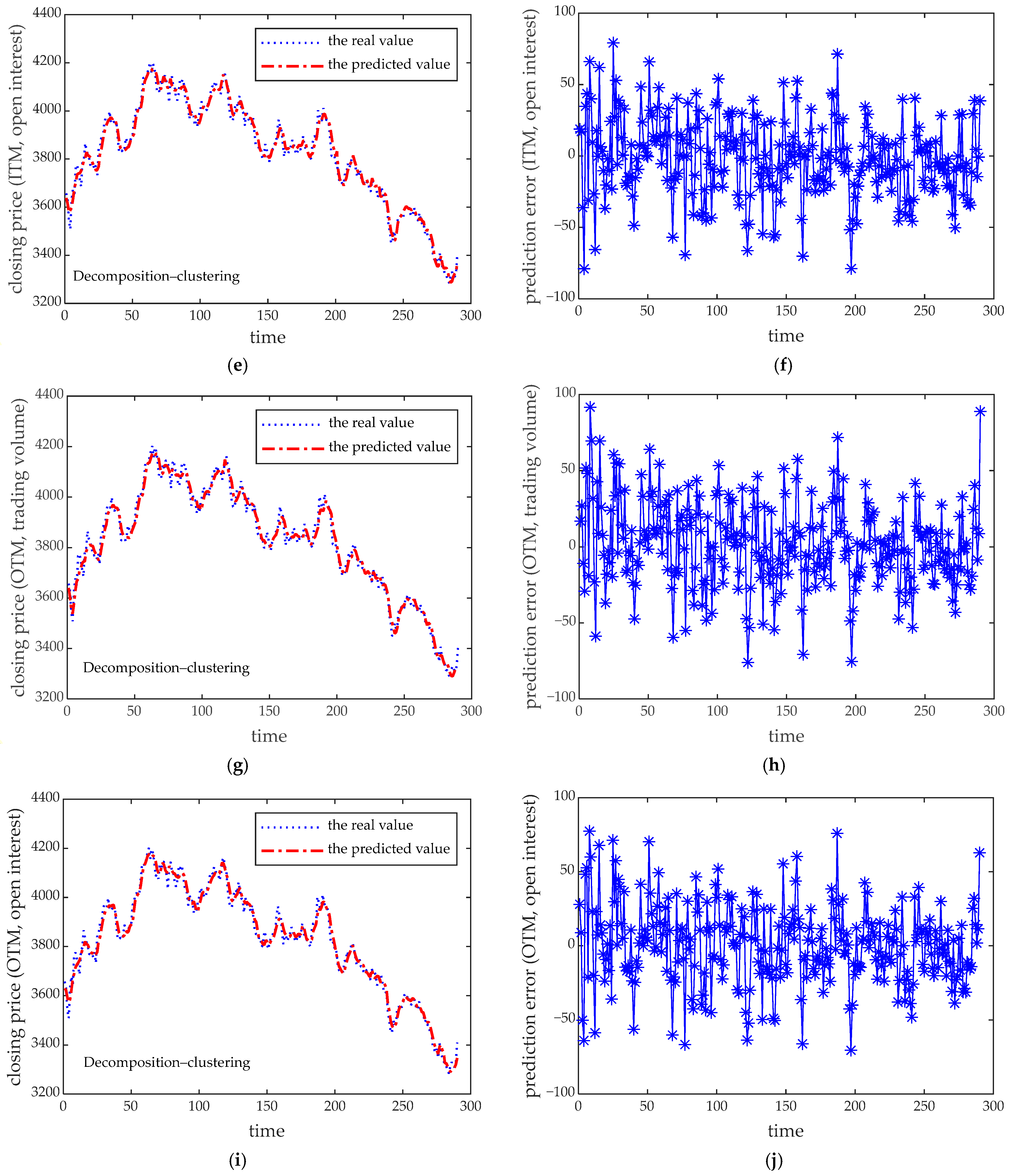

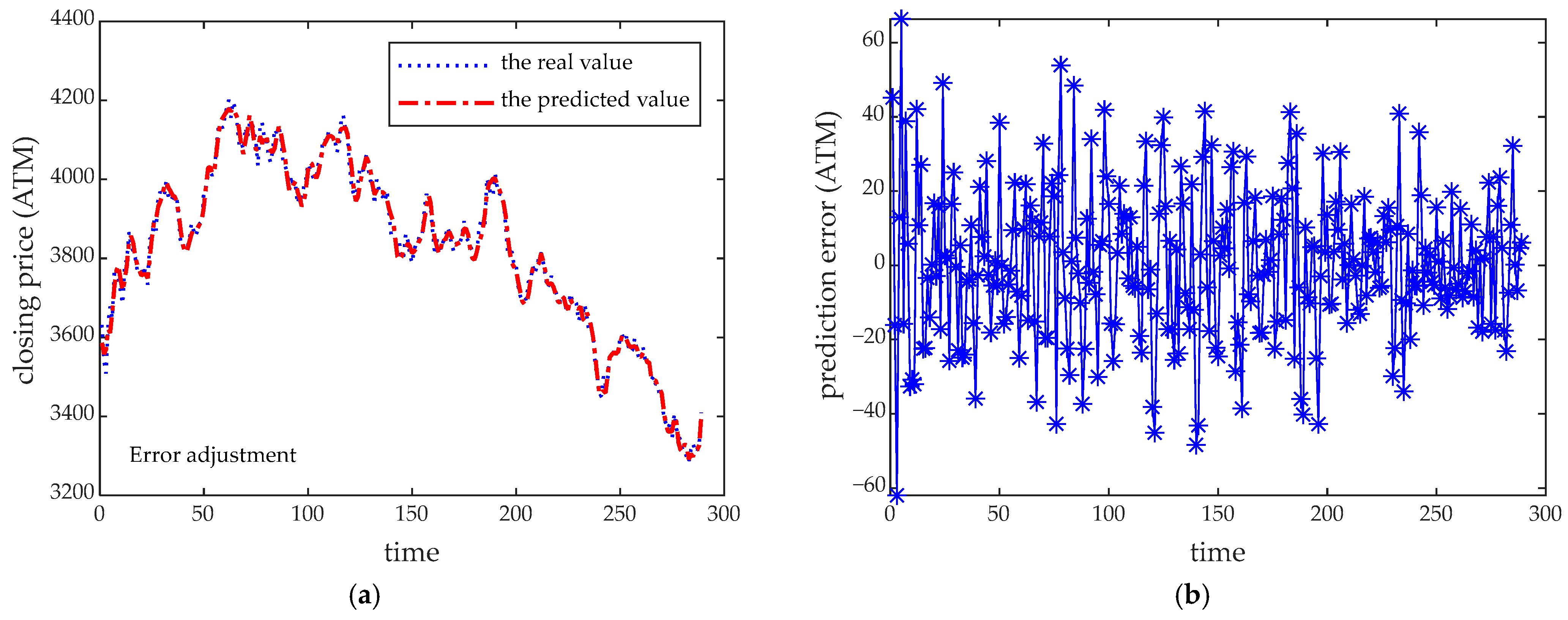

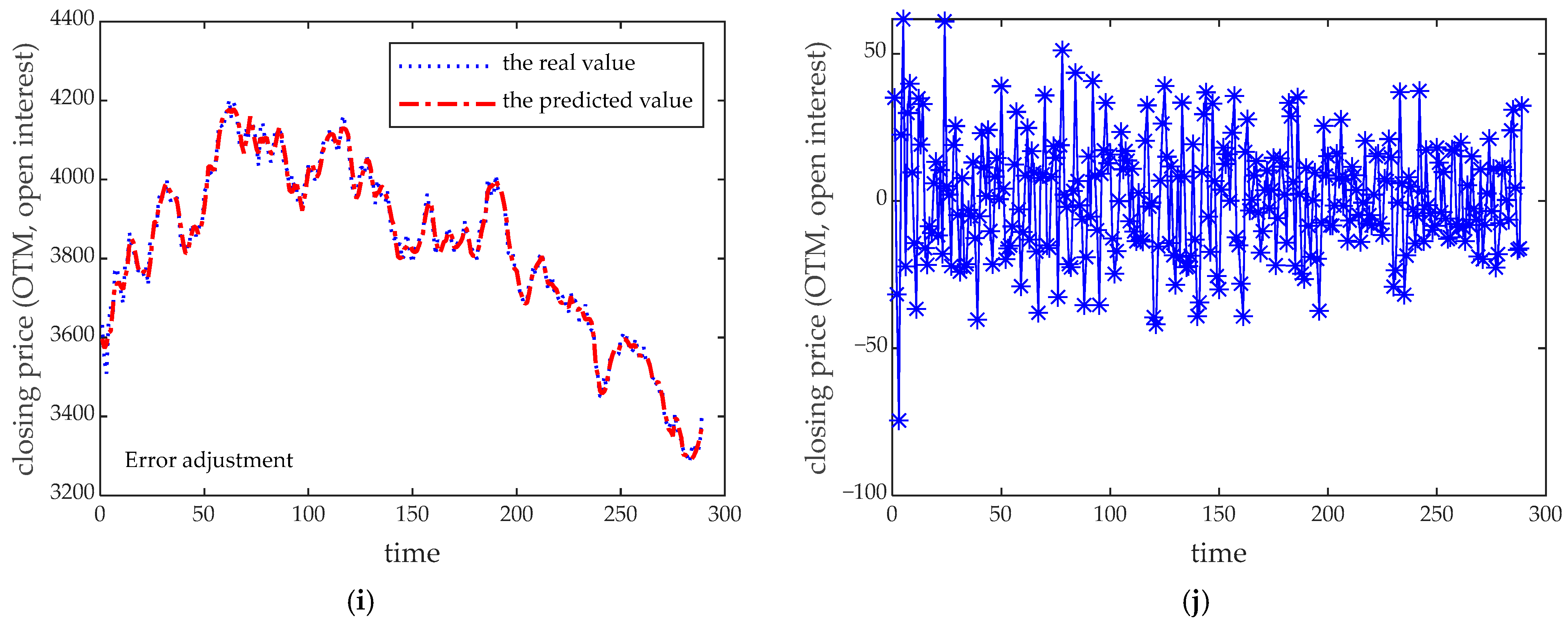

3.3. Optimization of Prediction Effect Based on Error Adjustment Method

3.3.1. Decomposition and Clustering of Prediction Error Information

3.3.2. Optimization Results and Comparative Analysis Based on the Error Adjustment Method

3.4. Optimization of Prediction Effects Based on the Weighted Integration Method

4. Summary

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Patel, J.; Shah, S.; Thakkar, P.; Kotecha, K. Predicting stock and stock price index movement using trend deterministic data preparation and machine learning techniques. Expert Syst. Appl. 2015, 42, 259–268. [Google Scholar] [CrossRef]

- You, S.D.; Liu, C.H.; Chen, W.K. Comparative study of singing voice detection based on deep neural networks and ensemble learning. Hum.-Centric Comput. Inf. Sci. 2018, 8, 34. [Google Scholar] [CrossRef]

- Cao, H.; Lin, T.; Li, Y.; Zhang, H. Stock price pattern prediction based on complex network and machine learning. Complexity 2019, 2019, 4132485. [Google Scholar] [CrossRef]

- Parray, I.R.; Khurana, S.S.; Kumar, M.; Altalbe, A.A. Time series data analysis of stock price movement using machine learning techniques. Soft Comput. 2020, 24, 16509–16517. [Google Scholar] [CrossRef]

- Chen, W.; Zhang, H.; Mehlawat, M.K.; Jia, L. Mean–variance portfolio optimization using machine learning-based stock price prediction. Appl. Soft Comput. 2021, 100, 106943. [Google Scholar] [CrossRef]

- Zhang, D.; Lou, S. The application research of neural network and BP algorithm in stock price pattern classification and prediction. Future Gener. Comput. Syst. 2021, 115, 872–879. [Google Scholar] [CrossRef]

- Dezhkam, A.; Manzuri, M.T. Forecasting stock market for an efficient portfolio by combining XGBoost and Hilbert–Huang transform. Eng. Appl. Artif. Intell. 2023, 118, 105626. [Google Scholar] [CrossRef]

- Cheng, C.H.; Wei, L.Y. A novel time-series model based on empirical mode decomposition for forecasting TAIEX. Econ. Model. 2014, 36, 136–141. [Google Scholar] [CrossRef]

- Li, Q.; Bao, L. Enhanced index tracking with multiple time-scale analysis. Econ. Model. 2014, 39, 282–292. [Google Scholar] [CrossRef]

- Tang, L.; Lin, Q. Stock selection based on a hybrid quantitative method. Open J. Stat. 2016, 6, 346–362. [Google Scholar] [CrossRef]

- Liu, S.; Zhang, C.; Ma, J. CNN-LSTM neural network model for quantitative strategy analysis in stock markets. In Neural Information Processing: 24th International Conference, ICONIP 2017, Guangzhou, China, 14–18 November 2017; Proceedings, Part II 24; Springer International Publishing: Cham, Switzerland; pp. 198–206.

- Wei, Y.; Chaudhary, V. TST: An Effective Approach to Extract Trend Feature in Stock Time Series. In Proceedings of the 2018 International Conference on Advances in Computing, Communications and Informatics (ICACCI), Bangalore, India, 19–22 September 2018; IEEE: Piscataway, NJ, USA; pp. 120–125. [Google Scholar]

- Lin, Y.; Lin, Z.; Liao, Y.; Li, Y.; Xu, J.; Yan, Y. Forecasting the realized volatility of stock price index: A hybrid model integrating CEEMDAN and LSTM. Expert Syst. Appl. 2022, 206, 117736. [Google Scholar] [CrossRef]

- Wu, J.; Dong, J.; Wang, Z.; Hu, Y.; Dou, W. A novel hybrid model based on deep learning and error correction for crude oil futures prices forecast. Resour. Policy 2023, 83, 103602. [Google Scholar] [CrossRef]

- Wei, J.; Han, L.Y. Risk transmission between stock index futures and options markets—The evidences from Hangseng index derivative markets. Appl. Stat. Manag. 2014, 6, 1132–1140. [Google Scholar]

- Wu, G.W. The impact of stock index ETF options on the volatility of China stock market—An empirical analysis based on the high frequency data of SSE 50ETF options. China Econ. Trade Her. 2015, 14, 37–38. [Google Scholar]

- Wang, S.S.; Xu, T.T.; Wang, J.B.; Yu, Z. Comparative Analysis of Price Discovery in Three SSE 50 index Markets:the index Futures, ETF and ETF Options Markets. Oper. Res. Manag. Sci. 2017, 9, 127–136. [Google Scholar]

- Cui, H.; Fei, J.; Lu, X. Can the Implied Information of Options Predict the Liquidity of Stock Market? A Data-Driven Research Based on SSE 50ETF Options. J. Math. 2021, 2021, 9059213. [Google Scholar] [CrossRef]

- Tao, L.B.; Zou, Y.; Pan, W.B. Determinants of Price Discovery in Options Market—Empirical Research Based on High Frequency Data of SSE 50 ETF. Rev. Investig. Stud. 2022, 7, 90–105. [Google Scholar]

- Wang, X.H.; Wu, Y.L. Study on the correlation between CSI 300 options and spot market prices. Secur. Futures China 2022, 2, 32–40. [Google Scholar] [CrossRef]

- Ahn, K.; Bi, Y.; Sohn, S. Price discovery among SSE 50 index-based spot, futures, and options markets. J. Futures Mark. 2019, 39, 238–259. [Google Scholar] [CrossRef]

- Goncalves-Pinto, L.; Grundy, B.D.; Hameed, A.; van der Heijden, T.; Zhu, Y. Why do option prices predict stock returns? The role of price pressure in the stock market. Manag. Sci. 2020, 66, 3903–3926. [Google Scholar] [CrossRef]

- Patel, V.; Putniņš, T.J.; Michayluk, D.; Foley, S. Price discovery in stock and options markets. J. Financ. Mark. 2020, 47, 100524. [Google Scholar] [CrossRef]

- Wang, X.D. Pricing research on CSI 300 stock index options based on B-S model and GARCH model. Financ. Eng. Risk Manag. 2023, 6, 48–55. [Google Scholar]

- Torres, M.E.; Colominas, M.A.; Schlotthauer, G.; Flandrin, P. A complete ensemble empirical mode decomposition with adaptive noise. In Proceedings of the 2011 IEEE International Conference on Acoustics, Speech and Signal Processing (ICASSP), Prague, Czech Republic, 22–27 May 2011; IEEE: Piscataway, NJ, USA; pp. 4144–4147. [Google Scholar]

- Huang, N.E.; Shen, Z.; Long, S.R.; Wu, M.C.; Shih, H.H.; Zheng, Q.; Yen, N.C.; Tung, C.C.; Liu, H.H. The empirical mode decomposition and the Hilbert spectrum for nonlinear and non-stationary time series analysis. Proc. R. Soc. Lond. Ser. A Math. Phys. Eng. Sci. 1998, 454, 903–995. [Google Scholar] [CrossRef]

- Wu, Z.; Huang, N.E. Ensemble empirical mode decomposition: A noise-assisted data analysis method. Adv. Adapt. Data Anal. 2009, 1, 1–41. [Google Scholar] [CrossRef]

- Rumelhart, D.E.; Hinton, G.E.; Williams, R.J. Learning representations by back-propagating errors. Nature 1986, 323, 533–536. [Google Scholar] [CrossRef]

- Zhu, C.; Ma, X.; Zhang, C.; Ding, W.; Zhan, J. Information granules-based long-term forecasting of time series via BPNN under three-way decision framework. Inf. Sci. 2023, 634, 696–715. [Google Scholar] [CrossRef]

- Zhang, Y.; Pan, G.; Chen, B.; Han, J.; Zhao, Y.; Zhang, C. Short-term wind speed prediction model based on GA-ANN improved by VMD. Renew. Energy 2020, 156, 1373–1388. [Google Scholar] [CrossRef]

- Chen, J.; Yang, H. A CSI 300 index Prediction Model Based on PSO-SVR-GRNN Hybrid Method. Mob. Inf. Syst. 2022, 2022, 7419920. [Google Scholar] [CrossRef]

- Wan, W.; Xu, Q.; Chen, H.; Chen, Q. Using Deep Learning Neural Networks and Stacking Ensemble Learning to Predict CSI 300 index. In Proceedings of the 2022 9th International Conference on Digital Home (ICDH), Guangzhou, China, 28–30 October 2022; IEEE: Piscataway, NJ, USA; pp. 81–86. [Google Scholar]

- Lin, Y.; Yan, Y.; Xu, J.; Liao, Y.; Ma, F. Forecasting stock index price using the CEEMDAN-LSTM model. N. Am. J. Econ. Financ. 2021, 57, 101421. [Google Scholar] [CrossRef]

| Information | MSE | MAE | MAPE |

|---|---|---|---|

| Spot information (only) | 1188.5568 | 25.9621 | 0.0068 |

| ATM options | 1076.4415 | 24.6099 | 0.0064 |

| ITM options (trading volume) | 1067.9506 | 24.6103 | 0.0064 |

| ITM options (open interest) | 1145.8858 | 25.5043 | 0.0066 |

| OTM options (trading volume) | 1112.8612 | 25.0586 | 0.0065 |

| OTM options (open interest) | 1170.6870 | 25.8819 | 0.0067 |

| Subsequence | Spot Information | ATM Options | ITM Options (Trading Volume) | ITM Options (Open Interest) | OTM Options (Trading Volume) | OTM Options (Open Interest) |

|---|---|---|---|---|---|---|

| IMF1 | 1.893 | 1.873 | 1.884 | 1.922 | 1.819 | 1.629 |

| IMF2 | 1.851 | 1.912 | 1.887 | 1.886 | 1.896 | 1.825 |

| IMF3 | 2.104 | 2.094 | 2.098 | 2.136 | 2.119 | 2.076 |

| IMF4 | 1.116 | 1.115 | 1.113 | 1.139 | 1.114 | 1.105 |

| IMF5 | 0.581 | 0.593 | 0.593 | 0.583 | 0.598 | 0.601 |

| IMF6 | 0.441 | 0.428 | 0.439 | 0.446 | 0.426 | 0.45 |

| IMF7 | 0.182 | 0.178 | 0.178 | 0.177 | 0.172 | 0.168 |

| IMF8 | 0.069 | 0.065 | 0.065 | 0.066 | 0.066 | 0.063 |

| IMF9 | 0.019 | 0.021 | 0.021 | 0.021 | 0.021 | 0.021 |

| Residual | 0.007 | 0.007 | 0.007 | 0.007 | 0.007 | 0.006 |

| Frequency | Spot Information | ATM Options | ITM Options (Trading Volume) | ITM Options (Open Interest) | OTM Options (Trading Volume) | OTM Options (Open Interest) |

|---|---|---|---|---|---|---|

| High | IMF1IMF2 | IMF1IMF2 | IMF1IMF2 | IMF1IMF2 | IMF1IMF2 | IMF1IMF2 |

| IMF3 | IMF3 | IMF3 | IMF3 | IMF3 | IMF3 | |

| Medium | IMF4 | IMF4 | IMF4 | IMF4 | IMF4 | IMF4 |

| Low | IMF5IMF6 | IMF5IMF6 | IMF5IMF6 | IMF5IMF6 | IMF5IMF6 | IMF5IMF6 |

| IMF7IMF8 | IMF7IMF8 | IMF7IMF8 | IMF7IMF8 | IMF7IMF8 | IMF7IMF8 | |

| IMF9 residual | IMF9 residual | IMF9 residual | IMF9 residual | IMF9 residual | IMF9 residual |

| Information | MSE | MAE | MAPE |

|---|---|---|---|

| Spot information (only) | 808.5210 | 22.1915 | 0.0058 |

| ATM options | 737.7592 | 20.7718 | 0.0054 |

| ITM options (trading volume) | 724.0461 | 20.7630 | 0.0054 |

| ITM options (open interest) | 761.7536 | 21.4761 | 0.0056 |

| OTM options (trading volume) | 788.2541 | 21.8041 | 0.0057 |

| OTM options (open interest) | 734.7153 | 21.0732 | 0.0055 |

| Subsequence | Spot Information | ATM Options | ITM Options (Trading Volume) | ITM Options (Open Interest) | OTM Options (Trading Volume) | OTM Options (Open Interest) |

|---|---|---|---|---|---|---|

| IMF1 | 1.501 | 1.481 | 1.493 | 1.493 | 1.549 | 1.507 |

| IMF2 | 0.444 | 0.428 | 0.401 | 0.401 | 0.355 | 0.397 |

| IMF3 | 0.741 | 0.794 | 0.807 | 0.807 | 0.850 | 0.818 |

| IMF4 | 0.577 | 0.595 | 0.609 | 0.609 | 0.590 | 0.578 |

| IMF5 | 0.579 | 0.588 | 0.586 | 0.586 | 0.585 | 0.587 |

| IMF6 | 0.315 | 0.411 | 0.380 | 0.380 | 0.420 | 0.455 |

| IMF7 | 0.129 | 0.182 | 0.141 | 0.141 | 0.176 | 0.169 |

| IMF8 | 0.048 | 0.065 | 0.061 | 0.061 | 0.095 | 0.070 |

| IMF9 | 0.023 | 0.029 | 0.030 | 0.030 | 0.033 | 0.024 |

| Residual | 0.009 | 0.014 | 0.014 | 0.014 | 0.018 | 0.000 |

| Frequency | Spot Information | ATM Options | ITM Options (Trading Volume) | ITM Options (Open Interest) | OTM Options (Trading Volume) | OTM Options (Open Interest) |

|---|---|---|---|---|---|---|

| High | IMF1 | IMF1 | IMF1 | IMF1 | IMF1 | IMF1 |

| Medium | IMF2IMF3 | IMF2IMF3 | IMF2IMF3 | IMF2IMF3 | IMF2IMF3 | IMF2IMF3 |

| IMF4 IMF5IMF6 | IMF4 IMF5IMF6 | IMF4 IMF5IMF6 | IMF4 IMF5IMF6 | IMF4 IMF5IMF6 | IMF4 IMF5IMF6 | |

| Low | IMF7IMF8 | IMF7IMF8 | IMF7IMF8 | IMF7IMF8 | IMF7IMF8 | IMF7IMF8 |

| IMF9 residual | IMF9 residual | IMF9 residual | IMF9 residual | IMF9 residual | IMF9 residual |

| Information | MSE | MAE | MAPE |

|---|---|---|---|

| Spot information only | 454.7686 | 17.0405 | 0.0045 |

| ATM options | 405.4575 | 15.7611 | 0.0041 |

| ITM options (trading volume) | 413.0152 | 16.1418 | 0.0042 |

| ITM options (open interest) | 426.1350 | 16.4313 | 0.0043 |

| OTM options (trading volume) | 427.7069 | 16.5095 | 0.0043 |

| OTM options (open interest) | 399.7328 | 16.1156 | 0.0042 |

| MSE | MAE | MAPE |

|---|---|---|

| 383.0989 | 15.5847 | 0.0041 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hu, Y.; Sui, X.; Zhang, Q.; Zhang, W. Research on Price Prediction of Stock Price Index Based on Combination Method with Introduction of Options Market Information. Information 2025, 16, 328. https://doi.org/10.3390/info16040328

Hu Y, Sui X, Zhang Q, Zhang W. Research on Price Prediction of Stock Price Index Based on Combination Method with Introduction of Options Market Information. Information. 2025; 16(4):328. https://doi.org/10.3390/info16040328

Chicago/Turabian StyleHu, Yi, Xin Sui, Qi Zhang, and Wei Zhang. 2025. "Research on Price Prediction of Stock Price Index Based on Combination Method with Introduction of Options Market Information" Information 16, no. 4: 328. https://doi.org/10.3390/info16040328

APA StyleHu, Y., Sui, X., Zhang, Q., & Zhang, W. (2025). Research on Price Prediction of Stock Price Index Based on Combination Method with Introduction of Options Market Information. Information, 16(4), 328. https://doi.org/10.3390/info16040328