Challenges and Trends of Financial Technology (Fintech): A Systematic Literature Review

Abstract

1. Introduction

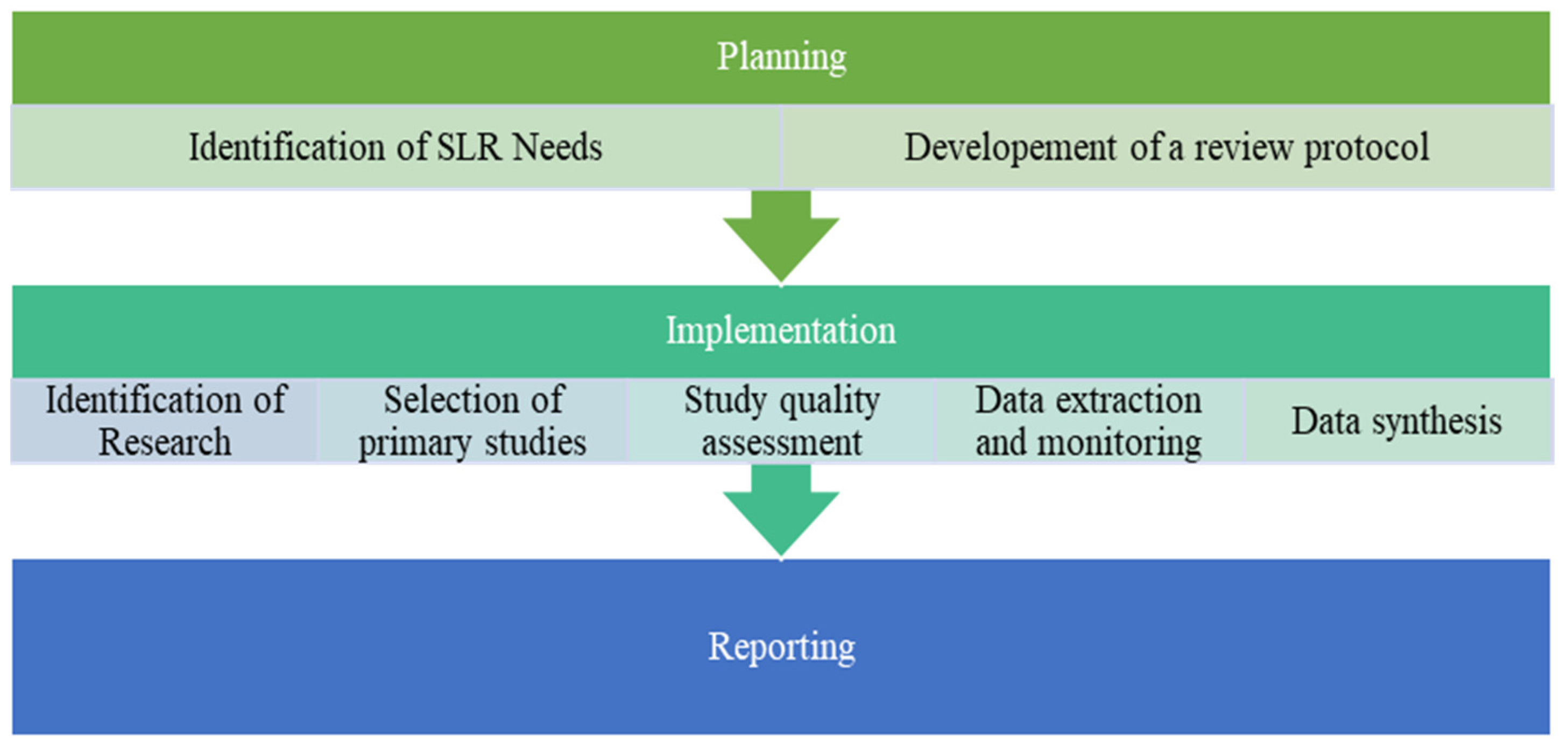

2. Methodology

2.1. Research Question

- RQ1. “What are the challenges and trends of fintech research?”

2.2. Search Process

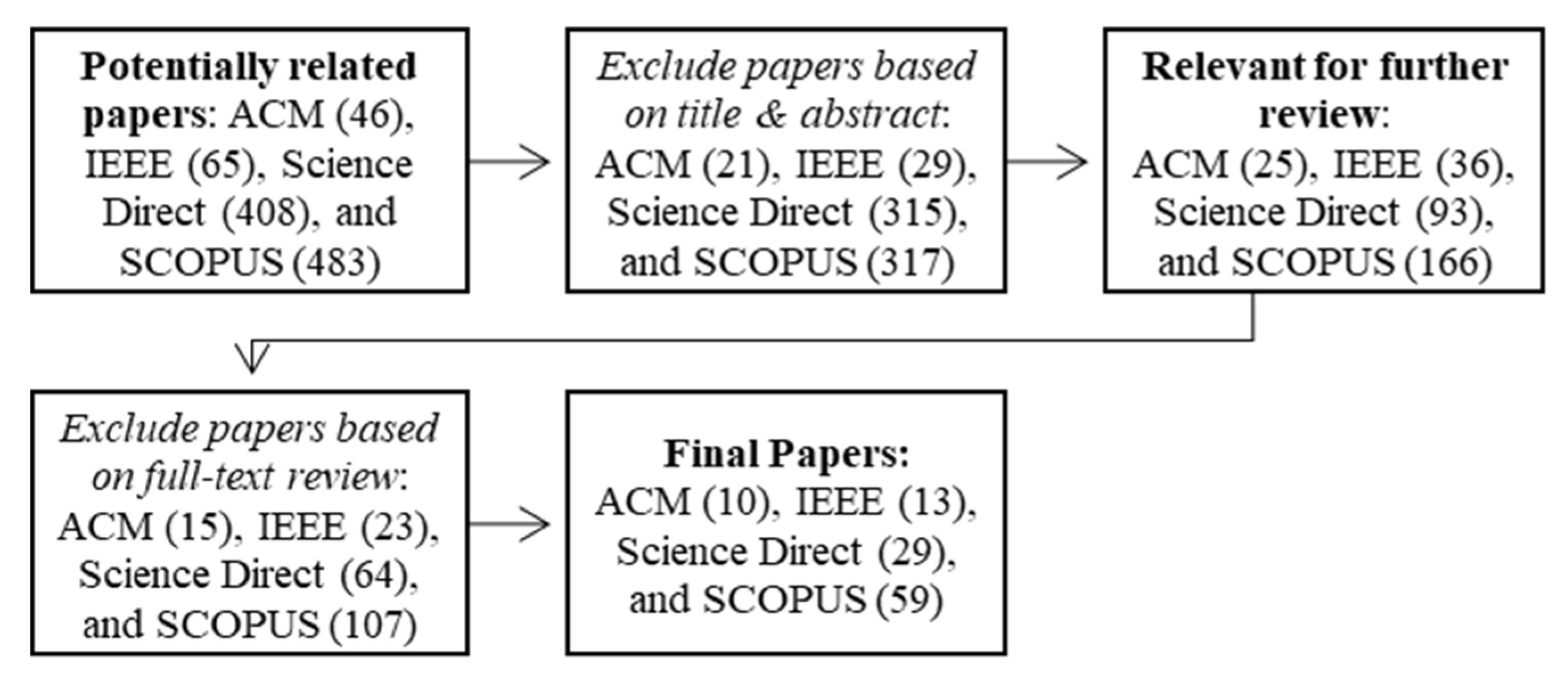

2.3. Implementation

3. Results

3.1. Background and Terminology

3.2. Thematic Analysis of the Articles Selected

3.2.1. Publication Per Year

3.2.2. Classification of Articles by Fintech Business Model

3.2.3. Classification of Articles by (Main) Methodology

3.2.4. Classification of Articles by Publications

3.2.5. Classification of Articles by Locations

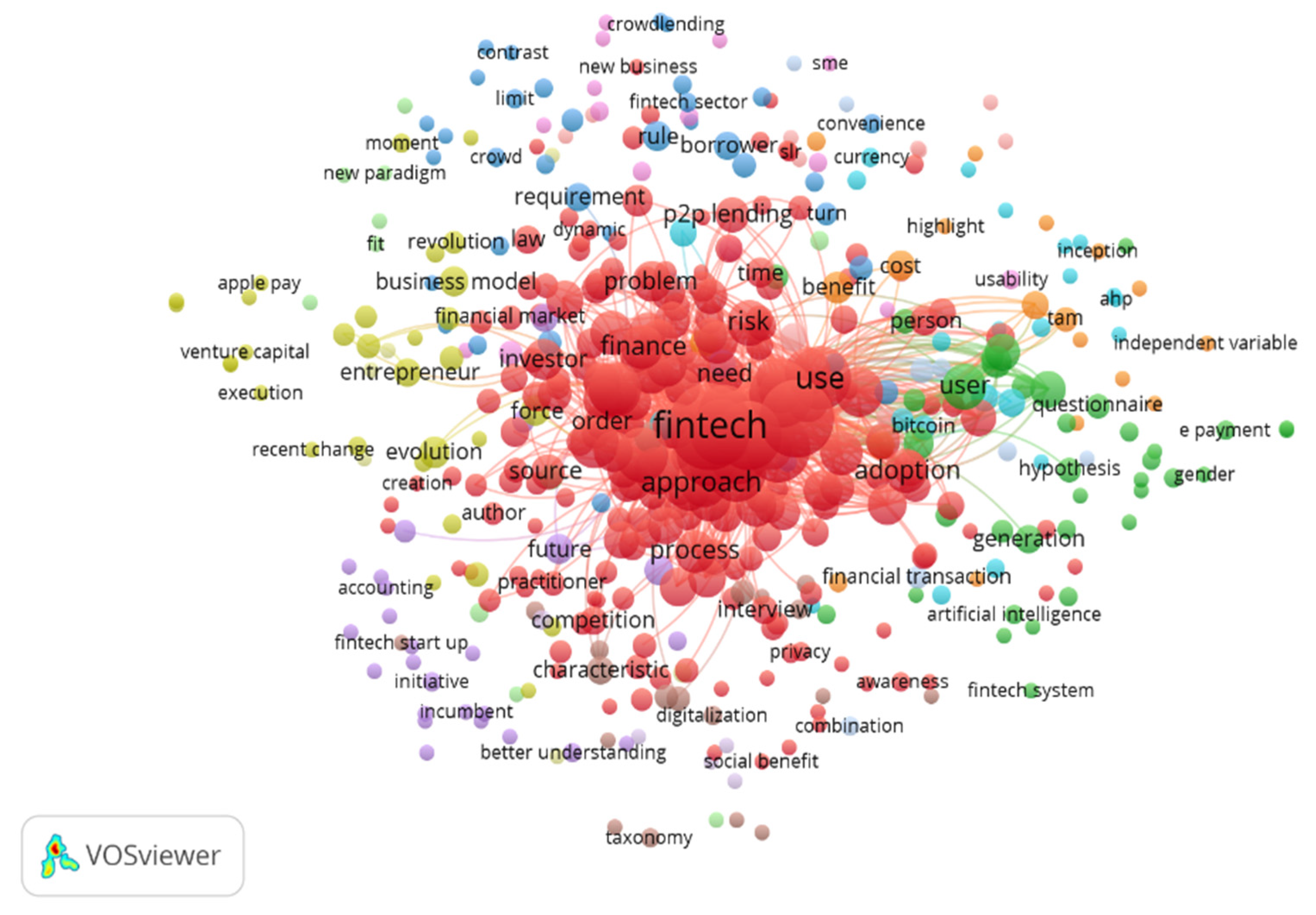

3.3. Meta-analysis of the Articles Selected

4. Discussions and Recommendations

4.1. Discussions

4.1.1. Research on Fintech (In General)

4.1.2. Research on Payment, Clearing, and Settlement

4.1.3. Research on Risk Management and Investment

4.1.4. Research on Market Aggregators

4.1.5. Research on Financing (Crowdfunding and P2P Lending)

4.1.6. Research on Cryptocurrency and Blockchain

4.2. Recommendations

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Schueffel, P. Taming the beast: A scientific definition of fintech. J. Innov. Manag. 2017, 4, 32–54. [Google Scholar] [CrossRef]

- Leong, K. FinTech (Financial Technology): What is it and how to use technologies to create business value in fintech way? Int. J. Innov. Manag. Technol. 2018, 9, 74–78. [Google Scholar] [CrossRef]

- Lee, I.; Shin, Y.J. Fintech: Ecosystem, business models, investment decisions, and challenges. Bus. Horiz. 2018, 61, 35–46. [Google Scholar] [CrossRef]

- Davis, K.; Maddock, R.; Foo, M. Catching up with Indonesia’s fintech industry. Law Financ. Mark. Rev. 2017, 11, 33–40. [Google Scholar] [CrossRef]

- Gimpel, H.; Rau, D.; Röglinger, M. Understanding FinTech start-ups—A taxonomy of consumer-oriented service offerings. Electron. Mark. 2018, 28, 245–264. [Google Scholar] [CrossRef]

- Stern, C.; Makinen, M.; Qian, Z. FinTechs in China—With a special focus on peer to peer lending. J. Chin. Econ. Foreign Trade Stud. 2017, 10, 215–228. [Google Scholar] [CrossRef]

- Zavolokina, L.; Dolata, M.; Schwabe, G. FinTech—What’s in a name? In Proceedings of the Thirty Seventh International Conference on Information Systems, Dublin, Ireland, 11–14 December 2016; pp. 469–490. [Google Scholar]

- Suryono, R.R.; Purwandari, B.; Budi, I. Peer to peer (P2P) lending problems and potential solutions: A systematic literature review. Procedia Comput. Sci. 2019, 161, 204–214. [Google Scholar] [CrossRef]

- Ashta, A.; Biot-Paquerot, G. FinTech evolution: Strategic value management issues in a fast changing industry. Strateg. Chang. 2018, 27, 301–311. [Google Scholar] [CrossRef]

- Kitchenham, B.; Brereton, P. A systematic review of systematic review process research in software engineering. Inf. Softw. Technol. 2013, 55, 2049–2075. [Google Scholar] [CrossRef]

- Panurach, P. Money in electronic commerce: Digital cash, electronic fund transfer, and eCash. Commun. ACM 1996, 39, 45–50. [Google Scholar] [CrossRef]

- Nicoletti, B. Financial Services and Fintech. In The Future of FinTech; Palgrave Macmillan: London, UK, 2017. [Google Scholar] [CrossRef]

- Chang, T.-C.; Chen, Y.-L. Fintech puzzle: The case of bitcoin. In Proceedings of the PICMET 2018 Portland International Conference on Management of Engineering and Technology: Managing Technological Entrepreneurship: The Engine for Economic Growth, Taichung, Taiwan, 19–23 August 2018. [Google Scholar]

- Eyal, I. Blockchain technology: Transforming libertarian cryptocurrency dreams to finance and banking realities. Computer 2017, 50, 38–49. [Google Scholar] [CrossRef]

- Gomber, P.; Koch, J.A.; Siering, M. Digital finance and FinTech: Current research and future research directions. J. Bus. Econ. 2017, 87, 537–580. [Google Scholar] [CrossRef]

- Gomber, P.; Kauffman, R.J.; Parker, C.; Weber, B.W. On the Fintech revolution: Interpreting the forces of innovation, disruption, and transformation in financial services. J. Manag. Inf. Syst. 2018, 35, 220–265. [Google Scholar] [CrossRef]

- Gai, K.; Qiu, M.; Sun, X. A survey on FinTech. J. Netw. Comput. Appl. 2018, 103, 262–273. [Google Scholar] [CrossRef]

- Puschmann, T. Fintech. Bus. Inf. Syst. Eng. 2017, 59, 69–76. [Google Scholar] [CrossRef]

- Mathur, N.; Karre, S.A.; Mohan, S.L.; Reddy, Y.R. Analysis of fintech mobile app usability for geriatric users in India. In Proceedings of the ACM International Conference on Human-Computer Interaction and User Experience in Indonesia, Yogyakarta, Indonesia, 23–29 March 2018; pp. 1–11. [Google Scholar]

- Fernando, E.; Surjandy; Meyliana; Touriano, D. Development and validation of instruments adoption fintech services in Indonesia (perspective of trust and risk). In Proceedings of the 3rd International Conference on Sustainable Information Engineering and Technology, Malang, Indonesia, 10–12 November 2018; pp. 283–287. [Google Scholar] [CrossRef]

- Nomakuchi, T. A case study on fintech in Japan based on keystone strategy. In Proceedings of the PICMET 2018 Portland International Conference on Management of Engineering and Technology: Managing Technological Entrepreneurship: The Engine for Economic Growth, Honolulu, HI, USA, 19–23 August 2018. [Google Scholar]

- Ryu, H.S. What makes users willing or hesitant to use Fintech? The moderating effect of user type. Ind. Manag. Data Syst. 2018, 118, 541–569. [Google Scholar] [CrossRef]

- Iman, N. Assessing the dynamics of fintech in Indonesia. Invest. Manag. Financ. Innov. 2018, 15, 296–303. [Google Scholar] [CrossRef]

- Stewart, H.; Jürjens, J. Data security and consumer trust in FinTech innovation in Germany. Inf. Comput. Secur. 2018, 26, 109–128. [Google Scholar] [CrossRef]

- Huei, C.T.; Cheng, L.S.; Seong, L.C.; Khin, A.A.; Leh Bin, R.L. Preliminary study on consumer attitude towards fintech products and services in Malaysia. Int. J. Eng. Technol. 2018, 7, 166–169. [Google Scholar] [CrossRef]

- Hu, Z.; Ding, S.; Li, S.; Chen, L.; Yang, S. Adoption intention of fintech services for bank users: An empirical examination with an extended technology acceptance model. Symmetry 2019, 11, 340. [Google Scholar] [CrossRef]

- Wang, Q.; Gu, L.; Xue, M.; Xu, L.; Niu, W.; Dou, L.; He, L.; Xie, T. FACTS: Automated black-box testing of fintech systems. In Proceedings of the 2018 26th ACM Joint Meeting on European Software Engineering Conference and Symposium on the Foundations of Software Engineering, Lake Buena Vista, FL, USA, 4–9 November 2018; pp. 839–844. [Google Scholar]

- Hatammimi, J.; Krisnawati, A. Financial literacy for entrepreneur in the industry 4.0 era: A conceptual framework in Indonesia. In Proceedings of the ACM International Conference on Information Management and Engineering, Salford, UK, 22–24 September 2018; pp. 183–187. [Google Scholar]

- Jin, T.; Wang, Q. FinExpert: Domain-specific test generation for fintech systems. In Proceedings of the 2019 27th ACM Joint Meeting on European Software Engineering Conference and Symposium on the Foundations of Software Engineering, Tallinn, Estonia, 26–30 August 2019; pp. 853–862. [Google Scholar]

- Pantielieieva, N.; Krynytsia, S.; Khutorna, M.; Potapenko, L. FinTech, transformation of financial intermediation and financial stability. In Proceedings of the 2018 International Scientific-Practical Conference on Problems of Infocommunications Science and Technology, Kharkiv, Ukraine, 9–12 October 2018; pp. 553–559. [Google Scholar]

- Mehrotra, A. Financial inclusion through fintech—A case of lost focus. In Proceedings of the 2019 International Conference on Automation, Computational and Technology Management (ICACTM), London, UK, 24–26 April 2019; pp. 103–107. [Google Scholar]

- Shim, Y.; Shin, D.H. Analyzing China’s fintech industry from the perspective of actor-network theory. Telecommun. Policy 2016, 40, 168–181. [Google Scholar] [CrossRef]

- Eickhoff, M.; Muntermann, J.; Weinrich, T. What Do Fintechs Actually Do? A Taxonomy of Fintech Business Models. In Proceedings of the ICIS 2017: Transforming Society with Digital Innovation, Seoul, Korea, 10–12 December 2017; Volume 22. [Google Scholar]

- Basole, R.C.; Patel, S.S. Transformation through unbundling: Visualizing the global FinTech ecosystem. Serv. Sci. 2018, 10, 379–396. [Google Scholar] [CrossRef]

- Riyanto, A.; Primiana, I.; Yunizar; Azis, Y. Disruptive technology: The phenomenon of FinTech towards conventional banking in Indonesia. Mater. Sci. Eng. 2018, 407. [Google Scholar] [CrossRef]

- Haddad, C.; Hornuf, L. The emergence of the global fintech market: Economic and technological determinants. Small Bus. Econ. 2019, 53, 81–105. [Google Scholar] [CrossRef]

- Anagnostopoulos, I. Fintech and regtech: Impact on regulators and banks. J. Econ. Bus. 2018, 100, 7–25. [Google Scholar] [CrossRef]

- Hung, J.L.; Luo, B. FinTech in Taiwan: A case study of a Bank’s strategic planning for an investment in a FinTech company. Financ. Innov. 2016, 2. [Google Scholar] [CrossRef]

- Kim, K.; Hong, S. The data processing approach for preserving personal data in fintech-driven paradigm. Int. J. Secur. Appl. 2016, 10, 341–350. [Google Scholar] [CrossRef]

- Okamura, T.; Teranishi, I. Enhancing FinTech security with secure multi-party computation technology. NEC Tech. J. 2017, 11, 46–50. [Google Scholar]

- Dimbean-Creta, O. Fintech—Already new fashion in finance, but what about the future? Qual. Access Success 2017, 18, 25–29. [Google Scholar]

- Muthukannan, P.; Tan, F.T.C.; Tan, B.; Leong, C. The Concentric Development of the Financial Technology (Fintech) Ecosystem in Indonesia. In Proceedings of the ICIS 2017: Transforming Society with Digital, Seoul, Korea, 10–12 December 2017. [Google Scholar]

- Sybirianska, Y.; Dyba, M.; Britchenko, I.; Ivashchenko, A.; Vasylyshen, Y.; Polishchuk, Y. Fintech platforms in sme’s financing: Eu experience and ways of their application in Ukraine. Invest. Manag. Financ. Innov. 2018, 15, 83–96. [Google Scholar] [CrossRef]

- Abubakar, L.; Handayani, T. Financial technology: Legal challenges for Indonesia financial sector. In Proceedings of the IOP Conference Series: Earth and Environmental Science, Makassar, Indonesia, 25–26 October 2018; Volume 175. [Google Scholar]

- Xiang, D.; Zhang, Y.; Worthington, A.C. Determinants of the use of fintech finance among Chinese small and medium-sized enterprises. In Proceedings of the TEMS-ISIE 2018 1st Annual International Symposium on Innovation and Entrepreneurship of the IEEE Technology and Engineering Management Society, Beijing, China, 30 March–1 April 2018; pp. 1–10. [Google Scholar]

- Milian, E.Z.; Spinola, M.D.M.; Carvalho, M.M. Fintechs: A literature review and research agenda. Electron. Commer. Res. Appl. 2019, 34, 100833. [Google Scholar] [CrossRef]

- Coeckelbergh, M. The invisible robots of global finance: Making visible machines, people and places. SIGCAS Comput. Soc. 2015, 45, 287–289. [Google Scholar] [CrossRef]

- Soloviev, V. Fintech ecosystem in Russia. In Proceedings of the 2018 11th International Conference on Management of Large-Scale System Development, Moscow, Russia, 1–3 October 2018; pp. 1–5. [Google Scholar]

- Drasch, B.J.; Schweizer, A.; Urbach, N. Integrating the ‘Troublemakers’: A taxonomy for cooperation between banks and fintechs. J. Econ. Bus. 2018, 100, 26–42. [Google Scholar] [CrossRef]

- Tsai, C.H.; Peng, K.J. The FinTech revolution and financial regulation: The case of online supply-chain financing. Asian J. Law Soc. 2017, 4, 109–132. [Google Scholar] [CrossRef]

- Wonglimpiyarat, J. FinTech banking industry: A systemic approach. Foresight 2017, 19, 590–603. [Google Scholar] [CrossRef]

- Azarenkova, G.; Shkodina, I.; Samorodov, B.; Babenko, M.; Onishchenko, I. The influence of financial technologies on the global financial system stability. Invest. Manag. Financ. Innov. 2018, 15, 229–238. [Google Scholar] [CrossRef]

- Chang, Y.; Wong, S.F.; Lee, H.; Jeong, S.P. What motivates Chinese consumers to adopt FinTech services: A regulatory focus theory. In Proceedings of the 18th Annual International Conference on Electronic Commerce: E-Commerce in Smart Connected World, Suwon, Korea, 17–19 August 2016; pp. 1–3. [Google Scholar] [CrossRef]

- Bello, G.; Perez, A.J. Adapting financial technology standards to blockchain platforms. In Proceedings of the 2019 ACM Southeast Conference, Columbus State University, Kennesaw, GA, USA, 18–20 April 2019; pp. 109–116. [Google Scholar]

- Nabila, M.; Purwandari, B.; Nazief, B.A.A.; Chalid, D.A.; Wibowo, S.S.; Solichah, I. Financial technology acceptance factors of electronic wallet and digital cash in Indonesia. In Proceedings of the 2018 International Conference on Information Technology Systems and Innovation, Padang, Indonesia, 22–26 October 2018; pp. 284–289. [Google Scholar] [CrossRef]

- Chandra, Y.U.; Kristin, D.M.; Suhartono, J.; Sutarto, F.S.; Sung, M. Analysis of determinant factors of user acceptance of mobile payment system in Indonesia. In Proceedings of the 2018 International Conference on Information Management and Technology, Jakarta, Indonesia, 3–5 September 2018; pp. 454–459. [Google Scholar]

- Wiradinata, T. Mobile payment services adoption: The role of perceived technology risk. In Proceedings of the 2018 International Conference on Orange Technologies, Nusa Dua, Indonesia, 23–26 October 2018. [Google Scholar]

- Ting, H.; Yacob, Y.; Liew, L.; Lau, W.M. Intention to use mobile payment system: A case of developing market by ethnicity. Procedia Soc. Behav. Sci. 2016, 224, 368–375. [Google Scholar] [CrossRef]

- Riskinanto, A.; Kelana, B.; Hilmawan, D.R. The moderation effect of age on adopting E-payment technology. Procedia Comput. Sci. 2017, 124, 536–543. [Google Scholar] [CrossRef]

- De Luna, I.R.; Liébana-Cabanillas, F.; Sánchez-Fernández, J.; Muñoz-Leiva, F. Mobile payment is not all the same: The adoption of mobile payment systems depending on the technology applied. Technol. Forecast. Soc. Chang. 2018, 146, 931–944. [Google Scholar] [CrossRef]

- Kalinic, Z.; Marinkovic, V.; Molinillo, S.; Liébana-Cabanillas, F. A multi-analytical approach to peer-to-peer mobile payment acceptance prediction. J. Retail. Consum. Serv. 2019, 49, 143–153. [Google Scholar] [CrossRef]

- Kelana, B.; Riskinanto, A.; Hilamawan, D.R. The acceptance of E-payment among Indonesian millennials. In Proceedings of the 2017 International Conference on Sustainable Information Engineering and Technology, Malang, Indonesia, 24–25 November 2017; pp. 348–352. [Google Scholar] [CrossRef]

- Armey, L.E.; Lipow, J.; Webb, N.J. The impact of electronic financial payments on crime. Inf. Econ. Policy 2014, 29, 46–57. [Google Scholar] [CrossRef]

- Dahlberg, T.; Guo, J.; Ondrus, J. A critical review of mobile payment research. Electron. Commer. Res. Appl. 2015, 14, 265–284. [Google Scholar] [CrossRef]

- Lin, C.Y.; Su, F.P.; Lai, K.K.; Shih, H.C.; Liu, C.C. Research and development portfolio for the payment FinTech company—The perspectives of patent statistics. In Proceedings of the 2nd International Conference on E-Society, E-Education and E-Technology, Taichung, Taiwan, 13–15 August 2018; pp. 98–102. [Google Scholar]

- Omarini, A.E. Fintech and the future of the payment landscape: The mobile wallet ecosystem—A challenge for retail banks? Int. J. Financ. Res. 2018, 9, 97–116. [Google Scholar] [CrossRef]

- Moon, W.Y.; Kim, S.D. A payment mediation platform for heterogeneous fintech schemes. In Proceedings of the 2016 IEEE Advanced Information Management, Communicates, Electronic and Automation Control Conference, Xi’an, China, 3–5 October 2016; pp. 511–516. [Google Scholar]

- Ogbanufe, O.; Kim, D.J. Comparing fingerprint-based biometrics authentication versus traditional authentication methods for e-payment. Decis. Support Syst. 2018, 106, 1–14. [Google Scholar] [CrossRef]

- Kang, J. Mobile payment in Fintech environment: Trends, security challenges, and services. Hum. Cent. Comput. Inf. Sci. 2018, 8, 32. [Google Scholar] [CrossRef]

- Lai, W.C. Measured near field communication antenna for Fintech innovation. In Proceedings of the 2018 7th International Symposium on Next-Generation Electronics, Taipei, Taiwan, 7–9 May 2018; pp. 1–3. [Google Scholar]

- Liu, J.; Kauffman, R.J.; Ma, D. Competition, cooperation, and regulation: Understanding the evolution of the mobile payments technology ecosystem. Electron. Commer. Res. Appl. 2015, 14, 372–391. [Google Scholar] [CrossRef]

- Heredia Salazar, R. Apple pay & digital wallets in Mexico and the United States: Illusion or financial revolution? Mex. Law Rev. 2017, 1, 29. [Google Scholar] [CrossRef]

- Iman, N. Is mobile payment still relevant in the fintech era? Electron. Commer. Res. Appl. 2018, 30, 72–82. [Google Scholar] [CrossRef]

- Chiu, I.H.Y. A new era in fintech payment innovations? A perspective from the institutions and regulation of payment systems. Law Innov. Technol. 2017, 9, 190–234. [Google Scholar] [CrossRef]

- Abdullah, E.M.E.; Rahman, A.A.; Rahim, R.A. Adoption of financial technology (Fintech) in mutual fund/unit trust investment among Malaysians: Unified theory of acceptance and use of technology (UTAUT). Int. J. Eng. Technol. 2018, 7, 110–118. [Google Scholar] [CrossRef]

- Belanche, D.; Casaló, L.V.; Flavián, C. Artificial intelligence in FinTech: Understanding robo-advisors adoption among customers. Ind. Manag. Data Syst. 2019, 119, 1411–1430. [Google Scholar] [CrossRef]

- Alexeev, V.; Urga, G.; Yao, W. Asymmetric jump beta estimation with implications for portfolio risk management. Int. Rev. Econ. Financ. 2019, 62, 20–40. [Google Scholar] [CrossRef]

- Liu, Y.; Peng, J.; Yu, Z. Big data platform architecture under the background of financial technology—In the insurance industry as an example example. In Proceedings of the ACM International Conference 2018 on Big Data Engineering and Technology, Chengdu, China, 25–27 August 2018; pp. 31–35. [Google Scholar]

- Kumari, A.; Kumar Sharma, A. Infrastructure financing and development: A bibliometric review. Int. J. Crit. Infrastruct. Prot. 2017, 16, 49–65. [Google Scholar] [CrossRef]

- Lee, R.S.T. COSMOS trader—Chaotic neuro-oscillatory multiagent financial prediction and trading system. J. Financ. Data Sci. 2019, 5, 61–82. [Google Scholar] [CrossRef]

- Faloon, M.; Scherer, B. Individualization of robo-advice. J. Wealth Manag. 2017, 20, 30–36. [Google Scholar] [CrossRef]

- Day, M.-Y.; Lin, J.-T.; Chen, Y.-C. Artificial intelligence for conversational robo-advisor. In Proceedings of the 2018 IEEE/ACM International Conference on Advances in Social Networks Analysis and Mining (ASONAM), Barcelona, Spain, 28–31 August 2018; pp. 1057–1064. [Google Scholar]

- Serrano, W. Fintech model: The random neural network with genetic algorithm. Procedia Comput. Sci. 2018, 126, 537–546. [Google Scholar] [CrossRef]

- Jung, D.; Dorner, V.; Weinhardt, C.; Pusmaz, H. Designing a robo-advisor for risk-averse, low-budget consumers. Electron. Mark. 2018, 28, 367–380. [Google Scholar] [CrossRef]

- Stoeckli, E.; Dremel, C.; Uebernickel, F. Exploring characteristics and transformational capabilities of InsurTech innovations to understand insurance value creation in a digital world. Electron. Mark. 2018, 28, 287–305. [Google Scholar] [CrossRef]

- Marafie, Z.; Lin, K.J.; Zhai, Y.; Li, J. Proactive fintech: Using intelligent IoT to deliver positive insurtech feedback. In Proceedings of the 2018 20th IEEE International Conference on Business Informatics, Vienna, Austria, 11–14 July 2018; pp. 72–81. [Google Scholar] [CrossRef]

- Liu, Y.; Chitawa, U.S.; Guo, G.; Wang, X.; Tan, Z.; Wang, S. A reputation model for aggregating ratings based on beta distribution function. In Proceedings of the ACM International Conference on Crowd Science and Engineering, Beijing, China, 6–9 July 2017; pp. 77–81. [Google Scholar]

- Ferreira, F.; Pereira, L. Success factors in a reward and equity based crowdfunding campaign. In Proceedings of the 2018 IEEE International Conference on Engineering, Technology and Innovation, Stuttgart, Germany, 17–20 June 2018; pp. 1–8. [Google Scholar] [CrossRef]

- Huang, T.; Zhao, Y. Revolution of securities law in the Internet Age: A review on equity crowd-funding. Comput. Law Secur. Rev. 2017, 33, 802–810. [Google Scholar] [CrossRef]

- Maier, E. Supply and demand on crowdlending platforms: Connecting small and medium-sized enterprise borrowers and consumer investors. J. Retail. Consum. Serv. 2016, 33, 143–153. [Google Scholar] [CrossRef]

- Zetzsche, D.; Preiner, C. Cross-border crowdfunding: Towards a single crowdlending and crowdinvesting market for Europe. Eur. Bus. Organ. Law Rev. 2018, 19, 217–251. [Google Scholar] [CrossRef]

- Barbi, M.; Mattioli, S. Human capital, investor trust, and equity crowdfunding. Res. Int. Bus. Financ. 2019, 49, 1–12. [Google Scholar] [CrossRef]

- Mamonov, S.; Malaga, R. Success factors in Title III equity crowdfunding in the United States. Electron. Commer. Res. Appl. 2018, 27, 65–73. [Google Scholar] [CrossRef]

- Anshari, M.; Almunawar, M.N.; Masri, M.; Hamdan, M. Digital marketplace and FinTech to support agriculture sustainability. Energy Procedia 2019, 156, 234–238. [Google Scholar] [CrossRef]

- Wonglimpiyarat, J. Challenges and dynamics of FinTech crowd funding: An innovation system approach. J. High Technol. Manag. Res. 2018, 29, 98–108. [Google Scholar] [CrossRef]

- Wang, W.; Mahmood, A.; Sismeiro, C.; Vulkan, N. The evolution of equity crowdfunding: Insights from co-investments of angels and the crowd. Res. Policy 2019, 48, 103727. [Google Scholar] [CrossRef]

- Lee, S. Evaluation of mobile application in user’s perspective: Case of P2P lending apps in FinTech industry. KSII Trans. Internet Inf. Syst. 2017, 11, 1105–1115. [Google Scholar] [CrossRef]

- Contreras Pinochet, L.H.; Diogo, G.T.; Lopes, E.L.; Herrero, E.; Bueno, R.L.P. Propensity of contracting loans services from FinTech’s in Brazil. Int. J. Bank Mark. 2019, 37, 1190–1214. [Google Scholar] [CrossRef]

- Rosavina, M.; Rahadi, R.A.; Kitri, M.L.; Nuraeni, S.; Mayangsari, L. P2P lending adoption by SMEs in Indonesia. Qual. Res. Financ. Mark. 2019, 11, 260–279. [Google Scholar] [CrossRef]

- Fang, X.; Wang, B.; Liu, L.; Song, Y. Heterogeneous traders, the leverage effect and volatility of the Chinese P2P market. J. Manag. Sci. Eng. 2018, 3, 39–57. [Google Scholar] [CrossRef]

- Leong, C.; Tan, B.; Xiao, X.; Tan, F.T.C.; Sun, Y. Nurturing a FinTech ecosystem: The case of a youth microloan startup in China. Int. J. Inf. Manag. 2017, 37, 92–97. [Google Scholar] [CrossRef]

- Wang, H.; Wang, Z.; Zhang, B.; Zhou, J. Information collection for fraud detection in P2P financial market. In Proceedings of the MATEC Web of Conferences 189, Beijing, China, 25–27 May 2018; p. 06006. [Google Scholar]

- Anugerah, D.P.; Indriani, M. Data Protection in financial technology services: Indonesian legal perspective. In Proceedings of the IOP Conference Series: Earth and Environmental Science, Makassar, Indonesia, 25–26 October 2017. [Google Scholar]

- Yunus, U. A comparison peer to peer lending platforms in Singapore and Indonesia. In Journal of Physics: Conference Series; IOP Publishing: Medan, Indonesia, 2019; Volume 1235, p. 012008. [Google Scholar]

- Buchak, G.; Matvos, G.; Piskorski, T.; Seru, A. Fintech, regulatory arbitrage, and the rise of shadow banks. J. Financ. Econ. 2018, 130, 453–483. [Google Scholar] [CrossRef]

- Tao, Q.; Dong, Y.; Lin, Z. Who can get money? Evidence from the Chinese peer-to-peer lending platform. Inf. Syst. Front. 2017, 19, 425–441. [Google Scholar] [CrossRef]

- Hsueh, S.C.; Kuo, C.H. Effective matching for P2P lending by mining strong association rules. In Proceedings of the 3rd International Conference on Industrial and Business Engineering, Sapporo, Japan, 17–19 August 2017; pp. 30–33. [Google Scholar]

- Fermay, A.H.; Santosa, B.; Kertopati, A.Y.; Eprianto, I.M. The development of collaborative model between fintech and bank in Indonesia. In Proceedings of the 2nd International Conference on E-commerce, E-Business and E-Government, Hong Kong, 13–15 June 2018; pp. 1–6. [Google Scholar] [CrossRef]

- Suryono, R.R.; Marlina, E.; Purwaningsih, M.; Sensuse, D.I.; Sutoyo, M.A.H. Challenges in P2P lending development: Collaboration with tourism commerce. In Proceedings of the 2019 International Conference on Computer Science, Information Technology, and Electrical Engineering, ICOMITEE 2019, Jember, Indonesia, 16–17 October 2019; pp. 129–133. [Google Scholar]

- Yu, T.; Shen, W. Funds sharing regulation in the context of the sharing economy: Understanding the logic of China’s P2P lending regulation. Comput. Law Secur. Rev. 2019, 35, 42–58. [Google Scholar] [CrossRef]

- Jagtiani, J.; Lemieux, C. Do fintech lenders penetrate areas that are underserved by traditional banks? J. Econ. Bus. 2018, 100, 43–54. [Google Scholar] [CrossRef]

- Anresnani, D.S.; Widodo, E.; Syairuddin, B. modelling integration of system dinamics and game theory for of financial technology peer to peer lending industry. In Proceedings of the International Mechanical and Industrial Engineering Conference, Malang, Indonesia, 30–31 August 2018; p. 07006. [Google Scholar]

- Huang, R.H. Online P2P lending and regulatory responses in China: Opportunities and challenges. Eur. Bus. Organ. Law Rev. 2018, 19, 63–92. [Google Scholar] [CrossRef]

- Nugraha, A.P.; Rolando; Puspasari, M.A.; Syaifullah, D.H. Usability Evaluation for User Interface Redesign of Financial Technology Application. In Proceedings of the 1st International Conference on Industrial and Manufacturing Engineering, Medan City North Sumatera, Indonesia, 16 October 2018. [Google Scholar] [CrossRef]

- Jonker, N. What drives the adoption of crypto-payments by online retailers? Electron. Commer. Res. Appl. 2019, 35, 100848. [Google Scholar] [CrossRef]

- Todorof, M. FinTech on the dark web: The rise of cryptos. In Era Forum; Springer: Berlin/Heidelberg, Germany, 2019; Volume 20. [Google Scholar] [CrossRef]

- Brownsword, R. Regulatory fitness: Fintech, funny money, and smart contracts. Eur. Bus. Organ. Law Rev. 2019, 20, 5–27. [Google Scholar] [CrossRef]

- Du, W.D.; Pan, S.L.; Leidner, D.E.; Ying, W. Affordances, experimentation and actualization of FinTech: A blockchain implementation study. J. Strateg. Inf. Syst. 2019, 28, 50–65. [Google Scholar] [CrossRef]

- Niu, B.; Ren, J.; Zhao, A.; Li, X. Lender trust on the P2P lending: Analysis based on sentiment analysis of comment text. Sustainability 2020, 12, 3293. [Google Scholar] [CrossRef]

- Fang, Z.; Zhang, J.; Zhiyuan, F. Study on P2P E-finance platform system: A case in China. In Proceedings of the 11th IEEE International Conference on E-Business Engineering, Guangzhou, China, 5–7 November 2014; pp. 331–337. [Google Scholar]

- Wang, J.G.; Xu, H.; Ma, J. Financing the Underfinanced: Online Lending in China; Springer: Berlin/Heidelberg, Germany, 2015; ISBN 9783662465257. [Google Scholar]

- Pohan, N.W.A.; Budi, I.; Suryono, R.R. Borrower sentiment on P2P lending in Indonesia based on Google Playstore reviews. In Proceedings of the Sriwijaya International Conference on Information Technology and Its Applications (SICONIAN 2019), Palembang, Indonesia, 16 November 2019; pp. 17–23. [Google Scholar]

- Suryono, R.R.; Budi, I. P2P Lending sentiment analysis in Indonesian online news. In Proceedings of the Sriwijaya International Conference on Information Technology and Its Applications (SICONIAN 2019), Palembang, Indonesia, 16 November 2019; pp. 39–44. [Google Scholar]

- Kursh, S.R.; Gold, N.A. Adding FinTech and blockchain to your curriculum. Bus. Educ. Innov. J. Contents 2016, 8, 6–12. [Google Scholar]

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | Total |

|---|---|---|---|---|---|---|---|

| Research on fintech (in general) | - | 1 | 4 | 7 | 23 | 6 | 41 |

| Research on payment, clearing, and settlement | 1 | 2 | 2 | 4 | 11 | 3 | 23 |

| Research on risk management and investment | - | - | - | 2 | 7 | 3 | 12 |

| Research on market aggregator | - | - | - | 1 | - | - | 1 |

| Research on crowdfunding | - | - | 1 | 1 | 4 | 3 | 9 |

| Research on P2P Lending | - | - | - | 5 | 8 | 7 | 20 |

| Research on cryptocurrency and blockchain | - | - | - | - | 1 | 4 | 5 |

| Total | 1 | 3 | 7 | 20 | 54 | 26 | 111 |

| Topic | Adoption | Problems | Trends | Challenges | Innovation |

|---|---|---|---|---|---|

| Research on Fintech (in general) | [19,20,21,22,23,24,25,26] | [27] | [5,7,17,28,29,30,31,32,33,34,35,36] | [3,15,37,38,39,40,41,42,43,44,45,46] | [16,18,47,48,49,50,51,52] |

| Research on Payment, Clearing, and Settlement | [53,54,55,56,57,58,59,60,61,62] | [63] | [64,65,66] | [67,68,69] | [9,70,71,72,73,74] |

| Research on Risk Management and Investment | [75,76] | [77] | [78,79,80,81] | - | [82,83,84,85,86] |

| Research on Market Aggregator | - | [87] | - | - | - |

| Research on Crowdfunding | - | - | [88,89,90,91] | [92,93,94] | [95,96] |

| Research on Peer-to-peer lending (P2P Lending) | [97,98,99] | [8,100,101,102,103,104] | [105,106] | [4,107,108,109,110,111,112,113,114] | - |

| Research on Cryptocurrency and Blockchain | [115] | [116] | [117] | - | [13,118] |

| Methodology (Main) | Total |

|---|---|

| Empirical | |

| -- articles using archival data | 13 |

| -- articles using survey data | 20 |

| Qualitative (case study/interviews/qual. analysis) | 27 |

| Experimental | 12 |

| Conceptual model | 18 |

| Simulative | 3 |

| Theoretical | 5 |

| Design science | 5 |

| Literature review | 8 |

| Total Articles | 111 |

| Journal and Proceedings Name | Total |

|---|---|

| Electronic Commerce Research and Applications | 6 |

| Electronic Markets | 3 |

| European Business Organization Law Review | 3 |

| Investment Management and Financial Innovations | 3 |

| Computer Law and Security Review | 2 |

| Industrial Management and Data Systems | 2 |

| International Journal of Engineering and Technology UAE | 2 |

| Journal of Retailing and Consumer Services | 2 |

| ACM International Conference Proceeding Series | 7 |

| Procedia Computer Science | 3 |

| IOP Conference Series: Earth and Environmental Science | 2 |

| IOP Conference Series: Materials Science and Engineering | 2 |

| Others | 74 |

| Challenges | Issues |

|---|---|

| Framework and Model | 1. Developing a practical and systematic framework for fintech [33,34,75] 2. The model of the fintech p2p lending system needs to be detailed [52,112] 3. Development of culturally appropriate models [56] 4. Design new service configurations [5] 5. Fintech is changing the role of IT, consumer behavior, ecosystems, and regulations [18] 6. The challenges and dynamics of the FinTech crowdfunding platform [51] |

| Regulation and Policy | 7. Fintech need for comprehensive regulation [4,15,38,44,50] 8. Development of international prudential standards [52] 9. Required regulatory reform regarding the information technology [44] 10. Revised licensing regime for financial companies [52] 11. Public policy requires a stable and efficient public infrastructure and trust in the payment system [74] 12. There must be clear rules in the agreement, including penalties, dispute resolution, and settlement mechanisms in the event of a business closure [4] 13. There are market standardization and transparency in the era of big data [100] 14. Fintech entrepreneurs should monitor upcoming changes in the regulatory environment [36] 15. Public policy against the financial revolution [72] 16. The online loan platform has registration requirements [113] 17. Securities law on the development of equity crowdfunding funding [89] 18. Fintech focus on changing the role of the state in encouraging national industrial growth [32] |

| Regulator | 19. Institutional support for new financial technologies [52] 20. Creating a regulatory sandbox for fintech start-ups [52,103] 21. Regulators must secure and respect the conditions of the moral community [117] |

| Financial Ethics | 22. Financial ethics must be following principles [47] |

| Financial Literacy | 23. Financial literacy should be technology-based oriented as well [28] 24. Lack of knowledge of success factors of equity crowdfunding open to non-accredited investors [93] |

| Supervisory | 25. Supervisory aspects by the financial services authorities are urgently [44] 26. Supervision of the problematic p2p lending platform [8] |

| Personal data protection | 27. The protection of misuse of personal data [17,44] 28. The use of big data and new technologies raises significant data protection issues [103] 29. Blockchain solves data protection issues regarding data integrity [54] 30. Privacy protection on InsurTech [86] |

| Customer Protection | 31. Trust in the payment system can fulfill consumer protection [74] 32. Utilization of electronic signatures for agreements [4] 33. Customer management [3] |

| Portfolio risk management | 34. The risk exposure of individual stocks with portfolios [77] |

| Collaboration | 35. Banks need to consider fintech and strategic partnerships [31,35,37,49,51,66] 36. Incubator model [108] 37. The channeling model can provide benefits for both fintech and banks [108] 38. Collaboration between online lending firms and banks [113] 39. Bank strategic planning for investment in fintech companies [38] 40. Offers strategic capabilities for a company to occupy a market niche in the financial sector [101] 41. Fintech collaboration with other industries [109] 42. Cross-Border Crowdfunding [91] |

| Security | 43. Broad access to electronic financial transactions should enhance personal protection [63] 44. Data security standards for blockchain platform payment applications [54] 45. Authentication and access control mechanisms [17] 46. Secure data storage and processing [17] 47. Developing a trust-based financial system, including comprehensive and measurable security mechanisms [39] 48. Data security and consumer trust [24] |

| Infrastructure | 49. Sources of infrastructure financing [79] 50. Role of infrastructure [79] 51. Factors affecting infrastructure construction projects [79] |

| Payment Systems | 52. Developing payment systems on mobile phones with biometric fingerprints or voice payments [60,68] 53. The right framework or guidelines for a mobile/digital wallet [72] 54. Requires standard definitions of mobile payments (including mobile banking, mobile money, mobile wallets, mobile commerce, mobile pos, and mobile finance) [73] 55. Fintech mobile payment services in the future will develop into a more secure service [69] |

| Blockchain | 56. The blockchain concept (including blockchain structures and payment transactions on the blockchain) [46,52,54,118] 57. Blockchain is a future technology [9,41] |

| Bitcoin | 58. Price conversion between bitcoin and the physical currency or other virtual currencies [13] 59. Explore ideas about coins that have major crypto features [116] |

| Technology | 60. Rapid developments in artificial intelligence (ai), machine learning, and blockchain [117] 61. Development of an optimization algorithm model and asset allocation to predict trends [82] 62. Develop integrated knowledge-based and generative models for the ai conversational robot advisor [82] 63. Need to ensure the quality of the software system at fintech [29] 64. Technology integration [3] 65. Alternative credit scoring based on non-traditional data [101] 66. Open Application Programming Interfaces (APIs) [43] 67. Digital identification and biometrics [43] 68. The design of big data-based lending markets [106] 69. Information collection for fraud detection [102] |

| Robo-Advisor | 70. Banks and other companies in the financial industry must design Robo-advisors [76] 71. AI for conversational Robo-advisor [82] 72. Designing a Robo-advisor for risk-averse [84] |

| Digital Insurances | 73. Concerning the business function of digital insurances [15] 74. Using Smart IoT to Provide Positive InsurTech Feedback [86] 75. Understand insurance value creation in a digital world [85] |

| Trends | Issues |

|---|---|

| Business Model and Ecosystem | 1. Fintech has a variety of business models [3,5,7,15,16,18,23,33,42,43,46,48,50,78] 2. The fintech business model can be adopted by existing financial organizations [36] 3. Fintech is changing the business and economic landscape [23,45] 4. Analyzed the function and structure of FinTech [21] 5. Transformation of financial intermediation and financial stability [30] 6. P2P lending business model [8,104] |

| Adoption | 7. The process of consumer self-regulation and behavioral intentions affects fintech adoption [53] 8. Adoption in mutual fund [75] 9. The attitude of consumers towards Robo-advisors influences adoption [76] 10. The adoption of mobile payments/fintech [20,22,26,25,56,57,58,59,62,97] 11. The adoption of fintech loans (P2P lending) [97,98,99] 12. Perceived usefulness of P2Pm-pay influences their decision to adopt [61] 13. Evaluating the usability of fintech [114] |

| Payment | 14. Bitcoin is a popular financial asset [13] 15. Multi-perspective framework for mobile payment ecosystems [64] 16. comparing mobile payment systems for SMS (short message service), NFC (near field communication), and QR (quick response) [60] 17. The most severe barrier for crypto-acceptance is a lack of consumer demand [105] 18. Development Portfolio for the Payment FinTech Company [65] 19. Evolution of the mobile payments technology ecosystem [71] 20. Developing payment transaction mediation among heterogeneous FinTech payment schemes [67] 21. Fintech acceptance factors of e-wallet and digital cash [55] 22. Ecosystem concepts as applied to the new payment landscape [66] |

| Financing | 23. Fintech is an alternative solution for small micro-businesses to obtain the funding through p2p lending model [44] 24. The company chooses a high level of profit margin [37] 25. The borrower decides a low level of debt time [37] 26. The lender chooses a high level of ROI [37] 27. Fintech is used to finance agriculture [94] 28. P2P platforms pose a considerable risk for market investors [100] 29. The advent of equity crowdfunding has had a fundamental impact on securities law and its legislative philosophy [89] 30. P2P lending consumer lending activity has penetrated areas that traditional banks may be underserved [111] 31. Success factors in equity crowdfunding [93,96] 32. Understanding P2P lending regulation [110] |

| Evolution of the mobile phone | 33. Mobile devices with increased storage media and data transfer capabilities [9] 34. Proposes a framework called UMETRIX for evaluating the usability of mobile applications [19] |

| Companies | 35. Early-stage companies will be at risk and do not understand market conditions [92] |

| Investor | 36. A higher level of participation of individual investors in the funding of new ventures [92] 37. Market consolidation trends through acquisitions and mergers between investors, start-ups, and financial shareholders [34] 38. Shareholders, including "big" banks, will continue to play a central role in the fintech ecosystem [34] 39. The rise of shadow banks [105] 40. Robo-advisors provide risky portfolios to individual investors based on an investment algorithm [81] 41. There are similarities in investor motivation in equity and crowdfunding rewards [88] 42. Connecting SME borrowers and consumer investors [90] |

| Start-up | 43. Focused on improving the consumer experience [34] 44. Focuses on integrating services across various fintech categories [34] |

| Technology | 45. The invisible robots of global finance [47] 46. Near Field Communication (NFC) antenna for fintech innovation [70] 47. New technological applications have emerged for electronic payments, electronic deposits, personal and consumer loans, insurance, various trade transactions driven by e-commerce [41] 48. Apply a priori algorithm to P2P lending [107] 49. Intelligent agent-based hedge and trading system design and development [80] 50. A reputation model for aggregating Ratings [87] 51. Big data platform architectural technology innovation combined with insurance [78] 52. NEC for Secure Multi-Party Computation (SMPC) technology [40] 53. The Random Neural Network with Genetic Algorithm [83] 54. FinTech Systems Automated Black Box Testing [27] |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Suryono, R.R.; Budi, I.; Purwandari, B. Challenges and Trends of Financial Technology (Fintech): A Systematic Literature Review. Information 2020, 11, 590. https://doi.org/10.3390/info11120590

Suryono RR, Budi I, Purwandari B. Challenges and Trends of Financial Technology (Fintech): A Systematic Literature Review. Information. 2020; 11(12):590. https://doi.org/10.3390/info11120590

Chicago/Turabian StyleSuryono, Ryan Randy, Indra Budi, and Betty Purwandari. 2020. "Challenges and Trends of Financial Technology (Fintech): A Systematic Literature Review" Information 11, no. 12: 590. https://doi.org/10.3390/info11120590

APA StyleSuryono, R. R., Budi, I., & Purwandari, B. (2020). Challenges and Trends of Financial Technology (Fintech): A Systematic Literature Review. Information, 11(12), 590. https://doi.org/10.3390/info11120590