1. Introduction

With the increase in international trade, the shipping industry is playing an increasingly important role in international logistics [

1]. Emissions from the shipping industry account for the majority of air pollution in ports and sea areas around the world [

2].

Figure 1 clearly shows that transportation accounts for 16.5% of global greenhouse gas emissions. Shipping is a part of transportation. According to a report of the International Maritime Organization (IMO), international shipping accounts for 2.6% of global CO

2 emissions [

3]. Containerization transportation accounts for a great proportion of international shipping [

4]. Kageson considered the ship itself as the liable entity [

5]. Therefore, the container ship itself is considered the liable entity. Container ships emit large amounts of CO

2 at sea, and CO

2 emissions from container ships are 1.3, 2.2 and 2.5 times greater than those from bulk shipping, crude oil tankers and general cargo ships [

6]. Container shipping is considered to be an emission-intensive industry [

7]. Large amounts of CO

2 emissions can cause several problems, such as global warming. Furthermore, IMO has projected a significant increase of 50.0% to 250.0% in the period to 2050 in maritime CO

2 emissions [

3]. Obviously, further action is imminent. The Paris Agreement [

8] aims to reduce the risk of climate change by limiting the rise in global average temperatures to well below 2 °C above pre-industrial levels and by working towards limiting the temperature increase to 1.5 °C above pre-industrial levels. Such a temperature target is conducive to addressing the massive CO

2 emissions and the resulting climate change. Therefore, reducing CO

2 emissions is not only critical to decarbonization but also related to the temperature targets of the Paris Agreement [

9]. IMO and national authorities have introduced relevant policies and applied appropriate measures to accelerate the decarbonization process.

IMO has developed an initial strategy to decarbonize the shipping industry. The strategy aims to reduce CO

2 emissions per transport work, as an average across international shipping, by at least 40.0% by 2030 and to pursue a 70.0% reduction by 2050, on the benchmark of 2008 levels [

10]. Moreover, to reduce more CO

2 emissions, net-zero carbon emissions have become the development direction of carbon reduction goals. Limiting warming to 1.5 °C would bring the world to net-zero CO

2 emissions around 2050 [

11]. Huang and Zhai stated that countries around the world have formally adopted or announced or are considering net-zero targets corresponding to the Paris Agreement [

12]. Lu et al. mentioned that over 60 countries around the world are working towards zero carbon emissions by 2050 at present [

13]. As an international power, China is also actively responding to carbon reduction initiatives. China has committed to achieving carbon neutrality before 2060 [

14]. Meanwhile, at the United Nations General Assembly in 2020, President Xi Jinping announced that China was stepping up its efforts to achieve peak CO

2 by 2030 and working towards achieving carbon neutrality by 2060 [

15]. Against this background, IMO has formulated many CO

2 emission reduction measures for the shipping industry, and China has proposed corresponding policies in response to the carbon reduction process.

There are many solutions to decarbonizing the shipping industry, which could be divided into three main categories: technical measures, operational measures and market-based measures (MBMs) [

16]. IMO introduced the Energy Efficiency Design Index (EEDI), applicable to new ships, and the Ship Energy Efficiency Management Plan (SEEMP), applicable to all ships [

17,

18]. To reduce the resistance of a ship during navigation, a Drag Reduction Coating (DRC) is a necessary measure. Waste Heat Recovery Systems (WHRSs) save fuel and significantly reduce CO

2 emissions [

19]. As an operational measure, Slow Steaming (SS) is considered to be a way to reduce shipping emissions [

20]. Gu et al. demonstrated the Maritime Emission Trading Scheme (METS), one of the market-based measures, which might be utilized to control CO

2 emissions from international shipping [

21]. There exist three scenarios of METS. For example, when CO

2 emissions are within the boundary of free quotas, operators have no need to pay CO

2 costs, and they can obtain extra benefits by selling their redundant quotas. However, if CO

2 emissions exceed free quotas but are within the boundary of the “cap” of CO

2 emissions, operators need to auction their quotas under METS. Unfortunately, operators have to purchase quotas in the market or pay a penalty when CO

2 emissions exceed the “cap” of CO

2 emissions. Under these conditions, the paper mainly refers to the European Union Emissions Trading System (EU ETS) to conduct an analysis on the possible auction rates in the future METS [

22].

Table 1 shows the significant elements of METS. Meanwhile, China has also introduced the policy of carbon trading pilot projects. The National Development and Reform Commission of China officially approved the implementation of carbon trading pilot projects in Beijing, Shanghai, Tianjin, Chongqing, Hubei and Guangdong.

The introduction and application of carbon reduction measures have had a positive impact on the decarbonization process of the shipping industry under carbon peaking and carbon neutrality. When using carbon reduction solutions to address emission reductions, both policymakers and container ship companies need to give some support. The achievement of the carbon reduction targets proposed by IMO requires the utilization of technical measures, operational measures and market-based measures. Hence, to better achieve carbon peaking and carbon neutrality, an overview of measures to achieve CO

2 reduction is presented. The benefits of applying carbon reduction measures under METS in terms of ship emission reduction are analyzed in detail. The best combination that allows container ship companies to achieve the optimal annual net income is obtained. Corresponding rewards for container ships using the carbon reduction measures and penalties beyond the prescribed CO

2 emission limits are also necessary. According to the carbon reduction requirements of IMO for the shipping industry, a “cap” on CO

2 emission is set to be 60.0% of 2008 levels by 2030 and 30.0% of 2008 levels by 2060 [

10]. This “cap” is used to limit CO

2 emissions from container ships to achieve carbon peaking and carbon neutrality as soon as possible. Above all, according to the final calculation results, not only could container ship companies choose the most appropriate and profitable strategy in the dual-carbon context, but policymakers could also receive advice on carbon reduction.

The remainder of this paper is organized as follows:

Section 2 reviews the existing literature. In the context of carbon peaking and carbon neutrality, a model is developed to select the emission reduction measures that can maximize the annual income for a container ship in

Section 3. Then,

Section 4 carries out a case study of an 8000-TEU container ship. Discussions and sensitivity analyses are carried out in

Section 5. The final section draws conclusions.

3. Modeling

A model is built to explore which combinations of reduction measures can help container ships obtain the maximum annual net income. It is assumed that bunker prices, freight rate, the auction and purchase prices of CO

2 and the actual sailing speed of the container ship are constant. The parameters and formulas that are used to calculate the annual net income of container ships are listed and explained below. The basic voyage estimation model and the 0–1 integer programming model are utilized. The variables and parameters are defined in

Table 2.

This paper uses Excel for data calculation and mainly involves a 0–1 integer programming model. Formulas (1)–(3) are used to calculate the total annual revenue and total annual cost. Formulas (5)–(12) are then used to calculate the various costs required over the course of the voyage. Finally, Formula (4) is used for integration.

Based on the parameters given, the number of trips travelled by the container ship per year can be calculated using Equation (1). The total annual revenue and the total annual cost of the container ship during the whole operation period are obtained using Equations (2) and (3). Our main objective is to obtain the maximum annual net income of the container ship, as shown in Equation (4).

Equations (5)–(7) refer to [

4,

6].

VP in Equation (5) means the optimal speed of a container ship, and it is set as the original speed (

OS) of a container ship [

4,

6]. The bunker consumption of a ship is the sum of the bunker consumed by the main engine and auxiliary engine; Equation (6) represents the total bunker cost of a container ship.

Once the bunker consumption of the container ship is obtained, we multiply it by the carbon content proportion of fuel (0.8645) and the factor of conversion of carbon to CO

2 (44/12) to convert the bunker consumption into CO

2 emissions [

6].

Equations (8) and (9) adapted from [

4] are used to estimate

CW and

CD by using the annual depreciation cost minus the annual bunker savings of the main engine.

Drawing on Qiu et al. [

53], the formulas are developed. The corresponding reward for container ships using the carbon reduction measures is expressed in Equation (10). In order to keep the emissions of container ships less than the initial emissions, carbon reduction measures must be taken. Hence, we set (

n,

m) ϵ {(0, 1),(1, 0),(1, 1)} in Equation (10). To achieve the dual-carbon target as soon as possible, a stricter mechanism is implemented, whereby operators have to pay certain fines. Equation (11) is utilized to calculate the corresponding penalties beyond the specified CO

2 emission limits. We assume that the reward is denoted by

CR and that the punishment is denoted by

CP.

Additionally, the total annual cost of CO

2 emissions is determined by comparing the actual CO

2 emissions with the free CO

2 emission allowances and the upper limit of CO

2 emissions.

When CO2(A) is not more than CO2(F), = 0, meaning that shipowners do not have to pay for CO2 emissions.

When CO2(F) < CO2(A) ≤ CO2(C), , indicating that there exist costs of CO2 emissions, that is, the cost of auctioning the quota of allowance.

When CO2(A) > CO2(C), In this case, shipowners not only have to auction CO2 allowances but also need to purchase quotas of allowance in the market.

4. Case Study

Among global container ships, the 7500–9999 TEU loading capacity is the most important in maritime industry [

54]. An 8000 TEU (

Table 3) container ship that travels on the Asia–North Europe route is taken as a case. This route can be divided into Westbound and Eastbound, and the distances are 11,449 nm and 11,017 nm, respectively

In addition to the parameters given above, the auction and purchase prices of carbon are assumed as 25 USD/ton and 30 USD/ton, respectively according to [

40]. The incentive level is set at 100.0%.

It can be calculated that the original speed of the container ship is 20.002 kn using Equation (5). Without using abatement measures, the corresponding CO

2 emissions in 2008 are calculated using Equation (7) to be 139,659.176 tons. Based on the “cap” emission of CO

2 and the free quotas set in

Table 1, the CO

2 emissions in 2008 are used for the calculations shown in

Table 4 and

Table 5. Meanwhile, OS and its 95.0%, 90.0% and 85.0% rates are used to calculate the results. [

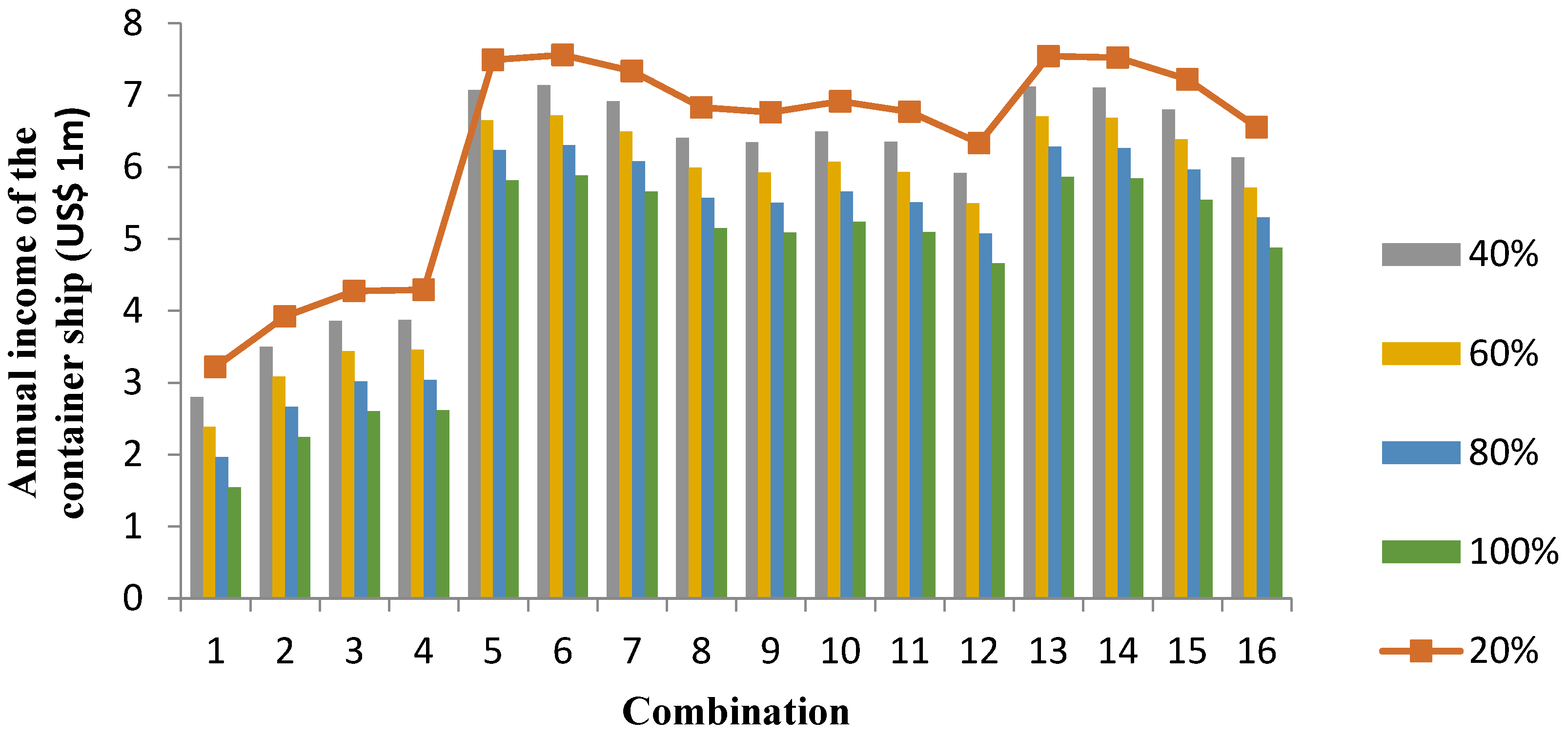

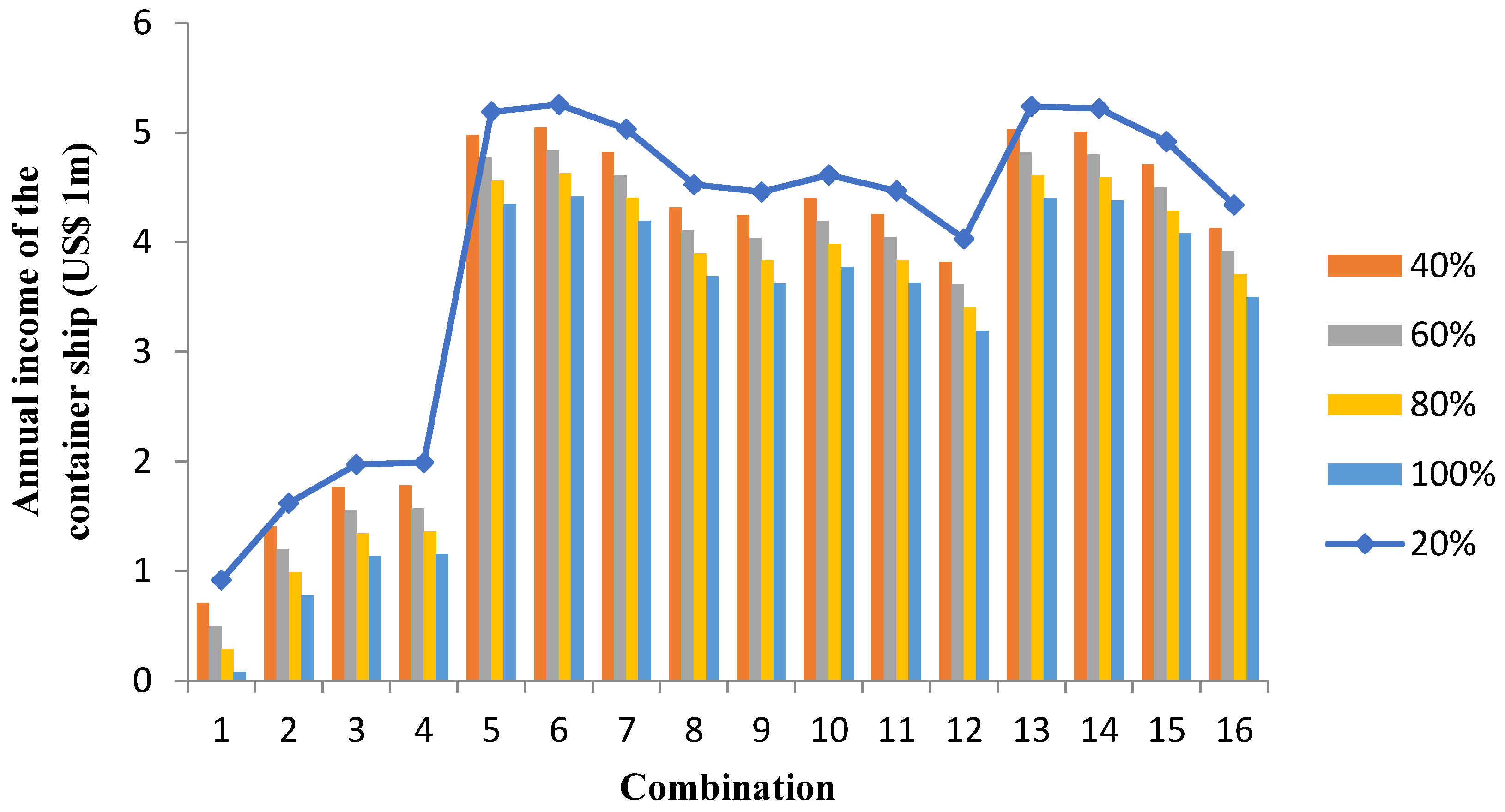

22]. On the basis of the corresponding formula, the costs of carbon reduction measures and other costs are first calculated separately under different speed reduction rates, and then the final results are obtained under multiple auction percentages. As a consequence, the final annual net incomes of the container ship in 2030 and 2060 are shown in

Table 6 and

Table 7, respectively. The corresponding figures are

Figure 2 and

Figure 3, respectively.

5. Sensitivity Analysis and Discussions

According to

Table 8 and

Table 9, it can be found that the changes in the maximum annual revenue of the container ship are generally similar under the different scenarios in 2030 and 2060. Accordingly, the discussion of the results and the sensitivity analysis of the parameters are carried out on the basis of carbon peaking.

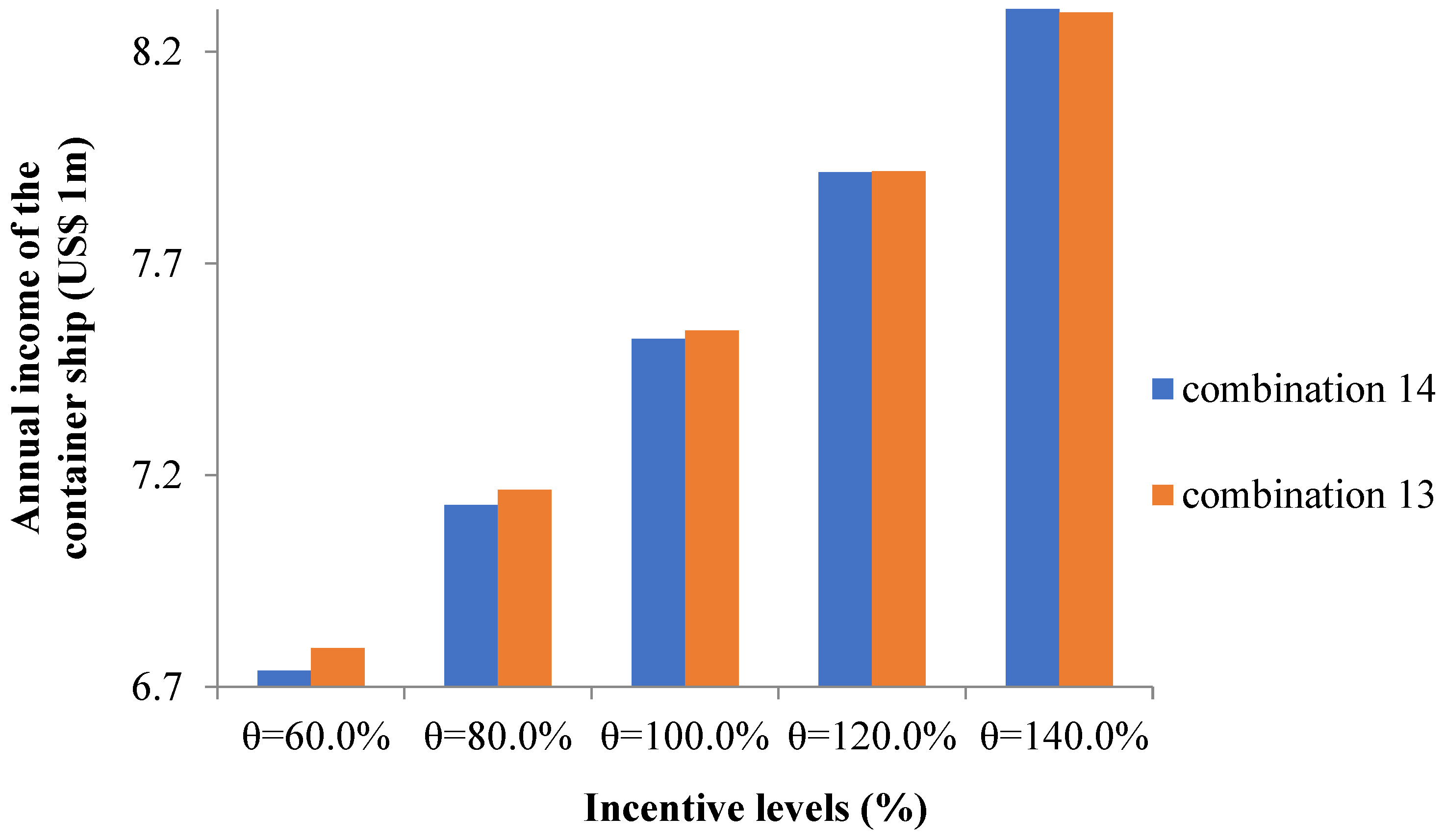

The freight rate, the average loading factor, the bunker price and the carbon auction and purchase prices of carbon are taken as constants. However, the fluctuations in these variables can cause certain impacts on the results. The freight rate and the average loading factor mainly influence the total annual revenue of a container ship. Therefore, this section attempts to estimate the impact on container ships by performing sensitivity analyses on bunker price, as well as on the auction and purchase prices of carbon, under METS. Meanwhile, five kinds of incentive levels are considered, that is, θ = 60.0%, θ = 80.0%, θ = 100.0%, θ = 120.0% and θ = 140.0% [

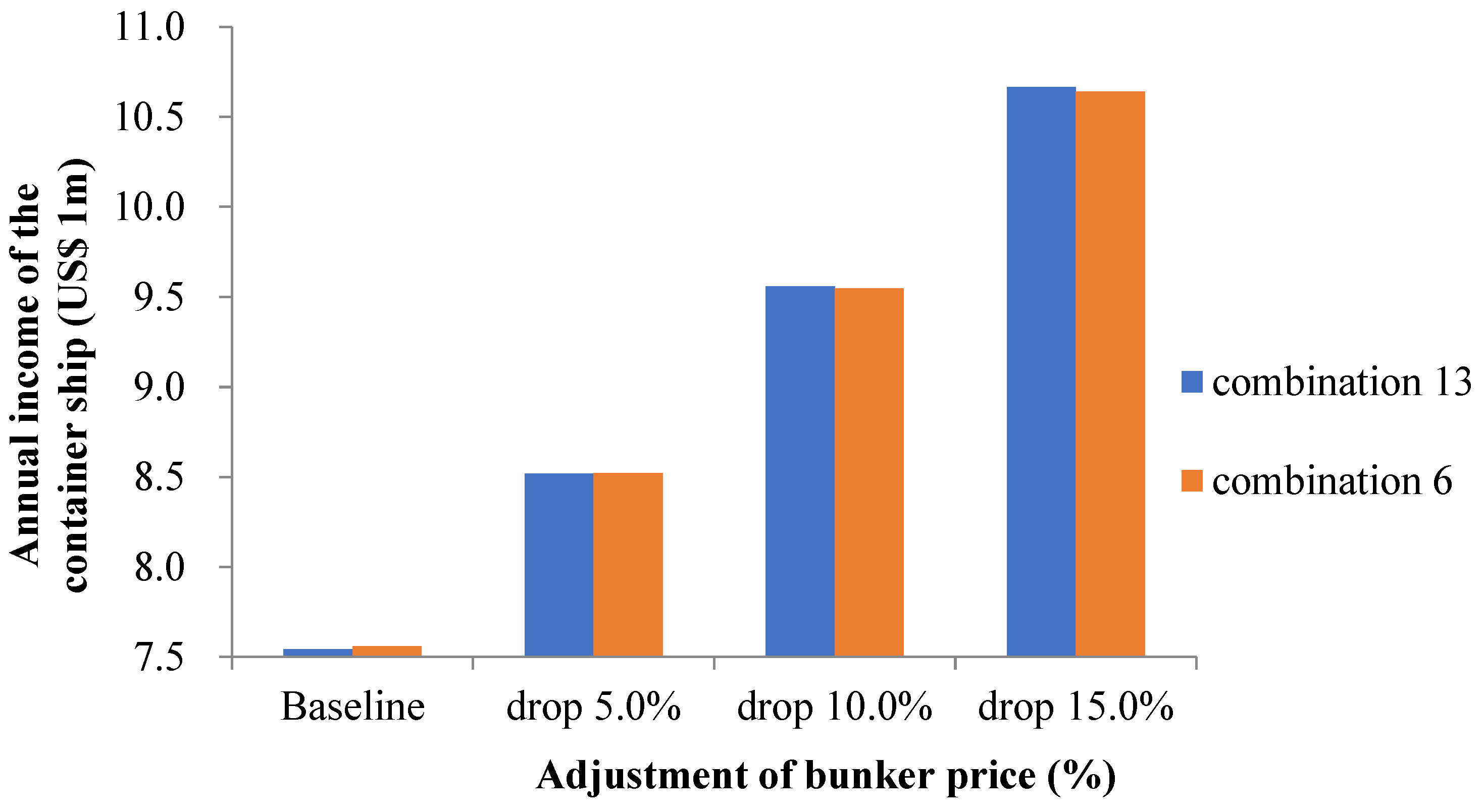

53]. The results of the sensitivity analysis for 5.0%, 10.0% and 15.0% adjustments above and below the bunker price baseline are shown in

Table 8. Annual net incomes for combination 6 and combination 13 when the percentage of bunker price drops to a certain point are shown in

Figure 4. However,

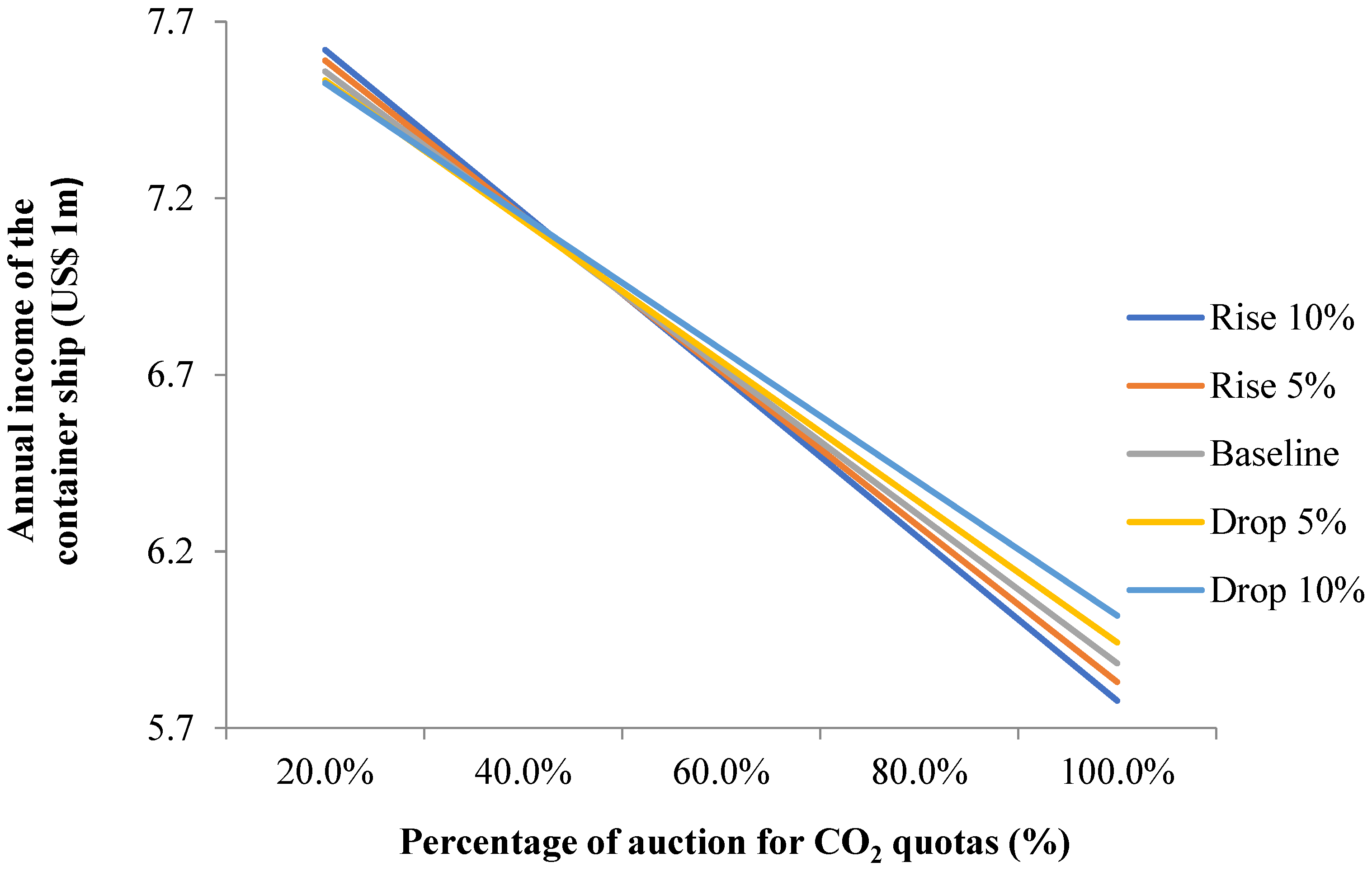

Table 9 shows the sensitivity analysis for calculating the auction and purchase prices of carbon with a 5.0% or 10.0% change in the baseline.The corresponding figure is presented in

Figure 5. Finally, the sensitivity analysis of the five incentive levels is presented in

Table 10.

Figure 6 reflects the annual net income for combination 13 and combination 14 when incentive levels rise. As mentioned above, the annual income decreases as the percentage of auction increases;

Figure 4 and

Figure 6 choose 20.0% as the percentage of auction.

The results are discussed according to

Figure 2 and

Figure 3. Our results show that combination 6 (using a WHRS alone and 5.0% of the original speed reduction) is the best, while combination 13 (using a WHRS and a DRC with the original speed) and combination 14 (using a WHRS and a DRC with a 5.0% reduction in the original speed) follow closely behind. The presence of a WHRS in the combination of abatement measures allows the container ship to achieve a greater annual income. Furthermore, the results show that the higher the proportion of CO

2 auction quotas, the lower the annual net income in the same combination. However, the proportion of CO

2 auction quotas has no impact on the selection of the mitigation measures for the container ship. Hence, these results can help container ship companies choose the most appropriate mitigation measures under carbon peaking and carbon neutrality.

It is clear that combination 14 allows container ships to earn a greater annual income than combination 13 with a continuous increase in bunker prices. When bunker prices and the auction and purchase prices of carbon rise, combination 6 remains the best mitigation measure. However,

Figure 4 shows the annual net income for combination 6 and combination 13 when the percentage of bunker prices falls to a certain level. In such a situation, the container ship companies are inclined to select combination 13 to obtain the maximum annual income. As shown in

Figure 5, the auction and purchase prices of carbon that bring the optimal income for container ships vary at different auction ratios.

Table 10 shows that combination 6 is the better choice for container ship companies at these five incentive levels. However, with increasing incentive levels, combination 14 is more likely to be chosen by container ship companies than combination 13. This is reflected in

Figure 6.

6. Conclusions

This paper explores the optimal CO2 reduction measures for container ship companies under the Maritime Emissions Trading Scheme (METS) to comply with the CO2 emission policy in the context of carbon peaking and carbon neutrality.

Our results show that combination 6 (using a WHRS alone and a 5.0% reduction in the original speed) is the most suitable solution for container ship companies with the selected values of parameters. The presence of a WHRS in the combination of abatement measures allows the container ship to achieve a greater annual income. Based on the results, the proportion of CO2 auction quotas has no impact on the selection of mitigation measures for container ships. To show a more clear analysis, sensitivity analyses are discussed. From the sensitivity analysis, it is found that a WHRS exists for the optimal combination of abatement measures within the fluctuation range of the parameters. When the bunker prices fluctuate up or down by 5.0%, it has no effect on the selection of the optimal combination for container ships. As the incentive level continues to increase, it is more likely that container ship companies choose to make a 5.0% speed reduction. The discussion and sensitivity analysis show the importance of installing a WHRS, which has practical implications for container companies.

However, there are also deficiencies in this paper that need to be further studied. Firstly, an 8000-TEU container ship and the Asia–North Europe route may not be able to reflect all types of ships and routes. Secondly, the cost calculation of the WHRS or DRC and the reward and penalty mechanism are not comprehensive. Therefore, a more detailed and comprehensive analysis of the above deficiencies remains to be explored in future studies, for example, considering various types of container ships and other routes. We leave this for future studies to further improve the emission reduction and annual net income of container ships under carbon peaking and carbon neutrality.