Strategic Sustainability of Offshore Arctic Oil and Gas Projects: Definition, Principles, and Conceptual Framework

Abstract

1. Introduction

2. Literature Review

2.1. Sustainability and Sustainable Development

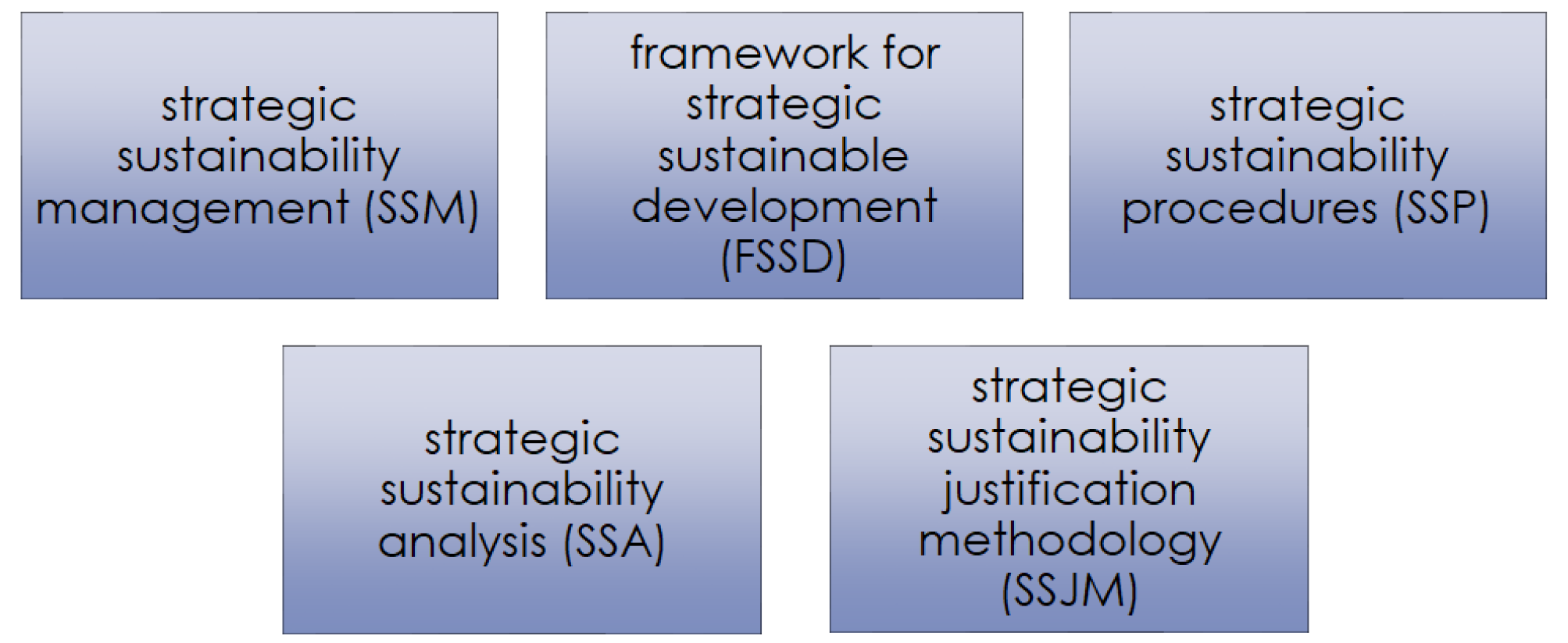

2.2. Strategic Sustainability

2.3. Efficiency/Sustainability Assessment of Arctic Oil and Gas Projects

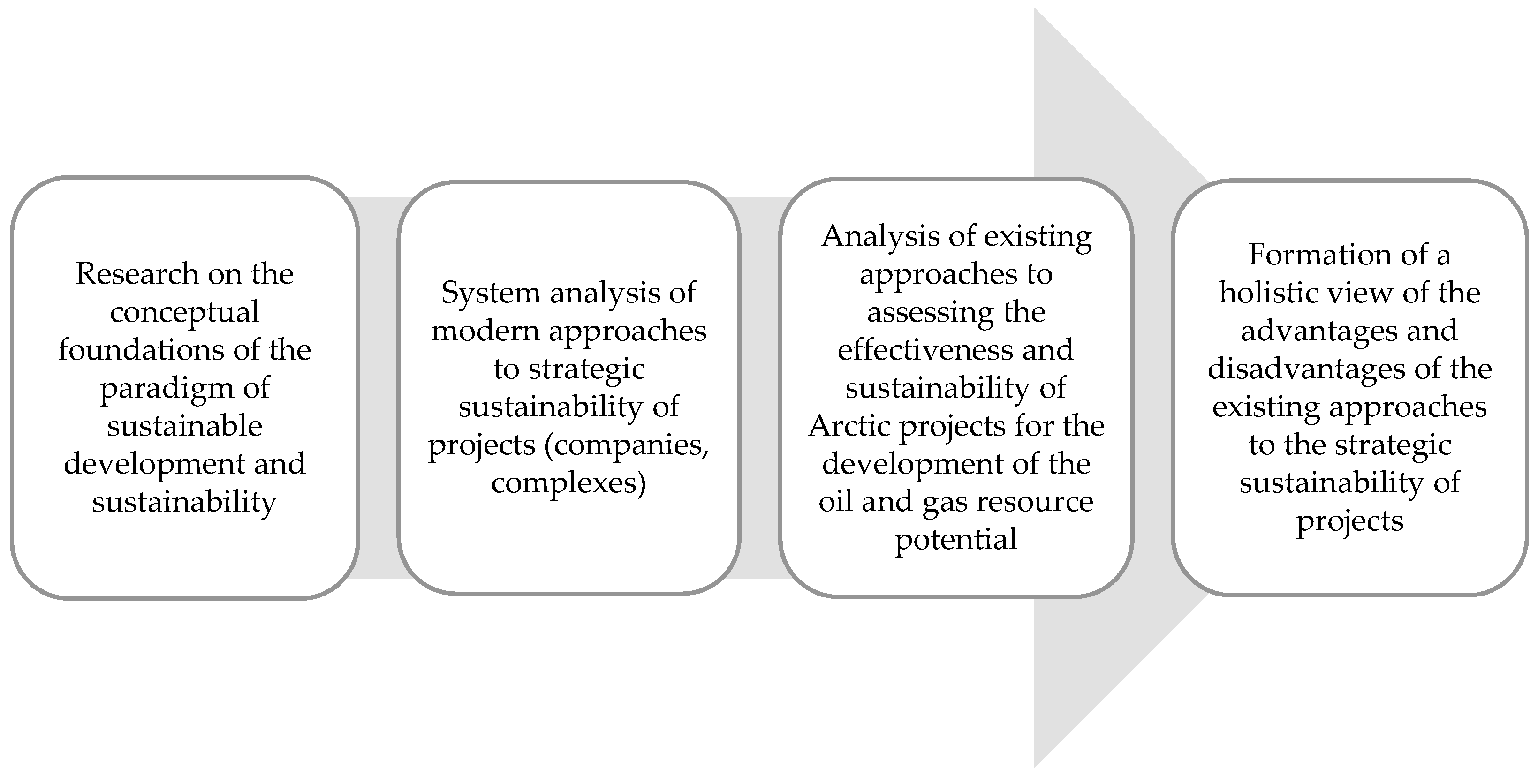

3. Methodology

4. Results

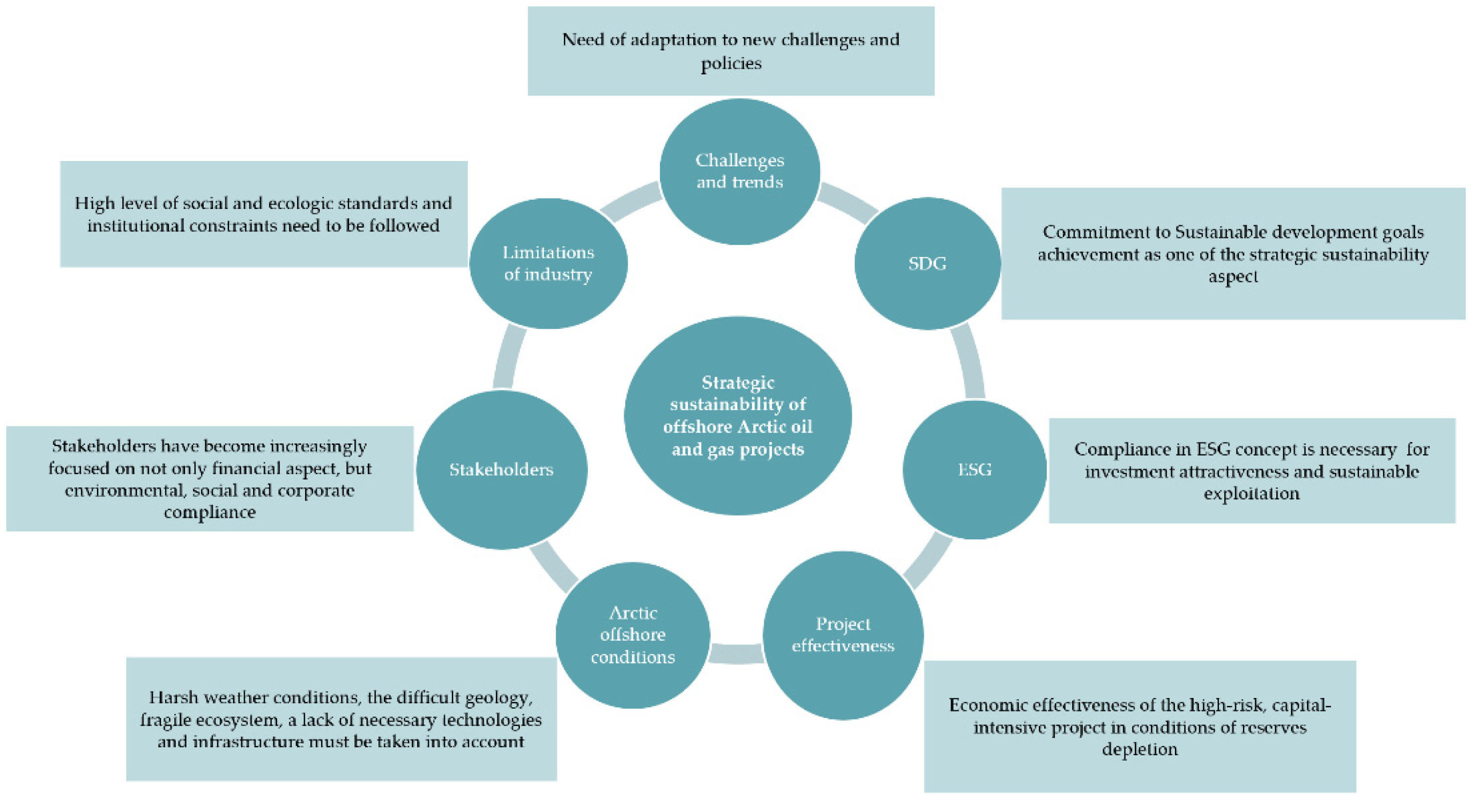

4.1. Modern Trends in the Oil and Gas Industry That Justify the Necessity of Strategic Sustainability of Arctic Offshore Oil and Gas Projects

- International cooperation (economic);

- Business development (economic);

- Knowledge development infrastructure (social);

- Environmental protection (environmental);

- Emergency preparedness (environmental).

- SDG 3. Good health and well-being.

- SDG 9. Industrialization, innovation and infrastructure.

- SDG 11. Sustainable cities and towns.

- SDG 12. Responsible consumption and production.

- SDG 14. Conservation of marine ecosystems.

- SDG 17. Partnership for sustainable development.

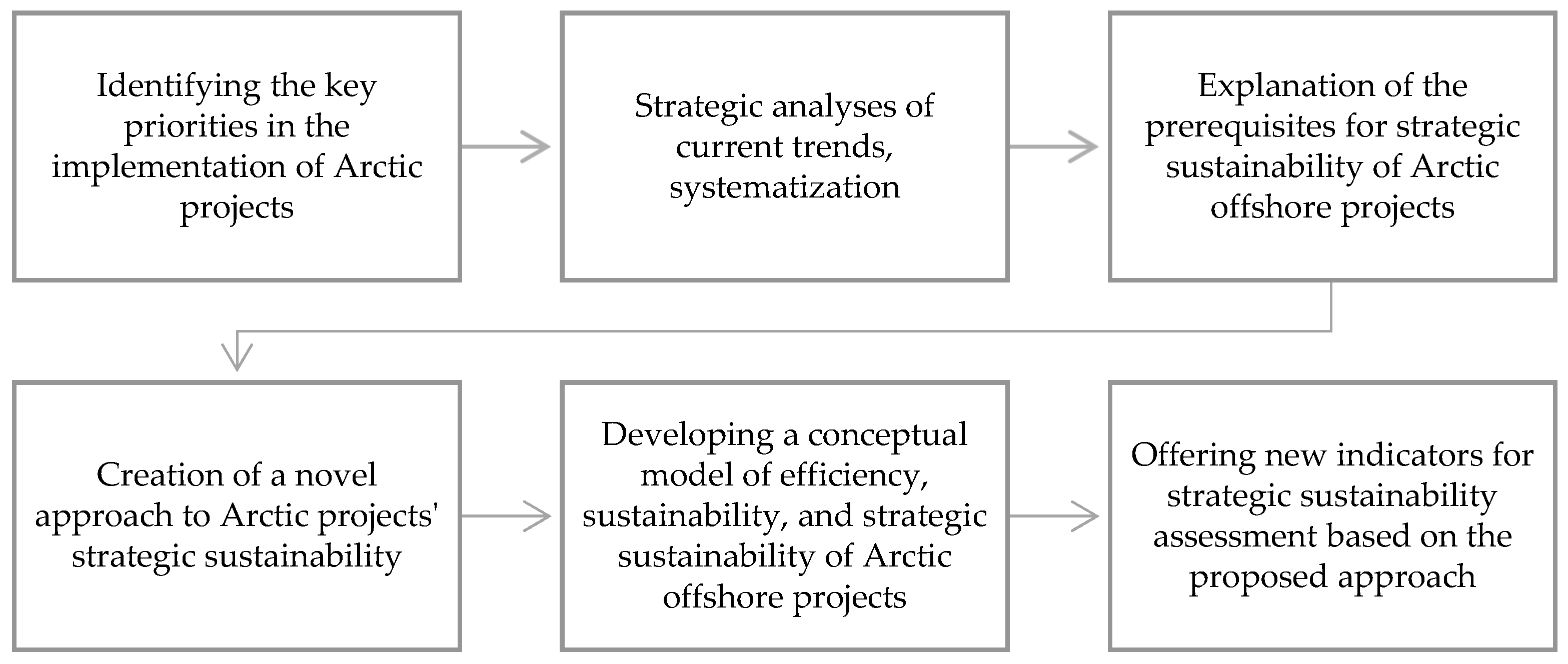

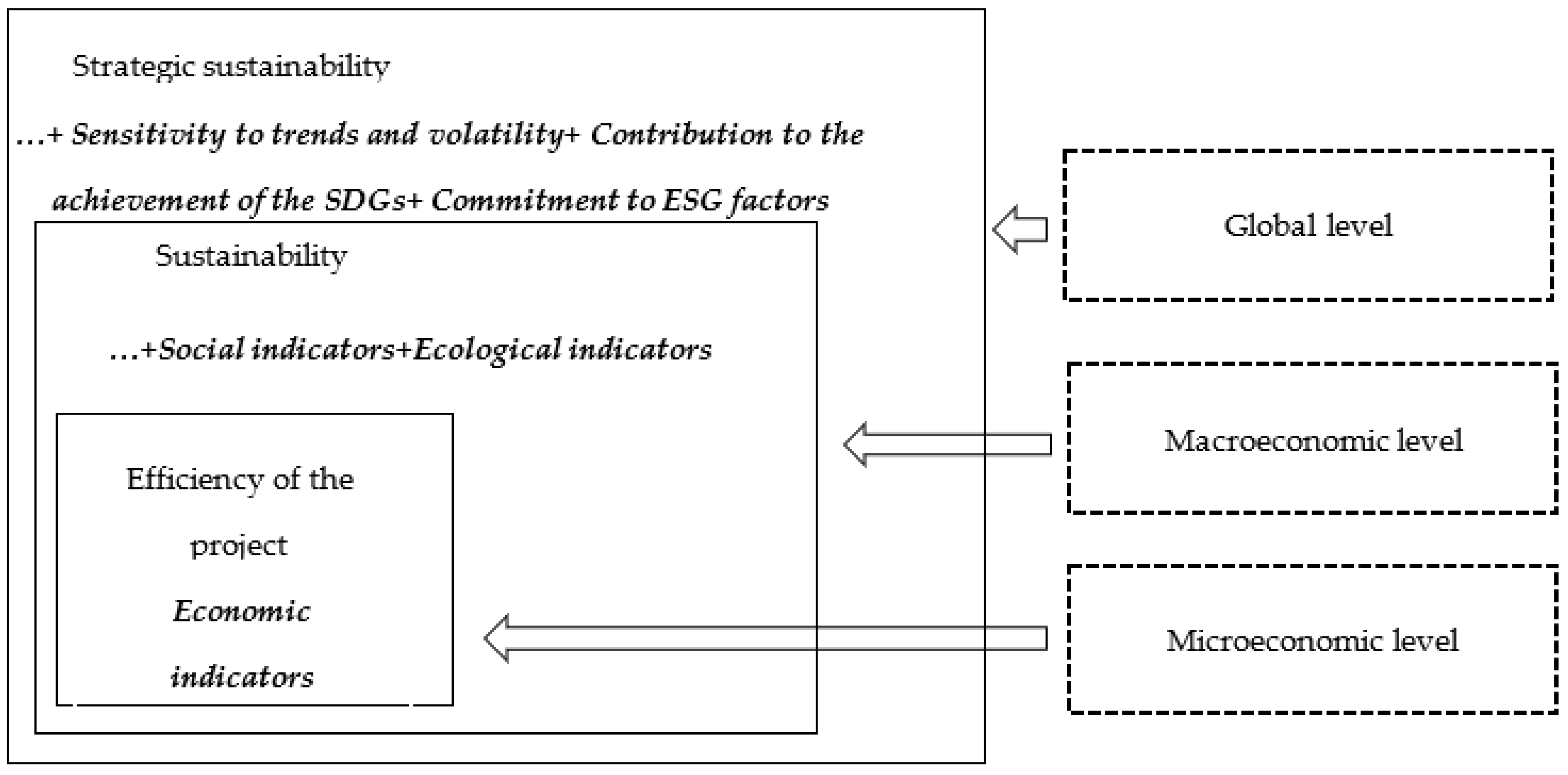

4.2. A Conceptual Framework for Strategic Sustainability in Arctic Oil and Gas Projects

- -

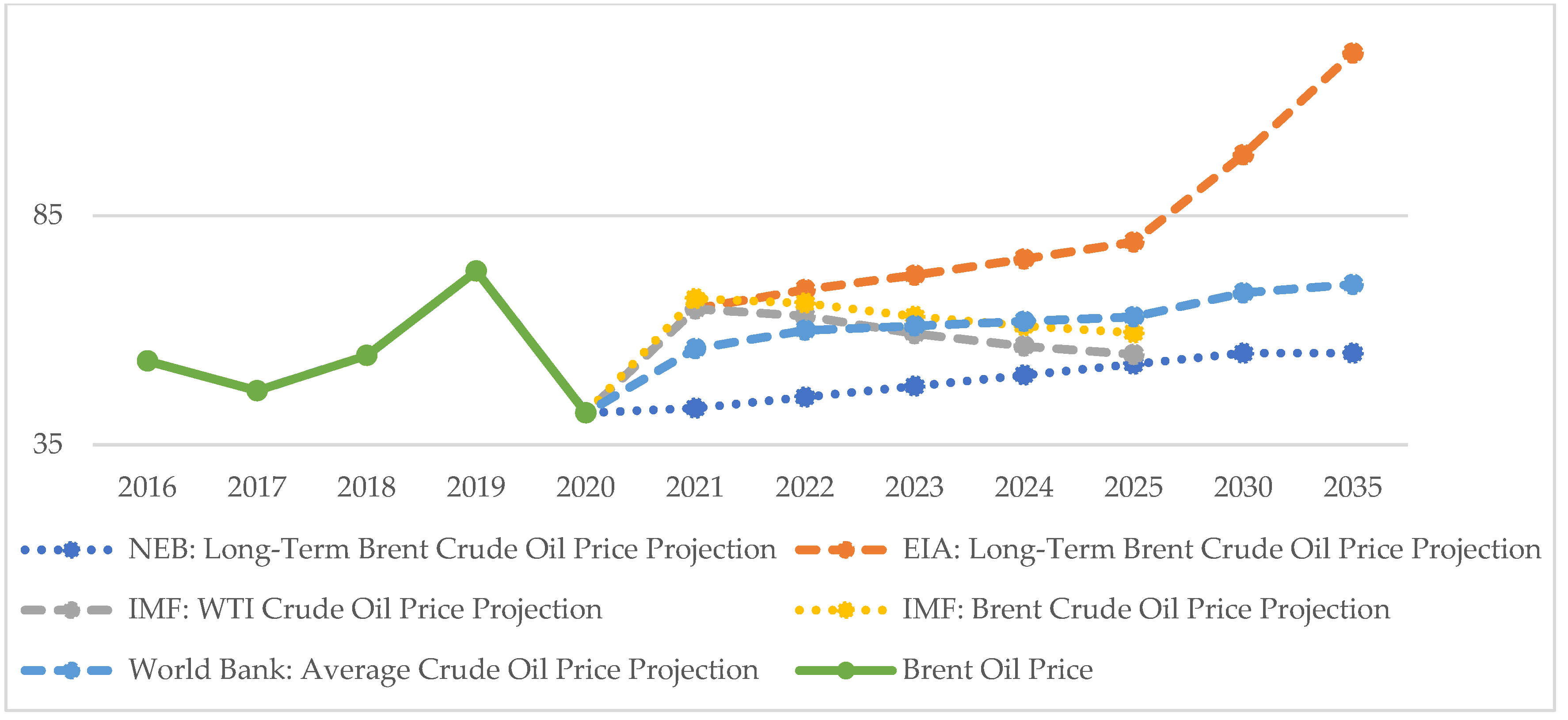

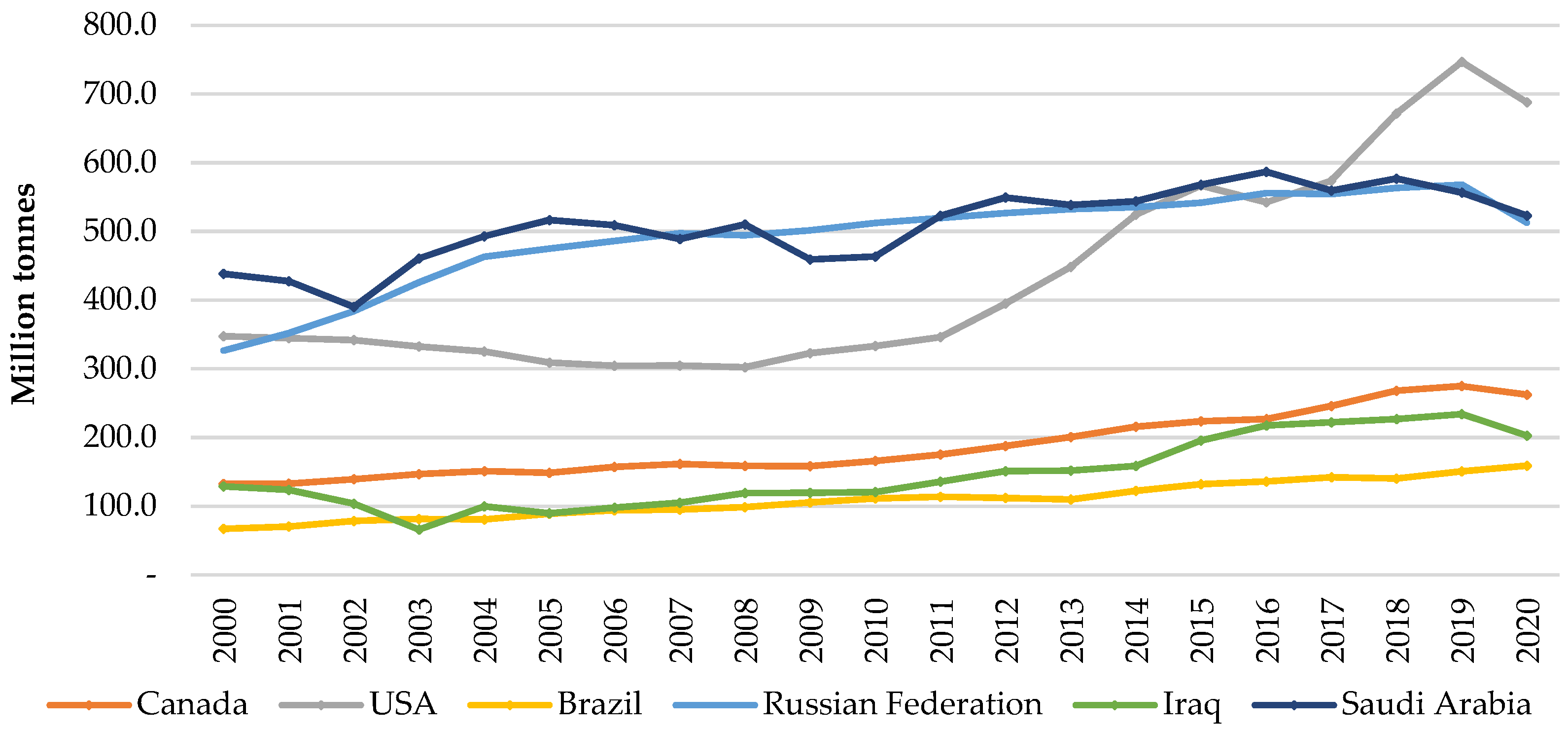

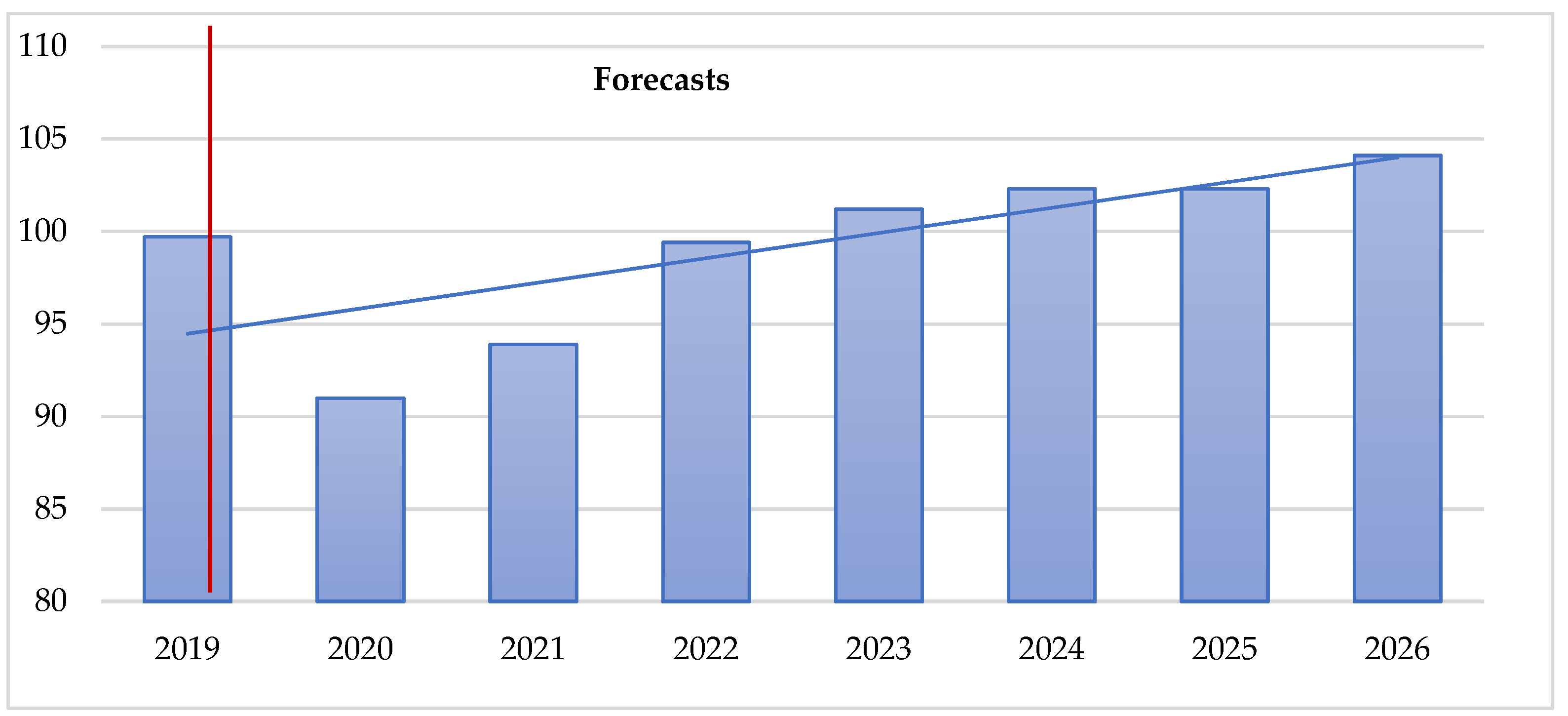

- the unpredictability of the oil and gas market caused by high price volatility, post-pandemic consequences, as well as green energy trends, substantiates the need for a special approach to the exploitation of Arctic offshore resources;

- -

- implementation of Arctic offshore projects nowadays requires not only economic justification, but also considering environmental, social, and governance aspects, which becomes possible if the strategic sustainability approach is used;

- -

- the strategic sustainability approach in the case of Arctic offshore projects is a complex dynamic system that allows for implementing such projects in accordance with the key principles of the SD concept based on the adaptation to the current challenges and the novel opportunities through strengthening competitive advantages, transforming traditional approaches towards sustainability, and taking into consideration resource constraints and contradictions between the interests of various stakeholders;

- -

- the strategic sustainability concept covers not only economics aspects (economic and financial efficiency—microeconomic level), but also social and environmental pillars (SD foundation—macroeconomic level) and novel findings provided in this research—”Sensitivity to trends and volatility + Contribution to the achievement of the SDGs + Commitment to ESG factors”.

5. Discussion

6. Conclusions

- -

- to develop long-term strategies including the ways and actions to meet key global challenges (related to low-carbon development in particular);

- -

- to represent the contribution to the environmental and social aspects;

- -

- to focus on the technological advances (to minimize possible environmental risks, to reduce production costs, to maintain a competitive position on the global market);

- -

- to create new approaches to interact with the key stakeholders;

- -

- to show commitment to the SDGs (not only in theory but also in practice).

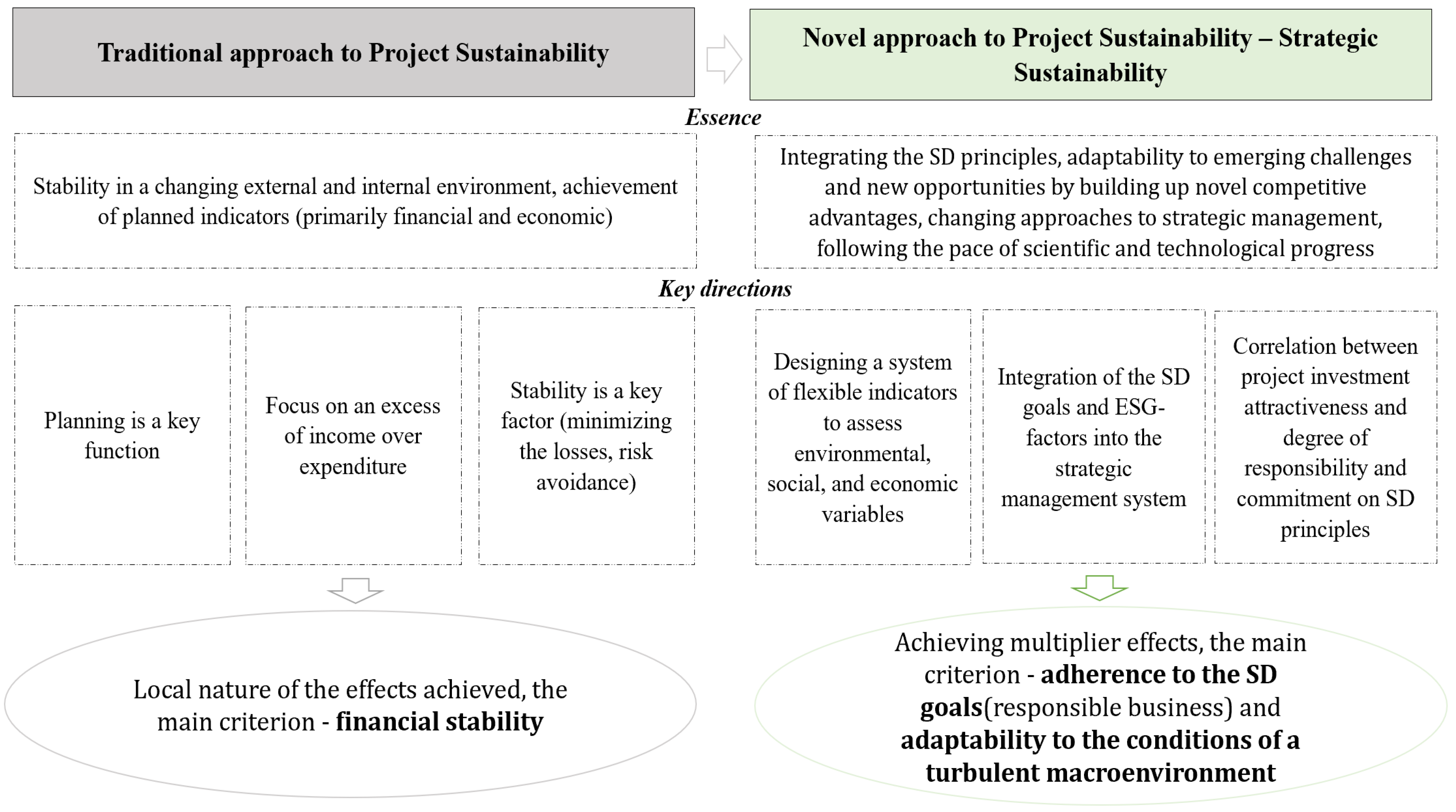

- -

- Designing a system of flexible indicators for assessing environmental, social, and economic variables;

- -

- Integrating SDG and ESG factors into strategic management systems;

- -

- Correlation between project investment attractiveness and the degree of responsibility and commitment on SD principles;

- -

- The key goal is to achieve multiplier effects; the main criterion is adherence to the SDGs (responsible business practices) and adaptability to the conditions of a turbulent macroenvironment.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Novel Trends and Challenges | Sensitivity towards Trends, Scores | ||

|---|---|---|---|

| 0 | 1 | 2 | |

| Strengthening competition in traditional hydrocarbon markets | A company has significant competitive advantages, holds a stable position in the market | A company has significant competitive advantages, but its position in the global market is unstable | A company loses its competitive position and cannot compete with other market players |

| Transition to low-carbon development | The project priorities are fully aligned with the targets of the global energy transition | A company attempts to diversify its activities in favor of green assets and introduces advanced technologies for sequestration of CO2 | Project priorities completely contradict with the low-carbon development vision |

| Growing role of innovations (technologies) | Use of advanced technologies, high innovative activity | Partial implementation of innovative technologies at the level of individual production and production processes | Low innovation activity, outdated technologies, high depreciation of fixed assets |

| Growing role of digitalization | Widespread use of advantages of digitalization, full automation of production and technological processes (“smart field”) | Partial use of digital solutions when performing certain operations, partial automation of production and technological processes | Lack of digital solutions in the organization of production and production processes |

| Social awareness | Practical implementation of socially responsible business concepts, use of progressive methods and tools for interaction with the public | Prerequisites for the implementation of socially responsible business concepts | Lack of effective interaction between the company and society |

| Environmental safety | Minimizing potential threats to environmental safety, continuous monitoring | Building an effective system for preventing environmental consequences | High level of environmental threats and risks, lack of effective oil spill prevention systems |

References

- Ryser, J. Pandemic Has Accelerated Transition to Low-Carbon Economy: Moody’s. 2020. Available online: https://www.spglobal.com/platts/en/market-insights/latest-news/electric-power/102220-pandemic-has-accelerated-transition-to-low-carbon-economy-moodys (accessed on 28 July 2021).

- The Oxford Institute for Energy Studies. The Rise of Renewables and Energy Transition: What Adaptation Strategy for Oil Companies and Oil-Exporting Countries? 2018. Available online: https://www.oxfordenergy.org/wpcms/wp-content/uploads/2018/05/The-rise-of-renewables-and-energy-transition-what-adaptation-strategy-for-oil-companies-and-oil-exporting-countries-MEP-19.pdf (accessed on 30 August 2021).

- Turbulent Outlook for Energy. 2020. Available online: https://www.energy-transition-institute.com/documents/17779499/17781921/06_Turbulent_outlook_for_energy.pdf/9307e8dd-0ece-244a-caf8-721125aed09f?t=1588099906000 (accessed on 24 October 2021).

- Moscow School of Management Skolkovo. Coronacrisis: The Impact of COVID-19 on the Fuel and Energy Sector in the World and in Russia. 2020. Available online: https://mks-group.ru/storage/presentations/SKOLKOVO_EneC_COVID19_and_Energy_sector_RU.pdf (accessed on 2 August 2021).

- Crude Oil Price Forecast: 2021, 2022 and Long Term to 2050. 2021. Available online: https://knoema.ru/infographics/yxptpab/crude-oil-price-forecast-2021-2022-and-long-term-to-2050 (accessed on 15 October 2021).

- U.S. Short Term Energy Outlook, April 2021. 2021. Available online: https://knoema.com/EIASTEO2021APR/u-s-short-term-energy-outlook-april-2021 (accessed on 24 October 2021).

- Canada’s Energy Future 2020. Canada Energy Regulator. 2020. Available online: https://www.cer-rec.gc.ca/en/data-analysis/canada-energy-future/2020/canada-energy-futures-2020.pdf (accessed on 24 October 2021).

- World Economic Outlook Database 2021. 2021. Available online: https://www.imf.org/en/Publications/WEO/weo-database/2021/October (accessed on 18 October 2021).

- International Energy Agency (IEA). Global Energy Review 2021. 2021. Available online: https://www.iea.org/reports/global-energy-review-2021 (accessed on 23 July 2021).

- Organization of the Petroleum Exporting Countries (OPEC). World Oil Outlook 2045. 2021. Available online: https://woo.opec.org (accessed on 24 July 2021).

- Rystad Energy. Covid-19 and Energy Transition Will Expedite Peak Oil Demand to 2028 and Cut Level to 102 Million Bpd. 2020. Available online: https://www.rystadenergy.com/newsevents/news/press-releases/covid-19-and-energy-transition-will-expedite-peak-oil-demand-to-2028-and-cut-level-to-102-million-bpd (accessed on 23 July 2021).

- BP Energy Outlook: 2020 Edition. 2020. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/energy-outlook/bp-energy-outlook-2020.pdf (accessed on 22 July 2021).

- The Green Course of Russia. Greenpeace. 2020. Available online: https://greenpeace.ru/wp-content/uploads/2020/09/GC_A4_006.pdf (accessed on 24 July 2021).

- Golovina, E.I. Environmental peculiarities of transboundary groundwater management. Int. J. Mech. Eng. 2019, 10, 511–519. [Google Scholar]

- DNV GL Energy Transition Outlook 2020. 2020. Available online: https://www.dnv.com/Publications/energy-transition-outlook-2020-186774 (accessed on 24 July 2021).

- BP Statistical Review of World Energy 69th Edition. 2020. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2020-full-report.pdf (accessed on 24 July 2021).

- Grushevenko, E.; Kapitonov, S.; Melnilkov, Y.; Perdereau, A.; Sheveleva, N.; Siginevich, D. Decarbonization of Oil and Gas: International Experience and Russian Priorities; Skolkovo School of Management: Skolkovo, Russia, 2021; Available online: https://energy.skolkovo.ru/downloads/documents/SEneC/Research/SKOLKOVO_EneC_Decarbonization_of_oil_and_gas_EN_22032021.pdf (accessed on 28 July 2021).

- OECD. Oil 2020 Analysis and Forecast to 2025. 2020. Available online: https://www.oecd.org/publications/market-report-series-oil-25202707.htm (accessed on 30 July 2021).

- Westwood Global Energy. 2020 High Impact Exploration and 2021 Key Wells to Watch. 2021. Available online: https://www.westwoodenergy.com/news/westwood-insight/2020-high-impact-exploration-and-2021-key-wells-to-watch (accessed on 22 July 2021).

- Balashova, E.S.; Gromova, E.A. Arctic shelf development as a driver of the progress of the Russian energy system. MATEC Web Conf. 2017, 106, 06008:1–06008:6. [Google Scholar] [CrossRef]

- Carayannis, E.G.; Cherepovitsyn, A.E.; Ilinova, A.A. Sustainable development of the Russian Arctic zone energy shelf: The role of the Quintuple Innovation Helix Model. J. Knowl. Econ. 2017, 8, 456–470. [Google Scholar] [CrossRef]

- Kapustin, A. From fragmentation to complex regulation. Law and development of oil and gas resources of the Russian Arctic and the continental shelf. Neftegaz. RU 2020, 5, 20–25. [Google Scholar]

- Decree of the President of the Russian Federation No. 645 of 26 October 2021. On the Strategy for the Development of the Arctic Zone of the Russian Federation and Ensuring National Security for the Period up to 2035. 2021. Available online: https://www.gov.spb.ru/static/writable/ckeditor/uploads/2020/11/24/01/Стратегия_Арктика_2035.pdf (accessed on 29 September 2021).

- Cherepovitsyn, A.E.; Tsvetkova, A.Y.; Komendantova, N.E. Approaches to assessing the strategic sustainability of high-risk offshore oil and gas projects. J. Mar. Sci. Eng. 2020, 8, 995. [Google Scholar] [CrossRef]

- Shestak, O.; Shcheka, O.L.; Klochkov, Y. Methodological aspects of use of countries experience in determining the directions of the strategic development of the Russian Federation Arctic regions. Int. J. Syst. Assur. Eng. Manag. 2020, 11, 44–62. [Google Scholar] [CrossRef]

- Papenov, K.V.; Nikonorov, S.M. Theoretical and practical problems of Arctic development. Arct. 2035 Actual Issues Probl. Solut. 2020, 3, 64–75. [Google Scholar] [CrossRef]

- Henderson, J.; Grushevenko, E. The Future of Russian Oil Production in the Short, Medium, and Long Term; The Oxford Institute for Energy Studies: Oxford, UK, 2019; Available online: https://www.oxfordenergy.org/wpcms/wp-content/uploads/2019/09/The-Future-of-Russian-Oil-Production-in-the-Short-Medium-and-Long-Term-Insight-57.pdf (accessed on 25 July 2021).

- Gritsenko, D.; Efimova, E. Is there Arctic resource curse? Evidence from the Russian Arctic regions. Resour. Policy 2020, 65, 101547. [Google Scholar] [CrossRef]

- Kobylkin, D.N. The resources of the Arctic shelf are our strategic reserve. Energy Policy 2019, 3, 6–9. [Google Scholar]

- Morgunova, M.O. Why is exploitation of Arctic offshore oil and natural gas resources ongoing? A multi-level perspective on the cases of Norway and Russia. Polar J. 2020, 9, 64–81. [Google Scholar] [CrossRef]

- Gielen, D.; Boshell, F.; Saygin, D.; Bazilian, M.; Wagner, N.; Gorini, R. The role of renewable energy in the global energy transformation. Energy Strategy Rev. 2019, 24, 38–50. [Google Scholar] [CrossRef]

- Brazovskaia, V.; Gutman, S.; Zaytsev, A. Potential impact of renewable energy on the sustainable development of Russian Arctic territories. Energies 2021, 14, 3691. [Google Scholar] [CrossRef]

- Grigoriev, G.A. Prospects for the development of hydrocarbon resources of the Russian Arctic shelf—A strategic pause is inevitable. Miner. Resour. Russia. Econ. Manag. 2019, 2, 37–45. [Google Scholar]

- Yurak, V.V.; Dushin, A.V.; Mochalova, L.A. Vs sustainable development: Scenarios for the future. J. Min. Inst. 2020, 242, 242–247. [Google Scholar] [CrossRef]

- Nazarov, V.; Krasnov, O.; Medvedeva, L. The Arctic oil and gas shelf of Russia at the stage of changing the world energy basis. Energy Policy 2021, 7, 70–85. [Google Scholar] [CrossRef]

- Fadeev, A.M.; Lipina, S.A.; Zaikov, K.S. Innovative approaches to environmental management in the development of hydrocarbons in the Arctic shelf. Polar J. 2021, 11, 208–229. [Google Scholar] [CrossRef]

- Shabalov, M.Y.; Dmitrieva, D.M. Implementation of cluster scenario approach for economic development of The Arctic zone of The Russian Federation. Int. J. Appl. Bus. Econ. Res. 2017, 15, 281–289. [Google Scholar]

- Palosaari, T. The Arctic paradox (and how to solve it). Oil, gas and climate ethics in the Arctic. In The GlobalArctic Handbook; Finger, M., Heininen, L., Eds.; Springer International Publishing: Cham, Switzerland, 2019; pp. 141–152. [Google Scholar]

- Bogoyavlensky, V.I.; Bogoyavlensky, I.V. Development of hydrocarbon resources and environmental safety in the Arctic. Arct. Vedom. 2021, 1, 30–43. [Google Scholar]

- Brekhuntsov, A.M.; Petrov, Y.V.; Prykova, O.A. Ecological aspects of the development of the natural resource potential of the Russian Arctic. Arct. Ecol. Econ. 2020, 3, 34–47. [Google Scholar] [CrossRef]

- Nikolaichuk, L.; Tcvetkov, P. Prospects of ecological technologies development in the Russian oil industry. Int. J. Appl. Eng. Res. 2016, 11, 5271–5276. [Google Scholar]

- Morgunova, M.; Kovalenko, A. Energy innovations in the Arctic. Energy Policy 2021, 4, 30–43. [Google Scholar] [CrossRef]

- Litvinenko, V.; Meyer, B. Syngas Production: Status and Potential for Implementation in Russian Industry; Springer International Publishing: Cham, Switzerland, 2017; 161p, ISBN 978-3-319-89022-7. [Google Scholar]

- Dmitrieva, D.M.; Romasheva, N.V. Sustainable development of oil and gas potential of the Arctic and its shelf zone: The role of innovations. J. Mar. Sci. Eng. 2020, 12, 1003. [Google Scholar] [CrossRef]

- Strategy&. 2020 Digital Operations Study for Energy. 2020. Available online: https://www.strategyand.pwc.com/gx/en/insights/2020/digital-operations-study-for-oil-and-gas/2020-digital-operations-study-for-energy-oil-and-gas.pdf (accessed on 29 July 2021).

- D’Adamo, I. Adopting a circular economy: Current practices and future perspectives. Soc. Sci. 2019, 8, 328. [Google Scholar] [CrossRef]

- Shi, L.; Han, L.; Yang, F.; Gao, L. The evolution of sustainable development theory: Types, goals, and research prospects. Sustainability 2019, 11, 7158. [Google Scholar] [CrossRef]

- Ghisellini, P.; Catia, C.; Sergio, U. A review on circular economy: The expected transition to a balanced interplay of environmental and economic systems. J. Clean. Prod. 2016, 114, 11–32. [Google Scholar] [CrossRef]

- Lahti, T.; Wincent, J.; Parida, V. A Definition and theoretical review of the circular economy, value creation, and sustainable business models: Where are we now and where should research move in the future? Sustainability 2018, 10, 2799. [Google Scholar] [CrossRef]

- Söderholm, P. The green economy transition: The challenges of technological change for sustainability. Sustain. Earth 2020, 3, 1–11. [Google Scholar] [CrossRef]

- Ponomarenko, T.; Nevskaya, M.; Marinina, O. An assessment of the applicability of sustainability measurement tools to resource-based economies of the Commonwealth of Independent States. Sustainability 2020, 12, 5582. [Google Scholar] [CrossRef]

- Huckle, J.; Wals, A. The UN decade of education for sustainable development: Business as usual in the end. Environ. Educ. Res. 2015, 21, 491–505. [Google Scholar] [CrossRef]

- United Nations General Assembly. Resolution Adopted by the General Assembly on 16 September 2005. 2005. Available online: https://www.un.org/en/development/desa/population/migration/generalassembly/docs/globalcompact/A_RES_60_1.pdf (accessed on 10 September 2021).

- Morton, S.; Pencheon, D.; Squires, N. Sustainable Development Goals (SDGs), and their implementation. Br. Med. Bull. 2017, 124, 81–90. [Google Scholar] [CrossRef]

- Rockström, J.; Bai, X.; DeVries, B. Global sustainability: The challenge ahead. Glob. Sustain. 2018, 1, 1–3. [Google Scholar] [CrossRef]

- Eggert, R. Mining, sustainability, and sustainable development. In Mineral Economics, 2nd ed.; Maxwell, P., Ed.; Australasian Institute of Mining and Metallurgy: Carlton, Australia, 2013; pp. 215–227. ISBN 978-1-921522-87-1. [Google Scholar]

- Choi, Y.; Song, J. Sustainable development of abandoned mine areas using renewable energy systems: A case study of the photovoltaic potential assessment at the Tailings Dam of abandoned Sangdong Mine, Korea. Sustainability 2016, 8, 1320. [Google Scholar] [CrossRef]

- Mesquita, M.J.; Corazza, R.I.; Souza, M.C.O.; Gomes, G.N.; Noronha, I.; Macedo, D. Mining and sustainability. In Environmental Sustainability, 1st ed.; da Cal Seixas, S.R., de Moraes Hoefel, J.L., Eds.; CRC Press: Boca Raton, FL, USA, 2021; 25p, ISBN 978-0367861698. [Google Scholar]

- Randall, A. Resource scarcity and sustainability—The shapes have shifted but the stakes keep rising. Sustainability 2021, 13, 5751. [Google Scholar] [CrossRef]

- Diesendorf, M. Sustainability and sustainable development. In Sustainability: The Corporate Challenge of the 21st Century; Dunphy, D., Benveniste, J., Griffiths, A., Sutton, P., Eds.; Allen&Unwin: Sydney, Australia, 2000; pp. 19–37. ISBN 978-1865082288. [Google Scholar]

- Khalili, N.R. Theory and concept of sustainability and sustainable development. In Practical Sustainability; Palgrave Macmillan: New York, NY, USA, 2011; pp. 1–22. [Google Scholar] [CrossRef]

- Jeronen, E. Sustainability and sustainable development. In Encyclopedia of Corporate Social Responsibility; Idowu, S.O., Capaldi, N., Zu, L., Gupta, A.D., Eds.; Springer: Berlin/Heidelberg, Germany, 2013; pp. 2370–2378. ISBN 978-3-642-28035-1. [Google Scholar]

- Sakalasooriya, N. Conceptual analysis of sustainability and sustainable development. Open J. Soc. Sci. 2021, 9, 396–414. [Google Scholar] [CrossRef]

- Otto, S. What means sustainability and sustainable development? ÖkologischesWirtschaften 2010, 4, 35–38. [Google Scholar] [CrossRef][Green Version]

- Rout, P.R.; Verma, A.K.; Bhunia, P.; Surampalli, R.Y.; Zhang, T.C.; Tyagi, R.D.; Goyal, M.K. Introduction to sustainability and sustainable development. In Sustainability: Fundamentals and Applications, 1st ed.; Surampalli, R.Y., Zhang, T.C., Goyal, M.K., Brar, S.K., Tyagi, R.D., Eds.; Wiley: Hoboken, NJ, USA, 2020; pp. 1–19. ISBN 978-1-119-43396-5. [Google Scholar]

- Sharmin, S. On “sustainable development” and “sustainability”: Different explanations and meanings. J. Indian Res. 2016, 4, 56–72. [Google Scholar]

- Mariani, A.; Vastola, A. Sustainable winegrowing: Current perspectives. Int. J. Wine Res. 2015, 7, 37–48. [Google Scholar] [CrossRef]

- United Nations Educational, Scientific and Cultural Organization. UNESCO Moving Forward the 2030 Agenda for Sustainable Development. 2017. Available online: https://en.unesco.org/creativity/sites/creativity/files/247785en.pdf (accessed on 13 July 2021).

- Chatterjee, K.K. Sustainability and sustainable development of mineral resources. In Macro-Economics of Mineral and Water Resources; Springer International Publishing: Cham, Switzerland; Capital Publishing Company: New Delhi, India, 2015; pp. 161–188. ISBN 978-3-319-15053-6. [Google Scholar]

- Ancione, G.; Paltrinieri, N.; Milazzo, M.F. Integrating real-time monitoring data in risk assessment for crane related offshore operations. J. Mar. Sci. Eng. 2020, 8, 532. [Google Scholar] [CrossRef]

- Liu, Y.; Ren, J. Overview of sustainability, sustainable development and sustainability assessment: Concepts and methods. In Energy Systems Evaluation. Green Energy and Technology; Ren, J., Ed.; Springer International Publishing: Cham, Switzerland, 2021; Volume 1, pp. 1–29. ISBN 978-3-030-67528-8. [Google Scholar]

- Beder, S. Costing the earth: Equity, sustainable development and environmental economics. N. Z. J. Environ. Law 2000, 4, 227–243. [Google Scholar]

- Beder, S. The stain in sustainability. New Int. 2005, 383, 14–15. [Google Scholar]

- Ruggerio, C.A. Sustainability and sustainable development: A review of principles and definitions. Sci. Total Environ. 2021, 786, 147481. [Google Scholar] [CrossRef] [PubMed]

- Tan, Y.S.; Kwek, L.J. Environmental sustainability and sustainable development. In 50 Years of Environment: Singapore’s Journey Towards Environmental Sustainability; Tan, Y.S., Ed.; World Scientific Publishing: Singapore, 2015; pp. 247–264. ISBN 978-9814696210. [Google Scholar]

- Connelly, S.; Markey, S.; Roseland, M. Strategic sustainability: Addressing the community infrastructure deficit. Can. J. Urban Res. 2009, 18, 1–23. [Google Scholar]

- Telesford, J.N.; Strachan, P.A. Strategic sustainability procedures: Focusing business strategic planning on the socio-ecological system in an island context. Sustain. Dev. 2016, 25, 35–49. [Google Scholar] [CrossRef]

- Kwon, M.; Tang, S.-Y.; Kim, C. Examining strategic sustainability plans and smart-growth land-use measures in California cities. J. Environ. Plan. Manag. 2017, 61, 1570–1593. [Google Scholar] [CrossRef]

- Da Rocha Vencato, C.H.; Gomes, C.M.; Scherer, F.L.; Kneipp, J.M.; Bichueti, R.S. Strategic sustainability management and export performance. Manag. Environ. Qual. 2014, 25, 431–445. [Google Scholar] [CrossRef]

- Lacy, P.; Cooper, T.; Hayward, R.; Neuberger, L. A New Era of Sustainability: UN Global Compact–Accenture CEO Study 2010. 2010. Available online: www.unglobalcompact.org/docs/news_events/8.1/UNGC_Accenture_CEO_Study_2010.pdf (accessed on 25 June 2021).

- Evans, A.; Strezov, V.; Evans, T.J. Assessment of sustainability indicators for renewable energy technologies. Renew. Sustain. Energy Rev. 2009, 13, 1082–1088. [Google Scholar] [CrossRef]

- Broman, G.; Robèrt, K. A Framework for strategic sustainable development. J. Clean. Prod. 2015, 140, 17–31. [Google Scholar] [CrossRef]

- Malenkov, Y.; Kapustina, I.; Shishkin, V.; Shishkin, V. Theoretical aspects of strategic sustainability of a trading enterprise under digitally transforming economy. IOP Conf. Ser. Mater. Sci. Eng. 2019, 497, 012128. [Google Scholar] [CrossRef]

- Singh, R.; Murty, H.R.; Gupta, S.K.; Dikshit, A. An overview of sustainability assessment methodologies. Ecol. Indic. 2009, 9, 189–212. [Google Scholar] [CrossRef]

- Presley, A.; Meade, L.; Sarkis, J. A strategic sustainability justification methodology for organizational decisions: A reverse logistics illustration. Int. J. Prod. Res. 2007, 45, 4594–4620. [Google Scholar] [CrossRef]

- Hallstedt, S.; Thompson, A.; Lindahl, P. Key elements for implementing a strategic sustainability perspective in the product innovation process. J. Clean. Prod. 2013, 51, 277–288. [Google Scholar] [CrossRef]

- Schade, W.; Rothengatter, W. Strategic sustainability analysis: Broadening existing assessment approaches for transport policies. Transp. Res. Rec. 2001, 1756, 3–11. [Google Scholar] [CrossRef]

- Smith, A.D. Strategic sustainability and operational efficiency dilemma of data centres. Int. J. Bus. Inf. Syst. 2011, 8, 107–130. [Google Scholar] [CrossRef]

- Russia Maritime Studies Institute. Foundations of the Russian Federation State Policy in the Arctic for the Period Up to 2035. 2020. Available online: https://dnnlgwick.blob.core.windows.net/portals/0/NWCDepartments/Russia%20Maritime%20Studies%20Institute/ArcticPolicyFoundations2035_English_FINAL_21July2020.pdf?sr=b&si=DNNFileManagerPolicy&sig=DSkBpDNhHsgjOAvPILTRoxIfV%2FO02gR81NJSokwx2EM%3D (accessed on 15 October 2021).

- WWF. Arctic Oil and Gas. 2021. Available online: https://arcticwwf.org/work/oil-and-gas (accessed on 12 September 2021).

- Conservation of Arctic Flora and Fauna (CAFF). Arctic Biodiversity Assessment: Status and Trends in Arctic Biodiversity. 2013. Available online: https://portals.iucn.org/library/sites/library/files/documents/Bios-Eco-Ter-Pol-027.pdf (accessed on 3 October 2021).

- Integrated Climate Change Strategies for Sustainable Development of Russia’s Arctic Regions. Case Study for Murmansk Oblast. 2009. Available online: https://research.fit.edu/media/site-specific/researchfitedu/coast-climate-adaptation-library/europe/russia-ukraine-georgia/Rrec--Undp.-2009.-Russia-Arctic-Sustainable-Development--CC-[in-Russian].pdf (accessed on 15 September 2021).

- Korchak, E.A.; Serova, N.A. Polar views on the Arctic: The Arctic policy of Russia and foreign countries. Contours Glob. Transform. Politics Econ. Law 2019, 12, 145–159. [Google Scholar] [CrossRef][Green Version]

- Gassiy, V.; Sleptsov, A. Russian Arctic ecosystem sustainability in rapid changes and challenges. E3S Web Conf. 2021, 291, 02010. [Google Scholar] [CrossRef]

- Foresight Study of the Development of the Arctic Offshore Industry Until 2030. 2021. Available online: https://www.dvfu.ru/schools/engineering/structure/research-and-education-centers/international_scientific_educational_center_r_d_center_arktika/foresight-study-of-the-development-of-arctic-offshore-industry-up-to-2030 (accessed on 16 September 2021).

- Fadeev, A.M.; Cherepovitsyn, A.E.; Larichkin, F.D. Strategic Management of the Oil and Gas Complex in the Arctic; KSC RAS: Apatity, Russia, 2019; 289p, ISBN 978-5-91137-407-5. [Google Scholar]

- Challenges and Opportunities of Oil and Gas Investment in the Arctic. 2015. Available online: https://sipa.columbia.edu/sites/default/files/downloads/Barclays_Final%20Report.pdf (accessed on 5 September 2021).

- Stipo, F.; Thorhaug, A.; Jackson, R.; Butler, K.; Gibbs, R.; Gray, J.; Marshall, P.; Oerke, A.; Simion, M.; White, L.; et al. The future of the Arctic: A key to global sustainability. Cadmus 2012, 42, 47–48. [Google Scholar]

- Verhaag, M.A. It is not too late: The need for a comprehensive international treaty to protect the Arctic environment. Georget. Int. Environ. Law Rev. 2003, 15, 555–579. [Google Scholar]

- Ocean Conservatory. 2021. Available online: https://oceanconservancy.org/programs (accessed on 14 August 2021).

- Rixey, C.M. Oil and Sustainability in the Arctic Circle. Denver J. Int. Law Policy 2016, 44, 441–452. [Google Scholar]

- Lee, O. Effect of corporate sustainability policies and investment risks for future Arctic oil and gas development in Alaska. 2020. Available online: https://arcticyearbook.com/images/yearbook/2020/Scholarly-Papers/2_Lee.pdf (accessed on 4 September 2021).

- Nikitina, O. Shelf formula. Sib. Oil 2016, 129, 38–41. [Google Scholar]

- Gazeev, M.H.; Volynskaya, N.A.; Rybak, A.B. Complex Efficiency Assessment of Development of Arctic Oil & Gas Resources in Russia. 2018. Available online: https://arcticyearbook.com/arctic-yearbook/2018/2018-scholarly-papers/289-complex-efficiency-assessment-of-development-of-arctic-oil-gas-resources-in-russia (accessed on 16 September 2021).

- Shibata, A.; Chuffart, R. Sustainability as an integrative principle: The role of international law in Arctic resource development. Polar Rec. 2020, 56, E37. [Google Scholar] [CrossRef]

- Degtyareva, E.V. Economic effects of the Arctic continental shelf development. In IOP Conference Series: Earth and Environmental Science,. 4th International Scientific Conference “Arctic: History and Modernity”, Saint Petersburg, Russian Federation, 17–18 April 2019; IOP Publishing: Bristol, UK, 2019; Volume 302, p. 012136. [Google Scholar] [CrossRef]

- Sustainable Development Goals in the Arctic. 2021. Available online: https://arctic-council.org/ru/projects/sustainable-development-goals-in-the-arctic (accessed on 1 October 2021).

- Mineev, A.; Timoshenko, A.; Zhurova, E.; Middleton, A. Implementering av FNs bærekraftsmål i det norske Arktis: Et fiks ferdig rammeverk? Magma 2020, 5, 74–85. [Google Scholar]

- Sustainable Development Action—The Nordic Way. 2017. Available online: https://norden.diva-portal.org/smash/get/diva2:1092868/FULLTEXT01.pdf (accessed on 6 September 2021).

- Nedosekin, A.O.; Rejshahrit, E.I.; Kozlovskij, A.N. Strategic approach to assessing economic sustainability objects of mineral resources sector of Russia. J. Min. Inst. 2019, 237, 354–360. [Google Scholar] [CrossRef]

- Kneen, J. Earth: What is Mining All About? The Up and Down Sides. 2007. Available online: https://miningwatch.ca/sites/default/files/Mining_Unsustainable_0.pdf (accessed on 13 October 2021).

- Hoff, M. Can Mining be Sustainable? 2013. Available online: https://ensia.com/articles/mine-over-matter (accessed on 5 October 2021).

- The Big Choices for Oil and Gas in Navigating the Energy Transition. 2021. Available online: https://www.mckinsey.com/industries/oil-and-gas/our-insights/the-big-choices-for-oil-and-gas-in-navigating-the-energy-transition (accessed on 10 September 2021).

- Norway’s Arctic Strategy: Innovation and Sustainability. 2016. Available online: https://www.openaccessgovernment.org/norways-arctic-strategy-innovation-sustainability/30391 (accessed on 14 September 2021).

- Dudin, M.N.; Lyasnikov, N.V.; Sekerin, V.D.; Gorohova, A.E.; Bank, S.V. Provision of global economic and energy security in the context of the development of the Arctic resource base by industrialized countries. Int. J. Econ. Financ. Issues 2015, 5, 248–256. [Google Scholar]

- The 2030 Decarbonization Challenge. The Path to the Future of Energy. 2020. Available online: https://www2.deloitte.com/cn/en/pages/energy-and-resources/articles/pr-the-2030-decarbonization-challenge.html (accessed on 9 October 2021).

- UBS Bank Won’t Fund New Offshore Arctic Oil, Gas Projects. 2020. Available online: https://www.pbs.org/newshour/economy/ubs-bank-wont-fund-new-offshore-arctic-oil-gas-projects (accessed on 20 August 2021).

- Mitrova, A.; Grushevenko, E.; Malov, A. Prospects for Russian Oil Production: Life Under Sanctions SEneC. 2018. Available online: https://energy.skolkovo.ru/downloads/documents/SEneC/research04-ru.pdf (accessed on 12 July 2021).

- Johan Sverdrup, the North Sea Giant, is on Stream. 2019. Available online: https://www.equinor.com/en/news/2019-10-johan-sverdrup.html (accessed on 30 May 2021).

- Kozlova, D.; Pifarev, D. Digital Mining: Tuning for the Industry. 2018. Available online: https://vygon.consulting/upload/iblock/d11/vygon_consulting_digital_upstream.pdf (accessed on 24 July 2021).

- Tretyakov, N.; Cherepovitsyn, A.; Komendantova, N. Technology predictions for Arctic hydrocarbon development: Digitalization potential. In Technological Transformation: A New Role For Human, Machines And Management; Schaumburg, H., Korablev, V., Ungvári, L., Eds.; Springer International Publishing: Cham, Switzerland, 2021; pp. 241–251. ISBN 978-3-030-64429-1. [Google Scholar]

- CSR in the Arctic—Way Forward. 2013. Available online: https://oaarchive.arctic-council.org/bitstream/handle/11374/1221/Doc5-1_CSR_Website_layout.pdf?sequence=1&isAllowed=y (accessed on 19 July 2021).

- Oil and Gas Projects in the Arctic—Further Development If Possible. Our Assessments and Actions. 2021. Available online: https://www.imemo.ru/files/File/ru/conf/2009/27052009/270509_prz_KNI.pdf (accessed on 22 July 2021).

- Fetisov, V.; Pshenin, V.; Nagornov, D.; Lykov, Y.; Mohammadi, A.H. Evaluation of pollutant emissions into the atmosphere during the loading of hydrocarbons in marine oil tankers in the Arctic region. J. Mar. Sci. Eng. 2020, 8, 917. [Google Scholar] [CrossRef]

- Al-Qudah, A.A.; Al-Okaily, M.; Alqudah, H. The relationship between social entrepreneurship and sustainable development from economic growth perspective: 15 “RCEP” countries. J. Sustain. Financ. Invest. 2021, 1, 1–18. [Google Scholar] [CrossRef]

- Xie, J.; Nozawa, W.; Yagi, M.; Fujii, H.; Managi, S. Do environmental, social, and governance activities improve corporate financial performance? Bus. Strategy Environ. 2019, 289, 286–300. [Google Scholar] [CrossRef]

- Nasrallah, N.; El Khoury, R. Is corporate governance a good predictor of SMEs financial performance? Evidence from developing countries (the case of Lebanon). J. Sustain. Financ. Invest. 2021, 11, 1–31. [Google Scholar] [CrossRef]

- Ferrero-Ferrero, I.; Fernández-Izquierdo, M.Á.; Muñoz-Torres, M.J. The effect of environmental, social and governance consistency on economic results. Sustainability 2016, 8, 1005. [Google Scholar] [CrossRef]

- Rahi, A.F.; Akter, R.; Johansson, J. Do sustainability practices influence financial performance? Evidence from the Nordic financial industry. J. Account. Res. 2021, in press. [Google Scholar] [CrossRef]

- Alsayegh, M.F.; Abdul Rahman, R.; Homayoun, S. Corporate economic, environmental, and social sustainability performance transformation through ESG disclosure. Sustainability 2020, 12, 3910. [Google Scholar] [CrossRef]

- Buallay, A. Is sustainability reporting (ESG) associated with performance? Evidence from the European banking sector. Manag. Environ. Qual. 2019, 30, 98–115. [Google Scholar] [CrossRef]

- Oncioiu, I.; Popescu, D.-M.; Aviana, A.E.; Șerban, A.; Rotaru, F.; Petrescu, M.; Marin-Pantelescu, A. The role of environmental, social, and governance disclosure in financial transparency. Sustainability 2020, 12, 6757. [Google Scholar] [CrossRef]

- Jonek-Kowalska, I.; Ponomarenko, T.V.; Marinina, O.A. Problems of interaction with stakeholders during implementation of long-term mining projects. J. Min. Inst. 2018, 232, 428–437. [Google Scholar] [CrossRef]

- Global Sustainable Investment Review 2020. 2020. Available online: http://www.gsi-alliance.org/wp-content/uploads/2021/08/GSIR-20201.pdf (accessed on 19 September 2021).

- Dickson, C. Working Together. What is Next for the Arctic? 2018. Available online: http://awsassets.panda.org/downloads/TheCircle0118_WEB.pdf (accessed on 16 August 2021).

- Mastepanov, A.M. On the competitiveness of oil and gas projects of the Arctic shelf in conditions of low energy prices. Neftegaz. RU 2017, 1, 20–30. [Google Scholar]

- Kozmenko, S.; Savelyev, A.; Teslya, A. Impact of global and regional factors on dynamics of industrial development of hydrocarbons in the Arctic continental shelf and on investment attractiveness of energy projects. IOP Conf. Ser. Earth Environ. Sci. 2019, 302, 012124. [Google Scholar] [CrossRef]

- Cherepovitcyn, A.E.; Romasheva, N.V.; Chvileva, T.A. Prospects for the exploration of hydrocarbon deposits in the Arctic based on socio-economic evaluation. Int. J. Civ. Eng. Technol. 2019, 13, 938–948. [Google Scholar]

| Sustainability vs. Sustainable Development (SD)—Points of View | Author/Source |

|---|---|

| Sustainability and SD are synonyms. These terms are perceived from the standpoint of environmental protection, social aspects, etc. | [64] |

| The concepts of sustainability and SD are strongly related to resolving social and ecological issues. Thus, they can be considered as unidirectional. A lack of integrated approaches to the terms applied is explained by the pluralism of opinions regarding SD issues in different sectors, companies, and projects. | [65,66] |

| SD is a process to achieve sustainability goals. | [60,67] |

| Sustainability is a general paradigm of the world’s future and an order based on the trinity of economics, ecology, and society, while SD means concrete steps for its implementation. | [68] |

| Sustainability is a key concept of how to maintain the resource potential under the exhaustion of raw materials, and SD refers to particular actions. | [68,69,70] |

| The interconnectedness of the SD and sustainability concepts. | [71] |

| Sustainability is the ability to maintain and to achieve Sustainable Development Goals (SDG), and it can be both weak and strong. This idea shows that “development” in the meaning of “progress” and “positive change” is not applicable to all countries, companies, and projects. | [72,73] |

| The concept of SD is considered to be wider as it focuses on achieving the established global SDGs, such as the development of green infrastructure, formation of sustainable cities, tackling climate change, etc. | [74,75] |

| Global Trends | Description—The Case of Arctic Offshore Projects | Prerequisites for Implementing the Strategic Sustainability Approach | Key Aspects |

|---|---|---|---|

| Strengthening competition in traditional hydrocarbon markets | The growing intensity of competition leads to searching for new opportunities to develop hydrocarbon resources. Therefore, Arctic offshore reserves are becoming important as prospective sources for meeting the global demand for energy resources [115]. | A need to create novel competitive advantages to achieve and to maintain high positions on the global market; ensuring the investment attractiveness of offshore projects, taking into account current requirements and approaches to assess it (ESG indicators). | Economic/Governance |

| Transition to low-carbon development [2,116] | For Arctic offshore projects, this challenge is particularly relevant. In 2020, multiple United States banks, including Wells Fargo & Company and Goldman Sachs, announced that they would not fund new offshore projects in the Arctic as these projects do not follow the established low-carbon directions [117]. Deloitte argues that investors request the long-term strategies of oil and gas companies to understand if they follow the climate and environment priorities or not [116]. Oil and gas companies should balance the investments needed to ensure sufficient supplies against the necessity of cutting emissions [18]. | A need to transform current business models. According to Deloitte, oil and gas companies have only two options to remain viable during the transition (to be resilient and sustainable): (1) Diversifying into other forms of energy and enabling technologies (new competencies in renewables, novel technologies, focus on biofuels); (2) Turning emissions into a business opportunity (carbon capture technologies). | Ecological/Economic |

| The growing role of innovation (technologies) | Arctic offshore projects require innovative technologies to exploit the resource base. Practice shows that there is a direct correlation between profitability of Arctic offshore projects and the current level of technological advances [118]. This fact was proven by Norwegian companies—the break-even rate of offshore projects reached USD 20 per barrel (Johan Castberg oil field) [119]. By contrast, a break-even point for Russian offshore projects is about USD 50–70 per barrel [118,120]. | The need to develop innovative technologies and approaches, to minimize the level of import dependency on foreign equipment and technologies for offshore resources’ exploitation (ice-resistant platforms, drilling rigs, etc.). Overall, the level of technological advances should become the key factor to resist the trends of high oil price volatility (maintain competitive positions on the global market against onshore oil projects). “Green” innovations might provide a contribution to environmental aspects. | Economic/ Ecological |

| The growing role of digitalization | Transformation of management systems and production processes based on the implementation of fundamentally new systems for receiving and processing data, digital tools and management mechanisms, technologies (remote sensing platforms, intelligent and smart technologies) [121]. | The need to develop and implement novel digital technologies. The effects can be discussed in different directions: social: to minimize labor; intensity, to reduce risks at work, to reduce the influence of the human factor; economic: to reduce production costs, to optimize production processes; ecological: to ensure effective operations without environment consequences, to enhance control systems (environmental factor). | Social/Economic/ Environmental |

| Social awareness | According to Norway’s Arctic strategy, it is essential to balance opportunities and responsibility [114]. A responsible business practice implies respect for human rights and standards [122]. The term of corporate social responsibility (CSR) in case of the Arctic means to reconcile the priorities of key stakeholders and to have an open dialogue with the public (the Arctic Council as a platform for interaction). | The need to follow the current principles of corporate social responsibility, to integrate in the global system (the Arctic Council), to enhance tools and methods for interacting between the state, business, investors and society, to focus on open policy in the case of CSR. | Social |

| Environmental safety | Environmental aspects are of particular importance in offshore projects as the Arctic’s environment is fragile and unstable. Specific risks associated with developing offshore hydrocarbon resources include oil spills, pollution, etc. The consequences of incidents might be not only dangerous but also irreversible. In severe weather conditions, it is impossible to react immediately to oil spills [123]. | The need to minimize or even to eliminate possible environmental risks of offshore reserve exploration by implementing special technologies for preventing environmental incidents, and improving the control system quality. According to the SD concept, environmental impact is vital to consider when making long-term investment decisions. | Ecological/Governance |

| Approach | Indicators | |

|---|---|---|

| Efficiency | Economic indicators [24] | Investments (including geological surveying costs, construction of infrastructure facilities, launch of production), mln rub |

| Expected monetary value, mln rub | ||

| Net present value, mln rub | ||

| Budget efficiency, mln rub | ||

| Return on investment | ||

| Internal rate of return, % | ||

| Payback period, years | ||

| Unit total cost, mln rub | ||

| Sustainability | Social indicators | The number of highly efficient jobs, units |

| Contribution to the socio-economic development of the region | ||

| Improving the living standards of the population | ||

| Degree of public involvement in decision making | ||

| New competencies | ||

| Indicator of the average level of wages, rub | ||

| Standard of living | ||

| Implementation of programs aimed at improving the qualifications of personnel, units | ||

| Environmental indicators | Energy intensity, % | |

| Resource efficiency, % | ||

| Prevented damage: (rub/year) -water resources; -air; -land resources (soil and land degradation); -bioresources | ||

| Resource intensity indicator, % | ||

| Carbon content, % | ||

| Waste capacity indicator, % | ||

| Water capacity indicator, % | ||

| Indicator of the degree of involvement of waste in production, % | ||

| Indicator of the level of purification of emissions of pollutants into the atmosphere, % | ||

| Indicator of innovative technologies, the level of technological support | ||

| Accident rate (assessment of the likelihood of potential environmental threats) | ||

| Creation of insurance funds to prevent possible environmental damage | ||

| Strategic sustainability | Sensitivity to trends and volatility | Strengthening competition in traditional hydrocarbon markets |

| Transition to low-carbon development [2,116] | ||

| Growing role of innovation (technologies) | ||

| Increasing role of digitalization | ||

| Social awareness | ||

| Environmental safety | ||

| Contribution to the achievement of the global SDGs | SDG 3. Good health and well-being | |

| SDG 9. Industrialization, innovation, and infrastructure | ||

| SDG 11. Sustainable cities and towns | ||

| SDG 12. Responsible consumption and production | ||

| SDG 14. Conservation of marine ecosystems | ||

| SDG 17. Partnership for sustainable development | ||

| Commitment to ESG factors | Effectiveness of corporate governance | |

| Corporate and social responsibility | ||

| Business reputation | ||

| Cooperative ventures with the government | ||

| Effectiveness of the risk management system | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dmitrieva, D.; Cherepovitsyna, A.; Stroykov, G.; Solovyova, V. Strategic Sustainability of Offshore Arctic Oil and Gas Projects: Definition, Principles, and Conceptual Framework. J. Mar. Sci. Eng. 2022, 10, 23. https://doi.org/10.3390/jmse10010023

Dmitrieva D, Cherepovitsyna A, Stroykov G, Solovyova V. Strategic Sustainability of Offshore Arctic Oil and Gas Projects: Definition, Principles, and Conceptual Framework. Journal of Marine Science and Engineering. 2022; 10(1):23. https://doi.org/10.3390/jmse10010023

Chicago/Turabian StyleDmitrieva, Diana, Alina Cherepovitsyna, Gennady Stroykov, and Victoria Solovyova. 2022. "Strategic Sustainability of Offshore Arctic Oil and Gas Projects: Definition, Principles, and Conceptual Framework" Journal of Marine Science and Engineering 10, no. 1: 23. https://doi.org/10.3390/jmse10010023

APA StyleDmitrieva, D., Cherepovitsyna, A., Stroykov, G., & Solovyova, V. (2022). Strategic Sustainability of Offshore Arctic Oil and Gas Projects: Definition, Principles, and Conceptual Framework. Journal of Marine Science and Engineering, 10(1), 23. https://doi.org/10.3390/jmse10010023