From Greenwashing to Sustainability: The Mediating Effect of Green Innovation in the Agribusiness Sector on Financial Performance

Abstract

1. Introduction

2. Literature Review

2.1. Greenwashing Behaviour and Green Innovation

2.2. Green Innovation and Corporate Financial Performance

2.3. Greenwashing Behaviour, Green Innovation, and Corporate Financial Performance

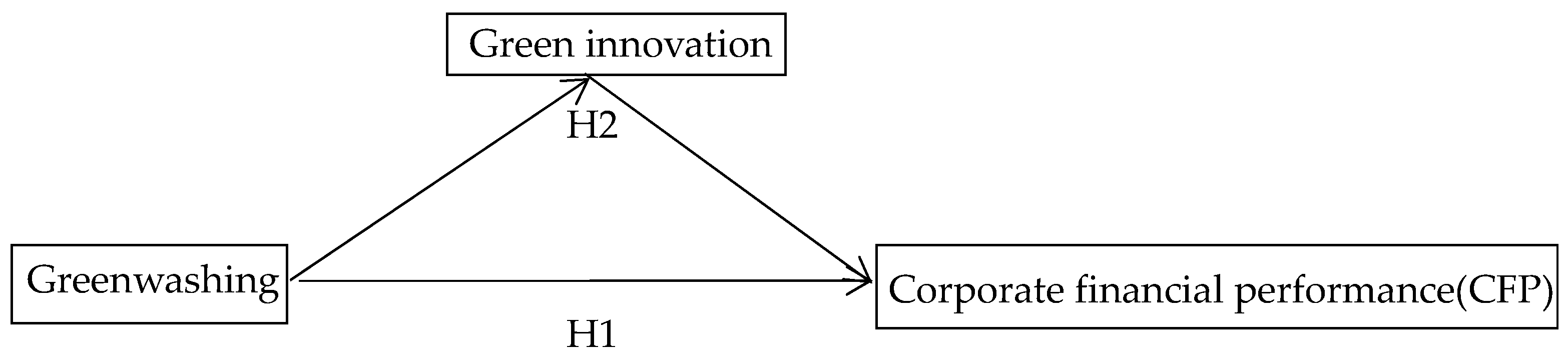

3. Theoretical Analysis, Research Hypotheses, and Conceptual Model

3.1. Definition of Key Concepts

3.2. Theoretical Analysis and Research Hypotheses

3.2.1. Impact of Greenwashing Behaviour on Financial Performance of Agribusinesses

3.2.2. Mediating Effect of Green Innovation on Greenwashing Behaviour and Corporate Financial Performance

3.3. Conceptual Model Construction

4. Research Design

4.1. Data Sources

4.2. Definition of Variables

4.2.1. Explained Variable: Corporate Financial Performance

4.2.2. Main Explanatory Variables: Agribusiness Greenwashing Behaviour (GW)

4.2.3. Mediating Variable: Corporate Green Innovation (GI)

4.2.4. Control Variables

4.3. Model Design

4.3.1. Baseline Model

4.3.2. Modelling of Mediating Effects

5. Analysis of Empirical Results

5.1. Descriptive Statistical Analysis of Variables

5.2. Correlation Analysis

5.3. Regression Analysis

5.4. Tests for Mediating Effects

5.5. Robustness Tests

5.6. Analysis of the Heterogeneity of Corporate Property Rights

6. Research Findings and Recommendations

6.1. Conclusions of the Study

6.2. Discussion

6.2.1. The Amplification Effect of Environmental Information Asymmetry in Agriculture

6.2.2. Differentiation of Innovation Incentives Under Heterogeneous Property Rights

6.2.3. The Paradox of the Applicability of Green Innovation in Agriculture

6.3. Theoretical Significance and Practical Enlightenment

6.3.1. Theoretical Implications

- (1)

- Construct a three-dimensional transmission model of “greenwashing behaviour–green innovation–financial performance”

- (2)

- The Dynamic Trap Effect of Deconstructing Institutional Legitimacy

6.3.2. Practical Insights

- (1)

- Micro-subjects: Capacity Building and Consciousness Reconstruction

- (2)

- Organisational Mechanism: Technological Empowerment and Institutional Guarantee

- (3)

- Industry Ecosystem: Technology Diffusion and Cost Sharing

- (4)

- Environmental Governance: Technology Integration and Participatory Monitoring

6.4. Policy Recommendations

6.4.1. Building a Global Synergistic Governance System for Greenwashing

6.4.2. Optimise the Capital Allocation Mechanism for Green Technologies

6.4.3. Implement a Classified Guidance Strategy for Enterprise Governance

6.4.4. Improve the Public-Participation, Supervision, and Feedback System

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Guo, R.; Tao, L.; Gao, P. The research on greenwashing brands’ rebuilding strategies and mechanism of brand trust after biochemical and other pollutions. Biotechnology 2014, 10, 3270–3279. [Google Scholar]

- Kim, E.H.; Lyon, T.P. Greenwash vs. brownwash: Exaggeration and undue modesty in corporate sustainability disclosure. Organ. Sci. 2015, 26, 705–723. [Google Scholar] [CrossRef]

- Marquis, C.; Toffel, M.W.; Zhou, Y. Scrutiny, norms, and selective disclosure: A global study of greenwashing. Organ. Sci. 2016, 27, 483–504. [Google Scholar] [CrossRef]

- Vollero, A.; Palazzo, M.; Siano, A.; Elving, W.J. Avoiding the greenwashing trap: Between CSR communication and stakeholder engagement. Int. J. Innov. Sustain. Dev. 2016, 10, 120–140. [Google Scholar] [CrossRef]

- Antunes, D.; Santos, A.; Hurtado, A. The communication of the LCA: The need for guidelines to avoid greenwashing. Espacios 2015, 36, 1. [Google Scholar]

- Wolniak, R.; Hąbek, P. Reporting process of corporate social responsibility and greenwashing. Int. Multidiscip. Sci. GeoConf. SGEM 2015, 5, 483–490. [Google Scholar]

- Chang, C.H.; Chen, Y.S. Managing green brand equity: The perspective of perceived risk theory. Qual. Quant. 2014, 48, 1753–1768. [Google Scholar] [CrossRef]

- Zhang, L.; Li, D.; Cao, C.; Huang, S. The influence of greenwashing perception on green purchasing intentions: The mediating role of green word-of-mouth and moderating role of green concern. J. Clean. Prod. 2018, 187, 740–750. [Google Scholar] [CrossRef]

- Delmas, M.A.; Burbano, V.C. The drivers of greenwashing. Calif. Manag. Rev. 2011, 54, 64–87. [Google Scholar] [CrossRef]

- Pearson, J. Are we doing the right thing? Leadership and prioritisation for public benefit. J. Corp. Citizsh. 2010, 37, 37–40. [Google Scholar]

- Greer, J.; Kenny, B. Greenwash: The Reality Behind Corporate Environmentalism; Apex Press: New York, NY, USA, 1996. [Google Scholar]

- KPMG. Avoiding the Greenwash Peril: Best Practices for the Asset Management Sector. 2023. Available online: https://assets.kpmg.com/content/dam/kpmg/ie/pdf/2023/01/ie-getting-ahead-of-greenwashing.pdf (accessed on 15 April 2024).

- Alves, I.M. Green Spin Everywhere: How Greenwashing Reveals the Limits of the CSR Paradigm. J. Glob. Change Gov. 2009, 2, 1. [Google Scholar]

- Bowen, F.; Aragon-Correa, J.A. Greenwashing in corporate environmentalism research and practice: The importance of what we say and do. Organ. Environ. 2014, 27, 107–112. [Google Scholar] [CrossRef]

- Testa, F.; Boiral, O.; Iraldo, F. Internalization of environmental practices and institutional complexity: Can stakeholders pressures encourage greenwashing? J. Bus. Ethics 2018, 147, 287–307. [Google Scholar] [CrossRef]

- Walker, K.; Wan, F. The harm of symbolic actions and green-washing: Corporate actions and communications on environmental performance and their financial implications. J. Bus. Ethics 2012, 109, 227–242. [Google Scholar] [CrossRef]

- Testa, F.; Iraldo, F.; Vaccari, A.; Ferrari, E. Why eco-labels can be effective marketing tools: Evidence from a study on Italian consumers. Bus. Strategy Environ. 2015, 24, 252–265. [Google Scholar] [CrossRef]

- Lyon, T.P.; Montgomery, A.W. The means and end of greenwash. Organ. Environ. 2015, 28, 223–249. [Google Scholar] [CrossRef]

- Li, H.; Jin, X.; Zhao, R.; Han, B.; Zhou, Y.; Tittonell, P. Assessing uncertainties and discrepancies in agricultural greenhouse gas emissions estimation in China: A comprehensive review. Environ. Impact Assess. Rev. 2024, 106, 107498. [Google Scholar] [CrossRef]

- Wang, R.; Chen, J.; Li, Z.; Bai, W.; Deng, X. Factors analysis for the decoupling of grain production and carbon emissions from crop planting in China: A discussion on the regulating effects of planting scale and technological progress. Environ. Impact Assess. Rev. 2023, 103, 107249. [Google Scholar] [CrossRef]

- Pang, A.; Wang, D. Evaluation of agricultural and rural pollution under environmental measures in the Yangtze River Economic Belt, China. Sci. Rep. 2023, 13, 15495. [Google Scholar] [CrossRef]

- Zhu, S.; Yin, G.; Sun, Q.; Zhang, Z.; Li, G.; Gao, L. Structural Changes to China’s Agricultural Business Entities System Under the Perspective of Competitive Evolution. Sustainability 2025, 17, 3024. [Google Scholar] [CrossRef]

- Deng, H.; Huang, J.; Xu, Z.; Rozelle, S. Policy support and emerging farmer professional cooperatives in rural China. China Econ. Rev. 2010, 21, 495–507. [Google Scholar] [CrossRef]

- Peng, Z.; Anderson, H.; Chi, J.; Liao, J. Going Green or Greenwashing? Evidence from a Quasi-Natural Experiment of Chinese Air Quality Monitoring Network. 2024. Available online: https://acfr.aut.ac.nz/__data/assets/pdf_file/0008/926009/Going-green-or-greenwashing-Evidence-from-a-quasi-natural-experiment-of-Chinese-Air-Quality-Monitoring-Network.pdf (accessed on 15 April 2024).

- Hojnik, J.; Ruzzier, M. The driving forces of process eco-innovation and its impact on performance: Insights from Slovenia. J. Clean. Prod. 2016, 133, 812–825. [Google Scholar] [CrossRef]

- Zhang, J.; Yang, J. Influence of Greenwashing Strategy on Pricing: A Game-Theoretical Model for Quality Heterogeneous Enterprises. In Proceedings of the 3rd International Conference on Green Energy, Environment and Sustainable Development; IOS Press: Amsterdam, The Netherlands, 2022; pp. 336–343. [Google Scholar]

- Hojnik, J.; Ruzzier, M. What drives eco-innovation? A review of an emerging literature. Environ. Innov. Soc. Transit. 2016, 19, 31–41. [Google Scholar] [CrossRef]

- Saunila, M. Understanding innovation performance measurement in SMEs. Meas. Bus. Excell. 2017, 21, 1–16. [Google Scholar] [CrossRef]

- Zhang, D.; Bai, D.; Chen, X. Can crude oil futures market volatility motivate peer firms in competing ESG performance? An exploration of Shanghai International Energy Exchange. Energy Econ. 2024, 129, 107240. [Google Scholar] [CrossRef]

- Zhang, D.; Kong, Q. Green energy transition and sustainable development of energy firms: An assessment of renewable energy policy. Energy Econ. 2022, 111, 106060. [Google Scholar] [CrossRef]

- Zhou, Y.; Chen, L.; Zhang, Y.; Li, W. “Environmental disclosure greenwashing” and corporate value: The premium effect and premium devalue of environmental information. Corp. Soc. Responsib. Environ. Manag. 2024, 31, 2424–2438. [Google Scholar] [CrossRef]

- Chen, X.; Fu, Q.; Chang, C.P. What are the shocks of climate change on clean energy investment: A diversified exploration. Energy Econ. 2021, 95, 105136. [Google Scholar] [CrossRef]

- Zhang, D. Does green finance really inhibit extreme hypocritical ESG risk? A greenwashing perspective exploration. Energy Econ. 2023, 121, 106688. [Google Scholar] [CrossRef]

- Chen, L.; Ma, Y.; Feng, G.F.; Chang, C.P. Does environmental governance mitigate the detriment of greenwashing on innovation in China? Pac.-Basin Financ. J. 2024, 86, 102450. [Google Scholar] [CrossRef]

- Hu, S.; Wang, M.; Wu, M.; Wang, A. Voluntary environmental regulations, greenwashing and green innovation: Empirical study of China’s ISO14001 certification. Environ. Impact Assess. Rev. 2023, 102, 107224. [Google Scholar] [CrossRef]

- Xing, C.; Zhang, X.; Zhang, Y.; Zhang, L. From green-washing to innovation-washing: Environmental information intangibility and corporate green innovation in China. Int. Rev. Econ. Financ. 2024, 93, 204–226. [Google Scholar] [CrossRef]

- Huang, X.; Tang, C.; Liu, Y.; Ge, P. Greening or greenwashing? Corporate green bonds and stock pricing efficiency in China. Sustain. Account. Manag. Policy J. 2025, 16. [Google Scholar] [CrossRef]

- Lu, J.; Liang, M.; Dabić, M.; Lin, W. “Chasing Grade” or “Driving Innovation”? Social Responsibility Grades of Heavily Polluting Enterprises and Exploratory Innovation. IEEE Trans. Eng. Manag. 2024, 71, 11166–11182. [Google Scholar] [CrossRef]

- Schmuck, D.; Matthes, J.; Naderer, B. Misleading consumers with green advertising? An affect–reason–involvement account of greenwashing effects in environmental advertising. J. Advert. 2018, 472, 127–145. [Google Scholar] [CrossRef]

- Baah, C.; Opoku-Agyeman, D.; Acquah, I.S.K.; Agyabeng-Mensah, Y.; Afum, E.; Faibil, D.; Abdoulaye, F.A.M. Examining the correlations between stakeholder pressures, green production practices, firm reputation, environmental and financial performance: Evidence from manufacturing SMEs. Sustain. Prod. Consum. 2021, 27, 100–114. [Google Scholar] [CrossRef]

- Przychodzen, W.; Gómez-Bezares, F.; Przychodzen, J. Green information technologies practices and financial performance–the empirical evidence from German publicly traded companies. J. Clean. Prod. 2018, 201, 570–579. [Google Scholar] [CrossRef]

- Deng, X.; Li, L. Promoting or inhibiting? The impact of environmental regulation on corporate financial performance—An empirical analysis based on China. Int. J. Environ. Res. Public Health 2020, 17, 3828. [Google Scholar] [CrossRef]

- Zhang, D.; Rong, Z.; Ji, Q. Green innovation and firm performance: Evidence from listed companies in China. Resour. Conserv. Recycl. 2019, 144, 48–55. [Google Scholar] [CrossRef]

- Agyabeng-Mensah, Y.; Afum, E.; Ahenkorah, E. Exploring financial performance and green logistics management practices: Examining the mediating influences of market, environmental and social performances. J. Clean. Prod. 2020, 258, 120613. [Google Scholar] [CrossRef]

- Guo, J.; Zhou, Y.; Ali, S.; Shahzad, U.; Cui, L. Exploring the role of green innovation and investment in energy for environmental quality: An empirical appraisal from provincial data of China. J. Environ. Manag. 2021, 292, 112779. [Google Scholar] [CrossRef] [PubMed]

- Harel, R.; Schwartz, D.; Kaufmann, D. Organizational culture processes for promoting innovation in small businesses. EuroMed J. Bus. 2021, 16, 218–240. [Google Scholar] [CrossRef]

- Delgado-Ceballos, J.; Aragón-Correa, J.A.; Ortiz-de-Mandojana, N.; Rueda-Manzanares, A. The effect of internal barriers on the connection between stakeholder integration and proactive environmental strategies. J. Bus. Ethics 2012, 107, 281–293. [Google Scholar] [CrossRef]

- Michelino, F.; Caputo, M.; Cammarano, A.; Lamberti, E. Inbound and outbound open innovation: Organization and performances. J. Technol. Manag. Innov. 2014, 9, 65–82. [Google Scholar] [CrossRef]

- Huang, F.; Wu, J.; Wu, Z.; Fu, W.; Guo, P.; Zhang, Z.; Khan, F. Unpacking greenwashing: The impact of environmental attitude, proactive strategies, and network embeddedness on corporate environmental performance. J. Environ. Manag. 2025, 373, 123625. [Google Scholar] [CrossRef]

- Kivimaa, P. Integrating environment for innovation: Experiences from product development in paper and packaging. Organ. Environ. 2008, 21, 56–75. [Google Scholar] [CrossRef]

- Kallio, T.J.; Nordberg, P. The evolution of organizations and natural environment discourse: Some critical remarks. Organ. Environ. 2006, 19, 439–457. [Google Scholar] [CrossRef]

- Cui, J.J.; Wang, L.Y.; Zhu, T.; Cui, J.J.; Wang, L.Y.; Zhu, T.; Gong, W.J.; Zhou, H.H.; Liu, Z.Q.; Yin, J.Y. Gene-gene and gene-environment interactions influence platinum-based chemotherapy response and toxicity in non-small cell lung cancer patients. Sci. Rep. 2017, 7, 5082. [Google Scholar] [CrossRef]

- Safari, A.; Salehzadeh, R.; Panahi, R.; Abolghasemian, S. Multiple pathways linking environmental knowledge and awareness to employees’ green behavior. Corp. Gov. Int. J. Bus. Soc. 2018, 18, 81–103. [Google Scholar] [CrossRef]

- De Burgos-Jiménez, J.; Vázquez-Brust, D.; Plaza-Úbeda, J.A.; Dijkshoorn, J. Environmental protection and financial performance: An empirical analysis in Wales. Int. J. Oper. Prod. Manag. 2013, 33, 981–1018. [Google Scholar] [CrossRef]

- Chen, Y.S. The positive effect of green intellectual capital on competitive advantages of firms. J. Bus. Ethics 2008, 77, 271–286. [Google Scholar] [CrossRef]

- Li, X.; Tian, Z.; Liu, Q.; Chang, B. The Impact and Mechanisms of State-Owned Shareholding on Greenwashing Behaviors in Chinese A-Share Private Enterprises. Sustainability 2025, 17, 741. [Google Scholar] [CrossRef]

- Shan, H.; Shao, S. Impact of green innovation on carbon reduction in China. Sci. Rep. 2024, 14, 14032. [Google Scholar] [CrossRef] [PubMed]

- Seele, P.; Gatti, L. Greenwashing revisited: In search of a typology and accusation—Based definition incorporating legitimacy strategies. Bus. Strategy Environ. 2017, 26, 239–252. [Google Scholar] [CrossRef]

- Li, T.; Shu, X.; Liao, G. Does corporate greenwashing affect investors’ decisions? Financ. Res. Lett. 2024, 67, 105877. [Google Scholar] [CrossRef]

- Du, X. How the market values greenwashing? Evidence from China. J. Bus. Ethics 2015, 128, 547–574. [Google Scholar] [CrossRef]

- Khalil, S.; O’sullivan, P. Corporate social responsibility: Internet social and environmental reporting by banks. Meditari Account. Res. 2017, 25, 414–446. [Google Scholar] [CrossRef]

- Zhang, K.; Pan, Z.; Zhang, K.; Ji, F. The effect of digitalization transformation on greenwashing of Chinese listed companies: An analysis from the dual perspectives of resource-based view and legitimacy. Front. Environ. Sci. 2023, 11, 1179419. [Google Scholar] [CrossRef]

- Lee, M.T.; Suh, I. Understanding the effects of Environment, Social, and Governance conduct on financial performance: Arguments for a process and integrated modelling approach. Sustain. Technol. Entrep. 2022, 11, 100004. [Google Scholar] [CrossRef]

- Robertson, J.L.; Montgomery, A.W.; Ozbilir, T. Employees’ response to corporate greenwashing. Bus. Strategy Environ. 2023, 32, 4015–4027. [Google Scholar] [CrossRef]

- Truong, Y.; Mazloomi, H.; Berrone, P. Understanding the impact of symbolic and substantive environmental actions on organizational reputation. Ind. Mark. Manag. 2021, 92, 307–320. [Google Scholar] [CrossRef]

- Akturan, U. How does greenwashing affect green branding equity and purchase intention? An empirical research. Mark. Intell. Plan. 2018, 36, 809–824. [Google Scholar] [CrossRef]

- Berrone, P.; Fosfuri, A.; Gelabert, L. Does greenwashing pay off? Understanding the relationship between environmental actions and environmental legitimacy. J. Bus. Ethics 2017, 144, 363–379. [Google Scholar] [CrossRef]

- Siddique, B.; Khalil, K.; Ahmad, S.; Ahmed, F.; Ullah, M.; Usama, H.A. Impact of Corporate Governance on Green Innovation: Evidence from Pakistan. Russ. Law J. 2023, 11, 2717–2725. [Google Scholar]

- Yu, Z.; Shen, Y.; Jiang, S. The effects of corporate governance uncertainty on state-owned enterprises’ green innovation in China: Perspective from the participation of non-state-owned shareholders. Energy Econ. 2022, 115, 106402. [Google Scholar] [CrossRef]

- Ai, M.; Luo, F.; Bu, Y. Green innovation and corporate financial performance: Insights from operating risks. J. Clean. Prod. 2024, 456, 142353. [Google Scholar] [CrossRef]

- Wang, Y.; Feng, J.; Shinwari, R.; Bouri, E. Do green finance and green innovation affect corporate credit rating performance? Evidence from machine learning approach. J. Environ. Manag. 2024, 360, 121212. [Google Scholar] [CrossRef]

- Suchman, M.C. Managing legitimacy: Strategic and institutional approaches. Acad. Manag. Rev. 1995, 20, 571–610. [Google Scholar] [CrossRef]

- Daroshka, V.; Aleksandrov, I.; Fedorova, M.; Chekhovskikh, I.; Ol, E.; Trushkin, V. Agriculture and ESG transformation: Domestic and foreign experience of green agribusiness finance. Int. Sci. Conf. Agric. Mach. Ind. Interagromash 2022, 575, 2357–2368. [Google Scholar]

- Geng, G.; Shen, Y.; Dong, C. The Impact of Green Finance on Agricultural Non-Point Source Pollution: Analysis of the Role of Environmental Regulation and Rural Land Transfer. Land 2024, 13, 1516. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Dechezleprêtre, A.; Sato, M. The impacts of environmental regulations on competitiveness. Rev. Environ. Econ. Policy 2017, 11. [Google Scholar] [CrossRef]

- Zhang, X.; Zhang, J.; Feng, Y. Can companies get more government subsidies through improving their ESG performance? Empirical evidence from China. PLoS ONE 2023, 18, e0292355. [Google Scholar] [CrossRef] [PubMed]

- Yu, E.P.; van Luu, B.; Chen, C.H. Greenwashing in environmental, social and governance disclosures. Res. Int. Bus. Financ. 2020, 52, 101192. [Google Scholar] [CrossRef]

- Huang, Y.; Francoeur, C.; Brammer, S. What drives and curbs brownwashing? Bus. Strategy Environ. 2022, 31, 2518–2532. [Google Scholar] [CrossRef]

| Variable Type | Variable Name | Variable Symbol | Definition Note |

|---|---|---|---|

| explained variable | corporate financial performance | ROA | return on total assets = net profit/total assets |

| explanatory variable | corporate greenwashing behaviour | GW | Equation (1) calculates this variable |

| mediating variable | corporate green innovation | GI | ln(1+ number of green inventions + number of green utility models) |

| enterprise size | SIZE | natural logarithm of total assets at the end of the period | |

| financial leverage | Lev | gearing ratio = total liabilities/total assets | |

| growth capacity | Growth | revenue growth rate | |

| control variable | equity structure | Top1 | shareholding ratio of the largest shareholder |

| capital intensity | CAPI | total asset turnover | |

| nature of property rights | State | state-owned assigned a value of 1, non-state-owned assigned a value of 0 | |

| percentage of independent directors | Lndep | number of independent directors/board of directors |

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| ROA | 754 | 0.061 | 0.067 | −0.188 | 0.258 |

| GW | 754 | −0.035 | 0.616 | −1.878 | 2.268 |

| GI | 754 | 0.481 | 0.742 | 0 | 3.219 |

| SIZE | 754 | 22.625 | 1.082 | 20.41 | 25.7 |

| Lev | 754 | 0.377 | 0.162 | 0.098 | 0.817 |

| Growth | 754 | 0.408 | 1.623 | −0.719 | 11.818 |

| Top1 | 754 | 37.11 | 14.679 | 9.13 | 71.45 |

| CAPI | 754 | 0.723 | 0.492 | 0.165 | 2.642 |

| State | 754 | 0.427 | 0.495 | 0 | 1 |

| Lndep | 754 | 38.684 | 6.864 | 30.77 | 60 |

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) |

|---|---|---|---|---|---|---|---|---|---|---|

| (1) ROA | 1.000 | |||||||||

| (2) GW | −0.323 * | 1.000 | ||||||||

| (3) GI | 0.238 * | −0.136 * | 1.000 | |||||||

| (4) SIZE | 0.295 * | −0.096 * | 0.387 * | 1.000 | ||||||

| (5) Lev | −0.368 * | 0.224 * | 0.059 | 0.257 * | 1.000 | |||||

| (6) Growth | 0.009 | 0.041 | −0.048 | −0.145 * | −0.060 | 1.000 | ||||

| (7) Top1 | 0.200 * | −0.017 | 0.078 * | 0.113 * | −0.061 | −0.054 | 1.000 | |||

| (8) CAPI | 0.126 * | 0.089 * | 0.177 * | 0.087 * | 0.212 * | −0.191 * | 0.135 * | 1.000 | ||

| (9) State | −0.001 | 0.067 | −0.010 | 0.150 * | −0.016 | −0.081 * | 0.063 | −0.099 * | 1.000 | |

| (10) Lndep | 0.036 | −0.108 * | −0.050 | 0.118 * | 0.090 * | −0.140 * | 0.125 * | 0.152 * | 0.089 * | 1.000 |

| (1) | (2) | |

|---|---|---|

| ROA | ROA | |

| GW | −0.016 *** | −0.011 *** |

| (−4.639) | (−3.225) | |

| SIZE | 0.047 *** | |

| (7.803) | ||

| Lev | −0.164 *** | |

| (−8.359) | ||

| Growth | 0.002 | |

| (1.145) | ||

| Top1 | 0.000 | |

| (0.298) | ||

| CAPI | 0.077 *** | |

| (8.428) | ||

| State | −0.004 | |

| (−0.314) | ||

| Lndep | −0.000 | |

| (−0.103) | ||

| _cons | −0.093 ** | −1.088 *** |

| (−2.208) | (−7.627) | |

| year effect | Yes | Yes |

| industry effect | Yes | Yes |

| N | 754 | 754 |

| R2 | 0.094 | 0.262 |

| F | 4.782 | 10.759 |

| (1) | (2) | (3) | |

|---|---|---|---|

| ROA | GI | ROA | |

| GW | −0.011 *** | −0.091 ** | −0.010 *** |

| (−3.225) | (−1.979) | (−3.033) | |

| SIZE | 0.047 *** | 0.369 *** | 0.045 *** |

| (7.803) | (4.317) | (7.301) | |

| Lev | −0.164 *** | −0.164 | −0.163 *** |

| (−8.359) | (−0.592) | (−8.333) | |

| Growth | 0.002 | −0.012 | 0.002 |

| (1.145) | (−0.443) | (1.194) | |

| Top1 | 0.000 | 0.000 | 0.000 |

| (0.298) | (0.091) | (0.291) | |

| CAPI | 0.077 *** | 0.393 *** | 0.074 *** |

| (8.428) | (3.055) | (8.100) | |

| State | −0.004 | 0.177 | −0.005 |

| (−0.314) | (0.963) | (−0.411) | |

| Lndep | −0.000 | −0.005 | −0.000 |

| (−0.103) | (−0.903) | (−0.013) | |

| GI | 0.007 ** | ||

| (2.506) | |||

| _cons | −1.088 *** | −8.567 *** | −1.028 *** |

| (−7.627) | (−4.249) | (−7.136) | |

| year effect | Yes | Yes | Yes |

| industry effect | Yes | Yes | Yes |

| N | 754 | 754 | 754 |

| R2 | 0.262 | 0.150 | 0.269 |

| F | 10.759 | 5.342 | 10.641 |

| (1) | (2) | |

|---|---|---|

| ROE | Lag One Period Behind | |

| GW | −0.025 *** | −0.013 *** |

| (−4.035) | (−3.87) | |

| SIZE | 0.102 *** | 0.026 *** |

| (8.786) | (10.86) | |

| Lev | −0.271 *** | −0.177 *** |

| (−7.221) | (−12.13) | |

| Growth | 0.004 | 0.004 |

| (1.124) | (3.89) | |

| Top1 | 0.001 | 0.000 |

| (1.364) | (1.95) | |

| CAPI | 0.140 *** | 0.023 *** |

| (8.048) | (5.46) | |

| State | −0.011 | −0.008 |

| (−0.440) | (−2.15) | |

| Lndep | 0.000 | 0.000 |

| (0.500) | (0.45) | |

| _cons | −2.612 *** | −0.510 *** |

| (−9.570) | (−9.96) | |

| year effect | Yes | Yes |

| industry effect | Yes | Yes |

| N | 754 | 602 |

| R2 | 0.289 | 0.420 |

| F | 12.325 | 21.88 |

| (1) | (2) | |

|---|---|---|

| State-Owned Enterprises | Non-State-Owned Enterprises | |

| GW | 0.000 | −0.014 *** |

| (0.085) | (−3.012) | |

| GI | 0.005 | 0.008 * |

| (1.629) | (1.846) | |

| SIZE | 0.040 *** | 0.050 *** |

| (4.883) | (5.553) | |

| Lev | −0.184 *** | −0.161 *** |

| (−7.283) | (−5.473) | |

| Growth | 0.003 | 0.002 |

| (0.880) | (0.834) | |

| Top1 | 0.000 | −0.000 |

| (1.072) | (−0.172) | |

| CAPI | 0.073 *** | 0.079 *** |

| (5.771) | (5.959) | |

| Lndep | 0.000 | 0.000 |

| (0.141) | (0.193) | |

| _cons | −0.833 *** | −1.165 *** |

| (−4.424) | (−5.622) | |

| year effect | Yes | Yes |

| industry effect | Yes | Yes |

| N | 322 | 432 |

| R2 | 0.334 | 0.273 |

| F | 7.462 | 6.190 |

| Hypothesis | Content | Test Results |

|---|---|---|

| H1 | Greenwashing behaviour is negatively correlated with the financial performance of agricultural enterprises. | Support (coefficient significantly negative, p < 0.01) |

| H2 | Green innovation plays a partial mediating role between greenwashing behaviour and financial performance. | Support (mediation effect proportion 9.09%, p < 0.05) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, Z.; Tian, X. From Greenwashing to Sustainability: The Mediating Effect of Green Innovation in the Agribusiness Sector on Financial Performance. Agriculture 2025, 15, 1316. https://doi.org/10.3390/agriculture15121316

Wang Z, Tian X. From Greenwashing to Sustainability: The Mediating Effect of Green Innovation in the Agribusiness Sector on Financial Performance. Agriculture. 2025; 15(12):1316. https://doi.org/10.3390/agriculture15121316

Chicago/Turabian StyleWang, Zhongping, and Xiaoying Tian. 2025. "From Greenwashing to Sustainability: The Mediating Effect of Green Innovation in the Agribusiness Sector on Financial Performance" Agriculture 15, no. 12: 1316. https://doi.org/10.3390/agriculture15121316

APA StyleWang, Z., & Tian, X. (2025). From Greenwashing to Sustainability: The Mediating Effect of Green Innovation in the Agribusiness Sector on Financial Performance. Agriculture, 15(12), 1316. https://doi.org/10.3390/agriculture15121316