Abstract

The increasing demand for hydrogen has made it a promising alternative for decarbonizing industries and reducing CO2 emissions. Although mainly produced through the gray pathway, the integration of carbon capture and storage (CCS) reduces the CO2 emissions. This study presents a sustainability method that uses flare gas for hydrogen production through steam methane reforming (SMR) with CCS, supported by a techno-economic analysis. Data Envelopment Analysis (DEA) was used to evaluate the oil company’s efficiency, and inverse DEA/sensitivity analysis identified maximum flare gas reduction, which was modeled in Aspen HYSYS V14. Subsequently, an economic evaluation was performed to determine the levelized cost of hydrogen (LCOH) and the cost–benefit ratio (CBR) for Nigeria. The CBR results were 2.15 (payback of 4.11 years with carbon credit) and 1.96 (payback of 4.55 years without carbon credit), indicating strong economic feasibility. These findings promote a practical approach for waste reduction, aiding Nigeria’s transition to a circular, low-carbon economy, and demonstrate a positive relationship between lean and green strategies in the petroleum sector.

Keywords:

gas flaring; sustainability; hydrogen; technology; petroleum industry; lean; green; lean green; Nigeria 1. Introduction

Global energy consumption has been steadily increasing due to the need for industrialization and the ongoing growth of the human population, resulting in a consistent rise in CO2 emissions [1]. This growth is primarily driven by increased demand in emerging and developing economies, particularly in sectors such as industry and transportation, which subsequently leads to considerable environmental impacts. Some scholars have argued that human growth and the emergence of industrialization are linked to the leading causes of climate change [2,3,4]. According to the International Energy Outlook report, global energy consumption is projected to increase by nearly 50% by 2050 [5]. This estimated increase in global energy consumption has heightened the need for sustainable and clean energy solutions, which are necessary to reduce CO2 emissions and achieve the target goal of below 2 °C, as outlined in the United Nations Framework Convention on Climate Change [6,7].

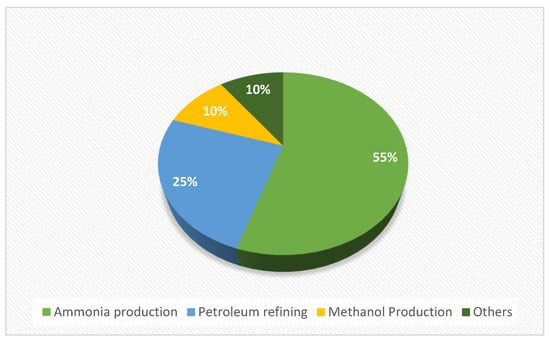

Hydrogen has been identified as a promising and key solution to achieving the net-zero greenhouse gas emissions commitments announced in recent years; it is a versatile and eco-friendly energy carrier with numerous applications in power generation, transportation, and industrial sectors [8,9,10]. The global industrial percentage of hydrogen consumption is shown in Figure 1.

Figure 1.

Global hydrogen consumption by industries (adapted from [11]).

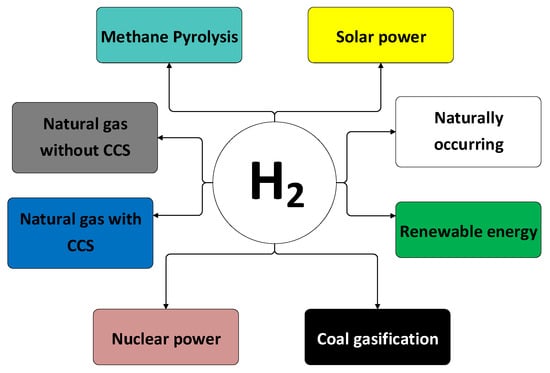

The potential of hydrogen to decarbonize several industries has led to a recent surge in the demand for hydrogen as a clean energy carrier on a global scale [12,13]. Its global demand reached 94 million tonnes (MT) in 2021 and is estimated to rise to 115 million tonnes (MT) by 2030 [14]. Hydrogen can be produced from various sources, and the color of the hydrogen distinguishes its production method as shown in Figure 2 [15,16].

Figure 2.

Hydrogen colors, sources, and production methods.

While natural gas remains the primary source for hydrogen production, accounting for 75% of the world’s supply through the SMR process, which is significantly higher than the electrolysis method [17], this method emits up to 10 kg of CO2 per kg of hydrogen produced [18]. However, this CO2 is significantly reduced when SMR is used with CCS, producing what is known as blue hydrogen [19,20,21]. Nigeria has a natural gas reserve of 5.94 trillion standard cubic meters [22], offering a promising market for hydrogen production, which could play a crucial role in alleviating the nation’s ongoing challenges with sustainable gas flaring.

1.1. Flare Gas to Hydrogen Production: Lean and Green Potentials

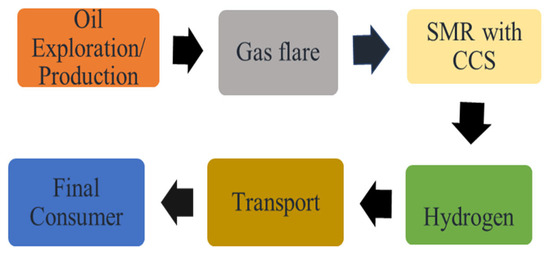

The quest for sustainable production in the oil and gas industry is gradually requiring methods that simultaneously improve operational efficiency and reduce the environmental impact of its activities. This means exploring approaches to transitioning from waste production to value-added production, which is the primary focus of lean and green integration [23,24] as depicted in Figure 3. Lean focuses on reducing waste and inefficiencies in industrial operations, while green prioritizes environmental sustainability and lower carbon footprints [23,25]. Lean and green practices can provide a solution when an industry poorly manages materials, leading to defects and waste that pollute the environment. This approach focuses on reducing non-value-added activities (muda) through lean and green tools, such as Value Stream Mapping, Sustainable Value Stream Mapping, Environmental Value Stream Mapping, and Kaizen, while also utilizing technologies that recycle waste into valuable products [26,27]. With the recent policy initiatives addressing climate change, industries have been compelled to adopt sustainable practices and transition to cleaner production [28]. Lean and green integration has become increasingly important across various industries, providing a pathway to sustainable business practices. This transformative approach enhances operational efficiency while addressing environmental concerns [24,29,30]. Various industries, such as the automotive industry, the healthcare sector, and SMEs, have achieved significant success rates by adopting lean and green practices [27,31,32,33]. Converting flare gas into hydrogen using technologies like SMR with CCS aligns with both philosophies by transforming pollutants into cleaner energy.

Figure 3.

Lean and green practice in the petroleum industry.

The hydrogen economy represents a significant advancement in energy and a transition toward sustainability that integrates social and technical aspects [34]. This shift presents a unique opportunity for Nigeria to complement industrial development with environmental management. Furthermore, it is currently positioned to transform Nigeria’s energy landscape while ensuring the protection of the planet for future generations. By implementing hydrogen technologies, especially SMR with CCS, the nation can significantly reduce its carbon emissions, enhance energy security, play a vital role in achieving global sustainability goals, and potentially its Nationally Determined Contribution (NDC) [35,36]. This pathway of hydrogen production using SMR with CCS enables countries to leverage the current natural gas infrastructure while reducing carbon emissions. Despite the growing global momentum of the hydrogen economy and the abundant natural gas resources, Nigeria continues to lag due to inadequate investment [35]. To address this challenge, Nigeria must attract investments and facilitate the development of carbon capture and storage (CCS) infrastructure to produce cleaner hydrogen, and a strong commitment from the government is required. However, the government plans to invest USD 122 billion in diversifying the energy sector, which will reduce the country’s dependence on the national grid while enhancing the stability and sustainability of Nigeria’s energy infrastructure [37].

1.2. Efficiency Assessment of the Oil Companies Using Data Envelopment Analysis (DEA) and Inverse DEA

The energy sector faces pressure to improve operational efficiency, manage resources, remain competitive, and reduce environmental impact. To optimize the performance of oil companies while mitigating their adverse effects, it is important to evaluate how effectively these companies utilize their resources. One analytical method that can assess the efficiency of these companies is the Data Envelopment Analysis tool (DEA). Data Envelopment Analysis (DEA) was first proposed by [38] and is a quantitative technique used to evaluate the efficiency of decision-making units (DMUs) within a set using input and output data. These DMUs can be organizations, departments, firms, or other entities that change inputs into outputs. It is commonly employed as a benchmarking tool to enhance organizational performance [39]. Benchmarking involves evaluating and analyzing companies’ processes, products, services, or various aspects to compare and use this data as reference points for future strategic decision-making [40]. The goal is to gain insights from the experiences of others in the sector to enhance the performance of the unit being assessed. Different studies, such as those by [41,42,43], have extensively utilized DEA to address pollution control, water treatment, waste management, and environmental efficiency. On the other hand, the inverse DEA is the reverse process of the conventional DEA. It was first developed by Wei et al. (2000) [44]. The DEA model calculates a DMU’s efficiency score. In contrast, the inverse DEA model employs a predetermined DMU efficiency score to calculate the best variations in input and output data. The inverse DEA model has greater flexibility than the standard DEA approach [45]. Different studies, such as [45,46,47,48], have been conducted on using inverse DEA to reduce CO2 emissions.

1.3. Problem Statement

Despite efforts by the Federal Government and other International Communities to reduce the flaring rate, gas flaring continues at an alarming rate in Nigeria. According to data from the World Bank, Nigeria ranks among the top 10 countries with the highest flaring rates in the world [49]. The Federal Government has introduced various policies and programs, such as the Nigerian Gas Flare Commercialization Program, the National Gas Policy, Flare Gas (Prevention and Waste Control) Regulations, and the most recent one, the Petroleum Industry Bill 2021, which has been signed into law [50]. The challenges associated with flaring stem from the government’s lack of stringent actions against violators, insufficient technology, and inadequate managerial control by oil companies [51,52]. As the world shifts toward cleaner energy systems, the potential of hydrogen to decarbonize various industries has resulted in a growing demand for this clean energy carrier. Transforming flare gas into value-added products, such as hydrogen, offers a viable path for sustainable energy production and carbon reduction, effectively addressing waste, lowering emissions, and generating clean energy. However, the techno-economic viability of this conversion, particularly in the context of lean and green practices, has not been thoroughly explored in Nigeria.

This study addresses this gap by conducting a comprehensive simulation of hydrogen production from Nigerian flare gas using Aspen HYSYS. The research applies DEA and inverse DEA for performance benchmarking. The study also evaluates the levelized cost of hydrogen (LCOH) and performs a cost–benefit analysis. By adhering to lean and green sustainability principles, the study presents a viable pathway for utilizing flare gas as a strategic asset for Nigeria’s low-carbon future.

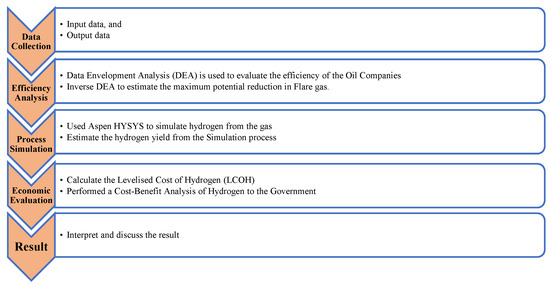

2. Method

This study applied a comprehensive approach to evaluate the feasibility of converting flare gas to hydrogen production from both operational and economic perspectives. Data were collected from the Nigerian National Petroleum Company’s Annual Statistical Bulletin. Data Envelopment Analysis (DEA) and inverse DEA were applied to conduct an efficiency assessment of oil companies operating in Nigeria and to estimate the maximum potential reduction in flare gas. After this, a process simulation was performed using Aspen HYSYS to model the conversion of flare gas into hydrogen. Finally, an economic analysis was performed. Figure 4 shows a simplified process flow diagram of the method.

Figure 4.

Methodology model.

2.1. Data Envelopment Analysis (DEA) and Inverse DEA for Efficiency Analysis

In this study, the directional Data Envelopment Analysis (DEA) was used to assess the performance of selected Multinational Oil Companies operating in Nigeria, classifying them as either efficient or inefficient. The directional DEA is primarily preferred because it considers the direction in which the DMUs are moving in terms of inputs and outputs. Unlike traditional DEA, which assesses efficiency without considering the direction of change in inputs and outputs, directional DEA considers whether a DMU is moving towards or away from the production frontier by classifying it into good and bad outputs. In this research, the bad output from the petroleum industry is the gas flare. In the petroleum industry, it is not just about being efficient, but also about continuous improvement in efficiency.

Terminology

The terminologies used for DEA models in different studies are almost similar.

The general nomenclatures used are listed below:

- n:

- number of decision-making units (DMUs);

- t:

- number of inefficient decision-making units (DMUs);

- m:

- number of inputs of each DMU;

- s:

- number of good outputs of each DMU;

- q:

- number of bad outputs of each DMU.

Data Parameters

- ith input of DMUj (j = 1…n);

- rth good output of DMUj (j = 1…n);

- pth bad output of DMUj (j = 1…n);

- inefficiency score of DMUk (k =1....n).

To obtain the efficiency score of the DMU-k (k = 1…., n), the following directional distance DEA proposed by [53] was used to classify both good and bad outputs; this will be used as the base model. The rationale for using this proposed model by [53] is its success in waste reduction, as shown in Equation (1)

where is referred to as the inefficiency score

Assumptions

From Equation (1) above, assuming there are n numbers of DMUs that will use m of the good inputs (to produce s of the good outputs (and q of the bad outputs (), the aim of Equation (1) is to reduce the undesirable bad outputs under evaluation, which in this case is the flare gas.

As a general guideline in efficiency evaluation, DMUk is said to be efficient if its inefficiency score = 0.

To obtain the efficiency score of each of the DMU-k, and using the formula according to [53] as depicted in Equation (2),

2.2. Inverse DEA for Maximum Reduction in Greenhouse Gas Emission

In computing the inverse DEA, every inverse DEA model relies on efficiency scores from a base DEA model. The base DEA optimizes forward, while the inverse model optimizes backward. This involves maximizing the inefficiency score of each inefficient producer through the base DEA (reaching a theoretical maximum), which then reduces to zero after applying the inverse DEA, allowing the producer to transition from inefficiency to efficiency.

To determine the maximum potential reduction in gas that the inefficient producers will save, the inverse DEA proposed by [46] was used as shown in Equation (3)

S.t

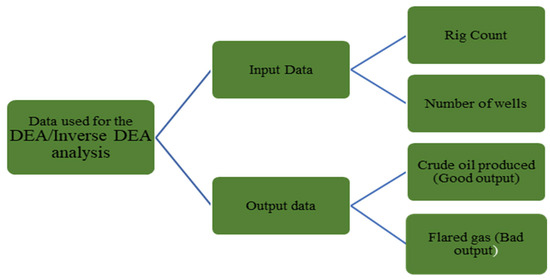

2.3. Data Collection for the DEA

Data for this analysis were obtained from the Annual Statistical Bulletin of the Nigerian National Petroleum Corporation (NNPC). This Federal Government website provides access to open data on crude oil and natural gas production over different years. The selection criteria were based on factors influencing GHG emissions and production rates. The factors identified by [42,45] include the total number of wells, rig count, crude oil produced, and flared gas. These data were classified as input and output, with outputs categorized into good and bad. The process simulation data is shown in Figure 5 and Table 1.

Figure 5.

Data description for the efficiency analysis.

Table 1.

Production data.

Input data

This refers to the resources used to produce petroleum, including drilling activities, capital, and labor.

Good output data

These are the desired products produced from petroleum production, and this can be crude oil.

Bad output data

These are the undesired by-products produced during the production process, which include flared gas.

2.4. Hydrogen Simulation Process Modeling Using Aspen HYSYS

Hydrogen was simulated from the flare gas volume obtained from DMU 3 of the inverse DEA. This volume of gas, derived from the sensitivity analysis, served as feedstock for hydrogen production used in the simulation. This approach aimed to quantify the hydrogen yield instead of flaring it. The same method can be applied to other inefficient DMUs.

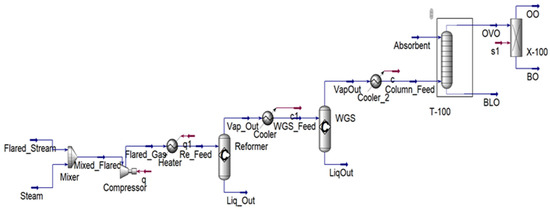

2.5. Hydrogen Simulation Set up

The process simulation of the steam methane reforming for the production of hydrogen from flare gas was performed using the Aspen HYSYS V14 [54] in a steady state and then optimized in terms of thermodynamic parameters to maximize hydrogen production and reduce pollutant gas. The main process in the simulation consists of the flare–steam stream intake, the reformer, water gas shift, and lastly, hydrogen purification, which consists of the separator and Pressure Swing Adsorption (PSA). The process flow diagram is shown in Figure 6, and the following simulation steps were followed.

Figure 6.

The process flow diagram of the hydrogen production simulation.

Define Component:

In setting up the simulation, the components of the natural gas were first specified. The composition of the natural gas used for this simulation, as shown in Table 2, was obtained from an existing gas plant located in the Niger Delta region of Nigeria [55]. Water (H2O) was also used in this simulation.

Table 2.

Natural gas composition.

Select the Thermodynamic Package:

Once the component has been defined, the next step involves selecting an appropriate thermodynamic package. Packages such as the Peng–Robinson or Soave–Redlich–Kwong are commonly employed for hydrocarbon processing [56]. In this study, the Peng–Robinson equation of state was selected due to its widespread acceptance in hydrocarbon simulation and its capability to accurately predict the pressure and temperature of gases [57]. Following the selection of the fluid package, the subsequent step is to construct the flow sheet by transitioning to the simulation environment in HYSYS.

Feed stream:

The model has two feed streams: The flare stream and the steam stream. Both streams were passed into a mixer and then into a compressor. During the industrial SMR process with CCS, natural gas reacts with steam to produce high-quality hydrogen as shown in Equation (4) [57,58].

The natural gas and steam mixture was heated before being moved to the reformer reactor.

Reformer reactor:

In the reformer reactor, methane combines with steam to generate hydrogen and carbon monoxide, which are then cooled before being directed to the water gas shift reactor, as shown in Equation (5). The reactor operates as a conversion reactor, and the reaction conditions were modified accordingly.

The CO and CO2 methanation pathways [59], though thermodynamically linked to this system, are not considered here because the reactor is designed for the SMR process, which is not conducive to methanation, and the study focuses on hydrogen production via SMR.

Water Gas Shift Reactor:

A second reactor, known as the water gas shift reactor, was added to convert CO and H2O into additional hydrogen and CO2, as shown in Equation (6). A second cooler was also used to cool the product before it was sent to the absorber and the Pressure Swing Adsorption for separation and purification. To maximize hydrogen production, the temperatures of the reformer and WGS were set at 263 °C and 203 °C, respectively.

Hydrogen Purification:

The product was separated using the absorber and then sent to the Pressure Swing Adsorption unit, where hydrogen was purified from other components, including CO2, CO, and residual methane. The undesirable gases were removed in the absorber zone, and a water-free gas was sent to the Pressure Swing Adsorption unit, resulting in pure 99.5% hydrogen gas. The hydrogen gas was allowed to meet the market product prerequisites.

2.6. Techno-Economic Analysis of Hydrogen Production from Natural Gas

Following the simulation of hydrogen production from natural gas using Aspen HYSYS V14, it is essential to evaluate the financial implications of the hydrogen production initiative, particularly in relation to gas flaring management and its benefits to the Nigerian government. The economic evaluation revealed the levelized cost of hydrogen (LCOH) and the project’s cost–benefit ratio, with the calculations based on capital investment and operational expenses. Currently, Nigeria has no active hydrogen projects, resulting in inadequate data on cost and installation information for equipment within the country, as well as limited research on this subject in the Nigerian context. Given the absence of data, a cost estimation method for chemical plants, created by [60], was utilized to compute the capital and operational costs. All costs, including direct, indirect, and operational expenses, were adjusted to 2025 using the Chemical Engineering Plant Index (CEPCI) and the equipment scaling formula by [61], as outlined in Equation (7).

The CEPCI values for 2022 and 2025 are 797.6 and 800, respectively. Table 3 outlines the fundamental assumptions used in this economic analysis for research purposes.

where

Table 3.

Basic assumptions for the economic calculations.

CA = new scaled equipment cost, CB = base equipment cost, CIA = CEPCI current year, CIB = CEPCI given year, SIA = new equipment capacity, SIB = old equipment capacity, and n = scaling exponent

This research assumes that a hydrogen distribution network is available; therefore, the shipping and distribution costs of the hydrogen were not considered in the calculation.

2.7. Determination of Total Capital Investment (TCI)

According to the standard engineering system economic analysis procedure, the total capital investment (TCI) is calculated as the sum of the working capital (WC) and the fixed capital investment (FCI), also referred to as the total plant cost [64]. The data for the total plant cost (direct cost) and the total capital requirement (indirect costs) were adjusted to the current year 2025 levels using the Chemical Engineering Plant Index (CEPCI) from the work of [62]. The total operating cost (OPEX) was calculated as the sum of the fixed operating cost and variable cost [65]. The summarized adjusted TPC, the cost estimation of the total capital investment (TCI), and the cost estimation of the annual operating cost (OPEX) are shown in Table 4, Table 5 and Table 6.

Table 4.

Adjusted TPC to the current year.

Table 5.

Cost estimation of the total capital investment parameters.

Table 6.

Cost Estimation of the annual operating cost (OPEX).

3. Results

The efficiency scores of each DMU are presented in Table 7, while Table 8 shows the Potential Maximum Reduction in the inefficient producers performed by the inverse DEA. DMUs 1, 2, 4, 9, and 11, with an efficiency score of zero, operate efficiently, while DMUs 3, 5, 6, 7, 8, 10, and 12 do not. The efficient DMUs exhibit minimal flaring, indicating they have implemented effective measures for managing flare gas during production. These practices could serve as benchmarks for the less efficient DMUs. In contrast, DMUs 3, 5, 6, 7, 8, 10, and 12 are considered inefficient due to their high flaring rates. These companies could enhance their operations by investing in targeted interventions, such as hydrogen production via the steam methane reforming process and the adoption of carbon capture and storage (CCS) technology.

Table 7.

Production data used for each of the DMUs and their efficiency scores.

Table 8.

Potential Maximum Reduction using the sensitivity analysis.

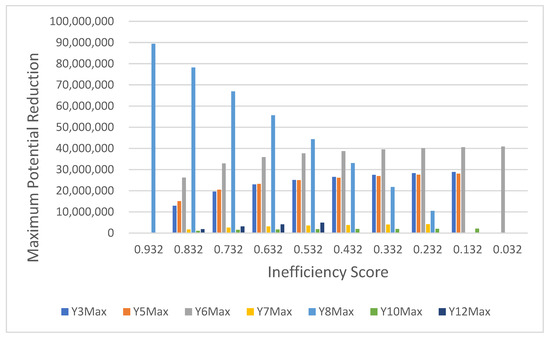

3.1. Sensitivity Analysis

A sensitivity analysis was performed on each of the inefficient DMUs to determine the potential increase if the inefficiency measure of each of the DMUs is reduced by 0.1. It was observed that the maximum potential reduction was recorded when the inefficiency measure of the DMUs was decreased to the barest minimum, which were at 0.086, 0.087, 0.032, 0.071, 0.081, 0.062, and 0.076 for DMUs 3, 5, 6, 7, 8, 10, and 12, respectively. This is shown in Table 9.

Table 9.

Potential Maximum Reduction using the sensitivity analysis.

The graph presented in Figure 7 displays the findings from the sensitivity analysis, which aimed to evaluate the maximum possible reduction in the number of inefficient companies listed in Table 7. It was found that as the inefficiency score decreases, the maximum potential reduction in flare gas increases. Out of the four inefficient DMUs, Y8Max, demonstrates the most significant potential for reduction, with an inefficiency score of 0.081.

Figure 7.

Efficiency score and potential reduction in gas of the DMUs.

3.2. Economic Calculation

A cost–benefit analysis of hydrogen production was performed. The hydrogen production simulation using SMR + CCS resulted in 212,400 kg per day from 28,847,770 Mscf of flare gas. The efficiency of CO2 capture reached 90%. The total capital investment was calculated using the TPC and TCR metrics. The costs are detailed in Table 10.

Table 10.

Economic parameter cost.

The annual revenue generated from the sale of hydrogen, priced at a market cost of USD 3 per kg, was USD 232,578,000, while the net Annual Benefit was USD 139,236,351.02. The payback period was estimated to be 4.55 years, which is a positive sign for potential investors to recoup their invested capital. Table 11 summarizes the effects of carbon credits on the key metrics.

Table 11.

Effects of carbon credits on the key metrics.

3.3. Levelized Hydrogen Cost (LCOH)

According to [66], LCOH assesses the total costs associated with hydrogen production throughout its lifecycle, encompassing annual capital cost and operational expenses (OPEX), dividing it by annual hydrogen production. The LCOH was calculated using the formula of [20], and the annual discount rate was assumed to be 8%. The EU trading scheme carbon price is 73 EUR/tonnes, and UK ETS carbon sale is GBP 45/tonne

where CRF is the capital recovery factor, calculated as follows:

The LCOH value from SMR with CCS is lower than that reported by [65] and almost the same as that of [67]. This suggests that establishing an SMR plant in Nigeria is more cost-effective due to the country’s abundant natural gas, which serves as a feedstock for hydrogen production. Therefore, the project presents a promising and economic opportunity for the government. Additionally, this hydrogen can be utilized and transported locally and internationally, as demand continues to rise, positioning Nigeria as a central hub for hydrogen production.

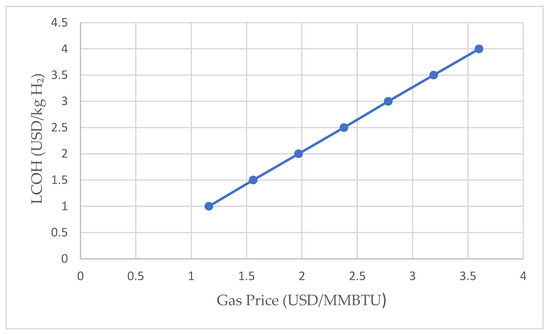

3.4. Sensitivity Analysis

To investigate the relationship between the price of natural gas and the LCOH in Nigeria, more scenarios were generated using the sensitivity factor calculation. The results from the different scenarios are then analyzed to determine the changes that occur to LCOH when the gas price is varied.

This translates to a rise of around USD 0.80/kg H2 for every increase in gas price per MMBTU in LCOH.

Given Nigeria’s vast natural gas reserves, its current price of USD 2.42/MMBTU is significantly lower than what other countries, such as Germany and the Netherlands, pay, which ranges from USD 6 to USD 12/MMBTU due to their reliance on imports or market conditions. The sensitivity analysis in Figure 8 shows that the LCOH becomes highly competitive at lower gas prices. In other words, an increase in natural gas price usually leads to an increase in LCOH. This makes Nigeria’s blue hydrogen highly competitive compared to other countries with higher gas prices. As a result, Nigeria could become a key hub for the commercial production of blue hydrogen.

Figure 8.

Sensitivity analysis of LCOH with natural gas price.

3.5. Cost–Benefit Ratio (CBR)

The benefit–cost ratio (BCR) evaluates a project’s feasibility by comparing its benefits and costs. Simply put, CBR is all about considering whether a particular project is worth your time and money by looking at its cost and the benefits you will receive from such a project. A CBR greater than one indicates that the benefits exceed the costs, suggesting the project is worthwhile. A CBR equal to one means that the benefits and costs are equal. Conversely, a CBR less than one suggests that the project’s costs outweigh its benefits.

The project’s CBR exceeds one, suggesting that investing in the hydrogen project in Nigeria is highly economical. Not only will it generate revenue for the government, but it will also provide an alternative to gas flaring by directing unused gas toward hydrogen production.

3.6. CO2 Avoided

The quantity of carbon dioxide emissions prevented from entering the atmosphere due to policies or technological advancements that reduce or eliminate the need for activities that would otherwise result in such emissions is known as greenhouse gas averted. That is, in essence, the difference between the actual emissions and what would have been emitted

where

CO2nt is the CO2 emission without technology;

CO2wt is the CO2 emission with technology;

Annual CO2 Avoided = 775,260,000 kg CO2/year–77,526,000 kg CO2/year;

Annual CO2 Avoided = 697,734,000kg/year or 697,734 tons of CO2/year.

The 697,734 tons of CO2/year represent CO2 emissions avoided through SMR + CCS hydrogen production technology. This significantly benefits the environment by reducing greenhouse gas emissions and supporting the government’s efforts to address global climate change.

If Nigeria is to sell its carbon credits at USD 20 per ton,

The value will be = USD 20 * 697,734 tons of CO2/year

USD 13,954,680

Updated annual revenue = USD 232,578,000+ USD 13,954,680

USD 246,532,680

This will significantly impact the CBR.

4. Discussions

4.1. Implications of the Results

Based on the results of the inverse DEA, four companies were identified as inefficient. This suggests that their activities have a negative impact on the environment. The economic analysis reveals that combining operational benchmarking with process simulation modeling can provide a comprehensive framework that enhances resource optimization and supports environmental sustainability in the petroleum industry. The simulation demonstrated that the recovered gas could be converted into hydrogen, a clean and high-demand fuel, thereby transforming an environmentally harmful by-product into a commercially valuable resource. Furthermore, this integration of DEA and process simulation establishes a solid foundation for lean–green transformations in the energy sector. The economic viability of this conversion was calculated using a cost–benefit ratio (CBR), resulting in a CBR of 1.96. This indicates that a return of 1.96 units is achievable for every unit of cost incurred. This positive CBR supports the feasibility of the conversion process, both economically and environmentally. This investment opportunity appeals to investors, with an estimated payback period of 4.11 years, particularly when enhanced with revenue from carbon credits. Overall, the results of this simulation process demonstrated a positive relationship between lean and green principles in the petroleum industry.

- Lean Optimization: Lean principles focus on eliminating waste (muda), increasing productivity, and enhancing quality [68,69]. The notable decrease in waste (flare gas) illustrates a more efficient operational model that utilizes energy resources more effectively. By transforming the excess gas that would have been flared into hydrogen, the process eliminates waste while maintaining output, aligning with lean manufacturing goals. The lean concept has been used to enhance operational and technical dimensions, contractor and supplier relationships, team organization, and project management practices within the petroleum industry [70].

- Green Sustainability: Green principles emphasize environmental sustainability by reducing emissions and resource consumption, while promoting eco-friendly practices [71]. Reducing flaring directly reduces greenhouse gas emissions, supports global sustainability and decarbonization goals. Hydrogen production further promotes the adoption of green energy, as hydrogen is a crucial enabler of carbon-neutral fuel systems.

- Economic-Environmental Balance: The CBR value supports integrating lean and green objectives without economic sacrifice. Instead of viewing sustainability as a cost center, this approach shows that sustainable practice can generate revenue.

Hydrogen plays a critical role in reducing carbon emissions until the production of green hydrogen becomes more readily available and cost-competitive. For a country like Nigeria, with abundant natural gas and a high flaring rate, transitioning into hydrogen production will serve as a sustainable solution for managing gas flaring. This study also showed that the annual CO2 avoided or otherwise to have been flared from the production of 77.5 million kilograms of hydrogen each year was 697,734 tons of CO2/year, but was prevented through the production of blue hydrogen technology. This avoided CO2 can be monetized through carbon credits or tax avoidance in regions where the emission trading scheme is strictly regulated. With a carbon pricing of USD 20/ton, the annual revenue from this research analysis increases by USD 13,954,680, significantly increasing the economic case for the blue hydrogen project. Consequently, this hydrogen production reduces carbon emissions and makes a significant contribution to global efforts to combat climate change.

4.2. Study Contributions to the Sustainable Development Goals (SDGs)

The government has made efforts to reduce gas flaring, although little progress has been achieved; however, there is still more to be done. The results of this study have strong and direct implications and contributions to the Sustainable Development Goals (SDGs), specifically related to Affordable Clean Energy (SDG 7), climate change (SDG 13), Responsible Consumption and Production, and Industry, Innovation, and Infrastructure (SDG 9). The integration of lean–green management principles and blue hydrogen production supports SDG 7 by promoting access to cleaner alternatives, such as low-carbon blue hydrogen, and contributes to Nigeria’s transition plan towards a more sustainable and secure energy system. The exploration of blue hydrogen as a feasible and economically viable alternative leverages Nigeria’s abundant natural gas resources to diversify the country’s energy mix while reducing environmental harm. In line with SDG 13, the study addresses climate action by targeting the reduction in greenhouse gas emissions through operational efficiency improvements and proposing an economically viable technology for gas utilization. Furthermore, the integration of lean and green principles advances SDG 12 by enhancing process efficiency, minimizing waste, and encouraging the adoption of sustainable practices within Nigeria’s petroleum industry. Lastly, the study encourages investment in cleaner technologies and sustainable infrastructure, aligning with SDG 9.

4.3. Hydrogen Distribution and Infrastructure Challenges

A key component of the hydrogen value chain is the infrastructure required for distributing and storing hydrogen. This infrastructure is just as important as production costs. Unlike traditional fuels like natural gas, hydrogen has unique physical and chemical properties that make it harder to handle. For example, it has low energy density, a small size, and easily diffuses [72,73]. As a result, specialized infrastructure is required to transport and store it efficiently, safely, and cost-effectively [74].

Hydrogen Transport: Transporting hydrogen from production sites to end-users involves various methods, depending on the distance, volume, and geographic location. It can be transported via pipeline, sea, or road [74]. For shorter distances, truck or rail transport is efficient; for longer distances, pipelines or sea transport are used. In the long run, pipelines are more economical, but they require specialized infrastructure [72,75]. The existing natural gas pipelines can be repurposed for hydrogen use; however, hydrogen can cause embrittlement to these natural gas pipelines [75]. Measures to prevent embrittlement include coating, using materials highly resistant to hydrogen embrittlement, the use of inhibitors, and enclosing the pipeline within another pipeline [72,75].

Hydrogen storage: Hydrogen can be stored in various forms, including compressed gas, liquid hydrogen, or chemically bound in materials such as metal hydrides and liquid organic hydrogen carriers (LOHCs) [76]. The most suitable storage method depends on various factors, including the desired storage capacity, energy density, and intended use application [76,77]. Hydrogen has great potential and versatility, but faces storage challenges due to low density and volatility [74]. Developing cost-effective, efficient storage systems is essential for the sustainable use [74].

5. Conclusions

This study presents a techno-economic analysis of blue hydrogen production in Nigeria using the lean and green approach. By integrating process simulation in Aspen HYSYS with Data Envelopment Analysis (DEA) and inverse DEA, the study not only demonstrates the technical feasibility of this method but also assesses its economic viability of SMR with CCS as a sustainable pathway for hydrogen production from flare gas.

The CBR results gave 2.15 (payback 4.11 years with carbon credit) and 1.96 (payback 4.5 years without carbon credit). This highlights the financial advantage of this approach. These results demonstrate the dual benefits of reducing environmental impact while achieving economic benefits, establishing flare gas management technology as a crucial element in Nigeria’s transition toward a circular and low-carbon economy.

Another key finding from the study is that the LCOH from SMR with CCS is lower compared to similar studies by other researchers. This suggests that establishing an SMR plant in Nigeria is more cost-effective due to the country’s abundant natural gas, which serves as a feedstock for hydrogen production. Nigeria’s cost advantage stems from its abundant natural gas reserves, making it a readily available feedstock for hydrogen production. Sensitivity analysis shows that the LCOH becomes highly competitive at lower gas prices. In other words, an increase in natural gas price usually leads to an increase in LCOH. This makes Nigeria’s blue hydrogen highly competitive compared to other countries with higher gas prices.

Therefore, the project presents a promising and economic opportunity for the government, as this hydrogen can be utilized and transported locally and internationally, positioning Nigeria as a central hub for hydrogen production as demand continues to rise. Overall, this integrated approach demonstrates the potential of combining lean practices with green goals to enhance sustainability in the petroleum industry.

Finally, future techno-economic research should be carried out on an alternate route of hydrogen production using the Autothermal reforming (ATR) and pyrolysis process to determine the best technology selection to adopt in Nigeria.

Author Contributions

Conceptualization, F.D., O.O., J.R., H.N.D. and C.D.; methodology, F.D.; formal analysis, F.D., O.O., J.R., C.D. and H.N.D.; original draft preparation, F.D.; writing—review and editing, F.D., C.D., O.O., J.R. and H.N.D.; supervision, O.O., H.N.D. and J.R. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The original contributions presented in this study are included in the article. Further inquiries can be directed to the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

Abbreviations

| SMR | Steam Methane Reforming |

| CCS | Carbon Capture and Storage |

| DEA | Data Envelopment Analysis |

| LCOH | Levelized Cost of Hydrogen |

| GHG | Greenhouse Gas |

| DMU | Decision-Making Units |

| WGS | Water Gas Shift Reactor |

| CBR | Cost–Benefit Ratio |

| USD/KG H2 | Cost of hydrogen in USD per kilogram of H2 |

References

- Castro, J.; Leaver, J.; Pang, S. Simulation and techno-economic assessment of hydrogen production from biomass gasification-based processes: A review. Energies 2022, 15, 8455. [Google Scholar] [CrossRef]

- Wadanambi, R.T.; Wandana, L.S.; Chathumini, K.K.G.L.; Dassanayake, N.P.; Preethika, D.D.P.; Arachchige, U.S. The effects of industrialization on climate change. J. Res. Technol. Eng. 2020, 1, 86–94. [Google Scholar]

- Osobajo, O.A.; Otitoju, A.; Otitoju, M.A.; Oke, A. The impact of energy consumption and economic growth on carbon dioxide emissions. Sustainability 2020, 12, 7965. [Google Scholar] [CrossRef]

- Ahmed, M.; Huan, W.; Ali, N.; Shafi, A.; Ehsan, M.; Abdelrahman, K.; Khan, A.A.; Abbasi, S.S.; Fnais, M.S. The effect of energy consumption, income, and population growth on CO2 emissions: Evidence from NARDL and machine learning models. Sustainability 2023, 15, 11956. [Google Scholar] [CrossRef]

- Institute for Energy Research. EIA Expects Energy Demand to Increase Almost 50 Percent Worldwide by 2050. (14 October 2021). Available online: https://www.instituteforenergyresearch.org/international-issues/eia-expects-energy-demand-to-increase-almost-50-percent-worldwide-by-2050/ (accessed on 18 February 2025).

- United Nations Framework Convention on Climate Change. The Paris Agreement. Available online: https://unfccc.int/process-and-meetings/the-paris-agreement (accessed on 9 July 2025).

- Gao, Y.; Gao, X.; Zhang, X. The 2 C global temperature target and the evolution of the long-term goal of addressing climate change—From the United Nations framework convention on climate change to the Paris agreement. Engineering 2017, 3, 272–278. [Google Scholar] [CrossRef]

- International Energy Agency. The Future of Hydrogen: Seizing Today’s Opportunities. 2019. Available online: https://www.iea.org/reports/the-future-of-hydrogen (accessed on 9 July 2025).

- WHA International. Hydrogen in Industry. 2023. Available online: https://wha-international.com/hydrogen-in-industry/ (accessed on 9 July 2025).

- Harichandan, S.; Kar, S.K.; Rai, P.K. A systematic and critical review of green hydrogen economy in India. Int. J. Hydrogen Energy 2023, 48, 31425–31442. [Google Scholar] [CrossRef]

- Rai, N.; Srivastava, V. Renewable Energy Growth in Industry with Hydrogen. Water Energy Int. 2024, 67, 24–33. [Google Scholar]

- Hassanpouryouzband, A.; Adie, K.; Cowen, T.; Thaysen, E.M.; Heinemann, N.; Butler, I.B.; Wilkinson, M.; Edlmann, K. Geological hydrogen storage: Geochemical reactivity of hydrogen with sandstone reservoirs. ACS Energy Lett. 2022, 7, 2203–2210. [Google Scholar] [CrossRef]

- Ishaq, H.; Dincer, I.; Crawford, C. A review on hydrogen production and utilization: Challenges and opportunities. Int. J. Hydrogen Energy 2022, 47, 26238–26264. [Google Scholar] [CrossRef]

- International Energy Agency. Promising Signs in Electrolyser Manufacturing Add to Growing Momentum for Low-Emissions Hydrogen. Available online: https://www.iea.org/news/promising-signs-in-electrolyser-manufacturing-add-to-growing-momentum-for-low-emissions-hydrogen (accessed on 9 July 2025).

- Panić, I.; Cuculić, A.; Ćelić, J. Color-coded hydrogen: Production and storage in maritime sector. J. Mar. Sci. Eng. 2022, 10, 1995. [Google Scholar] [CrossRef]

- Massarweh, O.; Al-khuzaei, M.; Al-Shafi, M.; Bicer, Y.; Abushaikha, A.S. Blue hydrogen production from natural gas reservoirs: A review of application and feasibility. J. CO2 Util. 2023, 70, 102438. [Google Scholar] [CrossRef]

- Hren, R.; Vujanović, A.; Van Fan, Y.; Klemeš, J.J.; Krajnc, D.; Čuček, L. Hydrogen production, storage and transport for renewable energy and chemicals: An environmental footprint assessment. Renew. Sustain. Energy Rev. 2023, 173, 113113. [Google Scholar] [CrossRef]

- Sun, P.; Young, B.; Elgowainy, A.; Lu, Z.; Wang, M.; Morelli, B.; Hawkins, T. Criteria air pollutants and greenhouse gas emissions from hydrogen production in US steam methane reforming facilities. Environ. Sci. Technol. 2019, 53, 7103–7113. [Google Scholar] [CrossRef] [PubMed]

- Hepburn, C.; Adlen, E.; Beddington, J.; Carter, E.A.; Fuss, S.; Mac Dowell, N.; Minx, J.C.; Smith, P.; Williams, C.K. The technological and economic prospects for CO2 utilization and removal. Nature 2019, 575, 87–97. [Google Scholar] [CrossRef]

- Lee, J.; Cho, H.; Kim, J. Techno-economic analysis of on-site blue hydrogen production based on vacuum pressure adsorption: Practical application to real-world hydrogen refueling stations. J. Environ. Chem. Eng. 2023, 11, 109549. [Google Scholar] [CrossRef]

- International Renewable Energy Agency. Geopolitics of the Energy Transformation: The Hydrogen Factor. 2022. Available online: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2022/Jan/IRENA_Geopolitics_Hydrogen_2022.pdf (accessed on 9 July 2025).

- Statista. Countries with the Largest Natural Gas Reserves in Africa as of 2023. 2024. Available online: https://www.statista.com/statistics/1197585/natural-gas-reserves-in-africa-by-main-countries/ (accessed on 13 February 2025).

- Garza-Reyes, J.A. Lean and green–a systematic review of the state of the art literature. J. Clean. Prod. 2015, 102, 18–29. [Google Scholar] [CrossRef]

- Bhattacharya, A.; Nand, A.; Castka, P. Lean-green integration and its impact on sustainability performance: A critical review. J. Clean. Prod. 2019, 236, 117697. [Google Scholar] [CrossRef]

- King, A.A.; Lenox, M.J. Lean and green? An empirical examination of the relationship between lean production and environmental performance. Prod. Oper. Manag. 2001, 10, 244–256. [Google Scholar] [CrossRef]

- Ikatrinasari, Z.F.; Hasibuan, S.; Kosasih, K. The implementation lean and green manufacturing through sustainable value stream mapping. In IOP Conference Series: Materials Science and Engineering, Proceedings of the International Conference on Design, Engineering and Computer Sciences 2018, Jakarta, Indonesia, 9 August 2018; IOP Publishing: Bristol, UK, 2018; Volume 453, p. 012004. [Google Scholar]

- Elemure, I.; Dhakal, H.N.; Leseure, M.; Radulovic, J. Integration of lean green and sustainability in manufacturing: A review on current state and future perspectives. Sustainability 2023, 15, 10261. [Google Scholar] [CrossRef]

- Kaswan, M.S.; Rathi, R. Green Lean Six Sigma for sustainable development: Integration and framework. Environ. Impact Assess. Rev. 2020, 83, 106396. [Google Scholar] [CrossRef]

- Dibia, F.; Dibia, C.; Dhakal, H.N.; Okpako, O.; Radulovic, J.; Isike, A. A Review on Achieving Sustainability in the Petroleum Industry Through the Integration of Lean and Green. Appl. Sci. 2025, 15, 2333. [Google Scholar] [CrossRef]

- Abreu, M.F.; Alves, A.C.; Moreira, F. Lean-Green models for eco-efficient and sustainable production. Energy 2017, 137, 846–853. [Google Scholar] [CrossRef]

- Choudhary, S.; Nayak, R.; Dora, M.; Mishra, N.; Ghadge, A. An integrated lean and green approach for improving sustainability performance: A case study of a packaging manufacturing SME in the UK. Prod. Plan. Control 2019, 30, 353–368. [Google Scholar] [CrossRef]

- Akdag, H.C.; Beldek, T. Green hospital together with a lean healthcare system. In Industrial Engineering in the Big Data Era, Proceedings of the Global Joint Conference on Industrial Engineering and Its Application Areas, GJCIE 2018, Nevsehir, Turkey, 21–22 June 2018; Springer International Publishing: Berlin/Heidelberg, Germany, 2019; pp. 461–470. [Google Scholar]

- Duarte, S.; Cruz Machado, V. Green and lean implementation: An assessment in the automotive industry. Int. J. Lean Six Sigma 2017, 8, 65–88. [Google Scholar] [CrossRef]

- International Energy Agency. Net Zero by 2050: A Roadmap for the Global Energy Sector. 2021. Available online: https://www.iea.org/reports/net-zero-by-2050 (accessed on 13 February 2025).

- Falowo, M. Powering Down Emissions: Blue, Geologic Hydrogen Take Centre Stage. Tribune Online. Available online: https://tribuneonlineng.com/powering-down-emissions-blue-geologic-hydrogen-take-centre-stage/ (accessed on 22 February 2025).

- Africa Energy Portal. Nigeria Sets Sights on $200B Hydrogen Economy. 2024. Available online: https://africa-energy-portal.org/news/nigeria-sets-sights-200b-hydrogen-economy#:~:text=Nigeria%20is%20positioning%20itself%20to,blue%20and%20green%20hydrogen%20production (accessed on 13 February 2025).

- CNBC Africa. Nigeria Eyes $122bn Investment to Diversify Energy Sources. Available online: https://www.cnbcafrica.com/media/6369549976112/nigeria-eyes-122bn-investment-to-diversify-energy-sources/ (accessed on 3 March 2025).

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Amirteimoori, A.; Allahviranloo, T. Improving technical efficiency in data envelopment analysis for efficient firms: A case on Chinese banks. Inf. Sci. 2024, 681, 121237. [Google Scholar] [CrossRef]

- Guevel, H.P.; Ramón, N.; Aparicio, J. Benchmarking in data envelopment analysis: Balanced efforts to achieve realistic targets. Ann. Oper. Res. 2024, 1–24. [Google Scholar] [CrossRef]

- Wang, J.; Zhao, T.; Zhang, X. Environmental assessment and investment strategies of provincial industrial sector in China—Analysis based on DEA model. Environ. Impact Assess. Rev. 2016, 60, 156–168. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Wang, D. Sustainability development for supply chain management in US petroleum industry by DEA environmental assessment. Energy Econ. 2014, 46, 360–374. [Google Scholar] [CrossRef]

- Molinos-Senante, M.; Hernández-Sancho, F.; Mocholí-Arce, M.; Sala-Garrido, R. Economic and environmental performance of wastewater treatment plants: Potential reductions in greenhouse gases emissions. Resour. Energy Econ. 2014, 38, 125–140. [Google Scholar] [CrossRef]

- Wei, Q.; Zhang, J.; Zhang, X. An inverse DEA model for inputs/outputs estimate. Eur. J. Oper. Res. 2000, 121, 151–163. [Google Scholar] [CrossRef]

- Orisaremi, K.K.; Chan, F.T.; Chung, N.S. Potential reductions in global gas flaring for determining the optimal sizing of gas-to-wire (GTW) process: An inverse DEA approach. J. Nat. Gas Sci. Eng. 2021, 93, 103995. [Google Scholar] [CrossRef]

- Wegener, M.; Amin, G.R. Minimizing greenhouse gas emissions using inverse DEA with an application in oil and gas. Expert Syst. Appl. 2019, 122, 369–375. [Google Scholar] [CrossRef]

- Ghiyasi, M. Industrial sector environmental planning and energy efficiency of Iranian provinces. J. Clean. Prod. 2017, 142, 2328–2339. [Google Scholar] [CrossRef]

- Emrouznejad, A.; Yang, G.L.; Amin, G.R. A novel inverse DEA model with application to allocate the CO2 emissions quota to different regions in Chinese manufacturing industries. J. Oper. Res. Soc. 2019, 70, 1079–1090. [Google Scholar] [CrossRef]

- World Bank. 2022 Global Gas Flaring Tracker Report. 2022. Available online: https://thedocs.worldbank.org/en/doc/1692f2ba2bd6408db82db9eb3894a789-0400072022/original/2022-Global-Gas-Flaring-Tracker-Report.pdf (accessed on 9 July 2025).

- Olujobi, O.J.; Yebisi, T.E.; Patrick, O.P.; Ariremako, A.I. The legal framework for combating gas flaring in Nigeria’s oil and gas industry: Can it promote sustainable energy security? Sustainability 2022, 14, 7626. [Google Scholar] [CrossRef]

- Babalola, A.A.; Olawuyi, D.S. Overcoming regulatory failure in the design and implementation of gas flaring policies: The potential and promise of an energy justice approach. Sustainability 2022, 14, 6800. [Google Scholar] [CrossRef]

- Moller, L.; Mohammed, J.I. The Problem of Gas Flaring: A Review of Current Legal and Policy Efforts in the UK and Nigeria. Oil, Gas and Energy Law (OGEL). 2021. Available online: https://www.ogel.org/journal-advance-publication-article.asp?key=700 (accessed on 9 July 2025).

- Chung, Y.H.; Färe, R.; Grosskopf, S. Productivity and undesirable outputs: A directional distance function approach. J. Environ. Manag. 1997, 51, 229–240. [Google Scholar] [CrossRef]

- Aspen Technology, Inc. Aspen HYSYS (Version 14); Aspen Technology: Bedford, MA, USA, 2022; Available online: https://www.aspentech.com/ (accessed on 9 July 2025).

- Anosike, N.; El-Suleiman, A.; Pilidis, P. Associated gas utilization using gas turbine engine, performance implication—Nigerian case study. Energy Power Eng. 2016, 8, 137–145. [Google Scholar] [CrossRef][Green Version]

- Zohuri, B.; McDaniel, P.; Zohuri, B.; McDaniel, P. Properties of pure substances. In Thermodynamics in Nuclear Power Plant Systems; Springer: Cham, Switzerland, 2019; pp. 25–54. [Google Scholar]

- Chehade, A.M.E.H.; Daher, E.A.; Assaf, J.C.; Riachi, B.; Hamd, W. Simulation and optimization of hydrogen production by steam reforming of natural gas for refining and petrochemical demands in Lebanon. Int. J. Hydrogen Energy 2020, 45, 33235–33247. [Google Scholar] [CrossRef]

- Khoshnoudı, A.; Akay, R. Simulation and optimization of hydrogen production by steam reforming of natural gas. J. Turk. Chem. Soc. Sect. B Chem. Eng. 2023, 6, 123–136. [Google Scholar] [CrossRef]

- Miao, B.; Ma, S.S.K.; Wang, X.; Su, H.; Chan, S.H. Catalysis mechanisms of CO2 and CO methanation. Catal. Sci. Technol. 2016, 6, 4048–4058. [Google Scholar] [CrossRef]

- Towler, G.; Sinnott, R. Chemical Engineering Design: Principles, Practice and Economics of Plant and Process Design; Butterworth-Heinemann: Oxford, UK, 2021. [Google Scholar]

- Yan, Y.; Manovic, V.; Anthony, E.J.; Clough, P.T. Techno-economic analysis of low-carbon hydrogen production by sorption enhanced steam methane reforming (SE-SMR) processes. Energy Convers. Manag. 2020, 226, 113530. [Google Scholar] [CrossRef]

- Bigestans, D.; Cardin, M.A.; Kazantzis, N. Economic performance evaluation of flexible centralised and decentralised blue hydrogen production systems design under uncertainty. Appl. Energy 2023, 352, 121944. [Google Scholar] [CrossRef]

- Chemical Engineering. (n.d.). Process Control & Instrumentation (PCI) Home. Available online: https://www.chemengonline.com/pci-home (accessed on 20 February 2025).

- Ma, L.C.; Castro-Dominguez, B.; Kazantzis, N.K.; Ma, Y.H. Integration of membrane technology into hydrogen production plants with CO2 capture: An economic performance assessment study. Int. J. Greenh. Gas Control 2015, 42, 424–438. [Google Scholar] [CrossRef]

- Collodi, G.; Azzaro, G.; Ferrari, N.; Santos, S. Techno-economic evaluation of deploying CCS in SMR based merchant H2 production with NG as feedstock and fuel. Energy Procedia 2017, 114, 2690–2712. [Google Scholar] [CrossRef]

- Clean Hydrogen Observatory. Manual–Levelised Cost of Hydrogen (LCOH) Calculator. European Commission. 2024. Available online: https://observatory.clean-hydrogen.europa.eu/tools-reports/levelised-cost-hydrogen-calculator (accessed on 2 February 2025).

- Moses, A.; Kuye, A.; Kanu, A.; Oji, A. A comparative techno-economic analysis of hydrogen production processes from locally available resources in Nigeria. J. Altern. Energy Sources Technol. 2024, 15, 29–46. [Google Scholar]

- Radin Umar, R.Z.; Tiong, J.Y.; Ahmad, N.; Dahalan, J. Development of framework integrating ergonomics in Lean’s Muda, Muri, and Mura concepts. Prod. Plan. Control 2024, 35, 1466–1474. [Google Scholar] [CrossRef]

- Jimenez, G.; Santos, G.; Sá, J.C.; Ricardo, S.; Pulido, J.; Pizarro, A.; Hernández, H. Improvement of Productivity and Quality in the Value Chain through Lean Manufacturing–a case study. Procedia Manuf. 2019, 41, 882–889. [Google Scholar] [CrossRef]

- Bathrinath, S.; Abuthakir, N.; Koppiahraj, K.; Saravanasankar, S.; Rajpradeesh, T.; Manikandan, R. An initiative towards sustainability in the petroleum industry: A review. Mater. Today Proc. 2021, 46, 7798–7802. [Google Scholar] [CrossRef]

- Zhichao, Y.; Yashu, Y. Promoting Environmental Sustainability Through the Principles of Green, Eco-Friendly Tourism. Imras 2024, 7, 63–74. [Google Scholar]

- Cristello, J.B.; Yang, J.M.; Hugo, R.; Lee, Y.; Park, S.S. Feasibility analysis of blending hydrogen into natural gas networks. Int. J. Hydrogen Energy 2023, 48, 17605–17629. [Google Scholar] [CrossRef]

- Mekonnin, A.S.; Wacławiak, K.; Humayun, M.; Zhang, S.; Ullah, H. Hydrogen storage technology, and its challenges: A review. Catalysts 2025, 15, 260. [Google Scholar] [CrossRef]

- Bhuiyan, M.M.H.; Siddique, Z. Hydrogen as an alternative fuel: A comprehensive review of challenges and opportunities in production, storage, and transportation. Int. J. Hydrogen Energy 2025, 102, 1026–1044. [Google Scholar] [CrossRef]

- Lipiäinen, S.; Lipiäinen, K.; Ahola, A.; Vakkilainen, E. Use of existing gas infrastructure in European hydrogen economy. Int. J. Hydrogen Energy 2023, 48, 31317–31329. [Google Scholar] [CrossRef]

- Aziz, M. Liquid hydrogen: A review on liquefaction, storage, transportation, and safety. Energies 2021, 14, 5917. [Google Scholar] [CrossRef]

- AlZohbi, G.; Almoaikel, A.; AlShuhail, L. An overview on the technologies used to store hydrogen. Energy Rep. 2023, 9, 28–34. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).