Using Big Data Analytics and Heatmap Matrix Visualization to Enhance Cryptocurrency Trading Decisions

Abstract

:1. Introduction

2. Literature Review

2.1. Bollinger Bands Trading Strategy

2.2. Market Efficiency

2.3. Herding Behavior and Momentum Strategies

2.4. Overreaction and Contrarian Strategies

3. Data and Methodology

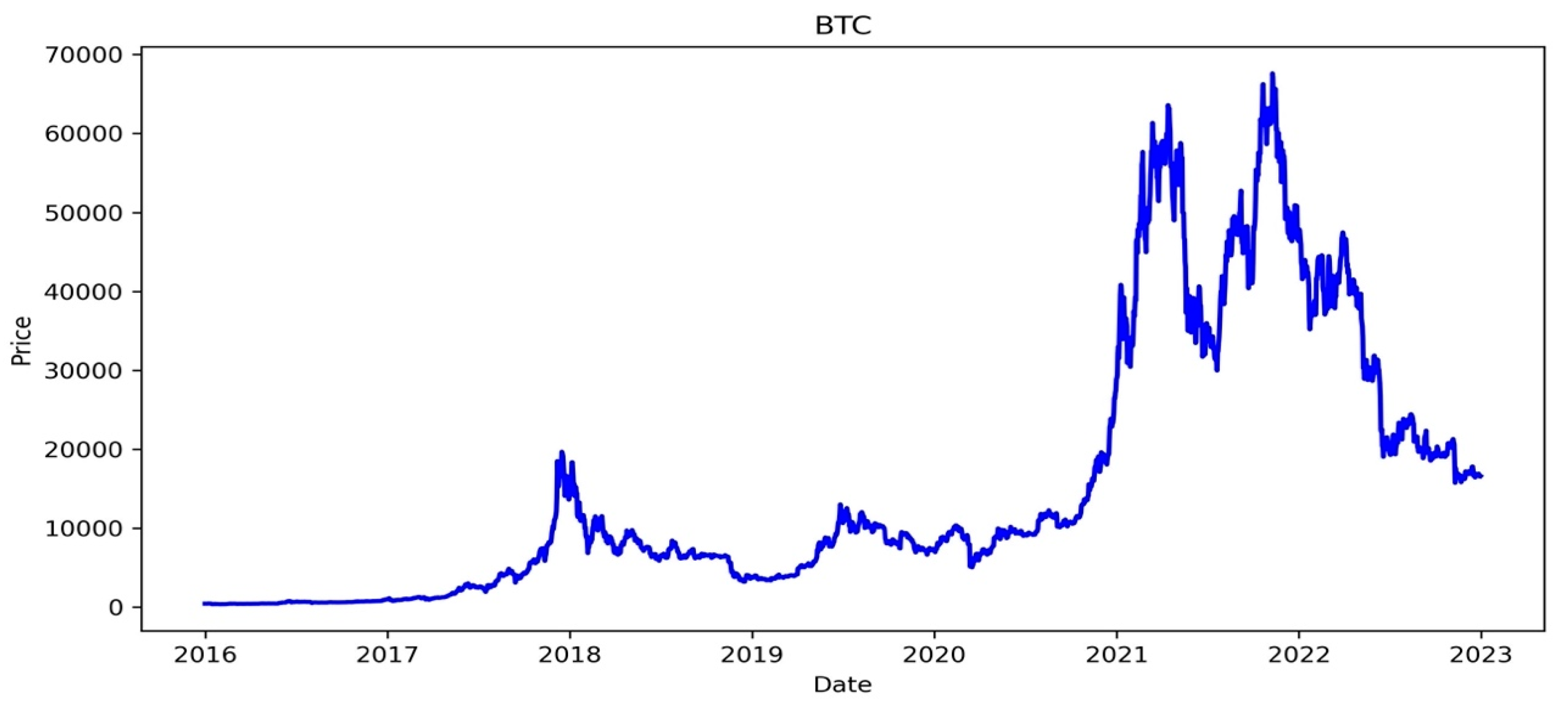

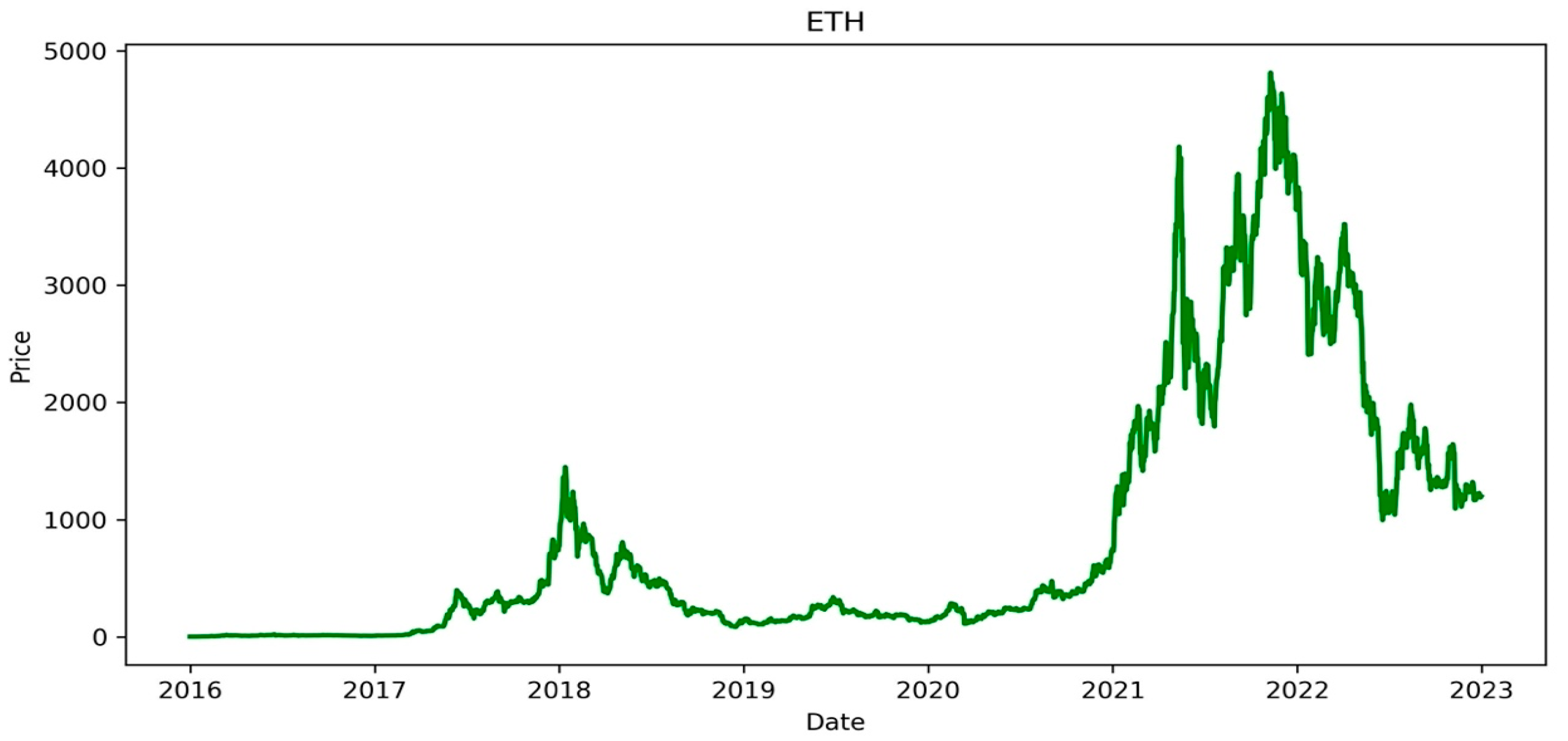

3.1. Data

3.2. Cumulative Holding Returns and Average Holding Return

4. Empirical Results and Analyses

4.1. Descriptive Statistics

4.2. Results for Exits following BBTS Viewed by the Conventional Design

4.3. Results for Exits following BBTS Viewed by a Heatmap Matrix

4.4. Results for Exits after Holding a Fixed Period Viewed by a Heatmap Matrix

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Fama, E.F. Efficient capital markets: A review of theory and empirical work. J. Financ. 1970, 25, 383–417. [Google Scholar] [CrossRef]

- Fama, E.F. Efficient capital markets: II. J. Financ. 1991, 46, 1575–1617. [Google Scholar] [CrossRef]

- Chen, W.; Xu, H.; Jia, L.; Gao, Y. Machine learning model for Bitcoin exchange rate prediction using economic and technology determinants. Int. J. Forecast. 2021, 37, 28–43. [Google Scholar] [CrossRef]

- Kahneman, D.; Tversky, A. Prospect theory: An analysis of decision under risk. Econometrica 1979, 47, 363–391. [Google Scholar] [CrossRef]

- Agosin, M.R.; Huaita, F. Overreaction in capital flows to emerging markets: Booms and sudden stops. J. Int. Money Financ. 2012, 31, 1140–1155. [Google Scholar] [CrossRef]

- De Bondt, W.F.; Thaler, R. Does the stock market overreact? J. Financ. 1985, 40, 793–805. [Google Scholar] [CrossRef]

- Christoffersen, J.; Stæhr, S. Individual risk tolerance and herding behaviors in financial forecasts. Eur. Financ. Manag. 2019, 25, 1348–1377. [Google Scholar] [CrossRef]

- Ni, Y.; Liao, Y.C.; Huang, P. MA trading rules, herding behaviors, and stock market overreaction. Int. Rev. Econ. Financ. 2015, 39, 253–265. [Google Scholar] [CrossRef]

- Chuang, W.I.; Lee, B.S. An empirical evaluation of the overconfidence hypothesis. J. Bank. Financ. 2006, 30, 2489–2515. [Google Scholar] [CrossRef]

- Daniel, K.; Hirshleifer, D.; Subrahmanyam, A. Investor psychology and security market under- and overreactions. J. Financ. 1998, 53, 1839–1885. [Google Scholar] [CrossRef]

- Saedi, R.; Rezaein, V. The effect of the manager’s excessive self-confidence on stock returns and unsystematic stock risk given the dual role of managing director: Evidence from Tehran Stock Exchange. Financ. Res. J. 2019, 21, 79–100. [Google Scholar]

- Antoniou, A.; Galariotis, E.C.; Spyrou, S.I. Contrarian profits and the overreaction hypothesis: The case of the Athens stock exchange. Eur. Financ. Manag. 2005, 11, 71–98. [Google Scholar] [CrossRef]

- George, T.J.; Hwang, C.Y. Long-term return reversals: Overreaction or taxes? J. Financ. 2007, 62, 2865–2896. [Google Scholar] [CrossRef]

- Vidal-García, J.; Vidal, M.; Boubaker, S.; Hassan, M. The efficiency of mutual funds. Ann. Oper. Res. 2018, 267, 555–584. [Google Scholar] [CrossRef]

- Chen, J.C.; Zhou, Y.; Wang, X. Profitability of simple stationary technical trading rules with high-frequency data of Chinese Index Futures. Phys. A Stat. Mech. Appl. 2018, 492, 1664–1678. [Google Scholar] [CrossRef]

- Leung, J.M.J.; Chong, T.T.L. An empirical comparison of moving average envelopes and Bollinger Bands. Appl. Econ. Lett. 2003, 10, 339–341. [Google Scholar] [CrossRef]

- Day, M.Y.; Ni, Y.; Huang, P. Trading as sharp movements in oil prices and technical trading signals emitted with big data concerns. Phys. A Stat. Mech. Appl. 2019, 525, 349–372. [Google Scholar] [CrossRef]

- Hu, Y.; Sun, X.; Nie, X.; Li, Y.; Liu, L. An enhanced LSTM for trend following of time series. IEEE Access 2019, 7, 34020–34030. [Google Scholar] [CrossRef]

- Zakamulin, V.; Giner, J. Trend following with momentum versus moving averages: A tale of differences. Quant. Financ. 2020, 20, 985–1007. [Google Scholar] [CrossRef]

- Deng, S.; Yu, H.; Wei, C.; Yang, T.; Tatsuro, S. The profitability of Ichimoku Kinkohyo based trading rules in stock markets and FX markets. Int. J. Financ. Econ. 2021, 26, 5321–5336. [Google Scholar] [CrossRef]

- Lucke, B. Are technical trading rules profitable? Evidence for head-and-shoulder rules. Appl. Econ. 2003, 35, 33–40. [Google Scholar] [CrossRef]

- Spelta, A.; Pecora, N.; Flori, A.; Giudici, P. The impact of the SARS-CoV-2 pandemic on financial markets: A seismologic approach. Ann. Oper. Res. 2023, 330, 639–664. [Google Scholar] [CrossRef] [PubMed]

- Chen, K.H.; Su, X.Q.; Lin, L.F.; Shih, Y.C. Profitability of moving-average technical analysis over the firm life cycle: Evidence from Taiwan. Pac.-Basin Financ. J. 2021, 69, 101633. [Google Scholar] [CrossRef]

- Chu, J.; Chan, S.; Zhang, Y. High frequency momentum trading with cryptocurrencies. Res. Int. Bus. Financ. 2020, 52, 101176. [Google Scholar] [CrossRef]

- Cooper, I.; Mitrache, A.; Priestley, R. A global macroeconomic risk model for value, momentum, and other asset classes. J. Financ. Quant. Anal. 2022, 57, 1–30. [Google Scholar] [CrossRef]

- Chen, C.H.; Lai, W.H.; Hung, S.T.; Hong, T.P. An advanced optimization approach for long-short pairs trading strategy based on correlation coefficients and bollinger bands. Appl. Sci. 2022, 12, 1052. [Google Scholar] [CrossRef]

- Day, M.Y.; Ni, Y.; Hsu, C.; Huang, P. Do Investment Strategies Matter for Trading Global Clean Energy and Global Energy ETFs? Energies 2022, 15, 3328. [Google Scholar] [CrossRef]

- Kim, K.; Ryu, D. Does sentiment determine investor trading behaviour? Appl. Econ. Lett. 2021, 28, 811–816. [Google Scholar] [CrossRef]

- Pagliaro, A. Forecasting Significant Stock Market Price Changes Using Machine Learning: Extra Trees Classifier Leads. Electronics 2023, 12, 4551. [Google Scholar] [CrossRef]

- Yu, S.; Yang, S.B.; Yoon, S.H. The Design of an Intelligent Lightweight Stock Trading System Using Deep Learning Models: Employing Technical Analysis Methods. Systems 2023, 11, 470. [Google Scholar] [CrossRef]

- Jin, X. Evaluating the predictive power of intraday technical trading in China’s crude oil market. J. Forecast. 2022, 41, 1416–1432. [Google Scholar] [CrossRef]

- Mishra, A.K.; Umrao, B.K.; Yadav, D.K. A survey on optimal utilization of preemptible VM instances in cloud computing. J. Supercomput. 2018, 74, 5980–6032. [Google Scholar] [CrossRef]

- Catania, L.; Grassi, S. Forecasting cryptocurrency volatility. Int. J. Forecast. 2022, 38, 878–894. [Google Scholar] [CrossRef]

- Kim, Y.; Byun, Y.C. Ultra-Short-Term Continuous Time Series Prediction of Blockchain-Based Cryptocurrency Using LSTM in the Big Data Era. Appl. Sci. 2022, 12, 11080. [Google Scholar] [CrossRef]

- Kou, G.; Olgu Akdeniz, Ö.; Dinçer, H.; Yüksel, S. Fintech investments in European banks: A hybrid IT2 fuzzy multidimensional decision-making approach. Financ. Innov. 2021, 7, 39. [Google Scholar] [CrossRef]

- Lee, N.Y. Hierarchical Multi-Blockchain System for Parallel Computation in Cryptocurrency Transfers and Smart Contracts. Appl. Sci. 2021, 11, 10173. [Google Scholar] [CrossRef]

- Elsayed, A.H.; Gozgor, G.; Lau, C.K.M. Causality and dynamic spillovers among cryptocurrencies and currency markets. Int. J. Financ. Econ. 2022, 27, 2026–2040. [Google Scholar] [CrossRef]

- Ilk, N.; Shang, G.Z.; Fan, S.K.; Zhao, J.L. Stability of Transaction Fees in Bitcoin: A Supply and Demand Perspective. MIS Q. 2021, 45, 563–592. [Google Scholar] [CrossRef]

- Khan, D.; Jung, L.T.; Hashmani, M.A. Systematic literature review of challenges in blockchain scalability. Appl. Sci. 2021, 11, 9372. [Google Scholar] [CrossRef]

- Mattke, J.; Maier, C.; Reis, L.; Weitzel, T. Bitcoin investment: A mixed methods study of investment motivations. Eur. J. Inf. Syst. 2021, 30, 261–285. [Google Scholar] [CrossRef]

- Chiu, C.L.; Ni, Y.; Hu, H.C.; Day, M.Y.; Chen, Y. Enhancing Crypto Success via Heatmap Visualization of Big Data Analytics for Numerous Variable Moving Average Strategies. Appl. Sci. 2023, 13, 12805. [Google Scholar] [CrossRef]

- Al Guindy, M. Cryptocurrency price volatility and investor attention. Int. Rev. Econ. Financ. 2021, 76, 556–570. [Google Scholar] [CrossRef]

- Woebbeking, F. Cryptocurrency volatility markets. Digit. Financ. 2021, 3, 273–298. [Google Scholar] [CrossRef]

- Bakry, W.; Rashid, A.; Al-Mohamad, S.; El-Kanj, N. Bitcoin and portfolio diversification: A portfolio optimization approach. J. Risk Financ. Manag. 2021, 14, 282. [Google Scholar] [CrossRef]

- Celeste, V.; Corbet, S.; Gurdgiev, C. Fractal dynamics and wavelet analysis: Deep volatility and return properties of Bitcoin, Ethereum and Ripple. Q. Rev. Econ. Financ. 2020, 76, 310–324. [Google Scholar] [CrossRef]

- Okorie, D.I.; Lin, B. Cryptocurrency spectrum and 2020 pandemic: Contagion analysis. Int. Rev. Econ. Financ. 2023, 84, 29–38. [Google Scholar] [CrossRef]

- Yarovaya, L.; Matkovskyy, R.; Jalan, A. The effects of a “black swan” event (COVID-19) on herding behavior in cryptocurrency markets. J. Int. Financ. Mark. Inst. Money 2021, 75, 101321. [Google Scholar] [CrossRef]

- Day, M.Y.; Cheng, Y.; Huang, P.; Ni, Y. The profitability of Bollinger Bands trading bitcoin futures. Appl. Econ. Lett. 2023, 30, 1437–1443. [Google Scholar] [CrossRef]

- Fang, J.; Jacobsen, B.; Qin, Y. Popularity versus profitability: Evidence from Bollinger bands. J. Portf. Manag. 2017, 43, 152–159. [Google Scholar] [CrossRef]

- Schwert, G.W. Anomalies and market efficiency. Handb. Econ. Financ. 2003, 1, 939–974. [Google Scholar]

- Wang, H.; Hu, D. Heterogeneous beliefs with herding behaviors and asset pricing in two goods world. N. Am. J. Econ. Financ. 2021, 57, 101434. [Google Scholar] [CrossRef]

- Griffin, J.M.; Harris, J.H.; Topaloglu, S. The dynamics of institutional and individual trading. J. Financ. 2003, 58, 2285–2320. [Google Scholar] [CrossRef]

- Bekiros, S.; Jlassi, M.; Lucey, B.; Naoui, K.; Uddin, G.S. Herding behavior, market sentiment and volatility: Will the bubble resume? N. Am. J. Econ. Financ. 2017, 42, 107–131. [Google Scholar] [CrossRef]

- Cheng, W.H.; Ni, Y.; Ho, T.H.; Chiang, C.J.; Huang, P.; Cheng, Y. Are the shareholding and trading behaviors of diverse investors affected by the relaxation of day trading? PLoS ONE 2021, 16, e0250121. [Google Scholar] [CrossRef]

- Nofsinger, J.R.; Sias, R.W. Herding and feedback trading by institutional and individual investors. J. Financ. 1999, 54, 2263–2295. [Google Scholar] [CrossRef]

- Ossareh, A.; Pourjafar, M.S.; Kopczewski, T. Cognitive Biases on the Iran Stock Exchange: Unsupervised Learning Approach to Examining Feature Bundles in Investors’ Portfolios. Appl. Sci. 2021, 11, 10916. [Google Scholar] [CrossRef]

- Stavroyiannis, S.; Babalos, V. Herding behavior in cryptocurrencies revisited: Novel evidence from a TVP model. J. Behav. Exp. Financ. 2019, 22, 57–63. [Google Scholar] [CrossRef]

- Narayan, P.K.; Phan, D.H.B. Momentum strategies for Islamic stocks. Pac.-Basin Financ. J. 2017, 42, 96–112. [Google Scholar] [CrossRef]

- King, T.; Koutmos, D. Herding and feedback trading in cryptocurrency markets. Ann. Oper. Res. 2021, 300, 79–96. [Google Scholar] [CrossRef] [PubMed]

- Bouri, E.; Gupta, R.; Roubaud, D. Herding behaviour in cryptocurrencies. Financ. Res. Lett. 2019, 29, 216–221. [Google Scholar] [CrossRef]

- Mandaci, P.E.; Cagli, E.C. Herding intensity and volatility in cryptocurrency markets during the COVID-19. Financ. Res. Lett. 2022, 46, 102382. [Google Scholar] [CrossRef]

- Mnif, E.; Jarboui, A. COVID-19, bitcoin market efficiency, herd behaviour. Rev. Behav. Financ. 2021, 13, 69–84. [Google Scholar] [CrossRef]

- Aslam, F.; Memon, B.A.; Hunjra, A.I.; Bouri, E. The dynamics of market efficiency of major cryptocurrencies. Glob. Financ. J. 2023, 58, 100899. [Google Scholar] [CrossRef]

- Cheah, E.T.; Fry, J. Speculative bubbles in Bitcoin markets? An empirical investigation into the fundamental value of Bitcoin. Econ. Lett. 2015, 130, 32–36. [Google Scholar] [CrossRef]

- Chopra, N.; Lakonishok, J.; Ritter, J.R. Measuring abnormal performance: Do stocks overreact? J. Financ. Econ. 1992, 31, 235–268. [Google Scholar] [CrossRef]

- Piccoli, P.; Chaudhury, M. Overreaction to extreme market events and investor sentiment. Appl. Econ. Lett. 2018, 25, 115–118. [Google Scholar] [CrossRef]

- Borgards, O.; Czudaj, R.L. The prevalence of price overreactions in the cryptocurrency market. J. Int. Financ. Mark. Inst. Money 2020, 65, 101194. [Google Scholar] [CrossRef]

- Chordia, T.; Roll, R.; Subrahmanyam, A. Liquidity and market efficiency. J. Financ. Econ. 2008, 87, 249–268. [Google Scholar]

- Ni, Y.; Cheng, Y.; Liao, Y.; Huang, P. Does board structure affect stock price overshooting informativeness measured by stochastic oscillator indicators? Int. J. Financ. Econ. 2022, 27, 2290–2302. [Google Scholar] [CrossRef]

- De Haan, L.; Kakes, J. Momentum or contrarian investment strategies: Evidence from Dutch institutional investors. J. Bank. Financ. 2011, 35, 2245–2251. [Google Scholar] [CrossRef]

- Wen, F.; Zou, Q.; Wang, X. The contrarian strategy of institutional investors in Chinese stock market. Financ. Res. Lett. 2021, 41, 101845. [Google Scholar] [CrossRef]

- Jackson, A.; Ladley, D. Market ecologies: The effect of information on the interaction and profitability of technical trading strategies. Int. Rev. Financ. Anal. 2016, 47, 270–280. [Google Scholar] [CrossRef]

- Chen, Q.; Hua, X.; Jiang, Y. Contrarian strategy and herding behaviour in the Chinese stock market. Eur. J. Financ. 2018, 24, 1552–1568. [Google Scholar] [CrossRef]

- Nnadi, M.; Tanna, S. Accounting analyses of momentum and contrarian strategies in emerging markets. Asia-Pac. J. Account. Econ. 2019, 26, 457–477. [Google Scholar] [CrossRef]

- Forbes, W.; Kiselev, E.; Skerratt, L. The stability and downside risk to contrarian profits: Evidence from the S&P 500. Int. J. Financ. Econ. 2021, 28, 733–750. [Google Scholar]

- Lento, C.; Gradojevic, N.; Wright, C.S. Investment information content in Bollinger Bands? Appl. Financ. Econ. Lett. 2007, 3, 263–267. [Google Scholar] [CrossRef]

- Chen, Y.F.; Yang, S.Y.; Lin, F.L. Foreign institutional industrial herding in Taiwan stock market. Manag. Financ. 2012, 38, 325–340. [Google Scholar]

- Ni, Y.; Day, M.Y.; Huang, P.; Yu, S.R. The profitability of Bollinger Bands: Evidence from the constituent stocks of Taiwan 50. Phys. A Stat. Mech. Appl. 2020, 551, 124144. [Google Scholar] [CrossRef]

- Gradojevic, N.; Kukolj, D.; Adcock, R.; Djakovic, V. Forecasting Bitcoin with technical analysis: A not-so-random forest? Int. J. Forecast. 2023, 39, 1–17. [Google Scholar] [CrossRef]

- Day, M.Y.; Ni, Y.; Hsu, C.; Huang, P. Visualizing profitability: A heatmap approach to evaluate Bitcoin futures trading using VMA trading rules. Heliyon 2023, 9, e21376. [Google Scholar] [CrossRef]

- Caporale, G.M.; Plastun, A. Price overreactions in the cryptocurrency market. J. Econ. Stud. 2019, 46, 1137–1155. [Google Scholar] [CrossRef]

- Schaub, M. Outlier Events in Major Cryptocurrency Markets: Is There Evidence of Overreaction? J. Wealth Manag. 2022, 24, 142–148. [Google Scholar] [CrossRef]

- Sadaqat, M.; Butt, H.A. Stop-loss rules and momentum payoffs in cryptocurrencies. J. Behav. Exp. Financ. 2023, 39, 100833. [Google Scholar] [CrossRef]

- Shen, D.; Urquhart, A.; Wang, P. Bitcoin intraday time series momentum. Financ. Rev. 2022, 57, 319–344. [Google Scholar] [CrossRef]

- Oyewola, D.O.; Dada, E.G.; Ndunagu, J.N. A novel hybrid walk-forward ensemble optimization for time series cryptocurrency prediction. Heliyon 2022, 8, e11862. [Google Scholar] [CrossRef] [PubMed]

- Azamjon, M.; Sattarov, O.; Cho, J. Forecasting Bitcoin Volatility through On-Chain and Whale-Alert Tweet Analysis using the Q-Learning Algorithm. IEEE Access 2023, 11, 108092–108103. [Google Scholar] [CrossRef]

- Ahmed, S.; Grobys, K.; Sapkota, N. Profitability of technical trading rules among cryptocurrencies with privacy function. Financ. Res. Lett. 2020, 35, 101495. [Google Scholar] [CrossRef]

- Ni, Y.S.; Lee, J.T.; Liao, Y.C. Do variable length moving average trading rules matter during a financial crisis period? Appl. Econ. Lett. 2013, 20, 135–141. [Google Scholar] [CrossRef]

- Chen, Y.; Huang, P.; Day, M.Y.; Ni, Y.; Liang, M.C. Using Heatmap Visualization to assess the performance of the DJ30 and NASDAQ100 Indices under diverse VMA trading rules. PLoS ONE 2023, 18, e0284918. [Google Scholar] [CrossRef]

| Cryptocurrencies | Sample | Mean | SD | CV | Median | Minimum | Maximum |

|---|---|---|---|---|---|---|---|

| Bitcoin spot price | 2557 | 15,183.93 | 16,630.05 | 109.52% | 8631.25 | 364.35 | 67,617.02 |

| ETH spot price | 2557 | 853.04 | 1122.11 | 131.54% | 292.21 | 0.94 | 4815.00 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| BBTS | CHR (%) | No. of Trades | AHR (%) | Average Duration Day | Maximum Duration Day |

| Panel A Bitcoin spot | |||||

| (20, 2) | 959.17% | 48 | 19.98% | 52 | 231 |

| (20, 1) | 129.50% | 14 | 9.25% | 32 | 108 |

| (60, 2) | 1322.86% | 24 | 55.12% | 96 | 426 |

| (60, 1) | 771.10% | 30 | 25.70% | 52 | 205 |

| (10, 2) | 824.26% | 61 | 13.51% | 42 | 170 |

| (10, 1) | 489.91% | 207 | 2.37% | 13 | 80 |

| Panel B ETH spot | |||||

| (20, 2) | 3031.25% | 60 | 50.52% | 41 | 217 |

| (20, 1) | 0.49% | 14 | 0.03% | 20 | 54 |

| (60, 2) | 3.61% | 6 | 0.60% | 26 | 88 |

| (60, 1) | 1463.59% | 19 | 77.03% | 56 | 263 |

| (10, 2) | 1523.52% | 60 | 25.39% | 39 | 174 |

| (10, 1) | 1154.74% | 197 | 5.86% | 13 | 76 |

| 60 | 12.67% | 11.25% | 18.06% | 25.70% | 21.69% | 25.59% | 49.80% | 55.12% | 125.94% | 156.78% |

| 55 | 12.83% | −0.27% | 11.30% | 16.84% | 17.92% | 25.11% | 38.31% | 52.36% | 74.62% | 92.49% |

| 50 | 13.05% | 10.74% | 0.07% | −14.07% | 15.00% | 29.98% | 33.25% | 50.30% | 80.48% | 101.03% |

| 45 | 13.18% | 1.72% | −9.51% | −0.19% | 2.65% | 19.00% | 33.69% | 38.50% | 58.82% | 63.12% |

| 40 | 9.73% | 13.32% | 16.45% | 12.77% | −6.96% | 2.46% | 23.47% | 32.86% | 11.41% | 53.56% |

| 35 | 8.26% | 13.86% | 13.82% | 26.33% | 12.49% | 13.69% | 16.21% | 1.21% | 29.87% | 47.17% |

| 30 | 7.60% | 8.74% | 9.17% | 15.11% | 11.21% | 14.23% | 16.92% | 20.09% | 25.04% | 36.02% |

| 25 | 6.45% | 0.78% | 6.17% | 7.73% | 14.28% | 18.39% | 16.92% | 17.13% | 26.23% | 33.80% |

| 20 | 4.76% | 4.40% | 4.50% | 9.25% | 11.52% | 13.43% | 11.57% | 19.98% | 23.82% | 31.06% |

| 15 | 3.98% | 2.86% | 3.97% | 4.90% | 9.18% | 10.58% | 12.39% | 14.73% | 21.19% | 35.89% |

| 10 | 2.04% | 2.62% | 3.19% | 2.37% | 3.01% | 3.23% | 7.86% | 13.51% | 24.85% | 91.12% |

| 5 | 1.08% | 1.71% | 2.27% | 3.52% | 1.14% | 2.75% | 29.34% | 0.00% | 0.00% | 0.00% |

| n1/n2 | 0.25 | 0.5 | 0.75 | 1 | 1.25 | 1.5 | 1.75 | 2 | 2.25 | 2.5 |

| 60 | 48.52% | 57.67% | 44.53% | 77.03% | 3.80% | 7.20% | 197.31% | 0.60% | 400.02% | 656.28% |

| 55 | 39.23% | 196.84% | 57.97% | 65.10% | 50.92% | 83.93% | 264.16% | 248.52% | 460.36% | 615.39% |

| 50 | 33.49% | 41.41% | 51.51% | 42.97% | 62.28% | 140.13% | 70.95% | 272.99% | 490.51% | 614.45% |

| 45 | 78.73% | 52.97% | 48.44% | 59.64% | 164.94% | 45.16% | 81.89% | 97.08% | 681.80% | 482.87% |

| 40 | −6.26% | 49.89% | 89.70% | 89.07% | 46.07% | 40.59% | 88.32% | 97.66% | 228.88% | 313.26% |

| 35 | −13.20% | −12.48% | −4.38% | 42.84% | 48.60% | 35.60% | 4.19% | 132.51% | 132.89% | 165.49% |

| 30 | 29.88% | 37.35% | 167.14% | 38.50% | 0.18% | 110.56% | 50.20% | 89.98% | 115.26% | 127.43% |

| 25 | 18.12% | −7.13% | 1.99% | 35.66% | 36.54% | 48.69% | 42.99% | 265.66% | 8.39% | 121.88% |

| 20 | 9.91% | 29.40% | −0.14% | 0.03% | 2.09% | 2.42% | 37.37% | 50.52% | 3.64% | 161.84% |

| 15 | 1.37% | 8.01% | 8.31% | 12.06% | 26.24% | 19.50% | 1.66% | 59.26% | 80.64% | 605.42% |

| 10 | 4.37% | 5.05% | 5.47% | 5.86% | 8.20% | 23.02% | 14.33% | 25.39% | 74.65% | 367.47% |

| 5 | 44.99% | 46.11% | 46.11% | 3.83% | 3.68% | 7.90% | 82.83% | 0.00% | 0.00% | 0.00% |

| n1/n2 | 0.25 | 0.5 | 0.75 | 1 | 1.25 | 1.5 | 1.75 | 2 | 2.25 | 2.5 |

| 60 | 21.87% | 0.21% | 18.51% | 38.11% | 9.90% | 6.02% | 7.36% | 7.36% | 7.36% | 7.36% |

| 55 | 22.37% | 0.21% | 0.21% | 26.30% | 18.51% | 3.88% | 7.36% | 7.36% | 7.36% | 7.36% |

| 50 | 22.03% | 29.58% | 0.21% | 28.09% | 0.21% | 7.38% | 18.51% | 7.36% | 7.36% | 7.36% |

| 45 | 23.87% | 25.31% | 25.60% | 0.21% | 0.21% | 7.38% | 18.51% | 7.36% | 7.36% | 7.36% |

| 40 | 23.30% | 22.74% | 26.15% | 0.21% | 1.81% | 0.21% | 0.21% | 18.51% | 18.51% | 18.51% |

| 35 | 7.71% | 28.56% | 25.13% | 11.91% | 14.78% | 0.21% | 0.21% | 0.21% | 0.21% | 0.21% |

| 30 | 7.18% | 7.78% | 22.79% | 24.68% | 20.86% | 13.43% | 13.43% | 0.21% | 0.21% | 0.21% |

| 25 | 4.82% | 6.86% | 5.47% | 20.50% | 24.05% | 33.60% | 13.43% | 13.43% | 0.21% | 0.21% |

| 20 | 4.60% | 3.34% | 5.42% | 5.84% | 21.02% | 28.69% | 29.51% | 24.74% | 0.21% | 0.21% |

| 15 | 3.33% | 3.77% | 3.02% | 4.60% | 6.26% | 10.63% | 10.23% | 24.83% | 14.92% | 20.86% |

| 10 | 3.03% | 2.96% | 3.08% | 3.17% | 4.57% | 4.97% | 6.05% | 7.71% | 14.28% | 12.25% |

| 5 | 1.77% | 1.99% | 2.00% | 2.10% | 2.75% | 4.80% | 15.26% | 0.00% | 0.00% | 0.00% |

| n1/n2 | 0.25 | 0.5 | 0.75 | 1 | 1.25 | 1.5 | 1.75 | 2 | 2.25 | 2.5 |

| 60 | 0.47% | 1.32% | 8.67% | 10.18% | 10.67% | 17.58% | 4.92% | 6.46% | 2.60% | 8.15% |

| 55 | −0.03% | 10.52% | 4.69% | 7.85% | 9.66% | 15.78% | 4.35% | 0.34% | 2.60% | 8.15% |

| 50 | −0.04% | 3.41% | 0.83% | 8.82% | 11.54% | 8.51% | 3.92% | 0.65% | 2.27% | 8.15% |

| 45 | 11.58% | 3.85% | 4.51% | 7.04% | 10.35% | 7.68% | 14.22% | 6.46% | 7.90% | 15.05% |

| 40 | 2.93% | 3.11% | 6.05% | 7.14% | 14.30% | 7.73% | 9.79% | 19.49% | 20.79% | 31.73% |

| 35 | 2.54% | 0.91% | 7.20% | 2.33% | 6.04% | 9.21% | 11.67% | 16.70% | 20.61% | 26.84% |

| 30 | 2.67% | 4.21% | 5.64% | 3.84% | 4.55% | 9.91% | 11.55% | 16.00% | 20.61% | 29.41% |

| 25 | 4.05% | 4.56% | 2.41% | 3.31% | 6.29% | 10.24% | 8.32% | 12.19% | 15.82% | 23.22% |

| 20 | 2.14% | 2.02% | 3.22% | 4.51% | 5.08% | 5.33% | 6.68% | 10.68% | 12.58% | 24.29% |

| 15 | 6.33% | 7.02% | 3.44% | 5.39% | 5.27% | 4.22% | 8.13% | 12.28% | 3.71% | 2.61% |

| 10 | 5.48% | 5.62% | 5.77% | 6.45% | 2.20% | 2.56% | 3.20% | 7.88% | 4.86% | −9.79% |

| 5 | 3.85% | 3.87% | 3.68% | 3.93% | 5.34% | 8.15% | −27.09% | 0.00% | 0.00% | 0.00% |

| n1/n2 | 0.25 | 0.5 | 0.75 | 1 | 1.25 | 1.5 | 1.75 | 2 | 2.25 | 2.5 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ni, Y.; Chiang, P.; Day, M.-Y.; Chen, Y. Using Big Data Analytics and Heatmap Matrix Visualization to Enhance Cryptocurrency Trading Decisions. Appl. Sci. 2024, 14, 154. https://doi.org/10.3390/app14010154

Ni Y, Chiang P, Day M-Y, Chen Y. Using Big Data Analytics and Heatmap Matrix Visualization to Enhance Cryptocurrency Trading Decisions. Applied Sciences. 2024; 14(1):154. https://doi.org/10.3390/app14010154

Chicago/Turabian StyleNi, Yensen, Pinhui Chiang, Min-Yuh Day, and Yuhsin Chen. 2024. "Using Big Data Analytics and Heatmap Matrix Visualization to Enhance Cryptocurrency Trading Decisions" Applied Sciences 14, no. 1: 154. https://doi.org/10.3390/app14010154

APA StyleNi, Y., Chiang, P., Day, M.-Y., & Chen, Y. (2024). Using Big Data Analytics and Heatmap Matrix Visualization to Enhance Cryptocurrency Trading Decisions. Applied Sciences, 14(1), 154. https://doi.org/10.3390/app14010154