A Garlic-Price-Prediction Approach Based on Combined LSTM and GARCH-Family Model

Abstract

1. Introduction

2. Related Work

2.1. Agricultural Price-Prediction Methods

2.2. Combined Models Based on Artificial Intelligence and Econometric Models in General Price Prediction

3. Materials and Methods

3.1. Data Sources

3.2. Symbol Meanings

3.3. Methods

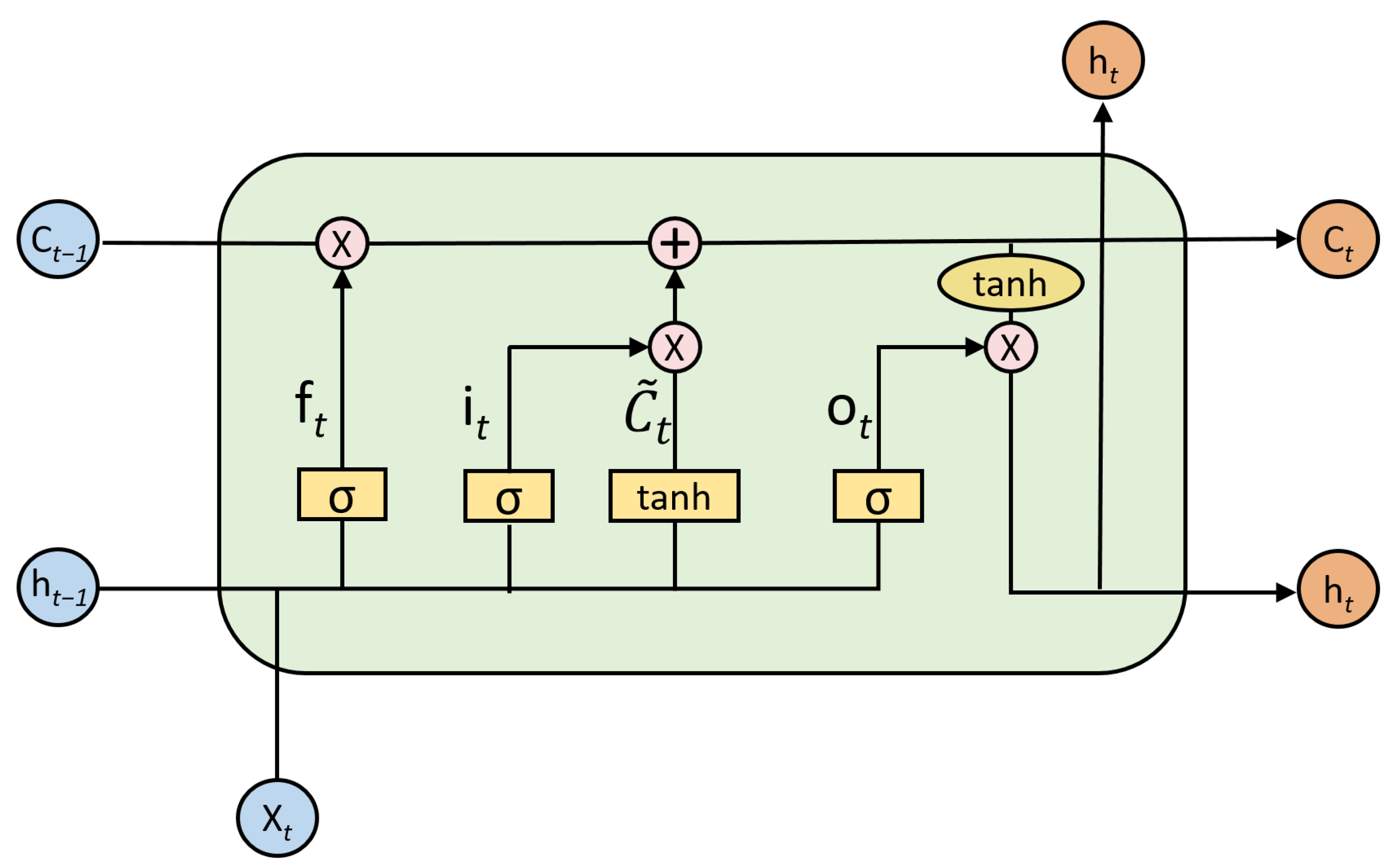

3.3.1. LSTM Model

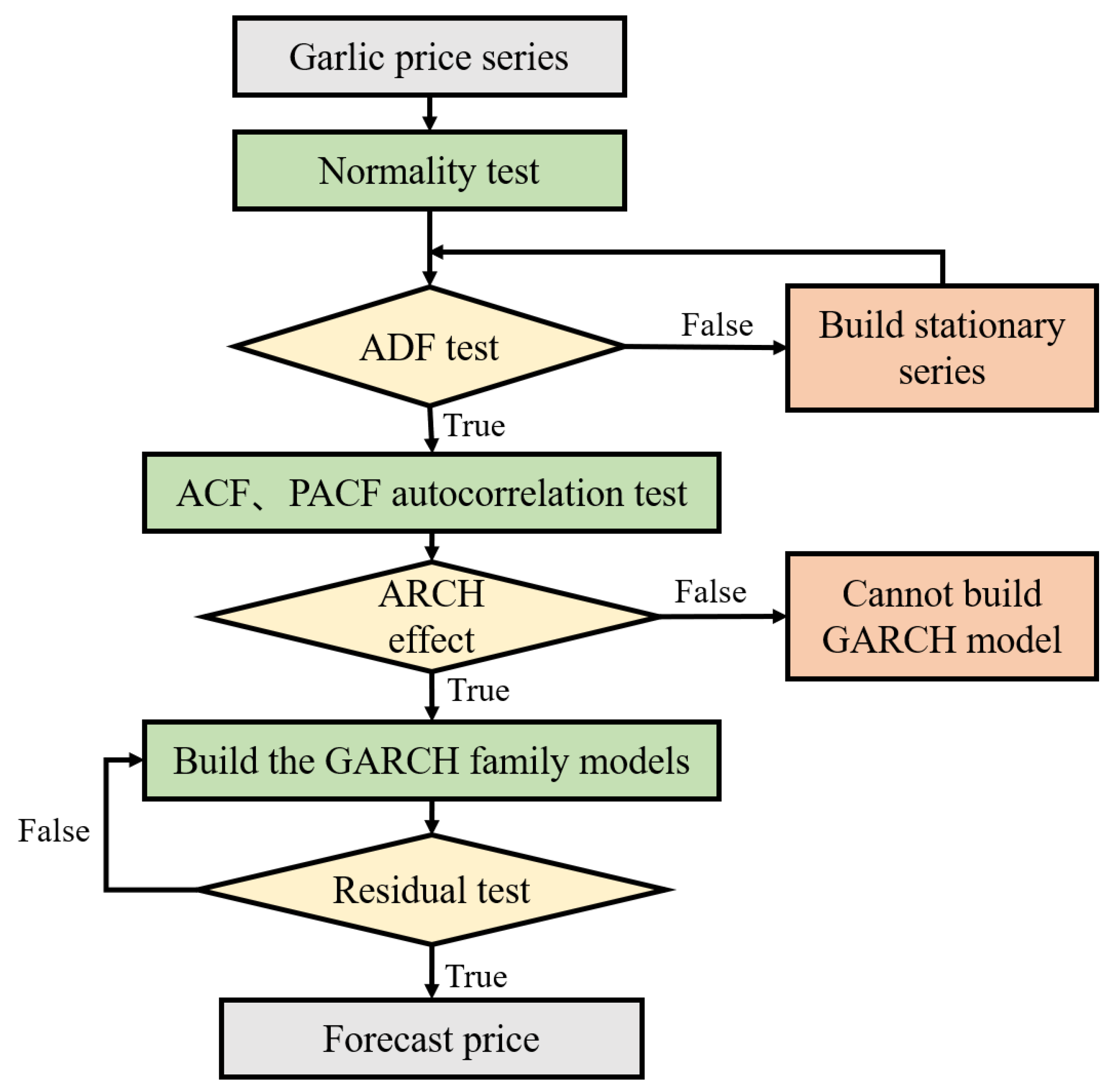

3.3.2. GARCH Family Models

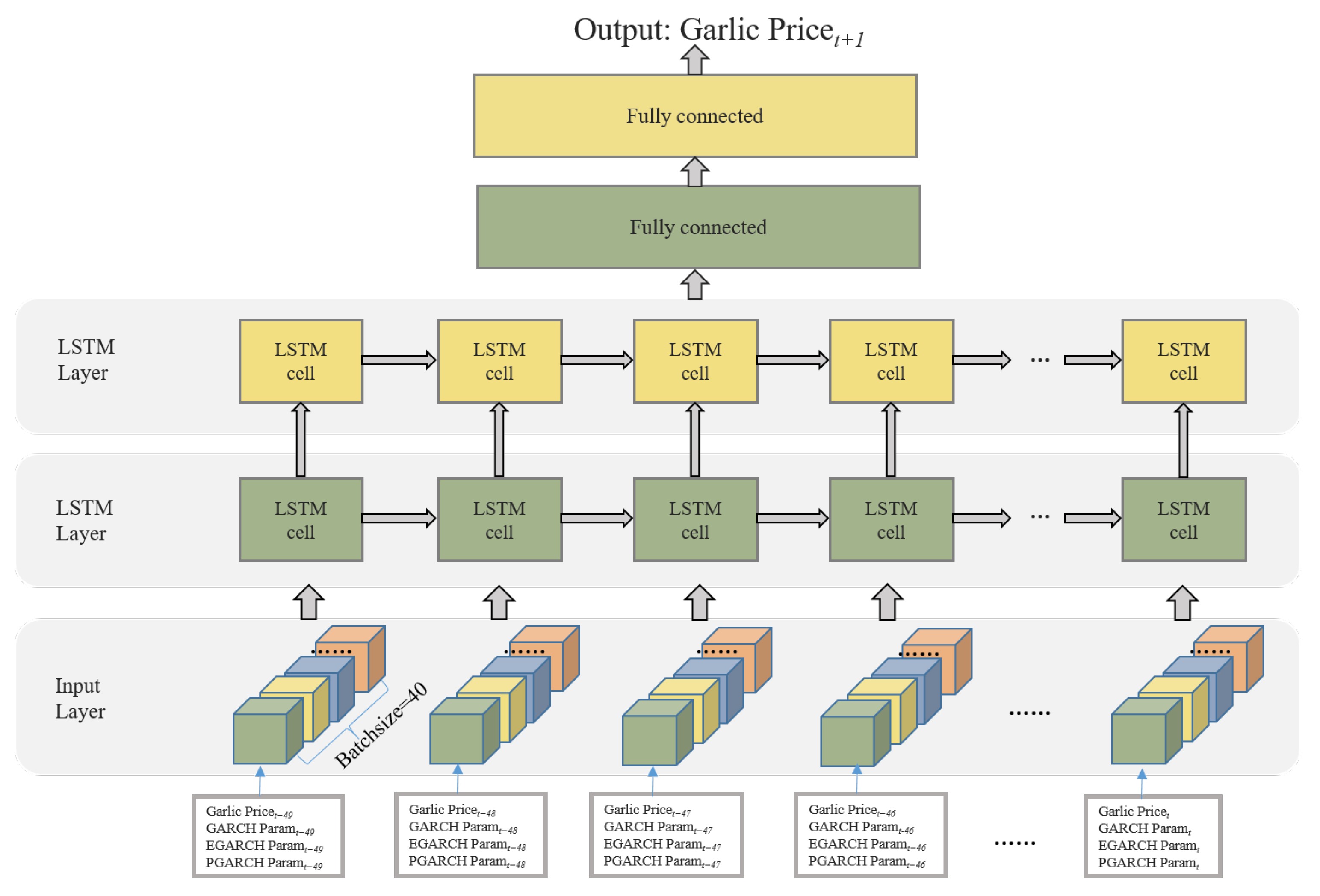

3.3.3. LSTM and GARCH Family Combined Models

4. Experimental Procedure and Analysis of Results

4.1. Experimental Setup

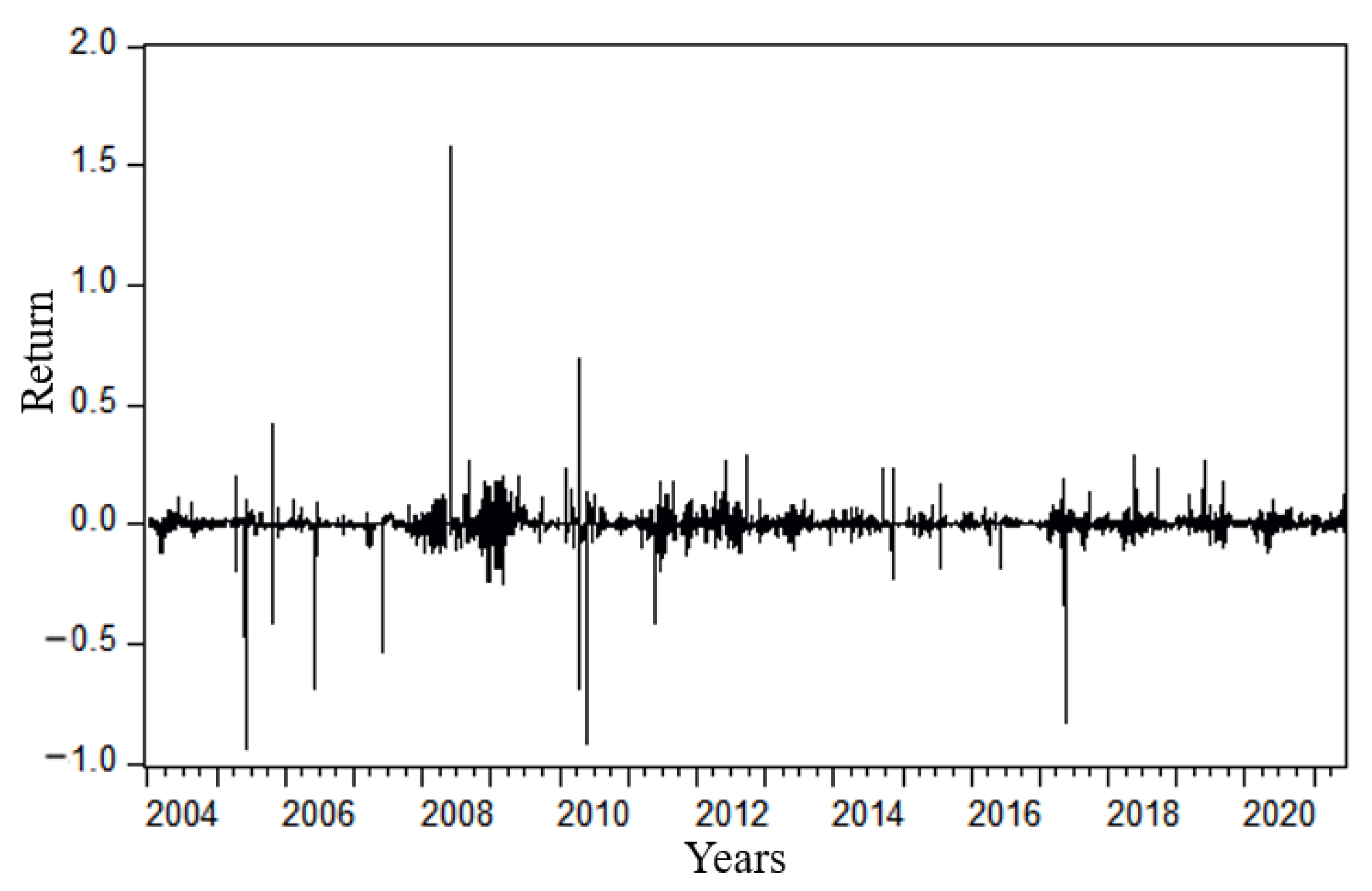

4.1.1. Dataset

4.1.2. Evaluation Metrics

4.1.3. The Structures and Hyperparameters of LSTM–GARCH-Family Combined Models

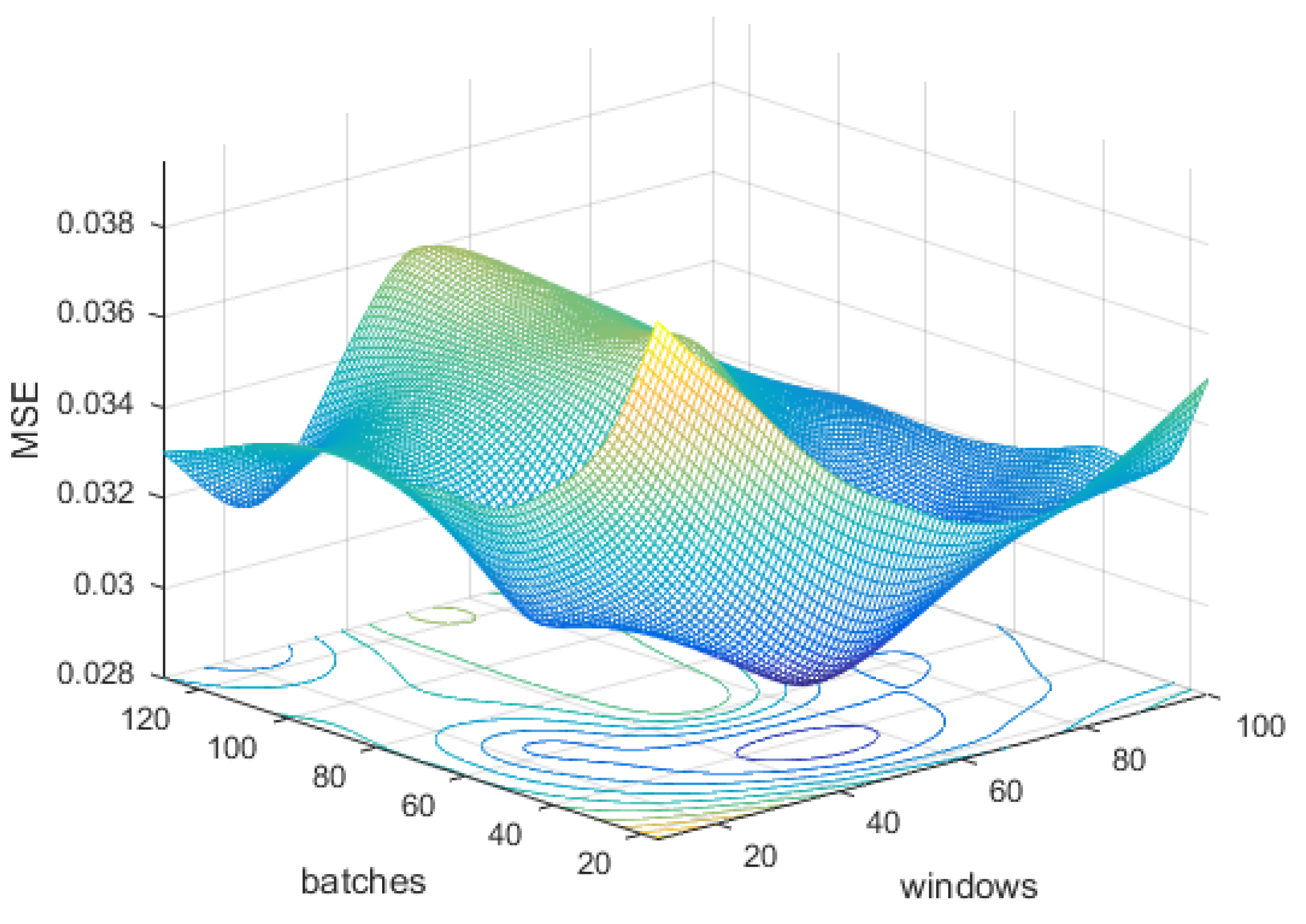

- Hyperparameter settings in LSTMFor deep-learning models, prediction performance is highly dependent on the choice of hyperparameters. Since the hyperparameter space is large and cannot be fully traversed, we used empirical tuning to get the hyperparameters with good performances for the selected dataset. The essential hyperparameters, such as learning rate, batch size, sliding window size, and the number of LSTM neurons, significantly influenced the model’s performance when building the model. For the hyperparameters selected for LSTM, we used MSE as the loss function. In addition, Adam was used as an optimizer, which combines the advantages of AdaGrad and RMSProp, including fast convergence and small memory requirements [48].For the learning rate setting, due to the learning rate being set to 0.001, the model converged faster and the accuracy was higher. We set the learning rate to 0.001. The computational time of the model was about 219.4s.For the values of batches and windows hyperparameters, we set the initial batches to and windows to . Next, we performed combined optimization of batches and windows. Figure 5 shows the results of the corresponding hyperparameter configurations; the final values of batches and windows were set to 40 and 50. In addition, we use Figure 6a to show the performance of LSTM with varying window values when the initial batch value is 40. We use Figure 6b to show the performance of LSTM with varying batch values when the initial window’s value is 50.To select the number of neurons, we first chose from and then fine-tuned them in the appropriate interval to achieve the ideal state. Finally, 20 neurons were selected for the first LSTM layer and ten neurons for the second LSTM layer.

- Parameter settings in GARCHFor econometric models, we chose to use the GARCH, EGARCH, and PGARCH from the GARCH-family models. The error distributions were the Student’s t distribution and the GED distribution. In GARCH, , , and . The results of the GARCH model with different parameters are shown in Table 5. According to the AIC, SC, and HQ criteria (the smaller the value, the better the model fit), the optimal GARCH model was selected among multiple GARCH models. The rules for EGARCH and PGARCH model selection were the same. We finally chose the GARCH, EGARCH, and PGARCH models by the GED distribution.

4.1.4. Benchmark Models

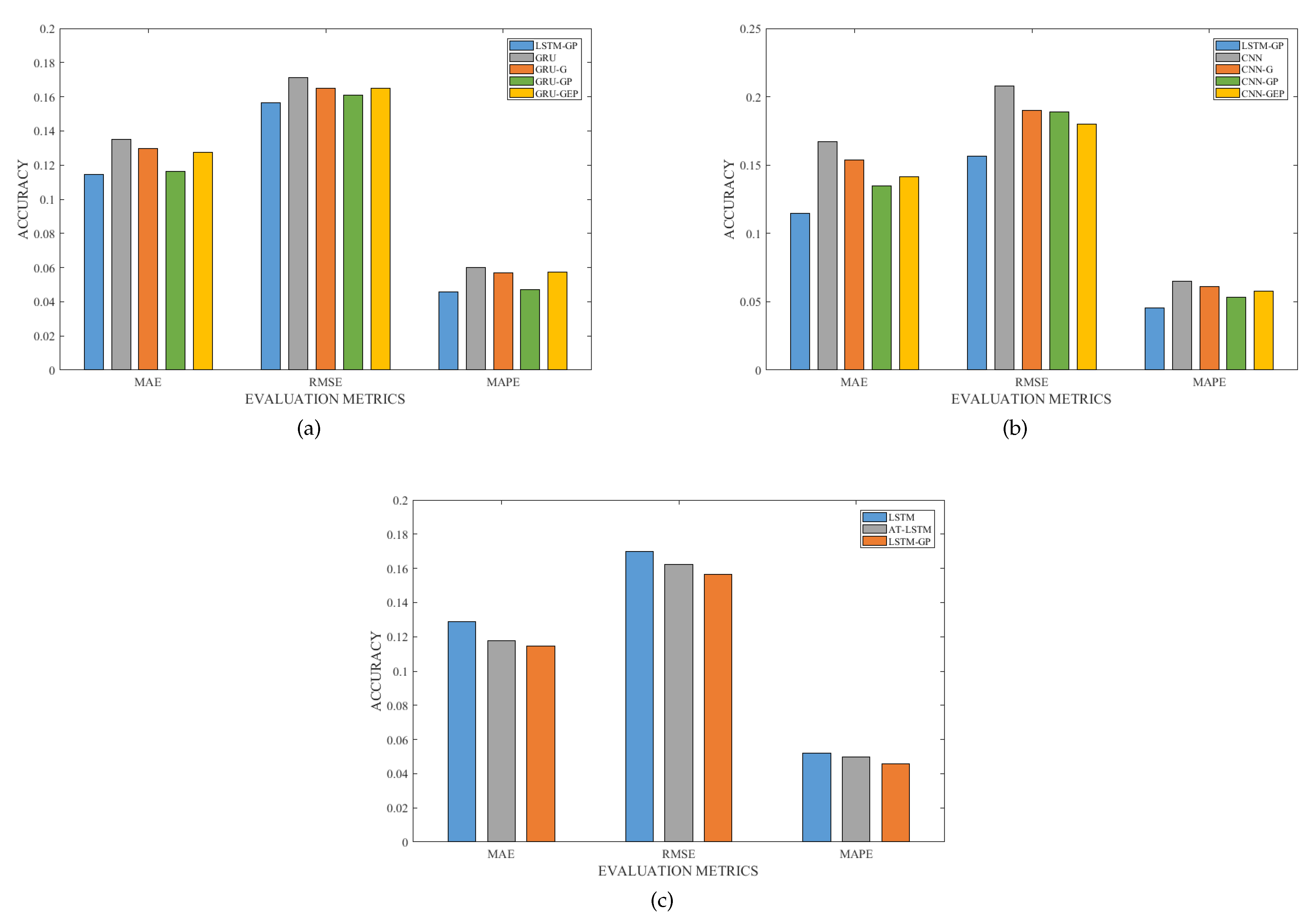

- GRU has a similar structure to the LSTM and can be regarded as a simple variant of LSTM. Both LSTM and GRU preserve important features through various gate structures and thus ensure they will not be lost even after a long period. GRU improves the complex cell structure of LSTM by merging the input and forgetting gates and merging the cell states and hidden states of LSTM. In the GRU model, the reset gate is used to determine how much past information to forget, and the update gate is used to decide how much input and previous output to pass to the next cell, so the GRU cell can decide how much information to copy from the past to reduce the risk of gradient disappearance. It has often been applied to price prediction in recent years [50]. The performances of LSTM and GRU are slightly different on different data sets. To further verify the superiority of our proposed model, we combined the GRU with the GARCH-family models to obtain the GRU–GARCH-family combined models. The GRU and GRU–GARCH-family models were selected as the benchmark models. We built a stacked GRU model similar to the LSTM model, i.e., with two GRU layers and two fully connected layers. With the hyperparameters adjusted to the optimal case, the optimal LSTM–GARCH-family combined models we obtained in the above experiments were compared with the GRU and GRU–GARCH-family combined models (GRU-G, GRU-GP, and GRU-GEP).

- A convolutional neural network (CNN) is suitable for spatial feature extraction and is widely used in the field of image recognition. It mainly includes an input layer, a convolutional layer, a pooling layer, a fully connected layer, and an output layer. We tried to use the CNN model for garlic price prediction work. In this work, the CNN model took garlic price and GARCH-family-related parameters as input data and extracted the correlation between each index and garlic price through convolution operation; then compressed the amount of data and parameters through pooling to avoid overfitting and reduce the complexity of the model; then transformed the data form through flattening layer; and finally fine-tunesd and output the prediction results using a fully connected layer. We combined the CNN with the GARCH-family models to get CNN–GARCH-family combined models to test the ability of the CNN to extract garlic-price series features. We compared the optimal LSTM–GARCH-family models with the combined CNN–GARCH-family models (CNN-G, CNN-GP, and CNN-GEP). We set the CNN to have two convolutional layers, a max pooling layer, a dropout layer, and a fully connected layer ui a grid search method. For the first two convolutional layers, the filter size was 1 and the numbers of filters were selected as 32 and 16, respectively. The filter size for the max pooling layer was 2. In addition, dropout regularization was set to 0.1 to prevent overfitting.

- Attention improves the model’s ability to select temporal correlations. The attention mechanism is a resource allocation mechanism that mimics human attention, and it can change the level of attention to input information by assigning reasonable weights to different features. Attention–LSTM models are often used in the field of price prediction. Many extant pieces of literature point out that LSTM incorporating the attention mechanism has an advantage over LSTM models in time-series data prediction. Therefore, we selected an attention–LSTM as a benchmark model. For a fair comparison, the attention–LSTM model had two LSTM layers, and the hyperparameters of the LSTM layers were the same as those of the solo LSTM. In addition, we added the attention layer after the two LSTM layers.

4.2. Analysis of Results

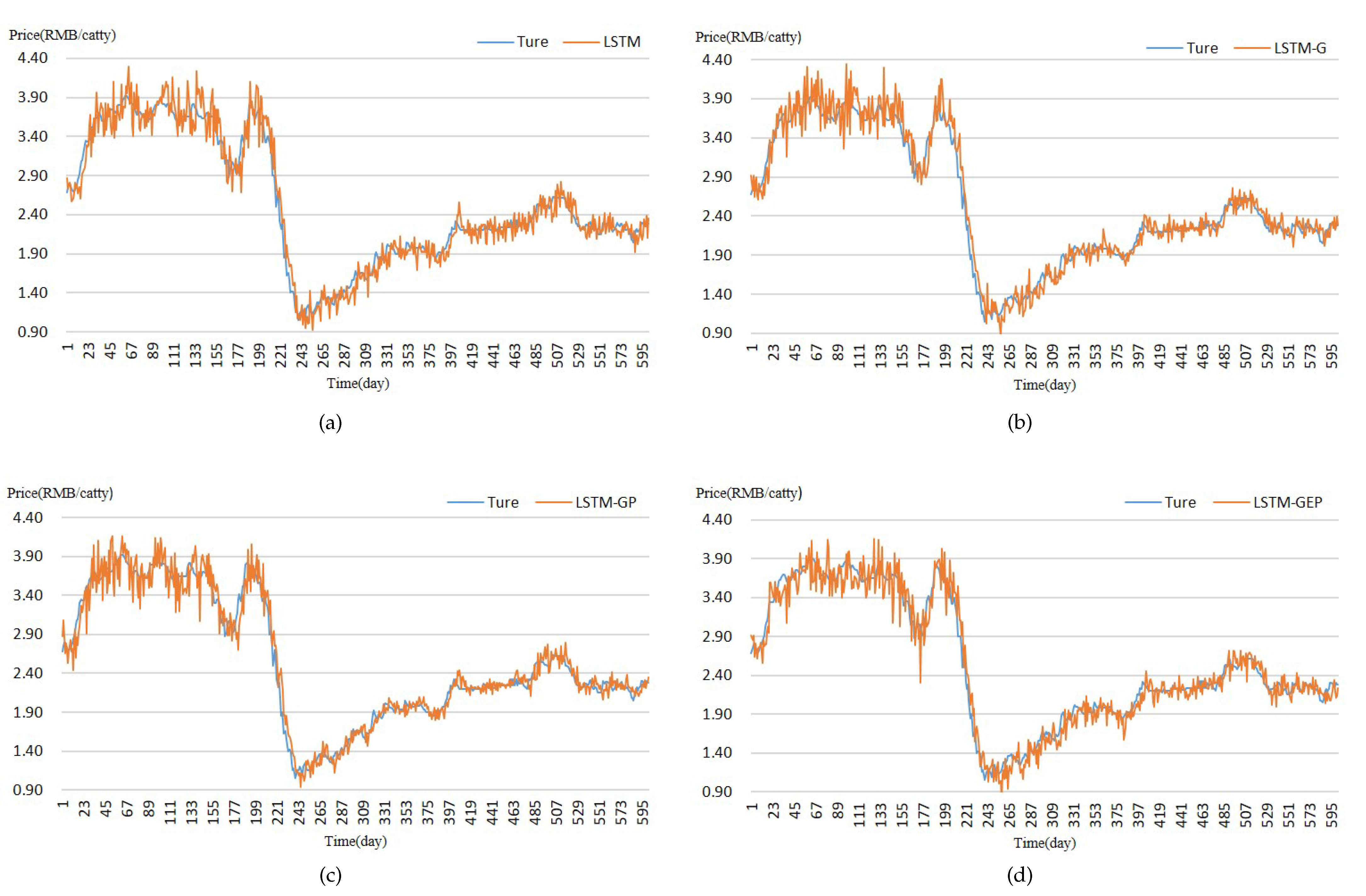

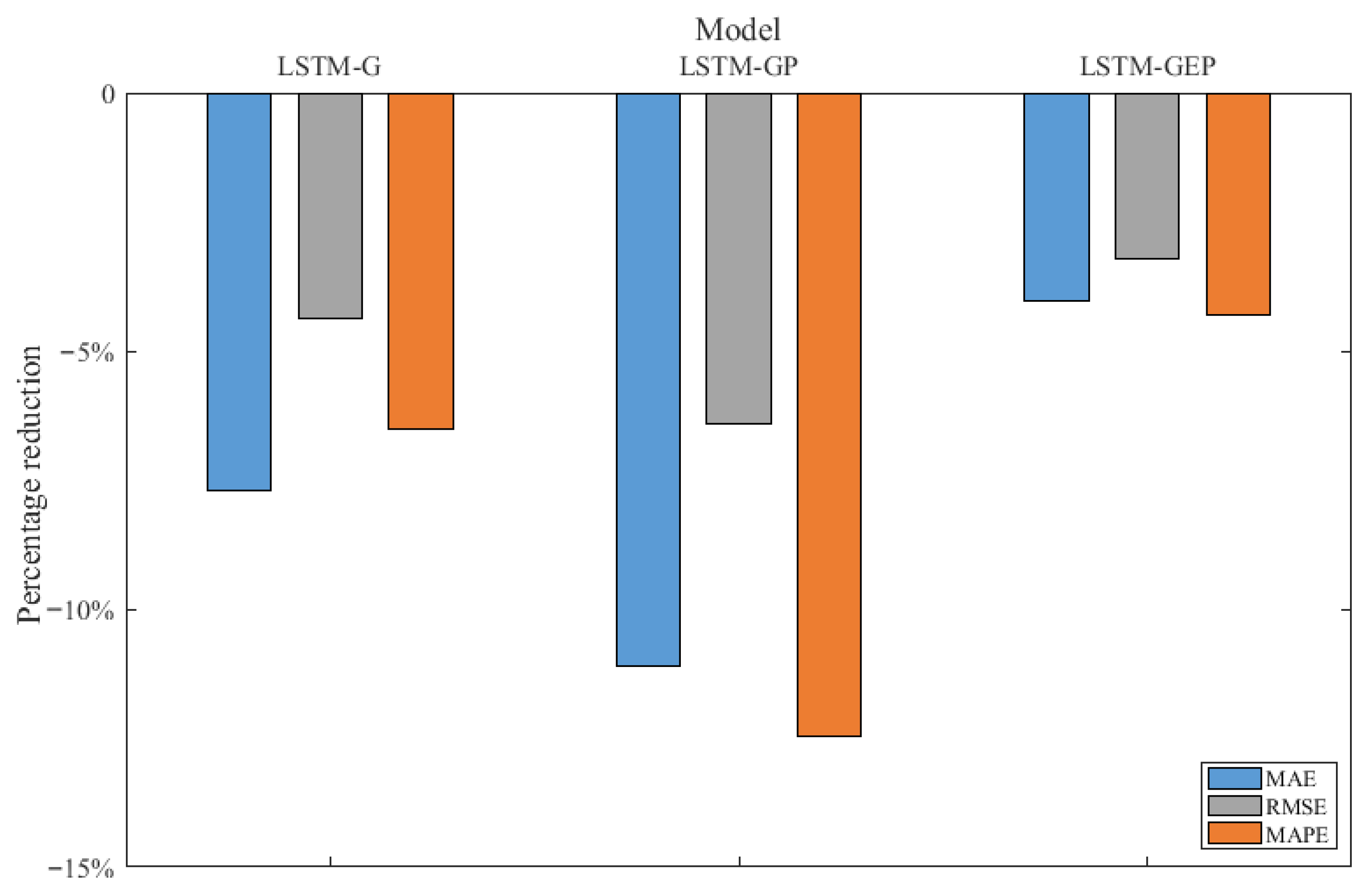

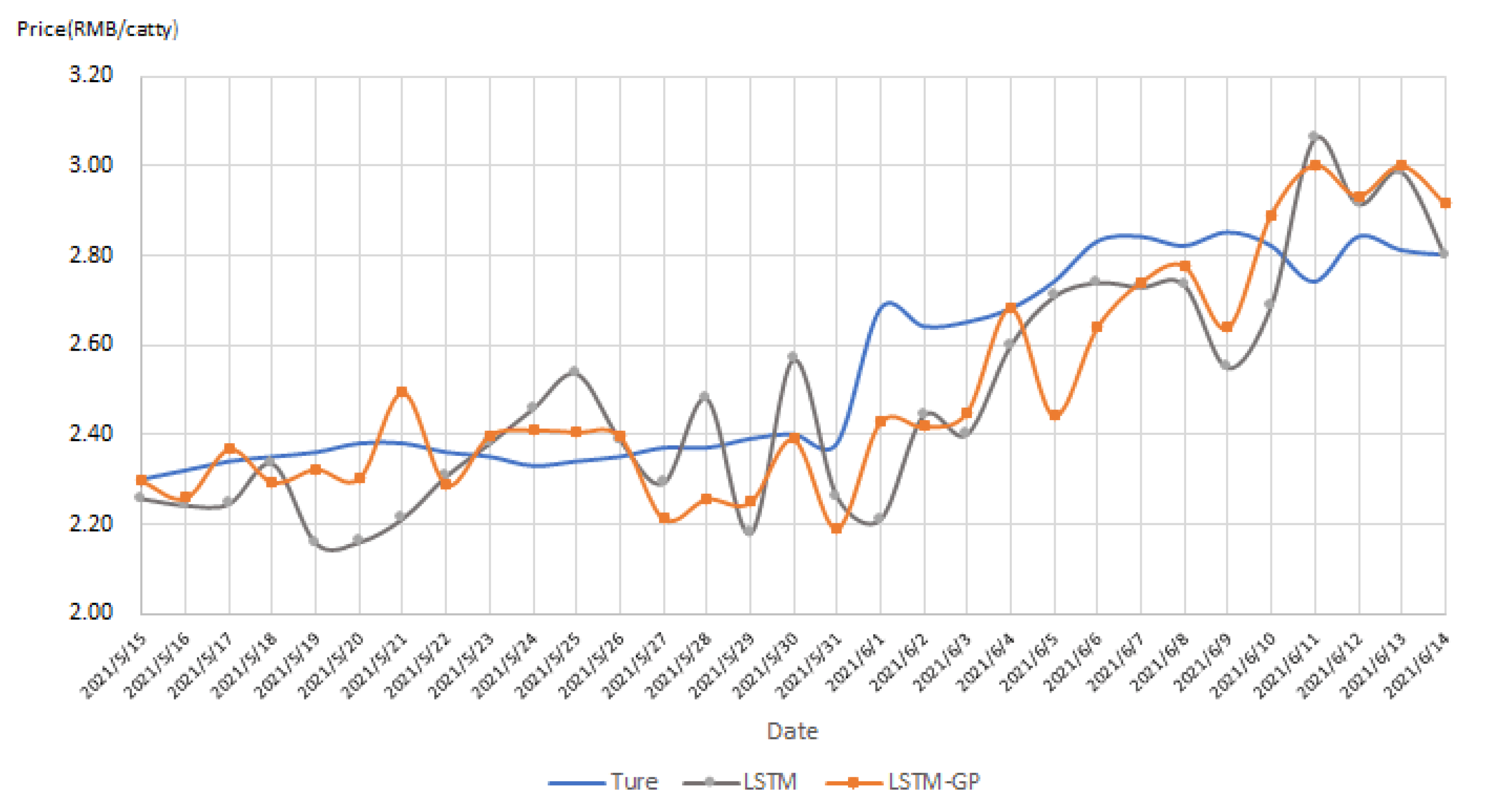

4.2.1. Results of LSTM–GARCH-Family Models

4.2.2. Results of Comparison with the Benchmark Models

4.3. Price Prediction Analysis

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Zhang, X.X.; Liu, L.; Su, C.W.; Tao, R.; Lobon, O.R.; Moldovan, N.C. Bubbles in agricultural commodity markets of China. Complexity 2019, 2019, 2896479. [Google Scholar] [CrossRef]

- Chen, W.J.; Guo, F.; Zhang, C.; Liu, P.Z.; Ren, W.M.; Cao, N.; Ding, J.R. Development and application of big data platform for garlic industry chain. Comput. Mater. Contin. 2019, 58, 229–248. [Google Scholar] [CrossRef]

- Wu, G.J.; Zhang, C.; Liu, P.Z.; Ren, W.M.; Zheng, Y.; Guo, F.; Chen, X.W.; Russell, H. Spatial quantitative analysis of garlic price data based on arcgis technology. Comput. Mater. Contin. 2019, 58, 183–195. [Google Scholar] [CrossRef]

- Guo, F.; Liu, P.Z.; Ren, W.M.; Cao, N.; Zhang, C.; Wen, F.J.; Zhou, H.M. Research on the relationship between garlic and young garlic shoot based on big data. Comput. Mater. Contin. 2019, 58, 363–378. [Google Scholar] [CrossRef]

- Wang, B.; Liu, P.; Zhang, C.; Wang, J.; Liu, P. Prediction of garlic price based on arima model. In Proceedings of the 4th International Conference on Cloud Computing and Security (ICCCS), Haikou, China, 8–10 June 2018; pp. 731–739. [Google Scholar] [CrossRef]

- Adanacioglu, H.; Yercan, M. An analysis of tomato prices at wholesale level in turkey: An application of sarima model. Custos E Agronegocio 2012, 8, 52–75. [Google Scholar]

- Jadhav, V.; Reddy, B.V.C.; Gaddi, G.M. Application of arima model for forecasting agricultural prices. J. Agric. Sci. Technol. 2017, 19, 981–992. [Google Scholar]

- Bhardwaj, S.; Paul, R.K.; Singh, D.; Singh, K. An empirical investigation of arima and garch models in agricultural price forecasting. Econ. Aff. 2014, 59, 415. [Google Scholar] [CrossRef]

- Guo, F.; Liu, P.Z.; Ren, W.M.; Cao, N.; Zhang, C.; Wen, F.J.; Zhou, H.M. Research on the law of garlic price based on big data. Comput. Mater. Contin. 2019, 58, 795–808. [Google Scholar] [CrossRef]

- Jang, B.; Kim, M.; Harerimana, G.; Kang, S.U.; Kim, J.W. Bi-lstm model to increase accuracy in text classification: Combining word2vec cnn and attention mechanism. Appl. Sci. 2020, 10, 5841. [Google Scholar] [CrossRef]

- Alfonso, G.; Nicola, L.; Delfina, M.; Rocco, Z.; Carmine, C. Automatic users’ gender classification via gestures analysis on touch devices. Neural Comput. Appl. 2022, 34, 18473–18495. [Google Scholar] [CrossRef]

- Li, Y.F.; Ngom, A. Data integration in machine learning. In Proceedings of the 2015 IEEE International Conference on Bioinformatics and Biomedicine (BIBM), Washington, DC, USA, 9–12 November 2015; pp. 1665–1671. [Google Scholar] [CrossRef]

- Jha, G.K.; Sinha, K. Time-delay neural networks for time series prediction: An application to the monthly wholesale price of oilseeds in india. Neural Comput. Appl. 2014, 24, 563–571. [Google Scholar] [CrossRef]

- Jaiswal, R.; Jha, G.K.; Kumar, R.R.; Choudhary, K. Deep long short-term memory based model for agricultural price forecasting. Neural Comput. Appl. 2021, 34, 4661–4676. [Google Scholar] [CrossRef]

- Yang, Y.R.; Xiong, Q.Y.; Wu, C.; Zou, Q.H.; Yang, Y.; Yi, H.L.; Gao, M. A study on water quality prediction by a hybrid CNN-LSTM model with attention mechanism. Environ. Sci. Pollut. Res. 2021, 28, 55129–55139. [Google Scholar] [CrossRef] [PubMed]

- Hochreiter, S.; Schmidhuber, J. Long short-term memory. Neural Comput. 1997, 9, 1735–1780. [Google Scholar] [CrossRef] [PubMed]

- Cho, K.; Van Merrienboer, B.; Gulcehre, C.; Bahdanau, D.; Bougares, F.; Schwenk, H.; Bengio, Y. Learning Phrase Representations using RNN Encoder-Decoder for Statistical Machine Translation. arXiv 2014, arXiv:1406.1078. [Google Scholar]

- Liu, Y.; Duan, Q.; Wang, D.; Zhang, Z.; Liu, C. Prediction for hog prices based on similar sub-series search and support vector regression. Comput. Electron. Agric. 2019, 157, 581–588. [Google Scholar] [CrossRef]

- Kim, H.Y.; Won, C.H. Forecasting the volatility of stock price index: A hybrid model integrating lstm with multiple garch-type models. Expert Syst. Appl. 2018, 103, 25–37. [Google Scholar] [CrossRef]

- Huang, Y.; Dai, X.; Wang, Q.; Zhou, D. A hybrid model for carbon price forecasting using garch and long short-term memory network. Appl. Energy 2021, 285, 116485. [Google Scholar] [CrossRef]

- Serkan, A. Stacking hybrid GARCH models for forecasting Bitcoin volatility. Expert Syst. Appl. 2021, 174, 114747. [Google Scholar] [CrossRef]

- Ye, K.; Piao, Y.; Zhao, K.; Cui, X. A heterogeneous graph enhanced lstm network for hog price prediction using online discussion. Agriculture 2021, 11, 359. [Google Scholar] [CrossRef]

- Jin, Z.G.; Yang, Y.; Liu, Y.H. Stock closing price prediction based on sentiment analysis and lstm. Neural Comput. Appl. 2020, 32, 9713–9729. [Google Scholar] [CrossRef]

- Liu, J.W.; Huang, X.H. Forecasting crude oil price using event extraction. IEEE Access 2021, 9, 149067–149076. [Google Scholar] [CrossRef]

- Busari, G.A.; Lim, D.H. Crude oil price prediction: A comparison between AdaBoost-LSTM and AdaBoost-GRU for improving forecasting performance. Comput. Chem. Eng. 2021, 155, 107513. [Google Scholar] [CrossRef]

- Ramirez, O.A.; Fadiga, M.L. Forecasting agricultural commodity prices with asymmetric-error garch models. West. J. Agric. Econ. 2003, 28, 71–85. [Google Scholar] [CrossRef]

- Yang, L.; Li, K.; Zhang, W.; Kong, Y. Short-term vegetable prices forecast based on improved gene expression programming. Int. J. High Perform. Comput. Netw. 2018, 11, 199–213. [Google Scholar] [CrossRef]

- Zhang, Y.; Na, S. A novel agricultural commodity price forecasting model based on fuzzy information granulation and mea-svm model. Math. Probl. Eng. 2018, 2018, 2540681. [Google Scholar] [CrossRef]

- Liu, Y.; Gong, C.; Yang, L.; Chen, Y. Dstp-rnn: A dual-stage two-phase attention-based recurrent neural network for long-term and multivariate time series prediction. Expert Syst. Appl. 2020, 143, 113082. [Google Scholar] [CrossRef]

- Li, Z.M.; Cui, L.G.; Xu, S.W.; Weng, L.Y.; Dong, X.X.; Li, G.Q.; Yu, H.P. Prediction model of weekly retail price for eggs based on chaotic neural network. J. Integr. Agric. 2013, 12, 2292–2299. [Google Scholar] [CrossRef]

- Hemageetha, N.; Nasira, G.M. Radial basis function model for vegetable price prediction. In Proceedings of the International Conference on Pattern Recognition, Salem, India, 21–22 February 2013. [Google Scholar] [CrossRef]

- Bengio, Y. Learning Deep Architectures for AI; Now Publishers Inc.: Boston, MA, USA, 2009. [Google Scholar]

- Weng, Y.; Wang, X.; Hua, J.; Wang, H.; Kang, M.; Wang, F. Forecasting horticultural products price using arima model and neural network based on a large-scale data set collected by web crawler. IEEE Trans. Comput. Soc. Syst. 2019, 6, 547–553. [Google Scholar] [CrossRef]

- Banerjee, T.; Sinha, S.; Choudhury, P. Long term and short term forecasting of horticultural produce based on the lstm network model. Appl. Intell. 2022, 52, 9117–91147. [Google Scholar] [CrossRef]

- Yeong, H.G.; Dong, J.; Helin, Y.; Ri, Z.; Xianghua, P.; Seong, J.Y. Forecasting agricultural commodity prices using dual input attention lstm. Agriculture 2022, 12, 256. Available online: https://www.mdpi.com/2077-0472/12/2/256 (accessed on 1 October 2022).

- Wang, B.; Liu, P.; Zhang, C.; Wang, J.; Chen, W.; Cao, N.; Wen, F. Research on hybrid model of garlic short-term price forecasting based on big data. Comput. Mater. Contin. 2018, 57, 283–296. [Google Scholar] [CrossRef]

- Teng, J.; Wang, X.; Zhang, Y.; Wen, F.; L, P. Research on ginger price prediction based on prophet- support vector machine (svm) combination model. Direct Res. J. Agric. Food Sci. 2020, 8, 340–345. [Google Scholar]

- Xiong, T.; Li, C.; Bao, Y. Seasonal forecasting of agricultural commodity price using a hybrid stl and elm method: Evidence from the vegetable market in china. Neurocomputing 2018, 275, 2831–2844. [Google Scholar] [CrossRef]

- Yin, H.; Jin, D.; Gu, Y.H.; Park, C.J.; Han, S.K.; Yoo, S.J. Stl-attlstm: Vegetable price forecasting using stl and attention mechanism-based lstm. Agriculture 2020, 10, 612. [Google Scholar] [CrossRef]

- Hu, Y.; Ni, J.; Wen, L. A hybrid deep learning approach by integrating LSTM-ANN networks with GARCH model for copper price volatility prediction. Phys. A Stat. Mech. Its Appl. 2020, 557, 124907. [Google Scholar] [CrossRef]

- Seo, M.; Kim, G. Hybrid forecasting models based on the neural networks for the volatility of bitcoin. Appl. Sci. 2020, 14, 4768. [Google Scholar] [CrossRef]

- Koo, E.; Kim, G. A Hybrid Prediction Model Integrating GARCH Models with a Distribution Manipulation Strategy Based on LSTM Networks for Stock Market Volatility. IEEE Access 2022, 10, 34743–34754. [Google Scholar] [CrossRef]

- Kakade, K.; Mishra, A.K.; Ghate, K.; Gupta, S. Forecasting Commodity Market Returns Volatility: A Hybrid Ensemble Learning GARCH-LSTM based Approach. Intell. Syst. Account. Financ. Manag. 2022, 29, 103–117. [Google Scholar] [CrossRef]

- Zolfaghari, M.; Gholami, S. A hybrid approach of adaptive wavelet transform, long short-term memory and ARIMA-GARCH family models for the stock index prediction. Expert Syst. Appl. 2021, 182, 115149. [Google Scholar] [CrossRef]

- Bollerslev, T. Generalized autoregressive conditional heteroskedasticity. J. Econom. 1986, 31, 307–327. [Google Scholar] [CrossRef]

- Nelson, D.B. Conditional heteroskedasticity in asset returns: A new approach. Econom. J. Econom. Soc. 1991, 59, 347–370. [Google Scholar] [CrossRef]

- Ding, Z.; Granger, C.W.; Engle, R.F. A long memory property of stock market returns and a new model. J. Empir. Financ. 1993, 1, 83–106. [Google Scholar] [CrossRef]

- Kingma, D.; Ba, J. Adam: A Method for Stochastic Optimization. In Proceedings of the International Conference on Learning Representations(ICLR), San Diego, CA, USA, 7–9 May 2015. [Google Scholar] [CrossRef]

- Srivastava, N.; Hinton, G.; Krizhevsky, A.; Sutskever, I.; Salakhutdinov, R. Dropout: A Simple Way to Prevent Neural Networks from Overfitting. J. Mach. Learn. Res. 2014, 15, 1929–1958. [Google Scholar]

- Gao, Y.; Wang, R.; Zhou, E. Stock Prediction Based on Optimized LSTM and GRU Models. Sci. Program. 2021, 2021, 4055281. [Google Scholar] [CrossRef]

- Alfonso, G.; Luca, G.; Domenico, S.; Francesco, M.; Rocco, Z. To learn or not to learn? Evaluating autonomous, adaptive, automated traders in cryptocurrencies financial bubbles. Neural Comput. Appl. 2022, 34, 20715–20756. [Google Scholar] [CrossRef]

| Author | Forecasting Target | Model | Conclusion |

|---|---|---|---|

| Huang et al. [20] | Carbon price | VMD-GARCH/LSTM-LSTM | The prediction error of the single model is greater than all decomposition-ensemble models. |

| Seo et al. [41] | Volatility of bitcoin | Neural networks and GARCH | Consequently, compared to the best GARCH model, the best GT-VIX-GARCH-H model improves by 11%, 2.2% and 30% for MAE, RMSE and MAPE, respectively. |

| Serkan et al. [21] | Bitcoin volatility | Hybrid GARCH and LASSO | The proposed combined LASSO and GARCH stacking model produces better forecasts than other benchmark models. |

| Koo et al. [42] | Stock market volatility | GARCH Models With a Distribution Manipulation Strategy Based on LSTM | They proposed a new hybrid model with GARCH-type models based on a novel non-linear filtering method to mitigate concentration property of volatility. |

| Kakade et al. [43] | Commodity market returns volatility | GARCH and LSTM | The results highlight that combining the information from the forecasts of multiple GARCH types into a hybrid LSTM model leads to superior volatility forecasting capability. |

| Zolfaghari et al. [44] | Stock index | AWT, LSTM, ARIMAX-GARCH-family models | The results indicate an overall improvement in forecasting of stock index using the AWT-LSTM-ARMAX-FIEGARCH model with student’s t distribution as compared to the benchmark models. |

| Symbol | Description |

|---|---|

| the garlic price value of the network input at t. | |

| the output price value of the LSTM cell at t | |

| the LSTM cell state at t | |

| the extracted information to be recorded at t | |

| the weight of allowing the corresponding information to pass at t | |

| the output of the cell state obtained by the sigmoid function at t | |

| the weight of allowing the corresponding information to pass at t | |

| the hidden state and the weight of information to pass at t | |

| the weight of allowing the corresponding information to pass at t | |

| the GRU cell state at t | |

| the value of the candidate state | |

| the weight matrices | |

| the bias terms | |

| the random disturbance term at t | |

| the unpredictable error term at t | |

| the conditional variance terms at t | |

| the GARCH coefficient | |

| the ARCH coefficient | |

| the leverage coefficient | |

| the power parameter of the estimated standard deviation |

| Mean | Standard Deviation | Skewness | Kurtosis | Jarque-Bera | p-Value | ADF |

|---|---|---|---|---|---|---|

| 0.0002 | 0.0456 | 2.1135 | 330.08 | 28,418,685 | 0.0000 | 27.5257 * |

| MODEL | Explanatoty Variable | GARCH Param | EGARCH Param | PGARCH Param | |

|---|---|---|---|---|---|

| Single model | LSTM | √ | |||

| Single-combination model | LSTM-G | √ | √ | ||

| LSTM-E | √ | √ | |||

| LSTM-P | √ | √ | |||

| Dual-combination model | LSTM-GE | √ | √ | √ | |

| LSTM-GP | √ | √ | √ | ||

| LSTM-EP | √ | √ | √ | ||

| Triple-combination model | LSTM-GEP | √ | √ | √ | √ |

| GARCH (p,q,r) | Error Distribution | p-Value | AIC | SC | HQ |

|---|---|---|---|---|---|

| GARCH (1,1,0) | Student’s t | 0.0000 | −0.122576 | −0.028818 | −0.084697 |

| GED | 0.0000 | −0.103389 | −0.009631 | −0.065510 | |

| GARCH (2,1,0) | Student’s t | 0.0000 | −0.113682 | −0.004298 | −0.069491 |

| GED | 0.0000 | −0.095590 | 0.013794 | −0.051399 | |

| GARCH (1,2,0) | Student’s t | 0.0000 | −0.121924 | −0.015540 | −0.080733 |

| GED | 0.0000 | −0.096971 | 0.012413 | −0.052779 | |

| GARCH (2,2,0) | Student’s t | 0.0000 | −0.117193 | 0.007817 | −0.066689 |

| GED | 0.0000 | −0.087844 | 0.037166 | −0.037340 | |

| GARCH (3,1,0) | Student’s t | 0.0000 | −0.109819 | 0.015191 | −0.059315 |

| GED | 0.0000 | −0.091065 | 0.033946 | −0.040560 | |

| GARCH (3,2,0) | Student’s t | 0.0000 | −0.127149 | 0.013488 | −0.070331 |

| GED | 0.0000 | −0.099995 | 0.040642 | −0.043177 |

| MODEL | MAE | RMSE | MAPE | |

|---|---|---|---|---|

| Single model | LSTM | 0.1287 | 0.1673 | 5.21% |

| GARCH | 0.1690 | 0.2561 | 7.31% | |

| EGARCH | 0.1718 | 0.2592 | 7.82% | |

| PGARCH | 0.1691 | 0.2561 | 7.31% | |

| Single-combination model | LSTM-G | 0.1188 | 0.1600 | 4.87% |

| LSTM-E | 0.1247 | 0.1620 | 5.21% | |

| LSTM-P | 0.1277 | 0.1683 | 5.34% | |

| Dual-combination model | LSTM-GE | 0.1155 | 0.1575 | 4.61% |

| LSTM-GP | 0.1144 | 0.1566 | 4.56% | |

| LSTM-EP | 0.1148 | 0.1607 | 4.60% | |

| Triple-combination | LSTM-GEP | 0.1235 | 0.1619 | 5.12% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, Y.; Liu, P.; Zhu, K.; Liu, L.; Zhang, Y.; Xu, G. A Garlic-Price-Prediction Approach Based on Combined LSTM and GARCH-Family Model. Appl. Sci. 2022, 12, 11366. https://doi.org/10.3390/app122211366

Wang Y, Liu P, Zhu K, Liu L, Zhang Y, Xu G. A Garlic-Price-Prediction Approach Based on Combined LSTM and GARCH-Family Model. Applied Sciences. 2022; 12(22):11366. https://doi.org/10.3390/app122211366

Chicago/Turabian StyleWang, Yan, Pingzeng Liu, Ke Zhu, Lining Liu, Yan Zhang, and Guangli Xu. 2022. "A Garlic-Price-Prediction Approach Based on Combined LSTM and GARCH-Family Model" Applied Sciences 12, no. 22: 11366. https://doi.org/10.3390/app122211366

APA StyleWang, Y., Liu, P., Zhu, K., Liu, L., Zhang, Y., & Xu, G. (2022). A Garlic-Price-Prediction Approach Based on Combined LSTM and GARCH-Family Model. Applied Sciences, 12(22), 11366. https://doi.org/10.3390/app122211366