Recent Trends and Economic Aspects in the Rainbow Trout (Oncorhynchus mykiss) Sector

Abstract

:1. Aquaculture Production

1.1. Global Aquaculture Production

1.2. Aquaculture Production in the European Union

1.3. Aquaculture Production in Italy: An Evolving Scenario

2. New Trends in Aquaculture Feed Production

2.1. Extraction of Active Ingredients from Molluscs and Algae

2.2. Use of Insects in Fish Feed

2.3. Recent and Future Trends of the Sector

3. Analysis of the Rainbow Trout Sector Using the Value Chain and Multi-Market Equilibrium Method

- (1)

- One month for incubation and hatching of eggs;

- (2)

- Three months for weaning of fry;

- (3)

- Ten to twelve months for the growing phase (commercial weight of 300–350 g) [66].

- T1: Closed-cycle farming with breeding animals;

- T2: Production for the restocking of recreational fishing;

- T3: Breeding with well water;

- T4: Breeding with derived water;

- T5: Multiple reproduction sites;

- T6: Integrated supply chain.

- Family-owned;

- Small size;

- Fish are mainly sold live or fresh. Product processing is only a small part of the total production. Raw materials are the only products purchased outside the farm;

- Fish are sold in local markets and less frequently nationally.

- Companies with professional management;

- One-third of the trout farms in Italy (approximately 20 farms with 60% of the total annual production);

- Products are sold regionally, nationally, and abroad;

- T5 companies sell live trout to both commercial operators and processing companies;

- T6 farms are integrated with the different stages of the supply chain.

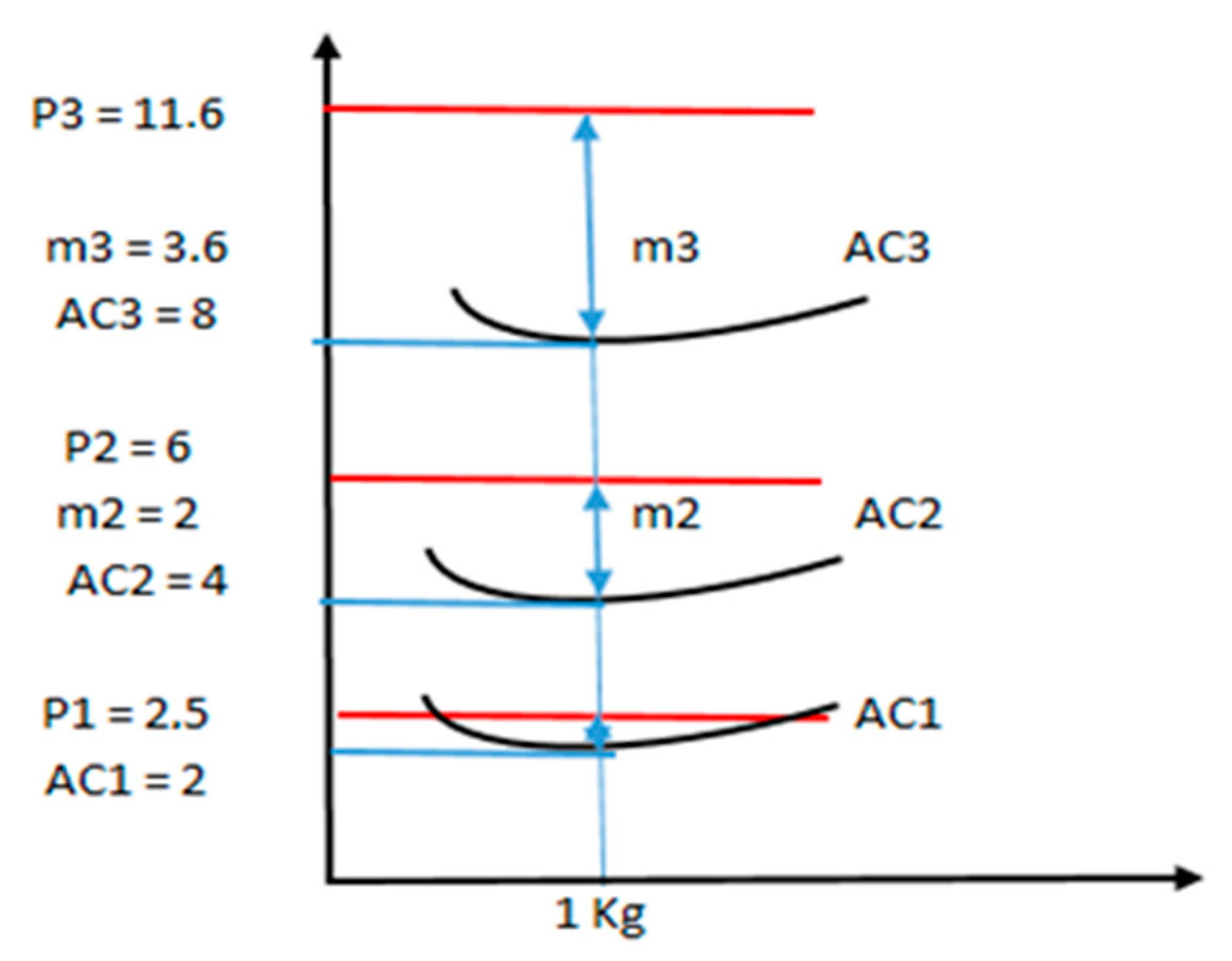

3.1. Competitiveness Indicators

3.2. Price Trend Analysis

3.3. New Consumption Trends

- -

- HoReCa: 25–30%;

- -

- Large-scale retailers: 20–25%;

- -

- Sport fishing: 25%;

- -

- Exports (mainly to Austria, Poland, Germany, and Romania): 25% [67].

4. Quality and Food Safety

5. Animal Welfare

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- FAO. The State of World Fisheries and Aquaculture. Towards Blue Transformation. 2022. Available online: www.fao.org (accessed on 4 July 2022).

- Helfman, G.; Collette, B.B.; Facey, D.E.; Bowen, B.W. The Diversity of Fishes: Biology, Evolution and Ecology; John Wiley and Sons: Hoboken, NJ, USA, 2009. [Google Scholar]

- OECD-FAO. Fish and Seafood. OECD/FAO Agricultural Outlook 2018–2027. 2018. Available online: www.oecd-ilibrary.org (accessed on 4 July 2022).

- STECF (Scientific Technical and Economic Committee for Fisheries). Economic Report of the EU Aquaculture Sector (STECF-18-19). 2018. Available online: https://stecf.jrc.ec.europa.eu/ (accessed on 4 July 2022).

- Asche, F.; Sikveland, M.; Zhang, D. Profitability in Norwegian salmon farming: The impact of firm size and price variability. Aquac. Econ. Manag. 2018, 22, 306–317. [Google Scholar] [CrossRef]

- CREA 2021. Annuario dell’Agricoltura Italiana. 2020. Available online: www.crea.gov.it (accessed on 1 July 2022).

- ISMEA 2021. I Consumi Domestici dei Prodotti Ittici, Report n. 4/21. 2021. Available online: www.ismeamercati.it (accessed on 1 July 2022).

- CREA 2018. Annuario dell’Agricoltura Italiana. 2018. Available online: www.crea.gov.it (accessed on 1 July 2022).

- Hicks, C.C.; Cohen, P.J.; Graham, N.A.J.; Nash, K.L.; Allison, E.H.; D’Lima, C.; Mills, D.J.; Roscher, M.; Thilsted, S.H.; Thorne-Lyman, A.L.; et al. Harnessing global fisheries to tackle micronutrient deficiencies. Nature 2019, 574, 95–98. [Google Scholar] [CrossRef]

- Konar, M.; Qiu, S.; Tougher, B.; Vause, J.; Tlusty, M.; Fitzsimmons, K.; Barrows, R.; Cao, L. Illustrating the hidden economic, social and ecological values of global forage fish resources. Resour. Conser. Recycl. 2019, 151, 104456. [Google Scholar] [CrossRef]

- Jannathulla, R.; Rajaram, V.; Kalanjiam, R.; Ambasankar, K.; Muralidhar, M.; Dayal, J.S. Fishmeal availability in the scenarios of climate change: Inevitability of fishmeal replacement in aquafeeds and approaches for the utilization of plant protein sources. Aquac. Res. 2019, 50, 3493–3506. [Google Scholar] [CrossRef]

- Rosenlund, G.; Torstensen, B.E.; Stubhaug, I.; Usman, N.; Sissener, N.H. Atlantic salmon require long-chain n-3 fatty acids for optimal growth throughout the seawater period. J. Nutr. Sci. 2016, 5, e19. [Google Scholar] [CrossRef]

- D’Agaro, E. Caratteristiche dei mangimi e alimentazione in troticoltura. In Troticoltura Moderna; Baruchelli, G., Ed.; Nuove Arti Grafiche: Trento, Italy, 2002; pp. 241–248. [Google Scholar]

- Sprague, M.; Dick, J.R.; Tocher, D.R. Impact of sustainable feeds on omega-3 long chain fatty acid levels in farmed Atlantic salmon, 2006–2015. Sci. Rep. 2016, 6, 21892. [Google Scholar] [CrossRef] [PubMed]

- Funge-Smith, S.J. Review of the State of World Fishery Resources: Inland Fisheries; FAO Fisheries and Aquaculture Circular 942. Rev. 3; FAO: Rome, Italy, 2018. [Google Scholar]

- Soliman, N.F.; Yacout, D.M.M.; Hassaan, M.A. Responsible fishmeal consumption and alternatives in the face of climate changes. Int. J. Maricult. Sci. 2017, 7, 130–140. [Google Scholar] [CrossRef]

- Shepherd, C.J.; Jackson, A.J. Global fishmeal and fish-oil supply: Inputs, outputs and markets. J. Fish Biol. 2013, 83, 1046–1066. [Google Scholar] [CrossRef]

- Hamilton, H.A.; Newton, R.; Auchterloni, N.A.; Müller, D.B. Systems approach to quantify the global omega-3 fatty acid cycle. Nat. Food 2020, 1, 59–62. [Google Scholar] [CrossRef]

- Cashion, T.; Le Manach, F.; Zeller, D.; Pauly, D. Most fish destined for fishmeal production are food-grade fish. Fish Fish. 2017, 18, 837–844. [Google Scholar] [CrossRef]

- Blanchard, J.L.; Watson, R.A.; Fulton, E.A.; Cottrell, R.S.; Nash, K.L.; Bryndum-Buchholz, A.A.; Büchner, M.; Carozza, D.A.; Cheung, W.W.L.; Elliott, J.; et al. Linked sustainability challenges and trade-offs among fisheries, aquaculture and agriculture. Nat. Ecol. Evol. 2017, 1, 1240–1249. [Google Scholar] [CrossRef] [PubMed]

- Whinston, M.D. On the transaction cost determinants of vertical integration. J. Law Econ. Organ. 2003, 19, 1–23. [Google Scholar] [CrossRef]

- Olsen, R.L.; Hasan, M.R. A limited supply of fishmeal: Impact on future increases in global aquaculture production. Trends Food Sci. Technol. 2012, 27, 120–128. [Google Scholar] [CrossRef]

- Thanuthong, T.; Francis, D.S.; Senadheera, S.D.; Jones, P.L.; Turchini, G.M. Fish oil replacement in rainbow trout diets and total dietary PUFA content: I) effects on feed efficiency, fat deposition and the efficiency of a finishing strategy. Aquaculture 2011, 320, 82–90. [Google Scholar] [CrossRef]

- Martin, S.A.M.; Król, E. Nutrigenomics and immune function in fish: New insights from omics technologies. Dev. Comp. Immunol. 2017, 75, 86–98. [Google Scholar] [CrossRef] [PubMed]

- D’Agaro, E. New Advances in NGS Technologies. In New Trends in Veterinary Genetics; Intech Editions: London, UK, 2017; pp. 219–251. [Google Scholar]

- Callet, T.; Médale, F.; Larroquet, L.; Surget, A.; Aguirre, P.; Kerneis, T. Successful selection of rainbow trout (Oncorhynchus mykiss) on their ability to grow with a diet completely devoid of fishmeal and fish oil, and correlated changes in nutritional traits. PLoS ONE 2017, 12, e0186705. [Google Scholar] [CrossRef]

- D’Agaro, E.; Rosa, F.; Akentieva, N.P. New Technology Tools and Life Cycle Analysis (LCA) Applied to a Sustainable Livestock Production. EuroBiotech J. 2021, 5, 130–141. [Google Scholar] [CrossRef]

- Aubin, J.; Papatryphon, E.; van der Werf, H.M.G.; Chatzifotis, S. Assessment of the environmental impact of carnivorous finfish production systems using life cycle assessment. J. Clean. Prod. 2009, 17, 354–361. [Google Scholar] [CrossRef]

- Lanari, D.; D’Agaro, E.; Ballestrazzi, R. Dietary N and P levels, effluent water characteristics and performance in rainbow trout. Water Sci. Technol. 1995, 31, 157–165. [Google Scholar] [CrossRef]

- Cao, L.; Diana, J.S.; Keoleian, G.A. Role of life cycle assessment in sustainable aquaculture. Rev. Aquac. 2013, 5, 61–71. [Google Scholar] [CrossRef] [Green Version]

- Philis, G.; Ziegler, F.; Gansel, L.; Jansen, M.D.; Gracey, E.; Stene, A. Comparing life cycle assessment (LCA) of salmonid aquaculture production systems: Status and perspectives. Sustainability 2019, 11, 2517. [Google Scholar] [CrossRef]

- Hashempour-Baltork, F.; Khosravi-Darani, K.; Hosseini, H.; Farshi, P.; Reihani, S.F.S. Mycoproteins as safe meat substitutes. J. Clean Prod. 2020, 253, 119958. [Google Scholar] [CrossRef]

- Boissy, J.; Joël, A.; Abdeljalil, D.; van der Werf, H.M.G.; Bell, B.J.; Kaushik, S.J. Environmental impacts of plant-based salmonid diets at feed and farm scales. Aquaculture 2011, 321, 61–70. [Google Scholar] [CrossRef]

- Maiolo, S.; Forchino, S.A.; Faccenda, F.; Pastres, R. From feed to fork—Life Cycle Assessment on an Italian rainbow trout (Oncorhynchus mykiss) supply chain. J. Clean. Prod. 2021, 289, 125155. [Google Scholar] [CrossRef]

- Ayer, N.; Tyedmers, P.; Pelletier, N.; Sonesson, U.; Scholz, A. Co-product allocation in life cycle assessments of seafood production systems: Review of problems and strategies. Int. J. Life Cycle Assess. 2007, 12, 480–487. [Google Scholar] [CrossRef]

- ISO 14040:2006 2006; Environmental Management-Life Cycle Assesment-Principles and Framework. International Organization for Standardization: Geneva, Switzerland, 2006. Available online: www.iso.org (accessed on 2 July 2022).

- Ardente, F.; Cellura, M. Economic allocation in life cycle assessment: The state of the art and discussion of examples. J. Ind. Ecol. 2012, 16, 387–398. [Google Scholar] [CrossRef]

- Wolf, M.A.; Pant, R.; Chomkhamsri, K.; Sala, S.; Pennington, D. The International Reference Life Cycle Data System (ILCD) Handbook—Towards More Sustainable Production and Consumption for a Resource-Efficient Europe. 2006. Available online: https://eplca.jrc.ec.europa.eu (accessed on 2 July 2022).

- Tillman, A.M. Significance of decision-making for LCA methodology. Environ. Impact Assess. Rev. 2000, 20, 113–123. [Google Scholar] [CrossRef]

- Henriksson, P.J.G.; Guinée, J.B.; Kleijn, R.; De Snoo, G.R. Life cycle assessment of aquaculture systems-A review of methodologies. Int. J. Life Cycle Assess. 2012, 17, 304–313. [Google Scholar] [CrossRef]

- Guinée, J.B.; Heijungs, R.; Huppes, G. Economic allocation: Examples and derived decision tree. Int. J. Life Cycle Assess. 2004, 9, 23–33. [Google Scholar] [CrossRef]

- European Union. PEFCR Feed for Food Producing Animals—Draft Version 1.1 for EF Steering Committee; EU: Brussels, Belgium, 2018; pp. 1–4. [Google Scholar]

- Jędrejek, D.; Levic, J.; Wallace, J.; Oleszek, W. Animal by-products for feed: Characteristics, European regulatory framework, and potential impacts on human and animal health and the environment. J. Anim. Feed Sci. 2016, 25, 189–202. [Google Scholar] [CrossRef]

- Nwoba, E.G.; Parlevliet, D.A.; Laird, D.W.; Alameh, K.; Moheimani, N.R. Light management technologies for increasing algal photobioreactor efficiency. Algal Res. 2019, 39, 101433. [Google Scholar] [CrossRef]

- Leong, Y.K.; Chen, C.Y.; Varjani, S.; Chang, J.S. Producing fucoxanthin from algae. Recent advances in cultivation strategies and downstream processing. Bioresour. Technol. 2022, 344, 126170. [Google Scholar] [CrossRef] [PubMed]

- Saadaoui, I.; Rasheed, R.; Aguilar, A. Microalgal-based feed: Promising alternative feedstocks for livestock and poultry production. J. Animal Sci. Biotechnol. 2021, 12, 76. [Google Scholar] [CrossRef]

- Smaal, A.C.; Ferreira, J.G.; Grant, J.; Petersen, J.K.; Strand, Ø. Goods and Services of Marine Bivalves; Springer: Berlin/Heidelberg, Germany, 2019. [Google Scholar]

- Makker, H.P.S.; Tran, G.; Heuze, V.; Ankers, P. State-of-the-art on use of insects as animal feed. Anim. Feed Sci. Technol. 2014, 197, 1–33. [Google Scholar] [CrossRef]

- Sogari, G.; Amato, M.; Biasato, I.; Chiesa, S.; Gasco, L. The Potential Role of Insects as Feed: A Multi-Perspective Review. Animals 2019, 9, 119. [Google Scholar] [CrossRef]

- Playne, C.L.R.; Dobermann, D.; Forkes, A.; House, J.; Josephs, J.; McBride, A.; Müller, A.; Quilliam, R.S.; Soares, S. Insects as food and feed: European perspectives on recent research and future priorities. J. Insects Food Feed 2016, 2, 269–275. [Google Scholar]

- Gasco, L.; Józefiak, A.; Henry, M. Beyond the protein concept: Health aspects of using edible insects on animals. J. Insects Food Feed 2020, 7, 715–741. [Google Scholar] [CrossRef]

- Specht, K.; Zoll, F.; Schümann, H.; Bela, J.; Kachel, J.; Robischon, M. How will we eat and produce in the cities of the future? From edible insects to vertical farming—A study on the perception and acceptability of new approaches. Sustainability 2019, 11, 4315. [Google Scholar] [CrossRef]

- Barroso, F.G.; de Haro, C.; Sánchez-Muros, M.J.; Venegas, E.; Martínez-Sánchez, A.; Pérez-Bañón, C. The potential of various insect species for use as food for fish. Aquaculture 2014, 422, 193–201. [Google Scholar] [CrossRef]

- Meneguz, M.; Schiavone, A.; Gai, F.; Dama, A.; Lussiana, C.; Renna, M.; Gasco, L. Effect of rearing substrate on growth performance, waste reduction efficiency and chemical composition of black soldier fly (Hermetia illucens) larvae. J. Sci. Food Agric. 2018, 98, 5776–5784. [Google Scholar] [CrossRef]

- Gałęcki, R.; Sokół, R. A parasitological evaluation of edible insects and their role in the transmission of parasitic diseases to humans and animals. PLoS ONE 2019, 14, e0219303. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Lazzarotto, V.; Médale, F.; Larroquet, L.; Corraze, G. Long-term dietary replacement of fishmeal and fish oil in diets for rainbow trout (Oncorhynchus mykiss): Effects on growth, whole body fatty acids and intestinal and hepatic gene expression. PLoS ONE 2018, 13, e0190730. [Google Scholar]

- Terova, G.; Rimoldi, S.; Ascione, C.; Gini, E.; Ceccotti, C.; Gasco, L. Rainbow trout (Oncorhynchus mykiss) gut microbiota is modulated by insect meal from Hermetia illucens prepupae in the diet. Rev. Fish Biol. Fish. 2019, 29, 465–486. [Google Scholar] [CrossRef]

- Antonopoulou, E.; Nikouli, E.; Piccolo, G.; Gasco, L.; Gai, F.; Chatzifotis, S.; Mente, E.; Kormas, K.A. Reshaping gut bacterial communities after dietary Tenebrio molitor larvae meal supplementation in three fish species. Aquaculture 2019, 503, 628–635. [Google Scholar] [CrossRef]

- Lyons, P.P.; Turnbull, J.F.; Dawson, K.A.; Crumlish, M. Effects of low-level dietary microalgae supplementation on the distal intestinal microbiome of farmed rainbow trout Oncorhynchus mykiss (Walbaum). Aquac. Res. 2017, 48, 2438–2452. [Google Scholar] [CrossRef]

- Huyben, D.; Nyman, A.; Vidaković, A.; Passoth, V.; Moccia, R.; Kiessling, A.; Dicksved, J.; Lundh, T. Effects of dietary inclusion of the yeasts Saccharomyces cerevisiae and Wickerhamomyces anomalus on gut microbiota of rainbow trout. Aquaculture 2017, 473, 528–537. [Google Scholar] [CrossRef]

- Gallick, E.C. Case Studies in Contracting and Organization; Oxford University Press: Oxford, UK, 1996. [Google Scholar]

- Gereffi, G.; Humphrey, J.; Sturgeon, T. The governance of global value chains. Rev. Int. Polit. Econ. 2005, 12, 78–104. [Google Scholar] [CrossRef]

- Trienekens, J.; van Velzen, M.; Lees, N.; Saunders, C.; Pascuccie, S. Governance of market-oriented fresh food value chains: Export chains. N. Z. Int. Food Agribus. Manag. Rev. 2018, 21, 249–268. [Google Scholar] [CrossRef]

- Szűcs, I.; Szőllősi, L. Potential of vertical and horizontal integration in the Hungarian fish product chain. Apstract 2014, 8, 5–15. [Google Scholar] [CrossRef]

- Porter, M.E. How Competitive Forces Shape Strategy. In Readings in Strategic Management; Asch, D., Bowman, C., Eds.; Palgrave: London, UK, 1989. [Google Scholar]

- MIPAAF. Annuario Acquacoltura. 2021. Available online: www.politicheagricole.it/ (accessed on 6 July 2022).

- EUMOFA. The EU Fish Market 2020. 2020. Available online: www.eumofa.eu (accessed on 6 July 2022).

- Tendall, D.M.; Joerin, J.; Kopainsky, B.; Edwards, P.; Shreck, A.; Le, Q.B.; Kruetli, P.; Grant, M.; Six, J. Food system resilience: Defining the concept. Glob. Food Secur. 2015, 6, 17–23. [Google Scholar] [CrossRef]

- Larsen, T.A.; Asche, F. Contracts in the Salmon Aquaculture Industry: An analysis of Norwegian Salmon Exports. Mar. Resour. Econ. 2011, 26, 141–150. [Google Scholar] [CrossRef]

- Erkan, N.; Alakavuk, D.U.; Tosun, Y.S. Quality assurance systems in food industry. J. Fish Sci. 2008, 2, 88–99. [Google Scholar] [CrossRef]

- Hajdukiewicz, A. European Union agri-food quality schemes for the protection and promotion of geographical indications and traditional specialities: An economic perspective. Folia Hort. 2014, 26, 3–17. [Google Scholar] [CrossRef]

- Osmundsen, T.C.; Amundsen, V.S.; Alexander, K.A.; Asche, F.; Bailey, J.; Finstad, B.; Olsen, M.S.; Hernández, K.; Salgado, H. The operationalisation of sustainability: Sustainable aquaculture production as defined by certification schemes. Glob. Environ. Change 2020, 60, 102025. [Google Scholar] [CrossRef]

- Ashley, P.J. Fish welfare: Current issues in aquaculture. Appl. Anim. Behav. Sci. 2007, 104, 199–235. [Google Scholar] [CrossRef]

- Martins, C.I.M.; Galhardo, L.; Noble, C.; Damsgård, B.; Spedicato, M.T.; Zupa, W.; Beauchaud, M.; Kulczykowska, E.; Massabuau, J.-C.; Carter, T. Behavioural indicators of welfare in farmed fish. Fish Physiol. Biochem. 2012, 38, 17–41. [Google Scholar] [CrossRef]

- Toni, M.; Manciocco, A.; Angiulli, E.; Alleva, E.; Cioni, C.; Malavasi, S. Review: Assessing fish welfare in research and aquaculture, with a focus on European directives. Animal 2019, 13, 161–170. [Google Scholar] [CrossRef] [PubMed]

- Ellis, T.; Yildiz, Y.H.; López-Olmeda, J.; Spedicato, M.T.; Tort, L.; Øverli, Ø.; Martins, C. Cortisol and fish welfare. Fish Physiol. Biochem. 2012, 38, 163–188. [Google Scholar] [CrossRef] [PubMed]

- Daskalova, A. Farmed fish welfare: Stress, post-mortem muscle metabolism, and stress-related meat quality changes. Int. Aquat. Res. 2019, 11, 113–124. [Google Scholar] [CrossRef]

- Wemelsfelder, F.; Lawrence, A.B. Qualitative assessment of animal behaviour as an On-Farm Welfare-monitoring tool. Acta Agric. Scan. Anim. Sci. 2001, 51, 21–25. [Google Scholar]

- Rushen, J.; Chapinal, N.; De Passillé, A.M. Automated monitoring of behavioural-based animal welfare indicators. Anim. Welf. 2012, 21, 339–350. [Google Scholar] [CrossRef]

- Sneddon, L.U.; Wolfenden, D.C.C.; Thomson, J.S. Stress Management and Welfare. In Fish Physiology; Schreck, C.B., Tort, L., Farrell, A.P., Brauner, C.J., Eds.; Academic Press: Cambridge, CA, USA, 2016; pp. 463–539. [Google Scholar]

- Gesto, M.; López-Patiño, M.A.; Hernández, J.; Soengas, J.L.; Míguez, J.M. Gradation of the stress response in rainbow trout exposed to stressors of different severity: The role of brain serotonergic and dopaminergic systems. J. Neuroendocrinol. 2015, 2, 131–141. [Google Scholar] [CrossRef] [PubMed]

- Bui, S.; Oppedal, F.; Sievers, M.; Dempster, T. Behaviour in the toolbox to outsmart parasites and improve fish welfare in aquaculture. Rev. Aquac. 2019, 11, 168–186. [Google Scholar] [CrossRef] [Green Version]

- RSPCA. RSPCA Welfare Standards for Farmed Rainbow Trout. 2022. Available online: https://science.rspca.org.uk (accessed on 5 July 2022).

| Species | Production (×1000 t) 2020 | % of Total |

|---|---|---|

| Grass carp, Ctenopharyngodon idellus | 5791.5 | 11.8 |

| Silver carp, Hypophthalmi-chthys molitrix | 4896.6 | 10 |

| Nile tilapia, Oreochromis niloticus | 4407.2 | 9 |

| Common carp, Cyprinus carpio | 4236.3 | 8.6 |

| Catla, Catla catla | 3540.3 | 7.2 |

| Bighead carp, Hypophthalmichthys nobilis | 3187.2 | 6.5 |

| Carassius spp. | 2748.6 | 5.6 |

| Striped catfish, Pangasianodon hypophthalmus | 2520.4 | 5.1 |

| Roho labeo, Labeo rohita | 2484.8 | 5.1 |

| Clarias catfishes, Clarias spp. | 1249.0 | 2.5 |

| Tilapias nei, Oreochromis spp. | 1069.9 | 2.2 |

| Wuchang bream, Megalobrama amblycephala | 781.7 | 1.6 |

| Rainbow trout, Oncorhynchus mykiss | 739.5 | 1.5 |

| Black carp, Mylopharyngodon piceus | 695.5 | 1.4 |

| Largemouth black bass, Micropterus salmoides | 621.3 | 1.3 |

| Fisheries | Aquaculture | ||||||

|---|---|---|---|---|---|---|---|

| Year | Marine | Inland | Total | Marine | Inland | Total | Total |

| 2010 | 77,820 | 11,271 | 89,099 | 22,310 | 36,790 | 59,100 | 148,200 |

| 2011 | 82,623 | 11,124 | 93,747 | 23,366 | 38,698 | 62,065 | 155,813 |

| 2012 | 79,179 | 11,630 | 91,350 | 24,707 | 41,948 | 66,655 | 158,025 |

| 2013 | 80,899 | 11,687 | 92,586 | 35,536 | 44,686 | 70,223 | 162,810 |

| 2014 | 81,564 | 11,895 | 93,460 | 26,727 | 47,104 | 73,832 | 167,292 |

| 2015 | 81,179 | 12,525 | 93,704 | 27,879 | 48,761 | 76,641 | 170,345 |

| 2016 | 79,288 | 11,635 | 90,923 | 28,703 | 51,360 | 80,071 | 170,395 |

| 2017 | 81,200 | 11,900 | 93,100 | 30,000 | 49,000 | 79,603 | 172,700 |

| 2018 | 84,400 | 12,000 | 96,400 | 30,800 | 51,300 | 82,100 | 178,500 |

| Country | Export | Country | Import |

|---|---|---|---|

| China | 14.1 | USA | 14.0 |

| Norway | 7.6 | Japan | 9.3 |

| Vietnam | 5.1 | China | 5.9 |

| Thailand | 4.1 | Spain | 5.0 |

| USA | 4.1 | France | 4.6 |

| Chile | 4.0 | Italy | 4.0 |

| Holland | 4.0 | Germany | 4.0 |

| World | EU | Italy | % World | %EU | |

|---|---|---|---|---|---|

| Fisheries | 93,204 | 5253 | 192 | 21 | 4 |

| Aquaculture | 111,966 | 1372 | 156 | 14 | 11 |

| Total | 205,170 | 6625 | 348 | 17 | 5 |

| 2010 | 2012 | 2014 | 2016 | 2018 | % Total | |

|---|---|---|---|---|---|---|

| Atlantic salmon | 1437 | 2074 | 2348 | 2247 | 2435 | 4.5 |

| Rainbow trout | 752 | 882 | 794 | 832 | 848 | 1.6 |

| Nation | 2000 | 2005 | 2010 | 2015 | 2018 |

|---|---|---|---|---|---|

| EU | 1402 | 1272 | 1263 | 1270 | 1318 |

| Italy | 330 | 350 | 310 | 350 | 350 |

| Denmark | 330 | 310 | 310 | 310 | 330 |

| France | 350 | 310 | 290 | 260 | 260 |

| Spain | 170 | 160 | 150 | 170 | 170 |

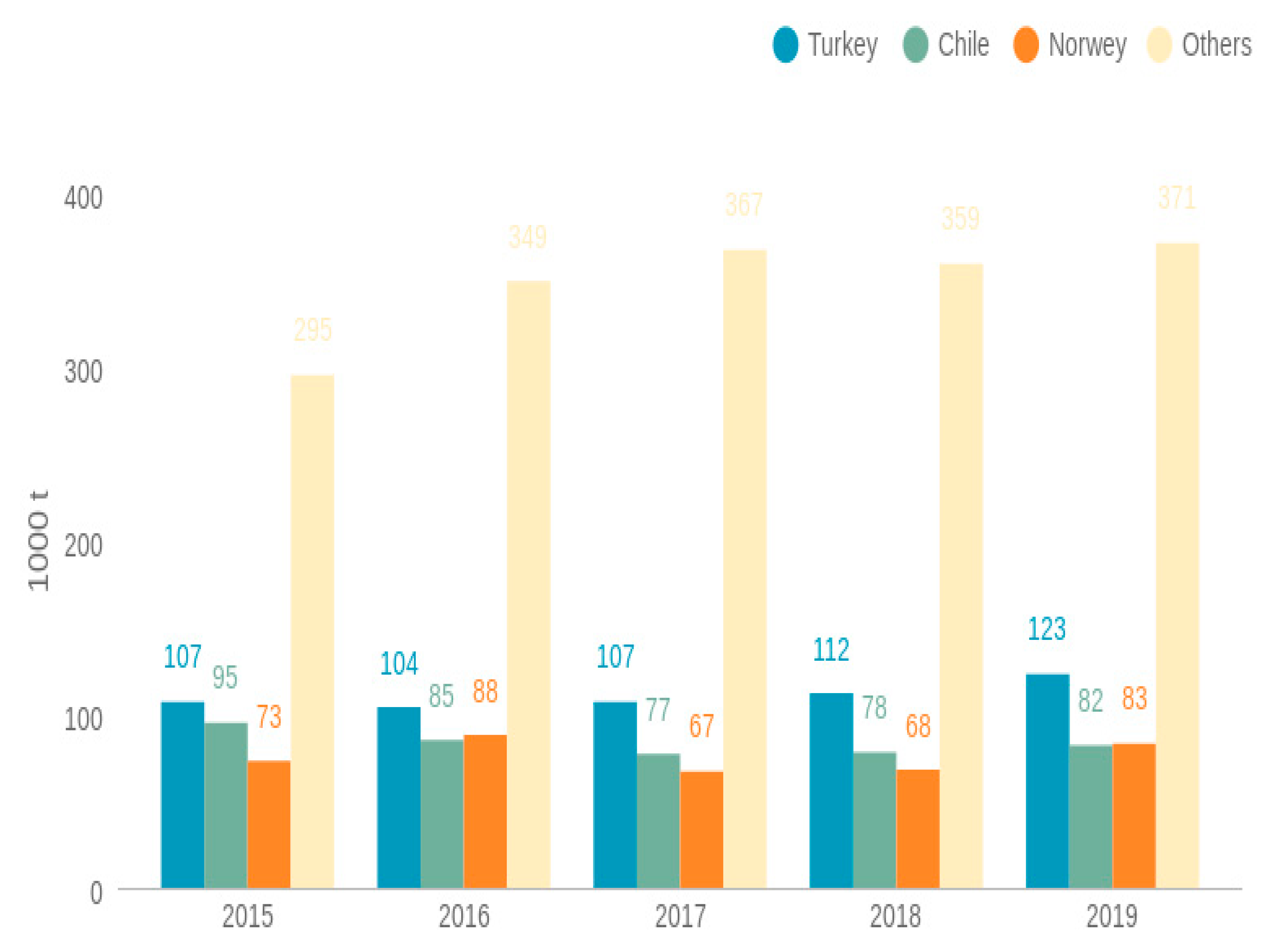

| Norway | 491 | 661 | 1019 | 1380 | 1354 |

| Others | 158 | 203 | 243 | 304 | 363 |

| Total | 2052 | 2137 | 2527 | 2948 | 3082 |

| Country | Import | Export | ||||

|---|---|---|---|---|---|---|

| Fresh | Frozen | Fresh | Frozen | |||

| Italy | 1128 | 968 | 4273 | 119 | ||

| Poland | 9957 | 2021 | 1021 | 87 | ||

| Germany | 4610 | 6627 | 770 | 744 | ||

| France | 2191 | 793 | 158 | 721 | ||

| Denmark | 1565 | 383 | 5877 | 7526 | ||

| United Kingdom | 388 | 176 | 2626 | 89 | ||

| Spain | 2168 | 286 | 3472 | 713 |

| Year | Soybean Meal | Fishmeal |

|---|---|---|

| 2010 | 400 | 1600 |

| 2012 | 410 | 1250 |

| 2014 | 450 | 1610 |

| 2016 | 390 | 1590 |

| 2018 | 400 | 1600 |

| 2020 | 380 | 1550 |

| Protein Ingredient | Inclusion Level (%) | Effects | Reference |

|---|---|---|---|

| Mixed plant meals | 46, 70, 100 | FBW (reduction) PUFA n-3 (reduction) | [56] |

| Schizochytrium limacinum | 5 | FBW (no difference) | [57] |

| Hermetia illucens | 10, 20, 30 | FBW, SGR, FCR (no difference) | [58] |

| Tenebio molitor | 50 | FBW (no difference) | [59] |

| Saccaromyces cerevisiae and wickerhamomyces anomalus | 10, 20, 30 | FBW, FCR (no difference) | [60] |

| Country | N° Enterprises | Total Production | Total Sales | Employment | FTE 1 | Ratio 1 | Ratio 2 | Ratio 3 | Ratio 4 | |

|---|---|---|---|---|---|---|---|---|---|---|

| N° | (t × 1000) | Millions EUR | N° | N° | % Sales | |||||

| (1) | (2) | (3) | (4) | (5) | (2)/(1) | (3)/(1) | (4)/(1) | (3)/(4) | ||

| United Kingdom | 473 | 195 | 1023 | 3285 | 2802 | 412 | 2.16 | 6.95 | 0.31 | 20.65 |

| France | 2700 | 220 | 765 | 15,064 | 8837 | 81 | 0.28 | 5.58 | 0.05 | 15.44 |

| Spain | 2990 | 295 | 627 | 17,811 | 6534 | 98 | 0.21 | 5.96 | 0.04 | 12.66 |

| Greece | 328 | 135 | 584 | 3986 | 3482 | 411 | 1.78 | 12.15 | 0.15 | 11.79 |

| Sum 1 * | 6491 | 845 | 2999 | 40,146 | 21,655 | 251 | 1.11 | 7.66 | 0.14 | 60.53 |

| % | 51.94 | 59.40 | 61.30 | 53.20 | 49.58 | |||||

| Italy | 711 | 201 | 557 | 5460 | 3289 | 282 | 0.78 | 7.68 | 0.10 | 11.24 |

| Germany | 293 | 41 | 129 | 1638 | 983 | 139 | 0.44 | 5.59 | 0.08 | 2.60 |

| Denmark | 107 | 48 | 185 | 549 | 366 | 448 | 1.73 | 5.13 | 0.34 | 3.73 |

| Ireland | 289 | 44 | 168 | 1948 | 1027 | 152 | 0.58 | 6.74 | 0.09 | 3,39 |

| Sum 2 ** | 7942 | 1238 | 4099 | 49,794 | 27,369 | 254 | 0.93 | 6.56 | 0.15 | 81.50 |

| % | 63.30 | 83.62 | 82.75 | 65.94 | 62.59 | |||||

| Malta | 6 | 14 | 164 | 301 | 256 | 2333 | 27.33 | 50.17 | 0.54 | 3.31 |

| Poland | 1242 | 38 | 110 | 8759 | 5256 | 30 | 0.09 | 7.05 | 0.01 | 2.22 |

| Others | 3357 | 191 | 581 | 16,665 | 10,848 | 56 | 0.17 | 4.96 | 0.03 | 11.73 |

| Total | 12,547 | 1481 | 4954 | 75,519 | 43,729 | 118 | 394 | 6.02 | 394 | 100 |

| Average | 1136 | 129 | 444 | 6860 | 39,700 | 404 | 3.23 | 10.72 | 0.16 | |

| Standard Deviation | 1200 | 91 | 294 | 6354 | 3379 | 627 | 7.65 | 12.62 | 0.16 |

| Country | VAL | EBIT | ROI | Mean Wage | Labour Productivity | Capital Productivity | Future Expect Index |

|---|---|---|---|---|---|---|---|

| Million EUR | Million EUR | % | Thousand EUR | Thousand EUR | Thousand EUR | ||

| (1) | (2) | (3) | (4) | (5) | (2)/(1) | (4)/(1) | |

| United Kingdom | 286 | 127 | 14.6 | 36.6 | 101.8 | 33.00 | 3.70 |

| France | 421 | 130 | 12.7 | 25.1 | 47.7 | 40.80 | −1.40 |

| Spain | 238 | 74 | 10.8 | 22.4 | 36.6 | 34.70 | −0.60 |

| Greece | 209 | 145 | 13.4 | 16.2 | 60.3 | 19.30 | 0.10 |

| Italy | 185 | 103 | 24.1 | 37.2 | 97.7 | 42.90 | 28.20 |

| Denmark | 44 | 12 | 5.9 | 65.7 | 127.7 | 21.90 | 0.40 |

| Ireland | 71 | 40 | 21.1 | 28.5 | 69.2 | 37.20 | 0.80 |

| Malta | 18 | 13 | 50.5 | 17.1 | 82.6 | 70.10 | 0.80 |

| Others | 225 | 120 | 13.76 | 26.41 | 69.99 | 29.61 | 0.73 |

| Total | 1701 | 767 | 14.5 | 24.6 | 57.3 | 32.20 | 3.10 |

| First 8 | |||||||

| Average | 184 | 80 | 19.14 | 31.10 | 77.95 | 37.49 | 4.00 |

| Other nations * | |||||||

| Average | 30 | 15 | 13.76 | 26.41 | 69.99 | 29.61 | 0.73 |

| Standard deviation | 26 | 18 | 18.27 | 19.53 | 49.00 | 25.89 | 7.11 |

| World | 20.3 |

|---|---|

| Europe | 21.6 |

| North America | 22.4 |

| South America | 10.5 |

| Asia | 24.1 |

| Africa | 9.9 |

| Fresh | 2 |

| Frozen | 14 |

| Transformed | 5 |

| Cured fish | 4 |

| Others | 5 |

| Different Trout Cuts | Area 1 | Area 2 | Area 3 | Area 4 | Area 5 | Area 6 |

|---|---|---|---|---|---|---|

| Trout fillet | 12.73 | 13.06 | 12.28 | 13.50 | 11.90 | 10.90 |

| Whole white trout | 6.50 | 6.70 | 5.95 | 6.81 | 7.41 | 5.94 |

| Whole salmon trout | 9.93 | 10.40 | 9.97 | 9.10 | 7.60 | 7.62 |

| Gutted salmon trout | 7.51 | 7.77 | 6.90 | 6.95 | 7.10 | 6.99 |

| Ethical Certification | Quality Certification | ||

|---|---|---|---|

| Social | Environmental | ||

| Community rights | Land use | Food safety | |

| Wages of workers | Pollution | Quality of food | |

| Working conditions | Protection of biodiversity | Traceability | |

| Work safety | Use of resources |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

D’Agaro, E.; Gibertoni, P.; Esposito, S. Recent Trends and Economic Aspects in the Rainbow Trout (Oncorhynchus mykiss) Sector. Appl. Sci. 2022, 12, 8773. https://doi.org/10.3390/app12178773

D’Agaro E, Gibertoni P, Esposito S. Recent Trends and Economic Aspects in the Rainbow Trout (Oncorhynchus mykiss) Sector. Applied Sciences. 2022; 12(17):8773. https://doi.org/10.3390/app12178773

Chicago/Turabian StyleD’Agaro, Edo, PierPaolo Gibertoni, and Stefano Esposito. 2022. "Recent Trends and Economic Aspects in the Rainbow Trout (Oncorhynchus mykiss) Sector" Applied Sciences 12, no. 17: 8773. https://doi.org/10.3390/app12178773

APA StyleD’Agaro, E., Gibertoni, P., & Esposito, S. (2022). Recent Trends and Economic Aspects in the Rainbow Trout (Oncorhynchus mykiss) Sector. Applied Sciences, 12(17), 8773. https://doi.org/10.3390/app12178773