Optimal Reserve and Energy Scheduling for a Virtual Power Plant Considering Reserve Activation Probability

Abstract

:1. Introduction

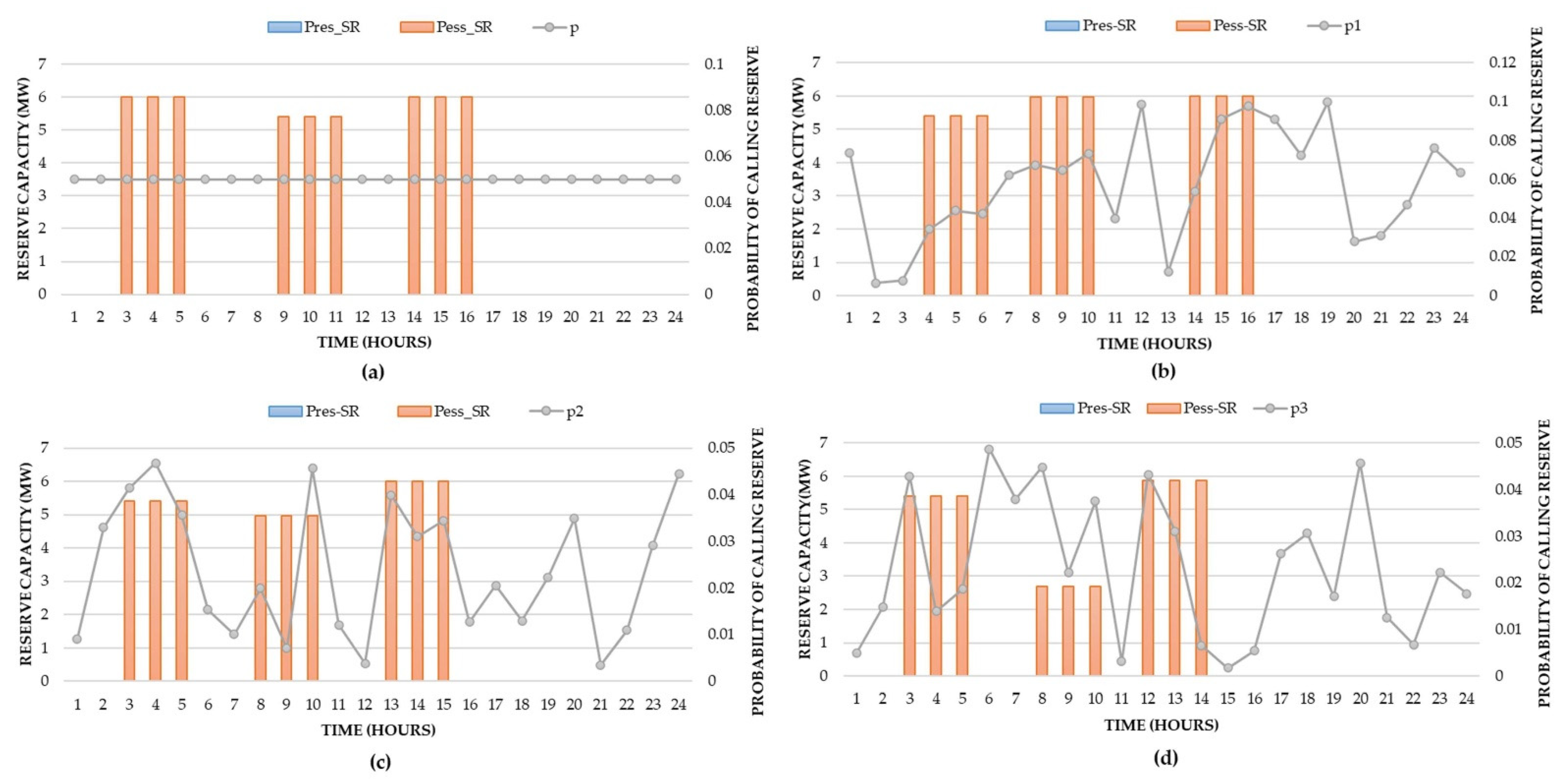

- The research focuses on the VPP’s optimal reserve sizing problem considering the probability of reserve activation each hour. Depending on the status of reserve activation, the VPP’s operating scheme in electricity markets is determined to maximize the VPP’s profit.

- The proposed optimal model is based on a two-stage chance-constrained problem which allows a certain risk level in the VPP’s scheduling. This model is suitable for the short-term planning of power systems with uncertain resources and demand.

- The impact of ESS sizing, RES sizing, and the probability of reserve activation on the VPP’s optimal reserve sizing is analyzed.

2. Problem Description

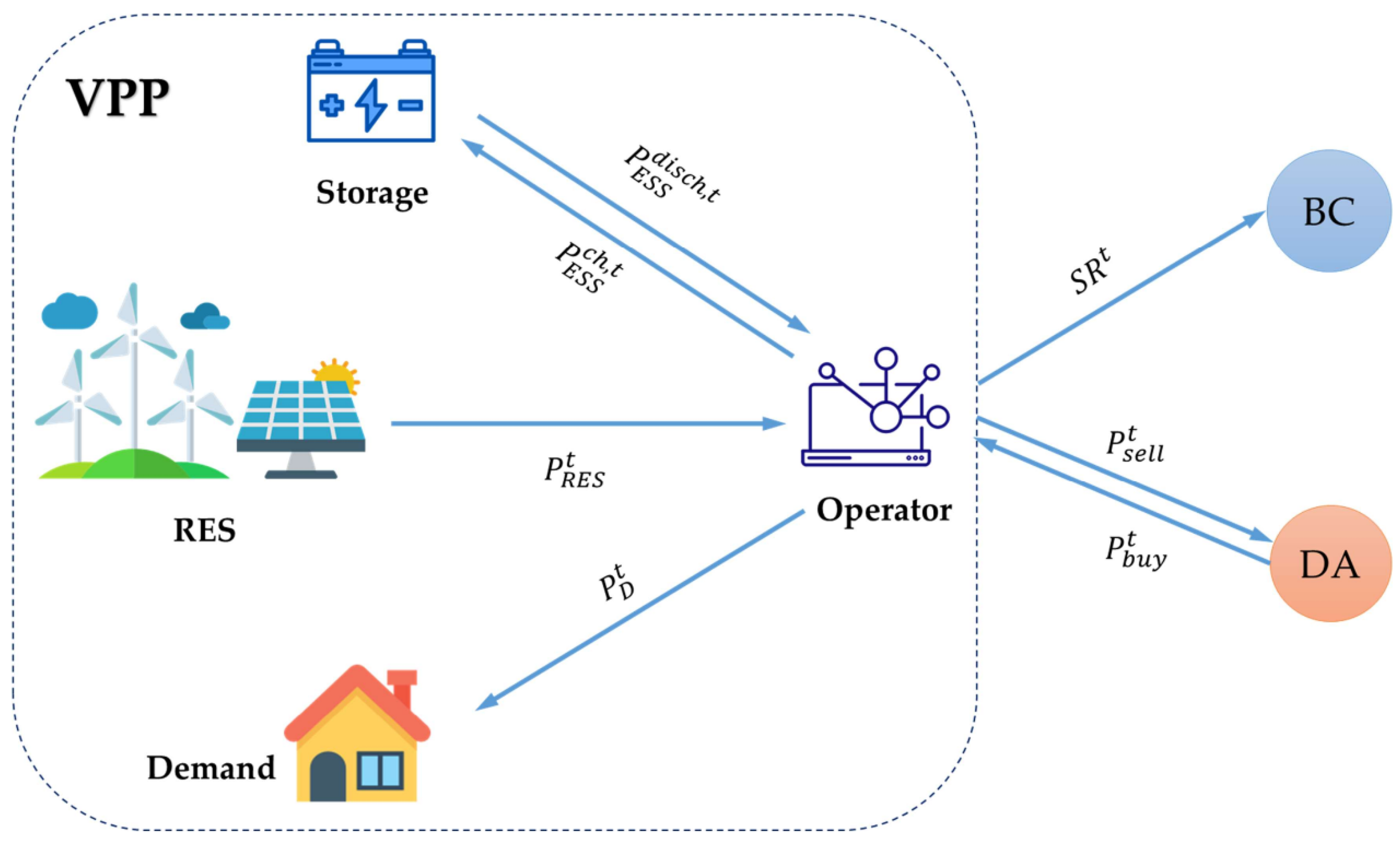

2.1. Coordination between the VPP and the Power Market

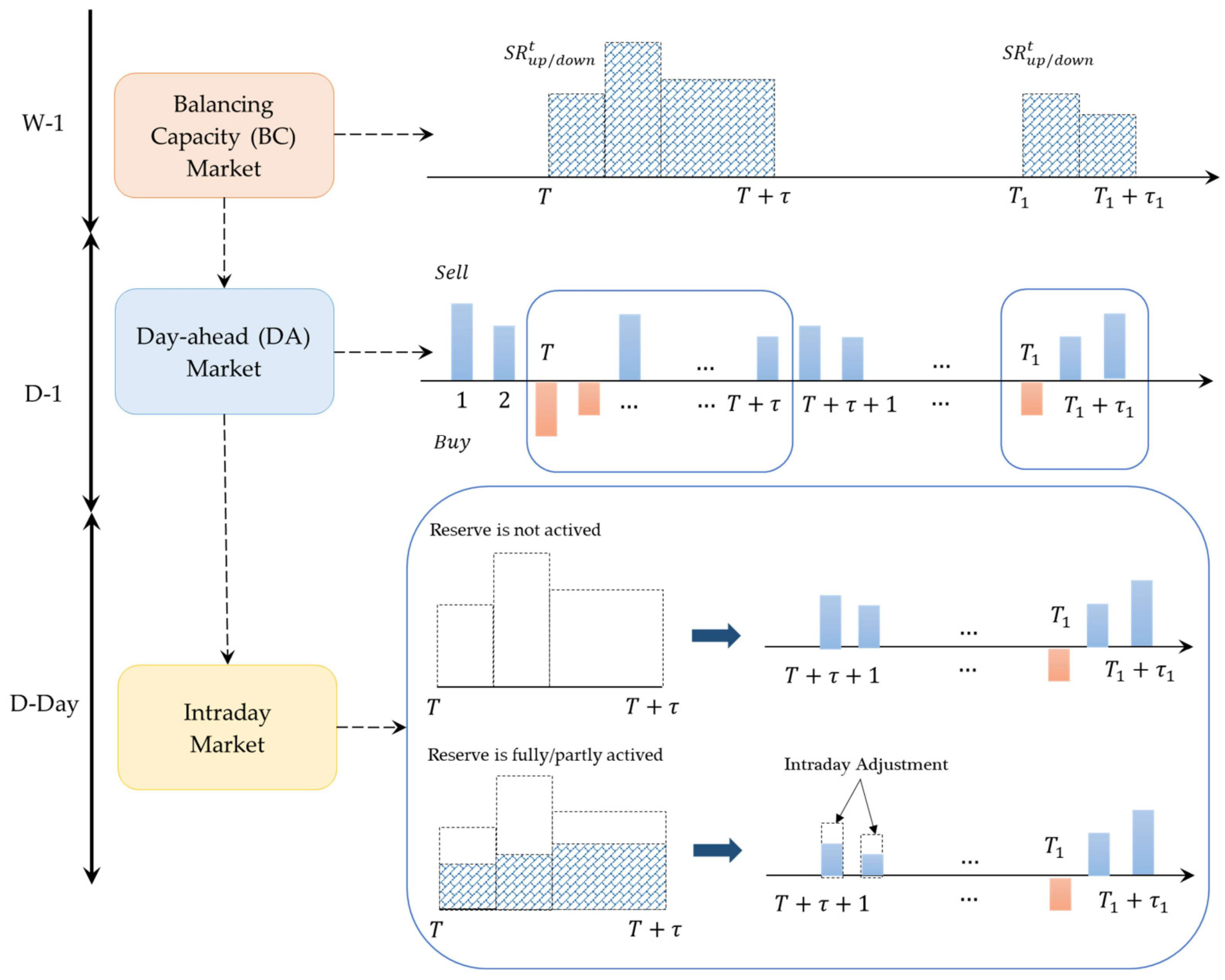

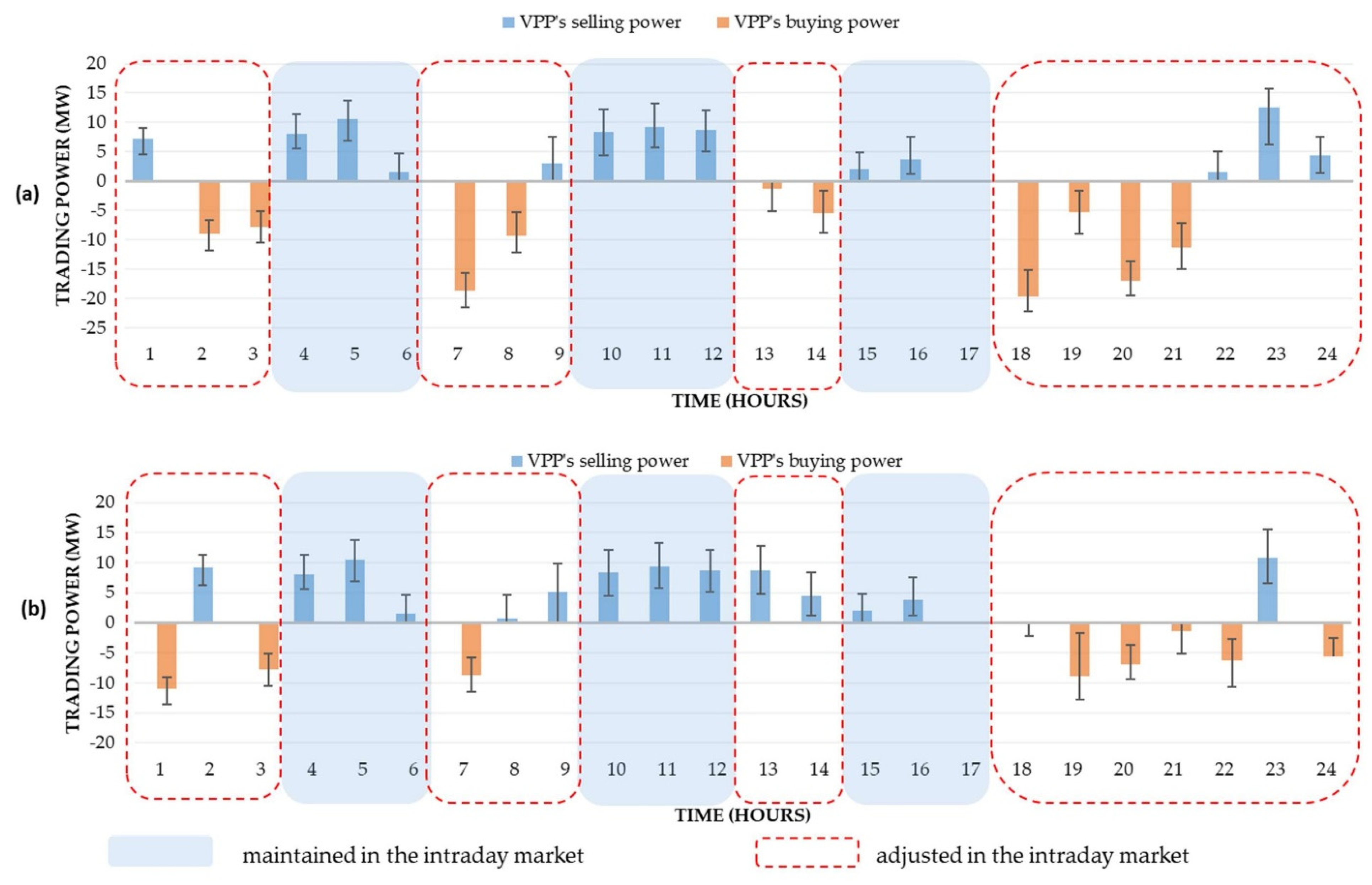

- In the first stage, the VPP decides its trading strategy in the BC market a few days before operating based on the long-term forecasted value. The reserve capacity should be higher than the minimum bid amount and be maintained over the required continuous operating duration . The variable is a here-and-now decision made before the realization of uncertain parameters.

- After determining , the VPP should predict its energy trading scenarios at hour t on the operating day. These scenarios are based on long-term forecasts and will be revised in the day-ahead market with the short-term forecast figures for load and RESs. At the same time, the scenarios of reserve activation are also taken into account to predict the amount of buying/selling energy that needs to be adjusted in the intraday market.

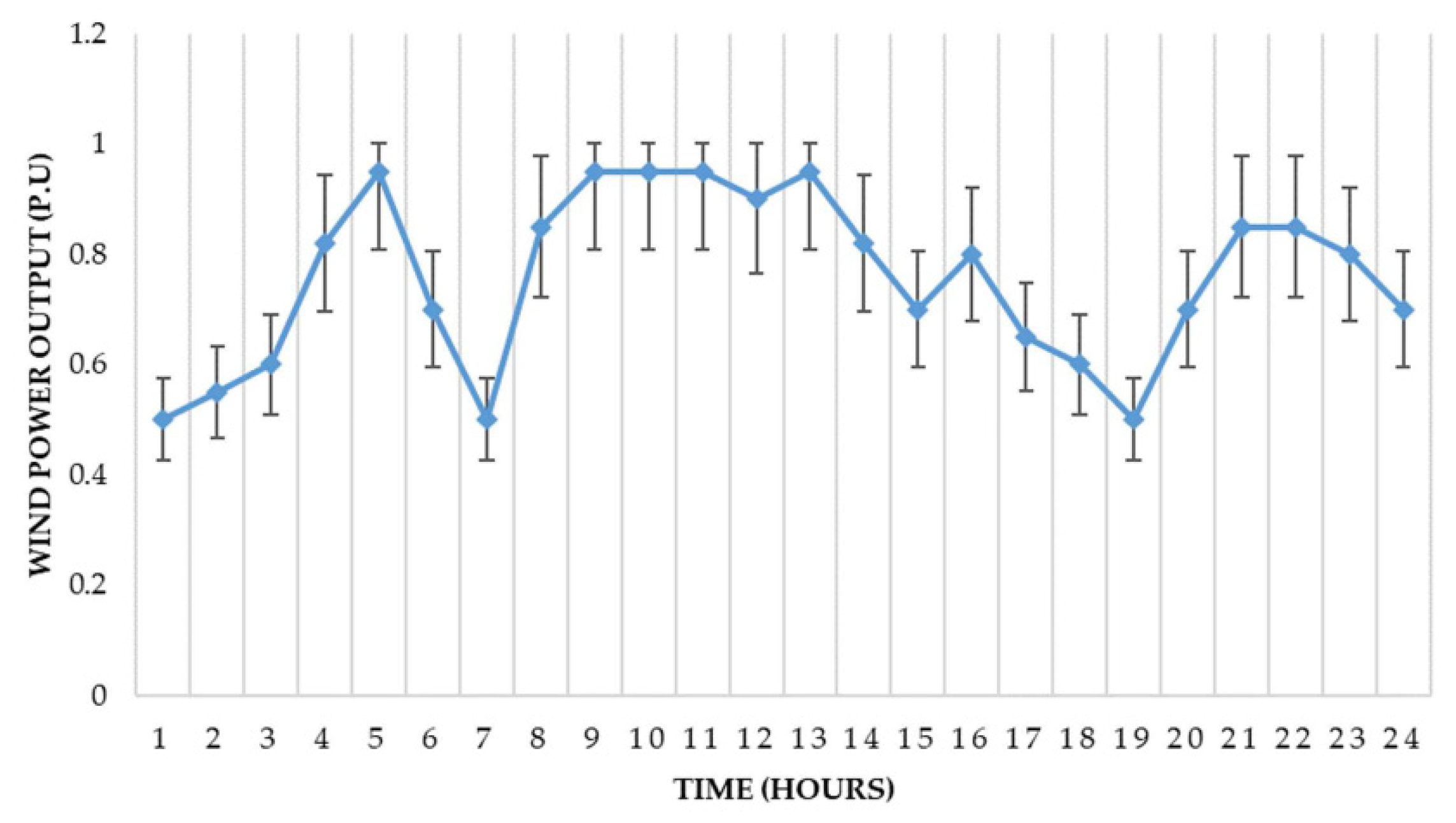

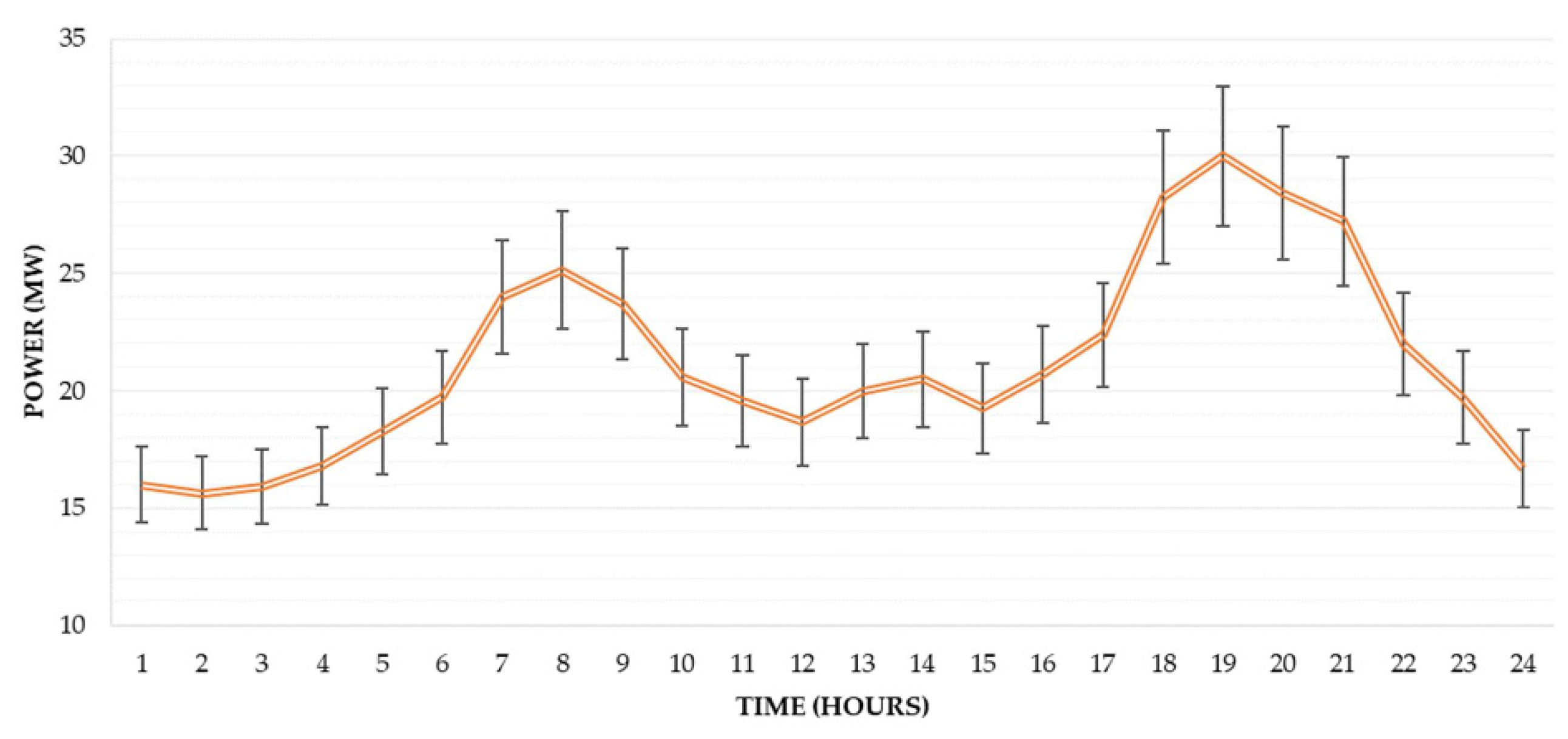

2.2. Uncertainty Parameters

3. Mathematical Formulation

3.1. Objective Function

3.2. Constraints

3.2.1. The First-Stage Constraints:

3.2.2. The Second-Stage Constraints

- Case 1: The reserve bid is activated:

- RES operating constraint: For a given forecasted available power and the minimum power threshold , the power output of the RES must satisfy Equation (5). Equation (6) shows that RES can supply electricity directly to the local loads and contribute to the contract of the VPP in the BC market and the DA market. Besides, RES’s excess energy (if any) is stored in the ESS to utilize RES’s available power output.

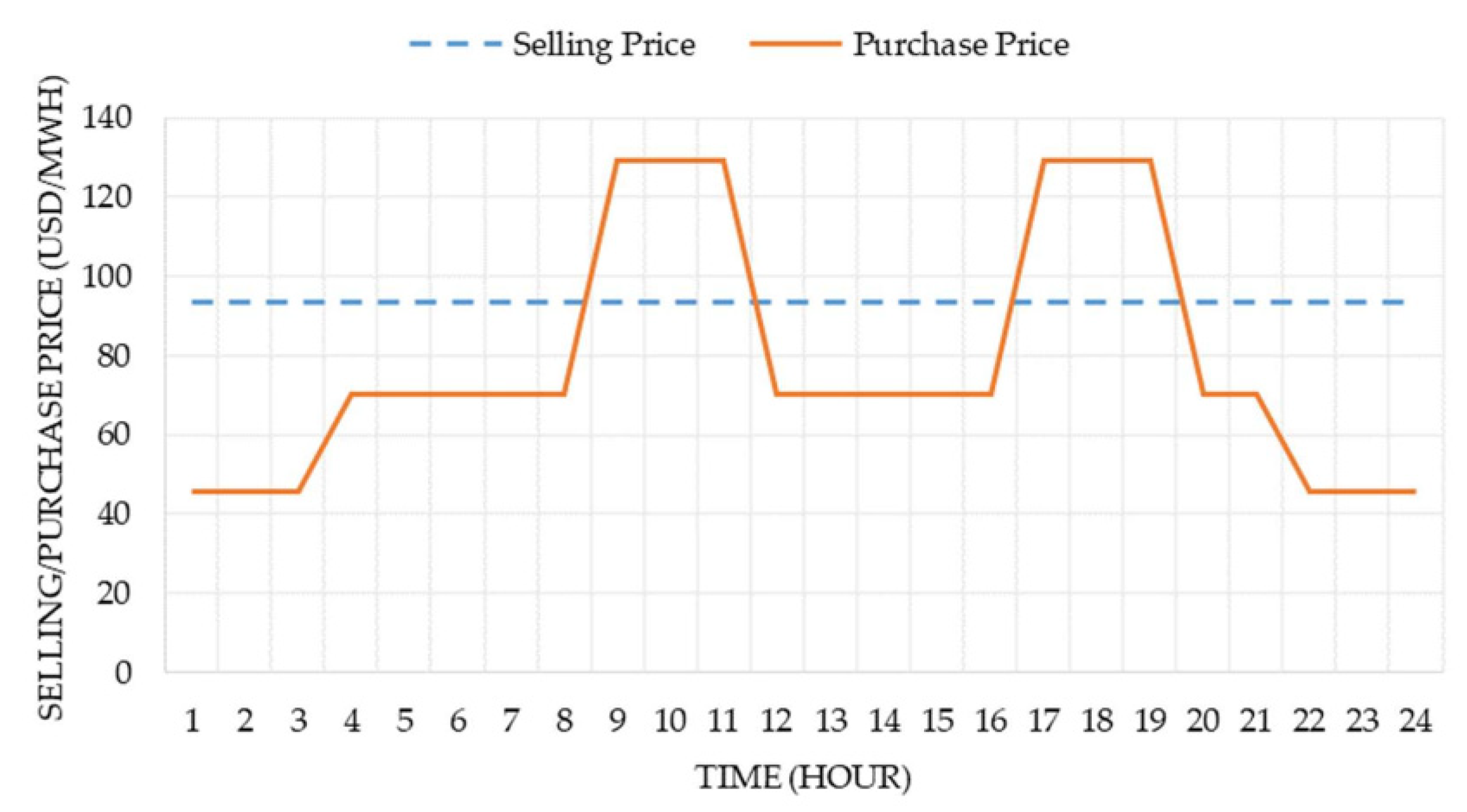

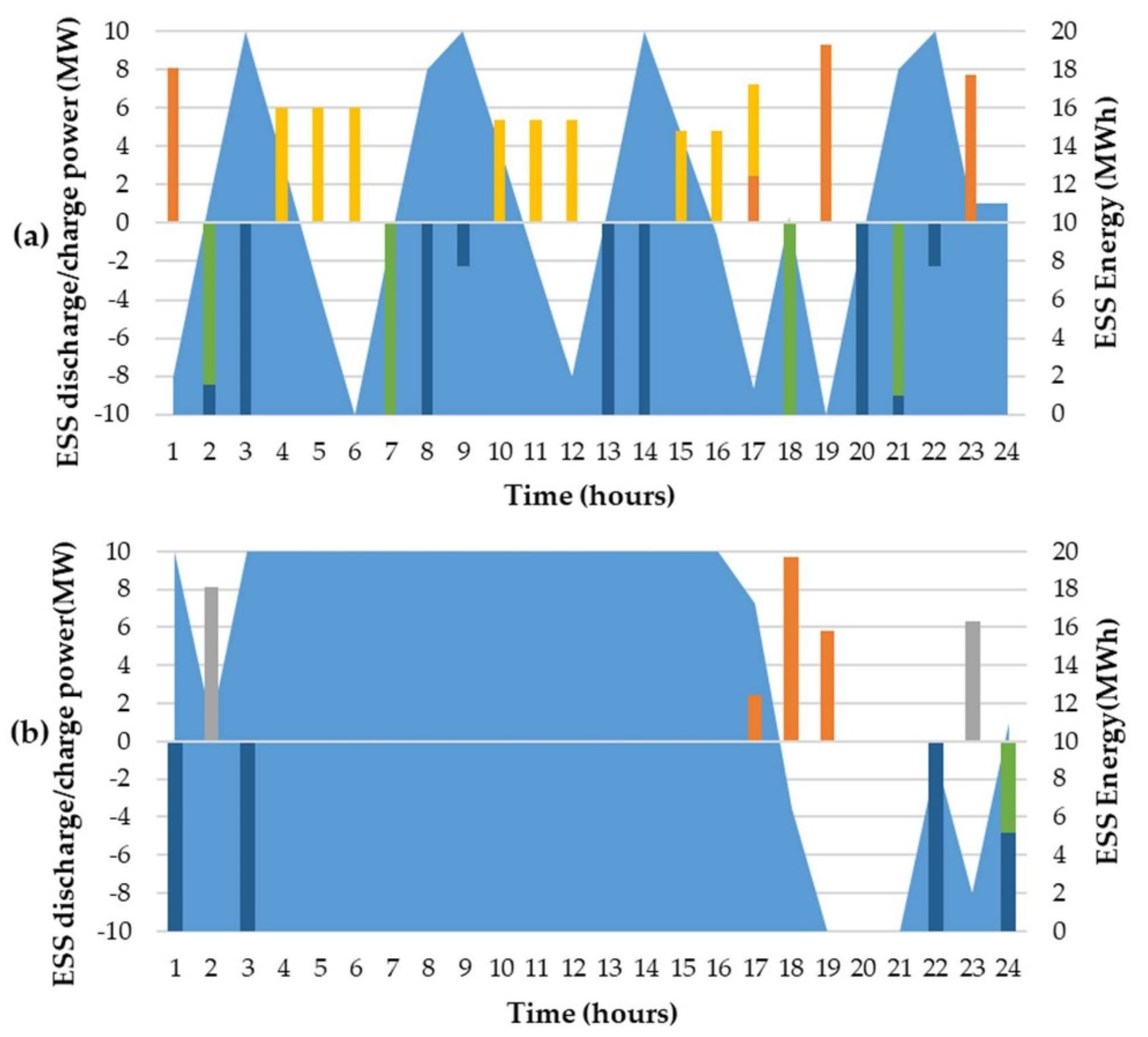

- ESS constraints: This article uses ESS to store the excess power of RESs or purchased power from the DA market if the electricity price is low. The stored energy will be released to supply the peak load of VPP or sell to both BC and DA markets if the electricity price is high. Equations (7) and (8) show that the charging/discharging power of the ESS is limited by the rated power . In these constraints, the binary variable makes sure that the ESS can only be in one state: charging or discharging. Equation (9) shows that the energy stored in the ESS should be limited by its rated capacity at all times. Furthermore, Equation (10) makes sure that the energy stored in the ESS will be set to a certain value after each operating day.

- Day-ahead market’s constraints: Constraints (11) and (12) show the role of RES and ESS in the DA market. Meanwhile, constraint (13) shows that the arbitrage between the BC and the DA market is not permitted. This means that the VPP is not allowed to buy electricity from the DA in order to sell to the BC market at the same time.

- Active power balance constraint: The VPP’s operator must balance demand and supply in all operating scenarios. If the reserve bids are called on to produce, the total active power output from RES and ESS must meet the demand and the power supplied to the main grid according to the signed BC and DA contract. This equation is formulated as a probability constraint to guarantee that the probability of power imbalance is less than a risk level , even if the difference between the real-time data and the predicted value of is quite high.

- 2.

- Case 2: The reserve bid is not activated:

- RES operating constraint:

- ESS constraints:

- Day-ahead market’s constraints:

- Active power balance constraint:

- 3.

- Constraint shows the association between case 1 and case 2:

3.3. Sample Average Approximation Methodology

| Algorithm 1. SAA method combined K-means clustering technique |

|

4. Results and Discussion

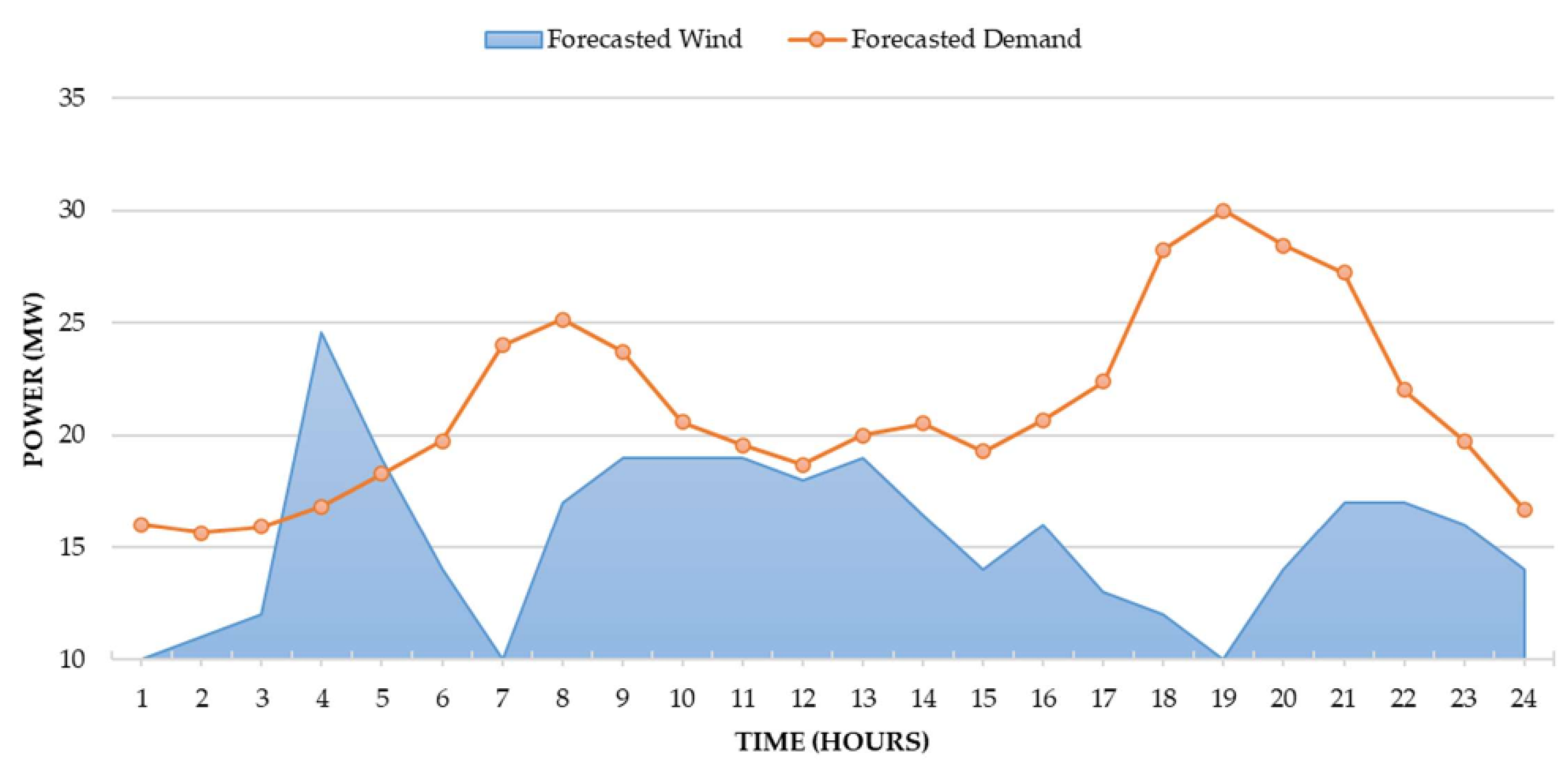

4.1. Study System

4.2. Optimization Results

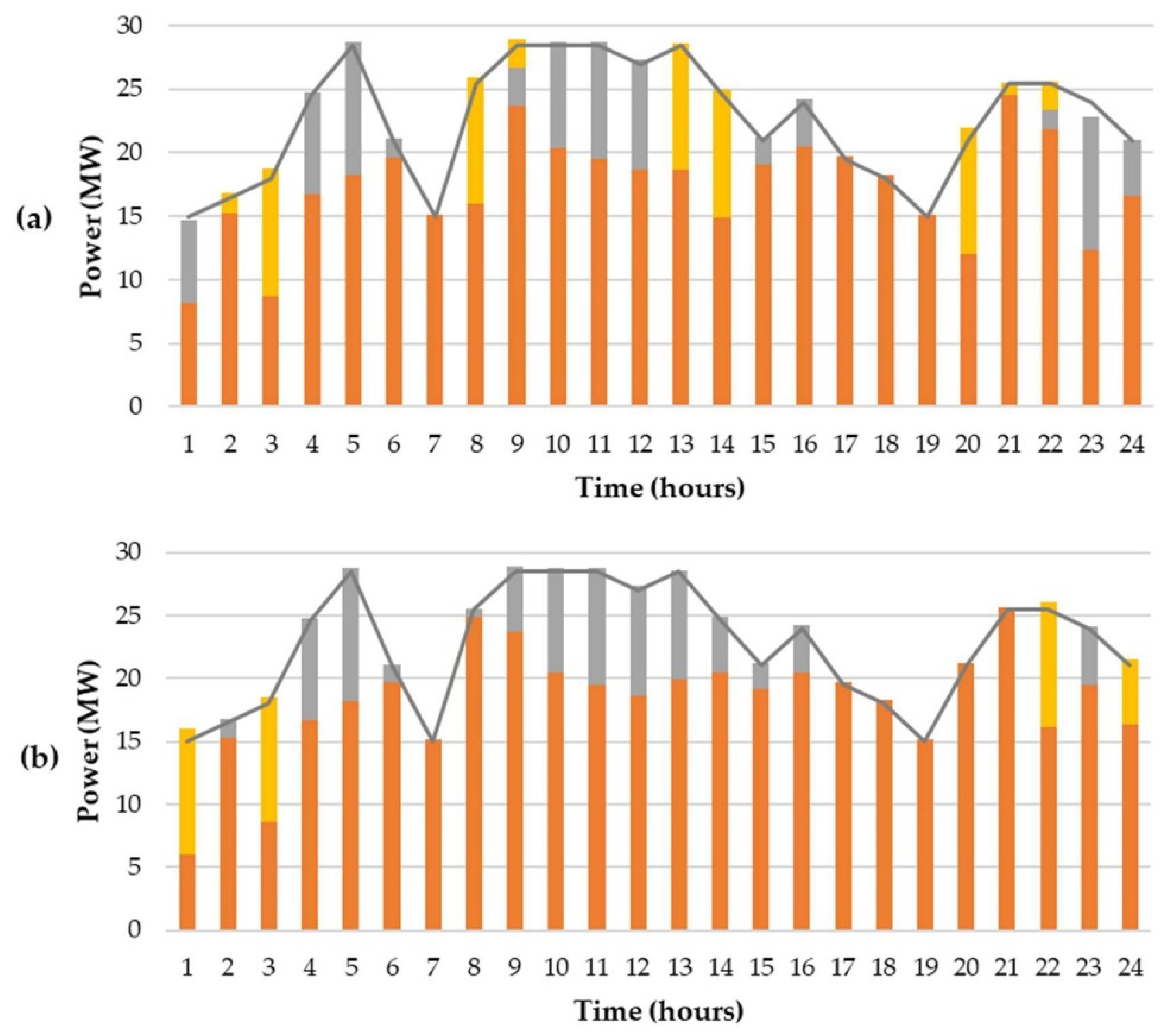

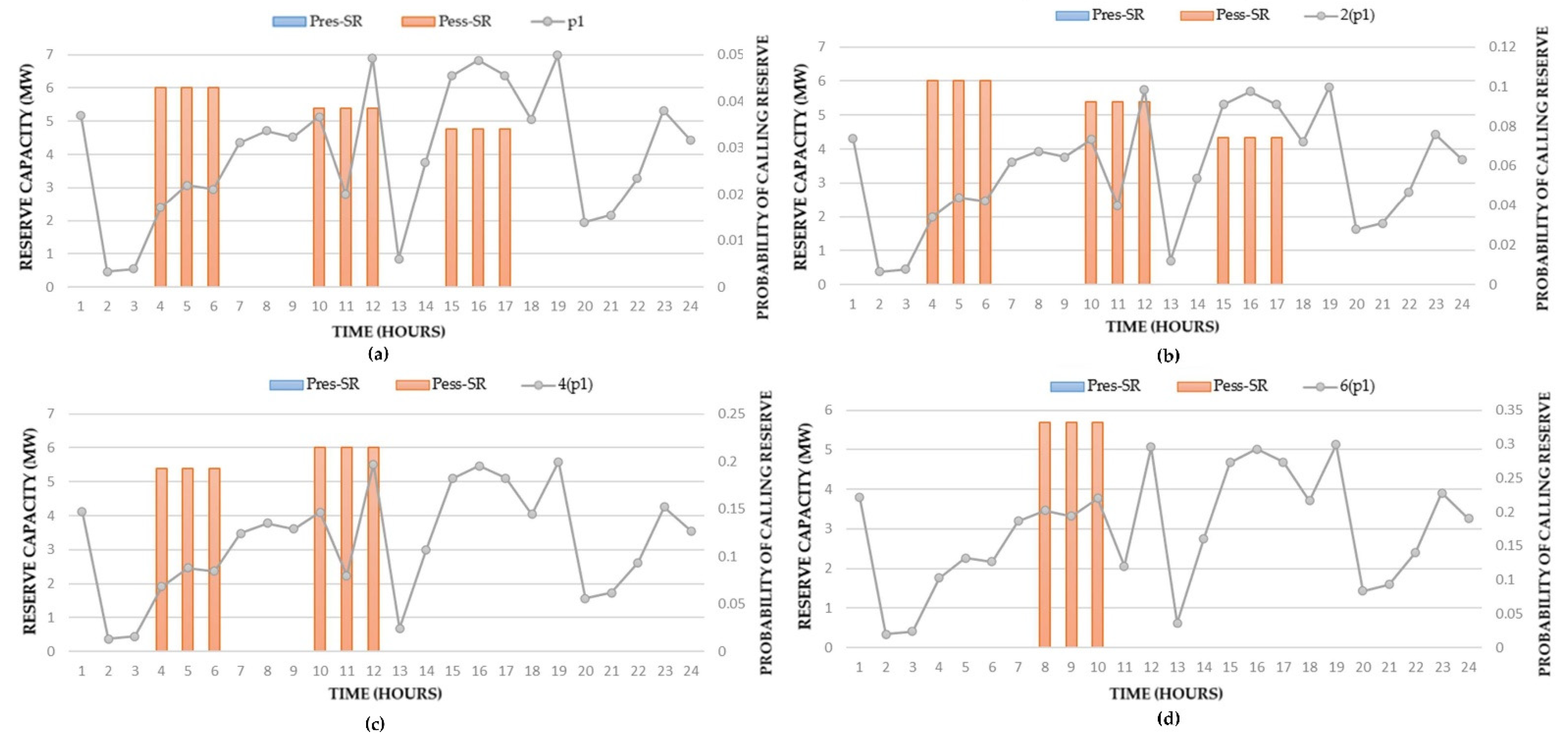

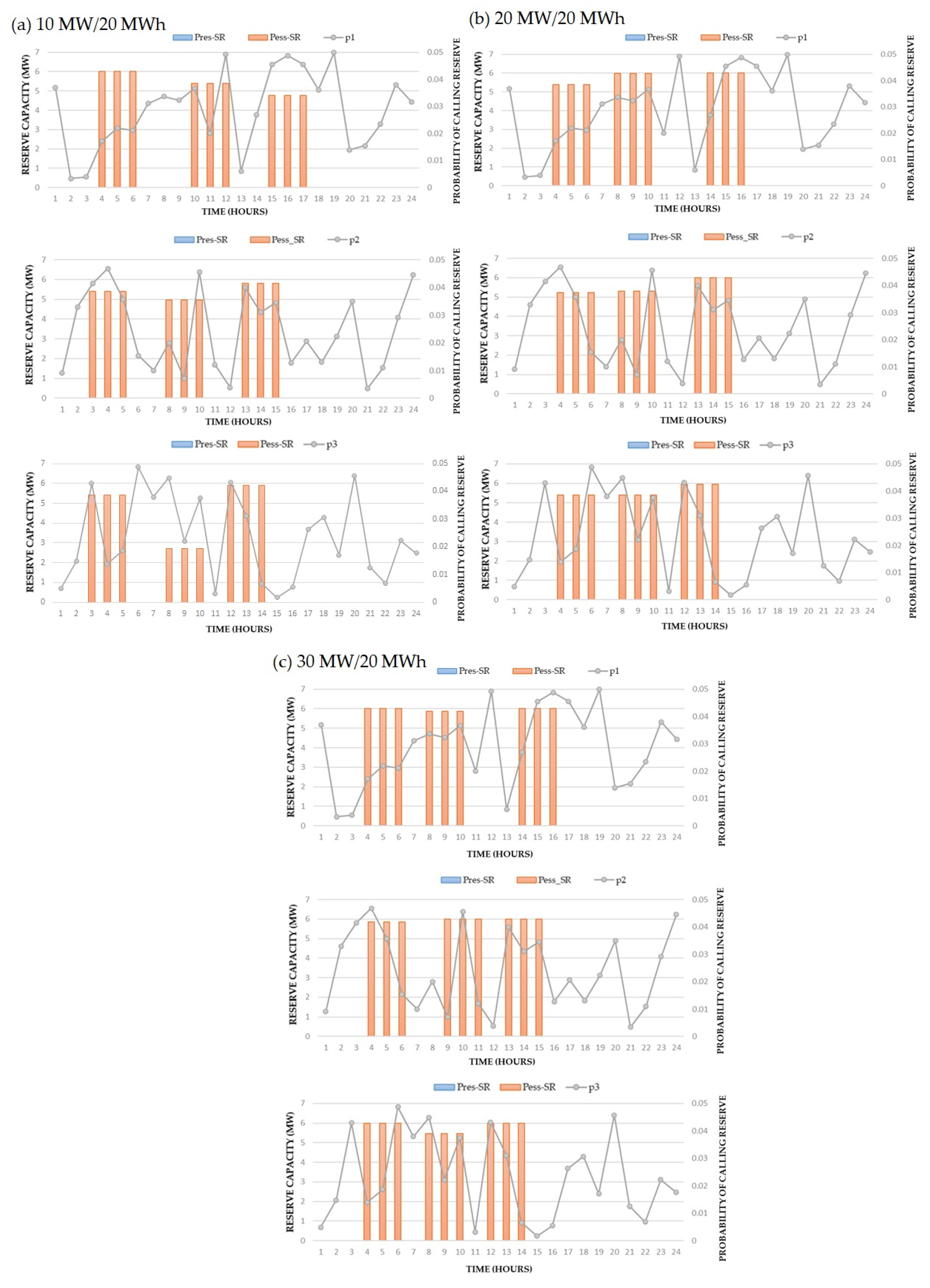

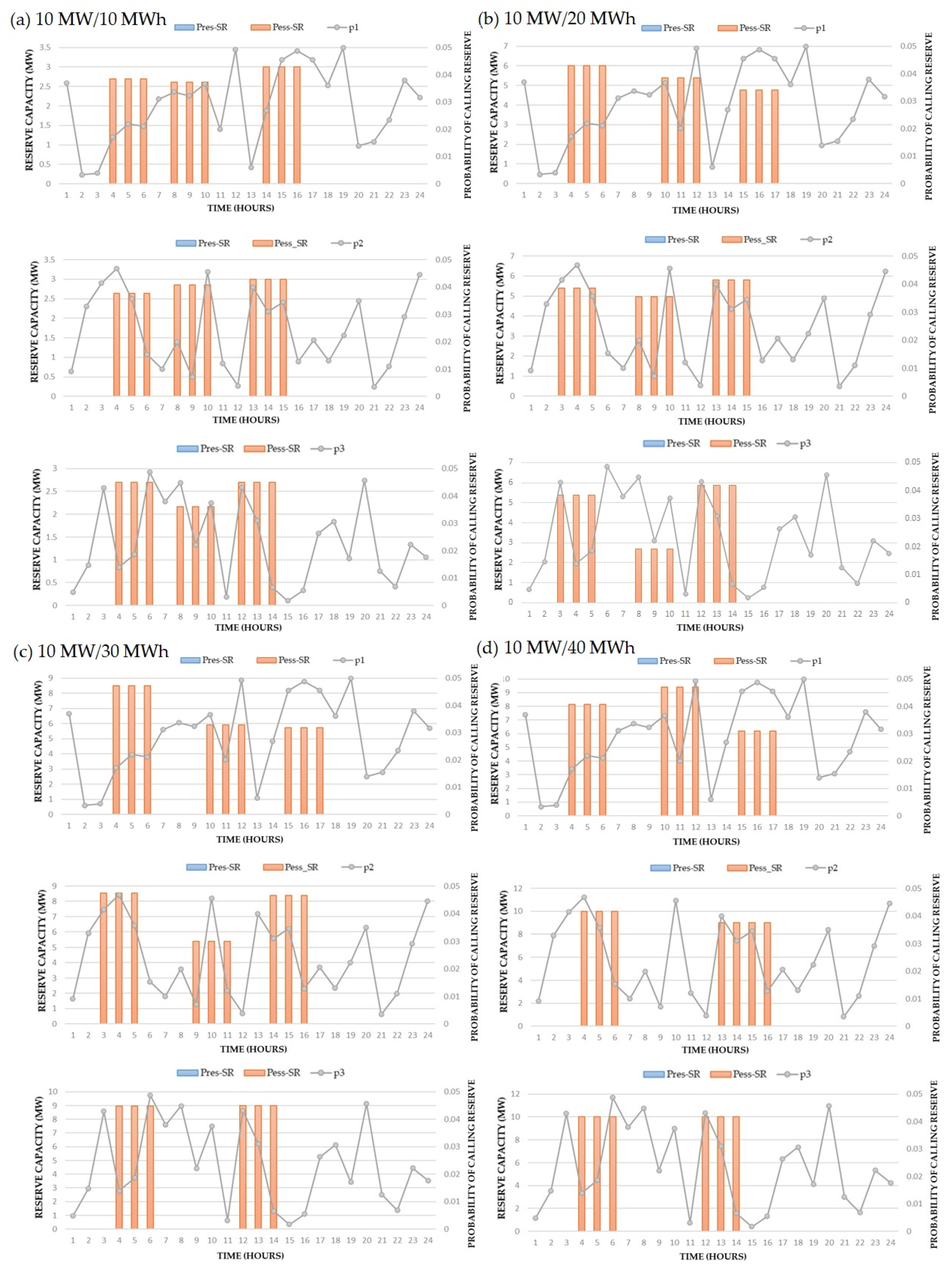

4.2.1. The Impact of the Reserve Activation Probability

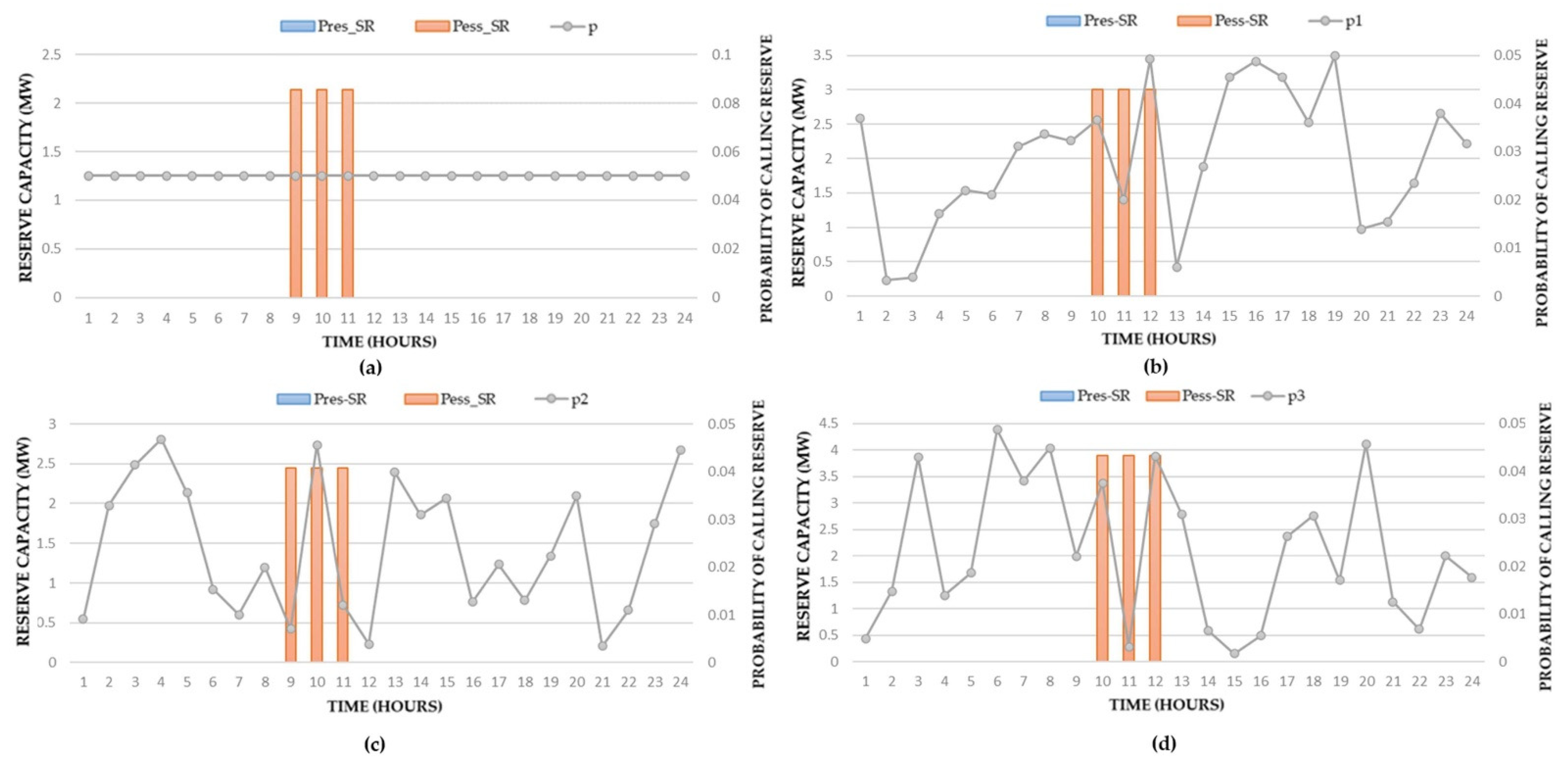

4.2.2. The Impact of the RES Sizing

4.2.3. The Impact of the ESS Sizing

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Nomenclature

| Indices and Sets | |

| Time intervals (of variable duration). | |

| Reserve activation cases: 1—fully reserve activation, 2—no reserve activation | |

| Random vector. | |

| Constants | |

| Reserve capacity price ($/MW). | |

| Reserve energy price at time t ($/MWh). | |

| Selling price in the energy market at time t ($/MWh). | |

| Buying price in the energy market at time t ($/MWh). | |

| RES power rating (MW). | |

| Minimum reserve provisioning period (hours). | |

| Minimum duration between two reserve provisioning periods (hours). | |

| ESS power rating (MW). | |

| ESS capacity rating (MWh). | |

| ESS minimum energy level (MWh). | |

| ESS charging/discharging efficiency. | |

| The highest possible value of demand (MW). | |

| A sufficiently large constant | |

| Semi-constants | |

| RES forecasted power output at time t (MW). | |

| Forecast error of RES power output at time t (%). | |

| Forecasted demand at time t (MW). | |

| Forecast error of demand at time t (%). | |

| Probability of fully reserve activation at time t. | |

| Variables | |

| A binary variable which equals 1 if the VPP sells reserve capacity at time t. | |

| A binary variable which equals 1 if the VPP starts a reserve provisioning period at time t. | |

| A binary variable which equals 1 if the VPP stops a reserve provisioning period at time t. | |

| Reserve capacity at time t (MW). | |

| Reserve capacity provided by RES at time t (MW). | |

| Reserve capacity provided by ESS at time t (MW). | |

| A binary variable that shows VPP’s buy/sell situation in the energy market at time t, 1 for buying and 0 for selling. | |

| Total active power sold by the VPP in the energy market at time t in case i (MW). | |

| Total active power bought by the VPP in the energy market at time t in case i (MW). | |

| RES on/off state at time t (binary). | |

| RES actual power output at time t in case i (MW). | |

| RES power output provides to the main grid at time t in case i (MW). | |

| RES power output provides to demand at time t in case i (MW). | |

| RES power output provides to ESS at time t in case i (MW). | |

| ESS charging state at time t in case i (binary). | |

| ESS charge power at time t in case i (MW) | |

| ESS discharge power at time t in case i (MW) | |

| ESS power output provided from the main grid at time t in case i (MW). | |

| ESS power output sold to the main grid at time t in case i (MW). | |

| ESS power output supply to demand at time t in case i (MW). | |

| ESS energy at time t in case i (MWh). | |

| ESS initial energy at t = 0 (MWh). | |

| ESS energy at the end of the day (t = 24) (MWh). | |

References

- Arias, J. Solar Energy, Energy Storage and Virtual Power Plants in Japan. Available online: https://www.eu-japan.eu/sites/default/files/publications/docs/min18_1_arias_solarenergy-energystorageandvirtualpowerplantsinjapan.pdf (accessed on 18 September 2021).

- Wassermann, S.; Reeg, M.; Nienhaus, K. Current challenges of Germany’s energy transition project and competing strategies of challengers and incumbents: The case of direct marketing of electricity from renewable energy sources. Energy Policy 2015, 76, 66–75. [Google Scholar] [CrossRef]

- Neme, C.; Energy Futures Group; Cowart, R.; Regulator Assistance Project. Energy Efficiency Participation in Electricity Capacity Markets—The US Experience; Regulator Assistance Project: Montpelier, VT, USA, 2014. [Google Scholar]

- Oureilidis, K.; Malamaki, K.N.; Gallos, K.; Tsitsimelis, A.; Dikaiakos, C.; Gkavanoudis, S.; Cvetkovic, M.; Mauricio, J.M.; Ortega, J.M.M.; Ramos, J.L.M.; et al. Ancillary services market design in distribution networks: Review and identification of barriers. Energies 2020, 13, 917. [Google Scholar] [CrossRef] [Green Version]

- Helman, U. Distributed energy resources in the US wholesale markets: Recent trends, new models, and forecasts. In Consumer, Prosumer, Prosumager: How Service Innovations Will Disrupt the Utility Business Model; Academic Press/Elsevier: San Diego, CA, USA, 2019; pp. 431–469. ISBN 9780128168356. [Google Scholar]

- IRENA. Redesigning Capacity Markets: Innovation Landscape Brief; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2019; ISBN 978-92-9260-130-0. [Google Scholar]

- Bai, H.; Miao, S.; Ran, X.; Ye, C.; Bai, H.; Miao, S.; Ran, X.; Ye, C. Optimal Dispatch Strategy of a Virtual Power Plant Containing Battery Switch Stations in a Unified Electricity Market. Energies 2015, 8, 2268–2289. [Google Scholar] [CrossRef] [Green Version]

- Mashhour, E.; Moghaddas-Tafreshi, S.M. Bidding Strategy of Virtual Power Plant for Participating in Energy and Spinning Reserve Markets—Part I: Problem Formulation. IEEE Trans. Power Syst. 2011, 26, 949–956. [Google Scholar] [CrossRef]

- Pudjianto, D.; Ramsay, C.; Strbac, G. Microgrids and virtual power plants: Concepts to support the integration of distributed energy resources. Proc. Inst. Mech. Eng. Part A J. Power Energy 2008, 222, 731–741. [Google Scholar] [CrossRef]

- Sikorski, T.; Jasiński, M.; Ropuszyńska-Surma, E.; Węglarz, M.; Kaczorowska, D.; Kostyła, P.; Leonowicz, Z.; Lis, R.; Rezmer, J.; Rojewski, W.; et al. A Case Study on Distributed Energy Resources and Energy-Storage Systems in a Virtual Power Plant Concept: Economic Aspects. Energies 2019, 12, 4447. [Google Scholar] [CrossRef] [Green Version]

- Pudjianto, D.; Ramsay, C.; Strbac, G. Virtual power plant and system integration of distributed energy resources. IET Renew. Power Gener. 2007, 1, 10–16. [Google Scholar] [CrossRef]

- Naval, N.; Yusta, J.M. Virtual power plant models and electricity markets—A review. Renew. Sustain. Energy Rev. 2021, 149, 111393. [Google Scholar] [CrossRef]

- Rahimiyan, M.; Baringo, L. Strategic Bidding for a Virtual Power Plant in the Day-Ahead and Real-Time Markets: A Price-Taker Robust Optimization Approach. IEEE Trans. Power Syst. 2016, 31, 2676–2687. [Google Scholar] [CrossRef]

- Gazijahani, F.S.; Salehi, J. IGDT-Based Complementarity Approach for Dealing with Strategic Decision Making of Price-Maker VPP Considering Demand Flexibility. IEEE Trans. Ind. Inform. 2020, 16, 2212–2220. [Google Scholar] [CrossRef]

- Koraki, D.; Strunz, K. Wind and solar power integration in electricity markets and distribution networks through service-centric virtual power plants. IEEE Trans. Power Syst. 2018, 33, 473–485. [Google Scholar] [CrossRef]

- Zhao, Q.; Shen, Y.; Li, M. Control and Bidding Strategy for Virtual Power Plants with Renewable Generation and Inelastic Demand in Electricity Markets. IEEE Trans. Sustain. Energy 2016, 7, 562–575. [Google Scholar] [CrossRef]

- Baringo, A.; Baringo, L.; Arroyo, J.M. Day-Ahead Self-Scheduling of a Virtual Power Plant in Energy and Reserve Electricity Markets under Uncertainty. IEEE Trans. Power Syst. 2019, 34, 1881–1894. [Google Scholar] [CrossRef]

- Mazzi, N.; Trivella, A.; Morales, J.M. Enabling active/passive electricity trading in dual-price balancing markets. IEEE Trans. Power Syst. 2019, 34, 1980–1990. [Google Scholar] [CrossRef] [Green Version]

- Nguyen, H.T.; Le, L.B.; Wang, Z. A Bidding Strategy for Virtual Power Plants with the Intraday Demand Response Exchange Market Using the Stochastic Programming. IEEE Trans. Ind. Appl. 2018, 54, 3044–3055. [Google Scholar] [CrossRef]

- Dabbagh, S.R.; Sheikh-El-Eslami, M.K. Risk Assessment of Virtual Power Plants Offering in Energy and Reserve Markets. IEEE Trans. Power Syst. 2016, 31, 3572–3582. [Google Scholar] [CrossRef]

- Vahedipour-Dahraie, M.; Rashidizade-Kermani, H.; Shafie-khah, M.; Catalao, J.P.S. Risk-Averse Optimal Energy and Reserve Scheduling for Virtual Power Plants Incorporating Demand Response Programs. IEEE Trans. Smart Grid 2020, 1. [Google Scholar] [CrossRef]

- Zhou, Y.; Wei, Z.; Sun, G.; Cheung, K.W.; Zang, H.; Chen, S. Four-level robust model for a virtual power plant in energy and reserve markets. IET Gener. Transm. Distrib. 2019, 13, 2006–2014. [Google Scholar] [CrossRef]

- Ocker, F.; Braun, S.; Will, C. Design of European balancing power markets. Int. Conf. Eur. Energy Mark. EEM 2016. [Google Scholar] [CrossRef] [Green Version]

- Poplavskaya, K.; Lago, J.; de Vries, L. Effect of market design on strategic bidding behavior: Model-based analysis of European electricity balancing markets. Appl. Energy 2020, 270, 115130. [Google Scholar] [CrossRef]

- Hayashi, K.; Mikami, Y.; Hirano, K.; Terayama, H. Development of Large-Scale Hybrid Power Storage System: System Demonstration Project in Lower Saxony, Germany: Hitachi Review. Available online: http://www.hitachi.com/rev/archive/2020/r2020_04/04c02/index.html (accessed on 18 September 2021).

- Bouffard, F.; Galiana, F.D. An Electricity Market with a Probabilistic Spinning Reserve Criterion. IEEE Trans. Power Syst. 2004, 19, 300–307. [Google Scholar] [CrossRef]

- Bruninx, K.; Delarue, E. Endogenous Probabilistic Reserve Sizing and Allocation in Unit Commitment Models: Cost-Effective, Reliable, and Fast. IEEE Trans. Power Syst. 2017, 32, 2593–2603. [Google Scholar] [CrossRef]

- Tahanan, M.; van Ackooij, W.; Frangioni, A.; Lacalandra, F. Large-scale Unit Commitment under uncertainty. 4OR 2015, 13, 115–171. [Google Scholar] [CrossRef] [Green Version]

- Pagnoncelli, B.K.; Ahmed, S.; Shapiro, A.; Ahmed, S.; Shapiro, A. Sample Average Approximation Method for Chance Constrained Programming: Theory and Applications. J. Optim. Theory Appl. 2009, 142, 399–416. [Google Scholar] [CrossRef] [Green Version]

- Wang, Q.; Guan, Y.; Wang, J. A chance-constrained two-stage stochastic program for unit commitment with uncertain wind power output. IEEE Trans. Power Syst. 2012, 27, 206–215. [Google Scholar] [CrossRef]

- Basciftci, B.; Ahmed, S.; Gebraeel, N.Z.; Yildirim, M. Stochastic optimization of maintenance and operations schedules under unexpected failures. IEEE Trans. Power Syst. 2018, 33, 6755–6765. [Google Scholar] [CrossRef]

- Yang, X.; Xu, C.; He, H.; Yao, W.; Wen, J.; Zhang, Y. Flexibility Provisions in Active Distribution Networks with Uncertainties. IEEE Trans. Sustain. Energy 2021, 12, 553–567. [Google Scholar] [CrossRef]

- AEMO Emerging Generation and Energy Storage in the NEM. Available online: https://aemo.com.au/-/media/files/electricity/nem/initiatives/emerging-generation/eges_stakeholder_paper_final.pdf?la=en&hash=5E82D40582C56B34327D120A366EF044 (accessed on 12 October 2021).

- IRENA. Electricity Storage Valuation Framework: Assessing System Value and Ensuring Project Viability; International Renewable Energy Agency: Abu Dhabi, United Arab Emirates, 2020; ISBN 978-92-9260-161-4. [Google Scholar]

- FINGRID. Reserve Products and Reserve Market Places. Available online: https://www.fingrid.fi/globalassets/dokumentit/en/electricity-market/reserves/reserve-products-and-reserve-market-places.pdf (accessed on 18 September 2021).

- Yamin, H.Y. Spinning reserve uncertainty in day-ahead competitive electricity markets for GENCOs. IEEE Trans. Power Syst. 2005, 20, 521–523. [Google Scholar] [CrossRef]

- Zhang, L.; Yuan, Y.; Yuan, X.; Chen, B.; Su, D.; Li, Q. Spinning Reserve Requirements Optimization Based on an Improved Multiscenario Risk Analysis Method. Math. Probl. Eng. 2017, 2017. [Google Scholar] [CrossRef] [Green Version]

- Wang, M.Q.; Yang, M.; Liu, Y.; Han, X.S.; Wu, Q. Optimizing probabilistic spinning reserve by an umbrella contingencies constrained unit commitment. Int. J. Electr. Power Energy Syst. 2019, 109, 187–197. [Google Scholar] [CrossRef]

- Toubeau, J.F.; Bottieau, J.; De Greeve, Z.; Vallee, F.; Bruninx, K. Data-Driven Scheduling of Energy Storage in Day-Ahead Energy and Reserve Markets with Probabilistic Guarantees on Real-Time Delivery. IEEE Trans. Power Syst. 2021, 36, 2815–2828. [Google Scholar] [CrossRef]

- Ahmed, S.; Shapiro, A.; Stewart, H.M. Solving Chance-Constrained Stochastic Programs via Sampling and Integer Programming. In State-of-the-Art Decision-Making Tools in the Information-Intensive Age; Informs: Catonsville, MD, USA, 2008. [Google Scholar] [CrossRef] [Green Version]

- EVN. The Price of Rooftop Solar Power after June 30, 2019 is 1,943 VND/kWh. Available online: https://www.evn.com.vn/d6/news/Gia-dien-mat-troi-mai-nha-sau-thoi-diem-3062019-la-1943-dongkWh-6-12-25351.aspx (accessed on 18 September 2021).

- EVN. Electricity Tariff in the Wholesale Market. Available online: https://www.evn.com.vn/c3/evn-va-khach-hang/Bieu-gia-ban-buon-dien-9-80.aspx (accessed on 18 September 2019).

- Löfberg, J. YALMIP: A toolbox for modeling and optimization in MATLAB. Proc. IEEE Int. Symp. Comput. Control Syst. Des. 2004, 284–289. [Google Scholar] [CrossRef]

| Primary Control Reserve | Secondary Control Reserve 1 | Secondary Control Reserve 2 | Tertiary Control Reserve 1 | Tertiary Control Reserve 2 | |

|---|---|---|---|---|---|

| GF Control Equivalent | LFC | EDC | EDC | ||

| Response time | Within 10 s | Within 5 min | Within 5 min | Within 15 min | Within 15 min |

| Continuous operation time | At least 5 min | At least 5 min | At least 30 min | 3 h | 3 h |

| Clearing time | 1 week ago | 1 week ago | 1 week ago | 1 week ago | 1 day ago |

| Minimum bid amount | 5 MW | 5 MW | 5 MW | 5 MW | 5 MW |

| Maximum/Minimum Energy Storage Limit (MWh) | 20 |

| Discharging/Charging Power (MW) | 10 |

| Charging Efficiency | 90% |

| Scenario | No Reserve | ||||

|---|---|---|---|---|---|

| The optimal profit (USD) | 3548 | 4134 | 4168 | 4230 | 4499 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nguyen Duc, H.; Nguyen Hong, N. Optimal Reserve and Energy Scheduling for a Virtual Power Plant Considering Reserve Activation Probability. Appl. Sci. 2021, 11, 9717. https://doi.org/10.3390/app11209717

Nguyen Duc H, Nguyen Hong N. Optimal Reserve and Energy Scheduling for a Virtual Power Plant Considering Reserve Activation Probability. Applied Sciences. 2021; 11(20):9717. https://doi.org/10.3390/app11209717

Chicago/Turabian StyleNguyen Duc, Huy, and Nhung Nguyen Hong. 2021. "Optimal Reserve and Energy Scheduling for a Virtual Power Plant Considering Reserve Activation Probability" Applied Sciences 11, no. 20: 9717. https://doi.org/10.3390/app11209717

APA StyleNguyen Duc, H., & Nguyen Hong, N. (2021). Optimal Reserve and Energy Scheduling for a Virtual Power Plant Considering Reserve Activation Probability. Applied Sciences, 11(20), 9717. https://doi.org/10.3390/app11209717