The Effects of Corruption in Entrepreneurial Ecosystems on Entrepreneurial Intentions

Abstract

1. Introduction

- The regulative dimension, linked to the laws, rules, norms and government policies that aim to support new firms by reducing the economic risks associated with start-ups and helping entrepreneurs to obtain credit.

- The normative dimension, that refers to culturally shared values regarding the importance of entrepreneurship and being an entrepreneur, and having personal qualities linked to the entrepreneurial field, such as creativity and divergent thinking.

- The cognitive-cultural dimension, that encompasses an individual’s feelings about the extent to which they possess the knowledge and skills required to start and manage a firm and his/her attitudes and perceptions towards entrepreneurship.

2. The Institutional Dimension and Entrepreneurial Intentions

2.1. Entrepreneurial Intentions and Entrepreneurship

2.2. A Differential Analysis of the Effects of Institutional Dimensions on Entrepreneurial Intentions

3. Corruption and Entrepreneurial Intentions

3.1. The Effects of Corruption on Entrepreneurial Intentions: The National Level of Analysis

3.2. The Effects of Corruption on Entrepreneurial Intentions: The Individual Level of Analysis

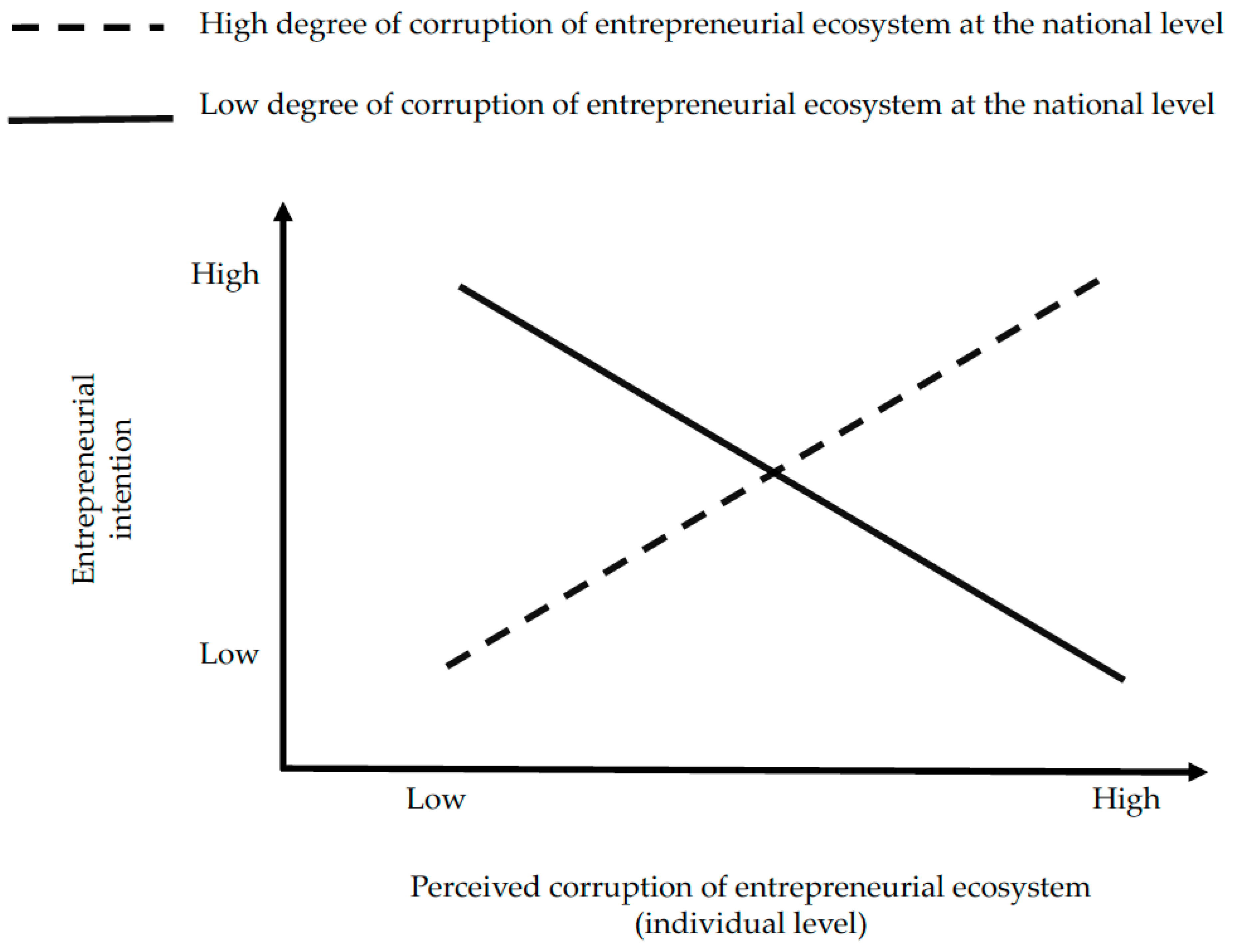

4. The Influence of National Culture on the Relationship between Corruption and Entrepreneurial Intentions: Interaction across Individual and National Levels of Analysis

- Individualism/collectivism (IND): This dimension refers to the extent people tend to act as individuals or as members of a community. In other words, this dimension investigates whether people base their decisions on their personal needs or on the needs of their group.

- Power distance (PD): this dimension refers to the extent to which people accept, within a country, that economic or political power is assigned unequally.

- Uncertainty avoidance (UA): this dimension refers to the extent to which a specific society feels threatened by ambiguous situations and tends to reduce the occurrence of these situations by creating more opportunities for career stability; establishing a lot of formal norms and rules; rejecting abnormal behavior and ideas; believing that there is an absolute truth; and attributing great value to specific expertise.

- Masculinity/femininity (MAS): this dimension refers to how many of the shared cultural values within a country can be associated with an ideal model of masculinity—such as assertiveness, the desire for domination over another person, and economic power, success and competitiveness, rather than being linked to characteristics of an ideal feminine model—such as importance being attributed to friendly relationships and cooperation as a way to achieve economic and physical safety.

- National cultures characterized by a low level of individualism predispose the population to a high level of corruption, since they emphasize values associated with putting the well-being of one’s own group before following formal norms and rules (Husted 1999; Davis and Ruhe 2003).

- National cultures characterized by a high level of power distance predispose the population to a high level of corruption since managerial and economic decisions are made by bosses at their sole discretion, instead of being based on meritocracy, accountability and responsibility. This situation leads people to become obsequious and show formal respect to these bosses, who might base their decisions on corruption or nepotism (Husted 1999; Davis and Ruhe 2003; Getz and Volkema 2001).

- National Cultures characterized by high levels of uncertainty avoidance may predispose the population to a high level of corruption since there are shared values and beliefs that corruption can be an effective tool to reduce the risks and ambiguity related to entrepreneurial activities, providing entrepreneurs with undeserved success (Husted 1999; Getz and Volkema 2001).

- National cultures characterized by a high level of Masculinity predispose the population to higher levels of corruption since they transmit shared values that view corruption as a means justified by the ultimate end. For example, people may display a high degree of tolerance towards ethically controversial activities that facilitate the satisfaction of entrepreneurs’ desires for success. (Husted 1999; Davis and Ruhe 2003).

5. Discussion

The Slippery Slope Phenomenon: The Effect of Corruption on Entrepreneurial Intentions at the Intra-Individual Level of Analysis

6. Conclusions and Limitations

Author Contributions

Funding

Conflicts of Interest

References

- Acs, Zoltan J., Erik Stam, David B. Audretsch, and Allan O’Connor. 2017. The lineages of the entrepreneurial ecosystem approach. Small Business Economics 49: 1–10. [Google Scholar] [CrossRef]

- Aidis, Ruta, Saul Estrin, and Tomasz Marek Mickiewicz. 2012. Size matters: Entrepreneurial entry and government. Small Business Economics 39: 119–39. [Google Scholar] [CrossRef]

- Ajzen, Icek. 1991. The theory of planned behavior. Organizational Behavior and Human Decision Processes 50: 179–211. [Google Scholar] [CrossRef]

- Allini, Alessandra, Luca Ferri, Marco Maffei, and Annamaria Zampella. 2017. The Effect of Perceived Corruption on Entrepreneurial Intention: Evidence from Italy. International Business Research 10: 75–86. [Google Scholar] [CrossRef]

- Alvedalen, Janna, and Ron Boschma. 2017. A critical review of entrepreneurial ecosystems research: Towards a future research agenda. European Planning Studies 25: 887–903. [Google Scholar] [CrossRef]

- Andersen, Henrik, and Jochen Mayerl. 2017. Social desirability and undesirability effects on survey response latencies. Bulletin of Sociological Methodology/Bulletin de Méthodologie Sociologique 135: 68–89. [Google Scholar] [CrossRef]

- Anokhin, Sergey, and William S. Schulze. 2009. Entrepreneurship, innovation, and corruption. Journal of Business Venturing 24: 465–76. [Google Scholar] [CrossRef]

- Aparicio, Sebastian, David Urbano, and David Audretsch. 2016. Institutional factors, opportunity entrepreneurship and economic growth: Panel data evidence. Technological Forecasting and Social Change 102: 45–61. [Google Scholar] [CrossRef]

- Armantier, Olivier, and Amadou Boly. 2008. Can Corruption Be Studied in the Lab? Comparing a Field and a Lab Experiment. Montreal: CIRANO-Scientific Publications. [Google Scholar]

- Arranz, N., M. F. Arroyabe, and J. C. Fdez. de Arroyabe. 2019. Entrepreneurial intention and obstacles of undergraduate students: the case of the universities of Andalusia. Studies in Higher Education 44: 2011–24. [Google Scholar] [CrossRef]

- Ashforth, Blake E., Dennis Gioia, Sandra L. Robinson, and Linda K. Trevino. 2008. Re-viewing organizational corruption. Academy of Management Review 33: 670–84. [Google Scholar] [CrossRef]

- Autio, Erkko, Robert H. Keeley, Magnus Klofsten, George G. C. Parker, and Michael G. Hay. 2001. Entrepreneurial intent among students in Scandinavia and in the USA. Enterprise and Innovation Management Studies 2: 145–60. [Google Scholar] [CrossRef]

- Bandura, Albert. 1986. Social Foundations of Thought and Action: A Social Cognitive Theory. Englewood Cliffs: Prentice-Hall, Inc. [Google Scholar]

- Bandura, Albert. 1999. Moral disengagement in the perpetration of inhumanities. Personality and Social Psychology Review 3: 193–209. [Google Scholar] [CrossRef] [PubMed]

- Bardhan, Pranab. 1997. Corruption and development: a review of issues. Journal of Economic Literature 35: 1320–46. [Google Scholar]

- Barr, Abigail, and Danila Serra. 2010. Corruption and culture: An experimental analysis. Journal of Public Economics 94: 862–69. [Google Scholar] [CrossRef]

- Bell, Robin. 2019. Predicting entrepreneurial intention across the university. Education and Training 61: 815–31. [Google Scholar] [CrossRef]

- Brown, Ross, and Suzanne Mawson. 2019. Entrepreneurial ecosystems and public policy in action: A critique of the latest industrial policy blockbuster. Cambridge Journal of Regions, Economy and Society. [Google Scholar] [CrossRef]

- Ceresia, Francesco. 2018. The Role of Entrepreneurship Education in Fostering Entrepreneurial Intentions and Performances: A Review of 30 Years of Research. Equidad y Desarrollo 31: 47–66. [Google Scholar] [CrossRef]

- Ceresia, Francesco, and Claudio Mendola. 2019. Entrepreneurial Self-Identity, Perceived Corruption, Exogenous and Endogenous Obstacles as Antecedents of Entrepreneurial Intention in Italy. Social Science 8: 54. [Google Scholar] [CrossRef]

- Choo, Stephen, and Melvin Wong. 2006. Entrepreneurial intention: Triggers and barriers to new venture creations in Singapore. Singapore Management Review 28: 47–64. [Google Scholar]

- Ciziceno, Marco, and Giovanni A. Travaglino. 2019. Perceived corruption and individuals’ life satisfaction: The mediating role of institutional trust. Social Indicators Research 141: 685–701. [Google Scholar] [CrossRef]

- Davis, James H., and John A. Ruhe. 2003. Perceptions of country corruption: Antecedents and outcomes. Journal of Business Ethics 43: 275–88. [Google Scholar] [CrossRef]

- del Mar Salinas-Jiménez, M., and Javier Salinas-Jiménez. 2007. Corruption, efficiency and productivity in OECD countries. Journal of Policy Modeling 29: 903–15. [Google Scholar] [CrossRef]

- Djankov, Simeon, Edward Miguel, Yingyi Qian, Gèrard Roland, and Ekaterina Zhuravskaya. 2005. Who are Russia’s entrepreneurs? Journal of the European Economic Association 3: 587–97. [Google Scholar] [CrossRef]

- Dreher, Alex, and Martin Gassebner. 2013. Greasing the wheels? The impact of regulations and corruption on firm entry. Public Choice 155: 413–32. [Google Scholar] [CrossRef]

- Drnovšek, Mateja, Joakim Wincent, and Melissa S. Cardon. 2010. Entrepreneurial self-efficacy and business start-up: developing a multi-dimensional definition. International Journal of Entrepreneurial Behavior and Research 16: 329–48. [Google Scholar] [CrossRef]

- Dutta, Nabamita, and Russell Sobel. 2016. Does corruption ever help entrepreneurship? Small Business Economics 47: 179–99. [Google Scholar] [CrossRef]

- Engle, Robert L., Nikolay Dimitriadi, Jose V. Gavidia, Christofer Schlaegel, Servane Delanoe, Irene Alvarado, Xiaohong He, Samuel Buame, and Birgitta Wolff. 2010. Entrepreneurial intent: A twelve-country evaluation of Ajzen’s model of planned behavior. International Journal of Entrepreneurial Behavior and Research 16: 35–57. [Google Scholar] [CrossRef]

- Esfandiar, Kourosh, Mohamad Sharifi-Tehrani, Stephen Pratt, and Levent Altinay. 2019. Understanding entrepreneurial intentions: A developed integrated structural model approach. Journal of Business Research 94: 172–82. [Google Scholar] [CrossRef]

- Faggian, Alessandra, Mark Partridge, and Edward J. Malecki. 2017. Creating an environment for economic growth: creativity, entrepreneurship or human capital? International Journal of Urban and Regional Research 41: 997–1009. [Google Scholar] [CrossRef]

- Festinger, Leon. 1957. A Theory of Cognitive Dissonance. Stanford: Stanford University. [Google Scholar]

- Freedman, Jonathan L., and Scott C. Fraser. 1966. Compliance without pressure: the foot-in-the-door technique. Journal of Personality and Social Psychology 4: 195–202. [Google Scholar] [CrossRef]

- Gang, Xu, and Go Yano. 2017. How does anti-corruption affect corporate innovation? Evidence from recent anti-corruption efforts in China. Journal of Comparative Economics 45: 498–519. [Google Scholar]

- Getz, Kathleen A., and Roger J. Volkema. 2001. Culture, perceived corruption, and economics: A model of predictors and outcomes. Business and Society 40: 7–30. [Google Scholar] [CrossRef]

- Gilmartin, Shannon K., Marissa E. Thompson, Emily Morton, Qu Jin, Helen L. Chen, Anne Colby, and Sheri D. Sheppard. 2019. Entrepreneurial intent of engineering and business undergraduate students. Journal of Engineering Education 108: 316–36. [Google Scholar] [CrossRef]

- Glaeser, Edward L., and Raven E. Saks. 2006. Corruption in America. Journal of Public Economics 90: 1053–72. [Google Scholar] [CrossRef]

- Hanoteau, Julien, and Virginie Vial. 2014. Grease or Sand the Wheel? The Effect of Individual Bribes on the Drivers of Aggregate Productivity Growth. Journal of Indonesian Economy and Business 29: 1–16. [Google Scholar] [CrossRef]

- Harbi, Sana E., and Alistair R. Anderson. 2010. Institutions and the shaping of different forms of entrepreneurship. Journal of Socio-Economics 39: 436–44. [Google Scholar] [CrossRef]

- Hayton, James C., Gerard George, and Shaker A. Zahra. 2002. National culture and entrepreneurship: A review of behavioral research. Entrepreneurship Theory and Practice 26: 33–52. [Google Scholar] [CrossRef]

- Heider, Fritz. 1946. Attitudes and cognitive organization. The Journal of Psychology 21: 107–12. [Google Scholar] [CrossRef]

- Hofstede, Geert. 1980. Culture’s Consequences: International Differences in Work-Related Values. Beverly Hills: Sage Publications, Inc. [Google Scholar]

- Hofstede, Geert. 2001. Culture’s Consequences: Comparing Values, Behaviors, Institutions and Organizations across Nations, 2nd ed. Thousand Oaks: Sage Publications. [Google Scholar]

- Holcombe, Randall G. 1998. Entrepreneurship and economic growth. The Quarterly Journal of Austrian Economics 1: 45–62. [Google Scholar] [CrossRef]

- Husted, Bryan W. 1999. Wealth, culture, and corruption. Journal of International Business Studies 30: 339–59. [Google Scholar] [CrossRef]

- Jancsics, David. 2019. Corruption as resource transfer: An interdisciplinary synthesis. Public Administration Review 79: 1–15. [Google Scholar] [CrossRef]

- Johnson, Timoty P., and Fons J. Van de Vijver. 2003. Social desirability in cross-cultural research. Cross-Cultural Survey Methods 325: 195–204. [Google Scholar]

- Kuckertz, Andreas. 2019. Let’s take the entrepreneurial ecosystem metaphor seriously! Journal of Business Venturing Insights 11: e00124. [Google Scholar] [CrossRef]

- Levitt, Steven D., and John A. List. 2007. What do laboratory experiments measuring social preferences reveal about the real world? Journal of Economic Perspectives 21: 153–74. [Google Scholar] [CrossRef]

- Li, Shaomin, and Jun Wu. 2010. Why some countries thrive despite corruption: The role of trust in the corruption–efficiency relationship. Review of International Political Economy 17: 129–54. [Google Scholar] [CrossRef]

- Linan, Francisco, and Yi W. Chen. 2009. Development and Cross-Cultural application of a specific instrument to measure entrepreneurial intentions. Entrepreneurship Theory and Practice 33: 593–617. [Google Scholar] [CrossRef]

- Lucas, David S., and Caleb S. Fuller. 2017. Entrepreneurship: Productive, unproductive, and destructive—Relative to what? Journal of Business Venturing Insights 7: 45–49. [Google Scholar] [CrossRef]

- Mauro, Paolo. 1995. Corruption and growth. The Quarterly Journal of Economics 110: 681–712. [Google Scholar] [CrossRef]

- Mazar, Nina, On Amir, and Dan Ariely. 2008. The dishonesty of honest people: A theory of self-concept maintenance. Journal of Marketing Research 45: 633–44. [Google Scholar] [CrossRef]

- Milgram, Stanley. 1963. Behavioral study of obedience. The Journal of Abnormal and Social Psychology 67: 371–78. [Google Scholar] [CrossRef]

- Moiseev, V. V., and I. V. Goncharova. 2019. Corruption in Russia: Reasons for the Growth. Paper presented at 2019 5th International Conference on Social Science and Higher Education (ICSSHE 2019), Xiamen, China, August 23–25. [Google Scholar]

- Moreno, Alejandro. 2002. Corruption and democracy: A cultural assessment. Comparative Sociology 1: 495–507. [Google Scholar] [CrossRef]

- Neneh, Brownhilder N. 2014. An assessment of entrepreneurial intention among university students in Cameroon. Mediterranean Journal of Social Sciences 5: 542–52. [Google Scholar] [CrossRef]

- North, Douglass C. 1991. Institutions. Journal of Economic Perspectives 5: 97–112. [Google Scholar] [CrossRef]

- North, Douglass C. 2005. Understanding the Process of Economic Change. Princeton: Princeton University Press. [Google Scholar]

- Olken, Benjamin A. 2009. Corruption perceptions vs. corruption reality. Journal of Public Economics 93: 950–64. [Google Scholar] [CrossRef]

- Orr, Ryan J., and W. Richard Scott. 2008. Institutional exceptions on global projects: A process model. Journal of International Business Studies 39: 562–88. [Google Scholar] [CrossRef]

- Paunov, Caroline. 2016. Corruption’s asymmetric impacts on firm innovation. Journal of Development Economics 118: 216–31. [Google Scholar] [CrossRef]

- Pertiwi, Kanti. 2018. Contextualizing Corruption: A Cross-Disciplinary Approach to Studying Corruption in Organizations. Administrative Sciences 8: 12. [Google Scholar] [CrossRef]

- Rosid, Arifin, Chris Evans, and Binh Tran-Nam. 2018. Perceptions of Corruption and Tax Non-Compliance Behaviour: Policy Implications for Developing Countries. Bullettin of Indonesian Economic Studies 54: 25–60. [Google Scholar] [CrossRef]

- Samila, Sampsa, and Olav Sorenson. 2011. Venture capital, entrepreneurship, and economic growth. The Review of Economics and Statistics 93: 338–49. [Google Scholar] [CrossRef]

- Scott, W. Richard. 1995. Institutions and Organizations. Thousand Oaks: Sage. [Google Scholar]

- Shwetzer, Claudia, Alex Maritz, and Quan Nguyen. 2019. Entrepreneurial ecosystems: A holistic and dynamic approach. Journal of Industry-University Collaboration 1: 79–95. [Google Scholar] [CrossRef]

- Singh, Shiwangi, Shuchi Sinha, Vellupillai M. Das, and Anuj Sharma. 2019. A framework for linking entrepreneurial ecosystem with institutional factors: A modified total interpretive structural modelling approach. Journal for Global Business Advancement 12: 382–404. [Google Scholar]

- Stam, Erik. 2015. Entrepreneurial ecosystems and regional policy: a sympathetic critique. European Planning Studies 23: 1759–769. [Google Scholar] [CrossRef]

- Stam, Erik. 2018. Measuring entrepreneurial ecosystems. In Entrepreneurial Ecosystems. New York: Springer, pp. 173–97. [Google Scholar]

- Stam, Erik, and Ben Spigel. 2016. Entrepreneurial ecosystems. USE Discussion Paper Series 16. Available online: https://ideas.repec.org/p/use/tkiwps/1613.html (accessed on 25 June 2018).

- Stenholm, Pekka, Zoltan J. Acs, and Robert Wuebker. 2013. Exploring country-level institutional arrangements on the rate and type of entrepreneurial activity. Journal of Business Venturing 28: 176–93. [Google Scholar] [CrossRef]

- Stone, Jeff, and Joel Cooper. 2001. A self-standards model of cognitive dissonance. Journal of Experimental Social Psychology 37: 228–43. [Google Scholar] [CrossRef]

- Swann, William B., Jr. 1983. Self-verification: Bringing social reality into harmony with the self. Social Psychological Perspectives on the Self 2: 33–66. [Google Scholar]

- Szerb, László, Esteben Lafuente, Krisztina Horváth, and Balàzs Páger. 2019. The relevance of quantity and quality entrepreneurship for regional performance: The moderating role of the entrepreneurial ecosystem. Regional Studies 53: 1308–320. [Google Scholar] [CrossRef]

- Taras, Vas, Bradley L. Kirkman, and Pier Steel. 2010. Examining the impact of culture’s consequences: A three-decade, multilevel, meta-analytic review of Hofstede’s cultural value dimensions. Journal of Applied Psychology 95: 405–39. [Google Scholar] [CrossRef]

- Thornton, Patricia H., Doming Ribeiro-Soriano, and David Urbano. 2011. Socio-cultural factors and entrepreneurial activity: An overview. International Small Business Journal 29: 105–18. [Google Scholar] [CrossRef]

- Transparency International. 2017. Corruption Perception Index. Available online: www.transparency.org (accessed on 25 June 2018).

- Urbano, David, and Claudia Alvarez. 2014. Institutional dimensions and entrepreneurial activity: An international study. Small Business Economics 42: 703–16. [Google Scholar] [CrossRef]

- Wang, Chengchun, Yiping Liu, and Norbert Mundorf. 2019. Regional differences in entrepreneurial intention of college students may exacerbate regional economic gap. Journal of Entrepreneurship Education 22: 1–11. [Google Scholar]

- Ward, Alexander, Brizeida Hernández-Sánchez, and Jose C. Sánchez-García. 2019. Entrepreneurial Intentions in Students from a Trans-National Perspective. Administrative Sciences 9: 37. [Google Scholar] [CrossRef]

- Welsh, David T., Lisa D. Ordóñez, Deirdre G. Snyder, and Michael S. Christian. 2014. The slippery slope: How small ethical transgressions pave the way for larger future transgressions. Journal of Applied Psychology. [Google Scholar] [CrossRef] [PubMed]

- Wennekers, Sander, and Roy Thurik. 1999. Linking entrepreneurship and economic growth. Small Business Economics 13: 27–56. [Google Scholar] [CrossRef]

- World Bank. 2016. Worldwide Governance Indicators. Available online: https://datamarket.com/data/set/16uz/control-of-corruptionestimate#!ds=16uz!i75=5qanddisplay=table (accessed on 27 June 2018).

- Zakharov, Nikita. 2019. Does corruption hinder investment? Evidence from Russian regions. European Journal of Political Economy 56: 39–61. [Google Scholar] [CrossRef]

- Zhou, Jessie Q., and Mike W. Peng. 2012. Does bribery help or hurt firm growth around the world? Asia Pacific Journal of Management 29: 907–21. [Google Scholar] [CrossRef]

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ceresia, F.; Mendola, C. The Effects of Corruption in Entrepreneurial Ecosystems on Entrepreneurial Intentions. Adm. Sci. 2019, 9, 88. https://doi.org/10.3390/admsci9040088

Ceresia F, Mendola C. The Effects of Corruption in Entrepreneurial Ecosystems on Entrepreneurial Intentions. Administrative Sciences. 2019; 9(4):88. https://doi.org/10.3390/admsci9040088

Chicago/Turabian StyleCeresia, Francesco, and Claudio Mendola. 2019. "The Effects of Corruption in Entrepreneurial Ecosystems on Entrepreneurial Intentions" Administrative Sciences 9, no. 4: 88. https://doi.org/10.3390/admsci9040088

APA StyleCeresia, F., & Mendola, C. (2019). The Effects of Corruption in Entrepreneurial Ecosystems on Entrepreneurial Intentions. Administrative Sciences, 9(4), 88. https://doi.org/10.3390/admsci9040088