1. Introduction

ESG (Environmental, Social, Governance) management has emerged as a core strategy for ensuring corporate sustainability and long-term performance. In particular, since 2020, ESG has been adopted as a new standard for corporate management across global financial markets and industries, with major companies in Korea and other countries actively pursuing various initiatives such as establishing ESG strategies, disclosing non-financial information, and responding to ESG evaluations.

However, recent external environmental changes such as high interest rates, economic slowdown, and sharp increases in energy prices have led to a reduction in ESG-related investments and implementation (

Furness, 2025), and, as a result, skepticism on the effectiveness and sustainability of ESG management is spreading (

Kräussl et al., 2025). In particular, activities focused solely on external disclosure or image enhancement have drawn criticism for greenwashing or ESG fatigue (

ESG News, 2024), and debates over whether ESG can be linked to actual business innovation or performance have intensified.

Ultimately, there is an increasing need for research to prove the feasibility and effectiveness of ESG management as a strategic means of solving actual business problems or achieving management performance. This is particularly important in South Korea, where ESG strategies tend to remain within the scope of existing ethical management or social responsibility and have been implemented at the institutional level (

Fan, 2024).

In this study, we aim to analyze whether ESG strategies can be utilized as sustainable strategies with practical necessity and effectiveness in solving problems within real business environments. To this end, we conducted an in-depth case study of Korean companies with representative and verifiable ESG implementation. A comprehensive case analysis of Hansol Paper (

Hansol Group, 2025), South Korea’s leading paper company and a global paper manufacturer, will explore the conditions and processes under which ESG strategies can address real-world challenges in the business environment and be implemented as sustainable management strategies.

2. Literature Review

2.1. Integrating ESG and Business Strategy

Recent ESG-related research shows that the way companies establish and implement ESG strategies is fundamentally changing. From 2020 to 2023, ESG was primarily addressed as a strategy for risk mitigation, regulatory compliance, or ethical responsibility fulfillment. Key studies during this period noted that while ESG activities could negatively impact financial performance in the short term due to resource dispersion and increased costs, they could lead to enhanced corporate credibility and strengthened market competitiveness in the long term.

For example,

Chen et al. (

2021) conducted an empirical study analyzing 311 Chinese companies and found that ESG implementation had a negative impact on performance in the short term through a substitution effect, but improved performance in the long term through publicity effects resulting from improved corporate image and trust.

Almaqtari et al. (

2022) used data from 1914 companies in the UK and Turkey to confirm that ESG indicators are more closely related to long-term value indicators such as Tobin’s Q than to short-term stock prices.

Kong et al.’s (

2023) study demonstrated that ESG investment contributes to profitability and future market value (PE ratio) for global technology leaders, emphasizing that ESG acts as a key factor in securing competitive advantage in technology-based industries.

However, studies conducted after 2024 have begun to address ESG integration at the level of core business strategy. ESG is now being approached as a strategic tool integrated with key competitive strategies such as product innovation, supply chain management, and financial and operational decision-making.

Michalski (

2024) argues that integrating ESG factors into the Balanced Scorecard (BSC) can simultaneously enhance sustainability and business competitiveness.

Gazzola et al. (

2024) analyzed the process by which leading manufacturing companies build sustainable business models by embedding UN SDG-based environmental sustainability goals into their corporate strategies. They classified companies into five types based on the level and speed of integrating ESG into their strategies, confirming that companies are actually applying ESG goals to their business strategies. Raden

Pujiyono et al. (

2025) suggested that business models reflecting ESG principles strengthen supply chain resilience and economic performance, using the Indonesian paint industry as a case study.

However, while many studies on integrating ESG into corporate business strategies have focused on the quantitative correlation between ESG and financial performance, research analyzing the process by which ESG strategies are established and implemented within companies and how they are linked to business strategies remains relatively scarce. Through a case study, we aim to address this limitation by examining how ESG strategies are connected to key strategic areas within Hansol Paper through a case study.

2.2. Changes in ESG Strategy in Compliance with IFRS S1·S2

The disclosure requirements for sustainability information have been rapidly institutionalized over the past few years, and ESG disclosure in particular is no longer considered optional reporting but rather key financial information. The International Sustainability Standards Board (ISSB) established IFRS S1 (General Requirements for Disclosure of Sustainability-related Financial Information) and IFRS S2 (Climate-related Disclosures) in June 2023 as standards for the disclosure of sustainability-related financial information (

IFRS Foundation, 2023). IFRS S1 requires companies to disclose how sustainability-related risks and opportunities affect their business strategy, business model, and financial plans. Companies must describe how sustainability-related risks and opportunities influence their strategy and decision-making, and this integrated explanation is a mandatory component of the disclosure (

IFRS Foundation, 2023).

These standards took effect internationally on 1 January 2024, but each country’s regulatory authorities are required to decide separately on the applicability and schedule for their domestic companies. South Korea has already announced disclosure guidelines for 2024 and is considering a plan to implement them for listed companies starting in 2026.

The EU is promoting harmonization with international standards while first implementing its own standards, the ESRS (European Sustainability Reporting Standards). As such, discussions are underway regarding the extent to which the global disclosure standards through IFRS S1 and S2 can ensure uniformity and comparability, given the differences in policy choices and institutional foundations among countries.

Some studies have concluded that international standards have improved the comparability of disclosures between companies and countries (

Li, 2024), but point out that differences in the interpretation and application of standards may arise due to differences in industry characteristics, institutional acceptance, and corporate capabilities in the actual implementation process (

Wahyuni, 2025;

Pratama et al., 2025). This suggests a gap between the goal of policy ensuring the uniformity of international disclosure standards and practical constraints.

Numerous analyses have also been conducted on the disclosure capabilities and readiness levels of actual companies.

Milhem (

2025) pointed out that the disclosure levels of Palestinian listed companies fall short of standards, particularly in terms of quantitative indicators.

Pratama et al. (

2025) derived ed a research results focused on the mining industry, revealing that while large firms demonstrate a certain level of compliance, small and medium-sized enterprises (SMEs) face difficulties in meeting standards due to resource and technological constraints.

Empirical analyses of market reactions to disclosure are also actively underway.

Dwiyandi (

2025) concluded that while disclosure regarding corporate strategy and governance may trigger negative market reactions, risk management disclosure has a positive impact on corporate value.

Yunita (

2025) proposed that the establishment of corporate social responsibility, corporate governance, and climate disclosure positively contributes to corporate performance in the palm oil industry.

As such, existing studies have examined the structural interpretation of IFRS S1 and S2 standards, the level of corporate response, and the market impact of disclosure from various perspectives. However, it is necessary to seek specific standards on how ESG disclosure should be integrated into corporate strategy and risk management.

2.3. Governance and ESG Performance

For a company’s ESG strategy to be effectively implemented and yield tangible results, a robust institutional framework is essential, with governance at its core. Governance serves as one of the three pillars of ESG and acts as the central mechanism supporting the other two elements—environmental (E) and social (S) strategies.

A board of directors with transparent and independent governance ensures that strategies for corporate sustainability are not compromised by short-term profits and supports the consistency and execution of strategies. Previous studies have emphasized that the independence and diversity of governance are key factors determining the strength and effectiveness of ESG strategy execution.

Amore and Bennedsen (

2016) analyzed European companies and found that of the total patents of companies with weak governance structures, a lower proportion were eco-friendly. The study emphasized that companies with a low proportion of institutional investors or limited experience in eco-friendly activities may have weaker ESG-related innovation capabilities.

Gerged (

2021) analyzed companies in emerging markets and argued that the independence and diversity of board composition substantially improve a company’s ESG disclosure level.

Kang et al. (

2022) analyzed the governance reports of Korean listed companies and found that the operation of committees within the board, the independence of audit bodies, and the level of disclosure of compensation policies have a significant positive relationship with environmental and social performance.

Gerged et al. (

2023) also confirmed in a study of African companies that the establishment of an environmental committee within the board and gender diversity have a synergistic effect on improving ESG disclosure levels.

Recent studies have focused on board diversity, and particularly the role of female directors.

Omenihu et al. (

2025) analyzed 45 companies in developed countries from 2012 to 2023 and found a significant positive relationship between board gender diversity and ESG disclosure levels.

Xu et al. (

2025) systematically reviewed 74 studies and confirmed that board diversity is a key factor in promoting environmental disclosure. In particular,

Babiker et al. (

2025) analyzed Saudi Arabian listed companies and empirically verified that companies that ensure and encourage female representation on the board of directors are more likely to provide ESG disclosure than those that do not.

As such, various domestic and international studies and cases suggest that corporate governance has a decisive impact on the effectiveness, transparency, and sustainability of ESG strategies. Therefore, to enhance the effectiveness of ESG strategies, structural designs such as strengthening board independence, ensuring diversity and expertise in committee composition, establishing fair compensation systems, and improving the quantitative and qualitative levels of information disclosure must be implemented concurrently. A robust governance framework serves as a prerequisite for successfully integrating ESG strategies into business strategies.

3. Research Design

3.1. Subject of Analysis: Hansol Paper

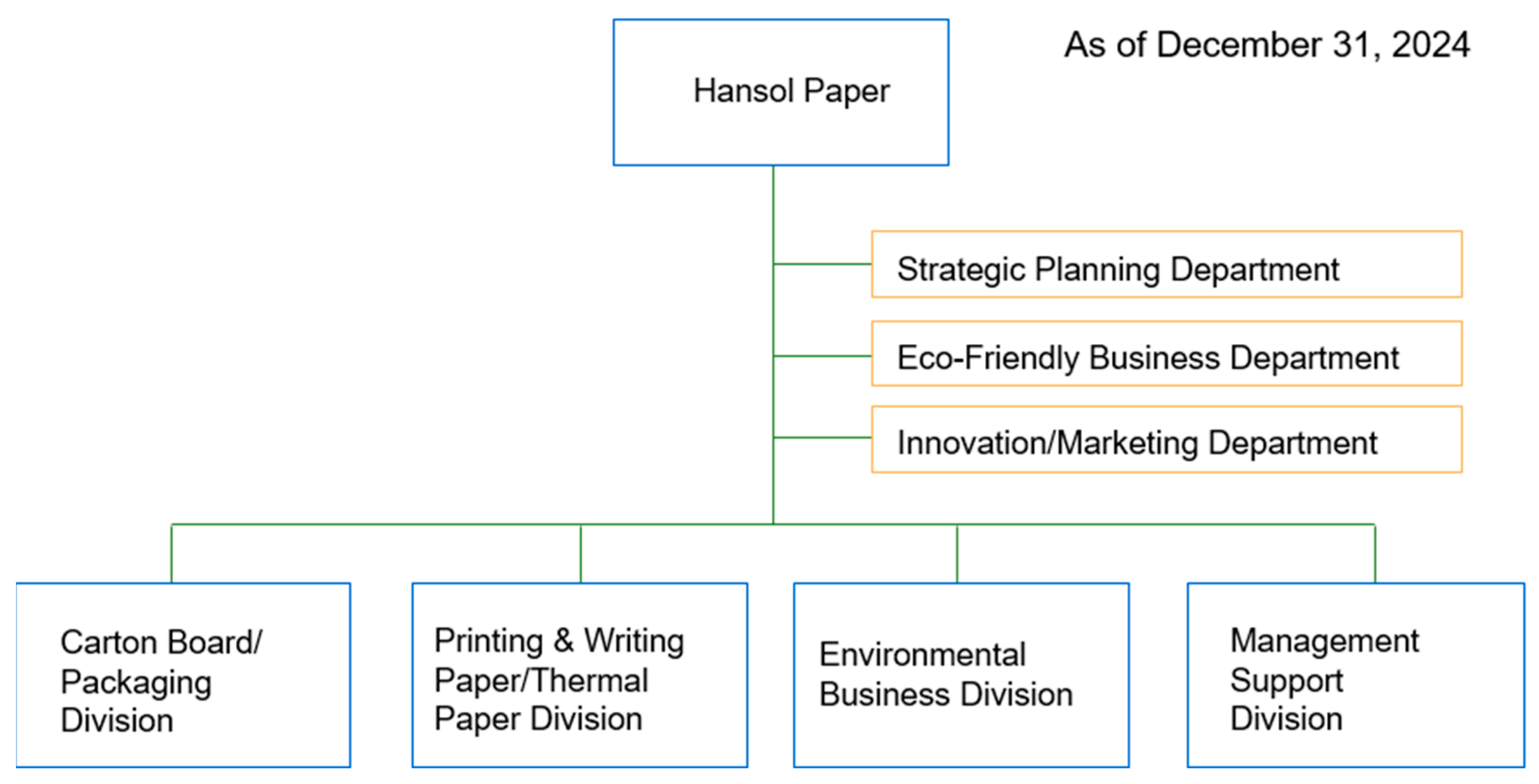

The subject of this study is Hansol Paper. Hansol Paper is a representative Korean paper company established in 1965 and was selected as the subject of this study for the following reasons.

First, Hansol Paper has the largest paper production capacity in Korea and the largest production capacity for thermal paper in the world (

Hansol Group, 2025). This quantitative position suggests that Hansol Paper is a clear representative of the paper industry in Korea and abroad and an appropriate case to examine the feasibility and sustainability of ESG strategies within this industry.

Second, its strategy formulation, implementation, and performance are completely publicly disclosed, making them highly verifiable. Hansol Paper’s ESG strategy consists of various tasks, such as developing eco-friendly products, expanding its use of renewable raw materials, and reducing greenhouse gas emissions, which can be objectively verified through official sources such as sustainability and audit reports and prospectuses. In addition, the strategy’s effectiveness has been verified through external evaluation, as the company received two consecutive platinum ratings (positioning it in the top 1% of companies internationally) from the global ESG rating agency EcoVadis in 2023 and 2024 (

Hansol, 2025).

The paper industry in particular is a fixed-cost manufacturing industry with high energy consumption and carbon emissions (

Hansol Paper Co., Ltd., 2025), which creates structural barriers to green transformation. As such, Hansol Paper is an example of a company that has established a strategy for ESG management and achieved results even under relatively difficult conditions, making this analysis both realistic and relevant.

3.2. Analytical Methods

This study was conducted to examine whether ESG management can function as a strategic tool that goes beyond meeting mere ethical and normative requirements and is linked to actual business performance. To do so, we analyzed the rationale and logic behind ESG strategies, their specific implementation, and how they are externally evaluated in the context of the structural business risks faced by a company.

In particular, we focused on exploring the alignment of structural conditions and implementation that is necessary for an ESG strategy to move beyond a formal activity and function as a substantive management strategy. To accomplish these objectives, this study adopted the qualitative case study methodology of inductive theory building proposed by

Eisenhardt (

1989). This methodology is recognized as an effective approach for deriving concepts and constructs from empirical cases in areas where the theoretical foundations are relatively weak or initial conceptualization is required.

In this study, we selected data from 2021 onwards, when ESG began to gain traction, as the criteria for selecting data for the case analysis of Hansol Paper. The selected documents are audit reports, sustainability reports, and investment prospectuses, each with the following purposes:

First, the audit reports (2021–2024) were used to identify how ESG-related cost items, such as energy costs, have changed over time, based on accurate financial figures verified by external auditors.

The sustainability reports (2022–2024) were analyzed with a focus on confirming how Hansol Paper’s ESG strategy was planned and executed, and what results were achieved. The 2021 report was excluded as it was not published in the relevant year.

The prospectuses (2021, 2022, 2023, 2025) are documents published at the time of corporate bond issuance, providing external investors with information on the company’s business operations, market conditions, and business risks. As there was no corporate bond issuance in 2024, the relevant document does not exist for this year.

This study did not include quantitative analysis, but rather a qualitative content analysis based on the collected documents. It did not include interviews with internal employees, and the analysis was limited to materials accessible from outside the company to ensure its objectivity and reproducibility.

5. Conclusions

5.1. Findings

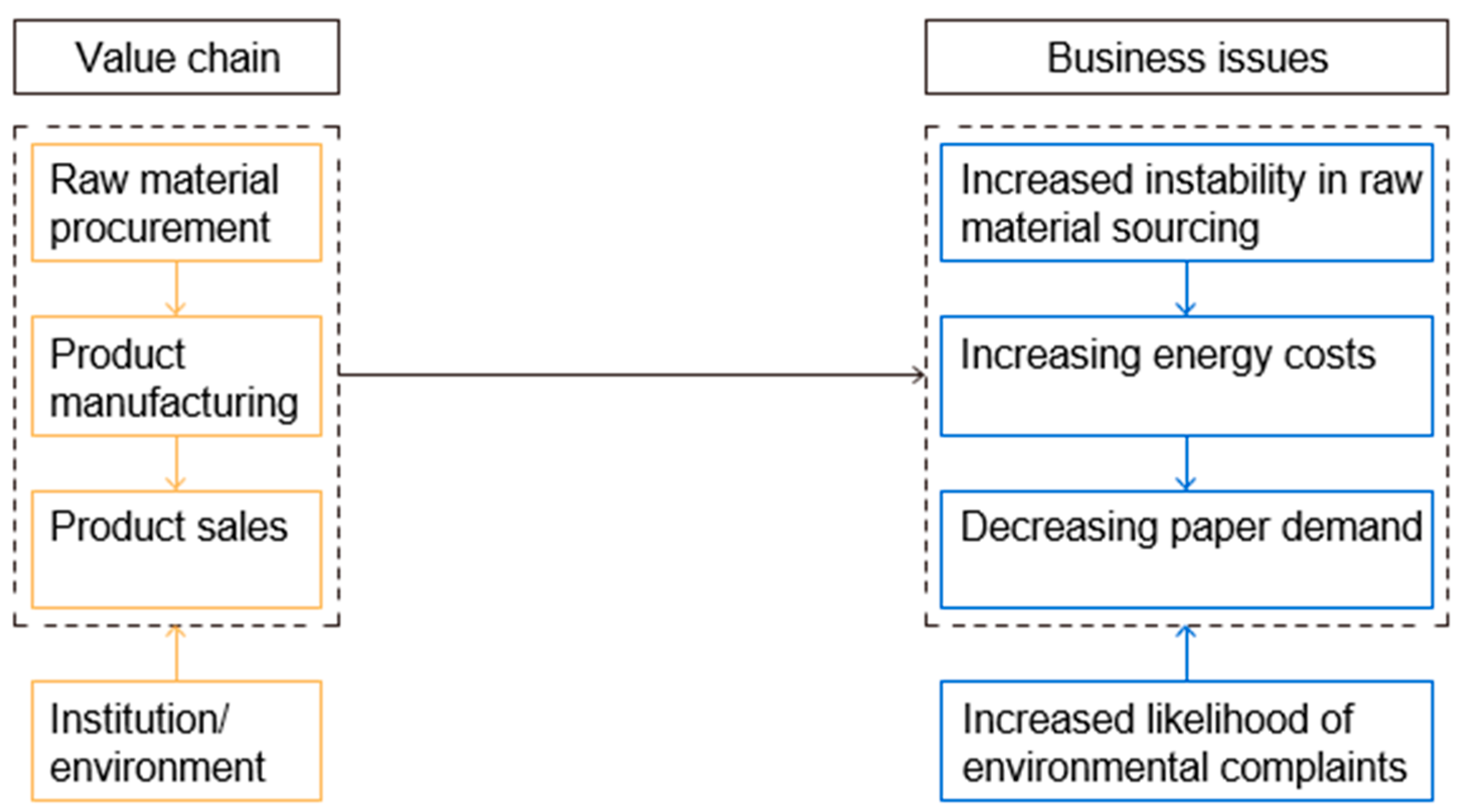

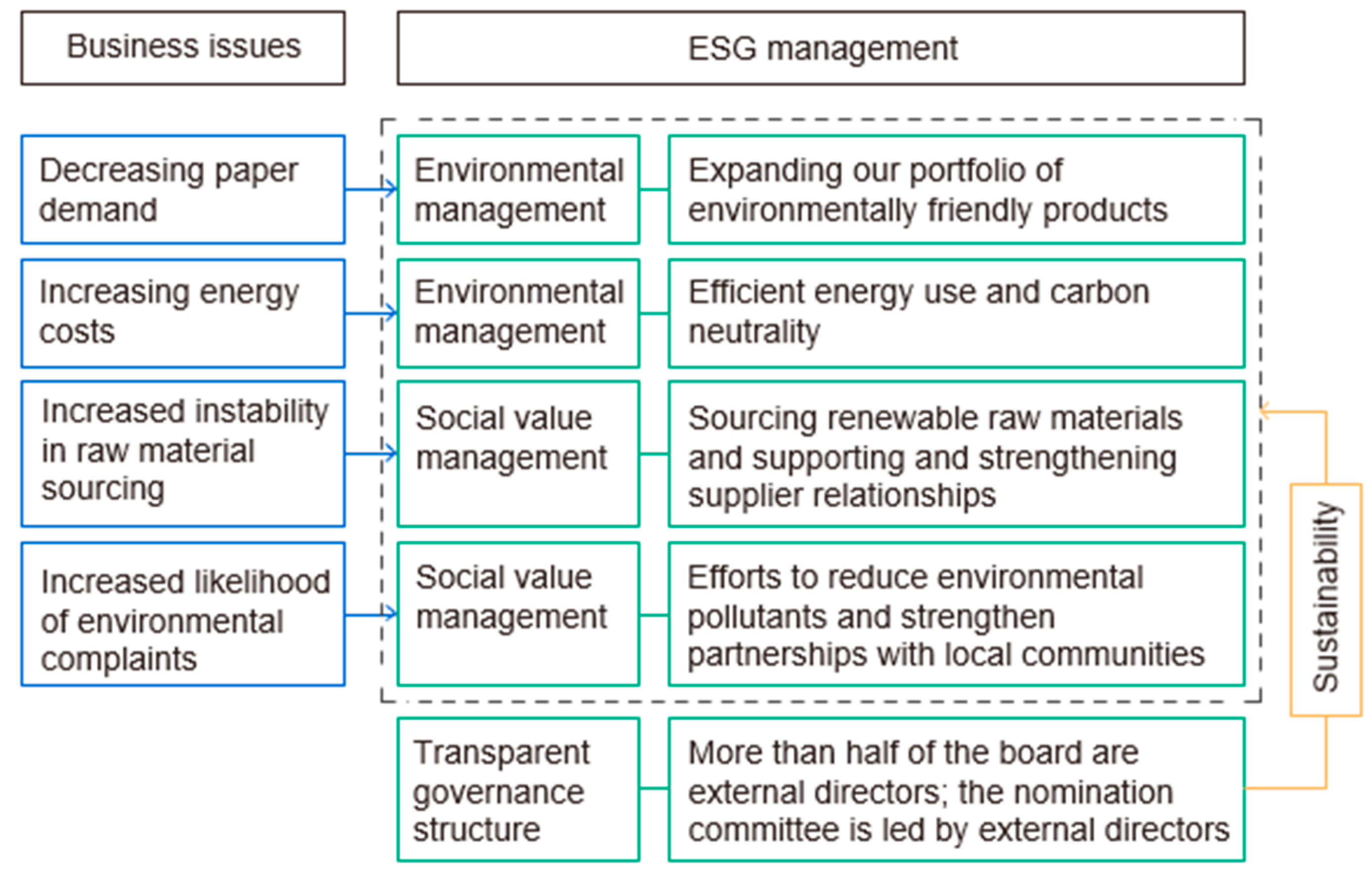

In this study, Hansol Paper linked its ESG strategy directly to its core business issues, thereby securing both the practical effectiveness and sustainability of its ESG strategy. Through a case analysis, the following processes and structures were derived for the ESG strategies to be effective.

First, ESG management can secure both ESG performance and sustainability when it is promoted in conjunction with the company’s core business issues.

Hansol Paper addressed specific business crises such as supply chain instability, rising energy costs, and declining paper demand by integrating them into its ESG strategy. This approach enabled the company to achieve results in business problem-solving and innovation, building trust with external stakeholders, and delivering ESG outcomes.

Second, business-based ESG strategies must be executed in conjunction with a long-term roadmap aligned with the company’s mid- to long-term strategic objectives.

The results of business-based ESG strategies tend to accumulate gradually and be-come visible externally over time. Hansol Paper has systematically implemented ESG activities linked to its mid- to long-term strategies, such as setting carbon neutrality goals, strengthening community cooperation systems, and establishing supply chain sustainability standards, thereby building a foundation for innovation and growth.

Third, the foundation for the linkage and sustained execution of ESG and business strategies must be maintained through the professionalism and transparency of the company’s governance structure.

Hansol Paper has a board of directors where over half of the members are independent directors, and the independent director nomination committee is also decided upon by independent directors, ensuring transparency in the board of directors. In particular, major ESG-related policies are approved through a process where they are reviewed by the board of directors, with independent directors taking the lead, ensuring the sustainability of ESG management.

5.2. Implications

This study presents more specific academic and practical implications from the perspective that a company’s ESG should be implemented as a strategy to solve business problems and drive growth and innovation.

First, building on the perspective that ESG can serve as a key factor in securing competitive advantage in technology-based industries, as argued by

Kong et al. (

2023), we conducted an analysis focused on the pulp and paper industry, which faces significant pressures from technological innovation and environmental changes, and presented a process for establishing and implementing ESG-linked strategies to address the business challenges within the value chain.

This is consistent with the findings of Raden

Pujiyono et al. (

2025), who concluded that business models reflecting ESG principles strengthen supply chain resilience and economic performance, and also presented a process for solving specific value chain issues such as raw material procurement, supply chain expansion, and overcoming demand reduction.

In addition, with the global adoption of IFRS S1 standards, specific standards and processes can be applied to disclose how sustainability-related risks and opportunities affect business strategies, business models, and financial plans.

Finally, existing studies support the importance of ensuring the independence and diversity of corporate governance as the foundation for the mid- to long-term implementation of such business-based ESG strategies.

In particular, in countries like Korea, where corporate culture is traditionally characterized by owner- and male-dominated governance structures, expanding the independence of governance through the appointment of external directors and ensuring diversity by increasing the proportion of female directors can significantly contribute to the long-term sustainability of corporate decision-making in response to business crises and cooperation with external stakeholders.

This study demonstrates that ESG research should now evolve into a long-term business strategy centered on an integrated process to address issues such as environmental responses and innovation demands that companies face.

In particular, through more specific and segmented approaches tailored to individual countries, industries, and companies, intensive research should be expanded to explore the business characteristics that can facilitate the innovation and high performance of companies through ESG, as well as the connections between ESG and internal and external issues, thereby advancing the theoretical development of ESG.

To achieve this, in addition to the empirical studies conducted so far on the links between ESG and corporate performance, there is a need to expand the use of various research methods, including exploratory case studies and qualitative research that focus on the strategic processes of internal ESG planning, implementation, and performance within individual industries and companies.

5.3. Limitations and Future Research

However, the results of this study are limited in their generalizability to all companies, as they are based on an analysis of a single company, Hansol Paper, a Korean firm. The business issues faced by each company and the processes of integrating their ESG strategies vary depending on the industry sector and the external environment in which the company operates. Therefore, further research is needed across various industries and companies to better understand these dynamics.

Therefore, in future studies, we plan to apply the problem identification process at each stage of the corporate value chain, the linkage process with ESG strategies, and the characteristics of governance structures that serve as the foundation for mid- to long-term implementation, as presented in this study, to various industries and companies across multiple countries, and continuously conduct single-case and multi-case comparisons.

Additionally, we aim to empirically analyze the relationship between business-based ESG strategies and long-term corporate performance to confirm their potential contribution to enhancing both tangible and intangible corporate value.

This study is expected to contribute to the academic and practical development of strategies that can respond to changes in industrial structure and business environments by presenting the processes and conditions under which ESG strategies are designed and implemented with the purpose of actively addressing business issues, using the in-depth case study of Hansol Paper.