Abstract

Corporate entrepreneurship is critical in determining a firm’s sustainability. Traditionally, middle managers have been believed to lead corporate entrepreneurship by developing relationships between top managers and subordinates. However, the high authority of a top manager can be both a threat and a strength for middle managers. Previous studies have not focused on the role of top managers in developing corporate entrepreneurship. To address this gap, this study aimed to identify the intuition of top managers in facilitating corporate entrepreneurship in China. We also identified the various industries that can develop corporate entrepreneurship, including the manufacturing and financial sectors. Based on a questionnaire survey conducted with 322 top managers in China, the research hypotheses were tested using structural equation modeling and multigroup analysis, respectively, via SPSS and AMOS. Research examined whether the intuition of top managers positively influences corporate entrepreneurship and whether this influence is stronger in a specific industry. Results revealed that the intuition of top managers positively influenced corporate entrepreneurship, and its impact was greater in the manufacturing industry compared to the financial industry. These results implied the need for the development and maintenance of top managers’ intuition. Synthesizing with the current literature, this study has identified new pathways to develop corporate entrepreneurship from the role of top managers rather than only from middle managers.

1. Introduction

“Both new ventures and established, larger organizations need to nurture entrepreneurial behaviors throughout their organization” (Glaser et al., 2021). The global economy has proven that corporate entrepreneurship is highly effective in increasing organizational performance (Kuratko & Audretsch, 2013), which equally influence the sustainability of the firm.

Currently, firms mainly adopt corporate entrepreneurship to foster profitability (Tajeddini & Mueller, 2012; Martín-Rojas et al., 2020), strategic renewal (Hornsby et al., 2002), and so on. These factors are considered as a significant indicator to measure whether firms can convert their resources toward competitive forces sustainably (Ziyae & Sadeghi, 2020). Corporate entrepreneurship can be classified into three types: entrepreneurship in the firm (Zahra, 1991), innovativeness (Baden-Fuller, 1995), and organizational renewal (M. H. Chen et al., 2015). In this study, we define corporate entrepreneurship following a previous article, which defined it as an activity that focuses on creating new business ventures, products, services, and technologies within a firm through individual forces to expand its core activities (Belousova & Gailly, 2013).

Corporate entrepreneurship must be implemented not only by the middle and top managers, but also by the non-managerial employees. Soltanifar et al. (2023) found that non-managerial employees’ entrepreneurship is requisite for achieving corporate entrepreneurship, as when they have profound access to strategic information they can both improve and accurately initiate their firm’s strategy. Without a doubt, it is the middle manager who has the closest relationship with the non-managerial employees; therefore, previous studies have suggested focusing on middle managers in developing corporate entrepreneurship as they address explorative, double-loop learning and revise innovative forces (Wu et al., 2018). This perception is driven by middle managers’ characteristic to be able to connect team members with access and control over a diverse environment (M. H. Chen et al., 2015; Jooss et al., 2024). They are fundamentally well-positioned to tackle the knowledge-sharing process, ultimately developing corporate entrepreneurship within firms (Mustafa et al., 2016; Donald & Goldsby, 2004). Moreover, entrepreneurial efforts require organizational agreement and resource commitment to lead products, processes, and organizational innovations (Hornsby et al., 2002). Therefore, firms with less government intervention tend to create economic freedom and increase managers’ awareness of the benefits of exchanging, facilitating innovative activities, and releasing positive entrepreneurial elements (Rao et al., 2024; Graafland & Gerlagh, 2019), as this implies the importance influence of not only the middle managers but also the top managers when considering the corporate entrepreneurship. Therefore, in the following section this study will conduct a literature review on both middle and top managers to comprehensively identify the role of top managers in developing corporate entrepreneurship.

1.1. Influence of Middle Managers on Corporate Entrepreneurship

M. H. Chen et al. (2015) surveyed 337 middle managers to identify the influence of middle managers’ entrepreneurial orientation on creative performance, also known as corporate entrepreneurship. Moreover, the study also identified whether middle managers’ social networks with upper management moderate this relationship. This study was based on the understanding that middle managers play a critical role in promoting corporate entrepreneurship because they propose innovative ideas to top managers while encouraging subordinates to foster corporate entrepreneurship activities (Kuratko et al., 2005). The results showed that middle managers’ entrepreneurship orientation directly influences corporate entrepreneurship. Moreover, upper management networks moderated this effect. These results show that middle managers’ entrepreneurship does affect corporate entrepreneurship. Also, middle managers’ relationship with upper management can create a notable influence on their corporate entrepreneurship.

Glaser et al. (2015) surveyed 397 middle managers and 72 top managers to identify the role of boundary spanning. Specifically, this study identified the effect of top and middle managers’ boundary spanning on exploratory innovation, also known as corporate entrepreneurship. Boundary spanning links multiple sources of diverse knowledge that may be useful for innovation. Moreover, exploratory innovation is defined as experimenting on new product and market combinations while developing new skills and capabilities. The results showed that the influence of top managers’ boundary spanning on exploratory innovation is greater than that of middle managers (Glaser et al., 2015). This study identified the role of top managers in corporate entrepreneurship. Furthermore, it raised a concern among top managers that their power could potentially make middle managers feel unable to meet their job expectations, known as role conflict.

Liu et al. (2021) conducted a study on 300 companies to identify the role of middle managers’ organizational identification. This study was based on the idea that middle managers influence corporate entrepreneurship by playing a role as supporting, improving, and guiding entrepreneurial plans while identifying, acquiring, and deploying entrepreneurial resources. Furthermore, this study identified the role of middle managers by grounding the discussion in social identity theory. While social identity theory explains how an individual with a high level of social identity tends to form behaviors that are consistent with their organizational goals. The result found that middle managers do influence corporate entrepreneurship with their organizational identification.

Feldermann and Hiebl (2025) conducted a study on the 176 middle managers to identify how strategy development mediates psychological ownership to develop entrepreneurial behavior. While the literature review above focused on the role of middle managers to develop corporate entrepreneurship, there was little attention on how middle managers develop their entrepreneurial behavior. The results found that content-related involvement in strategy develops entrepreneurial behavior while mediating psychological ownership. This indicates that providing the control over the content-related strategy allows middle managers to develop their psychological ownership. Moreover, this can only be performed by the members in the firm who have greater authority such as top managers. Therefore, to develop middle managers’ entrepreneurship it is necessary to develop top manager’s understanding towards corporate entrepreneurship.

Based on the discussion above, the role of middle managers has a positive and significant influence on corporate entrepreneurship. However, a previous study has shown a concern that the top manager has a slightly negative influence towards corporate entrepreneurship for middle managers (Glaser et al., 2015). Therefore, in the following section, we will conduct a literature review on top managers’ entrepreneurship in corporate entrepreneurship.

1.2. Influence of Top Managers on Corporate Entrepreneurship

With the strength of a top manager, the company’s direction can change drastically. For instance, when top managers focus on technology, they make employees obtain more technology-based competencies (Martín-Rojas et al., 2011). Previous studies have reported that top managers can delay the development of corporate entrepreneurship by restricting and rejecting middle managers’ actions and ideas (Glaser et al., 2021). Some middle managers are terrified of top managers’ negative opinions toward them, which prompts them not to act on new strategies. In other words, top managers have the authority to either maximize or minimize the middle managers’ work. Therefore, top managers’ support toward middle managers is a significant factor when achieving corporate entrepreneurship. This usually depends on whether top managers can sense and identify the opportunities in the same way as the middle managers (Heavey & Simsek, 2013; Afshar Jahanshahi et al., 2018). Based on the discussion, it is important to analyze how top managers positively and significantly influence corporate entrepreneurship.

Chebbi et al. (2020) studied a French biscuit manufacturer to identify a mechanism to achieve corporate entrepreneurship. Based on Kotter’s model, this study conducted a case study. Data was gathered through semi-structured interviews. The results showed that top managers’ support, including the leadership, trust, employee risk-taking, autonomy, training, and empowerment, influences the entire workforce to be a change process. Based on this study, top managers must lead the entire team with determination, dedication, and support to facilitate corporate entrepreneurship. These factors serve as the foundation for a firm’s radical transformation from a traditional to a more innovative and dynamic organization.

Hung et al. (2024) studied how top managers influence middle managers to develop corporate entrepreneurship. Specifically, they studied middle managers’ perceptions of top managers’ strategic planning capacity and entrepreneurial orientation. A questionnaire survey of 259 middle managers found that when top managers have both competencies of strategic planning capacity and entrepreneurial orientation, they influence middle managers to be more vigorous in achieving corporate entrepreneurship. Moreover, this study was the first to develop the hypothesis that top managers’ strategic planning capacity itself has a negative influence on middle managers’ corporate entrepreneurship. This is because strategic planning is known to have strong control and clear communication. This was assumed to lead to unintended consequences that can diminish creativity and innovation for middle managers.

Chang et al. (2024) studied the role of top managers’ effect on the relationship between employees’ internal bridging ties and general managers’ transformational leadership. A survey on the 87 firms from Taiwan identified that when leaders allow employees to explore their ties between various functions can develop a general manager’s transformational leadership, also known as corporate entrepreneurship. However, when top managers attempt to bridge ties with the employees, it can create resource loss, as they try to reduce tension between the firm’s goals and limited resources. This study was the first to find that the direct connection between top managers and employees can create a negative effect on the overall corporate entrepreneurship performance.

Based on the discussion above, the influence of top managers’ entrepreneurship on corporate entrepreneurship was found to have both positive and negative effects. A previous quantitative study identified that middle managers’ perception of top managers with both strategic capacity and entrepreneurial orientation influenced middle managers towards corporate entrepreneurship (Hung et al., 2024). However, to the best of the author’s knowledge, there are no studies that directly assessed the top managers’ role in developing corporate entrepreneurship. Therefore, in this study, we will identify the top managers’ intuition effect on corporate entrepreneurship.

2. Hypothesis Development

2.1. Research Model Development

Intuition is known to be the most important aspect when predicting managers’ entrepreneurship as it directly plays a role in entrepreneurship decision-making (Tajpour et al., 2023), as it supports strategic decision-making. Moreover, intuition in managers is developed through experience and imagination. A previous study has identified how managers’ intuition influenced corporate entrepreneurship. Therefore, in this study, we will identify the role of the top managers’ intuition in developing corporate entrepreneurship.

Corporate entrepreneurship is an initiative that fosters all people in the firm to be innovative, ultimately to initiate entrepreneurship. In other words, it is important to initiate entrepreneurship as the firm’s goal, direction, and plan to enter new markets with new products and services (Ziyae & Sadeghi, 2020). This study developed a variable of corporate entrepreneurship while basing on a previous study that combined the two variables to develop a variable of entrepreneurial orientation (Y. C. Chen et al., 2022). The current study has selected proactiveness and risk-taking to develop a variable of corporate entrepreneurship. These two variables are the most essential factors to achieve corporate entrepreneurship, as they allow all managers and employees to be entrepreneurial. Previous studies have mentioned that “a firm is considered highly entrepreneurial when it habitually embarks on innovative actions, takes bold risks, seizes opportunities and performs sooner than its rivals” (Ziyae & Sadeghi, 2020). Based on this discussion, in this study, we will utilize risk-taking and proactiveness as they are variables to examine firms’ corporate entrepreneurship.

2.2. Top Managers’ Intuition Toward Corporate Entrepreneurship

Intuition is defined as the capacity of people to understand events around them to make decisions for the future. Intuition plays a significant role in entrepreneurial decision-making (Tajpour et al., 2023). Moreover, intuition supports the identification of new business opportunities (Ziyae & Sadeghi, 2020). The characteristic of intuition is that their decision-making process is relatively fast, effortless, and uncontrolled processing (Oktar & Lombrozo, 2022). On the other hand, using deliberation such as cognition and analytical decision-making process requires time and effort. Previous studies found that having intuition can deliver greater authenticity and stronger commitment, which is crucial in developing corporate entrepreneurship for top managers since they face a number of hurdles while achieving their goal as developing new ideas. Moreover, a previous study found that the entrepreneurial intuition of good managers can encourage organizations to adapt to external and internal changes, which ultimately supports the sustainability of small and medium-sized enterprises (Tajpour et al., 2023).

Risk-taking involves venturing into the unknown while committing resources and capital to projects with little or no assurance of success (Ziyae & Sadeghi, 2020; M. H. Chen et al., 2015). Taking risks is necessary for a firm because all employees are required to provide an encouraging environment and culture (Burgess, 2013). Moreover, M. H. Chen et al. (2015) defined proactiveness as opportunity-seeking behavior that includes monitoring current trends, identifying future markets, and anticipating industrial changes and new opportunities. In the development of creative ideas of the firm, a consistent focus and an uninterrupted flow of thought are necessary. In this way, proactiveness strengthens people’s motivation to find the best ideas while breaking the conventional system.

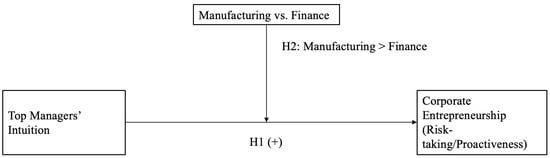

The current hypothesis will be based on a previous study, which examined managers’ intuition to influence the sustainability of small and medium-sized enterprises, known as corporate entrepreneurship (Tajpour et al., 2023). This study’s results found that the manager’s intuition has a positive and significant effect on the sustainability of small and medium-sized enterprises. In this study, we will adopt this research model by implementing managers’ intuition as top managers’ intuition. Also, we implemented the sustainability of small and medium-sized enterprises as corporate entrepreneurship. Accordingly, we formulate the following hypothesis and present the research model (Figure 1).

Figure 1.

Research model in the study: H: hypothesis.

Hypothesis 1 (H1).

Top managers’ intuition directly and positively influences corporate entrepreneurship.

2.3. Manufacturing and Financial Industries in the Corporate Entrepreneurship Context

The discussion on whether the manufacturing or financial industry is more prone to develop corporate entrepreneurship is controversial. One previous study has mentioned that manufacturing industry uses highly equipped machines and digital instruments that are helpful in their production (Jaeger & Upadhyay, 2019); however, they are bound by tradition and change is slow and costly. Regarding financial industry, a previous study has defined it as an industry which has been rapidly transforming and adapting, offering innovative services including digital banking, cross-institutional collaboration, blockchain technology, and automated processes (M. H. Wang et al., 2023). Other previous studies mentioned that the manufacturing industry is an industry which develops corporate entrepreneurship while implementing new technologies (Kim & Oh, 2024; Rehman et al., 2020). Regarding the financial industry, a previous study defined it as having a culture of bureaucracy and predominant efficiency-oriented mechanisms (Morici, 2022). This phenomenon is due to the regulations created to manage risks associated with providing financial services. Therefore, large and established financial firms often have the lowest chance of changing their conventional systems. In particular, the development of new ideas and the change in flow are not encouraged among employees.

Based on the discussion above can be explained using the structure–conduct–performance (SCP) paradigm. The concept of SCP states that the industry’s structure conditions a firm’s results (Fernández et al., 2022). SCP is based on the idea that the characteristics of the industry influence how the firms should behave, which ultimately influences the firm’s performance. For instance, the high bureaucracy of the financial industry tends to be rigorous compared to the manufacturing industry, regardless of their resistance to change. The financial industry is relatively easier to influence by the market structure due to regulation and risks that arise while providing services. Previous studies have also indicated that corporate entrepreneurship is relatively easier to be implemented by the manufacturing industries due to their way of seeking and adopting new and innovative products for greater returns (Kim & Oh, 2024). Accordingly, we formulate the following hypothesis (Figure 1).

Hypothesis 2 (H2).

Top managers’ intuition more strongly influences the corporate entrepreneurship of financial industries than manufacturing industries.

Based on the two hypotheses, we have developed two research questions: (1) Does top managers’ intuition influence corporate entrepreneurship? (2) How do these effects differ across industries?

3. Methods

3.1. Data Collection

This study conducted a questionnaire survey of top managers of manufacturing and financial companies in China. The questionnaire was translated from English to Chinese using the following steps. Step 1: The fifth author translated the English version into the Chinese version according to the original meaning of the questionnaire. Step 2: After the first author has reviewed the Chinese version of the questionnaire by translating it is translated back to English using Google Translate. Both the first author and the fifth author are proficient in English and Chinese. Step 3: We have conducted pre-testing to assess the understanding of the questionnaire by native Chinese speakers. The questionnaire survey was conducted during 1–12 August 2023, through Changsha Ranxing Information Technology, a Chinese research company that provides a data collection, analysis, and management platform. The questionnaire was administered to 154 and 168 top managers in the manufacturing and financing industries, respectively. The descriptions of the respondents are presented in Table 1.

Table 1.

Demographic information of respondents (N = 322).

3.2. Measurement and Construct

Top managers’ intuition was evaluated using two items adopted from (Hassan & Omar, 2016). An example item is “Making mistakes is a good way of finding out how to solve a problem”. Corporate entrepreneurship was evaluated using two variables, namely, risk-taking and proactiveness, with four items adapted from (Covin & Slevin, 1989). An example item of risk-taking is “A strong proclivity for high-risk projects (with chances of very high returns)”. An example item of proactiveness is “Typically initiates actions which competitors then respond to”. For all variables, participants were asked to answer using a seven-point Likert scale ranging from 1 = strongly disagree to 7 = strongly agree. The questionnaire was translated from English to Chinese to ensure that the respondents understood the concepts of the questions.

3.3. Data Analysis

We have utilized SPSS (version 29) and AMOS (version 29) to proceed with the data analysis. Moreover, we have utilized structural equation modeling to develop a model and to identify the relationship between each variable (Kozlinska et al., 2020). Multi-group analysis is a statistical method to compare two different types of data while identifying the relationship between each variable. Multi-group analysis was examined using a chi-square (X2) difference test on the values of the measurement residuals and unconstrained model (Ramadani et al., 2022).

Before conducting an analysis, we must perform confirmatory factor analysis (CFA) to identify the good fit between the proposed research model and the data. To execute CFA, we have identified the absolute fit indices and incremental fit indices. Absolute fit indices show how developed model fits the acquired data by comparing different models to choose the better fit (Hooper et al., 2008; McDonald & Ho, 2002). Incremental fit indices compare the Chi-square value to the base model with its hypothesis that all variables are uncorrelated. In this current study, we have selected CMIN/DF, Chi-square value, and RMSEA for the absolute fit index. As for the incremental fit indices, we have selected GFI, IFI, TLI, and CFI. The critical value of CMIN/DF is three or less, as results showed 2.248, suggesting that the fit of the hypothesized model is acceptable. Moreover, our results reveal a satisfactory fit to our data (X2 (11) = 24.733, p < 0.01, RMSEA = 0.062). Results for incremental fit indices, also known as GFI, IFI, TLI, CFI, the critical values are 0.9 or higher. Since all values were greater than 0.9, which indicated an acceptable model fit. To determine whether the items were aligned with their variable concepts, we have verified the strength of the relationship between the variables and items using absolute factor loadings. As all factor loadings were greater than 0.40, the items were deemed to sufficiently capture the common factors (DeVon et al., 2007). The overall Cronbach’s alpha did not indicate a good scale reliability due to the limited number of items for each variable. The overall value of AVE was greater than 0.36, which indicated an acceptable value for convergent validity (Z. Wang et al., 2022). For the value of CR, while an acceptable value is greater than 0.7, only corporate entrepreneurship showed an acceptable value. For the convergent validity test, the current study did not meet all conditions, as this study is still in the exploratory stage. Therefore, the results must be interpreted with caution for further analysis. For the discriminant validity, the critical value is the square root of AVE to be greater than the correlation coefficient. The current study was not acceptable for measuring the intended concepts. The results of the confirmatory factor analysis are presented in Table 2.

Table 2.

Results of confirmatory factor analysis.

Moreover, correlation analysis was conducted to identify the relationship between each variable. The results of the correlation coefficients are shown in Table 3. The results indicated that top managers’ intuition and corporate entrepreneurship have a significant and weak positive correlation (correlation coefficient = 0.301, p < 0.01). Finally, the effect of top managers’ intuition on corporate entrepreneurship and its different effects between manufacturing and financial industries were analyzed.

Table 3.

Correlation coefficients between variables.

4. Results

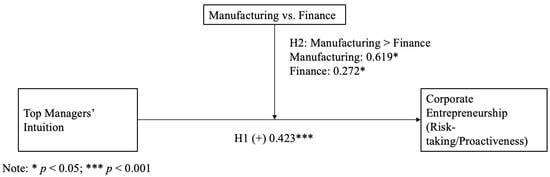

The effect of top managers’ intuition on corporate entrepreneurship is shown in Figure 2. The results found that top managers’ intuition has a significant and positive influence on corporate entrepreneurship; hence, H1 was supported (standardized coefficient = 0.423, standard error = 0.095, p < 0.05). Meanwhile, the multigroup analysis revealed that top managers’ intuition influence on corporate entrepreneurship is stronger in the manufacturing industry than in the financial industry; hence, H2 was supported.

Figure 2.

Results of the research model.

5. Discussion

In this study, we aimed to address two research questions: (1) Does top managers’ intuition influence corporate entrepreneurship? (2) How do these effects differ across industries? Our study of 322 top managers in the manufacturing and financial industries provided insights into these questions. First, the results indicate that top managers’ intuition positively and significantly influences corporate entrepreneurship. This finding suggests that top managers must embrace intuition as an entrepreneurial practice for firms to develop corporate entrepreneurship. These results support the previous study results conducted by Chebbi et al. (2020). This study conducted a qualitative study on a French biscuit manufacturer to identify the role of top managers in achieving corporate entrepreneurship. To the best of the author’s knowledge, the current study was the first to identify the role of top managers in developing corporate entrepreneurship using a quantitative study method. Second, our results show that the influence of top managers’ intuition on corporate entrepreneurship is stronger in the manufacturing industry than in the financial industry. This finding indicated that top managers’ intuition impact on corporate entrepreneurship that varies across industries. A previous study was conducted to identify whether industry and market structure influence a firm’s success (Fernández et al., 2022). The current study followed the findings of Fernández et al. (2022), that the financial industry, also known as the service industry, has the power over the firm. Moreover, this phenomenon can influence a firm’s corporate entrepreneurship. Overall, these findings are critical for achieving corporate entrepreneurship in the financial industry with its company policies and culture, as it can be relatively more challenging to foster corporate entrepreneurship.

This study offers two theoretical implications. First, the current study results expanded our understanding of top managers’ roles in developing corporate entrepreneurship. Previous studies have reported that top managers have both positive and negative impacts on developing corporate entrepreneurship (Chebbi et al., 2020; Hung et al., 2024). For instance, a previous study suggested that middle managers generate more support for corporate entrepreneurship and have a higher degree of implementation than top managers (Glaser et al., 2021). However, the limited number of studies on top managers’ roles in developing corporate entrepreneurship hinders the understanding of this topic in practice. This issue is adequately addressed in our study. Meanwhile, our study sheds light on the importance of top managers’ intuition in corporate entrepreneurship while clarifying the positive effect on corporate entrepreneurship. These findings provide a pathway for firms to develop corporate entrepreneurship effectively. Second, our results demonstrate how industries contribute to the development of corporate entrepreneurship. Previous studies have shown that adopting new technology in manufacturing industries can boost firm growth and improve product and process quality while achieving automation (Kim & Oh, 2024). Moreover, a previous study mentioned that financial industries face challenges as they generally lack entrepreneurship activities and must deal with high risks in managing information systems (Lee, 2020). Our study identified that industry characteristics do significantly influence the development of corporate entrepreneurship. However, a previous study found that, regarding environmental sustainability, the Chinese manufacturing industry tends to follow customers’ opinions rather than interpreting what the firm should do (Dai et al., 2018). In other words, customer pressure and the firm’s organizational culture matter in China when it comes to environmental sustainability. Therefore, it is important to identify the specific field in the manufacturing industry to consider whether organizational culture also supports the development of corporate entrepreneurship.

This study has three practical implications for firms in developing corporate entrepreneurship. First, this study found that top managers’ intuition promotes the development of corporate entrepreneurship. This finding emphasizes the need to develop top managers’ intuition to foster corporate entrepreneurship. This finding can be explained by the intentions model, as people who show entrepreneurial behavior tend to score high on intuition (Krueger et al., 2024). Moreover, a previous study identified the importance of developing the top management team as the moderating factor for a CEO’s transformational leadership to develop corporate entrepreneurship (Pan et al., 2021). While combining the findings of the previous study and the current study, it is crucial for top managers to not only gather new information while attending seminars to create new networks and environments for developing entrepreneurship, but also to take a lead and support the CEO in the firm to develop their transformational leadership to ultimately foster corporate entrepreneurship in the firm.

Second, our findings spread awareness of the challenges in developing corporate entrepreneurship in the financial industry. The financial sector faces hurdles in developing corporate entrepreneurship, even with the top managers’ intuition. A previous study found while conducting a structural equation modeling on the Swedish major insurance companies that organizational factors known as management support and reward/reinforcement have a positive effect on both incremental and discontinuous strategic corporate entrepreneurship (Morici, 2022). While comparing the current study and this previous study, in financial service firms with a strong requirement for bureaucratic and predominantly efficiency-oriented organizational mechanisms top managers must encourage the CEO and middle managers to take calculated risks with ideas while supporting many small projects with the realization that some will undoubtedly fail, give special recognition to employees’ work performance, and rewards employees’ depending on their established work (Hornsby et al., 2013).

Finally, from the aspects of the firm’s sustainability, the manufacturing and financial industries must develop a way that allows firms to sustainably create new ideas and innovate through corporate entrepreneurship. The roadmap for the sustainability of the firm consists of three phases. In the first phase, the top manager must develop relationships between the CEO, the entrepreneurship mentor firms, the risk management leader, and the resource allocation leader to develop the firm’s entrepreneurship leader at each department and level. In the second phase, they must develop a competition to develop new products or services from within the firm while developing a group of employees to challenge the idea to obtain resources from the firm if the idea is accepted by the top managers and the CEO. Throughout the idea generation and idea development, the employee has a way to reach an entrepreneurship mentor firm through an entrepreneurship leader in the department. In the last phase, at the end of the year the groups must share their progress regarding their new ideas, including the achievements and challenges developed through the entrepreneurship program in the firm. This initiative can cultivate a firm’s leadership, strategic planning, and culture to share and challenge new ideas.

Considering the aspects of the financial industry with a stronger culture of high bureaucracy, the initiatives above can be challenging at first. Therefore, for firms with high bureaucracy it is important to conduct entrepreneurship education for top managers. First, set up a meeting with a firm with a high-level manager in entrepreneurship who has already developed a system to incorporate new ideas into practice. Second, allow the top manager to understand the benefit of entrepreneurship by indicating the data and case study. Finally, allow the top manager to join the process of developing new products and services while joining the entrepreneurship education program. Through this process, the top manager will be able to identify both the concept and practice of entrepreneurship.

6. Conclusions

While previous studies on corporate entrepreneurship have primarily focused on middle managers, the current study shifts the focus to top managers (M. H. Chen et al., 2015; Glaser et al., 2015). Through a questionnaire survey of 322 top managers in China, we identified the role of top managers in developing corporate entrepreneurship. The results showed a positive and significant relationship between top managers’ intuition and corporate entrepreneurship. We also conducted a comparative analysis of the manufacturing and financial industries. The results showed that it is easier to develop corporate entrepreneurship in manufacturing industries than in financial industries. Moreover, it is more crucial for top managers in the financial industry to have the intuition to develop corporate entrepreneurship by influencing the CEO and middle managers to break the conventional culture of bureaucracy. These findings shed light on the importance of understanding the characteristics of each industry to develop corporate entrepreneurship. From the aspect of sustainability, regardless of the industries, firms initiating the development of new products, services, or systems can cause greater risks. The dilemma between risk and returns has been happening and will happen in the future. The biggest challenge is to gain approval from the higher-level leader in the hierarchical structure of the firm. While developing corporate entrepreneurship, the higher-level employees including leaders such as middle managers and top managers, must be able to take responsibility by approving the subordinates’ ideas while creating opportunities for them to think, discuss, and challenge.

7. Limitations

This study has five limitations. First, this study did not identify the interactions between top and middle managers’ entrepreneurship. This limitation creates a gap in our understanding of how the relationship between top managers and middle managers influences corporate entrepreneurship. Future studies should thus consider the relationship between them in developing corporate entrepreneurship. Second, this study only surveyed Chinese top managers. Therefore, the cultural, institutional, and regulatory differences that could have influenced the effect of top managers’ intuition on corporate entrepreneurship were not fully examined. Therefore, in future study conducting a questionnaire survey in two or more countries while identifying the characteristics of institutions and regulations to deliver more in-depth discussion can be expected. Third, this study has only used two items to identify the variable of top managers’ intuition. Regardless of whether this variable was developed based on the previous study, the lack of items has caused a challenge in data validation. Therefore, in future study referencing a questionnaire that has more than three items is recommended. Fourth, this study has conducted a questionnaire survey on top managers in firms, which indicates that all the item data are extracted from self-reports surveys. This could potentially develop biased results. Therefore, in future study it is better to extract the firm’s growth rate as the data for measuring corporate entrepreneurship. Fifth, this study utilized structural equation modeling to conduct statistical analysis. Some extracted data of AVE and CR values have shown lower values than the thresholds. In future analysis we would like to use more scales to analyze the factor in the structural equation modeling to mitigate this challenge.

Author Contributions

Conceptualization, X.L. and Y.L.; methodology, I.K.; software, Y.K.; validation, Y.K. and Y.L.; formal analysis, I.K.; investigation, K.K. (Karin Kurata) and X.L.; resources, K.K. (Kota Kodama) and Y.L.; data curation, X.L.; writing—original draft preparation, K.K. (Karin Kurata); writing—review and editing, K.K. (Kota Kodama); visualization, K.K. (Kota Kodama); supervision, Y.L.; project administration, Y.K. and X.L.; funding acquisition, Y.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Grant-in-Aid for Early-Career Scientists (grant number 22K13466).

Institutional Review Board Statement

Ethical review and approval were waived for this study due to the research ethics checklist of National Institute of Technology, Tsuruoka College. The checklist indicated that we do not need to conduct institutional review board (accessed on 12 April 2025).

Informed Consent Statement

Informed consent was obtained from all participants involved in the study.

Data Availability Statement

Raw data are unavailable to protect the personal information of the firms.

Conflicts of Interest

K.K. has received a research donation for the institution from Kumagaya Gumi, Sumitomo Life Insurance, Merge system, NEC, Pasona, Tamai Investment Educations, Yasuhara Chemical and Ernst & Young ShinNihon LLC.

References

- Afshar Jahanshahi, A. A., Nawaser, K., & Brem, A. (2018). Corporate entrepreneurship strategy: An analysis of top management teams in SMEs. Baltic Journal of Management, 13, 528–543. [Google Scholar] [CrossRef]

- Baden-Fuller, C. (1995). Strategic innovation, corporate entrepreneurship and matching outside-in to inside-out approaches to strategy research. British Journal of Management, 6, S3–S16. [Google Scholar] [CrossRef]

- Belousova, O., & Gailly, B. (2013). Corporate entrepreneurship in a dispersed setting: Actors, behaviors, and process. International Entrepreneurship and Management Journal, 9, 361–377. [Google Scholar] [CrossRef]

- Burgess, C. (2013). Factors influencing middle managers’ ability to contribute to corporate entrepreneurship. International Journal of Hospitality Management, 32, 193–201. [Google Scholar] [CrossRef]

- Chang, Y. Y., Lin, Y. M., Chang, T. W., & Chang, C. Y. (2024). Sustainable corporate entrepreneurship performance and social capital: A multi-level analysis. Review of Managerial Sciences, 18, 2373–2395. [Google Scholar] [CrossRef]

- Chebbi, H., Yahiaoui, D., Sellami, M., Papasolomou, I., & Melanthiou, Y. (2020). Focusing on internal stakeholders to enable the implementation of organizational change towards corporate entrepreneurship: A case study from France. Journal of Business Research, 119, 209–217. [Google Scholar] [CrossRef]

- Chen, M. H., Chang, Y. Y., & Chang, Y. C. (2015). Entrepreneurial orientation, social networks, and creative performance: Middle managers as corporate entrepreneurs. Creativity and Innovation Management, 24, 493–507. [Google Scholar] [CrossRef]

- Chen, Y. C., Arnold, T., Liu, P. Y., & Huang, C. Y. (2022). Understanding the role of entrepreneurial orientation in creating ambidextrous competitive advantage: A comparative-design, longitudinal study. European Journal of Marketing, 57(1), 89–124. [Google Scholar] [CrossRef]

- Covin, J. G., & Slevin, D. P. (1989). Strategic management of small firms in hostile and benign environments. Strategic Management Journal, 10, 75–87. [Google Scholar] [CrossRef]

- Dai, J., Chan, H. K., & Yee, R. W. Y. (2018). Examining moderating effect of organizational culture on the relationship between market pressure and corporate environmental strategy. Industrial Marketing Management, 74, 227–236. [Google Scholar] [CrossRef]

- DeVon, H. A., Block, M. E., Moyle-Wright, P., Ernst, D. M., Hayden, S. J., Lazzara, D. J., Savoy, S. M., & Kostas-Polston, E. (2007). A psychometric toolbox for testing validity and reliability. Journal of Nursing Scholarship, 39, 155–164. [Google Scholar] [CrossRef]

- Donald, K. F., & Goldsby, M. G. (2004). Corporate entrepreneurs or rogue middle managers? A framework for ethical corporate entrepreneurship. Journal of Business Ethics, 55, 13–30. [Google Scholar] [CrossRef]

- Feldermann, S. K., & Hiebl, M. R. W. (2025). Strategies to evoke entrepreneurial behavior in middle managers: Involvement in strategy development and the creation of psychological ownership. International Journal of Entrepreneurial Behavior & Research, 31(11), 235–253. [Google Scholar] [CrossRef]

- Fernández, E., López-López, V., Jardón, C. M., & Iglesias-Antelo, S. (2022). A firm-industry analysis of services versus manufacturing. European Research on Management and Business Economics, 28, 100181. [Google Scholar] [CrossRef]

- Glaser, L., Fourné, S. P. L., Brennecke, J., & Elfring, T. (2021). Leveraging middle managers’ brokerage for corporate entrepreneurship: The role of multilevel social capital configurations. Long Range Planning, 54, 1–16. [Google Scholar] [CrossRef]

- Glaser, L., Fourné, S. P. L., & Elfring, T. (2015). Achieving strategic renewal: The multi-level influences of top and middle managers’ boundary-spanning. Small Business Economics, 45, 305–327. [Google Scholar] [CrossRef]

- Graafland, J., & Gerlagh, R. (2019). Economic freedom, internal motivation, and corporate environmental responsibility of SMEs. Environmental and Resource Economics, 74, 1101–1123. [Google Scholar] [CrossRef]

- Hassan, R. A., & Omar, S. N. B. (2016). The effect of emotional intelligence and entrepreneurial attitude on entrepreneurial intention. Kuwait Chapter of Arabian Journal of Business and Management Review, 5, 1–10. [Google Scholar] [CrossRef][Green Version]

- Heavey, C., & Simsek, Z. (2013). Top management compositional effects on corporate entrepreneurship: The moderating role of perceived technological uncertainty. Journal of Product Innovation Management, 30, 837–855. [Google Scholar] [CrossRef]

- Hooper, D., Coughlan, J., & Mullen, M. R. (2008). Structural equation modelling: Guidelines for determining model fit. Electronic Journal of Business Research Methods, 6(1), 53–60. [Google Scholar]

- Hornsby, J. S., Kuratko, D. F., Holt, D. T., & Wales, W. J. (2013). Assessing a measurement of organizational preparedness for corporate entrepreneurship. Journal of Product Innovation Management, 30(5), 937–955. [Google Scholar] [CrossRef]

- Hornsby, J. S., Kuratko, D. F., & Zahra, S. A. (2002). Middle managers’ perception of the internal environment for corporate entrepreneurship: Assessing a measurement scale. Journal of Business Venturing, 17, 253–273. [Google Scholar] [CrossRef]

- Hung, K. T., Banerjee, S., Nordstrom, O., Tangpong, C., Li, Y., & Li, J. (2024). The influence of top management’s strategic planning capacity and entrepreneurial orientation on corporate entrepreneurship. Entrepreneurship Research Journal, 14, 2001–2028. [Google Scholar] [CrossRef]

- Jaeger, B., & Upadhyay, A. (2019). Understanding barriers to circular economy: Cases from the manufacturing industry. Journal of Enterprise Information Management, 33(4), 729–745. [Google Scholar] [CrossRef]

- Jooss, S., McDonnell, A., & Skuza, A. (2024). Middle managers as key talent management stakeholders: Navigating paradoxes. European Management Review, 21, 459–476. [Google Scholar] [CrossRef]

- Kim, J., & Oh, I. (2024). Adoption of emerging technologies and growth of manufacturing firms: The importance of technology types and corporate entrepreneurship. Technology Analysis & Strategic Management, 36, 2476–2488. [Google Scholar] [CrossRef]

- Kozlinska, I., Mets, T., & Rõigas, K. (2020). Measuring learning outcomes of entrepreneurship education using structural equation modeling. Administrative Sciences, 10, 58. [Google Scholar] [CrossRef]

- Krueger, N., Mestwerdt, S., & Kickul, J. (2024). Entrepreneurial thinking: Rational vs intuitive. Journal of Intellectual Capital, 25(5/6), 942–962. [Google Scholar] [CrossRef]

- Kuratko, D. F., & Audretsch, D. B. (2013). Clarifying the domains of corporate entrepreneurship. International Entrepreneurship and Management Journal, 9, 323–335. [Google Scholar] [CrossRef]

- Kuratko, D. F., Ireland, R. D., Covin, J. G., & Hornsby, J. S. (2005). A model of middle-level managers’ entrepreneurial behavior. Entrepreneurship Theory and Practice, 29, 699–716. [Google Scholar] [CrossRef]

- Lee, H. (2020). Role of artificial intelligence and enterprise risk management to promote corporate entrepreneurship and business performance: Evidence from Korean banking sector. Journal of Intelligent & Fuzzy Systems, 39, 5369–5386. [Google Scholar] [CrossRef]

- Liu, Y., Xi, M., Li, F., & Geng, X. (2021). Linking CEO relationship-focused leadership and corporate entrepreneurship: A multilevel moderated mediation model. Chinese Management Studies, 15(4), 940–958. [Google Scholar] [CrossRef]

- Martín-Rojas, R., García-Morales, V. J., & García-Sánchez, E. (2011). The influence on corporate entrepreneurship of technological variables. Industrial Management & Data Systems, 111, 984–1005. [Google Scholar] [CrossRef]

- Martín-Rojas, R., Garrido-Moreno, A., & García-Morales, V. J. (2020). Fostering corporate entrepreneurship with the use of social media tools. Journal of Business Research, 112, 396–412. [Google Scholar] [CrossRef]

- McDonald, R. P., & Ho, M. H. R. (2002). Principles and practice in reporting structural equation analysis. Psychological Methods, 7(1), 64–82. [Google Scholar] [CrossRef]

- Morici, B. C. (2022). Strategic corporate entrepreneurship practices in financial services firms: The role of organizational factors. SN Business & Economics, 2, 130. [Google Scholar] [CrossRef] [PubMed]

- Mustafa, M., Lundmark, E., & Ramos, H. M. (2016). Untangling the relationship between human resource management and corporate entrepreneurship: The mediating effect of middle managers’ knowledge sharing. Entrepreneurship Research Journal, 6, 273–295. [Google Scholar] [CrossRef]

- Oktar, K., & Lombrozo, T. (2022). Deciding to be authentic: Intuition is favored over deliberation when authenticity matters. Cognition, 223, 105021. [Google Scholar] [CrossRef] [PubMed]

- Pan, Y., Verbeke, A., & Yuan, W. (2021). CEO transformational leadership and corporate entrepreneurship in China. Management and Organizational Review, 17(1), 45–76. [Google Scholar] [CrossRef]

- Ramadani, V., Rahman, M., Salamzadeh, A., Rahaman, S., & Abazi-Alili, H. (2022). Entrepreneurship education and graduates’ entrepreneurial intentions: Does gender matter? A multi-group analysis using AMOS. Technological Forecasting & Social Change, 180, 121693. [Google Scholar] [CrossRef]

- Rao, Y., Zhu, X., Sun, Y., & Qian, X. (2024). CEO’s knowledge integration, entrepreneurship, and corporate innovation: Evidence for China. International Review of Financial Analysis, 91, 102963. [Google Scholar] [CrossRef]

- Rehman, N., Razaq, S., Farooq, A., Zohaib, N. M., & Nazri, M. (2020). Information technology and firm performance: Mediation role of absorptive capacity and corporate entrepreneurship in manufacturing SMEs. Technology Analysis & Strategic Management, 32, 1049–1065. [Google Scholar] [CrossRef]

- Soltanifar, M., Hughes, M., O’Connor, G., Covin, J. G., & Roijakkers, N. (2023). Unlocking the potential of non-managerial employees in corporate entrepreneurship: A systematic review and research agenda. International Journal of Entrepreneurial Behavior & Research, 29(11), 206–240. [Google Scholar] [CrossRef]

- Tajeddini, K., & Mueller, S. L. (2012). Corporate entrepreneurship in Switzerland: Evidence from a case study of Swiss watch manufacturers. International Entrepreneurship and Management Journal, 8, 355–372. [Google Scholar] [CrossRef]

- Tajpour, M., Hosseini, E., Ratten, V., Bahman-Zangi, B., & Soleymanian, S. M. (2023). The role of entrepreneurial thinking mediated by social media on the sustainability of small and medium-sized enterprises in Iran. Sustainability, 15, 4518. [Google Scholar] [CrossRef]

- Wang, M. H., Chen, C. C., Chen, K. Y., & Lo, H. W. (2023). Leadership competencies in the financial industry during digital transformation: An evaluation framework using the Z-DEMATEL technique. Axioms, 12, 855. [Google Scholar] [CrossRef]

- Wang, Z., Jiang, Q., & Li, Z. (2022). How to promote online education through educational software—An analytical study of factor analysis and structural equation modeling with Chinese users as an example. Systems, 10, 100. [Google Scholar] [CrossRef]

- Wu, Y., Ma, Z., & Wang, M. S. (2018). Developing new capability: Middle managers’ role in corporate entrepreneurship. European Business Review, 30, 470–493. [Google Scholar] [CrossRef]

- Zahra, S. A. (1991). Predictors and financial outcomes of corporate entrepreneurship: An exploratory study. Journal of Business Venturing, 6, 259–285. [Google Scholar] [CrossRef]

- Ziyae, B., & Sadeghi, H. (2020). Exploring the relationship between corporate entrepreneurship and firm performance: The mediating effect of strategic entrepreneurship. Baltic Journal of Management, 16, 113–133. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).