The Relationship Between IT Governance, Digital Financial Transformation, and Economic Sustainability Performance

Abstract

1. Introduction

2. Theoretical Background

3. Literature Review and Hypotheses Development

3.1. The Relationship Between IT Governance and Digital Financial Transformation

3.2. The Relationship Between Digital Financial Transformation and Economic Sustainability Performance

3.3. The Relationship Between IT Governance, Digital Financial Transformation, and Economic Sustainability Performance

4. Methodology

4.1. Research Design

4.2. Measurements and Operation Definitions of the Variables

4.3. Data Collection

4.4. Sampling

4.5. Statistical Tools and Analysis

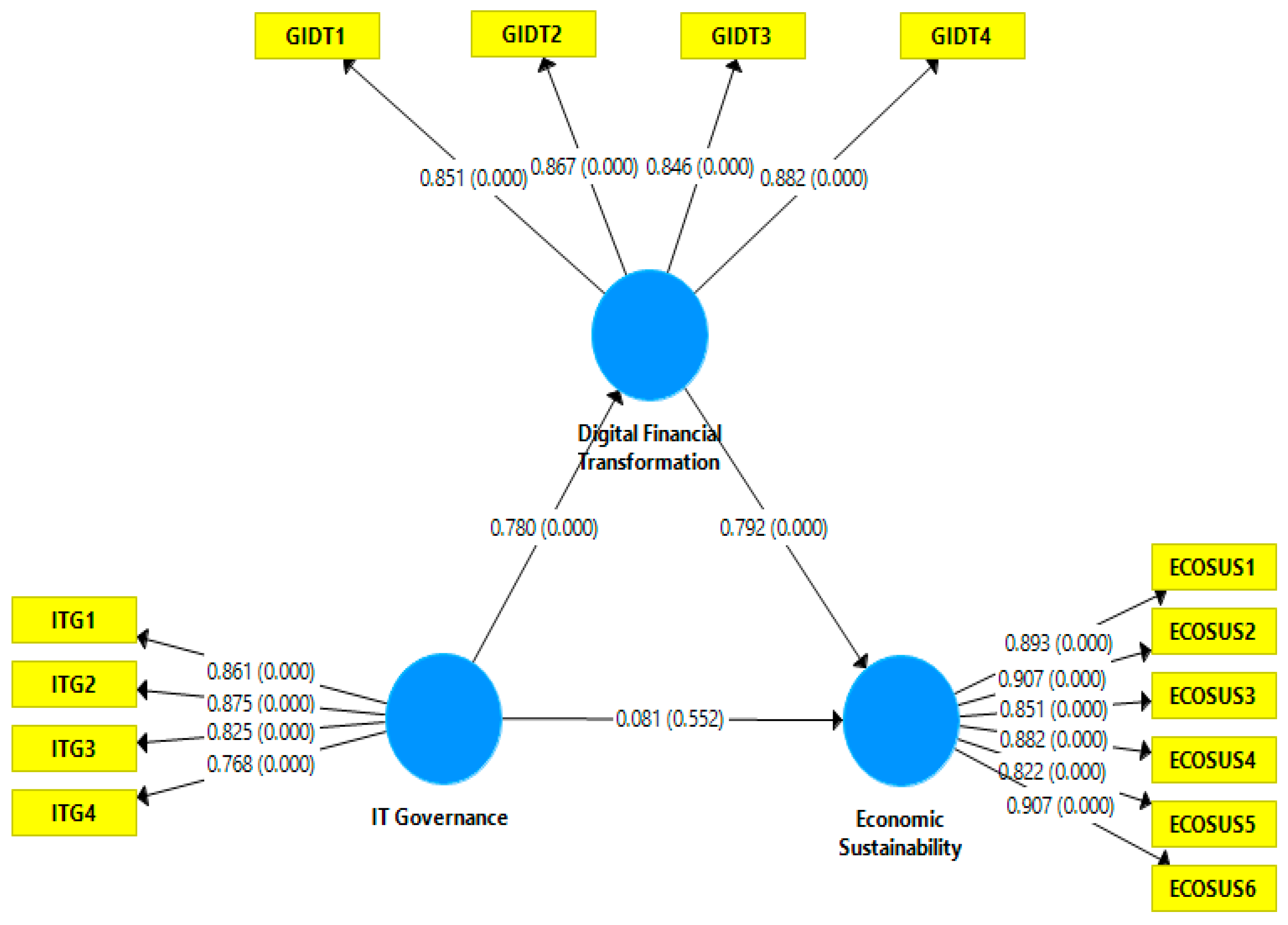

4.6. Measurement Model

5. Results and Discussion

5.1. Path Analysis

5.2. Importance Performance Mapping

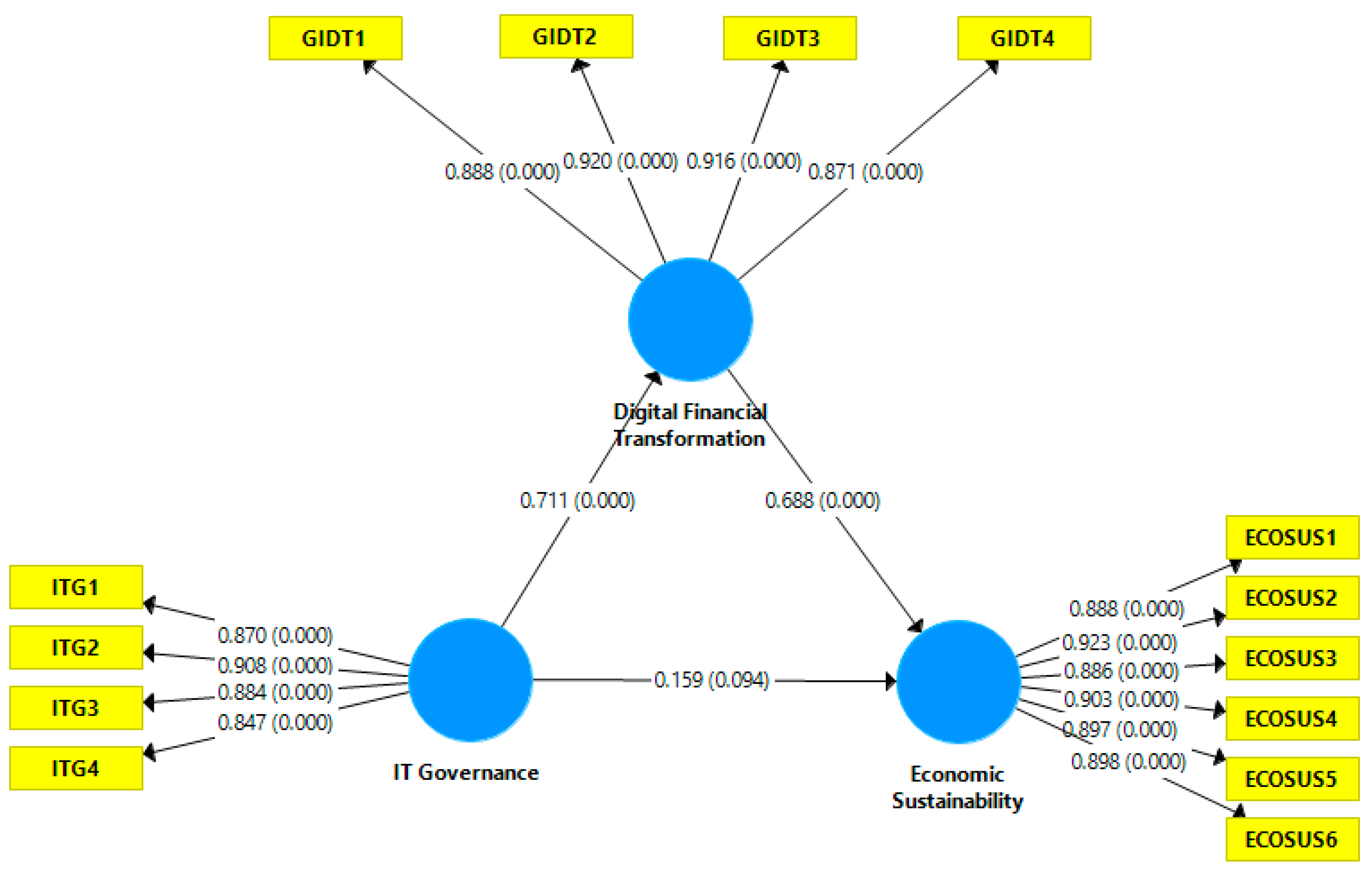

5.3. Sensitivity Analysis (Bootstrapping)

6. Discussion and Policy Implications

7. Conclusions

8. Limitations and Future Research Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Aggarwal, G., KM, A. A., Muslim, M., & Khan, M. U. A. (2024). Sustainable investment strategies for Oman Vision 2040-contribution towards socioeconomic development and environmental conservation. SSR Journal of Economics, Business and Management (SSRJEBM), 1(1), 7–13. [Google Scholar]

- Akter, N., Siddik, A. B., & Al Mondal, M. S. (2018). Sustainability reporting on green financing: A study of listed private sustainability. Journal of Business and Technology, 12(1), 14–27. [Google Scholar]

- Al Darmaki, A., Khan, A., Bait-Suwailem, M., & Mughal, M. R. (2025). Digital transformation in Oman: A comprehensive review. International Journal of Computing and Digital Systems, 18(1), 1–10. [Google Scholar] [CrossRef]

- Al Ghunaimi, H., Almaqtari, F. A., Almamari, S., & Al-Hattami, H. M. (2025a). The role of digital advancement and artificial intelligence in improving the efficiency of accounting software to facilitate optimal tax procedures and prevent legal appeals. In Digital transformation in customs and taxation: A catalyst for economic resilience. CRC Press. [Google Scholar] [CrossRef]

- Al Ghunaimi, H., Almaqtari, F. A., Wesonga, R., & Elmashtawy, A. (2025b). The rise of fintech and the journey toward a cashless society: Investigating the use of mobile payments by SMEs in Oman in the context of vision 2040. Administrative Sciences, 15(5), 178. [Google Scholar] [CrossRef]

- Ali, S., & Green, P. (2012). Effective information technology (IT) governance mechanisms: An IT outsourcing perspective. Information Systems Frontiers, 14(2), 179–193. [Google Scholar] [CrossRef]

- Ali, S., Green, P., & Robb, A. (2015). Information technology investment governance: What is it and does it matter? International Journal of Accounting Information Systems, 18, 1–25. [Google Scholar] [CrossRef]

- Almaqtari, F. A. (2024a). The moderating role of IT governance on the relationship between FinTech and sustainability performance. Journal of Open Innovation: Technology, Market, and Complexity, 10(2), 100267. [Google Scholar] [CrossRef]

- Almaqtari, F. A. (2024b). The role of IT governance in the integration of AI in accounting and auditing operations. Economies, 12(8), 199. [Google Scholar] [CrossRef]

- Almaqtari, F. A., Farhan, N. H. S., Yahya, A. T., Al-Dalaien, B. O. A., & Shamim, M. (2023). The mediating effect of IT governance between corporate governance mechanisms, business continuity, and transparency & disclosure: An empirical study of COVID-19 Pandemic in Jordan. Information Security Journal: A Global Perspective, 32, 39–57. [Google Scholar] [CrossRef]

- Alojail, M., & Khan, S. B. (2023). Impact of digital transformation toward sustainable development. Sustainability, 15(20), 14697. [Google Scholar] [CrossRef]

- Alreemy, Z., Chang, V., Walters, R., & Wills, G. (2016). Critical success factors (CSFs) for information technology governance (ITG). International Journal of Information Management, 36(6), 907–916. [Google Scholar] [CrossRef]

- Al Shanti, A. M., & Elessa, M. S. (2023). The impact of digital transformation towards blockchain technology application in banks to improve accounting information quality and corporate governance effectiveness. Cogent Economics and Finance, 11(1), 2161773. [Google Scholar] [CrossRef]

- Anthony, B., Jr. (2018). Using green IT governance as a catalyst to improve sustainable practices adoption: A contingency theory perspective. International Journal of Business Continuity and Risk Management, 8(2), 124–157. [Google Scholar] [CrossRef]

- Arner, D. W., Buckley, R. P., Zetzsche, D. A., & Veidt, R. (2020). Sustainability, Fintech and financial inclusion. European Business Organization Law Review, 21, 7–35. [Google Scholar] [CrossRef]

- Astudillo, S., Cordero, D., Bermeo, V., & Mory, A. (2020, July 27–28). IT governance and green IT: A systematic review. 2020 Fourth World Conference on Smart Trends in Systems, Security and Sustainability (WorldS4), London, UK. [Google Scholar] [CrossRef]

- Attah, R. U., Garba, B. M. P., Gil-Ozoudeh, I., & Iwuanyanwu, O. (2024). Digital transformation in the energy sector: Comprehensive review of sustainability impacts and economic benefits. International Journal of Advanced Economics, 6(12), 760–776. [Google Scholar] [CrossRef]

- Barroso, M., & Laborda, J. (2022). Digital transformation and the emergence of the Fintech sector: Systematic literature review. Digital Business, 2(2), 100028. [Google Scholar] [CrossRef]

- Battisti, E., Nirino, N., & Christofi, M. (2023). Financial innovation (FinTech) and sustainability: New tools for sustainable achievements. Qualitative Research in Financial Markets, 12, 647–654. [Google Scholar] [CrossRef]

- Bianchi, I., Shurenov, N., Tovma, N., Maslova, I., & Shansharkhanov, A. (2023). IT governance mechanisms to foster digital transformation in higher education institutions. In Digital technologies and transformation in business, industry and organizations: Volume 2 (pp. 79–99). Springer. [Google Scholar]

- Billi, A., & Bernardo, A. (2025). The effects of digital transformation, IT innovation, and sustainability strategies on firms’ performances: An empirical study. Sustainability, 17(3), 823. [Google Scholar] [CrossRef]

- Bocean, C. G., & Vărzaru, A. A. (2023). EU countries’ digital transformation, economic performance, and sustainability analysis. Humanities and Social Sciences Communications, 10(1), 875. [Google Scholar] [CrossRef]

- Calder, A. (2008). ISO/IEC 38500: The IT governance standard. IT Governance Ltd. ISBN 978-1-905356-58-4. [Google Scholar]

- Castelo-Branco, I., Oliveira, T., Simões-Coelho, P., Portugal, J., & Filipe, I. (2022). Measuring the fourth industrial revolution through the Industry 4.0 lens: The relevance of resources, capabilities, and the value chain. Computers in Industry, 138, 103639. [Google Scholar] [CrossRef]

- Chen, Y., & Guo, H. (2025). Corporate performance: Green supply chain management, digital transformation, and carbon neutrality. Management Decision, 63(7), 2432–2451. [Google Scholar] [CrossRef]

- Chuang, S.-P., & Huang, S.-J. (2018). The effect of environmental corporate social responsibility on environmental performance and business competitiveness: The mediation of green information technology capital. Journal of Business Ethics, 150, 991–1009. [Google Scholar] [CrossRef]

- D’Adamo, I., Gastaldi, M., & Morone, P. (2022). Economic sustainable development goals: Assessments and perspectives in Europe. Journal of Cleaner Production, 354, 131730. [Google Scholar] [CrossRef]

- Dao, V. T., Langella, I. M., & Carbo, J. A. (2011). From green to sustainability: Information technology and an integrated sustainability framework. Journal of Strategic Information Systems, 20, 63–79. [Google Scholar] [CrossRef]

- De Haes, S., & Van Grembergen, W. (2005, January 3–6). IT governance structures, processes, and relational mechanisms: Achieving IT/business alignment in a major Belgian financial group. 38th Annual Hawaii International Conference on Systems (p. 237b), Big Island, HI, USA. [Google Scholar] [CrossRef]

- Dhyanasaridewi, I. G. A. D., Murwaningsari, E., & Mayangsari, S. (2024). The effect of sustainability innovation, proactive sustainability strategy, and digital transformation on corporate sustainability performance. Revista de Gestão Social e Ambiental, 18(6), 1–23. [Google Scholar] [CrossRef]

- El Hilali, W., El Manouar, A., & Janati Idrissi, M. A. (2020). Reaching sustainability during a digital transformation: A PLS approach. International Journal of Innovation Science, 12(1), 52–79. [Google Scholar] [CrossRef]

- Fattah, A., Saragih, H., Saragih, H., & Setyadi, R. (2021). Determinants effectiveness of information technology governance and IT performance in Higher Education Institutions (HEI): A conceptual framework. Internationational Journal of Science, Technology and Management, 2, 36–47. [Google Scholar] [CrossRef]

- Ferguson, C., Green, P., Vaswani, R., & Wu, G. (2013). Determinants of effective information technology governance. International Journal of Auditing, 17(1), 75–99. [Google Scholar] [CrossRef]

- Feroz, A. K., Zo, H., & Chiravuri, A. (2021). Digital transformation and environmental sustainability: A review and research agenda. Sustainability, 13(3), 1530. [Google Scholar] [CrossRef]

- Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18(1), 39–50. [Google Scholar] [CrossRef]

- Gomez-Trujillo, A. M., & Gonzalez-Perez, M. A. (2022). Digital transformation as a strategy to reach sustainability. Smart and Sustainable Built Environment, 11(4), 1137–1162. [Google Scholar] [CrossRef]

- Guandalini, I. (2022). Sustainability through digital transformation: A systematic literature review for research guidance. Journal of Business Research, 148, 456–471. [Google Scholar] [CrossRef]

- Hair, J., & Alamer, A. (2022). Partial Least Squares Structural Equation Modeling (PLS-SEM) in second language and education research: Guidelines using an applied example. Research Methods in Applied Linguistics, 1(3), 100027. [Google Scholar] [CrossRef]

- Hair, J. F. (2014). A primer on partial least squares structural equation modeling (PLS-SEM) (1st ed.). Sage. [Google Scholar]

- Hair, J. F., Hult, G. T. M., Ringle, C. M., Sarstedt, M., & Thiele, K. O. (2017). Mirror, mirror on the wall: A comparative evaluation of composite-based structural equation modeling methods. Journal of the Academy of Marketing Science, 45(5), 616–632. [Google Scholar] [CrossRef]

- Hamdan, A., Khamis, R., Anasweh, M., Al-Hashimi, M., & Razzaque, A. (2019). IT governance and firm performance: Empirical study from Saudi Arabia. SAGE Open, 9(2), 215824401984372. [Google Scholar] [CrossRef]

- Hung, N. T. (2023). Green investment, financial development, digitalization and economic sustainability in Vietnam: Evidence from a quantile-on-quantile regression and wavelet coherence. Technological Forecasting and Social Change, 186, 122185. [Google Scholar] [CrossRef]

- Ingale, A. (2024). IT governance: Navigating the digital transformation era. In IT governance, digital transformation, large-scale data analytics, cloud computing. SSRN. [Google Scholar] [CrossRef]

- Jalil, A., & Khawaja, K. F. (2025). Digital transformation strategy and e-governance sustainability: The mediating role of sustainability-oriented innovation. Jinnah Business Review, 13(1), 1–11. [Google Scholar] [CrossRef]

- Jeffers, P. I. (2010). Embracing sustainability: Information technology and the strategic leveraging of operations in third-party logistics. International Journal of Operations & Production Management, 30, 260–287. [Google Scholar] [CrossRef]

- Jermsittiparsert, K. (2020). Leadership and Industry 4.0 as a tool to enhance organization performance: Direct and indirect role of job satisfaction, competitive advantage and business sustainability. In Agile business leadership methods for Industry 4.0 (pp. 233–257). Emerald Publishing Limited. [Google Scholar] [CrossRef]

- Jewer, J., & Van Der Meulen, N. (2022, January 4–7). Governance of digital transformation: A review of the literature. Hawaii International Conference on System Sciences (HICSS) (pp. 1–10), Maui, HI, USA. [Google Scholar]

- Joshi, A., Benitez, J., Huygh, T., Ruiz, L., & De Haes, S. (2022). Impact of IT governance process capability on business performance: Theory and empirical evidence. Decision Support Systems, 153, 113668. [Google Scholar] [CrossRef]

- Korachi, Z., & Bounabat, B. (2020, December 21–26). IT management and governance framework for formulating a digital transformation strategy. International Conference on Advanced Intelligent Systems for Sustainable Development (pp. 475–498), Tangier, Morocco. [Google Scholar]

- Li, J., & Xu, X. (2024). Can ESG rating reduce corporate carbon emissions?—An empirical study from Chinese listed companies. Journal of Cleaner Production, 434, 140226. [Google Scholar] [CrossRef]

- Li, L. (2022). Digital transformation and sustainable performance: The moderating role of market turbulence. Industrial Marketing Management, 104, 28–37. [Google Scholar] [CrossRef]

- Liu, R., Gailhofer, P., Gensch, C.-O., Köhler, A., Wolff, F., Monteforte, M., Urrutia, C., Cihlarova, P., & Williams, R. (2019). Impacts of the digital transformation on the environment and sustainability. Issue Paper Under Task, 3, 2019. [Google Scholar]

- Lunardi, G. L., Maçada, A. C. G., & Becker, J. L. (2014, January 6–9). IT governance effectiveness and its antecedents: An empirical examination in Brazilian firms. Annual Hawaii International Conference on System Sciences (pp. 4376–4385), Waikoloa, HI, USA. [Google Scholar] [CrossRef]

- Martínez-Peláez, R., Ochoa-Brust, A., Rivera, S., Félix, V. G., Ostos, R., Brito, H., Félix, R. A., & Mena, L. J. (2023). Role of digital transformation for achieving sustainability: Mediated role of stakeholders, key capabilities, and technology. Sustainability, 15(14), 11221. [Google Scholar] [CrossRef]

- Mata, F. J., Fuerst, W. L., & Barney, J. B. (1995). Information technology and sustained competitive advantage: A resource-based analysis. In Management information systems quarterly. University of Minnesota. [Google Scholar] [CrossRef]

- Mavlutova, I., Spilbergs, A., Verdenhofs, A., Natrins, A., Arefjevs, I., & Volkova, T. (2022). Digital transformation as a driver of the financial sector sustainable development: An impact on financial inclusion and operational efficiency. Sustainability, 15(1), 207. [Google Scholar] [CrossRef]

- Medaglia, R., Eaton, B., Hedman, J., & Whitley, E. A. (2022). Mechanisms of power inscription into IT governance: Lessons from two national digital identity systems. Information Systems Journal, 32(2), 242–277. [Google Scholar] [CrossRef]

- Mijwil, M., Filali, Y., Aljanabi, M., Bounabi, M., & Al-Shahwani, H. (2023). The purpose of cybersecurity governance in the digital transformation of public services and protecting the digital environment. Mesopotamian Journal of Cybersecurity, 2023, 1–6. [Google Scholar] [CrossRef]

- Mulyana, R. (2025). IT governance influence on digital transformation. Department of Computer and Systems Sciences, Stockholm University. [Google Scholar]

- Mulyana, R., Rusu, L., & Perjons, E. (2021, August 9–13). IT governance mechanisms influence on digital transformation: A systematic literature review. Twenty-Seventh Americas’ Conference on Information Systems (AMCIS), Digital Innovation and Entrepreneurship (pp. 1–10), Virtual. [Google Scholar]

- Mulyana, R., Rusu, L., & Perjons, E. (2024). Key ambidextrous IT governance mechanisms for successful digital transformation: A case study of Bank Rakyat Indonesia (BRI). Digital Business, 4(2), 100083. [Google Scholar] [CrossRef]

- Nguyen, T. T. H., & Phan, H. D. (2025). The role of governance and digital transformation in enhancing operational sustainability of non-banking financial institutions. Pakistan Journal of Life & Social Sciences, 23(1), 1118–1130. [Google Scholar] [CrossRef]

- Palmieri, E. (2025). Corporate governance, sustainability, and digital transformation. Corporate and Business Strategy Review, 6(2), 4–5. [Google Scholar] [CrossRef]

- Pankowska, M., & Pańkowska, M. (2019). Information technology outsourcing chain: Literature review and implications for development of distributed coordination. Sustainability, 11, 1460. [Google Scholar] [CrossRef]

- Papathomas, A., & Konteos, G. (2024). Financial institutions digital transformation: The stages of the journey and business metrics to follow. Journal of Financial Services Marketing, 29(2), 590–606. [Google Scholar] [CrossRef]

- Park, I., Kim, D., Moon, J., Kim, S., Kang, Y., & Bae, S. (2022). Searching for new technology acceptance model under social context: Analyzing the determinants of acceptance of intelligent information technology in digital transformation and implications for the requisites of digital sustainability. Sustainability, 14(1), 579. [Google Scholar] [CrossRef]

- Priyadarsini, A., & Kumar, A. (2022). A literature review on IT governance using a systematicity and transparent framework. Digital Policy, Regulation and Governance, 24(3), 309–328. [Google Scholar]

- Ringle, C. M., & Sarstedt, M. (2016). Gain more insight from your PLS-SEM results: The importance-performance map analysis. Industrial Management & Data Systems, 116(9), 1865–1886. [Google Scholar] [CrossRef]

- Robertsone, G., & Lapiņa, I. (2023). Digital transformation as a catalyst for sustainability and open innovation. Journal of Open Innovation: Technology, Market, and Complexity, 9(1), 100017. [Google Scholar] [CrossRef]

- Rosário, A. T., & Dias, J. C. (2022). Sustainability and the digital transition: A literature review. Sustainability, 14(7), 4072. [Google Scholar] [CrossRef]

- Sarkar, B., Ullah, M., & Sarkar, M. (2022). Environmental and economic sustainability through innovative green products by remanufacturing. Journal of Cleaner Production, 332, 129813. [Google Scholar] [CrossRef]

- Sarwar, M. I., Abbas, Q., Alyas, T., Alzahrani, A., Alghamdi, T., & Alsaawy, Y. (2023). Digital transformation of public sector governance with IT service management—A pilot study. IEEE Access, 11, 6490–6512. [Google Scholar] [CrossRef]

- Sengik, A. R., Lunardi, G. L., Bianchi, I. S., & Wiedenhöft, G. C. (2022). Using design science research to propose an IT governance model for higher education institutions. Education and Information Technologies, 27(8), 11285–11305. [Google Scholar] [CrossRef]

- Siswanti, I., Riyadh, H. A., Nawangsari, L. C., Mohd Yusoff, Y., & Wibowo, M. W. (2024). The impact of digital transformation for sustainable business: The meditating role of corporate governance and financial performance. Cogent Business & Management, 11(1), 2316954. [Google Scholar] [CrossRef]

- Sofyani, H., Pratolo, S., & Putra, W. M. (2023). The IT governance role on internal accountability and performance in higher education institutions: Testing the intervening role of performance measurement system and IT capabilities. Jurnal Dinamika Akuntansi, 15(2), 166–179. [Google Scholar] [CrossRef]

- Sofyani, H., Riyadh, H. A., & Fahlevi, H. (2020). Improving service quality, accountability and transparency of local government: The intervening role of information technology governance. Cogent Business and Management, 7(1), 1735690. [Google Scholar] [CrossRef]

- Spremic, M. (2017). Governing digital technology—How mature IT governance can help in digital transformation? International Journal of Economics and Management Systems, 2, 214–223. [Google Scholar]

- Sun, Y., Shahzad, M., & Razzaq, A. (2022). Sustainable organizational performance through blockchain technology adoption and knowledge management in China. Journal of Innovation and Knowledge, 7(4), 100247. [Google Scholar] [CrossRef]

- Trevisan, L. V., Eustachio, J. H. P. P., Dias, B. G., Filho, W. L., & Pedrozo, E. Á. (2024). Digital transformation towards sustainability in higher education: State-of-the-art and future research insights. Environment, Development and Sustainability, 26(2), 2789–2810. [Google Scholar] [CrossRef] [PubMed]

- Truong, T. C. (2022). The impact of digital transformation on environmental sustainability. Advances in Multimedia, 2022(1), 6324325. [Google Scholar] [CrossRef]

- Tumpa, R. J., Naeni, L. M., Afzal, F., & Ghanbaripour, A. N. (2025). Leveraging digital technology to improve environmental, social, and governance performance of infrastructure projects. Management Decision, 63(13), 455–496. [Google Scholar] [CrossRef]

- Varriale, V., Cammarano, A., Michelino, F., & Caputo, M. (2020). The unknown potential of blockchain for sustainable supply chains. Sustainability, 12(22), 9400. [Google Scholar] [CrossRef]

- Vergara, C. C., & Agudo, L. F. (2021). Fintech and sustainability: Do they affect each other? Sustainability, 13(13), 7012. [Google Scholar] [CrossRef]

- Vincent, N. E., Higgs, J. L., & Pinsker, R. E. (2017). IT governance and the maturity of IT risk management practices. Journal of Information Systems, 31(1), 59–77. [Google Scholar] [CrossRef]

- Wang, C., Khan, K., & Zhang, H. (2025). Digital transformation of government: Sustainability through e-governance. Public Money & Management, 45, 1–9. [Google Scholar] [CrossRef]

- Wang, J. (2021). “The party must strengthen its leadership in finance!”: Digital technologies and financial governance in China’s Fintech development. China Quarterly, 247, 773–792. [Google Scholar] [CrossRef]

- Wang, Y., & Wen, H. (2024). Digital finance, digital transformation, and the development of off-balance sheet activities by commercial banks. Systems, 12(8), 301. [Google Scholar] [CrossRef]

- Wilkin, C. L., & Chenhall, R. H. (2020). Information technology governance: Reflections on the past and future directions. Journal of Information Systems, 34(2), 257–292. [Google Scholar] [CrossRef]

- Xu, J., Yu, Y., Zhang, M., & Zhang, J. Z. (2023). Impacts of digital transformation on eco-innovation and sustainable performance: Evidence from Chinese manufacturing companies. Journal of Cleaner Production, 393, 136278. [Google Scholar] [CrossRef]

- Zahid, M., Rahman, H. U., Ullah, Z., & Muhammad, A. (2021). Sustainability and branchless banking: The development and validation of a distinct measurement scale. Technology in Society, 67, 101764. [Google Scholar] [CrossRef]

- Zheng, G. W., Siddik, A. B., Masukujjaman, M., & Fatema, N. (2021). Factors affecting the sustainability performance of financial institutions in Bangladesh: The role of green finance. Sustainability, 13(18), 10165. [Google Scholar] [CrossRef]

| Construct | Items | Synthesized Literature Review |

|---|---|---|

| ITG | ITG1: Our organization has comprehensive IT policies and standards. | (Ali & Green, 2012; Ali et al., 2015; Alreemy et al., 2016; Castelo-Branco et al., 2022; Ferguson et al., 2013) |

| ITG2: Our organization has a clear framework for implementing IT governance. | ||

| ITG3: Periodic reviews are conducted to ensure compliance with IT regulations. | ||

| ITG4: Our organization’s IT governance framework aligns with the IT governance framework of the MTCIT. | ||

| GIDT | GIDT1: Our IT initiatives support our organization’s digital transformation for sustainability objectives. | (Almaqtari, 2024a; Barroso & Laborda, 2022; Mavlutova et al., 2022; Papathomas & Konteos, 2024; Y. Wang & Wen, 2024) |

| GIDT2: Our organization invests in emerging technologies to enhance IT infrastructure. | ||

| GIDT3: Our organization actively adopts advanced digital technologies (e.g., cloud computing, AI, big data) to improve operations. | ||

| GIDT4: Digital transformation has automated routine tasks and improved service delivery speed. | ||

| ECOSUS | ECOSUS1: Our digital initiatives contribute to the growth of the digital economy. | (Akter et al., 2018; Almaqtari, 2024a; Zheng et al., 2021) |

| ECOSUS2: Investments in digital technologies have improved our competitiveness in the market. | ||

| ECOSUS3: Digital transformation has opened new sources of income for our organization. | ||

| ECOSUS4: Digital solutions have reduced the operating costs of delivering services. | ||

| ECOSUS5: Automation has led to significant cost savings. | ||

| ECOSUS6: The adoption of IT has improved operational processes, leading to cost efficiency. |

| Variables | Factor Loading | CA | rho_A | CR | AVE | ||

|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | |||||

| ITG1 | 0.861 | 0.900 | 0.903 | 0.901 | 0.694 | ||

| ITG2 | 0.875 | ||||||

| ITG3 | 0.825 | ||||||

| ITG4 | 0.768 | ||||||

| GIDT1 | 0.851 | 0.920 | 0.920 | 0.920 | 0.742 | ||

| GIDT2 | 0.867 | ||||||

| GIDT3 | 0.846 | ||||||

| GIDT4 | 0.882 | ||||||

| ECOSUS1 | 0.893 | 0.953 | 0.953 | 0.953 | 0.770 | ||

| ECOSUS2 | 0.907 | ||||||

| ECOSUS3 | 0.851 | ||||||

| ECOSUS4 | 0.882 | ||||||

| ECOSUS5 | 0.822 | ||||||

| ECOSUS6 | 0.907 | ||||||

| Fornell-Larcker Criterion | |||

|---|---|---|---|

| Variables | GIDT | ECOSUS | ITG |

| GIDT | 0.862 | ||

| ECOSUS | 0.855 | 0.878 | |

| ITG | 0.780 | 0.699 | 0.833 |

| Path | β | STDEV | T Stat | p Values |

|---|---|---|---|---|

| Direct Effect | ||||

| Digital Financial Transformation -> Economic Sustainability performance | 0.792 | 0.124 | 6.376 | 0.000 |

| IT Governance -> Digital Financial Transformation | 0.780 | 0.064 | 12.267 | 0.000 |

| IT Governance -> Economic Sustainability performance | 0.081 | 0.135 | 0.596 | 0.552 |

| Indirect Effect | ||||

| IT Governance -> Digital Financial Transformation -> Economic Sustainability performance | 0.618 | 0.118 | 5.236 | 0.000 |

| Path | β | STDEV | T Stat | p Values |

|---|---|---|---|---|

| Direct Effect | ||||

| Digital Financial Transformation -> Economic Sustainability | 0.688 | 0.092 | 7.494 | 0.000 |

| IT Governance -> Digital Financial Transformation | 0.711 | 0.068 | 10.449 | 0.000 |

| IT Governance -> Economic Sustainability | 0.159 | 0.095 | 1.676 | 0.094 |

| Indirect Effect | ||||

| IT Governance -> Digital Financial Transformation -> Economic Sustainability | 0.489 | 0.083 | 5.899 | 0.000 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Almaqtari, F.A.; Al Sinawi, S.; Elmashtawy, A.; Ibrahim, A.; Al Ghunaimi, H. The Relationship Between IT Governance, Digital Financial Transformation, and Economic Sustainability Performance. Adm. Sci. 2025, 15, 500. https://doi.org/10.3390/admsci15120500

Almaqtari FA, Al Sinawi S, Elmashtawy A, Ibrahim A, Al Ghunaimi H. The Relationship Between IT Governance, Digital Financial Transformation, and Economic Sustainability Performance. Administrative Sciences. 2025; 15(12):500. https://doi.org/10.3390/admsci15120500

Chicago/Turabian StyleAlmaqtari, Faozi A., Saleh Al Sinawi, Ahmed Elmashtawy, Abdulhadi Ibrahim, and Hisham Al Ghunaimi. 2025. "The Relationship Between IT Governance, Digital Financial Transformation, and Economic Sustainability Performance" Administrative Sciences 15, no. 12: 500. https://doi.org/10.3390/admsci15120500

APA StyleAlmaqtari, F. A., Al Sinawi, S., Elmashtawy, A., Ibrahim, A., & Al Ghunaimi, H. (2025). The Relationship Between IT Governance, Digital Financial Transformation, and Economic Sustainability Performance. Administrative Sciences, 15(12), 500. https://doi.org/10.3390/admsci15120500