Investigating Accounting Factors through Audited Financial Statements in Businesses toward a Circular Economy: Why a Sustainable Profit through Qualified Staff and Investment in Technology?

Abstract

1. Introduction

1.1. Investigating Accounting Factors, Financial Statements, Auditing, Qualified Staff, and Investment on Technologies for Sustainable Profit in Businesses toward a Circular Economy

1.2. Investigating Variables of Audited Financial Statements in Businesses (TASS, IASS, TLIA, TREV, and NFI) for Sustainable Profit in Businesses toward a Circular Economy

2. Literature Review

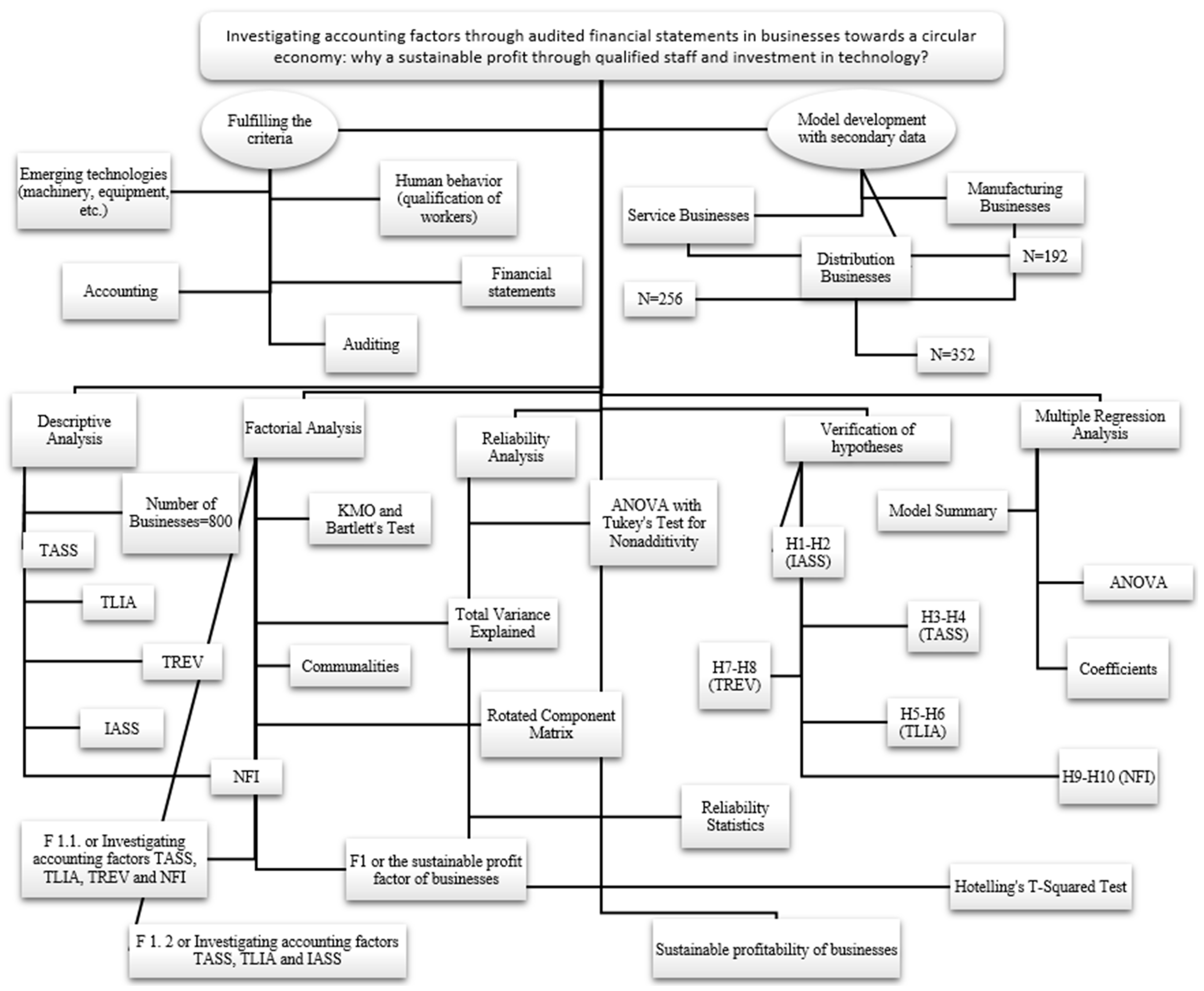

3. Methodology

3.1. The Purpose of the Paper

- (1)

- Investigation of empirically audited financial statements for 800 businesses regarding sustainable profit: which financial items are sustainable and of which financial items should companies be careful?

- (2)

- Businesses that do not invest in technology (equipment, machinery, etc.) and qualified staff—does this hinder the sustainability of profit?

3.2. Methods

3.2.1. Data Collection

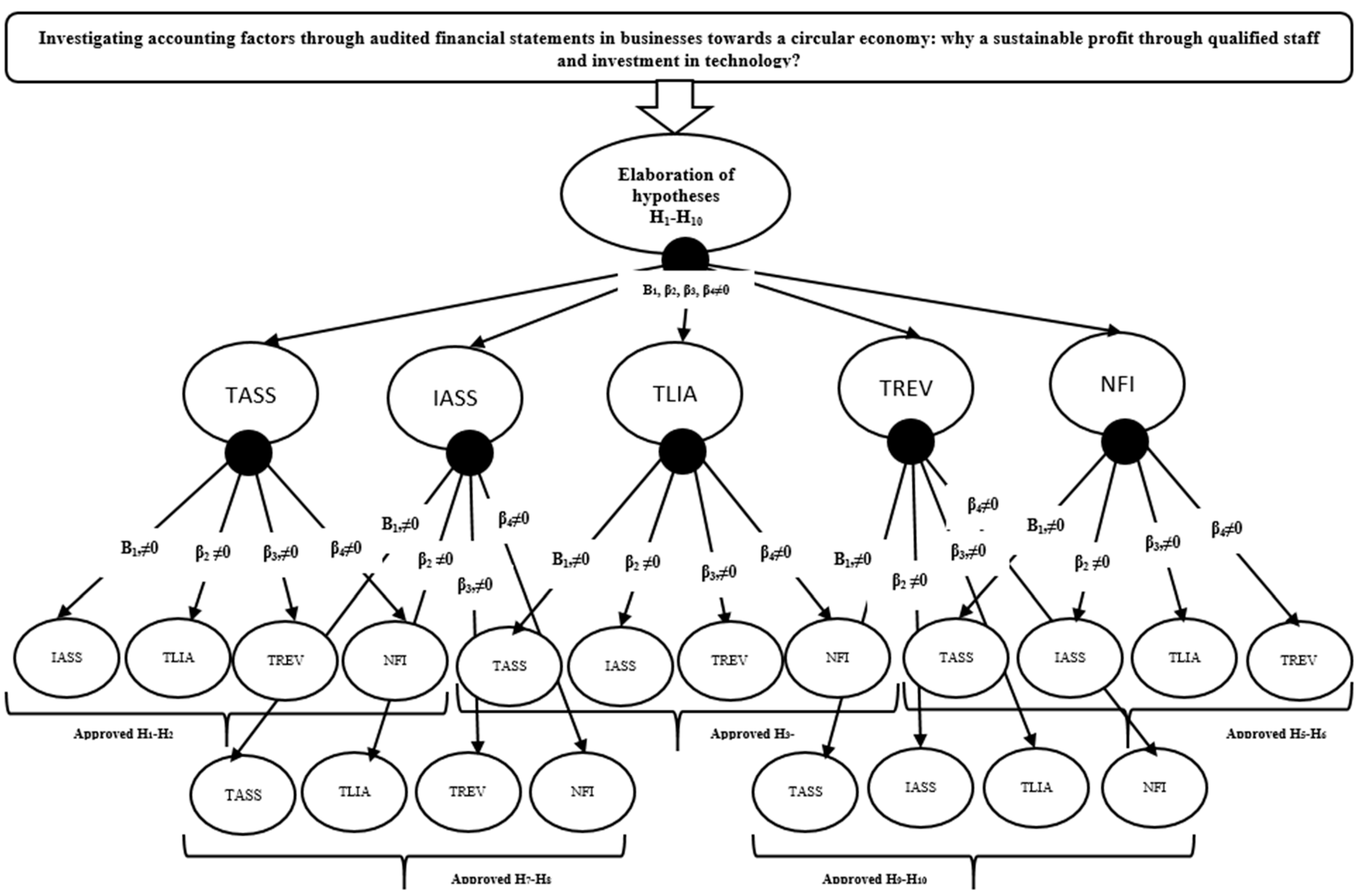

3.2.2. Hypotheses

Hypotheses for the IASS Variable

Hypotheses for the TASS Variable

Hypotheses for the TLIA Variable

Hypotheses for the TREV Variable

Hypotheses for the NFI Variable

4. Empirical Results

- Descriptive analysis for the investigation of accounting factors through audited financial statements for sustainable profit in businesses;

- Factor analysis and reliability analysis for investigating accounting factors through audited financial statements for sustainable profit in businesses;

- Multiple regression analysis for investigating accounting factors through audited financial statements for sustainable profit in businesses;

- Validating hypothesis for investigating accounting factors through audited financial statements by analyzing qualified staff and investments in technology (equipment, machinery, etc.) for sustainable profit in business.

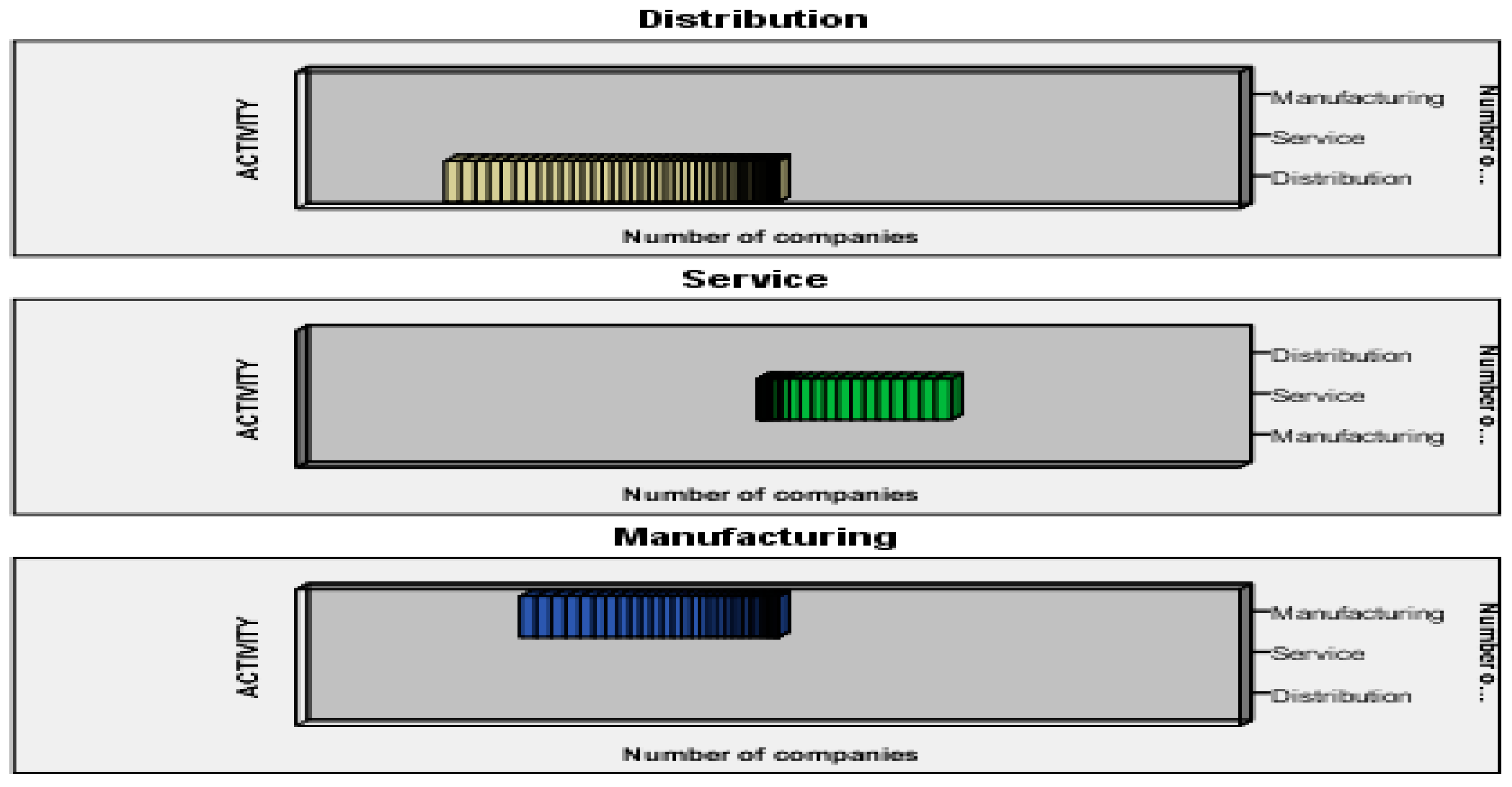

4.1. Descriptive Analysis for the Investigation of Accounting Factors through Audited Financial Statements for Sustainable Profit in Businesses

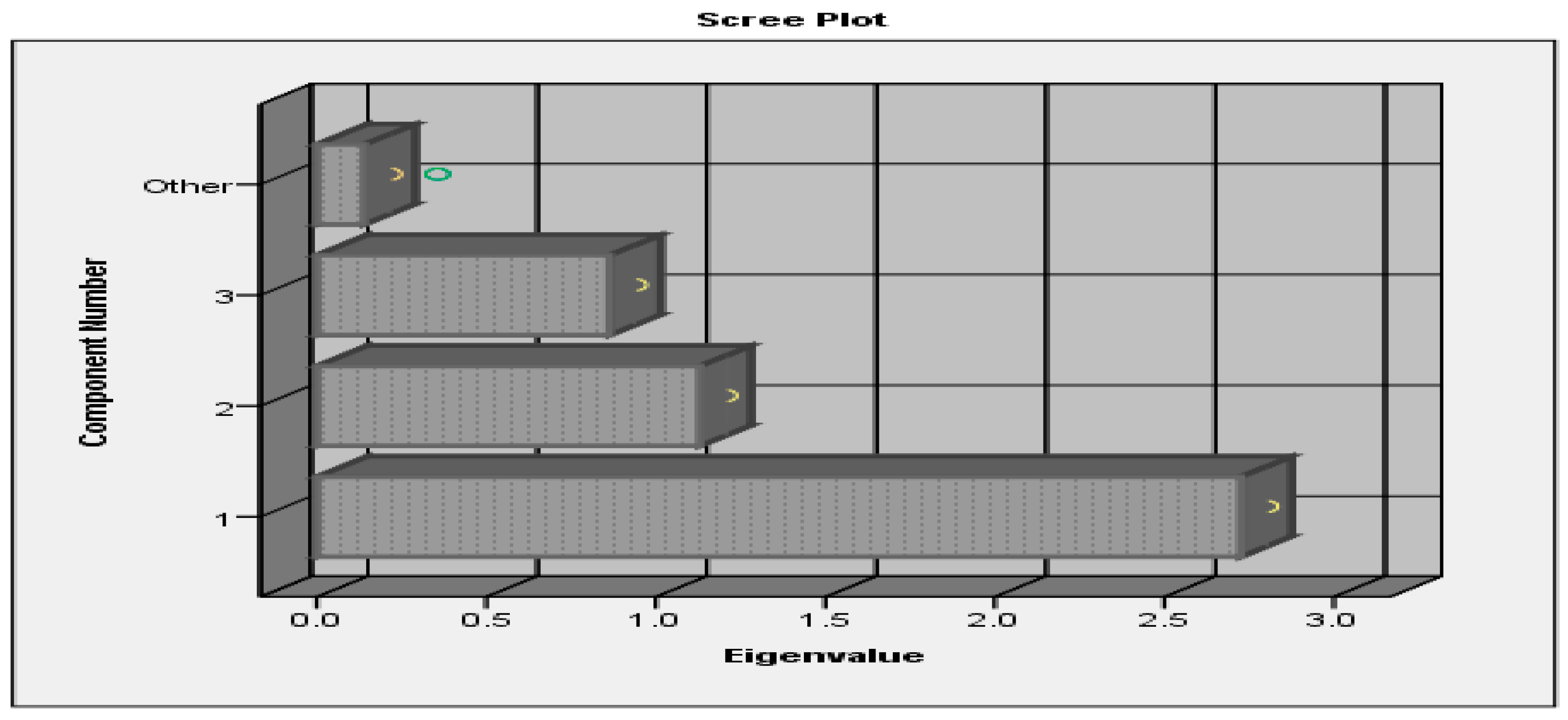

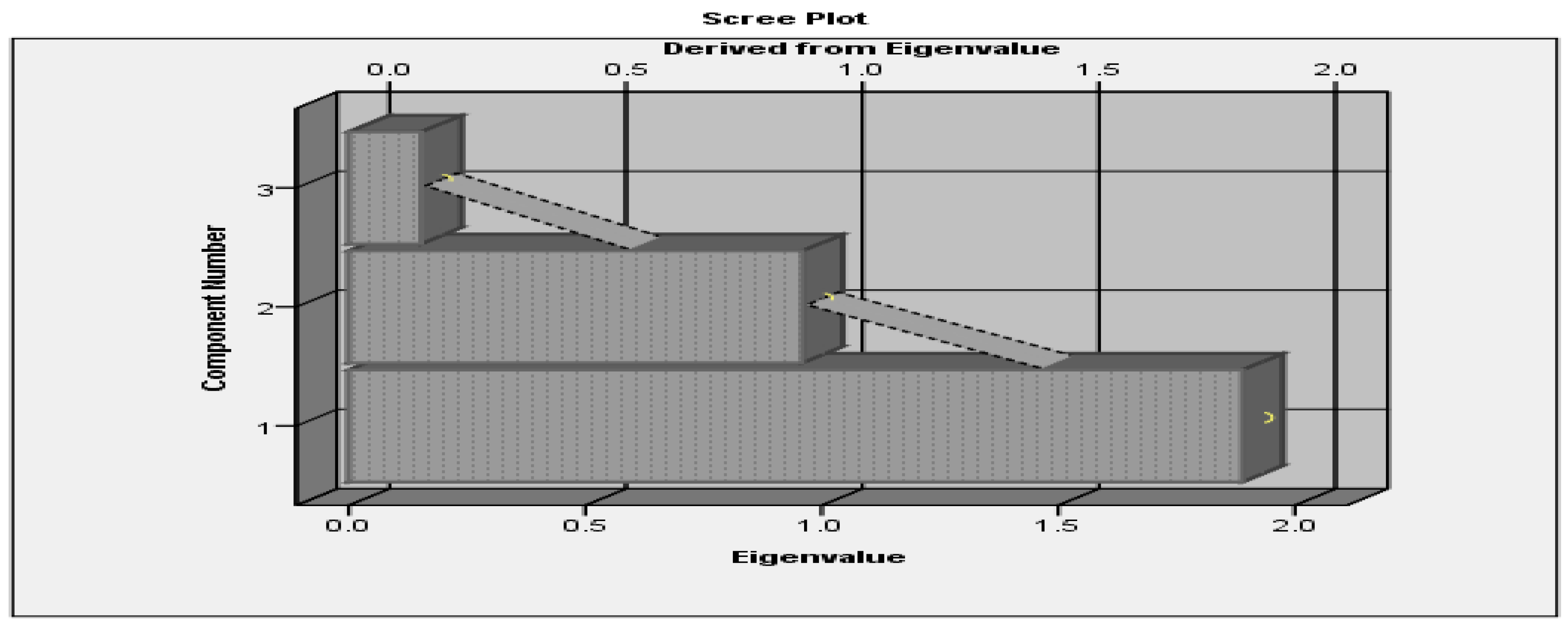

4.2. Factor Analysis and Reliability Analysis for Investigating Accounting Factors through Audited Financial Statements for Sustainable Profit in Businesses

- -

- F1 or sustainable profit factor in businesses;

- -

- F 1.1 or investigation of TASS, TLIA, TREV, and NFI accounting factors;

- -

- F 1.2 or investigation of TASS, TLIA, and IASS accounting factors.

4.2.1. The Results of the Sustainable Profit Factor in Businesses

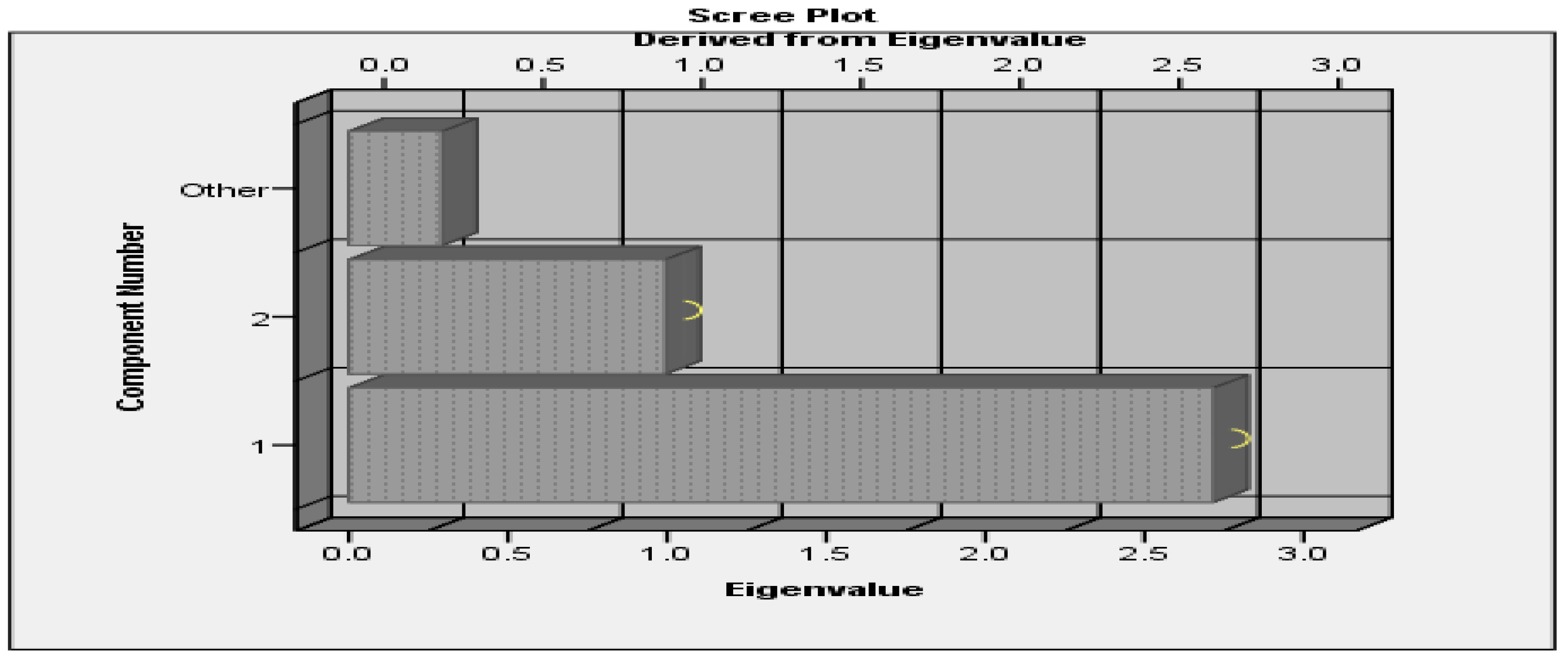

4.2.2. The Results of the First Sub-Factor (F1.1) of Sustainable Profit through the Investigation of TASS, TLIA, TREV, and NFI Accounting Factors

4.2.3. The Results of the Second Sub-Factor (F1.2) of Sustainable Profit through the Investigation of TASS, TLIA, and IASS Accounting Factors

4.3. Multiple Regression Analysis for Investigating Accounting Factors through Audited Financial Statements for Sustainable Profit in Businesses

4.4. Validating Hypothesis for Investigating Accounting Factors through Audited Financial Statements by Analyzing Qualified Staff and Investments in Technology (Equipment, Machinery, etc.) for Sustainable Profit in Business

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Adwan, Sami, Alaa Alhaj-Ismail, and Claudia Girardone. 2020. Fair value accounting and value relevance of equity book value and net income for European financial firms during the crisis. Journal of International Accounting, Auditing and Taxation 39: 100320. [Google Scholar] [CrossRef]

- Agyei-Boapeah, Henry, Richard Evans, and Tahir MNisar. 2022. Disruptive innovation: Designing business platforms for new financial services. Journal of Business Research 150: 134–46. [Google Scholar] [CrossRef]

- Ahadiat, Nasrollah, and James Jay Mackie. 1993. Ethics education in accounting: An investigation of the importance of ethics as a factor in the recruiting decisions of public accounting firms. Journal of Accounting Education 11: 243–57. [Google Scholar] [CrossRef]

- Al-Ajmi, Jasim. 2008. Audit and reporting delays: Evidence from an emerging market. Advances in Accounting 24: 217–26. [Google Scholar] [CrossRef]

- Alduais, Fahd, Nashat Ali Almasria, Abeer Samara, and Ali Masadeh. 2022. Conciseness, Financial Disclosure, and Market Reaction: A Textual Analysis of Annual Reports in Listed Chinese Companies. International Journal of Financial Studies 10: 104. [Google Scholar] [CrossRef]

- Alfaro, Emigdio, Fei Yu, Naqeeb Ur Rehman, Eglantina Hysa, and Patrice Kandolo Kabeya. 2019. Strategic management of innovation. In The Routledge Companion to Innovation Management. Abingdon: Routledge, pp. 107–68. [Google Scholar]

- Allal-Chérif, Oihab, Juan Costa Climent, and Klaus Jurgen Ulrich Berenguer. 2023. Born to be sustainable: How to combine strategic disruption, open innovation, and process digitization to create a sustainable business. Journal of Business Research 154: 113379. [Google Scholar] [CrossRef]

- Al-Mana, Ali A., Waqas Nawaz, Athar Kamal, and Muammer Koҫ. 2020. Financial and operational efficiencies of national and international oil companies: An empirical investigation. Resources Policy 68: 101701. [Google Scholar] [CrossRef]

- Argilés, Josep M., and Josep Garcia-Blandon. 2011. Accounting Research: A Critical View Of The Present Situation And ProspectsInvestigación En Contabilidad: Una Visión Crítica De La Situación Actual Y Perspectivas. Revista de Contabilidad 14: 9–34. [Google Scholar] [CrossRef]

- Azudin, Afirah, and Noorhayati Mansor. 2018. Management accounting practices of SMEs: The impact of organizational DNA, business potential and operational technology. Asia Pacific Management Review 23: 222–26. [Google Scholar] [CrossRef]

- Bakre, Owolabi M. 2008. Financial reporting as technology that supports and sustains imperial expansion, maintenance and control in the colonial and post-colonial globalisation: The case of the Jamaican economy. Critical Perspectives on Accounting 19: 487–522. [Google Scholar] [CrossRef]

- Balanay, Raquel M., Rowena P. Varela, and Anthony B. Halog. 2022. Chapter 25—Circular economy for the sustainability of the wood-based industry: The case of Caraga Region, Philippines. In Circular Economy and Sustainability. Volume 2: Environmental Engineering. Amsterdam: Elsevier, pp. 447–62. [Google Scholar] [CrossRef]

- Balli, Faruk, Anne De Bruin, Hatice Ozer Balli, and Jamshid Karimov. 2020. Corporate net income and payout smoothing under Shari’ah compliance. Pacific-Basin Finance Journal 60: 101265. [Google Scholar] [CrossRef]

- Beattie, Vivien, and Stella Fearnley. 1998. Audit Market Competition: Auditor Changes And The Impact Of Tendering. The British Accounting Review 30: 261–89. [Google Scholar] [CrossRef]

- Bebbington, Jan, Judy Brown, and Bob Frame. 2007. Accounting technologies and sustainability assessment models. Ecological Economics 61: 224–36. [Google Scholar] [CrossRef]

- Bi, Yulin. 2022. Financial Accounting Information Data Analysis System Based on Internet of Things. Mathematical Problems in Engineering 2022: 6162504. [Google Scholar] [CrossRef]

- Caddy, Ian. 2000. Intellectual capital: Recognizing both assets and liabilities. Journal of Intellectual Capital 1: 129–46. [Google Scholar] [CrossRef]

- Cao, June, and Paul J. Coram. 2020. Auditors’ Response to Different Reporting Environments: Experimental Evidence From the Quantity and Quality of Auditors’ Evidence Demands in China. Internationa Journal of Auditing 24: 73–89. [Google Scholar] [CrossRef]

- Carcello, Joseph V., and Terry L. Neal. 2003. Audit Committee Characteristics and Auditor Dismissals Following “New” Going-Concern Reports. The Accounting Review 78: 95–117. [Google Scholar] [CrossRef]

- Carroll, J. Douglas, and Paul E. Green. 1997. CHAPTER 6—Applying the Tools to Multivariate Data. In Mathematical Tools for Applied Multivariate Analysis (Revised Edition). Cambridge: Academic Press, pp. 259–94. [Google Scholar] [CrossRef]

- Castka, Pavel, Cory Searcy, and Jakki Mohr. 2020. Technology-enhanced auditing: Improving veracity and timeliness in social and environmental audits of supply chains. Journal of Cleaner Production 258: 20773. [Google Scholar] [CrossRef]

- Chae, Soo-Joon, Makoto Nakano, and Ryosuke Fujitani. 2020. Financial Reporting Opacity, Audit Quality and Crash Risk: Evidence from Japan. The Journal of Asian Finance, Economics and Business 7: 9–17. [Google Scholar] [CrossRef]

- Chambers, Valerie A., and Philip M. J. Reckers. 2022. Auditor interventions that reduce auditor liability judgments. Advances in Accounting 58: 100614. [Google Scholar] [CrossRef]

- Chams, Nour, and Josep García-Blandón. 2019. On the importance of sustainable human resource management for the adoption of sustainable development goals. Resources, Conservation and Recycling 141: 109–22. [Google Scholar] [CrossRef]

- Chen, Xiaowei. 2022. The Fusion Model of Financial Accounting and Management Accounting Based on Neural Networks. Mobile Information Systems 2022: 1587274. [Google Scholar] [CrossRef]

- Chen, Ziyue. 2021. Research on Accounting Intelligence System Modeling of Financial Performance Evaluation. Security and Communication Networks 2021: 5550382. [Google Scholar] [CrossRef]

- Chiarot, Christian, Robert Eduardo Cooper Ordoñez, and Carlos Lahura. 2022. Evaluation of the Applicability of the Circular Economy and the Product-Service System Model in a Bearing Supplier Company. Sustainability 14: 12834. [Google Scholar] [CrossRef]

- Colovic, Ana, Bisrat A. Misganaw, and Dawit Z. Assefa. 2022. Liability of informality and firm participation in global value chains. Journal of World Business 57: 101279. [Google Scholar] [CrossRef]

- Corrado, Carol, Charles Hulten, and Daniel Sichel. 2009. Intangible capital and u.s. economic growth. The Review of Income and Wealth 55: 661–85. [Google Scholar] [CrossRef]

- Cudeck, Robert. 2000. 10—Exploratory Factor Analysis. In Handbook of Applied Multivariate Statistics and Mathematical Modeling. Amsterdam: Elsevier, pp. 265–96. [Google Scholar] [CrossRef]

- Dantas, Rui Miguel, Aamar Ilyas, José Moleiro Martins, and João Xavier Rita. 2022. Circular Entrepreneurship in Emerging Markets through the Lens of Sustainability. Journal of Open Innovation: Technology, Market, and Complexity 8: 211. [Google Scholar] [CrossRef]

- Dawid, Herbert, and Gerd Muehlheusser. 2022. Smart products: Liability, investments in product safety, and the timing of market introduction. Journal of Economic Dynamics and Control 134: 104288. [Google Scholar] [CrossRef]

- De Villiers, Charl, and Matteo Molinari. 2022. How to communicate and use accounting to ensure buy-in from stakeholders: Lessons for organizations from governments’ COVID-19 strategies. Accounting, Auditing & Accountability Journal 35: 20–34. [Google Scholar] [CrossRef]

- EFRAG. 2021. Interconnection between Financial and Non-Financial Information. Brussels: European Financial Reporting Advisory Group. Available online: https://www.efrag.org/ (accessed on 20 February 2021).

- Ellis, Charles, Eu-Lin Fang, Katharina Baudouin-Goerlitz, Ruoyu Wen, Fengying Ye, Shi Li, and C. A. Jyoti Singh. 2022. ESG Reporting White Paper. Australia: Division 3 of the Copyright Act 1968 (Cth). Available online: https://www.cpaaustralia.com.au/-/media/project/cpa/corporate/documents/tools-and-resources/environmental-social-governance/esg-reporting-white-paper-2022.pdf?icid=copy-internal-page-banner (accessed on 12 January 2023).

- Gebauer, Heiko, Alexander Arzt, Marko Kohtamäki, Claudio Lamprecht, Vinit Parida, Lars Witell, and Felix Wortmann. 2020. How to convert digital offerings into revenue enhancement—Conceptualizing business model dynamics through explorative case studies. Industrial Marketing Management 91: 429–41. [Google Scholar] [CrossRef]

- Gebauer, Heiko, and Elgar Fleisch. 2007. An investigation of the relationship between behavioral processes, motivation, investments in the service business and service revenue. Industrial Marketing Management 36: 337–48. [Google Scholar] [CrossRef]

- Gerlich, Michael. 2023. How Short-Term Orientation Dominates Western Businesses and the Challenges They Face—An Example Using Germany, the UK, and the USA. Administrative Sciences 13: 25. [Google Scholar] [CrossRef]

- Ghafran, Chaudhry, Noel O’Sullivan, and Sofia Yasmin. 2022. When does audit committee busyness influence earnings management in the UK? Evidence on the role of the financial crisis and company size. Journal of International Accounting 47: 100467. [Google Scholar] [CrossRef]

- Goddard, Francis, and Martin Schmidt. 2021. Exploratory insights into audit fee increases: A field study into board member perceptions of auditor pricing practices. International Journal of Auditing 25: 637–60. [Google Scholar] [CrossRef]

- Goretzko, David, Trang Thien Huong Pham, and Markus Bühner. 2021. Exploratory factor analysis: Current use, methodological developments and recommendations for good practice. Current Psychology 40: 3510–21. [Google Scholar] [CrossRef]

- Ha, Hoang Thi Viet, Dang Ngoc Hung, and Nguyen Thi Thanh Phuong. 2018. The Study of Factors Affecting the Timeliness of Financial Reports: The Experiments on Listed Companies in Vietnam. Asian Economic and Financial Review 8: 294–307. [Google Scholar] [CrossRef]

- Haji, Abdifatah Ahmed, Paul Coram, and Indrit Troshani. 2023. Consequences of CSR reporting regulations worldwide: A review and research agenda. Accounting, Auditing & Accountability Journal 36: 177–208. [Google Scholar] [CrossRef]

- Han, Junghee, Almas Heshmati, and Masoomeh Rashidghalam. 2020. Circular Economy Business Models with a Focus on Servitization. Sustainability 12: 8799. [Google Scholar] [CrossRef]

- He, Xianjie, Jeffrey A. Pittman, and Oliver M. Rui. 2016. Do Social Ties between External Auditors and Audit Committee Members Affect Audit Quality? Available online: https://ssrn.com/abstract=2868205 (accessed on 14 November 2016). [CrossRef]

- Hosseininesaz, Hamid, and Milad Jasemi. 2022. Development of a new asset liability Management model with liquidity and inflation risks based on the Lower Partial Moment. Expert Systems with Applications 210: 118427. [Google Scholar] [CrossRef]

- Hou, Xuechen. 2022. Design and Application of Intelligent Financial Accounting Model Based on Knowledge Graph. Mobile Information Systems 2022: 8353937. [Google Scholar] [CrossRef]

- Hu, Tiancheng, Rui Guo, and Lutao Ning. 2022. Intangible assets and foreign ownership in international joint ventures: The moderating role of related and unrelated industrial agglomeration. Research in International Business and Finance 61: 101654. [Google Scholar] [CrossRef]

- Hui, Loi Teck, and Quek Kia Fatt. 2007. Strategic organizational conditions for risks reduction and earnings management: A combined strategy and auditing paradigm. Accounting Forum 31: 179–201. [Google Scholar] [CrossRef]

- Humphrey, Christopher, and Peter Moizer. 1990. From techniques to ideologies: An alternative perspective on the audit function. Critical Perspectives on Accounting 1: 217–38. [Google Scholar] [CrossRef]

- Hysa, Eglantina, Alba Kruja, Naqeeb Ur Rehman, and Rafael Laurenti. 2020. Circular economy innovation and environmental sustainability impact on economic growth: An integrated model for sustainable development. Sustainability 12: 4831. [Google Scholar] [CrossRef]

- Iatridis, George Emmanuel. 2016. Financial reporting language in financial statements: Does pessimism restrict the potential for managerial opportunism? International Review of Financial Analysis 45: 1–17. [Google Scholar] [CrossRef]

- Ishak, Suhaimi. 2016. Going-concern Audit Report: The Role of Audit Committee. International Journal of Economics and Financial Issues 6: 36–39. Available online: http://www.econjournals.com/ (accessed on 1 May 2016).

- Jans, Mieke, Banu Aysolmaz, Maarten Corten, Anant Joshi, and Mathijs van Peteghem. 2023. Digitalization in accounting–Warmly embraced or coldly ignored? Accounting, Auditing & Accountability Journal 36: 61–85. [Google Scholar] [CrossRef]

- Janvrin, Diane J., Maureen Francis Mascha, and Melvin A. Lamboy-Ruiz. 2020. SOX 404(b) Audits: Evidence from Auditing the Financial Close Process of the Accounting System. Journal of Information Systems 34: 77–103. [Google Scholar] [CrossRef]

- Kabbach-de-Castro, Luiz Ricardo, Guilherme Kirch, and Rafael Mattac. 2022. Do internal capital markets in business groups mitigate firms’ financial constraints? Journal of Banking & Finance 143: 106573. [Google Scholar] [CrossRef]

- Kabir, Humayun, and Li Su. 2022. How did IFRS 15 affect the revenue recognition practices and financial statements of firms? Evidence from Australia and New Zealand. Journal of International Accounting, Auditing and Taxation 49: 100507. [Google Scholar] [CrossRef]

- Kacani, Jolta, Lindita Mukli, and Eglantina Hysa. 2022. A framework for short- vs. long-term risk indicators for outsourcing potential for enterprises participating in global value chains: Evidence from Western Balkan countries. Journal of Risk and Financial Management 15: 401. [Google Scholar] [CrossRef]

- Karasioğlu, Fehmi, Humayun Humta, and Ibrahim Emre Göktürk. 2021. Investigation of Accounting Ethics Effects on Financial Report Quality & Decision Making: Evidence from Kabul-based Logistic Corporations. International Journal of Management, Accounting and Economics 8: 122–42. [Google Scholar] [CrossRef]

- Korhonen, Jouni, Antero Honkasalo, and Jyri Seppälä. 2018. Circular Economy: The Concept and its Limitations. Ecological Economics, Elsevier 143: 37–46. [Google Scholar] [CrossRef]

- Kusnic, Michael W., and Julie Davanzo. 1986. Accounting for non-market activities in the distribution of income: An empirical investigation. Journal of Development Economics 21: 211–27. [Google Scholar] [CrossRef]

- Labidi, Manel, and Jean François Gajewski. 2019. Does increased disclosure of intangible assets enhance liquidity around new equity offerings? Research in International Business and Finance 48: 426–37. [Google Scholar] [CrossRef]

- Le, Huong Nguyen Quynh, Thai Vu Hong Nguyen, and Christophe Schinckus. 2022. The role of strategic interactions in risk-taking behavior: A study from asset growth perspective. International Review of Financial Analysis 82: 02127. [Google Scholar] [CrossRef]

- Lev, Baruch. 2018. The deteriorating usefulness of financial report information and how to reverse it. Accounting and Business Research 48: 465–93. [Google Scholar] [CrossRef]

- Li, Jun. 2019. Research on Limitations of Financial Statement Analysis Based on Data of Listed Companies. In Advances in Economics, Business and Management Research, Volume 110. 5th International Conference on Economics, Management, Law and Education (EMLE 2019). Dordrecht: Atlantis Press SARL. [Google Scholar]

- Lim, Steve C., Antonio J. Macias, and Thomas Moeller. 2020. Intangible assets and capital structure. Journal of Banking & Finance 118: 105873. [Google Scholar] [CrossRef]

- Lin, Han, Lu Chen, Mingchuan Yu, Chao Li, Joseph Lampel, and Wan Jiang. 2021. Too little or too much of good things? The horizontal S-curve hypothesis of green business strategy on firm performance. Technological Forecasting and Social Change 172: 121051. [Google Scholar] [CrossRef]

- Low, Mary, Howard Daveya, and Keith Hooper. 2008. Accounting scandals, ethical dilemmas and educational challenges. Critical Perspectives on Accounting 19: 222–54. [Google Scholar] [CrossRef]

- Lucianetti, Lorenzo, Charbel Jose Chiappett Jabbour, Angappa Gunasekaran, and Hengky Latan. 2018. Contingency factors and complementary effects of adopting advanced manufacturing tools and managerial practices: Effects on organizational measurement systems and firms’ performance. International Journal of Production Economics 200: 318–28. [Google Scholar] [CrossRef]

- Lulaj, Enkeleda. 2021a. Accounting, Reforms and Budget Responsibilities in the Financial Statements. Accounting and Finance/Oblik i Finansi 21: 61–69. [Google Scholar] [CrossRef]

- Lulaj, Enkeleda. 2021b. Quality and reflecting of financial position: Anenterprises model through logistic regression andnatural logarithm. Journal of Economic Development, Environment and People 10: 26–50. [Google Scholar] [CrossRef]

- Lulaj, Enkeleda. 2022. An unstoppable and navigating journey towards development reform in complex financial-economic systems: An interval analysis of government expenses (past, present, future). Business, Management and Economics Engineering 20: 329–57. [Google Scholar] [CrossRef]

- Lulaj, Enkeleda, and Blerta Dragusha. 2022. Incomes, Gaps and Well-Being: An Exploration of Direct Tax Income Statements Before and During Covid-19 Through the Comparability Interval. International Journal of Professional Business Review 7: e0623. [Google Scholar] [CrossRef]

- Lulaj, Enkeleda, and Etem Iseni. 2018. Role of Analysis CVP (Cost-Volume-Profit) as Important Indicator for Planning and Making Decisions in the Business Environment. European Journal of Economics and Business Studies 4: 99–114. [Google Scholar] [CrossRef]

- Lulaj, Enkeleda, Ismat Zarin, and Shawkat Rahman. 2022. A Novel Approach to Improving E-Government Performance from Budget Challenges in Complex Financial Systems. Complexity 2022: 2507490. [Google Scholar] [CrossRef]

- Macve, Richard H. 2015. Fair value vs conservatism? Aspects of the history of accounting, auditing, business and finance from ancient Mesopotamia to modern China. The British Accounting Review 47: 124–41. [Google Scholar] [CrossRef]

- Mardi, Mardi, Petrolis Nusa Perdana, Suparno Suparno, and Imam Aris Munandar. 2020. Effect of Accounting Information Systems, Teamwork, and Internal Control on Financial Reporting Timeliness. The Journal of Asian Finance, Economics and Business 7: 809–18. [Google Scholar] [CrossRef]

- McDonough, Ryan P., and Claire J. Yan. 2022. Accounting policies in the public sector: Characteristics and consequences of accounting for capital assets. Journal of Accounting and Public Policy 42: 107033. [Google Scholar] [CrossRef]

- Merchant, Kenneth A. 2008. Why interdisciplinary accounting research tends not to impact most North American academic accountants. Critical Perspectives on Accounting 19: 901–8. [Google Scholar] [CrossRef]

- Merello, Paloma, Antonio Barberá, and Elena Dela Pozab. 2022. Is the sustainability profile of FinTech companies a key driver of their value? Technological Forecasting and Social Change 174: 121290. [Google Scholar] [CrossRef]

- Milios, Leonidas. 2018. Advancing to a Circular Economy: Three essential ingredients for a comprehensive policy mix. Sustainability Science 13: 861–78. [Google Scholar] [CrossRef]

- Mironiuc, Marilena, Mihai Carp, and Ionela-Corina Chersan. 2015. The Relevance of Financial Reporting on the Performance of Quoted Romanian Companies in the Context of Adopting the IFRS. Procedia Economics and Finance 20: 404–13. [Google Scholar] [CrossRef]

- Mohd, Yunika Murdayanti, and Noor Azli Ali Khan. 2021. The development of internet financial reporting publications: A concise of bibliometric analysis. Heliyon 7: e08551. [Google Scholar] [CrossRef]

- Nazir, Mian Sajid, and Talat Afza. 2018. Does managerial behavior of managing earnings mitigate the relationship between corporate governance and firm value? Evidence from an emerging market. Future Business Journal 4: 139–56. [Google Scholar] [CrossRef]

- Panait, Mirela, Eglantina Hysa, Lukman Raimi, Alba Kruja, and Antonio Rodriguez. 2022. Guest editorial: Circular economy and entrepreneurship in emerging economies: Opportunities and challenges. Journal of Entrepreneurship in Emerging Economies 14: 673–77. [Google Scholar] [CrossRef]

- Peecher, Mark E., Rachel Schwartz, and Ira Solomon. 2007. It’s all about audit quality: Perspectives on strategic-systems auditing. Accounting, Organizations and Society 32: 463–85. [Google Scholar] [CrossRef]

- Popescu, Catalin, Eglantina Hysa, Alba Kruja, and Egla Mansi. 2022. Social Innovation, Circularity and Energy Transition for Environmental, Social and Governance (ESG) Practices—A Comprehensive Review. Energies 15: 9028. [Google Scholar] [CrossRef]

- Rehman, Fazal Ur, Basheer M. Al-Ghazali, and Mohamed Riyazi M. Farook. 2022. Interplay in Circular Economy Innovation, Business Model Innovation, SDGs, and Government Incentives: A Comparative Analysis of Pakistani, Malaysian, and Chinese SMEs. Sustainability 14: 15586. [Google Scholar] [CrossRef]

- Rezaee, Zabihollah. 2016. Business sustainability research: A theoretical and integrated perspective. Journal of Accounting Literature 36: 48–64. [Google Scholar] [CrossRef]

- Robu, Ioan Bogdan, and Costel Istrate. 2015. The Analysis of the Principal Components of the Financial Reporting in the Case of Romanian Listed Companies. Procedia Economics and Finance 20: 553–61. [Google Scholar] [CrossRef]

- Rossi, Jessica, Augusto Bianchini, and Patricia Guarnieri. 2020. Circular Economy Model Enhanced by Intelligent Assets from Industry 4.0: The Proposition of an Innovative Tool to Analyze Case Studies. Sustainability 12: 7147. [Google Scholar] [CrossRef]

- Roychowdhury, Sugata, Nemit Shroff, and Rodrigo S. Verdi. 2019. The effects of financial reporting and disclosure on corporate investment: A review. Journal of Accounting and Economics 68: 101246. [Google Scholar] [CrossRef]

- Sainio, Liisa-Maija, and Emma Marjakoski. 2009. The logic of revenue logic? Strategic and operational levels of pricing in the context of software business. Technovation 29: 368–78. [Google Scholar] [CrossRef]

- Salijeni, George, Anna Samsonova-Taddei, and Stuart Turley. 2021. Understanding How Big Data Technologies Reconfigure the Nature and Organization of Financial Statement Audits: A Sociomaterial Analysis. European Accounting Review 30: 531–55. [Google Scholar] [CrossRef]

- Scapens, Robert W. 1990. Researching management accounting practice: The role of case study methods. The British Accounting Review 22: 259–81. [Google Scholar] [CrossRef]

- Smith, Deborah Drummond, Kimberly C. Gleason, and Yezen H. Kannan. 2021. Auditor liability and excess cash holdings: Evidence from audit fees of foreign incorporated firms. International Review of Financial Analysis 78: 101947. [Google Scholar] [CrossRef]

- Soundararajan, Vivek, Sreevas Sahasranamam, Zaheer Khan, and Tanusree Jain. 2021. Multinational enterprises and the governance of sustainability practices in emerging market supply chains: An agile governance perspective. Journal of World Business 56: 101149. [Google Scholar] [CrossRef]

- Sun, Xuan Sean, Ahsan Habib, and Md. Borhan Uddin Bhuiyan. 2020. Workforce environment and audit fees: International evidence. Journal of Contemporary Accounting & Economics 16: 100182. [Google Scholar] [CrossRef]

- Taber, Keith S. 2018. The Use of Cronbach’s Alpha When Developing and Reporting Research Instruments in Science Education. Research in Science Education 48: 1273–96. [Google Scholar] [CrossRef]

- Tan, Qing, Nashwa El-Bendary, Magdy A. Bayoumi, Xiaokun Zhang, Javier Sedano, and José R. Villar. 2018. Emerging Technologies: IoT, Big Data, and CPS with Sensory Systems. Journal of Sensors 2018: 3407542. [Google Scholar] [CrossRef]

- Tang, Jianyun, and W. Glenn Rowe. 2022. The liability of closeness: Business relatedness and foreign subsidiary performance. Journal of World Business 47: 288–96. [Google Scholar] [CrossRef]

- Thum-Thysen, Anna, Peter Voigt, Beñat Bilbao-Osorio, Christoph Maier, and Diana Ognyanov. 2019. Investment dynamics in Europe: Distinct drivers and barriers for investing in intangible versus tangible assets? Structural Change and Economic Dynamics 51: 77–88. [Google Scholar] [CrossRef]

- Türegün, Nida. 2019. Impact of technology in financial reporting: The case of Amazon Go. Journal of Corporate Accounting & Finance 30: 90–95. [Google Scholar] [CrossRef]

- Uddin, Mohammad Riaz, Mostafa Monzur Hasan, and Nour Abadi. 2022. Do intangible assets provide corporate resilience? New evidence from infectious disease pandemics. Economic Modelling 110: 105806. [Google Scholar] [CrossRef]

- Velte, Patrick. 2022. The impact of external auditors on frms’ fnancial restatements: A review of archival studies and implications. Management Review Quarterly. [Google Scholar] [CrossRef]

- Villani, Davide. 2021. Revisiting the external financial dependence index in light of the rise of corporate net lending: What do we really measure? Structural Change and Economic Dynamics 58: 361–76. [Google Scholar] [CrossRef]

- Wang, Chenxi. 2022. Firm asset structure and risk aversion. Economics Letters 221: 110913. [Google Scholar] [CrossRef]

- Waterhouse, John H, and Peter Tiessen. 1978. A contingency framework for management accounting systems research. Accounting, Organizations and Society 3: 65–76. [Google Scholar] [CrossRef]

- Wiesmeth, Hans. 2020. Implementing the Circular Economy for Sustainable Development, 1st ed. Dresden: TU Dresden, Faculty of Economics. ISBN 9780128218044. [Google Scholar] [CrossRef]

- Wójcik-Karpacz, Anna, Jarosław Karpacz, Piotr Brzeziński, Anna Pietruszka-Ortyl, and Bernard Ziębicki. 2023. Barriers and Drivers for Changes in Circular Business Models in a Textile Recycling Sector: Results of Qualitative Empirical Research. Energies 16: 490. [Google Scholar] [CrossRef]

- Xu, Xingmei, and Chao Xuan. 2021. A study on the motivation of financialization in emerging markets: The case of Chinese nonfinancial corporations. International Review of Economics & Finance 72: 606–23. [Google Scholar] [CrossRef]

- Yang, Lin. 2021. Cloud Data Integrity Verification Algorithm for Sustainable Accounting Informatization. Mathematical Problems in Engineering 2021: 2330502. [Google Scholar] [CrossRef]

- Yang, Ruicheng, and Qi Jiang. 2020. Detecting Falsified Financial Statements Using a Hybrid SM-UTADIS Approach : Empirical Analysis of Listed Traditional Chinese Medicine Companies in China. Discrete Dynamics in Nature and Society 2020: 8865489. [Google Scholar] [CrossRef]

- Zambon, Stefano, Giuseppe Marzo, Laura Girella, Mario Abela, and Nicola D’Albore. 2020. Academic Report. A Literature Review on the Reporting of Intangibles. Brussels: EFRAG (European Financial Reporting Advisory Group). [Google Scholar]

- Zhang, Wenyao, Ruzhi Xu, and Lu Wang. 2021. Investigating the Complex Relationship between Financial Performance and Company’s Green Behavior: A Comparative Analysis. Discrete Dynamics in Nature and Society 2021: 9979835. [Google Scholar] [CrossRef]

| Statistics | ||||||||

|---|---|---|---|---|---|---|---|---|

| No. | Activity | TASS | IASS | TLIA | TREV | NFI | ||

| N | Valid | 800 | 800 | 800 | 800 | 800 | 800 | 800 |

| Missing | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Activity | |||||

|---|---|---|---|---|---|

| Frequency | Percent | Valid Percent | Cumulative Percent | ||

| Valid | Manufacturing | 256 | 32.0 | 32.0 | 32.0 |

| Service | 192 | 24.0 | 24.0 | 56.0 | |

| Distribution | 352 | 44.0 | 44.0 | 100.0 | |

| Total | 800 | 100.0 | 100.0 | ||

| KMO and Bartlett’s Test | Communalities | Total Variance Explained | Rotated Component Matrix | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy. | 0.803 | Factors | Initial | Extraction | Initial Eigenvalues | Rotation Sums of Squared Loadings | Factors | Sub-factors | ||

| F.1.1 | F.1.2 | |||||||||

| Bartlett’s Test of Sphericity | Approx. Chi-Square | 2274.685 | IASS | 1.000 | 0.587 | 2.724 | 47.431 | NFI | 0.940 | 0.036 |

| df | 10 | TASS | 1.000 | 0.815 | 1.129 | 77.058 | TREV | 0.883 | 0.027 | |

| Sig. | 0.000 | TLIA | 1.000 | 0.785 | 0.865 | IASS | −0.248 | 0.725 | ||

| PCA-MATRIX | TREV | 1.000 | 0.780 | 0.154 | TLIA | 0.549 | 0.695 | |||

| NFI | 1.000 | 0.885 | 0.129 | TASS | 0.588 | 0.685 | ||||

| ANOVA with Tukey’s Test for Non-Additivity | |||||||

|---|---|---|---|---|---|---|---|

| Sum of Squares | df | Mean Square | F | Sig | |||

| Between People | 16,015,018,683,524,993,000.000 | 799 | 20,043,828,139,580,716.000 | ||||

| Within People | Between Items | 6,564,201,617,575,351,300.000 | 6 | 1,094,033,602,929,225,220.000 | 124.301 | 0.000 | |

| Residual | Nonadditivity | 24,618,292,153,668,825,000.000 | 1 | 24,618,292,153,668,825,000.000 | 6713.468 | 0.000 | |

| Balance | 17,575,934,665,844,765,000.000 | 4793 | 3,667,000,764,833,041.000 | Reliability Statistics | |||

| Total | 42,194,226,819,513,590,000.000 | 4794 | 8,801,465,752,923,152.000 | Cronbach’s Alpha | N of Items | ||

| Total | 48,758,428,437,088,944,000.000 | 4800 | 10,158,005,924,393,530.000 | 0.961 | 7 | ||

| Total | 64,773,447,120,613,930,000.000 | 5599 | 11,568,752,834,544,370.000 | PCA-MATRIX | |||

| Hotelling’s T-Squared Test | |||||||

| 4990.051 | 826.471 | 6 | 794 | 0.000 | |||

| KMO and Bartlett’s Test | Communalities | Total Variance Explained | Rotated Component Matrix | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy. | 0.818 | Factors | Initial | Extraction | Initial Eigenvalues | Rotation Sums of Squared Loadings | Factors | Sub-factor | |

| F.1.1 | |||||||||

| Bartlett’s Test of Sphericity | Approx. Chi-Square | 2285.209 | TASS | 1.000 | 0.701 | 2.715 | 67.885 | NFI | 0.854 |

| df | 6 | TLIA | 1.000 | 0.653 | 0.994 | TASS | 0.837 | ||

| Sig. | 0.000 | TREV | 1.000 | 0.632 | 0.156 | TLIA | 0.808 | ||

| PCA-MATRIX | NFI | 1.000 | 0.729 | 0.135 | TREV | 0.795 | |||

| ANOVA with Tukey’s Test for Non-Additivity | |||||||

|---|---|---|---|---|---|---|---|

| Sum of Squares | df | Mean Square | F | Sig | |||

| Between People | 27,849,097,855,760,130,000.000 | 799 | 34,854,940,995,945,096.000 | ||||

| Within People | Between Items | 3,251,902,239,610,027,000.000 | 3 | 1,083,967,413,203,342,340.000 | 85.753 | 0.000 | |

| Residual | Nonadditivity | 12,814,002,862,658,808,000.000 | 1 | 12,814,002,862,658,808,000.000 | 1755.881 | 0.000 | |

| Balance | 17,485,444,384,121,932,000.000 | 2396 | 7,297,764,767,997,467.000 | Reliability Statistics | |||

| Total | 30,299,447,246,780,740,000.000 | 2397 | 12,640,570,399,157,588.000 | Cronbach’s Alpha | N of Items | ||

| Total | 33,551,349,486,390,768,000.000 | 2400 | 13,979,728,952,662,820.000 | 0.837 | 4 | ||

| Total | 61,400,447,342,150,890,000.000 | 3199 | 19,193,637,806,236,604.000 | PCA-MATRIX | |||

| Hotelling’s T-Squared Test | |||||||

| 340.772 | 113.306 | 3 | 797 | 0.000 | |||

| KMO and Bartlett’s Test | Communalities | Total Variance Explained | Rotated Component Matrix | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Kaiser-Meyer-Olkin Measure of Sampling Adequacy. | 0.713 | Factors | Initial | Extraction | Initial Eigenvalues | Rotation Sums of Squared Loadings | Factors | Sub-factor | |

| F.1.2 | |||||||||

| Bartlett’s Test of Sphericity | Approx. Chi-Square | 1025.200 | TASS | 1.000 | 0.904 | 1.889 | 62.963 | TASS | 0.951 |

| df | 3 | TLIA | 1.000 | 0.900 | 0.958 | 31.949 | TLIA | 0.949 | |

| Sig. | 0.000 | IASS | 1.000 | 0.585 | 0.153 | 5.088 | IASS | 0.591 | |

| PCA-MATRIX | |||||||||

| ANOVA with Tukey’s Test for Non-Additivity | |||||||

|---|---|---|---|---|---|---|---|

| Sum of Squares | df | Mean Square | F | Sig | |||

| Between People | 31,104,022,603,656,884,000.000 | 783 | 39,724,166,799,050,936.000 | ||||

| Within People | Between Items | 979,732,230,293,473,150.000 | 1 | 979,732,230,293,473,150.000 | 75.532 | 0.000 | |

| Residual | Nonadditivity | 8,764,078,942,720,470,000.000 | 1 | 8,764,078,942,720,470,000.000 | 4922.309 | 0.000 | |

| Balance | 1,392,336,398,035,725,310.000 | 782 | 1,780,481,327,411,413.500 | Reliability Statistics | |||

| Total | 10,156,415,340,756,195,000.000 | 783 | 12,971,156,246,176,494.000 | Cronbach’s Alpha | N of Items | ||

| Total | 11,136,147,571,049,669,000.000 | 784 | 14,204,269,861,032,740.000 | 0.873 | 3 | ||

| Total | 42,240,170,174,706,550,000.000 | 1567 | 26,956,075,414,618,092.000 | PCA-MATRIX | |||

| Hotelling’s T-Squared Test | |||||||

| 75.532 | 75.532 | 1 | 783 | 0.000 | |||

| Model Summary | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| IASS | R | R Square | Adjusted R Square | Std. Error of the Estimate | Change Statistics | Durbin-Watson | ||||

| R Square Change | F Change | df1 | df2 | Sig. F Change | ||||||

| 0.890 | 0.784 | 0.878 | 8,491,628.7 | 0.784 | 14.150 | 5 | 770 | 0.000 | 1.833 | |

| ANOVA | ||||||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |||||

| IASS | Regression | 5,101,491,613,238,856.000 | 5 | 1,020,298,322,647,771.200 | 14.150 | 0.000 | ||||

| Residual | 55,522,974,140,050,720.000 | 770 | 72,107,758,623,442.500 | |||||||

| Total | 60,624,465,753,289,576.000 | 775 | ||||||||

| Coefficients | ||||||||||

| IASS | Beta | t | Sig. | |||||||

| (Constant) | 0.189 | 0.035 | ||||||||

| TASS | 0.161 | 2.421 | 0.016 | |||||||

| TLIA | 0.189 | 1.357 | 0.075 | |||||||

| TREV | 0.393 | 5.865 | 0.000 | |||||||

| NFI | −0.519 | −7.312 | 0.000 | |||||||

| Model Summary | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| IASS | R | R Square | Adjusted R Square | Std. Error of the Estimate | Change Statistics | Durbin-Watson | ||||

| R Square Change | F Change | df1 | df2 | Sig. F Change | ||||||

| 0.857 | 0.734 | 0.732 | 113,160,712.48393 | 0.734 | 425.375 | 5 | 770 | 0.000 | 1.917 | |

| ANOVA | ||||||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |||||

| IASS | Regression | 272,353,953,251,997,450 | 5 | 5,447,079,065,039,948,800 | 425.375 | 0.000 | ||||

| Residual | 986,011,707,440,093,600 | 770 | 12,805,346,849,871,346.0 | |||||||

| Total | 3,7095,512,399,600,680,000 | 775 | ||||||||

| Coefficients | ||||||||||

| IASS | Beta | t | Sig. | |||||||

| (Constant) | 0.084 | 0.094 | ||||||||

| IASS | 0.147 | 2.421 | 0.016 | |||||||

| TLIA | 0.777 | 36.240 | 0.000 | |||||||

| TREV | 0.245 | 1.226 | 0.021 | |||||||

| NFI | 0.101 | 2.577 | 0.010 | |||||||

| Model Summary | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| IASS | R | R Square | Adjusted R Square | Std. Error of the Estimate | Change Statistics | Durbin-Watson | ||||

| R Square Change | F Change | df1 | df2 | Sig. F Change | ||||||

| 0.850 | 0.722 | 0.721 | 38,488,552.72757 | 0.722 | 501.437 | 4 | 771 | 0.000 | 1.954 | |

| ANOVA | ||||||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |||||

| IASS | Regression | 2,971,251,952,944,959,500.0 | 4 | 742,812,988,236,239,870.000 | 501.437 | 0.000 | ||||

| Residual | 1,142,135,260,809,414,400.0 | 771 | 1,481,368,691,062,794.200 | |||||||

| Total | 4,113,387,213,754,374,100.0 | 775 | ||||||||

| Coefficients | ||||||||||

| IASS | Beta | t | Sig. | |||||||

| (Constant) | 0.210 | 0.000 | ||||||||

| IASS | 0.027 | 1.358 | 0.175 | |||||||

| TASS | 0.812 | 36.281 | 0.000 | |||||||

| NFI | 0.157 | 3.942 | 0.000 | |||||||

| TREV | −0.114 | −3.031 | 0.003 | |||||||

| Model Summary | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| IASS | R | R Square | Adjusted R Square | Std. Error of the Estimate | Change Statistics | Durbin-Watson | ||||

| R Square Change | F Change | df1 | df2 | Sig. F Change | ||||||

| 0.864 | 0.747 | 0.745 | 73,883,346.2 | 0.747 | 453.931 | 5 | 770 | 0.000 | 1.701 | |

| ANOVA | ||||||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |||||

| IASS | Regression | 12,389,486,791,683,520,000 | 5 | 2,477,897,358,336,704,000.00 | 453.931 | 0.000 | ||||

| Residual | 4,203,236,622,434,580,500.0 | 770 | 5,458,748,860,304,650.000 | |||||||

| Total | 16,592,723,414,118,100,000 | 775 | ||||||||

| Coefficients | ||||||||||

| IASS | Beta | t | Sig. | |||||||

| (Constant) | 0.181 | 0.000 | ||||||||

| IASS | 0.109 | 5.865 | 0.000 | |||||||

| NFI | 0.890 | 41.604 | 0.000 | |||||||

| TASS | 0.043 | 1.226 | 0.221 | |||||||

| TLIA | −0.104 | −3.027 | 0.003 | |||||||

| Model Summary | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| IASS | R | R Square | Adjusted R Square | Std. Error of the Estimate | Change Statistics | Durbin-Watson | ||||

| R Square Change | F Change | df1 | df2 | Sig. F Change | ||||||

| 0.883 | 0.779 | 0.777 | 6,512,640.1 | 0.779 | 542.320 | 5 | 770 | 0.000 | 2.033 | |

| ANOVA | ||||||||||

| Model | Sum of Squares | df | Mean Square | F | Sig. | |||||

| IASS | Regression | 115,011,145,035,664,896.00 | 5 | 23,002,229,007,132,980.000 | 542.320 | 0.000 | ||||

| Residual | 32,659,151,302,284,872.000 | 770 | 42,414,482,210,759.570 | |||||||

| Total | 147,670,296,337,949,760.00 | 775 | ||||||||

| Coefficients | ||||||||||

| IASS | Beta | t | Sig. | |||||||

| (Constant) | 0.278 | 0.781 | ||||||||

| IASS | −0.125 | −7.312 | 0.000 | |||||||

| TASS | 0.084 | 2.577 | 0.010 | |||||||

| TLIA | 0.125 | 3.919 | 0.000 | |||||||

| TREV | 0.777 | 41.604 | 0.000 | |||||||

| Analyses | Factors | Hypotheses | The Equations | Accepted/Rejected | |

|---|---|---|---|---|---|

| Descriptive | Manufacturing | N/A | N/A | This method estimates the number of participating businesses in future analyses | |

| Service | |||||

| Distribution | |||||

| Factorial | F1 | F1.1 | TREV = 0.883 NFI = 0.854 | N/A | This method preceded the validation of the hypotheses |

| F1.2 | TLIA = 0.695 TASS = 0.685 TASS = 0.951 TLIA = 0.949 | ||||

| Reliability | F1 | F1.1 | α = 0.961 ≈ 91% α = 0.837 ≈ 84% | Sig. = 0.000 | This method ensures the reliability of the data |

| F1.2 | α = 0.873 ≈ 87% | ||||

| Multiple regression | IASS | TASS | H1 | Rejected H0 | |

| TLIA | |||||

| TREV | H2 | Accepted ( ≠ 0 | |||

| NFI | |||||

| TASS | IASS | H3 | Rejected H0 | ||

| TLIA | |||||

| TREV | H4 | Accepted ( ≠ 0 | |||

| NFI | |||||

| TLIA | IASS | H5 | Rejected H0 | ||

| TASS | |||||

| NFI | H6 | ( ≠ 0 | |||

| TREV | |||||

| TREV | IASS | H7 | Rejected H0 | ||

| NFI | |||||

| TASS | H8 | (≠ 0 | |||

| TLIA | |||||

| NFI | IASS | H9 | Rejected H0 | ||

| TLIA | |||||

| TREV | H10 | ( ≠ 0 | |||

| NFI | |||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lulaj, E.; Dragusha, B.; Hysa, E. Investigating Accounting Factors through Audited Financial Statements in Businesses toward a Circular Economy: Why a Sustainable Profit through Qualified Staff and Investment in Technology? Adm. Sci. 2023, 13, 72. https://doi.org/10.3390/admsci13030072

Lulaj E, Dragusha B, Hysa E. Investigating Accounting Factors through Audited Financial Statements in Businesses toward a Circular Economy: Why a Sustainable Profit through Qualified Staff and Investment in Technology? Administrative Sciences. 2023; 13(3):72. https://doi.org/10.3390/admsci13030072

Chicago/Turabian StyleLulaj, Enkeleda, Blerta Dragusha, and Eglantina Hysa. 2023. "Investigating Accounting Factors through Audited Financial Statements in Businesses toward a Circular Economy: Why a Sustainable Profit through Qualified Staff and Investment in Technology?" Administrative Sciences 13, no. 3: 72. https://doi.org/10.3390/admsci13030072

APA StyleLulaj, E., Dragusha, B., & Hysa, E. (2023). Investigating Accounting Factors through Audited Financial Statements in Businesses toward a Circular Economy: Why a Sustainable Profit through Qualified Staff and Investment in Technology? Administrative Sciences, 13(3), 72. https://doi.org/10.3390/admsci13030072