Development of Quality Digital Innovation by Optimally Utilizing Company Resources to Increase Competitive Advantage and Business Performance

Abstract

1. Introduction

2. Theoretical Framework, Hypothesis, and Research Model Framework

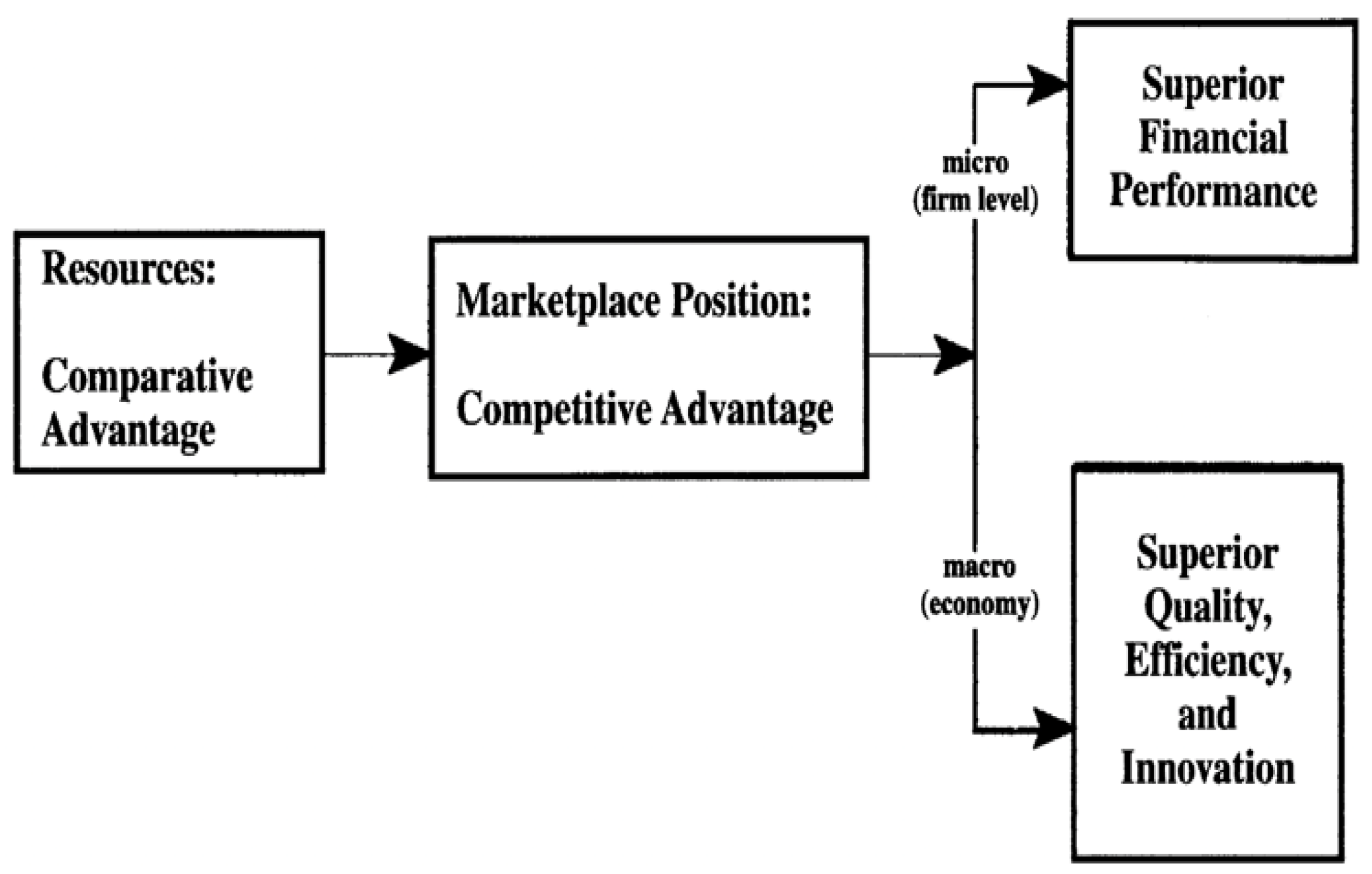

2.1. Theoretical Framework

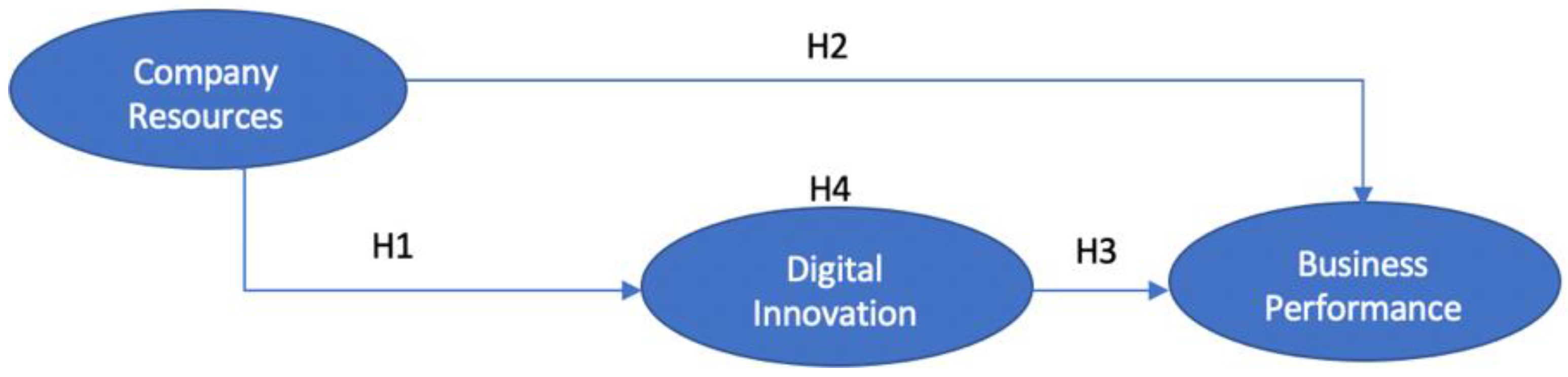

2.2. Hypothesis

2.3. Research Model Framework

3. Methods

4. Research Findings

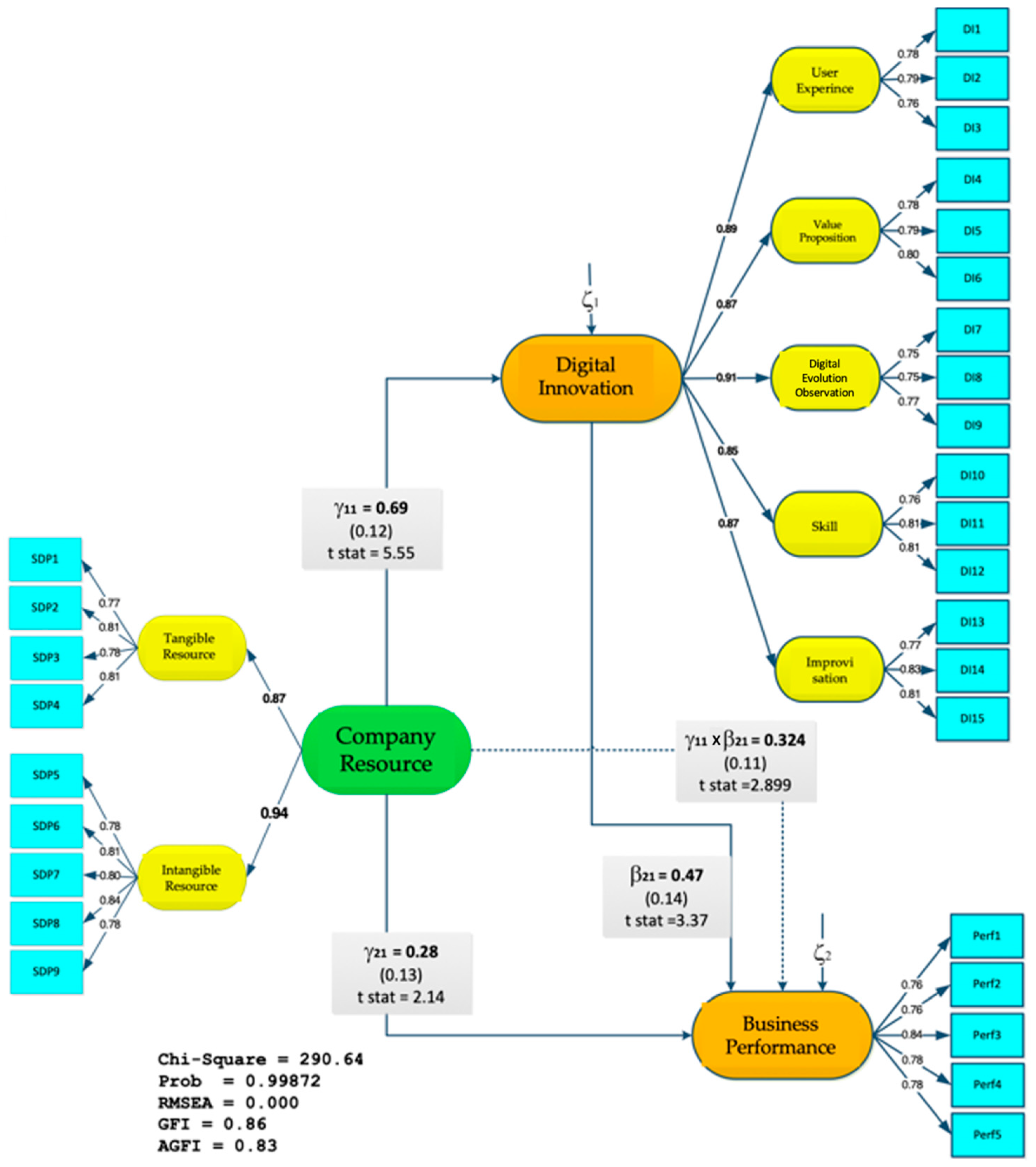

4.1. Goodness-of-Fit Analysis

4.2. Validity and Reliability Test

4.3. Hypothesis Testing

- Company resources have a significant direct effect on business performance and digital information, with a t-value > 1.98 and a p-value <0.05.

- Digital innovation has a significant direct effect on business performance, with a t-value >1.98 and a p-value <0.05.

- Company resources significantly indirectly affect business performance through digital innovation, with a t-value >1.98 and a p-value <0.05.

- The indirect effect of company resources on business performance through digital innovation (R2 = 0.166) is more dominant compared to the direct effect of company performance on business performance (R2 = 0.078).

5. Discussion and Conclusions

- Prioritize the achievement of performance indicators by first ensuring that the ROIC (return on invested capital) target is achieved because the ISP industry is a capital-intensive industry in deploying its service infrastructure. This capital is generally obtained from bank loans, so ISPs must ensure they can repay the loan. Furthermore, ensuring that the target market share is achieved through asset growth while ensuring the level of ROA (return on assets) and EBITDA of the company.

- The development and implementation of quality digital innovation begin with prioritizing observation of digital evolution to know user behavior and the right digital equipment and marketing channel that will be used, then focus on improving customer experience through developing products/services that have aesthetics and usefulness with customer engagement, and continuing to deliver value proposition through implementing correct commissions, product bundling, and implementing customer segmentation, improving improvisation with the right scheduling, coordination, and opportunities to innovate, and lastly improving skills by team building, role fulfillment, and learning.

- In utilizing company resources optimally, the ISP company needs to utilize intangible resources in the form of a supportive organizational culture, superior customer service, mastery of IT technology, company reputation, and internal business processes.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

Appendix A. Survey Questions

Appendix A.1. Company Resources

| Number | Questions | Answers | ||||

| Tangible Resources | 5 | 4 | 3 | 2 | 1 | |

| 1 | The company provides a representative office building | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

| 2 | The company provides complete office facilities | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

| 3 | The company has sufficient capital | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

| 4 | The company has adequate human resources | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

| Intangibe Resources | 5 | 4 | 3 | 2 | 1 | |

| 5 | The company builds and maintains a good company reputation | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

| 6 | The company provides superior customer service | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

| 7 | The company has mastery of IT technology | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

| 8 | The company has a supportive organizational culture | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

| 9 | The company always develops internal business processes | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

- □

- Limited ability to innovate digitally to anticipate changes in the business environment

- □

- The company has difficulty cooperating with the Government and/or other companies

- □

- Lack of sufficient capital/investment allocation

- □

- The limitations of the experts

- □

- Inadequate human resource capacity development

- □

- Lack of good collaboration both internal and external to the company

- □

- Mastery of technology, especially digital technology

- □

- Others ....................................................................................

Appendix A.2. Digital Innovation

| Number | Questions | Answers | ||||

| 5 | 4 | 3 | 2 | 1 | |

| 1 | The company always prepares products/services that are easy to use | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

| 2 | The company always articulates an aesthetic trait that evokes a positive emotional response to the products/services provided | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

| 3 | The company always creates products/services by involving customers to create a meaningful user experience | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

| 5 | 4 | 3 | 2 | 1 | |

| 4 | The company always performs the right customer segmentation | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

| 5 | The company always performs the right product/service bundling | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

| 6 | The company always evaluates/negotiates the commission given to the marketing channel owner | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

| 5 | 4 | 3 | 2 | 1 | |

| 7 | The company always follows the development of the necessary digital equipment technology | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

| 8 | The company always manages effective digital marketing channels | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

| 9 | The company always pays attention to user behavior that appears in the market | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

| 5 | 4 | 3 | 2 | 1 | |

| 10 | The company always encourages learning on the development of digital technology | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

| 11 | The company always maintains a balance of roles between those with general and specific digital skills | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

| 12 | The company can always put together a team with the right combination of skills for any digital project | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

| 5 | 4 | 3 | 2 | 1 | |

| 13 | The company always supports the development of flexible space for innovation | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

| 14 | The company always dedicates time to improvisation efforts in every product/service provided | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

| 15 | The company always has a mechanism to coordinate efforts to improvise with related parties | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

- □

- Lack of sufficient budget allocation/investment in the development of digital innovation

- □

- Mastery over digital technology, for example, big data, artificial intelligence, mobile application, robotic processing automation

- □

- Company policies and culture do not support the development of digital innovation

- □

- Limitations of creativity and capability of human resources

- □

- The existence of related external policies (government or stakeholders) that do not support the achievement of digital innovation development

- □

- Others ....................................................................................

Appendix A.3. Business Performance

| Pilihan Jawaban | ||||||

| 5 | 4 | 3 | 2 | 1 | |

| 1 | Achievement of the last year’s ROA growth target in accordance with the target | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

| ||||||

| 2 | Achievement of the EBITDA growth target: The last year’s margin was in line with the target | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

| ||||||

| 3 | Achievement of the last year’s ROIC growth target in line with the target | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

| ||||||

| 5 | 4 | 3 | 2 | 1 | |

| 4. | Achievement of the last year’s asset growth target in accordance with the target | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

| ||||||

| 5 | 4 | 3 | 2 | 1 | |

| 5. | Achievement of the market share target for the last year in accordance with the target | Strongly Agree | Agree | Neutral | Disagree | Strongly Disagree |

| ||||||

- □

- Lack of good collaboration with external partners (government, financiers, competitors, suppliers, customers, etc.)

- □

- The company’s internal collaboration is going poorly

- □

- Human resources do not have sufficient capabilities

- □

- Companies are lacking in digital innovation to improve products and services

- □

- Limited capital owned

- □

- Limited mastery of digital technology

- □

- Companies are not able to adapt to environmental changes

- □

- Others ....................................................................................

References

- Al-Tamimi, Hussein A. Hassan. 2010. Factors Influencing Performance of the UAE Islamic and Conventional National Banks. Sharjah: Department of Accounting, Finance, and Economics, College of Business Administration, University of Sharjah. [Google Scholar]

- Atalay, Murat, Nilgün Anafarta, and Fulya Sarvan. 2013. The relationship between innovation and firm performance: Empirical evidence from Turkish automotive supplier industry. Procedia—Social Behavioral Science 75: 226–35. [Google Scholar] [CrossRef]

- Bagheri, Sodeif, Habib Ebrahimpour, and Mohammad Bashokoh Ajirloo. 2013. Surveying The Impact of Managers Competencies on Business Performance of Agricultural Bank Managers In Ardabil Province. International Journal of Management Research and Reviews 3: 3424–33. [Google Scholar]

- Barney, Jay. 1991. Firm Resources and Sustained Competitive Advantage. Journal of Management 17: 99–120. [Google Scholar] [CrossRef]

- Best, Roger. 2014. Market-Based Management: Strategies for Growing Customer Value and Profitability, 6th ed. Upper Saddle River: Prentice Hall. [Google Scholar]

- Chin, Wynne. 2000. Partial Least Squares for Researchers: An Overview and Presentation of Recent Advances Using the PLS Approach. Available online: http://disc-nt.cba.uh.edu/chin/indx.html (accessed on 1 October 2022).

- David, Fred. 2017. Strategic Management, Concepts & Cases, 16th ed. London: Pearson Education Limited. [Google Scholar]

- Estrada, Isabel, Dries Faems, and Pedro de Faria. 2016. Coopetition and product innovation performance: The role of internal knowledge sharing mechanisms and formal knowledge protection mechanisms. Industrial Marketing Management 53: 56–65. [Google Scholar] [CrossRef]

- Ferdinand, Augusty. 2014. Metode Penelitian Manajemen Pedoman Penelitian untuk Penulisan Skripsi Tesis dan Disertasi Ilmu Manajemen, 5th ed. Semarang: BP Undip. ISBN 979-704-254-5. [Google Scholar]

- Ghalem, Âta, Chafik Okar, Razane Chroqui, and Sema Elalami. 2016. Performance: A Concept to Define. Available online: https://www.researchgate.net/publication/316630175_Performance_A_concept_to_define (accessed on 1 October 2022). [CrossRef]

- Gurlek, Mert, and Murat Cemberci. 2019. Understanding the relationships among knowledge-oriented leadership, knowledge management capacity, innovation performance, and organizational performance. Kybernetes 49: 2819–46. [Google Scholar]

- Hafeez, Muhammad Haroon, Mohd Noor Mohd Shariff, and Halim Bin Mad Lazim. 2012. Relationship between Entrepreneurial Orientation, Firm Resources, SME Branding and Firm’s Performance: Is Innovation the Missing Link? American Journal of Industrial and Business Management 2: 153–59. [Google Scholar] [CrossRef][Green Version]

- Hahn, William, and Thomas Powers. 2013. Strategic plan quality, implementation capability, and firm performance. Academy of Strategic Management Journal 9: 63–81. [Google Scholar]

- Hair, Joseph. 2006. Multivariate Data Analysis, 5th ed. Hoboken: Pearson Prentice Hall. [Google Scholar]

- Hunt, Shelby, and Robert Morgan. 1995. The Comparative Advantage Theory of Competition. Journal of Marketing 59: 1–15. [Google Scholar] [CrossRef]

- Hussain, Rana Tanveer, and Abdul Waheed. 2019. Strategic Resources and Firm Performance: An Application of the Resource-Based View. The Lahore Journal of Business 7: 59–94. [Google Scholar] [CrossRef]

- Kafetzopoulos, Dimitrios, and Evangelos Psomas. 2015. The impact of innovation capability on the performance of manufacturing companies. Journal of Manufacturing Technology Management 26: 104–30. [Google Scholar] [CrossRef]

- Karami, Azdar, Samira Sahebalzamani, and Babak Sarabi. 2015. The Influence of HR Practices on Business Strategy and Firm Performance: The Case of Banking Industry in Iran. The IUP Journal of Management Research 14: 30–53. [Google Scholar]

- Khin, Sabai, and Theresa Char Fey Ho. 2018. Digital technology, digital capability and organizational performance: A mediating role of digital innovation. International Journal of Innovation Science 11: 177–95. [Google Scholar] [CrossRef]

- Kohansal, Mohammad Reza, Mohsen Rahimi, and Saeed Vazifehshenas. 2013. Environmental Efficiency, Innovation and Corporate Performance in Management Human Resources. International Journal of Agriculture and Crop Sciences 5: 2906–10. [Google Scholar]

- Krause, Oliver. 2005. Performance Measurement—Eine Stakeholder-Nutzenorientierte und Geschäft sprozess-basierte Methode. Ph.D. dissertation, Technische Universität Berlin, Berlin, Germany. [Google Scholar]

- Mariani, Marcelo, and Maksin Belitski. 2022. The effect of competition intensity on first mover advantage and imitation in innovation-related coopetition: Empirical evidence from UK firms. European Management Journal. Available online: https://www.sciencedirect.com/science/article/pii/S0263237322000640?via%3Dihub (accessed on 1 October 2022). [CrossRef]

- Nunnally, Jum C., and Ira H. Bernstein. 1994. The Assessment of Reliability. Psychometric Theory 3: 248–92. [Google Scholar]

- Nylen, Daniel, and Joony Holmstrom. 2015. Digital innovation strategy: A framework for diagnosing and improving digital product and service innovation. Business Horizons 58: 57–67. [Google Scholar] [CrossRef]

- Quintana-Garcia, Cristina, and Carlos A. Benavides-Velasco. 2004. Cooperation, competition, and innovative capability: A panel data of European dedicated biotechnology firms. Technovation 24: 927–38. [Google Scholar] [CrossRef]

- Ritala, Paavo. 2012. Coopetition Strategy—When is it Successful? Empirical Evidence on Innovation and Market Performance. British Journal of Management 23: 307–24. [Google Scholar] [CrossRef]

- Ritala, Paavo, and Pia Hurmelinna-Laukkanen. 2013. Incremental and Radical Innovation in Coopetition—The Role of Absorptive Capacity and Appropriability. Journal of Product Innovation Management 30: 154–69. [Google Scholar] [CrossRef]

- Sami, Parinaz, Farrajollah Rahnavard, and Alireza Alavi Tabar. 2019. The effect of political and business ties on firm performance. Management Research Review 42: 778–96. [Google Scholar] [CrossRef]

- Sammut-Bonnici, Tanya. 2015. Coopetition. Wiley Encyclopedia of Management. Hoboken: John Wiley & Sons, Ltd. [Google Scholar]

- Sulistyo, Heru, and Siyamtinah. 2016. The innovation capability of SMEs through entrepreneurship, marketing capability, relational capital, and empowerment. Asia Pacific Management Review 21: 196–233. [Google Scholar] [CrossRef]

- Thompson, Arthur, Margaret Peteraf, and Jhon Gamble. 2020. Crafting and Executing Strategy, The Quest for Competitive Advantage, Concepts, and Cases, 19th ed. New York: McGraw Hill Education. [Google Scholar]

- Tchuta, Leonard, and Fuji Xie. 2017. Towards A Synergic Innovation Management Model: The Interplay of Market, Technology, and Management Innovations. International Journal of Business and Economic Development 5: 60–70. [Google Scholar]

- Tifow, Abdulkadir Ali, and Ozlem Sayilir. 2015. Capital Structure and Firm Performance: An Analysis of Manufacturing Firms In Turkey. Eurasian Journal of Business and Management 3: 13–22. [Google Scholar] [CrossRef]

- Wheelen, Thomas. L., David J. Hunger, Alan N. Hoffman, and Charles E. Bamford. 2018. Strategic Management and Business Policy: Globalization, Innovation, and Sustainability, 15th ed. London: Pearson Education Limited. [Google Scholar]

- Yasa, Ni Nyoman Kerti, Ni Wayan Ekawati, and Putu Laksmita Dewi Rahmayanti. 2019. The role of digital innovation in mediating digital capability on business performance. European Journal of Management and Marketing Studies 4: 111–28. [Google Scholar]

- Yen, Yu-Fang. 2013. The impact of bank’s human capital on organizational performance: How innovation influences performance. Innovation: Management, Policy & Practice 15: 112–27. [Google Scholar]

| Author | Result |

|---|---|

| Hafeez et al. (2012), Bagheri et al. (2013), Karami et al. (2015), Yen (2013) | Significant |

| Hussain and Waheed (2019) | Not Significant |

| Classification | Population | Samples |

|---|---|---|

| Large | 14 | 7 |

| Medium | 65 | 33 |

| Small | 395 | 200 |

| Total | 474 | 240 |

| No. | Size Degree of Fit | Value | Acceptable Match Rate | Note |

|---|---|---|---|---|

| 1 | Absolute Fit Test | |||

| Chi-Square | 290.64 | p-value > 0.05 | Close fit | |

| Normed Chi-Square (χ2/df) | p-value = 0.99872 | |||

| Goodness-of-Fit Index (GFI) | 0.86 | >0.80 | Close fit | |

| Root Mean Square Error of Approximation (RMSEA) | 0.000 | RMSEA ≤ 0.08 (good fit) RMSEA < 0.05 (close-fit) | Close fit | |

| 2 | Incremental Fit Measures | |||

| Adjusted Goodness-of-Fit Index (AGFI) | 0.83 | AGFI > 0.8 | Close fit | |

| Normed Fit Index (NFI) | 0.94 | NFI > 0.90 | Close fit | |

| Comparative Fit Index (CFI) | 0.99 | CFI > 0.90 | Close fit | |

| 3 | Parsimonius Fit Measures | |||

| Parsimonious Normed Fit Index (PNFI) | 0.95 | PNFI > 0.90 | Close fit | |

| Parsimonious GFI (PGFI) | 0.92 | PGFI > 0.90 | Fit | |

| Variables | Dimension-Indicator | Code | Loading Factor | t-Value | p-Value | Average Variance Extracted (AVE) | Composite Reliability |

|---|---|---|---|---|---|---|---|

| Company Resources | Tangible Resources | 0.87 | 7.44 | 0.000 | 0.628 | 0.871 | |

| Representative office building | SDP1 | 0.77 | - | - | |||

| Facilities | SDP2 | 0.81 | 7.95 | 0.000 | |||

| Sufficient capital | SDP3 | 0.78 | 7.72 | 0.000 | |||

| Adequate human resources | SDP4 | 0.81 | 7.98 | 0.000 | |||

| Intangible Resources | 0.94 | 8.06 | 0.000 | 0.644 | 0.900 | ||

| Company’s reputation | SDP5 | 0.78 | - | - | |||

| Customer service | SDP6 | 0.81 | 8.34 | 0.000 | |||

| Mastery of IT technology | SDP7 | 0.80 | 8.25 | 0.000 | |||

| Organizational culture | SDP8 | 0.84 | 8.64 | 0.000 | |||

| Internal business processes | SDP9 | 0.78 | 7.95 | 0.000 | |||

| Tangible Resources | |||||||

| Digital Innovation | User Experience | 0.89 | 7.20 | 0.000 | 0.603 | 0.820 | |

| Product/service usefulness | DI1 | 0.78 | 7.68 | ||||

| Product/service aesthetics | DI2 | 0.79 | 7.68 | 0.000 | |||

| Customer engagement | DI3 | 0.76 | 7.41 | 0.000 | |||

| Value Proposition | 0.87 | 7.10 | 0.000 | 0.624 | 0.833 | ||

| Customer segment | DI4 | 0.78 | - | ||||

| Bundling | DI5 | 0.79 | 7.65 | 0.000 | |||

| Commission | DI6 | 0.80 | 7.79 | 0.000 | |||

| Digital Evolution Observation | 0.91 | 7.07 | 0.000 | 0.573 | 0.884 | ||

| Digital equipment | DI7 | 0.75 | - | ||||

| Marketing channel | DI8 | 0.75 | 7.07 | 0.000 | |||

| User behavior | DI9 | 0.77 | 7.17 | 0.000 | |||

| Skill | 0.85 | 6.76 | 0.000 | 0.630 | 0.836 | ||

| Learning | DI10 | 0.76 | - | ||||

| Role fulfillment | DI11 | 0.81 | 7.55 | 0.000 | |||

| Team building | DI12 | 0.81 | 7.51 | 0.000 | |||

| Improvisation | 0.87 | 7.01 | 0.000 | 0.646 | 0.845 | ||

| Innovation space development | DI13 | 0.77 | - | ||||

| Timing | DI14 | 0.83 | 7.95 | 0.000 | |||

| Coordination with related parties | DI15 | 0.81 | 7.83 | 0.000 | |||

| Business Performance | ROA | Perf1 | 0.76 | - | - | 0.625 | 0.869 |

| EBITDA Margin | Perf2 | 0.76 | 7.40 | 0.000 | |||

| ROIC | Perf3 | 0.84 | 8.18 | 0.000 | |||

| Asset Growth | Perf4 | 0.78 | 7.66 | 0.000 | |||

| Market Share | Perf5 | 0.78 | 7.65 | 0.000 |

| No | Hyphotesis | Coefficient Estimated | t-Value | R2 | p-Value | Conclusion |

|---|---|---|---|---|---|---|

| 1 | Company resources → Digital Innovation | 0.69 | 5.55 | 0.476 | 0.000 | Significant |

| 2 | Company Resources → Business Performance | 0.28 | 2.14 | 0.078 | 0.033 | Significant |

| 3 | Digital Innovation → Company Resources | 0.69 | 3.37 | 0.476 | 0.001 | Significant |

| 4 | Company Resoources → Digital Innovation → Business performance | 0.34 | 2.899 | 0.116 | 0.004 | Significant |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hidayat, S.; Setiawan, M.; Rohman, F.; Hussein, A.S. Development of Quality Digital Innovation by Optimally Utilizing Company Resources to Increase Competitive Advantage and Business Performance. Adm. Sci. 2022, 12, 157. https://doi.org/10.3390/admsci12040157

Hidayat S, Setiawan M, Rohman F, Hussein AS. Development of Quality Digital Innovation by Optimally Utilizing Company Resources to Increase Competitive Advantage and Business Performance. Administrative Sciences. 2022; 12(4):157. https://doi.org/10.3390/admsci12040157

Chicago/Turabian StyleHidayat, Saiful, Margono Setiawan, Fatchur Rohman, and Ananda Sabil Hussein. 2022. "Development of Quality Digital Innovation by Optimally Utilizing Company Resources to Increase Competitive Advantage and Business Performance" Administrative Sciences 12, no. 4: 157. https://doi.org/10.3390/admsci12040157

APA StyleHidayat, S., Setiawan, M., Rohman, F., & Hussein, A. S. (2022). Development of Quality Digital Innovation by Optimally Utilizing Company Resources to Increase Competitive Advantage and Business Performance. Administrative Sciences, 12(4), 157. https://doi.org/10.3390/admsci12040157