1. Introduction

The globalization of markets has turned internationalization into an essential strategy for businesses, so the number of such firms expanding their operations into international markets has increased significantly. Internationalization provides businesses with a variety of potential benefits, but it also involves challenges and risks (for example,

Barkema and Vermeulen 1998;

Hitt et al. 2006). In the literature, there are opposing opinions on whether family businesses internationalize more or less than nonfamily businesses.

Family businesses have a unique set of business resources (familiness) due to the interaction between the family’s systems, its individual members, and the business (

Habbershon and Williams 1999;

Habbershon et al. 2003), and this can play an important role in the internationalization process.

As in many strategic decisions, internationalization involves possible positive and negative results. Strategic decisions can be considered as mixed bets and in the case of internationalization can explain the differences between family and nonfamily businesses (

Alessandri et al. 2018). In this regard, nonfamily businesses are mainly focused on economic goals and are willing to exchange risks for higher returns, while family businesses seek economic and non-economic objectives because of their concern for maintaining SEW (

Alessandri et al. 2018;

Hernández-Perlines et al. 2021).

The lack of consensus in the studies published may be due to the different moment in which the businesses started their internationalization, since they develop this process based on two approaches: an early or from-the-start internationalization (hereinafter, EI) and an internationalization from consolidation in the local market (hereinafter, LMI).

In the case of small and medium family businesses (hereinafter, FB), its specific characteristics can clarify and justify the existence of different results with small and medium nonfamily businesses (hereinafter, NFB). In this regard, this study explores whether FB have different outcomes in terms of internationalization intensity, depending on the time when the process started.

Furthermore, in the previous literature, different studies have shown that generational change, which is a specific factor in family businesses, and the incorporation of second and successive generations in the management of these companies can have effects on the strategy followed by family businesses. In this sense, this study also explores whether the entry of the second generation represents a strategic change that enhances the internationalization of FB.

To answer our research question, this paper analyzes a set of panel data corresponding to a sample of Spanish small- and medium-sized family enterprises for a period of 12 years (2005–2016), extracted from the Spanish Survey on Business Strategies (SSBS).

This paper aims to contribute to research into the internationalization of family businesses in various ways: firstly, to cover the gap that exists due to the lack of sufficient studies about the relationship between the start time of the process and the internationalization level achieved in family businesses, and secondly, to analyze the influence that the specific characteristics of family businesses have on the levels of internationalization obtained.

This study also aims to contribute by reaching certain practical conclusions to help the owners and managers of FB to correctly choose the time for starting the internationalization process and how quickly they should move forward.

The document is structured as follows. The second section presents the theoretical framework, which serves as the foundation for the hypotheses. The third section describes the data set and statistical approach used. The fourth section shows the results of the empirical analysis and provides an interpretation of these. Finally, the fifth section contains the conclusions from the results obtained in the previous section, offering implications for owners and managers, pointing out the limitations of the study, and proposing lines for future research.

2. Theoretical Framework

2.1. The Behavioral Agency Model and the Perspective of Mutual Commitment in Family and Nonfamily Businesses

The theoretical framework used in this study is based on the behavioral agency model. This model explains how risk preferences change with problem formulation and the importance of benchmarks (

Wiseman and Gomez-Mejia 1998). Most strategic decisions can be seen as a mixed bet (

Gomez-Mejia et al. 2014;

Martin et al. 2013). Decision makers prefer to protect existing wealth, avoiding risky options. However, the potential for future wealth can relax loss aversion (

Martin et al. 2013).

Family businesses use two benchmarks, financial wealth and SEW, and weigh the potential financial gains and losses against profit and loss potential of SEW (

Alessandri et al. 2018). However, preservation of SEW is the most important goal to make major strategic decisions (

Berrone et al. 2012).

As for nonfamily businesses, their main reference point is to maximize financial wealth (

Gomez-Mejia et al. 2014). These businesses are more willing to exchange risks for higher returns and are less likely to limit their internationalization strategies than family businesses (

Gomez-Mejia et al. 2010). As a result, the pursuit of future wealth reduces concerns about the protection of the current wealth (

Martin et al. 2013).

In summary, the literature applying the behavioral agency theory and mixed bet suggests that, given the different benchmarks of family and nonfamily businesses, family businesses tend to be more cautious in relation to nonfamily businesses; however, family businesses are not homogeneous in their prioritization of protecting SEW when making strategic decisions.

2.2. The Specific Characteristics of Family Businesses

2.3. The Different Internationalization Paths

Businesses do not always follow the same internationalization paths and those chosen can pose important challenges for them. For the purposes of this study, we will consider two types of processes.

The second, an internationalization process starting from a local market (LMI) in which firms begin their adventure abroad after a period of consolidation of their local business. This second group corresponds to the traditional approach represented by the Uppsala School (

Johanson and Vahlne 1977,

2009;

Vahlne and Johanson 2017) and to the born-again global businesses (

Bell et al. 2001,

2003), which begin their internationalization suddenly after their consolidation in the local market.

With respect to family businesses, they also follow the paths mentioned above, obtaining different performance depending on the path followed (

Varas-Fuente et al. 2022). Some authors suggest that FB internationalize their businesses after consolidating their position in the domestic market, once they have accumulated the resources and skills necessary for their growth there (

Segaro 2012). In keeping with the propositions established by the Uppsala internationalization model (

Claver et al. 2007;

Graves and Thomas 2008), they follow a sequential process into countries that are close from a geographical and/or cultural viewpoint (

Child et al. 2002) and favor indirect methods when entering markets (

Kontinen and Ojala 2010). However, other businesses follow a faster or accelerated path, rapidly internationalizing into several countries following two models: global born, starting their international expansion from their foundation, and born-again global, which are internationalized, for example, after the second generation takes over management (

Fernández and Nieto 2005;

Graves and Thomas 2008).

Family businesses have specific characteristics that can motivate strategic behaviors that lead to decisions on the path to take, either internationalization from the start or after consolidation in the local market. The interest of this work is focused on analyzing the relationship between the process followed and the intensity of internationalization achieved by this type of business.

2.3.1. Early Internationalization

As for the businesses that start an IE process, these are start-ups that, in general, will be led by founders.

According to

Fernández and Nieto (

2005), the founders of FB are often reluctant to make changes in the organizational structures and professional management systems that favor decentralized decision-making.

SME family managers tend to be conservative and reluctant to internationalize as they perceive that it can lead to loss of business control, family wealth, family reputation, social status, and greater chances of family conflict (

Arregle et al. 2012;

Carney et al. 2015;

Lahiri et al. 2020).

In addition, even if the founders are entrepreneurs, they may be reluctant to embark on internationalization due to their concentration of personal wealth in the business and their objective of consolidating the business’s position in the national market (

Menendez-Requejo 2005). In this line,

Sciascia et al. (

2012) showed that family participation negatively influences international entrepreneurship in family businesses.

Zahra (

2003) notes that the founders of some US family businesses avoided international expansion since it requires large commitments of resources.

Fernández and Nieto (

2005) observed that the percentage of Spanish export businesses is lower for first generation family businesses. For its part,

Basly and Saunier (

2019) found that the more searching of the owning family to maintain control and influence over the businesses, the lower the exports of family SMEs.

In this sense, it seems that the founders of family businesses will give greater importance to the preservation of SEW when making strategic decisions, assuming fewer risks in the internationalization process. Therefore, the following hypothesis is proposed:

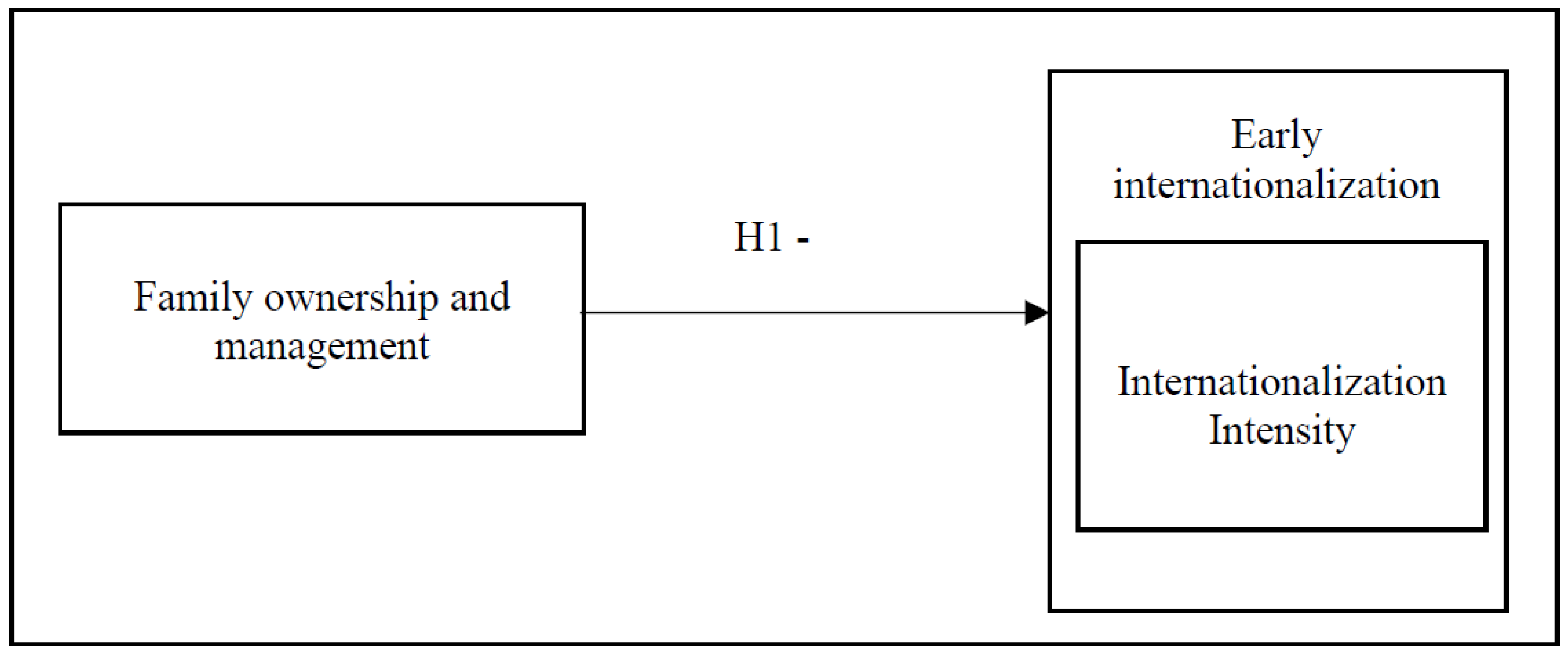

Hypothesis 1. Family ownership and management have a negative influence on export intensity when businesses follow an EI process.

2.3.2. Internationalization from the Local Market

Regarding businesses that follow an LMI process, these are businesses that start their internationalization processes after having consolidated their local businesses. The founder has already managed to launch his business and begins to worry about maintaining it for their descendants. Therefore, they have the experience obtained in these local markets and begin gradually or suddenly to expand into new foreign markets.

The research suggests that ownership significantly influences the strategic decisions of a business (

Zahra 1996;

Zahra and Pearce 1989), especially in family businesses where owners have a significant participation.

Internationalization can create new employment opportunities, growth of businesses, and new members of the family according to the non-financial goals that coexist in a family business with financial objectives (

Gersick et al. 1997;

Menendez-Requejo 2005).

The altruistic behaviors of family members (

Schulze et al. 2001) imply that, if internationalization is important for the long-term success of the business and for increasing the employment of family members, then the owner-managers can follow this strategy, even when the perceived risks are high (

Gallo and García-Pont 1996;

Zahra 2003).

All of this leads us to think that once the risk aversion of the first years of the company’s life has been overcome, the managers of family businesses will be more willing than the managers of nonfamily businesses to assume greater risks associated with internationalization with the goal of increasing socio-emotional wealth (SEW). For these reasons, the following hypothesis is proposed:

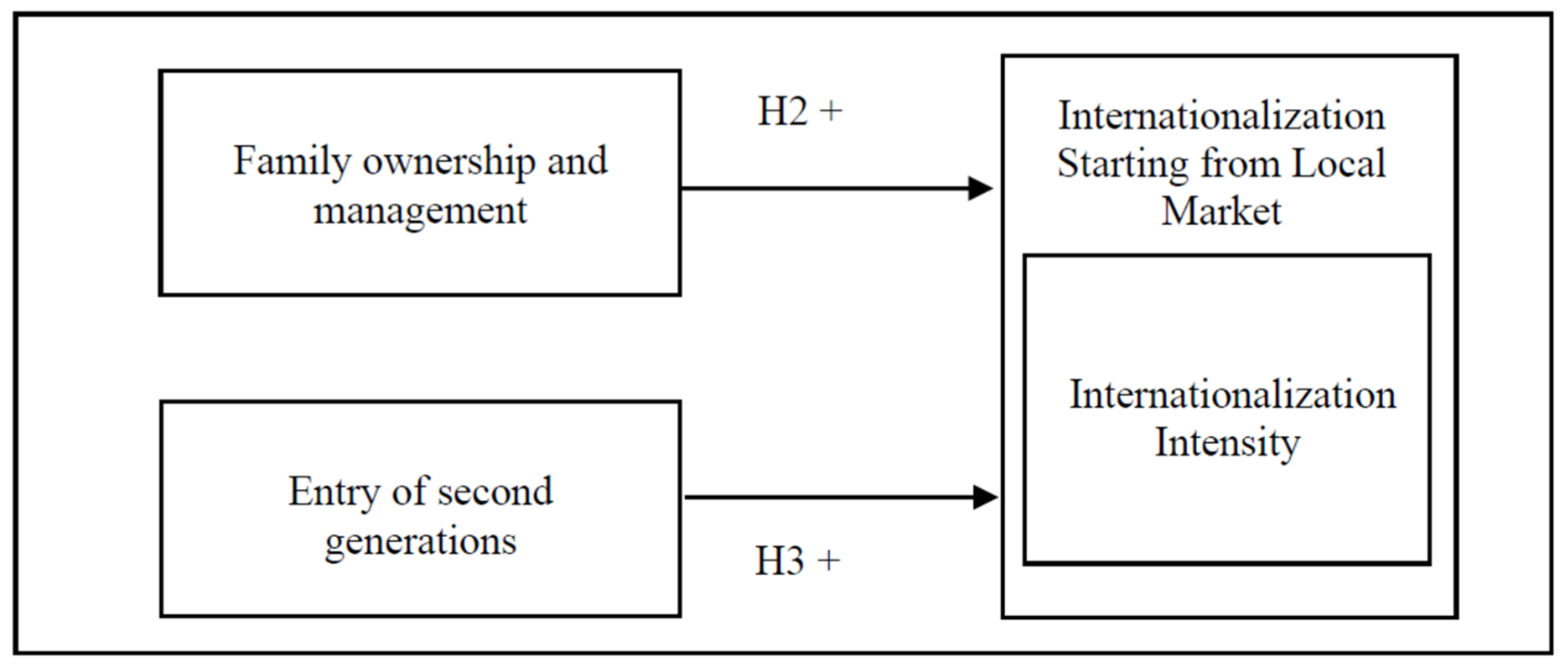

Hypothesis 2. Family ownership and management have a positive influence on export intensity when businesses follow an LMI process.

2.4. The Entry of the New Generations

FB with greater family involvement in management opt for internationalization strategies through entry modes that involve greater risk and resource commitment (

Andreu et al. 2020), and this greater family involvement usually occurs when the second generation appears on the scene.

Each new generation brings new strategic ideas that are based on the underlying competencies (

Ward 1997) and it is possible to expect that subsequent generations will be more qualified (

Fernández and Nieto 2005).

The second generation may be more motivated and ready to start projects abroad, while the founders may prefer stability (

Menendez-Requejo 2005).

Gallo and García-Pont (

1996) note that family businesses tend to internationalize when the second and successive generations have joined the business, because they are better trained in international affairs and are looking for new responsibilities in the business.

For

Calabrò et al. (

2016), the participation of the new generations can be understood as a particular episode that can lead to an era of rapid and dedicated internationalization of the family business, after a time of action focused on the local market. Additionally, the presence of young successors favors internationalization (

Bannò and Trento 2016).

Basly and Saunier (

2019) found that the more the owning family seeks to renew family bonds through generations, the higher exports are in family SMEs.

In summary, subsequent generations of the founder have more training and information, being more prepared to undertake the process of internationalization.

For all of the above, the following hypothesis is posed:

Hypothesis 3. The intensity of internationalization in FB is favored by the presence of the second generation.

3. Methodology

3.1. Sample Selection and Data Collection

This database has an annual panel data structure and is produced by the SEPI Foundation, sponsored by the Ministry of Finance and Public Administrations. The reference population of the SSBS is Spanish businesses belonging to the manufacturing sector. The selection of a business was carried out through random sampling.

SSBS is chosen for its representativeness and for being panel data. While most researchers agree that the internationalization process is dynamic and time-dependent, almost all existing models are of a static nature (

Leonidou and Katsikeas 1996) and the use of cross-sectional data limits the understanding of this process (

Cabrera-Suárez and Olivares-Mesa 2012;

Coviello and McAuley 1999). For this reason, this study has opted to use panel data.

From this database, the study has taken as a reference those businesses established since 1980 and with sales abroad, with the aim of obtaining a time series to analyze their evolution over time.

The next step was to apply a filter for the small and medium sized businesses in accordance with the definition established by the European Commission, which on 6 May 2003 adopted Recommendation 2003/361/EC, amending the recommendation from 1996 (businesses which meet the following parameters: fewer than 250 employees, business turnover that is less than or equal to 50 million euros, and a total balance sheet of less than or equal to 43 million euros). This left an initial 268 small and medium businesses (hereinafter, SMB); a total of 30 had mostly foreign social capital and were thus eliminated because the objective of this study is to investigate Spanish SMB. The final study sample was made up of 238 SMB.

For the 238 units finally selected, the data described in the following section have been obtained for the period between 2005 and 2016, both inclusive, which has resulted in an unbalanced data panel with 2.340 observations (2016 is the last year for which complete information is available in the official database used).

The above sample has been divided into two sub-samples (EI and LMI), based on the criteria set by

Bell et al. (

2001).

Bell et al. (

2001) define born global businesses as those that begin their intensive internationalization after 2 years from their establishment and born- again global businesses as those that begin their intensive internationalization after 10 years.

Applying the above criteria, the final sample to be studied includes the following number of businesses: 78 SMB (712 observations) that have followed the EI process and 160 SMB (1628 observations) that have followed the LMI process.

3.2. Definition of Variables

3.2.1. Dependent Variable

One dependent variable was used to evaluate the international participation of FB,

export intensity, which measures the proportion of foreign sales over total sales. This variable is one well-established measure of internationalization (for example,

Bonaccorsi 1992;

Calof 1994;

Fernández and Nieto 2005,

2006;

Wakelin 1998).

3.2.2. Independent Variables

Family business. The business belongs to a family with one or more members who hold management positions, which allows an identification of the family’s capacity for effective control (

Fernández and Nieto 2005,

2006;

Menendez-Requejo 2005). From a question from the SSBS that looks at whether a family participates actively in the control and/or management of the business, a dummy variable with a value of 1 was added when the family participated actively in the management and control, and 0 in all other cases.

Second generation. Family businesses are classified into two groups according to the family generation in charge of them. Following

Fernández and Nieto (

2005), a dummy variable with a value of 1 was included to indicate a second generation of the family (business that are more than 30 years old) and 0 when it was the first generation of a family (less than or equal to 30 years).

3.2.3. Control Variables

In keeping with previous research, the following control variables, which may influence the dependent variables, are used:

Products diversification. When the business has a diversified production, it can count on a competitive advantage in the different markets and influence its internationalization (

Muñoz-Bullón and Sánchez-Bueno 2012). From a field included in the SBSS that asks if the business is diversified or not, a dummy variable with a value of 1 was included when the business presented diversification and 0 when it was not diversified.

Sector. Following

Fernández and Nieto (

2005,

2006), to capture the characteristics of the sector, the average export intensity of the industry and year is used.

3.3. Methods of Analysis

A Tobit model has been estimated to analyze the determinants of export intensity. The methodology is adjusted to process panel data.

A Tobit model is a regression model in which the range of the dependent variable is limited in some direction (limited dependent variables model). In this case, the dependent variable “export intensity” adopts the value 0 for several observations. This characteristic destroys the linearity assumption, which means that least squares methods are not appropriate.

According to

Wooldridge (

2006), the Tobit model expresses the observed response,

y, in terms of an underlying latent variable:

Therefore, the observable variable

y is equal to

y*, when

y* ≥ 0, but

y = 0, when

y* < 0.

In this research, several Tobit models are estimated to study the impact of different variables on the intensity of exports.

4. Analysis, Results, and Discussion

Table 1 shows the distribution between FB and NFB for each of the two sub-samples analyzed.

Table 2 and

Table 3 show mean, standard deviation, variance inflation factor (VIF), and correlation matrices between the variables selected for each of the two groups analyzed.

The existence of multicollinearity between the explanatory variables has been verified by calculating the variance inflation factors (VIFs) of each of these variables. In all cases, the VIF obtained is lower than the cut-off value of 10 (

Kleinbaum et al. 1988). Therefore, a priori, we could conclude the existence of non-multicollinearity.

Table 4 shows the results obtained from the application of the Tobit model to the set of variables and observations for the EI group.

In

Table 4, model 1 includes the control variables. Model 2 includes the independent variable family business.

Table 5 shows the results obtained from the application of the Tobit model to the set of variables and observations for the LMI group. As in the EI group, in the first model (3) the control variables are included, and in the second model (4) the independent variables family business and second generation are included.

Hypothesis 1 was tested, using model 2. In this model, it is observed that the coefficient of the family business variable has a negative sign and a weak significant relationship (p < 0.05) with export intensity. For these reasons, we obtain a weak confirmation of the negative relationship between family participation and internationalization that is proposed in Hypothesis 1.

Model 4 shows that the coefficient is negative for the family business variable and has a significant relationship with export intensity. Therefore, we obtained the opposite result to that proposed in Hypothesis 2. This suggests that there is no difference according to the internationalization path followed, and in both cases, family participation has a negative influence on the degree of internationalization in relation to nonfamily businesses. This result is in line with that obtained, for example, by

Alessandri et al. (

2018),

Arregle et al. (

2017),

Bannò and Trento (

2016),

Fernández and Nieto (

2005),

Graves and Thomas (

2008), and

Merino et al. (

2015), who found a negative relationship between family ownership and level of internationalization of the business.

A possible explanation for this result is that, according to the behavioral agency model, when making important strategic decisions (such as internationalization), family businesses are faced with a mixed bet (

Gomez-Mejia et al. 2014;

Martin et al. 2013) with two points of reference (financial wealth and socio-emotional wealth—SEW) that must be weighed (

Alessandri et al. 2018). Additionally, in this mixed bet, family managers have the preservation of SEW as their main objective, regardless of the internationalization path followed (

Berrone et al. 2012), avoiding risky options. In this sense,

Pukall and Calabrò (

2014) conclude that the lower rate of internationalization observed in family businesses is related to the concern to preserve SEW. On the other hand,

Bannò and Trento (

2016), also based on socio-emotional wealth, discover that family ownership has a negative effect on internationalization. In addition,

Arregle et al. (

2017) conclude that, due to family ownership and management, family businesses are particularly affected by restrictive elements, such as SEW protection.

In terms of the control variables, in the EI group, variables’ business size, R&D activities, and sector are significant in the two models included in

Table 4, presenting positive coefficients, which is in accordance with previous research. The variables’ leverage and diversification are not significant in the two models.

Regarding the control variables in the LMI group, variables’ business size and sector are significant and with a positive sign in the two models included in

Table 5, coinciding with previous research. However, the leverage variable is significant and has a negative sign, which means that higher debt leads to a reduction in internationalization levels. This result coincides with that obtained in previous research (for example,

Chang et al. 2014), although it differs from others, which suggests a positive relationship between leverage and internationalization (

Fernández and Nieto 2005). Finally, the variables diversification and R&D activities do not show significance in either of the two models.

5. Conclusions, Limitations, and Future Lines of Research

This study has proposed an analysis of the internationalization intensity of FB depending on the speed with which the process begins. Previous research has not focused on the differences between the two groups, and studies have addressed the problem as a whole. This paper examines this issue by exploring a set of variables that may influence the level of internationalization obtained by FB, from the consideration that the effect of these variables is different depending on the starting moment of this process.

From a theoretical perspective, this research contributes to the literature on the internationalization of family businesses, showing that the behavioral agency model and the concept of mixed bet can help to evaluate how the objectives of owners and managers of family businesses preserve socio-emotional wealth and influence the internationalization of these businesses. To the best of our knowledge, this research is the first that, based on the conceptual agency model combined with the unique characteristics of family businesses and with the SEW perspective, evaluates the influence that the internationalization path followed by businesses has on the levels of internationalization achieved.

The results obtained lead us to conclude that family ownership and management have a negative influence on the intensity of exports, regardless of the internationalization path followed.

Secondly, we have confirmed the positive relationship that the entry of the second generation has in the level of internationalization of these businesses.

This study extends the empirical literature by contrasting that the moment when the internationalization process starts does not involve different results of the internationalization intensity. In addition, the findings contribute to filling the existing gap in relation to studies on the internationalization process of FB that had not been sufficiently addressed for this type of businesses. Particularly, it looks at the influence of family participation and the presence of second generations of families. It has been found that in all family businesses (regardless of the internationalization path followed), family ownership and management have a negative influence on export intensity, a similar result as that obtained in previous investigations (for example,

Alessandri et al. 2018 or

Fernández and Nieto 2005). It has also been found that there is an enhancing effect on international intensity due to entry of the second generation in the management team.

The results obtained have implications for the managers of the FB who are analyzing their possible internationalization. In the first place, they must consider that the participation of the second generation has a positive effect on the levels of internationalization. Second, they must consider that business size has a positive effect on those levels of international activity, and that investment R&D activities also has a positive influence when an early internationalization is followed.

The results of this study may also be important for authorities when implementing public programs aimed at helping businesses in general, and FB in particular, to begin and extend their internationalization journey. They must encourage the implementation of long-term internationalization strategies and help the owners and managers of FB to acquire international capabilities that allow them to achieve an optimum level of internationalization.

Finally, we should point out the limitations of our study, which open future lines of research. Our research focuses on a sample of small and medium-sized family businesses belonging to a single sector (manufacturing) and to a single country (Spain), which limits the generalization of the findings to other sectors and sizes of businesses (large family businesses and no family businesses), as well as to other countries. Therefore, it would be helpful to extend the study to sectors other than manufacturing to test whether the findings obtained can be extended to FB in other sectors. In addition, the research could be extended to a segment of large family businesses. The hypotheses proposed could also be tested for family businesses from other countries.

Author Contributions

Conceptualization, O.J.V.-F., R.A.-S. and B.R.-M.; data curation, O.J.V.-F., R.A.-S. and B.R.-M.; formal analysis, O.J.V.-F., R.A.-S. and B.R.-M.; methodology, O.J.V.-F., R.A.-S. and B.R.-M.; project administration, O.J.V.-F., R.A.-S. and B.R.-M.; visualization, O.J.V.-F., R.A.-S. and B.R.-M.; writing—original draft preparation, O.J.V.-F., R.A.-S. and B.R.-M.; writing—review and editing, O.J.V.-F., R.A.-S. and B.R.-M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data is not publicly available because the researcher agrees with the owner of the database (Fundación SEPI) to the exclusive use of the data for the project presented and not to transmit it to third parties.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Alessandri, Todd M., Daniele Cerrato, and Kimberly A. Eddleston. 2018. The mixed gamble of internationali-zation in family and nonfamily firms: The moderating role of organizational slack. Global Strategy Journal 8: 46–72. [Google Scholar] [CrossRef]

- Almodóvar, Paloma, and Alan M. Rugman. 2014. The M Curve and the performance of Spanish international new ventures. British Journal of Management 25: S6–S23. [Google Scholar] [CrossRef]

- Andreu, Rosario, Diego Quer, and Laura Rienda. 2020. The influence of family character on the choice of foreign market entry mode: An analysis of Spanish hotel chains. European Research on Management and Business Economics 26: 40–44. [Google Scholar] [CrossRef]

- Arregle, Jean-Luc, Lucia Naldi, Mattias Nordqvist, and Michael A. Hitt. 2012. Internationalization of family-controlled firms: A study of the effects of external involvement in governance. Entrepreneurship Theory and Practice 36: 1115–43. [Google Scholar] [CrossRef]

- Arregle, Jean-Luc, Patricio Duran, Michael A. Hitt, and Marc Van Essen. 2017. Why is family firms’ internationalization unique? A meta-analysis. Entrepreneurship Theory and Practice 41: 801–31. [Google Scholar] [CrossRef]

- Astrachan, Joseph H., Sabine B. Klein, and Kosmas X. Smyrnios. 2002. The F-PEC scale of family influence: A proposal for solving the family business definition problem1. Family Business Review 15: 45–58. [Google Scholar] [CrossRef]

- Bannò, Mariasole, and Sandro Trento. 2016. International expansion of family firms: The moderating role of successors and external managers. International Journal of Globalisation and Small Business 8: 292–315. [Google Scholar] [CrossRef]

- Barkema, Harry G., and Freek Vermeulen. 1998. International expansion through start-up or acquisition: A learning perspective. Academy of Management Journal 41: 7–26. [Google Scholar]

- Basly, Samy, and Paul-Laurent Saunier. 2019. Familiness, socio-emotional goals and the internationalization of French family SMEs. Journal of International Entrepreneurship 18: 270–311. [Google Scholar] [CrossRef]

- Bell, Jim, Rod McNaughton, and Stephen Young. 2001. ‘Born-again global’ firms: An extension to the ‘born global’ phenomenon. Journal of International Management 7: 173–89. [Google Scholar] [CrossRef]

- Bell, Jim, Rod McNaughton, Stephen Young, and Dave Crick. 2003. Towards an integrative model of small firm internationalisation. Journal of International Entrepreneurship 1: 339–62. [Google Scholar] [CrossRef]

- Berrone, Pascual, Cristina Cruz, and Luis R. Gomez-Mejia. 2012. Socioemotional wealth in family firms: Theoretical dimensions, assessment approaches, and agenda for future research. Family Business Review 25: 258–79. [Google Scholar] [CrossRef]

- Bonaccorsi, Andrea. 1992. On the relationship between firm size and export intensity. Journal of International Business Studies 23: 605–35. [Google Scholar] [CrossRef]

- Cabrera-Suárez, Katiuska, and Aristides Olivares-Mesa. 2012. Family firms’ resources and the timing of the export development process. Atlantic Review of Economics 1: 1–25. [Google Scholar]

- Calabrò, Andrea, and Donata Mussolino. 2013. How do boards of directors contribute to family SME export intensity? The role of formal and informal governance mechanisms. Journal of Management and Governance 17: 363–403. [Google Scholar] [CrossRef]

- Calabrò, Andrea, Marina Brogi, and Mariateresa Torchia. 2016. What does really matter in the internationalization of small and medium-sized family businesses? Journal of Small Business Management 54: 679–96. [Google Scholar] [CrossRef]

- Calof, Jonathan L. 1994. The relationship between firm size and export behavior revisited. Journal of International Business Studies 25: 367–87. [Google Scholar] [CrossRef]

- Carney, Michael, Marc Van Essen, Eric R. Gedajlovic, and Pursey P. M. A. R. Heugens. 2015. What do we know about private family firms? A meta-analytical review. Entrepreneurship Theory and Practice 39: 513–44. [Google Scholar] [CrossRef]

- Chang, Yi-Chieh, Ming-Sung Kao, and Anthony Kuo. 2014. The influences of governance quality on equity-based entry mode choice: The strengthening role of family control. International Business Review 23: 1008–20. [Google Scholar] [CrossRef]

- Chen, Hsiang-Lan. 2011. Internationalization in Taiwanese family firms. Global Journal of Business Research 5: 15–23. [Google Scholar]

- Child, John, Sek Hong Ng, and Christine Wong. 2002. Psychic distance and internationalization: Evidence from Hong Kong firms. International Studies of Management & Organization 32: 36–56. [Google Scholar]

- Chrisman, James J., and Pankaj C. Patel. 2012. Variations in R&D investments of family and nonfamily firms: Behavioral agency and myopic loss aversion perspectives. Academy of Management Journal 55: 976–97. [Google Scholar]

- Claver, Enrique, Laura Rienda, and Diego Quer. 2007. The internationalisation process in family firms: Choice of market entry strategies. Journal of General Management 33: 1–14. [Google Scholar] [CrossRef]

- Claver, Enrique, Laura Rienda, and Diego Quer. 2008. Family firms’ risk perception: Empirical evidence on the internationalization process. Journal of Small Business and Enterprise Development 15: 457–71. [Google Scholar] [CrossRef]

- Claver, Enrique, Laura Rienda, and Diego Quer. 2009. Family firms’ international commitment: The influence of family-related factors. Family Business Review 22: 125–35. [Google Scholar] [CrossRef]

- Coviello, Nicole E., and Andrew McAuley. 1999. Internationalisation and the smaller firm: A review of contemporary empirical research. MIR: Management International Review 39: 223–56. [Google Scholar]

- Efrat, Kalanit, and Aviv Shoham. 2012. Born global firms: The differences between their short-and long-term performance drivers. Journal of World Business 47: 675–85. [Google Scholar] [CrossRef]

- Fernández, Zulima, and María Jesús Nieto. 2005. Internationalization strategy of small and medium-sized family businesses: Some influential factors. Family Business Review 18: 77–89. [Google Scholar] [CrossRef]

- Fernández, Zulima, and María Jesús Nieto. 2006. Impact of ownership on the international involvement of SMEs. Journal of International Business Studies 37: 340–51. [Google Scholar] [CrossRef]

- Fernández-Olmos, Marta, Ana Gargallo-Castel, and Enrique Giner-Bagües. 2016. Internationalisation and performance in Spanish family SMES: The W-curve. BRQ Business Research Quarterly 19: 122–36. [Google Scholar] [CrossRef]

- Fernández-Olmos, Marta, and Isabel Díez-Vial. 2015. Internationalization pathways and the performance of SMEs. European Journal of Marketing 49: 420–43. [Google Scholar] [CrossRef]

- Gallo, Miguel Angel, and Carlos García-Pont. 1996. Important factors in family business internationalization. Family Business Review 9: 45–59. [Google Scholar] [CrossRef]

- Gallo, Miguel Ángel, Josep Tàpies, and Kristin Cappuyns. 2004. Comparison of family and nonfamily business: Financial logic and personal preferences. Family Business Review 17: 303–18. [Google Scholar] [CrossRef]

- Gersick, Kelin E., John A. Davis, Marion McCollom Hampton, and Ivan Lansberg. 1997. Generation to Generation: Life Cycles of the Family Business. Cambridge: Harvard Business School Press. [Google Scholar]

- Gomez-Mejia, Luis R., Cristina Cruz, Pascual Berrone, and Julio De Castro. 2011. The bind that ties: Socioemotional wealth preservation in family firms. Academy of Management Annals 5: 653–707. [Google Scholar] [CrossRef]

- Gomez-Mejia, Luis R., Joanna Tochman Campbell, Geoffrey Martin, Robert E. Hoskisson, Marianna Makri, and David G. Sirmon. 2014. Socioemotional Wealth as a Mixed Gamble: Revisiting Family Firm R&D Investments with the Beha-vioral Agency Model. Entrepreneurship Theory and Practice 38: 1351–74. [Google Scholar]

- Gomez-Mejia, Luis R., Katalin Takács Haynes, Manuel Nunez-Nickel, Kathyrn J. L. Jacobson, and José Moyano-Fuentes. 2007. Family owned firms: Risk loving or risk averse. Administrative Science Quarterly 52: 106–37. [Google Scholar]

- Gomez-Mejia, Luis R., Marianna Makri, and Martin Larraza Kintana. 2010. Diversification decisions in family-controlled firms. Journal of Management Studies 47: 223–52. [Google Scholar] [CrossRef]

- Graves, Chris, and Jill Thomas. 2008. Determinants of the internationalization pathways of family firms: An examination of family influence. Family Business Review 21: 151–67. [Google Scholar] [CrossRef]

- Graves, Chris, and Yuan George Shan. 2014. An empirical analysis of the effect of internationalization on the performance of unlisted family and nonfamily firms in Australia. Family Business Review 27: 142–60. [Google Scholar] [CrossRef]

- Habbershon, Timothy G., and Mary L. Williams. 1999. A resource-based framework for assessing the strategic advantages of family firms. Family Business Review 12: 1–25. [Google Scholar] [CrossRef]

- Habbershon, Timothy G., Mary Williams, and Ian C. MacMillan. 2003. A unified systems perspective of family firm performance. Journal of Business Venturing 18: 451–65. [Google Scholar] [CrossRef]

- Hernandez-Perlines, Felipe. 2018. Moderating effect of absorptive capacity on the entrepreneurial orientation of international performance of family businesses. Journal of Family Business Management 8: 58–74. [Google Scholar] [CrossRef]

- Hernández-Perlines, Felipe, Antonio Ariza-Montes, and Luis Araya-Castillo. 2020. Socioemotional wealth, entrepreneurial orientation and international performance of family firms. Economic Research-Ekonomska Istraživanja 33: 3125–45. [Google Scholar] [CrossRef]

- Hernández-Perlines, Felipe, Jeffrey G. Covin, and Domingo E. Ribeiro-Soriano. 2021. Entrepreneurial orientation, concern for socioemotional wealth preservation, and family firm performance. Journal of Business Research 126: 197–208. [Google Scholar]

- Hitt, Michael A., Laszlo Tihanyi, Toyah Miller, and Brian Connelly. 2006. International diversification: Antecedents, outcomes, and moderators. Journal of Management 32: 831–67. [Google Scholar] [CrossRef]

- Johanson, Jan, and Jan-Erik Vahlne. 1977. The internationalization process of the firm—A model of knowledge development and increasing foreign market commitments. Journal of International Business Studies 8: 23–32. [Google Scholar] [CrossRef]

- Johanson, Jan, and Jan-Erik Vahlne. 2009. The Uppsala internationalization process model revisited: From liability of foreignness to liability of outsider ship. Journal of International Business Studies 40: 1411–31. [Google Scholar] [CrossRef]

- Kleinbaum, David G., Lawrence L. Kupper, and Keith E. Muller. 1988. Applied Regression Analysis and Other Multivariate Methods. Boston: PWS-Kent. [Google Scholar]

- Kontinen, Tanja, and Arto Ojala. 2010. Internationalization pathways of family SMEs: Psychic distance as a focal point. Journal of Small Business and Enterprise Development 17: 437–54. [Google Scholar] [CrossRef]

- Kontinen, Tanja, and Arto Ojala. 2012. Internationalization pathways among family-owned SMEs. International Marketing Review 29: 496–518. [Google Scholar] [CrossRef]

- Lahiri, Somnath, Debmalya Mukherjee, and Mike W. Peng. 2020. Behind the internationalization of family SMEs: A strategy tripod synthesis. Global Strategy Journal 10: 813–38. [Google Scholar]

- Leonidou, Leonidas C., and Constatine S. Katsikeas. 1996. The export development process: An integrative review of empirical models. Journal of International Business Studies 27: 517–51. [Google Scholar] [CrossRef]

- Li, Lei. 2007. Multinationality and performance: A synthetic review and research agenda. International Journal of Management Reviews 9: 117–39. [Google Scholar] [CrossRef]

- Lin, Wen-Ting. 2012. Family ownership and internationalization processes: Internationalization pace, internationalization scope, and internationalization rhythm. European Management Journal 30: 47–56. [Google Scholar] [CrossRef]

- Lu, Jane W., and Paul W. Beamish. 2001. The internationalization and performance of SMEs. Strategic Management Journal 22: 565–86. [Google Scholar] [CrossRef]

- Lu, Jane W., and Paul W. Beamish. 2004. International diversification and firm performance: The S-curve hypothesis. Academy of Management Journal 47: 598–609. [Google Scholar]

- Martin, Geoffrey P., Luis R. Gomez-Mejia, and Robert M. Wiseman. 2013. Executive stock options as mixed gambles: Revisiting the behavioral agency model. Academy of Management Journal 56: 451–72. [Google Scholar] [CrossRef]

- Martínez, Jon I., Bernhard S. Stöhr, and Bernardo F. Quiroga. 2007. Family ownership and firm performance: Evidence from public companies in Chile. Family Business Review 20: 83–94. [Google Scholar] [CrossRef]

- Menendez-Requejo, Susana. 2005. Growth and internationalisation of family businesses. International Journal of Globalisation and Small Business 1: 122–33. [Google Scholar] [CrossRef]

- Merino, Fernando, Joaquín Monreal-Pérez, and Gregorio Sánchez-Marín. 2015. Family SMEs’ internationalization: Disentangling the influence of familiness on Spanish firms’ export activity. Journal of Small Business Management 53: 1164–84. [Google Scholar] [CrossRef]

- Monreal-Pérez, Joaquín, and Gregorio Sánchez-Marín. 2017. Does transitioning from family to non-family controlled firm influence internationalization? Journal of Small Business and Enterprise Development 24: 775–92. [Google Scholar] [CrossRef]

- Muñoz-Bullón, Fernando, and Maria J. Sánchez-Bueno. 2012. Do family ties shape the performance consequences of diversification? Evidence from the European Union. Journal of World Business 47: 469–77. [Google Scholar] [CrossRef]

- Okoroafo, Sam C. 1999. Internationalization of family businesses: Evidence from northwest Ohio, USA. Family Business Review 12: 147–58. [Google Scholar] [CrossRef]

- Olivares-Mesa, Aristides, and Katiuska Cabrera-Suarez. 2006. Factors affecting the timing of the export development process: Does the family influence on the business make a difference? International Journal of Globalisation and Small Business 1: 326–39. [Google Scholar] [CrossRef]

- Oviatt, Benjamin M., and Patricia Phillips McDougall. 2005. Toward a theory of international new ventures. Journal of International Business Studies 36: 29–41. [Google Scholar] [CrossRef]

- Pukall, Thilo J., and Andrea Calabrò. 2014. The internationalization of family firms: A critical review and integrative model. Family Business Review 27: 103–25. [Google Scholar] [CrossRef]

- Rau, Sabine B., Joseph H. Astrachan, and Kosmas X. Smyrnios. 2018. The F-PEC revisited: From the family business definition dilemma to foundation of theory. Family Business Review 31: 200–13. [Google Scholar] [CrossRef]

- Rennie, Michael W. 1993. Global competitiveness: Born global. The McKinsey Quarterly 4: 45–52. [Google Scholar]

- Rialp, Alex, Josep Rialp, and Gary A. Knight. 2005. The phenomenon of early internationalizing firms: What do we know after a decade (1993–2003) of scientific inquiry? International Business Review 14: 147–66. [Google Scholar] [CrossRef]

- Schulze, William S., Michael H. Lubatkin, Richard N. Dino, and Ann K. Buchholtz. 2001. Agency relationships in family firms: Theory and evidence. Organization Science 12: 99–116. [Google Scholar] [CrossRef]

- Sciascia, Salvatore, Pietro Mazzola, Joseph H. Astrachan, and Torsten M. Pieper. 2012. The role of family ownership in international entrepreneurship: Exploring nonlinear effects. Small Business Economics 38: 15–31. [Google Scholar] [CrossRef]

- Segaro, Ethiopia. 2012. Internationalization of family SMEs: The impact of ownership, governance, and top management team. Journal of Management & Governance 16: 147–69. [Google Scholar]

- Sirmon, David G., and Michael A. Hitt. 2003. Managing resources: Linking unique resources, management, and wealth creation in family firms. Entrepreneurship Theory and Practice 27: 339–58. [Google Scholar] [CrossRef]

- Tokarczyk, John, Eric Hansen, Mark Green, and Jon Down. 2007. A resource-based view and market orientation theory examination of the role of “familiness” in family business success. Family Business Review 20: 17–31. [Google Scholar] [CrossRef]

- Vahlne, Jan-Erik, and Jan Johanson. 2017. From internationalization to evolution: The Uppsala model at 40 years. Journal of International Business Studies 48: 1087–102. [Google Scholar] [CrossRef]

- Varas-Fuente, Oscar Javier, Raquel Arguedas-Sanz, and Beatriz Rodrigo-Moya. 2022. Internationalisation and performance in family businesses: Influence of the internationalisation path followed. International Journal of Entrepreneurship and Small Business 46: 185–209. [Google Scholar]

- Wakelin, Katharine. 1998. Innovation and export behaviour at the firm level. Research Policy 26: 829–41. [Google Scholar] [CrossRef]

- Ward, John L. 1997. Growing the family business: Special challenges and best practices. Family Business Review 10: 323–37. [Google Scholar] [CrossRef]

- Wiseman, Robert M., and Luis R. Gomez-Mejia. 1998. A Behavioral Agency Model of Managerial Risk Taking. Academy of Management Review 23: 133–53. [Google Scholar] [CrossRef]

- Wooldridge, Jeffrey M. 2006. Introducción a la Econometría: Un Enfoque Moderno. Madrid: International Thomson Paraninfo. [Google Scholar]

- Wright, Mike, Igor Filatotchev, Robert E. Hoskisson, and Mike W. Peng. 2005. Strategy Research in Emerging Economies: Challenging the Conventional Wisdom. Journal of Management Studies 42: 1–33. [Google Scholar] [CrossRef]

- Zaheer, Srilata. 1995. Overcoming the liability of foreignness. Academy of Management Journal 38: 341–63. [Google Scholar]

- Zahra, Shaker A. 1996. Governance, ownership, and corporate entrepreneurship: The moderating impact of industry technological opportunities. Academy of Management Journal 39: 1713–35. [Google Scholar]

- Zahra, Shaker A. 2003. International expansion of US manufacturing family businesses: The effect of ownership and involvement. Journal of Business Venturing 18: 495–512. [Google Scholar] [CrossRef]

- Zahra, Shaker A., and John A. Pearce. 1989. Boards of directors and corporate financial performance: A review and integrative model. Journal of Management 15: 291–334. [Google Scholar] [CrossRef]

| Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).