Abstract

Understanding the factors that drive the successful commercialisation of indigenous innovation in Sub-Saharan African economies is still limited. From both policy and theoretical perspectives, regulation is one factor that remains crucial for the successful commercialisation of innovation. However, the empirical evidence is still unclear regarding its effect on firm performance, urging the need for more evidence from different economies, sectors, and firms. This study, therefore, examined the effects of regulation on the performance of firms engaged in the commercialisation of indigenous innovation in the Ghanaian small-scale industry, a typical low-income economy in Sub-Sahara Africa. From the frugal innovation theoretical perspective, the study assumed that firms engaged in the commercialisation of indigenous innovation in such low-income economies operate in an environment with regulatory gaps and voids. Using a sample survey of 557, it deployed PLS-SEM to test the effects of regulation on key successful commercialisation metrics. The findings show that at a 5% statistical significance level, regulation has significant positive effects on sales, employment, and owners’ feelings of success. Regulation also positively moderates the influence of finance and organisational factors on overall firm performance. The study provides leading evidence of the effect of regulation on the commercialisation of indigenous innovation from Ghana and adds to the clarification of the impact of regulation. It suggests that in such low-income economies, the policy must consider more balanced and appropriate regulations, not less, or deregulating to promote indigenous innovation.

1. Introduction

The crucial role of innovation in industrialisation and socioeconomic development is not contestable (Hu et al. 2020; Edler and Fagerberg 2017; Phelps 2018; OECD/Eurostat 2018). Nonetheless, African countries are underperforming in their innovation drive and development (Nwuke 2015; Cornell University et al. 2018). No African country ranks in the top 20 countries for patent applications, and it is the worst performer of all the global regions in innovation generation, development, and ownership (Nwuke 2015; Cornell University et al. 2019). These facts have led to increased calls for government intervention to support indigenous innovation and industrialisation by addressing the weakness in the small-scale industry (SSI) sector, where the commercialisation of indigenous innovation is most observable (Alhassan et al. 2016). Only when innovations are successfully commercialised can they generate socioeconomic value. Successful innovation commercialisation is typically measured at the firm level using indicators such as sales, market shares, employment, productivity, or profitability (Rass et al. 2013). However, micro and small-scale enterprises (MSEs) and small-scale entrepreneurs at the forefront of commercializing indigenous innovations in most Sub-Saharan African countries are plagued with slow and low sales (UNIDO 2013).

Even though there is a wealth of literature on innovation and its outcomes over the last three decades, the understanding of how indigenous innovations originate and the factors that drive their successful commercialisation in African countries remains limited (Klepper 2016; Ockwell and Byrne 2016; Fu et al. 2018; Dyck and Silvestre 2019). This lack of understanding, coupled with limited country-specific innovation studies and analysis of the region, has contributed to scepticism about whether and how innovations are spreading in these settings. Therefore, there is a need for further investigation of the form and impact of innovation in African countries.

The perceived poor performance of African countries in their innovation drives, on the one hand, and the increasing prominence of innovation as the primary driver of socioeconomic change, on the other hand, have led to calls for more government intervention. One important but complex element of such state intervention is regulation and regulatory support (Olefirenko and Shevliuga 2017). The literature (Edler et al. 2016; Fu et al. 2018; Tang et al. 2020) largely suggests an unclear effect of regulation on the innovation and profitability of firms, urging the need for different studies on specific sectors, firms, and economies. The few studies that have examined the effect of regulation on innovation in Ghana have reported mixed results (Oduro and Nyarku 2018; Johnson 2018; Donbesuur et al. 2020; Tang et al. 2020). For example, Oduro and Nyarku (2018), Johnson (2018), and Tang et al. (2020) portrayed a negative association, while studies such as Adomako (2020) provided some evidence that positively links regulation with SME employment growth.

Theoretically, there are regulatory voids and lack thereof in Sub Sahara-Africa, and regulation and its compliance can affect the success of innovations on the market (Prahalad 2012; Quaye et al. 2019). Constitutionally, in Ghana, most policies to support innovation involving public funding require regulation. Regulation is also required as the basis for establishing standards to achieve the desired goal of such support (Edler et al. 2016). On the other hand, firms, particularly indigenous MSEs, perceive regulations largely as burdens that threaten their commercial success in terms of survival, viability, and prosperity (Oduro and Nyarku 2018; Oduro 2020). Nonetheless, in low-income economies, it is almost impossible for indigenous innovations to get widely applied and generate strong cash flow without state intervention. (Olefirenko and Shevliuga 2017; Oderanti and Li 2018).

Regulation remains very crucial for the successful commercialisation of innovation and firm performance. Indeed, it has attracted extensive research attention and discussion (Edler et al. 2016; Johnson 2018; Mallett et al. 2019; Tang et al. 2020). This study, therefore, examines the direct effect of regulation on firms’ successful innovation commercialisation measures, such as sales, employment, and owners’ feelings of success achieved in the small-scale industry (SSI) in Ghana. The study also tests the moderating effects of regulation on finance and organisational factors on firm performance and provides leading empirical evidence of the effect of regulation on the commercialisation of indigenous innovation from the Ghanaian SSI sector. The study’s findings add to our understanding of the commercialisation of indigenous innovation. It highlights the role of regulation in successfully commercialising indigenous innovation activities.

2. Background, Theory, and Hypotheses Development

2.1. Background

2.1.1. Promoting Indigenous Innovation in Africa

Due to the strong linkage between innovation and development, scholars continue to call for African countries to develop their indigenous innovation systems to support and sustain their development agenda (Feige and Vonortas 2017; Botchie et al. 2017). In the context of the study, indigenous innovations include modernisation and use of indigenous resources, indigenous practices, and indigenous knowledge, as well as the creation of domestic standards that reduce the burden of paying royalties and other fees to foreign economies (Wachinga 2019; Wandera 2021). Indigenous innovations are distinguished from foreign innovations because they originate from and/or are owned by indigenes, as opposed to foreign innovations, which are developments in high-tech industries and forefront technologies resulting from inward foreign direct investment (FDI) (Edler and Fagerberg 2017). While it is acknowledged that FDI and foreign innovation may help narrow the technological gap with developed countries in the short run (Huang et al. 2018), some experts strongly argue that African countries must focus on developing their own technologies and indigenous innovations (Feige and Vonortas 2017; Botchie et al. 2017).

Overemphasis on FDI and high-tech made some low-income African countries incur huge costs by investing in internationally competitive high-tech and reaped only a small benefit (Chatterji 2016). Phelps (2018) suggests that it is mostly through indigenous innovation that developing countries can achieve development, as they can set their level of innovative activities according to their values and that indigenous innovation is more impactful than foreign direct investment or adopted innovation. While the call for indigenous innovation is intensifying, it is also evident that efforts to promote indigenous innovation in some countries are ineffectual (Ibrahim 2017; Quaye et al. 2017). Despite a number of policy efforts in Ghana (MESTI 2017), the flooding of domestic markets with imported products, the foreign takeover of the domestic market, and the increasing claim over domestic assets by foreign firms remain a serious concern among citizens and policymakers in Ghana. Most innovations in the Ghanaian market are imported by foreign-owned businesses, while most indigenous firms still prefer to import and sell goods and services (Quaye et al. 2017). Clearly, the made in Ghana goods campaign has not been effective.

Several obstacles to innovation, including access to credit, under-skilled employees, perceived economic risks of indigenous innovation, inconsistent innovation policy, and low levels of collaboration with universities and research institutions, have been raised as barriers to innovation in Ghana (UNIDO 2013; Bartels et al. 2016). All of these, in relation to the government and regulation, can be summed up as poor policy management. The country’s strategic posture recognises the importance of innovation-driven industrialisation. Indeed, it has formulated explicit science, technology, and innovation policies, enacted other innovation-related sectorial policies, and made several institutional and legal arrangements for their implementation (Nwuke 2015; Amankwah-Amoah 2016). However, it appears that the available policy instruments are neither calibrated nor configured to overcome barriers to indigenous innovation commercialisation (Quaye et al. 2017). Unquantified and non-indexed policy directives, recommendations, and incentives appeared to be making policy management in terms of coordination, prioritisation, operationalisation, and control difficult.

It appears that policy incentives and regulations to achieve these beneficial goals are severely hampered (UNIDO 2013). There are several government institutions that are together supposed to play a crucial role in the development, diffusion, adoption, and commercialisation of innovation. Generally, however, the Ghanaian National Innovation System is characterised by low-density relationships between the actors, perforated, truncated, and, in some instances, absent actor linkages (UNIDO 2013; Quaye et al. 2019). Ghanaian businesses have limited influence over policy instruments aimed at promoting and accelerating business R&D and institutional innovation (Cornell University et al. 2018; UNCTAD 2019).

Despite good policy design, resource application in the Ghanaian innovation system is still generally problematic (UNIDO 2013; Quaye et al. 2017). Despite various forms of private-sector engagement, including investment, capacity building, and knowledge sharing (Amankwah-Amoah et al. 2017; MESTI 2017), the Ghanaian private sector generally has limited and low capacity to undertake and absorb science and technology for innovation. Because over 90% of Ghanaian businesses are micro and small (MESTI 2017), they are unable to build the capacity to produce products on a large scale. Weak financial intermediation and asymmetry of innovation is one major constraint to policies in promoting indigenous innovation and commercialisation.

Furthermore, in respect of regulation, some evidence (Oduro and Nyarku 2018; Johnson 2018) also suggests regulatory voids and the associated excessive cost burden and deadweight losses may limit the expansion and profitability of innovative indigenous activities and increase the risk for firms. On the demand side, regulation is indeed contributing to improving standards and creating new markets, but is also leading to higher prices for consumers. The market for indigenous innovation is also fragmented, and volumes are low and difficult to build. The local content policy prescriptions echelon is also not yet obvious in incentives to MSES (Quaye et al. 2019).

Some scholars believe that the problem of African countries’ poor innovation performance is more about commercialisation than it is about the creation of innovative activities, and they advocate for increasing the rate of development and commercialisation of indigenous innovation (Shpak et al. 2014; Osoro et al. 2017; Weyori et al. 2018). They contended that the successful commercialisation of indigenous innovation is important due to the belief that innovation originating in the developing world will become a major driver of economic development for these countries (Weyori et al. 2018). In response to these calls, the promotion of indigenous innovation has now permeated the policy agenda of most Sub-Saharan African countries (Dzansi et al. 2015; Fox et al. 2016)

2.1.2. Commercialisation of Indigenous Innovation and Economic Performance

Commercialisation has become prominent in the innovation discourse because of the increasing recognition of its role in knowledge transfer, entrepreneurship, job creation, and economic growth (Azarmi 2016; Edler and Fagerberg 2017). Osoro et al. (2017), echoing Schumpeterian 1910s views, opined that the commercialisation of indigenous innovation should be an important aspect of every African country’s growth strategy because it is the avenue for innovations to facilitate economic development. It is through commercialisation that innovations can get accepted on the market, get adopted, create value, and lead to industrialisation and economic development (Olefirenko and Shevliuga 2017).

In Africa, the commercialisation of indigenous innovation is most observable among micro and small enterprises (MSEs) in the SSI sector. The SSI in Africa is, however, plagued with low growth rates, stale development and stagnation of innovation, limited commercialisation, low returns, and firm exit, which are reflected in poor firm and innovation performance (Tsatsenko 2020). The commercialisation of innovation and firm performance in African countries has been quite low over the years (Bartels et al. 2016; UNESCO 2018; World Bank Group 2019; Cornell University et al. 2016, 2017, 2018, 2019). According to Bartels et al. (2016), African countries are “factor-driven” economies that cannot typically add value to their indigenous resources and are dominated by local MSEs. Bartels et al. (2016) explained that these countries are unsophisticated, have limited commercial and technological links with the global economy, and end up exporting raw materials. These facts also emphasise the importance of enhancing indigenous innovation’s commercialisation if innovation is to contribute meaningfully to economic development.

In Ghana, apart from the low level of innovativeness due to the barrage of barriers, it is clear that only a small percentage of the innovations that occur are successfully commercialised (Quaye et al. 2019). Rather, most indigenous innovations are rapidly fading out and losing market share to imports due to indigenous firms’ inability to brand and promote them (Quaye and Mensah 2019). Foreign brands account for 75% of retail brands in Ghana (Konfidants 2021). It is common to see attractive indigenous innovations limited to a locality and not available in a convenient form to customers in other parts of the Ghanaian market. It is also clear that major Ghanaian supermarkets are hesitant to stock indigenous products (Konfidants 2021). As of 2020, only 25% of the shelf space in these supermarkets is stocked with Ghana-made goods, the majority of which are water and unprocessed foods (Ragasa et al. 2020; Konfidants 2021). Meanwhile, Olefirenko and Shevliuga (2017) defined successful commercialisation of innovation as widespread sales and widespread adaptation and opined that for innovation to be commercialised successfully, it should be embraced by pragmatists who account for a large share of the market, not just innovation enthusiasts who may account for a small portion of the market.

Access to finance, under-skilled employees, perceived economic risks of innovation, inconsistent innovation policy, and low levels of collaboration with research institutions, among others, have all been highlighted as barriers to innovation in Africa (UNIDO 2013; Bartels et al. 2016; Fu et al. 2018). While a few innovation studies (UNIDO 2013; Bartels et al. 2016; Fu et al. 2018; Johnson 2018; Quaye et al. 2017) concerning Ghana have identified the reasons for low indigenous innovative activities, the issues of a commercialisation gap or limited commercialisation are largely unaddressed. The unbridgeable gap between many indigenous knowledge and activities, as well as domestic scientific discoveries that remain on shelves and what is successfully commercialised is referred to as the innovation commercialisation gap in the literature (Mcintyre 2014). The commercialisation gaps in Ghana can be adequately and practically explained by bureaucratic processes, inconsistent innovation regulation, regulatory voids and lack thereof, resulting in high financial, operational and market risks and the unwillingness of stakeholders in the innovation system to undertake (Fu et al. 2018; Oduro and Nyarku 2018; Quaye et al. 2019).

2.1.3. Regulation, Finance, and Organisational Support as a Triangle of Support

Olefirenko and Shevliuga (2017), in explaining drivers of successful commercialisation of innovation, identified and emphasised financial and organisational support and regulation, and described them as a triangle of support with the state playing a significant role. Favourable financial conditions for the innovations commercialisation process in terms of availability and factors that enable the firm to assess and use financial resources to achieve results are key for successful commercialisation (Ullah 2019). From finance literature, the favourable financial environment for commercialisation innovation requires accessible and low-cost finance as well as support for innovation mediation mechanism between innovators, developers, the business community and potential customers (Olefirenko and Shevliuga 2017). In the context of organising and managing innovation in small firms, the literature described organisational factors as factors which influence a firm’s ability to mobilise and deploy resources and capabilities to utilise work process, team, communication, interaction, leadership, and other business infrastructure to achieve results (Kumar et al. 2020).

Regulation of the innovation commercialisation process involves legislation to create the legal framework for innovation developers. It provides the basis for expanding innovation activities and entities on the market. Regulatory support is so important in the commercialisation process because it is the basis of availability, awareness, acceptability, and affordability (the 4As) of innovation on the market (Edler et al. 2016; Olefirenko and Shevliuga 2017). Generally, regulation refers to implementing rules by public authorities to influence market activities and behaviours in the economy to maximise collective interest (Edler et al. 2016). Three types of regulation can be identified in terms of their impact on innovation (Pelkmans and Renda 2014). First, regulations to promote innovation, such as IPRs and specific regulations to protect innovations in the market as postulated in Porter’s Hypothesis. Second, regulation to achieve specific objectives such as taxation, the environment, and health and safety standards, which can create innovation pressure and opportunities. Traditionally, standards and innovations are perceived to be contradictory, but according to Edler et al. (2016), standardisation can serve as a platform for the innovation process and as a tool to coordinate the preferences of consumers and other actors on the demand side. Thirdly are the regulations that can create burdens for innovative activities. According to Pelkmans and Renda (2014), these include general rules, innovation-specific rules, and sector-specific legislation.

While the empirical evidence suggests a clear positive link between most organisational factors as well as financial variables and the commercial success of firms, the overall effects of regulation on innovation performance are, so far, unclear. There is recognition in the literature of various regulations and their effects on different kinds of sectors and products, firms, sectors, and economies (Edler et al. 2016; Fu et al. 2018). Commercialising indigenous innovations in the small-scale Ghanaian industry often begins informally and has to comply with regulations as they expand. Some regulations, as explained by Edler et al. (2016), can indeed create new demand and force innovators to improve standards and add additional value for consumers. Indeed, a few demand-side policy prescriptions are emerging in the current Ghanaian innovation policy environment (UNIDO 2013; Quaye et al. 2019).

2.2. Theory and Hypotheses Development

2.2.1. Frugal Innovation Theory (FIT)

Below-the-radar theory of innovations, particularly frugal innovation models, underpinned this study investigating the effect of regulation on successful commercialisation in Ghana. There is a limited theoretical understanding of how innovation occurs, gets commercialised, diffuses, and impacts low-income economies in general (Dyck and Silvestre 2019). There is also scepticism about whether or how innovations are spreading in Sub-Sahara Africa (UNIDO 2013; Quaye et al. 2019). Frugal innovation theories (FIT), however, recognise that something is happening in these settings, albeit mostly below the radar, and provide a direction for researchers to analyse innovation systems in developing countries (Fu et al. 2018). Frugal innovation models can therefore serve as an anchor to examine the successful commercialisation of indigenous innovation in countries such as Ghana. Frugal innovation models recognise that in low-income settings, it is the incremental and often non-technological innovations, often not within the radar of science and technology and policy, that translate into a substantial increase and sustained firm performance, generating income, employment and better living standards (Anderson and Markides 2007; Clark et al. 2009; Radjou et al. 2012; Bhatti 2012; Madhavan 2017).

Prahalad’s frugal innovation propositions suggested variables such as resource availability, regulatory factors, and consumer income for successful innovation and its commercialisation (Prahalad 2012). According to Prahalad (2012), the three main challenges for innovation in developing countries are firm resource constraints, challenges in dealing with institutional voids and lacks, and the need to address the needs of the poor with low income. Most empirical evidence on applying frugal innovation models has been prominent in Asia and Latin America. Because of the success in these countries and the focus of FIT on involving low-income producers and consumers in the value chain, it has been recommended that African countries embrace the models in their development agenda (Abdelnour and Saeed 2014).

The frameworks highlight the fact that firms in low-income economies are resource-constrained and thereby have to use resources differently, serve income-constrained customers, and face many regulatory voids and lacks in the commercialisation process (Radjou et al. 2012; Chataway et al. 2014; Radjou and Prabhu 2015). While firms in SSI in countries such as Ghana face a lot of regulatory and institutional voids in the commercialisation process, the benefit of regulatory compliance to them is unclear. In some instances, the potential of regulatory compliance and enforceability for enhancing consumer acceptance and export potential is somehow recognised (Donbesuur et al. 2020). However, regulatory voids have been raised even more vociferously as constraints to commercialising indigenous innovation and firm performance (Oduro and Nyarku 2018; Johnson 2018). Therefore, an integrated framework such as the frugal innovation theory is useful for analysing the impact of regulation on the successful commercialisation of indigenous innovation in such economies.

Frugal innovation theorists postulate that because the low-income settings have institutional and resource constraints, innovation has to follow a path different from the capital-intensive and research and development-led process (Kaplinsky et al. 2009; Prahalad and Mashelkar 2010; Bhatti 2012). They demonstrated that globally useful solutions could be produced without slack resources, supporting institutions and high-income users as the first target market (Prahalad 2012; Bhatti 2012). Despite similar constraints in Ghana, there is evidence that some innovation is happening, helping businesses survive and grow (Afful and Owusu 2017; Fu et al. 2018; Hu et al. 2020). The evidence also revealed that much of this innovation in the SSI sector is informal and ’under the radar (Fu et al. 2018). The Ghanaian SSI sector, therefore, offers an interesting context to study the commercialisation of indigenous innovation and test the frugal innovation theory.

FIT emphasised the need to understand and address the needs of poor people when designing innovations and offering value to them. The central argument of this study is that regulation has a substantial direct effect and a moderating influence on factors such as finance and organisational factors on the performance of MSEs engaged in the commercialisation of indigenous innovation in Ghana. Since MSEs in Ghana mainly cater for the needs of the poor, frugal innovation models are the most appropriate models to explain how Ghanaian SSIs can serve customers with their innovations profitably and achieve commercial success.

2.2.2. Direct Effect of Regulation on Firm Performance

The literature provides varying evidence of the effects of regulation on firms and innovation activities. The investigation of industrial enterprises in China (Tang et al. 2020) provided some evidence that, in general, environmental regulation negatively influences innovation efficiency and generates detrimental effects on all firms and more on small enterprises in the short-term through reduced cash flows. The majority of the few empirical studies on regulations and innovation performance in Ghana found a negative relationship. Oduro and Nyarku (2018) studied the effects of legal and regulatory frameworks on the growth of Ghanaian SMEs and noted that regulatory regimes negatively affect SMEs’ performance. Johnson (2018) also investigated the institutional factors that affect innovative activity in the technology start-up ecosystem and highlighted regulation and bureaucratic processes as common challenges in Ghana. These studies largely focused on the financial performance of firms in assessing the success of innovation.

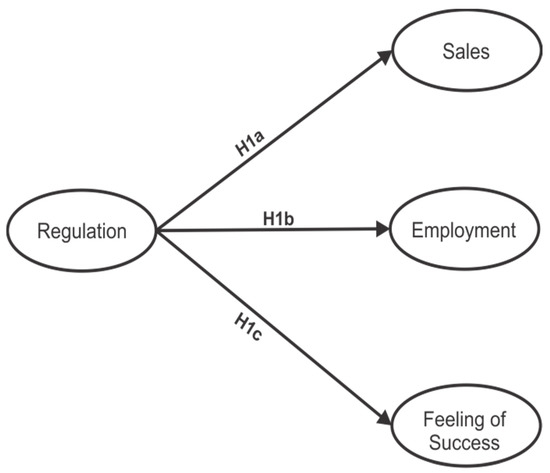

Some emerging studies are, however, showing that isolating different dimensions of successful commercialisation can yield different results. A study of the antecedents of innovation intentions in Germany’s renewable energy sector has identified, for example, that reliability and continuity of regulation were particularly relevant to entrepreneurs’ considerations of introducing innovation to the market (Grünhagen and Berg 2011). Adomako (2020) also provided evidence that sustainable innovation is positively associated with SME employment growth. Although regulation in the form of general rules, innovation-specific rules, and sector-specific legislation can impose burdens on innovative activities, in the form of standardisation, it can serve as a platform for the innovation process and a tool to coordinate consumer preferences (Pelkmans and Renda 2014), Edler et al. (2016). For example, Donbesuur et al. (2020), using structural equation modelling on a sample of 204 internationalised SMEs operating in Ghana, have shown that regulatory compliance and enforceability enhance consumer acceptance and export potential of SSI products. Regulatory compliance is a necessary ingredient for an SME’s growth (Mallett et al. 2019). Based on the debates in the literature, Hypotheses H1a–c (Figure 1) propose that regulation (Reg) has a positive effect on the performance of firms engaged in the commercialisation of indigenous innovation and are set as follows:

Figure 1.

A hypothetical model of direct effects of regulation on successful commercialisation.

Hypothesis 1a (H1a):

Regulation is positively related to sales of indigenous innovation in SSI.

Hypothesis 1b (H1b):

Regulation is positively related to the level of employment of firms commercialising indigenous innovation in SSI.

Hypothesis 1c (H1c):

Regulation is positively related to firm owner’s feeling of achieved success in the commercialisation of indigenous innovation in SSI.

2.2.3. Moderating Effects of Regulation and Firm Performance

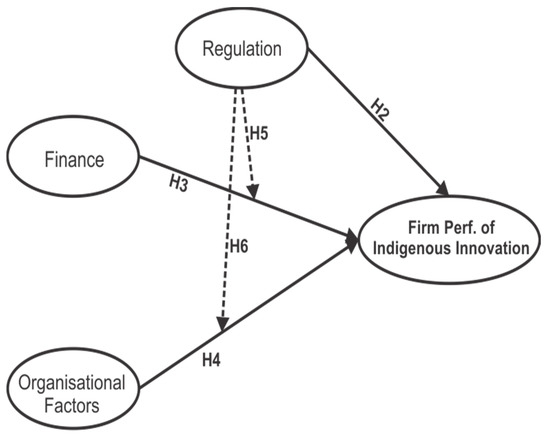

Amid varying evidence from the literature, regulation, in general, can positively moderate the relationships between other factors such as finance, organisational and market factors and firms’ innovation performance (Mohd Shariff et al. 2010; Kitching et al. 2015; Olefirenko and Shevliuga 2017; Mallett et al. 2019). Mallett et al. (2019) offered a plausible explanation that the positive effects of regulation are often not direct and that small firms can, through strategies, minimise the regulatory burdens and enhance competitive opportunities or protections offered by regulation. Using hierarchical regression, Odoom et al. (2017) provided evidence from emerging markets that while brand capabilities of SMEs positively affect firm performance in all sectors, brand regulation creates varying outcomes across manufacturing and service-based firms. In the context of low-income economies, Mohd Shariff et al. (2010), using data from Cambodia and hierarchical multiple regression analysis, provided some evidence that government policy and regulation are full moderators of a positive relationship between entrepreneurial values, firm financing, management, market practices, and SME performance. Specifically, in Ghana, Donbesuur et al. (2020), using structural equation modelling on a sample of internationalised SMEs operating in the country, showed that institutional environment specificity and regulation enforceability enhance the complementary effect of organisational and technological innovation on the international performance of SMEs. Based on the above and other evidence in the literature, hypotheses H2 to H6 (Figure 2) are proposed to be tested.

Figure 2.

A hypothetical model of moderating effects of regulation on firm performance in the commercialisation of indigenous innovation.

Hypothesis 2 (H2):

Regulation is positively related to successful commercialisation of indigenous innovation in terms of overall firm performance.

Hypothesis 3 (H3):

Finance is positively related to successful commercialisation of indigenous innovation in terms of overall firm performance.

Hypothesis 4 (H4):

Organisational factors are positively related to successful commercialisation of indigenous innovation in terms of overall firm performance.

Hypothesis 5 (H5):

Regulation positively moderates the effects of finance on the successful commercialisation of indigenous innovation in terms of overall firm performance.

Hypothesis 6 (H6):

Regulation positively moderates the effects of organisational factors on the successful commercialisation of indigenous innovation in terms of overall firm performance.

3. Materials and Methods

3.1. Sample and Data

The study is designed to examine the effects of regulation on the successful commercialisation of indigenous innovation and was conducted among firms in Ghanaian small-scale industries (SSIs) in the Volta Region, one of the administrative regions in Ghana. The region is deemed a microcosm of the country as it cuts across all geographical zones (coastal, coastal savannah, forest and savannah) in Ghana. It consists of suburban, periurban and rural areas. The density of rural small-scale industry (RSSI) activities is high and evenly distributed. The reason for choosing the SSI is that commercialising innovative indigenous activities is mostly observable in the SSI. Micro and small enterprises (MSEs) promote indigenous technological know-how and use mainly local resources.

A total of 2000 registered members of the association of the small-scale industry (ASSI) in the Volta Region represent the population for the study. These MSEs are active players in the commercialisation of indigenous innovation and are considered suitable for the study. Using Slovin’s formula (Adam 2020), the four (4) major geographical zones were stratified, and 537 MSE respondents were randomly selected and sampled from the population. Out of the 537 respondents contacted in April 2021, 453 responded positively, giving a response rate of 85%. This study followed the strategies suggested by Atiase and Botchie (2018). It worked with the Association of Small-Scale Industry (ASSI) and the Association of Ghana Industry (AGI), attending their programmes to understand the environment and connect with influencers. Developing a good relationship with the respondents through their associations, and self-administering the questionnaires to MSE owners as much as possible, enabled the researchers to achieve a high response rate. Table 1 shows the profiles of the sampled MSE respondents.

Table 1.

Profile of Sampled MSEs.

The study used multi-item psychometric scales to collect data and measure respondents’ views on the drivers of commercialisation of indigenous innovation. To ensure that the selected variables are very relevant to the study, the questionnaire items were based on the enterprise and innovation follow-up survey of the World Bank, innovation impact surveys of the OECD, the Global Innovation Index and other previous studies (Anning-Dorson 2018; Lee et al. 2018; Bayer et al. 2020). Prior to the main survey, the researchers pretested questionnaires on 50 respondents. The research instrument for the study was tested for reliability and validity, as suggested by Robison (2018), to ensure internal consistency for the variables in measuring successful commercialisation.

The Partial Least Square–Structural Equation Model (PLS-SEM) was used because the study sought to explain the relationship between regulation, together with financial and organisational factors, as the explanatory variables and the successful commercialisation of indigenous innovation, measured by sales, employment, and feelings of success as the dependent variables. PLS-SEM analysis is the most preferred method because the study examines seven hypotheses based on different theories or models (Ong and Puteh 2017; Hair et al. 2019). PLS-SEM can also normalise the data for further analysis and can reduce the impact of type 1 error (Hair et al. 2019).

3.2. Constructs and Measures

3.2.1. Independent Variables

Following previous scholars (Pelkmans and Renda 2014; Edler et al. 2016; Fu et al. 2018), the study designed regulation as the main independent variable. Indigenous innovation, by its nature, begins informally, and firms must comply with required rules as commercialisation activities expand. Based on this, to assess the effect of regulation. The study used seven items: reasonability and ease of compliance; affordability of regulatory cost; timeliness of approval; time burden on SMEs; attitudes of regulatory staff; customer/market requirements for regulatory approval; and new demand opportunities

Also, based on the triangle of support views (Olefirenko and Shevliuga 2017), the study designed finance and organisational factors as other independent variables to measure the moderating effect of regulation on successful commercialisation (Table 2). All the independent variables are measured on a Likert scale of agreement anchored on strongly disagreeing (1) to strongly agreeing (5).

Table 2.

Reliability and convergent validity results.

3.2.2. Independent Variables

From the emerging innovation commercialisation literature (Cirera and Muzi 2016; Olefirenko and Shevliuga 2017; Mahmutaj and Krasniqi 2020; Bayer et al. 2020), sales and sales variables are the most basic and primary measures of successful commercialisation. Sales variables such as revenue, growth, and product reach can easily be tracked and can point out what exactly a firm is doing and generating from its innovative activities. Some scholars (Shpak et al. 2014; Osoro et al. 2017) think that market-preferred innovations are more likely to lead to further exploitation, development, and socioeconomic development.

Also, employment is an important conduit for transmitting innovation impacts into socioeconomic development and employment level or growth, as innovation performance indicators are very visible and simple to obtain. Employment generation is, therefore, an appropriate and important measure of the successful commercialisation of innovation. According to Chege and Wang (2020), the potential for employment generation is precisely the reason for the policy focus on MSEs and indigenous innovation commercialisation. From the frugal innovation framework perspective, indigenous innovation reduces technological sophistication, uses local resources more intensively, and can employ more labour per unit of capita (Radjou et al. 2012).

Again, one thing that drives entrepreneurs and innovators to undertake and create is a feeling of success, often from both achieved financial success as well as cathartic and meaningful personal feelings and community recognition for being responsible for something new in the world (Sherman and Shavit 2020; Wach et al. 2016). Internal measures of success held by entrepreneurs themselves, on the other hand, are largely ignored in the literature (Dijkhuizen et al. 2018). Emerging evidence that subjective measures are becoming more predictive of entrepreneurs’ behaviour has generated interest in subjective measures (Wach et al. 2016; Gorgievski and Stephan 2016). Extremely few studies (Moynihan et al. 2012; De Jong and van Witteloostuijn 2015; Kitching et al. 2015) have analysed the effect of regulation on a firm’s performance from the owner’s or manager’s perspectives.

For the above reasons, the study used sales revenue, employment level, and feelings of success to objectively measure the successful commercialisation of indigenous innovation. These successful innovation commercialisation metrics were obtained by capturing data from MSEs in the Volta Region of Ghana for 5 years (2016–2020). The 5-year data were then aggregated to produce the average growth rate, which is used in the regression analysis.

3.3. Measurement Model

To ensure that the required reliability and validity criteria are met, the measurement model was first examined as prescribed (Ringle et al. 2015; Hair et al. 2019). From the reliability and validity tests (Table 2), all the indicators have significant loadings.

All the constructs in the study are satisfied. The CA ranged from 0.837 to 0.940 and were all above Cronbach’s > 0.7 thresholds (Shmueli et al. 2019). The CR values and the AVE values are all higher than the recommended thresholds of 0.70 and 0.50, respectively (Hair et al. 2019; Shmueli et al. 2019). Also, all the Heterotrait-Monotrait ratio (HTMT) values for determining the discriminant validity of the constructs (Table 3) are below the recommended maximum threshold of 0.85. From HTMT values, discriminant validity can be established for all the constructs in the study. The measurement model satisfied all the required criteria (Hair et al. 2019). Therefore, the structural model is assessed (Table 4 below).

Table 3.

Discriminant validity by Heterotrait-Monotrait Ratio (HTMT) criterion.

Table 4.

Structural model assessment of direct effects of regulations.

4. Results of the Structural Model

4.1. Direct Effects of Regulation on the Success of Indigenous Innovation

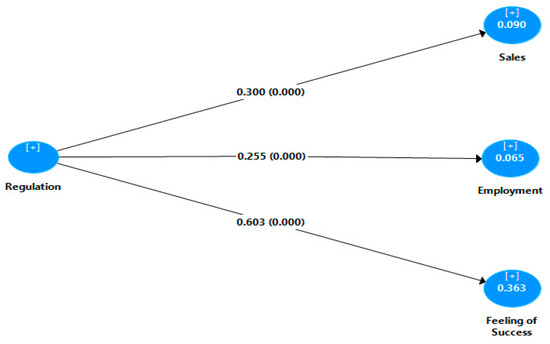

The adjusted R2 statistics indicate that the model explains 8.8%, 6.3%, and 36.2% of the variations in sales, employment, and owners’ feelings of achieving success levels, respectively. This implies that regulation has a significant impact on the performance of firms and contributes to the commercialisation of indigenous innovation. Correspondingly, the Q2 values of the model span from 0.043 to 0.309, which is greater than 0.0, indicating that the PLS structural model has some predictive relevance. The results also show that the model has a good fit as the SRMR is 0.071, which is less than the 0.08 threshold (Hair et al. 2019). From R2 statistics, the model has moderate power to explain variations in feelings of success and weak but satisfactory explanation power for sales and employment levels (Shmueli et al. 2019; Hair et al. 2019). Similarly, from the Q2 statistics, the model has small predictive relevance or capability to predict sales and employment, and medium capability to predict feelings of success. The path results are also depicted in Figure 3 below.

Figure 3.

Direct effects of regulation on successful commercialisation of indigenous innovation.

The VIF values are all lower than the conservative threshold of 3.3, meaning collinearity is a non-issue (Hair et al. 2019); hence the path relations can be examined. The direct effect of regulation on the commercialisation of indigenous innovation was assessed with the guidance of hypotheses (H1a–c). The standardised path coefficients and their p-values and t-values exhibited positive effects on all the performance variables. Thus, from the model result, a hundred per cent improvement in the regulatory environment, ceteris paribus, could increase sales, employment and firm owners’ feelings of success level by about 30%, 25.5%, and 60%, respectively. Therefore, hypotheses H1a–c are all accepted.

4.2. Moderating Effects of Regulation on Success of Indigenous Innovation

Following earlier studies (Edler et al. 2016; Fu et al. 2018; Olefirenko and Shevliuga 2017; Atiase and Botchie 2018; Allen et al. 2019), the study considers financial and organisational factors alongside regulation as the main drivers of successful commercialisation of indigenous innovation. Because the current study believes that regulation can play both direct and moderating roles in the impact of drivers on successful commercialisation, it tested the direct effects of finance and organisational factors alongside regulation, as well as the moderating effects of regulation on the link between finance and organisational factors and the success of indigenous innovation (Figure 2). The path results are presented in Table 5 below.

Table 5.

Structural model assessment of moderating effects of regulations.

The model showed adequate predictive relevance (Q2 = 0.150) and moderate explanatory power (R2 = 0.468). Thus, the model accounted for about 47% of the variations in the successful commercialisation of indigenous innovations. At 5% significance level, the result show that regulation, finance and organisational factors all significantly drive commercialisation of commercialisation: regulation by about 37% (β = 0.369; SE = 0.042; p = 0.000), finance by about 17% (β = 0.166; SE = 0.057; p = 0.004) and organisational factors by about 28% (β = 0.275; SE = 0.056; p = 0.000). Clearly, the path results also show that regulation has a significant positive (9.2% on finance and 9.7% on organisational factors), moderating effects on successful commercialisation. Hypotheses H2–H6 are, therefore, all accepted.

5. Discussion

The study grounded regulation as a crucial determinant of the successful commercialisation of innovation and professed regulatory incentives and compliance as appropriate strategies to promote indigenous innovation in low-income economies. From the PLS-SEM path test, regulation has overall significant positive effects on all three dimensions of successful commercialisation. The direct effects of regulation on overall firm performance, as well as its moderating influence on financial and organisational factors, are all significant.

This finding is broadly dissimilar to many earlier studies that portrayed negative links between regulation and firm performance in Ghana (Oduro and Nyarku 2018; Johnson 2018). These earlier studies focused on the financial performance of firms, argued that regulation creates constraints and cost burdens, and raised the regulatory regime in Ghana as a constraint to commercialisation and new venture creation. The new evidence is, however, not surprising and does not necessarily negate the fact that regulation creates a cost burden which can negatively affect the profitability of firms (Hart and Blackburn 2004; Djankov 2009). Successful commercialisation in the current study is measured by sales, employment and owners’ feeling of success. The current findings are also consistent with the view that testing the effect of regulation on specific dimensions of innovation performance can yield different results (Grünhagen and Berg 2011; Mallett et al. 2019; Adomako 2020; Donbesuur et al. 2020).

Specifically, the positive links between regulation and firms’ sales evidence provided by this study imply that while it is undeniable that in the Ghanaian SSI sector there are a lot of institutional voids and regulatory compliance, which create a lot of unnecessary burdens, there are also regulatory advantages. Market-augmenting regulations support the commercialisation of indigenous innovation, and improving the capability of firms in SSI to comply with the regulations can help them enjoy the associated advantages and hence market success.

The positive correlation between regulation and employment is consistent with other studies (Adomako 2020) and is expected. Generally, firms in SSI serve as the bedrock for indigenous entrepreneurship, are labour-intensive, employ more, and adapt easily to constraints (Cozzens and Sutz 2014). Despite a little scepticism about jobs in the SSI sector (Edusah 2014; Essel et al. 2019), the strong and positive link between regulation and employment has good implications for policy in Ghana. It implies that as regulation improves standards, more formal and regulated jobs can be created through indigenous innovation in the SSI sector. Regulatory compliance means going formal and making informal sector jobs count as proper jobs. Many rules and regulations (e.g., health and safety, security rules, labour law) can help MSEs in the SSI create a better working environment and enhance employees’ productivity.

The observed positive link between regulation and owners’ feelings of success is rather unexpected and interesting. The overall effect of regulation on firm performance is complex. Indeed, there is evidence on the ground that some aspects of innovation regulation create burdens and sometimes personal harassment for firm owners in the SSI sector. This finding is also amid the evidence that firms in low-income and emerging economies exhibit dangerously low rates of regulatory compliance (Malesky and Taussig 2017). It is also clear that Ghanaian SME owners and managers generally dislike regulation. Nonetheless, the current findings confirm that meeting regulatory requirements improves a firm owner’s reputation in the eyes of the public, regulators, the media and other stakeholders. Firms in the Ghanaian SSI sector that managed to secure licences and permits tout it as an achievement. Local radio stations, for example, insist herbalists and food processors comply with the Food and Drug Authority (FDA) before their innovations are promoted on the radio. Regulation compliance shows that a firm is running a trustworthy operation, has a sense of responsibility and a positive culture that can attract and retain talented employees, all of which can contribute to a higher feeling of achieved success. Regulation and its compliance legalise innovative activities, reduce legal problems, and give MSE owners peace of mind

The significant moderating effect of regulation on successful commercialisation confirms the fact that governmental rules, licensing, and regulation compliance legalises innovative activities, enhance access to finance, and can help address organisational challenges. In the Ghanaian context, indigenous industries are not well developed. Because of their size, firms in the SSI sector cannot make certain investments, relying heavily on shared resources and business infrastructure. It is therefore inferred from the evidence that regulation can also enhance how these firms leverage, use, and benefit from common business infrastructure and resources. Based on the current findings of some positive effects of regulation on the successful commercialisation of indigenous innovation, and juxtaposed with other evidence of regulatory gaps and voids that make MSEs dislike regulation, the study advocates the following for the promotion of indigenous innovation:

Firstly, there is a need to have more simplified regulations for MSEs in SSI. Policies must pay attention to regulatory burdens. Despite the evidence of the positive effect of overall regulation on indigenous innovation, the supporting literature suggests the regulatory environment in the Ghanaian context creates an excessive cost burden and deadweight losses, which limit the expansion and reduce the profitability of innovative indigenous activities. Where appropriate, there should be regulatory incentives instituted and integrated to enable MSEs to comply without losing out.

Secondly, policy should deal with regulatory shortcomings, particularly on the demand side. The evidence from this study suggests regulation can create new demand and enhance market opportunities. There should be more regulations that improve standards, enhance values, and boost the demand for indigenous innovation. Local content requirements, such as the “Buy Made in Ghana campaign,” could be better delivered through regulation. Requiring, through regulation, that supermarkets dedicate a percentage of shelf space to some approved indigenous innovations can help promote, improve demand and further stimulate the commercialisation of indigenous innovations. Again, through regulation, public institutions could allocate a percentage of their budgetary spending on the procurement of approved indigenous innovations. This could help close commercialisation gaps and encourage indigenous innovation and its commercialisation

Finally, and in respect of firm strategy, the current finding and other evidence on the ground suggest that regulation is, overall, a double-edged sword. It creates both burdens and opportunities for the commercialisation of indigenous innovation. However, the benefits can outweigh the burdens. Firms, as one of the first steps in the commercialisation process, should strategise for regulatory compliance as this can reduce the cost burden, and compliance can enhance their market opportunities. Firms must, at all times, scan for opportunities arising out of regulation and strategise to take advantage of them. The literature (UNIDO 2013; Oduro-Marfo 2015; Amankwah-Amoah et al. 2017) portrayed local businesses as playing an extremely limited role in influencing public procurement policy and encouraging collaboration between Ghanaian National Innovation System actors. Firms in SSI should use their trade associations to improve links with institutions and lobby for market-enhancing regulations and against unfavourable regulations.

6. Conclusions

In conclusion, the study has achieved its main aim of examining the effects of regulation on the successful commercialisation of indigenous innovation. Despite the evidence of regulatory burdens, overall regulation has a substantial positive influence on the commercialisation of indigenous innovations in the small-scale Ghanaian industry. The study established regulation as a key determinant of the successful commercialisation of indigenous innovation. From the PLS-SEM path testing at a 5% statistical significance level, regulation has significant direct positive effects on sales, employment, and firm owners’ feelings of success. Similarly, from the results, regulation also positively moderates the influence of financial and organisational factors on overall firm performance. Thus, all the hypotheses about the positive relationship between regulation and firm performance in the study are accepted, implying that better regulation can lead to higher commercialisation of indigenous innovation in Ghana. Based on the findings of the current study and other facts, regulation should be viewed as a necessary evil for the success of indigenous innovations in low-income economies. Appropriate and balanced regulations are required if the promotion and campaign for indigenous innovation is to succeed. Impliedly, policy efforts should be made to reduce regulatory burden and cost, provide regulatory incentives, and enhance compliance by firms in SSI

The main limitation is that the objective variables measured in the study are sales and employment. Financial performance in terms of profitability was not measured. Therefore, the overwhelming significant positive bearing should not be interpreted as a negation of the fact that regulation creates burdens, and the cost burden can negatively affect the profitability of firms, as evident in other studies. Moreover, the subjective measurement of personal and internal feelings of success held by MSE owners could be prone to inferential challenges. Presumably, however, the respondents, as business owners, reflected well on their financial and other realities when making their subjective assessments. Notwithstanding these limitations, the findings of the study are very valid. It adds to knowledge by contributing to establishing regulation as a key determinant of the successful commercialisation of indigenous innovation. Unlike developed economies, where there are calls for less or deregulation, the study provided new evidence that in low-income economies, indigenous innovation mostly begins informally, and regulation overall aids successful commercialisation. It also substantiates the view that MSEs can maximise the effect of finance and organisational factors on their performance by leveraging regulatory incentives and compliance.

The current study followed the research direction of Edler et al. (2016) to investigate the effect of regulation on innovation in different sectors and economies and evaluated the effect of regulation on indigenous innovation in the Ghanaian SSI sector. Its consequent findings of positive effects of regulation on sales, employment, and MSE owners’ feelings of success, in addition to other evidence of regulation’s negative impact on firm profitability in the same setting, imply that more research is needed to identify areas for regulatory improvement to enhance the commercialisation of indigenous innovation. Furthermore, the study used a case study approach, selecting samples from a single region and the Ghanaian SSI sector. Future studies could expand the research to the whole economy to improve generalizability. Future studies could also embark on comparative cross-country analysis to gain more generalisability. Finally, the impact of the COVID-19 crisis on government interventions and MSEs is difficult to predict and should therefore be of interest for further research.

Author Contributions

Conceptualisation, H.P.A. and D.Y.D.; methodology, H.P.A. and V.Y.A.; software, H.P.A.; validation, H.P.A., V.Y.A. and D.Y.D.; formal analysis, H.P.A.; investigation, H.P.A.; resources, D.Y.D.; data curation, V.Y.A.; writing—original draft preparation, H.P.A. and V.Y.A.; writing—review and editing, H.P.A.; visualisation, H.P.A., V.Y.A. and D.Y.D.; supervision, D.Y.D.; project administration. V.Y.A.; funding acquisition, D.Y.D. All authors have read and agreed to the published version of the manuscript.

Funding

This study is funded by the Central University of Technology (CUT), Free State South Africa.

Institutional Review Board Statement

The study was conducted in accordance with the Declaration of Helsinki, and approved by Departmental and Faculty Research Committees, Faculty of Management Sciences, Central University of Technology (FMSEC on 30 March 2020).

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

Not applicable.

Acknowledgments

The authors are grateful to the Central University of Technology (CUT), Free State South Africa and Ho Technical University (HTU), Ghana, whose collaboration gave birth to the research.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Abdelnour, Samer, and Akbar M. Saeed. 2014. Technologizing humanitarian space: Darfur advocacy and the rape-stove Panacea. International Political Sociology 8: 145–63. [Google Scholar] [CrossRef]

- Adam, M. Anokye. 2020. Sample size determination in survey research. Journal of Scientific Research and Reports 26: 9097. [Google Scholar] [CrossRef]

- Adomako, Samuel. 2020. Environmental collaboration, sustainable innovation, and small and medium-sized enterprise growth in sub-Saharan Africa: Evidence from Ghana. Sustainable Development 28: 1609–19. [Google Scholar] [CrossRef]

- Afful, Benedict, and Gideon Owusu. 2017. Types and Drivers of Innovation in the Manufacturing Sector of Ghana. Working Paper nesra/wp/17/006. Accra: Network for Socioeconomic Research and Advancement. [Google Scholar]

- Alhassan, N. Jinbaani, Donkoh A. Samuel, Mabe N. Franklin, and Isaac Gershon Kodwo Ansah. 2016. Commercialising innovations from agricultural research in Northern Ghana and farmers willingness to pay. African Journal of Business Management 10: 140–50. [Google Scholar] [CrossRef]

- Allen, Franklin, Meijun Qian, and Jing Xie. 2019. Understanding informal financing. Journal of Financial Intermediation 39: 19–33. [Google Scholar] [CrossRef]

- Amankwah-Amoah, Joseph. 2016. The evolution of science, technology and innovation policies: A review of the Ghanaian experience. Technological Forecasting and Social Change 110: 134–42. [Google Scholar] [CrossRef]

- Amankwah-Amoah, Joseph, Yaw A. Debrah, Ben Q. Honyenuga, and Paulina N. Adzoyi. 2017. Business and government interdependence in emerging economies: Insights from hotels in Ghana. International Journal of Tourism Research 20: 72–81. [Google Scholar] [CrossRef]

- Anderson, Jamie, and Costas Markides. 2007. Strategic innovation at the base of the pyramid. MIT Sloan Management Review 49: 83. [Google Scholar]

- Anning-Dorson, Thomas. 2018. Customer involvement capability and service firm performance: The mediating role of innovation. Journal of Business Research 86: 269–80. [Google Scholar] [CrossRef]

- Atiase, Victor, and David Botchie. 2018. Does Managerial Training have any Impact on the Performance of MSE Managers? Empirical Evidence from Ghana. London: British Academy of Management. [Google Scholar]

- Azarmi, Davar. 2016. Factors affecting technology innovation and its commercialisation in firms. Modern Applied Science 10: 36–48. [Google Scholar] [CrossRef][Green Version]

- Bartels, Frank L., Ritin Koria, and Elisa Vitali. 2016. Barriers to innovation: The case of Ghana and implications for developing countries. Triple Helix 3: 1–30. [Google Scholar] [CrossRef]

- Bayer, Emanuel, Shuba Srinivasan, Edward J. Riedl, and Bernd Skiera. 2020. The impact of online display advertising and paid search advertising relative to offline advertising on firm performance and firm value. International Journal of Research in Marketing 37: 789–804. [Google Scholar] [CrossRef]

- Bhatti, Yasser Ahmad. 2012. What is Frugal, What Is Innovation? Towards a Theory of Frugal Innovation. Available online: https://ssrn.com/abstract=2005910 (accessed on 16 January 2019).

- Botchie, David, David Sarpong, and Jianxiang Bi. 2017. Technological inclusiveness: Northern versus Chinese induced technologies in the garment industry. Technological Forecasting and Social Change 119: 310–22. [Google Scholar] [CrossRef]

- Chataway, Joanna, Rebecca Hanlin, and Raphael Kaplinsky. 2014. Inclusive innovation: An architecture for policy development. Innovation and Development 4: 33–54. [Google Scholar] [CrossRef]

- Chatterji, Manas. 2016. Technology Transfer in the Developing Countries. Berlin and Heidelberg: Springer. [Google Scholar]

- Chege, Samwel Macharia, and Daoping Wang. 2020. Information technology innovation and its impact on job creation by SMEs in developing countries: An analysis of the literature review. Technology Analysis & Strategic Management 32: 256–71. [Google Scholar]

- Cirera, Xavier, and Silvia Muzi. 2016. Measuring firm-level innovation using short questionnaires: Evidence from an experiment. World Bank Policy Research Working Paper 7696: 1–43. [Google Scholar]

- Clark, Norman, Joanna Chataway, Rebecca Hanlin, Dinar Kale, Raphael Kaplinsky, and Peter Robbins. 2009. Below the radar: What does innovation in the Asian driver economies have to offer other low income economies. Paper presented at GLOBELICS 2009, 7th International Conference, Dakar, Senegal, October 6–8. [Google Scholar]

- Cornell University, INSEAD, and WIPO. 2016. Winning with Global Innovation, Global Innovation Index, Ithaca, Fontainebleau, and Geneva. Ithaca: Cornell University. Paris: INSEAD. Geneva: WIPO. [Google Scholar]

- Cornell University, INSEAD, and WIPO. 2017. Innovation Feeding the World, Global Innovation Index, Ithaca, Fontainebleau, and Geneva. Ithaca: Cornell University. Fontainebleau: INSEAD. Geneva: WIPO. [Google Scholar]

- Cornell University, INSEAD, and WIPO. 2018. Energising the World with Innovation, Global Innovation Index, Ithaca, Fontainebleau, and Geneva. Ithaca: Cornell University. Fontainebleau: INSEAD. Geneva: WIPO. [Google Scholar]

- Cornell University, INSEAD, and WIPO. 2019. Creating Healthy Lives—The Future of Medical Innovation, Global Innovation Index Ithaca, Fontainebleau, and Geneva. Ithaca: Cornell University. Fontainebleau: INSEAD. Geneva: WIPO. [Google Scholar]

- Cozzens, Susan, and Judith Sutz. 2014. Innovation in informal settings: Reflections and proposals for a research agenda. Innovation and Development 4: 5–31. [Google Scholar] [CrossRef]

- De Jong, Gjalt, and Arjen van Witteloostuijn. 2015. Regulatory red tape and private firm performance. Public Administration 93: 34–51. [Google Scholar] [CrossRef]

- Dijkhuizen, Josette, Marjan Gorgievski, Marc van Veldhoven, and René Schalk. 2018. Well-being, personal success and business performance among entrepreneurs: A two-wave study. Journal of Happiness Studies 19: 2187–204. [Google Scholar] [CrossRef]

- Djankov, Simeon. 2009. The regulation of entry: A survey. The World Bank Research Observer 24: 183–203. [Google Scholar] [CrossRef]

- Donbesuur, Francis, George Oppong Appiagyei Ampong, Diana Owusu-Yirenkyi, and Irene Chu. 2020. Technological innovation, organisational innovation and international performance of SMEs: The moderating role of domestic institutional environment. Technological Forecasting and Social Change 161: 120252. [Google Scholar] [CrossRef]

- Dyck, Bruno, and Bruno S. Silvestre. 2019. A novel NGO approach to facilitate the adoption of sustainable innovations in low-income countries: Lessons from small-scale farms in Nicaragua. Organisation Studies 40: 443–61. [Google Scholar] [CrossRef]

- Dzansi, Dennis Yao, Patience Rambe, and William James Coleman. 2015. Enhancing new venture creation success in South Africa: A project management perspective. Problems and Perspectives in Management 13: 418–26. [Google Scholar]

- Edler, Jakob, and Jan Fagerberg. 2017. Innovation policy: What, why, and how. Oxford Review of Economic Policy 33: 2–23. [Google Scholar] [CrossRef]

- Edler, Jakob, Paul Cunningham, and Abdullah Gök. 2016. Handbook of Innovation Policy Impact. Cheltenham: Edward Elgar Publishing. [Google Scholar]

- Edusah, Sampson. 2014. The socioeconomic contribution of rural small-scale industries in Ghana. Journal of Economics and Sustainable Development 5: 161–72. [Google Scholar]

- Essel, Bernard Kwamena Cobbina, Faizal Adams, and Kwadwo Amankwah. 2019. Effect of entrepreneur, firm, and institutional characteristics on small-scale firm performance in Ghana. Journal of Global Entrepreneurship Research 9: 1–20. [Google Scholar] [CrossRef]

- Feige, David, and Nicholas S. Vonortas. 2017. Context appropriate technologies for development: Choosing for the future. Technological Forecasting and Social Change 119: 219–26. [Google Scholar] [CrossRef]

- Fox, Louise, Lemma W. Senbet, and Witness Simbanegavi. 2016. Youth employment in Sub-Saharan Africa: Challenges, constraints and opportunities. In Journal of African Economies. vol. 25, (Suppl. 1), pp. i3–i15. [Google Scholar]

- Fu, Xiaolan, Pierre Mohnen, and Giacomo Zanello. 2018. Innovation and productivity in formal and informal firms in Ghana. Technological Forecasting and Social Change 131: 315–25. [Google Scholar] [CrossRef]

- Gorgievski, Marian J., and Ute Stephan. 2016. Advancing the psychology of entrepreneurship: A review of the psychological literature and an introduction. Applied Psychology 65: 437–68. [Google Scholar] [CrossRef]

- Grünhagen, Marc, and Holger Berg. 2011. Modelling the antecedents of innova-tion-based growth intentions in entrepreneurial ventures—The role of perceived regulatory conditions in the German renewable energies and disease management industries. International Journal of Technology, Policy and Management 11: 220–49. [Google Scholar] [CrossRef]

- Hair, Joseph F., Jeffrey J. Risher, Marko Sarstedt, and Christian M. Ringle. 2019. When to use and how to report the results of PLS-SEM. European Business Review 31: 2–24. [Google Scholar]

- Hart, Mark, and Robert Blackburn. 2004. Labour Regulation and SMEs: A Challenge to Competitiveness and Employability? New York: Routledge. [Google Scholar]

- Hu, Xuhua, Bertha Ada Danso, Isaac Adjei Mensah, and Michael Adda. 2020. Does innovation type influence firm performance? A dilemma of star-rated hotels in Ghana. Sustainability 12: 9912. [Google Scholar] [CrossRef]

- Huang, Junbing, Yu Hao, and Hongyan Lei. 2018. Indigenous versus foreign innovation and energy intensity in China. Renewable and Sustainable Energy Reviews 81: 1721–29. [Google Scholar] [CrossRef]

- Ibrahim, Isaac. 2017. Impact of Sino-Africa economic relations on the Ghanaian Economy: The case of textiles. International Journal of Innovation and Economic Development 3: 7–27. [Google Scholar]

- Johnson, Nickie B. 2018. Facilitating Innovation in Technology Startups in Ghana: A Multiple Case Study of the Technology Entrepreneurship Ecosystem in Ghana. Master’s Thesis, Södertörn University, Huddinge, Sweden. [Google Scholar]

- Kaplinsky, Raphael, Joanna Chataway, Norman Clark, Rebecca Hanlin, Dinar Kale, Lois Muraguri, Theo Papaioannou, Peter Robbins, and Watu Wamae. 2009. Below the radar: What does innovation in emerging economies have to offer other low-income economies? International Journal of Technology Management & Sustainable Development 8: 177–97. [Google Scholar]

- Kitching, John, Mark Hart, and Nick Wilson. 2015. Burden or benefit? Regulation as a dynamic influence on small business performance. International Small Business Journal 33: 130–47. [Google Scholar] [CrossRef]

- Klepper, Steven. 2016. Experimental Capitalism: The Nanoeconomics of American High-Tech Industries. Princeton: Princeton University Press. [Google Scholar]

- Konfidants. 2021. How Well are Made in Ghana Products Represented in Ghana’s Leading Supermarkets. Available online: http://www.konfidants.com/2021/03/15/ (accessed on 24 July 2021).

- Kumar, Anil, Rohit Kr Singh, and Sachin Modgil. 2020. Exploring the relationship between ICT, SCM practices and organizational performance in agri-food supply chain. Benchmarking 27: 1003–41. [Google Scholar] [CrossRef]

- Lee, Hsiao-Hui, Jianer Zhou, and Jingqi Wang. 2018. Trade Credit Financing Under Competition and Its Impact on Firm Performance in Supply Chains. Manufacturing & Service Operations Management 20: 36–52. [Google Scholar]

- Madhavan, Harilal. 2017. Below the radar innovations and emerging property right approaches in Tibetan medicine. The Journal of World Intellectual Property 20: 239–57. [Google Scholar] [CrossRef]

- Mahmutaj, Lura Rexhepi, and Besnik Krasniqi. 2020. Innovation types and sales growth in small firms: Evidence from Kosovo. The South East European Journal of Economics and Business 15: 27–43. [Google Scholar] [CrossRef]

- Malesky, Edmund, and Markus Taussig. 2017. The danger of not listening to firms: Government responsiveness and the goal of regulatory compliance. Academy of Management Journal 60: 1741–70. [Google Scholar] [CrossRef]

- Mallett, Oliver, Robert Wapshott, and Tim Vorley. 2019. How do regulations affect SMEs? A review of the qualitative evidence and a research agenda. International Journal of Management Reviews 21: 294–316. [Google Scholar] [CrossRef]

- Mcintyre, Robin A. 2014. Overcoming the valley of death. Science Progress 97: 234–48. [Google Scholar] [CrossRef]

- MESTI. 2017. National Science, Technology and Innovation (DRAFT) Policy (2017–2020). Accra: Ministry of Environment, Science, Technology, and Innovation (MESTI). [Google Scholar]

- Mohd Shariff, Mohd Noor, Chea Peou, and Juhary Ali. 2010. Moderating effect of government policy on entrepreneurship and growth performance of small-medium enterprises in Cambodia. International Journal of Business and Management Science 3: 57–72. [Google Scholar]

- Moynihan, Donald P., Sanjay K. Pandey, and Bradley E. Wright. 2012. Setting the table: How transformational leadership fosters performance information use. Journal of Public Administration Research and Theory 22: 143–64. [Google Scholar] [CrossRef]

- Nwuke, Kasirim. 2015. Science, Technology and Innovation Policy in Africa in the Age of Brilliant and Disruptive Technologies: An Analysis of Policies at the National, Regional and Continental Levels. Background paper for ARIA VII. Addis Ababa: Economic Commission for Africa. [Google Scholar]

- Ockwell, David, and Rob Byrne. 2016. Sustainable Energy for All: Innovation, Technology and Pro-Poor Green Transformations. London: Routledge. [Google Scholar]

- Oderanti, Festus Oluseyi, and Feng Li. 2018. Commercialisation of eHealth innovations in the market of the U.K. healthcare sector: A framework for a sustainable business model. Psychology & Marketing 35: 120–37. [Google Scholar]

- Odoom, Raphael, George Cudjoe Agbemabiese, T. Anning-Dorson, and Priscilla Mensah. 2017. Branding capabilities and SME performance in an emerging market: The moderating effect of brand regulations. Marketing Intelligence & Planning 35: 473–87. [Google Scholar]

- Oduro, Stephen. 2020. Exploring the barriers to SMEs’ open innovation adoption in Ghana: A mixed research approach. International Journal of Innovation Science 12: 21–51. [Google Scholar] [CrossRef]

- Oduro, Stephen, and Kwamena Minta Nyarku. 2018. Incremental innovations in Ghanaian SMEs: Propensity, types, performance and management challenges. Asia-Pacific Journal of Management Research and Innovation 14: 10–21. [Google Scholar] [CrossRef]

- Oduro-Marfo, Smith. 2015. Toward a national innovation strategy: A critique of Ghana’s science, technology and innovation policy. The Innovation Journal 20: 1. [Google Scholar]

- OECD/Eurostat. 2018. Oslo Manual 2018: Guidelines for Collecting, Reporting and Using Data on Innovation, 4th ed. Luxembourg: The Measurement of Scientific, Technological and Innovation Activities, OECD Publishing and Paris/Eurostat. [Google Scholar]

- Olefirenko, Oleg, and Olena Shevliuga. 2017. Commercialisation of innovations: Peculiarities of sales policy at innovation active enterprise. Innovative Marketing 13: 6–12. [Google Scholar] [CrossRef]

- Ong, Mohd Hanafi Azman, and Fadilah Puteh. 2017. Quantitative data analysis: Choosing between SPSS, PLS, and AMOS in social science research. International Interdisciplinary Journal of Scientific Research 3: 14–25. [Google Scholar]

- Osoro, Otieno, Stephen Kirama, and Patrick Vermeulen. 2017. Factors affecting engagement and commercialisation of innovation activities of firms in Tanzania. Tanzania Economic Review 4: 73–90. [Google Scholar]

- Pelkmans, Jacques, and Andrea Renda. 2014. How can EU legislation Enable and/or Disable Innovation. European Commission. Available online: https://ec.europa.eu/futurium/en/system/files/ged/39-how_can_eu_legislation_enable_and-or_disable_innovation.pdf (accessed on 29 December 2019).

- Phelps, Edmund. 2018. The dynamism of nations: Toward a theory of indigenous innovation. Journal of Applied Corporate Finance 30: 8–26. [Google Scholar]

- Prahalad, Coimbatore Krishnarao. 2012. Bottom of the Pyramid as a Source of Breakthrough Innovations. Journal of Product Innovation Management 29: 6–12. [Google Scholar] [CrossRef]

- Prahalad, Coimbatore Krishnarao, and Raghunath Anant Mashelkar. 2010. Innovation’s holy grail. Harvard Business Review 88: 132–41. [Google Scholar]

- Quaye, Daniel, and Isaac Mensah. 2019. Marketing innovation and sustainable competitive advantage of manufacturing SMEs in Ghana. Management Decision 57: 1535–53. [Google Scholar] [CrossRef]

- Quaye, Daniel M., Kwame Ntim Sekyere, and George Acheampong. 2017. Export promotion programmes and export performance: A study of selected SMEs in the manufacturing sector of Ghana. Review of International Business and Strategy 27: 466–83. [Google Scholar] [CrossRef]

- Quaye, Wilhelmina, Gordon Akon-Yamga, Chux Daniels, Blanche Ting, and Adelaide Asante. 2019. Mapping of Science, Technology and Innovation Policy Development in Ghana Using the Transformative Change Lens. Accra: Council for Science and Industrial Research (CSIR). [Google Scholar]

- Radjou, Navi, and Jaideep Prabhu. 2015. Frugal Innovation: How to Do More with Less. London: The Economist. [Google Scholar]

- Radjou, Navi, Jaideep Prabhu, and Simone Ahuja. 2012. Jugaad Innovation: Think Frugal, Be Flexible, Generate Breakthrough Growth. Hoboken: John Wiley & Sons. [Google Scholar]

- Ragasa, Catherine, Kwaw S. Andam, Seth B. Asante, and Sena Amewu. 2020. Can local products compete against imports in West Africa? Supply-and demand-side perspectives on chicken, rice, and tilapia in Ghana. Global Food Security 26: 100448. [Google Scholar] [CrossRef]

- Rass, Matthias, Martin Dumbach, Frank Danzinger, Angelika C. Bullinger, and Kathrin M. Moeslein. 2013. Open innovation and firm performance: The mediating role of social capital. Creativity and Innovation Management 22: 177–94. [Google Scholar] [CrossRef]

- Ringle, Christian M., Sven Wende, and Jan-Michael Becker. 2015. SmartPLS 3. SmartPLS GmbH, Boenningstedt. Journal of Service Science and Management 10: 32–49. [Google Scholar]

- Robinson, A. Mark. 2018. Using multi-item psychometric scales for research and practice in human resource management. Human Resource Management 57: 739–50. [Google Scholar] [CrossRef]

- Sherman, Arie, and Tal Shavit. 2020. Work and happiness: An economic perspective. In The Routledge Companion to Happiness at Work. London: Routledge, pp. 283–93. [Google Scholar]

- Shmueli, Galit, Marko Sarstedt, Joseph F. Hair, Jun-Hwa Cheah, Hiram Ting, Santha Vaithil-ingam, and Christian M. Ringle. 2019. Predictive model assessment in PLS-SEM: Guidelines for using PLSpredict. European Journal of Marketing 53: 2322–47. [Google Scholar] [CrossRef]

- Shpak, Nestor, Sviatoslav Knyaz, N. Myroshchenko, and O. Kolomiyets. 2014. Commercialisation of high-tech products: Theoretical-methodological aspects. Econtechmod 3: 81–88. [Google Scholar]

- Tang, Kai, Yuan Qiu, and Di Zhou. 2020. Does command-and-control regulation promote green innovation performance? Evidence from China’s industrial enterprises. Science of the Total Environment 712: 136362. [Google Scholar] [CrossRef]

- Tsatsenko, Natalia. 2020. SME development, economic growth and structural change: Evidence from Ghana and South Africa. Journal of Agriculture and Environment 2: 1–13. [Google Scholar]

- Ullah, Barkat. 2019. Firm innovation in transition economies: The role of formal versus informal finance. Journal of Multinational Financial Management 50: 58–75. [Google Scholar] [CrossRef]

- UNCTAD. 2019. Report of Ghana Private Sector Development Strategy 2010–2015. Available online: https://unctad.org/en/Pages/DIAE/Entrepreneurship (accessed on 8 October 2020).

- UNESCO. 2018. Higher Education and the Sustainable Development Goals. Available online: https://en.unesco.org/themes/higher-education/sdgs (accessed on 16 March 2020).

- UNIDO. 2013. The Industrial Policy Process in Ghana. Working Paper. Available online: https://moti.gov.gh/docs/IndustrialPolicy (accessed on 2 March 2020).

- Wach, Dominika, Ute Stephan, and Marjan Gorgievski. 2016. More than money: Developing an integrative multi-factorial measure of entrepreneurial success. International Small Business Journal 34: 1098–121. [Google Scholar] [CrossRef]

- Wachinga, Hillary. 2019. National Innovation System Factors, Incentives, Culture and Institutional Linkages in Kenyan Ict Innovation Firms. Callaghan: UoN. [Google Scholar]

- Wandera, Faith Hamala. 2021. The innovation system for diffusion of small wind in Kenya: Strong, weak or absent? A technological innovation system analysis. African Journal of Science, Technology, Innovation and Development 13: 527–39. [Google Scholar] [CrossRef]

- Weyori, Alirah Emmanuel, Mulubrhan Amare, Hildegard Garming, and Hermann Waibel. 2018. Agricultural innovation systems and farm technology adoption: Findings from a study of the Ghanaian plantain sector. The Journal of Agricultural Education and Extension 24: 65–87. [Google Scholar] [CrossRef]

- World Bank Group. 2019. Ghana Digital Economy Diagnostic. Washington, DC: World Bank. Available online: https://openknowledge.worldbank.org/handle (accessed on 2 October 2020).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).