Abstract

The present research focuses on whether the different combinations of the micro, small and medium-sized enterprises’ (SMEs) international scale and scope affect their international performance differently. The major purpose of this research is to study the paramount relationship between the SMEs’ international strategies and international performance. With a sample composed of 307 international SMEs, our empirical analysis defines three different strategic groups regarding the scale and scope of internationalization, that is, a high, medium and low international exposure of the firms. The scope, as an important international strategic dimension, is taken from two angles, the number of countries and the number of regional blocs where the firms operate. We assessed the strategic groups’ implications on the firms’ international performance. The latter was taken as a multidimensional construct composed of the financial, strategic and overall international performance respectively. We used the hierarchical regression analysis to test our hypotheses, and major results emerged. Higher levels of commitment with the international markets lead to better financial, strategic and overall international performances. These results are of utmost importance from the theoretical point of view and for the strategic decision-making of SMEs, opening new avenues for future studies.

1. Introduction

The present research is grounded in the international business and strategic management fields. The conceptual and empirical approach addresses the international strategy and international performance relationship of the micro, small and medium-sized enterprises (SMEs). The major purpose of this research concerns the study of whether the different combinations of the SMEs’ international scale and scope affect their international performance differently. Thus, our primary research aim is to study the effects of the different international strategic positioning on the international performance of SMEs. To accomplish this objective, we took the degree of internationalization and the international performance of the firms as multidimensional constructs.

In the context of SMEs, the international strategy is an important strategy that deserves more investigation (Lobo et al. 2020). We took the SMEs’ international strategy as a multidimensional construct combining the firms’ international strategic decisions concerning the scale and scope of internationalization (e.g., Cerrato and Fernhaber 2018). Then, we classified three different strategic groups based on the SMEs international exposure, linking these two determinant dimensions within the domain of the firms’ internationalization, i.e., concerning their strategic positioning (cf. Kumar Singal and Jain 2014). Concerning the SMEs’ international performance, in this research, it is composed of the SMEs’ international objectives and overall evaluation of the international activity. Thus, we considered the financial, strategic and an overall dimension of international performance, respectively.

Studying the internationalization and performance of SMEs is part of the recent stage of research within the internationalization context (Morais and Ferreira 2020; Steinhäuser et al. 2020). SMEs are an important agent of the world economy (Genc et al. 2019). Due to their increased presence and importance within the international markets, SMEs’ internationalization is an important field of research (Steinhäuser et al. 2020). This, however, is fragmented (Steinhäuser et al. 2020) with a relative lack of consensus concerning the relationships (Morais and Ferreira 2020), although “the notion that international expansion is ‘good’ is a core argument of International Management studies” (Contractor et al. 2007, p. 401). It is in this rationale that the present research is focused.

As a final point, according to Pangarkar (2008), the observed inconsistency of results in the literature regarding the internationalization and performance relationship is a consequence of a wide variety in the usage of measures of the degree of internationalization (DOI) and the firms’ performance. Despite the little consensus and the complexity surrounding this relationship, this is a very important issue in the business field (Cerrato et al. 2016). In this vein, the relationship between the DOI and performance is a critical and relevant one within the international business context of the SMEs (e.g., Hosseini et al. 2018; Pacheco 2019). Hence, our focus is on the relationship between the internationalization and performance of SMEs, a relationship that is not fully understood and deserves more investigation (Benito-Osorio et al. 2016).

Concerning the structure of the present research, section two is composed of the theoretical foundation regarding the international strategy, the international performance, their relationship and the development of the hypotheses. In the following section, number three, the methodology followed is addressed. In section four we present the hypotheses testing and the empirical results. Subsequently, sections five and six contain the discussion and conclusion of the research, respectively. Finally, in section seven we address the limitations and future research avenues.

2. Theoretical Foundation

2.1. International Strategy

The international expansion of the SMEs is an important decision that may allow firms to grow and survive (Dutot et al. 2014). The present research takes the SMEs’ international strategy as a major one in the today’s globalized business world. Furthermore, research on business internationalization in Portugal is a pertinent subject, given the economic characteristics of the national market. As Portugal is a small country, firms are more likely to expand internationally (Nielsen 2010).

To perform our study, we defined the SMEs’ strategic groups according to their strategic positioning, considering the scale and scope of the international decisions. In fact, the international intensity, i.e., the scale of internationalization, and the geographic scope, i.e., the number of countries or regions in which firms operate, are two major decisions reflecting the firms’ international strategy (Tallman and Li 1996; Zahra 2020). To classify the different combinations between the two dimensions, we used the degree of internationalization (DoI) (Kuivalainen et al. 2012b). This is a widely used multidimensional measure of internationalization, despite the different approaches across the literature (e.g., Cerrato et al. 2016; Genc et al. 2019; Pacheco 2019; Pangarkar 2008).

Strategic Positioning

This research assesses the relationship between the firms’ DoI and their international performance. Measuring the DoI is an important procedure within the sphere of the firms’ internationalization, making it possible to identify different international strategies (Cerrato et al. 2016; Kuivalainen et al. 2012b). Performing this measurement is not a simple task, however, resulting in disparate and inconsistent results across the literature (Pangarkar 2008). The common usage of a single variable to assess the SMEs’ degree of internationalization (e.g., Hosseini et al. 2018; Ren et al. 2015; Thi Ngoc Huynh et al. 2018) does not reflect the complex business reality that it intends to measure (Genc et al. 2019). Therefore, in the present research, to avoid a simplistic approach concerning the SMEs’ international strategies and the assessment of the DoI, we used the combination between the scale and scope of the SMEs’ internationalization. The scale of internationalization assesses the level of the strategic intensity towards the international markets (Hosseini et al. 2018). The foreign sales to total sales (FSTS) is a widely used indicator to reflect that intensity, showing “(…) the strategic concern that a company attributes to serving international markets (…)” (Hosseini et al. 2018, p. 114). Given the fact that the international strategy of geographical diversity is not captured by the FSTS (Pangarkar 2008), we used the internationalization scope. This is a critical dimension to the internationalization strategy (Cerrato et al. 2016) and to the firms’ performance (Pangarkar 2008). To assess the scope we used the number of countries (e.g., Hsu et al. 2013; Navarro-García 2016) and regional blocs (e.g., Pangarkar 2008; Rugman and Verbeke 2004), in which firms perform their international sales (Kuivalainen et al. 2012b). It should be emphasized that the regional analysis is a relevant dimension in the international strategy (e.g., Freixanet and Renart 2020; Ismail and Kuivalainen 2015; Rugman and Verbeke 2004), bringing an additional and more accurate measure of the firms’ internationalization (Pangarkar 2008). Thus, to distinguish the different strategic groups, we took the DoI as a multidimensional construct, combining the referred dimensions of the SMEs internationalization.

Therefore, we classified three different levels of the firms’ strategic positioning. The firms with a high DoI exhibited high levels of international intensity, i.e., FSTS, and a diversified and wide geographical scope of their international sales, i.e., a correspondingly high number of countries and a high number of regions. The firms with a low DoI exhibited a low level of international sales, and the firms with a medium DoI are those that exhibited high levels of international intensity, while they do not fulfil the high scope criteria concerning the corresponding number of countries and regions.

2.2. SMEs Internationalization and International Performance

The present research line focuses on the relationship between the SMEs international strategies and international performance. This is an undoubtedly important relationship within the international business research field (Hitt et al. 2006; Hosseini et al. 2018; Kuivalainen et al. 2012b; Pacheco 2019). The internationalization strategy embodies an opportunity for development and growth for SMEs (Benito-Osorio et al. 2016; Navarro et al. 2010; Ruzzier et al. 2007), and specifically for the new ventures, a strategic option that brings challenges and opportunities (Sapienza et al. 2006). For many firms, internationalization embodies a competitive necessity (Joensuu-Salo et al. 2018). In this sense, research on the impact of the scale and scope of the internationalization on the firms’ performance is an important line of research (Kuivalainen et al. 2007).

Compared to the larger firms, the SMEs typically suffer from scarcity of resources, specially, financial, physical and human (Steinhäuser et al. 2020). In regard to internationalization, firms face a wide range of challenges that emerge from the typical environmental uncertainty in the international markets (Nielsen 2010). A lot of risks arise, namely, those associated with culture shock, different legal regimes and customer behaviors (Lin and Cheng 2013), differences in distribution systems and profitability of the industry (Zahra and George 2002). Barkema and Chvyrkov (2002) also highlight the complexity that arises from different governments, suppliers, customers and competitors. Moreover, these firms may suffer from the liability of newness (Zahra 2005), the liability of foreignness and the liability of outsidership (Johanson and Vahlne 2009). In this international context, SMEs also may suffer from scarcity of resources (Hollender et al. 2017), and other types of limitations, such as those related to information, capital or managers’ skills (Lobo et al. 2020). Despite the resource issues, however, SMEs are more flexible and nimbler than larger firms, a fact that may facilitate their internationalization (Li et al. 2012). Nevertheless, internationalization, despite all the complexities, embodies a strategic option that promotes the exploration, exploitation and development of growth and learning opportunities (Johanson and Vahlne 2009; Zahra et al. 2000) as well the application of core competencies (Hitt et al. 2006). Internationalization also makes it possible to achieve economies of scale and scope (Hsu et al. 2013), to exploit the firms’ tangible and intangible assets (Zahra et al. 2003), to obtain technological and organizational learning (Hitt et al. 2006) and exploit specific advantages of the host countries (Lu and Beamish 2004). Therefore, knowing, studying, and understanding the effect of internationalization on the SMEs’ performance emerge as determinant for their activity. This embodies a critical relationship in the international business context, and it is a current discussion theme due to its importance and the increasing global competitive context of the markets (Benito-Osorio et al. 2016).

However, this is not a “peaceful” relationship. Across the literature we observed inconclusive findings. In fact, according to many empirical results, the effects of internationalization on the firms’ performance are somewhat mixed and inconsistent (Hutzschenreuter and Horstkotte 2013; Lu and Beamish 2004; Thi Ngoc Huynh et al. 2018). “Researchers found significant, insignificant, positive, negative, linear, non-linear, U-shaped, inverted U-shaped, sigmoid, and inverted sigmoid relationships between internationalization and performance” (Hosseini et al. 2018:119). Accordingly, the relationship between the DoI and performance appears to be non-consensual (Hsu et al. 2013). One of the main reasons that gives rise to the non-robustness of the results across the literature is due to the non-homogenized use of internationalization measures and also to some contradictions between theory and measurement (Hennart 2007). It should be noted that, not only due to the internationalization measures, but also to the diverse usage and narrowness of performance measures, the results have proved to be inconsistent (Pangarkar 2008). In fact, as highlighted by Christoffersen et al. (2014), with different measures, a given antecedent may have an accordingly positive, negative or neutral effect. On the other hand, Contractor et al. (2007) stress that the internationalization in general is positive for firms, arguing that the inconsistencies in the literature are due to not taking into account the different stages of the firms’ internationalization and to the studies not being divided into sectors, namely, services and industry, which will behave differently. Internationalization offers advantages and sets up an important growth-promoting strategy (Ruzzier et al. 2007; Zahra et al. 2000), particularly for SMEs located in limited domestic markets (Hsu et al. 2013). Along this line, we took internationalization as a strategy that promotes better performances to the SMEs.

2.3. International Performance

The focus on performance is important, although a blind view of growth and cost-cutting may have harmful consequences, such as damaging the organization’s uniqueness and weakening competitive advantages, so “in fact, the growth imperative is hazardous to strategy” (Porter 1996, pp. 76–77). Studying performance and, in particular, international performance, is crucial for the understanding of what determines it and of its composition (Diamantopoulos and Kakkos 2007). It should be noted that in the international business field, performance is surrounded by critical issues and challenges with regard to its measurement (Hult et al. 2008). In this context, the internationalization and performance relationship is a widely debated territory, both in relation to the larger firms (e.g., Ferraris et al. 2016), as well as to SMEs (e.g., Morais and Ferreira 2020).

The definition of performance is not homogeneous and consensual (Hosseini et al. 2018). Thus, regarding the concept of international performance, the conceptual approach followed in the present research is based on the following definitions. To Knight and Cavusgil (2004, p. 129), international performance “(…) is defined as the extent to which financial and other goals are achieved as a function of business strategies”. According to Knight and Cavusgil (2005, p. 18) “international performance is defined as the extent to which firm objectives are attained in foreign markets as a function of specific orientations and strategies.” Finally, following Zou et al. (1998, p. 41), the export performance is taken “(…) as the financial and strategic performance of the export venture and the firm’s satisfaction with the export venture.” Therefore, taking the above definitions into account, we took the SMEs’ international performance as a multidimensional construct assessing different organizational objectives concerning the firms’ international actions, namely, in three dimensions, financial, strategic and overall performance, respectively. In this context, given the importance of the Cavusgil and Zou’s (1994) study to the literature, the consideration by the authors of the strategic and economic objectives should be noted. It is important to understand the impact of the firms’ internationalization on financial performance but also on non-financial performance (Zahra and George 2002). In fact, to carry out research on the SMEs’ international involvement, it is required that performance measures not only assess financial performance, but other types of outcomes (Martineau and Pastoriza 2016). Considering the multidimensional approach of performance in this investigation, and according to one of the key performance concepts that we followed that defined a triple vision of the construct into financial, strategic and overall satisfaction performance (cf. Zou et al. 1998), we attest its current application in recent investigations (e.g., Ahamed and Skallerud 2015; Gnizy and Shoham 2014; Oura et al. 2016). Moreover, Kuivalainen et al. (2012b) in their holistic model regarding the SMEs international patterns recommended several categories regarding the international performance, of which we highlight the international financial performance and the performance relative to firm goals.

Due to the necessary construct validity in the investigation (cf. Christoffersen et al. 2014), an international performance scale with several domains is used. Those domains are scientifically based on the international business literature and allow the international performance evaluation. From our literature review, we took performance as multidimensional, and because the typical and important financial measures do not assess the entire reality and the firms’ objectives, then, a more accurate analysis is pursued concerning financial, non-financial and overall performance, respectively (Hult et al. 2008; Katsikeas et al. 2000). In fact, a firm, when attempting its international action, has multiple objectives (Diamantopoulos and Kakkos 2007; Madsen 1998). Considering the different dimensions and objectives of the firms’ international performance, we emphasize, following Gerschewski and Xiao (2015, pp. 617–18), that it constitutes a “(…) suitable approach, as it recognizes that each individual firm may have different internal goals in comparison to its competitors.” In fact, firms do not have the same objectives and do not look to the international action in the same way and with the same degree of importance (Madsen 1998). Depending on the stage they are in, as Pangarkar (2008) points out, firms, for instance, may give more significance to sales than to profitability. Therefore, the adapted international performance scale in this research, measures the SMEs financial objectives, strategic objectives and the satisfaction with the overall performance.

2.4. Overview of the Conceptual Model and Hypotheses Development

Internationalization is taken as a major decision within SMEs, with important implications for the international performance. A multidimensional approach to DoI is a more accurate portrait of the complex reality it intends to represent (e.g., Genc et al. 2019). We used the internationalization scale and geographical scope to define the SMEs’ strategic positioning. Analyzing the relationship between internationalization and performance is a significant research subject within the international business, and requires further investigation and robustness (Morais and Ferreira 2020; Pangarkar 2008; Wiersema and Bowen 2011). In this context, there is a need to distinguish between international performance, national performance and total performance (Martineau and Pastoriza 2016). In fact, there are many researchers who do not establish this distinction, a fact that jeopardizes the understanding and the interpretation of the results (Martineau and Pastoriza 2016). The distinction between domestic and international performance is a relevant point in the field, although not always verified (Lages et al. 2005). Following this line, we measured the SMEs’ international performance as a multidimensional construct.

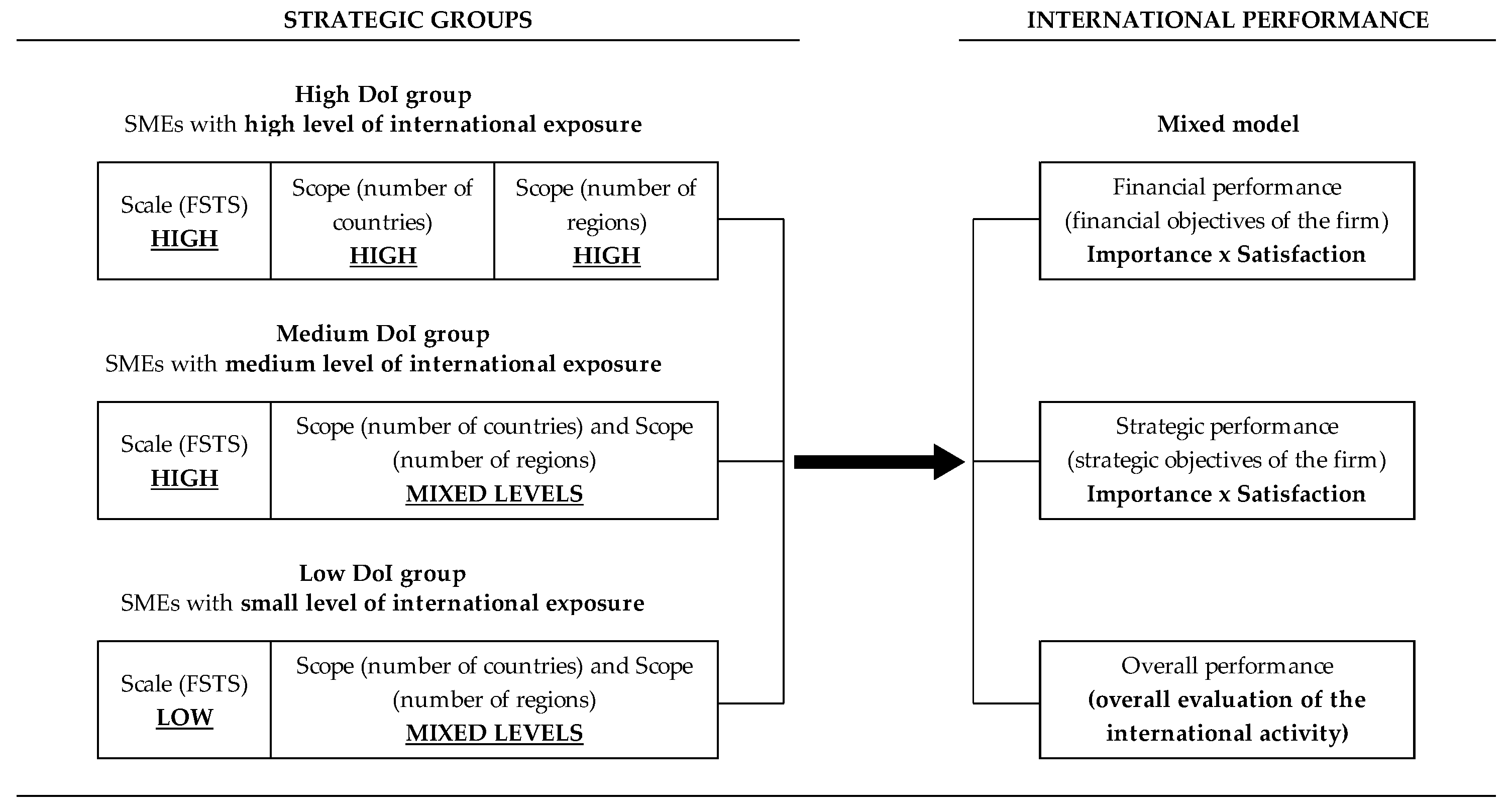

The present research assesses the link between the firms’ DoI and international performance (Figure 1 below). Although, as we have already mentioned, this is not a consensual relationship (Hosseini et al. 2018). Following the rationale that, as internationalization increases, the performance improves because of the knowledge gained, the access to resources, (Hitt et al. 2006), the learning opportunities with the different business environments, the recoup of R&D costs and economies of scale (Pangarkar 2008), we assumed that the more intense and diverse the internationalization is, the more international performance the firm accomplishes.

Figure 1.

Conceptual model overview.

2.4.1. International Financial and Strategic Performance

In the context of firms’ internationalization, the different international markets, while strategically relevant, may generate new opportunities to firms (Hitt et al. 1997; Zahra et al. 2000); may help them to reduce risks by the operations across the different countries (Lobo et al. 2020); and may promote potentially lower levels of competitive intensity (Li et al. 2012). Hence, a dispersed internationalization suggests the possibility to better performances. In fact, according to Schwens et al. (2018) meta-analysis on the internationalization and performance relationship, the firms’ international scale and scope positively affect the firms’ sales growth and profitability. Accordingly, this result indicates that the benefits from internationalization accordingly outweigh the costs (Schwens et al. 2018). In this sense, internationalization embodies a strategy that promotes the firms’ performance (Gnizy and Shoham 2014). Additionally, according to Hitt et al.’s (2006) literature review, internationalization promotes learning and operational efficiency that positively affect the firms’ financial performance. In fact, the financial performance is an important outcome of the firms’ internationalization, and many studies attest the positive effect of internationalization on it (Zahra et al. 2000). For instance, Kuivalainen et al. (2007) attest that the true born-globals are associated with higher sales performance, profit performance and sales efficiency performance. Among several aspects, the authors approach the degree of satisfaction with the export volume, market share, overall profitability, and the ratios of the export sales turnover to the total number of employees allocated to the activity and to the total number of countries. Following Pangarkar (2008), a high international diversity, with an inherent psychological distance, allows firms to improve competitiveness and performance, as a consequence of the possibility of learning through the variety of markets. Pangarkar (2008) attests the positive impact of DOI on the SMEs’ performance, this latter composed of the experience or knowledge gained by the internationalization and financial objectives. Following Karagozoglu and Lindell (1998), internationalization promotes the firms’ success, insofar as it allows for increasing the potential exploitation of new strategic opportunities, responding to requests from foreign buyers, achieving competitive levels of R&D spending, and compensating for the weaknesses and saturation of the domestic market. Financial performance is often the main objective of firms (Zou and Cavusgil 2002). However, depending on the specific objectives and context of the different firms, the financial objectives can be delayed due to other purposes (Trudgen and Freeman 2014). Further, as emphasized by McDougall and Oviatt (1996), a strong profitability does not always embody the main performance objective of the firms. In fact, the extant literature emphasizes that, when firms go international, both financial and strategic objectives are in the core of their international activities, because an exclusive focus on the financial ones may overlook the firms’ strategic and competitive goals (e.g., Cavusgil and Zou 1994; Chung and Kuo 2018; Li et al. 2017). As Porter (1996, p. 77) states, “unlike broadening domestically, expanding globally is likely to leverage and reinforce a company’s unique position and identity.” For instance, Ren et al. (2015) attest that internationalization positively affects innovation performance, specifically when R&D or marketing capabilities exhibit high levels. Therefore, major strategic objectives emerge during the firms’ internationalization. Taking the above into account and according to other studies in the field (e.g., Pangarkar 2008), the higher they have their DoI, the better performance they should accomplish. Consequently, we formulate hypothesis one (H1) and two (H2) as the following:

Hypothesis 1a (H1a).

The higher the firms’ DoI, the better is their international financial performance. firms with high DoI (high levels of international exposure) have better levels of international financial performance than firms with low DoI (low levels of international exposure).

Hypothesis 1b (H1b).

The higher the firms’ DoI, the better is their international financial performance. firms with medium DoI (medium levels of international exposure) have better levels of international financial performance than firms with low DoI (low levels of international exposure).

Hypothesis 1c (H1c).

The higher the firms’ DoI, the better is their international financial performance. firms with high DoI (high levels of international exposure) have better levels of international financial performance than firms with medium DoI (medium levels of international exposure).

Hypothesis 2a (H2a).

The higher the firms’ DoI, the better is their international strategic performance. firms with high DoI (high levels of international exposure) have better levels of international strategic performance than firms with low DoI (low levels of international exposure).

Hypothesis 2b (H2b).

The higher the firms’ DoI, the better is their international strategic performance. firms with medium DoI (medium levels of international exposure) have better levels of international strategic performance than firms with low DoI (low levels of international exposure).

Hypothesis 2c (H2c).

The higher the firms’ DoI, the better is their international strategic performance. firms with high DoI (high levels of international exposure) have better levels of international strategic performance than firms with medium DoI (medium levels of international exposure).

2.4.2. International Overall Performance

Internationalization promotes advantages for the firms, such as the improvement of management processes, international skills and competitiveness, economies of scale and the increase of the overall performance (Lages et al. 2009). Measuring the overall performance is also an important dimension of the international sphere of the firms. In addition, it is also important to consider its measurement in relation to competitors (e.g., Hollender et al. 2017; Martin et al. 2017). Consequently, taking all the above-mentioned implications of internationalization for the firms’ performance, we formulate hypothesis three (H3) as the following:

Hypothesis 3a (H3a).

The higher the firms’ DoI, the better is their international overall performance. firms with high DoI (high levels of international exposure) have better levels of international overall performance than firms with low DoI (low levels of international exposure).

Hypothesis 3b (H3b).

The higher the firms’ DoI, the better is their international overall performance. firms with medium DoI (medium levels of international exposure) have better levels of international overall performance than firms with low DoI (low levels of international exposure).

Hypothesis 3c (H3c).

The higher the firms’ DoI, the better is their international overall performance. firms with high DoI (high levels of international exposure) have better levels of international overall performance than firms with medium DoI (medium levels of international exposure).

3. Methodology

3.1. Research Sampling and Procedure

The present research focuses on the international strategy and international performance of the Portuguese international SMEs. The definition of SME is not a consensual one (Hsu et al. 2013). However, firms must be of this type to be part of the present study. We followed the European Union’s definition (e.g., Schueffel et al. 2014). The firms that did not meet the SME criteria were removed from our database. Additionally, we used the respondents’ position to assess and allow their participation. As it is a widely used method in the context of international business research (e.g., Diamantopoulos et al. 2014; Hagen et al. 2012; Jin and Jung 2016; Li et al. 2012), the most knowledgeable individual concerning the firms’ international activities was the target of our survey. Therefore, our sample is composed of founders, owners, chief executive officers (CEOs), managers of international activities, international market managers and commercial managers. The data collection instrument is the survey, which was sent by e-mail directed at the international top manager from 2–30 April 2019. Thus, our study is based on primary data. A pretest was conducted with 10 individuals representing managers working in internationalized firms.

Concerning the structure of the survey, an initial question was made as an admissibility criterion for participation, assessing the job position performed by the respondent. As mentioned, only the most knowledgeable individuals concerning the firms’ international activities participated in this study. The next section of the survey was composed of the questions concerning the firms’ international scale and scope. The respondents indicated whether the firms had already reached the level of 25% or not in FSTS and the number of countries and which regional blocs they operate in. In the following section, the firm’s international performance was requested by the financial and strategic objectives and the overall performance. Here, the respondents indicated which financial and strategic objectives were considered in their firms’ international activities and their corresponding importance and satisfaction. Concerning the overall performance, the respondents indicated their evaluation of the overall performance of the firms’ international activities. Finally, the firms’ year of founding, the industry sector and the social desirability were requested as control variables.

The level of analysis is grounded on the firm level, as many investigations (e.g., Bianchi et al. 2017; Dutot et al. 2014; Pangarkar 2008). Due to the small size of SMEs, this appears to be the adequate level, contrary to the larger firms, where some research bias and inconsistencies may emerge due to the business’ diversity (Pangarkar 2008).

The sample of the present study is composed of 307 Portuguese international SMEs. We used a multi-industry sampling approach to increase the observed variance and increase the possibility of generalizing the results (e.g., Navarro-García et al. 2016). The respondents are Portuguese speakers, thus, the international performance scale and the social desirability scale were translated from English to Portuguese following the translation/back-translation procedure of Behling and Law (2000).

Regarding the data source, we controlled for common method bias given that this research is based on a single respondent self-report (Podsakoff et al. 2003). Following Podsakoff et al. (2003), social desirability was controlled to mitigate the effects of corresponding socially desirable responses. In fact, the use of self-report measures is common in business management research, where the presence of the social desirability effect in the response is a reality that must be controlled (Thompson and Phua 2005). Additionally, the item ambiguity and complexity were also taken into account (Podsakoff et al. 2003). During the translation process and the pretest, some items were adapted and improved in slight details. Other issues relating to the survey structure and content were addressed during the pretest. The confidentiality of the participation and the non-existence of right or wrong answers was assured. We also appealed for honest responses (Podsakoff et al. 2003).

We also controlled for the age of the firms, given that it may influence the firms’ internationalization strategy, since it represents the firms’ business experience, resources and capabilities (Cerrato et al. 2016; Cerrato and Fernhaber 2018). The firms’ age may also influence their international performance (Lu et al. 2010). The industry where the firms operate should also be controlled in studies regarding the relationship between internationalization and performance (Hennart 2007). For instance, the type of industry affects the firms’ fixed costs (Hennart 2007), the ability to internationalize and the firms’ performance (Hitt et al. 2006; Li et al. 2012). Therefore, we controlled for the firms’ industry effects.

3.2. Measurement

3.2.1. Dependent Variable: International Performance

In the literature, the results are often contradictory about the relationship between internationalization and performance (Martineau and Pastoriza 2016). It should be noted that there is no consensus on the set of indicators to be used to measure international performance (Ruzo et al. 2011). The complexity of its operationalization is manifest, not only given its multidimensional nature (e.g., Diamantopoulos and Kakkos 2007; Gerschewski and Xiao 2015; Katsikeas et al. 2000) and the conceptualization of the construct, but also, given the difficulties in obtaining concrete and rigorous indicators (Dess and Robinson 1984). In fact, in regard to this last aspect, many managers show themselves, as noted by Musteen et al. (2014, p. 759) “(…) reluctant to provide objective performance data (given prevailing mistrust).” Therefore, the subjective measures appear to be of utmost importance when performance is at stake. Given the difficulties in operating a holistic measure of performance, it is certain that in addition to the objective measures, often economic, the subjective measures of performance are important and even required by managers, who approve the subjective way of measurement (Madsen 1998). Thus, performance can be measured by objective and subjective measures simultaneously (e.g., Hagen et al. 2012; Ruzo et al. 2011) or not, the preference for the subjective ones being observable (Hult et al. 2008). Indeed, they make it possible to overcome the difficulties when studying private companies whose objective data are not easily available (Hult et al. 2008). Katsikeas et al. (2000) also report on the problem of the access to objective data, stating the importance and applicability of the subjective measures. These authors also recognize the difficulties of accessing updated secondary data and accessing the data of small firms. Therefore, despite the common use of objective measures, the subjective ones are an important type of assessing performance due, to their advantages in their application and in data collection (Wall et al. 2004). Indeed, the use of subjective performance measures is widely observable in the international business research (e.g., Diamantopoulos et al. 2014; Gerschewski et al. 2015; Hagen et al. 2012; Martin et al. 2017; Prange and Pinho 2017). Both because of the managers’ resistance to provide objective information (cf. Musteen et al. 2014), and the difficult availability of performance information, the subjective measures are widely used (Costa et al. 2015). This kind of measures also enables making the comparison between very different companies with regard to their objectives (Hult et al. 2008) and makes it possible to overcome the internal non-distinction between the domestic and international activities from the financial point of view (Prange and Pinho 2017). We follow a multidimensional approach of performance where the consideration of the firms’ objectives is at the core of its measurement. Notably, the subjective measures of performance allow us to assess the degree of satisfaction and/or the fulfillment of objectives related to the firms’ performance as a whole and also in different dimensions (Christoffersen et al. 2014). Such a measurement becomes feasible despite the possible personal biases in self-reporting (Musteen et al. 2014), due to the fact that subjective performance measures are associated with the objective ones (Dess and Robinson 1984; Wall et al. 2004). This fact, is observable in previous research (e.g., Hollender et al. 2017). These authors emphasize the advantages of the subjective measures, their usefulness and scientific adjustment in the strategic studies of SMEs. Consequently, “(…) we can have some confidence in findings from studies so far that have been based on subjective company performance” (Wall et al. 2004, p. 115).

Hult et al. (2008) emphasize the need for performance measures to integrate as a multidimensional construct the measurement of financial performance, operational or non-financial performance, and general effectiveness measured by indicators such as the perception of overall performance and performance in relation to competitors. Additionally, in their extensive review of the literature, Katsikeas et al. (2000) highlight the use of financial, non-financial and generic performance measures. To measure performance, and because a firm when attempting its international action has multiple objectives (Diamantopoulos and Kakkos 2007), not only the economic objectives but also the strategic ones should be taken into account (Cavusgil and Zou 1994).

Therefore, taking the above into account, for this research, we measured the SMEs international performance by primary data, by a subjective multidimensional measure, at the firm level, assessing the financial, strategic and the overall performance respectively.

Dimensions

Based on studies in the international business field, the financial performance indicators par excellence are those related to sales and profits. These indicators are widely used when measuring the international performance (e.g., Hollender et al. 2017; Jin and Jung 2016; Knight and Cavusgil 2005; Navarro et al. 2010; Ruzo et al. 2011). Taking into consideration the proposed measurement mechanics, each item reflects a specific objective. The respondent indicated which of those, or if all of them, were objectives of the firms’ international activity and if so, what their corresponding degree of importance and satisfaction was. The adopted objectives for the financial dimension are: international sales growth (Gerschewski et al. 2015); profit growth in foreign markets (Zhou et al. 2012); and increase the profitability of the company (Cavusgil and Zou 1994).

Similarly to the financial dimension, a three-component response scale is used for the strategic dimension. First, the respondent is asked to state whether or not each of the strategic objectives was an objective of the firms’ international activity. Second, what the degree of importance of each of the considered objectives was, and third, what the corresponding degree of satisfaction was. For the strategic dimension, we took the Cavusgil and Zou (1994, p. 18) strategic objectives scale: “gain a foothold in the export market; increase the awareness of our product/company; respond to competitive pressure; improve our company’s market share position; expand strategically into foreign markets; increase the profitability of the company; just respond to enquiries from abroad”. This is a widely used and adapted scale in studies within the field of internationalization when measuring strategic performance (e.g., Chung 2012; Chung and Kuo 2018; Chung et al. 2015; Jeong 2016; Li et al. 2017). Given the nature of the item “increase the profitability of the company” (Cavusgil and Zou 1994, p. 18), it was relocated in the financial dimension. A final item was added, “experience or knowledge gained as a result of entering foreign markets”, adopted from Pangarkar (2008, p. 480), given the revealed importance of learning and knowledge during the internationalization. Both the financial and strategic objectives were measured on two 5-point Likert scales response format: (to assess the objectives’ level of importance), the scale ranging from 1 = not important to 5 = very important; and (to assess the objectives’ level of satisfaction), ranging from 1 = not at all satisfied to 5 = very satisfied.

As emphasized, the overall performance of the international activity is also taken into consideration. We adapted the overall performance scale developed by Jaworski and Kohli (1993, p. 68), used in several studies (e.g., Hollender et al. 2017). This scale assesses the satisfaction with the firms’ overall performance in the last year, and the overall performance in relation to the main competitors also in the last year. The adapted items are the following: how do you evaluate the overall performance of your firm’s international activity in the last year; how do you evaluate the overall performance of your firm’s international activity in relation to your competitors in the last year. A final item was added: how do you evaluate the performance of your firm’s international activity in the last 3 years. This last item is a complementary item of performance related to the historical perspective of the firm performance (Katsikeas et al. 2000). This historical perspective is important and acknowledged in the international business literature (e.g., Bianchi et al. 2017; Cavusgil and Zou 1994). We considered the time period of three years as other studies have (e.g., Hagen et al. 2012; Prange and Pinho 2017). It is a commonly used temporal space (Katsikeas et al. 2000). This scale was submitted to a 5-point Likert scale response format ranging from 1 = very bad to 5 = very good.

Therefore, in order to assess the international financial, strategic, and overall performance of the firm, we performed the following procedure. First, the respondent had to indicate which of the financial objectives was or were considered for the firm’s international activity. After the selection of the objectives, those are the ones for which the respondent had to provide the level of importance. Further, for each selected objective, together with the level of importance, the respondent had to indicate the level of satisfaction. Second, the respondent had to proceed with the same structure of response to the international strategic objectives. These measurement mechanics makes it possible to avoid the problems of considering by the same token, for instance, a high satisfaction level with some objectives with high and low importance. Finally, to assess the international overall performance, the respondent provided the evaluation of the international activity regarding the last year of international activity, the last three years of international activity and in relation to the competitors in the last year. Subsequently, we provide the way to calculate the corresponding different considered dimensions of international performance.

Mode of Assessment

The firms’ objectives can be realistically different between the firms. Madsen (1998, p. 90) notes that “it only needs to be pointed out that, in some instances, it may be more important for a firm to gain experiential knowledge about exporting processes than it is to reap immediate sales and profits”. Consequently, the objectives that each firm establishes and intends to achieve with its international action can be quite varied.

In order to adopt a more appropriate measure of international performance and avoid narrow measures, we took into account different firms’ objectives, and their corresponding importance and satisfaction. In fact, to effectively measure the firms’ international performance, it is crucial to assess the different firms’ objectives, their importance and satisfaction (Diamantopoulos and Kakkos 2007). Gerschewski et al. (2015) follow this performance measurement philosophy, multiplying the levels of importance and satisfaction for each item. According to the practice in the literature, we proceeded with the calculation of the corresponding composite measures for the three dimensions (Gerschewski and Xiao 2015; Katsikeas et al. 2000).

Therefore, following this approach, and to improve the measurement of performance, Diamantopoulos and Kakkos (2007, p. 12) edited a composite measure of export performance: [ , where Ij is the importance of each objective, and Sj is the achievement satisfaction of each objective]. As central features in the measurement of performance, the degree of importance and the degree of satisfaction of each objective are taken into consideration. If not, some assessment errors may occur, for instance: an objective that exhibits high levels of satisfaction may not be important and does not, therefore, imply a successful scenario; and, on the other hand, an objective that exhibits low levels of satisfaction may not be important and, therefore, does not imply a scenario of failure (Diamantopoulos and Kakkos 2007).

Therefore, following this measurement mechanics, we developed the composite measure for the financial dimension (varying between 0 and 1), calculated by the following financial performance index (FPIi):

- FPIi is the financial performance index for company i;

- IFj is the importance of the financial objective j;

- SFj is the satisfaction of the financial objective j;

- and five is the maximum possible satisfaction for each objective.

Similarly, we developed a composite measure for the strategic dimension (varying between 0 and 1) calculated as the following strategic performance index (SPIi):

- SPIi is the strategic performance index for company i;

- IEj is the importance of the strategic objective j;

- SEj is the satisfaction of the strategic objective j;

- and five is the maximum possible satisfaction for each objective.

Finally, the overall performance assessment was developed with the following overall performance index (OPIi) (varying between 0 and 1):

- OPIi is the overall performance index for company i;

- Dj is the performance level of the item j;

- five is the maximum possible satisfaction value for each item;

- and three the total number of overall performance items.

3.2.2. Independent Variable: Degree of Internationalization (International Exposure)

Taking the DoI as a multidimensional indicator, we measured it by the combination between the internationalization scale and scope of the SMEs. International SMEs are mainly exporting firms due to the low initial required investment of this international entry mode (Hosseini et al. 2018). Therefore, exporting is their major entry mode in the international markets (Morais and Ferreira 2020). As Navarro-García et al. (2016, p. 1880) stated, “export is firms’ traditional route of access to foreign markets.” In this context, to accurately measure the scale of the internationalization, the international sales is a better indicator than only the value of exports, as it reflects not only exports, but also the sales of the foreign subsidiaries (Contractor et al. 2007; Denicolai et al. 2014; Ferraris et al. 2016). Thus, while an important indicator of the DoI, we took the FSTS to measure the scale of internationalization (Cerrato and Fernhaber 2018; Kuivalainen et al. 2012a; Sullivan 1994). To classify the strategic positioning of the firms to the FSTS, we took the widely used threshold of 25% (e.g., Gerschewski et al. 2015; Knight and Cavusgil 2004). Hence, we took the FSTS of 25% or more as indicative of a significant, intense and not sporadic internationalization (Kuivalainen et al. 2012a).

In relation to the geographical scope of internationalization, we considered the number of countries and the number of regions in which the firms generated international sales. The number of countries in which the firm operates was compared with the number of neighboring countries of the home country (Kuivalainen et al. 2012a). In this line, a firm with a high scope should generate international sales in at least one more country than the number of neighboring ones. However, in applying this criterion we must be aware that Portugal is a single-border country with Spain. Therefore, the consideration of the value one as the threshold to differentiate between a high or low international scope does not appear to be a fair criterion for the international SMEs’ strategic positioning. In the present research, taking into consideration that Portugal is part of the European Union, we took four countries as the distinctive criterion, since the average land borders of all the European Union members is four. Thus, the criterion for a high scope is that firms should generate international sales in five or more countries. As mentioned, jointly with the number of countries, we also took the regional criterion, using six regional blocs: “(…) (1) European Union countries; (2) other European countries (including Russia and Turkey); (3) North America; (4) Central and South America; (5) Asia; (6) Africa and Australia” (Cerrato et al. 2016, pp. 289–90). To classify the different DoI, we took two regions or more as indicative of a wider scope. Therefore, concerning the scope of internationalization, firms exhibit a diversification strategy with a wide geographical scope, if they generate their international sales in five or more countries within two or more regional blocs.

In the present research, as mentioned by Cerrato and Fernhaber (2018), we took a theory-driven approach taking into consideration the defined thresholds of scale and scope,. We measured the DoI as a categorical variable with three different DoI. A firm with a high DoI must exhibit 25% or more in FSTS, must be in five or more countries and in two or more regional blocs. A low DoI reflects the firms that do not exhibit 25% in FSTS, and a medium DoI the firms that exhibit 25% in FSTS although with mixed levels concerning the geographical scope.

3.2.3. Control Variables: Firms’ Age, Industry and Social Desirability

Firms’ Age

We controlled for the firms’ age with the number of years of activity since their creation (e.g., Cerrato et al. 2016). It was measure by the difference between the year of data collection and the year of firm foundation (Hollender et al. 2017).

Industry

Industry effects were assessed by dummy variables, concerning the three industry sectors that, following Gerschewski and Xiao (2015), are: other, e.g., agriculture, fishing and forestry (Sector I); manufacturing (Sector II); services (Sector III). In order to represent these sectors we used two binary variables with the following codification: binary variable 1 (BV1) with the codification (1 and 0) for sector I; binary variable 2 (BV2) with the codification (0 and 1) for sector II. Sector III took the codification (0 and 0).

Social Desirability

To control for social desirability we used the scale of Reynolds (1982) Form C. This scale was translated from English to Portuguese and was measured on a 5-point Likert scale response format ranging from 1 = strongly disagree to 5 = strongly agree.

4. Empirical Results

As a results’ preamble to the hypotheses testing, we should report on the Harman’s single factor test. Following Podsakoff et al. (2003), we performed this test and the result suggests that common method bias is not a major concern, because no single factor emerged and the first one did not account for the majority of the variance. An exploratory factor analysis was performed for social desirability and no unidimensional structure emerged. However, both the true and false dimensions may be expected. Therefore, after the structure purification due to some issues, two factors in a total of eight items emerged. A total scale mean score was calculated for this variable.

In relation to the sample, concerning the industrial sectors, we observed the following: sector I (other, e.g., agriculture = 4.23%); sector II (manufacturing = 53.42%); sector III (services = 42.35%). Table 1 reports on the firms’ strategic groups, firms’ age and the respondents’ job position.

Table 1.

Firms’ strategic groups, firms’ age and the respondents’ job position.

In relation to the total sample, in regard to the occupied position in the firm, 46.9% were founders and owners; 21.8% were CEOs; 13.7% commercial managers; 13% managers of international activities; and 4.6% international market managers. Regarding the social desirability, the respondents exhibited a total mean of 3.585.

4.1. Hypotheses Testing

To execute the hypotheses testing, we performed several hierarchical linear regression analyses with a confidence interval of 95% in IBM SPSS Statistics version 25 controlling for industry, firms’ age and social desirability. We performed the hypotheses testing following Field (2009). Therefore, no influential cases were detected with an undue influence on all the following models. Regarding the correlations, the VIF and the T tolerance values, no multicollinearity concerns exist within the models. The independence of errors was verified in all regression models with the Durbin-Watson statistic (d) = 2.026; d = 2.004; d = 2.097 in hypothesis one, two and three, respectively. The linearity, homoscedasticity and the normality of the residuals were also observed.

4.1.1. Hypothesis 1

The statistic F test shows that the final regression model is significant at p < 0.001. Hypothesis one stated that the firms with high and medium DoI will financially perform better than firms with low DoI and firms with high DoI will financially perform better than firms with medium DoI.

According to the results (Table 2; final model one), both international SME classes, firms with high DoI and firms with medium DoI respectively, significantly differed from the firms with low DoI. We corroborated the expected positive relationship between the DoI and the international financial performance. Therefore, Hypothesis H1a and Hypothesis H1b were supported. To test Hypothesis H1c we ran another regression analysis with the medium DoI firms as the reference category (Table 2; final model two). Accordingly, the classes (firms with high DoI and firms with medium DoI) did not significantly differ. Therefore, Hypothesis H1c was not supported.

Table 2.

Regression analysis (international financial performance).

4.1.2. Hypothesis 2

The following regression results (Table 3) reports the hypothesis two testing. Hypothesis two stated that the firms with high and medium DoI will strategically perform better than firms with low DoI and firms with high DoI will strategically perform better than firms with medium DoI.

Table 3.

Regression analysis (international strategic performance).

According to the results (Table 3; final model one), both the firms with high DoI and with medium DoI significantly differed from the firms with low DoI. The expected positive relationship between the DoI and the international strategic performance was supported. Therefore, according to the final model one (Table 3) Hypothesis H2a and Hypothesis H2b were supported. To test the Hypothesis H2c another regression analysis was performed with the medium DoI firms as the reference category (Table 3; final model two). Accordingly, the classes (firms with high DoI and firms with medium DoI) did not significantly differ. Therefore, Hypothesis H1c was not supported.

4.1.3. Hypothesis 3

Hypothesis three stated that the higher the firms’ international exposure, the better is their international overall performance. The following Table 4 reports the results of the hypothesis testing.

Table 4.

Regression analysis (international overall performance).

The results (Table 4; final model one) show that both the firms with high DoI and with medium DoI significantly differed from the firms with low DoI. According to the results, we corroborated the expected positive relationship between the DoI and the international overall performance. Therefore, according to the final model one (Table 4) the hypothesis H3a and the hypothesis H3b were supported. Hypothesis H3c was tested by the regression in the final model two (Table 4) with the medium DoI firms as the reference category. Accordingly, firms with high DoI and firms with medium DoI did not significantly differ. Hypothesis H3c was not supported.

The following Table 5 summarizes the above hypotheses testing results.

Table 5.

Hypotheses summary report.

5. Discussion

The relationship between SMEs international decisions and international performance is of paramount importance within the international business and strategic management fields. In this research the focus concerned the relationship between the differentiated international strategies and international performance of SMEs. In fact, we took this topic as one of the major ones in the international business research agenda. Our empirical analysis defines three different strategic groups with three correspondingly different international strategic positionings, regarding the scale and scope of internationalization. We also assessed their implications on the firms’ international performance. Therefore, this research took the differentiated SMEs’ strategic positioning as determining the distinguished international financial, strategic and overall performances.

Hosseini et al. (2018) stressed that, among the literature, different types of relationships between internationalization and performance are observable, namely, positive, negative, linear, non-linear, U-shaped, inverted U-shaped, sigmoid, and inverted sigmoid relationships. Therefore, contrary to other studies, but in line with others (e.g., Pangarkar 2008), we found a positive linear relationship between internationalization and the firms’ performance. The meta-analysis of Schwens et al. (2018) also illustrates our results insofar as the firms’ international scale and scope may positively contribute to the firms’ performance. According to our results, the firms with an intense internationalization, i.e., FSTS above 25%, exhibited a better financial performance than the firms with a lower scale of internationalization (H1a and H1b). In fact, the higher the foreign sales, the better the possibilities to achieve economies of scale and cost reduction (Zahra 2020). However, the benefits from internationalization may outweigh the costs or not (Schwens et al. 2018). Therefore, our results show that the firms with a high scale of internationalization and with mixed and high geographical scopes may perform significantly better financially than the international firms with a low international scale. Accordingly, other studies emphasize the positive role of firms’ internationalization in the financial performance (e.g., Hitt et al. 2006; Zahra et al. 2000). However, the expected result concerning the financial performance of the firms with a high and medium DoI did not emerge (H1c). This suggests that firms with a higher geographical scope in regard to different regional blocs may face psychic distance issues that do not allow them to overcome the challenges of those operations (Pangarkar 2008). In fact, Pangarkar (2008) pointed to the possibility of the negative effects of psychic distance on performance despite the argued positive ones. The firms may face some issues concerning costs and economies of scale as they increase their internationalization. However, it should be highlighted that the difference between the high and medium international exposure firms’ financial performance mean is not a relevant and accentuated one (Table 6: firms with high DoI exhibited 0.719 and the firms with medium DoI 0.721).

Table 6.

Strategic groups’ means of the international performance dimensions.

Following the results of this research, the firms with a high and medium international exposure achieve better international strategic performances (H2a and H2b) than those with low DoI. According to Pangarkar (2008) high levels of internationalization may improve the firm competitiveness and performance. The decision to internationalize is an important strategic decision. In this context, the decision to internationalize intensely and to multiple countries and regions is even more important, bringing challenges and complexity, but also benefits. Therefore, by embracing an intense and geographical diverse international strategy, firms incur greater strategic efforts for the fulfillment of their strategic objectives. As observed, and despite the H2c being not supported, the firms with high DoI were those that exhibited the biggest international strategic performance. According to the measure used for international strategic performance, the results suggest that as the scale and scope grow, so do the possibility to enter in the international markets and to expand strategically, as well as the awareness of the firm or product and the response to competitive pressure. These firms are also able to improve their market share position, gain experience and knowledge and improve their capability to respond to requests from the international markets. In this sense, Zahra (2020) even emphasized the ability to innovate. Therefore, strategically speaking, this result suggests the potential positive role of the intensity of the international operation as well as the importance of a high geographical diversity concerning the number of countries and the number of regional blocs. Accordingly, the different international markets may provide new opportunities (Hitt et al. 1997; Zahra et al. 2000), may help to reduce risks (Lobo et al. 2020) and may promote potentially lower levels of competitive intensity (Li et al. 2012).

Finally, concerning the overall performance, the firms with a high and a medium international exposure exhibited a better international overall performance than the firms with a low DoI. In this vein, the top managers reported that the overall performance of the international activity (in the last year; in the last three years; and in in the last year in relation to the competitors) is better for firms that exhibited an intense internationalization (H3a and H3b). In relation to the firms with high DoI, despite the H3c being not supported, these firms exhibited the highest level of international overall performance (Table 6: IOP = 0.764). This result suggests that the firms that diversify geographically to more distant countries achieve a better overall realization of their objectives with the international activities, even in relation to their competitors.

Therefore, taking into account the strategic and overall international performances, the more diverse and distant the international scope is, the better the strategic and overall international performances are. This in an important insight into the international business field.

6. Conclusions

The SMEs’ international strategy and performance is, as widely emphasized in the present research, an important side of the firms’ strategic management. We addressed some important issues concerning this relationship. The consideration of a multidimensional nature of the degree of internationalization and of the international performance both are two major questions within the firms’ internationalization spectrum.

This research makes major contributions in this field. It considered two key dimensions of the international strategy to define the SMEs’ degree of internationalization, the international scale and geographical scope. In relation to the international performance, its multidimensional nature was taken into account and three major dimensions were considered, the financial performance, the strategic performance, and the overall performance. Another important aspect is the consideration of the firms’ different objectives, their importance and satisfaction when dealing with the international markets. Therefore, this research helps to extend the body of knowledge concerning the internationalization and performance relationship, not only methodologically but also empirically.

Major results emerged from this investigation of the Portuguese international SMEs. The firms’ internationalization, as it evolves, may lead to improvements in the financial, strategic, and overall performance. Although, as noted above concerning the financial performance, as the intense internationalization increases its geographical scope, the financial performance is higher at the medium level of international exposure.

In relation to major implications of the present research for managers, this study emphasized the effects of the firms’ international exposure. This allows managers to observe different outcomes, not only the financial ones, of the different levels of the firms’ international exposure. SMEs appear to have many advantages in internationalizing their activity. Therefore, managers must be aware of these advantages and should empower their firms to internationalize rapidly, putting this strategy as an important one in the strategic mental framework of the firms.

Concerning policy makers, this research highlights the important role of internationalization for the SMEs. These are major actors of the world economy that must be followed by governments. The important outcomes of SMEs’ internationalization must be taken into account when the public policies to support internationalization are at stake (Bell et al. 2003). In this context, public policies face many challenges, namely, in providing firms with valuable information about the different markets, in supporting innovation and R&D, in promoting conditions for the emergence of more venture capital and in providing more mechanisms for the improvement of the firms’ international networks (Bell et al. 2003). In this context, export promotion agencies should take into account the reality of international SMEs and those that intend to internationalize, in order to ideally provide access to a larger, better and more sophisticated set of resources, namely, human, financial and knowledge (Bell et al. 2003). For SMEs, growing internationally appears to be a positive attitude. In this context, our results provide important knowledge to governments, policy makers, public policies and internationalization promotion programs.

7. Limitations and Future Research Avenues

The present research also has its own limitations. First, we highlight its cross-sectional nature. This aspect makes it difficult to claim causality in the context of the present research. A fact that draws attention to the longitudinal studies. Second, it is based on a single country sample of SMEs, in this case Portugal, a fact that hinders the generalization of results. Third, the study relies on self-reporting measures that can lead to bias. Nevertheless, social desirability was controlled in the hypotheses testing and causes of concern did not emerge. Fourth, we did not consider the firms’ contextual features, an element of utmost importance for the internationalization and performance relationship (Hosseini et al. 2018). A final limitation concerns to the fact that we did not consider any objective performance measure. It is an important type of performance measure due to its complementary value to the subjective ones (e.g., Ruzo et al. 2011).

Concerning the future research avenues, we highlight the following. Due to the inconsistency of results across the literature concerning the relationship between internationalization and performance, this should be studied on a more detailed level, namely, at the country-industry level and at the firms’ contextual level, for instance in a single industry and in a specific type of firms (Hosseini et al. 2018). Emphasizing the role of context in the degree of internationalization and performance relationship is an aspect of paramount importance within this area of studies (Morais and Ferreira 2020). Another important aspect concerns the wide use of FSTS as the only measure of the firms’ internationalization. The geographical diversity should also be considered as an important feature of the international strategy (Hosseini et al. 2018) and with important implications for performance (Pangarkar 2008). The present research makes such a contribution. An additional line for future studies concerns the integrative consideration of the antecedents from different perspectives of the international strategy and the outcomes, apart from the financial ones (Martineau and Pastoriza 2016). In this line of research, it is also an important aspect to consider and define which type of performance is being assessed. In fact, there are many studies that do not consider this differentiation. Therefore, to improve the body of knowledge surrounding this relationship, it is pertinent to distinguish between international performance, national performance or total performance (Martineau and Pastoriza 2016). Additionally, addressing the firms’ survival within the internationalization context is another important line of research that deserves further attention and longitudinal studies (Hollender et al. 2017). Another relevant concern is the fact that firms may have different objectives when they go international. This is acknowledged in the context of this research and it is highly recommended to incorporate further investigations. Considering this important aspect in the international performance measurement, context is important. In this sense, we highly recommend the use of our mode of measurement mechanics. Finally, despite the difficulties concerning the data collection in the longitudinal studies concerning SMEs’ internationalization (Kuivalainen et al. 2012a), these are greatly needed to improve the body of knowledge concerning the internationalization and performance relationship (Hitt et al. 2006; Hosseini et al. 2018; Kuivalainen et al. 2012b).

Author Contributions

Â.M.R.C. developed conceptualization, wrote methodology, collected data, conducted data analysis and drafted first version; F.M.P.O.C. developed conceptualization, supervision, and significant interpretation of empirical results; J.A.V.F. supervision of methodology and data analysis, and provided a significant interpretation of empirical results. Conceptualization, Â.M.R.C. and F.M.P.O.C.; formal analysis, F.M.P.O.C. and J.A.V.F.; investigation, Â.M.R.C.; methodology, J.A.V.F.; supervision, F.M.P.O.C. and J.A.V.F.; writing—original draft, Â.M.R.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by FCT—Fundação para a Ciência e a Tecnologia, I.P., grant number UIDB/05037/2020.

Acknowledgments

The authors are grateful to the referees and the editor-in-chief for insightful comments and suggestions.

Conflicts of Interest

The authors declare no conflict of interest. The funders had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript, or in the decision to publish the results.

References

- Ahamed, AFM Jalal, and Kåre Skallerud. 2015. The link between export relationship quality, performance and expectation of continuing the relationship: A South Asia exporters’ perspective. International Journal of Emerging Markets 10: 16–31. [Google Scholar] [CrossRef]

- Barkema, Harry, and Oleg Chvyrkov. 2002. What sort of top management team is needed at the helm of internationally diversified firms? In Strategic Entrepreneurship: Creating a New Mindset. Edited by Michael A. Hitt, R. Duane Ireland, S. Michael Camp and Donald L. Sexton. Oxford: Blackwell Publishers Ltd., pp. 289–305. [Google Scholar]

- Behling, Orlando, and Kenneth S. Law. 2000. Solving semantic problems: Translation/back-translation. In Translating Questionnaires and Other Research Instruments: Problems and Solutions. Thousand Oaks: Sage Publications Inc., pp. 19–21. Available online: https://books.google.pt/books?hl=pt-PT&lr=&id=qu9C-OgWI-YC&oi=fnd&pg=PR5&dq=Behling,+O.+and+Law,+K.S.+(2000),+Translating+Questionnaires+and+Other+Research+Instruments:Problems+and+Solutions&ots=H8XQFpmK4l&sig=DlzVJzwatxCyYJwY1bKOMcY1izU&redir_esc=y#v=one (accessed on 8 February 2019).

- Bell, Jim, Rod McNaughton, Stephen Young, and Dave Crick. 2003. Towards an Integrative Model of Small Firm Internationalisation. Journal of International Entrepreneurship 1: 339–62. [Google Scholar] [CrossRef]

- Benito-Osorio, Diana, Alberto Colino, Luis Ángel Guerras-Martín, and José Ángel Zúñiga-Vicente. 2016. The international diversification-performance link in Spain: Does firm size really matter? International Business Review 25: 548–58. [Google Scholar] [CrossRef]

- Bianchi, Constanza, Charmaine Glavas, and Shane Mathews. 2017. SME international performance in Latin America: The role of entrepreneurial and techological capabilities. Journal of Small Business and Enterprise Development 24: 176–95. [Google Scholar] [CrossRef]

- Cavusgil, S. Tamer, and Shaoming Zou. 1994. Marketing strategy-performance relationship: An investigation of the empirical link in export market ventures. Journal of Marketing 58: 1–21. [Google Scholar] [CrossRef]

- Cerrato, Daniele, and Stephanie A. Fernhaber. 2018. Depth versus breadth: Exploring variation and performance differences among internationalising new ventures. International Small Business Journal: Researching Entrepreneurship 36: 758–79. [Google Scholar] [CrossRef]

- Cerrato, Daniele, Lisa Crosato, and Donatella Depperu. 2016. Archetypes of SME internationalization: A configurational approach. International Business Review 25: 286–95. [Google Scholar] [CrossRef]

- Christoffersen, Jeppe, Thomas Plenborg, and Matthew J. Robson. 2014. Measures of strategic alliance performance, classified and assessed. International Business Review 23: 479–89. [Google Scholar] [CrossRef]

- Chung, Henry F. L. 2012. Export market orientation, managerial ties, and performance. International Marketing Review 29: 403–23. [Google Scholar] [CrossRef]

- Chung, Henry F. L., and Tsuang Kuo. 2018. When and how managerial ties matter in international competitive strategy, export financial and strategic performance framework: A standardized or customized approach? European Journal of Marketing 52: 260–78. [Google Scholar] [CrossRef]

- Chung, Henry F. L., Zhilin Yang, and Pei-How Huang. 2015. How does organizational learning matter in strategic business performance? The contingency role of guanxi networking. Journal of Business Research 68: 1216–24. [Google Scholar] [CrossRef]

- Contractor, Farok J., Vikas Kumar, and Sumit K. Kundu. 2007. Nature of the relationship between international expansion and performance: The case of emerging market firms. Journal of World Business 42: 401–17. [Google Scholar] [CrossRef]

- Costa, Cláudia, Luis Filipe Lages, and Paula Hortinha. 2015. The bright and dark side of CSR in export markets: Its impact on innovation and performance. International Business Review 24: 749–57. [Google Scholar] [CrossRef]

- Denicolai, Stefano, Antonella Zucchella, and Roger Strange. 2014. Knowledge assets and firm international performance. International Business Review 23: 55–62. [Google Scholar] [CrossRef]

- Dess, Gregory G., and Richard B. Robinson. 1984. Measuring organizational performance in the absence of objective measures: The case of the privately-held firm and conglomerate business unit. Strategic Management Journal 5: 265–73. [Google Scholar] [CrossRef]

- Diamantopoulos, Adamantios, and Nikolaos Kakkos. 2007. Managerial assessments of export performance: Conceptual framework and empirical illustration. Journal of International Marketing 15: 1–31. [Google Scholar] [CrossRef]

- Diamantopoulos, Adamantios, Amata Ring, Bodo B. Schlegelmilch, and Eva Doberer. 2014. Drivers of export segmentation effectiveness and their impact on export performance. Journal of International Marketing 22: 39–61. [Google Scholar] [CrossRef]

- Dutot, Vincent, François Bergeron, and Louis Raymond. 2014. Information management for the internationalization of SMEs: An exploratory study based on a strategic alignment perspective. International Journal of Information Management 34: 672–81. [Google Scholar] [CrossRef]

- Ferraris, Alberto, Stefano Bresciani, and Manlio Del Giudice. 2016. International diversification and firm performance: A four-stage model. EuroMed Journal of Business 11: 362–75. [Google Scholar] [CrossRef]

- Field, Andy. 2009. Discovering Statistics Using SPSS, 3rd ed. London: SAGE Publications Ltd. [Google Scholar]

- Freixanet, Joan, and Gemma Renart. 2020. A capabilities perspective on the joint effects of internationalization time, speed, geographic scope and managers’ competencies on SME survival. Journal of World Business 55: 101110. [Google Scholar] [CrossRef]

- Genc, Ebru, Mumin Dayan, and Omer Faruk Genc. 2019. The impact of SME internationalization on innovation: The mediating role of market and entrepreneurial orientation. Industrial Marketing Management 82: 253–64. [Google Scholar] [CrossRef]

- Gerschewski, Stephan, and Simon Shufeng Xiao. 2015. Beyond financial indicators: An assessment of the measurement of performance for international new ventures. International Business Review 24: 615–29. [Google Scholar] [CrossRef]

- Gerschewski, Stephan, Elizabeth L. Rose, and Valerie J. Lindsay. 2015. Understanding the drivers of international performance for born global firms: An integrated perspective. Journal of World Business 50: 558–75. [Google Scholar] [CrossRef]

- Gnizy, Itzhak, and Aviv Shoham. 2014. Uncovering the influence of the international marketing function in international firms. International Marketing Review 31: 51–78. [Google Scholar] [CrossRef]

- Hagen, Birgit, Antonella Zucchella, Paola Cerchiello, and Nicolò De Giovanni. 2012. International strategy and performance—Clustering strategic types of SMEs. International Business Review 21: 369–82. [Google Scholar] [CrossRef]

- Hennart, Jean-François. 2007. The theoretical rationale for a multinationality-performance relationship. Management International Review 47: 423–52. [Google Scholar] [CrossRef]