Failure to CAPTCHA Attention: Null Results from an Honesty Priming Experiment in Guatemala

Abstract

:1. Introduction

2. Materials and Methods

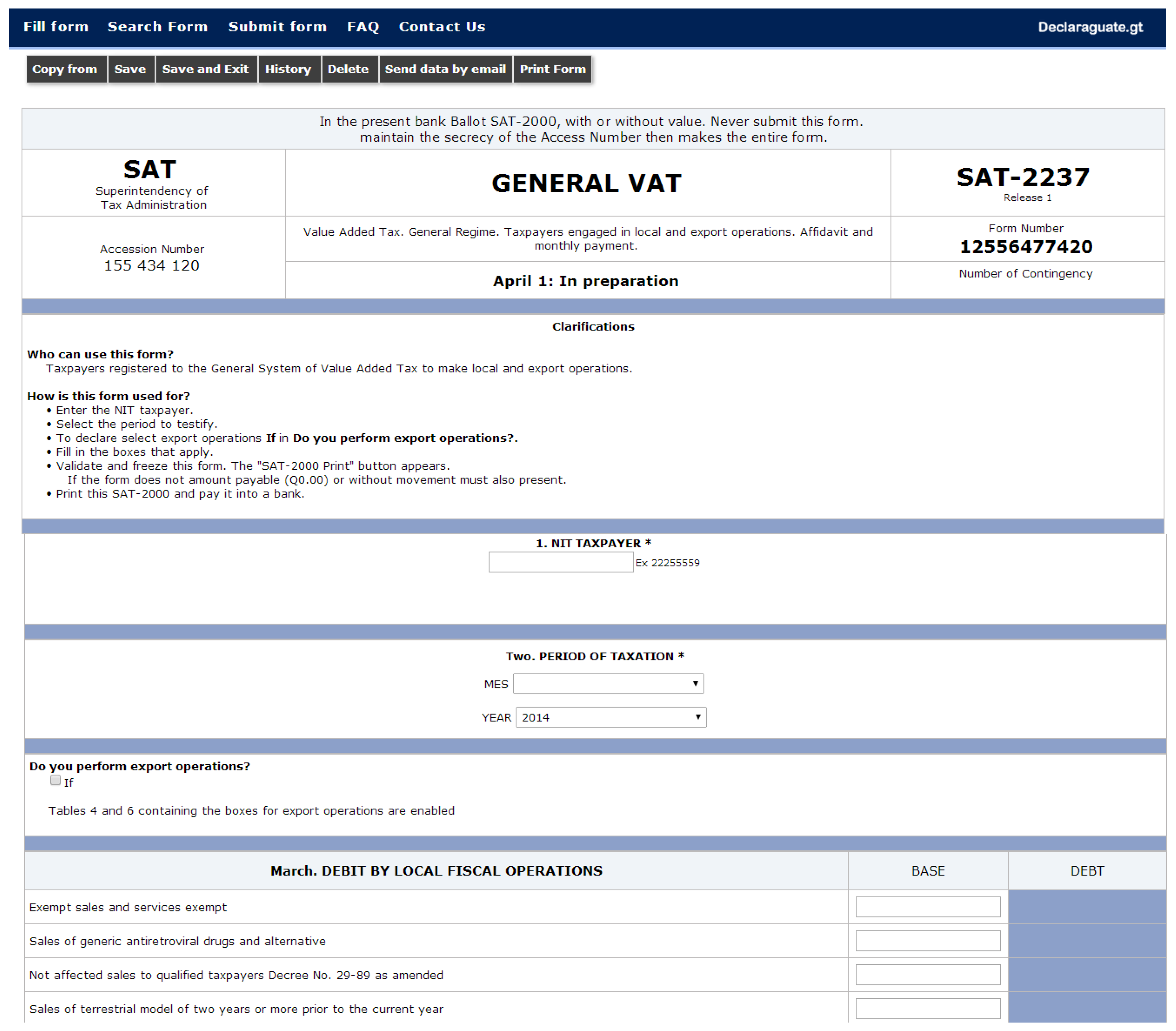

2.1. Tax Regime Selection

2.2. Sample Selection and Random Treatment Assignment

2.3. Experimental Design and Treatments

2.3.1. Control Group

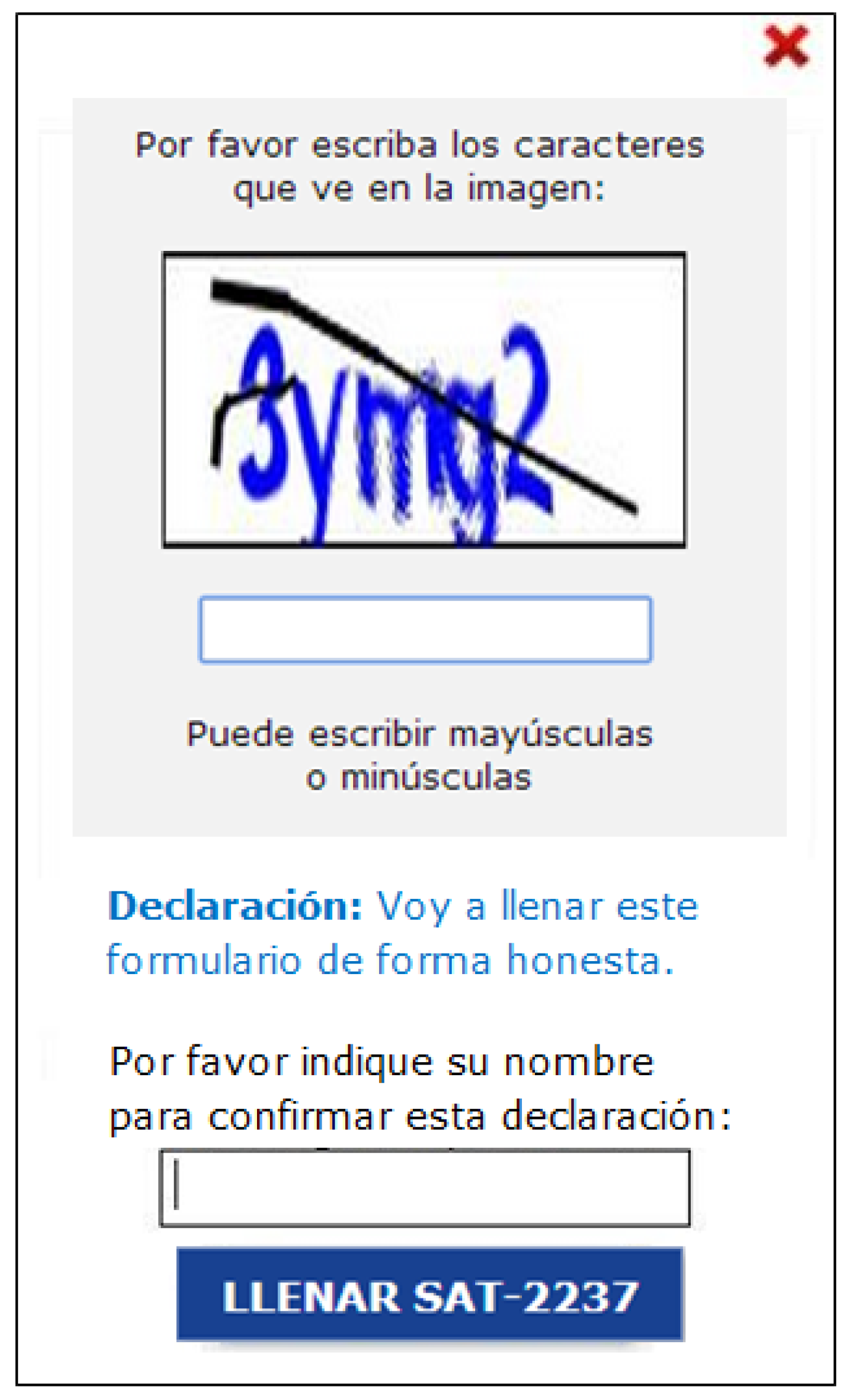

2.3.2. Honesty Declaration

2.3.3. Public Good

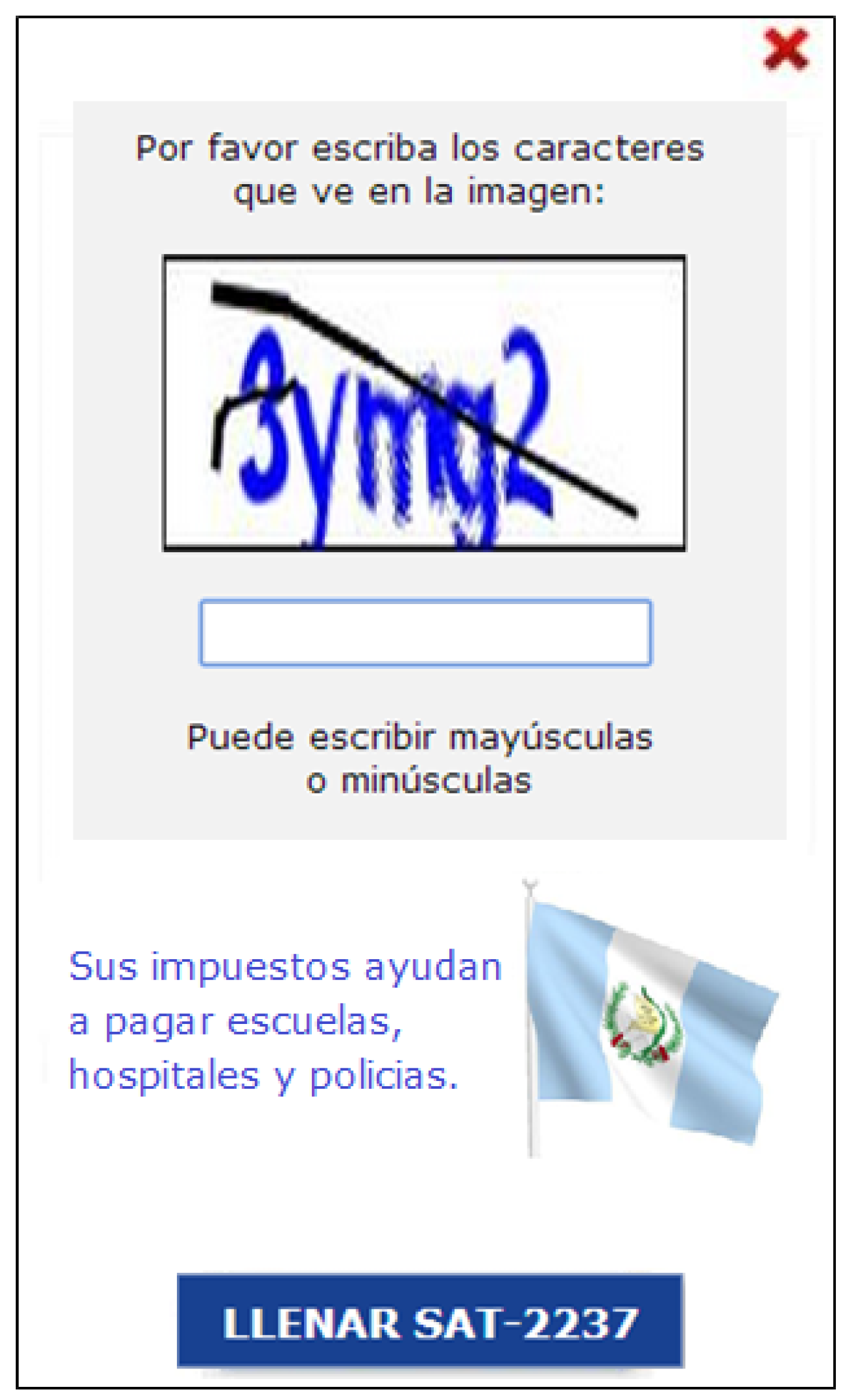

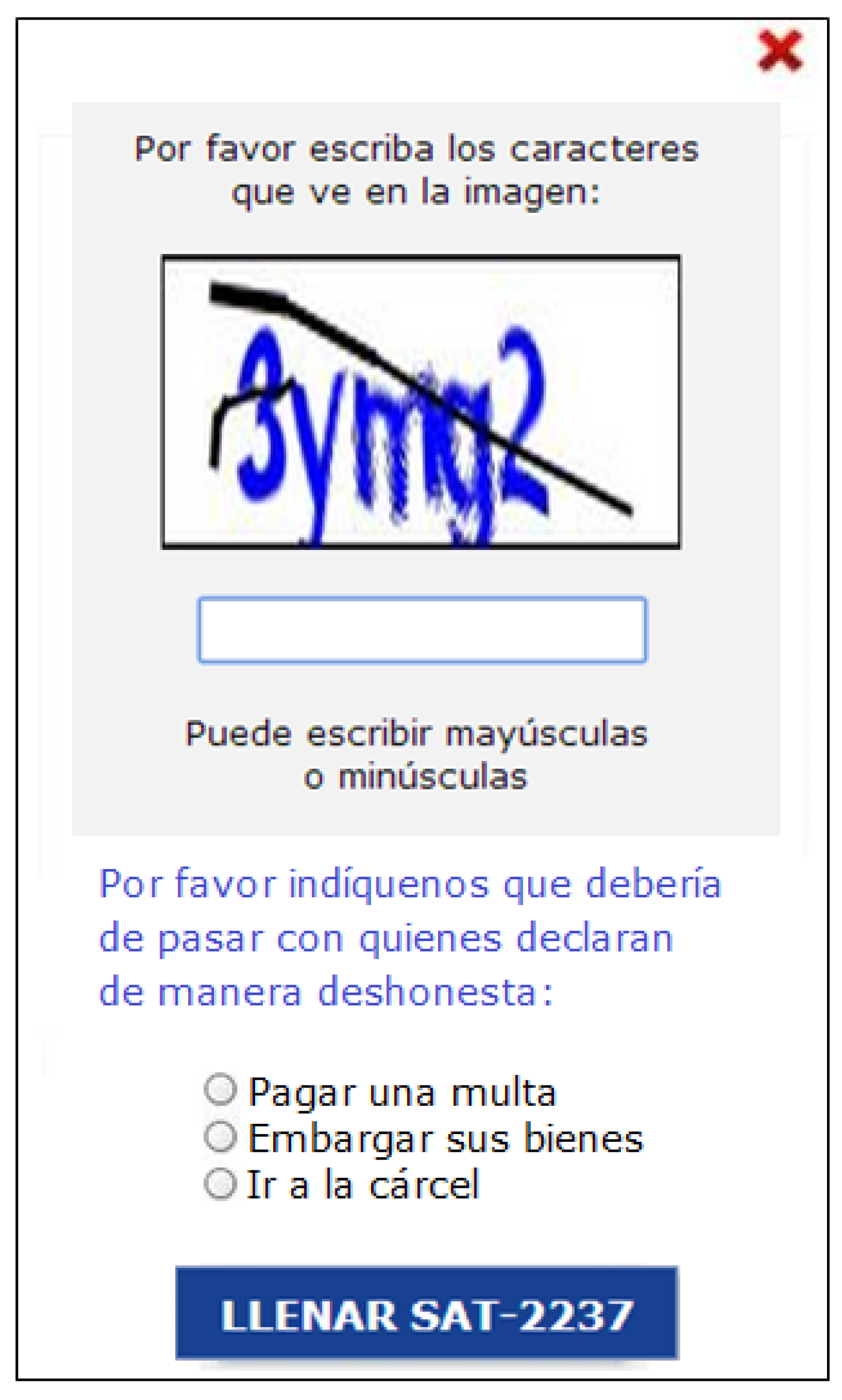

2.3.4. Enforcement

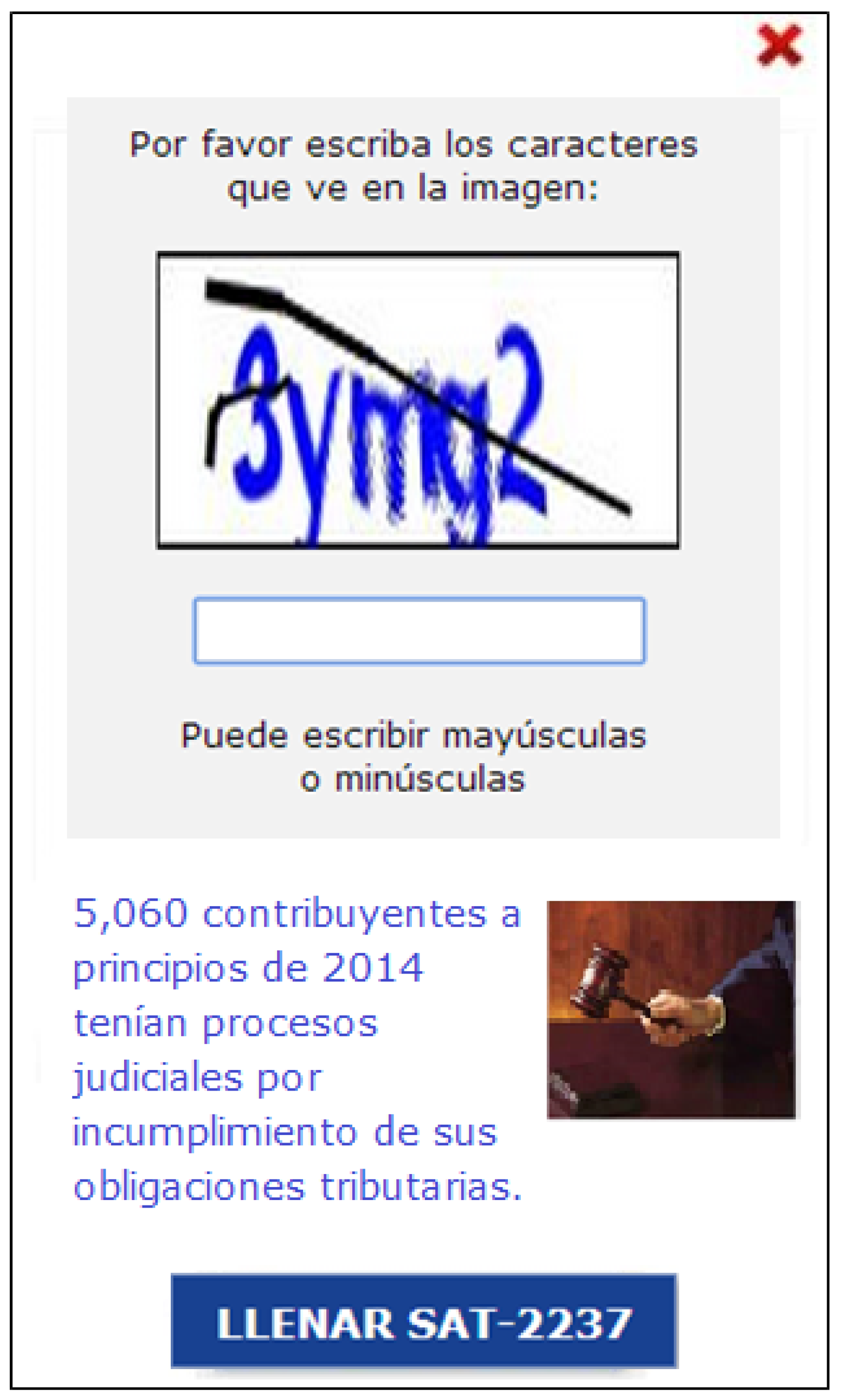

2.3.5. Choice Public Good

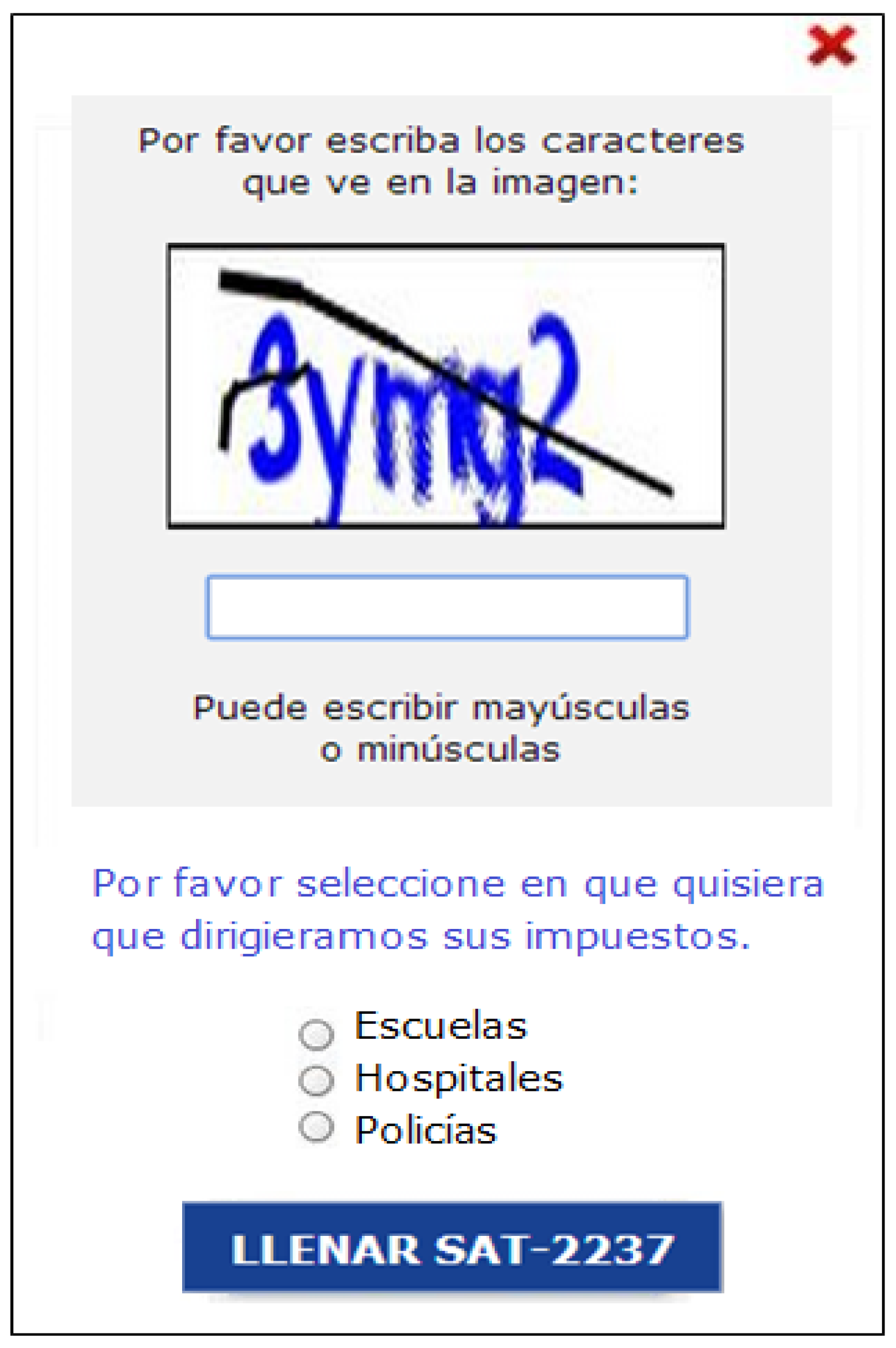

2.3.6. Choice Enforcement

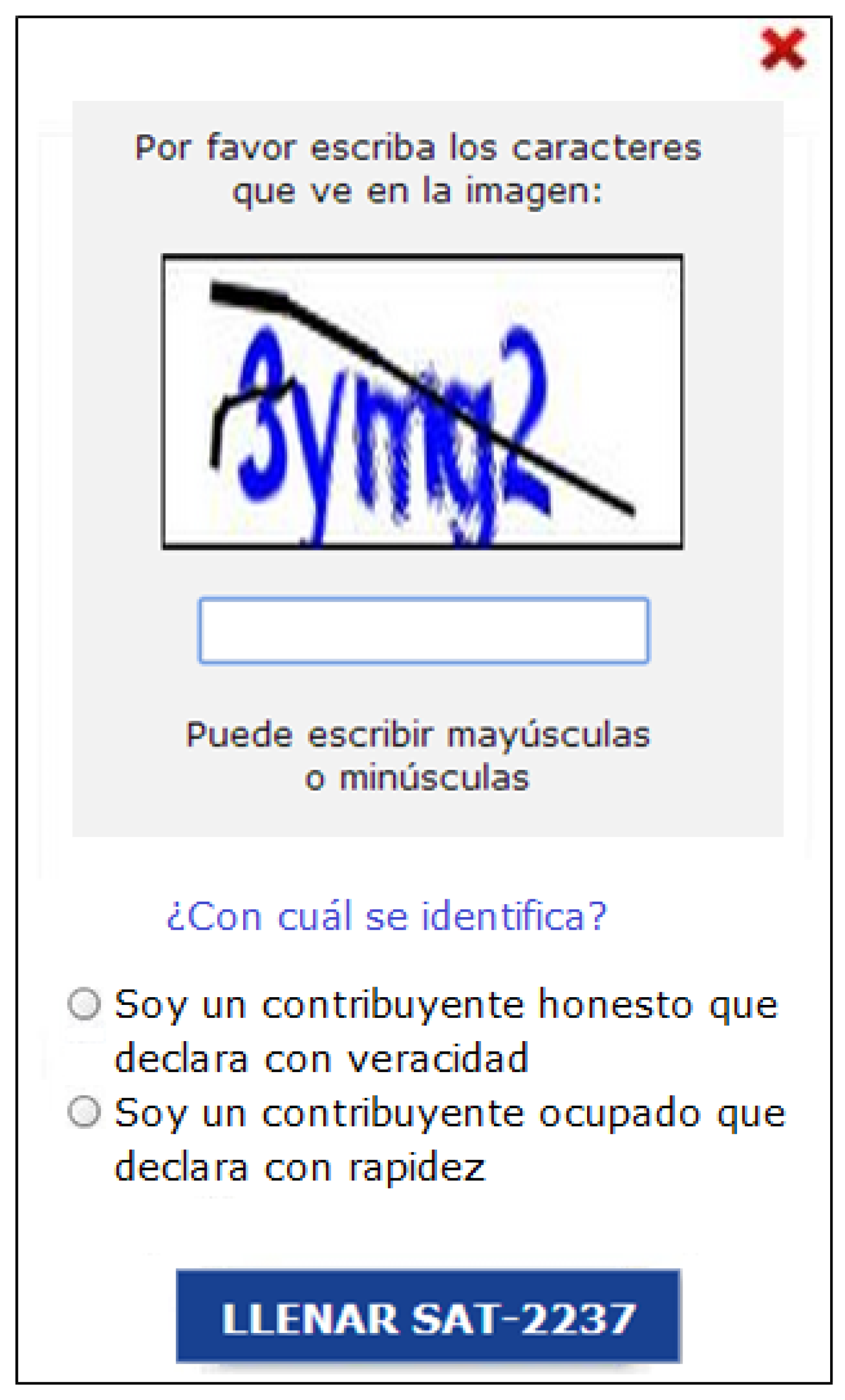

2.3.7. Self-Select ‘I Am Honest’

2.4. Outcome Variables

2.5. Sample Size Estimation

3. Results

3.1. Estimation

3.2. Primary Analysis—First Exposure Only

3.3. Secondary Analysis—Full Sample

3.4. Impact of Treatments on Propensity to Declare

4. Discussion

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A. Treatments

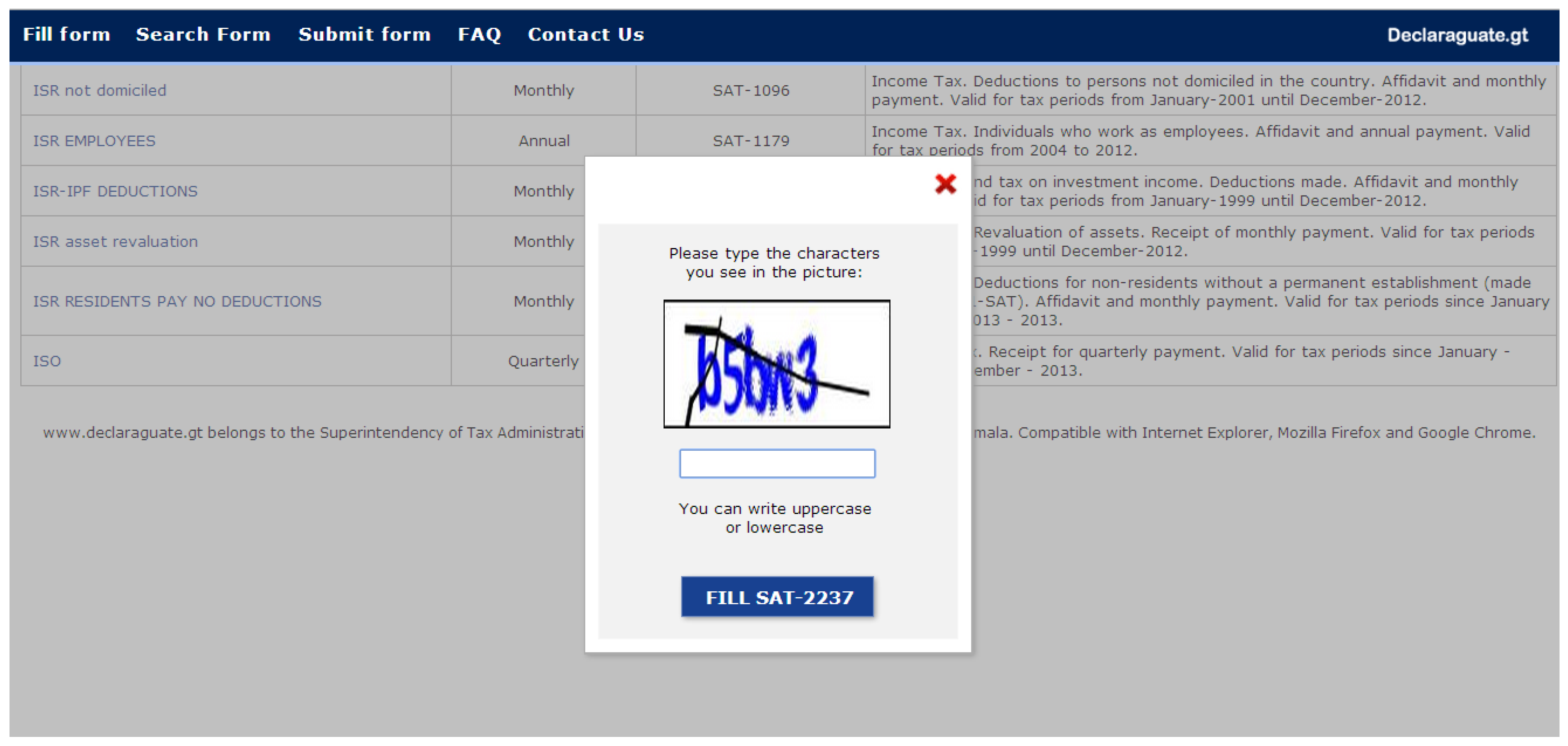

Appendix B. Declaraguate Website

Appendix C. Balance Checks

| Variable | (1) | (2) |

|---|---|---|

| (First) | (All) | |

| Sign before | 0.080 | 0.130 *** |

| (0.074) | (0.034) | |

| Public Good | 0.044 | −0.015 |

| (0.073) | (0.033) | |

| Enforcement | 0.018 | −0.077 * |

| (0.073) | (0.033) | |

| Sign before | 0.045 | −0.033 |

| (0.074) | (0.034) | |

| Public Good | 0.004 | 0.004 |

| (0.075) | (0.034) | |

| Enforcement | 0.034 | −0.016 |

| (0.074) | (0.034) | |

| Constant | 37.906 *** | 37.338 *** |

| (0.051) | (0.023) | |

| Observations | 715,026 | 3,885,225 |

| Variable | (1) | (2) |

|---|---|---|

| (First) | (All) | |

| Sign before | −0.005 * | −0.001 |

| (0.002) | (0.001) | |

| Public Good | −0.002 | 0.000 |

| (0.002) | (0.001) | |

| Enforcement | 0.002 | 0.001 |

| (0.002) | (0.001) | |

| Sign before | −0.000 | −0.000 |

| (0.002) | (0.001) | |

| Public Good | −0.004 | −0.002 * |

| (0.002) | (0.001) | |

| Enforcement | −0.002 | −0.000 |

| (0.002) | (0.001) | |

| Constant | 0.384 *** | 0.375 *** |

| (0.002) | (0.001) | |

| Observations | 627,300 | 3,232,686 |

| Variable | (1) | (2) |

|---|---|---|

| (First) | (All) | |

| Sign before | −164.272 | −1188.269 |

| (2263.356) | (1264.250) | |

| Public Good | −856.039 | 692.126 |

| (2213.478) | (1238.355) | |

| Enforcement | −605.685 | −1118.926 |

| (2230.887) | (1243.896) | |

| Sign before | 2424.769 | 38.043 |

| (2261.094) | (1252.387) | |

| Public Good | −1654.504 | 147.031 |

| (2277.990) | (1257.991) | |

| Enforcement | −3296.176 | −1779.398 |

| (2266.044) | (1254.607) | |

| Constant | 10,422.377 *** | 12,294.340 *** |

| (1551.063) | (871.032) | |

| Observations | 715,190 | 3,886,240 |

References

- United Nations. Resolution adopted by the General Assembly. Paper presented at Addis Ababa Action Agenda of the Third International Conference on Financing for Development, Addis Ababa, Ethiopia, 27 July 2015. [Google Scholar]

- Harrison, G.W.; List, J.A. Field experiments. J. Econ. Lit. 2004, 42, 1009–1055. [Google Scholar] [CrossRef]

- Levitt, S.D.; List, J.A. What do laboratory experiments measuring social preferences reveal about the real world? J. Econ. Pers. 2007, 21, 153–174. [Google Scholar] [CrossRef]

- Behavioural Insights Team. Behavioural Insights Team Annual Update 2010–11; Cabinet Office: London, UK, 2011.

- Haynes, L.; Service, O.; Goldacre, B.; Torgerson, D. Test, Learn, Adapt: Developing Public Policy with Randomised Controlled Trials; Cabinet Office: London, UK, 2012.

- Dolan, P.; Hallsworth, M.; Halpern, D.; King, D.; Metcalfe, R.; Vlaev, I. Influencing behaviour: The mindspace way. J. Econ. Psy. 2012, 33, 264–277. [Google Scholar] [CrossRef]

- Hauser, O.P.; Hendriks, A.; Rand, D.G.; Nowak, M.A. Think global, act local: Preserving the global commons. Sci. Rep. 2016, 6. [Google Scholar] [CrossRef] [PubMed]

- Slemrod, J.; Yitzhaki, S. Tax avoidance, evasion, and administration. Handbook Publ. Econ. 2002, 3, 1423–1470. [Google Scholar]

- Slemrod, J. Cheating ourselves: The economics of tax evasion. J. Econ. Pers. 2007, 21, 25–48. [Google Scholar] [CrossRef]

- Ariel, B. Deterrence and moral persuasion effects on corporate tax compliance: findings from a randomized controlled trial. Criminology 2012, 50, 27–69. [Google Scholar] [CrossRef]

- Torgler, B. Tax Compliance and Tax Morale: A Theoretical and Empirical Analysis; Edward Elgar Publishing: Cheltenham, UK; Northampton, MA, USA, 2007. [Google Scholar]

- Kettle, S.; Hernandez, M.; Ruda, S.; Sanders, M.A. Behavioral Interventions in Tax Compliance: Evidence from Guatemala; Policy Research Working Paper No. WPS 7690; Impact Evaluation Series; World Bank Group: Washington DC, USA, June 2016. [Google Scholar]

- Blumenthal, M.; Christian, C.; Slemrod, J.; Smith, M.G. Do normative appeals affect tax compliance? Evidence from a controlled experiment in Minnesota. Ntl. Tax J. 2001, 54, 125–138. [Google Scholar] [CrossRef]

- Torgler, B. Moral suasion: An alternative tax policy strategy? Evidence from a controlled field experiment in Switzerland. Econ. Gov. 2004, 5, 235–253. [Google Scholar] [CrossRef]

- Gangl, K.; Torgler, B.; Kirchler, E.; Hofmann, E. Effects of supervision on tax compliance: Evidence from a field experiment in Austria. Econ. Lett. 2014, 123, 378–382. [Google Scholar] [CrossRef] [PubMed]

- Fehr, E.; Schmidt, K.M. A theory of fairness, competition, and cooperation. Q. J. Econ. 1999, 114, 817–868. [Google Scholar] [CrossRef]

- Hauser, O.P.; Rand, D.G.; Peysakhovich, A.; Nowak, M.A. Cooperating with the future. Nature 2014, 511, 220–223. [Google Scholar] [CrossRef] [PubMed]

- Gangl, K.; Torgler, B.; Kirchler, E. Patriotism's impact on cooperation with the state: an experimental study on tax compliance. Political Psychol. 2016, 37, 867–881. [Google Scholar] [CrossRef] [PubMed]

- Feld, L.P.; Tyran, J.R. Tax evasion and voting: An experimental analysis. Kyklos 2002, 55, 197–221. [Google Scholar] [CrossRef]

- Thaler, R.H.; Sunstein, C.R. Nudge: Improving Decisions About Health, Wealth, and Happiness; Yale University Press: New Haven, CT, USA, 2008. [Google Scholar]

- Hallsworth, M. The use of field experiments to increase tax compliance. Ox. R. Econ. Pol. 2014, 30, 658–679. [Google Scholar] [CrossRef]

- Perez-Truglia, R.; Troiano, U. Shaming Tax Delinquents: Theory and Evidence from a Field Experiment in the United States; Working Paper No. w21264; National Bureau of Economic Research: Cambridge, MA, USA, June 2015. [Google Scholar]

- Allingham, M.G.; Sandmo, A. Income tax evasion: A theoretical analysis. J. Publ. Econ. 1972, 1, 323–338. [Google Scholar] [CrossRef]

- Mazar, N.; Amir, O.; Ariely, D. The dishonesty of honest people: A theory of self-concept maintenance. J. Mark. Res. 2008, 45, 633–644. [Google Scholar] [CrossRef]

- Shu, L.L.; Mazar, N.; Gino, F.; Ariely, D.; Bazerman, M.H. Signing at the beginning makes ethics salient and decreases dishonest self-reports in comparison to signing at the end. Proc. Natl. Acad. Sci. USA 2012, 109, 15197–15200. [Google Scholar] [CrossRef] [PubMed]

- Bhanot, S.P. Cheap Promises: Evidence from Loan Repayment Pledges in an Online Experiment. Unpublished Paper. 2017. [Google Scholar]

- Andreoni, J.; Erard, B.; Feinstein, J. Tax compliance. J. Econ. Lit. 1998, 36, 818–860. [Google Scholar]

- Kirchler, E. The Economic Psychology of Tax Behaviour; Cambridge University Press: Cambridge, UK, 2007. [Google Scholar]

- Erard, B.; Feinstein, J. The role of moral sentiments and audit perceptions in tax compliance. Public Finance = Finances Publiques 1994, 49, 70–89. [Google Scholar]

- McGraw, K.M.; Scholz, J.T. Appeals to civic virtue versus attention to self-interest: Effects on tax compliance. Law Soc. Rev. 1991, 471–498. [Google Scholar] [CrossRef]

- Fehr, E.; Gächter, S. Cooperation and punishment in public goods experiments. Am. Econ. Rev. 2000, 90, 980–994. [Google Scholar] [CrossRef]

- Kahneman, D.; Tversky, A. The Simulation Heuristic; Technical Report No. 5; Department of Psychology at Stanford University: Sanford, CA, USA, 15 May 1981. [Google Scholar]

- Castro, L.; Scartascini, C. Tax compliance and enforcement in the pampas evidence from a field experiment. J. Econ. Behav. Org. 2015, 116, 65–82. [Google Scholar] [CrossRef]

- Ortega, D.; Sanguinetti, P. Deterrence and Reciprocity Effects on Tax Compliance: Experimental Evidence from Venezuela. Available online: https://www.caf.com/media/1871239/deterrence-reciprocity-effects-tax-compliance-experimental-evidence-venezuela.pdf (accessed on 26 April 2017).

- Norton, M.; Mochon, D.; Ariely, D. The“IKEA Effect”: When Labor Leads to Love. J. Consum. Psychol. 2012, 22, 453–460. [Google Scholar] [CrossRef]

- Lamberton, C.P.; De Neve, J.E.; Norton, M.I. Eliciting Taxpayer Preferences Increases Tax Compliance. Available online: https://ssrn.com/abstract=2365751 (accessed on 26 April 2017).

- Vohs, K.D.; Baumeister, R.F.; Schmeichel, B.J.; Twenge, J.M.; Nelson, N.M.; Tice, D.M. Making choices impairs subsequent self-control: A limited-resource account of decision making, self-regulation, and active initiative. J. Pers. Soc. Psychol. 2008, 94, 883–898. [Google Scholar] [CrossRef] [PubMed]

- Festinger, L. A Theory of Cognitive Dissonance; Stanford University Press: Redwood City, CA, USA, 1962; Volume 2. [Google Scholar]

- Stets, J. E.; Burke, P. J. Identity theory and social identity theory. Soc. Psychol. Q. 2000, 63, 224–237. [Google Scholar] [CrossRef]

- Stryker, S.; Burke, P.J. The past, present, and future of an identity theory. Soc. Psychol. Q. 2000, 63, 284–297. [Google Scholar] [CrossRef]

- Guala, F.; Filippin, A. The Effect of Group Identity on Distributive Choice: Social Preference or Heuristic? Available online: http://onlinelibrary.wiley.com/doi/10.1111/ecoj.12311/abstract (accessed on 26 April 2017).

- Cohn, A.; Fehr, E.; Maréchal, M.A. Business Culture and Dishonesty in the Banking Industry. Nature 2014, 516, 86–89. [Google Scholar] [CrossRef] [PubMed]

- Benjamin, D.J.; Choi, J.J.; Fisher, G. Religious identity and economic behavior. Rev. Econ. Stat. 2016, 98, 617–637. [Google Scholar] [CrossRef]

- Herley, C. Why Do Nigerian Scammers Say They Are from Nigeria? Available online: http://www.econinfosec.org/archive/weis2012/presentation/Herley_presentation_WEIS2012.pdf (accessed on 26 April 2017).

- Ayal, S.; Gino, F. Honest rationales for dishonest behavior. In The Social Psychology of Morality: Exploring the Causes of Good and Evil; American Psychological Association: Washington, DC, USA, 2011; pp. 149–166. [Google Scholar]

- Bryan, C.J.; Walton, G.M.; Rogers, T.; Dweck, C.S. Motivating voter turnout by invoking the self. Proc. Natl. Acad. Sci. USA 2011, 108, 12653–12656. [Google Scholar] [CrossRef] [PubMed]

- Bryan, C.J.; Adams, G.S.; Monin, B. When cheating would make you a cheater: Implicating the self prevents unethical behavior. J. Exp. Psychol. Gen. 2013, 142, 1001–1005. [Google Scholar] [CrossRef] [PubMed]

- Social and Behavioral Sciences Team. Social and Behavioral Sciences Team 2016 Annual Report; Executive Office of the President, National Science and Technology Council: Washington, DC, USA, September 2016.

- Chou, E.Y. What’s in a name? The toll e-signatures take on individual honesty. J. Exp. Soc. Psychol. 2015, 61, 84–95. [Google Scholar] [CrossRef] [PubMed]

- Hallsworth, M.; List, J.A.; Metcalfe, R.D.; Vlaev, I. The behavioralist as tax collector: Using natural field experiments to enhance tax compliance. J. Public Econ. 2017, 148, 14–31. [Google Scholar] [CrossRef]

- Rosenthal, R. The file drawer problem and tolerance for null results. Psychol. Bull. 1979, 86, 638–641. [Google Scholar] [CrossRef]

- Miguel, E.; Camerer, C.; Casey, K.; Cohen, J.; Esterling, K.M.; Gerber, A.; Laitin, D. Promoting transparency in social science research. Science 2014, 343, 30–31. [Google Scholar] [CrossRef] [PubMed]

| Condition | Female | Age | Tax Type Filed (Proportion Declaring) | |||

|---|---|---|---|---|---|---|

| Gross Income | Profits Income | VAT Small Taxpayers | VAT General | |||

| Control Group | 0.375 | 37.34 | 0.156 | 0.0202 | 0.526 | 0.297 |

| (0.484) | (17.91) | (0.363) | (0.141) | (0.499) | (0.457) | |

| Honesty Declaration | 0.374 | 37.47 | 0.154 | 0.0193 | 0.532 | 0.294 |

| (0.484) | (17.80) | (0.361) | (0.137) | (0.499) | (0.456) | |

| Public Good | 0.375 | 37.32 | 0.157 | 0.0204 | 0.528 | 0.295 |

| (0.484) | (17.93) | (0.364) | (0.141) | (0.499) | (0.456) | |

| Enforcement | 0.375 | 37.26 | 0.157 | 0.0201 | 0.528 | 0.295 |

| (0.484) | (17.93) | (0.364) | (0.140) | (0.499) | (0.456) | |

| Choice Public Good | 0.374 | 37.30 | 0.159 | 0.0206 | 0.524 | 0.296 |

| (0.484) | (17.96) | (0.366) | (0.142) | (0.499) | (0.456) | |

| Choice Enforcement | 0.372 | 37.34 | 0.161 | 0.0204 | 0.522 | 0.297 |

| (0.483) | (17.97) | (0.367) | (0.141) | (0.500) | (0.457) | |

| Self-select, ‘I am Honest’ | 0.374 | 37.32 | 0.159 | 0.0199 | 0.527 | 0.295 |

| (0.484) | (17.93) | (0.365) | (0.140) | (0.499) | (0.456) | |

| Total | 0.374 | 37.34 | 0.158 | 0.0201 | 0.527 | 0.296 |

| (0.484) | (17.92) | (0.364) | (0.140) | (0.499) | (0.456) | |

| Condition | Message and Procedure |

|---|---|

| Control Group, Number of forms submitted = 585,872 |

|

| Honesty Declaration, Number of forms submitted = 529,397 |

|

| Public Good, Number of forms submitted = 573,676 |

|

| Enforcement, Number of forms submitted = 563,670 |

|

| Choice Public Good, Number of forms submitted = 548,915 |

|

| Choice Enforcement, Number of forms submitted = 539,542 |

|

| Self Select ‘I am Honest’, Number of forms submitted = 545,168 |

|

| Variable | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| (Gross Income) | (Profits Income) | (VAT Small) | (VAT General) | (Pooled Taxes) | |

| Sign before | −6.432 | −71.332 | −0.560 | −2.468 | −1.170 |

| (−12.468) | (−60.643) | (−0.643) | (−4.644) | (−1.273) | |

| Public Good | 10.244 | −86.205 | −0.291 | −9.302 | −1.200 |

| (−20.846) | (−66.939) | (−0.615) | (−8.405) | (−2.080) | |

| Enforcement | 2.094 | −64.222 | −0.397 | −3.472 | −1.639 |

| (−13.704) | (−74.212) | (−0.658) | (−4.774) | (−1.263) | |

| Public Good Choice | −0.783 | −89.340 | −0.772 | −8.419 | −2.603 * |

| (−11.658) | (−62.236) | (−0.661) | (−5.100) | (−1.315) | |

| Enforcement Choice | −7.950 | −102.452 | −0.019 | 1.178 | −0.580 |

| (−12.840) | (−67.784) | (−0.685) | (−10.492) | (−2.370) | |

| Self-select Honesty | 20.135 | −46.944 | −0.971 | −1.382 | 0.204 |

| (−15.040) | (−65.386) | (−0.613) | (−5.341) | (−1.577) | |

| Age | −0.426 | −0.605 | −0.030 * | −0.219 | −0.142 * |

| (−0.281) | (−0.745) | (−0.014) | (−0.154) | (−0.058) | |

| Female | −20.820 ** | 39.438 | −0.321 | −1.231 | −0.667 |

| (−7.546) | (−36.834) | (−0.374) | (−2.805) | (−0.793) | |

| Central Region | 21.652 | −4.330 | 7.092 *** | 7.296 | 5.533 *** |

| (−11.091) | (−15.456) | (−0.513) | (−4.109) | (−1.064) | |

| Northern Region | 22.997 | 89.048 | −1.528 * | −0.428 | 0.149 |

| (−15.765) | (−45.614) | (−0.609) | (-6.604) | (−1.489) | |

| Eastern Region | −2.401 | 45.397 | 1.735 *** | 7.947 | 2.885 * |

| (−14.240) | (−45.505) | (−0.504) | (−5.353) | (−1.149) | |

| Access Month | 29.559 * | 147.802 * | 20.001 *** | 22.070 *** | 22.717 *** |

| (−14.181) | (−66.204) | (−0.514) | (−6.069) | (−1.086) | |

| Access Day | 3.527 ** | 7.665 * | 0.803 *** | 0.657 ** | 0.848 *** |

| (−1.185) | (−3.422) | (−0.032) | (−0.201) | (−0.038) | |

| Constant | −71.210 | −278.628 * | −40.138 *** | −40.981 * | −43.749 *** |

| (−43.955) | (−127.002) | (−1.663) | (−18.079) | (−3.038) | |

| Lagged Declarations | Yes | Yes | Yes | Yes | Yes |

| Control Mean | 190.27 | 90.73 | 58.70 | 270.47 | 109.18 |

| Observations | 24641 | 2177 | 467409 | 133015 | 627242 |

| Variable | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| (Gross Income) | (Profits Income) | (VAT Small) | (VAT General) | (Pooled Taxes) | |

| Sign before | 6.224 | 81.742 | −0.286 | 19.266 | 6.598 |

| (7.483) | (105.072) | (0.389) | (15.302) | (3.861) | |

| Public Good | 1.192 | −41.440 | −0.512 | −4.228 | −1.152 |

| (6.234) | (50.409) | (0.372) | (12.568) | (3.089) | |

| Enforcement | 0.563 | −4.401 | −0.271 | 8.405 | 1.765 |

| (6.592) | (44.509) | (0.383) | (14.419) | (3.491) | |

| Public Good Choice | −2.609 | −52.511 | −0.345 | 9.547 | 2.162 |

| (5.887) | (41.748) | (0.387) | (14.896) | (3.558) | |

| Enforcement Choice | −7.217 | −35.598 | 0.641 | 3.806 | 0.300 |

| (6.313) | (67.750) | (0.425) | (14.026) | (3.398) | |

| Self-select Honesty | 0.162 | 193.019 | −0.191 | −12.334 | -0.536 |

| (5.992) | (164.711) | (0.385) | (12.415) | (3.353) | |

| Age | −0.350 * | −3.387 | −0.009 | 0.729* | 0.396 ** |

| (0.163) | (2.352) | (0.010) | (0.340) | (0.132) | |

| Female | −14.913 *** | 6.568 | −0.557 * | −40.296 *** | −14.092 *** |

| (4.028) | (55.787) | (0.241) | (6.401) | (1.954) | |

| Central Region | 16.549 * | 50.940 | 8.273 *** | 74.527 *** | 33.112 *** |

| (8.239) | (40.881) | (0.301) | (10.841) | (3.646) | |

| Northern Region | −0.525 | −46.185 | −4.282 *** | 33.353 ** | 4.664 |

| (11.834) | (30.883) | (0.312) | (12.848) | (2.605) | |

| Eastern Region | 3.838 | −31.319 | −0.431 | 33.614 *** | 5.369 ** |

| (9.135) | (25.455) | (0.317) | (9.441) | (1.886) | |

| Access Month | 3.989 ** | 90.629 | 0.800 *** | −4.263 | −0.673 |

| (1.509) | (59.315) | (0.083) | (2.367) | (0.601) | |

| Access Day | 2.677 *** | 3.163 | 0.082 *** | 0.746 * | 0.120 |

| (0.631) | (3.328) | (0.012) | (0.376) | (0.103) | |

| Constant | −6.622 | −126.860 | 10.202 *** | −6.060 | 5.706 |

| (12.560) | (131.249) | (0.834) | (19.377) | (5.276) | |

| Lagged Declarations | Yes | Yes | Yes | Yes | Yes |

| Control Mean | 259.07 | 207.88 | 58.18 | 419.32 | 169.07 |

| Observations | 423832 | 26983 | 2036259 | 745356 | 3232430 |

| Variable | (1) | (2) |

|---|---|---|

| First Exposure | Full Sample | |

| Sign before | 0.002 | 0.001 |

| (0.002) | (0.001) | |

| Public Good | −0.001 | −0.001 |

| (0.002) | (0.001) | |

| Enforcement | 0.000 | 0.001 |

| (0.002) | (0.001) | |

| Public Good Choice | −0.002 | −0.001 |

| (0.002) | (0.001) | |

| Enforcement Choice | −0.005 * | −0.002 |

| (0.002) | (0.001) | |

| Self-select Honesty | −0.001 | -0.000 |

| (0.002) | (0.001) | |

| Age | 0.002 *** | 0.002 *** |

| (0.000) | (0.000) | |

| Female | 0.039 *** | 0.031 *** |

| (0.001) | (0.001) | |

| Central Region | −0.061 *** | −0.064 *** |

| (0.002) | (0.002) | |

| Northern Region | −0.041*** | −0.035 *** |

| (0.002) | (0.002) | |

| Eastern Region | −0.054 *** | −0.047 *** |

| (0.002) | (0.002) | |

| Trial Month | 0.031 *** | −0.001 *** |

| (0.001) | (0.000) | |

| Access Day | −0.000 | 0.000 *** |

| (0.000) | (0.000) | |

| Constant | 0.255 *** | 0.334 *** |

| (0.004) | (0.003) | |

| Lagged Declarations | Yes | Yes |

| Observations | 627242 | 3232430 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kettle, S.; Hernandez, M.; Sanders, M.; Hauser, O.; Ruda, S. Failure to CAPTCHA Attention: Null Results from an Honesty Priming Experiment in Guatemala. Behav. Sci. 2017, 7, 28. https://doi.org/10.3390/bs7020028

Kettle S, Hernandez M, Sanders M, Hauser O, Ruda S. Failure to CAPTCHA Attention: Null Results from an Honesty Priming Experiment in Guatemala. Behavioral Sciences. 2017; 7(2):28. https://doi.org/10.3390/bs7020028

Chicago/Turabian StyleKettle, Stewart, Marco Hernandez, Michael Sanders, Oliver Hauser, and Simon Ruda. 2017. "Failure to CAPTCHA Attention: Null Results from an Honesty Priming Experiment in Guatemala" Behavioral Sciences 7, no. 2: 28. https://doi.org/10.3390/bs7020028

APA StyleKettle, S., Hernandez, M., Sanders, M., Hauser, O., & Ruda, S. (2017). Failure to CAPTCHA Attention: Null Results from an Honesty Priming Experiment in Guatemala. Behavioral Sciences, 7(2), 28. https://doi.org/10.3390/bs7020028