Consumer Preferences for Cheese Products with Quality Labels: The Case of Parmigiano Reggiano and Comté

Abstract

:Simple Summary

Abstract

1. Introduction

2. Materials and Methods

2.1. Theoretical Framework and Model Specification

2.2. Data Collection and Sample

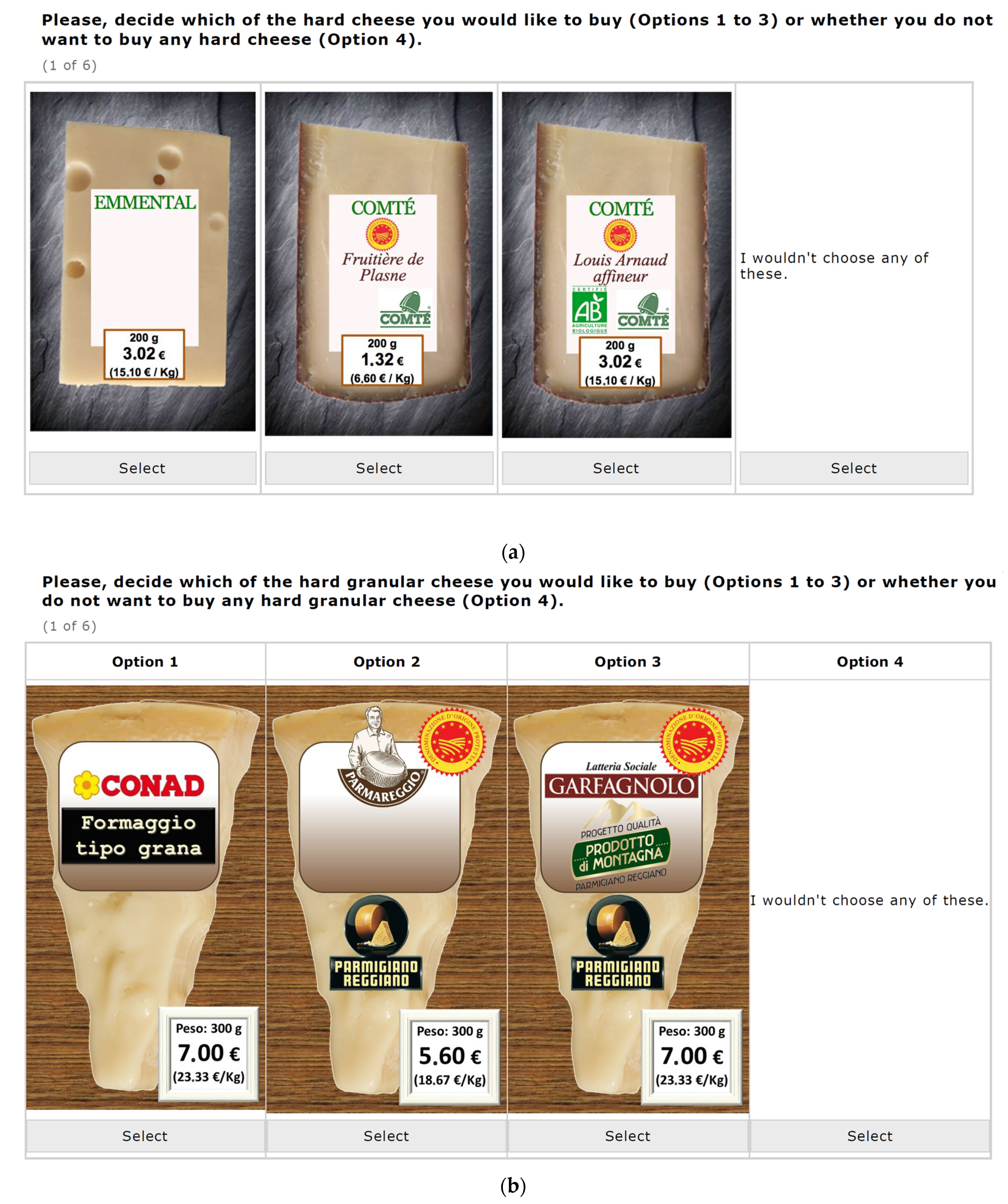

2.3. Experimental Design

3. Results

3.1. RPL Model Estimates

3.2. Profiling Consumers: Characteristics, Attitudes and Willingness to Pay

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Variables | France (n = 400) | Italy (n = 408) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Price-Sensitive, Quality-Adverse | Quality Seekers | High-Quality Seekers | PDO Lovers | |||||||

| 21.50% | 78.50% | 88.70% | 11.30% | |||||||

| Mean | Sd | Mean | Sd | p-Value | Mean | Sd | Mean | Sd | p-Value | |

| Socio-demographics | ||||||||||

| Gender | 1.53 | 0.50 | 1.49 | 0.50 | 0.542 | 1.51 | 0.50 | 1.43 | 0.50 | 0.330 |

| Age | 38.27 | 15.29 | 40.52 | 13.58 | 0.157 | 42.85 | 12.46 | 43.13 | 13.48 | 0.859 |

| Living Location | 1.69 | 0.79 | 1.78 | 0.85 | 0.483 | 2.32 | 0.70 | 2.37 | 0.57 | 0.884 |

| Education | 2.95 | 1.15 | 3.16 | 1.15 | 0.183 | 3.10 | 1.31 | 2.83 | 1.25 | 0.207 |

| Income | 3.73 | 1.80 | 4.05 | 1.62 | 0.096 | 3.67 | 1.71 | 3.35 | 1.84 | 0.141 |

| Household Size | 2.49 | 1.35 | 2.62 | 1.24 | 0.295 | 3.14 | 1.08 | 2.78 | 1.19 | 0.042 |

| Purchase behavior | ||||||||||

| What price do you normally pay for one package of 200 g hard cheese? | 3.91 | 2.23 | 4.26 | 1.84 | 0.030 | 3.24 | 2.00 | 2.11 | 1.68 | 0.000 |

| On average, how often do you buy hard cheese? | 3.20 | 1.65 | 3.30 | 1.47 | 0.329 | 3.28 | 1.36 | 2.76 | 1.18 | 0.019 |

| On average, how often do you eat hard cheese? | 3.33 | 1.72 | 3.50 | 1.48 | 0.182 | 3.94 | 1.34 | 3.83 | 1.37 | 0.490 |

| Affective attitude | ||||||||||

| Buying PDO labeled hard cheese instead of hard cheese without such a label would make me feel... | ||||||||||

| Unsatisfied/ Satisfied | 5.13 | 1.20 | 5.65 | 1.26 | 0.000 | 5.43 | 1.50 | 5.00 | 1.41 | 0.011 |

| Unhappy/Happy | 5.02 | 1.28 | 5.24 | 1.61 | 0.025 | 5.10 | 1.71 | 4.70 | 1.41 | 0.022 |

| Bad/Good | 5.12 | 1.34 | 5.38 | 1.54 | 0.017 | 5.20 | 1.68 | 4.89 | 1.43 | 0.062 |

| Cognitive attitude | ||||||||||

| I think that buying PDO labeled hard cheese instead of hard cheese without such a label is… | ||||||||||

| Meaningless/Meaningful | 4.92 | 1.10 | 5.42 | 1.22 | 0.000 | 5.46 | 1.41 | 5.11 | 1.20 | 0.020 |

| Harmful/Beneficial | 5.11 | 1.42 | 5.43 | 1.53 | 0.015 | 5.31 | 1.55 | 5.02 | 1.27 | 0.037 |

| Unimportant/Important | 4.72 | 1.55 | 5.38 | 1.43 | 0.000 | 5.54 | 1.46 | 5.02 | 1.26 | 0.002 |

| Perceived barriers | ||||||||||

| PDO labeled hard cheese is too expensive | 4.60 | 1.44 | 4.74 | 1.29 | 0.464 | 4.40 | 1.49 | 4.80 | 1.85 | 0.049 |

| I rarely pay attention to PDO labels while grocery shopping | 4.44 | 1.66 | 3.80 | 1.79 | 0.006 | 3.38 | 1.83 | 3.41 | 1.38 | 0.755 |

| There is no PDO labeled hard cheese of my preferred brand available in the store where I generally do my grocery shopping | 3.66 | 1.49 | 3.35 | 1.63 | 0.089 | 3.23 | 1.86 | 3.24 | 1.43 | 0.919 |

| I have no time to consider PDO labels when grocery shopping | 4.09 | 1.53 | 3.27 | 1.70 | 0.000 | 3.26 | 1.84 | 3.07 | 1.25 | 0.732 |

| I find it difficult to recognize products with a PDO label in the supermarket | 4.01 | 1.55 | 3.53 | 1.64 | 0.016 | 3.25 | 1.81 | 2.93 | 1.55 | 0.328 |

| Perceived effectiveness | ||||||||||

| When I buy products, I consider the impact my purchase has on the environment and on other people | 4.33 | 1.44 | 4.83 | 1.35 | 0.002 | 4.90 | 1.39 | 4.46 | 1.28 | 0.011 |

| Since one single person cannot have any impact upon how farms and food processing firms behave, it does not make any difference what I do | 4.15 | 1.57 | 3.47 | 1.78 | 0.001 | 3.64 | 1.75 | 3.24 | 1.64 | 0.144 |

| Each consumer’s behavior can have a positive effect on society by purchasing products produced and sold by companies that behave in a socially and environmentally responsible manner | 4.96 | 1.38 | 5.50 | 1.18 | 0.001 | 5.43 | 1.30 | 5.26 | 1.31 | 0.356 |

| Trust in labels | ||||||||||

| Products with the EU PDO label fulfil strict rules | 4.98 | 1.25 | 5.27 | 1.15 | 0.023 | 5.39 | 1.25 | 4.93 | 1.44 | 0.018 |

| The EU PDO label guarantees that the products are of a higher quality | 4.92 | 1.25 | 5.13 | 1.24 | 0.097 | 5.40 | 1.31 | 4.93 | 1.29 | 0.010 |

| I have great trust in the control system behind the EU PDO label | 4.75 | 1.32 | 5.06 | 1.25 | 0.033 | 5.24 | 1.39 | 4.83 | 1.40 | 0.040 |

| Products with the organic label fulfil strict rules | 4.94 | 1.37 | 5.43 | 1.22 | 0.001 | 4.94 | 1.27 | 4.46 | 1.15 | 0.011 |

| The organic label guarantees that the products are of a higher quality | 4.67 | 1.45 | 5.19 | 1.41 | 0.001 | 5.17 | 1.29 | 4.70 | 1.35 | 0.013 |

| I have great trust in the control system behind the organic label | 4.67 | 1.50 | 5.26 | 1.38 | 0.000 | 5.04 | 1.28 | 4.28 | 1.22 | 0.000 |

| Equality label standards | ||||||||||

| PDO labeled products produced outside of the European Union fulfil the same standards as PDO labeled products produced in the European Union | 3.98 | 1.42 | 4.06 | 1.63 | 0.565 | 3.89 | 1.74 | 3.28 | 1.39 | 0.020 |

| PDO labeled products from other countries of the European Union fulfil the same standards as PDO labeled products produced in France | 4.15 | 1.40 | 4.32 | 1.45 | 0.337 | 4.27 | 1.55 | 3.70 | 1.63 | 0.024 |

| I check the country of origin when I buy PDO labeled products | 4.56 | 1.55 | 5.16 | 1.42 | 0.001 | 5.31 | 1.42 | 5.02 | 1.64 | 0.265 |

| I am convinced that, regardless of the country of origin, all PDO labeled products guarantee the close link between the product and a place or region | 4.69 | 1.21 | 5.00 | 1.23 | 0.018 | 4.68 | 1.48 | 4.11 | 1.59 | 0.017 |

| Food choice questionnaire | ||||||||||

| It is important to me that the food I eat on a typical day… | ||||||||||

| is healthy | 5.29 | 1.33 | 5.84 | 1.05 | 0.001 | 5.07 | 1.18 | 4.72 | 1.50 | 0.277 |

| is a way of managing my mood (e.g., a good feeling or coping with stress) | 4.45 | 1.44 | 4.64 | 1.40 | 0.187 | 5.16 | 1.21 | 5.00 | 1.32 | 0.565 |

| is convenient (in buying and cooking) | 5.06 | 1.24 | 5.15 | 1.08 | 0.420 | 5.79 | 1.02 | 5.72 | 1.28 | 0.898 |

| provides me with pleasure (e.g., appearance, texture, smell, taste) | 5.53 | 1.27 | 5.84 | 1.06 | 0.057 | 5.70 | 1.14 | 5.41 | 1.39 | 0.247 |

| is natural (no additives, only natural ingredients) | 5.13 | 1.32 | 5.71 | 1.14 | 0.000 | 4.91 | 1.36 | 4.98 | 1.44 | 0.643 |

| is affordable | 5.38 | 1.26 | 5.56 | 1.09 | 0.296 | 4.98 | 1.37 | 4.72 | 1.44 | 0.207 |

| helps me control my weight | 4.48 | 1.43 | 4.72 | 1.42 | 0.115 | 4.79 | 1.44 | 3.87 | 1.65 | 0.000 |

| is familiar | 4.95 | 1.18 | 5.02 | 1.10 | 0.495 | 5.37 | 1.30 | 5.20 | 1.29 | 0.323 |

| is environmentally friendly | 5.12 | 1.35 | 5.40 | 1.20 | 0.056 | 5.43 | 1.29 | 5.15 | 1.56 | 0.314 |

| is animal friendly | 5.14 | 1.27 | 5.39 | 1.29 | 0.059 | 5.20 | 1.19 | 5.11 | 1.34 | 0.605 |

| is produced and traded in a fair manner | 5.05 | 1.30 | 5.26 | 1.20 | 0.107 | 5.79 | 1.10 | 5.57 | 1.26 | 0.263 |

References

- Martins, N.; Ferreira, I.C.F.R. Mountain food products: A broad spectrum of market potential to be exploited. Trends Food Sci. Technol. 2017, 67, 12–18. [Google Scholar] [CrossRef]

- Deselnicu, O.C.; Costanigro, M.; Souza-Monteiro, D.M.; McFadden, D.T. A Meta-Analysis of Geographical Indication Food Valuation Studies: What Drives the Premium for Origin-Based Labels? J. Agric. Resour. Econ. 2013, 38, 204–219. [Google Scholar]

- Arfini, F.; Mancini, M.C.; Donati, M. Local Agri-Food Systems in a Global World: Market, Social and Environmental Challenges; Cambridge Scholars Publishing: Newcastle upon Tyne, UK, 2012; ISBN 978-1-4438-3664-7. [Google Scholar]

- Arfini, F.; Cozzi, E.; Mancini, M.C.; Ferrer-Perez, H.; Gil, J.M. Are Geographical Indication Products Fostering Public Goods? Some Evidence from Europe. Sustainability 2019, 11, 272. [Google Scholar] [CrossRef] [Green Version]

- Vandecandelaere, E.; Teyssier, C.; Barjolle, D.; Jeanneaux, P.; Fournier, S.; Beucherie, O. Strengthening Sustainable Food Systems through Geographical Indications; FAO, European Bank for Reconstruction and Development: Rome, Italia, 2018; ISBN 978-92-5-130389-4. [Google Scholar]

- Vaquero-Piñeiro, C. The long-term fortunes of territories as a route for agri-food policies: Evidence from Geographical Indications. Bio-Based Appl. Econ. J. 2021, 10, 89–108. [Google Scholar] [CrossRef]

- Bérard, L.; Marchenay, P. Biodiversité culturelle, productions localisées et indications géographiques. In Proceedings of the III Congreso Internacional de la Red SIAL: Alimentación y Territorios, Baeza, Spain, 18–21 October 2006. [Google Scholar]

- Arfini, F.; Bellassen, V. Sustainability of European Food Quality Schemes: Multi-Performance, Structure, and Governance of PDO, PGI, and Organic Agri-Food Systems; Springer Nature Switzerland AG: Cham, Switzerland, 2019; ISBN 3030275086. [Google Scholar]

- Van Der Lans, I.A.; Van Ittersum, K.; De Cicco, A.; Loseby, M. The role of the region of origin and EU certificates of origin in consumer evaluation of food products. Eur. Rev. Agric. Econ. 2001, 28, 451–477. [Google Scholar] [CrossRef]

- Wirth, D.A. Geographical indications, food safety, and sustainability: Conflicts and synergies. Bio-Based Appl. Econ. 2016, 5, 135–151. [Google Scholar] [CrossRef]

- Verbeke, W.; Pieniak, Z.; Guerrero, L.; Hersleth, M. Consumers’ awareness and attitudinal determinants of European Union quality label use on traditional foods. Bio-Based Appl. Econ. 2012, 1, 213–229. [Google Scholar]

- Muller, P.; Böhm, M.; Csillag, P.; Donati, M.; Drut, M.; Ferrer-Pérez, H.; Gauvrit, L.; Gil, J.M.; Hoang, V.; Malak-Rawlikowska, A.; et al. Are Certified Supply Chains More Socially Sustainable? A Bargaining Power Analysis. J. Agric. Food Ind. Organ. 2021, 19, 177–192. [Google Scholar] [CrossRef]

- van Ittersum, K.; Meulenberg, M.T.G.; van Trijp, H.C.M.; Candel, M.J.J.M. Consumers’ appreciation of regional certification labels: A pan-European study. J. Agric. Econ. 2007, 58, 1–23. [Google Scholar] [CrossRef]

- Grunert, K.G.; Hieke, S.; Wills, J. Sustainability labels on food products: Consumer motivation, understanding and use. Food Policy 2014, 44, 177–189. [Google Scholar] [CrossRef] [Green Version]

- Kos Skubic, M.; Erjavec, K.; Klopčič, M. Consumer preferences regarding national and EU quality labels for cheese, ham and honey. Br. Food J. 2018, 120, 650–664. [Google Scholar] [CrossRef]

- Menapace, L.; Colson, G.; Grebitus, C.; Facendola, M. Consumers’ preferences for geographical origin labels: Evidence from the Canadian olive oil market. Eur. Rev. Agric. Econ. 2011, 38, 193–212. [Google Scholar] [CrossRef]

- Aprile, M.C.; Caputo, V.; Nayga, R.M., Jr. Consumers’ valuation of food quality labels: The case of the European geographic indication and organic farming labels. Int. J. Consum. Stud. 2012, 36, 158–165. [Google Scholar] [CrossRef]

- Garavaglia, C.; Mariani, P. How Much Do Consumers Value Protected Designation of Origin Certifications? Estimates of willingness to Pay for PDO Dry-Cured Ham in Italy. Agribusiness 2017, 33, 403–423. [Google Scholar] [CrossRef]

- Santeramo, F.G.; Lamonaca, E. Evaluation of geographical label in consumers’ decision-making process: A systematic review and meta-analysis. Food Res. Int. 2020, 131, 108995. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Roselli, L.; Giannoccaro, G.; Carlucci, D.; De Gennaro, B. EU quality labels in the Italian olive oil market: How much overlap is there between geographical indication and organic production? J. Food Prod. Mark. 2018, 24, 784–801. [Google Scholar] [CrossRef]

- de-Magistris, T.; Gracia, A. Consumers’ willingness to pay for light, organic and PDO cheese: An experimental auction approach. Br. Food J. 2016, 118, 560–571. [Google Scholar] [CrossRef]

- Lusk, J.L.; Briggeman, B.C. Food values. Am. J. Agric. Econ. 2009, 91, 184–196. [Google Scholar] [CrossRef]

- Katt, F.; Meixner, O. A systematic review of drivers influencing consumer willingness to pay for organic food. Trends Food Sci. Technol. 2020, 100, 374–388. [Google Scholar] [CrossRef]

- Sanjuán, A.I.; Khliji, S. Urban consumers’ response to the EU food mountain labelling: An empirical application in Southern Europe. New Medit 2016, 15, 72–80. [Google Scholar]

- Brun, F.; Zanchini, R.; Mosso, A.; Di Vita, G. Testing consumer propensity towards novel optional quality terms: An explorative assessment of “mountain” labelled honey. AIMS Agric. Food 2020, 5, 190–203. [Google Scholar] [CrossRef]

- Zuliani, A.; Esbjerg, L.; Grunert, K.G.; Bovolenta, S. Animal welfare and mountain products from traditional dairy farms: How do consumers perceive complexity? Animals 2018, 8, 207. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Almli, V.L.; Næs, T. Conjoint analysis in sensory and consumer science: Principles, applications, and future perspectives. In Methods in Consumer Research, Volume 1; Woodhead Publishing: Duxford, UK, 2018; pp. 485–529. [Google Scholar]

- Louviere, J.J.; Hensher, D.A.; Swait, J.D. Stated Choice Methods: Analysis and Applications; Cambridge University Press: Cambridge, UK, 2000; ISBN 9780511753831. [Google Scholar]

- Husson, E.; Delesse, L.; Paget, A.; Courbou, R.; Bellassen, V.; Drut, M. PDO Comté Cheese in France; Arfini, F., Bellassen, V., Eds.; Springer Nature Switzerland AG: Cham, Switzerland, 2019; ISBN 9783030275082. [Google Scholar]

- Comité Interprofessionnel de Gestion du Comté. Portrait d’un grand fromage. Available online: https://www.comte.com/portrait-dun-grand-fromage (accessed on 10 May 2022).

- Arfini, F.; Antonioli, F.; Cozzi, E.; Donati, M.; Guareschi, M.; Mancini, M.C.; Veneziani, M. Sustainability, Innovation and Rural Development: The Case of Parmigiano-Reggiano PDO. Sustainability 2019, 11, 4978. [Google Scholar] [CrossRef] [Green Version]

- Mancini, M.C.; Arfini, F.; Guareschi, M. Innovation and typicality in localised agri-food systems: The case of PDO Parmigiano Reggiano. Br. Food J. 2019, 121, 3043–3061. [Google Scholar] [CrossRef]

- Dentoni, D.; Menozzi, D.; Capelli, M.G. Group heterogeneity and cooperation on the geographical indication regulation: The case of the “Prosciutto di Parma” Consortium. Food Policy 2012, 37, 207–216. [Google Scholar] [CrossRef]

- Menozzi, D.; Giraud, G.; Saïdi, M.; Yeh, C.-H. Choice Drivers for Quality-Labelled Food: A Cross-Cultural Comparison on PDO Cheese. Foods 2021, 10, 1176. [Google Scholar] [CrossRef] [PubMed]

- McFadden, D. The Choice Theory Approach to Market Research. Mark. Sci. 1986, 5, 275–297. [Google Scholar] [CrossRef]

- Hensher, D.; Louviere, J.; Swait, J. Combining sources of preference data. J. Econom. 1998, 89, 197–221. [Google Scholar] [CrossRef] [Green Version]

- Train, K.E. Discrete Choice Methods with Simulation; Cambridge University Press: Cambridge, UK, 2009; ISBN 9780511805271. [Google Scholar]

- Jaeger, S.R.; Rose, J.M. Stated choice experimentation, contextual influences and food choice: A case study. Food Qual. Prefer. 2008, 19, 539–564. [Google Scholar] [CrossRef]

- Hensher, D.; Johnson, L.W. Applied Discrete-Choice Modelling; Routledge: Abingdon, UK, 1981; ISBN 9780815350477. [Google Scholar]

- Swait, J. A structural equation model of latent segmentation and product choice for cross-sectional revealed preference choice data. J. Retail. Consum. Serv. 1994, 1, 77–89. [Google Scholar] [CrossRef]

- Boxall, P.C.; Adamowicz, W.L. Understanding Heterogeneous Preferences in Random Utility Models: A Latent Class Approach. Environ. Resour. Econ. 2002, 23, 421–446. [Google Scholar] [CrossRef]

- Yeh, C.-H.; Menozzi, D.; Török, Á. Eliciting egg consumer preferences for organic labels and omega 3 claims in Italy and Hungary. Foods 2020, 9, 1212. [Google Scholar] [CrossRef] [PubMed]

- Loureiro, M.L.; Umberger, W.J. A choice experiment model for beef: What US consumer responses tell us about relative preferences for food safety, country-of-origin labeling and traceability. Food Policy 2007, 32, 496–514. [Google Scholar] [CrossRef]

- Orme, B.K. Getting Started with Conjoint Analysis: Strategies for Product Design and Pricing Research, 2nd ed.; Research Publishers LLC: Madison, WI, USA, 2010; ISBN 9780972729772. [Google Scholar]

- Hartmann, M.; Yeh, C.-H.; Amilien, V.; Čeliković, Z.; Csillag, P.; Filipović, J.; Giraud, G.; Gorton, M.; Kuč, V.; Menozzi, D.; et al. Report on Quantitative Research Findings on European Consumers’ Perception and Valuation of EU Food Quality Schemes as Well as Their Confidence in Such Measures; University of Bonn: Bonn, Germany, 2019. [Google Scholar]

- Vittersø, G.; Torjusen, H.; Laitala, K.; Tocco, B.; Biasini, B.; Csillag, P.; de Labarre, M.D.; Lecoeur, J.L.; Maj, A.; Majewski, E.; et al. Short food supply chains and their contributions to sustainability: Participants’ views and perceptions from 12 European cases. Sustainability 2019, 11, 4800. [Google Scholar] [CrossRef] [Green Version]

- Penn, J.M.; Hu, W. Understanding Hypothetical Bias: An Enhanced Meta-Analysis. Am. J. Agric. Econ. 2018, 100, 1186–1206. [Google Scholar] [CrossRef]

- ChoiceMetrics Ngene. 1.2 User Manual & Reference Guide; ChoiceMetrics: Sydney, Australia, 2018. [Google Scholar]

- Meyerding, S.G.H.; Bauchrowitz, A.; Lehberger, M. Consumer preferences for beer attributes in Germany: A conjoint and latent class approach. J. Retail. Consum. Serv. 2019, 47, 229–240. [Google Scholar] [CrossRef]

- McFadden, D. Quantitative Methods for Analysing Travel Behaviour of Individuals. Some Recent Developments. In Behavioural Travel Modelling; Hensher, D.A., Stopher, P.R., Eds.; Routledge: Abingdon, UK, 1979; ISBN 9781003156055. [Google Scholar]

- Leufkens, D. The problem of heterogeneity between protected geographical indications: A meta-analysis. Br. Food J. 2018, 120, 2843–2856. [Google Scholar] [CrossRef]

- Duvaleix, S.; Emlinger, C.; Gaigné, C.; Latouche, K. Geographical indications and trade: Firm-level evidence from the French cheese industry. Food Policy 2021, 102, 102118. [Google Scholar] [CrossRef]

- Hassan, D.; Monier-Dilhan, S.; Orozco, V. Measuring Consumers’ Attachment to Geographical Indications. J. Agric. Food Ind. Organ. 2011, 9, 1–30. [Google Scholar] [CrossRef]

- Sampalean, N.I.; Rama, D.; Visentin, G. An investigation into Italian consumers’ awareness, perception, knowledge of European Union quality certifications, and consumption of agri-food products carrying those certifications. Bio-Based Appl. Econ. 2021, 10, 35–49. [Google Scholar] [CrossRef]

- Stefani, G.; Romano, D.; Cavicchi, A. Consumer expectations, liking and willingness to pay for specialty foods: Do sensory characteristics tell the whole story? Food Qual. Prefer. 2006, 17, 53–62. [Google Scholar] [CrossRef] [Green Version]

- Mazzocchi, C.; Sali, G. Supporting mountain agriculture through “mountain product” label: A choice experiment approach. Environ. Dev. Sustain. 2022, 24, 701–723. [Google Scholar] [CrossRef]

- Endrizzi, I.; Cliceri, D.; Menghi, L.; Aprea, E.; Gasperi, F. Does the “Mountain Pasture Product” Claim Affect Local Cheese Acceptability? Foods 2021, 10, 682. [Google Scholar] [CrossRef] [PubMed]

- Di Vita, G.; Pippinato, L.; Blanc, S.; Zanchini, R.; Mosso, A.; Brun, F. Understanding the Role of Purchasing Predictors in the Consumer’s Preferences for PDO Labelled Honey. J. Food Prod. Mark. 2021, 27, 42–56. [Google Scholar] [CrossRef]

- Beuvier, E.; Duboz, G. The Microbiology of Traditional Hard and Semihard Cooked Mountain Cheeses. Microbiol. Spectr. 2013, 1, 1–15. [Google Scholar] [CrossRef] [Green Version]

- Pekic, B. Italy’s Agriform, Parmareggio Merge To Create New PDO Cheese Company. Available online: https://www.esmmagazine.com/fresh-produce/agriform-parmareggio-create-italian-pdo-cheese-leader-118644 (accessed on 10 May 2022).

- Menozzi, D.; Mora, C.; Faioli, G. Consumer’s preferences for brand, country of origin and traceability of UHT milk. Prog. Nutr. 2011, 13, 263–275. [Google Scholar]

- Grunert, K.G.; Aachmann, K. Consumer reactions to the use of EU quality labels on food products: A review of the literature. Food Control 2016, 59, 178–187. [Google Scholar] [CrossRef]

- Tebby, C.; Giraud, G.; Amblard, C. Determinants of interest in mountain food products: A European cross-country study. In Proceedings of the 9th European IFSA Symposium, Vienna, Austria, 7–10 July 2010; pp. 1568–1578. [Google Scholar]

- Fishbein, M.; Ajzen, I. Predicting and Changing Behavior: The Reasoned Action Approach; Psychology Press: New York, NY, USA; Taylor & Francis Group: New York, NY, USA, 2011; ISBN 9780203838020. [Google Scholar]

- Mazzocchi, C.; Orsi, L.; Sali, G. Consumers’ Attitudes for Sustainable Mountain Cheese. Sustainability 2021, 13, 1743. [Google Scholar] [CrossRef]

- Menozzi, D.; Finardi, C. May trust and solidarity defy food scares? The case of Parmigiano-Reggiano PDO sales in the aftermath of natural disaster. Br. Food J. 2019, 121, 3119–3134. [Google Scholar] [CrossRef]

- Consorzio del Formaggio Parmigiano Reggiano. Progetto Qualità Prodotto di Montagna. Available online: https://www.parmigianoreggiano.com/it/consorzio-disciplinare-normative (accessed on 10 May 2022).

- Borghesi, G.; Stefanini, R.; Vignali, G. Are consumers aware of products’ environmental impacts? Different results between life cycle assessment data and consumers’ opinions: The case study of organic Parmigiano Reggiano and its packaging. Int. J. Food Eng. 2021, 18, 185–192. [Google Scholar] [CrossRef]

- Meerza, S.I.A.; Gustafson, C.R. Does prior knowledge of food fraud affect consumer behavior? Evidence from an incentivized economic experiment. PLoS ONE 2019, 14, e0225113. [Google Scholar] [CrossRef] [PubMed]

| Socio-Demographic Categories | France | Italy | All | p-Value | ||||

|---|---|---|---|---|---|---|---|---|

| n = 400 | n = 408 | n = 808 | ||||||

| n | % | n | % | n | % | |||

| Food purchase responsibility | Responsible | 288 | 72.0 | 260 | 63.7 | 548 | 67.8 | 0.012 a |

| Co-responsible | 112 | 28.0 | 148 | 36.3 | 260 | 32.2 | ||

| Gender | Female | 200 | 50.0 | 203 | 49.8 | 403 | 49.9 | 0.944 a |

| Male | 200 | 50.0 | 205 | 50.2 | 405 | 50.1 | ||

| Age (years) | Mean (SD) | 40.0 (14.0) | 42.9 (12.6) | 41.5 (13.3) | 0.003 b | |||

| Median (IR) | 39.0 (27.0–51.0) | 44.0 (34.0–54.0) | 42.0 (31.0–53.0) | |||||

| Living area | Rural area | 198 | 49.5 | 52 | 12.7 | 250 | 30.9 | <0.001 a |

| Urban medium town | 100 | 25.0 | 171 | 41.9 | 271 | 33.5 | ||

| City | 102 | 25.5 | 185 | 45.3 | 287 | 35.5 | ||

| Education | Lower secondary/primary education or lower | 18 | 4.5 | 29 | 7.1 | 47 | 5.8 | <0.001 a |

| Upper secondary education | 127 | 31.8 | 157 | 38.5 | 284 | 35.1 | ||

| University or college entrance qual. | 110 | 27.5 | 67 | 16.4 | 177 | 21.9 | ||

| Bachelor’s degree or equivalent level | 82 | 20.5 | 67 | 16.4 | 149 | 18.4 | ||

| Master, postgraduate or doctoral degree | 63 | 15.8 | 88 | 21.6 | 151 | 18.7 | ||

| Household monthly net income | (FR) < EUR 1130/(IT) < EUR 900 | 46 | 11.5 | 29 | 7.1 | 75 | 9.3 | <0.001 a |

| (FR) EUR 1131–EUR 1450/(IT) EUR 901–EUR 1500 | 26 | 6.5 | 75 | 18.4 | 101 | 12.5 | ||

| (FR) EUR 1451–EUR 2090/(IT) EUR 1501–EUR 2500 | 83 | 20.8 | 126 | 30.9 | 209 | 25.9 | ||

| (FR) EUR 2091–EUR 2890/(IT) EUR 2501–EUR 3500 | 74 | 18.5 | 88 | 21.6 | 162 | 20.0 | ||

| (FR) EUR 2891–EUR 4100/(IT) EUR 3501–EUR 4500 | 98 | 24.5 | 24 | 5.9 | 122 | 15.1 | ||

| (FR) ≥ EUR 4101/(IT) ≥ EUR 4501 | 50 | 12.5 | 7 | 1.7 | 57 | 7.1 | ||

| Prefer not to answer | 23 | 5.8 | 59 | 14.5 | 82 | 10.1 | ||

| Household size 1 | Mean (SD) | 2.6 (1.2) | 3.1 (1.1) | 2.9 (1.2) | <0.001 b | |||

| Median (IR) | 2.0 (1.0–3.0) | 3.0 (2.0–4.0) | 3.0 (2.0–4.0) | |||||

| Number of children 2 | Mean (SD) | 0.6 (0.9) | 0.5 (0.8) | 0.6 (0.9) | 0.169 b | |||

| Median (IR) | 0.0 (0.0–1.0) | 0.0 (0.0–1.0) | 0.0 (0.0–1.0) | |||||

| Attribute/Levels | France | Italy |

|---|---|---|

| Food quality labels | No-label semi-hard cheese | No-label hard granular cheese |

Comté PDO | Parmigiano Reggiano PDO | |

Organic + Comté PDO | Mountain Product + Parmigiano Reggiano PDO | |

| Brand | No brand | Large-scale retailer brand |

| Farm brand (i.e., Fruitière de Plasne) | National brand | |

| Cheese refiner brand (i.e., Louis Arnaud affineur) | Local brand | |

| Price | Level 1: EUR 1.32/200 g | Level 1: EUR 5.60/300 g |

| Level 2: EUR 2.17/200 g | Level 2: EUR 6.30/300 g | |

| Level 3: EUR 3.02/200 g | Level 3: EUR 7.00/300 g | |

| Level 4: EUR 3.87/200 g | Level 4: EUR 7.70/300 g |

| France (n = 400) | Italy (n = 408) | ||||

|---|---|---|---|---|---|

| Attribute/Levels | Relative Importance (%) | Average Utilities (SD) | Attribute/Levels | Relative Importance (%) | Average Utilities (SD) |

| Food quality labels | 34.33 | Food quality labels | 28.71 | ||

| Comté PDO vs. No label | 1.13 (2.06) *** | Parmigiano Reggiano PDO vs. No label | 1.46 (1.32) *** | ||

| Organic + Comté PDO vs. No label | 2.64 (3.30) *** | Mountain Product + Parmigiano Reggiano PDO vs. No label | 2.01 (1.79) *** | ||

| Brands | 8.20 | Brands | 19.15 | ||

| Farm brand vs. No brand | 0.43 (1.05) *** | National brand vs. Large-scale retailer brand | 1.21 (2.05) *** | ||

| Cheese refiner brand vs. No brand | 0.63 (1.18) *** | Local brand vs. Large-scale retailer brand | −0.16 (1.29) | ||

| Price | 57.47 | Price | 52.14 | ||

| Level 2 vs. Level 1 | −0.64 (1.40) *** | Level 2 vs. Level 1 | −0.78 (1.08) *** | ||

| Level 3 vs. Level 1 | −2.21 (2.59) *** | Level 3 vs. Level 1 | −2.14 (1.79) *** | ||

| Level 4 vs. Level 1 | −4.40 (3.60) *** | Level 4 vs. Level 1 | −3.65 (2.69) *** | ||

| Constant (opt-out option) | −1.34 *** | Constant (opt-out option) | −1.02 *** | ||

| Wald chi-square | 357.17 | Wald chi-square | 456.23 | ||

| Prob > chi-square | 0.00 | Prob > chi-square | 0.00 | ||

| Pseudo R-square | 0.34 | Pseudo-R-square | 0.30 | ||

| Null loglikelihood | −3327.11 | Null loglikelihood | −3393.65 | ||

| Restricted loglikelihood | −2196.09 | Restricted loglikelihood | −2381.56 | ||

| Likelihood ratio test: prob > chi-square | 0.000 | Likelihood ratio test: prob > chi-square | 0.000 | ||

| France (n = 400) | Italy (n = 408) | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Price-Sensitive, Quality-Adverse | Quality Seekers | High-Quality Seekers | PDO Lovers | ||||||

| 21.50% | 78.50% | 88.70% | 11.30% | ||||||

| Attribute/Level | β | WTP | β | WTP | Attribute/Level | β | WTP | β | WTP |

| Opt-out option | −0.909 *** | −2.834 *** | Opt-out option | −3.171 *** | 0.146 | ||||

| Comté PDO vs. No label | −1.156 *** | −4.16 *** | 1.489 *** | 2.32 *** | Parmigiano Reggiano PDO vs. No label | 0.829 *** | 1.62 *** | 1.663 *** | 0.95 *** |

| Organic + Comté PDO vs. No label | −1.101 *** | −3.96 *** | 2.307 *** | 3.60 *** | Mountain Product + Parmigiano Reggiano PDO vs. No label | 1.157 *** | 2.26 *** | 1.537 *** | 0.88 *** |

| Farm brand vs. No brand | 0.138 | n.s. | 0.277 ** | 0.43 ** | National brand vs. Large-scale retailer brand | 0.767 *** | 1.50 *** | 1.113 *** | 0.63 *** |

| Cheese refiner brand vs. No brand | 0.110 | n.s. | 0.444 *** | 0.69 *** | Local brand vs. Large-scale retailer brand | 0.012 | n.s. | −0.192 | n.s. |

| Price | −0.278 *** | −0.641 *** | Price | −0.512 *** | −1.755 *** | ||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Menozzi, D.; Yeh, C.-H.; Cozzi, E.; Arfini, F. Consumer Preferences for Cheese Products with Quality Labels: The Case of Parmigiano Reggiano and Comté. Animals 2022, 12, 1299. https://doi.org/10.3390/ani12101299

Menozzi D, Yeh C-H, Cozzi E, Arfini F. Consumer Preferences for Cheese Products with Quality Labels: The Case of Parmigiano Reggiano and Comté. Animals. 2022; 12(10):1299. https://doi.org/10.3390/ani12101299

Chicago/Turabian StyleMenozzi, Davide, Ching-Hua Yeh, Elena Cozzi, and Filippo Arfini. 2022. "Consumer Preferences for Cheese Products with Quality Labels: The Case of Parmigiano Reggiano and Comté" Animals 12, no. 10: 1299. https://doi.org/10.3390/ani12101299

APA StyleMenozzi, D., Yeh, C.-H., Cozzi, E., & Arfini, F. (2022). Consumer Preferences for Cheese Products with Quality Labels: The Case of Parmigiano Reggiano and Comté. Animals, 12(10), 1299. https://doi.org/10.3390/ani12101299