1. Introduction

Developing countries, with mostly limited resources, have focused development policy mostly on increasing levels of investment (

Porter and Kramer 2019). Although investment is important for economic growth and employment, it has limitations, and a balance needs to be achieved between ongoing investment versus improvement in productivity for economic growth and development (

Ahluwalia 1991). South Africa, over the last twenty years, has been affected by extremely high levels of unemployment and low levels of employment absorption. The latest data release by Statistics South Africa indicate still-rising levels of unemployment. Unemployment in South Africa increased from 27.2% in 2018 to 29.0% in 2019, while the employment absorption rate decreased from 43.1% to 42.4% over the same period (

StatsSA 2019). These employment datasets are shocking compared to most other developing countries.

Table 1 provides a summary of data for a range of countries that have, or are still experiencing, labour market problems where reliable data are available. Of all these countries, South Africa has by far the highest, and growing, unemployment rate, followed by Greece and Turkey. Colombia, Brazil and South Africa have the lowest minimum wages, at below

$300. Looking at the Human Capital Index, again South Africa has the lowest index, followed by Brazil and Turkey. South Africa and Argentina have the lowest employment rates, of 42.6% and 42.3%, respectively, followed by Turkey. The countries with the highest labour cost indexes are Turkey and South Africa. The results from

Table 1 paint a problematic labour market picture for most of these struggling countries, but especially for South Africa, where the market has been deteriorating.

The South African labour market is one of the worst performing markets in the world and, for this reason, it is important to analyse it from all angles in the quest to find answers to this problem. Other developing and unstable developing economies, such as Turkey, Brazil and Argentina, have similar problems in their labour markets, and the results from this study could be useful for these countries. This study has the aim of analysing the South African labour market from an employment absorption point of view, and its impact on and relationship with productivity, investment and real wages.

2. Review of the Literature

This section provides definitions of variables included in the study, followed by an empirical analysis of previous studies on this subject of research. The employment absorption rate is defined as “the proportion of the working-age population aged 15 to 65 years that is employed” (

National Development Agency 2000). Higher levels of the employment absorption rate indicate more employment opportunities. Labour productivity is defined in simple terms as output per unit of labour input (

OECD 2002); higher levels of productivity have a positive impact on output and economic growth. In economic terms, investment means the capital outlay of money usually for income or profit (

Merriam-Webster 2019). Higher levels of domestic and foreign investment could lead to economic growth. Lastly, real wages are defined as the value of goods and services that could be purchased with the level of wages received as income, taking inflation into account (

OECD 2002). The theoretical foundation of the study is based on the historical theories of Okun’s Law, who stated that unemployment is related to economic growth, and higher levels of economic growth are positively related to employment creation (

Okun 1962). Okun’s Law, although it has some limitations, has been used over a number of decades as a theoretical guideline, estimating, in general, that a one percent decrease in the unemployment rate could lead to a three percent increase in economic output. This relationship is, however, also affected by other variables, such as labour supply, wages and productivity (

Prachowny 1993). In addition, the Phillips curve states there is a trade-off between unemployment and inflation (

Phillips 1958). Various studies have analysed this relationship and added variables such as productivity and wages (

Ball and Moffittm 2001).

Regarding empirical studies, a comprehensive analysis is provided from across the world on the relationship between the variables included in the study.

Mahadea and Simson (

2010) analysed the employment situation in South Africa. Their study found that, although the economy has shown positive growth from 1994 to 2008, the formal sector could not provide adequate jobs during this period. The question of what impacts would result from the economy experiencing a recession, or period of low growth, could be asked. The study used a regression model to analyse the relationship between economic growth and employment and found that the employment elasticity was low over the period, and employment growth was limited in relation to economic growth. This situation could be described as jobless growth.

Klein (

2012) analysed the employment environment in South Africa during and since the financial crisis in 2008. The main finding from this research was that employment creation is limited and restricted when real wages grow faster than productivity in labour. The results from the research also indicate that, in the long run, cointegration exists between real wages and productivity, but not in the short run. In a comprehensive employment study in South Africa by

Fourie (

2011) he listed the key issues in the local employment environment, which included workers finding it difficult to transit from the informal to formal employment sectors; structural problems limiting the smooth functioning of the labour market, such as labour regulations and poverty; unemployment being affected by real wage elasticity of labour demand, which was approximately 0.7, and an output-elasticity of employment of only 0.5; and employment creation and the labour market being affected by poverty, social-welfare grants and supply of labour.

Barnichon (

2010) analysed the correlation between unemployment and productivity. He found that technology shocks or impacts can lead to a positive relationship between unemployment and productivity, and non-technology shocks, such as aggregate demand, cause a negative relationship.

Sawyer (

2002) investigated the relationship between inflation, employment, wages and capital investment. Some of the findings include that rising aggregate demand drives the relationship between real wage and employment, and that investment plays a major role in the creation of employment opportunities.

Meager and Speckesser (

2011) state that a strong link exists between productivity and wages, and public policy has limited impact on this relationship. When wage increases are faster than growth in productivity, it has a negative impact on the economy, but the relationship will always attempt to move to equilibrium due to international competition. The study found that wage moderation could allow employment creation.

Hellwig and Irmen (

2001) analysed the interrelationships between wages, employment and endogenous productivity growth. This study found that “steady-state equilibria employment contracts at a constant rate equal to the difference between the growth rates of productivity and output”, which disagrees with the statement or view that equality of wage growth and productivity growth is a condition for constant employment. According to

Rowthorn (

1999), theory predicts that factors such as capital investment, innovation and technology do not have a long-run impact on the levels of unemployment or, on the other hand, employment creation. The study found, however, that if capital investment is endogenous, it may have a long-run impact on employment.

Results of studies in developed countries provide different results compared to developing countries. In a study by

Guthrie (

2001), in New Zealand, on employment and productivity, it was found that the productivity of firms is positively affected by employee retention strategies such as increased involvement in decision-making.

Bresnahan et al. (

2002) analysed factors that affect demand for labour in the United States and found that innovation and productivity are key factors. Businesses with increased levels of innovation usually make use of highly skilled labour.

Van Ark et al. (

2008) studied labour productivity in developed countries. Since the 1990s, European growth in labour productivity has been low, while in the US the growth has been much higher, leading to an increased productivity gap. The research found that the main reason for this growing gap is the difference in the growth rate of the knowledge economy. A number of factors were identified and one of them is productivity growth, which acts as a proxy for innovation and technology improvements. In Europe, the labour market is subjected to higher levels of regulations when compared to the US.

Girma et al. (

2001) analysed the possible existence of a gap in wages and productively between foreign and domestic firms. The interesting results from the study are that foreign managed firms actually have higher levels of productivity and wages when compared to local firms, and no proof of intra-industry spill-overs affecting productivity were established.

Barry et al. (

2005), however, found evidence of improved productivity spill-overs from FDI.

Arnold and Javorcik (

2009) also analysed the impact of FDI and foreign firms on productivity. The study established that foreign ownership had a significant positive impact on productivity at firm level, mostly due to increases in investment, employment and wages, as well as improved integration of firms for extended international trade into the global economy.

Dearden et al. (

2006) state that wages are used to predict the level of productivity and their study had tested this relationship in the UK. The study found that training of workers in an industry had a significant impact on improved productivity and also led to increased wages.

Conti (

2005) also analysed this relationship in Italy, and the study found similar results, with training leading to significant increases in productivity, but movements in wages were not detected.

Blundell et al. (

2014) analysed labour productivity in the UK, and found that both productivity and wages have been decreasing since the financial crisis. This phenomenon could possibly be explained via the over-supply of labour.

Bedi and Cielik (

2002) analysed the impact of FDI on employment and wages in Poland. Evidence from this study indicates that wages are higher in foreign owned companies.

Lazear (

2006) states that output and productivity are more than 30% higher in the US compared to other developed countries due to an environment of growth in capital and investment. Factors such as flexible labour regulations, entrepreneurship development, and ongoing skills development could lead to increased productivity.

Empirical results from developing countries indicate the following:

Coniglio et al. (

2015) indicate that employment creation is a major problem for most developing countries, and their study analysed the relationship between FDI and employment in sub-Saharan African countries. Results include that foreign firms use more skilled workers for employment and pay higher wages when compared to local firms.

McMillan and Rodrik (

2011) found that developing countries have a dilemma of productivity gaps between traditional and modern sectors, and that the ongoing flow from low-productivity sectors to high-productivity sectors drives growth and development in these countries. The study found an interesting result, in that the Asian countries followed this pattern for rapid development, while Africa and Latin America followed the opposite path, but with poor developmental results. Additional results from the study indicated that developing countries, where exports are dominated by raw natural resources, have a negative impact on structural change and economic growth, because these mostly highly productive sectors do not have the capacity to absorb excess labour from low-skilled and low-productivity traditional sectors.

Debaere et al. (

2010) analysed the impact of FDI on employment. The study found that investment by multi-national corporations in developing countries has a negative impact on the specific company’s possible short-term employment situation, while investment in developed countries does not affect employment growth significantly. In contrast to the previous findings,

Habib and Sarwar (

2013) state that FDI is critical for economic growth and development. The authors studied the relationship between FDI, economic growth and employment growth from 1970 to 2011 in Pakistan, using Johanson cointegration methodology. The study found significant long-term relationships with cointegration between variables.

Aitken et al. (

1996) investigated the relationship between FDI and foreign business ownership and wages in Mexico and Venezuela. Results indicate that FDI had a negative impact on wages at local firms. It should, however, be kept in mind that foreign involvement in the local economy could have different impacts on wages and productivity depending on the specific firm and sectors.

In summary, this specific study field allows for interesting empirical findings with contrasting views, and to find consensus on the impact and relationships between the variables is not possible in a dynamic environment. Herewith are some of the lessons from the literature view. In most countries, including South Africa, economic growth does not always translate to the creation of additional employment. If wages increase faster than productivity, the impact is negative on both employment creation and the economy. Wages and productivity should have a positive correlation. When local demand increases, wage pressure increases, as well as demand for labour, while it is also the case that, when wage moderation occurs, employment creation becomes a possibility. In addition, domestic investment drives economic growth and employment. In studies in developed countries, job security could lead to higher levels of productivity. Productivity increases are dependent on innovation and technology. From a negative perspective, labour and other regulations have a negative impact on employment creation. Foreign investment by foreign firms could have both positive and negative impacts. Foreign firms usually require and appoint mostly skilled labour and such firms usually have higher levels of productivity and wages and could lead to destroying the competitiveness of local firms and local employment. Higher levels of skill lead to improved productivity and higher wages, while an over-supply of labour leads to lower wages.

3. Methodology

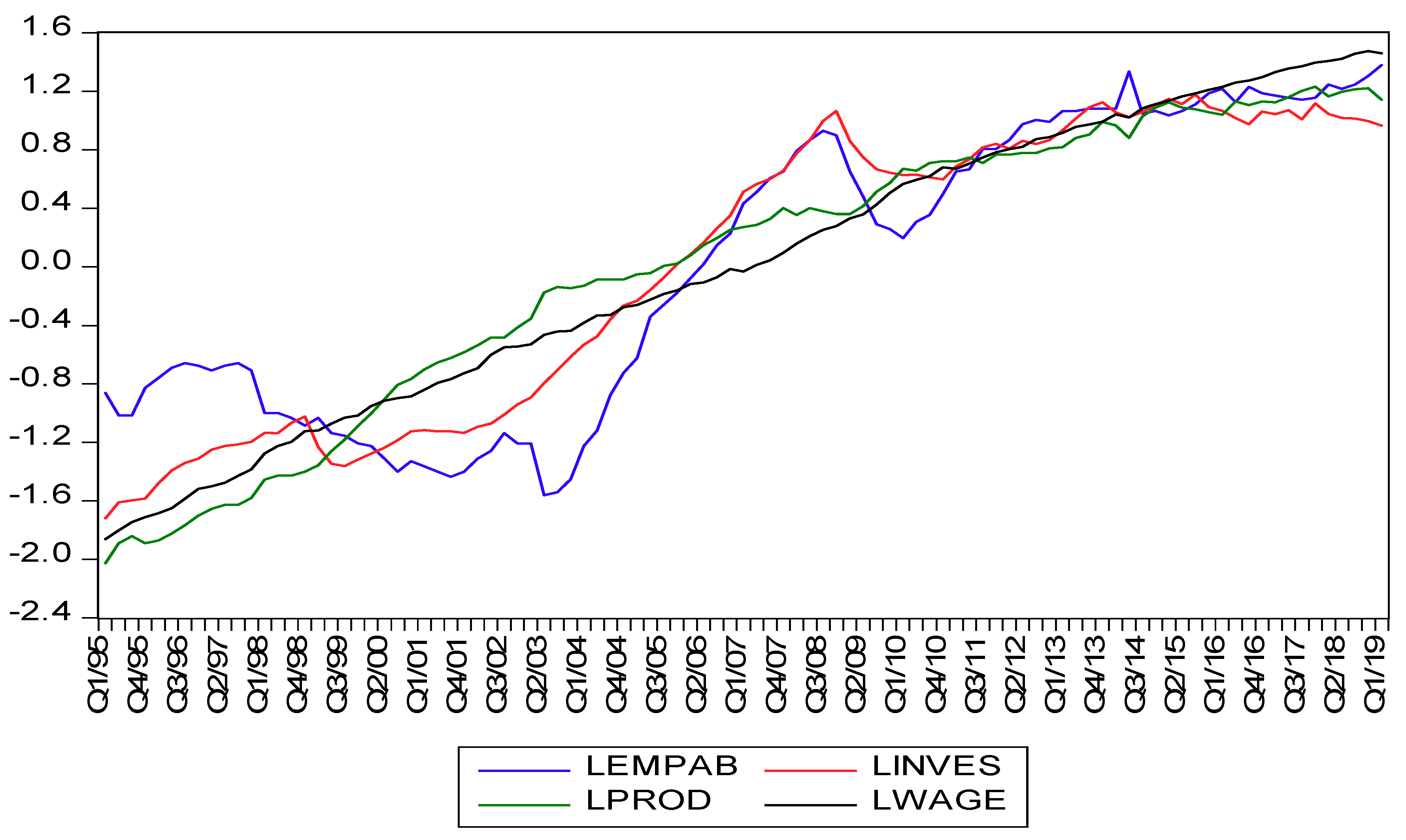

The dataset used in this study consists of employment absorption rate (LEMPAB), productivity (PROD), gross capital formation or investment spending (INVES) and real wages (WAGE). Quarterly data covered the period between the first quarter of 1995 and the first quarter of 2019. The time period was selected based on two reasons. The first is that the authors’ aim was to determine the extent to which employment absorption is affected by labour productivity, investment spending and real wages after the apartheid era (with the democratic government), and the second reason was the availability of data. The entire dataset was acquired from the South African Reserve Bank (SARB). Before the econometric estimation, the dataset was transformed into a natural logarithm. The augmented Dickey–Fuller (ADF) and the Phillips–Perron (PP) tests were employed to establish the presence or absence of unit roots within LEMPAB, LPROD, LINVES and LWAGE. Although it is noted that the ARDL model can be applied to a set of variables without performing unit root tests, it is advisable to carry out a unit root test to certify that data do not contain an I(2) variable, as the ARDL approach is only appropriate for variables that are integrated with order I(0) and I(1) or a combination of the two. The reason for this is that, according to

Ouattara (

2004), the ARDL model produces spurious results when applied to I (2) variables.

The augmented Dickey–Fuller (ADF) test for unit root was introduced in the econometrics field as an extension to the Dickey–Fuller (DF) test to eradicate the issue of error term that appeared unlikely to be white noise in the DF test. To achieve improved unit root test results, the ADF adds an extra lagged term of dependent variable (

Dickey and Fuller 1979). The lag length on the extra terms, in this study, is achieved using the Schwarz information criterion (SIC). The SIC is considered a most effective criterion for model selection (

Cavanaugh and Neath 1999). The ADF test can be performed in the following three ways:

Mackinnon (

1991) provides the critical values for each of the above presented three models. The null hypothesis of

has unit root, and is rejected if the ADF statistic value is greater that the critical value (in absolute terms), and the conclusion will be that

is stationary.

Phillips and Perron (

1988) established a general rule of the augmented Dickey–Fuller test process that allows for impartially mild assumptions regarding the error distribution. The Phillips and Perron test is the AR (1) procedure, which is stated as follows:

The Phillips and Perron (PP) test rectifies the t-statistic of the coefficient δ from the AR (1) model to incapacitate the serial correlation within the

. Consequently, the PP test is an alteration of the ADF test, where it considers the restrictiveness nature of the error procedure. This test also uses the

Mackinnon (

1991) critical values. The Phillips and Perron is seen to be robust to general forms of heteroscedasticity within the error term, and it can be applied for regression without taking into account the lag length specification (

Pinn et al. 2011).

Contrary, to ADF and PP unit root tests whose null hypotheses suggest the occurrence of a unit root in the series, the Kwiatkowski–Phillips–Schmidt–Shin (KPSS) employs the Lagrange multiplier (LM) test and suggests that series are initially stationary (

Hadri 2000). Consequently, all three tests (ADF, PP and KPSS) are used in this study to ensure robust results.

Following the unit root tests, the cointegration test was performed using the bound testing approach. The aim of this test was to empirically establish a long-term relationship among variables of interest. The test was selected based on the results from unit root tests. The ARDL bound testing procedure is considered to be more robust and appropriate when applied to a dataset with a diminutive sample size. Moreover, it simultaneously provides the estimation for short- and long-term parameters (

Haug 2002). The ARDL (p,q), developed by

Pesaran et al. (

2001), is applied to this study and presented as follows:

Applying Equation (5) on variables of this study, the following Equation (6) was obtained:

where

is the drift,

,

,

and

are the long-run coefficients and

denotes white noise errors. The cointegration between variables is achieved by means of performing the F-test for the joint significance of the

,

,

and

coefficients in Equation (6). The null hypothesis of no cointegration (

:

=

=

= 0) is tested against the alternative (

:

≠

≠

≠ 0).

Pesaran et al. (

2001) suggested two asymptotic critical values that are utilised to test for cointegration when the independent variables are considered as

I(

m) where 0 ≤

m ≤ 1. The lower bound values suggest that regressors are I(0), while the upper bound values suggest that these variables are I(1). Regardless of the order of integration, the null hypothesis (

) is rejected if the estimated F-statistic is larger than the critical value of the upper bound. Conversely, the study fails to reject

if the estimated F-statistic falls below the lower bound critical value. Lastly, for the estimated F-statistic that falls between both critical values, the regression results are inconclusive. Once the cointegration among variables is established, the ARDL error correction model (ARDL-ECM) also has to be determined. Equation (7) determines the error correction model associated with the cointegration (long run) estimates:

where

denotes error correction term and

is the coefficient of the ECT utilised to measure the model speed of adjustment towards long-run equilibrium. In the absence of cointegration among variables, the error correction model (ECM) without error correction term can be estimated following Equation (8):

where

,

,

and

are short run coefficients.

The presence of dynamic error correction model derived by Equation (7) does not automatically infer stability of the estimated coefficients. Therefore,

Pesaran et al. (

2001) recommended the stability test of estimated parameters on the studied model. This is done by the means of cumulative sum (CUSUM) and/or cumulative square sum (CUSUMSQ) tests.

Granger causality is one of the tests that can be utilised to establish a causal relationship among variables. However, this test can lead to spurious results on functions with time lags on integrated variables (

Dritsaki 2017). Additionally, the standard granger causality tests suffer from inconvenience parameter dependency asymptotically (

Toda and Phillips 1993); (

Toda and Yamamoto 1995). The potency of Toda and Yamamoto’s procedures in establishing causal relationship among variables lies in its ability to overcome numerous deficiencies of the standard Granger causality procedures. The Toda and Yamamoto test for granger non-causality is conducted from the modified Wald test (

Rambaldi and Doran 1996), and, therefore, the Wald statistic is valid irrespective of variables’ integration order, be it I(0), I(1) or I(2). For these reasons, the Toda and Yamamoto test for Granger non-causality test is applied to this study. In order to analyse Granger causality (1961),

Toda and Yamamoto (

1995) developed a model based on the estimation of augmented VAR model (

k +

), where k denotes the optimal time lag and

the maximum integrated order of variables in the VAR model. According to

Toda and Yamamoto (

1995), for

d = 1, any lag selection process is always effective, since

k ≥ 1 =

d. However, if

d = 2, the procedure is valid only if

k ≠ 1. Using the VAR model, the Toda–Yamamoto causality is expressed as follows:

where

k is the optimum time lag and

is the maximum integration order on variable (both in VAR model).