Abstract

This paper examines the role of connectors in a fraud and corruption-prone environment of the circular economy. A qualitative approach and critical perspective were adopted. In the same line of thought, this study drew on narratives of fraud experiences from the Criminalistica Symposium between 2017 and 2022, as well as interviews with forensic accountants, auditing experts, and police investigators, to foment discourse analysis derived from Machiavellian theory. Thematic coding was selected for the presentation of results. Our findings lead us to the conclusion that there are five identified connector roles in an organization. The connectors have the role of mainly influencing acts of corporate fraud and corruption, which have the characteristics of a double-edged sword. Connectors serve as team motivators and sometimes as manipulators, and they also have the role of spearheading negotiations in tumultuous times of employee disorder and employers’ disagreements, almost leading to uneasy truces. Additionally, in a bid to perpetrate fraud, the connector assists in the role of overriding controls. Inasmuch as it bears the trait of acting as an agent of knowledge building by facilitating learning and communication in organizations in a CE environment, this study contributes to the literature showing various roles of connectors in fraud schemes. Finally, bearing the originality, understanding the role of connectors in circular economy fraud and corruption schemes clarifies our path to expected wellbeing in the concept of sustainability in our ways of life in the coming decades attuned to policymakers and regulators.

1. Introduction

Connection is one of the main intangible assets in the circular economy. A connected person demonstrates the preparedness for problems solving, being a rare competence of our time. If one is well connected, one may be able to derive some affluence in the current World Wide Web and digital transformation. It is what connects a public figure to millions of followers, and it can also be converted to monetary value. De facto, is there something unconnected today? One might say no. However, there could be various intentions to establish a connection, which could also be for fraudulent purposes.

The Association of Certified Fraud Examiners (ACFE) classifies fraud into three categories: corruption, misappropriation of assets, and financial statement fraud. In fact, the extent to which misappropriation of assets leads to cases of occupational fraud astonishes, to the effect that the 2022 Fraud Index shows this category as 86% of the cases. Financial statement fraud was 9%, and the rest, including corruption, was 5%. Because of their impact on various economies, fraud, and corruption have gained prominence in today’s world. This spurs this study, which aims to examine a possible relationship between the roles of connectors, corporate fraud, and the horizon in the circular economy. Moreover, cases of large-scale corporate fraud that occurred, such as Enron, Global Crossing, and WorldCom in the USA, or cases such as Banco Santos, Daslu, Boi Gordo, and Lava Jato in Brazil, left even more questions and sparked interest in research.

Considering the numerous losses resulting from these acts and the relevance of a possible solution, we examined how the presence of a unique set of individuals (“Connectors”) could also contribute to the minimization or escalation of the possible risk. This is in addition to the anti-fraud controls that are implemented through stringent policies within the organizations.

Thus, it fuels the argument that policies that streamline control functions aimed at monitoring the powers invested in connectors will play a critical enabler role in creating value and resources capable of minimizing fraud and corruption in organizations. This is because it affects the tone of control activities in organizations as well as relationships between interested parties.

Connectors have always been linked to natural sciences, physics, and engineering, frequently referred to as hard science. Wang et al. (2022) investigate the fatigue performance of sud connectors of steel–concrete composite structures, drawing from the efficiency and fatigue crack propagation and life analysis. In the same vein, Zhou et al. (2022) study the battery modules with different connection modes designed to reveal Thermal Runaway (TR) propagation mechanisms, and a passive strategy based on thermal insulation is proposed to inhibit TR propagation. However, not very common in social sciences, but recently, there arose the need to investigate the relationships between connectors in corporate governance structures and individual functions.

Connectors could have some systemic perspective when units are joined together with interface for propagation of related control objectives. This could be seen in the case of a distributed system, where the connectors are used to link the different components of the systems. The connectors provide the necessary communication pathways for the systems to function properly. In this case, the connectors could have a significant impact on the overall performance of the system, as they are responsible for the efficient transfer of data and control signals between the different components.

Previous research has presented a reduction in employee turnover from the implementation of connectors (Autrey et al. 2019). Other impacts are connectors on organs, on executives’ personal connections with legal support in society, and on manifestations of corporate fraud. Imoniana and Silva (2013) provided a straightforward discussion of forensic accounting as a tool for detecting corporate fraud. Additionally, Imoniana and Murcia (2016) explored the similarity of cases of corporate fraud. In the same vein, according to Costa and Wood (2012), one understands that studies on corporate fraud are still few, despite its relevance and the numerous consequences it generates in the capital market. So far, forensic accounting research has not identified many aspects of social relationships as a factor that can potentially cause fraud behavior (Shaleh et al. 2022). So, the breadth of these concepts and their interrelationships still have some nuances that are worthy of investigation. Fraudsters’ motivation and social disorganization or the loss of social and moral values (Riahi-Belkauoni and Picur 2000; Schnatterly 2003) are some aspects that could emanate from fraudulent institutions. In the theory of fraud, there is a model of the fraud triangle (opportunity, collusion, and rationalization) that is worth highlighting in this work. Proposed by Donald Cressey in mid-1953, it is a model that points out the main causes of corporate fraud practices. Given that most frauds are committed by two or more people in collusion and that the influence of connectors occurs through socialization and the strengthening of relationships in environments (Autrey et al. 2019), it is assumed that their presence in groups reduces any hidden intention or act of bad faith in fraud.

Research has also shown that companies that have implemented the traditional fraud prevention schemes (internal audit, complete technology-based solutions, frequent assessments of the risk in question, and better control of their partners and third parties) present a lower fraud risk when compared to companies that do not bet on these measures. In the mentioned studies, no one referred to the relationships between connectors. This study, therefore, argues that companies that have at least one connector in the groups will have an even lower fraud rate than companies that do not have any connectors in the work groups.

Following this line of thought, the present study sought to explore aspects of connectors and corporate fraud and thus fill the apparent scientific gap. As a result of this introduction, the following section provides the theoretical background for this study. The third section covers the research question and methodology, and the fourth section analyzes the data. The fifth section is the discussion of this study. To finalize, a conclusion is drawn in the sixth section of the article.

2. Theoretical Background

2.1. Connector

Connectors are highly motivated individuals who find it easy to approach others, interact, connect with anyone, and manage to gain their trust in the first few minutes of conversation. They are happy people, curious, well known, willing to listen, feel the warmth of others, love to help, and are inspiring. This picture places connectors in the group of good articulators and shows an enviable network.

According to Autrey et al. (2019), connectors are individuals that we identify who possess a blend of innate traits and skills that predispose them to be personable, willing to relate to others, and able to influence others’ relationships and can serve as a catalyst for improving group outcomes. These attributes single them out, and they are not necessarily in the upper echelons of the organization.

The presence of a connector in a group makes all the difference in the communication between the elements of the group, enabling the achievement of objectives and performance improvements in the business environment. Due to this ability to easily interact with people, the connector manages to both win and maintain trust, something that one assumes is essential to favor the generation and strengthening of harmony between different employees and the top hierarchy in the work environment by handling uneasy truces. In this sense, we emphasize the presupposition that the attribution of a connector in the group increases both the positive experience of the group and the good faith of the members that compose it.

In the study carried out by Autrey et al. (2019), it was demonstrated from experiments how the implementation of connectors in workgroups is an important and effective factor for a more comprehensive retention strategy. “Connectors are people who maintain the trust of a large group of people” (Saddy 2017). In the same line of thought, a survey carried out in 2019 by the Gartner Group, called The Future of HR, has proven the important role of connectors in terms of solving the most varied obstacles that may be present in the business environment, making the space more conducive to both the development of the skills of the work team members and personal development, generating profitability for the company. All this makes it possible to characterize connectors as motivating elements in a work environment that could be erroneously misused.

In effect, when defining a connector, it would be prudent to say that, based on the theory of planned behavior, he or she connects individuals to a group of persons with the aim of gaining a benefit from this relationship. This relationship could be a durable one or one that is meant for a brief purpose.

2.2. Fraud

Fraud is an intentional error that leads to the subtraction of another person’s assets. Fraud has evolved over time, growing from ordinary pilferage and misappropriation of petty cash books where replenishments and reimbursements are manipulated for self-interest to frauds of greater proportions. Organizational fraud consists of the misappropriation of assets, pilferage of assets, falsification of documents, bribery, double funding, and corruption. In the accounting occupation, fraud can be perceived in the business process through corruption, misappropriation of assets, and fraudulent disclosure of financial statements. Societies with a bulk of things to cater to never thought of having an eye on closer associates of the civil servants or private employees with invested authorities in view of monitoring power abuse.

The focus of many white-collar criminal offenses is fraud Podgar (Podgar 1999). Fraud evolved substantially very recently. As of 1998–1999, in the American federal system, there was no indictment or conviction for fraud. Fraud is a little-explored topic because of its delicateness, and considering its complexity, difficult proof of its occurrence, and how in companies, many cases are kept confidential or pushed under the carpet. De facto, many fraudulent acts are carried out by people who have a certain authority and power within a company, which makes it difficult to detain such an action followed by some punishment (SÁ and HOOG 2010).

Notorious fraud cases, such as that of Enron, Global Crossing, and WorldCom from the USA, or cases such as Banco Santos, Daslu, Boi Gordo, and Lava Jato from Brazil, have served as discussions in the pulpit. In March 2012, a search on the topic of corporate fraud on google returned more than 1 million results (Costa and Wood 2012), and in June 2021, more than 21 million results. This shows us how relevant this topic is and, at the same time, confirms that although there are currently fraud prevention measures in organizations, they still do not cover these gaps, making evident the need for further studies on the subject.

In a global view, fraud is any cunning, deceitful act, in bad faith, with the intention of harming or deceiving others, or of not fulfilling a certain duty (Houaiss 2007). By the same token, fraud is the main source of human greed and the sheer arrogance of human nature, and this is innate in those who perpetuate it, who are never content with what they have, or who always take advantage of a perceived failure in control. (Imoniana and Silva 2013).

From this, it is called corporate fraud when this fact applies or occurs in a company or association. According to KPMG (2021) most fraud is carried out in collusion between two or more people. According to the same reference, group fraud is twice as common as individual fraud.

This act generates enormous damage both for the company itself and for third parties such as investors, suppliers, customers, and the government. Frauds harm the company’s image in the eyes of society, causing customers to lose confidence, generating a feeling of failure and revolt, and all of this, in addition, generates losses for the company and for society as a whole. These losses affect the country as a whole, reducing employment, increasing poverty, and obviously impacting the country’s economy. It is possible to quantify some costs, such as direct financial losses or expenses with fines, sanctions, and response or remediation actions. However, other harms are not easily quantifiable, such as damage to the brand, loss of market position or employee engagement, and loss of untapped future opportunities (PwC 2020). Depending on the severity and taking into account the particular situation of each company, fraud can lead to more devastating consequences, such as the winding up of the company.

Thus, in the face of the consequences that corporate fraud could generate, its eradication is part of the goals of all companies in the era of CE. In this context, KPMG partner Phillip Ostwalt has highlighted some basic controls to prevent this phenomenon, such as internal auditing, implementation of complete technology solutions, conducting frequent fraud risk assessments as part of the company’s risk assessment process. as a whole, closely monitoring business partners and other third parties, etc.

In addition to these controls that minimize the occurrence of such a situation, we examined in this study how the presence of a single set of individual “Connectors” could also contribute to the minimization of this eventual risk. In other words, we emphasize that although a company has implemented the controls mentioned above, it can also assign a connector in all its areas for better engagement, commitment, strengthening the good faith of members, harmony in the workplace, and transparency in the activities, which can further mitigate this risk.

Of note, in the model fraud triangle, the causes are grouped into three distinct groups, namely opportunity, pressure, and rationalization. On this topic, Pardini (2020) makes a detailed exploration of each of the groups, listing elements that are included in each of them, describing the following: (a) opportunity: it can arise from failures, absence, or deficiencies in terms of control and inspection within the company, in addition to the lack of commitment to the management team itself, favoring opportune moments for malicious actions; (b) pressure: also called motivation by some authors, it may have a personal origin such as insufficient wages, pressure in the work environment demanding a lot from the employee and often with little recognition, generating feelings of discontentment and discomfort; and (c) rationalization: it concerns the act of self-justifying for the bad habits committed, that is, the fraudster seeks reasons to make the act of fraud something plausible.

It is worth stressing that most frauds attract collusion with two or more people. These arguments could lead one to see how much socialism impacts the manifestation of fraud. In fact, as Costa and Wood (2012) have stated, society is considered the first component related to corporate fraud.

2.3. The Relationship between Connectors and Fraud

Alatas (1968) observed that humans do build social relations; however, these relationships lead to nepotism and collusion in public organizations. These collusions are normally made to weaken the process of internal controls in order to pave the way for perpetration. In other words, the internal controls that can be thwarted to hinder their effectiveness. This is why internal control policies are purposely implemented so that errors of omission or compensation are tackled to mitigate the risk of material misstatement (Oliveira et al. 2022).

Connectors have the powers to arrange for certain forces, which could lead to collusion and cartelization practices for a fraud scheme. As observed by Sabet (2010), connectors in collusion with corrupt police officers working with organized crime regularly offer intelligence, provide security, weapons, and uniforms and release criminals. In other words, efforts of the government to maintain law and order have been thwarted by the compromised groups of police who are in allegiance with drug cartels in Mexico. Daily newspaper reports illustrate how many police officers have not only turned a blind eye to organized crime but have also become active participants in crime activities (Sabet 2010).

When the connector plans to implement a fraudulent strategy, it breaks down the ethical base of the member of the group in order to have a way through. With trust, this is cautiously cultivated with all ease. Financial Crisis Inquiry Commission, in its final report, used variants of the word “fraud” no fewer than 157 times in describing what led to the crisis, concluding that there was a “systemic breakdown,” not just in accountability, but also in ethical behavior (Rakoff 2014).

In the same vein, this could be likened to corporate lobbying that sustains fraud. The effect of corporate lobbying on fraud and money laundering (Salehi and Norouzi 2022).

2.4. Circular Economy Waste Leads to Fraud

Circular economy (CE) is based on environmental, economic, and social dimensions and aims to ensure sustainable development at each step of product creation, transformation, and conversion by creating a closed-loop economy (Nikonorova et al. 2020). CE harnesses all the resources, including human, material, economical, technological, and socially embedded, to create a dream of wellbeing.

The circular economy strategy is intended to facilitate the implementation of an innovative technological environment with security enhancement. This houses an entrepreneurial control environment that allows management and corporate governance to rethink the horizon of the business.

The implementation of CE may vary among organizations as a result of business maturity and workforce for externalities of the concepts within the business teams. This could drag the steps and therefore distinguish the CE approaches in different business environments and countries.

To engineer this, change is always embodied in the circular economy, which in turn values the effort organizations put into redirecting their business. Who has not performed reshufflement or reorganized business structures in order to accommodate innovative changes? This is always arduous and needs sacrifices from all the collaborators. Ultimately, this needs the learning of new tools, normally technological, and tasks that displace persons.

The circular economy came in the time of COVID-19, in which organizations never thought of the home office or the implementation of virtual communications with clients, employees, and general stakeholders. De facto, better housekeeping is being performed. As mentioned by Imoniana et al. (2021) sound data are vital in leading the transition to sustainable, circular waste management systems. This, in fact, has come to stay and currently needs adaptations in order that the close-loop circle would pave the way for continuous learning for the betterment of the business. After all, we were lamenting the better organization of data to assist circular economy management.

In regard to this, fraud perpetrators can enjoy lavishness or waste, which goes contrary to the principles of the circular economy. The article Woman Who Flaunted Lavish Lifestyle on Instagram Charged with $100K COVID Relief Fraud serves as an example (Staff and Wire Report 2021). It does mean that CE is a tool to face off against lavishness in a world where there are millions of people who have not eaten three square meals in a day. Waste management, sustainability, accountability, and management accounting practices help to develop an ecosystem and achieve the sustainable development goals of the United Nations 2030 Agenda (Di Vaio et al. 2022).

In the same vein, as observed by Mackey and Liang (2012), consumption is a serious threat to global health outcomes leading to financial waste and adverse allegations of misuse of funds and fraud in global health initiatives. Additionally, Layman (2016), studying business programs that allow self-certification, observed that mistakes and waste owing to mass inefficiencies foster fraud.

2.5. The Machiavellian Theory and Relationship to Fraud and Corruption

Over time, the Machiavellian theory has pointed to a double-edged personality trait in the literature. Meaning that one cannot, de facto, predict the actions of these persons being depicted. We might say that Machiavelli’s theory legitimizes people’s “natural” disposition toward passivity (McCormick 2021). This is further expanded by Lang (2015), who termed the phenomenological (manipulativeness) and dynamic (emotion dysregulation) analogies between Machiavellianism and Borderline Personality Organization (BPO).

In the same vein, Calic et al. (2023) segregated the Machiavellian rhetoric into eight facets, which are categorized into hard and soft influence tactics; the hard tactics include revenge, intimidation, betrayal, and manipulation, and the soft tactics include ingratiation, supplication, self-disclosure, and persuasion. McIlwain (2003) contends that Machiavellianism may as well have a dual function: to diminish discomfort via the cognitive modification of empathic tendencies and to point out weaknesses ripe for exploitation. The double-sided approach of the theory is common in the literature.

Therefore, the rationale of the unscrupulous actions of the connectors that give an incentive for fraud and corruption could be likened to Machiavellian moments. The moment in which the republic confronts the problem of its own instability in time, which Pocock (2016) calls the “Machiavellian moment,” Kahn (1994) observed that historians of political thought have argued that the real Machiavelli is the thinker and theorist of civic virtue. Machiavellian rhetoric, on the other hand, contends that Renaissance readers were correct to see Machiavelli as a figure of force and deception, rhetorical cunning and deception. In fact, the great dissimilarities between intentional errors and unintentional ones, which are purposely mapped out in a cunning manner, are fertile ground for perpetration by the connectors.

To put it another way, the connectors who intend to commit criminal and fraudulent activity should be taken with a grain of salt, as the traces of actions already planned through internal control procedures may be contrary to normal operational functions. Prociuk and Breen (1976) observed that Machiavellianism is related to a specific control expectation and that Machiavellianism and internal control are mutually exclusive orientations.

3. Research Question and Methodological Procedures

In all that has been mentioned, it is observable that this study is intended to obtain a greater understanding of the role of connectors as a phenomenon in corporate fraud and corruption by laying more emphasis on in-depth research. In this context, the present study bears on the following research question: what is the role of connectors in corporate fraud and corruption in organizations in the era of the circular economy?

This study was carried out with a constructivist intent, through qualitative strategies, such as the study of lived experiences (Imoniana et al. 2022). Qualitative research proposes describing and studying subjects’ actual actions in real-life contexts (Gephart 2004).

Based on Burrell and Morgan (1979), this study is positioned on nominative, anti-positivist, voluntariness, and subjective ideological dimensions. Consequently, this study levies on critical perspective.

Data corpus consists of constructs of data from the Criminalistics Conference (CNC2022) to support this investigation. Criminalistica 2022 aimed to spark debate on topics such as applied technology in criminology and forensic accounting, as well as aspects of criminal fraud. The rationale behind criminal fraud is that the circular economy requires enormous investments to curb fraud and corruption, which are ills that corrode society, and needs political will to drive adequate laws, regulatory frameworks, and watchdogs to foster conducive approaches and more eco-friendly technologies in the CE era.

Yet, this study further interviewed seven specialists from different large companies that work in forensics and auditing as a strategy to enrich and support the theme. Additionally, this study interviewed experts from the Brazilian federal police’s forensic investigation units supporting the national banking system. These experts were reached through snowballing.

The age group of the respondents ranged from 30 to 51 years, with professional experience between 7 and 23 years. See Table 1 for the demography of the respondents.

Table 1.

Demography of the respondents.

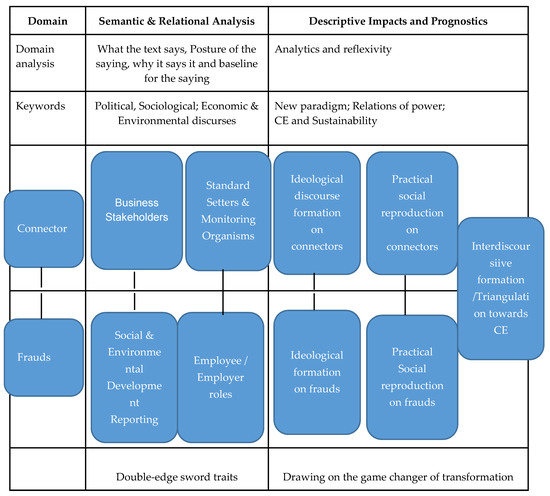

Furthermore, this study draws on discourse analysis to expatiate on the data constructed. The approach of discourse analysis borrowed a leaf from Laclau and Mouffe (2001) and also, Bakhtin (1997), who stressed that words are woven from a multitude of ideological threads and serve as the fabric of all social relations in all domains. In the same vein, Spradley (1979) breaks a discourse on ethnography into three stages, namely, domain analysis, taxonomic analysis, and componential analysis. This study, therefore, expands the discursivity approach by proposing domain analysis, semantic and relational analysis, descriptive impacts, and prognostics aiming to highlight what the different discourses tend to reveal. An epistemological rupture of ideology that the texts intend to hide (Maingueneau 2015); see Figure 1. In this figure, we map the double-edged sword traits of the connector in the semantic and relational analysis and confront them with the turning points of the connector and impacts of fraud in organizations.

Figure 1.

Approach on discourse analysis.

4. Results and Analysis

The following are the results and the related interpretations derived from the discourse analysis proffered by Laclau and Mouffe (2001) and the Machiavellian moments expressed therein. According to Laclau and Mouffe (2001, p. 96), “whereas the classical notion of ‘real object’ excludes contradiction, a relation of contradiction can exist between two objects of discourse”. In the same vein, Bourdieu (1994) observed that in particular social conditions, certain words do have power.

In light of this, this study follows the thematic coding drawing from Merriam (2002). This helped to highlight the semantic relationships between connectors and fraud from the significance drawn from the analysis of the archival data of the Criminalistica Conference. Afterward, it followed the coding of the interviews derived from the experts.

4.1. Analysis of Archival Data from CNC 2017 to CNC 2022

The analysis of archival data from the Criminalista Conference in the periods of 2017 through 2022 paved the way for extending studies discussed under the tracks of crime against life and properties, forensic accounting, environmental crimes, and IT forensics. Others were genetic forensics, medical and legal crimes, and lastly, management and innovation forensics. These have been presented under the relevant topics that relate directly to fraud as follows:

Fraud from public tender (public procurement)

The connectors were lodged in a nearby house to the competition site with an aim to capture information about the exams of the public procurement to then solve the answers and connect them to their clients who are fraudulent competitors. Fraudsters utilized micro cameras and transmitters from various electronic points of approximately 10 m with the resources of Bluetooth to transmit answers to the competition questions to the candidates of the public tender, who have receptors with SIM cards installed in their GSM.

Forensic examiners broke into the nearby houses and the kits, composed of the electronic ear point with battery and the electronic receiver device similar to a credit card with SIM CARD seen as signal receiver type for establishing communication between transmitter and receiver, allowing the bearer of the receiving device to successfully listen to the audio files or those sent to telephones set were retrieved.(Szilagyi et al. 2017)

The sociological discourse that emanates is the undue advantage that the perpetrators implemented. The investigation and penalties levied on the perpetrators reveal an exemplary sentence for those who invest in such devices in order to take advantage of such resources to the detriment of competitors.

Energy fraud by employee installation of internal temporizer in the meter

Every energy-tapping fraud is categorized as fraud that leads to a reduction in VAT to the state.

The police investigation was able to identify the method used to break the seals, and the timer device that at a certain point in time did not allow the recording of a phase of power supply in the meter, thus leading to the reduction in bills by one third.

In this case, the role of the connector was the identification of an employee from the partner firm that provides service for the energy company (POLITEC) to, in collusion, adulterate the security of the meters. Pathetic to note that an employee of the strategically aligned company worked in collusion to commit fraud.

Employees who collude on the side of fraud have always had an advantage because they have insider information. From a broader perspective, employees seem a bit unrealistic in their desire to ascend in their organizations, bearing unsustainable rationale, which does not yet have room in the organizational plans, and is a form of greed. The literature posits that employee involvement in fraud tops all types of fraud. Hence, Imoniana and Murcia (2016) emphasize human greed in their fraud octagon in confirmation of this phenomenon.

Frauds of ATM electronic terminals

Politically, all ATMs spread over the country are meant to socially alleviate the sufferings of the masses from dislocating from their areas of habitat in order to access banking services. This creates a de facto social wellbeing in the era of CE. However, they are objects of criminal fraudsters who vandalize the ATM for the retrieval of cash. Particularly because they have been installed in locations without adequate security protection.

It was observed that the fraudsters installed notebooks with keyboards that emulate the bank terminals. The programs monitored by the connectors, who are fraudsters, did not allow the prey being phished to complete the banking operations by instructing them to move to another terminal, whereas the fraud had been consummated.

The police investigation using the reverse engineering tapping a program decompiler for mapping the origin of the fraud was an effective methodology used by the forensic investigators. In this case, transcribes all information gathered to a high-level program language that enhances forensic analysis.

Fraud from fish processing in restaurant

As fish have environmental impacts as it perishes quickly, the main way to avoid this degradation is to process its meat in various ways, such as smoking, canning, pickling, or filleting. The common feature of processing is that many morphological features are removed, making the recognition of the species difficult. The correct identification of fish is one of the most powerful tools to avoid a fraudulent substitution of species during processing. The discourse is that surface is economical, by trying to strip the clients of their right to the quality of fish they already paid for. The connectors with the owners of the restaurants violate all the standard rules to maintain quality, in this case in a Japanese restaurant, and conceal the species of the fish. Practically, they lure clients into buying a pig in a poke.

According to (Marrero et al. 2017) Using barcode DNA principles, a disparity was found between advertised label and molecular identification of fish in Japanese restaurants and fishmongers in Florianópolis, Brazil: 34% of frauds in fishmongers and 17% in restaurants. The most common frauds involve those that substitute fish of higher commercial value for fish of very low value.

The connecting sniffer dog in the detection of attempted fraud against COVID-19

The sniffer dog’s work as a connector of the social welfare investigator not only appears in the elucidation of crimes but also in every criminal case in the K9 project in Brazil.

Trained in a variety of purposes to locate drugs, explosives and even hotel bed parasites, a puppy Dexter Morgan is one of the service dogs (K9) trained to detect people with Covid-19 in airports and frontiers with sanitary barriers. The dog gives the first alert that needs to be confirmed with the exam. This speeds up scanning of long queues.(Sene 2022)

4.2. The Connector within Companies’ Roles in Perpetration and/or Prevention of Fraud

This topic implies signaling the ethical issue in the exercise of any professional in the performance of delegated duties, given that the main agent who commits fraud acts as a trustee. Acting transparently and honestly is only possible when the individual conducts his actions respecting ethical values as expected by the trustor. However, not everyone acts as the connector in good faith and in accordance with ethics, as they are better apprised of matters in the organizations than everyone.

According to PwC Brazil’s 2020 global survey on fraud and economic crimes, fraud is mostly committed by internal and external agents or through a combination of the two. It also reinforces that companies that suffer from fraudulent acts bear large losses, with an estimate of more than USD 100 million, carried out by internal agents. This reinforces the idea that no one should be considered too ethical, believing that they will not be able to apply fraudulent practices.

In this context, the implementation of anti-fraud controls becomes extremely important in organizations. Currently, there are different ways of regulating and punishing in cases of fraud; among them, one would refer to the 2002 Sarbanes Oxley Act, which emerged after the occurrence of fraud in the United States with the aim of increasing controls and reducing these actions (Ashforth et al. 2008; Borgerth 2007; Gornik-Tomaszewski and Mccarthy 2005).

Although the different anti-fraud measures available to be applied in companies are not capable of preventing all fraudulent acts, when implemented correctly, with strong controls and supervision, they can interfere with the behavior of people who have evil thinking, causing this action to be more difficult to perform (Ashforth et al. 2008). Therefore, the idea is that within the company, there is a firm and clear opposition to the anti-fraud posture. This can happen through fraud training carried out by subject matter experts targeting employees and executives (ACFE 2020).

On the other hand, economically, the practice of fraudulent actions is often also related to the company’s own organizational structure, given that companies that enjoy unethical organizational environments contribute to inappropriate behavior by employees (Butterfield et al. 2000).

Thus, in order to further draw on the reflexivity, herewith is the analysis of additional data from the interviewees that enables one to corroborate the inference that the connector has a profile that can be both useful and harmful to the organization.

Conception of connector

From the perspective of fraud, a connector could be termed to be a manipulator. Additionally, what best characterizes a connector is the deceit of people in order to commit fraud.

TTN observed:

“In an organization it is the person who makes the network function within the operational lines, people who end up being key actors within that organization”.

As per RSL:

“Hence the name connector. Being that in no way it can be related to negative figures since he assumes both positive and negative sides in the organization”.

Identifying these key actors in the organization would help to disseminate information, allowing the central body’s perspective to spread across the business environment. These are people who are in contact with various people within the organization. He may be the person who promotes fraud, but he may also be combating or minimizing the occurrence of fraud.

Connector as a dual persona

According to RSL:

“The connector should not necessarily be seen as a person who disturbs in the course of curbing fraud. In police department, we investigate those who contribute or hinder probes”.

Sociologically, the connector is a person who maintains a double standard and may have a dual persona in order to attain their objective.

As per NPX:

“The power of a connector could be used for both good and bad. Just be ethical and this will add much more to fraud prevention. Also reinforcing that, the connector could be very useful in training, in communication with employees, because tends to be an influential person, a dear person whose tips are welcome makes the training more efficient and feed the company’s culture and thus helping to mitigate risks”.

With this, it is important to point out that fraud awareness training accelerates fraud detection and reduces losses (ACFE 2020), where the importance of efficient training.

SSL follows this same line of thought, seeing the profile of a connector as a transformative leader; that is, it understands that a bona fide connector will certainly be very useful in mitigating corporate fraud.

GHK understands that the connector’s influence on corporate fraud detection could vary depending on the size of the company.

Connector with team motivational role

TTR states the following:

“The connector, being a person interested in everything, who knows a lot of people in the company, is very persuasive and with his power of influence, to easily obtain information his way, can also easily suspect fraud from other employees, or that is, it has more ability to perceive strange movements”.

In this regard, it is important to be a bona fide connector to become a fraud defense within the company.

Connector with hegemonic role of overriding controls

Connectors maintain hegemony over others, trying to neutralize some hierarchical setups in the control procedures, such as political influence, by cheating and swindling control activities to their favor by commanding override of authorities.

RSL states the following:

“The person at the headquarters would not listen to the person in the hierarchy of information communication but would hear from the connector. This in effect neutralizes the powers of the person in the line of command”.

It does imply that the connectors create enmity with their ability to jump control points in the organizations.

Additionally, according to TTN:

“Connectors appear and disappear with the aim of evading the existing control instruments in the financial system, which end up distorting financial information to practice fraud”.

4.3. Fraudster Is Probably a Connector but Not on the Contrary

The sociological standpoint that connectors would be an important agent in the prevention of fraud in organizations may not be totally true, inasmuch as the fraudster may likely be the connector himself as he harbors the characteristics and typification of a fraudster profile. However, there is another school of thought that says that some fraudsters have an aversion to connection: those with no empathy for co-workers who like to work in isolation and also perpetrate alone. So, even though these types of connectors establish contacts with others with fraudulent intentions, they tend to have fewer connections.

RSL observed the following:

“Connectors in such as the cases of treasury misappropriation in the banks counts with persons who does not like to mingle with others so that their fraud schemes are not easily shared”.

This attitude of distancing from others normally shows a red flag to the forensic investigator, who may perceive the strangeness in the lack of interaction of the employee. Hence, the moderateness in the connection is established by connectors who are antipathetic to colleagues.

The interviews brought to light that the connector not only enjoys the personal skills that favor this act, but also has the advantage of knowing the internal flows of the company and often also comes to question the power he exercises within the organization. Therefore, our initial vision was expanded as the interviews were carried out, which led us to several other perceptions of connectors within companies.

It is worth mentioning that, although the self-report can often provide unreliable data, the participants’ statements were considered a great contribution and very important in this work, as they are professionals who have been working for a significant time in this area of corporate fraud investigation, and this ends up giving a certain credibility to the answers.

Connector as a double-edged sword role

For TTR:

Generally, fraudsters are connectors, but not all connectors are fraudsters. With his ability to rearrange certain things, thinking above others, for his empathy, he has greater proximity to suppliers, knows about systems failures because of his proximity to people within the company, and is very persuasive and often tends to be manipulative. These characteristics of a connector could impact the opportunity and rationalization of the fraud triangle, as per Cressey (1953). That is why one would believe that companies should be more careful with the connectors within the company, holding to the Machiavellian posture.

SSL partially agrees, but also emphasizes the importance of the control measures that already exist for the mitigation of fraud, such as having a sophisticated control system that allows double validation by different people.

As per SSL:

“Maybe the rationalization is too fast for a connector, but it takes the opportunity that will depend on the company’s controls”.

What became unanimous among the interviewees was the mentioning of the “fraud triangle”. As proposed at some point in this work, this triangle is an important model when it comes to understanding the causes that can lead to fraud.

Jamal et al. (1995) reinforce in this context of causes of fraud that they happen when fraudsters identify an opportunity or flaws in inspection within the company, thus taking advantage of the circumstances to make successive decisions aiming to obtain illicit advantages.

In view of this, companies must be careful with the employees they hire, analyzing their history and behavior, since this act of fraud can become something vicious, and those who have already carried out a deviant event will probably repeat it (Daboud et al. 1995).

In the same line of thought, TRT affirms the following:

“The sweet word of mouth of the connector persuades and makes one to believe in what is been sold. So, the auditor for instance, should always be skeptical”.

Connector’s attitude in association with Machiavellian trait

As per RSL:

“Connectors in general have a stronger perception of analyzing others more than non-connectors seeing others. Their ability to take advantage of it, whether for good or bad, maybe it will awaken the Machiavellianism that we all have a little bit inside of us”.

TTN observed the following:

“Connectors, see the weaknesses, capabilities, and strengths of others. This is part of the connectors’ personal skill box”.

4.4. The Networking of the Connector

The law in social networks states that the emergence of connectors is something natural.

As observed by TTN:

“The figure of connectors is extremely important in designing a more reliable network within the company”.

Connector resonates with another connector

In order to hold on to a more sustainable network, socially, connectors would like to establish their contacts with other or intelligent connectors who are even more connected, aiming to gain cognizance in this linkage. In fact, in the cultivation of a solid connection, naturally, new connectors do emerge.

RSL observed the following:

“There is a tendency for new people entering the network to seek connections with people who are more connected than they are. This naturally gives rise to connectors, which can grow to become hubs”.

It is most likely a spiritual gift because others resonate with one’s ideas and it fits with the way others think.

4.5. The Connector and Accounting Fraud in Circular Economy

The Federal Accounting Council (CFC), in NBC TI 01 (2003), which addresses auditing and accounting standards, the term fraud is defined as any “intentional act of omission and/or manipulation of transactions and operations, document tampering, records, reports, information and financial statements, both in physical and monetary terms.” All these actions assume a criminal character and, often for their own benefit, result in various false situations, including accounts, profits, income, and expenses, putting the company’s assets at serious risk (SÁ and HOOG 2010).

According to ACFE’s report to the nations 2020, the accounting department was ranked as the second largest department with the highest risk of fraud, second only to the area of operation. Noting that one of the great corporate fraud scandals in the world were in the financial statements, scandals such as Xerox and Delphi Corporation in 2000, Enron in 2001, and WorldCom in 2002, among others.

Thus, owing to the sociological discourse, since the era bears on the social wellbeing of the society, what will persist is the positive trait of connectors.

RSL observed:

“The competencies of the connector that enhances the obtention of privilege information in the mist of information asymmetry will be used in the favor of the group at large”.

This will enable the connector to cultivate more efficient resources that will be pleasing to the group toward goal congruence. These are naturally innovative apparatuses that drive the CE.

Mitigation of fraud risk agent of innovation toward CE

The vast cases of perpetration of fraud in the era of CE, particularly relating to technological resources, have also generated a major concern from the organizational management to implement innovative procedures to give response to the possible cases. For instance, an increasing phenomenon with the adoption of mobile applications, G5, not to mention the growing cases of cyber theft, has contributed immensely. The blockchain enhancing accounting information systems seems to be a tool that is being considered nowadays.

GNK:

“Organizations are already planning and implementing procedures to track possible vulnerability of fraud in their accounting information systems. Particularly now, in the advent of COVID-2019, impacts have been measured, and responses are being given. A client of mine performs the PEN test to support the needed assessment”.

De facto, periodic assessment performed by independent auditors helps to assure the confidence level of the organizational level of its maturity. Of note is that the penetration test is one of the simulations made by organizations to verify how vulnerable they are exposed.

Fraud in the accounting area exists from the moment these actions start to take place, which aim to create false facts that do not coincide with the reality of the company (Medeiros et al. 2004).

As mentioned in a few moments in this work, although organizations have anti-fraud control as an external audit of the financial statements, many of them still suffer from fraud. For example, it was revealed that more than 83% of cases reported in ACFE’s report to the nations in 2020 that suffered from fraud had external auditing.

Therefore, we can see that in many cases, the profile of employees is still essential in mitigating such risk; that is, it could even have good anti-fraud control, but it is necessary to evaluate the profile of people responsible for these areas that reflect greater risk.

The circular economy environment seems to be a turnaround phase, but how does one extend on this issue, overcoming diverse interests to create social wellbeing; de facto, how does one talk about current socially corrupted relationships?

As observed by TTN:

“Connectors, at any time, can favor the maturation of the organization, being able to act as propelling engines for the strengthening of this environment. At the same time, if these connectors start to have no interest in this type of action, for example: ESG, especially connectors who commit fraud, if they see that this type of action can expose them to risk, they will act against”.

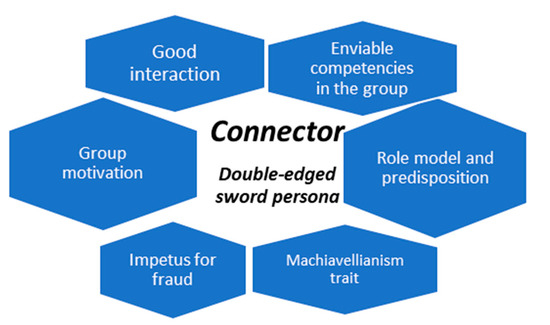

Thus, the reflexivity could be summarized in Figure 2—supporting environment of connectors’ attitude.

Figure 2.

Overall supporting environment of connectors’ attitude.

5. Discussion

So far, a holistic analysis has been presented in order to comprehend the roles of the connector and their effects on fraud and corruption. This generates a reflexivity upon the allied factors that spur the action of the connectors in the environment of the circular economy. Drawing on various conjectures about the roles of the connectors identified in the cases of fraud narrated in Criminalistica and through interviews, it would be prudent to say that the connectors’ roles are preponderant to either back their successes or unknowingly ruin themselves. In essence, connectors would contribute or depreciate their means to the consistency of their goal.

On one side of the coin, connectors could use their roles as a collusion to reach their means, probably adopting the accounting maneuvers, inasmuch as they move easily amongst co-workers, de facto luring the others to participate in the planned schema that perfectly suits their individual objectives. Thus, the connector instilled in the facets that depict Machiavellianism would protect the cash cow to the last flame of the flesh. In such an environment, the connector, due to the roles played in the organizations, probably would be a suspect or more exposed to the criminal investigation of cases of fraud and corruption.

On the other side of the coin, the individual makes ends meet by collaborating amongst the employees to drive business objectives in the mix of complex operational processes; this makes the connector gain respect before the boss and the colleagues. In fact, during times of employee unrest, such as salary negotiations between employee and employer, this role could bear fruit in the organization, helping to alleviate all tensions and avert business interruptions.

What contradicts this is when the Machiavellian moments ought to be called to normalcy, and the management implements operational policies where duties are segregated, accountability is put into place, and periodic assurance is used to monitor the control activities. In fact, in such an environment, monitoring functions are inextricably linked to ensuring the effectiveness of internal controls; these conditions are analogous to Siamese twins: one cannot exist without the other. In other words, monitoring the control activities that are the connectors’ responsibilities is a visionary response to posterity that tilts the scales in favor of a perpetrator, auspiciously de facto, in favor of an individual in a built collusion.

Accordingly, supposed auditor needs to assist in mitigating the risk of fraud when the connector might have reached out to collaborators outside the organization to thwart the control procedures. In this process, also imagine the auditor trying to apply the confirmation letter to a substantive procedure. Since the Health Laboratory, for instance, being a client of the organization being audited, will not respond to confirmation letters, the auditor would probably need to design another test for the existence of an asset. Thus, the auditor would attempt to confirm that the asset is in operational use by determining whether the third-party laboratory purchases reagents on a consistent basis.

Therefore, since what is good for the goose is also good for the gander, corporate governance internal control policies have to be alerted to mitigate any risks of anomalies emanating from the actions of the connector. Of note, the internal control policy is not enough to track the whole scheme of fraud propelled by the connector, as it is not unlimited by the will of the management to perform the monitoring function. The corporate governance mechanisms adopting preventive controls could be used to cushion the relationships between the connectors in fraud schemes. As a corporate governance, audit committee efforts have a significant and negative impact on fraudulent financial reporting and money laundering (Mousavi et al. 2022).

Thus, in order to distance connectors from the bad image that corruption portrays, it may be fair to see agents of connection isolate themselves and be compliant with policies that have stringent responses to cases of fraud. When a connector has the objectives of a group to maintain, there is no chance of a corrupt person saying their connection is just to dribble the rules of law or is in disobedience to standards, unless one does that.

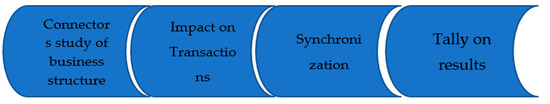

De facto, each and every one of us has a bit of Macheavellianism in us. The connector would like to see the others and take advantage of some identified weaknesses. So, connectors explore the roles and objectives, the process synchronization taking advantage of the first-hand information, and later tallying the results of the transaction, as in Figure 3.

Figure 3.

Connectors’ role in the unaligned business structure.

It is difficult to sense all the Machiavellian political mischief that may be afoot connector’s traps during negotiations, sense the connector’s Machiavellian trait of double edge sword. This means that they can be used to both benefit and harm a situation. For example, a connector may be used to bring two parties together to negotiate a deal, but they can also be used to manipulate the situation to benefit one party over the other. Connectors can also be used to spread false information or rumors in oder to gain an advantage. In this way, connectors can be seen as a tool that can be used for both good and bad purposes.

In other words, to the connector, holding to Macheavelianism, all the acts might have been performed in good faith. However, one would look at the other side of the coin by assessing the impacts on its stakeholders.

The trust borne on the connectors weaponizes them to rationalize the impetus to perpetrate fraud. Suppose one wants to take solace in the crumbs that fell from the connectors tables by asserting that the motivating roles pay off; then, unless fraud itself is consummated, the research argument would just be a sort of epistemological rupture being contemplated.

In all, conceptualizing a connector as just the bad egg in the organization that has the trait to foment fraud is engaging in a mistake of categorization. That is, attaching just the properties of a manipulator for self-benefit; in this case, one is carried away in the Machiavellian concept.

Overall, a connector, as a wise warrior who has two pence worth of imagination, knows that in any battlefield as an organization, he who lives and runs away with fraud lives to fight detection another day, so he is vigilant of and compliant with controls. In effect, internal control tools are being ameliorated with the use of technologies such as blockchain and continuous auditing to prevent fraud in accounting processes. This has been a tool that would neutralize the negative aspects of the role of the connector, averting fraud and corruption in the CE organization.

6. Conclusions

This work showed a strong role for the connectors in relation to fraudulent and corrupt acts, as well as being a team motivator with the capability to manipulate others, probably drawing on Machiavellianism and being at the center of group negotiations. The argument for the definition of policies that streamline control functions to monitor the powers invested in connectors to play key roles in facilitating the creation of value and resources capable of minimizing fraud and corruption may be seen as workable.

In this regard, this study concludes with five identified roles. With the characteristics of a double-edged sword, the connectors primarily influence the act of corporate fraud and corruption. Connectors serve as team motivators and, at times, as manipulators. Additionally, has the role of spearheading negotiations in the tumultuous times of employees’ and employers’ disagreements, almost leading to uneasy truces trying to cultivate harmony in the group. In a bid to perpetrate fraud, the connector assists in the role of overriding controls.

This reinforces the answer provided to the research question, which posits what the roles of connectors in corporate fraud and corruption in organizations are. Thus, for the good and proclivity toward social wellbeing that connectors bring to organizational contexts, they should be specifically hired with the goal of establishing a harmonious relationship within internal control environments. Their trait enhances the cushioning of relationships in tumultuous times, thereby nourishing the operational strategies that tend to favor the organization. Say an organization of 1000 employees already has 10 connectors. By mapping these connectors, the company will achieve its goals instead of working with 30 or 50 department heads. Of course, connectors are not necessarily bosses but end up being hidden leaders.

The findings enhanced the expansion of several perceptions of connectors within companies, as they contradict the initial knowledge that the connector is frequently the fraud agent due to its unimaginable profile. Nevertheless, this could be an agent of knowledge building by facilitating learning in CE environments and communication in organizations.

In view of what has been exposed in this work, the connectors are likely the main fraud agents, given the profiles they have and the knowledge of the company’s internal flows at hand. However, it is worth mentioning that, on the other hand, it is also recognized that the connector can represent a fraud defendant or be the first detector only if it is a bona fide connector that motivates. Therefore, we understand that organizations must invest even more in the ethics of connectors so that they are useful in mitigating risk. All this leaves several questions and points out the need for more studies working with connectors since it is a subject that has not been fully explored.

Our theory and findings gained extension with regard to prior research in an interesting manner. Apart from facilitating knowledge development, we found the role of connectors to be central to the resolution of disputes between employers and employees. In this sense, considering the relationship between the connector and fraudulent actions, this work highlighted the importance of knowing the profiles of internal agents and not ruling out any possibility of control through the agent’s appearance or high empathy, given that no professional should be considered ethical unless policies are in place to engage collaborators in their functions.

Finally, it is worth noting that a company’s market share and dependence on the part of society, customers, and others stem from the connections and goodwill of all the elements that work toward a common goal. In this sense, as discussed in this study, the importance of performing delegated tasks with transparency and ethics looks imperative; nevertheless, the roles of the connectors ought to be promoted and monitored. This raises questions about the limitations of openness to fraud investigation in organizations, which point to the need for more research.

Author Contributions

Conceptualization, S.R.B.N. and J.O.I.; methodology, S.R.B.N. and J.O.I.; software, W.L.S.; validation, S.R.B.N., L.R. and J.O.I.; formal analysis, J.O.I.; investigation, S.R.B.N. and J.O.I.; resources, W.L.S.; data curation, J.O.I.; writing—original draft preparation, S.R.B.N.; writing—review and editing, J.O.I.; visualization, J.O.I.; supervision, L.R. and W.L.S.; project administration, W.L.S. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- ACFE Report to the nations. 2020. Global Fraud Study. Available online: https://www.acfe.com/report-to-the-nations/2020/ (accessed on 10 November 2021).

- Alatas, Syed Hussein. 1968. Sociology of Corruption the Nature, Function, Causes and Prevention of Corruption. Singapore: Donald Moore Press. [Google Scholar]

- Ashforth, Blake E., Dennis A. Gioia, Sandra L. Robinson, and Linda K. Trevino. 2008. Reviewing organizational corruption. Academy of Management Review 33: 670–84. [Google Scholar] [CrossRef]

- Autrey, Romana L., Tim D. Bauer, Kevin E. Jackson, and Elena Klevsky. 2019. Deploying “Connectors”: A Control to Manage Employee Turnover Intentions. Accounting Organization and Society 79: 101059. Available online: https://www.sciencedirect.com/science/article/abs/pii/S0361368219300546 (accessed on 20 October 2021). [CrossRef]

- Bakhtin, Mikhail. 1997. Marxismo e Filosofia da Linguagem: Problemas Fundamentais do Método Sociológico na Ciência da Linguagem. Rio de Janeiro: Editora Hucitec. [Google Scholar]

- Borgerth, Vania Maria da Costa. 2007. SOX: Entendendo a Lei Sarbanes-Oxley—Um Caminho para a Informação Transparente. São Paulo: Thompson Learning. [Google Scholar]

- Bourdieu, Pierre. 1994. Vida, Conceitos, Obras, frases. Brasil Escola. São Paulo: Àtica. Available online: https://brasilescola.uol.com.br/sociologia/pierre-bourdieu.htm (accessed on 20 October 2021).

- Burrell, W. Gibson, and Gareth Morgan. 1979. Sociological Paradigms and Organizational Analysis. London: Heinemann. [Google Scholar]

- Butterfield, Kenneth D., Linda Klebe Trevin, and Gary R. Weaver. 2000. Moral awareness in business organizations: Influences of issue-related and social context factors. Human Relations 53: 981–1018. [Google Scholar] [CrossRef]

- Calic, Goran, Rene Arseneault, and Maryam Ghasemaghaei. 2023. The dark side of machiavellian rhetoric: Signaling in reward-based crowdfunding performance. Journal of Business Ethics 182: 875–96. [Google Scholar] [CrossRef]

- CNC2022. 2022. Criminalistica, XXVI Congresso Nacional de Criminalística, IX Congresso Internacional de Pericial Criminal. Available online: https://app.virtualieventos.com.br/criminalistica2022/inscricao (accessed on 4 May 2022).

- Costa, Ana Paula Paulina, and Thomaz Wood, Jr. 2012. Fraudes Corporativas. Available online: https://doi.org/10.1590/S0034-75902012000400008 (accessed on 10 May 2021).

- Cressey, Donald R. 1953. Other People’s Money: A Study in the Social Psychology of Embezzlement. Glencoe: The Free Press. [Google Scholar]

- Daboud, Anthony J., Abdul M. Rasheed, Richard L. Priem, and David Gray. 1995. Top management team characteristics and corporate illegal activity. Academy of Management Review 20: 138–70. [Google Scholar]

- Di Vaio, Assunta, Sohail Hasan, Rosa Palladino, and Rohail Hassan. 2022. The transition towards circular economy and waste within accounting and accountability models: A systematic literature review and conceptual framework. Environment, Development and Sustainability 25: 734–810. [Google Scholar] [CrossRef]

- Gephart, Robert. 2004. Qualitative Research and the Academy of Management Journal. Academy of Management Journal 47: 454–62. [Google Scholar] [CrossRef]

- Gornik-Tomaszewski, Sylwia, and Irene N. Mccarthy. 2005. Response to corporate fraud in the United States and Europe: Towards a consistent approach to regulation. Review of Business 26: 15–23. [Google Scholar]

- Houaiss, Antonio. 2007. Dicionario eletronico Houaiss da lingua. 2ª ED. Available online: https://www.travessa.com.br/dicionario-eletronico-houaiss-da-lingua-portuguesa-2-ed-2007/artigo/149afeb7-229a-434f-977c-bd5d19ad6168 (accessed on 20 October 2021).

- Imoniana, Joshua O., and Fernando D. Murcia. 2016. Patterns of similarity of corporate frauds. The Qualitative Report 21: 143–62. [Google Scholar] [CrossRef]

- Imoniana, Joshua O., and Robson M. Silva. 2013. Revisiting the concepts of forensic accounting and corporate fraud. International Journal of Auditing Technology 1: 175–202. [Google Scholar] [CrossRef]

- Imoniana, Joshua O., Janette Brunstein, and Silvia Casa Nova. 2022. The account of teaching qualitative research method in accounting program in Brazil. Educational Research and Reviews 17: 264–72. [Google Scholar] [CrossRef]

- Imoniana, Joshua O., Washington L. Silva, Luciane Reginato, Valmor Slomski, and Vilma G. Slomski. 2021. Sustainable technologies for the transition of auditing towards a circular economy. Sustainability 13: 218. [Google Scholar] [CrossRef]

- Jamal, Karim, Paul E. Johnson, and R. Glen Berryman. 1995. La detection des effets de mise en scene dans les etats financiers. Recherche Comptable Contemporaine 12: 107–30. [Google Scholar] [CrossRef]

- Kahn, Victoria. 1994. Machiavellian Rhetoric: From the Counter-Reformation to Milton. Princeton: Princeton University Press. [Google Scholar] [CrossRef]

- KPMG. 2021. Fraud Survey. Available online: https://home.kpmg/au/en/home/insights/2021/03/fraud-risk-survey-2021.html (accessed on 28 October 2021).

- Laclau, Ernesto, and Chantal Mouffe. 2001. Hegemony and Socialist Strategy: Towards a Radical Democratic Politics, 2nd ed. London: Verso. [Google Scholar]

- Lang, András. 2015. Borderline Personality Organization predicts Machiavellian interpersonal tactics. Personality and Individual Differences 80: 28–31. [Google Scholar] [CrossRef]

- Layman, Matthew. 2016. Mistake, fraud and waste: Mass inefficiencies in small business program that allow self-certification. Public Contract Law Journal 46: 167–88. [Google Scholar]

- Mackey, Tim K., and Bryan A. Liang. 2012. Combating healthcare corruption and fraud with improved global health governance. BMC International Health and Human Rights 12: 1–7. [Google Scholar] [CrossRef]

- Maingueneau, Dominique. 2015. Discurso e análise do discurso. São Paulo: Parábola Editorial. [Google Scholar]

- Marrero, Andrea R., Clisten F. Staffen, Mari D. Staffen, Mariana L. Becker, Sara Emelie Löfgren, Yara Costa Netto Muniz, and Renato Hajenius Aché de Freitas. 2017. Projeto Gato por Lebre: Utilização de DNA Barcode na Identificação de Fraudes no Comércio de Peixes em Peixarias e Restaurantes de Comida Japonesa. Available online: https://attitudepromo.iweventos.com.br/evento/floripaforense2017/trabalhosaprovados/naintegra/275 (accessed on 6 May 2022).

- McCormick, John P. 2021. Machiavellian Democracy: Controlling Elites with Ferocious Populism. American Political Science Review 95: 297–313. [Google Scholar] [CrossRef]

- McIlwain, Doris. 2003. Bypassing empathy: A Machiavellian theory of mind and sneaky power. In Individual Differences in Theory of Mind: Implications for Typical and Atypical Development. Edited by B. Repacholi and V. Slaughter. London: Psychology Press, pp. 39–66. [Google Scholar]

- Medeiros, Andressa Kely de, Lucicleia de Moura Sergio, and Ducineli Régis Botelho. 2004. A importância da auditoria e perícia para combate a fraudes e erros na contabilidade das empresas—Revista de Contabilidade da Universidade Federal do Rio Grande do Norte. Available online: https://portalidea.com.br/cursos/introduo-auditoria-e-percia-contbil-apostila02.pdf (accessed on 3 March 2022).

- Merriam, Sharan B. 2002. Qualitative Research in Practice. Examples for Discussion and Analysis. San Francisco: Jossey-Bass, pp. 37–39. [Google Scholar]

- Mousavi, Maryam, Grzegorz Zimon, Mahdi Salehi, and Nina Stepnicka. 2022. The Effect of Corporate Governance Structure on Fraud and Money Laundering. Risks 10: 176. [Google Scholar] [CrossRef]

- NBC TI 01. 2003. CONSELHO FEDERAL DE CONTABILIDADE (CFC). Da Auditoria Interna. Resolução do CFC n. 986/03. Dispõe Sobre o Item 12 da NBC TI 01. Normas de Auditoria Interna, Proporcionando Esclarecimentos Adicionais Sobre a Responsabilidade do Auditor Interno nas Fraudes e Erros. Available online: http://www.cfc.org.br (accessed on 5 November 2021).

- Nikonorova, Marta, Joshua O. Imoniana, and Jelena Stankeviciene. 2020. Analysis of social dimension and well-being in the context of circular economy. International Journal of Global Warming 21: 299–316. [Google Scholar] [CrossRef]

- Oliveira, Debor Kobayashyi M., Joshua O. Imoniana, Valmor Slomski, Luciane Reginato, and Vilma G. Slomski. 2022. How do internal control environments connect to sustainable development to curb fraud in Brazil? Sustainability 14: 5593. [Google Scholar] [CrossRef]

- Pardini, Eduardo P. 2020. Fraudes Corporativas: Prevenção e Detecção. Available online: https://www.legiscompliance.com.br/colunistas/eduardo-person-pardini/2641-fraudes-corporativas-prevencao-e-deteccao (accessed on 5 December 2021).

- Pocock, John Greville A. 2016. The Machiavellian Moment: Florentine Political Thought and the Atlantic Republican Tradition. Princeton: Princeton University Press. [Google Scholar] [CrossRef]

- Podgar, Ellen S. 1999. Criminal Fraud. American University Law Review 48: 729–67. [Google Scholar]

- Prociuk, Terry J., and Lawrence J. Breen. 1976. Machiavellianism and locus of control. The Journal of Social Psychology 98: 141–142. [Google Scholar] [CrossRef]

- PwC. 2020. Pesquisa Global Sobre Fraudes e Crimes Econômicos. Available online: https://www.pwc.com.br/pt/estudos/servicos/consultoria-negocios/2020/pesquisa-global-sobre-fraudes-e-crimes-economicos-2020.html (accessed on 27 September 2021).

- Rakoff, Jed S. 2014. The Financial Crisis: Why Have No High-Level Executives Been Prosecuted? The New York Review. Available online: https://msfraud.org/articles/the-financial-crisis_why-have-no-high-level-executives-been-prosecuted_judge-rakoff_1-14.pdf (accessed on 22 May 2022).

- Riahi-Belkauoi, A., and Ronald D. Picur. 2000. Understanding fraud in the accounting environment. Managerial Finance 26: 33–41. [Google Scholar] [CrossRef]

- SÁ, A. L., and W. A. Z. HOOG. 2010. Corrupção, Fraude e Contabilidade, 3rd ed. Curitiba: Juruá Editora. [Google Scholar]

- Sabet, Daniel. 2010. Confrontation, collusion na tolerance: The relationship between law enforecement and organized crime in Tijuana. Mexican Law Review 2: 3–29. [Google Scholar]

- Saddy. 2017. Raphael Saddy—“Esqueça Networking! Pense em ser um Conector de Pessoas”. Available online: https://pt.linkedin.com/pulse/esque%C3%A7a-networking-pense-em-ser-um-conector-de-pessoas-raphael-saddy (accessed on 11 March 2021).

- Salehi, Mahdi, and Fatemeh Norouzi. 2022. The effect of corporate lobbying on fraud and money laundering. Journal of Money Laundering Control. ahead-of-print. [Google Scholar] [CrossRef]

- Schnatterly, Karen. 2003. Increasing firm value through detection and prevention of white-collar crime. Strategic Management Journal 24: 587–614. [Google Scholar] [CrossRef]

- Sene, Soraia. 2022. Congresso Nacional de Criminalistica terá até CSI Canino. Available online: https://www.mirapolicial.com.br/congresso-nacional-de-criminalistica-tera-ate-csi-canino/ (accessed on 31 May 2022).

- Shaleh, Kairhul, Gugus Irianto, Ali Djamhuri, and Noval Adib. 2022. Forensic Investigation of Fraud in Village Government Agencies: An Ethnographic Study in Indonesian. The Qualitative Report 27: 1204–20. [Google Scholar] [CrossRef]

- Spradley, James P. 1979. The Ethnographic Interview. San Diego: Hardcourt. Available online: https://spada.uns.ac.id/pluginfile.php/262424/mod_resource/content/1/James%20P.%20Spradley%20-%20The%20Ethnographic%20Interview-Harcourt%2C%20Brace%2C%20Jovanovich%20%281979%29%20%281%29.pdf (accessed on 3 March 2022).

- Staff and Wire Report. 2021. Woman Who Flaunted Lavish Lifestyle. Available online: https://www.nbcboston.com/news/local/woman-who-flaunted-lavish-lifestyle-on-instagram-charged-with-100k-covid-relief-fraud/2378544/ (accessed on 3 March 2022).

- Szilagyi, Luciana Bezerra Von, Eliane Helena Alvim De Souza, Marcelo Lopes Burity, José Rodrigues Laureano Filho, Gabriella Henriques Da Nóbrega, Sérgio Louredo Maia Lacerda, Elaine Helena Alvim De Souza, and Susyara Medeiros De Souza. 2017. Fraude de Concursos Públicos e Perícia de Eficiência de Dispositivos Eletrônicos—Materialidade e Dinâmica Criminosas. Available online: https://attitudepromo.iweventos.com.br/evento/floripaforense2017/trabalhosaprovados/naintegra/301 (accessed on 4 May 2022).

- Wang, Da, Benkun Tan, Shengtao Xiang, and Xie Wang. 2022. Fatigue Crack Propagation and Life Analysis of Stud Connectors in Steel-Concrete Composite Structures. Sustainability 14: 7253. [Google Scholar] [CrossRef]

- Zhou, Zhizuan, Xiaodong Zhou, Boxuan Wang, K. M. Liew, and Lizhong Yang. 2022. Experimentally exploring thermal runaway propagation and prevention in the prismatic lithium-ion battery with different connections. Process Safety and Environmental Protection 164: 517–27. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).