Abstract

The employment of fintech as a product and service distribution mechanism in various sectors has been widely adopted for the provision of seamless services. The adoption of fintech by both individuals and organisations avails more convenience in product and service provision. The combination of fintech and social protection service provision has been receiving increased attention, especially during the COVID-19 pandemic era. This paper sought to investigate and show the importance of fintech in social protection research. The study aims to show the evolutionary idea of fintech in social protection to elucidate how much research has been done and elucidate the emerging areas surrounding fintech in social protection. A review of the literature that links social protection provision and fintech was conducted to establish whether more research is needed in integrating fintech with social protection provision. This study employed a bibliometric review to explore linkages that exist between financial technology (fintech) and social protection provision to establish whether the area needs further research. Data were sourced from the SCOPUS database using the Boolean search approach with the use of keywords and filters. Search results were processed and analysed in both SCOPUS and VOSviewer for visual and network positioning. The findings of the study show that fintech and social protection have received increased attention, as shown by the number of publications since 2018. Details of the most influential authors, documents, countries, and sources were documented. The results indicate the following emerging research themes: (1) the adoption of fintech in social protection service provision; (2) blockchain technology research on social protection, (3) fintech in health care service provision combined with health insurance; and (4) fintech as a cushion against the impacts of climate change.

1. Introduction

The employment of fintech as a product and service distribution channel in various sectors has been widely embraced for the availing of seamless service (Moufakkir and Mohammed 2021). The inclusive acceptance of fintech by both individuals and organisations avails more convenience in product and service provision (Frost 2020). The fintech platform serves as a delivery passage for financial products and services as availed by service providers (Fu and Mishra 2022). It accommodates peer-to-peer transactions, facilitating convenient social/communal transactions (Gao et al. 2018; Kumari et al. 2022). Moreover, the COVID-19 pandemic popularised financial technology platforms and improved their acceptance amongst the less privileged (Svider et al. 2020; Sarkar 2021; Li et al. 2022).

Despite the moderate-to-high fintech prevalence rate in developing countries, most social protection service organisations still employ manual methods that are full of challenges (Xu and Zou 2022). The emergence of COVID-19 further complicated the manual social protection distribution methods with the introduction of COVID-19 safety measures. Safety measures included movement restrictions, social distancing, banned gatherings, and requirements to use personal protective equipment (Jaji 2022). The acquisition of personal protective equipment to be used by program administrators increased the program costs, which were not budgeted for and derailed program budgets (Ruane and Peter 2022).

Several NGOs involved in distributing international food aid noted political intimidation towards persons who are suspected or actual opposition supporters. These persons are then too afraid to collect aid at distribution points (Kwashirai 2023). Waiting for collection time exposes beneficiaries to opportunity costs that arise by forgoing other tasks to collect their humanitarian benefits. After the catastrophic cyclone Idai in Zimbabwe, beneficiaries spent an average of over six hours collecting aid from a humanitarian organisation named GOAL Zimbabwe (Nyahunda et al. 2022). Criminal and health safety are other issues that arise when a substantial number of people gather. Beneficiaries at a social protection program distribution point do not feel safe while collecting their payment and afterwards (Chikoko et al. 2021).

Another issue of concern around social welfare is the actual timeliness and predictability of payments, which has consequences on the programme impact as far as they affect the planning and forward thinking of beneficiaries (Nawazish et al. 2022). During the COVID-19 pandemic, organisations that distributed social protection services manually faced challenges in seeking travel clearance to organise the distribution of aid, resulting in delays in providing social protection services (Pina et al. 2022). The administration and transportation of in-kind aid are time-consuming, often impacting distribution timetables. The efficient consumption of the aid is linked to the timing of receiving the next handout (Nawazish et al. 2022).

Administration processes and the associated costs of administering in-kind aid are demanding and high (García Castillo 2021). Whether cash, vouchers, or in-kind aid are availed as philanthropic assistance, it is imperative to recognise the cost-effectiveness of diverse transfer modalities, their relative efficiency in achieving demarcated purposes, and the bearing on local markets (Morais 2019; Sahinyazan et al. 2019). Each in-kind aid distribution entity is estimated to cost 25% of the program budget in overheads (Yenice 2020). The costs of vouchers and food aid are additionally increased if beneficiaries trade them at a discount to acquire essential needs (Archambault and Ehrhardt 2019).

Having such a list of challenges in manual social protection provision that are believed to be solved by the employment of fintech, this paper analyses fintech incorporated into social protection provision to counter challenges encountered in social protection service provision schemes. The motivation behind this study lies essentially in showing the connection that can be created between financial technology and social protection service provision. The literature review was conducted based on a bibliometric review by analysing research papers acquired from the SCOPUS database to show the linkages between fintech and social protection service provision.

The rest of the article is structured as follows: Section 2 presents the theoretical framework underpinning the study, which outlines and discusses selected social protection theories and fintech adoption theories in relation. The research methodology adopted for the study is discussed in Section 3, which was based on a bibliometric review. The research findings are presented and discussed in Section 4 of the study, showing details of the most influential authors, documents, countries, and sources documented. Section 5 concludes the article, where a discussion of the findings is presented and how they contribute to new knowledge.

2. Theoretical Framework

Social protection is a set of policies and programs that covers and addresses a plethora of lifetime consequences of exclusion and poverty (Jorgensen and Siegel 2019). Social protection programs ensure health and skill development to assist in connecting vulnerable citizens with health care, nutritious food, and quality education to give all citizens a fair chance in life regardless of the conditions they were born into (Alderman and Mustafa 2013). On the other hand, financial technology is a platform for the delivery of banking and financial services through the employment of modern technological innovation (Ozili 2018). Digital finance is also viewed as a financial service that is availed through computer programs and algorithms. Fintech allows individuals to access financial services using mobile phones, the internet, and smart cards.

The existence of social protection service programs is supported by theories; namely, among others, the Pareto Optimality Theory, which was developed by Pareto (1896); the social contract theory, advanced by Rousseau (1712–78); and the distributive justice theory, propounded by Rawls (1971).

The Pareto Optimality Theory postulates that the Pareto optimal condition is achieved when no additional variations in the economy can be made to improve the state of one person without worsening the state of another. According to Pareto Optimality, social welfare is said to have increased even if it means that a single individual’s welfare has improved while the rest of the society’s utility remains the same (Garg and McGlaughlin 2020). The theory suggests that income redistribution in imperfectly competitive setups improves social welfare. Such imperfect competitive setups may result in the rich getting even richer while the poor get even poorer. Income distribution through social protection services, as supported by Pareto Optimality, ensures income and improves social welfare for the poor without affecting the welfare of other citizens. However, the Pareto Optimality Theory falls short in that it is possible to achieve Pareto Optimality with just a few people enjoying most of the available resources. The Pareto Optimality does not dictate a standard value of welfare improvement that is regarded essential, hence any social protection transfer or service is considered welfare improvement even if it is very small. Governments have crafted policies to foster and protect democratic functioning through wealth and income distribution by establishing social protection programs to reduce the degree of inequality prevailing in societies (Mearman and McMaster 2019).

The social contract theory was advanced by Rousseau (1712–78). He proposed that in the past, man existed in a state of nature. The kind of life led in this condition of nature was unforgiving, ruthless, and comparatively short (Manzoor et al. 2013). In a bid to cushion these sufferings, people entered into an agreement to respect each other and live in peace in exchange for the security of life, food, property, and liberty from the leading authority. The social contract theory relies on two key assumptions, one of which states that human beings are in some sense preceding any founded social order, so their compliance with the state must be warranted. The second assumption of the theory is that the state of human beings outside the socially established state, or in what is referred to as the state of nature, is completely undesirable, thus availing humans with a motive to get away from such a state by a social contract (Hobbes (1588–1679) and Locke (1632–1704)). The government, through various organisations, is responsible for the protection of the basic human rights of its citizens (Mapp et al. 2019). The social contract theory obliges the government to handle the economic and social risks of its people, such as redundancy, marginalisation, bad health, hunger, old age, and disability (Kersting 2013). The obligation drives the need for the government to adopt social protection transfers to mitigate crises and improve the living standards of its people (Puaschunder 2018). The social contract theory states that all social principles such as freedom and opportunity, revenue and prosperity, and the roots of self-esteem are to be dispersed equally (Cavalier et al. 1990). The social contract theory supports the notion of governments and non-governmental organisations providing social protection services and honouring their end of the bargain (Brown 2016). Governments are obliged to look after the welfare of their citizens, especially the underprivileged. On the other hand, Amartya Sen (1977) constructed an extensive study that grouped problems of interpersonal choice aggregation into numerous groups. He convincingly argued that the various categories of social choice problems require tailor-made solutions, not a one-size-fits-all kind of solution.

The distributive justice theory was propounded by Rawls (1971). The theory postulates that equal work should provide individuals with an equal outcome in terms of goods acquired or the ability to acquire goods. Distributive justice is absent when equal work does not produce equal outcomes or when an individual or a group acquires a disproportionate amount of goods. The theory concentrates on the collective rational distribution of wealth founded on the conception of equal value and the ethical standing of human beings, thereby giving rise to social protection provision. Distributive justice theory relies on the assumption that there is a greater amount of fairness during the distribution of goods and services. The principle of distributive justice is most justified on the grounds that people are morally equal and that equality in material goods and services is the best way to realise this moral ideal (Deygers 2019). Nozick (1974) proffers that focusing on compensations for unfair disparities in society through the reallocation of principal goods is a responsive position that exposes citizens to suffering before redistribution. Instead, Laurent (2019) asserts that egalitarian intellectuals should provide the essential concept upon which the theory is founded and endeavour to construct organisations that stimulate evocative, equivalent prospects from inception. The concept of distributive justice upholds that societies have a moral responsibility to look after the underprivileged and recognises that the obligation of assisting the disadvantaged is everyone’s call (Burri et al. 2021). However, proponents of welfare-based concepts are not convinced that material goods and services should be the principal distributive concern. They assert that the value of material goods and services is realised only if they can improve the recipient’s welfare since they do not have intrinsic value. They went on to proclaim that the design and assessment of distributive principles should be in accordance with how they affect welfare.

On the other hand, the adoption of financial technology in social protection service provision is supported by technology adoption theories, namely the diffusion of innovation theory by Rogers (1962); the Technology Acceptance Model (TAM), as advanced by Davis (1989); and the Task–Technology Fit theory by Goodhue and Thompson (1995). We give an overview of some of these theories in the context of social protection provision.

The diffusion of innovation theory was advanced by Rogers (1962). The theory postulates that when a new plan, way of doing things, or technology is introduced, it has perceivable ways, timeframes, and systems for it to be adopted by end users (Rogers and Williams 1983). He reasoned that adoption is the decision to employ an innovation as the finest course of action available and disapproval is the choice to not employ the invention. He went on to define diffusion as a process of communicating an innovation through defined channels over a period in a social structure. Drawing from Rogers (1995)’s definitions, the diffusion of innovation is centred on four main pillars, which are innovation, time, communication channels, and the social system (Toews 2003). Rogers (2003) highlighted the innovation-adoption decision-making process, in which he mentioned information-seeking and information-processing as the basis of decision-making. Individuals seek and process related information about an innovation based on its advantages and disadvantages to make the resolution to either approve of or discard the innovation (Kassen 2022). On the other hand, Currie and Spyridonidis (2019) insisted against the DOI theory, citing that human beings and their networks are a diverse structure, hence diffusion cannot be numerically calculated or valued. Further, he declared that identifying the specific motive for adopting a certain innovation is nearly impossible. The diffusion of innovation theory is structured in such a way that it cannot consider all variables, accordingly leaving important adoption predictors unaccounted for (Plsek and Greenhalgh 2001). Just like any other organisation, social protection organisations go through the same course as others in the adoption of innovation. However, in addition to organisational adoption factors, beneficiaries need to be considered in the decision criteria.

The Technology Acceptance Model (TAM) was advanced by Davis (1989), who avers that when a new technology is presented to users, numerous factors influence their decision about how and when they will adopt or reject the innovation. The TAM assumes that when users become aware of the usefulness and ease of use of a new technology, they become willing to adopt it (Ajibade 2018). Accordingly, when social protection organisations realise how a new system eases their tasks, the better the chances that they are willing to employ it, as it is useful (Ajibade 2018). The TAM postulates that perceived usefulness and perceived ease of use are the main factors to consider in the adoption of new technology (Buabeng-Andoh 2018). If these main two factors are met, it leaves personal attitude as the remaining determining variable (Buabeng-Andoh 2018). Social influence has a direct bearing on attitude (Pérez and Mugny 2018). On the other hand, the TAM has faced criticism despite its repeated employment. The main reasons for its criticism are limited explanatory and predictive power, a lack of practical value, a lack of heuristic value, and triviality (Nnaji et al. 2019; Dellsén 2018; Ajibade 2018). Lunceford (2009) also argued that the TAM framework of perceived usefulness and ease of use neglect other essential issues that need to be considered, such as costs and available infrastructure, which factor into deciding whether to adopt the technology. The Task-Technology Fit theory was advanced by Goodhue and Thompson (1995). The theory suggests that innovative technologies that fit the existing duty generate better results as compared to generalised poorly suited technologies (Gebauer et al. 2010). The theory asserts that the employment of technology is most likely to produce progressive results on individual performance if the employed technology fits the task at hand. In a setting where technology is used by individuals to perform certain duties, Task–Technology Fit is founded on the value/performance of equipment that is generated by the technology alignment in relation to the task (Goodhue et al. 2000). Employing the Task–Technology Fit theory in social protection results in different explicit job features to address. Nevertheless, in theory, the procedures that need to be adhered to, to identify the features of the job at hand, are similar and classically comprise task analysis, incorporating the working environment, and crafting different task classes and their subclasses to be interrelated with Task–Technology Fit (Lee et al. 2007; Goodhue 1998; Barki et al. 2007; Wang and Lin 2019; Ali et al. 2018). The Task–Technology Fit theory offers a method of measuring the efficiency of the employed technology in a structure by evaluating the connection between the technology innovation and the duties the technology intends to achieve (Wu and Chen 2017). The enhanced performance is typically owed to the flawless completion of the task, reducing the budget of executing the job, or making the task easier to accomplish (Howard and Rose 2019). However, the TTF theory and its extensions have several limitations, among which are the complexity of the model, which makes it difficult to test empirically, weak predictive power, and a lack of focus on situational and personal factors. The most significant fault of the novel TTF model is that owing to multi-dimensional concepts, the pertinency of the theory in diverse positions and states is restricted. Consequently, there are limited studies that have verified all scopes of the TTF (Eybers et al. 2019; Teo and Men 2008).

Previous studies that have endeavoured to link fintech platforms as a distribution channel and social development have mainly focused on financial inclusion. Their main thrust was to explore the deployment of fintech to improve the livelihoods of the previously unbanked population through the provision of cheap loans, peer-to-peer lending, equity crowdfunding, and cross-border remittances. On the other hand, these studies that have integrated fintech in social protection service provision have mainly done so focusing on developed countries, with little focus on developing nations. (see, for instance: Pereira and Fernando 2017; World Bank 2018; Sahay et al. 2020; Schlein 2020; Sáenz-Díez and Moreno 2018; Adegbite and Machethe 2020; Arner et al. 2019; Philippon 2016; Leong and Sung 2018; Fortnum et al. 2017).There are a few studies that have tried to examine fintech as a distribution mechanism, such as Tucci et al. (2016); Brunswicker and Chesbrough (2018).; Mention (2019); Albitar et al. (2020); Gobble (2018); Gomber et al. (2018); Nguyen et al. (2020); Bagherzadeh et al. (2019); and Pambudianti et al. (2020). Notwithstanding, these studies have mainly focused on fintech as a distribution channel of investment and banking products without mentioning the savings that accrue for governments, organisations, companies, and individuals that employ fintech. In the era of COVID-19, Poosarla (2018) outlined the need to employ fintech in government-to-person payments to improve social protection service provision and maintain social distancing. Furthermore, most of such studies have anchored their investigations on fintech fostering financial inclusion while giving insufficient attention towards fintech as a distribution mechanism for social protection services. Hence, this study wishes to show the gap in the research towards the adoption of fintech in social protection.

3. Research Methodology

This study was based on a bibliometric review. A bibliometric review is a scientific, computer-assisted review methodology that can identify core research or authors, as well as their relationships, by covering all the publications related to a given topic or field (Han et al. 2020). A bibliometric analysis provides plentiful and interactive information concerning the topic under study. This promotes and avails better comprehension of the general academic landscape surrounding the area of study (Han et al. 2020). A bibliometric analysis provides visual scientific charts that promote a comprehensive study review, unlike the traditional reviewing methods (Singh and Bashar 2021; Khan et al. 2022), whilst meta-analysis is a research procedure employed to scientifically integrate the results of specific, separate studies by making use of statistical techniques to determine a general or fundamental impact (Shorten and Shorten 2013).

Data were retrieved from the SCOPUS database by searching for documents using the study’s keywords for financial technology and social protection. The SCOPUS database was used because of its broad database of high-quality articles and because the university library is affiliated with the database (Baas et al. 2020). Keywords and phrases were selected for the search criteria, as shown below in Table 1.

Table 1.

Study keywords and Phrases.

The keywords and phrases that were selected for the search are “financial technology”, “fintech”, “social protection”, and “social welfare provision”. These keywords were derived from the topic and then supported by the theoretical framework. The documents search option covered all document fields, which include, among others, article titles, abstracts, authors, source titles, affiliations, and keywords, to produce a comprehensive list of documents for the study (ALL (fintech) AND ALL (financial AND technology) AND ALL (social AND protection) AND ALL (social AND welfare)).

The search was conducted using the Boolean approach as provided by the SCOPUS search engine. The approach allowed the study to search for its keywords, which are “social protections”, “financial technology”, “fintech”, and “social welfare”. The initial search results produced 145 documents. Since social protection is a multi-disciplinary topic, the study accommodated all subject areas in SCOPUS. The search did not employ any filters concerning the type of accessibility, period, authors, document type, source title, publication stage, affiliations, funding sponsors, country/territory, source type, and language. From this search, the study remained with 145 articles to consider. The final list of results was saved in SCOPUS for future reference and adjustment. The titles and abstracts of selected articles were sampled to make sure that they are aligned with the project at hand.

Two platforms were adopted to analyse the bibliometric data collected. The first analysis was done on the SCOPUS platform where figures were presented and analysed based on country, documents per year, documents per year by source, documents by author, documents by affiliation, and documents by subject area. The following procedure was performed on VOSviewer; again, visual presentations were carried out focusing on the citations of the documents, co-citations, and, lastly, a co-occurrence analysis. The analysis allowed the study to recognise the highly prominent authors, highly cited articles, highly cited journals, and countries with the most relevant contributions towards the field.

Reference co-citation was conducted to recognise the main authors and themes that constitute the fundamentals surrounding social protection and financial technology. Similarly, an analysis of the co-occurrence of keywords was conducted to show the main channels of the study of incorporating fintech in social protection service provision (Contreras and Abid 2022). VOSviewer is an instrument for the graphic analysis of system charts founded on citations, co-citations, and the co-occurrence of keywords that elucidates the intellectual and social structure of a research study (Wong 2018; Setyowati 2022; Chandel and Kaur 2022). The functionality of VOSviewer is particularly valuable in its ability to display huge bibliometric charts in the most simplified way for easy interpretation (Van Eck and Waltman 2010).

4. Research Findings

This section presents and analyses the descriptive statistics of the study towards the incorporation of fintech in social protection provision.

4.1. Characteristics of the Data

The results of the search criteria the study utilised in SCOPUS produced 145 results for the period ranging from 2017 to 2023, as shown in Table 2, below. The total results consist of 27 books, 85 articles, 6 book chapters, 18 reviews, and 9 conference papers. A total of 265 authors were involved in the production of the 145 documents. The collaboration of authors shows the overall increase in interest in the subject of combining fintech into social protection programs.

Table 2.

Distribution of the characteristics of the data.

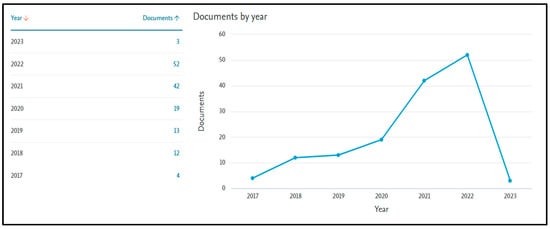

4.2. Distribution of Article Production by Year

The information presented in Figure 1 was produced in the SCOPUS data analysis software from the analysis of data obtained from SCOPUS. Figure 1, below, presents the number of journal articles produced per year from 2007 to 2022. It can be noted that the production trend is on an increasing trajectory, starting with just four articles for the year 2017 to 52 for 2022 up to November, when the search was conducted. The increasing trajectory shows the development in interest around the incorporation of fintech in improving social protection provision. The greatest jump was between 2019 and 2021 during the COVID-19 pandemic, where human contact was minimal, up until 2022. During the COVID-19 pandemic, fintech emerged as the main transfer platform for social protection and utility payments, hence the increased interest in the area (Javed et al. 2022).

Figure 1.

Annual documents published.

4.3. Citation Overview

Table 3 presents the citation overview of the selected 145 documents on social protection and financial technology. This shows the number of citations reviewed per year in comparison to the number of citable years. The maximum average total citations per year was realised in 2018, with 19.11 citations, followed by 2020, with 9.8 citations. The citation analysis criteria exclude self-citations by all authors. It is interesting to note that as the number of documents increased, citations reduced, igniting thinking about the fast realisation of the importance of fintech during the COVID-19 pandemic for the payment of utilities and social protection distribution, hence more new authors produced new work. Globalisation is one of the main drivers for the fusion of fintech in social protection. Usually, NGO headquarters are housed outside the countries their offerings help. Fintech then makes it easy to move funds to and from the headquarters for various reasons. The increase in the use of money as an aid response tool has also pushed the adoption of fintech in social protection since cash handling procedures are demanding and expensive. The emergence of COVID-19, resulting in contact and movement restrictions, pushed for the faster adoption of fintech in various sectors, including social protection. The distribution of aid during the COVID-19 pandemic necessitated the rise in research interest towards fintech in social protection.

Table 3.

Citation overview.

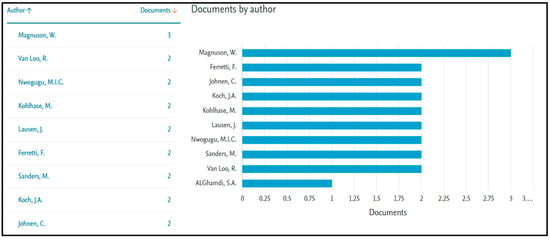

4.4. Most Productive Authors

The production of the authors has been measured by the number of articles they managed to publish for the period under study. The study considered 265 authors, as provided by the search results. Figure 2, below, as produced by SCOPUS analytical software, presents the top ten statistics per author as extracted from the SCOPUS database to show their respective rankings determined by their publications. The leading author in the area of social protection and financial technology for the period under consideration is Magnuson, W with three publications to his name and an h-index of five. Eight of the top ten authors have published two documents each, with an average h-index of 5.75. AlGhamdi, S.A. had just one publication and has an h-index of zero. Most of the authors had just one publication, some of which were co-authorships. Authors making the top ten list have their research interests in support of fintech and social protection. Three authors are aligned with social sciences (Magnuson, W, Ferretti, F, and Johnen, C), which shows the coverage of social protection in the search results. The rest (seven) of the top ten authors cover areas such as business management, computer sciences, multidisciplinary research, economics, econometrics, and finance. These subject areas deal with efficient means of business operations, leading to the adoption of fintech as an efficient operational tool. Computer science is one subject area that was aligned with three authors as a subject of focus, thereby strengthening the fintech in social protection claim.

Figure 2.

Document production by author.

4.5. Most Prominent Sources

The most prominent sources referred to in the research on social protection and financial technology are presented in Table 4, below. The measurement used to determine the prominence of the source was based on the number of citations the source received. Over the period of 12 years, Sustainability, which is the leading source, had an average citation number of 40,604.67. The following influential source was Environmental Science and Pollution Research, with an average of 40,091.33 citations. The lowest citation number by source in the top ten was the Annual Review of Financial Economics, which had 486.50 average citations. The use of source citations as a unit of measurement is motivated by the foundation that attention is given to the most essential product (Wang et al. 2020). It is important to note that the leading sources such as Sustainability, Environmental Science and Pollution Research, the Journal for Environmental Management, Energy Economics, Business Strategy and the Environment, Technological Forecasting and Social Change, and the International Journal of Bank Marketing highly support the study’s theme of social protection and financial technology.

Table 4.

Citations received per source.

4.6. Most Prominent Countries in Fintech and Social Protection Research

An analysis of the most influential countries by the number of documents produced in collaboration with the number of citations received was conducted. A total of 53 countries were noted by the search. The top ten countries in the findings are presented in Table 5. China is leading the country list, with 34 documents produced under its name, attracting 159 citations, with an average citation rate of 7.95. The United States of America is in the second position, with 29 documents, yielding 365 citations, and an average citation number of 17.38. Ghana received 294 citations for the period, with an average citation rate of 12, whilst the United Kingdom had 19 documents, attracting 88 citations, with an average of 6.77 for the same period. The lowest-performing country in the top 10 was Hong Kong, with six documents being cited 30 times, producing an average citation number of six. It is important to note that although Italy has seven documents, it has received a lot (108 citations) of attention, as shown by its high average citations (18). China has a high population in which the use of technology is high and has a well-established social protection system in which the use of fintech and sustainable development is evidenced (Nassiry 2018; Zhou et al. 2022). The United States of America has shown the effectiveness of fintech in improving access to health care for the poor (Grassi and Fantaccini 2022).

Table 5.

Most influential countries in fintech and social protection research.

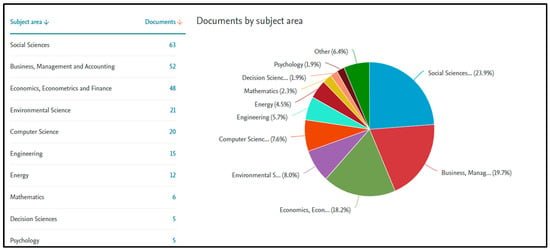

4.7. Most Prominent Subject Area in Fintech and Social Protection Research

Using the subject area as a unit of measurement of the distribution of documents shows the breadth of the adoption of financial technology to improve social protection provision. This shows that the topic of fintech in social protection is multi-disciplinary, covering a wide scope of subjects. Figure 3, as generated by the SCOPUS Citation Overview software, shows the leading distribution of documents towards the social sciences, with 23.9% of the search results, followed by business management and accounting, with 19.7%. Economics, econometrics, and finance is in the third position, with 18.2% and environmental science is in the fourth position, with eight per cent.

Figure 3.

Prominent subject areas.

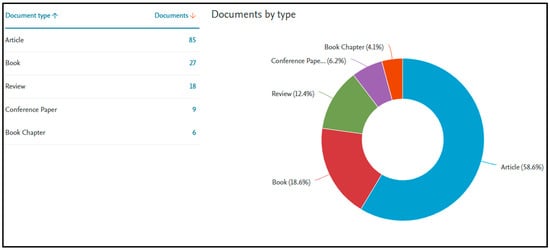

4.8. Most Popular Document Type in Fintech and Social Protection Research

Academic produce is presented on various platforms depending on the preference of the author and or the requirements of the affiliated institution. Figure 4, below, as generated by the SCOPUS Citation Overview software, shows a comparison of the distribution of documents by document type. Figure 4 shows that the majority (58.6%) of documents were presented as articles, followed by books, with 18.6% of the documents. The least-used (4.1%) type of document is book chapters. Articles have gained respect and are viewed as more competitive sources of information, as they usually offer more current information and have better credibility due to the peer review process they go through. Journal articles are more accessible across the globe using the internet and search engines, hence they are preferable (Kulkarni 2019).

Figure 4.

Popular document type.

The least-used document type in the search data was book chapters, which comprised 4.1% of the searched documents. The issue of book chapters being less visible and difficult to access is responsible for the low uptake (Chapnick and Kukucha 2016). The results indicate that most scholars prefer the use of journal articles to show and publish their work.

4.9. Network Analysis and Visualisation

The subsequent sections are established on the analysis and interpretation of visual network interpretation. The citation analysis of documents, co-citation analysis of authors, and co-occurrence analysis will be carried out based on the results generated from VOSviewer after processing the study’s keywords to understand the research trajectory of social protection and financial technology.

4.9.1. Analysis of Citations

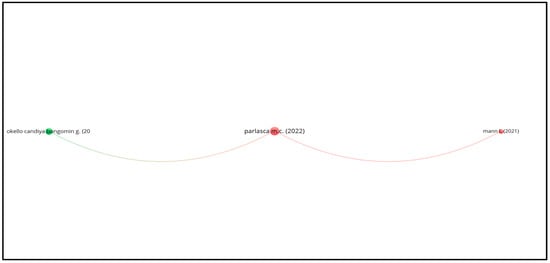

Citation analysis is a technique of examining the influence of a study by determining the overall quantity of citations of a document, source, or author that would have been cited by other authors, sources, or documents (Wang et al. 2018). The citation analysis of the collected documents was processed by the VOSviewer software application, and the results are presented in Table 6 and Figure 5, below. A filter for the minimum number of citations needed by a document to qualify for the analysis was set at two. Depending on the volume of data, the higher the volume, the higher the filter, and vice-versa (Al Husaeni and Nandiyanto 2022). The filter was set at two to make sure the study picks up all the citations around the search results. From the list of 145 documents, only 74 qualified for the analysis. The system calculated citations of the 74 documents and the documents with the largest links were selected. Only three documents were connected and had the highest number of links, making two clusters. A network map was generated and distributed over two clusters; the leading cluster had two authors, represented in red, and the second cluster had one author, represented by the colour green.

Table 6.

Distribution of citations, clusters, and documents by author.

Figure 5.

Network map for citations by authors. Source: Authors’ own compilation processed in VOSViewer.

Cluster one is made up of two documents that cover areas such as digital credit; Kenya; mobile banking (Sutiyo 2022); mobile money (Sun et al. 2021; Fotta and Schmidt 2022); small farms, agricultural finance, and agricultural technology (Hellmuth et al. 2009; Hansen et al. 2019; Nyahunda and Tirivangasi 2021; Todd and Todd 2021); digitisation (Sun et al. 2021; Fotta and Schmidt 2022); economic theory; infrastructural development; power relations; and private sector and theoretical study. Mann and Iazzolino (2021) received three citations from Green (2022), Bernards (2022), and Parlasca et al. (2022), who have already received at least three citations each. The three documents are aligned with the social sciences and economics, econometrics, and finance, showing the linkages between social protection and fintech. The quantities of qualifying documents show the need for more research in social protection and fintech.

The second cluster covered areas such as investment (Yu 2019), digital consumer protection (Bongomin and Ntayi 2020), climate change (Brunetti et al. 2021; Mohamed 2021), financial innovation (Sutiyo 2022), mobile money (Sun et al. 2021; Fotta and Schmidt 2022), the fintech ecosystem (Pauliukevičienė and Stankeviciene 2022), cost-effectiveness (Yengeni and Alhassan 2022), and financial inclusion (Hellmuth et al. 2009; Constant 2011; Hansen et al. 2019; Nyahunda and Tirivangasi 2021; Todd and Todd 2021; Khanal et al. 2022; Palinkas et al. 2022). These paper citations could be low owing to the recency of the publications in relation to the time the study was conducted.

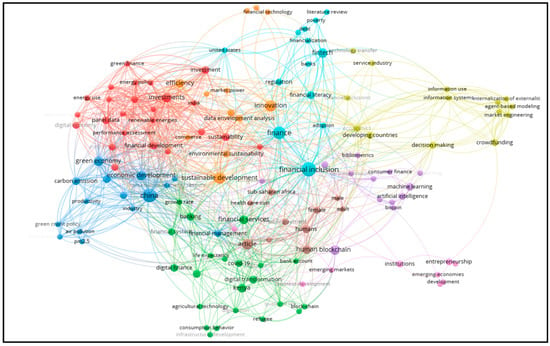

4.9.2. Analysis of the Co-Occurrence of Keywords

The concept of co-occurrence mentions the mutual existence, rate of recurrence, and closeness of similar keywords existing across various data sources. Co-occurrence includes keywords that have the same meaning, referring to the same topics, but may not be exactly the same. The co-occurrence of keywords also refers to the rate of recurrence of similar-meaning words and/or expressions that arise in a data set (Galletta et al. 2022; Ribeiro et al. 2022). To analyse the co-occurrence of keywords, VOSviewer was employed to show the network-mapping relationship of keywords and provide a visual presentation for the bibliometric analysis, as shown in Figure 6 (Setyowati 2022).

Figure 6.

Network of the co-occurrence of keywords. Source: Authors’ own compilation processed on VOSViewer.

In the creation of the network map, the minimum threshold of the occurrence of keywords was limited to two for a word or phrase to qualify for the analysis. The occurrence of keywords or phrases was limited to two since the integration of fintech into social protection is a relatively new phenomenon, so it was meant to accommodate most of the keyword co-occurrences. After the filter, 137 keywords met the threshold conditions, and for every word, the system produced link strength. The analysis identified nine cluster themes that are identified with colours in the figure below.

Cluster one has 24 items under its banner. Phrases such as energy management, financial development, green finance, sustainability, performance assessment, investment efficiency, economic and social effects, and digital economy were picked, among others. Green financing is meant to increase financing to the public and private sectors for non-profit sustainable development programs. Sustainability is a societal objective that generally relates to the ability to co-exist and develop without exhausting resources for the future. These terms support the study theme of social protection, as they cover important aspects of social protection. Digital economy is a global network of commercial transactions, economic activities, and professional interactions enabled using information systems. Financial development is basically overcoming costs incurred in the financial sector, which can be identified as competition, concentration, efficiency, and access, which are highly constrained using technology. Fintech becomes relevant in the establishment of digital economies fostering financial development.

Cluster two is the second one considering the number of items per cluster. Cluster two has 22 items, including agricultural technology, digital finance, refugees, bank accounts, digital transformation, blockchain, financial systems, technological adoption, COVID-19, mobile banking, and infrastructure development, among others (Nwogugu 2019; National Academies of Sciences, Engineering, and Medicine 2021; Mäntysaari 2021; Śledziewska and Włoch 2021; AlMalki and Durugbo 2022; Kararach 2022). The results show a link between fintech and social protection in having technological advancement, the establishment of technological infrastructure, bank account issues, and addressing issues surrounding refugees and COVID-19. In cluster two there emerge various fintech sub-areas such as blockchain, mobile banking, bank accounts, and digital transformation. Blockchain technology allows one to send money securely to a peer without having to visit a formal bank or financial service provider. Refugees and COVID-19 are terms that are associated with people suffering or people in an uncomfortable state; for example, unemployment due to the COVID-19 crisis or due to forced relocations. These cases resonate with social protection cases.

The third cluster has 15 items, namely economic development, environmental protection, financial management, economic growth, green card policy, productivity, and environmental economics, among others. Environmental economics and protection are an area of study that focuses on the cost-effectiveness of the use, allocation, and protection of natural resources. In other words, it is the way in which human beings produce and consume goods and services to offer efficient solutions. The Task–Technology Fit theory supports environmental economics in advancing novel inventions to effectively produce and consume products and services. Environmental economics ensures that the effects of climate change are reduced, whilst climate change has a direct effect on the prosperity and safety of people, affecting the most vulnerable people the most. Social protection can serve as a strategic tool for climate risk management and responds to the current calls for climate action and increased resilience.

Cluster four has 14 items, including agent-based modelling, financial inclusion, crowdfunding, developing countries, technology transfers, and information systems among others. Agent-based modelling is the use of information technology to study the connectedness between people, time, and environment to establish surrounding factors for the realised outcomes. Financial inclusion highlights the availability and equal access to financial systems for all. Financial inclusion has been highlighted as one of the developments to foster social protection. Developing countries usually do not have well-established infrastructure, hence the use of fintech such as mobile money can be cost-effective. Crowdfunding is the practice of funding a project or cause via a vast number of people without geographical boundaries using internet technology.

Items such as artificial intelligence, Bitcoin, blockchain technology, consumer finance, government, and sustainable development comprise cluster five. The cluster has 13 items in total. Artificial intelligence is the simulation of a human’s way of thinking by technology such as computer systems. Bitcoin, on the other hand, is a digital currency that can be transferred on a peer-to-peer basis on the Bitcoin network. Bitcoin is a technological platform that allows the transfer of finance in a secure and mostly unregulated manner. Bitcoin uses blockchain technology, as it allows the existence of cryptocurrency. One cannot discuss sustainable development without mentioning social protection according to the dictates of the United Nations’ sustainable development goals.

Cluster six has 13 items, including fintech adoption, financial inclusion, financial literacy, fintech, poverty, regulation, and security. The flowing cluster seven has 12 items, including commerce, efficiency, environmental sustainability, financial technology, innovation, public policy, regulatory sandbox, and sustainable development, among others. Fintech adoption is the decision to employ fintech after analysing the advantages and disadvantages of the innovation. Factors such as efficiency, financial literacy, and environmental sustainability are also factored in when organisations are deciding whether to adopt or reject a fintech. Fintech adoption in developed countries has been widely accepted for its ability to foster financial inclusion even for the most vulnerable citizens. Innovations in the financial sector are subject to the regulatory sandbox to test their efficiency and security before being rolled out to the mainstream economy.

Clusters eight and nine have ten and nine items, respectively. Items in cluster eight include health care costs, mobile money, mobile payments, sub-Saharan Africa, and developing countries, among other items. Cluster nine’s items include business development, economic policy, financial inclusion, and emerging markets, among others. Mobile money is a fintech that allows payments to be made or received using a mobile phone. In essence, mobile money is a digital wallet. Mobile money has been received well in sub-Saharan Africa’s developing countries that have permitting regulations. Mobile money wallets have been a major driving force for fostering financial inclusion in emerging markets. Social protection comprises promotion and protection agendas, within which financial inclusion is part of the social protection promotion agenda.

The search results have shown the interconnectedness of the nine clusters by the recurring keywords in the different clusters that support the study theme of social protection and fintech. Words such as financial development, fintech, sustainability, financial inclusion, poverty, green finance, emerging markets, developing countries, and financial innovation, among others, directly support the notion of the fusion of fintech in social protection. Financial inclusion has been fostered by financial technologies such as mobile money that have less know-your-customer documentation required. Financial technology through financial inclusion allows social protection to adopt fintech in social protection programs. Financial inclusion through the employment of fintech promotes social protection.

5. Conclusions

Financial technology in social protection has recently been gaining momentum in the research field. A thorough synopsis of financial technology incorporated into social protection has been attempted by conducting a bibliometric review based on keywords, namely fintech, financial technology, social welfare, and social protection. These keywords were derived from the topic and supported by the theoretical framework. The SCOPUS database search engine was used for data collection, and it picked 145 documents. Data analysis was conducted on two platforms, namely SCOPUS and VOSviewer. To determine whether financial technology in social protection has been receiving increased attention, the study adopted key measurement tools to prove the notion. Thus, citations, co-citations, publications, and the places of publication were considered to measure the attention received by financial technology in social protection.

The main findings of this study were that from the beginning of 2018, the number of publications in this realm dramatically increased, proving that financial technology in social protection is receiving increased attention from academics. During the COVID-19 pandemic, people suffered from income losses, hence the pandemic increased charitable cases. The pandemic had containment regulations that prohibited movement and closed most businesses and banks, hence social protection turned to fintech. Picking the right tool for the job is supported by the Task–Technology Fit theory, discussed earlier, which highlights the importance of picking the correct tool for the task to improve efficiency and counter environmental challenges. On the other hand, the Technology Acceptance Model assumes that when users become aware of the usefulness and ease of use of a new technology, they become willing to adopt it. The adoption of an innovation is a process that goes through various stages and factor considerations, as advanced by the diffusion of innovation theory, presented earlier. The theory postulates that when a new plan, way of doing things, or technology is introduced, it has perceivable ways, timeframes, and systems for it to be adopted by end users. This justifies the gradual adoption of fintech in social protection, as organisations have realised the benefits, security, and usefulness of the innovation.

Social protection assists vulnerable people and families, cushioning them against crises and shocks, improving their productivity, investing in health and education, and protecting ageing citizens. The theory of social contract, as presented earlier, shows that responsible administrations are obliged to look after their citizens’ welfare. The Pareto Optimality also supports the notion through income distribution to improve the livelihoods of poor and vulnerable people to reduce the inequality gap. The study established that social protection is linked to poverty alleviation and is a policy issue that countries should have. Results from the keyword co-occurrences show that poverty alleviation is strongly linked to fintech, financial inclusion, and financial literacy. This shows the links that exist between social protection and fintech.

The citation analysis results presented three documents that met the threshold. This shows that there is still more room for research in the area of fintech in social protection. The results also show that this study’s focus area is receiving increased attention, as the adoption of financial technology is proving to be unavoidable. The search results produced 145 documents according to the keywords without any other filter, which is a relatively low number considering that social protection and social welfare have 95,777 documents, whilst fintech and financial technology have 8296 documents, separately. These results, compared to the 145 documents received from the study search results, show that there is still more room to explore the combination of fintech and social protection. The results show that authors that made it to the top 10 have an average h-index of five. An h-index of five is mainly associated with entry-level assistant professors, suggesting that the study focus area of fintech and social protection is attractive to new researchers as it is relatively new. Nine of the top ten authors have at least two documents each, suggesting that fintech and social protection research presents opportunities as a less-researched area. The research established that fintech in social protection started receiving attention in 2017 with just four publications, indicating that the study area is relatively new and needs more research in the area. The study results highlight literature gaps that future scientific studies could cover and avoid over-researched areas. Based on the analysis of average citations and linkages of keywords, the study identified areas warranting further research. These are as follows:

- Adopting fintech in social protection service provision;

- Blockchain technology research on social protection;

- Fintech in health care service provision;

- There is still room for further research on the adoption of financial technology in social protection cash transfers as a payment modality.

Further, the results of this study showed that there was a poor linkage between financial inclusion and social protection. Future studies could be carried out to explore the option of financial inclusion fostering social protection.

Author Contributions

Conceptualisation, A.M. and A.B.S.; methodology, A.M. and A.B.S.; software, A.M.; validation, A.M. and A.B.S.; formal analysis, A.M.; investigation, A.M.; resources, A.M.; data curation, A.M.; writing—original draft preparation, A.M.; writing—review and editing, A.B.S.; visualisation, A.M.; supervision, A.B.S.; project administration, A.M.; funding acquisition, A.B.S. All authors have read and agreed to the published version of the manuscript.

Funding

The APC was funded by the University of South Africa.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are available upon request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Adegbite, Olayinka O., and Charles L. Machethe. 2020. Bridging the financial inclusion gender gap in smallholder agriculture in Nigeria: An untapped potential for sustainable development. World Development 127: 104755. [Google Scholar] [CrossRef]

- Ajibade, Patrick. 2018. Technology acceptance model limitations and criticisms: Exploring the practical applications and use in technology-related studies, mixed-method, and qualitative researches. Library Philosophy and Practice 9: 1–13. [Google Scholar]

- Alderman, Harold, and M. Mustafa. 2013. Preparatory Technical Meeting for the International Conference on Nutrition (Icn2). Social Protection and Nutrition 1: 37–46. [Google Scholar]

- Al Husaeni, Dwi Fitria, and Asep Bayu Dani Nandiyanto. 2022. Bibliometric using Vosviewer with Publish or Perish (using google scholar data): From step-by-step processing for users to the practical examples in the analysis of digital learning articles in pre and post Covid-19 pandemic. ASEAN Journal of Science and Engineering 2: 19–46. [Google Scholar] [CrossRef]

- Albitar, Khaldoon, Ali Meftah Gerged, Hassan Kikhia, and Khaled Hussainey. 2020. Auditing in times of social distancing: The effect of COVID-19 on auditing quality. International Journal of Accounting & Information Management 29: 169–78. [Google Scholar] [CrossRef]

- AlMalki, Hameeda A., and Christopher M. Durugbo. 2022. Systematic review of institutional innovation literature: Towards a multi-level management model. Management Review Quarterly 1: 1–55. [Google Scholar] [CrossRef]

- Ali, Sana B., Juana Romero, Kevin Morrison, Baria Hafeez, and Jessica S. Ancker. 2018. Focus section health IT usability: Applying a task-technology fit model to adapt an electronic patient portal for patient work. Applied Clinical Informatics 9: 174–84. [Google Scholar] [CrossRef]

- Archambault, Caroline, and David Ehrhardt. 2019. Food Aid. In Food and Sustainability. Edited by Paul Behrens, David Ehrhardt and Thijs Bosker. New York: Oxford University Press. [Google Scholar]

- Arner, Douglas W., Ross P. Buckley, Dirk A. Zetzsche, and Robin Veidt. 2019. Sustainability, FinTech and Financial Inclusion. European Business Organization Law Review 21: 19–63. [Google Scholar] [CrossRef]

- Baas, Jeroen, Michiel Schotten, Andrew Plume, Grégoire Côté, and Reza Karimi. 2020. SCOPUS as a curated, high-quality bibliometric data source for academic research in quantitative science studies. Quantitative Science Studies 1: 377–86. [Google Scholar] [CrossRef]

- Bagherzadeh, Mehdi, Andrei Gurca, and Sabine Brunswicker. 2019. Problem types and open innovation governance modes: A project-level empirical exploration. IEEE Transactions on Engineering Management 69: 287–301. [Google Scholar] [CrossRef]

- Barki, Henri, Ryad Titah, and Céline Boffo. 2007. Information system use–related activity: An expanded behavioral conceptualization of individual-level information system use. Information Systems Research 18: 173–92. [Google Scholar] [CrossRef]

- Bernards, Nick. 2022. Colonial Financial Infrastructures and Kenya’s Uneven Fintech Boom. Antipode 54: 708–28. [Google Scholar] [CrossRef]

- Bongomin, George Okello Candiya, and Joseph Mpeera Ntayi. 2020. Mobile money adoption and usage and financial inclusion: Mediating effect of digital consumer protection. Digital Policy, Regulation and Governance 22: 157–76. [Google Scholar] [CrossRef]

- Brown, Bill. 2016. Other things. In Other Things. Chicago: University of Chicago Press. [Google Scholar]

- Buabeng-Andoh, Charles. 2018. Predicting students’ intention to adopt mobile learning: A combination of theory of reasoned action and technology acceptance model. Journal of Research in Innovative Teaching & Learning 26: 241–56. [Google Scholar]

- Brunetti, Celso, Benjamin Dennis, Dylan Gates, Diana Hancock, David Ignell, Elizabeth K. Kiser, Gurubala Kotta, Anna Kovner, Richard J. Rosen, and Nicholas K. Tabor. 2021. Climate Change and Financial Stability. FEDS Notes. [Google Scholar] [CrossRef]

- Brunswicker, Sabine, and Henry Chesbrough. 2018. The Adoption of Open Innovation in Large Firms: Practices, Measures, and Risks A survey of large firms examines how firms approach open innovation strategically and manage knowledge flows at the project level. Research-Technology Management 61: 35–45. [Google Scholar] [CrossRef]

- Burri, Susanne, Daniela Lup, and Alexander Pepper. 2021. What do business executives think about distributive justice? Journal of Business Ethics 174: 15–33. [Google Scholar] [CrossRef]

- Cavalier, Tom M., Panos M. Pardalos, and Allen L. Soyster. 1990. Modeling and integer programming techniques applied to propositional calculus. Computers & Operations Research 17: 561–70. [Google Scholar]

- Chandel, Ajay, and Tejbir Kaur. 2022. Demystifying Neuromarketing: A Bibliometric Analysis Using VOSviewer. In Developing Relationships, Personalization, and Data Herald in Marketing 5.0. Hershey: IGI Global, pp. 256–83. [Google Scholar] [CrossRef]

- Chapnick, Adam, and Christopher J. Kukucha. 2016. The Harper Era in Canadian Foreign Policy: Parliament, Politics, and Canada’s Global Posture. Vancouver: UBC Press. [Google Scholar]

- Chikoko, Witness, Kudzai Nyabeze, Kwashirai Zvokuomba, Kudzai Mwapaura, and Samson Mhizha. 2021. The Harmonized Social Cash Transfer Program in Zimbabwe: Achievements and Challenges. Journal of Economics and Behavioral Studies 13: 12–21. [Google Scholar] [CrossRef]

- Constant, Labintan Adeniyi. 2011. Climate change and poverty reduction in sahel: Climate risk management contribution to poverty reduction. Paper presented at the 55TH Annual Conference, Melbourne, Australia, February 8–11. [Google Scholar]

- Contreras, Francoise, and Ghulam Abid. 2022. Social sustainability studies in the 21st century: A bibliometric mapping analysis using VOSviewer Software. Pakistan Journal of Commerce and Social Sciences 16: 167–203. [Google Scholar]

- Currie, Graeme, and Dimitrios Spyridonidis. 2019. Sharing leadership for diffusion of innovation in professionalized settings. Human Relations 72: 1209–1233. [Google Scholar] [CrossRef]

- Davis, Fred D. 1989. Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly 13: 319–40. [Google Scholar] [CrossRef]

- Dellsén, Finnur. 2018. Scientific progress: Four accounts. Philosophy Compass 13: e12525. [Google Scholar] [CrossRef]

- Deygers, Bart. 2019. Fairness and social justice in English language assessment. In Second Handbook of English Language Teaching. Berlin: Springer, pp. 541–69. [Google Scholar]

- Eybers, Sunet, Marie J. Hattingh, and Liako Kuoe. 2019. Investigating factors that influence the adoption of BI systems by end users in the mining industry in Southern Africa. In Conference on e-Business, e-Services and e-Society. Cham: Springer, pp. 113–24. [Google Scholar]

- Fortnum, Dennis, Ian Pollari, Warren Mead, Brian Hughes, and Arik Speier. 2017. The Pulse of Fintech Q1 2017: Global Analysis of Investment in Fintech. Amstelveen: KPMG. [Google Scholar]

- Fotta, Martin, and Mario Schmidt. 2022. Cash Transfers. Cambridge Encyclopedia of Anthropology. Available online: https://www.anthroencyclopedia.com/entry/cash-transfers#wrapped-content (accessed on 6 December 2022).

- Frost, Jon. 2020. The economic forces driving fintech adoption across countries. In The Technological Revolution in Financial Services: How Banks, Fintechs, and Customers Win Together. Toronto: University of Toronto Press. [Google Scholar]

- Fu, Jonathan, and Mrinal Mishra. 2022. Fintech in the time of COVID−19: Technological adoption during crises. Journal of Financial Intermediation 50: 100945. [Google Scholar] [CrossRef]

- Galletta, Simona, Sebastiano Mazzù, and Valeria Naciti. 2022. A bibliometric analysis of ESG performance in the banking industry: From the current status to future directions. Research in International Business and Finance 62: 101684. [Google Scholar] [CrossRef]

- Gao, Chaoyue, Yanchao Ji, Jianze Wang, and Xiangyv Sai. 2018. Application of Blockchain Technology in Peer-to-Peer Transaction of Photovoltaic Power Generation. Paper presented at the 2018 2nd IEEE Advanced Information Management, Communicates, Electronic and Automation Control Conference (IMCEC), Xi’an, China, May 25–27; pp. 2289–93. [Google Scholar] [CrossRef]

- García Castillo, Jorge. 2021. Deciding between cash-based and in-kind distributions during humanitarian emergencies. Journal of Humanitarian Logistics and Supply Chain Management 11: 272–95. [Google Scholar] [CrossRef]

- Garg, Jugal, and Peter McGlaughlin. 2020. Improving Nash Social Welfare Approximations of Indivisible Goods. Journal of Artificial Intelligence Research 68: 225–45. [Google Scholar]

- Gebauer, Judith, Michael J. Shaw, and Michele L. Gribbins. 2010. Task-technology fit for mobile information systems. Journal of Information Technology 25: 259–72. [Google Scholar] [CrossRef]

- Gobble, MaryAnne M. 2018. Digitalization, digitization, and innovation. Research-Technology Management 61: 56–59. [Google Scholar] [CrossRef]

- Gomber, Peter, Robert J. Kauffman, Chris Parker, and Bruce W. Weber. 2018. On the fintech revolution: Interpreting the forces of innovation, disruption, and transformation in financial services. Journal of Management Information Systems 35: 220–65. [Google Scholar] [CrossRef]

- Goodhue, Dale L. 1998. Development and measurement validity of a task-technology fit instrument for user evaluations of information systems. Decision Sciences 29: 105–138. [Google Scholar] [CrossRef]

- Goodhue, Dale L., Barbara D. Klein, and Salvatore T. March. 2000. User evaluations of IS as surrogates for objective performance. Information & Managemen 38: 87–101. [Google Scholar]

- Goodhue, Dale L., and Ronald L. Thompson. 1995. Task-technology fit and individual performance. MIS Quarterly, 213–36. [Google Scholar]

- Grassi, Laura, and Simone Fantaccini. 2022. An overview of Fintech applications to solve the puzzle of health care funding: State-of-the-art in medical crowdfunding. Financial Innovation 8: 1–27. [Google Scholar] [CrossRef] [PubMed]

- Green, W. Nathan. 2022. Financing agrarian change: Geographies of credit and debt in the global south. Progress in Human Geography 46: 849–69. [Google Scholar] [CrossRef]

- Han, Jieun, Hyo-Jin Kang, Minjung Kim, and Gyu Hyun Kwon. 2020. Mapping the intellectual structure of research on surgery with mixed reality: Bibliometric network analysis (2000–2019). Journal of Biomedical Informatics 109: 103516. [Google Scholar] [CrossRef]

- Hansen, James, Jon Hellin, Todd Rosenstock, Eleanor Fisher, Jill Cairns, Clare Stirling, Christine Lamanna, Jacob van Etten, Alison Rose, and Bruce Campbell. 2019. Climate risk management and rural poverty reduction. Agricultural Systems 172: 28–46. [Google Scholar] [CrossRef]

- Hellmuth, Molly, H. Bhojwani, D. Osgood, J. Hansen, and A. Moorhead. 2009. Index insurance: Capturing knowledge for improved climate risk management and poverty reduction. IOP Conference Series: Earth and Environmental Science 6: 1. [Google Scholar] [CrossRef]

- Howard, Matt C., and Julia C. Rose. 2019. Refining and extending task–technology fit theory: Creation of two task–technology fit scales and empirical clarification of the construct. Information & Management 56: 103–34. [Google Scholar]

- Jaji, Rose. 2022. COVID-19 Safety Measures and Socioeconomic Status in Urban Zimbabwe. In The Coronavirus Crisis and Challenges to Social Development. Edited by Maria do Carmo dos Santos Gonçalves, Rebecca Gutwald, Tanja Kleibl, Ronald Lutz, Ndangwa Noyoo and Janestic Twikirize. Cham: Springer. [Google Scholar] [CrossRef]

- Javed, Abdul Rehman, Faisal Shahzad, Saif ur Rehman, Yousaf Bin Zikria, Imran Razzak, Zunera Jalil, and Guandong Xu. 2022. Future smart cities: Requirements, emerging technologies, applications, challenges, and future aspects. Cities 129: 103794. [Google Scholar] [CrossRef]

- Jorgensen, Steen Lau, and Paul B. Siegel. 2019. Social Protection in an Era of Increasing Uncertainty and Disruption. Available online: https://openknowledge.worldbank.org/handle/10986/31812 (accessed on 6 December 2022).

- Kararach, George Auma. 2022. Disruptions and Rhetoric in African Development Policy, Disruptions and Rhetoric in African Development Policy, 1st ed. London: Routledge. [Google Scholar] [CrossRef]

- Kassen, Maxat. 2022. Blockchain and e-government innovation: Automation of public information processes. Information Systems 103: 101862. [Google Scholar] [CrossRef]

- Kersting, Norbert. 2013. Online participation: From ‘invited’ to ‘invented’ spaces. International Journal of Electronic Governance 6: 270–280. [Google Scholar] [CrossRef]

- Khan, Ashraf, John W. Goodell, M. Kabir Hassan, and Andrea Paltrinieri. 2022. A bibliometric review of finance bibliometric papers. Finance Research Letters 47: 102520. [Google Scholar] [CrossRef]

- Khanal, Sudeepa, Lira Ramadani, and Melanie Boeckmann. 2022. Health Equity in Climate Change Policies and Public Health Policies Related to Climate Change: Protocol for a Systematic Review. International Journal of Environmental Research and Public Health 19: 9126. [Google Scholar] [CrossRef]

- Kulkarni, Mukta. 2019. Digital accessibility: Challenges and opportunities. IIMB Management Review 31: 91–98. [Google Scholar] [CrossRef]

- Kumari, Aparna, Urvi Chintukumar Sukharamwala, Sudeep Tanwar, Maria Simona Raboaca, Fayez Alqahtani, Amr Tolba, Ravi Sharma, Ioan Aschilean, and Traian Candin Mihaltan. 2022. Blockchain-Based Peer-to-Peer Transactive Energy Management Scheme for Smart Grid System. Sensors 22: 4826. [Google Scholar] [CrossRef]

- Kwashirai, Vimbai Chaumba. 2023. Election Violence in Zimbabwe. Cambridge: Cambridge University Press. [Google Scholar]

- Laurent, Sylvie. 2019. King and the Other America: The Poor People’s Campaign and the Quest for Economic Equality. Oakland: Oakland University of California Press. [Google Scholar]

- Lee, Ching-Chang, Hsing Kenneth Cheng, and Hui-Hsin Cheng. 2007. An empirical study of mobile commerce in insurance industry: Task–technology fit and individual differences. Decision Support Systems 43: 95–110. [Google Scholar] [CrossRef]

- Leong, Kelvin, and Anna Sung. 2018. FinTech (Financial Technology): What is it and how to use technologies to create business value in fintech way?. International Journal of Innovation. Management and Technology 9: 7478. [Google Scholar]

- Li, Lixu, Yang Tong, Long Wei, and Shuili Yang. 2022. Digital technology-enabled dynamic capabilities and their impacts on firm performance: Evidence from the COVID-19 pandemic. Information & Management 59: 103689. [Google Scholar] [CrossRef]

- Lunceford, Brett. 2009. Taxonomies, The Ecological Fallacy, and the Net Generation. Etc.: A Review of General Semantics 75: 371–82. [Google Scholar]

- Mann, Laura, and Gianluca Iazzolino. 2021. From development state to corporate leviathan: Historicizing the infrastructural performativity of digital platforms within Kenyan agriculture. Development and Change 52: 829–54. [Google Scholar] [CrossRef]

- Mäntysaari, Petri. 2021. Stocks for All: People’s Capitalism in the Twenty-First Century. Berlin and Boston: De Gruyter. [Google Scholar] [CrossRef]

- Manzoor, Hamid, Jani Kelloniemi, Annick Chiltz, David Wendehenne, Alain Pugin, Benoit Poinssot, and Angela Garcia-Brugger. 2013. Involvement of the glutamate receptor A t GLR 3.3 in plant defense signaling and resistance to H yaloperonospora arabidopsidis. The Plant Journal 76: 466–80. [Google Scholar] [CrossRef]

- Mapp, Susan, Jane McPherson, David Androff, and Shirley Gatenio Gabel. 2019. Social work is a human rights profession. Social Work 64: 259–69. [Google Scholar] [CrossRef]

- Mention, Anne-Laure. 2019. The future of fintech. Research-Technology Management 62: 59–63. [Google Scholar] [CrossRef]

- Mearman, Andrew, and Robert McMaster. 2019. Teaching future economists. In The Ethical Formation of Economists. Oxfordshire: Routledge, pp. 24–43. [Google Scholar]

- Mohamed, Sabry. 2021. Social Protection against Climate Change. IOP Conference Series: Earth and Environmental Science 6: 422004. [Google Scholar]

- Morais, Julieta. 2019. Cash Transfer Modalities and Women’s Economic Empowerment. Master’s Thesis, ResearchGate Berlin, Berlin, Germany. [Google Scholar] [CrossRef]

- Moufakkir, Marouane, and Qmichchou Mohammed. 2021. The Nexus Between FinTech Adoption and Financial Inclusion. In Research Anthology on Personal Finance and Improving Financial Literacy. Edited by I. Management Association. Hershey: IGI Global, pp. 175–91. [Google Scholar] [CrossRef]

- Nassiry, Darius. 2018. The Role of Fintech in Unlocking Green Finance: Policy Insights for Developing Countries. No. 883. ADBI Working Paper. Tokyo: ADBI. [Google Scholar]

- National Academies of Sciences, Engineering, and Medicine. 2021. Sexually Transmitted Infections: Adopting a Sexual Health Paradigm. Washington: The National Academies Press. [Google Scholar] [CrossRef]

- Nawazish, Mohammed, Sidhartha S. Padhi, and T. C. Edwin Cheng. 2022. Stratified delivery aid plans for humanitarian aid distribution centre selection. Computers & Industrial Engineering 171: 108451. [Google Scholar] [CrossRef]

- Nguyen, Long H., David A. Drew, Mark S. Graham, Amit D. Joshi, Chuan-Guo Guo, Wenjie Ma, Raaj S. Mehta, Andrew T. Chan, Mingyang Song, Jaime E. Hart, and et al. 2020. Risk of COVID-19 among front-line health-care workers and the general community: A prospective cohort study. The Lancet Public Health 5: e475–e483. [Google Scholar] [CrossRef]

- Nnaji, Chukwuma, Ifeanyi Okpala, and Sungjin Kim. 2019. A simulation framework for technology adoption decision making in construction management: A composite model. In Computing in Civil Engineering 2019: Visualization, Information Modeling, and Simulation. Reston: American Society of Civil Engineers, pp. 499–506. [Google Scholar]

- Nozick, Robert. 1974. Constraints and Animals. Anarchy, State and Utopia, 35–42. [Google Scholar]

- Nwogugu, Michael I. C. 2019. Earnings Management, Fintech-Driven Incentives and Sustainable Growth: On Complex-Systems, Legal and Mechanism Design Factors. London: Routledge. [Google Scholar] [CrossRef]

- Nyahunda, Louis, and Happy Mathew Tirivangasi. 2021. Barriers to Effective Climate Change Management in Zimbabwe’s Rural Communities. In African Handbook of Climate Change Adaptation. Edited by Nicholas Oguge, Desalegn Ayal, Lydia Adeleke and Izael da Silva. Cham: Springer. [Google Scholar] [CrossRef]

- Nyahunda, Louis, Happy Mathew Tirivangasi, and Thembinkosi E. Mabila. 2022. Challenges faced by humanitarian organisations in rendering services in the aftermath of Cyclone Idai in Chimanimani, Zimbabwe. Cogent Social Sciences 8: 1–12. [Google Scholar] [CrossRef]

- Ozili, Peterson K. 2018. Banking stability determinants in Africa. International Journal of Managerial Finance 14: 462–83. [Google Scholar] [CrossRef]

- Palinkas, Lawrence A., Meaghan O’Donnell, Susan Kemp, Jemaima Tiatia, Yvonette Duque, Michael Spencer, Rupa Basu, Kristine Idda Del Rosario, Kristin Diemer, Bonifacio Doma, Jr., and et al. 2022. Regional Research-Practice-Policy Partnerships in Response to Climate-Related Disparities: Promoting Health Equity in the Pacific. International Journal of Environmental Research and Public Health 19: 9758. [Google Scholar] [CrossRef]

- Pambudianti, Feronica Fa Rozalyne, Budi Purwanto, and Tubagus Nur Ahmad Maulana. 2020. The implementation of fintech: Efficiency of MSMEs loans distribution and users’ financial inclusion index. Jurnal Keuangan Dan Perbankan 24: 68–82. [Google Scholar] [CrossRef]

- Pareto, Vilfredo. 1896. The New Theories of Economics. Journal of Political Economy 5: 485–502. [Google Scholar] [CrossRef]

- Parlasca, Martin C., Constantin Johnen, and Matin Qaim. 2022. Use of mobile financial services among farmers in Africa: Insights from Kenya. Global Food Security 32: 100590. [Google Scholar] [CrossRef]

- Pauliukevičienė, Gintarė, and Jelena Stankeviciene. 2022. Assessment of the Impact of SDG Indicators on the Sustainable Development of FinTech Industry. Green Economy and Sustainable Development, Vilnius, Lithuania, 290–98. [Google Scholar] [CrossRef]

- Pereira, Ana C., and Fernando Romero. 2017. A review of the meanings and the implications of the Industry 4.0 concept. Procedia Manufacturing 13: 1206–214. [Google Scholar] [CrossRef]

- Pérez, Juan Antonio, and Gabriel Mugny. 2018. The conflict elaboration theory of social influence. In Understanding Group Behavior. Hove: Psychology Press, pp. 191–210. [Google Scholar]

- Philippon, Thomas. 2016. The Fintech Opportunity. No. w22476. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Pina, Theresa, Marc Lewis, Charity Garrison, and Anna Razatos. 2022. Using automation to manage donor engagement and fine-tune supply and demand during the first year of the COVID-19 pandemic. Transfusion and Apheresis Science 61: 103420. [Google Scholar] [CrossRef] [PubMed]

- Plsek, Paul E., and Trisha Greenhalgh. 2001. The challenge of complexity in health care. Bmj 323: 625–28. [Google Scholar] [CrossRef]

- Poosarla, Akshay. 2018. Bone Age Prediction with Convolutional Neural Networks. Ph.D. thesis, California State University, Sacramento, CA, USA. [Google Scholar]

- Puaschunder, Julia M. 2018. Intergenerational leadership: An extension of contemporary corporate social responsibility (CSR) models. Corporate Governance and Organizational Behavior Review 2: 7–17. [Google Scholar] [CrossRef]

- Rawls, John. 1971. Atheory of Justice. Boston: The Belknap Press of Harvard University Press. [Google Scholar]

- Ribeiro, João Paulo Coelho, Fábio Duarte, and Ana Paula Matias Gama. 2022. Does microfinance foster the development of its clients? A bibliometric analysis and systematic literature review. Financial Innovation 8: 34. [Google Scholar] [CrossRef]

- Rogers, Carl R. 1962. The Interpersonal Relationship: The Core of Guidance. Washington: American Psychological Association. [Google Scholar]

- Rogers, Everett M. 1995. Lessons for guidelines from the diffusion of innovations. The Joint Commission Journal on Quality Improvement 21: 324–28. [Google Scholar] [CrossRef]

- Rogers, Everett M. 2003. Diffusion of Innovations, 5th ed. New York: Free Press. [Google Scholar]

- Rogers, Everett M., and D. Williams. 1983. Diffusion of Innovations. Glencoe: The Free Press. [Google Scholar]

- Ruane, Cian, and Alessandra Peter. 2022. Distribution Costs. IMF Working Papers 2022: 1. [Google Scholar] [CrossRef]

- Sahay, Ratna, Ulric Eriksson von Allmen, Amina Lahreche, Purva Khera, Sumiko Ogawa, Majid Bazarbash, and Kimberly Beaton. 2020. The Promise of Fintech: Financial Inclusion in the Post COVID-19 Era. Washington: International Monetary Fund. [Google Scholar]

- Sáenz-Díez Rojas, Rocío, and Ana Patricia Moreno González. 2018. Social Fintech: The New Approach to Reduce Global Poverty. Available online: http://hdl.handle.net/11531/29861 (accessed on 1 January 2022).

- Sahinyazan, Feyza G., Marie-Ève Rancourt, and Vedat Verter. 2021. Food Aid Modality Selection Problem. Production and Operations Management 30: 965–83. [Google Scholar] [CrossRef]

- Sarkar, Soumodip. 2021. Breaking the chain: Governmental frugal innovation in Kerala to combat the COVID-19 pandemic. Government Information Quarterly 38: 101549. [Google Scholar] [CrossRef]

- Schlein, Candace. 2020. Critical and narrative research perspectives on in-service intercultural teaching. Theory into Practice 59: 321–31. [Google Scholar]

- Sen, Amartya K. 1977. Rational fools: A critique of the behavioral foundations of economic theory. Philosophy & Public Affairs 6: 317–44. [Google Scholar]

- Setyowati, Ro’fah. 2022. The Existence of Sharia Supervisory Board in Sharia Fintech: Legal Basis and Problematic in Indonesia. Syariah: Jurnal Hukum dan Pemikiran 20: 135–44. [Google Scholar]

- Shorten, Allison, and Brett Shorten. 2013. What is meta-analysis? Evidence-Based Nursing 16: 3–4. [Google Scholar] [CrossRef] [PubMed]

- Singh, Shalini, and Abu Bashar. 2021. A bibliometric review on the development in e-tourism research. International Hospitality Review. [Google Scholar] [CrossRef]