Tax Compliance and Conditional Cooperation: A Study Based on the Dense Social Trust of Young People

Abstract

1. Introduction

2. Brief Review of the Literature

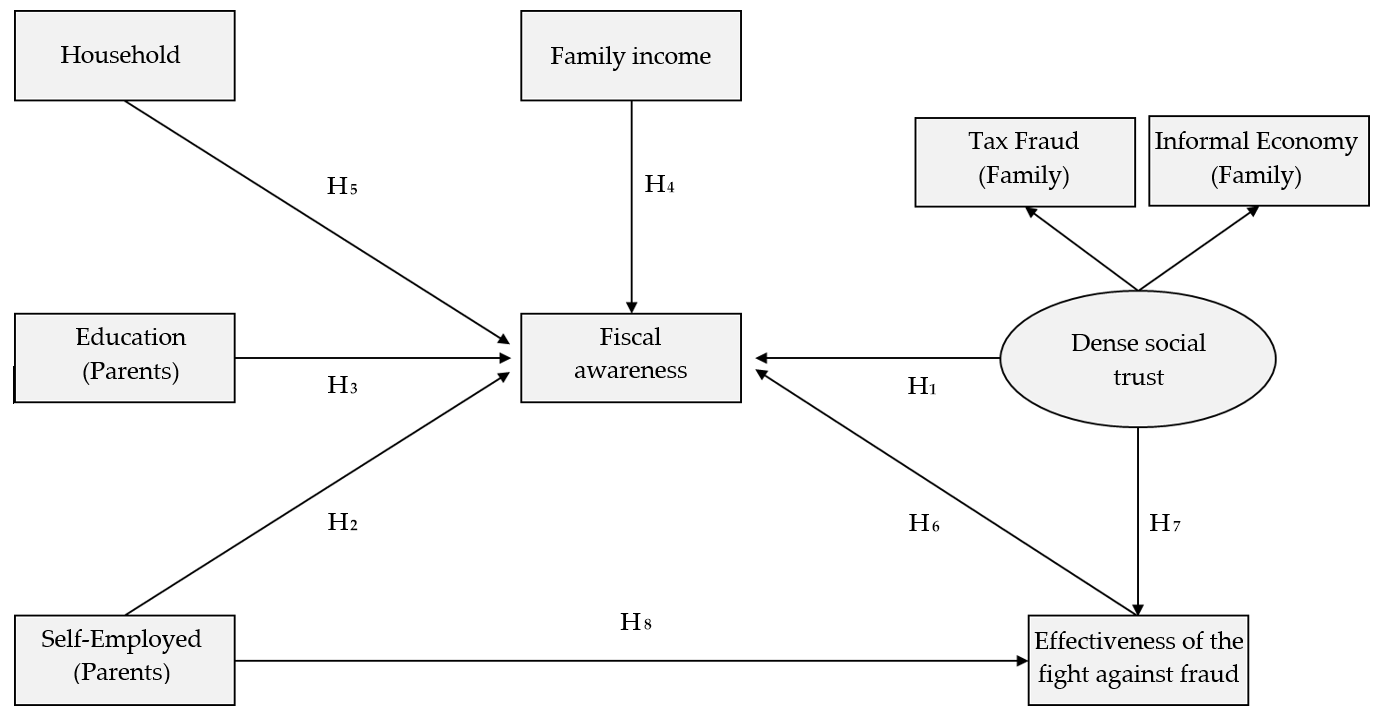

3. Theoretical Model and Hypotheses

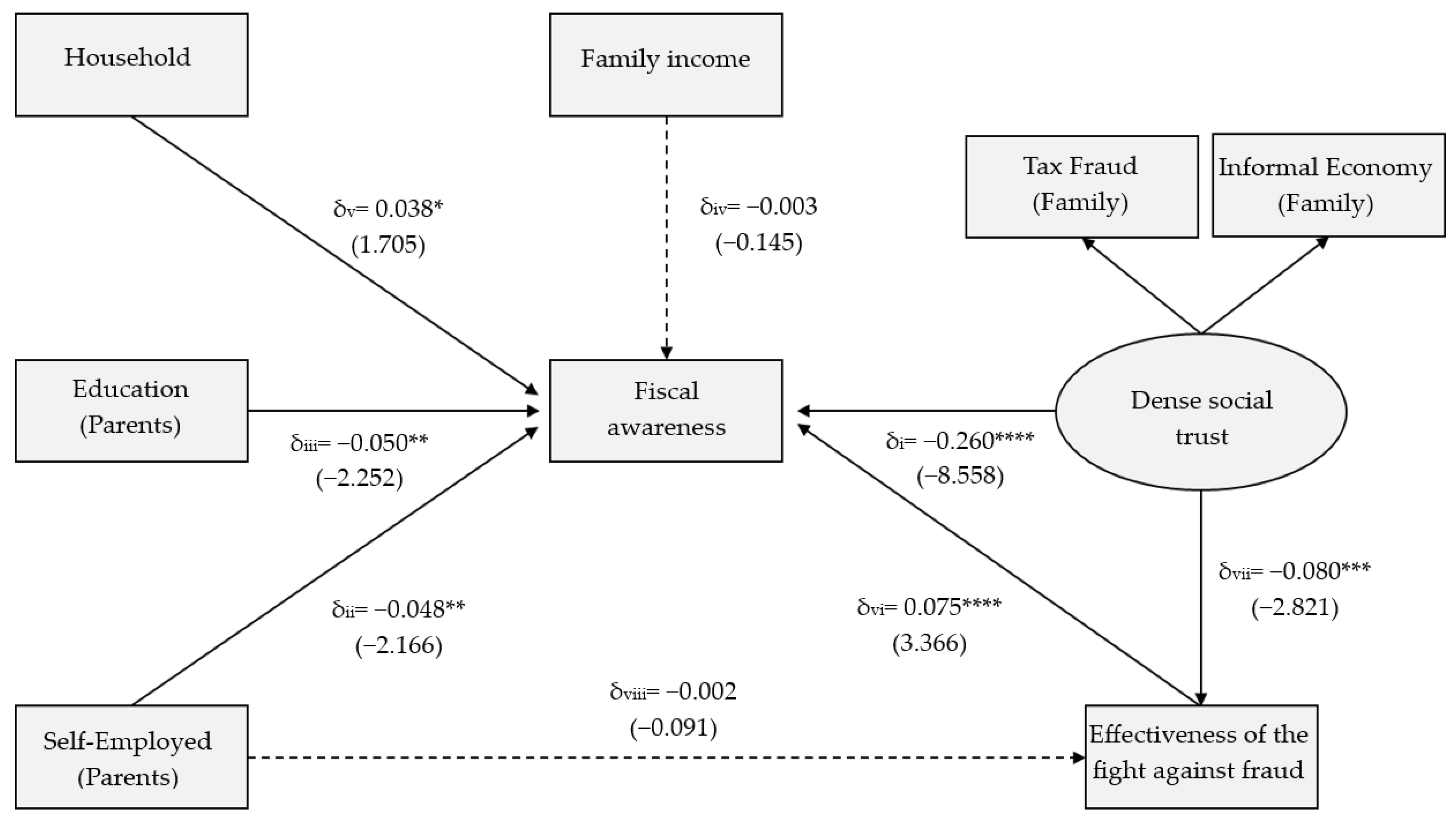

4. Sample and Measurement of the Variables

- (a)

- Fiscal awareness

- (b)

- Dense social trust

- (c)

- Fight against tax fraud

- (d)

- Educational level of parents

- (e)

- Employment status of parents

- (f)

- Household members and family income

5. Results and Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Delgado, M.L. ¿Por qué una educación fiscal? In La Experiencia Educativa de la Administración Tributaria Española; Doc. N.o13/09; Instituto de Estudios Fiscales: Madrid, Spain, 2009; pp. 11–18. [Google Scholar]

- Alm, J. Measuring, explaining, and controlling tax evasion: Lessons from theory, experiments, and field studies. Int. Tax Public Finance 2012, 19, 54–77. [Google Scholar] [CrossRef]

- Frey, B.S.; Torgler, B. Tax morale and conditional cooperation. J. Comp. Econ. 2007, 35, 136–159. [Google Scholar] [CrossRef]

- Lubian, D.; Zarri, L. Happiness and tax morale: An empirical analysis. J. Econ. Behav. Organ. 2011, 80, 223–243. [Google Scholar] [CrossRef]

- Torgler, B. Tax Morale in Latin America. Public Choice 2005, 122, 133–157. [Google Scholar] [CrossRef]

- Alarcón-García, G.; Beyaert, A.; De Pablos, L. Fiscal awareness: A study of female versus male attitudes towards tax fraud in Spain. In Tax Evasion and the Shadow Economy; Pickhardt, M., Prinz, A., Eds.; Edward Elgar Publishing: Cheltenham, UK, 2012; pp. 61–88. [Google Scholar] [CrossRef]

- Gino, F.; Ayal, S.; Ariely, D. Contagion and differentiation in unethical behavior: The effect of one bad apple on the barrel. Psychol. Sci. 2009, 20, 393–398. [Google Scholar] [CrossRef]

- Traxler, C. Social norms and conditional cooperative taxpayers. Eur. J. Polit. Econ. 2010, 26, 89–103. [Google Scholar] [CrossRef]

- Battiston, P.; Gamba, S. The impact of social pressure on tax compliance: A field experiment. Int. Rev. Law Econ. 2016, 46, 78–85. [Google Scholar] [CrossRef]

- Brizi, A.; Giacomantonio, M.; Schumpe, B.M.; Mannetti, L. Intention to pay taxes or to avoid them: The impact of social value orientation. J. Econ. Psychol. 2015, 50, 22–31. [Google Scholar] [CrossRef]

- Fellner, G.; Sausgruber, R.; Traxler, C. Testing enforcement strategies in the field: Threat, moral appeal and social information. J. Eur. Econ. Assoc. 2013, 11, 634–660. [Google Scholar] [CrossRef]

- Lamantia, F.; Pezzino, M. Social norms and evolutionary tax compliance. Manch. Sch. 2021, 89, 385–405. [Google Scholar] [CrossRef]

- Onu, D.; Oats, L. The role of social norms in tax compliance: Theoretical overview and practical implications. J. Tax Adm. 2015, 1, 113–137. [Google Scholar]

- Onu, D.; Oats, L. Paying tax is part of life: Social norms and social influence in tax communications. J. Econ. Behav. Organ. 2016, 124, 29–42. [Google Scholar] [CrossRef]

- Bethencourt, C.; Kunze, L. Tax evasion, social norms, and economic growth. J. Public Econ. Theory 2019, 21, 332–346. [Google Scholar] [CrossRef]

- Gächter, S. Conditional Cooperation: Behavioral Regularities from the Lab and the Field and Their Policy Implications. In Economics and Psychology: A Promising New Cross-Disciplinary Field; Frey, B.S., Stutzer, A., Eds.; CESifo Seminar Series: London, UK, 2007; pp. 19–50. [Google Scholar] [CrossRef]

- Giachi, S. Dimensiones sociales del fraude fiscal: Confianza y moral fiscal en la España contemporánea. REIS Rev. Española Investig. Sociol. 2014, 145, 73–98. [Google Scholar] [CrossRef]

- Bedoya, A.; Vásconez, B. Entendiendo la Moral Tributaria en Ecuador. Fisc. Rev. Inst. Serv. Rentas Internas 2010, 5, 91–132. [Google Scholar]

- Chan, H.F.; Supriyadi, M.W.; Torgler, B. Trust and Tax Morale. In The Oxford Handbook of Social and Political Trust; Uslaner, E.M., Ed.; Oxford University Press: Oxford, UK, 2018; pp. 497–534. [Google Scholar] [CrossRef]

- Martínez, J.A.; Miquel, A.B. Instrumentos clave en la lucha contra el fraude: La importancia de la educación fiscal. Crónica Tribut. 2013, 146, 179–192. [Google Scholar]

- Nurkholis, N.; Dularif, M.; Rustiarini, N.W. Tax evasion and service-trust paradigm: A meta-analysis. Cogent Bus. Manag. 2020, 7, 1827699. [Google Scholar] [CrossRef]

- Antequera, G.; Florensa, M. Determinantes de la Moral Tributaria en la Provincia de Buenos Aires; Asociación Argentina de Economía Política: Buenos Aires, Argentine, 2008; pp. 1–15. [Google Scholar]

- Molero, J.C.; Pujol, F. Walking Inside the Potential Tax Evader’s Mind: Tax Morale Does Matter. J. Bus. Eth. 2012, 105, 151–162. [Google Scholar] [CrossRef]

- Job, J.; Reinhart, M. Trusting the Tax Office: Does Putnam’s Thesis Relate to Tax? Working Paper 53; Centre for Tax System Integrity, Australian National University: Canberra, Australia, 2004. [Google Scholar]

- Herreros, F. ¿Son las relaciones sociales una fuente de recursos? Una definición del capital social. Pap. Rev. Sociol. 2002, 67, 129–148. [Google Scholar] [CrossRef]

- Guerra, A.; Harrington, B. Attitude–behavior consistency in tax compliance: A cross-national comparison. J. Econ. Behav. Organ. 2018, 156, 184–205. [Google Scholar] [CrossRef]

- Gebrihet, H.G.; Gebresilassie, Y.H.; Woldu, G.T. Trust, Corruption, and Tax Compliance in Fragile States: On a Quest for Transforming Africa into Future Global Powerhouse. Soc. Sci. 2023, 13, 3. [Google Scholar] [CrossRef]

- Çevik, S. Tax morale and tax compliance in socio-political context. In Political Economy of Taxation; Aydin, M., Tan, S.S., Eds.; IJOPEC Publication: London, UK, 2016; pp. 37–57. [Google Scholar]

- Horodnic, I. Tax morale and institutional theory: A systematic review. Int. J. Sociol. Soc. Policy 2018, 38, 868–896. [Google Scholar] [CrossRef]

- Kondelaji, M.H.; Sameti, M.; Amiri, H.; Moayedfar, R. Analyzing determinants of tax morale based on social psychology theory: Case study of Iran. Iran. Econ. Rev. 2016, 20, 581–598. [Google Scholar]

- Kouamé, W.A. Trust to pay? Tax morale and trust in Africa. J. Dev. Stud. 2021, 57, 1086–1105. [Google Scholar] [CrossRef]

- Luttmer, E.F.P.; Singhal, M. Tax morale. J. Econ. Perspect. 2014, 28, 149–168. [Google Scholar] [CrossRef]

- Bobek, D.D.; Hageman, A.M.; Kelliher, C.F. Analyzing the role of social norms in tax compliance behavior. J. Bus. Eth. 2013, 115, 451–468. [Google Scholar] [CrossRef]

- Górecki, M.A.; Letki, N. Social norms moderate the effect of tax system on tax evasion: Evidence from a large-scale survey experiment. J. Bus. Eth. 2021, 172, 727–746. [Google Scholar] [CrossRef]

- Wenzel, M. A letter from the Tax Office: Compliance effects of informational and interpersonal justice. Soc. Justice Res. 2006, 19, 345–364. [Google Scholar] [CrossRef]

- Alstadsæter, A.; Kopczuk, W.; Telle, K. Social networks and tax avoidance: Evidence from a well-defined Norwegian tax shelter. Tax Public Finance 2019, 26, 1291–1328. [Google Scholar] [CrossRef]

- Fitriana, A. The Influence of Family Ties and Trust in Government on Tax Compliance with Tax Morality as a Moderating Variable. Doctoral Dissertation, Universitas Islam Indonesia, Yogyakarta, Indonesia, 2024. [Google Scholar]

- Frimmel, W.; Halla, M.; Paetzold, J. The intergenerational causal effect of tax evasion: Evidence from the commuter tax allowance in Austria. J. Eur. Econ. Assoc. 2019, 17, 1843–1880. [Google Scholar] [CrossRef]

- Marè, M.; Motroni, A.; Porcelli, F. How family ties affect trust, tax morale and underground economy. J. Econ. Behav. Organ. 2020, 174, 235–252. [Google Scholar] [CrossRef]

- Schmölders, G. Fiscal psychology: A new branch of public finance. Natl. Tax J. 1959, 12, 340–345. [Google Scholar] [CrossRef]

- Baron, R.A.; Byrne, D. Psicología Social, 10th ed.; Pearson Education, Inc.: Madrid, Spain, 2005. [Google Scholar]

- Serra, P. Evasión tributaria, ¿cómo abordarla? Estud. Públicos 2000, 80, 193–228. [Google Scholar]

- Jiménez, P.; Iyer, G.S. Tax compliance in a social setting: The influence of social norms, trust in government, and perceived fairness on taxpayer compliance. Adv. Account. 2016, 34, 17–26. [Google Scholar] [CrossRef]

- Morales, J.F.; Moya, M.C.; Gaviria, E.; Cuadrado, I. Psicología Social, 3rd ed.; McGraw-Hill Companies, Inc.: Madrid, Spain, 2007. [Google Scholar]

- De Juan, A. Un modelo psico-económico de fraude fiscal. Rev. Psicol. Trab. Organ. 1992, 8, 179–188. [Google Scholar]

- Spicer, M.W.; Lundstedt, S.B. Understanding Tax Evasion. Public Financ. 1976, 31, 295–304. [Google Scholar]

- Sutherland, E.H. The theory of differential association. In Readings in Criminology and Penology; Columbia University Press: New York, NY, USA, 1972; pp. 365–371. [Google Scholar] [CrossRef]

- Flaquer, L. El Destino de la Familia; Editorial Ariel, S.A.: Barcelona, Spain, 1998. [Google Scholar]

- Revilla, A. La familia como agente de educación moral. Corintios XIII 2012, 142, 45–62. [Google Scholar]

- Rodríguez, C.; Herrera, L.; Quiles, O.L.; Álvarez, J. El valor familia en estudiantes universitarios de España: Análisis y clasificación. Enseñ. Investig. Psicol. 2008, 13, 215–230. [Google Scholar]

- Álvarez, J.; Rodríguez, C. El valor de la institución familiar en los jóvenes universitarios de la Universidad de Granada. Bordón Rev. Pedag. 2008, 60, 7–21. [Google Scholar]

- Ortega, P.; Mínguez, R. Familia y transmisión de valores. Teor. Educ. 2003, 15, 33–56. [Google Scholar] [CrossRef]

- García, R.; Pérez, C.; Escámez, J. La Educación Ética en la Familia; Desclée De Brouwer: Bilbao, Spain, 2009. [Google Scholar]

- Bermúdez de Caicedo, C. Necesidad de la bioética en la educación superior. Acta Bioethica 2006, 12, 35–40. [Google Scholar] [CrossRef]

- Mercado, A.; Hernández, A.V. El proceso de construcción de la identidad colectiva. Converg. Rev. Cienc. Soc. 2010, 53, 229–251. [Google Scholar]

- Kogler, C.; Muehlbacher, S.; Kirchler, E. Testing the “slippery slope framework” among self-employed taxpayers. Econ. Gov. 2015, 16, 125–142. [Google Scholar] [CrossRef]

- Torgler, B. The Importance of Faith: Tax Morale and Religiosity. J. Econ. Behav. Organ. 2006, 61, 81–109. [Google Scholar] [CrossRef]

- Prieto, J.; Sanzo, M.J.; Suárez, J. Análisis económico de la actitud hacia el fraude fiscal en España. Hacienda Pública Española 2006, 177, 107–128. [Google Scholar]

- Martinez-Vazquez, J.; Torgler, B. The Evolution of Tax Morale in Modern Spain. J. Econ. Issues 2009, 43, 1–28. [Google Scholar] [CrossRef]

- Cechovsky, N. The importance of tax knowledge for tax compliance: A study on the tax literacy of vocational business students. In Trends in Vocational Education and Training Research; Nägele, C., Stalder, B.E., Eds.; Vocational Education and Training Network (VETN): Berlin, Germany, 2018; pp. 113–121. [Google Scholar] [CrossRef]

- Kurniawan, D. The influence of tax education during higher education on tax knowledge and its effect on personal tax compliance. J. Indones. Econ. Bus. 2020, 35, 57–72. [Google Scholar] [CrossRef]

- Alarcón-García, G.; Mayor, J.M.; Ayala, E.A. La participación ciudadana y el pago voluntario de los impuestos. Obets 2021, 16, 227–244. [Google Scholar] [CrossRef]

- Alarcón-García, G.; Mayor, J.M.; Quintanilla, C.M. Conciencia fiscal y presupuestos participativos: Un estudio exploratorio. REIS Rev. Española Investig. Sociol. 2022, 177, 69–88. [Google Scholar] [CrossRef]

- INE. Encuesta de Población Activa. Available online: https://www.ine.es/dyngs/INEbase/es/operacion.htm?c=Estadistica_C&cid=1254736176918&menu=ultiDatos&idp=1254735976595 (accessed on 30 January 2025).

- Goenaga, M. Medidas Sociales para Combatir el Fraude Fiscal en España; Documento de trabajo 184/2014; Laboratorio de Alternativas: Madrid, Spain, 2014. [Google Scholar]

- Martínez, M.; Sanz, J.F. La Percepción del Gasto Público en el Cumplimiento Fiscal: Contrastación Empírica de la Hipótesis de Falkinger; Papeles de Trabajo No.02/99; Instituto de Estudios Fiscales: Madrid, Spain, 1999. [Google Scholar]

- Dörrenberg, P.; Peichl, A. Tax Morale and the Role of Social Norms and Reciprocity. Evidence from a Randomized Survey Experiment; CESifo Working Paper Series No. 7149; Munich Society for the Promotion of Economic Research—CESifo GmbH: Munich, Germany, 2018. [Google Scholar] [CrossRef]

- Hair, J.F.; Anderson, R.E.; Tatham, R.L.; Black, W.C. Análisis Multivariante, 5th ed.; Prentice Hall: Madrid, Spain, 1999. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, XVIII, 39–50. [Google Scholar] [CrossRef]

- Williams, J.; Sickles, R. An Analysis of the Crime as Work Model: Evidence from the 1958 Philadelphia Birth Cohort Study. J. Hum. Resour. 2002, 37, 479–509. [Google Scholar] [CrossRef][Green Version]

- Hjalmarsson, R.; Lindquist, M.J. Like Godfather, Like Son: Exploring the Intergenerational Nature of Crime. J. Hum. Resour. 2012, 47, 550–582. [Google Scholar] [CrossRef]

- Hjalmarsson, R.; Lindquist, M.J. Driving Under the Influence of Our Fathers. B.E. J. Econ. Anal. Policy 2010, 10, 1–15. [Google Scholar] [CrossRef]

- Castañeda, V.M. La moral tributaria en América Latina y la corrupción como uno de sus determinantes. Rev. Mex. Cienc. Polit. Soc. 2015, 60, 103–132. [Google Scholar] [CrossRef]

- Eriksen, K.; Fallan, L. Tax knowledge and attitudes towards taxation. A report on a quasi-experiment. J. Econ. Psychol. 1996, 17, 387–402. [Google Scholar] [CrossRef]

- Bitzenis, A.; Vlachos, V. Tax morale in times of economic depression: The case of Greece. In Advances in Taxation; Emerald Publishing Limited: Bradford, UK, 2018; pp. 173–199. [Google Scholar] [CrossRef]

- Azar, K.; Gerstenblüth, M.; Rossi, M. Moral fiscal en el Cono Sur. Desarro. Soc. 2010, 65, 43–69. [Google Scholar] [CrossRef]

- Gutiérrez, A. Determinantes y diferencias en la Moral Fiscal en Centroamérica. Un análisis desde el Latinobarómetro 2005. Cienc. Econ. 2011, 29, 341–356. [Google Scholar] [CrossRef]

- McGee, R.W.; Yoon, Y. Attitudes Toward Tax Evasion in Korea: A Study in Public Finance. In Handbook of Asian Finance. Financial Markets and Sovereign Wealth Funds; Chuen, D.L.K., Gregoriou, G.N., Eds.; Elsevier Inc.: Amsterdam, The Netherlands, 2014; pp. 271–283. [Google Scholar] [CrossRef]

- García, G.A.; Azorín, J.D.B.; de la Vega, M.d.M.S. Tax Evasion in Europe: An Analysis Based on Spatial Dependence. Soc. Sci. Q. 2018, 99, 7–23. [Google Scholar] [CrossRef]

- Alexander, P.; Balavac-Orlic, M. Tax morale: Framing and fairness. Econ. Syst. 2022, 46, 100936. [Google Scholar] [CrossRef]

- Kasipillai, J.; Aripin, N.; Amran, N.A. The influence of education on tax avoidance and tax evasion. eJTR 2003, 1, 134–146. [Google Scholar]

- Alm, J. What motivates tax compliance? J. Econ. Surv. 2019, 33, 353–388. [Google Scholar] [CrossRef]

- Amin, S.N.; Buhari, P.Z.A.; Yaacob, A.S.; Iddy, Z. Exploring the Influence of Tax Knowledge in Increasing Tax Compliance by Introducing Tax Education at Tertiary Level Institutions. Open J. Account. 2022, 11, 57–70. [Google Scholar] [CrossRef]

- Inasius, F. Voluntary and Enforced Tax Compliance: Evidence from Small and Medium-Sized Enterprises in Indonesia. Adv. Tax. 2019, 26, 99–111. [Google Scholar] [CrossRef]

- Musimenta, D. Knowledge Requirements, Tax Complexity, Compliance Costs and Tax Compliance in Uganda. Cogent Bus. Manag. 2020, 7, 1812220. [Google Scholar] [CrossRef]

- Alarcón, G.; Ayala, E.A. Trust in Spanish Governments: Antecedents and Consequences. Econ. Anal. Policy 2013, 43, 177–193. [Google Scholar] [CrossRef]

- Marti, L.O. Taxpayers’ Attitudes and Tax Compliance Behavior in Kenya. Afr. J. Bus. Manag. 2010, 1, 112–122. [Google Scholar]

- Hofmann, E.; Hoelzl, E.; Kirchler, E. Preconditions of Voluntary Tax Compliance. Knowledge and Evaluation of Taxation, Norms, Fairness, and Motivation to Cooperate. Z. Psychol./J. Psychol. 2008, 216, 209–217. [Google Scholar] [CrossRef]

- Loo, E.C.; Margaret, M.; Hansford, A. Understanding the compliance behaviour of Malaysian individual taxpayers using a mixed method approach. J. Australas. Tax Teach. Assoc. 2014, 4, 181–202. [Google Scholar]

- Rodríguez-Justicia, D.; Theilen, B. Education and tax morale. J. Econ. Psychol. 2018, 64, 18–48. [Google Scholar] [CrossRef]

| Academic Year | Total Students | Female Students (N) | Male Students (N) | Female Students (%) | Male Students (%) |

|---|---|---|---|---|---|

| 2010/2011 | 156 | 86 | 70 | 55.13 | 44.87 |

| 2011/2012 | 143 | 82 | 61 | 57.34 | 42.66 |

| 2012/2013 | 149 | 77 | 72 | 51.68 | 48.32 |

| 2013/2014 | 153 | 86 | 67 | 56.21 | 43.79 |

| 2014/2015 | 136 | 75 | 61 | 55.15 | 44.85 |

| 2015/2016 | 164 | 91 | 73 | 55.49 | 44.51 |

| 2016/2017 | 152 | 86 | 66 | 56.58 | 43.42 |

| 2017/2018 | 139 | 77 | 62 | 55.40 | 44.60 |

| 2018/2019 | 142 | 76 | 66 | 53.52 | 46.48 |

| 2019/2020 | 148 | 79 | 69 | 53.38 | 46.62 |

| 2020/2021 | 156 | 85 | 71 | 54.49 | 45.51 |

| 2021/2022 | 146 | 85 | 61 | 58.22 | 41.78 |

| 2022/2023 | 133 | 70 | 63 | 52.63 | 47.37 |

| 2023/2024 | 142 | 81 | 61 | 57.04 | 42.96 |

| 2.059 | 1.136 | 923 | 55.17 | 44.83 |

| Comments | Mean | Median | Standard Deviation | Median Absolute Deviation (MAD) | |

|---|---|---|---|---|---|

| Fiscal awareness | |||||

| Unjustified Fraud | 2.059 | 0.29 | 0.00 | 0.455 | 0.00 |

| Common Good | 2.059 | 0.60 | 1.00 | 0.490 | 0.00 |

| Dense social trust | |||||

| Tax Fraud (Family) | 2.059 | 3.03 | 2.00 | 2.825 | 2.00 |

| Informal Economy (Family) | 2.059 | 3.81 | 4.00 | 2.916 | 2.00 |

| Fight against tax fraud | |||||

| Effectiveness of the fight against fraud | 2.059 | 6.04 | 6.00 | 1.824 | 1.00 |

| Educational level of parents | 2.059 | 0.55 | 1.00 | 0.497 | 0.00 |

| Education (Mother) | 2.059 | 3.02 | 3.00 | 0.837 | 1.00 |

| Education (Father) | 2.059 | 3.01 | 3.00 | 0.868 | 1.00 |

| Education (Parents) | 2.059 | 5.88 | 6.00 | 1.653 | 1.00 |

| Employment status of parents | |||||

| Self-Employed (Mother) | 2.059 | 0.12 | 0.00 | 0.331 | 0.00 |

| Self-Employed (Father) | 2.059 | 0.27 | 0.00 | 0.444 | 0.00 |

| Self-Employed (Parents) | 2.059 | 0.39 | 0.00 | 0.624 | 0.00 |

| Household members | |||||

| Household | 2.059 | 4.05 | 4.00 | 1.146 | 1.00 |

| Family income | |||||

| Family Income | 2.059 | 2.57 | 2.00 | 1.041 | 1.00 |

| (1) Factorial Loading Est. Li | (2) VPE | (3) Reliability of Construct | ||||||

|---|---|---|---|---|---|---|---|---|

| Li2 | Indicator | ∑Li | (∑Li)2 | ei Estimate | ∑ei | Indicator | ||

| Fiscal awareness | - | - | 0.197 | 0.861 | 0.741 | - | 1.605 | 0.316 |

| Common Good | 0.321 | 0.103 | - | - | - | 0.897 | - | - |

| Unjustified Fraud | 0.540 | 0.292 | - | - | - | 0.708 | - | - |

| Dense social trust | - | - | 0.676 | 1.351 | 1.825 | - | 1.070 | 0.631 |

| Tax Fraud (Family) | 0.770 | 0.593 | - | - | - | 0.407 | - | - |

| Informal Economy (Family) | 0.581 | 0.338 | - | - | - | 0.662 | - | - |

| Bj | bj | SE | t | p | |

|---|---|---|---|---|---|

| Dense social trust → Fiscal awareness | −0.260 | −0.070 | 0.008 | −8.558 | 0.000 |

| Self-employed (parents) → Fiscal awareness | −0.048 | −0.035 | 0.016 | −2.166 | 0.030 |

| Education (parents) → Fiscal awareness | −0.050 | −0.014 | 0.006 | −2.252 | 0.024 |

| Family income → Fiscal awareness | −0.003 | −0.001 | 0.010 | −0.145 | 0.884 |

| Household → Fiscal awareness | 0.038 | 0.015 | 0.009 | 1.705 | 0.088 |

| Effectiveness of the Fight Against Fraud → Fiscal awareness | 0.075 | 0.019 | 0.006 | 3.366 | 0.000 |

| Dense social trust → Effectiveness of the fight against fraud | −0.080 | −0.085 | 0.030 | −2.821 | 0.005 |

| Self-employed (parents) → Effectiveness of the fight against fraud | −0.002 | −0.006 | 0.066 | −0.091 | 0.927 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alarcón-García, G.; Mayor Balsas, J.M.; Ayala Gaytán, E.A. Tax Compliance and Conditional Cooperation: A Study Based on the Dense Social Trust of Young People. Societies 2025, 15, 39. https://doi.org/10.3390/soc15020039

Alarcón-García G, Mayor Balsas JM, Ayala Gaytán EA. Tax Compliance and Conditional Cooperation: A Study Based on the Dense Social Trust of Young People. Societies. 2025; 15(2):39. https://doi.org/10.3390/soc15020039

Chicago/Turabian StyleAlarcón-García, Gloria, José Manuel Mayor Balsas, and Edgardo Arturo Ayala Gaytán. 2025. "Tax Compliance and Conditional Cooperation: A Study Based on the Dense Social Trust of Young People" Societies 15, no. 2: 39. https://doi.org/10.3390/soc15020039

APA StyleAlarcón-García, G., Mayor Balsas, J. M., & Ayala Gaytán, E. A. (2025). Tax Compliance and Conditional Cooperation: A Study Based on the Dense Social Trust of Young People. Societies, 15(2), 39. https://doi.org/10.3390/soc15020039