Enhanced Fast Fractional Fourier Transform (FRFT) Scheme Based on Closed Newton-Cotes Rules

Abstract

1. Introduction

2. Composite Newton-Cotes Quadrature Formulas

2.1. Composite Rules

2.2. Weights Computation

3. Fast Fractional Fourier Transform (FRFT) and Composite Newton-Cotes Quadrature Rules

3.1. Fast Fourier Transform and Fractional Fourier Transform

3.2. FRFT of QN-Long Weighted Sequence

3.3. Composite of FRFTs: FRFT of Q-Long Weighted Sequence and FRFT of N-Long Sequence

3.4. Composite of FRFTs: FRFT of N-Long Sequence and FRFT of Q-Long Weighted Sequence

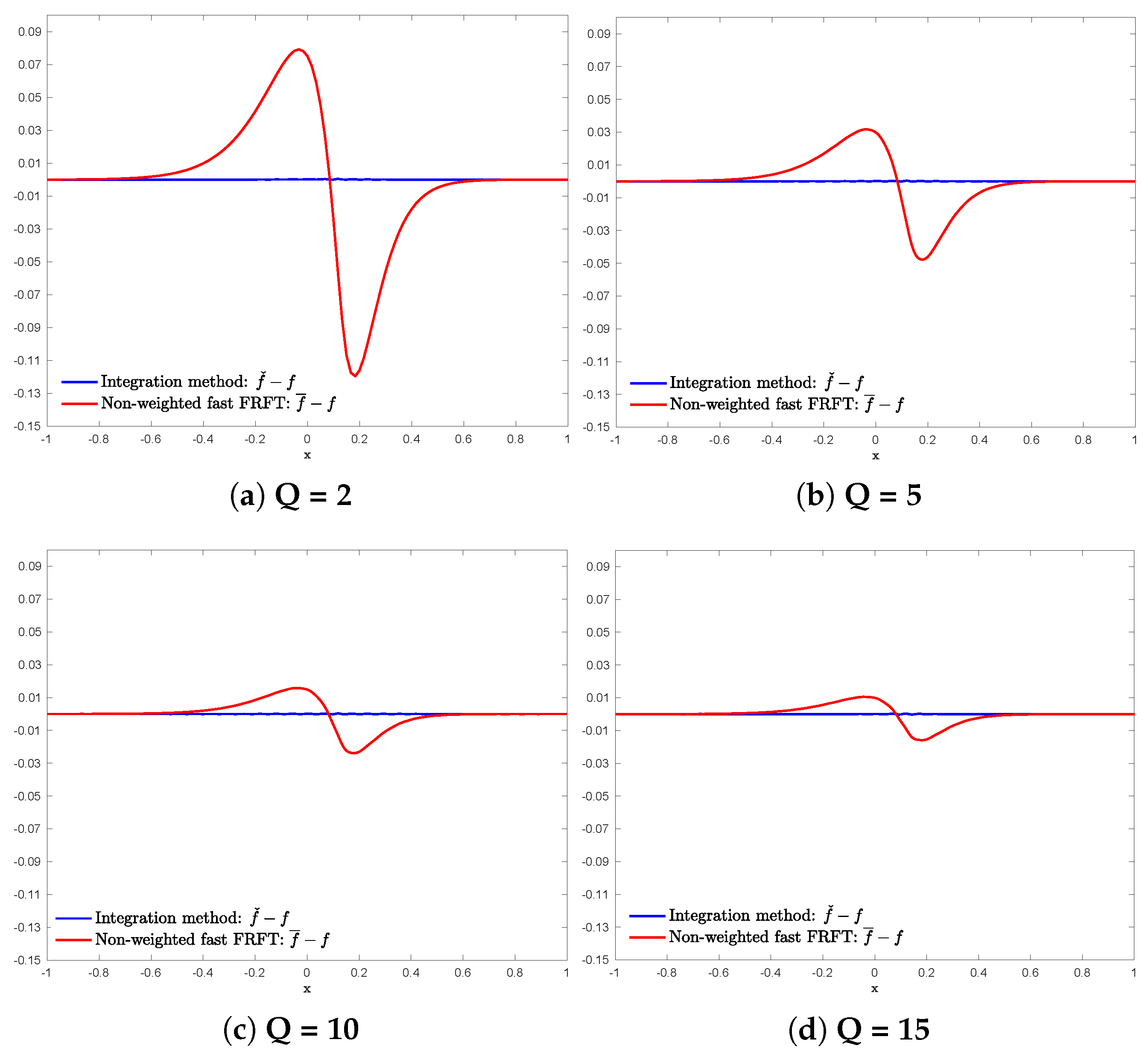

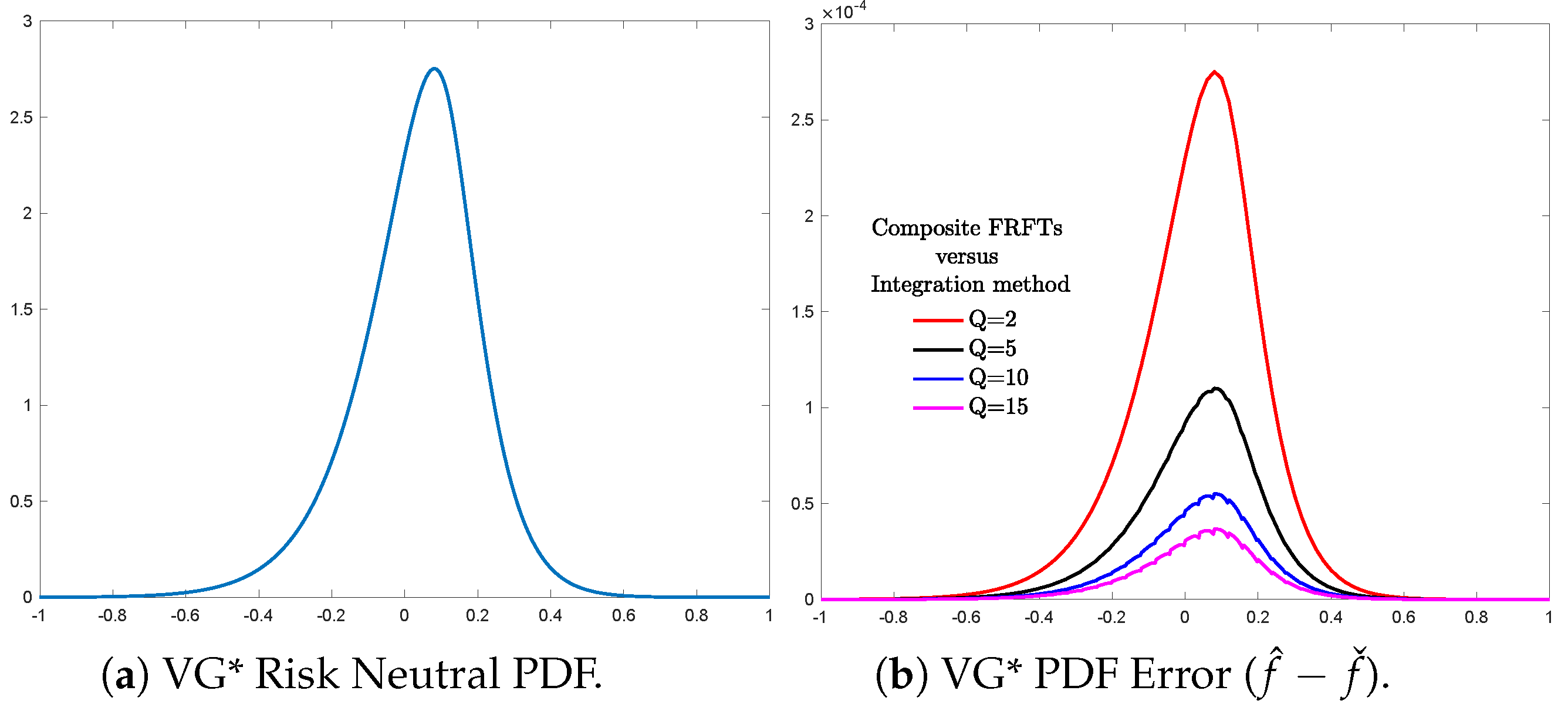

4. Illustration Examples

4.1. Variance-Gamma (VG) Distribution

4.2. Generalized Tempered Stable (GTS) Distribution

- Risk Management: Assesses the potential for losses or gains in derivative portfolios.

- Investment Strategy: Informs investment decisions by revealing market expectations about future asset prices.

- Financial Analysis: Aids in analyzing the prices of financial instruments and evaluating their relative value.

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Weight Vector Computation: weig(q)

function result=weig(q); % input: q % initialisation res=zeros(q+1,q+1); x=zeros(q+1,1); y=ones(q+1,1); z=ones(q+1,1); w=zeros(q+1,1); u1=ones(1); % Compute the coefficients(res(i,k)) for a polynomial p(x) of degree q that is the best fit (in a least-squares sense) for the data in y for k=1:(q+1) x(k)=k-1; end; % solving the following equations with a Vandermonde matrix for k=1:(q+1) y=ones(q+1,1); for j=1:(q+1) for i=1:(q+1) if x(k)==(i-1) u1=u1; else u1=u1*(x(j)-(i-1)); end; end; y(j)=u1; u1=1; end; z=polyfit(x,y,q); for i=1:(q+1) res(i,k)=z(q+1-(i-1)); end; end; res=transpose(res); % compute the weight vector (output) : w(k) k=1,...,q,q+1 for k=1:(q+1) for j=1:(q+1) w(k)= w(k) + res(k,j)*(q^(j))*((-1)^(q-(k-1)))/(j*factorial(k-1)*factorial(q-(k-1))); end; end; result=w;

Appendix B. Standard Fast FRFT Algorithm: GFR(f,k,s,alpha)

function result=weig(q); % input: q % initialisation res=zeros(q+1,q+1); x=zeros(q+1,1); y=ones(q+1,1); z=ones(q+1,1); w=zeros(q+1,1); u1=ones(1); % Compute the coefficients(res(i,k)) for a polynomial p(x) of degree q that is the best fit (in a least-squares sense) for the data in y for k=1:(q+1) x(k)=k-1; end; % solving the following equations with a Vandermonde matrix for k=1:(q+1) y=ones(q+1,1); for j=1:(q+1) for i=1:(q+1) if x(k)==(i-1) u1=u1; else u1=u1*(x(j)-(i-1)); end; end; y(j)=u1; u1=1; end; z=polyfit(x,y,q); for i=1:(q+1) res(i,k)=z(q+1-(i-1)); end; end; res=transpose(res); % compute the weight vector (output) : w(k) k=1,...,q,q+1 for k=1:(q+1) for j=1:(q+1) w(k)= w(k) + res(k,j)*(q^(j))*((-1)^(q-(k-1)))/(j*factorial(k-1)*factorial(q-(k-1))); end; end; result=w;

Appendix C. Composite of FRFTs: FRFT of N-Long Sequence and FRFT of Q-Long Weighted Sequence

function zxf=CompositeFRNQ(f,zx,q,alpha,beta,limit); % compute the weight vector of size q w=zeros(q,1); w=weig(q); pd=size(w,2); if size(w,2)==1. pd=size(w,1); end; pd=pd-1; % compute sizes: m, datm of the input vectors f and zx m=size(f,2)-1; if size(f,2)==1 m=size(f,1)-1; end; n=m/pd; datm=size(zx,2); if size(zx,2)==1 datm=size(zx,1); end; % compute the lower (u1) and upper (u1) boundaries u1=0; u2=0; i=1; if min(zx(:)) < -limit while zx(i)< -limit i=i+1; end; u1=i; else u1=i; end; i=1; if limit<max(zx(:)) while zx(i)<limit i=i+1; end; u2=i; else u2=datm; end; % adjusting, creating and initializing variables zx=scalev(zx,m,beta); alpha1=alpha*pd; alpha2=alpha*pd*pd; s=zeros(1,datm); zxf=zeros(1,datm); res=zeros(1,datm); quot=zeros(1,datm); quotq=zeros(1,datm); uyz=zeros(1,2*m); vyz=zeros(1,2*m); wyz=zeros(1,2*m); fp=zeros(n,pd+1); comp=zeros(n,datm); gp=zeros(n,datm); if m==(datm-1) zx=round(zx); end; % data zx decomposition: Dividend( zx(P), Divisor (pd), Quotient (quot(p)), Remainder(res(p)) for p=1:datm s(p)=(zx(p)-fix(zx(p))); res(p)=mod(fix(zx(p)),pd); quot(p)=(fix(zx(p))-res(p))/pd; quotq(p)=(res(p)+ s(p))/pd; end; for p=u1:u2 for k=1:n % adjusting the data f for j=1:(pd+1) fp(k,j)=w(j)*f(j+pd*(k-1))*exp(-2*pi*alpha*(pd*quot(p)-(m/2))*(j-1)*(1i)); end; end; % Computation of the FRFT compositions for k=1:n comp(k,p)=GFR(fp(k,:),res(p),s(p),alpha); gp(k,p)=comp(k,p)*exp(pi*alpha*m*pd*(k-1)*(1i)); end; % output zxf(p)=GFR(gp(:,p),quot(p),quotq(p),alpha2); zxf(p)=beta*zxf(p)*exp(pi*alpha*m*(zx(p)-(m/2))*(1i)); if alpha<0 zxf(p)=zxf(p)/(2*pi); end; end;

Appendix D. Composite of FRFTs: FRFT of Q-Long Weighted Sequence and FRFT of N-Long Sequence

function zxf=CompositeFRQN(f,zx,q,alpha,beta,limit); % compute the weight vector of size q w=zeros(q,1);w=weig(q); pd=size(w,2); if size(w,2)==1 pd=size(w,1); end; pd=pd-1; % compute sizes: m, datm of the input vectors f and zx m=size(f,2)-1; if size(f,2)==1 m=size(f,1)-1; end; n=m/pd; datm=size(zx,2); if size(zx,2)==1 datm=size(zx,1); end; % compute the lower (u1) and upper (u1) boundaries u1=0; u2=0; i=1; if min(zx(:)) < -limit while zx(i)< -limit i=i+1; end; u1=i;else u1=i; end; i=1; if limit<max(zx(:)) while zx(i)<limit i=i+1; end; u2=i; else u2=datm; end; % adjusting, creating and initializing variables zx=scalev(zx,m,beta); alpha1=alpha*pd; alpha2=alpha*pd*pd; s=zeros(1,datm); zxf=zeros(1,datm); res=zeros(1,datm); quot=zeros(1,datm); quotq=zeros(1,datm); uyz=zeros(1,2*m); vyz=zeros(1,2*m); wyz=zeros(1,2*m); fp=zeros(n,pd+1); comp=zeros(pd+1,datm); gp=zeros(pd+1,datm); if m==(datm-1) zx=round(zx); end % adjusting the data f for k=1:n for j=1:(pd+1) fp(k,j)=f(j+pd*(k-1))*exp(m*pi*alpha1*(k-1)*(1i)); end; end; % data zx decomposition: Dividend( zx(P), Divisor (pd), Quotient (quot(p)), Remainder(res(p)) for p=1:datm s(p)=(zx(p)-fix(zx(p))); res(p)=mod(fix(zx(p)),pd); quot(p)=(fix(zx(p))-res(p))/pd; quotq(p)=(res(p)+ s(p))/pd; end; % FRFT composition computation for p=u1:u2 for k=1:(pd+1) comp(k,p)=GFR(fp(:,k),quot(p),quotq(p),alpha2); gp(k,p)=w(k)*comp(k,p)*exp(-2*((pd*quot(p))-(m/2))*pi*alpha*(k-1)*(1i)); end; % output zxf(p)=GFR(gp(:,p),res(p),s(p),alpha); zxf(p)=beta*zxf(p)*exp(pi*alpha*m*(zx(p)-(m/2))*(1i)); if alpha<0 zxf(p)=zxf(p)/(2*pi); end; end;

References

- Zhang, Y.; Wang, S.; Yang, J.F.; Zhang, Z.; Phillips, P.; Sun, P.; Yan, J. Comprehensive Survey on Fractional Fourier Transform. Fundam. Informaticae 2017, 151, 48. [Google Scholar] [CrossRef]

- Bailey, D.H.; Swarztrauber, P.N. A Fast Method for the Numerical Evaluation of Continuous Fourier and Laplace Transforms. SIAM J. Sci. Comput. 1994, 15, 1105–1110. [Google Scholar] [CrossRef]

- Mei, L.; Sha, X.; Ran, Q.; Zhang, N. Research on the Application of 4-Weighted Fractional Fourier Transform in Communication System. Sci. China Inf. Sci. 2010, 53, 1251–1260. [Google Scholar] [CrossRef]

- Creutzburg, R.; Rundblad, E.; Labunets, V.G. Fast Algorithms for Fractional Fourier Transforms. In Proceedings of the NSIP, Chicago, IL, USA, 5–7 November 1999; pp. 383–387. [Google Scholar]

- Wang, Y. Fractional Fourier Transform and Its Application. Theor. Nat. Sci. 2024, 42, 8–12. [Google Scholar] [CrossRef]

- Singh, U.; Singh, S.N. Application of Fractional Fourier Transform for Classification of Power Quality Disturbances. IET Sci. Meas. Technol. 2017, 11, 67–76. [Google Scholar] [CrossRef]

- Sejdić, E.; Djurović, I.; Stanković, L. Fractional Fourier Transform as a Signal Processing Tool: An Overview of Recent Developments. Signal Process. 2011, 91, 1351–1369. [Google Scholar] [CrossRef]

- Ma, J.; Miao, H.; Su, X.; Gao, C.; Kang, X.; Tao, R. Research Progress in Theories and Applications of the Fractional Fourier Transform. Opto-Electron. Eng. 2018, 45, 170747. [Google Scholar] [CrossRef]

- Zhao, T.; Chi, Y. Circuit of Quantum Fractional Fourier Transform. Fractal Fract. 2024, 8, 464. [Google Scholar] [CrossRef]

- Gupta, P.; Verma, A. Recent trends in Fourier-type transforms: A survey. arXiv 2024, arXiv:2402.06645. [Google Scholar]

- Pavlíček, V.; Bhandari, A. Sparse Sampling in Fractional Fourier Domain: Recovery Guarantees and Cramér–Rao Bounds. IEEE Signal Process. Lett. 2024, 31, 1665–1669. [Google Scholar] [CrossRef]

- Li, B.; Zhang, Z. Synchroextracting Transform Based on the Novel Short-Time Fractional Fourier Transform. Fractal Fract. 2024, 8. [Google Scholar] [CrossRef]

- Press, W.H.; Teukolsky, S.A.; Vetterling, W.T.; Flannery, B.P. Numerical Recipes 3rd Edition: The Art of Scientific Computing; Cambridge University Press: Cambridge, UK, 2007. [Google Scholar]

- Chapra, S.C.; Canale, R.P. Numerical Methods for Engineers, 6th ed.; McGraw-Hill: New York, NY, USA, 2010. [Google Scholar]

- Guicciardini, N. Newton on Quadratures: A Brief Outline. In Theory, Evidence, Data: Themes from George E. Smith; Springer: Berlin/Heidelberg, Germany, 2023; pp. 197–222. [Google Scholar] [CrossRef]

- Iserles, A. On the numerical quadrature of highly-oscillating integrals I: Fourier transforms. IMA J. Numer. Anal. 2004, 24, 365–391. [Google Scholar] [CrossRef]

- Júnior, P.A.A.M.; Magalhães, C.A. Higher-Order Newton–Cotes Formulas. J. Math. Stat. 2010, 6, 193–204. [Google Scholar] [CrossRef]

- Shampine, L.F.; Allen, R.C.; Pruess, S. Fundamentals of Numerical Computing; John Wiley & Sons: New York, NY, USA, 1997. [Google Scholar]

- Rangel-Kuoppa, V.T. Newton–Cotes Quadrature Formula, 3/8 Rule, and Boole’s Rule Integration. Discov. Electron. 2024, 1, 31. [Google Scholar] [CrossRef]

- Tuck, E.O. A Simple “Filon-Trapezoidal” Rule. Math. Comput. 1967, 21, 239–241. [Google Scholar] [CrossRef]

- Milovanović, G.V.; Stanić, M.P. Numerical Integration of Highly Oscillating Functions. In Analytic Number Theory, Approximation Theory, and Special Functions; Springer: Heidelberg, Germany, 2014; pp. 613–649. [Google Scholar] [CrossRef]

- Barakat, R.; Sandler, B.H. Filon Trapezoidal Schemes for Hankel Transforms of Orders Zero and One. Comput. Math. Appl. 2000, 40, 1037–1041. [Google Scholar] [CrossRef]

- Majidian, H. A Comparative Study of Filon-Type Rules for Oscillatory Integrals. J. Numer. Anal. Approx. Theory 2024, 53, 130–143. [Google Scholar] [CrossRef]

- Rachev, S.T.; Kim, Y.S.; Bianchi, M.L.; Fabozzi, F.J. Stable and Tempered Stable Distributions. In Financial Models with Lévy Processes and Volatility Clustering; The Frank J. Fabozzi Series; Rachev, S.T., Kim, Y.S., Bianchi, M.L., Fabozzi, F.J., Eds.; John Wiley & Sons, Ltd.: Hoboken, NJ, USA, 2011; Volume 187, Chapter 3; pp. 57–85. [Google Scholar] [CrossRef]

- Boyarchenko, S.I.; Levendorskiĭ, S.Z. Non-Gaussian Merton-Black-Scholes Theory; Advanced Series on Statistical Science & Applied Probability; World Scientific: Singapore; River Edge, NJ, USA, 2002; Volume 9. [Google Scholar] [CrossRef]

- Küchler, U.; Tappe, S. Bilateral Gamma distributions and processes in financial mathematics. Stoch. Process. Their Appl. 2008, 118, 261–283. [Google Scholar] [CrossRef]

- Küchler, U.; Tappe, S. Tempered stable distributions and processes. Stoch. Process. Their Appl. 2013, 123, 4256–4293. [Google Scholar] [CrossRef]

- Carr, P.; Geman, H.; Madan, D.B.; Yor, M. Stochastic volatility for Lévy processes. Math. Financ. 2003, 13, 345–382. [Google Scholar] [CrossRef]

- Nzokem, A.H. Self-Decomposable Laws Associated with General Tempered Stable (GTS) Distribution and their Simulation Applications. arXiv 2024, arXiv:2405.16614. [Google Scholar] [CrossRef]

- Sermutlu, E. A close look at Newton–Cotes integration rules. Results Nonlinear Anal. 2022, 2, 48–60. [Google Scholar]

- Trefethen, L.N. Exactness of Quadrature Formulas. SIAM Rev. 2022, 64, 132–150. [Google Scholar] [CrossRef]

- Abramowitz, M.; Stegun, I.A. Handbook of Mathematical Functions with Formulas, Graphs, and Mathematical Tables; Dover: New York, NY, USA, 1972. [Google Scholar]

- Huybrechs, D. Stable high-order quadrature rules with equidistant points. J. Comput. Appl. Math. 2009, 231, 933–947. [Google Scholar] [CrossRef]

- Aguilar, J.C. Higher-order Newton–Cotes rules with end corrections. Appl. Numer. Math. 2015, 88, 66–77. [Google Scholar] [CrossRef]

- Wiersma, M. Quadrature Rules with (Not Too Many) Derivatives. Atl. Electron. J. Math. 2012, 5, 60–67. [Google Scholar]

- Graça, M.M. A Simple Derivation of Newton-Cotes Formulas with Realistic Errors. J. Math. Res. 2012, 4, 34–47. [Google Scholar] [CrossRef][Green Version]

- Moheuddin, M.M.; Uddin, M.J.; Kowsher, M. A New Study of Trapezoidal, Simpson’s 1/3 and Simpson’s 3/8 Rules of Numerical Integral Problems. Appl. Math. Sci. Int. J. (MathSJ) 2019, 6, 1–12. [Google Scholar] [CrossRef]

- Catapang, L.A.; Mendaje, J.R.; Siong, V.D. Convergence Analysis of Newton–Cotes Methods: Optimizing Sub-Intervals Selection for Precise Integral Approximation. Appl. Math. Sci. Int. J. (MathSJ) 2024, 11, 1–21. [Google Scholar] [CrossRef]

- Nzokem, A.H. Numerical Solution of a Gamma-Integral Equation Using a Higher Order Composite Newton-Cotes Formulas. J. Phys. Conf. Ser. 2021, 2084, 012019. [Google Scholar] [CrossRef]

- Nzokem, A.H. Stochastic and Renewal Methods Applied to Epidemic Models. Ph.D. Thesis, York University, North York, ON, Canada, 2020. [Google Scholar]

- Krylov, V.I.; Stroud, A.H. Approximate Calculation of Integrals, 6th ed.; Dover Books on Mathematics; Dover Publications: Mineola, NY, USA, 2006. [Google Scholar]

- AL-Sammarraie, O.A.; Bashir, M.A. Error Analysis of the High Order Newton-Cotes Formulas. Int. J. Sci. Res. Publ. 2015, 5, 1–6. [Google Scholar]

- Kalman, D. The Generalized Vandermonde Matrix. Math. Mag. 1984, 57, 15–21. [Google Scholar] [CrossRef]

- Nzokem, A.H.; Maposa, D. Bitcoin versus S&P 500 Index: Return and Risk Analysis. Math. Comput. Appl. 2024, 29, 44. [Google Scholar] [CrossRef]

- Nzokem, A.; Maposa, D. Fitting the Seven-Parameter Generalized Tempered Stable Distribution to Financial Data. J. Risk Financ. Manag. 2024, 17, 531. [Google Scholar] [CrossRef]

- Nzokem, A.H. Gamma Variance Model: Fractional Fourier Transform (FRFT). J. Phys. Conf. Ser. 2021, 2090, 012094. [Google Scholar] [CrossRef]

- Nzokem, A.H.; Montshiwa, V.T. Fitting Generalized Tempered Stable Distribution: Fractional Fourier Transform (FRFT) Approach. arXiv 2022, arXiv:2205.00586. [Google Scholar] [CrossRef]

- Bailey, D.H.; Swarztrauber, P.N. The Fractional Fourier Transform and Applications. SIAM Rev. 1991, 33, 389–404. [Google Scholar] [CrossRef]

- Nzokem, A.H. Fitting Infinitely Divisible Distribution: Case of Gamma-Variance Model. arXiv 2021, arXiv:2104.07580. [Google Scholar] [CrossRef]

- Olver, F.W.J.; Olde Daalhuis, A.B.; Lozier, D.W.; Schneider, B.I.; Boisvert, R.F.; Clark, C.W.; Miller, B.R.; Saunders, B.V.; Cohl, H.S.; McClain, M.A. NIST Digital Library of Mathematical Functions; Release 1.1.11; NIST: Gaithersburg, MD, USA, 2023. [Google Scholar]

- Fischer, A.; Gaunt, R.E.; Sarantsev, A. The Variance–Gamma Distribution: A Review. Statist. Sci. 2024, 40, 235–258. [Google Scholar] [CrossRef]

- Gaunt, R.E. Variance–Gamma approximation via Stein’s method. Electron. J. Probab. 2014, 19, 1–33. [Google Scholar] [CrossRef]

- Nestler, S.; Hall, A. The variance gamma distribution. Significance 2019, 16, 10–11. [Google Scholar] [CrossRef]

- Kotz, S.; Kozubowski, T.J.; Podgórski, K. The Laplace Distribution and Generalizations: A Revisit with Applications to Communications, Economics, Engineering, and Finance, 1st ed.; Birkhäuser: Boston, MA, USA, 2001. [Google Scholar] [CrossRef]

- Nzokem, A.H.; Montshiwa, V.T. The Ornstein-Uhlenbeck Process and Variance Gamma Process: Parameter Estimation and Simulations. Thai J. Math. 2023, 21, 160–168. [Google Scholar]

- Nzokem, A.H. Five-Parameter Variance-Gamma Process: Lévy versus Probability Density. AIP Conf. Proc. 2024, 3005, 020030. [Google Scholar] [CrossRef]

- Nzokem, A.H. Pricing European Options under Stochastic Volatility Models: Case of Five-Parameter Variance-Gamma Process. J. Risk Financ. Manag. 2023, 16, 55. [Google Scholar] [CrossRef]

- Nzokem, A.H. European Option Pricing Under Generalized Tempered Stable Process: Empirical Analysis. arXiv 2023, arXiv:2304.06060. [Google Scholar] [CrossRef]

- Figlewski, S. Risk-Neutral Densities: A Review. Annu. Rev. Financ. Econ. 2018, 10, 329–359. [Google Scholar] [CrossRef]

- Ivanov, R.V. On the Stochastic Volatility in the Generalized Black-Scholes-Merton Model. Risks 2023, 11, 111. [Google Scholar] [CrossRef]

- Qayyum, M.; Ahmad, E. New Solutions of Time-and Space-Fractional Black–Scholes European Option Pricing Model via Fractional Extension of He-Aboodh Algorithm. J. Math. 2024, 2024, 6623636. [Google Scholar] [CrossRef]

- Malz, A.M. A Simple and Reliable Way to Compute Option-Based Risk-Neutral Distributions. In FRB of New York Staff Report; Federal Reserve Bank of New York: New York, NY, USA, 2014. [Google Scholar]

| Q | W0 | W1 | W2 | W3 | W4 | W5 | W6 | W7 | W8 | W9 | W10 | W11 | W12 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||

| 2 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||

| 3 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||

| 4 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |||||

| 5 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | ||||||

| 6 | 0 | 0 | 0 | 0 | 0 | 0 | |||||||

| 7 | 0 | 0 | 0 | 0 | 0 | ||||||||

| 8 | 0 | 0 | 0 | 0 | |||||||||

| 9 | 0 | 0 | 0 | ||||||||||

| 10 | 0 | 0 | |||||||||||

| 11 | 0 | ||||||||||||

| 12 |

| Model | |||||

|---|---|---|---|---|---|

| VG | |||||

| VG(*) |

| Model | |||||||

|---|---|---|---|---|---|---|---|

| GTS | −0.693477 | 0.682290 | 0.242579 | 0.458582 | 0.414443 | 0.822222 | 0.727607 |

| GTS* | −0.208043 | 0.682290 | 0.242579 | 0.594234 | 4.068436 | 84.667097 | 70.31591 |

| Q | VG | GTS | VG | GTS |

| 2 | 0.0550 | 0.1350 | 9.975 × | 9.975 × |

| 5 | 0.0220 | 0.0538 | 3.983 × | 3.983 × |

| 10 | 0.0110 | 0.0270 | 1.947 × | 1.947 × |

| 15 | 0.0073 | 0.0181 | 1.307 × | 1.307 × |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nzokem, A.; Maposa, D.; Seimela, A.M. Enhanced Fast Fractional Fourier Transform (FRFT) Scheme Based on Closed Newton-Cotes Rules. Axioms 2025, 14, 543. https://doi.org/10.3390/axioms14070543

Nzokem A, Maposa D, Seimela AM. Enhanced Fast Fractional Fourier Transform (FRFT) Scheme Based on Closed Newton-Cotes Rules. Axioms. 2025; 14(7):543. https://doi.org/10.3390/axioms14070543

Chicago/Turabian StyleNzokem, Aubain, Daniel Maposa, and Anna M. Seimela. 2025. "Enhanced Fast Fractional Fourier Transform (FRFT) Scheme Based on Closed Newton-Cotes Rules" Axioms 14, no. 7: 543. https://doi.org/10.3390/axioms14070543

APA StyleNzokem, A., Maposa, D., & Seimela, A. M. (2025). Enhanced Fast Fractional Fourier Transform (FRFT) Scheme Based on Closed Newton-Cotes Rules. Axioms, 14(7), 543. https://doi.org/10.3390/axioms14070543