Abstract

In this paper we study an ODE model for the interaction between nature and society where the system dynamics is driven largely by the social wealth. The relevant variables are renewable resources, non-renewable ones, and wealth, while population depends on wealth and does not act on the other variables. We first obtain that the relevant trajectories are positive and cannot grow arbitrarily large. Then we compute all the equilibria and study their stability. We also give numerical simulations of some trajectory.

Keywords:

human and nature dynamics; ODE systems for society dynamics; ecological–economic modeling; sustainability analysis; nonlinear dynamical systems MSC:

34A34; 92D25; 91B76

1. Introduction

This paper continues research that we have carried out in our three previous works [1,2,3]. In all these papers we introduced low-dimension ODE systems intended to model the interactions between society and natural resources. The models in the quoted papers deal with four variables: x is the population, y the level of renewable resources, z the level of non-renewable resources, and w the wealth produced using and depleting the resources. In this paper we introduced a model dealing only with . This derives from the effort to study a model able to capture some characteristics of modern wealthy societies. In these kinds of societies, population is less or more stationary (or slowly decreasing) and the dynamics of interaction between society and resources is led by other variables. In [3], we introduced an ODE system in which the dynamics is led by non-renewable resources, while in the present paper we study a model in which the evolution is driven by the wealth w. The system is the following

Here, are as we said above, while are positive coefficients. The equation for is the usual logistic equation, with a depletion term . This means that the rate of depletion is given by the level of wealth in the society. In the same way, the equation for has a depletion term with rate of depletion . There is also, in the equation for z, a replenishment term, which says that human ingenuity is able to find new sources of non-renewable resources. The replenishment term depends only on w and is given through the function , which is a saturation function of the type used in population dynamics. This term means that there is a replenishment of these kinds of resources, but its rate is bounded. Finally, the equation for states that wealth increases thanks to the use of resources (renewable and non-renewable) and decreases because of consumption () and because of the investment needed to replenish non-renewable resources (). In the present model, differently from our previous papers, the rate of consumption depends on w, to be coherent with the idea to study a model in which the dynamics is driven by w.

The search for mathematical models to investigate global social evolution and highlight the risks of collapse has, nowadays, a long tradition, starting at least with the celebrated work of the MIT group on the “Limits to growth”: see the books [4,5,6], the update [7] and also [8]. The models introduced by the MIT group are high dimensional, and are studied through numerical computations. More recently, some low-dimensional models have been proposed for the same purposes. Our work started, in [1], from the HANDY model, which was introduced in [9,10]. This model connects natural resources, wealth, and population, split in the two classes of Commoner and Elite, and the dynamics of the system is studied through numerical simulations. In [11,12] the main ideas of the HANDY model have been applied to more general types of systems. More recently, Ref. [13] presented a rewrite of the HANDY model and studied its dynamics clarifying the influence of two parameters: the nature depletion rate and the inequality between Commoner and Elite. In [14,15] the distinction between renewable and non-renewable resources is introduced, the former modeled as a depletable stock, using an equation like which is a direct antecedent of our equation for z. HANDY-type models have been extended in several different directions, not directly linked with our work, see, for example, [16,17,18]).

After [1] we changed our models in various ways, so the problems studied in [2,3] and in the present paper cannot be considered examples of HANDY models anymore. See also [19] for another model of interactions between society and nature.

We now briefly describe the main result of this paper (see also the Conclusions, Section 8). As we are interested in the trajectories with a positive or non negative component, we first prove that relevant trajectories remain positive. We then prove that none of the variables can diverge to , which means, in particular, that there cannot be indefinite growth in wealth. We then compute the equilibrium points of the system, and we study their stability. In some cases, due to the difficulty of this study, we obtain stability or instability results only when the depletion coefficients . We obtain that there are stable equilibria with positive values for all the variables, at least for some range of the parameters.

The main contribution of our research (including the present paper and the quoted ones) to this debate lies in the fact that, even assuming a moderate optimism on the replenishment of non-renewable resources, the aim of an indefinite growth in wealth seems impossible to attain, and also disruptive for the society. During our research, we have obtained these kinds of results with different hypotheses on the main drivers of societal evolution, so they seem to have some kind of robustness (using the word in a non-rigorous sense).

This paper is organized as follows: After the introduction, in Section 2 we prove that the relevant trajectories are defined and non-negative for all , and that they cannot go to . In Section 3 we compute all the equilibria of System (1). In the following Section 4, Section 5 and Section 6, we analyze the stability of the equilibria. In Section 7 we show some numerical simulations and in Section 8 we present a summary of the main results obtained.

2. General Results

We are interested in non-negative solutions of (1); therefore, following the approach of our previous papers, we will work in the positive cone defined as

or in its closure

Let be the vector field of System (1). Note that . Thus, we have a standard result of existence and uniqueness:

Proposition 1.

For any and , there exists a unique solution to the Cauchy problem

defined on a maximal interval with .

If , we assume , that is, we assume that the social–nature evolution we study starts with a positive amount of renewable and non-renewable resources, while the starting social wealth is positive or zero. However, the next proposition shows that the case can be dealt with in a very easy way.

Proposition 2.

Let with . Let be the solution of the logistic equation

Then the function is the unique solution of the Cauchy problem:

Proof.

If is as above and are the constant functions , , then the first equation in (1) becomes , which is satisfied by hypothesis, while the second and the third reduce to . □

Proposition 2 shows that, when the initial value is zero, the solution is known, and no further analysis is necessary. For this reason, from now on, we assume , that is, we will study System (1) with initial condition . We will also assume .

Proposition 3.

Let be a solution of (2) with and . Then for all .

Proof.

From Proposition 2, we know that for all . On the other hand, the two equations for and have the zero constant as a solution for all ; hence, this constant cannot be crossed by another solution, ensuring that and remain positive for all . □

Proposition 4.

Let and be the solution of (2) with . Then is bounded on .

Proof.

We distinguish two cases as follows

- (i)

- for all : in this case for all t; hence, for all t, and hence is bounded.

- (ii)

- for some . Let us define

If , we have for all , so is obviously bounded in . If we assume , then by continuity, it is easy to obtain , for all , , so that . On the other hand, using the equation for , we get

This is a contradiction, so this case is ruled out; hence, and y is bounded. □

Proposition 5.

Under the same assumptions as in Proposition 3, we have .

Proof.

We argue by contradiction. Assume . Consider the variable , which satisfies for all ; hence, for all . Consequently, for all , so it is bounded in . Similarly, for , recalling that is bounded, we have , hence on . Therefore, on , implying that is bounded on . Thus, is bounded on , which contradicts the standard ODE theory. Therefore, . □

Proposition 6.

It cannot happen that .

Proof.

Assume by contradiction that . Then we have , and given that

we obtain that there exists such that for all . Therefore, is decreasing on and has a limit . If , then , which contradicts well-known theorems. Hence, . Now, consider . Since is bounded, , and , there exists such that for all . This implies for all , which contradicts the assumption . The thesis is thus proved. □

Proposition 7.

It cannot happen that .

Proof.

We will prove that implies , and by Proposition 6 this is a contradiction, hence the thesis. Thus, assume as . Fix and such that for all .

We consider the following cases:

- Assume for all . This implies on ; hence, there exists a limit . If , recalling that , from we would obtain , a contradiction with well-known theorems. Hence, it must be , that is, , but this contradicts Proposition 6. Thus, we can rule out this case, meaning that it is not possible that

- Therefore, there exists such thatNow, let us pick . Ifwe obtain because ; hence, . On the other hand, assumeDefineBy continuity, we get , for all , and . Hence, on , so . We have thus proved that for all , it holds that . Therefore, for any , there exists such that for all , which meansThis is ruled out by Proposition 6, so we have obtained a contradiction, and the thesis is proved. □

3. Equilibrium Points

Equilibrium points are the solutions of the following system:

Let us consider the different possible cases:

- (1)

- , no conditions on z. We obtain a family of equilibria with .

- (2)

- , , . In this case, we obtain the equilibrium , which is not in , so it is not of interest.

- (3)

- , , . In this case, from (5b), we obtain the equation for w:which has the solutionsand we assume of course . For z we obtain, from Equation (5c),Hence, we have two equilibria:

- (4)

- , . We obtain and no conditions on z, so we have a family of equilibria:

- (5)

- , , . In this case, we obtain the linear system:whose solutions areThus, we obtain an equilibrium:

- (6)

- , , . As before, we obtain the two values , given in (6) for the variable w, while the values for y and z are now given bygiving rise to two steady states:

4. Stability of Equilibria: Cases 1 and 3

The Jacobian matrix of the vector field at a point is given by:

Let us now analyze the stability of the equilibria previously identified. We will not consider Case (2) because, as we have seen above, the equilibrium is not in .

4.1. Case 1

In Case (1), we have , so the first row of is the vector . This means that is an eigenvalue; hence, all these equilibria are unstable.

4.2. Case 3

In Case (3), we also have , so the first row of is the vector . This means that is an eigenvalue. We will obtain asymptotic results as for . In this section we will assume, for simplicity, linear relations between the coefficients . Specifically, we assume , , and with , and we will study the asymptotic behavior of equilibria as . Now we want to obtain the asymptotic developments of w. Recall that

Let us now find what happens as . First, we have

hence,

For the equilibrium , we obtain the eigenvalue , indicating that this is an unstable equilibrium, as . For the equilibrium , the eigenvalue becomes

Therefore, if , the equilibrium is also unstable for . Let us now analyze the case . We have

so the entry of (13), computed at the points (12), becomes

Hence, in this case becomes

We have

We obtain the following equations:

As a consequence, we have

Given these asymptotic expansions, we obtain

This matrix has an eigenvalue and we assume ; hence, as . The other eigenvalues are obtained from the submatrix

We have Trace() = and Det() = , so the eigenvalues of have a negative real part as . Hence, all the eigenvalues of have a negative real part, and is an asymptotically stable equilibrium.

The following proposition summarizes the results of this section.

Proposition 8.

All the equilibria of Case 1 are unstable (for any value of the parameters). As for Case 3, the equilibrium is unstable as , while equilibrium is unstable if and is asymptotically stable if (and ).

5. Stability of Equilibria: Case 4

In Case 4 the equilibria are given by with , and the Jacobian matrix is

The eigenvalues are , , and . If , then and the equilibria are unstable. Let us study the case , that is, . In this case the study of the Jacobian matrix is not useful because two eigenvalues are negative and one is zero. We will, however, obtain a stability result with an ad hoc argument. We will deal only with trajectories starting in because in our model these are the relevant trajectories.

Let us start by introducing the rectangular neighborhoods of P as follows, for :

After this we introduce the constants as follows. Since , it is possible to choose two positive numbers such that for all , the following holds:

Additionally, we pick such that , that is, .

We then state the result we are going to prove:

Proposition 9.

There is such that for all there is such that, if we pick and we call the trajectory starting from Q at , then for all . Additionally, it holds that:

- (i)

- are decreasing functions, and for all .

- (ii)

- .

- (iii)

- There exists a positive constant , independent of ϵ and , such that the following holds:

Notice that Proposition 9 states that P is Lyapunov-stable and gives some information on the asymptotic behavior of the variables as but does not imply asymptotic stability. Indeed, if , does not converge to Z.

The proof of Proposition 9 will be conducted in several steps.

- Step 1: For any , if , then for all .

Proof.

Through the arguments of Proposition 4, it can be obtained that , and if , then obviously . □

- Step 2: Assume and , , . Then it holds that and for all .

Proof.

As it is easy to get

Hence, we get

As a consequence, there exists such that for all , it holds that and .

Now we define

We know that . We want to prove that , which gives the thesis. Let us consider all other possible cases and show that they lead to a contradiction.

- (i)

- If , then ; we have for all , and hence . Therefore,implying for . Since , we obtain a contradiction with the definition of .

- (ii)

- If , we have for all ; hence, . Therefore,and hence, for all . Since , this is a contradiction with the definition of .

- (iii)

- If , by continuity, we easily obtain and on , with . Therefore, as above, for all , and on ; hence, , which is a contradiction.Thus, the only possibility left is , which proves the thesis.

□

- Step 3: The hypotheses are as in Step 2. Then, it is for all .

Proof.

Through the previous steps, we know that and for all . Using the equation for , we obtain, as in Step 2:

and a simple integration gives the result. □

- Step 4: The hypotheses are as in Step 2. Then there exists a positive constant , independent of and , such that the following holds:

Proof.

The inequality is obvious from Step 2. Now, using Step 3 and the equation for in the model (1), we have

and hence, , so that

so that with . □

- Step 5: There are and such that, if , , , and , then for all .

Proof.

Notice that the thesis is obvious if because is decreasing and positive. Hence, we assume . Let us take . We have for all , by the hypotheses and the previous Steps. Now, assume and define

Let us pick and consider the inequality

By the standard asymptotic development of , this is equivalent to

and by simple computations this is equivalent to

For the next Step 6, we introduce , and we notice that for all and all , it is .

- Step 6: Choose and . Assume , , . Then for all .

Proof.

Through the equation for and the previous Steps we get

where . Let us consider the function which is the solution of the following logistic Cauchy problem:

Through standard comparison principles we obtain for all . Now, the well-known properties of the logistic equation give that, if , then for all ; hence, for all . On the other hand, if , we know that for all t, so also , through our choice of . The proof of Step 6 is now complete. □

- Step 7: Assume the hypotheses of Step 6. Then it is .

Proof.

We will study and , and we will prove that they are equal. Let us start by proving that . We use the arguments of Proposition 4, and we distinguish two cases, as we did there:

for all : in this case we know that for all t, so there exists and it holds that . If , then recalling Step 3,

which is a contradiction with the standard result. Hence, , which trivially implies .

for some : in this case we have proved, in Proposition 4, that for all , which of course implies .

Thus we obtain, in any case, .

Let us now prove that . Fix any , and pick such that for all it holds that . From the equation for , we get

where and the inequality holds for all . Now we pick the value and consider the function which is the solution of the following logistic Cauchy problem

As , standard results give that is increasing for and . On the other hand, an easy application of comparison principles gives that for all ; hence, . As this holds for all , we obtain .

We can now conclude the argument: we have obtained , and this obviously implies

The thesis is proved. □

- Step 8: We now end the proof of Proposition 9: it is enough to choose and and, for any , to define . The previous Steps give all the results stated in Proposition 9.

Let us now collect the results of this section.

Proposition 10.

Let with . If , then the equilibrium point P is unstable. If , then P is Lyapunov-stable and the asymptotic results of Proposition 9 hold.

Remark 1.

We notice that the results of this section are not asymptotic results but hold for any value of the parameters, provided the hypotheses are satisfied.

6. Stability of Equilibria: Cases 5 and 6

We now deal with Cases 5 and 6. As in Section 3 we will study the stability and instability properties of equilibria when and we will assume, for simplicity, linear relations between the coefficients . Thus, as above, we set , , and with , and we will study the asymptotic behavior of equilibria as . This approach rules out Case 5 because, as , from (9) we obtain , so the steady state is not in . We can repeat the same computations of Case 3, obtaining that the Jacobian matrix (13), computed at the points (12), is as follows:

Now we want to obtain the asymptotic developments of y, z, and w. For the values (), the same computations of Case 3 hold, while for , we use (11). Hence, we have, for ,

Looking at the Jacobian matrix (21), we obtain in this case

Considering

we have

Hence, the Jacobian matrix is given by

Its determinant is given by Det. Denoting by = Det its characteristic polynomial, we obtain DetDet as . As lower order terms, we obtain that has a real positive root, which is a real positive eigenvalue of . We then deduce that the equilibrium is unstable as .

Let us now see what happens for . We have:

We note that if , which is true only if the previously encountered condition is satisfied. From now on, we will consider this condition valid so that remains in . Looking at the Jacobian matrix (21), we obtain in this case:

Now we notice that

so that we have:

Hence, the Jacobian matrix is given by:

Denoting by its characteristic polynomial, we obtain:

We apply now the Routh–Hurwitz criterion (see [20]). As we are assuming , we have . Thus, we need only to check if . We have

as , so we have asymptotic stability.

The following proposition summarizes the results of this section.

Proposition 11.

When , we have the following results:

- (i)

- The equilibrium of Case 5 is not in .

- (ii)

- The equilibrium of Case 6 is always unstable.

- (iii)

- The equilibrium of Case 6 is asymptotically stable if and it is outside if .

Remark 2.

If , that is , we obtain the condition that we found in our previous works.

7. Simulations

We present simulation results obtained using MATLAB’s ode45 solver, based on an explicit adaptive Runge–Kutta method; see [21,22]. The goal of these simulations was to verify our theoretical analyses. We display our findings in two formats: Cartesian graphs in scenarios where instability is more pronounced and phase diagrams in cases of stability where these representations provide clearer insights.

In the Cartesian graphs shown, the evolution of the variables is depicted by introducing small perturbations to the initial conditions around the equilibrium point. Different colors represent the variables: green for renewable resources, black for non-renewable resources, and blue for accumulated wealth. Dashed lines indicate the coordinates of the equilibrium point under consideration, with the color corresponding to each specific component (e.g., blue for wealth). The x-axis is labeled with a generic time unit that does not correspond to specific intervals such as days, months, or years, but instead represents a general time scale that may not cover extended periods. The simulation is terminated once the system’s behavior becomes evident.

The phase diagrams illustrate the behavior of renewable or non-renewable resources and wealth in proximity to the steady states discussed in our study. These diagrams focus on two main variables, plotting three distinct trajectories (depicted in magenta, dark green, and red) generated by applying three different perturbations around the critical point within a two-dimensional space. The graphs highlight stable points, where the dynamics naturally lead the system towards equilibrium. Initial points are marked with small circles, while steady states are indicated by small stars.

7.1. Case 3

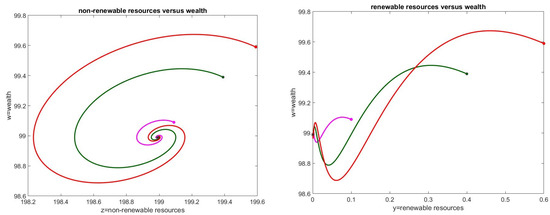

We wanted to test a stable situation with . We considered the following parameter values: , that is , resulting in the stable point with . In Figure 1 we represent the phase diagrams obtained by considering non-renewable resources versus wealth on the left, and renewable resources versus wealth on the right. Table 1 shows the time evolution of the absolute differences between the system’s state variables and their corresponding equilibrium values at . The observed decay and stabilization of these quantities over time indicate steady state convergence, confirming the numerical stability of the simulation. The Jacobian matrix calculated at has eigenvalues .

Figure 1.

Case 3. Phase diagram related to the analysis of the stable point . (left): non-renewable resources versus wealth. (right): renewable resources versus wealth.

Table 1.

Stability of the equilibrium point : time evolution of the norm of the difference vector .

We also tested, without displaying the graph, some cases of instability, noting that the trajectories, in this situation, stabilize at the point denoted as in Case 6. Specifically, by varying the parameter in Case 3, we obtain with a critical point and convergence to , which corresponds to the point with the same parameters as in Case 6.

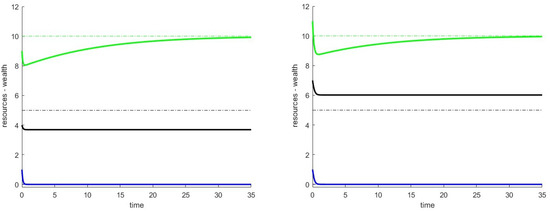

7.2. Case 4

In the simulations for the scenario described in Case 4, we considered the parameters , starting from the critical point with ; since we want to study , we have set .

In Figure 2, we show the simulations related to ; on the left, we started with a positive perturbation on the coordinate while applying a negative perturbation to and . In Figure 2 on the right, all perturbations are positive. As predicted by the theory, the trajectories of the variables and decrease, while . We note that for both graphs, we have convergence , while the trajectory of behaves differently. Furthermore, the convergence of the variable varies depending on the magnitude of the input perturbation and its relationship with Z. The Jacobian matrix calculated at the point has the following eigenvalues: .

Figure 2.

Case 4. The variable z stabilizes at a value different from the critical one. (left): negative perturbations on and . (right): all initial perturbations are positive.

7.3. Case 6

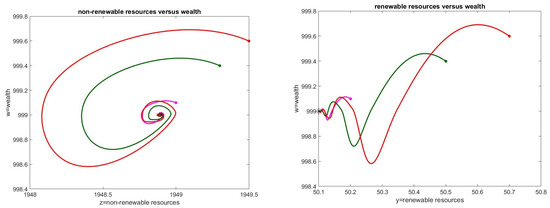

Figure 3 shows the simulations related to the point obtained with , i.e., , and , which is a stable point. The eigenvalues of the Jacobian matrix calculated here are . We note that this is a stable situation where all variables are strictly positive.

Figure 3.

Case 6. Phase diagram related to the analysis of the stable point . (left): non-renewable resources versus wealth. (right): renewable resources versus wealth.

8. Conclusions

We now summarize the main results of this paper. First, we have obtained that for the trajectories in , it cannot happen that or or , as . Of course, this does not mean that this variables remain bounded but that there is a positive constant C such that if, for example, at a time , then w must go below C at a time . Thus, an excessive growth in wealth generates oscillations, and these are phenomena that generally have negative social consequences. Another relevant result is the following: although we have obtained that many equilibria of the system are unstable (or are outside ), there are still, at least for some range of the parameters, stable equilibria with positive values for all the variables (see Proposition 11 and Figure 3). We also obtained that the stability of equilibria may change when the parameters change, see, for example, Propositions 8 and 10. Moreover, the equilibrium of Proposition 11 can be negatively affected and driven outside the positive cone by a change in parameters. This suggests that the precise tuning of the parameters should be a relevant concern to lead human society on a safe path.

We note that all numerical simulations confirm the theoretical results obtained.

From these results a general indication seems to emerge: within the framework of our model, an indefinite growth in wealth is not a reasonable aim, while it seems possible to drive the society towards a steady state with positive values of all the variables, at least for small rates of exploitation of resources. Hence, the results of our research are in line with the ideas of those who support the need to abandon the design of infinite growth and instead to search for a path towards stationary economic situations, possibly through a period of degrowth.

These results are similar to those that we obtained in our previous papers, using similar but different models. This seems to us a relevant achievement in itself because these results appear to be very stable with respect to changes in the model (of course, here we use the word “stable” in a non-technical sense). Despite the fact that all the models that we have studied, in the present and the previous papers, are of course too simple to allow precise predictions on social evolution, this stability of the qualitative ideas that they suggest may be an interesting contribution to the debate on the future of our societies.

Author Contributions

Conceptualization, M.B.; Methodology, M.B. and I.C.; Validation, I.C.; Formal analysis, M.B.; Visualization, I.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are contained within the article.

Acknowledgments

We thank the reviewers for their constructive comments, which helped clarify the real-world relevance of our model and refine its presentation.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Badiale, M.; Cravero, I. A HANDY-type model with non-renewable resources. Nonlinear Anal. Real World Appl. 2024, 77, 104071. [Google Scholar] [CrossRef]

- Badiale, M.; Cravero, I. A Nonlinear ODE Model for a Consumeristic Society. Mathematics 2024, 12, 1253. [Google Scholar] [CrossRef]

- Badiale, M.; Cravero, I. A Nonlinear ODE Model for a Society Strongly Dependent on Non-Renewable Resources. AppliedMath 2025, 5, 43. [Google Scholar] [CrossRef]

- Meadows, D.H.; Meadows, D.L.; Randers, J. Beyond the Limits: Confronting Global Collapse, Envisioning a Sustainable Future; Chelsea Green Publishing Co.: White River Junction, VT, USA, 1992. [Google Scholar]

- Meadows, D.H.; Meadows, D.L.; Randers, J. The Limits to Growth: The 30-Year Update; Chelsea Green Publishing Co.: White River Junction, VT, USA, 2004. [Google Scholar]

- Meadows, D.H.; Meadows, D.L.; Randers, J.; Behrens, W.W. The Limits to Growth: A Report for the Club of Rome’s Project on the Predicament of Mankind; Universe Books: New York, NY, USA, 1972. [Google Scholar]

- Herrington, G. Update to limits to growth: Comparing the World3 model with empirical data. J. Ind. Ecol. 2022, 26, 312–324. [Google Scholar] [CrossRef]

- Murphy, T.W. Limits to economic growth. Nat. Phys. 2022, 18, 844–847. [Google Scholar] [CrossRef]

- Motesharrei, S.; Rivas, J.; Kalnay, E. Human and nature dynamics (HANDY): Modeling inequality and use of resource in the collapse or sustainability of societies. Ecol. Econ. 2014, 101, 90–102. [Google Scholar] [CrossRef]

- Motesharrei, S.; Rivas, J.; Kalnay, E.; Asrar, G.; Busalacchi, A.; Cahalan, R.; Cane, M.; Colwell, R.; Feng, K.; Franklin, R.S.; et al. Modeling sustainability: Population, inequality, consumption, and bidirectional coupling of the Earth and Human Systems. Natl. Sci. Rev. 2016, 3, 470–494. [Google Scholar] [CrossRef] [PubMed]

- Akhavan, N.; Yorke, A. Population collapse in Elite-dominated societies: A differential model without differential equations. SIAM J. Appl. Dyn. Syst. 2020, 19, 1736–1757. [Google Scholar] [CrossRef]

- Grammaticos, B.; Willox, R.; Satsuma, J. Revisiting the Human and Nature Dynamics Model. Regul. Chaotic Dyn. 2020, 25, 178–198. [Google Scholar] [CrossRef]

- Tonnelier, A. Sustainability or societal collapse, dynamics and bifurcations of the handy model. SIAM J. Appl. Dyn. Syst. 2023, 22, 1877–1905. [Google Scholar] [CrossRef]

- Al-Khawaja, T. Mathematical Models, Analysis and Simulations of the HANDY Model with Middle Class. Ph.D. Thesis, Oakland University, Rochester, MI, USA, 2021. Available online: https://our.oakland.edu/handle/10323/11946 (accessed on 20 March 2024).

- Shillor, M.; Kadhim, T. Analysis and simulation of the HANDY model with social mobility, renewables and nonrenewables. Electron. J. Differ. Equ. 2023, 2023, 1–22. [Google Scholar] [CrossRef]

- Castro, R.; Fritzson, P.; Cellier, F.; Motesharrei, S.; Rivas, J. Human-Nature Interaction in World Modeling with Modelica. In Proceedings of the 10th International Modelica Conference, Lund, Sweden, 10–12 March 2014; pp. 477–488. [Google Scholar] [CrossRef]

- Sendera, M. Data Adaptation in Handy Economy-Ideology Model. arXiv 2019, arXiv:1904.04309. [Google Scholar]

- Yang, Z.; Abdollahian, M.; Neal, P. Social Spatial Heterogeneity and System Entrainment in Modeling Human and Nature Dynamics. In Proceedings of the Theory, Methodology, Tools and Applications for Modeling and Simulation of Complex Systems, Beijing, China, 8–11 October 2016; Zhang, L., Song, X., Wu, Y., Eds.; Springer: Singapore, 2016; pp. 311–318. [Google Scholar]

- Nitzbon, J.; Heitzig, J.; Parlitz, U. Sustainability, collapse and oscillations in a simple World-Hearth model. Environ. Res. Lett. 2017, 12, 074020. [Google Scholar] [CrossRef]

- Gantmacher, F.R. The Theory of Matrices Volume 2; AMS Chelsea Publishing: Providence, RI, USA, 2000. [Google Scholar]

- Dormand, J.R.; Prince, P.J. A family of embedded Runge-Kutta formulae. J. Comput. Appl. Math. 1980, 6, 19–26. [Google Scholar] [CrossRef]

- Shampine, L.F.; Reichelt, M.W. The MATLAB ODE Suite. SIAM J. Sci. Comput. 1997, 18, 1–22. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).