Abstract

Since the early 21st century, within fuzzy mathematics, there has been a stream of research in the field of option pricing that introduces vagueness in the parameters governing the movement of the underlying asset price through fuzzy numbers (FNs). This approach is commonly known as fuzzy random option pricing (FROP). In discrete time, most contributions use the binomial groundwork with up-and-down moves proposed by Cox, Ross, and Rubinstein (CRR), which introduces epistemic uncertainty associated with volatility through FNs. Thus, the present work falls within this stream of literature and contributes to the literature in three ways. First, analytical developments allow for the introduction of uncertainty with intuitionistic fuzzy numbers (IFNs), which are a generalization of FNs. Therefore, we can introduce bipolar uncertainty in parameter modelling. Second, a methodology is proposed that allows for adjusting the volatility with which the option is valued through an IFN. This approach is based on the existing developments in the literature on adjusting statistical parameters with possibility distributions via historical data. Third, we introduce into the debate on fuzzy random binomial option pricing the analytical framework that should be used in modelling upwards and downwards moves. In this sense, binomial modelling is usually employed to value path-dependent options that cannot be directly evaluated with the Black–Scholes–Merton (BSM) model. Thus, one way to assess the suitability of binomial moves for valuing a particular option is to approximate the results of the BSM in a European option with the same characteristics as the option of interest. In this study, we compared the moves proposed by Renddleman and Bartter (RB) with CRR. We have observed that, depending on the moneyness degree of the option and, without a doubt, on options traded at the money, RB modelling offers greater convergence to BSM prices than does CRR modelling.

Keywords:

intuitionistic fuzzy numbers; probability–possibility transformation; fuzzy binomial option pricing; zero-coupon bond options; binomial up-and-down modelling MSC:

62A88; 91G20; 91G30

1. Introduction

The Black–Scholes–Merton (BSM) model for valuing European options [1,2] has been one of the fundamental pillars of financial economics since the late 20th century [3]. The approach used to determine the BSM formula, which is based on the no-arbitrage argument, allows the valuation of not only options but also any asset containing some form of optionality, using a few parameters that are relatively easy to estimate because they do not depend on subjective risk perception. Thus, option pricing theory enables pricing not only for a great deal of derivative assets but also for some embedded rights, such as convertibility rights and early amortization in bonds or financial assets such as life insurance or mortgage loans [3]. It also allows for the valuation of companies [1] or investment projects using real options theory [3].

However, while the BSM philosophy allows for the valuation of a wide range of economic rights, continuous-time option valuation models do not allow for the evaluation of the majority of path-dependent options. This encompasses American options, several types of exotic options, or flexibilities associated with real options [4]. Thus, one of the main derivations of the BSM is the binomial approximation, also called the two-state model [4], where up-and-down moves are instantaneous, which is equivalent to the BSM formula [5]. Therefore, the use of a binomial methodology in valuing path-dependent options allows the application of the philosophy and assumptions underlying the BSM [5].

The so-called binomial approximation is not a single model but comprises a great deal of up-and-down binomial moves modelling. The most widely used and well-known method is the one proposed by Cox, Ross, and Rubinstein [6] (CRR hereafter), although there are many more approximations. In this regard, we can mention the ones simultaneously published by Rendleman and Bartter [7] (RB hereafter) or [8,9]. In fact, [5] identified up to 11 possible variants of the binomial method.

Conventional option valuation models assume that the parameters governing variations in underlying asset prices are crisp values. However, in practical situations, there is often imprecision and/or vagueness regarding their values. For example, the historical volatility of the underlying asset must be estimated through sample values; thus, a more comprehensive but also imprecise estimation requires at least the use of confidence interval estimations associated with a significance level [10]. In the case of real options, parameters such as the exercise price or even its date may be imprecisely estimated by the evaluator or manager [11,12]. Thus, at the beginning of the 21st century, a trend in fuzzy mathematics emerged, which we can label fuzzy random option pricing (FROP). A considerable number of studies have modelled uncertainty in valuation parameters through possibility distributions [13]. These works are based on conventional option valuation frameworks, such as the BSM or the binomial method, which introduce the vagueness of parameters governing movements of the underlying asset through fuzzy subsets [13]. In most cases, the type of fuzzy subset used is the type-1 fuzzy number, which is typically triangular or trapezoidal [12,13] and should be considered an epistemic fuzzy set [14].

FROP development spans both discrete and continuous periods. Over time, contributions within the BSM framework have been particularly numerous [10,11,15,16,17,18,19,20,21]. However, FROP has utilized possibility distributions to model the parameter uncertainty of other price variation models, such as multivariate Brownian geometric models [22] or Levy processes [23,24].

Discrete-time developments have mainly focused on extending the binomial model to price options for stocks [25,26,27,28,29,30] and real options [31,32,33,34]. In these papers, all binomial models shape the up-and-down moves with the analytical groundwork of the CRR without considering any of the numerous alternatives provided in the literature. However, there is no reason not to choose any other binomial model from those mentioned earlier, such as the RB model [31]. Likewise, to the best of our knowledge, modelling vagueness over the value of parameters governing the movement of the underlying asset price is performed through fuzzy numbers, which are typically linear [13]. An exception to this assertion is the intuitionistic triangular extension to CRR [35], which uses soft set parameters to model CRR. Notably, a significant number of FROP binomial extensions consider volatility to be the main source of uncertainty [22,26,36].

The reflections outlined in the preceding paragraphs lead to the development of the present work, in which we extend the two-state model of option valuation to estimate the parameters governing underlying assets quantified by intuitionistic fuzzy numbers (IFNs), with particular emphasis on volatility. This study introduces the following novelties to the FROP literature:

- We model uncertainty via IFNs, which generalize FNs, in an option pricing context. Introducing parameter quantification with IFNs allows for the incorporation of bipolar information; that is, capturing values that can actually take the parameter, as well as those that are definitely not [37]. It should not be understood that IFNs introduce more uncertainty in parameter estimation but rather introduce new information [38]. Although intuitionistic fuzzy uncertainty has been considered in some studies [39,40,41,42,43], it is quite residual and absent in fuzzy binomial modelling.

- We propose a methodology that allows for the adjustment of the volatility necessary to value the option as an IFN using the historical volatility approach [4] and the concept of coherent probability–possibility transformation [44]. This focus has been adopted to fit fuzzy number parameters in an FROP setting to price stock options [10], in a real options setting [45], and in the field of valuation of interest-sensitive instruments [46].

- We contribute to FROP in a binomial setting by critically proposing the modelling of up-and-down moves in the valuation of the path-dependent option under assessment. We compared the commonly used fuzzy literature CRR with the alternative of Rendleman and Bartter [7]. In this sense, given that the use of the binomial model is justified by its convergence to the BSM, the evaluation of binomial models is carried out by comparing the proximity of their calculated price with the BSM in a European option with the same characteristics as those intended to be evaluated [47].

The paper is organized as follows. The following section presents the analytical foundations of fuzzy mathematics used in this paper and proposes an intuitionistic fuzzy estimate of option volatility on the basis of the concept of historical volatility. In the Section 3, intuitionistic expressions of the BSM and binomial option prices are developed. Fourth, we evaluated the modelling of binomial up-and-down moves with CRR and RB in an intuitionistic fuzzy setting. We assume that volatility is a unique uncertain parameter. To test up-and-down moves, we used historical data from the IBEX-35 Futures Index, which is the reference index for the most traded options on stocks in the Spanish derivatives financial market.

2. Intuitionistic Fuzzy Estimates of Statistical Parameters and Intuitionistic Fuzzy Number Arithmetic

2.1. Fuzzy Numbers, Intuitionistic Fuzzy Numbers, and Distance between Intuitionistic Fuzzy Numbers

Definition 1.

A fuzzy set in a universe of discourse , , is where is the so-called membership function [48]. Conversely, can be represented through level sets or -cuts: :

Definition 2.

A fuzzy number (FN), , is a fuzzy subset of a real line. It is normal (i.e., ) or convex (i.e., ) [49]. Therefore, the level sets of and are confidence intervals:

where increases with α and where decreases with respect to .

Remark 1.

A fuzzy number is also known as a possibility distribution, and is known as the possibility distribution function.

Definition 3.

The intuitionistic fuzzy set (IFS) in the universe of discourse is where is the membership value of in and where is the nonmembership value. The following relation holds: [50].

Remark 2.

The degree of hesitancy of , , is Note that an IFS generalizes the concept of an FS such that if , is a conventional FS .

Definition 4.

An intuitionistic fuzzy number (IFN) is an IFS defined on real numbers such that [51]:

(i) is normal,

(ii) is convex, which implies that and are concave; that is,

Remark 3.

An IFN can be represented throughout its level sets or -cuts, , as:

where

and

increase

with respect to

and

, respectively. Similarly,

and

decrease with respect to these arguments.

Remark 4.

In an IFN, is the lower possibility distribution function of , and is its upper distribution function [52]. Consequently, the -cut representation of , and the -cut representation in (2), accomplishes that for = , i.e.,

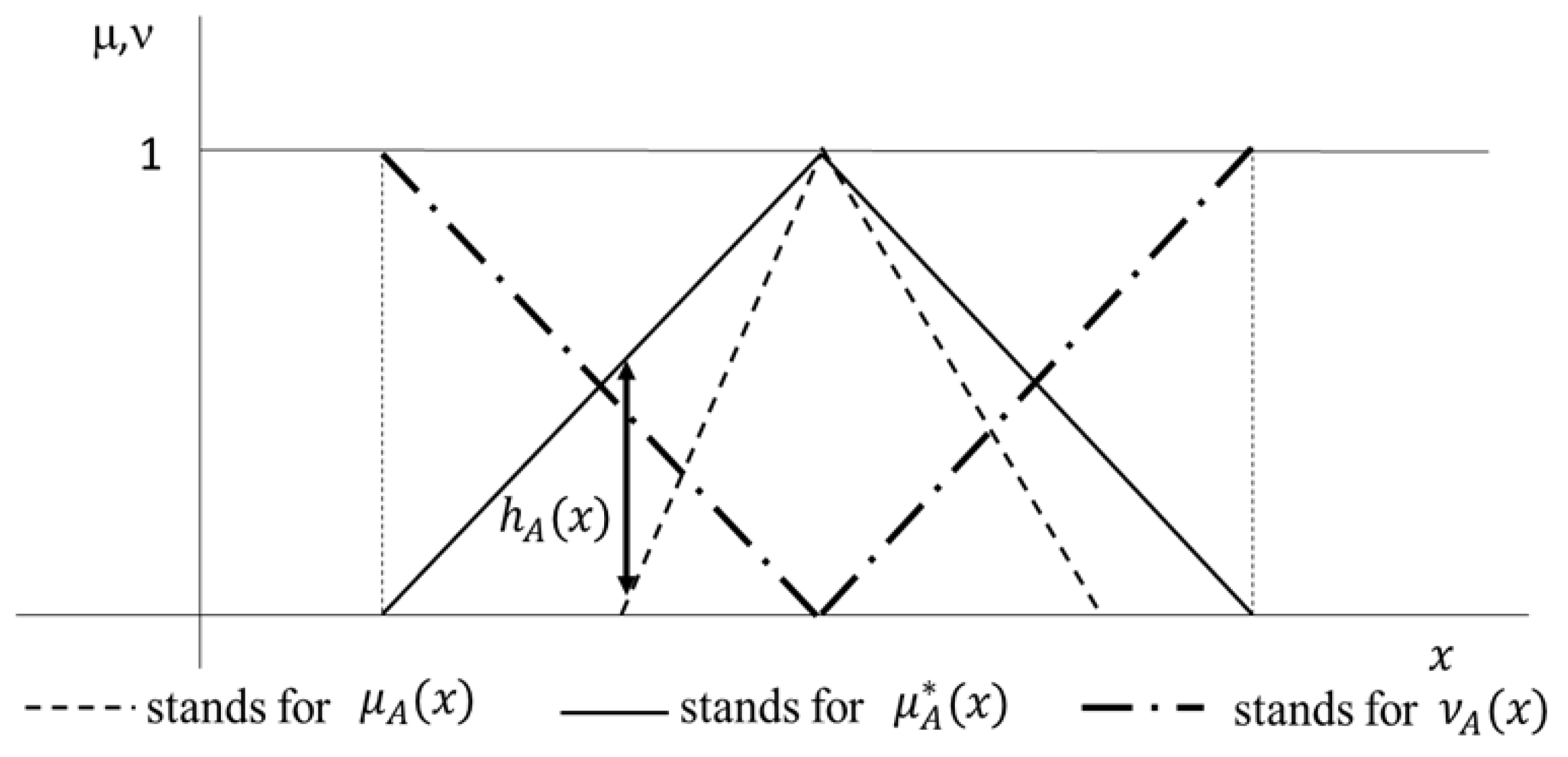

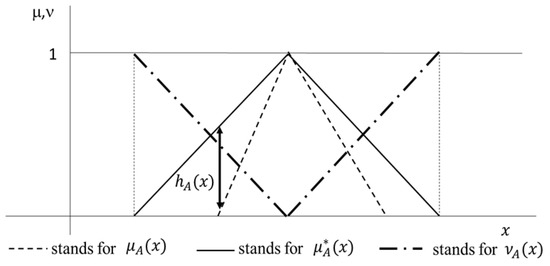

Thus, and can be interpreted as bipolar measurements of the reliability of as [38]. Thus, quantifies for the potential possibility and its real possibility. Figure 1 shows the shape of an intuitionistic triangular fuzzy number.

Figure 1.

Shape of a triangular intuitionistic fuzzy number.

Definition 5.

The expected value of an intuitionistic fuzzy number, , can be defined via (2) and (3) as follows [53]:

where is a function that satisfies and Therefore, we consider in this paper .

Definition 6.

Let there be two IFNs: and . The distance between these IFNs is defined by (2) and (3) as follows [54]:

where

is the same function as in (4).

Note that (4) and (5) can be implemented by using any of the numerical approximations to integral calculations existing in the literature, such as Simpson’s rule.

2.2. Fitting Statistical Parameters with Intuitionistic Fuzzy Numbers

Fuzzy numbers are frequently employed in fuzzy mathematics to represent the epistemic uncertainty of parameters and play an analogous role to random variables in probability theory [38]. Consequently, several studies have investigated the equivalence between fuzzy numbers and random variables with the aim of facilitating consistent ways to transform random variables into possibility distribution functions [44,55,56].

Definition 7.

From a random variable and a family of confidence intervals such that , where P(·) is a probability measure, we can induce an equivalent FN whose α-cut representation is [55]:

Thus, the membership function of the fuzzy number equivalent to is as follows:

This analytical connection between random variables and possibility distributions has led several authors to propose adjusting statistical parameters, such as the mean or variance, with fuzzy numbers that are built up by overlaying sample confidence intervals from the lowest to the highest level of significance [57,58,59,60,61]. Therefore, we define:

Definition 8.

Let (i) be a sample of independent and identically distributed random variables with an unknown parameter that allows its interval estimate to be obtained with a significance level (1 − α)%, (ii) be a monotonic function . Then, from , we can induce a fuzzy number estimate for , whose α-cuts are [59]:

The function transforms the significance level of the probabilistic confidence interval to a possibilistic membership degree.

Remark 5.

According to [59], the parameter determines the width of the support of . The determination of to encompass all potential values considered in can be interpreted through the application of the 95% and 99.7% rules, which are commonly employed in finance and business modelling [62]. A 95% value (implying a significance level of 5%) covers typical scenarios, incorporating those that are reasonable but not entirely extreme. Conversely, the utilization of significance levels γ close to 0, such as 0.3% (i.e., the 99.7% rule), assumes virtually all conceivable scenarios in support of .

Remark 6.

In this study, the function is defined as a linear function [59]:

Definition 9.

Let be a sample with n observations and a sample variance (standard deviation ). For variance , we can build a possibilistic estimate whose membership function is [59]:

where is the distribution function of a Chi-squared distribution with n − 1 degrees of freedom; is its inverse for a probability level (⋅); and M is the median of the Chi-squared distribution. Therefore, the α-levels of and are as follows:

Remark 7.

Therefore, for the standard deviation, , the possibility distribution function estimate, , can be obtained by performing ; thus, the α-cuts are as follows:

Definition 10.

Let us suppose a sample of a random variable with an associated unknown parameter that allows us to obtain an interval estimate with a significance level of (1 − )%. Therefore, we can adjust an intuitionistic estimate by fitting its lower distribution function via (8) and (9) , (), that is, , and its upper distribution function with in (7), (), that is, . Therefore, for , we can state that:

Thus, where:

Remark 8.

Note that the proposed approach utilizes, on the one hand, the transformation of confidence intervals for statistical parameters into possibility distributions. On the other hand, an IFN can be delimited through two possibility distributions: a lower distribution, which gathers the values of the parameters of interest considered real according to the available evidence, and an upper distribution, which gathers the potential values of the parameters [38].

Definition 11.

Let be a sample with n observations and sample variance . From Definition 10, we can fit intuitionistic variance by adjusting and . From (13), we can define a possibilistic estimate, where:

Therefore, the level set representation

can be denoted as , where by using (11), (14), and (15):

Remark 9.

Therefore, for the standard deviation , we can fit an IFN obtained by performing and . Therefore, the -cuts are:

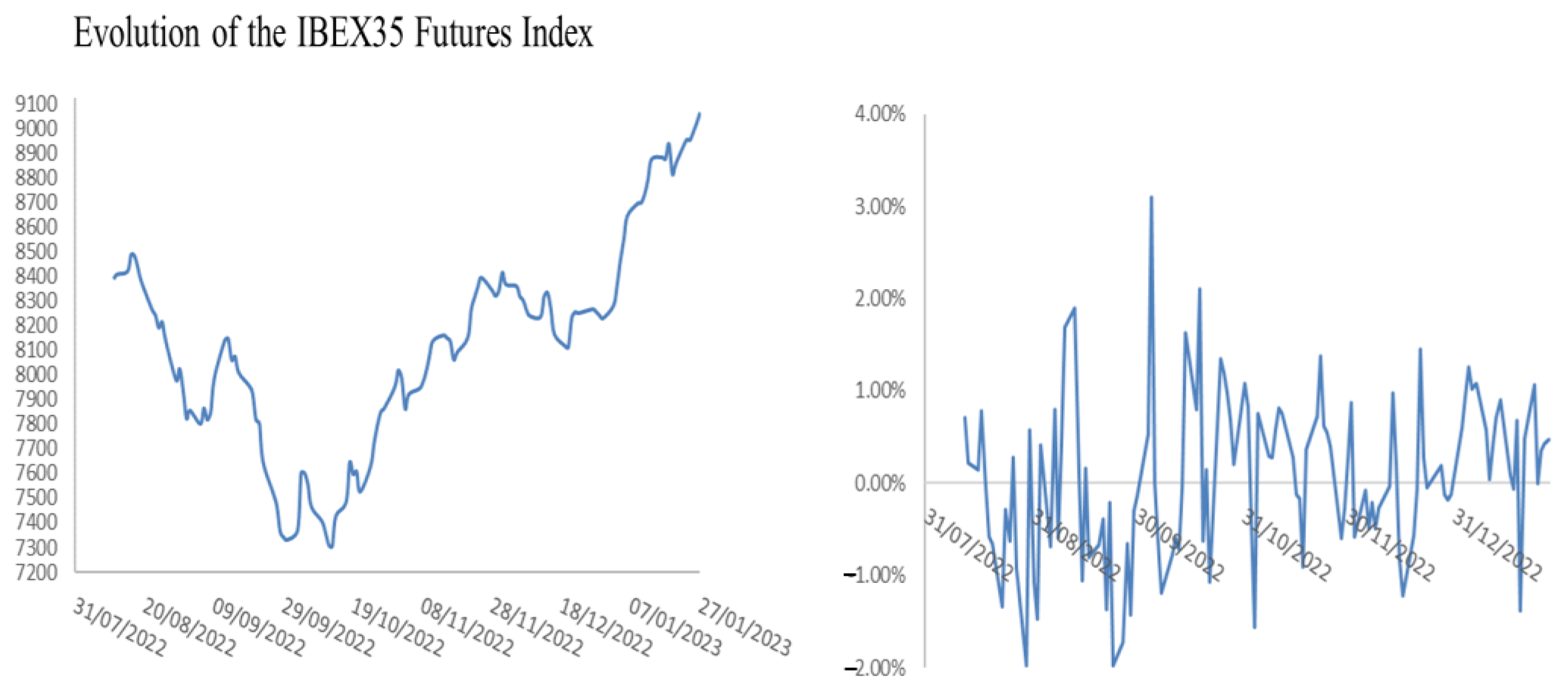

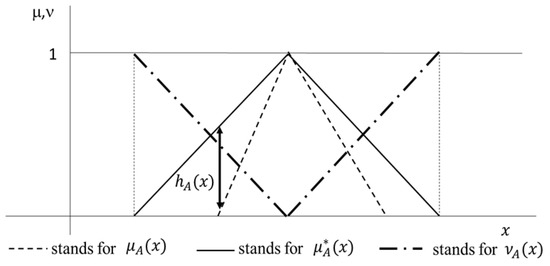

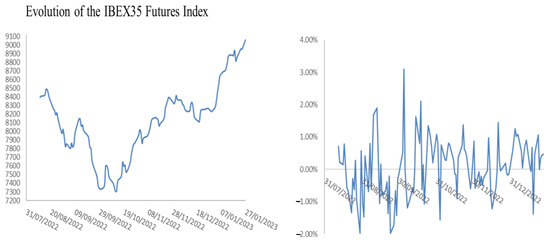

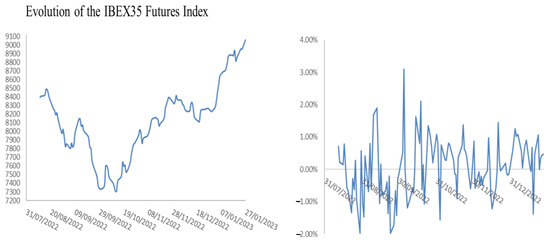

Numerical application 1. The empirical applications developed in this section are based on the daily average values of the IBEX35 Futures Index, which serves as the underlying asset for most liquid stock options in the Spanish derivative market. This numerical analysis uses daily data from 11 August 2022, to 27 January 2023, comprising 121 observations. Figure 2 illustrates the evolution of the index throughout the specified period and the corresponding logarithmic returns.

Figure 2.

Evolution of IBEX 35 Futures from 4 November 2022, to 27 January 2023.

The volatility of the index requires a predefined time horizon that varies over time. In this example, we adjust an IFN for volatility over calculation horizons of n = 60 observations and n = 120 observations as of 27 January 2023. That is, we calculate the 60-day and 120-day volatility recorded on 27 January 2023.

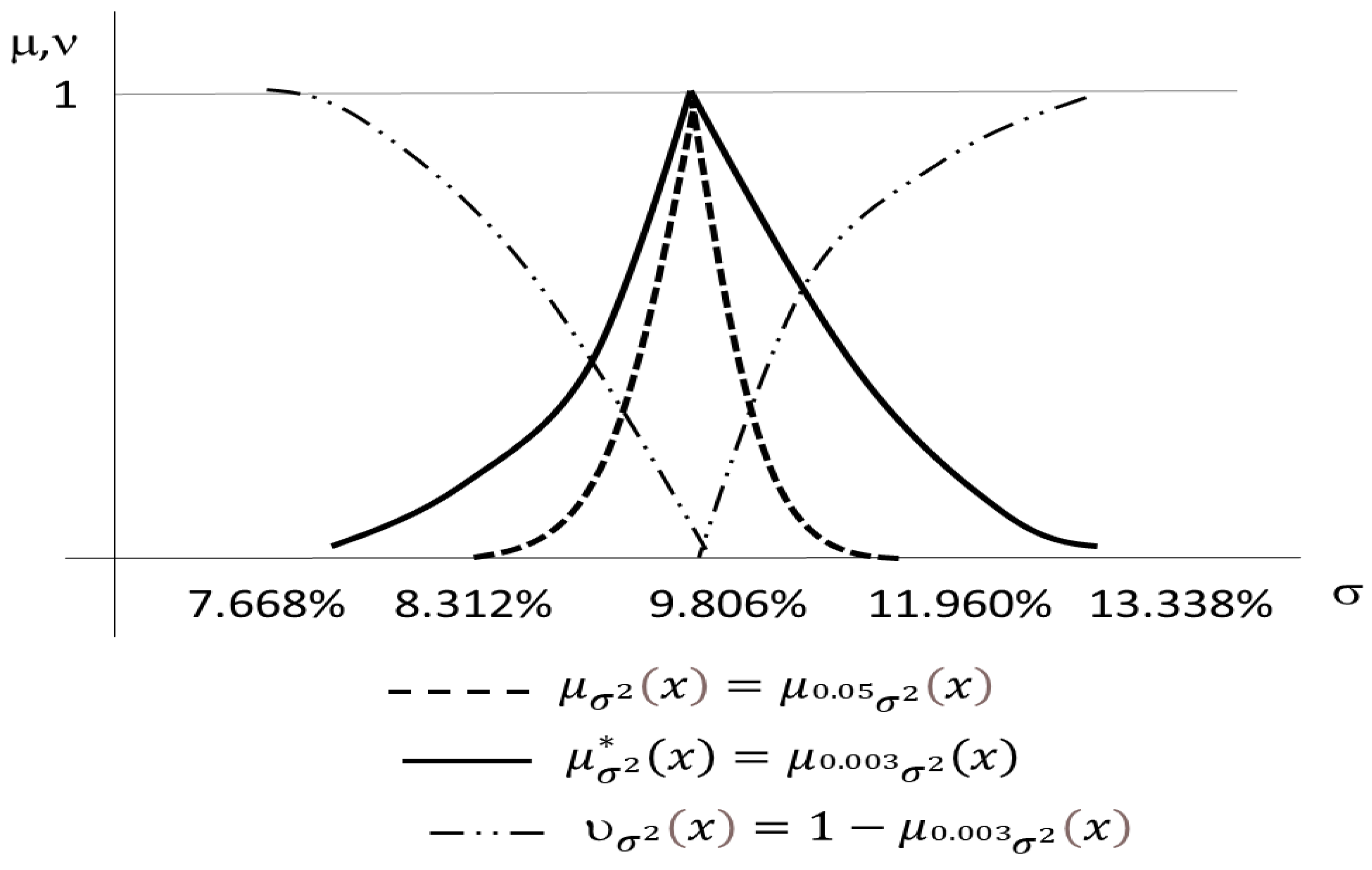

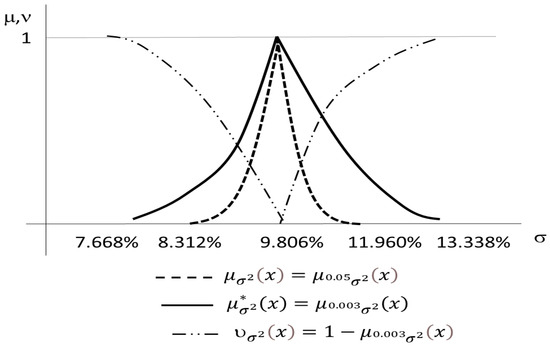

The annualized 60-day volatility of the index is 9.806%. Thus, for a significance level of = 5% (i.e., with the 95% rule), we obtain a membership function for the annualized standard deviation , whose shape starts from (16) and Remark 5.

Therefore, the α-cuts (12) are:

We can construct an intuitionistic estimate for the volatility of the index in the period of interest on the basis of and adjust an upper possibility distribution whose support is set by the 99.7% rule in (16) and (19); that is, by stating γ* = 0.3% and using to state the nonmembership function. Thus, :

From (16) and (19), :

In such a way, the nonmembership of is :

Similarly, where:

and,

Figure 3 shows the shape of the possibilistic estimates of the annualized volatility for the last 60 days of the IBEX-35 Futures Index on 27 January 2023, and , and the IFN developed above.

Figure 3.

Fuzzy number and intuitionistic fuzzy number estimates of the 60-day volatility of the IBEX35 Futures in 27 January 2023.

On the other hand, the annualized 120-day volatility of the IBEX-35 Futures index is 13.908%. Thus, analogous to the 60-day volatility, we can construct an intuitionistic estimate for the 120-day volatility of the index in the period of interest on the basis of and . Thus, :

From (16) and (19), :

In such a way, the nonmembership of is :

Similarly, where:

and,

Regarding the obtained results, the following points need to be clarified:

- To determine historical volatility, the desired time horizon (e.g., 30 days, 60 days) must be specified. The choice of horizon will determine the core of the IFN that quantifies volatility.

- The time horizon for volatility affects the breadth of the membership and nonmembership functions: a shorter time horizon implies fewer observations for calculating volatility and broader confidence intervals (17) and (18).

- The percentiles used to set the upper and lower possibility functions determine their breadth. The percentiles associated with lower probabilities result in narrower membership and nonmembership functions. For example, using 90% rules for the lower possibility function and 95% for the upper possibility function would result in narrower -cuts.

2.3. Intuitionistic Fuzzy Number Arithmetic

We are now interested in evaluating continuous and differentiable functions such that the values of the arguments are estimated by IFNs . Thus, generates an IFN , . The membership and nonmembership functions of can be obtained via the generalization of Zadeh’s extension principle [63]:

Therefore, if are simply fuzzy numbers , the result is also a fuzzy number whose shape only depends on in (20).

The compatibility of Zadeh’s extension with the α-cut arithmetic can also be extended to the evaluation of . Thus, to obtain from , we must implement:

Thus, given that is supposed to be continuous, can be represented as

where for = 1,2,…,:

If increases with respect to and decreases in ,, we obtain [64]:

and thus, by induction, for :

In the case where we evaluate in the fuzzy numbers , i = 1,2,…,n, the α-cuts of the result, , are simply , which can be fitted with (23), (25), and (26) when f(⋅) is a monotonic function.

In this regard, alternatives exist for directly computing (22)–(28) to reduce the computation time. For example, using piecewise linear approximations can significantly reduce computational overhead.

3. An Extension Black–Scholes–Merton and Binomial Option Pricing Model for the Use of Intuitionistic Fuzzy Parameters

3.1. Pricing European Options with the Black–Scholes–Merton Model and Intuitionistic Fuzzy Parameters

Let be a call European option for an asset with price , strike price , and volatility σ that can be exercised in T years. The BSM formula [1,2] for the price of a call option, , for the free risk rate is

where is the cumulative standard Gaussian function.

In the case of a European put option, the price is also a function of , and T such that

Note that in the case of options on future contracts, Black [65] demonstrates that prices (29) and (30) are obtained by evaluating them at = 0.

A mainstream research field within the FROP literature is located within the BSM framework. Within these applications, we outline the following settings:

- Analytical aspects include computing prices (29)–(30) with possibility distributions [16,66,67].

- The immunization measures derived from formulas (29)–(30), so-called ‘the Greeks’, are computed and analysed when data are given fuzzy numbers [10,68,69,70].

- The most relevant parameter is computed, at least for options on financial assets traded in organized markets, which is volatility. Studies include both computing historical volatility [10] and calculating implied volatility [19,20,21,67,71].

- A fuzzy BSM formula is used for corporate and real option pricing [11,15,72,73].

Obviously, the parameters that should be subject to fuzzification depend on the context in which optionality is embedded. In options for stocks traded in exchange markets, parameters that may be vague include the price of the underlying asset, the risk-free interest rate, and volatility. In contrast, exercise price and expiration are crisp parameters because they are standardized contracts [12]. However, in the valuation of real options, a common situation is that the exercise price or expiration date are parameters whose knowledge is not precise [11,12,72].

Without loss of generality, we assume that all the variables used to evaluate (29) and (30) , , , σ, and are given by IFNs , and , respectively. With the exception of , the remaining IFNs were defined strictly in . Therefore, (29) induces an intuitionistic fuzzy price for a call option whose level sets are obtained by evaluating Therefore, by considering that and [3] and applying rules (25)–(28) in (29)

and

Similarly, in the case of put options, we can induce an intuitionistic fuzzy price whose level sets are obtained by evaluating To do so, we must apply rules (22)–(28) in (30) by considering and [3]. Therefore, we obtain the following for :

and considering:

3.2. Pricing European Options with a Binomial Model and Intuitionistic Fuzzy Parameters

The origin of the binomial option pricing model can be traced back to the nearly simultaneous publication of Cox et al. [6] and Rendleman and Bartter [7]. In the binomial framework, variation in stock prices occurs in discrete time, and there are only two possible moves, which are growth (up) and decline (down). In both CRR and RB, as well as in their multiple variants, movements of the prices of the underlying asset are multiplicative, and both these movements and the risk-neutral probabilities depend on the volatility of the underlying asset and the risk-free rate [5,9].

Thus, we symbolize the upwards growth rate of the underlying asset as and the downwards rate as , where . Similarly, we denote the risk-neutral probability of the upwards movement as and the associated probability of the downwards movement as . Table 1 shows the models analysed in our work. The first is the most commonly used method in practice and is unanimously considered in the fuzzy literature; we call this the CRR [6]. The alternative tested in this paper is [7], which we call the RB. Note that both cases can be unified into a general formulation of up-and-down moves, and . Therefore, while in the case of CRR , for the RB, it can be checked that and .

Table 1.

Models of binomial up-and-down moves used in this paper.

In any binomial model, maturity is divided into periods of duration years such that . Then, the price of a European call option is

For a put option,

As , Formulas (37)–(38) tend towards the price obtained with the BSM [5]. The primary utility of using binomial lattices lies in their applicability to options where the use of the BSM formula is challenging, such as American options, exotic options, or different flexibilities linked to real options [4].

In the FROP literature, the binomial model is the most widely used discrete-time option valuation method. In all the studies, modelling of the up-and-down moves and their probabilities was performed using the CRR model, with volatility being the parameter commonly considered fuzzy. Furthermore, in all contributions, uncertainty is introduced epistemically through fuzzy numbers, which are typically triangular or trapezoidal [12,13].

Next, we extend (18) and (19), assuming that all the parameters, except those associated with maturity, are IFNs . With the exception of , these IFNs are defined in The hypothesis that and are crisp parameters is a unanimous assumption in the FROP literature. Therefore, (37) induces an intuitionistic fuzzy price of call options whose level sets are obtained by evaluating and by applying rules (25)–(28) in (37)

and

For the case of an intuitionistic fuzzy price of a put option , the level sets are obtained by evaluating analogous to the case of call options. Therefore, we obtain by applying (25)–(28) in (38)

and

Numerical application 2. In this section, we evaluate European call options for IBEX-35 futures via the intuitionistic versions of the BSM and binomial models developed in this section. Within the binomial models, we considered both CRR and RB for modelling moves. The only intuitionistic fuzzy parameter is the 60-day volatility (), which was adjusted in the numerical application on 27 January 2023, in numerical application 1. Additionally, we consider the intuitionist estimate of the 60-day volatility obtained from the S&P 500 index on 4 November 2020.

In the application, we assume that the value of the underlying asset is = 1 and = 0% because we are pricing futures on options [65]. The maturity of all the options was = 1 year. We consider three possible strike prices with three different degrees of moneyness as follows: = 0.9 (in the money), = 1 (in the money), and = 1.1 (out of the money).

For the binomial models, we considered the following eight different jump frequencies: annual (h = 1, n = 1), semiannual (, = 2), quarterly (, = 4), monthly (, = 12), biweekly (, = 24), weekly (, = 48), daily (, n = 252), and every 12 h , = 504).

Therefore, to calculate the prices of call options with the BSM formula, we use (29), (31), and (32) to implement

Thus, the level sets of the BSM option price in the case of the 60-day volatility obtained for the IBEX-35 of Futures obtained in numerical application 1 are

and

On the other hand, if call option prices are calculated using the binomial formula, they are evaluated via an evaluation of (37) with intuitionistic volatility: . The level sets are calculated using (39)–(40) as follows: , where

and

Obviously, the final form of the above -cuts will depend on how we model the moves of the underlying asset, which, in this work, are those listed in Table 1. Table 2 shows the results of the expected values of the European call prices, which we calculate via (4); that is, in the case of prices calculated with the BSM and with those calculated with the binomial model.

Table 2.

A comparison of European option prices (with = 1 and 0%) on futures over IBEX-35 obtained using the Black–Scholes–Merton model and binomial models such as CRR and RB via the intuitionistic fuzzy variance in numerical example 1.

When evaluating a particular option that cannot be valued with the BSM formula, it seems reasonable to choose a binomial model that yields prices of the European option of the same type (call or put) and with the closest strike prices, maturities, and of the same type as the BSM formula [47]. Therefore, Table 2 also shows the distance between the value of the price calculated with the BSM and with the binomial model, which is expressed in relation to the expected value of the BSM price; that is, . It involves using (4) and (5). This ratio indicates the error caused by the binomial approximation of the BSM formula. The calculations of (4) and (5) were performed by computing the integrals using Simpson’s rule.

We can draw the following conclusions from the results presented in Table 2:

- As expected, both the CRR and the RB converge to the BSM since when .

- For the in-the-money options, the number of times that the CRR and RB are the closest to the BSM is the same (50%). The RB provides the closest price when there is only one move, and the CRR provides the closest price when the number of moves is the maximum ( = 504).

- For out-of-the-money options, the RB tends to provide better approximations to the BSM. However, when the movement frequency is annual, the CRR is better, but when , the price closest to the BSM comes from the RB.

- For at-the-money options, the best model is the RB model, regardless of the movement frequency.

- The price equations are monotonic functions of volatility, so the extremes of and are easily programmable even in a spreadsheet. On the other hand, the calculation of the integrals to obtain and has been carried out via Simpson’s rule with the discretization of the -cuts, which in our case have been obtained as = 0, 0.25, 0.5, 0.75, 1, and 1 − . Thus, these calculations are also easily implemented with a spreadsheet.

The 60-day volatility of the S&P 500 index on 4 November 2020, was 17.462%. Thus, from (16)–(19), the -cut of the intuitionistic volatility is Likewise, the -cut of the volatility is Therefore, the results of the approximation to BSM prices for the same call options analysed in Table 2 are presented in Table 3.

Table 3.

A comparison of European option prices (with = 1 and 0%) on the S&P 500 obtained via the Black–Scholes–Merton model and binomial models such as the CRR and RB using the intuitionistic fuzzy volatility on 4 November 2020.

Table 2 and Table 3 both show that for options trading in the money and out of the money, whether one binomial approximation is better than the other depends on the frequency of the moves. However, for at-the-money options, the RB modelling of the moves is better than CRR regardless of their frequency.

Therefore, when deciding how to model up-and-down moves in a situation with fuzzy volatility, which is the most common assumption in models developing binomial FROP, it is worth considering Rendleman and Bartter modelling [7] as a more accurate alternative than the more common CRR modelling. In the following section, we develop a deeper analysis of the convergence of the RB and CRR to the BSM.

4. Assessment of the Convergence of Two Alternative Binomial Moves Modelling to Black–Scholes–Merton Prices with Intuitionistic Fuzzy Volatility

4.1. Materials and Methods

In this section, we compare the ability of the two modelling approaches of binomial moves (CRR and RB) to approximate the price obtained with the BSM for a European call option on the IBEX 35 futures. We assume a notional value of 1 monetary unit, = 1 year, and strike prices of = 0.9 (in the money), = 1 (at the money), and = 1.1 (out of the money). Because these are options for futures, we consider = 0 [65]. Thus, as in numerical application 1, the only intuitionistic fuzzy parameter is volatility.

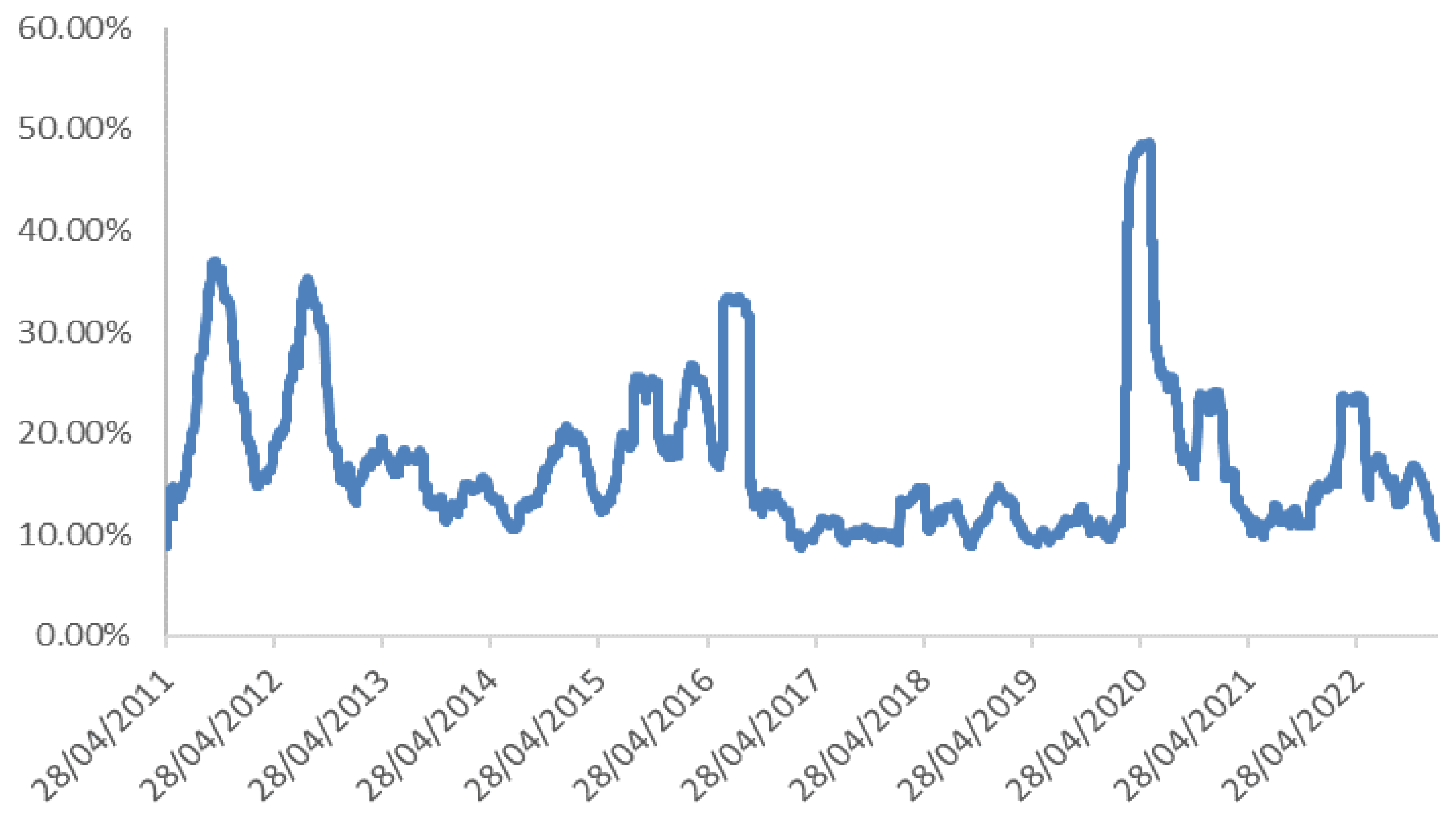

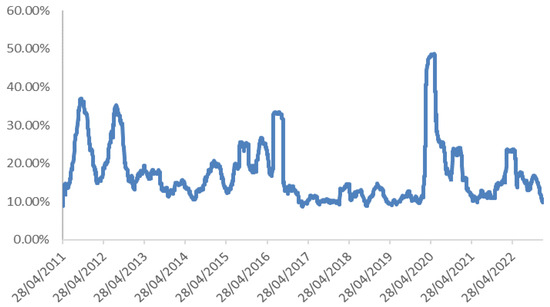

To evaluate the scenarios of fuzzy intuitionistic volatility, we considered the evolution of the IBEX 35 futures index from 27 April 2011, to 27 January 2023. Therefore, we used 3020 observations. For this index, we determined volatility, measured as the annualized standard deviation of logarithmic returns in a temporal window of 60 days. Figure 4 shows the evolution of the 60-day historical volatility during the entire analysed period. We observe that the average volatility is 17.21%, with a minimum of 8.71% and a maximum of 48.74%.

Figure 4.

Evolution of the 60-day volatility of the IBEX35 Futures Index from 27 April 2011, to 27 January 2023.

The empirical analysis was conducted using the following steps:

- Step 1: We identified five scenarios of low volatility, five of medium volatility, and five of high volatility. The low-volatility scenarios are the 1st, 5th, 19th, 20th, and 30th percentiles of historical volatility. The medium volatility scenarios are determined from percentiles 40, 45, 50, 55, and 60 of the calculated standard deviations. The high-volatility scenarios are identified with 70th, 80th, 90th, 95th, and 99th percentiles. Table 4 shows the <0,1>-cut, <0.5,0.5>-cut, and <1,0>-cut of the volatility scenarios considered in this empirical application.

Table 4. <1,0>-cut, <0.5, 0.5>-cut, and <0, 1>-cut of historical intuitionistic fuzzy volatilities of futures on the IBEX-35 linked to the 60-day windows are considered in this empirical analysis.

Table 4. <1,0>-cut, <0.5, 0.5>-cut, and <0, 1>-cut of historical intuitionistic fuzzy volatilities of futures on the IBEX-35 linked to the 60-day windows are considered in this empirical analysis. - Step 2: For these volatility scenarios, we fit an intuitionistic estimation using Equations (16)–(19). We used 95 and 99.7 rules to adjust the membership and nonmembership functions, respectively. Thus, with γ = 0.05, we obtain , and with γ* = 0.003, and so

- Step 3: We determined the prices of the evaluated European call options (for = 0.9, 1, 1.1, and = 1) for all evaluated volatility scenarios. To calculate the binomial prices, we used periodicities /504, 1/252, 1/48, 1/24, 1/12, 1/4, 1/2, 1}.

- Step 4: In all valuations, we determined the distance (5) between the value obtained with the BSM and the tested binomial models; that is, . Comparing the distances of the prices obtained with CRR and RB in a specific option, volatility scenario, and move frequency with respect to the benchmark, the BSM, allows us to establish which model converges better to the BSM.

- Step 5: We conducted three analyses of the convergence of the binomial IFN to the intuitionistic BSM as follows:

- We analysed the level of convergence for each degree of moneyness (in the money, out of the money, and at the money) separately, considering all volatility scenarios and moving frequencies together.

- We analysed the convergence levels by differentiating the degree of moneyness and movement frequency by considering conjointly all volatility scenarios. Within move frequencies, we differentiated between ‘low’ frequencies (monthly, quarterly, semiannual, and annual) and ‘high’ frequencies (every 12 h, daily, weekly, and every half month).

- We analysed the convergence levels by differentiating the moneyness degree and volatility scenarios without differentiating move periodicity. Within the volatility scenarios, we differentiated low-volatility, medium-volatility, and high-volatility scenarios, as indicated in Table 4.

In all three analyses, we calculated the proportion , in which RB modelling was closer than CRR was to the BSM. Thus, if both methods provide approximations of equal quality, the proportion ρ in which the RB improves the CRR should be 0.5. If the RB is generally better than the CRR, > 0.5, and if the CRR is better than the RB, then < 0.5. In all the cases, we evaluated the null hypothesis about the proportion = 0.5, with the test statistic , which tends to follow a standard normal distribution. where is the number of simulations embedded in the statistical test.

4.2. Results

The results in Table 5 suggest that while in the in-the-money options, the CRR model converges more to the BSM than to the RB (44.17% = < 50%), this closer proximity in prices is not significant, because the p value (p) is 0.212. In contrast, if the option is out of the money, the better performance of RB ( = 60%) is significant (p = 0.029).

Table 5.

Convergence of the CRR and RB binomial models to the BSM on the moneyness degree.

Table 6 shows that the different comparative performances of the intuitionistic binomial models tested to approximate the BSM depend on the periodicity of the moves. Thus, the slightly greater performance of RB over CRR in the in-the-money and out-of-the-money options when the frequency is low (periodicities 1/12) is not significant. In contrast, better CRR convergence is observed for the in-the-money options when the frequency is high (periodicities lower than one month), which is significant ( = 36.67%, p = 0.039). Greater convergence of the RB to the BSM at these frequencies is also noted for the out-of-the-money options, which is also significant ( = 63.33%, p = 0.0389).

Table 6.

Convergence of the CRR and RB binomial models to the BSM based on the moneyness degree and the periodicity of the moves.

Table 7 shows that the volatility scenario also determines the significance at which the RB or CRR converges more to the BSM. Thus, within low- and high-volatility scenarios and in the in-the-money and out-of-the-money options, we do not observe that either of the two binomial modelling approaches significantly provides greater convergence to the BSM than the other approaches do. In contrast, in the ‘medium’ volatility scenarios and in-the-money options, CRR provides greater convergence to the BSM than RB does ( = 32.5%, p = 0.027). Conversely, in the out-of-the-money options and the same ‘medium’ volatility scenarios, the RB generates prices closer to the BSM than the CRR does ( = 80%, < 0.001).

Table 7.

Convergence of the CRR and RB binomial models to the BSM based on the moneyness degree and the periodicity of moves.

5. Conclusions and Further Research

Fuzzy random option pricing (FROP) is a branch of fuzzy mathematics that models the uncertainty of the parameters necessary for valuing options through fuzzy subsets [12]. A common approach in FROP involves assuming stochastic variation in the underlying asset price, where the uncertainty in the parameters governing these fluctuations is introduced through type-1 fuzzy numbers [13]. In FROP, possibility distributions must be interpreted as epistemic fuzzy sets [14].

Among the continuous-time frameworks considered by FROP, the most developed is the Black–Scholes–Merton (BSM) model [10,11,15,16,17,18,19,20,71]. Similarly, the most commonly used analytic groundwork for option pricing in discrete time in FROP is the binomial model [25,26,27,29,30,31,32,33,34]. In most fuzzy literature, the forms used to model uncertainty as parameters such as volatility are fuzzy numbers, usually with a linear shape [13], and the modelling of Cox, Ross, and Rubinstein moves [6], denoted as CRRs.

The contributions of this study are located in the FROP with a binomial framework, highlighting three aspects. First, the modelling of the parameters governing the valuation of options is carried out through intuitionistic fuzzy numbers (IFNs), which are a generalization of fuzzy numbers. Their use allows the introduction of bipolar uncertainty of parameters into option pricing. Thus, in financial analysis, they not only offer information about the possible values that variables may introduce but also information about those variables that are certainly not worth considering [37]. We are aware that IFNs increase computational complexity with respect to the use of simple type-1 fuzzy numbers. Therefore, the use of a Gaussian quadrature or other numerical integration techniques that require fewer evaluation points while maintaining accuracy and implement processing for the computation of level sets and integrals should be considered. Modern computational environments with multicore processors can be utilized to speed up these computations.

Second, we propose a methodology that allows for the adjustment of the volatility of the underlying asset, which is the key parameter in option valuation and typically involves the most uncertainty, with an IFN. The proposed methodology combines the concept of historical volatility [4] and the interpretation of the α-level sets of possibility distributions of the variable as the narrowest interval containing those values with a probability of occurrence of 1-α [55]. This approach has already been used in the field of FROP to adjust the volatility of the underlying asset through type-1 fuzzy numbers [10,45,46] by applying the contributions of possibilistic adjustments of statistical parameters [57,58,59,60,61].

The proposed method requires adjusting two possibility distributions. On the one hand, a lower possibility distribution, whose support can be aligned with the 95% rule, assesses the current possibility levels. On the other hand, an upper possibility distribution, encompassing a broader range of values and adjustable, for instance, using the 99.7% rule, measures the potential possibility of the parameter of interest taking specific values. The IFN resulting from applying the proposed methodology allows for the parametric representation of all possible outcomes for the parameter of interest. This includes both highly probable results (which form the core of the membership function and align with the 95% rule) and those that are almost certainly not considered for the parameter (i.e., values that are not part of the 99.7% rule selection and have a nonmembership level of 1).

Third, although the literature on option pricing has proposed a wide variety of methodologies for modelling up-and-down moves [5,8,9], developments in FROP have been limited to the most well-known method developed in [6], which we refer to as CRR. In this study, the suitability of using an alternative, which we refer to as RB [7], is analysed. Notably, the main justification for using the BSM is its ability to use the conceptual BSM framework in path-dependent options, where the direct application of the BSM does not apply [4]. To assess binomial approximations to the BSM in the valuation of path-dependent options, we compared their convergence to the value of the BSM in a European option with the same characteristics (strike price, expiration date, volatility, and initial price of the underlying asset). In this study, we evaluated the CRR and RB models on a call option on IBEX35 futures with a maturity of one year that can be traded in the money, at the money, and out of the money.

We observe that the moneyness of the option is relevant for determining the convergence of the proposed intuitionistic fuzzy binomial move models. While the CRR might perform better for options traded in the money, the RB tends to perform better for out-of-the-money options. Additionally, for options traded at the money, the RB always approximated BSM prices better than the CRR did.

The periodicity of moves is a relevant second-order factor. We observe that the best convergence of the CRR in-the-money options and that of the RB out-of-the-money options is significant when the periodicity of the movements is less than one month. However, in periods equal to or greater than monthly, it cannot be established whether any of the methods approximate these moneyness degrees better than the alternatives do. Similarly, we find that the volatility of the option determines which particular model of the binomial moves is better than that of the alternative. We observe that both the superiority of the CRR in the in-the-money options and the superiority of the RB in the out-of-the-money options are significant only in the central volatility scenarios.

The results presented in this study have various theoretical and practical implications. Studies introducing bipolar uncertainty through IFNs are scarce in financial economics, and option principles are nonexistent in fuzzy binomial option pricing. In this context, we outline contributions in the fields of FROP [36,39,40,41,42,43], capital budgeting [51,74,75], and risk evaluation [76,77].

In the contributions of FROP with a binomial framework, the modelling of up-and-down moves was carried out with the formulation of CRR without any critical consideration. We highlight the need to consider alternative models that may converge better to the BSM. In this work, we found that the contemporary modelling by Rendleman and Bartter [7] often converges better to BSM prices than do CRRs in the out-of-the-money options and always in the at-the-money options. The analysis presented in this work can be expanded by introducing alternative up-and-down moves, such as those in [8,9].

The findings of this paper can be useful for practitioners because although volatility or prices are assumed to be intuitionistic fuzzy subsets, their interpretation is very intuitive and does not require knowledge of fuzzy logic. This covers both the construction of the possibility distributions of volatility and the calculation of option prices. The construction of IFNs to measure bipolar uncertainty is based on common quantitative concepts in financial pricing, such as historical volatility [4] and the 95–99.7% rule [62]. Thus, the <1,0>-cut of the variable of interest is a singleton that indicates its possible value with maximum reliability. This is comparable to the result offered by the BSM model or the evaluated binomial models using crisp parameters. The <0,1>-cut set was delimited by extreme values. Thus, the 0-cut of the membership function indicates moderately extreme scenarios, comparable to those generated via the 95% rule. The 1-cut of the nonmembership function indicates extremely extreme scenarios, similar to those generated using the 99.7% rule. Using intermediate levels of membership and nonmembership allows for the structuring of several scenarios linked to prefixed membership and nonmembership levels of interest to the decision maker.

The developments presented in this paper open up several lines for future research, both within option price modelling and in more general areas of quantitative finance. This analysis can undoubtedly be extended to more binomial moves than the two considered in the work and can be applied not only to stock market data but also in the field of real option valuation. In any case, our work has shown that to value a specific non-European option with a proposed binomial model, alternative binomial moves to the CRR should be considered. To determine the optimum moves, it may be particularly useful to assume that these can take the general form in the case of up and for down. Thus, in this problem, the decision variables are and , which must minimize the distance between the binomial and BSM prices of an equivalent European option that we actually want to value (same maturity, strike price, etc.).

The modelling of the parameters that determine price behavior proposed in this work can be generalized to option valuation models where the stochastic process governing the movement of the underlying asset’s price is more complex than a univariate geometric Brownian motion. The uncertainty of other parameters that govern price movements, such as the correlation between the stochastic components in multivariate movements or the parameter quantifying the speed of return to the equilibrium value in mean-reverting processes, can be captured in the intuitional estimation through a probability–possibility transformation criterion, as presented in this work. In this context, [46] quantified the mean reversion parameter as a type-1 fuzzy number on the basis of its estimation through probabilistic intervals with a time series model and applied the criterion of Equation (8).

The intuitionistic fit of volatility presented in this work is based on the concept of historical volatility associated with the prices of the underlying asset [4], which has also been used in the FROP literature [10,45,46]. An alternative procedure could be to adjust intuitionistic fuzzy volatility from observed implicit volatilities. The modelling of implied volatility has been the subject of extensive debate in quantitative finance [78]. In the FROP literature, implicit volatility has been adjusted with fuzzy numbers, either with fuzzy regression [19,20] or with coherent transformations of the empirical distribution functions to possibility distributions [21,71]. These contributions can serve as an analytical basis for adjusting empirical volatilities through IFNs, either by using intuitionistic regression instruments or considering that IFNs can be modelled as bivariate distribution functions.

In financial modelling, methods aimed at making the best possible point predictions, such as neural networks and many machine learning algorithms, are certainly useful [79]. However, we also understand the importance of being able to parametrize predictions that take into account the variability of the parameter of interest, which will be the subject of future analysis. In this work, we have demonstrated that intuitionistic fuzzy modelling can be reliable.

Funding

This research received no external funding.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors on request.

Conflicts of Interest

The author declares no conflicts of interest.

References

- Black, F.; Scholes, M. The pricing of options and corporate liabilities. J. Political Econ. 1973, 81, 637–654. Available online: http://www.jstor.org/stable/1831029 (accessed on 13 October 2023). [CrossRef]

- Merton, R.C. Theory of rational option pricing. Bell J. Econ. Manag. Sci. 1973, 4, 141–183. [Google Scholar] [CrossRef]

- Hull, J.C. Options Futures and Other Derivatives; Pearson Education: New Delhi, India, 2008. [Google Scholar]

- Van der Hoek, J.; Elliott, R.J. Binomial Models in Finance; Springer: New York, NY, USA, 2006. [Google Scholar]

- Chance, D.M. A Synthesis of Binomial Option Pricing Models for Lognormally Distributed Assets. J. Appl. Financ. (Former. Financ. Pract. Educ.) 2008, 18, 38–56. [Google Scholar] [CrossRef]

- Cox, J.; Ross, S.; Rubinstein, M. Option Pricing: A Simplified Approach. J. Financ. Econ. 1979, 7, 229–263. [Google Scholar] [CrossRef]

- Rendleman, R.J., Jr.; Bartter, B.J. Two state option pricing. J. Financ. 1979, 34, 1092–1110. [Google Scholar]

- Trigeorgis, L. A log-transformed binomial numerical analysis method for valuing complex multioption investments. J. Financ. Quant. Anal. 1991, 26, 309–326. [Google Scholar] [CrossRef]

- Jabbour, G.M.; Kramin, M.V.; Young, S.D. Two-state option pricing: Binomial models revisited. J. Futures Mark. Futures Options Other Deriv. Prod. 2001, 21, 987–1001. [Google Scholar] [CrossRef]

- Chrysafis, K.A.; Papadopoulos, B.K. On theoretical pricing of options with fuzzy estimators. J. Comput. Appl. Math. 2009, 223, 552–566. [Google Scholar] [CrossRef]

- Carlsson, C.; Fuller, R. A fuzzy approach to real option valuation. Fuzzy Sets Syst. 2003, 139, 297–312. [Google Scholar] [CrossRef]

- Andrés-Sánchez, J. A systematic review of the interactions of fuzzy set theory and option pricing. Expert Syst. Appl. 2023, 223, 119868. [Google Scholar] [CrossRef]

- Muzzioli, S.; De Baets, B. Fuzzy approaches to option price modelling. IEEE Trans. Fuzzy Syst. 2016, 25, 392–401. [Google Scholar] [CrossRef]

- Romaniuk, M.; Hryniewicz, O. Interval-based, nonparametric approach for resampling of fuzzy numbers. Soft Comput. 2019, 23, 5883–5903. [Google Scholar] [CrossRef]

- Zmeskal, Z. Application of the fuzzy-stochastic methodology to appraising the firm value as a European call option. Eur. J. Oper. Res. 2001, 135, 303–310. [Google Scholar] [CrossRef]

- Wu, H.C. Pricing European options based on the fuzzy pattern of Black-Scholes formula. Comput. Oper. Res. 2004, 31, 1069–1081. [Google Scholar] [CrossRef]

- Guerra, M.L.; Sorini, L.; Stefanini, L. Option price sensitivities through fuzzy numbers. Comput. Math. Appl. 2011, 61, 515–526. [Google Scholar] [CrossRef]

- Kim, Y.; Lee, E.B. Optimal Investment Timing with Investment Propensity Using Fuzzy Real Options Valuation. Int. J. Fuzzy Syst. 2018, 20, 1888–1900. [Google Scholar] [CrossRef]

- Muzzioli, S.; Gambarelli, L.; De Baets, B. Indices for Financial Market Volatility Obtained Through Fuzzy Regression. Int. J. Inf. Technol. Decis. Mak. 2018, 17, 1659–1691. [Google Scholar] [CrossRef]

- Muzzioli, S.; Gambarelli, L.; De Baets, B. Option implied moments obtained through fuzzy regression. Fuzzy Optim. Decis. Mak. 2020, 19, 211–238. [Google Scholar] [CrossRef]

- Capotorti, A.; Figà-Talamanca, G. SMART-or and SMART-and fuzzy average operators: A generalized proposal. Fuzzy Sets Syst. 2020, 395, 1–20. [Google Scholar] [CrossRef]

- Anzilli, L.; Villani, G. Cooperative R&D investment decisions: A fuzzy real option approach. Fuzzy Sets Syst. 2023, 458, 143–164. [Google Scholar] [CrossRef]

- Zhang, H.; Watada, J. Fuzzy Levy-GJR-GARCH American option pricing model based on an infinite pure jump process. IEICE Trans. Inf. Syst. 2018, E101D, 1843–1859. [Google Scholar] [CrossRef]

- Nowak, P.; Pawłowski, M. Application of the Esscher Transform to Pricing Forward Contracts on Energy Markets in a Fuzzy Environment. Entropy 2023, 25, 527. [Google Scholar] [CrossRef] [PubMed]

- Yoshida, Y. A discrete-time model of American put option in an uncertain environment. Eur. J. Oper. Res. 2003, 151, 153–166. [Google Scholar] [CrossRef]

- Muzzioli, S.; Torricelli, C. A multiperiod binomial model for pricing options in a vague world. J. Econ. Dyn. Control 2004, 28, 861–887. [Google Scholar] [CrossRef]

- Lee, C.F.; Tzeng, G.-H.; Wang, S.-Y. A fuzzy set approach for generalized CRR model: An empirical analysis of S&P 500 index options. Rev. Quant. Financ. Account. 2005, 25, 255–275. [Google Scholar] [CrossRef]

- Wang, G.X.; Wang, Y.Y.; Tang, J.M. Fuzzy Option Pricing Based on Fuzzy Number Binary Tree Model. IEEE Trans. Fuzzy Syst. 2022, 30, 3548–3558. [Google Scholar] [CrossRef]

- Meenakshi, K.; Kennedy, F.C. A study of european fuzzy put option buyers model on future contracts involving general trapezoidal fuzzy numbers. Glob. Stoch. Anal. 2021, 8, 47–59. [Google Scholar] [CrossRef]

- Meenakshi, K.; Kennedy, F.C. On some properties of American fuzzy put option model on fuzzy future contracts involving general linear octagonal fuzzy numbers. Adv. Appl. Math. Sci. 2021, 21, 331–342. [Google Scholar] [CrossRef]

- Zmeskal, Z. Generalized soft binomial American real option pricing model (fuzzy-stochastic approach). Eur. J. Oper. Res. 2010, 207, 1096–1103. [Google Scholar] [CrossRef]

- Ho, S.H.; Liao, S.H. A fuzzy real option approach for investment. Expert Syst. Appl. 2011, 38, 15296–15302. [Google Scholar] [CrossRef]

- Anzilli, L.; Facchinetti, G.; Pirotti, T. Pricing of minimum guarantees in life insurance contracts with fuzzy volatility. Inf. Sci. 2018, 460, 578–593. [Google Scholar] [CrossRef]

- Zhang, X.Y.; Yin, J.B. Assessment of investment decisions in bulk shipping through fuzzy real options analysis. Marit. Econ. Logist. 2023, 25, 122–139. [Google Scholar] [CrossRef]

- Zhang, M.J.; Qin, X.Z.; Nan, J.X. Binomial tree model of the European option pricing based on the triangular intuitionistic fuzzy numbers. Syst. Eng. Theory Pract. 2013, 33, 34–40. [Google Scholar] [CrossRef]

- Zmeskal, Z.; Dluhosova, D.; Gurny, P.; Kresta, A. Generalized soft multimode real options model (fuzzy-stochastic approach). Expert Syst. Appl. 2022, 192, 116388. [Google Scholar] [CrossRef]

- Dubois, D.; Prade, H. An overview of the asymmetric bipolar representation of positive and negative information in possibility theory. Fuzzy Sets Syst. 2009, 160, 1355–1366. [Google Scholar] [CrossRef]

- Dubois, D.; Prade, H. Gradualness, uncertainty and bipolarity: Making sense of fuzzy sets. Fuzzy Sets Syst. 2012, 192, 3–24. [Google Scholar] [CrossRef]

- Wu, L.; Liu, J.F.; Wang, J.T.; Zhuang, Y.M. Pricing for a basket of LCDS under fuzzy environments. SpringerPlus 2016, 5, 1747. [Google Scholar] [CrossRef]

- Wu, L.; Zhuang, Y.M.; Li, W. A New Default Intensity Model with Fuzziness and Hesitation. Int. J. Comput. Intell. Syst. 2016, 9, 340–350. [Google Scholar] [CrossRef]

- Wu, L.; Mei, X.B.; Sun, J.G. A New Default Probability Calculation Formula an Its Application under Uncertain Environments. Discret. Dyn. Nat. Soc. 2018, 2018, 3481863. [Google Scholar] [CrossRef]

- Ersen, H.Y.; Tas, O.; Kahraman, C. Intuitionistic fuzzy real-options theory and its application to solar energy investment projects. Eng. Econ. 2018, 29, 140–150. [Google Scholar] [CrossRef]

- Ersen, H.Y.; Tas, O.; Ugurlu, U. Solar Energy Investment Valuation with Intuitionistic Fuzzy Trinomial Lattice Real Option Model. IEEE Trans. Eng. Manag. 2023, 70, 2584–2593. [Google Scholar] [CrossRef]

- Dubois, D.; Folloy, L.; Mauris, G.; Prade, H. Probability–possibility transformations, triangular fuzzy sets, and probabilistic inequalities. Reliab. Comput. 2004, 10, 273–297. [Google Scholar] [CrossRef]

- Chrysafis, K.A.; Papadopoulos, B.K. Decision Making for Project Appraisal in Uncertain Environments: A Fuzzy-Possibilistic Approach of the Expanded NPV Method. Symmetry 2021, 13, 27. [Google Scholar] [CrossRef]

- Andrés-Sánchez, J. A Fuzzy-Random Extension of Jamshidian’s Bond Option Pricing Model and Compatible One-Factor Term Structure Models. Axioms 2023, 12, 668. [Google Scholar] [CrossRef]

- Hull, J.; White, A. The use of the control variate technique in option pricing. J. Financ. Quant. Anal. 1988, 23, 237–251. [Google Scholar] [CrossRef]

- Zadeh, L.A. Fuzzy Sets. Inf. Control 1965, 8, 338–353. [Google Scholar] [CrossRef]

- Dubois, D.; Prade, H. Fuzzy numbers: An overview. In Readings in Fuzzy Sets and Intelligent Systems; Dubois, D., Prade, H., Yager, R.R., Eds.; Elsevier: Amsterdam, The Netherlands, 1993; pp. 112–148. [Google Scholar] [CrossRef]

- Atanassov, K. Intuitionistic fuzzy sets. Fuzzy Sets Syst. 1986, 20, 87–96. [Google Scholar] [CrossRef]

- Kahraman, C.; Onar, Ç.; Öztayşi, B. Engineering economic analyses using intuitionistic and hesitant fuzzy sets. J. Intell. Fuzzy Syst. 2015, 29, 1151–1168. [Google Scholar] [CrossRef]

- Mitchell, H.B. Ranking-intuitionistic fuzzy numbers. Int. J. Uncertain. Fuzziness Knowl.-Based Syst. 2004, 12, 377–386. [Google Scholar] [CrossRef]

- Arefi, M.; Taheri, S.M. Least-Squares Regression Based on Atanassov’s Intuitionistic Fuzzy Inputs–Outputs and Atanassov’s Intuitionistic Fuzzy Parameters. IEEE Trans. Fuzzy Syst. 2015, 23, 1142–1154. [Google Scholar] [CrossRef]

- Mohan, S.; Kannusamy, A.P.; Samiappan, V. A new approach for ranking of intuitionistic fuzzy numbers. J. Fuzzy Ext. Appl. 2020, 1, 15–26. [Google Scholar]

- Couso, I.; Montes, S.; Gil, P. The necessity of the strong α-cuts of a fuzzy set. Int. J. Uncertain. Fuzziness Knowl. Based Syst. 2001, 9, 249–262. [Google Scholar] [CrossRef]

- Mauris, G.; Lasserre, V.; Foulloy, L. A fuzzy approach for the expression of uncertainty in measurement. Measurement 2001, 29, 165–177. [Google Scholar] [CrossRef]

- Buckley, J.J. Fuzzy statistics: Hypothesis testing. Soft Comput. 2005, 9, 512–518. [Google Scholar] [CrossRef]

- Falsafain, A.; Taheri, S.M. On Buckley’s approach to fuzzy estimation. Soft Comput. 2011, 15, 345–349. [Google Scholar] [CrossRef]

- Sfiris, D.S.; Papadopoulos, B.K. Nonasymptotic fuzzy estimators based on confidence intervals. Inf. Sci. 2014, 279, 446–459. [Google Scholar] [CrossRef]

- Adjenughwure, K.; Papadopoulos, B. Fuzzy-statistical prediction intervals from crisp regression models. Evol. Syst. 2020, 11, 201–213. [Google Scholar] [CrossRef]

- Al-Kandari, M.; Adjenughwure, K.; Papadopoulos, K. A Fuzzy-Statistical Tolerance Interval from Residuals of Crisp Linear Regression Models. Mathematics 2020, 8, 1422. [Google Scholar] [CrossRef]

- Alostad, H.; Davulcu, H. Directional prediction of stock prices using breaking news on Twitter. Web Intell. 2017, 15, 1–17. [Google Scholar] [CrossRef]

- Parvathi, R.; Malathi, C.; Akram, M.; Atanassov, K. Intuitionistic fuzzy linear regression analysis. Fuzzy Optim. Decis. Mak. 2013, 12, 215–229. [Google Scholar] [CrossRef]

- Buckley, J.J.; Qu, Y. On using α-cuts to evaluate fuzzy equations. Fuzzy Sets Syst. 1990, 38, 309–312. [Google Scholar] [CrossRef]

- Black, F. The pricing of commodity contracts. J. Financ. Econ. 1976, 3, 167–179. [Google Scholar] [CrossRef]

- Thiagarajah, K.; Appadoo, S.S.; Thavaneswaran, A. Option valuation model with adaptive fuzzy numbers. Comput. Math. Appl. 2007, 53, 831–841. [Google Scholar] [CrossRef]

- Andrés-Sánchez, J. Pricing European Options with Triangular Fuzzy Parameters: Assessing Alternative Triangular Approximations in the Spanish Stock Option Market. Int. J. Fuzzy Syst. 2018, 20, 1624–1643. [Google Scholar] [CrossRef]

- Guerra, M.L.; Sorini, L.; Stefanini, L. Value Function Computation in Fuzzy Models by Differential Evolution. Int. J. Fuzzy Syst. 2017, 19, 1025–1031. [Google Scholar] [CrossRef]

- Li, H.; Ware, A.; Di, L.; Yuan, G.; Swishchuk, A.; Yuan, S. The application of nonlinear fuzzy parameters PDE method in pricing and hedging European options. Fuzzy Sets Syst. 2018, 331, 14–25. [Google Scholar] [CrossRef]

- Chen, H.M.; Hu, C.F.; Yeh, W.C. Option pricing and the Greeks under Gaussian fuzzy environments. Soft Comput. 2019, 23, 13351–13374. [Google Scholar] [CrossRef]

- Capotorti, A.; Figa-Talamanca, G. On an implicit assessment of fuzzy volatility in the Black and Scholes environment. Fuzzy Sets Syst. 2013, 223, 59–71. [Google Scholar] [CrossRef]

- Collan, M.; Carlsson, C.; Majlender, P. Fuzzy Black and Scholes real options pricing. J. Decis. Syst. 2003, 12, 391–416. [Google Scholar] [CrossRef]

- Tolga, A.Ç.; Kahraman, C.; Demircan, M.L. A Comparative Fuzzy Real Options Valuation Model using Trinomial Lattice and Black-Scholes Approaches: A Call Center Application. J. Mult.-Valued Log. Soft Comput. 2010, 16, 135. [Google Scholar]

- Boltürk, E.; Kahraman, C. Interval-valued and circular intuitionistic fuzzy present worth analyses. Informatica 2022, 33, 693–711. [Google Scholar] [CrossRef]

- Haktanır, E.; Kahraman, C. Intuitionistic fuzzy risk adjusted discount rate and certainty equivalent methods for risky projects. Int. J. Prod. Econ. 2023, 257, 108757. [Google Scholar] [CrossRef]

- Uzhga-Rebrov, O.; Grabusts, P. Methodology for Environmental Risk Analysis Based on Intuitionistic Fuzzy Values. Risks 2023, 11, 88. [Google Scholar] [CrossRef]

- Andrés-Sánchez, J.D. Pricing Life Contingencies Linked to Impaired Life Expectancies Using Intuitionistic Fuzzy Parameters. Risks 2024, 12, 29. [Google Scholar] [CrossRef]

- Di Persio, L.; Vettori, S. Markov Switching Model Analysis of Implied Volatility for Market Indexes with Applications to S&P 500 and DAX. J. Math. 2014, 2014, 753852. [Google Scholar] [CrossRef]

- Di Persio, L.; Honchar, O. Multitask machine learning for financial forecasting. Int. J. Circuits Syst. Signal Process. 2018, 12, 444–451. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).