2. Intuitionistic Fuzzy Numbers

2.1. Fuzzy Numbers and Intuitionistic Fuzzy Numbers

Definition 1. A fuzzy set (FS) in a referential set

,

is defined as [44]: where

is the so-called membership function. Definition 2. The fuzzy set

can be represented through level sets or -cuts,

[44]: Definition 3. A fuzzy number (FN),

, is a fuzzy subset of the real line [45] such that the membership function is an upper semicontinuous function that accomplishes: - i.

is normal, i.e.,

- ii.

is convex, i.e.,

Remark 1. As a consequence, the α-cuts of and are confidence intervals:

where

is an increasing function of

and

is a decreasing function. Remark 2. The membership function of is also called the distribution function.

Definition 4. A triangular fuzzy number (TFN) can be represented by the triplet , . Then, the membership function is as follows:

being the α-cut representation: Fuzzy set theory commonly represents imprecise quantities and parameters using fuzzy numbers (FNs) [

45]. Specifically, TFNs are very common in practical applications within fuzzy set theory since the grading of the membership level is performed linearly, which is reasonable because it applies the principle of parsimony when dealing with vague information [

46].

Definition 5. The intuitionistic fuzzy set (IFS) defined in a referential set is [30]: where

measures the membership of

in

, and

is nonmembership. These functions must accomplish the following: Remark 3. Note that is not necessarily true, that is, an element is allowed to belong to and its complement with a degree of hesitancy, , which is:

Remark 4. An IFS generalizes the concept of an FS such that if , is a conventional FS.

Definition 6. An IFN can be expressed using -levels or -cuts, , [30]: Remark 5. can be decoupled into two level sets [47]: Definition 7. An intuitionistic fuzzy number (IFN) is an IFS defined for real numbers [34], such that the membership function and the nonmembership function are upper semicontinuous functions that accomplish the following: - i.

It is normal, i.e.,

- ii.

is convex,

- iii.

and

is concave:

Remark 6. The -cuts of and can be decoupled as:

where is an increasing (decreasing) function of and decreases (increases) with respect to . Remark 7. Thus, an -level of can be represented:

An IFN is an imprecise quantity that must be quantified by a real number. If nonmembership is established as

, then

is an FN.

Remark 8. In an IFN, is also known as the lower possibility distribution function of the quantity of interest A, and is the upper distribution function of the uncertain quantity [32].

The membership functions

and

can be interpreted as bipolar possibility distribution measurements in such a way that

accounts for the potential possibility and

accounts for the real possibility of

being

[

10].

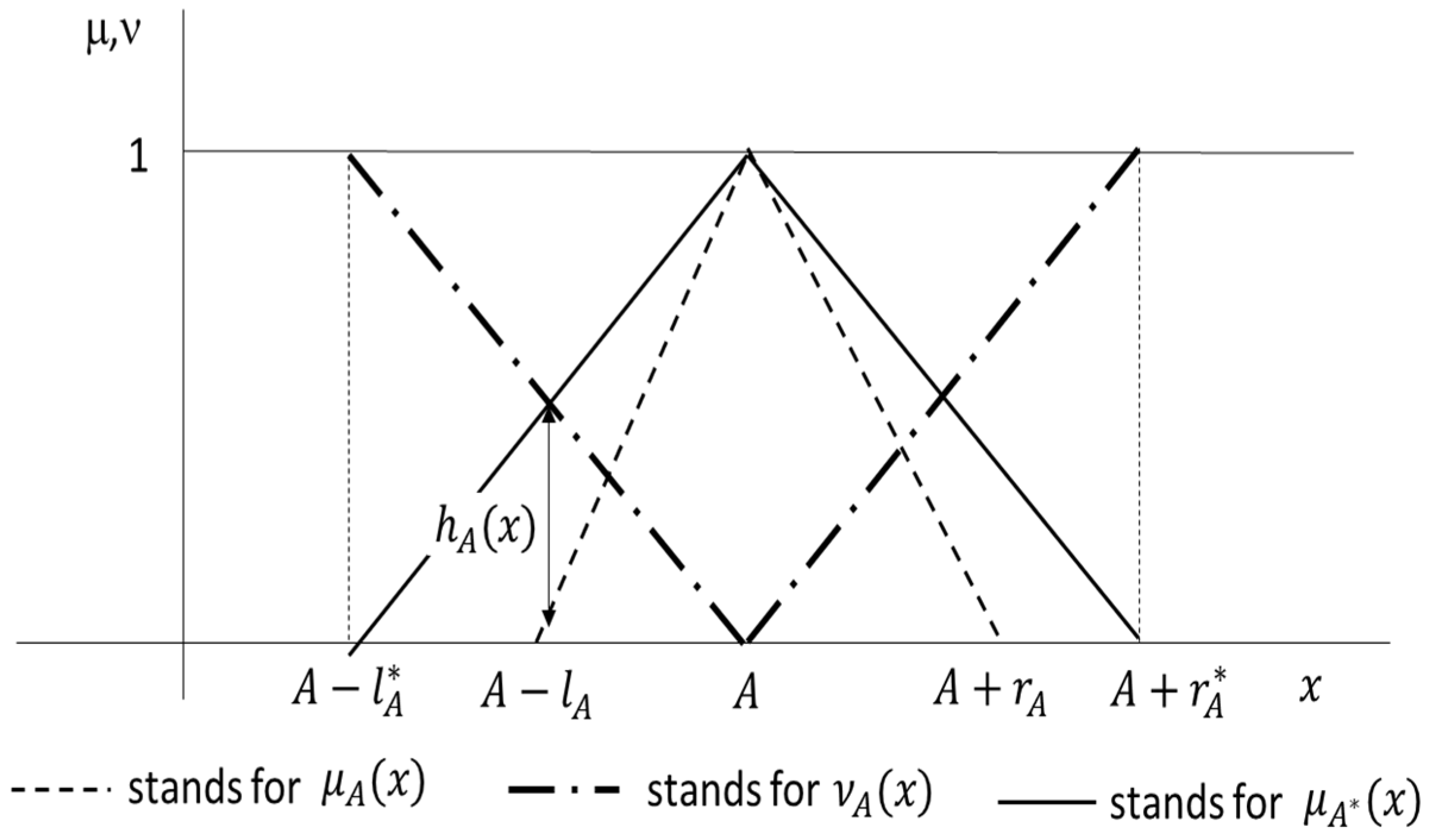

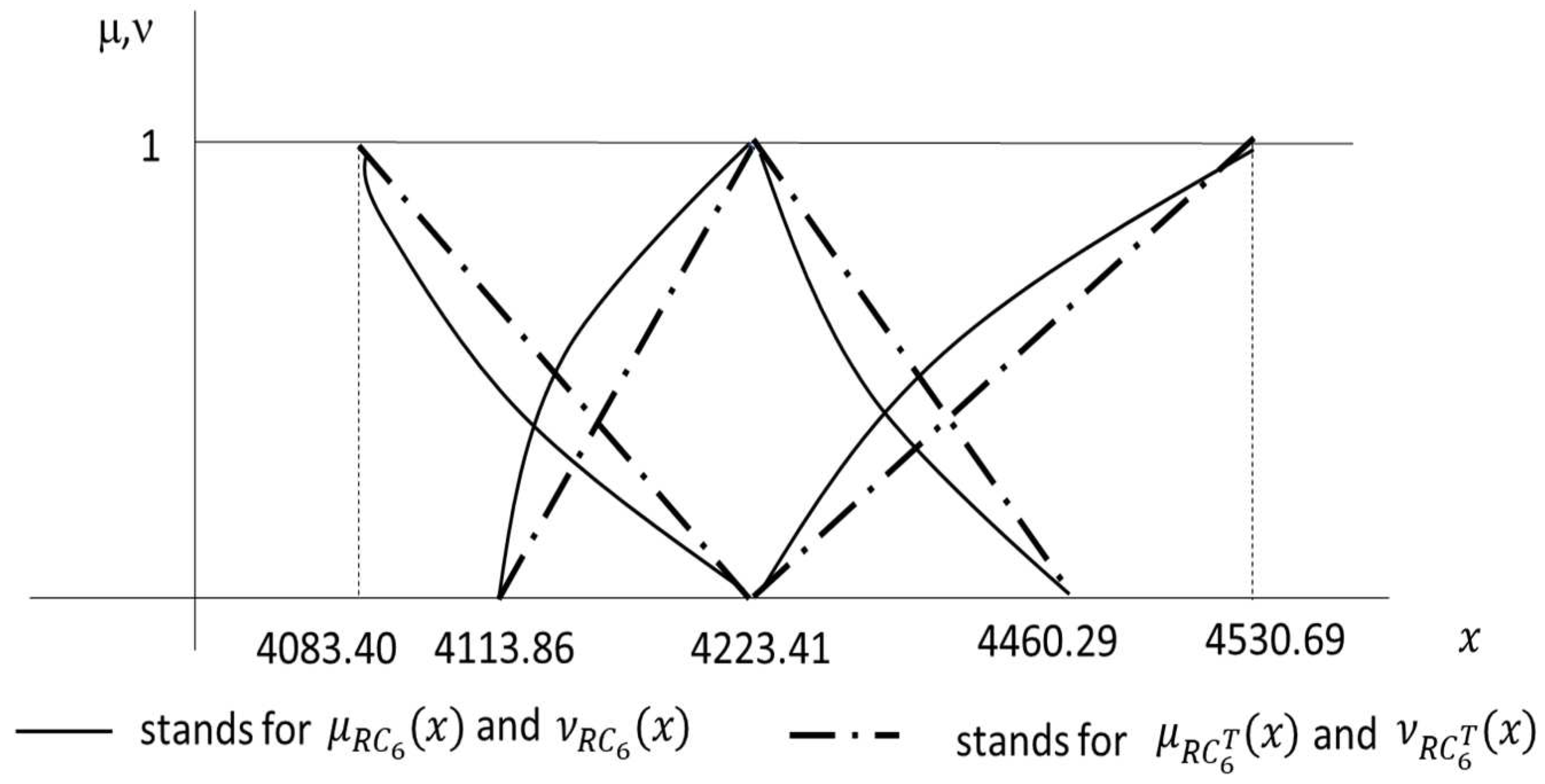

Definition 8. A triangular intuitionistic fuzzy number (TIFN) can be denoted as , with membership and nonmembership functions [41]: andwhere and . Figure 1 depicts the shape of a TIFN and the relationship between the embedded functions, , and Remark 9. The level sets

of a TIFN can be decoupled into:

Thus, TIFNs are an extension of TFNs, such that if

and

, we deal with a conventional TFN [

48]. Triangular uncertain parameters are commonly considered in practical applications involving intuitionistic modelling [

34,

48,

49,

50,

51]. The argument put forward in [

46], based on the application of the parsimony principle for the use of TFNs, can be extended to the use of TIFNs.

A TIFN adapts very naturally to the way humans make estimations by incorporating more nuances than are necessary to fit a TFN. Thus, represents the scenario with the maximum reliability. Moreover, whereas and are two extreme lower-case scenarios, and are two extreme upper-case scenarios. is considerably lower than the central value, and is exceptionally low compared to the possible values of the parameter. For example, in the context of a random variable, the first scenario could be a reasonably small percentile (e.g., the 5th percentile), and the second could be a virtually impossible value (e.g., the 0.1 percentile). If 0, we do not assign a likelihood to parameter taking the value but rather express some level of doubt about its nonmembership, , because .

Of course, , which can be assimilated to a relatively high percentile of a random variable (e.g., the 95th percentile) must be interpreted in a similar way. In contrast, is potentially an extremely high value (e.g., 99.5th percentile).

Note that TIFNs allow modelling estimations of a parameter that, while its knowledge may also be vague and imprecise, contains more nuances than an FN. For instance, a statement such as “An adequate interest rate to fit discounted reserves is approximately 3%, ranging from 2.5% to 4%. However, that a value must not be lower than 2% or higher than 5%” could be quantified as the TIFN (3%, 0.5%, 0.5%, 1%, 1%).

2.2. Intuitionistic Fuzzy Number Arithmetic

In the Introduction, we reviewed various approaches that fuzzy research has provided for estimating claim reserves using fuzzy logic. Ultimately, obtaining estimates for outstanding claims at different time points will require the evaluation of parameter functions whose values are fuzzy. This issue necessitates the application of Zadeh’s extension principle with max–min operators, which are typically implemented through the functional analysis of alpha-level sets.

The results of [

52] allow the evaluation of functions with fuzzy estimates of variables through alpha-cuts developed in [

53,

54,

55] to be generalized to IFN arithmetic. As far as we are concerned, we will evaluate continuous and differentiable functions,

, such that the values of the input variables are given the means of IFNs

. This generates IFN

,

. The use of the generalized Zadeh’s principle by using the min–norm and max–conorm allows us to state the membership and nonmembership of

as [

41,

52]:

Therefore, if are FNs, it is only necessary to obtain using the usual max–min principle.

The evaluation of the functions of FNs such as TFNs is often performed through α-level sets [

54,

55]. Similarly, the value of the intuitionistic fuzzy number

is obtained by means of its

cuts,

, instead of by evaluating

and

. Thus, to obtain

, we must implement

from the

cuts of

,

:

and given that

is decoupled in

and

(see Remark 7) and that

is continuous,

can also be decoupled in

and

. According to [

54,

55], when

monotonically increases with respect to

and monotonically decreases in

,

,

is:

By comparison, the

β-cuts of

are

The linear combination of TIFNs is also a TIFN. Therefore, let us have a linear operation

where

and

Therefore,

, where [

41]

Given that the evaluation of nonlinear functions using TFNs does not produce a TIFN, it can also be generalized to TIFNs. Despite this limitation, [

46] argues that linear shapes often offer an effective solution to practical issues in the majority of cases. It is well known that there are many financial functions that, despite not being linear, when they are evaluated, the result is accurately approximated by a TFN that conserves the same support (the 0-cut) and core (the 1-cut). In the actuarial field, this has been proposed for the estimation of claim reserves [

11,

12,

17,

24], the final value of a pension plan [

56], asymptotic probabilities of the number of claims in a bonus-malus system [

57], or the price of life settlements [

58]. Following the same philosophy, [

33] postulates that the net present value function, when cash flows and discount rates are estimated using TIFNs, can be approximated through a TIFN with the same <0,1>-cut and <1,0>-cut. Therefore, in this study, when the initial data are estimated by TIFNs

, the approximate TIFN

is considered:

By comparison with the error measurement in the triangular approximation of fuzzy numbers [

58], the quality of the relative error measurement in the bounds of

calculated with (2a–d) by those of its triangular approximation, (4),

in

are:

The use of Equation (5) allows us to assess the goodness of fit of the linear approximation in numerical applications, which requires only evaluating five scenarios in (4) compared to the exact -cuts that require the calculation of (3a–d) for the established pairs.

3. Intuitionistic Linear Regression with the Minimum Fuzziness Principle and Asymmetric Coefficients

Within fuzzy regression models, we can identify two major families. The first group consists of possibilistic regressions that are also referred to as minimum fuzziness principle (MFP) regressions. Some examples are [

21,

22,

23], which fit parameters by minimizing the fuzziness of the system, subject to the condition that the adjusted function must include the observations [

20]. Secondly, we can outline the methodology based on the minimization of the distance between observations and estimates. A clear example in this regard is the method known as fuzzy least squares [

20]. Our approach should be understood within this first stream.

Parvati et al. [

41] generalized the regression model [

21,

22]. Thus, given that [

21,

22] modelled the coefficients as symmetric TFNs, [

41] assumed that these coefficients were symmetric TIFNs. Drawing inspiration from [

41], our study extends the fuzzy regression method [

23] to the use of TIFNs. In contrast to [

41], we do not require the coefficients to be symmetrical. The advantage of this approach is that we can capture the possibility of asymmetry in the system, as the adjusted coefficients will generally be nonsymmetric. The disadvantage is that, while in [

41], the parameters are adjusted by solving a single minimization program, our method requires the sequential application of ordinary least squares and the resolution of a linear program similar to that of [

41].

We start with the assumption that the system is adjusted and has an outcome variable dependent on

m crisp input variables,

, i = 0, 1, 2…,

m, where

and

,

i = 1, 2,…,

n. The outcome is a linear function of intuitionistic coefficients

and, therefore, a TIFN

. This is obtained by considering that the observations of the input variables

are the scalars in (3a–c). Thus, Equation (3) in [

41] is extended to nonsymmetrical TIFNs as follows:

Moreover, both the observations of the input and output variables are crisp. This is a common circumstance in fuzzy regression models, and [

23,

41] also assume such a situation. Thus, for the

j-th observation, the outcome is the crisp number

, generated by the crisp incomes

. Therefore,

is a possible value of a TIFN

, whose membership function

and nonmembership function

in (1a) and (1b) are determined by the following:

The objective of MFP regression models is to obtain the parameter estimates of

such that

. In possibilistic regression models, there is a dual objective: minimizing the uncertainty of the system and maximizing the membership of the elements within it. Thus, similar to [

41], the problem of finding

involves solving a multiobjective programming problem with four cost functions.

subject to:

To solve (8a–c), we implement the following steps:

Step 1: Following [

23], we first fit the estimates of the centres

,

,

i = 0, 1,…,

m by using the least squares method. Therefore, the point estimates of

are

, as are the residuals,

.

Step 2: Following [

41], we must state a minimum reachable value

and

β = 1 −

−

h for the system defined in Equation (8a,b). Note that

∈ [0,1) scales the total fuzziness of the estimated system. If

= 0, the uncertainty of the system is minimal; conversely, the inclusiveness of the observations may be low. On the other hand, a higher

causes all observations to be included with high intensity, but the system may make fewer specific predictions [

59].

The value of

h ∈ [0,1 −

) reflects the level of system hesitancy. For

h = 0, the actual and potential possibility of a particular value are identical; therefore, we have a conventional possibilistic regression. In contrast, higher

h values suggest a greater degree of hesitancy, indicating a greater discrepancy between

and

. Therefore, in this step, (8a–c) are decoupled as follows:

subject to

and

subject to

Step 3. By following [

60], we initially fit (9a–d) by considering

. Thus, we adjusted a possibilistic regression model [

23],

and

. This leads to an estimate of

and

, which we denote as

and

, respectively, where

i = 0, 1,…,

m. It is easy to confirm that if

,

=

. Thus, we must solve:

subject to

Step 4. We establish the optimal value of

based on the criterion [

60]. This value optimizes what these authors refer to as the credibility of the system. To achieve this, we define the estimation of

obtained from the parameters adjusted in step 1 and step 3 as

, i.e.,

is a TFN where:

was obtained in step 1 and

Thus, [

60] proposed the following for the optimum value of

:

being:

Then, for

and

, we state the following:

Step 5. We subsequently proceed to obtain the estimates of

and

. To achieve this, we must determine the degree of hesitancy in the system, where

In the case where

, there is no hesitancy; if

, the level of hesitancy is at its maximum. Thus,

5. Empirical Application

This section develops an empirical application to test the intuitionistic methodology proposed in the above section. The data come from the run-off triangle of accumulated claims and its associated triangle of incremental claims, as shown in

Table 4, which have been utilized in studies such as [

3,

62,

63]. To complete the run-off triangles, we implement the chain ladder methodology (12a,b) two-way ANOVA (14a–d). The results from the deterministic chain ladder method are provided in

Table 5. With respect to two-way ANOVA, the coefficient estimates from (14b) are provided in

Table 6, and the complete run-off triangle of incremental claims is provided in

Table 7.

In both cases, using Equation (13a–d), we can obtain the point estimate of the reserves, as shown in

Table 5 for the chain-ladder methodology and in

Table 7 for the log-normal model. The empirical application is focused on fitting total reserves (

) and those associated with the origin year 5 (

) and the calendar year 6 (

).

Subsequently, in

Table 8, we apply the bootstrapping methodology [

62] to make interval predictions, both with the scheme provided by the chain ladder and that provided by two-way ANOVA. In both cases, we present confidence intervals for significance levels of 0.5%, 5%, 10%, and 50%, which is simply the median.

Next, we adjust the intuitionistic model proposed in

Section 4.2. To achieve this, we need the coefficients and errors from fitting the log-normal model in

Table 6 and

Table 9. First, we must solve the linear program (16a–c), which, in our case, is:

subject to:

Table 10 displays the argmax of

and

for

. From these values, using (11a–e), we must obtain the value

, which allows

to be fitted with (11f). We found that

; thus, the spreads of the membership coefficients are those shown in

Table 10. We must subsequently determine the hesitancy level of the system, which must be

h∈[0, 0.897]. In this numerical application, we have stated that

h = 0.2. Using (11g), we finally fitted the spreads

, as shown in

Table 10.

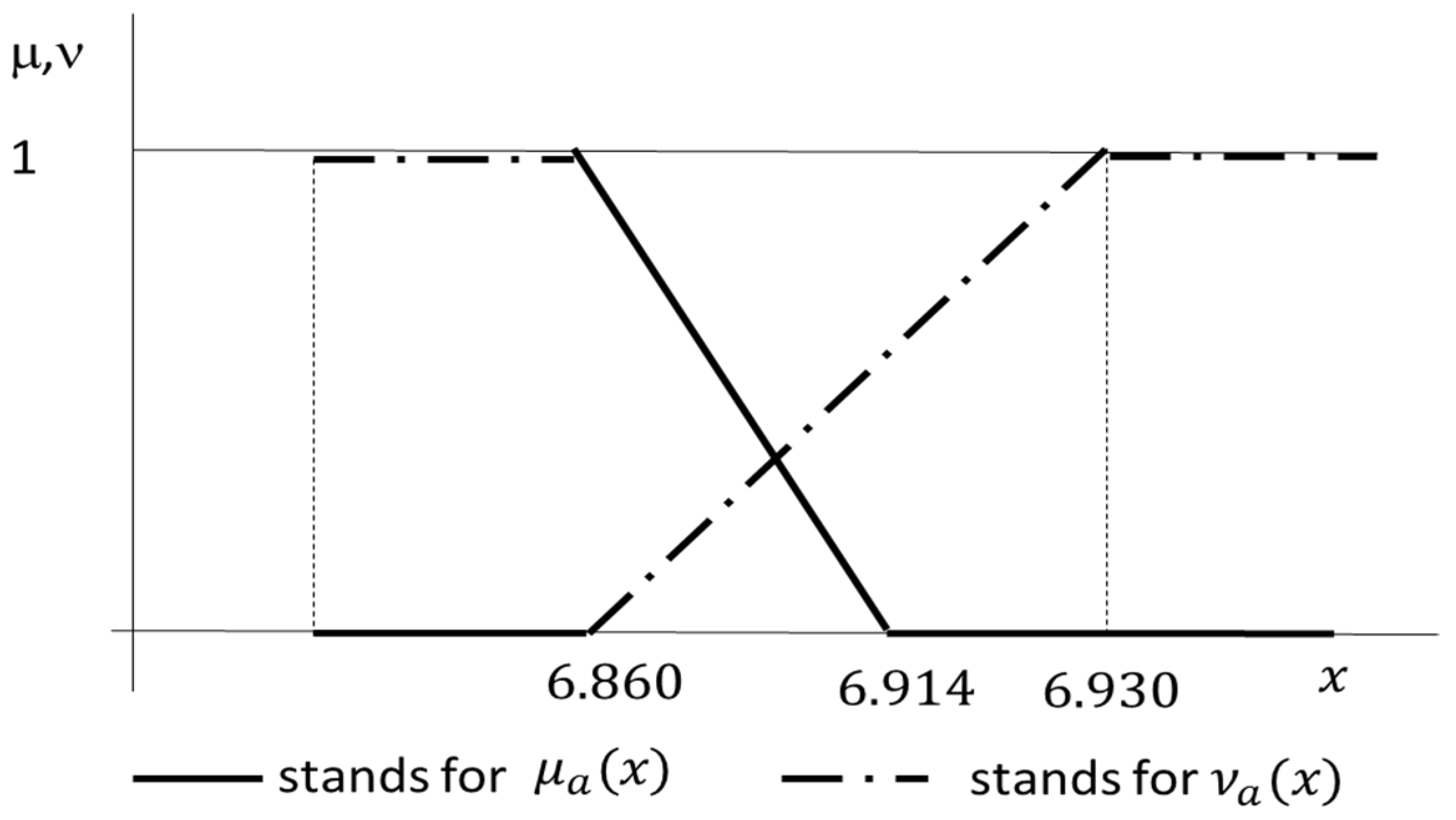

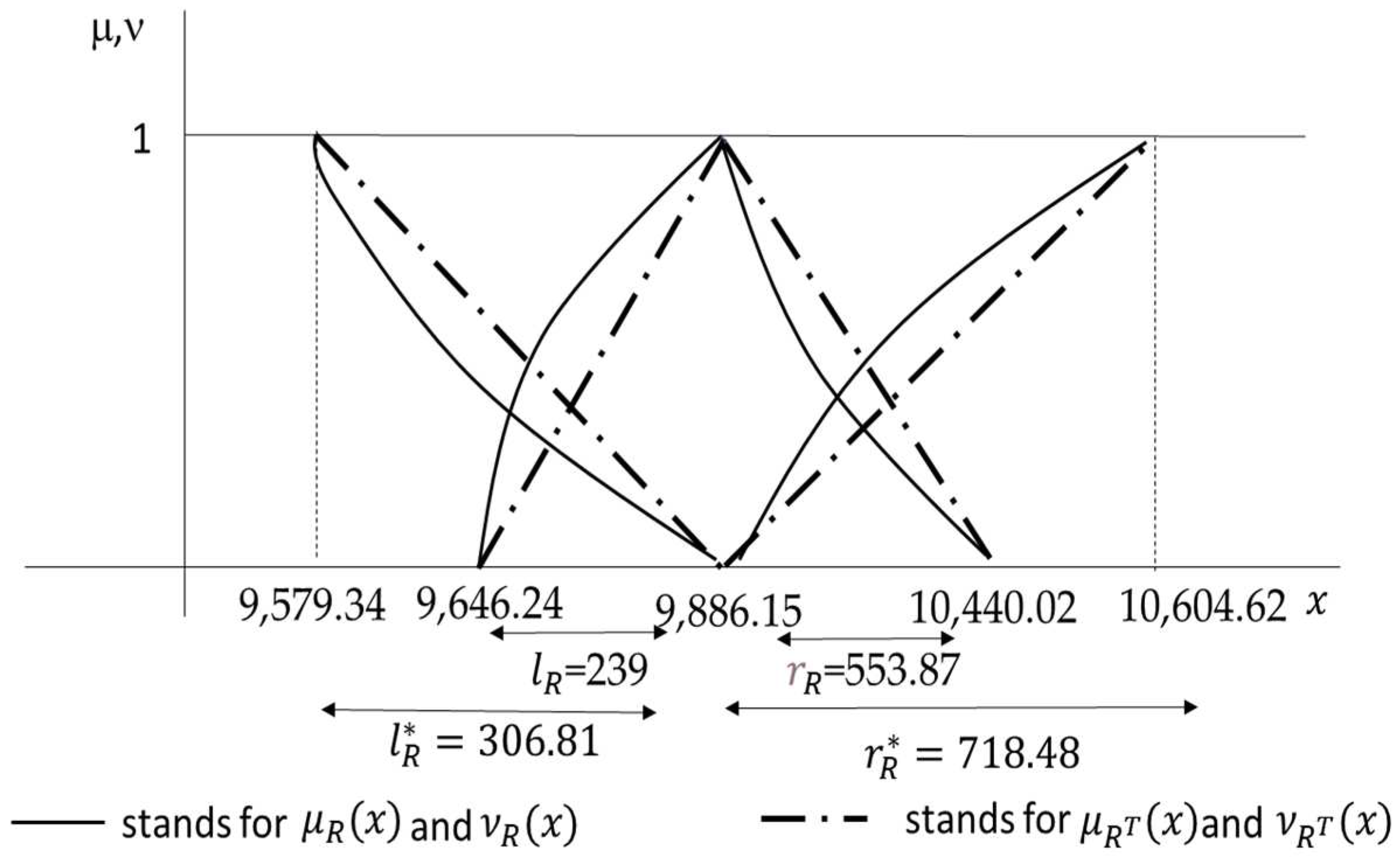

Figure 2 displays the shape of the parameter

, while

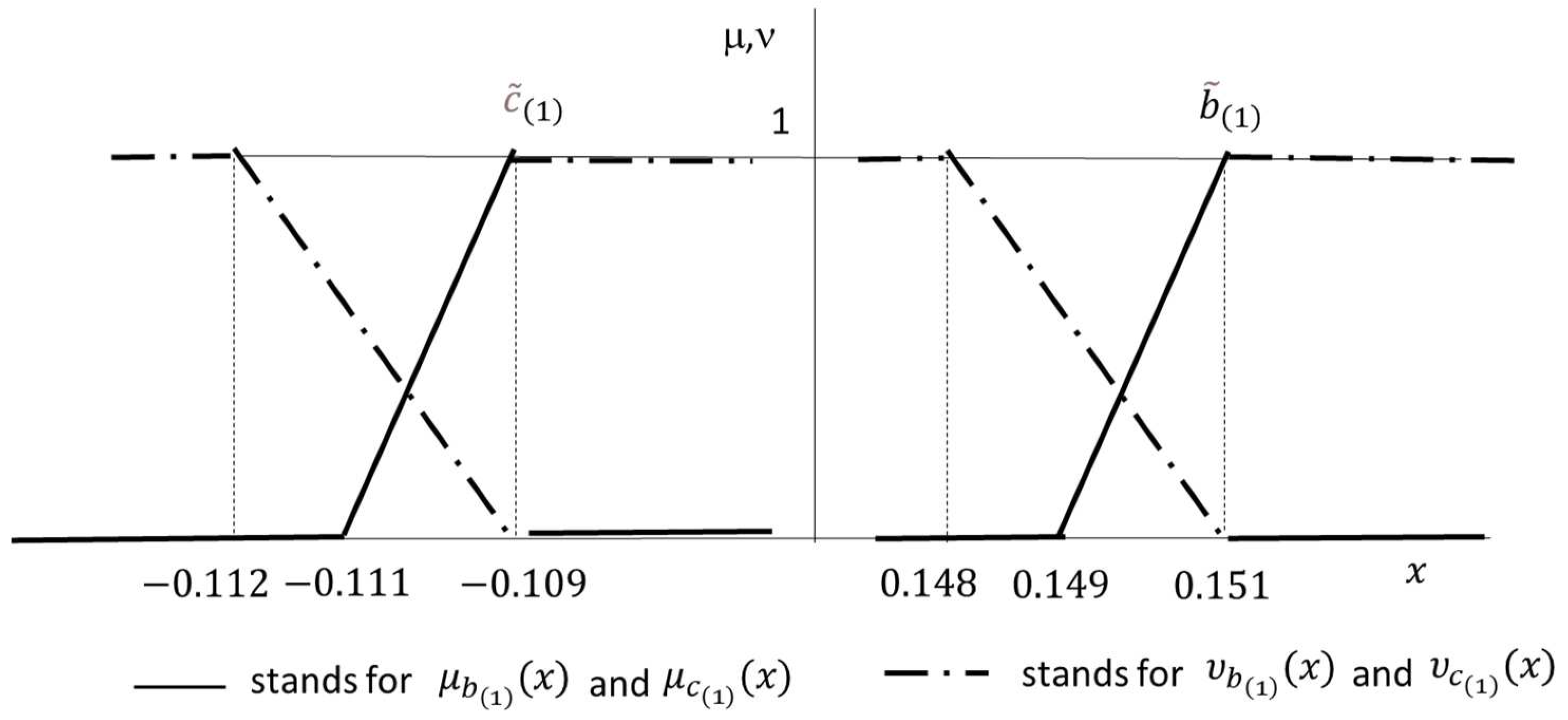

Figure 3 displays

and

.

The fact that the parameters governing the evolution of incremental claims are TIFNs allows for their interpretation as a structured sensitivity analysis of the values that can be reached and not reached. Thus, in

Figure 2, we can observe that the logarithm of the baseline incremental claims (

) has a maximum likelihood value of 6.86. However, a value of 6.914 is estimated to be possible, and values greater than 6.930 are deemed impossible. Values below 6.860 are not considered unattainable.

Using

Figure 3, we can similarly interpret the growth rates of claims for origin year 1 and development year 1. For example, the most likely value for

is −0.109. However, deviations below this value up to −0.111 are estimated as much as possible, and values less than −0.112 are unavailable. Analogous considerations can be made for the remaining TIFN parameters shown in

Table 10. Thus, while the most sensitive parameters, that is, those with larger radii, are

,

and

(in order of sensitivity), the least sensitive growth rates are

and

since their radii are zero.

Table 11 shows the

-cuts of the estimates for the reserves associated with the fifth year of origin

and the sixth calendar year

.

Table 12 shows those for the total reserves

. In all the cases, we considered

,

α = 0, 0.25, 0.5, 0.75, 1. The

-cuts of their triangular approximations

, the calendar year

, and the total reserves

are also provided. We can observe that the linear approximation for all three reserves is practically perfect. The largest errors (5) are never greater than 0.06% and always in the

-cuts.

The set of

-cuts of

,

and

in

Table 11 and

Table 12 can be interpreted as sensitivity assessments regarding the variability of reserves. The ability to include all reserves is maximal at

= 0 and

= 1 (i.e., in the <0,1>-cut). However, the reserves estimated in this <0,1>-cut exhibit very low specificity. In contrast, in the <1,0>-cut, the specificity of the prediction is maximal, but it does not provide any estimation of possible deviations from the most plausible value. The interval between comprehensiveness and specificity may be the <0.5,0.5>-cut.

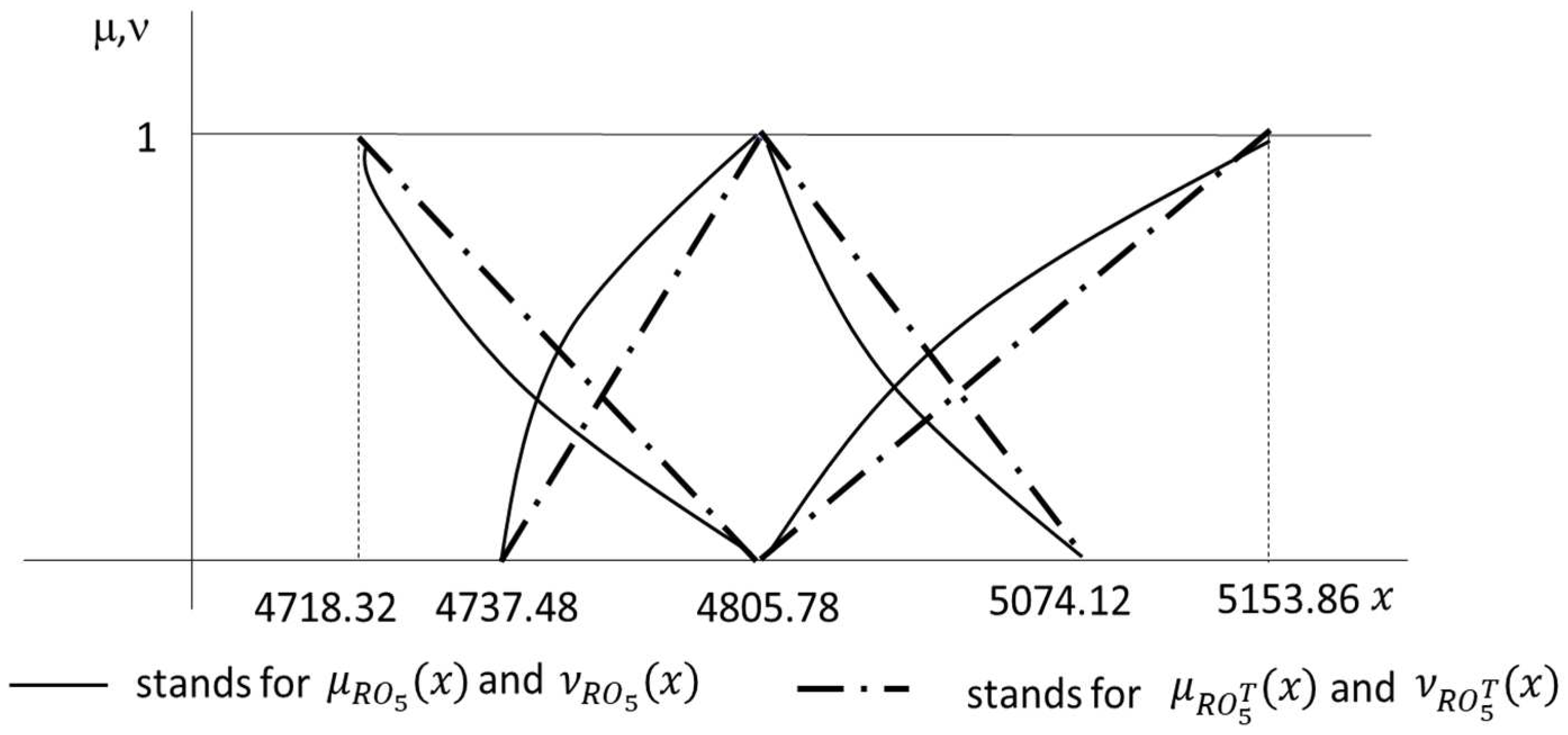

While

Figure 4 and

Figure 5 illustrate the shape of the intuitionistic fuzzy number that quantifies partial reserves and their triangular approximations,

Figure 6 does so for the overall reserves. The information provided by the TIFN estimation of reserves is very intuitive for identifying an actuarial judgement and can also be interpreted as a structured sensitivity analysis of the adequate value for a set of five scenarios. The overall reserve with the highest reliability is 9886.15. The estimated deviations for these reserves are presented in the form of bipolar information, foreseeing possible maximum upper deviations of 553.87; in other words, the reserve to be allocated would be 10,443.02. Regardless, such fluctuations can never exceed 718.48, resulting in reserves of 10,604.62.

We can interpret the

-cuts of reserves (

Table 11 and

Table 12) as similar to probabilistic intervals (

Table 8). The equivalence between the α-cuts of possibility distributions and probabilistic confidence intervals has been extensively documented in the literature on probability–possibility transformations [

64,

65,

66,

67]. In this regard, it should be emphasized that the

-cut of the nonmembership function of an IFN can be interpreted as the (1 −

) of the upper possibility function [

32]. Thus, the 0-cut of the membership function could be likened to probabilistic confidence intervals that include a majority of possible outcomes but not the most extreme ones. We refer, for example, to significance levels of 10% or 5%. Similarly, the 1-cut of the nonmembership function can be interpreted as a probabilistic confidence interval whose goal is to include practically all outcomes, which could be positioned at 0.5% or lower.

On the other hand, as shown in

Table 13, we can observe that the adjusted IFN reports the expressed level of reliability, from an intuitional point of view, regarding possible realizations of reserves. The tested values come from the point estimation and bootstrap estimates that accumulate 50%, 95%, 97.5%, and 99.95% probability. As we could expect, the point predictions and those associated with the 50th percentile have an almost total or total level of membership and an almost negligible level of nonmembership, with a degree of hesitancy that is almost nonexistent. The levels of membership, nonmembership, and hesitancy provide complementary measures to the accumulated probability levels that can be very useful for the decision maker in determining the final level of reserves, which should be prudent but not extremely unrealistic, thus unnecessarily burdening the insurer’s financial statements.

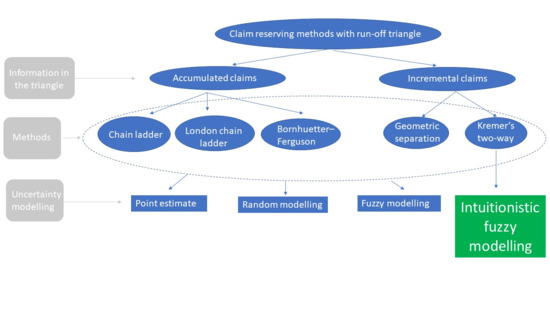

6. Discussion

A robust quantification of provisions for pending claims requires establishing a value with maximum reliability but also allowing for a margin of variability. While deterministic methods provide reliable values, stochastic methods can additionally estimate variability margins [

2]. A third stream of methods, encompassing this work, involves modelling claims provisions through fuzzy quantities [

10], which also entails predicting a reliable value and the variability of reserves.

The evolution of claims over time can be deterministically modelled, for example, with methods such as the chain ladder. However, the final determination of loss values is subject to deviations from deterministic predictions. Stochastic methods model these deviations by generalizing deterministic models through the random modelling of deviations [

2]. Similarly, possibilistic models generalize these schemes under the assumption that the parameters governing claiming processes are fuzzy numbers (FNs). These include schemes such as the chain ladder [

12,

29], London chain ladder [

11,

27], Bornhuetter–Ferguson scheme [

24], Taylor’s geometric separation method [

14], and two-way models [

16,

17,

18,

19].

All the reviewed studies on loss reserving methods model uncertainty using type-1 fuzzy numbers, which are typically triangular and often symmetric. Our work extends these results by modelling parameters that govern claim processes with intuitionistic fuzzy numbers (IFNs). Notably, to the best of our knowledge, the application of intuitionistic logic to finance and actuarial issues is novel. In this regard, we can highlight applications in capital budgeting [

33,

34,

35,

36,

38,

39] and risk assessment [

40].

The use of FNs in the context of actuarial and financial pricing allows for the introduction of epistemic uncertainty, that is, the perceived reliability of the possible values of the parameters of interest [

10]. Therefore, FNs only allow the introduction of positive information about the feasible values of the parameter. On the other hand, intuitionistic fuzzy numbers (IFNs) permit bipolarity to be added by introducing both positive and negative information regarding variables of interest. In other words, it involves not only using estimated reliable values of the variables but also using unfeasible values [

10].

The introduction of IFNs in determining loss reserves is carried out by generalizing the two-way ANOVA schema [

42,

43] and its possible extension [

16], employing intuitionistic regression. The results of the comparison of the intuitionistic fuzzy method with two deterministic methods and their stochastic extensions suggest that it is able to produce useful results. Moreover, intuitionistic fuzzy quantifications can be interpreted as similar to the results obtained with stochastic methods. Furthermore, our method provides the possibility of assessing the membership and nonmembership of a possible final quantification in financial statements of loss provisions. Therefore, the results enrich the tools available to the actuary to exercise professional judgement, which is a fundamental step in the process of estimating claim reserves [

3].

This study also contributes to the field of intuitionistic mathematics, specifically in a regression setting with a minimum fuzziness focus. While [

41] generalizes possibilistic regression models [

21,

22], this work adapts the model from [

23] to obtain IFN parameters. Thus, the estimates of the parameters governing the claiming process over time in our model are triangular IFNs (TIFNs) that are not necessarily symmetric. Our extension of intuitionistic regression can be applied in other financial and actuarial contexts where possibilistic regression has already been used, such as estimating the fuzzy temporal structure of interest rates [

11], estimating mortality evolution [

68], or estimating the implicit moments of options [

69,

70].

We focused on the use of input variables estimated by triangular IFNs and the approximation of the results obtained with linear shapes. Linear shapes often provide an effective resolution for practical applications of fuzzy set theory [

46]. The interpretability of results by end users who may not necessarily have knowledge of fuzzy logic [

46,

58] is a desirable property of using TIFNs. The value of the reserves with TIFN parameters governing the two-way ANOVA system can be implemented with a very low error by evaluating five scenarios: one considered the maximum reliability scenario and two pairs of extreme positive and negative scenarios. Although the actuarial functions are nonlinear, they admit a good triangular approximation in accordance with the literature on fuzzy actuarial mathematics [

11,

12,

14,

58].

The extreme scenarios of intuitionistic fuzzy estimates can be interpreted within the concept of bipolar possibility [

10]. The extreme scenarios associated with the values considered in the membership function can be understood as reasonable; those originating from the nonmembership measure potential extreme situations. Since the final determination of the provision value requires actuarial judgement, the intuitive interpretation of TIFNs favours their application.

The information that should be used in estimating pending claims is subject to various sources of vagueness, such as the scarcity of usable data, which tends to be current [

9] and often imprecise [

7]. The tools of fuzzy subset theory allow this kind of data to be handled. Therefore, generalizing our results to the case where observations of the run-off triangle are vague and modelled by fuzzy numbers or intuitionistic fuzzy numbers is feasible.

In recent years, other emerging techniques, such as neural networks (NNs) [

71,

72] and machine learning (ML) [

73], have been applied to fit claim reserves in claim reserve calculations. Fuzzy and stochastic methods are implemented on the basis of classical schemes such as chain ladder. As an advantage of these novel approaches, [

71,

72,

73] reported that they are capable of providing more accurate point estimates than classical methods. Therefore, they likely provide better estimates of the maximum likelihood value than the intuitionistic–fuzzy method proposed in this paper since the latter constructs the <1,0>-cut with the value of the classical method [

42].

However, our method has two strengths compared to the methods of [

71,

72,

73]. The first is that the adjusted parameters continue to have an economic interpretation, unlike those from deep learning techniques, where the adjusted parameters are more difficult to interpret. On the other hand, our intuitionistic fuzzy method fits bands of variability of reserves that incorporate bipolar information and are parameterized in a very natural way. In contrast, neural networks and machine learning techniques produce point estimates. In any case, deep learning methods and our intuitionistic fuzzy methods are not competitive but complementary. Whereas point estimates from NNs and ML techniques can be used as a reference for the maximum reliability values, intuitionistic fuzzy estimates provide a complete estimate of the uncertainty of these values.