Assessment of Materials and Rare Earth Metals Demand for Sustainable Wind Energy Growth in India

Abstract

:1. Introduction

2. Material and Methodology

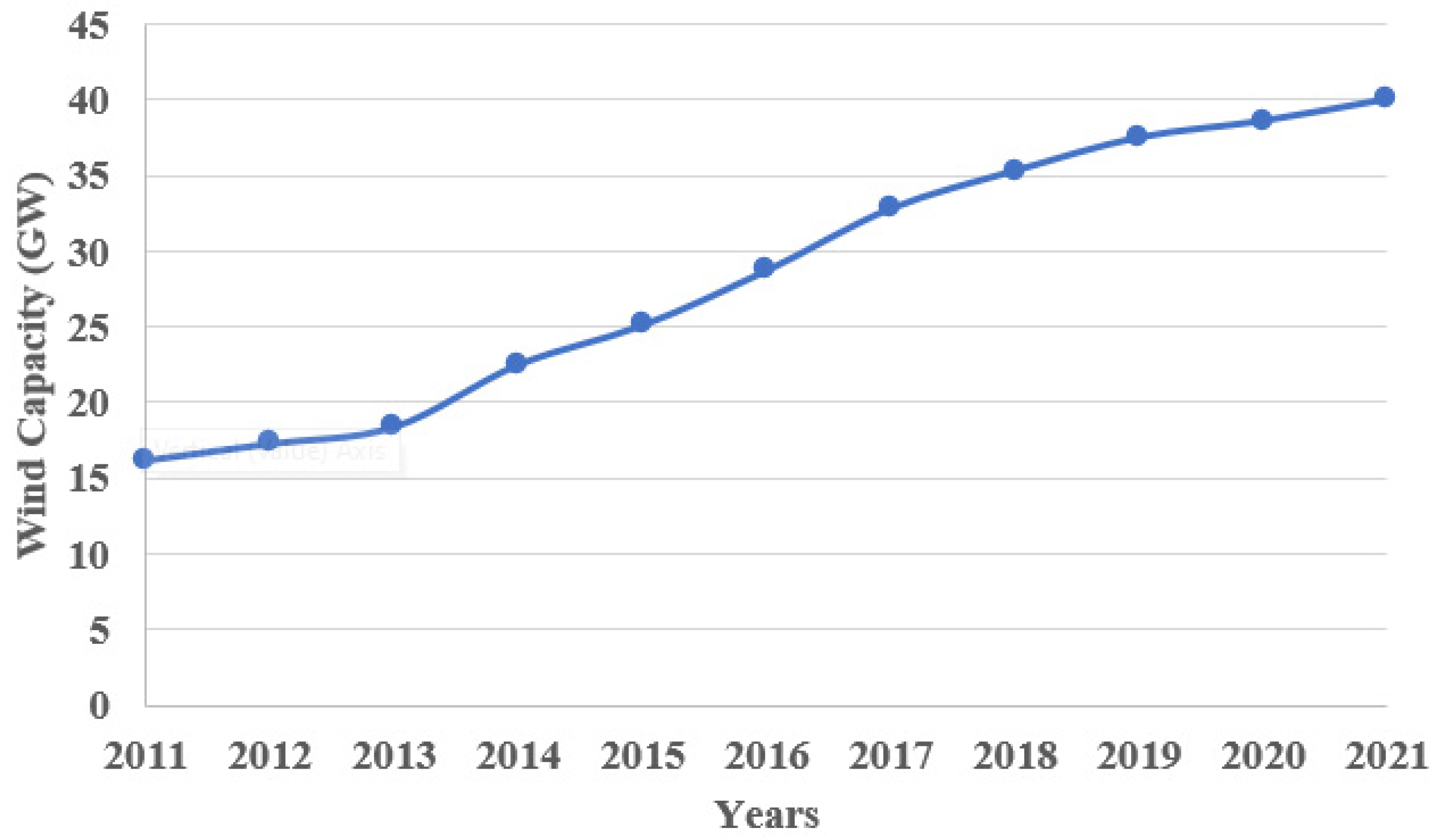

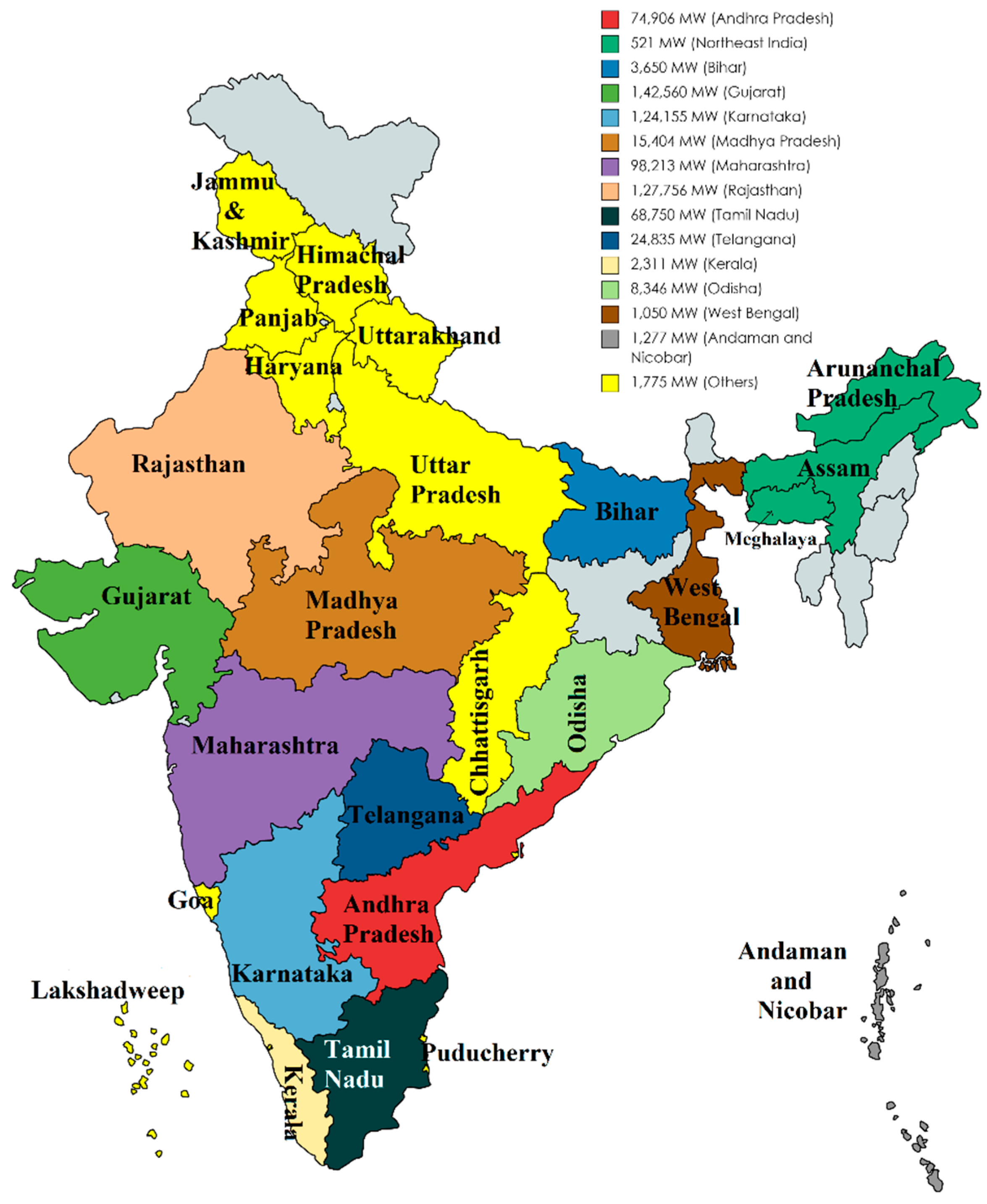

3. Current State and Potential of Wind Energy Development in India

4. Mineral Resources in Wind Energy

4.1. Raw Materials Used in Wind Energy

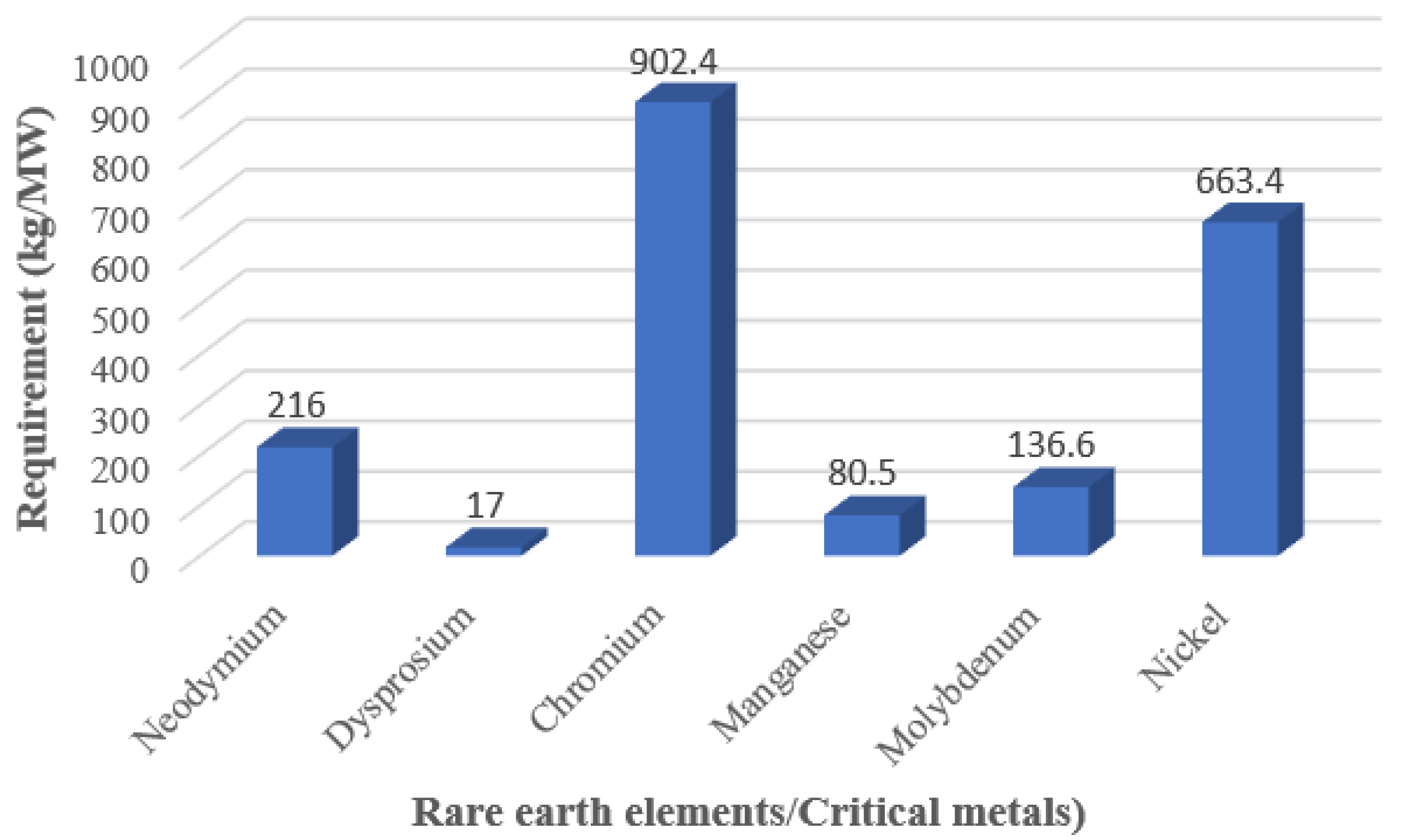

4.2. Rare Earth Elements and Critical Metals Used in Wind Energy

5. Results

5.1. Estimation of Raw Materials in Short and Long-Term Production

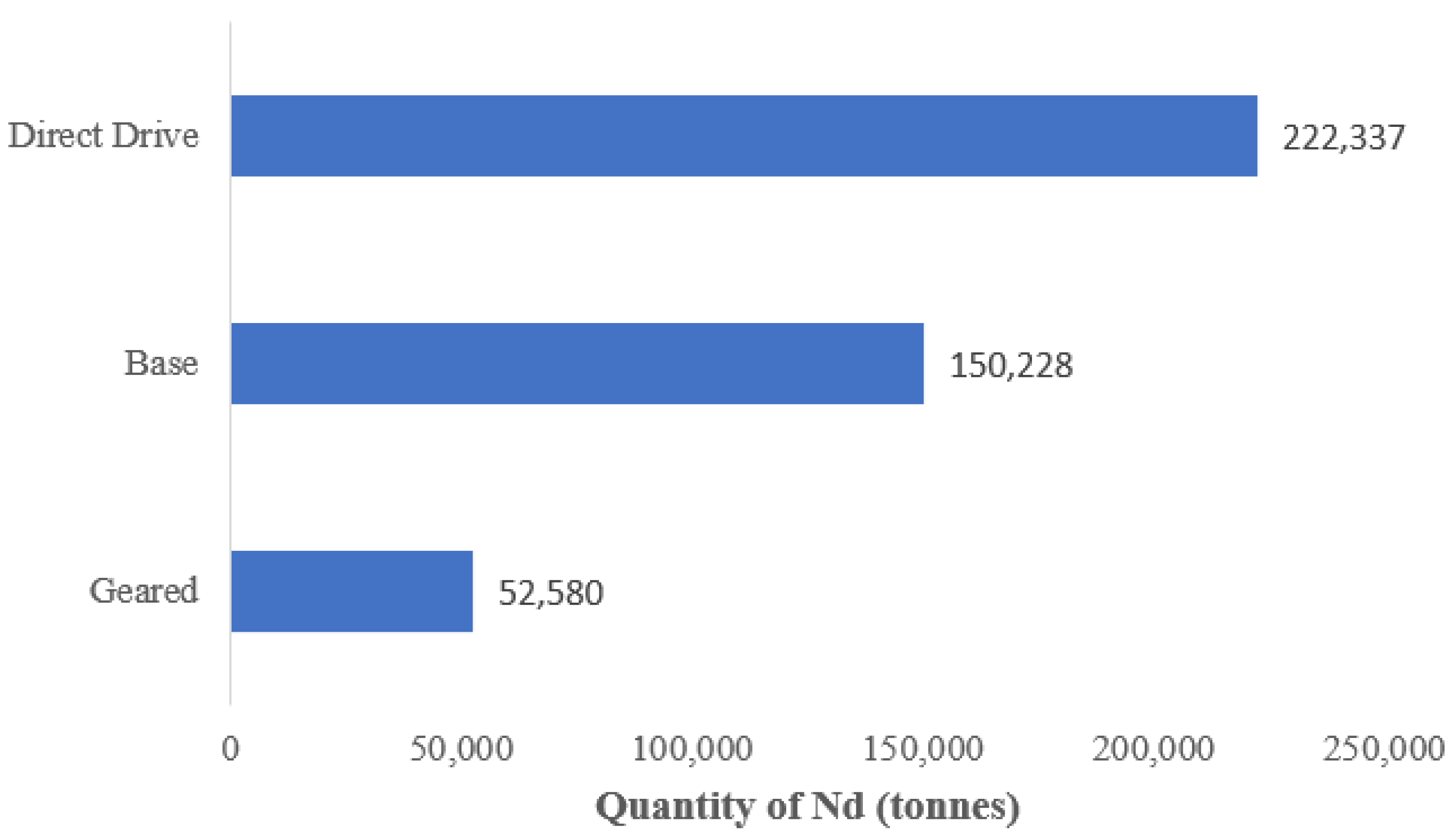

5.2. Estimation of Rare Earth and Critical Metals in Short and Long-Term Production

5.3. Economic Analysis of Raw Materials, Rare Earth and Critical Metals

6. Discussion

7. Conclusions and Recommendations

- Mostly used raw material in wind turbine production is steel, cast iron, aluminum, copper, fiber glass with epoxy resin, and glass/ceramics. The tower is generally made of steel and contributes the highest contribution 60% to 71%. Other parts except tower and blade contributes cast iron 12% to 16%, aluminum 1% to 4%, copper 0.7% to 2%. Blade materials are fiber glass and epoxy resin with 11% or glass/ceramics with 6%, and polymers of 4%.

- The estimated analysis revealed that the material demands vary depending upon the different wind turbine systems due to different capacities, rotor diameter, hub height, and technologies of the wind turbine. The demand for rare earth elements (REE) like neodymium varies depending upon the direct drive and geared type wind turbine. There is already high pressure on the supply chains of REE. In addition, there is a strong pressure on REE as it is also needed in electro-mobility. Hence, the less availability of the REE can jeopardize wind power growth.

- The price for different materials has a lesser difference between 2016 and 2020, but a drastic increase can be seen between 2020 to 2022. The predicted price of the material for 2024 is calculated considering the average inflation rate of 2.96% and base year data 2022.

- In order to tap 100% wind power in India, the contribution of price is higher for steel, copper, nickel, and neodymium.

- Study of circular economy is used to make better use of components throughout the life cycle. A systematic analysis is required for wind turbines in their approach to sustainability. This will be analyzed in a future study for wind turbine components and materials.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviation

| AGL | Above ground level |

| CSP | Concentrated Solar Power |

| GHG | Greenhouse gas |

| HAWT | Horizontal axis wind turbine |

| IEC | International Electrotechnical Commission |

| MNRE | Ministry of New and Renewable Energy |

| NIWE | National Institute of Wind Energy |

| PMSG | Permanent magnet generators |

| PV | Photovoltaics |

| REE | Rare earth element |

| VAWT | Vertical axis wind turbine |

| MTPA | Million t per annum |

| NdFeB | Neodymium Iron Boron Magnets |

References

- Kumar, S.; Madlener, R. CO2 emission reduction potential assessment using renewable energy in India. Energy 2016, 97, 273–282. [Google Scholar] [CrossRef]

- Bruckner, T.; Fulton, L.; Hertwich, E.; McKinnon, A.; Perczyk, D.; Roy, J.; Schaeffer, R.; Schlömer, S.; Sims, R.; Smith, P.; et al. Technology-specific Cost and Performance Parameters [Annex III]. In Climate Change 2014: Mitigation of Climate Change; Cambridge University Press: Cambridge, UK, 2014; pp. 1329–1356. [Google Scholar]

- Khaleghi, S.; Moghaddam, R.K. Parameters optimization to maximize the wave energy extraction. In Proceedings of the 2015 International Congress on Technology, Communication and Knowledge, Mashhad, Iran, 11–12 November 2015; pp. 260–267. [Google Scholar] [CrossRef]

- Bhandari, K.P.; Collier, J.M.; Ellingson, R.J.; Apul, D.S. Energy payback time (EPBT) and energy return on energy invested (EROI) of solar photovoltaic systems: A systematic review and meta-analysis. Renew. Sustain. Energy Rev. 2015, 47, 133–141. [Google Scholar] [CrossRef]

- Bonou, A.; Laurent, A.; Olsen, S.I. Life cycle assessment of onshore and offshore wind energy-from theory to application. Appl. Energy 2016, 180, 327–337. [Google Scholar] [CrossRef] [Green Version]

- Gomaa, M.R.; Rezk, H.; Mustafa, R.J.; Al-Dhaifallah, M. Evaluating the Environmental Impacts and Energy Performance of a Wind Farm System Utilizing the Life-Cycle Assessment Method: A Practical Case Study. Energies 2019, 12, 3263. [Google Scholar] [CrossRef] [Green Version]

- Verma, S.; Paul, A.R.; Jain, A. Performance investigation and energy production of a novel horizontal axis wind turbine with winglet. Int. J. Energy Res. 2022, 46, 4947–4964. [Google Scholar] [CrossRef]

- Verma, S.; Paul, A.R.; Jain, A.; Alam, F. Numerical investigation of stall characteristics for winglet blade of a horizontal axis wind turbine. E3S Web Conf. 2021, 321, 03004. [Google Scholar] [CrossRef]

- Hund, K.; La Porta, D.; Fabregas, T.P.; Laing, T.; Drexhage, J. Minerals for Climate Action: The Mineral Intensity of the Clean Energy Transition; World Bank: Washington, DC, USA, 2020. [Google Scholar]

- Moné, C.; Hand, M.; Bolinger, M.; Rand, J.; Heimiller, D.; Ho, J. 2015 Cost of Wind Energy Review; Technical Report No. NREL/TP-6A20-66861; National Renewable Energy Lab: Golden, CO, USA, 2017. [Google Scholar]

- Miyamoto, W.; Kosai, S.; Hashimoto, S. Evaluating Metal Criticality for Low-Carbon Power Generation Technologies in Japan. Minerals 2019, 9, 95. [Google Scholar] [CrossRef] [Green Version]

- Kim, J.; Guillaume, B.; Chung, J.; Hwang, Y. Critical and precious materials consumption and requirement in wind energy system in the EU 27. Appl. Energy 2015, 139, 327–334. [Google Scholar] [CrossRef]

- Muilerman, H.; Blonk, H. Towards a Sustainable Use of Natural Resources; Stichting Natuur en Milieu: Utrecht, The Netherland, 2001; pp. 1–18. [Google Scholar]

- Li, J.; Peng, K.; Wang, P.; Zhang, N.; Feng, K.; Guan, D.; Meng, J.; Wei, W.; Yang, Q. Critical rare-earth elements mismatch global wind-power ambitions. One Earth 2020, 3, 116–125. [Google Scholar] [CrossRef]

- García-Olivares, A.; Ballabrera-Poy, J.; García-Ladona, E.; Turiel, A. A global renewable mix with proven technologies and common materials. Energy Policy 2012, 41, 561–574. [Google Scholar] [CrossRef] [Green Version]

- Deng, X.; Ge, J. Global wind power development leads to high demand for neodymium praseodymium (NdPr): A scenario analysis based on market and technology development from 2019 to 2040. J. Clean. Prod. 2020, 277, 123299. [Google Scholar] [CrossRef]

- Dodd, J. Rethinking the Use of Rare-Earth Elements. Wind Power Monthly, 30 November 2018. Available online: https://www.windpowermonthly.com/article/1519221/rethinking-use-rare-earth-elements (accessed on 20 October 2020).

- Green Spur Renewables. Introducing the GreenSpur Wind Generator. 2020. Available online: https://www.greenspur.co.uk/ (accessed on 20 October 2020).

- Snieckus, D. Offshore Wind Turbine 20MW Generator Ready within Three Years. 22 November 2019. Available online: https://www.rechargenews.com/ (accessed on 20 October 2020).

- Coey, J.M.D. Perspective and Prospects for Rare Earth Permanent Magnets. Engineering 2020, 6, 119–131. [Google Scholar] [CrossRef]

- Wilburn, D.R. Wind energy in the United States and materials required for the land-based wind turbine industry from 2010 through 2030. In Scientific Investigations Report; US Department of the Interior, US Geological Survey: Washington, DC, USA, 2011; p. 5036. [Google Scholar]

- Imholte, D.D.; Nguyen, R.T.; Vedantam, A.; Brown, M.; Iyer, A.; Smith, B.J.; Collins, J.W.; Anderson, C.G.; O’Kelley, B. An assessment of U.S. rare earth availability for supporting U.S. wind energy growth targets. Energy Policy 2018, 113, 294–305. [Google Scholar] [CrossRef]

- Fishman, T.; Graedel, T.E. Impact of the establishment of US offshore wind power on neodymium flows. Nat. Sustain. 2019, 2, 332–338. [Google Scholar] [CrossRef]

- Farina, A.; Anctil, A. Material consumption and environmental impact of wind turbines in the USA and globally. Resour. Conserv. Recycl. 2022, 176, 105938. [Google Scholar] [CrossRef]

- Zimmermann, T.; Rehberger, M.; Gößling-Reisemann, S. Material Flows Resulting from Large Scale Deployment of Wind Energy in Germany. Resources 2013, 2, 303–334. [Google Scholar] [CrossRef]

- Shammugam, S.; Gervais, E.; Schlegl, T.; Rathgeber, A. Raw metal needs and supply risks for the development of wind energy in Germany until 2050. J. Clean. Prod. 2019, 221, 738–752. [Google Scholar] [CrossRef]

- Arántegui, R.L. Materials use in electricity generators in wind turbines—State-of-the-art and future specifications. J. Clean. Prod. 2015, 87, 275–283. [Google Scholar] [CrossRef]

- Schmidt, A. Life Cycle Assessment of Electricity Produced from Onshore Sited Wind Power Plants Based on Vestas V82-1.65 MW Turbines. Vestas Reports. 2016. Available online: https://www.vestas.com/~/media/vestas/about/sustainability/pdfs/lca%20v82165%20mw%20onshore2007 (accessed on 21 August 2020).

- Razdan, P.; Garrett, P. Life Cycle Assessment of Electricity Production from an Onshore V112-3.45 MW Wind Plant; Vestas Wind System: Aarhus, Denmark, 2017. [Google Scholar]

- Carrara, S.; Alves, D.P.; Plazzotta, B.; Pavel, C. Raw Materials Demand for Wind and Solar PV Technologies in the Transition Towards a Decarbonised Energy System, EUR 30095 EN; Publications Office of the European Union: Luxembourg, 2020.

- Moss, R.L.; Tzimas, E.; Kara, H.; Willis, P.; Kooroshy, J. Critical Metals in Strategic Energy Technologies; Assessing Rare Metals as Supply-Chain Bottlenecks in Low-Carbon Energy Technologies. JRC Scientific and Technical Reports; Publications Office of the European Union: Luxembourg, 2011.

- Ministry of New and Renewable Energy. Physical Progress 2020–2021. GOI. 2021. Available online: https://mnre.gov.in/the-ministry/physical-progress (accessed on 10 October 2020).

- International Renewable Energy Agency. Renewable Capacity Statistics 2021; International Renewable Energy Agency (IRENA): Abu Dhabi, United Arab Emirates, 2021. [Google Scholar]

- Dawn, S.; Tiwari, K.; Goswami, A.K.; Singh, A.K.; Panda, R. Wind power: Existing status, achievements and government’s initiative towards renewable power dominating India. Energy Strategy Rev. 2019, 23, 178–199. [Google Scholar] [CrossRef]

- National Institute of Wind Energy. India’s Wind Potential Atlas at 120 m agl; Under Ministry of New and Renewable Energy, Government of India: New Delhi, India, 2019.

- Rabe, W.; Kostka, G.; Smith Stegen, K. China’s supply of critical raw materials: Risks for Europe’s solar and wind industries? Energy Policy 2017, 101, 692–699. [Google Scholar] [CrossRef]

- Reimer, M.V.; Schenk-Mathes, H.Y.; Hoffmann, M.F.; Elwert, T. Recycling decisions in 2020, 2030, and 2040—When can substantial NdFeB extraction be expected in the EU? Metals 2018, 8, 867. [Google Scholar] [CrossRef] [Green Version]

- Magnosphere Price Development for Neodymium Magnets. Available online: https://www.magnosphere.co.uk/price-development-for-neodymium-magnets (accessed on 3 May 2022).

- SMM. Rare Earth Metals: Dysprosium. 2022. Available online: https://www.metal.com/Rare-Earth-Metals/201102250389 (accessed on 3 May 2022).

- Ministry of Mines. Non-Ferrous Minerals & Metals, Aluminium; Government of India: New Delhi, India, 2022.

- Ministry of Mines. Non-Ferrous Minerals & Metals, Copper; Government of India: New Delhi, India, 2022.

- Trading Economics. Nickel. 2022. Available online: tradingeconomics.com (accessed on 3 May 2022).

- SMM. Chromium. April 2022. Available online: https://www.metal.com/price/Minor%20Metals/Chromium (accessed on 3 May 2022).

- Trading Economics. Molybdenum. 2022. Available online: tradingeconomics.com (accessed on 3 May 2022).

- Metals and Mining. India Brand Equity Foundation; IBEF: New Delhi, India, 2020. [Google Scholar]

- Indian Brand Equity Foundation. Indian Steel Industry Report. 2021. Available online: https://www.ibef.org/industry/steel.aspx (accessed on 20 March 2022).

- Ministry of Mines, India Bureau of Mines. Indian Minerals Yearbook 2019, Bauxite; Government of India: New Delhi, India, 2020.

- Ministry of Mines, India Bureau of Mines. Non-Ferrous Minerals and Metals; Government of India: New Delhi, India, 2021.

- U.S. Geological Survey. Mineral Commodity Summaries; U.S. Geological Survey: Washington, DC, USA, 2021.

- Zangeneh, S. State of India’s Rare Earth Industry—Understanding India’s Current Position; ISSSP: Bangalore, India, 2018. [Google Scholar]

- Ministry of Mines, India Bureau of Mines. Indian Minerals Yearbook 2020, Nickel; Government of India: New Delhi, India, 2021.

- Ministry of Mines, India Bureau of Mines. Indian Minerals Yearbook 2019, Manganese Ore; Government of India: New Delhi, India, 2020.

- Ministry of Mines, India Bureau of Mines. Indian Minerals Yearbook 2019, Molybdenum; Government of India: New Delhi, India, 2021.

- Bloomberg NEF. India’s Top Wind Suppliers in 2019; Bloomberg NEF: London, UK, 2020. [Google Scholar]

- Vestas. Vestas to Establish New Nacelle and Hub Assembly Factory in India, Quadrupling Local Manufacturing Jobs. 2019. Available online: https://www.vestas.com/en/media/company-news/2019/vestas-to-establish-new-nacelle-and-hub-assembly-factor-c2963168 (accessed on 21 March 2022).

| Components | Sub-Components | Materials | Manufacturers in India |

|---|---|---|---|

| Rotor | Blade | Glass fibers, Carbon fibers, Epoxy resins, Honeycomb, Balsa wood, Polyester resins, | Suzlon (New Delhi), Vestas India (Chennai), RRB energy limited (New Delhi), ReGen Powertech Pvt. Ltd. (Chennai), Wind World India Ltd. (Mumbai), Inox Wind (Uttar Pradesh). |

| Hub | Steel, Cast iron. | Suzlon, Vestas India, ReGen Powertech Pvt. Ltd., Inox Wind. | |

| Nacelle | Gearbox | Steel, Aluminium, Brass, Chromium, Iron, Manganese, Molybdenum, Nickel. | ReGen Powertech Pvt. Ltd., Suzlon, Wind World India Ltd., Inox Wind. |

| Anemometer | Stainless steel | ||

| Shaft | Steel | ||

| Generator | Copper, iron, rare earth elements (Neodymium, Dysprosium, Praseodymium, Terbium) | ||

| Others | Aluminium, Chromium, Copper, Iron, Manganese, Molybdenum, Nickel. | ||

| Tower | Steel, Aluminium, Plastic, Copper, Pre-stressed concrete, Chromium, Iron, Manganese, Molybdenum, Nickel. | Suzlon, ReGen Powertech Pvt. Ltd., Wind World India Ltd., Inox Wind. | |

| Foundation | Steel/iron, Concrete. | Wind World India Ltd. | |

| Cables | Plastic, Aluminium, Copper. | ||

| Transformer Station | Steel, Copper. | Suzlon. |

| Wind Turbine with 1.65 MW Capacity (V-82) | Wind Turbine with 3.45 MW Capacity (V-112) | ||||

|---|---|---|---|---|---|

| Materials | Quantity (t) | t/ MV | Materials | Quantity (t) | t/ MW |

| Steel | 136.6 | 82.79 | Steel and iron materials | 311.6 | 90.34 |

| Aluminium | 3.10 | 1.88 | Aluminium | 4.48 | 1.30 |

| Plastic | 3.00 | 1.82 | Copper | 3.21 | 0.93 |

| Copper | 2.90 | 1.76 | Cast Iron | 70.1 | 20.32 |

| Cast Iron | 29.30 | 17.76 | Electronics/electrics | 3.28 | 0.95 |

| Tool Steel | 14.50 | 8.79 | Lubricants and liquids | 1.86 | 0.54 |

| Stainless Steel | 7.80 | 4.73 | Polymer materials | 17.44 | 5.06 |

| Fibre glass, epoxy | 27.00 | 16.36 | Ceramic/glass | 25.93 | 7.52 |

| Electronics | 2.50 | 1.52 | Rest | 0.45 | 0.13 |

| Oil | 1.30 | 0.79 | |||

| Materials | Wind Turbine with 1.65 MW Capacity (V-82) | Wind Turbine with 3.45 MW Capacity (V-112) | ||

|---|---|---|---|---|

| Quantity (Mt) 2022–2032 (140 GW) | Quantity (Mt) 695.5 GW | Quantity (Mt) 2022–2032 (140 GW) | Quantity (Mt) (695.5 GW) | |

| Steel | 11.6 | 57.6 | 12.65 | 62.8 |

| Aluminium | 0.266 | 1.32 | 0.182 | 0.90 |

| Copper | 0.252 | 1.25 | 0.13 | 0.65 |

| Cast Iron | 2.5 | 12.4 | 2.84 | 14.13 |

| Tool Steel | 1.232 | 6.12 | - | - |

| Stainless Steel | 0.658 | 3.27 | - | - |

| Fibre glass, epoxy | 2.296 | 11.4 | - | - |

| Ceramic/Glass | - | - | 1.05 | 5.23 |

| Rare Earth Elements and Critical Metals | Quantity in t 2022–2032 (140 GW) | Quantity in t for 695.5 GW |

|---|---|---|

| Neodymium | 30,240 | 150,228 |

| Dysprosium | 2380 | 11,823.5 |

| Chromium | 126,336 | 627,619.2 |

| Manganese | 11,270 | 55,987.8 |

| Molybdenum | 19,124 | 95,005.3 |

| Nickel | 92,876 | 461,394.7 |

| Materials | Price of Materials (US$/t) | |||

|---|---|---|---|---|

| 2016 | 2020 | 2022 | 2024 | |

| Steel | 519.95 | 687.92 | 779.6 | 826.44 |

| Aluminium | 1772.52 | 1962.1 | 3538 | 3750.55 |

| Copper | 4863 | 6181 | 10,237.59 | 10,852.63 |

| Nickel | 9595 | 14,000 | 30,644 | 32,484.97 |

| Neodymium | 40,000 | 52,963.8 | 181,590 | 192,499.23 |

| Dysprosium | 198,000 | 260,000 | 518,288.13 | 549,424.89 |

| Chromium | 10,955.87 | 8708.3 | 11,576.36 | 12,271.82 |

| Molybdenum | 14,400 | 20,000 | 46,300 | 49,081.53 |

| Materials | Estimated Price for 2022 (Billion US$) | Expected Price for 2024 (Billion US$) |

|---|---|---|

| Steel | 49 | 52 |

| Aluminium | 4.7 | 4.9 |

| Copper | 12.8 | 13.6 |

| Neodymium | 27.28 | 28.9 |

| Dysprosium | 6.13 | 6.46 |

| Chromium | 7.27 | 7.7 |

| Molybdenum | 4.4 | 4.66 |

| Nickel | 14.14 | 14.99 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Verma, S.; Paul, A.R.; Haque, N. Assessment of Materials and Rare Earth Metals Demand for Sustainable Wind Energy Growth in India. Minerals 2022, 12, 647. https://doi.org/10.3390/min12050647

Verma S, Paul AR, Haque N. Assessment of Materials and Rare Earth Metals Demand for Sustainable Wind Energy Growth in India. Minerals. 2022; 12(5):647. https://doi.org/10.3390/min12050647

Chicago/Turabian StyleVerma, Shalini, Akshoy Ranjan Paul, and Nawshad Haque. 2022. "Assessment of Materials and Rare Earth Metals Demand for Sustainable Wind Energy Growth in India" Minerals 12, no. 5: 647. https://doi.org/10.3390/min12050647

APA StyleVerma, S., Paul, A. R., & Haque, N. (2022). Assessment of Materials and Rare Earth Metals Demand for Sustainable Wind Energy Growth in India. Minerals, 12(5), 647. https://doi.org/10.3390/min12050647