Access to Affordable Houses for the Low-Income Urban Dwellers in Kigali: Analysis Based on Sale Prices

Abstract

1. Introduction

2. The Income-housing Affordability Nexus in Kigali City Zoning Regulations

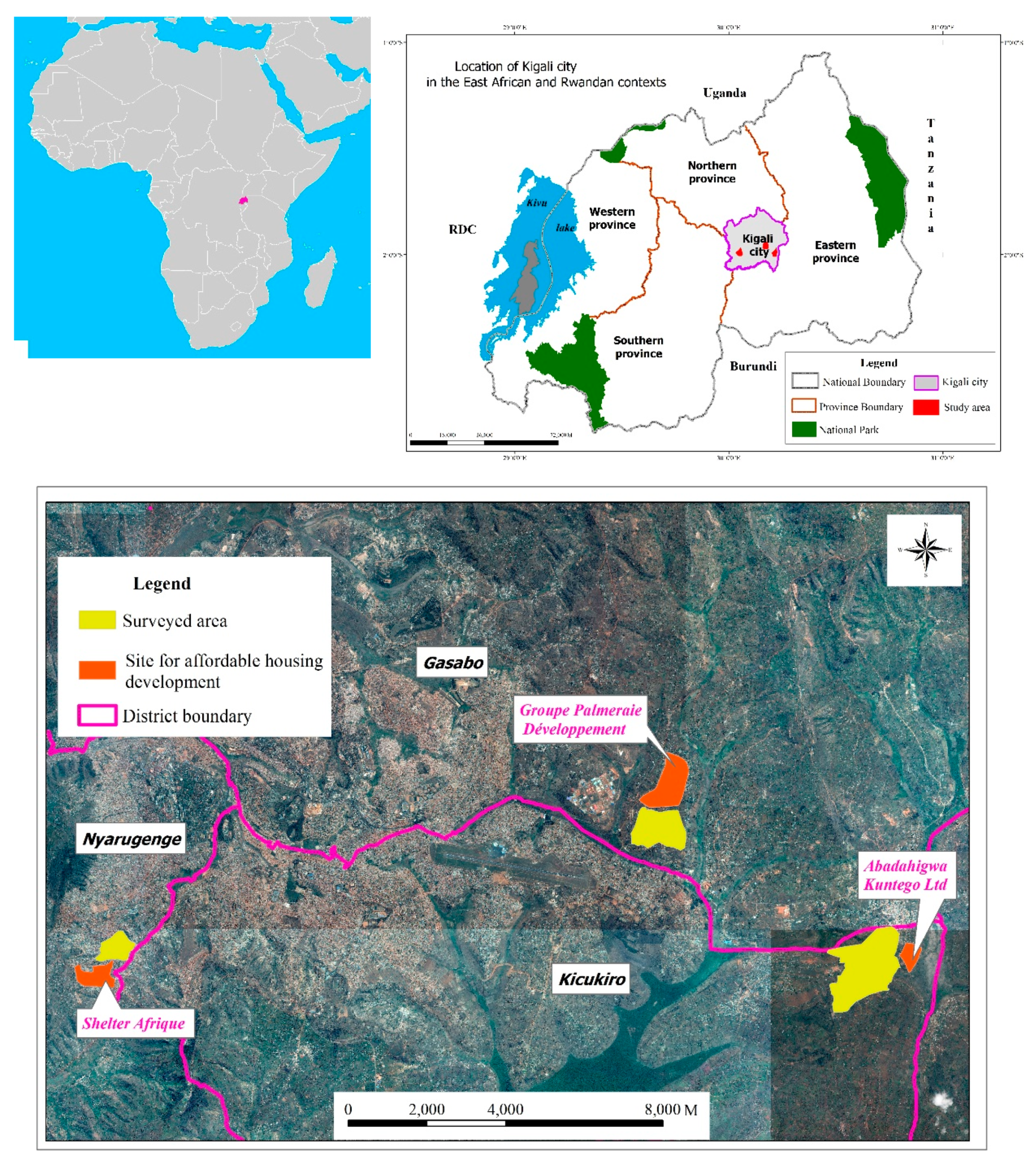

2.1. Households Income Sources in Rwanda

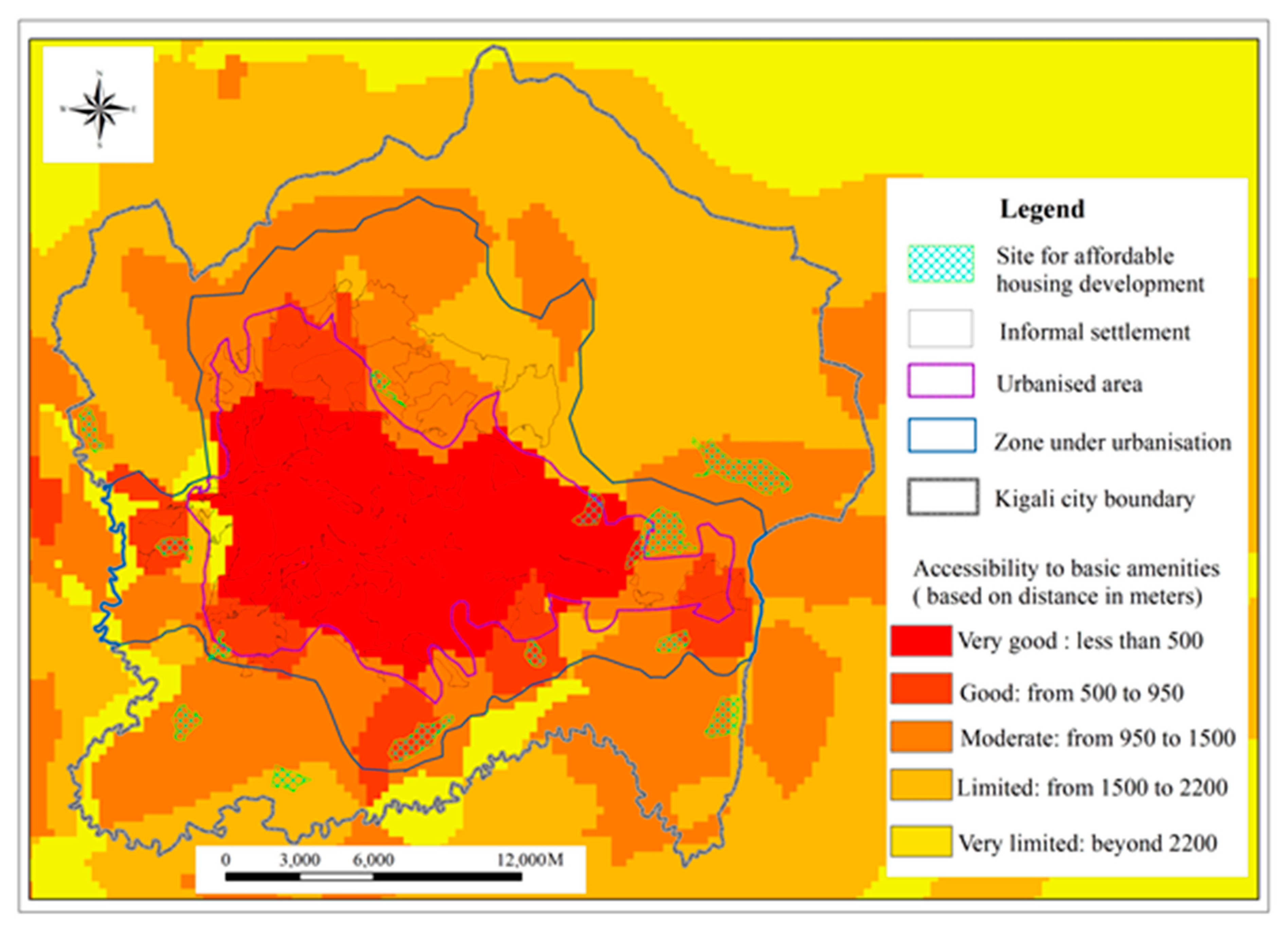

2.2. Housing Development and Market Trends in Kigali City

- Social housing: A housing typology that is affordable by households below the poverty line, earning less than 120.00 US dollars per month. This is under-development by the government through a subsidy system;

- Affordable housing: This is demand for households earning between 120.00 and 772.00 US dollars per month. This is the largest segment of the housing market. These households have some payment capacity and could access a special rental market which may include the rent-to-own leasing mechanisms, etc.;

- Mid-range housing: Targets households whose incomes vary from 772.00 to 4110.00 US dollars per month. Households whose income is less than 1320. 00 US dollars can also buy these dwellings under the affordable housing scheme and apply for the related bank loan, as stated in the current affordable housing schemes. Others can use their income or apply for mortgage financing to fund their houses;

- Premium housing: This addresses housing demand from the high-income group whose monthly income is greater than 4110.00 US dollars per month.

2.3. Regulatory Framework for Housing Development in Kigali City

3. Analytical Approach to the Housing Affordability

- The PIR below 3 reveals the general situation of “affordability” in which the household is sufficiently able to purchase the house, without difficulties in covering other basic needs;

- The PIR beyond 3.0 to 4.0 shows that the house is “moderately unaffordable”, but its cost does not have much negative impact on further household consumption;

- The PIR beyond 4.0 to 5.0 shows that the house is “seriously unaffordable”. Households must adjust the housing type to their income levels, otherwise the cost for housing can seriously affect their living conditions;

- The PIR beyond 5.0 portrays a situation where the housing is “severely unaffordable”, even if the household may extend the loan period.

4. Data Sources

5. Results Presentation and Discussion

5.1. Trends in Housing (Un)Affordability Based on Households’ Incomes

5.2. Strategies to Promote Housing Affordability in Kigali City

5.2.1. Access Through Private Low-cost Rental Housing

5.2.2. Progressive Housing Ownership through Rent-to-Own

5.2.3. Decreasing Housing Costs and Change in Investment Strategies

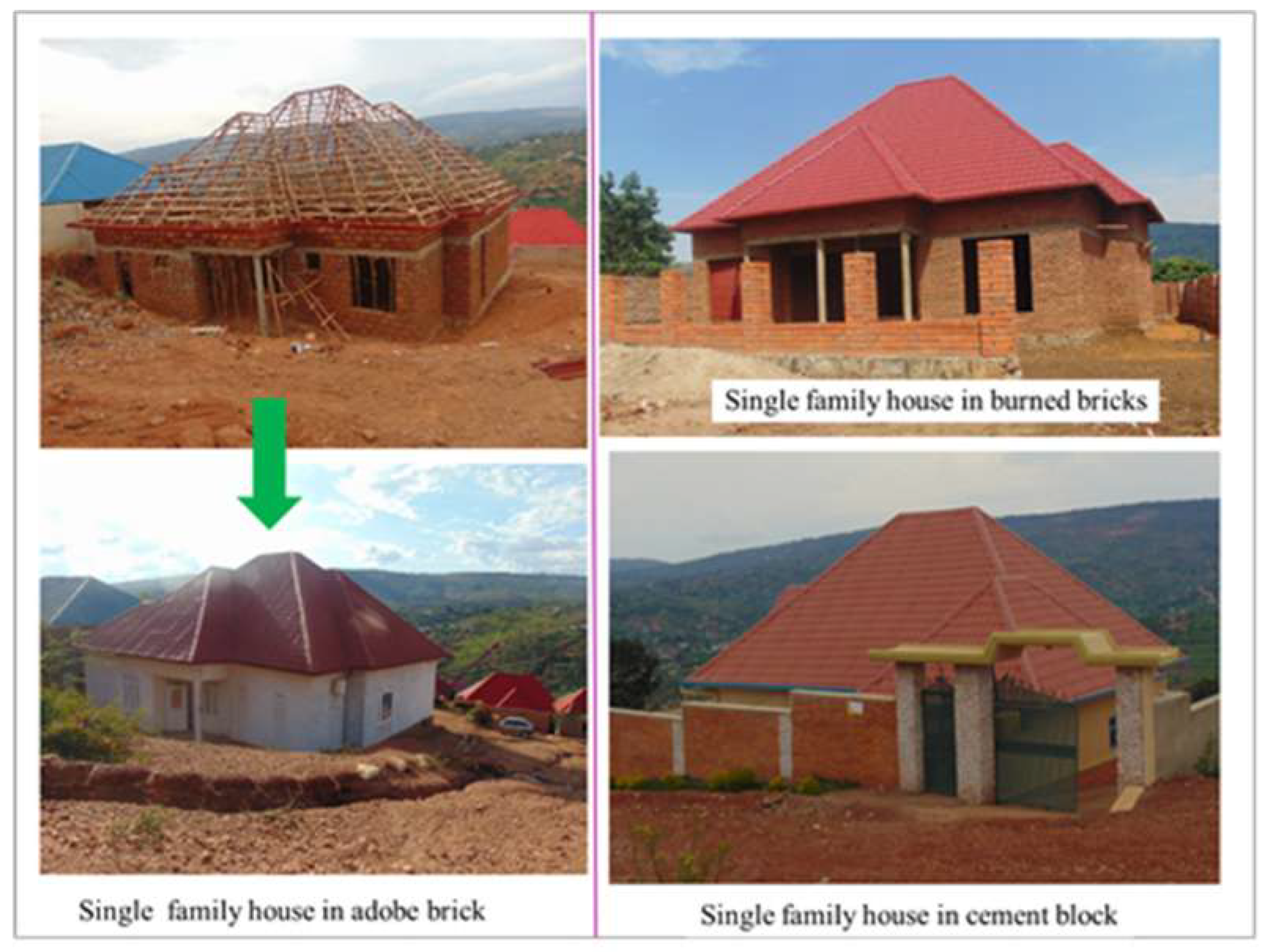

5.2.4. Access through Self-help Housing Development with Local Materials

5.2.5. Improving the Existing Houses through Informal Settlements Upgrading

5.2.6. Slum Conversion into Shared Residential Apartments

6. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Fainstein, S.S. The just city. Int. J. Urban Sci. 2014, 18, 1–18. [Google Scholar] [CrossRef]

- Soja, E. Seeking Spatial Justice; University of Minnesota Press: Minneapolis, MN, USA, 2013; p. 280. [Google Scholar]

- Lefebvre, H. The Production of Space; Basil Blackwell: Oxford, UK, 1991; p. 464. [Google Scholar]

- Lefebvre, H. Writings on Cities; Kofman, E., Lebas, E., Eds.; Blackwell: Oxford, UK, 1996. [Google Scholar]

- Sekoboto, L.; Landman, K. Searching for more than just a house? The extent to which government provided RDP housing compared to self-help housing empower poor communities in South Africa. Urban Forum 2019, 30, 97–113. [Google Scholar] [CrossRef]

- Mosha, A.C. Low-Income access to urban land and housing in Botswana. Urban Forum 2013, 24, 137–154. [Google Scholar] [CrossRef]

- van den Nouwelant, R.; Davison, G.; Gurran, N.; Pinnegar, S. Delivering affordable housing through the planning system in urban renewal contexts: Converging Government roles in Queensland, South Australia and New South Wales. Aust. Plan. 2015, 52, 77–89. [Google Scholar] [CrossRef]

- Uwayezu, E.; de Vries, T.W. Indicators for Measuring Spatial Justice and Land Tenure Security for Poor and Low Income Urban Dwellers. Land 2018, 7, 34. [Google Scholar] [CrossRef]

- Jonkman, A.; Janssen-Jansen, L.; Schilder, F. Rent increase strategies and distributive justice: the socio-spatial effects of rent control policy in Amsterdam. J. Hous. Built Environ. 2018, 33, 653–673. [Google Scholar] [CrossRef] [PubMed]

- Cowan, S. Anti-snob land use laws, suburban exclusion and housing opportunity. J. Urban Affairs 2006, 28, 295–313. [Google Scholar] [CrossRef]

- Radzimski, A. Subsidized mortgage loans and housing affordability in Poland. GeoJournal 2014, 79, 467–494. [Google Scholar] [CrossRef]

- Planet Consortium. Housing Market Demand, Housing Finance and Housing Preferences for the City of Kigali; Planet Consortium: Kigali, Rwanda, 2012; p. 65. [Google Scholar]

- Iyandemye, S.; Barayandema, J.; Gasheja, F. Mortgage finance market and housing affordability in urban areas in Rwanda: A case of Kigali city. J. Adv. Dev. Econ. 2018, 7, 41–58. [Google Scholar]

- Gardner, D.; Lockwood, K.; Pienaar, J. Assessing Rwanda’s Affordable Housing Sector; Centre for Affordable Housing Finance in Africa (CAHF): Gauteng, South Africa, 2019; p. 58. [Google Scholar]

- Rwanda Environment Management Authority. State of Environment and Outlook Report; Rwanda Environment Management Authority: Kigali, Rwanda, 2017; p. 252.

- World Bank Group. Creating Markets in Rwanda. Transforming for the Jobs of Tomorrow; World Bank Group: Washington, DC, USA, 2019; p. 127. [Google Scholar]

- Ministry of Infrastructure. National Housing Policy; Government of Rwanda: Kigali, Rwanda, 2015; p. 63.

- Government of Rwanda. Law n°06/2015 of 28/03/2015 relating to investment promotion and facilitation; Government of Rwanda: Kigali, Rwanda, 2015; p. 40.

- Development Bank of Rwanda. Annual Report. Financing Development in a Challenging Environment; Development Bank of Rwanda: Kigali, Rwanda, 2015; p. 71. [Google Scholar]

- Uwayezu, E.; de Vries, T.W. Expropriation of real property in Kigali City: Scoping the patterns of spatial justice. Land 2019, 8, 23. [Google Scholar] [CrossRef]

- Hoops, B. Rethinking Expropriation Law III. Fair Compensation; Eleven International Publishing: Hague, The Netherlands, 2018; Volume 9, p. 244. [Google Scholar]

- Government of Rwanda. Law N° 43/2013 of 16/06/2013 Governing land in Rwanda; Government of Rwanda: Kigali, Rwanda, 2013; p. 55.

- Ngoga, T. Land Governance Assessment Framework: Final Report, Rwanda; World Bank Group: Washington, DC, USA, 2016; p. 142. [Google Scholar]

- Ministry of Natural Resources. National Land Policy; Ministry of Natural Resources: Kigali, Rwanda, 2004; p. 54.

- City of Kigali. The City of Kigali Development Plan (2013-2018); City of Kigali: Kigali, Rwanda, 2013; p. 98. [Google Scholar]

- Government of Rwanda. Prime minister’s instructions n°004/03 of 13/11/2015 determining the conditions and procedures for obtaining government support for affordable housing projects; Government of Rwanda: Kigali, Rwanda, 2015; p. 20.

- Rwanda Housing Authority. Affordable Housing Program. 2017. Available online: http://www.rha.gov.rw/index.php?id=180 (accessed on 19 August 2019).

- Government of Rwanda. 7 Years Government Programme: National Strategy for Transformation (NST1) 2017–2024; Government of Rwanda: Kigali, Rwanda, 2017; p. 65.

- Centre for Affordable Housing Finance in Africa. Housing Finance in Africa: A Review of Some of Africa’s Housing Finance Markets; Centre for Affordable Housing Finance in Africa: Johannesburg, South Africa, 2018; p. 290. [Google Scholar]

- Manirakiza, V.; Ansoms, A. Modernizing Kigali: The struggle for space in the Rwandan urban context. In Losing Your Land Dispossession in the Great Lakes; Ansoms, A., Hilhorst, T., Eds.; Boydell and Brewer: Rochester, NY, USA, 2014; p. 218. [Google Scholar]

- Hanratty, M. Do local economic conditions affect. homelessness? Impact of area housing market. Factors, unemployment, and poverty on community homeless rates. Hous. Policy Debate 2017, 27, 640–655. [Google Scholar] [CrossRef]

- Ministry of Finance and Economic Planning; National Institute of Statistics of Rwanda. Fourth Population and Housing Census, Rwanda, 2012; Ministry of Finance and Economic Planning: Kigali, Rwanda; National Institute of Statistics of Rwanda: Kigali, Rwanda, 2014; p. 256.

- Ministry of Infrastructure. Urbanization and Rural Settlement Sector Strategic Plan 2012/13–17/18; Ministry of Infrastructure: Kigali, Rwanda, 2013; p. 108.

- World Bank. Rwanda: Doing Business, Investing in Rwanda Guide; Strategic, Practical Information, Regulations, Contacts, World Business and Investment; International Business Publications: Alexandria, VA, USA, 2019; Volume 1, p. 286. [Google Scholar]

- World Bank. Rwanda-Employment and Jobs Study; World Bank: Washington, DC, USA, 2015; p. 107. [Google Scholar]

- National Institute of Statistics of Rwanda. The Fifth Integrated Household Living Conditions Survey EICV5; Rwanda Poverty Profile Report 2016/17; National Institute of Statistics of Rwanda: Kigali, Rwanda, 2018; p. 82. [Google Scholar]

- Ministry of Finance and Economic Planning. Annual Economic Report Fiscal Year 2017/2018; Ministry of Finance and Economic Planning: Kigali, Rwanda, 2019; p. 34.

- United Nations Children’s Fund. National Budget Brief: Investing in Children in Rwanda 2017/2018; United Nations Children’s Fund: Kigali, Rwanda, 2017; p. 16. [Google Scholar]

- Baffoe, G.; Malonza, J.; Manirakiza, V.; Mugabe, L. Understanding the concept of neighbourhood in Kigali City, Rwanda. Sustainability 2020, 12, 1555. [Google Scholar] [CrossRef]

- Mathema, A. Addressing affordable housing in a modernizing city: The Rwanda experience. In Proceedings of the Sixth Urban Research and Knowledge Symposium, Barcelona, Spain, 10 October 2012. [Google Scholar]

- Nkubito, F.; Baiden-Amissah, A. Regulatory planning and affordable housing in Kigali City: Policies, challenges and prospects. Rwanda J. Eng. Sci. Technol. Environ. 2019, 2. [Google Scholar] [CrossRef]

- World Bank Group. Reshaping Urbanization in Rwanda: Urbanization and the Evolution of Rwanda’s Urban Landscape; World Bank Group: Washington, DC, USA, 2017; p. 40. [Google Scholar]

- National Institute of Statistics of Rwanda. Integrated Household Living Conditions Survey (EICV 4); Main Indicators Report; National Institute of Statistics of Rwanda: Kigali, Rwanda, 2015; p. 240. [Google Scholar]

- City of Kigali. Final Report on High Risk Zone Survey 2016 Conducted in Kigali City; Kigali City: Kigali, Rwanda, 2016; p. 18. [Google Scholar]

- City of Kigali. Kigali Master Plan Review; Interim Master Plan Update; City of Kigali: Kigali, Rwanda, 2019; p. 318. [Google Scholar]

- City of Kigali. Kigali: A Rising Star in Africa: Five Year Achievements (2011–2015); City of Kigali: Kigali, Rwanda, 2016; p. 96. [Google Scholar]

- Government of Rwanda. Law 15-2010 Creating and Organizing Condominiums and Setting-Up Procedures for Their Registration; Official Gazette 14 May 2010; Government of Rwanda: Kigali, Rwanda, 2010.

- Government of Rwanda. Law N° 32/2015 of 11/06/2015 Relating to Expropriation in the Public Interest; Government of Rwanda: Kigali, Rwanda, 2015; p. 54.

- Ministry of Infrastructure. National Urbanization Policy; Ministry of Infrastructure: Kigali, Rwanda, 2015; p. 52.

- City of Kigali. Detailed Master Plan and Urban Design Report for CBD1, CBD2 and Kimicanga; City of Kigali: Kigali, Rwanda, 2010; p. 189. [Google Scholar]

- Uwayezu, E.; de Vries, T.W. Scoping land tenure security for the poor and low-income urban dwellers from a spatial justice lens. Habitat Int. 2019. [Google Scholar] [CrossRef]

- Pirie, G. On Spatial Justice. E. P.A: Economy Space 1983, 15, 465–473. [Google Scholar] [CrossRef]

- Turk, S. Private finance integration to affordable housing production: A comparison between Copenhagen and Istanbul. J. Hous. Built Environ. 2019. [Google Scholar] [CrossRef]

- Bertaud, A. Annual Demographia International Housing Affordability Survey (2018: 3rd Quarter); New York, London and Los Angeles; The Word Bank: New York, NY, USA, 2019; p. 62. [Google Scholar]

- Acolin, A.; Green, R. Measuring housing affordability in São Paulo metropolitan region: Incorporating location. Cities 2017, 62, 41–49. [Google Scholar] [CrossRef]

- Gopalan, K.; Venkataraman, M. Affordable housing: Policy and practice in India. IIMB Manag. Rev. 2015, 27, 129–140. [Google Scholar] [CrossRef]

- UN-Habitat. Affordable Land and Housing in Asia; UN-Habitat: Kenya, Nairobi, 2011; p. 102. [Google Scholar]

- Milligan, V.; Phibbs, P.; Fagan, K.; Gurran, N. A Practical Framework for Expanding Affordable Housing Services in Australia: Learning from Experience; Australian Housing and Urban Research Institute: Melbourne, Australia, 2004; p. 190. [Google Scholar]

- Zhang, C.; Jia, S.; Yang, R. Housing affordability and housing vacancy in China: The role of income inequality. J. Hous. Econ. 2016, 33, 4–14. [Google Scholar] [CrossRef]

- Zhang, Y.; Tan, J. An empirical study of the housing-price-to-income ratio of some typical cities on the basis of purchase installment payment model. In Proceedings of the International Conference on the Modern Development of Humanities and Social Science, Hong Kong, China, 1–2 December 2013; Atlantis Press: Hong Kong, China, 2013; p. 5. [Google Scholar]

- Jewkes, M.; Delgadillo, L. Weaknesses of housing affordability indices used by practitioners. J. Financ. Couns. Plan. 2010, 21, 43–52. [Google Scholar]

- Kopanyi, M. Supporting Affordable Housing in Rwanda—Plans and Options; International Growth Centre: London, UK, 2015; p. 27. [Google Scholar]

- Sheng, Y.K. Housing priorities, expenditure patterns, and the urban poor in third-world countries. Neth. J. Hous. Environ. Res. 1989, 4, 5–15. [Google Scholar] [CrossRef]

- Napoli, G.; Trovato, M.R.; Giuffrida, S. Housing affordability and income-threshold in social housing policy. Procedia Soc. Behav. Sci. 2016, 223, 181–186. [Google Scholar] [CrossRef]

- World Economic Forum. Making Affordable Housing a Reality in Cities; Menon, A., Ed.; World Economic Forum: Geneva, Switzerland, 2019; p. 60. [Google Scholar]

- Schwartz, A. Housing Policy in the United States; Routledge: New York, NY, USA, 2014; p. 466. [Google Scholar]

- Un-Habitat. Planning Sustainable Cities: Global Report on Human Settlements 2009; Sterling: New York, NY, USA; Earthscan: London, UK, 2009; p. 336. [Google Scholar]

- Bah, E.; Faye, I.; Geh, Z. Slum upgrading and housing alternatives for the poor. In Housing Market: Dynamics in Africa; Palgrave Macmillan: London, UK, 2018; pp. 215–253. [Google Scholar]

- World Bank. Rwanda Affordable Housing Finance Project; World Bank: Kigali, Rwanda, 2018; p. 17. [Google Scholar]

- Krishnaswamy, K.N.; Sivakumar, A.I.; Mathirajan, M. Management Research Methodology: Integration of Principles, Methods and Techniques; Pearson Education: Bengaluru, India, 2006. [Google Scholar]

- Ministry of Finance and Economic Planning. Key statistics on Rwanda Plan; Ministry of Finance and Economic Planning: Kigali, Rwanda, 2018; p. 31.

- Ram, P.; Needham, B. Changing ability to pay for housing into effective demand: Evidence of institutional constraints from the slums in India. Cities 2017, 62, 71–77. [Google Scholar] [CrossRef]

- Arundel, R.; Hochstenbach, C. Divided access and the spatial polarization of housing wealth. Urban Geogr. 2019, 1–27. [Google Scholar] [CrossRef]

- Government of Rwanda. Prime Minister’s Order n° 104/03 of 06/05/2015 Determining Procedures for Formulation, Approval, Publication and Revision of the Local Land Development Plan; Government of Rwanda: Kigali, Rwanda, 2015.

- UN-Habitat. World cities report 2016. In Urbanization and Development: Emerging Futures; UN-Habitat: Kenya, Nairobi, 2016; p. 264. [Google Scholar]

- Bah, E.-H.; Faye, I.; Geh, Z. The political economy of housing development in Africa. In Housing Market: Dynamics in Africa; Palgrave Macmillan: London, UK, 2018; pp. 23–55. [Google Scholar]

- Bah, E.-H.; Faye, I.; Geh, Z. The construction cost conundrum in Africa. In Housing Market: Dynamics in Africa; Palgrave Macmillan: London, UK, 2018; pp. 159–214. [Google Scholar]

- UN-Habitat. Citywide Action Plan for Upgrading Unplanned and Unserviced Settlements in Dar Es Salaam; UN-Habitat: Nairobi, Kenya, 2010; p. 74. [Google Scholar]

- Gurran, N.; Whitehead, C. Planning and affordable housing in Australia and the UK: A comparative perspective. Hous. Stud. 2011, 26, 1193–1214. [Google Scholar] [CrossRef]

- Norris, M. Developing, designing and managing mixed tenure estates: Implementing planning gain legislation in the Republic of Ireland. Eur. Plan. Stud. 2006, 14, 199–218. [Google Scholar] [CrossRef]

- O’Dell, W.; Smith, T.M.; White, D. Weaknesses in current measures of housing needs. Hous. Soc. 2004, 31. [Google Scholar] [CrossRef]

- O’Sullivan, E.; de Decker, P. Regulating the private rental housing market in Europe. Eur. J. Homelessness 2007, 1, 95–114. [Google Scholar]

- de Kam, G.; Needham, B.; Buitelaar, E. The embeddedness of inclusionary housing in planning and housing systems: Insights from an international comparison. J. Hous. Built Environ. 2014, 29, 389–402. [Google Scholar] [CrossRef]

- Klug, N.; Rubin, M.; Todes, A. Inclusionary housing policy: A tool for re-shaping South. Africa’s spatial legacy? J. Hous. Built Environ. 2013, 28, 667–678. [Google Scholar] [CrossRef]

- Mulligan, C.T. Inclusionary Zoning: A Guide to Ordinances and the Law; UNC School of Government: Chapel Hill, NC, USA, 2010. [Google Scholar]

- Mukhija, V.; Das, A.; Regus, L.; Tsay, S.S. The tradeoffs of inclusionary zoning: What do we know and what do we need to know? Plan. Pract. Res. 2015, 30, 222–235. [Google Scholar] [CrossRef]

- Schuetz, J.; Meltzer, R.; Been, V. 31 flavors of inclusionary zoning: Comparing policies from San Francisco, Washington, DC, and Suburban Boston. J. Am. Plan. Assoc. 2009, 75, 441–456. [Google Scholar] [CrossRef]

- Szüdi, G.; Kováčová, J. “Building hope: From a shack to 3E house”-Innovative housing approach in the provision of affordable housing for Roma in Slovakia. J. Hous. Built Environ. 2016, 31, 423–438. [Google Scholar] [CrossRef]

- Speck, J. Mandate smart inclusionary zoning. In Walkable City Rules: 101 Steps to Making Better Places; Island Press/Center for Resource Economics: Washington, DC, USA, 2018; pp. 26–27. [Google Scholar]

- de Duren, L.N.R. Why there? Developers’ rationale for building social housing in the urban periphery in Latin America. Cities 2018, 72, 411–420. [Google Scholar] [CrossRef]

- Tsinda, A.; Mugisha, R. Synthesis of the Literature of Studies on Affordable Housing in Kigali, Rwanda; Centre for Global Development, University of Aberdeen: Aberdeen, Scotland, 2018. [Google Scholar]

- Shinde, S.; Karankal, A. Affordable housing materials & techniques for urban poor’s. Int. J. Sci. Res. IJSR 2013, 1, 30–36. [Google Scholar]

- Skat Consulting Rwanda Ltd. Construction Manual for the Great Lakes Region; Stabilised Compressed Earth Blocks—SCEB; Skat Consulting Rwanda Ltd: Kigali, Rwanda, 2017; p. 28. [Google Scholar]

- Dettmer, H.W. Goldratt’s Theory of Constraints: A Systems Approach to Continuous Improvement; Holloway, R., Bohn, W.J., Eds.; ASQC Quality Press: Milwaukee, WI, USA, 1997; p. 378. [Google Scholar]

- Nielsen, R. Varieties of win-win solutions to problems with ethical dimensions. J. Bus. Ethics 2009, 88, 333–349. [Google Scholar] [CrossRef]

- Sara, K.; Laura, T.; Christopher, W. A renter’s tax credit to curtail the affordable housing crisis. RSF Russell Sage Found. J. Soc. Sci. 2018, 4, 131–160. [Google Scholar]

- Randolph, P. Reducing Housing Development Costs: Strategies for Affordable Housing. Urban Lawyer 1982, 14, 401–406. [Google Scholar]

- Government of Rwanda. Ministerial Order N° 04/Cab.M/015 of 18/05/2015 determining urban planning and building regulations; Government of Rwanda: Kigali, Rwanda, 2015; p. 795.

- Ministry of Finance and Economic Planning. Economic Development and Poverty Reduction Strategy II, 2013-2018; Ministry of Finance and Economic Planning: Kigali, Rwanda, 2013; p. 173.

- Michelon, B. The local market in Kigali as controlled public space: Adaptation and resistance by local people to modern city life. In Proceedings of the PhD Seminar on Public Space, Delft, The Netherlands, 19–20 March 2009. [Google Scholar]

- Tian, L.; Yao, Z.; Fan, C.; Zhou, L. A systems approach to enabling affordable housing for migrants through upgrading Chengzhongcun: A case of Xiamen. Cities 2018. [Google Scholar] [CrossRef]

- Muchadenyika, D.; Waiswa, J. Policy, politics and leadership in slum upgrading: A comparative analysis of Harare and Kampala. Cities 2018, 82, 58–67. [Google Scholar] [CrossRef]

- Rwanda Housing Authority. Profiling and providing indication of the status quo and trends in informal settlements and propose mechanisms for their upgrading in Kigali city; Rwanda Housing Authority: Kigali, Rwanda, 2014; p. 145.

- Rwanda Housing Authority. Informal Settlement Upgrading: Kangondo, Kibiraro, Nyabisindu and Nyagatovu; Rwanda Housing Authority: Kigali, Rwanda, 2017; p. 251.

- Smets, P.; van Lindert, P. Sustainable housing and the urban poor. Int. J. Urban Sustain. Dev. 2016, 8, 1–9. [Google Scholar] [CrossRef]

- Nunbogu, A.M.; Korah, P.I.; Cobbinah, P.B.; Poku-Boansi, M. Doing it ‘ourselves’: Civic initiative and self-governance in spatial planning. Cities 2018, 74, 32–41. [Google Scholar] [CrossRef]

- Gwaleba, M.; Masum, F. Participation of informal settlers in participatory land use planning project in pursuit of tenure security. Urban Forum 2018, 29, 169–184. [Google Scholar] [CrossRef]

- Gwaleba, M.J.; Chigbu, U.E. Participation in property formation: Insights from land-use planning in an informal urban settlement in Tanzania. Land Use Policy 2020, 92, 104482. [Google Scholar] [CrossRef]

- Mahadevia, D.; Bhatia, N.; Bhatt, B. Private sector in affordable housing? Case of slum rehabilitation scheme in Ahmedabad, India. Environ. Urban. ASIA 2018, 9, 1–17. [Google Scholar] [CrossRef]

- Chichilnisky, G. A robust theory of resource allocation. Soc. Choice Welf. 1996, 13, 1–10. [Google Scholar] [CrossRef][Green Version]

- Bower, J. Resource allocation theory. In The Palgrave Encyclopedia of Strategic Management; Augier, M., Teece, D.J., Eds.; Palgrave Macmillan: London, UK, 2018; pp. 1445–1448. [Google Scholar]

- Harris, D. Condominium and the city: The rise of property in Vancouver. Law Soc. Inq. 2011, 36, 694–726. [Google Scholar] [CrossRef]

- Makhzoumi, J.; Al-Sabbagh, S. Landscape and urban governance: Participatory planning of the public realm in Saida, Lebanon. Land 2018, 7, 48. [Google Scholar] [CrossRef]

- Takeuchi, A.; Cropper, M.; Bento, A. Measuring the welfare effects of slum improvement programs: The case of Mumbai. J. Urban Econ. 2008, 64, 65–84. [Google Scholar] [CrossRef]

- Dikeç, M. Justice and the Spatial Imagination. Environ. Plan. A 2001, 33, 1785–1805. [Google Scholar] [CrossRef]

- de Vries, W.T.; Chigbu Uchendu, E. Responsible land management—Concept and application in a territorial rural context. Fub Flächenmanag. Bodenordn. 2017, 2, 65–73. [Google Scholar]

- de Vries, W.T.; Voß, W. Economic Versus Social Values in Land and Property Management: Two Sides of the Same Coin? Raumforsch. Raumordn. Spat. Res. Plan. 2018, 76, 381–394. [Google Scholar] [CrossRef]

| 1 | 1 US dollar was equivalent to 906.6 Rwandan Francs on 04 September 2019. See https://www.bnr.rw/index.php?id=23. |

| 2 | Access to housing for people whose monthly income is less than 220.63 US dollars will be promoted through the social housing schemes that the government has recently started to implement across Kigali city. |

| 3 | Ground floor. |

| 4 | This type of zoning is applied in urban fringes, which are still rural areas. |

| 5 | Highly affects the housing affordability. |

| 6 | Moderately affects the housing affordability. |

| 7 | Data were acquired from the price lists on different housing packages which are developed by RSSB. |

| 8 | |

| 9 | The exchange rate was 886 Rwandan Francs for 1 US dollars on 17 January 2019. |

| 10 | |

| 11 | These costs were calculated based on different housing designs and estimates of their costs collected from different engineers and architects operating on the housing market in Kigali city. |

| 12 |

| Housing Category | Number of Unit | Percentage |

|---|---|---|

| Social housing | 43,436.00 | 12.62 |

| Affordable housing | 186,163.00 | 54.11 |

| Mid-range housing | 112,867.00 | 32.80 |

| Premium housing | 1601.00 | 0.47 |

| Total | 344,068.00 | 100.00 |

| Instruments and Tools | Indicative Provisions Related to Housing Development |

|---|---|

| Land policy (2004) | Section 5.5 promotes the good management of urban land through: - Densification in the planned residential areas through the development of high-rise buildings and horizontal semi-detached houses; - Restructuration of informal settlements, including the expropriation of land rights, clearance of houses located in public areas, provision of basic infrastructure and services and resettlement of displaced communities; - Real estate development through the sale of state land to individuals or real estate agencies in order to replace existing buildings with new ones that are bigger, taller, and more luxurious; - Production of a high number of buildable plots and their diversification, so that they can accommodate the highest number of settlement units; - Promotion of access to housing funding schemes. |

| National human settlement policy (2009) | Principle 3.1: The Government of Rwanda recognizes the fundamental right to housing for every citizen. It is determined to provide the population with easy access to decent housing and improve their housing conditions. |

| Strategy 2.2: Rehabilitation of residential areas should give priority to home security for their residents, by means of various solutions including rehousing. | |

| Organic law repealing organic law n° 08/2005 of 14/07/2005 determining the use and management of land in Rwanda (2015) | Article 2 allows for the expropriation of the private land for public interest, including the development of social and affordable housing. |

| Law N° 32/2015 of 11/06/2015 relating to expropriation in the public interest (2015) | Article 7 grants the public agencies or private investors the rights to carry out the expropriation for the implementation of various urban development projects, including the construction of affordable houses. |

| National Urbanisation Policy (2015) | The densification pillar promotes urban compactness, including the development of high building densities for different categories of income group. |

| National housing policy (2015) | Section 3.2 promotes access to housing for all people; Housing development options include: private urban rental housing; shared condominium ownership; rent-to-own; owner mortgage; self-construction with local materials mainly sourced on site; and incremental housing development and improvement; Section 3.3 supports affordable housing development: a housing unit whose cost is around a third of the household’s income. |

| Law n°15/2010 of 07/05/2010 creating and organizing condominiums and setting up procedures for their registration | Article 3 and 4 allow different property owners to own and develop a land plot, like the construction of shared apartments in a condominium tenure. |

| 7 Year Government Programme: National Strategy for Transformation 2017–2024 (2017). | The priority area 5 of the social transformation pillar promotes the improvement of household living conditions through: - The relocation of households living in in high-risk zones through the development of affordable and sustainable housing models for urban and rural areas; - Operationalization of the affordable housing fund to facilitate citizens to acquire affordable and decent housing. The fund will offer affordable interest rates to both private sector and beneficiaries. |

| Zoning Category | Types of Residential Housing Unit | Maximum Number of Floors | Total Areas in Km2 by 2040 |

|---|---|---|---|

| R1: Single-family residential | All types of single-family houses in form of a detached villa | G3 + 1 | 17.23 |

| R1A: Mixed single-family residential | All types of single-family houses and low-rise apartments: detached and semi-detached Villas | G + 1 | 57.73 |

| R1B: Rural residential4 | All types of single-family houses: detached and semi-detached villas | G + 1 | 18.66 |

| R2: Low-rise residential | All types of single-family houses and low-rise apartments: detached and semi-detached villas | G + 3 (apartments) | 35.48 |

| R3: Medium-rise residential | Low- and medium-rise apartments, detached and semi-detached villas. | G + 7 (apartments) | 38.45 |

| R4: High-rise residential | Low- and medium-rise multifamily and high-rise apartments | G+15 (apartments) | 1.53 |

| Real Estate Developer | Housing Package | Housing Price in US Dollars | PIR: ≤3.0 (Affordable) | PIR: >3.0 ≤ 4.0 (Moderately Unaffordable) | PIR: >4.0 ≤ 5.0 (Seriously Unaffordable) | PIR: > 5.0 (Severely Unaffordable) | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| % of Households | Income Range | % of Households | Income Range | % of Households | Income Range | % of Households | Income Ranges | |||

| Abadahigwa Kuntego Ltd. | 3-bedroom house | 30,535 | 19.62 | 902.93–1354.41 | 15.89 | 677.20– 846.50 | 9.35 | 564.33–620.77 | 55.14 | 225.73–507.90 |

| Groupe Palmeraie Développement | 2-bedroom, 1st and 2nd floor | 32,500 | 19.62 | 902.93–1354.402 | 15.89 | 677.2–846.5 | 9.35 | 564.33–620.77 | 55.14 | 225.73–507.9 |

| 2-bedroom, 2nd and 3rd floor | 36,500 | 15.17 | 1015.8–1354.402 | 12.15 | 790.07–959.37 | 13.54 | 620.77–733.63 | 60.75 | 225.73–564.33 | |

| 2-bedroom, ground floor | 39,000 | 10.28 | 1128.67–1354.402 | 13.08 | 846.5–1072.23 | 12.15 | 677.2–790.07 | 64.49 | 225.73–620.77 | |

| 3-bedroom, 1st, 2nd & 3rd floor | 42,500 | 8.41 | 1185.11–1354.41 | 11.21 | 902.93–1128.67 | 12.15 | 733.63–846.50 | 68.23 | 225.73–677.20 | |

| Shelter Afrique | 1-bedroom | 22,953 | 35.51 | 677.20–1354.41 | 14.02 | 507.90–620.77 | 14.02 | 395.03–451.47 | 36.45 | 225.73–338.60 |

| 2-bedroom | 42,627 | 8.41 | 1185.11–1354.41 | 11.21 | 902.93–1128.67 | 12.15 | 733.63–846.50 | 68.23 | 225.73–677.20 | |

| 3-bedroom | 55,743 | 0.00 | - | 8.41 | 1185.11–1354.41 | 23.36 | 733.63–1128.67 | 68.23 | 225.73–677.20 | |

| 4-bedroom | 68,859 | 0.00 | - | 0.00 | - | 31.77 | 1185.102–1354.41 | 68.23 | 225.73–1,128.67 | |

| Mean | 16.7 | 12.73 | 15.32 | 60.54 | ||||||

| (Un)Affordability trends | Affordable | Moderately unaffordable | Seriously unaffordable | Severely unaffordable | ||||||

| Household Details | Housing Developer | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Abadahigwa Kuntego Ltd. | Groupe Palmeraie Développement | Shelter Afrique | ||||||||||

| Percentage of surveyed households | Monthly income in $ | Annual income in $ | Cumulative percentage of surveyed households | 3 bedroom | 2 bedroom, 1st and 2nd floor | 2-bedroom 2nd and 3rd floor and Parking | 2-bedroom Ground floor and parking | 3-bedroom 1st, 2nd & 3rd floor | 1-bedroom | 2-bedroom | 3-bedroom | 4-bedroom |

| Number of Units and Unit Price | ||||||||||||

| 54 | 264 | 246 | 234 | 566 | 866 | 982 | 719 | 107 | ||||

| 30,535 | 32,500 | 36,500 | 39,000 | 42,500 | 22,953 | 42,627 | 55,743 | 68,859 | ||||

| 15.89 | 225.73 | 2,708.80 | 100.00 | 11.27 | 12.00 | 13.47 | 14.40 | 15.69 | 8.47 | 15.74 | 20.58 | 25.42 |

| 11.21 | 282.17 | 3,386.00 | 84.11 | 9.02 | 9.60 | 10.78 | 11.52 | 12.55 | 6.78 | 12.59 | 16.46 | 20.34 |

| 9.35 | 338.60 | 4,063.21 | 72.9 | 7.51 | 8.00 | 8.98 | 9.60 | 10.46 | 5.65 | 10.49 | 13.72 | 16.95 |

| 7.48 | 395.03 | 4,740.41 | 63.55 | 6.44 | 6.86 | 7.70 | 8.23 | 8.97 | 4.84 | 8.99 | 11.76 | 14.53 |

| 6.54 | 451.47 | 5,417.61 | 56.07 | 5.64 | 6.00 | 6.74 | 7.20 | 7.84 | 4.24 | 7.87 | 10.29 | 12.71 |

| 4.67 | 507.90 | 6,094.81 | 49.53 | 5.01 | 5.33 | 5.99 | 6.40 | 6.97 | 3.77 | 6.99 | 9.15 | 11.30 |

| 5.61 | 564.33 | 6,772.01 | 44.86 | 4.51 | 4.80 | 5.39 | 5.76 | 6.28 | 3.39 | 6.29 | 8.23 | 10.17 |

| 3.74 | 620.77 | 7,449.21 | 39.25 | 4.10 | 4.36 | 4.90 | 5.24 | 5.71 | 3.08 | 5.72 | 7.48 | 9.24 |

| 3.74 | 677.20 | 8,126.41 | 35.51 | 3.76 | 4.00 | 4.49 | 4.80 | 5.23 | 2.82 | 5.25 | 6.86 | 8.47 |

| 4.67 | 733.63 | 8,803.61 | 31.77 | 3.47 | 3.69 | 4.15 | 4.43 | 4.83 | 2.61 | 4.84 | 6.33 | 7.82 |

| 3.74 | 790.07 | 9,480.81 | 27.10 | 3.22 | 3.43 | 3.85 | 4.11 | 4.48 | 2.42 | 4.50 | 5.88 | 7.26 |

| 3.74 | 846.50 | 10,158.01 | 23.36 | 3.01 | 3.20 | 3.59 | 3.84 | 4.18 | 2.26 | 4.20 | 5.49 | 6.78 |

| 2.80 | 902.93 | 10,835.21 | 19.62 | 2.82 | 3.00 | 3.37 | 3.60 | 3.92 | 2.12 | 3.93 | 5.14 | 6.36 |

| 1.87 | 959.37 | 11,512.42 | 16.82 | 2.65 | 2.82 | 3.17 | 3.39 | 3.69 | 1.99 | 3.70 | 4.84 | 5.98 |

| 2.80 | 1015.80 | 12,189.62 | 14.95 | 2.51 | 2.67 | 2.99 | 3.20 | 3.49 | 1.88 | 3.50 | 4.57 | 5.65 |

| 1.87 | 1072.23 | 12,866.82 | 12.15 | 2.37 | 2.53 | 2.84 | 3.03 | 3.30 | 1.78 | 3.31 | 4.33 | 5.35 |

| 1.87 | 1128.67 | 13,544.02 | 10.28 | 2.25 | 2.40 | 2.69 | 2.88 | 3.14 | 1.69 | 3.15 | 4.12 | 5.08 |

| 1.87 | 1,185.102 | 14,221.22 | 8.41 | 2.15 | 2.29 | 2.57 | 2.74 | 2.99 | 1.61 | 3.00 | 3.92 | 4.84 |

| 2.80 | 1,241.535 | 14,898.42 | 6.54 | 2.05 | 2.18 | 2.45 | 2.62 | 2.85 | 1.54 | 2.86 | 3.74 | 4.62 |

| 1.87 | 1,297.968 | 15,575.62 | 3.74 | 1.96 | 2.09 | 2.34 | 2.50 | 2.73 | 1.47 | 2.74 | 3.58 | 4.42 |

| 1.87 | 1,354.402 | 16,252.82 | 1.87 | 1.88 | 2.00 | 2.25 | 2.40 | 2.61 | 1.41 | 2.62 | 3.43 | 4.24 |

| (Un)Affordability trends | Affordable | Moderately unaffordable | Seriously unaffordable | Severely unaffordable | ||||||||

| Household Details | Housing Developer | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Abadahigwa Kuntego Ltd. | Groupe Palmeraie Développement | Shelter Afrique | |||||||||||

| Percentage of surveyed households | Monthly income in $ | Annual income in $ | Percentage of surveyed households | Cumulative percentage of households | 3 bed room | 2 bedroom, 1st and 2nd Floor | 2-bedroom 2nd and 3rd Floor and Parking | 2 bedroom Ground Floor and parking | 3 bedroom 1st, 2nd & 3rd Floor | 1 bed room | 2 bed room | 3 bed room | 4 bed room |

| Number of Units and Unit Price | |||||||||||||

| 54 | 264 | 246 | 234 | 566 | 866 | 982 | 719 | 107 | |||||

| 30,535 | 32,500 | 36,500 | 39,000 | 42,500 | 22,953 | 42,627 | 55,743 | 68,859 | |||||

| 17 | 225.73 | 2708.80 | 15.89 | 100 | 130.68 | 139.11 | 155.94 | 166.57 | 181.63 | 98.35 | 182.08 | 238.34 | 294.60 |

| 12 | 282.17 | 3386.00 | 11.21 | 84.11 | 104.55 | 111.28 | 124.75 | 133.25 | 145.31 | 78.68 | 145.66 | 190.67 | 235.67 |

| 10 | 338.60 | 4063.21 | 9.35 | 72.9 | 87.13 | 92.74 | 103.96 | 111.05 | 121.087 | 65.56 | 121.38 | 158.89 | 196.39 |

| 8 | 395.03 | 4740.41 | 7.48 | 63.55 | 74.68 | 79.48 | 89.11 | 95.18 | 103.78 | 56.20 | 104.04 | 136.19 | 168.34 |

| 7 | 451.47 | 5417.61 | 6.54 | 56.07 | 65.35 | 69.55 | 77.97 | 83.28 | 90.82 | 49.17 | 91.04 | 119.17 | 147.30 |

| 5 | 507.90 | 6094.81 | 4.67 | 49.53 | 58.08 | 61.82 | 69.31 | 74.03 | 80.73 | 43.71 | 80.92 | 105.93 | 130.94 |

| 6 | 564.33 | 6772.01 | 5.61 | 44.86 | 52.28 | 55.64 | 62.37 | 66.63 | 72.65 | 39.34 | 72.83 | 95.34 | 117.84 |

| 4 | 620.77 | 7449.21 | 3.74 | 39.25 | 47.52 | 50.58 | 56.71 | 60.57 | 66.05 | 35.76 | 66.21 | 86.67 | 107.13 |

| 4 | 677.20 | 8126.41 | 3.74 | 35.51 | 43.56 | 46.37 | 51.98 | 55.53 | 60.54 | 32.78 | 60.69 | 79.45 | 98.19 |

| 5 | 733.63 | 8803.61 | 4.67 | 31.77 | 40.21 | 42.81 | 47.98 | 51.25 | 55.88 | 30.26 | 56.03 | 73.34 | 90.64 |

| 4 | 790.07 | 9480.81 | 3.74 | 27.1 | 37.34 | 39.74 | 44.56 | 47.59 | 51.89 | 28.09 | 52.03 | 68.09 | 84.17 |

| 4 | 846.50 | 10,158.01 | 3.74 | 23.36 | 34.85 | 37.09 | 41.58 | 44.42 | 48.44 | 26.23 | 48.55 | 63.56 | 78.56 |

| 3 | 902.93 | 10,835.21 | 2.80 | 19.62 | 32.67 | 34.77 | 38.98 | 41.64 | 45.41 | 24.58 | 45.52 | 59.58 | 73.65 |

| 2 | 959.37 | 11,512.42 | 1.87 | 16.82 | 30.75 | 32.73 | 36.69 | 39.19 | 42.74 | 23.14 | 42.85 | 56.08 | 69.32 |

| 3 | 1,015.80 | 12,189.62 | 2.80 | 14.95 | 29.04 | 30.91 | 34.65 | 37.02 | 40.36 | 21.85 | 40.47 | 52.97 | 65.46 |

| 2 | 1,072.23 | 12,866.82 | 1.87 | 12.15 | 27.52 | 29.28 | 32.83 | 35.06 | 38.24 | 20.71 | 38.34 | 50.18 | 62.03 |

| 2 | 1,128.67 | 13,544.02 | 1.87 | 10.28 | 26.14 | 27.82 | 31.18 | 33.32 | 36.33 | 19.67 | 36.42 | 47.67 | 58.92 |

| 2 | 1,185.102 | 14,221.22 | 1.87 | 8.41 | 24.89 | 26.49 | 29.71 | 31.73 | 34.59 | 18.73 | 34.68 | 45.40 | 56.12 |

| 3 | 1,241.535 | 14,898.42 | 2.80 | 6.54 | 23.76 | 25.29 | 28.35 | 30.28 | 33.03 | 17.88 | 33.11 | 43.34 | 53.57 |

| 2 | 1,297.968 | 15,575.62 | 1.87 | 3.74 | 22.73 | 24.19 | 27.12 | 28.97 | 31.58 | 17.11 | 31.67 | 41.45 | 51.24 |

| 2 | 1,354.402 | 16,252.82 | 1.87 | 1.87 | 21.78 | 23.18 | 25.98 | 27.76 | 30.27 | 16.39 | 30.35 | 39.73 | 49.10 |

| (Un)Affordability trends | Affordable | Moderately unaffordable | Unaffordable | ||||||||||

| Less than 30% of household income | Between 30% and 40% of household income | Over 40% of household income | |||||||||||

| Factors for Housing Unaffordability | City and Country | References | |||

|---|---|---|---|---|---|

| Nairobi (Kenya) | Kampala (Uganda) | Dar Es Salaam (Tanzania) | Kigali (Rwanda) | ||

| Low household income | ++5 | ++ | ++ | ++ | [29,41,65,75,76,77,78] |

| High construction costs | ++ | ++ | ++ | ++ | |

| Limited access to bank loan | ++ | ++ | ++ | ++ | |

| Construction materials | +6 | ++ | ++ | ++ | |

| Taxes on the investment | ++ | ++ | ++ | ++ | |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Uwayezu, E.; Vries, W.T.d. Access to Affordable Houses for the Low-Income Urban Dwellers in Kigali: Analysis Based on Sale Prices. Land 2020, 9, 85. https://doi.org/10.3390/land9030085

Uwayezu E, Vries WTd. Access to Affordable Houses for the Low-Income Urban Dwellers in Kigali: Analysis Based on Sale Prices. Land. 2020; 9(3):85. https://doi.org/10.3390/land9030085

Chicago/Turabian StyleUwayezu, Ernest, and Walter T. de Vries. 2020. "Access to Affordable Houses for the Low-Income Urban Dwellers in Kigali: Analysis Based on Sale Prices" Land 9, no. 3: 85. https://doi.org/10.3390/land9030085

APA StyleUwayezu, E., & Vries, W. T. d. (2020). Access to Affordable Houses for the Low-Income Urban Dwellers in Kigali: Analysis Based on Sale Prices. Land, 9(3), 85. https://doi.org/10.3390/land9030085