1. Introduction

Inclusive businesses (IBs) are commercially viable business partnerships between large-scale farms, agribusinesses or large corporations (the commercial partner) on the one hand, and smallholder farmers and low-income communities (the beneficiaries) on the other [

1]. These partnerships, which can take various forms as will be described in this paper, are considered to play an increasingly vital role in developing countries, not only in terms of creating local jobs, improving livelihoods and food security, supporting gender diversity, and enhancing economic options, but also in respect to transferring skills, technologies, quality management and sound business standards along value chains, particularly in favor of the smaller farm entities and low-income communities [

2]. IBs are increasingly complex institutional set-ups, combining numerous levels of organization, as well as different instruments, aimed at including smallholder farmers and other previously disadvantaged groups in commercial agricultural value chains, and subsequently, at transferring a share of the IBs’ value addition to these beneficiaries [

1]. The combination of instruments, embedded in IB structures, partly relates to the well-documented shortcomings of individual instruments. These interlinked instruments further aim to overcome uncertainty and indicate a power imbalance between the commercial partner and the beneficiaries.

In addition, in the particular case of South Africa, IBs are presently being promoted as “win–win” strategies for smallholders and agribusinesses, and as a solution for revitalizing stagnating land reform and agricultural development, particularly among smallholders and emergent farmers [

3,

4,

5,

6]. Firstly, the country is characterized by concentrated land ownership and a highly dualistic agricultural sector. The government aims to address this skewed land ownership through its land reform policy framework. This framework is built on three pillars: land restitution to return land to communities that were forcefully removed during the apartheid era; land redistribution to increase ownership of land for black farmers; and land tenure reform aimed at enhancing tenure security under different legal and traditional arrangements [

7]. Secondly, the government is seeking to bring about a more equal agricultural sector with increased participation by the formerly excluded black population through a policy framework aimed at sector transformation and empowerment. To achieve these dual reforms, the government actively supports certain forms of partnerships such as strategic partnerships between the land claimant community and a commercial operator for redistributed or restituted farms, grants to establish farm-worker equity share schemes to alter land ownership, and prescribed mentorships with commercial partners as a condition for emerging farmers to gain access to government land and grant funding [

1,

8,

9,

10]. It envisages these IB partnerships as tools to provide smallholders with, among other things, technical assistance and market access, but also financial contributions, to prevent the failure of the many land reform projects in South Africa [

11,

12]. These partnerships fit the narrative of an efficient, market-led model of land reform that supports the large-scale commercial farming model [

12,

13].

The question that arises in this context of commercial contribution to developmental goals set by government is how these IBs contribute to beneficiary empowerment, transforming land distribution and generating agrarian reform. This question is imperative considering that the commercial partner potentially prioritizes its profit drive over the government’s aim of transformation [

14], and as such, jeopardizes the essence of IBs.

This paper aims to provide an answer to this question based on strong and extensive empirical evidence, as it presents insights from primary research on 14 IB cases across South Africa. Each of these case studies, active in various agricultural sub-sectors and provinces, was selected for its unique organizational structure and its relatively stable and sustainable state. The case studies’ unique structures reflect the diversity of IBs and the combination of instruments, and allows for the assessment of diverging results for IBs as a project and the impact of these combinations of instruments with regard to the inclusion of smallholder farmers and poor communities in particular. The choice of stable and sustainable IB cases was retained to allow for conclusions to be drawn from concrete evidence based on relative success stories or good practices.

Following this contextualization and problem-statement introduction, the next section provides a brief description of the theoretical framework that underlies the formation of complex IB structures and presents the case studies and instruments which were empirically assessed for this project.

Section 3 links the theoretical and policy frameworks to provide an answer to the first question on how the policy framework influences the establishment of IBs.

Section 4 and

Section 5 present insights into the multi-level impact of the performance of IBs and their contributions to development.

Section 4 analyzes the IBs from a project level, whereas

Section 5 analyzes the performance relating to individual beneficiaries in particular. While referring back to the theoretical framework,

Section 6 analyzes the structural limitations of IBs as tool for beneficiary empowerment and South Africa’s broader development and transformation objectives. This leads to

Section 7 which outlines recommendations to make IBs more equitable and sustainable, enhancing their contribution as tools for public development. In conclusion,

Section 8 places IBs within the wider debate on land reform and agricultural transformation.

2. From Theoretical Framework to Concrete Set-Up—IBs as Complex Organizational Structures

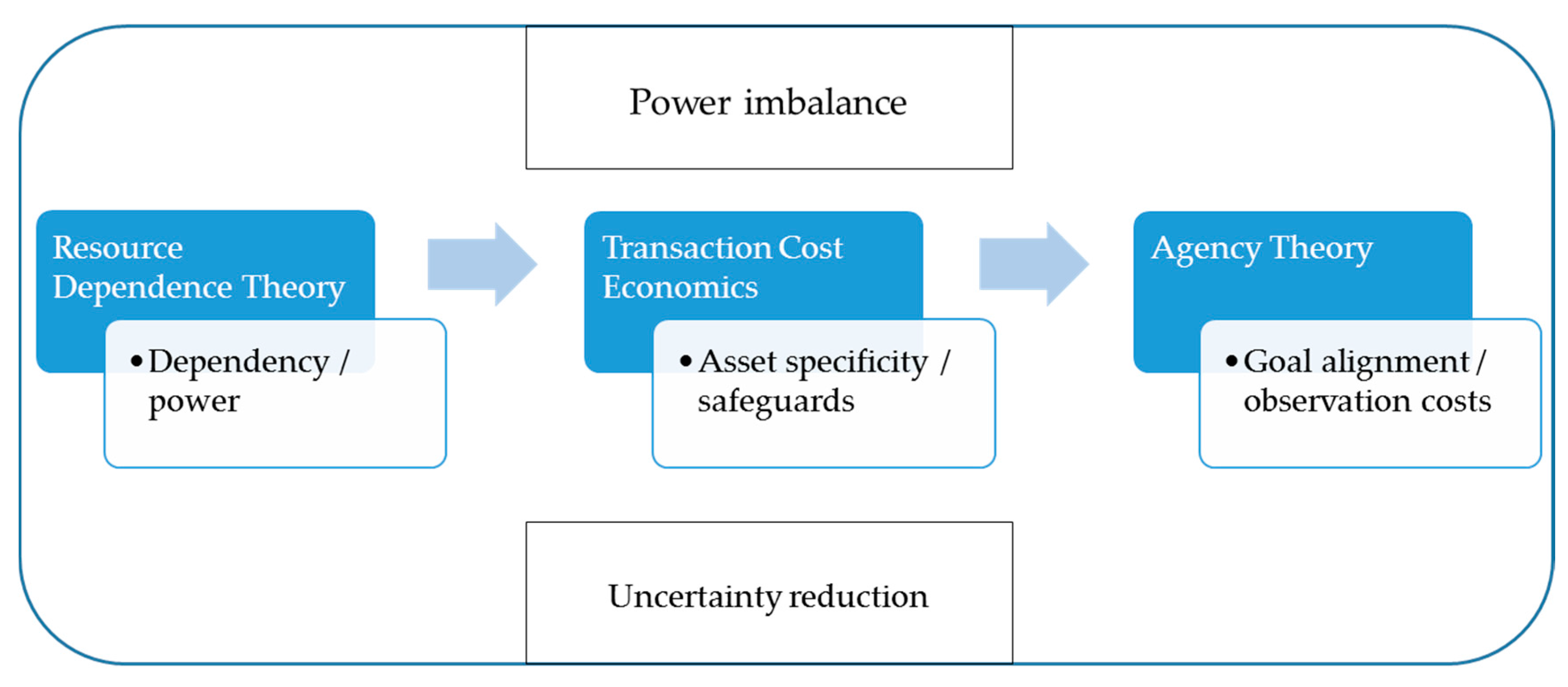

This section briefly addresses the questions as to why partnerships between agribusinesses and smallholders/low-income communities are established, why these partnerships implement unique organizational structures using standard instruments, and how these instruments are combined. The answers lie in three sequential steps (

Figure 1). Firstly, resource dependence theory (RDT) argues that partners are driven to minimize uncertainty related to dependency on external parties for their core activities [

15]. Rather than aiming for efficiency, partners try to obtain power over the resources of another stakeholder [

16]. This thinking is particularly relevant to IBs which are inherently uncertain due to the unfamiliarity between the agribusiness and the low-income community [

17] and the power imbalance favoring the commercial partner [

18]. RDT thus identifies the likely partners and the core instrument implemented by the more powerful partner to overcome uncertainty related to resources owned by the partner. Secondly, the more powerful commercial partner then aims to transact as efficiently as possible with the low-income community and to protect its IB-specific investments, core arguments of Transaction Cost Economics (TCE) [

19]. The greater financial means of the commercial partner are likely to drive safeguards in the contractual agreement that favor this stakeholder, potentially at the expense of the smallholders/low-income community in that IB. Once the partnership is operational, the principal (the commercial agribusiness in an IB) wants to ensure that the agents (smallholders or low-income community) act in accordance with the contract entered into as reasoned by Agency Theory (AT) [

20]. Principals are faced with moral hazard (shirking by the agent) and adverse selection risks. Reducing these risks requires observation costs. The principal’s aim is to balance these risks and costs, with goal alignment a critical tool to obtain this balance [

20] Instruments are thus implemented in the overall IB structure to minimize shirking risks and observation costs, once again with the likelihood of benefiting the commercial partner more than the beneficiaries. The central elements binding these theories are power imbalance and uncertainty reduction, as expressed through different risk profiles between the partners [

21]. See Chamberlain and Anseeuw [

22] for a detailed argumentation and application of this theoretical framework.

To gain insight into the contribution of IBs to the development and transformation goals of the South African government, 14 case studies have been selected. Interviews with the commercial partner, beneficiary representatives and randomly selected individual beneficiaries, as well as external stakeholders such as financiers or government officials, provided insights into the organizational structure, the drivers behind IB participation, and the impacts of these IBs. The case studies, which have all achieved a certain level of sustainability, vary greatly in terms of scale, crop, location, and type of beneficiary (

Table 1). To illustrate, Mphiwe Siyalima only has one beneficiary who is fully dependent on the IB for his livelihood, whereas cases such as Mondi, New Dawn and Richmond have over 1000 beneficiaries, who are not actively engaged in the IB and rely on alternative income streams such as social grants and non-IB related employment. Other beneficiaries, such as in the THS and SST cases, are passive landowners who are unable to independently cultivate their land and consider IB participation as a way to supplement their non-IB related income with land rental.

Each of the standard instruments identified can be implemented for the production of a range of crops, and are thus not crop or sector specific. Nor are the IBs crop and sector specific, although certain combinations of instruments tend to fit certain contexts better. For example, Tongaat Hulett Sugar (THS) and other sugar producers source sugar cane directly from small farmers through a simple supply contract and through two models included in this study, whereas several models have been implemented in the forestry sector, varying from large-scale plantations (the Mondi case in this study) to supply contracts from smallholder farmers [

23]. IBs only seem less suitable for highly mechanized grain production where economies of scale dominate [

24].

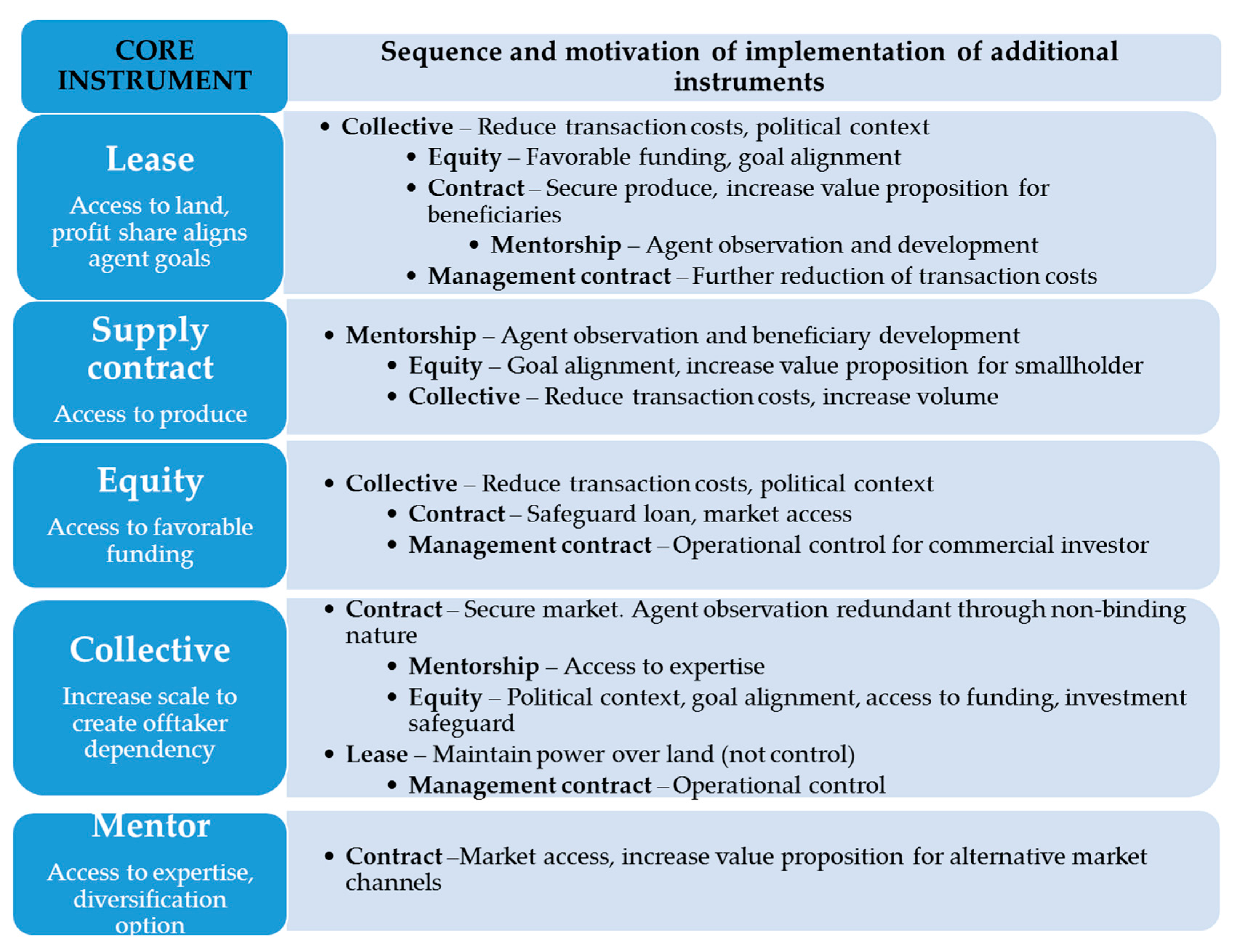

Following from the theoretical framework,

Figure 2 summarizes the combinations of instruments as observed in our 14 case studies. Each of the IBs is centered on the instrument best suited to gain access to a specific resource (in

italic in

Table 1), thus overcoming an initial dependency. Additional instruments are then added to the IB structure to reduce transaction costs, to safeguard IB-specific investments, and to ensure that the smallholders/low-income communities adhere to the contract that they agreed upon. These motivations create unique organizational structures, interlinking up to five different instruments, for the integration of IB beneficiaries into commercial value chains.

Firstly, a lease agreement provides a commercial agribusiness with access to land owned by smallholders/low-income communities at minimum risk. In this study, this instrument is always combined with a collective organization that either holds the land title, as dictated by government to land restitution communities (Mondi, New Dawn and Richmond), or is a gathering of individuals, each with a small area of land (THS cases). The collective organization allows the commercial lessee to minimize transaction costs. Shared equity with the landowners in the operating farm company provides the commercial partner access to favorable financing earmarked to assist poor landowners to engage in activities on their land (New Dawn), underlining the resource dependency argument. It also aligns the goals of both equity partners, reducing the risk of shirking as argued by AT. Shared equity requires a supply contract and a management agreement by the commercial partner to gain control over the produce and operation respectively, effectively allowing the commercial partner to appropriate the output of its efforts as operator [

25]. A supply contract is also implemented where the beneficiaries own both the land and the productive assets such as sugarcane roots (THS-Vuselela) or trees. A lease plus mentorship prepares the landowners for independent farm operations whilst allowing the off-taker to closely monitor the activities of the landowners (Mondi). Lastly, a commercial lessor enters into a management contract with a third party to reduce transaction costs related to the interaction with the smallholders (THS-Simamisa).

Secondly, a supply contract rather allows the commercial partner to gain access to produce instead of land, involving smallholders actively working their land. These smallholder farmers are unfamiliar with the business of supplying the commercial value chain and thus require additional support in the form of a mentorship (TNS-MM). This instrument not only improves the skills of the smallholder, but also allows the off-taker to observe the smallholder’s behavior and warrant the smallholder’s adherence to the contractual obligations as argued by AT. Working with a collective of smallholders reduces the off-taker’s transaction costs. In several cases (TNS-MM, WUFA), the smallholders have been provided equity in downstream facilities, increasing their interests in supplying this particular channel, and, in theory, reducing extra-contractual sales [

22].

The third instrument—equity—is applied to establish joint ventures that can gain access to favorable financing earmarked to bring about transformation and stimulate development through increased ownership by poor communities. The availability of favorable financing creates external dependency by the commercial partner on these communities and is the main driver for the choice of this instrument. In this study, equity always involves a collective organization of beneficiaries to efficiently manage the shareholding of these beneficiaries (Blue Mountain Berries, Bosman Vineyards). A supply contract subsequently transfers ownership of the produce fully to the off-taker, whereas a management contract transfers control over the IB operation to the commercial partner (Katmakoep Boerdery). Both instruments diminish the IB-related risks for the commercial partner, but also reduce the inclusion of the beneficiaries, undermining the development goal that underlines the funding.

Fourthly, a collective organization potentially allows smallholders to overcome scale issues and increase their appeal as a partner for a commercial agribusiness argued by RDT. This collective can consist of active farmers entering into a supply contract (WUFA), or passive landowners leasing out their land (SST). In the first scenario, mentorship and equity improve the business case for the smallholders and align goals between the farmers and the firm. In the second scenario, shared asset contribution between the partners motivates the commercial partner to negotiate an additional management contract to gain control over the farming activities.

Lastly, a smallholder can search for a mentor to enable him/her to gain access to the commercial value chain (TNS-Nwanedi). In the particular case of South Africa, the institutional environment compels farmers signing a land lease with the government to enter into such a mentorship, thus directly dictating the instrument choice for the lessee (Mphiwe Siyalima). A supply contract anchors the smallholder’s business, whilst the independent mentor reduces the smallholder’s dependency on this particular off-taker through the development of the farmer’s skills and the opening up of diversification opportunities.

This short elaboration on the interlinkage of instruments illustrates that the power imbalance allows the commercial partner to indeed dictate the organizational structure of the IB. Control over the IB structure is further increased by the risk attitude of both partners. Risk averse smallholders without full information regarding both the highly complex contracts and commercial market operation appear to accept a lower share of the rewards of the IB in return for a lower risk exposure, whereas the risk-taking commercial partners are able to appropriate the results of high input of efforts [

25,

26,

27]. Risk reduction, specifically in the form of moral hazard by an unfamiliar partner, drive the agri-businesses in particular to implement interlinked instruments, within the specific policy framework of South Africa [

21]. A more detailed analysis on the interaction between these instruments within the confines of an IB is outside of the scope of this particular paper.

1 3. Land Reform Policies as a Driver of IBs

The IBs analyzed in this study strongly reflect the South African government’s transformation goals, and land reform policies in particular, which not only promote but also shape the implementation of IBs and their organizational structure. Two areas of policy impacting on the institutional set-up have been identified, namely indirect and direct policy. Indirect policy is related to the country’s land redistribution and restitution policies, which change the ownership structure of land, thus affecting the access to land and produce. This results in the creation of dependency—either for land or produce—of commercial businesses on smallholders/low-income communities as new landowners, indirectly stimulating the establishment of IBs. Land dependency tends to stimulate IBs based on the lease instrument, especially where the new landowners are inexperienced and have no technical or financial capacity to develop their farming activities. Vice versa, the new landowners, conditioned by government to continue the often high-value, commercial activities on their newly acquired land, are dependent on a commercial operator, driving equity- and mentorship-based IBs.

Agribusiness dependency on smallholders in the South African context is extended through the AgriBEE policy. Under this scheme, agri-processing companies are stimulated to increase their supply from smallholders and low-income communities. Agribusinesses affected by this policy can implement IBs centered on a supply contract with historically disadvantaged farmers. Dependency between agribusiness and smallholders is further deepened by the availability of favorable government funding to achieve the policy goals of land reform and agricultural transformation. Thus, the policy framework creates a stimulating environment that reinforces smallholders and low-income communities [

28], but the stakeholders are flexible in the organizational structure they implement.

In addition, the government supports, and even forces, the implementation of favored instruments, and thus directly drives the structure of an IB, illustrating that the institutional context limits the contract choice between partners [

21]. As such, the Limpopo provincial government forced land claimant communities and commercial partners to enter into joint venture structures where both partners share equity in a newly established operating company (New Dawn) [

8]. The government in the Western Cape Province rather favored farm-worker equity schemes, providing grant funding to numerous projects under its jurisdiction to transfer land/farm ownership from a commercial farmer to his/her employees (Blue Mountain Berries, Bosman Vineyards) [

29]. Furthermore, under the national land redistribution framework, emerging farmers gained access to government land rental on condition of a mentorship by a commercial farmer/agribusiness (Mphiwe Siyalima). Lastly, smallholders across the country are stimulated by government to organize themselves into cooperatives in order to offer scale to a commercial partner (SST).

Despite the positive impact of the policy framework on the initiation of IBs, this study also illustrates the shortcomings of government engagement. Financing for beneficiaries’ equity, be it to land claimant communities or farm workers, has either been cumbersome or has not materialized at all, putting IBs with an equity component under significant financial, and subsequent operational, strain. The drive for collective organizations is not backed up by the capacitation of these communal bodies, leaving the beneficiaries in a vulnerable position vis-à-vis the commercial partner. Even government-initiated mentorships have been more beneficial to the mentor than to the mentee [

1]. Contract constraints, although aimed at assisting the IB beneficiaries, can thus result in an opposite effect [

21].

Nevertheless, the socio-political context of South Africa has forced agribusinesses to create partnerships with smallholders and low-income communities. However, these partnerships do not necessarily align with their profit objective. To reduce their risk in relation to these unfamiliar partnerships, the commercial partner will aim to safeguard control over the IB according to the theoretical framework. This has driven many of the complexities observed in the studied IB structures, with most of the additional instruments implemented to benefit the commercial partner rather than the smallholders/low-income communities. The risk is thus of corporate control over low-income community-owned resources, rather than the envisaged development of the beneficiaries IBs aim to assist [

26]. This will be further analyzed in the next two sections elaborating on the results of IBs.

4. Varying Results at IB Project Level

The IBs studied show different outcomes, not only as a business, but also for the beneficiaries included. The IBs performances on these two levels subsequently lead to varying impact on the overall government goals of agricultural sector transformation and land reform. The same instruments can lead to different results, depending on factors such as the combination with other instruments, as well as the specific conditions in operation. This section analyzes the results of the IB as organization, whereas the next section focuses on the impact on the individual beneficiaries. The remaining sections refer back to the wider public debate.

At project level in particular, the assessments of the IB cases studied show positive results, as envisaged by proponents of IBs [

2,

30,

31,

32]. Overall, the large majority of the case studies showed a degree of sustainability, and in many cases even growth at project level. This is illustrated by an increase in land under production, the accumulation of assets and infrastructure, and the accrual of income at project level. Although the businesses are not necessarily generating profits, most seem to be able to grow and develop their activities. Positive results were also manifested when considering external linkages. Although linkages to the local economy were in some cases minimal, with few spatial spin-offs [

33], access to input and output markets for the IBs were attained in most, if not all, cases. In addition, the projects provided access to technology and technological development, enabled certifications, and created job opportunities for the local community. As such, IBs—as complex combinations of inclusive instruments—have been shown at project level to have the capacity to create conditions for the sustainable inclusion of smallholders and low-income communities in modern value chains.

However, a few notes of caution are necessary. The IBs analyzed were selected because they had been in existence for some time and were in a medium to longer state of maintenance (required for assessment purposes). Even the cases that were struggling at project level, and which were evolving into new structural set-ups, showed regular and significant income at project level. This purposive selection bias has to be taken into consideration when drawing conclusions from this work, and when generalizing the impact of IBs. One should indeed be careful not to overrate the overall impact (positive and less positive) of these IBs, even at project level. Many of the IBs in South Africa do not reach the implementation phase, or fail during implementation [

34], thus illustrating the many challenges to be overcome before being able to start operating. In no case can the results based on this study’s analysis lead to a quantification of the overall impact, when all IBs—success stories and failures—are considered. The positive impact of the IBs described here should be seen as a positive outcome of successful cases, or in other words, as potential benefits and rewards when an IB is successful.

The results of this study also indicate that outcomes are diverse, even when the same instrument is used. This is illustrated, for example, in the case of mentorship related to land reform policies. Two emerging farmers gained access to government-owned land on a leasehold, on condition of a mentorship agreement. Whereas little knowledge transfer occurred for one farmer, the other farmer seems to have gained from the mentorship agreement [

1]. Similarly, farm-worker equity is implemented in different ways, leading to vastly different outcomes at project level [

35]. A decisive role in the implementation and operation of the IB, especially regarding the level of empowerment, is required for the (team of) individuals driving the IB company. Whereas a commercial partner might be vital to the operation of the farm, its profit-generating argument needs to be accompanied by a drive for inclusion of the smallholders in order to establish mutually beneficial partnerships.

5. Results to Be Nuanced at Smallholder and Beneficiary Level

The outcomes and results on IB level as presented in the previous section also need to be nuanced at smallholder and beneficiary level. Even when IBs show positive results at project level, the outcomes for individual beneficiaries might be less optimistic. This is certainly the case when the IBs are assessed in practice: the effective impact on smallholders is often less positive than the theoretical and potential impact [

1].

One of the most significant challenges is the lack of

rewards, whether financial or material, for the beneficiaries. The benefits for the smallholders and low-income community members at individual levels are often very low—if they exist at all. This is confirmed by other evaluations. For example, Lahiff et al. [

8] write that “twelve years after the lodgment of their restitution claims, and five years after the return of the first lands, most households have yet to see any positive impact on their livelihood. This is a source of great frustration for many, given the expectations that were raised by the restoration of the land and the establishment of commercial partnerships with private-sector operators, the huge sums of public money consumed and the extensive participation by community members over many years in discussions and planning exercises”. Several aspects can be noted here. Firstly, the financial revenues for individual beneficiaries are often low when the case involves a large collective of often passive smallholders/beneficiaries among which IB funds need to be divided. The limited revenues from the IB have often been intermittent and generally well below the expected rates [

8]. Secondly, few of the IBs studied have made a profit since implementation and thus few have disbursed dividends to the beneficiaries, even though many members expected these to be the main form of revenue received from the IB where equity is concerned [

36]. Rental incomes for individual landowners and landowning collectives have been equally disappointing. In many cases, the IBs are new or neglected farms where any revenues realized need to be used for reinvestments, farm expansion and debt repayments. In general, these IBs, which have become complex business set-ups, will need time to grow and stabilize. Important to note is the possible goal incongruence between the commercial partners, whose aim is to establish a viable company in the long term, and the beneficiaries and communities who often expect financial returns for the individual beneficiaries in the short term [

37]. Thirdly, in many cases confusion exists around what has happened to the limited revenues received, especially where larger community organizations are involved. The non-transparent use of received funds by the organization’s leadership has led to even less effective direct payment, in cash or kind, to the individual community members. As Lahiff et al. [

8] observed, community leaders were generally not in favor of paying out cash benefits to members (and under the prevailing financial conditions this would have been very difficult), and were actively involved in dampening down popular expectations. They did, however, acknowledge that people could not wait indefinitely to see some benefits from their “successful” restitution claim. This lack of transparency undermines the position of the (sometimes democratically elected) community representatives who are seen to be abusing their position of power for self-enrichment, and preventing any residual claims from flowing through to the general members [

38]. Even active smallholder beneficiaries who (partly) depend on the IB activities for their livelihoods, such as the smallholders operating under a mentorship, struggle with the high levels of debt related to their commercial activities, negatively impacting on their income. Social benefits, such as jobs and skills transfer for the IB beneficiaries have been disappointing. Lastly, positive outcomes from the IB at project level, such as market access and certification, often remain at the level of the IB as a whole and do not trickle through to the individual community members.

An IB cannot be considered inclusive without an equitable partnership between the commercial partner and the smallholder farmers/low-income community. This implies that the beneficiaries should actively participate in the decision-making processes regarding objectives, planning, operating methods and the like [

39]. As such, the beneficiaries’ voice is central to an IB. Historically, smallholders’ and farm workers’

voice and influence on decision making has been limited [

40]. Several instruments provide potential to increase the active participation of the smallholders in the IB. Firstly, equity/ownership is generally combined with representation on the decision-making bodies of the IB [

36]. Secondly, collective organization creates a platform for the individual members to bundle their voice [

41,

42]. However, this study illustrates that IBs are not able (in the short term) to overcome the unequal balance of power between corporate partner and beneficiaries. Lack of knowledge and (financial and material) resources often leave the smallholder/low-income community in a dependent position. The skills development of the beneficiaries is generally not part of the commercial partner’s responsibilities. Whereas the commercial partner might transfer knowledge regarding the operational activities, it does not extend to the management of a collective of beneficiaries, or the long-term management of a commercially operated agricultural business. Even mentorships, where in essence the mentee is an independent actor, still show a high degree of dependence on the part of the smallholder farmer. This paints a bleak picture for the long-term capability of the beneficiaries to independently operate their assets. As remarked by Hendrickson et al. regarding the particular situation in South Africa, “It can take a very long time for oppressed groups to strengthen their voice to the dominant members of society” [

43].

The dominant position of the commercial partner in the IB enables it to transfer to the smallholders a non-corresponding share of the

risks related to the farming operation, despite the general risk-averse character of the smallholders. Instruments such as mentorship and supply contracts leave the smallholders exposed to a high degree of operational risk in particular, with crop failure and price changes having a direct impact on their income [

44]. The lease agreements in this study are often based on a small profit-/produce-sharing basis, once again transferring to the beneficiaries a portion of the risks from the commercial partner, who has full say over the activities on the smallholders’ land, as well as ownership over the produce. On the other hand, collective organization—either by the beneficiaries or through shared equity in an IB—can spread the risk for the individuals [

45]. Nevertheless, it is observed that collective organization adds high levels of complexity to the business and exposes the IB to additional challenges related to the internal management of the collective [

36]. However, whereas the beneficiaries seem to carry a high degree of operational risk, financial risks are usually borne by the commercial partner or a third-party financier. Individual beneficiaries are rarely exposed financially on a personal title. Grant funding plays a significant role in managing the risks for the commercial partner when entering into what are considered high-risk projects, due to, for example, the inexperience of the smallholders or the high level of financial investment required for the development of the farming operation. This confirms that commercial partners often engage in IBs if they can manage their risks to ensure a positive return on their investment, whereas the smallholders seem to suffer from a lack of insight to fully understand their risks.

Ownership and/or secure rights, especially of land, are often crucial to the beneficiaries. Most commercial partners are driven to engage with smallholders by the need to access this land. As such, ownership and/or long-term secure rights give the smallholders concrete negotiating power in the partnership, although this alone is not a panacea, as illustrated in the previous paragraph. Ownership/secure rights take on different forms. As such, equity in an IB has allowed beneficiaries to grow their asset bases. This is illustrated by considerable investments by the IB in the development of the land and fixed assets of an IB farm. However, whereas ownership of land often lies with the smallholders, the produce is generally owned by the commercial partner. The IBs studied show very limited levels of ownership in downstream activities, severely limiting the bargaining power regarding the proceeds of their land, and negatively impacting on the potential benefits. Rather, in many IBs the smallholders become mere rent seekers, leaving the control over their assets to the commercial partner. Overall, whereas the IB, certainly at project level, generally opens up markets and gives the smallholders access to inputs, equipment and the like, the level of ownership generally reduces.

6. IBs and Their Limitations for Transformation

Analysis of the IB cases, as multi-instrument set-ups, and their outcomes provides insights into the structural limitations of these IBs as tools for agricultural sector transformation and general development. According to the theoretical framework presented in

Section 2, the starting point of an IB partnership lies in the drive to limit uncertainty related to external dependency. In the case of the IBs analyzed in this study, this dependency is predominantly created by the policy environment aimed at land reform and transformation of the agricultural sector. This forced dependency is the first challenge to obtaining inclusiveness: commercial agribusinesses are not motivated to enter into partnerships with smallholders to develop these IB beneficiaries or the communities in which the IB operates, rather these partnerships become a necessary cog in their profit-focused strategy. However, whereas most commercial partners are only partly dependent on low-income communities for their activities and income, the reciprocal dependency, both for beneficiary communities and individuals, is much stronger, considering the beneficiaries’ lack of knowledge and finances to enter into commercial agricultural operations. This power and knowledge asymmetry allows for contracts that foremost benefit the commercial partners, undermining the inclusiveness objective from as early as the design phase. This is apparent for example in the addition of a management contract that transfers control to the commercial partner.

The second challenge for IBs to contribute to transformation and development lies in the conflicting IB-specific investment safeguard goal of the commercial partner as argued by TCE. Since financial contributions to the IB are skewed towards the better resourced commercial partner, contractual safeguards foremost benefit this agribusiness or other commercial entities. Hence, the inclusion of clauses such as the repayment of loans before dividends can be declared. The inclusion of collective organizations in most of the IBs further underlines the challenge of the resulting governance structure to achieve government’s development goals: whereas these collectives enable the commercial partners to decrease the costs related to transacting with multiple beneficiaries, these organizations generally add complexity and challenges for the member beneficiaries. This has a particularly adverse effect on the financial impact from the IB for the individual beneficiaries. Combining multiple instruments within an IB has not been able to overcome the challenge of skewed financial contributions. Complexity, unbalanced power relationships and corporate control all contribute to continued financial imbalanced tilted towards the commercial partner.

Thirdly, as the principal in the IB partnership, the commercial partner is able to include mechanisms that align the beneficiaries’ goals. Equity in downstream facilities and produce-/profit share based lease contracts are designed to incentivize the smallholders to maximize IB production, although the price determination lies with the commercial partner as owner of the crops. As such, the internal profit drive of the commercial partner, through optimal farm operation, often abolishes the distributive objective of the IB. Furthermore, the implementation of the contract is driven by the commercial partner, based on the organizational set-up that assigns control over the IB to this stakeholder, and which is reinforced by the asymmetry in knowledge and financial contribution. The community is often not able to enforce certain clauses detailed in the contract designed for effective enactment of inclusiveness aspects, specifically training and empowerment activities. Effective implementation of the IB tends to lag behind the commercial objectives of the IB as a result.

The financial contribution, experience and networks that the commercial partners bring to an IB allow for positive developments at project level, as observed in farm development and production growth. However, the structural differences of objectives and the overarching knowledge gap, both during design and implementation, makes any true inclusiveness in the short term a serious challenge, certainly for the individual beneficiaries involved, regardless of how the IB is structured and operated.

7. Recommendations—Towards More Sustainable and Equitable Inclusive Businesses

Certain lessons are to be learnt from this research that can be applied by stakeholders active in the field of IB and land reform to create more equitable and sustainable business set-ups [

1]. These lessons are all related and complementary.

The first step regarding the empowerment of smallholders as beneficiaries is ownership. This can be achieved through ownership of, and/or secure rights over, land and/or produce, but it can also be attained through equity in joint ventures. Not only is the correlation between ownership—particularly land—and development well known [

46,

47], regarding IBs it also relates to the state of being an owner, i.e., engagement, willingness to contribute, contribution to own development and to self-determination, contribution to decision making, and balancing of power structures [

48]. Although ownership and/or long-term secure rights are not a cure-all (as others might still control the asset), it certainly serves as a stepping stone to be built upon.

Secondly, there is a need for effective capacitation of the smallholders/low-income communities. Ownership contributes to this, but the need to capacitate smallholders and beneficiaries will also be achieved through knowledge development. This should not only cover operational and technical skills; equally important are managerial and financial skills, and overall business knowledge. As such, the beneficiaries should acquire an understanding of commercial farming activities and of the internal management of a collective organization. It is important to implement a program that ensures knowledge distribution between the beneficiaries to prevent dependency on a limited number of leaders who become difficult to replace. Strongly related to this point is the capacity required to build a truly equal relationship in which the smallholders participate as valued and informed negotiators and decision makers. This is particularly the case in a situation where historically an unequal relationship existed, e.g., that of laborer and employer. Thus, whereas smallholders can be integrated into the commercial agricultural supply chain within a short timeframe, it will take much longer to empower them to become equal partners, or for the beneficiaries to engage independently in the commercial value chain.

Thirdly, IBs as organization require support. This study showed that, contrary to expectations, IBs are not a substitute for the support and investment required to achieve agricultural transformation or rural development, whether from the State or a third party. Indeed, private financial resources are needed, as many IBs are either new farming businesses, or are set up to reinvigorate neglected farmland, both of which require significant funds to develop. Large agribusinesses are often in a better position to engage in these potentially volatile partnerships. Operational and even developmental costs are thus likely to be borne by the more financially endowed agribusinesses to enable sustained operation. At the same time, however, this financial asymmetry can possibly aggravate the power disparity between the partners, as discussed in the previous paragraph. Besides limiting the risks for agribusinesses to engage in community partnerships, grant funding or subsidized loans can play a fundamental role in overcoming the financial burden of such projects, as well as the financial inequality in the partnership, and with it, an overall imbalance of power within the IB. But support also involves mediation, the safeguarding of smallholders’ assets, the balancing of power relations, the monitoring of compliance with contractual agreements, and the exploring of new legal aspects and dispute resolutions, as well as more flexible options for land use.

Fourthly, related to the previous point, the involvement of a third impartial party can help overcome power and knowledge asymmetry between the smallholders and the commercial partner. Often, smallholders/low-income communities can benefit from professional assistance, during both contract negotiations and the implementation phase when the contractual obligations of both parties need to be monitored. External assistance in the form of funding can also play a role in addressing the financial power imbalances, which in part cause the perceived lack of decision-making powers of the beneficiaries. A third aspect where outside involvement can benefit IBs as organization, and their beneficiaries in specific, is the mentoring of the collective when beneficiaries are organized in a collective organization. Whereas the commercial agribusiness partner generally provides knowledge related to the operational and management aspects of a commercial farming business, the responsibility for the internal management of the collective smallholder organization is often unclear and beyond the scope of the commercial partner. This leaves the smallholder collective impaired when it comes to the efficient running of the organization, which in turn impacts negatively on the role the collective plays in the IB.

Fifthly, no sustainable partnership can develop without a high degree of transparency, both between the partners and internally (in the case of a collective organization of beneficiaries). As Vollman [

49] emphasizes, transparency relates to decision making, pricing structures, financial performance and allocation of funds, and must be accompanied by clear accountability, practiced from the first negotiations. Transparency also contributes to evaluation and impact measurement. Due to a lack of transparency, many smallholders are unable to understand how the IB operates, and specifically why their level of reward is so low. This in turn impacts negatively on their support of the IB. For transparent communication to be effective, the beneficiaries must have a basic understanding of business management, which will have to form part of the overall knowledge development program. Transparency and accountability must be accompanied by realistic expectation management for smallholders in order for them to understand that benefits, both financial and social, will take time to materialize.

Lastly, in order to implement a partnership with smallholders, time and realism are indeed required to achieve results. In many cases, the IBs overall—and the agricultural activities in particular—have to be developed, or redeveloped, when reviving previously productive areas. However, this is not the only reason. The capacitation of smallholders, the effective transfer of knowledge and know-how, and the building of equal relationships in which the smallholders participate as valued and informed negotiators and decision makers within a broader set-up of establishing a viable large-scale agricultural enterprise takes time. This can lead to frustration, especially when expectations diverge. Indeed, alongside the major commercial difficulties being experienced by the IBs, the most obvious weakness is the lack of material benefits reaching the smallholders and the great majority of community members. This questions both the effectiveness of the use of public funds, and the expectation management of the beneficiaries of both their renewed land ownership and the community-private partnership [

8]. For such partnerships to be sustainable, it is critical that smallholders and communities benefit from the venture, be it financially (often difficult to implement) or through the implementation of diverse land use systems (some to be used by members independently from the IB), or other benefits such as housing and employment [

11]. This is certainly a complex challenge when IBs engage with large groups of smallholders, beneficiaries and communities.

8. Conclusions: IB as a New Paradigm for Development and Structural Transformation?

IBs are considered to contribute to the public objectives of development and transformation. Partnerships between corporate agribusiness and smallholder farmers and low-income communities are, among other things, an avenue to provide access to the commercial value chain, to develop skills and to improve the livelihoods of IB beneficiaries. However, the results presented in this paper illustrate that IBs are not a panacea for development and transformation.

Land reform processes and transformation focused policies play a vital role in the establishment of IBs. The change in land ownership brought about by a diversity of land reform policies triggers a situation where commercial agribusinesses become dependent on the new landowners for access to land and produce. These new landowners often lack knowledge, financing and market access, leading to a reciprocal dependency. Partnerships between commercial agribusinesses and landowning communities can overcome these dependencies. As such, government supports IBs in general, and even prescribes specific partnership structures as a condition of land reform beneficiation. However, the power asymmetry that is tilted in favor of the commercial partner allows the agribusiness to adjust the organizational structure of the IB to suit its primary objective, namely the generation of profit. Whereas this might enhance the performance of the IB as a business organization, the developmental aspect of the IB is reduced in importance, if not completely ignored. Thus, whereas land reform is generally achieved, the underlying transformation and beneficiary development objectives are severely compromised.

Although it is shown that IBs can lead to positive results, particularly at project level (see also [

24] for other examples), in practice the outcome for beneficiaries has to be nuanced. This is even the case for the projects examined in this study, which purposively focused on relatively stable and sustainable IBs, and avoided those that were the worst off and those that had failed completely. IBs represent only a relatively small number of projects in the broader context of smallholder farming and land reform in South Africa. The National Department of Agriculture estimates that 40,000 commercial farm units existed in 2007, together with several thousand emerging farmers and 1.2 million small-scale farms in the former homelands [

50]. The extent of the participation of smallholder farmers in IBs thus appears insignificant. In addition, the replicability of many of the complex IBs is limited, leaving behind the hope for a broad-based snowball effect [

51]. The number of IBs remains low, the IBs that are successful and sustainable are few, and the IBs have a mixed impact, so it therefore seems appropriate to say that the IB model or paradigm will only have a marginal impact on the broad transformation of the agricultural sector in South Africa. We are merely in the presence of a (relatively small) number of “islands of effectiveness” [

52], which do not seem to have the capacity, nor the muscle, to profoundly restructure the sector.

The low potential for structural transformation in the specific context of South Africa should not, however, lead to a repudiation of the IB model and paradigm. IBs contribute to agricultural investment needs, particularly in the case where the State has little capacity and where investment is needed from the private sector [

53,

54]. It is thus important to learn from the implemented cases and to take note of the recommendations in order to improve these models. The study shows, however, that other development models will be needed if structural transformation and broad-based inclusion of smallholder farmers are sought in South Africa [

55] or elsewhere on the continent and beyond [

56].

These insights also apply to global debates on agricultural and rural transformation, and in particular to the global phenomenon of large-scale land investments and acquisitions, where a similar power asymmetry between investor and local community plays out [

57]. There is a growing call to make these investments more inclusive for the local communities, for example through the implementation of out-grower schemes, representing one of the inclusive instruments [

58,

59]. The results of these kinds of initiatives have remained equally mixed and largely disappointing [

60,

61], strengthening the dual observation of the limited effectiveness of such inclusive models and the need for other—often complementary—development paradigms to initiate large-scale agricultural and rural transformation. The question of development approaches focusing more on smallholder farmers and on their endogenous growth, instead of on the linkages between small and big, remains highly relevant.