Investigating the Factors Influencing the Intention to Adopt Long-Term Land Leasing in Northern Ireland

Abstract

1. Introduction

2. Theoretical Framework

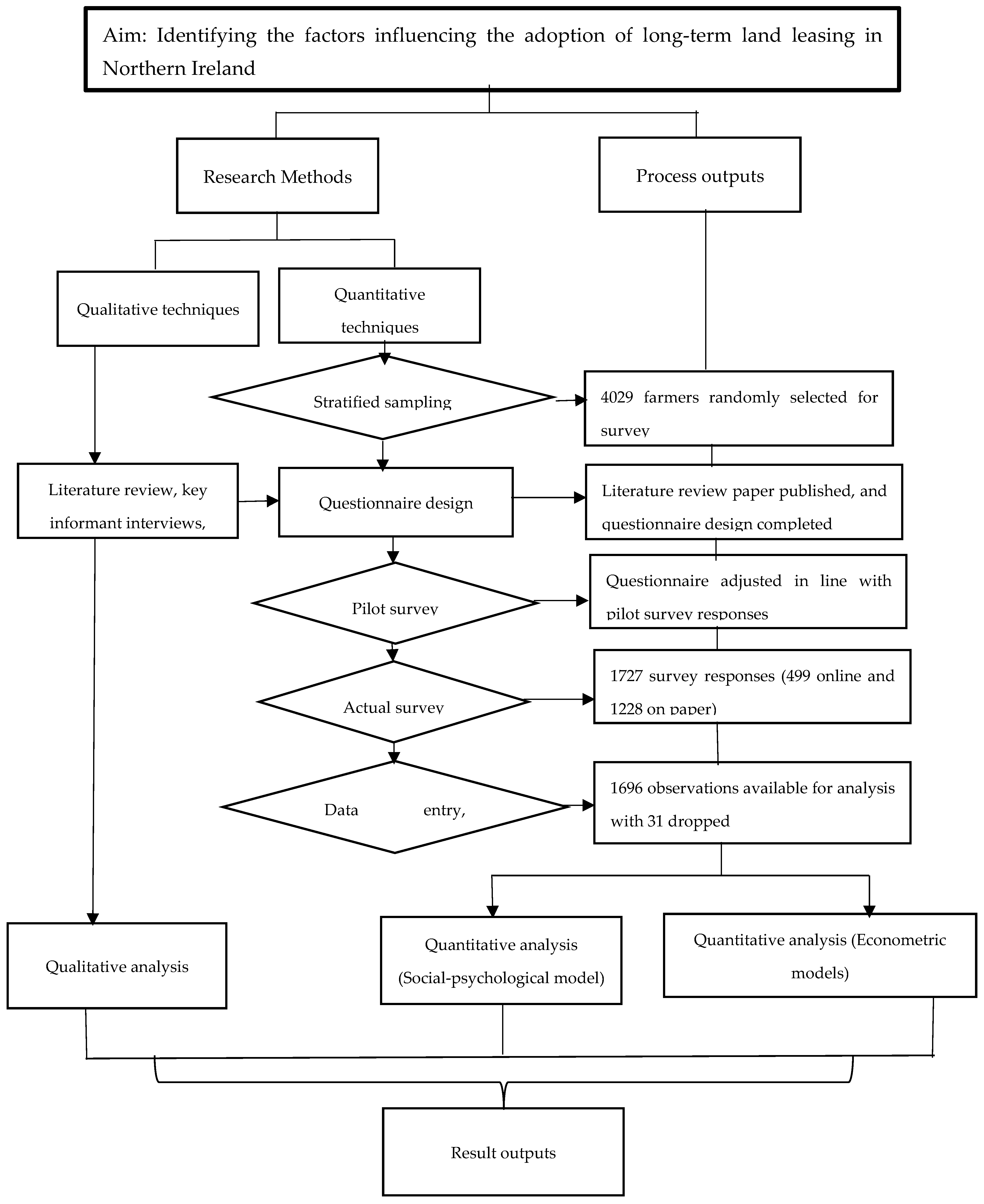

3. Methodology

3.1. Study Sample and Data Collection

3.2. Questionnaire Design and Survey Development

3.3. Principal Component Analysis

3.4. Ordered Logistic Regression Model

4. Results and Discussion

4.1. Descriptive and Socioeconomic Characteristics

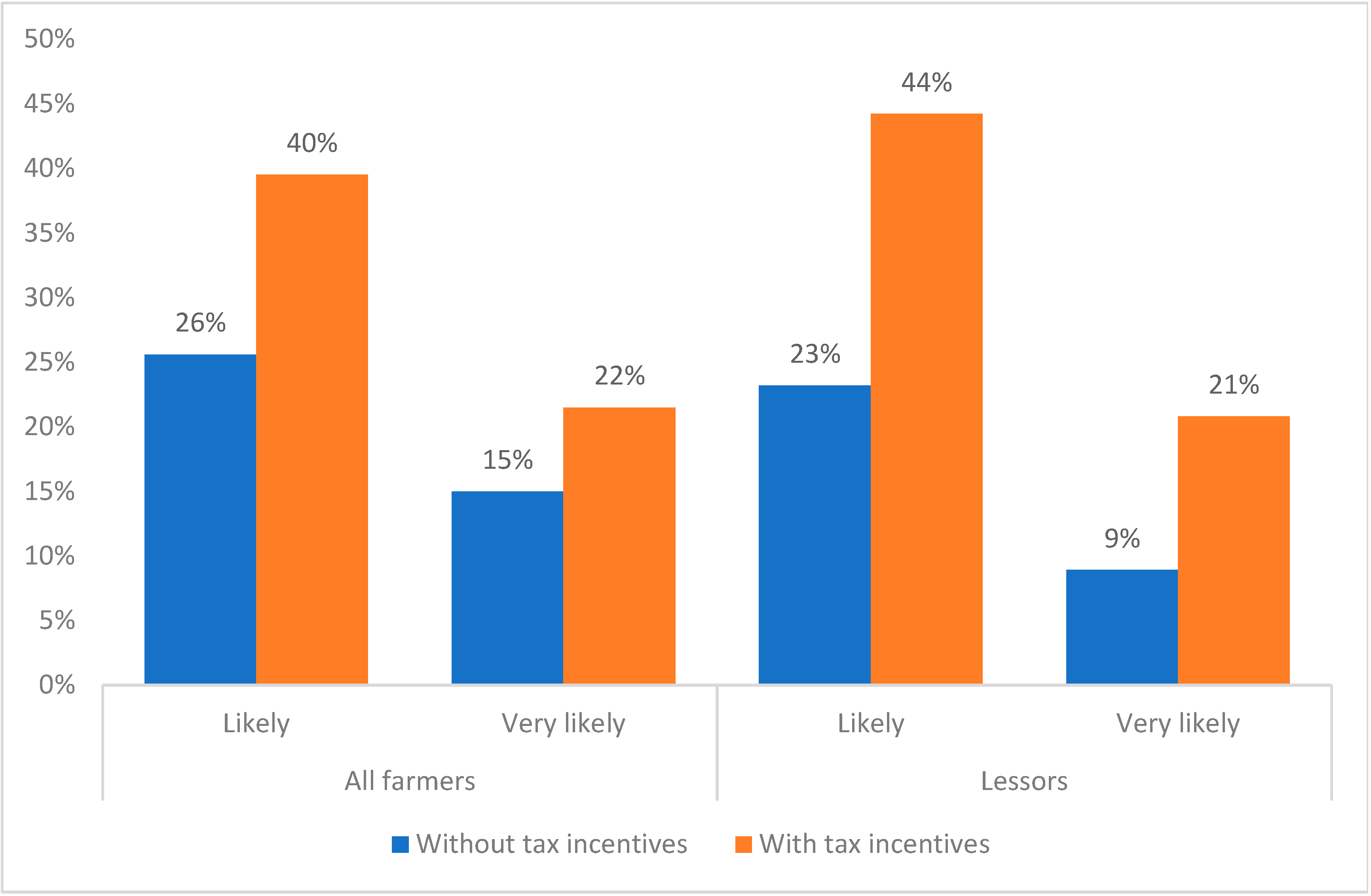

4.2. Intention to Engage in Long-Term Land Leasing

4.3. Results of Principal Component Analysis

4.4. Results of Ordered Logit Model

4.5. Determinant of Intention to Engage in Long-Term Land Leasing without Tax Incentives (Model 1)

4.6. Determinant of Intention to Engage in Long-Term Land Leasing with Tax Incentives (Model 2)

4.7. Determinant of Intention to Engage in Long-Term Land Leasing with and without Tax Incentives for Lessors (Model 3 and 4)

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Without Incentive | With Incentive | |||||||

|---|---|---|---|---|---|---|---|---|

| Variables | Coef. | Std. Err. | % | %StdX | Coef. | Std. Err. | % | %StdX |

| Food security | −0.054 | 0.107 | −5.2 | −6.1 | −0.145 | 0.117 | −13.5 | −15.6 |

| Risk averse | −0.387 *** | 0.101 | −32.1 | −42.6 | −0.351 *** | 0.106 | −29.6 | −39.5 |

| Environment neutral | 0.082 | 0.099 | 8.6 | 11.2 | −0.007 | 0.104 | −0.7 | −0.9 |

| Pro-environment | −0.057 | 0.094 | −5.5 | −7.7 | −0.028 | 0.097 | −2.8 | −3.9 |

| Profit conscious | 0.454 *** | 0.091 | 57.5 | 99.3 | 0.227 ** | 0.095 | 25.4 | 41.1 |

| BDG membership | 0.482 | 0.309 | 62.0 | 22.4 | 0.687 ** | 0.350 | 98.7 | 33.4 |

| Off-farm employment | 0.374 | 0.288 | 45.4 | 20.2 | −0.100 | 0.317 | −9.5 | −4.8 |

| Successor | 0.734 *** | 0.244 | 108.4 | 44.0 | 0.128 | 0.259 | 13.7 | 6.6 |

| Dairy enterprise | 0.024 | 0.503 | 2.4 | 1.0 | −0.131 | 0.557 | −12.3 | −5.1 |

| Beef enterprise | −0.181 | 0.449 | −16.5 | −8.6 | −0.073 | 0.501 | −7.1 | −3.6 |

| Sheep enterprise | −0.446 | 0.503 | −36.0 | −15.1 | −0.977 * | 0.549 | −62.4 | −30.2 |

| Farmland owned (ha) | 0.000 | 0.002 | 0.0 | 2.2 | −0.000 | 0.002 | −0.0 | −1.4 |

| Fewer than 5 GCSEs | 0.038 | 0.395 | 3.9 | 1.1 | 0.089 | 0.427 | 9.3 | 2.6 |

| 5 GCSEs or equivalent | −0.378 | 0.354 | −31.4 | −13.3 | −0.367 | 0.368 | −30.7 | −12.9 |

| A level or equivalent | −0.312 | 0.473 | −26.8 | −7.2 | 0.723 | 0.628 | 106.0 | 18.9 |

| Higher education—diploma or equivalent | 0.324 | 0.391 | 38.3 | 14.1 | 0.755 * | 0.453 | 112.8 | 35.9 |

| Degree level or higher | 0.385 | 0.470 | 47.0 | 14.5 | −0.023 | 0.461 | −2.3 | −0.8 |

| Full-time | 0.309 | 0.274 | 36.2 | 16.6 | 0.156 | 0.297 | 16.9 | 8.0 |

| 30–40 | −1.358 | 1.132 | −74.3 | −34.9 | 0.576 | 0.763 | 77.8 | 20.0 |

| 41–54 | −1.442 | 1.103 | −76.4 | −46.6 | −0.070 | 0.699 | −6.8 | −3.0 |

| 55–64 | −2.107 * | 1.107 | −87.8 | −61.9 | 0.203 | 0.724 | 22.5 | 9.7 |

| 65–74 | −2.837 ** | 1.128 | −94.1 | −67.8 | −0.493 | 0.749 | −38.9 | −17.9 |

| 75 or older | −1.861 | 1.175 | −84.4 | −41.4 | 0.009 | 0.836 | 0.9 | 0.3 |

| Disadvantaged | 0.430 | 0.270 | 53.7 | −21.7 | −0.027 | 0.292 | −2.7 | −1.2 |

| Severely Disadvantaged | 0.655 ** | 0.299 | 92.5 | 33.2 | 0.327 | 0.325 | 38.7 | 15.4 |

| Have formal agricultural qualification | 0.194 | 0.307 | 21.4 | 10.0 | 0.249 | 0.333 | 28.3 | 13.0 |

| Diversification activities | −0.319 | 0.305 | −27.3 | −12.2 | −0.297 | 0.308 | −25.7 | −11.4 |

References

- Adenuga, A.H.; Jack, C.; McCarry, R. The Case for Long-Term Land Leasing: A Review of the Empirical Literature. Land 2021, 10, 238. [Google Scholar] [CrossRef]

- Zhang, L.; Cao, Y.; Bai, Y. The impact of the land certificated program on the farmland rental market in rural China. J. Rural Stud. 2019, 93, 165–175. [Google Scholar] [CrossRef]

- Awasthi, M.K. Dynamics and resource use efficiency of agricultural land sales and rental market in India. Land Use Policy 2009, 26, 736–743. [Google Scholar] [CrossRef]

- Bradfield, T.; Butler, R.; Dillon, E.J.; Hennessy, T. The factors influencing the profitability of leased land on dairy farms in Ireland. Land Use Policy 2020, 95, 104649. [Google Scholar] [CrossRef]

- Deininger, K.; Jin, S.; Nagarajan, H.K. Determinants and Consequences of Land Sales Market Participation: Panel Evidence from India; The World Bank: Washington, DC, USA, 2007. [Google Scholar]

- Gao, L.; Sun, D.; Huang, J. Impact of land tenure policy on agricultural investments in China: Evidence from a panel data study. China Econ. Rev. 2017, 45, 244–252. [Google Scholar] [CrossRef]

- Muraoka, R.; Jin, S.; Jayne, T.S. Land access, land rental and food security: Evidence from Kenya. Land Use Policy 2018, 70, 611–622. [Google Scholar] [CrossRef]

- Lovo, S. Tenure insecurity and investment in soil conservation. Evidence from Malawi. World Dev. 2016, 78, 219–229. [Google Scholar] [CrossRef]

- Abdulai, A.; Owusu, V.; Goetz, R. Land tenure differences and investment in land improvement measures: Theoretical and empirical analyses. J. Dev. Econ. 2011, 96, 66–78. [Google Scholar] [CrossRef]

- Rock, K.; Clark, A.; Smith, S.D.; Martin, A.; Norton, E.; Cowap, C.; Dunn, G.; Morris, M. Working Together for a Thriving Agricultural Tenanted Sector; Tenancy Working Group: London, UK, 2022. [Google Scholar]

- Forbord, M.; Bjørkhaug, H.; Burton, R.J. Drivers of change in Norwegian agricultural land control and the emergence of rental farming. J. Rural Stud. 2014, 33, 9–19. [Google Scholar] [CrossRef]

- Harris, L. Mixed fortune for Wales and NI land despite high demand. In Farmers Weekly; Mark Allen Group: London, UK, 2022. [Google Scholar]

- Milne, G.; Byrne, A.W.; Campbell, E.; Graham, J.; McGrath, J.; Kirke, R.; McMaster, W.; Zimmermann, J.; Adenuga, A.H. Quantifying Land Fragmentation in Northern Irish Cattle Enterprises. Land 2022, 11, 402. [Google Scholar] [CrossRef]

- Adenuga, A.H.; Davis, J.; Hutchinson, G.; Donnellan, T.; Patton, M. Modelling regional environmental efficiency differentials of dairy farms on the island of Ireland. Ecol. Indic. 2018, 95, 851–861. [Google Scholar] [CrossRef]

- Jordan, D.; Turner, J. Northern Ireland’s Productivity Challenge: Exploring the Issues; The Productivity Institute: New York, NY, USA, 2021. [Google Scholar]

- DAERA. Statistical Review of Northern Ireland Agriculture, 56th ed.; Policy Economics and Statistics Division, Ed.; Department of Agriculture, Environment and Rural Affairs Belfast: Belfast, UK, 2021. [Google Scholar]

- Edwards-Jones, G. Modelling farmer decision-making: Concepts, progress and challenges. Anim. Sci. 2006, 82, 783–790. [Google Scholar] [CrossRef]

- Howley, P.; Buckley, C.; Donoghue, C.O.; Ryan, M. Explaining the economic ‘irrationality’of farmers’ land use behaviour: The role of productivist attitudes and non-pecuniary benefits. Ecol. Econ. 2015, 109, 186–193. [Google Scholar] [CrossRef]

- Vanclay, F. Social principles for agricultural extension to assist in the promotion of natural resource management. Aust. J. Exp. Agric. 2004, 44, 213–222. [Google Scholar] [CrossRef]

- O’Kane, H.; Ferguson, E.; Kaler, J.; Green, L. Associations between sheep farmer attitudes, beliefs, emotions and personality, and their barriers to uptake of best practice: The example of footrot. Prev. Vet. Med. 2017, 139, 123–133. [Google Scholar] [CrossRef]

- Lapple, D.; Kelley, H. Understanding Farmers’ Uptake of Organic Farming: An Application of the Theory of Planned Behaviour. In Proceedings of the Agricultural Economics Society, 84th Annual Conference, Edinburgh, Scotland, 29–31 March 2010. [Google Scholar]

- Howley, P. The happy farmer: The effect of nonpecuniary benefits on behavior. Am. J. Agric. Econ. 2015, 97, 1072–1086. [Google Scholar] [CrossRef]

- Fakayode, S.B.; Adenuga, A.H.; Yusuf, T.; Jegede, O. Awareness of and demand for private agricultural extension services among small-scale farmers in Nigeria. J. Agribus. Rural Dev. 2016, 4, 521–531. [Google Scholar]

- Kaplan, S.; Prato, C.G. Risk factors associated with bus accident severity in the United States: A generalized ordered logit model. J. Saf. Res. 2012, 43, 171–180. [Google Scholar] [CrossRef]

- Williams, R. Generalized ordered logit/partial proportional odds models for ordinal dependent variables. Stata J. 2006, 6, 58–82. [Google Scholar] [CrossRef]

- Deneke, T.T.; Bekele, A.; Moore, H.L.; Mamo, T.; Almaw, G.; Mekonnen, G.A.; Mihret, A.; Tschopp, R.; Yeheyis, L.; Hodge, C. Milk and meat consumption patterns and the potential risk of zoonotic disease transmission among urban and peri-urban dairy farmers in Ethiopia. BMC Public Health 2022, 22, 222. [Google Scholar] [CrossRef]

- Adenuga, A.H.; Jack, C.; Ashfield, A.; Wallace, M. Assessing the Impact of Participatory Extension Programme Membership on Farm Business Performance in Northern Ireland. Agriculture 2021, 11, 949. [Google Scholar] [CrossRef]

- Long, J.S.; Freese, J. Regression Models for Categorical Dependent Variables Using Stata; Stata Press: College Station, TX, USA, 2006; Volume 7. [Google Scholar]

- Brant, R. Assessing proportionality in the proportional odds model for ordinal logistic regression. Biometrics 1990, 46, 1171–1178. [Google Scholar] [CrossRef] [PubMed]

- Central Association of Agricultural Valuers. The Annual Agricultural Land Occupation Surveys For Great Britain 2021; Central Association of Agricultural Valuers: Gloucestershire, UK, 2022. [Google Scholar]

- Shaw, L.; Stafford, R. Tenant Farming Rent Review Survey: Final Report; Agriculture, E.A.M., Ed.; The Scottish Government: Edinburgh, Scotland, 2021. [Google Scholar]

- Li, L.; Zheng, Y.; Ma, S. Indoor Air Purification and Residents’ Self-Rated Health: Evidence from the China Health and Nutrition Survey. Int. J. Environ. Res. Public Health 2022, 19, 6316. [Google Scholar] [CrossRef] [PubMed]

- Fagerland, M.W.; Hosmer, D.W. How to test for goodness of fit in ordinal logistic regression models. Stata J. 2017, 17, 668–686. [Google Scholar] [CrossRef]

- Armstrong, J.; White-Lewis, E.; Nicole Farris, D.; Edwards, W.J. Reevaluating factors associated with negative attitudes toward police: Capturing information from college students. J. Ethn. Crim. Justice 2021, 19, 73–100. [Google Scholar] [CrossRef]

- Ruxton, M.M.; Heiden, E.O.; Begum, N.; Losch, M.E. Understanding Farmer and Landowner Decision-Making and Message Preference Concerning Conservation Practice Adoption in the Clear Creek Watershed; Iowa State University: Ames, IA, USA, 2019. [Google Scholar]

- Myyrä, S.; Ketoja, E.; Yli-Halla, M.; Pietola, K. Land improvements under land tenure insecurity: The case of pH and phosphate in Finland. Land Econ. 2005, 81, 557–569. [Google Scholar] [CrossRef]

- Leonhardt, H.; Penker, M.; Salhofer, K. Do farmers care about rented land? A multi-method study on land tenure and soil conservation. Land Use Policy 2019, 82, 228–239. [Google Scholar] [CrossRef]

- Zhang, Q.; Tian, J.; Zheng, J.; Abdullahi, N.M.; Huo, X. How Does Land Tenure Security Affect Farm Succession? Evidence from Apple Growers in China. Land 2022, 11, 1036. [Google Scholar] [CrossRef]

- Tensi, A.F.; Ang, F.; van der Fels-Klerx, H.J. Behavioural drivers and barriers for adopting microbial applications in arable farms: Evidence from the Netherlands and Germany. Technol. Forecast. Soc. Chang. 2022, 182, 121825. [Google Scholar] [CrossRef]

| Farmland Ownership and Rental Status | Total Number in Population | Percentage of Total | Land Types | Total Number in Sample | ||

|---|---|---|---|---|---|---|

| NDA | DA | SDA | ||||

| Farmers that farm on owned land only | 6052 | 48.1 | 1601 | 1757 | 2694 | 1210 |

| Farmers that farm on owned and rented land | 4625 | 36.8 | 1551 | 1402 | 1672 | 924 |

| Farmers that farm on owned and rented land but also let out land | 261 | 2.1 | 113 | 87 | 61 | 261 |

| Farmers that farm on owned land only but also let out land | 1042 | 8.3 | 477 | 321 | 244 | 1042 |

| Farmers that farm only on rented land | 446 | 3.5 | 148 | 132 | 166 | 446 |

| Farms that have let out all their land | 146 | 1.2 | 60 | 52 | 67 | 146 |

| Total | 12,572 | 100 | 3950 | 3751 | 4904 | 4029 |

| Variables | PC1 | PC2 | PC3 | PC4 | PC5 |

|---|---|---|---|---|---|

| Profit Conscious (α = 0.68) | Pro-Environment (α = 0.60) | Not-for- Environment (α = 0.63) | Risk Averse (α = 0.66) | Food Security (α = 0.48) | |

| I am generally keen to adopt new technologies | 0.5360 | 0.0302 | −0.0362 | −0.2308 | 0.0429 |

| I try to find new ways of increasing profit on the farm | 0.5113 | −0.0116 | 0.0202 | −0.0744 | −0.0036 |

| Good farming is about maximising profits from the farm business | 0.3187 | −0.0656 | 0.2566 | 0.0665 | 0.0731 |

| I find farming rewarding from a quality-of-life perspective | 0.3460 | 0.0213 | −0.0088 | 0.1408 | −0.1343 |

| I think good record keeping is very important in managing a farm business | 0.4218 | 0.0288 | −0.1092 | 0.0423 | 0.0020 |

| I take some actions to protect the environment when managing my farm because I feel it is the right thing to do | 0.0403 | 0.3953 | −0.1207 | 0.0352 | 0.3456 |

| Farmers should receive subsidies for protecting the environment and not for the total amount of land farmed | −0.0237 | 0.5710 | 0.2662 | 0.0483 | −0.1470 |

| In terms of what I produce on my farm, I think it is important to take the environment into consideration, even if it lowers profit | −0.0285 | 0.4532 | −0.1470 | −0.0159 | 0.1447 |

| I am concerned about the loss of biodiversity in our farmed environment | 0.0557 | 0.5396 | 0.0532 | −0.0397 | −0.0729 |

| It is more important to maximize profits than protect the environment | 0.0173 | 0.1062 | 0.6611 | −0.0601 | −0.0589 |

| I believe society places too much emphasis on environmental issues | −0.0646 | 0.0182 | 0.3348 | 0.0184 | 0.4525 |

| I am not that concerned about environmental issues | −0.0769 | 0.0064 | 0.5179 | −0.0383 | 0.0708 |

| I try to avoid taking risky farm business decisions | −0.1111 | −0.0097 | −0.0245 | 0.6502 | 0.0192 |

| I try to keep debt levels as low as possible | −0.0734 | 0.0188 | −0.0793 | 0.6356 | 0.0338 |

| I think the media exaggerate the negative impact of agricultural activities on the environment | 0.0112 | −0.0404 | −0.0591 | 0.0050 | 0.6774 |

| It is a waste leaving farmland idle and not using it to produce food | 0.1630 | −0.1141 | 0.0397 | 0.1204 | 0.3407 |

| I think it is difficult to make a living just from farming alone | 0.1088 | 0.0616 | 0.0541 | 0.2990 | −0.1401 |

| Initial eigenvalues | 2.35 | 1.87 | 1.75 | 1.70 | 1.56 |

| Ordered Logit Model | Partial Ordered Logit Model | |||||||

|---|---|---|---|---|---|---|---|---|

| Variables | Coef. | Std. Err. | % | %StdX | Coef. (1) | Std. Err. | Coef. (2) | Std. Err. |

| Food security | −0.019 | 0.054 | −1.9 | −2.3 | −0.018 *** | 0.054 | ||

| Risk averse | −0.218 *** | 0.052 | −19.6 | −24.8 | −0.224 | 0.052 | ||

| Environment neutral | 0.034 | 0.050 | 3.4 | 4.6 | 0.036 | 0.050 | ||

| Pro-environment | 0.046 | 0.048 | 4.7 | 6.7 | 0.047 | 0.048 | ||

| Profit conscious | 0.199 *** | 0.045 | 22.0 | 34.7 | 0.122 ** | 0.048 | 0.278 *** | 0.049 |

| BDG membership | 0.213 | 0.167 | 23.8 | 8.1 | 0.210 | 0.167 | ||

| Off-farm employment | 0.139 | 0.145 | 14.9 | 7.1 | 0.154 | 0.146 | ||

| Successor | 0.187 | 0.121 | 20.6 | 9.7 | 0.187 | 0.121 | ||

| Dairy enterprise | 0.933 *** | 0.261 | 154.3 | 30.5 | 0.945 *** | 0.261 | ||

| Beef enterprise | 0.145 | 0.169 | 15.7 | 7.5 | 0.141 | 0.169 | ||

| Sheep enterprise | −0.012 | 0.192 | −1.2 | −0.5 | −0.021 | 0.193 | ||

| Farmland owned (ha) | 0.002 * | 0.001 | 0.2 | 12.5 | 0.002 * | 0.001 | ||

| Fewer than 5 GCSEs | 0.035 | 0.220 | 3.5 | 1.0 | 0.026 | 0.220 | ||

| 5 GCSEs or equivalent | −0.061 | 0.185 | −6.0 | −2.2 | −0.061 | 0.185 | ||

| A level or equivalent | 0.025 | 0.241 | 2.5 | 0.6 | 0.014 | 0.242 | ||

| Higher education—diploma or equivalent | 0.267 | 0.195 | 30.6 | 10.7 | 0.275 | 0.195 | ||

| Degree level or higher | 0.185 | 0.185 | 20.3 | 7.7 | 0.192 | 0.186 | ||

| Full-time | 0.158 | 0.139 | 17.1 | 8.0 | 0.150 | 0.139 | ||

| 30–40 | −0.020 | 0.454 | −2.0 | −0.5 | 0.016 | 0.455 | ||

| 41–54 | −0.641 | 0.414 | −47.3 | −23.4 | −0.606 | 0.415 | ||

| 55–64 | −0.778 * | 0.415 | −54.0 | −29.7 | −0.738 * | 0.416 | ||

| 65–74 | −1.229 *** | 0.426 | −70.7 | −41.4 | −1.189 *** | 0.426 | ||

| 75 or older | −1.140 ** | 0.445 | −68.0 | −32.5 | −1.099 ** | 0.446 | ||

| Disadvantaged | 0.221 * | 0.132 | 24.7 | 10.9 | 0.220 * | 0.132 | ||

| Severely Disadvantaged | 0.206 | 0.153 | 22.9 | 8.9 | 0.209 | 0.153 | ||

| Have formal agricultural qualification | 0.064 | 0.144 | 6.6 | 3.1 | 0.061 | 0.145 | ||

| Diversification activities | 0.236 | 0.146 | 32.6 | 10.1 | 0.233 | 0.147 | ||

| Variables | Coef. | Std. Err. | % | %StdX |

|---|---|---|---|---|

| Food security | −0.030 | 0.057 | −2.9 | −3.5 |

| Risk averse | −0.145 *** | 0.055 | −13.5 | −17.3 |

| Environment neutral | −0.083 | 0.053 | −8.0 | −10.5 |

| Pro-environment | 0.021 | 0.051 | 2.1 | 3.0 |

| Profit conscious | 0.143 *** | 0.047 | 15.4 | 23.9 |

| BDG membership | 0.429 ** | 0.194 | 53.6 | 17.0 |

| Off-farm employment | 0.245 | 0.154 | 27.7 | 13.0 |

| Successor | −0.135 | 0.127 | −12.6 | −6.4 |

| Dairy enterprise | 0.563 * | 0.289 | 75.6 | 17.4 |

| Beef enterprise | 0.088 | 0.180 | 9.2 | 4.5 |

| Sheep enterprise | −0.197 | 0.204 | −17.9 | −7.7 |

| Farmland owned (ha) | 0.003 ** | 0.002 | 0.3 | 16.2 |

| Fewer than 5 GCSEs | 0.033 | 0.226 | 3.3 | 0.9 |

| 5 GCSEs or equivalent | −0.154 | 0.189 | −14.3 | −5.5 |

| A level or equivalent | 0.407 | 0.273 | 50.2 | 10.6 |

| Higher education—diploma or equivalent | 0.500 ** | 0.215 | 64.9 | 21.0 |

| Degree level or higher | 0.222 | 0.196 | 24.9 | 9.4 |

| Full-time | −0.001 | 0.147 | −0.1 | 0.0 |

| 30–40 | 0.248 | 0.498 | 28.2 | 6.5 |

| 41–54 | −0.134 | 0.452 | −12.5 | −5.4 |

| 55–64 | 0.095 | 0.455 | 9.9 | 4.4 |

| 65–74 | −0.096 | 0.462 | −9.1 | −4.1 |

| 75 or older | −0.138 | 0.482 | −12.9 | −4.6 |

| Disadvantaged | 0.033 | 0.142 | 3.4 | 1.6 |

| Severely Disadvantaged | −0.034 | 0.160 | −3.3 | −1.4 |

| Have formal agricultural qualification | 0.216 | 0.156 | 24.2 | 10.9 |

| Diversification activities | 0.026 | 0.156 | 2.6 | 1.6 |

| Without Incentive | With Incentive | |||||||

|---|---|---|---|---|---|---|---|---|

| Variables | Coef. | Std. Err. | % | %StdX | Coef. | Std. Err. | % | %StdX |

| Food security | 0.010 | 0.094 | 1.0 | 1.2 | −0.064 | 0.109 | −6.2 | −7.7 |

| Risk averse | −0.084 | 0.090 | −8.1 | −10.1 | −0.013 | 0.102 | −1.3 | −1.6 |

| Environment neutral | 0.074 | 0.091 | 7.7 | 10.6 | −0.009 | 0.104 | −0.9 | −1.2 |

| Pro-environment | 0.270 *** | 0.096 | 31.0 | 43.9 | 0.200 * | 0.107 | 22.2 | 30.9 |

| Profit conscious | −0.017 | 0.079 | −1.7 | −2.5 | 0.170 * | 0.091 | 18.5 | 28.6 |

| BDG membership | −0.163 | 0.300 | −15.1 | −5.5 | 0.473 | 0.374 | 60.5 | 17.9 |

| Off-farm employment | 0.056 | 0.250 | 5.8 | 2.8 | 0.469 | 0.286 | 59.9 | 26.5 |

| Successor | −0.025 | 0.212 | −2.5 | −1.2 | −0.588 ** | 0.234 | −44.5 | −24.8 |

| Dairy enterprise | 0.406 | 0.726 | 50.1 | 6.2 | 1.286 | 0.915 | 261.7 | 21.1 |

| Beef enterprise | 0.215 | 0.247 | 24.0 | 11.4 | 0.196 | 0.280 | 21.7 | 10.3 |

| Sheep enterprise | −0.038 | 0.287 | −3.7 | −1.6 | 0.047 | 0.320 | 4.8 | 2.0 |

| Farmland owned (ha) | 0.003 | 0.002 | 0.3 | 16.2 | 0.002 | 0.003 | 0.2 | 12.6 |

| Fewer than 5 GCSEs | 0.488 | 0.459 | 62.9 | 12.6 | −0.083 | 0.493 | −8.0 | −2.0 |

| 5 GCSEs or equivalent | 0.034 | 0.345 | 3.5 | 1.2 | −0.046 | 0.378 | −4.5 | −1.6 |

| A level or equivalent | 0.118 | 0.402 | 12.5 | 3.3 | 0.239 | 0.449 | 27.0 | 6.8 |

| Higher education—diploma or equivalent | 0.360 | 0.341 | 43.3 | 14.6 | 0.280 | 0.391 | 32.3 | 11.2 |

| Degree level or higher | 0.369 | 0.309 | 44.7 | 18.1 | 0.053 | 0.345 | 5.5 | 2.4 |

| Full-time | 0.108 | 0.248 | 11.4 | 5.1 | −0.042 | 0.274 | −4.1 | −1.9 |

| 30–40 | 0.637 | 1.097 | 89.1 | 11.5 | 1.138 | 1.601 | 212.2 | 21.6 |

| 41–54 | 0.044 | 0.928 | 4.5 | 1.6 | −0.196 | 1.226 | −17.8 | −6.8 |

| 55–64 | 0.048 | 0.929 | 4.9 | 2.3 | 0.157 | 1.226 | 17.0 | 7.7 |

| 65–74 | −0.174 | 0.943 | −16.0 | −7.5 | 0.629 | 1.245 | 87.5 | 32.7 |

| 75 or older | −0.374 | 0.973 | −31.2 | −13.8 | −0.059 | 1.267 | −5.8 | −2.3 |

| Disadvantaged | 0.307 | 0.226 | 36.0 | 15.1 | 0.207 | 0.263 | 23.0 | 10.0 |

| Severely Disadvantaged | 0.092 | 0.303 | 9.7 | 3.2 | −0.079 | 0.343 | −7.6 | −2.7 |

| Have formal agricultural qualification | 0.173 | 0.241 | 18.9 | 8.6 | 0.289 | 0.280 | 33.6 | 14.8 |

| Diversification activities | 0.278 | 0.242 | 32.1 | 12.8 | −0.208 | 0.276 | −18.8 | −8.6 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Adenuga, A.H.; Jack, C.; McCarry, R. Investigating the Factors Influencing the Intention to Adopt Long-Term Land Leasing in Northern Ireland. Land 2023, 12, 649. https://doi.org/10.3390/land12030649

Adenuga AH, Jack C, McCarry R. Investigating the Factors Influencing the Intention to Adopt Long-Term Land Leasing in Northern Ireland. Land. 2023; 12(3):649. https://doi.org/10.3390/land12030649

Chicago/Turabian StyleAdenuga, Adewale Henry, Claire Jack, and Ronan McCarry. 2023. "Investigating the Factors Influencing the Intention to Adopt Long-Term Land Leasing in Northern Ireland" Land 12, no. 3: 649. https://doi.org/10.3390/land12030649

APA StyleAdenuga, A. H., Jack, C., & McCarry, R. (2023). Investigating the Factors Influencing the Intention to Adopt Long-Term Land Leasing in Northern Ireland. Land, 12(3), 649. https://doi.org/10.3390/land12030649