Regional Heterogeneity in China’s Rural Collectively Owned Commercialized Land Market: An Empirical Analysis from 2015–2020

Abstract

1. Introduction

2. Methodology

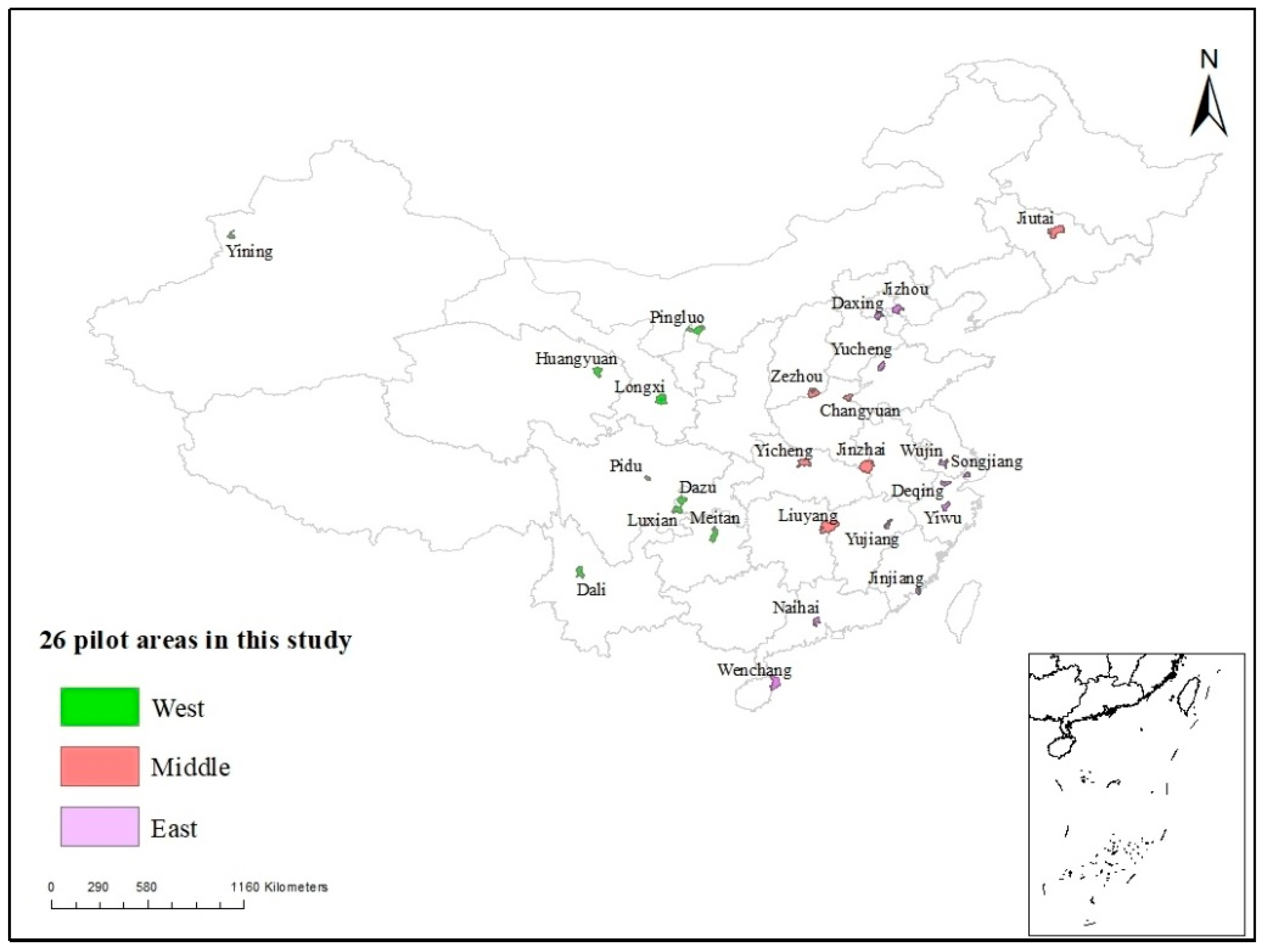

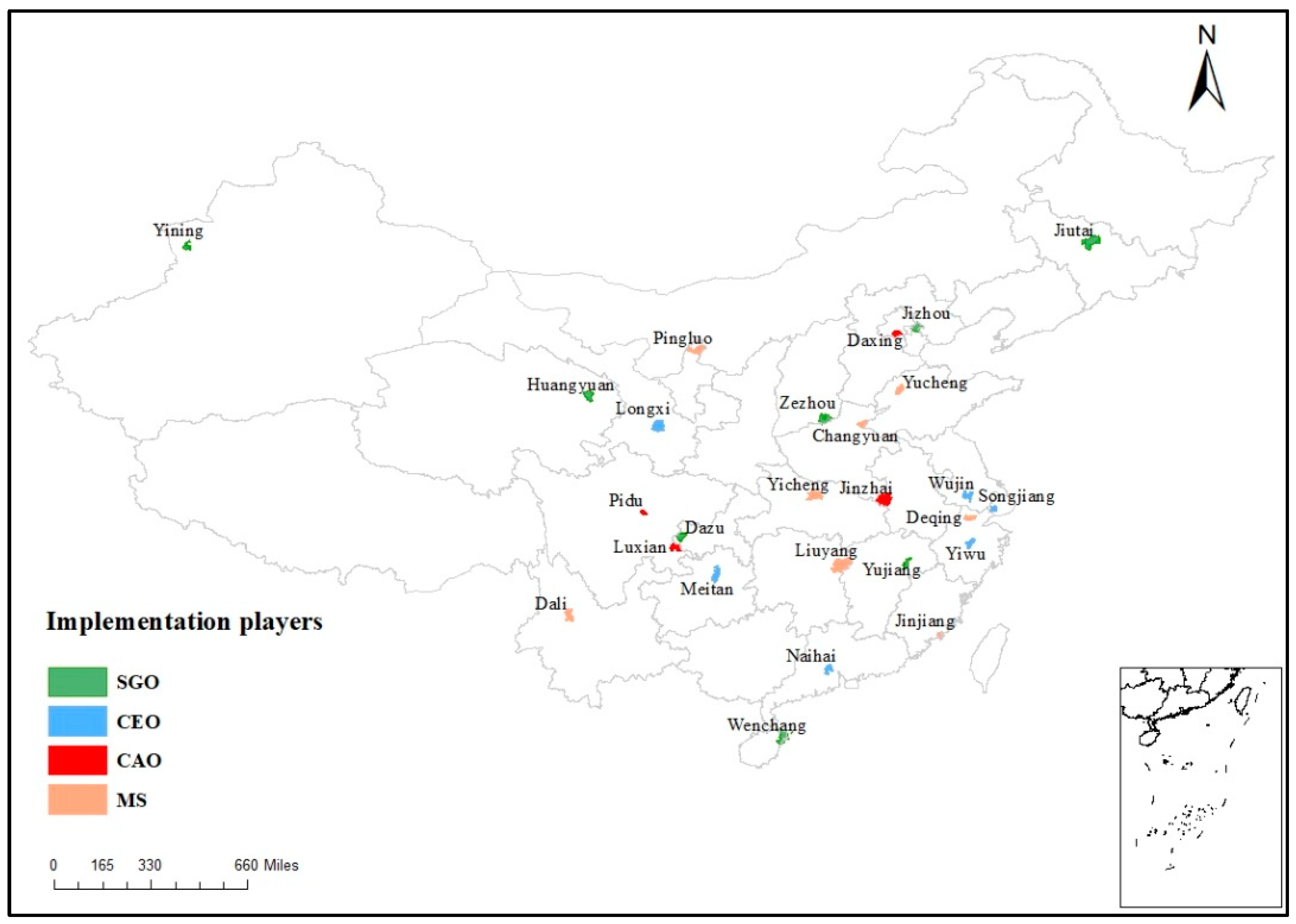

2.1. Study Areas and Data

2.2. Methods

3. Results

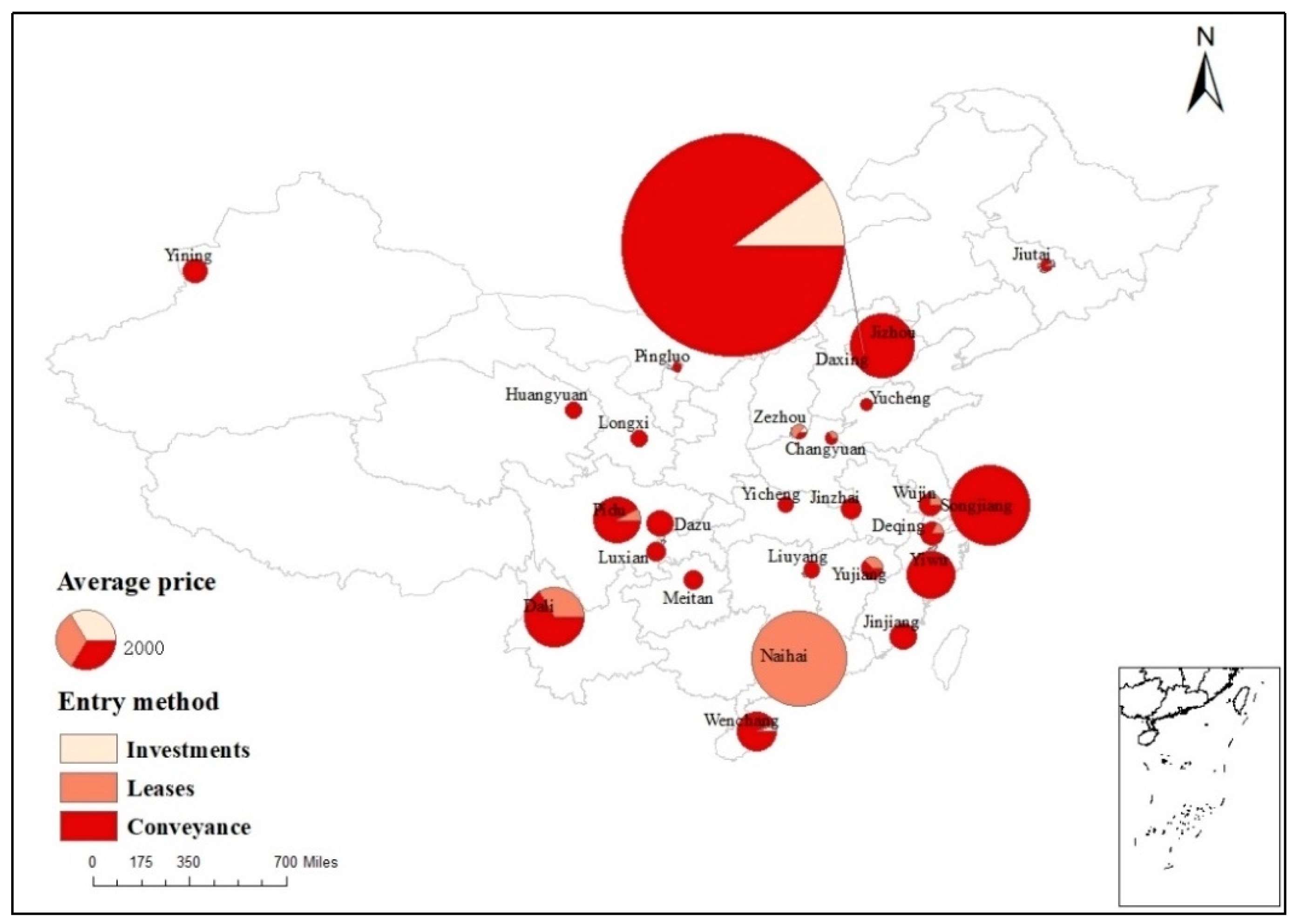

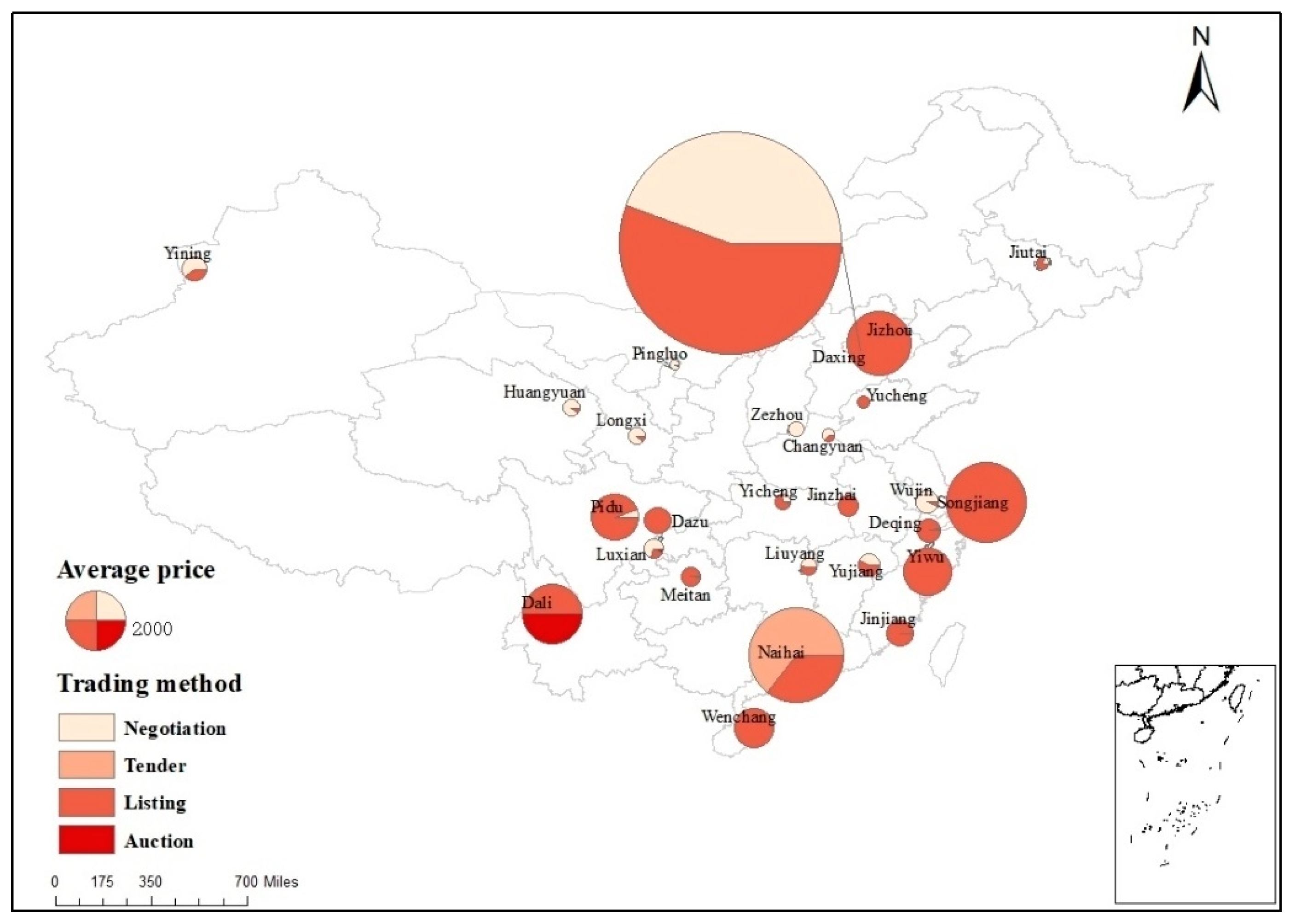

3.1. An Overview of CCCLM

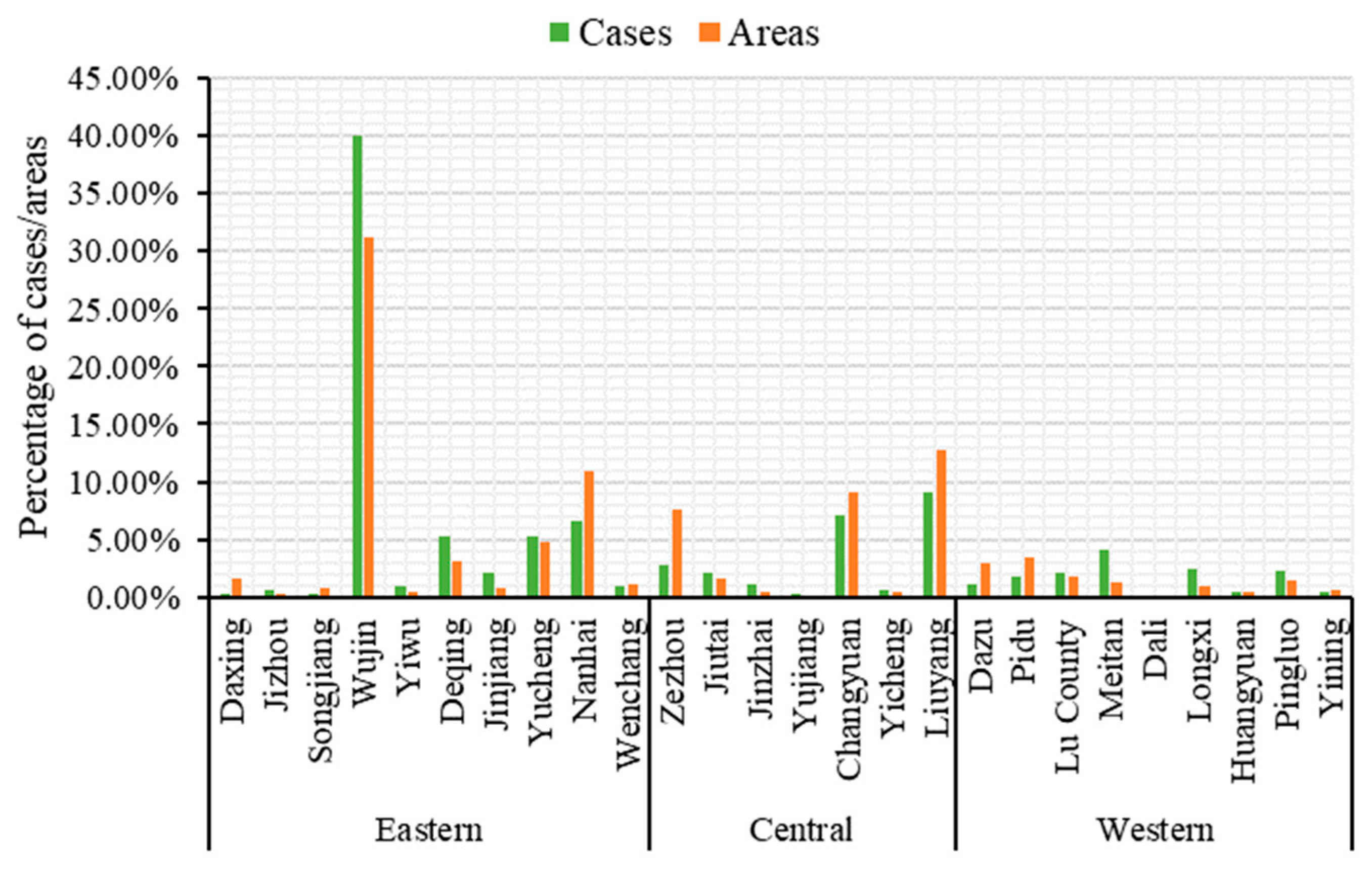

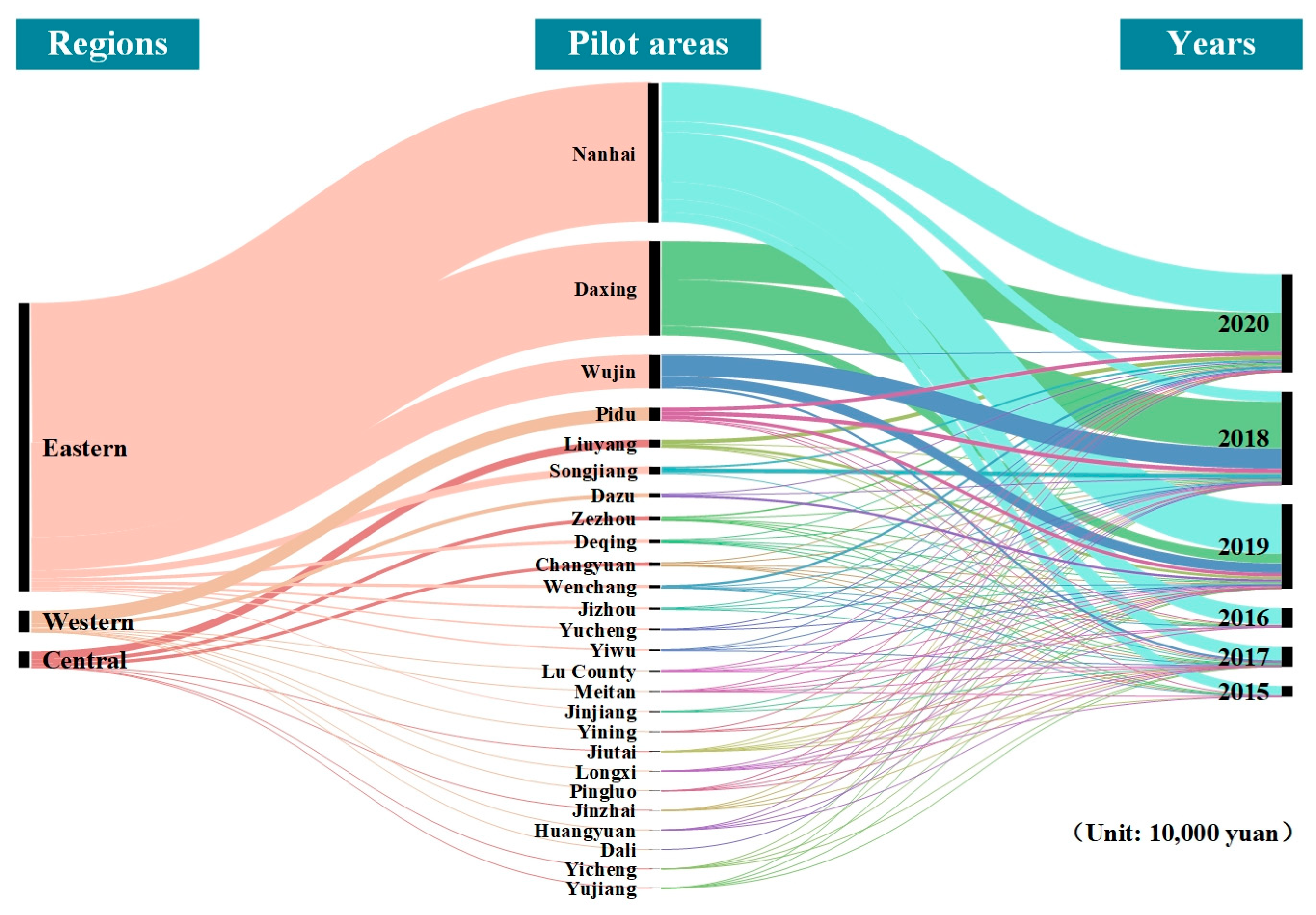

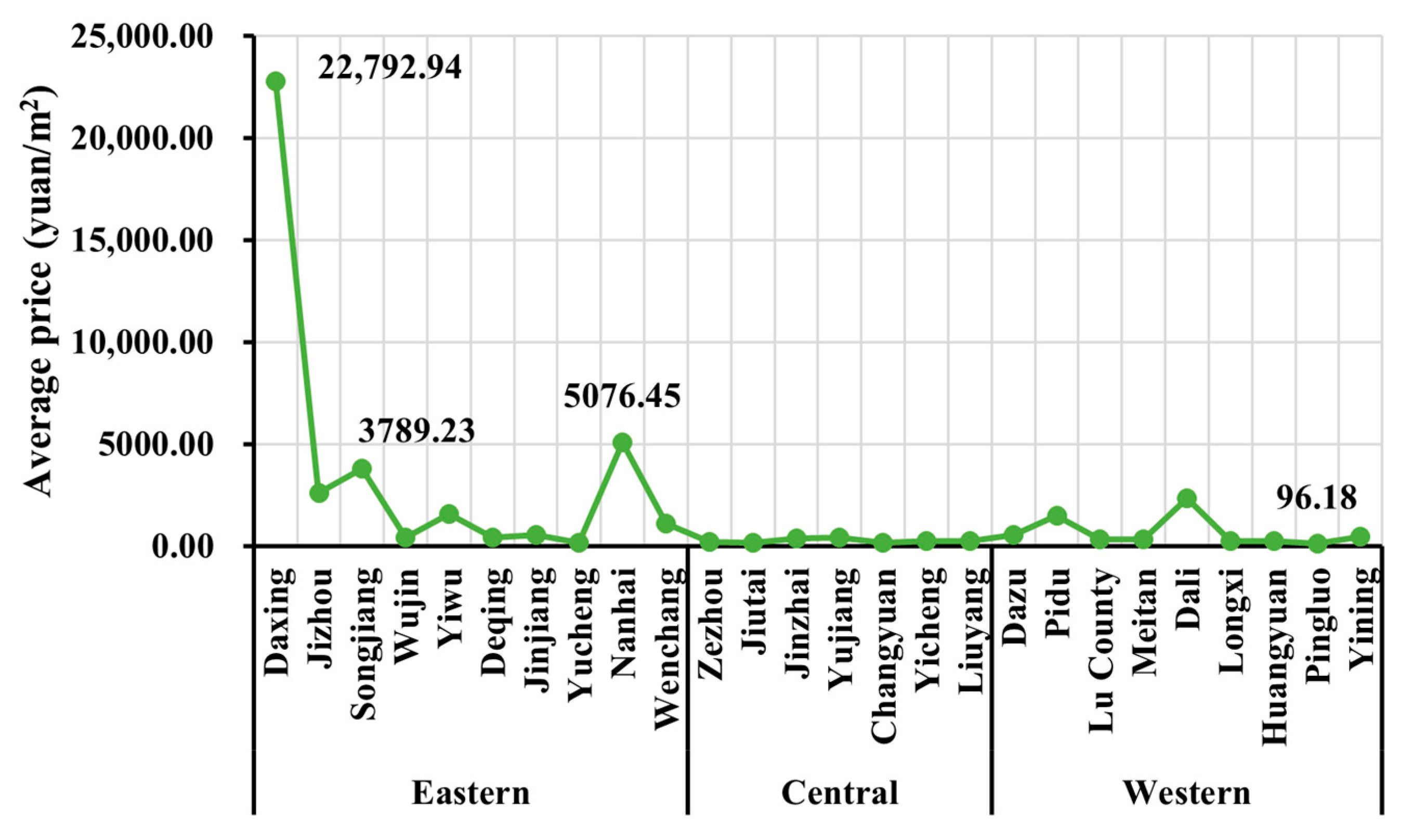

3.1.1. Transaction Volumes, Areas, and Values

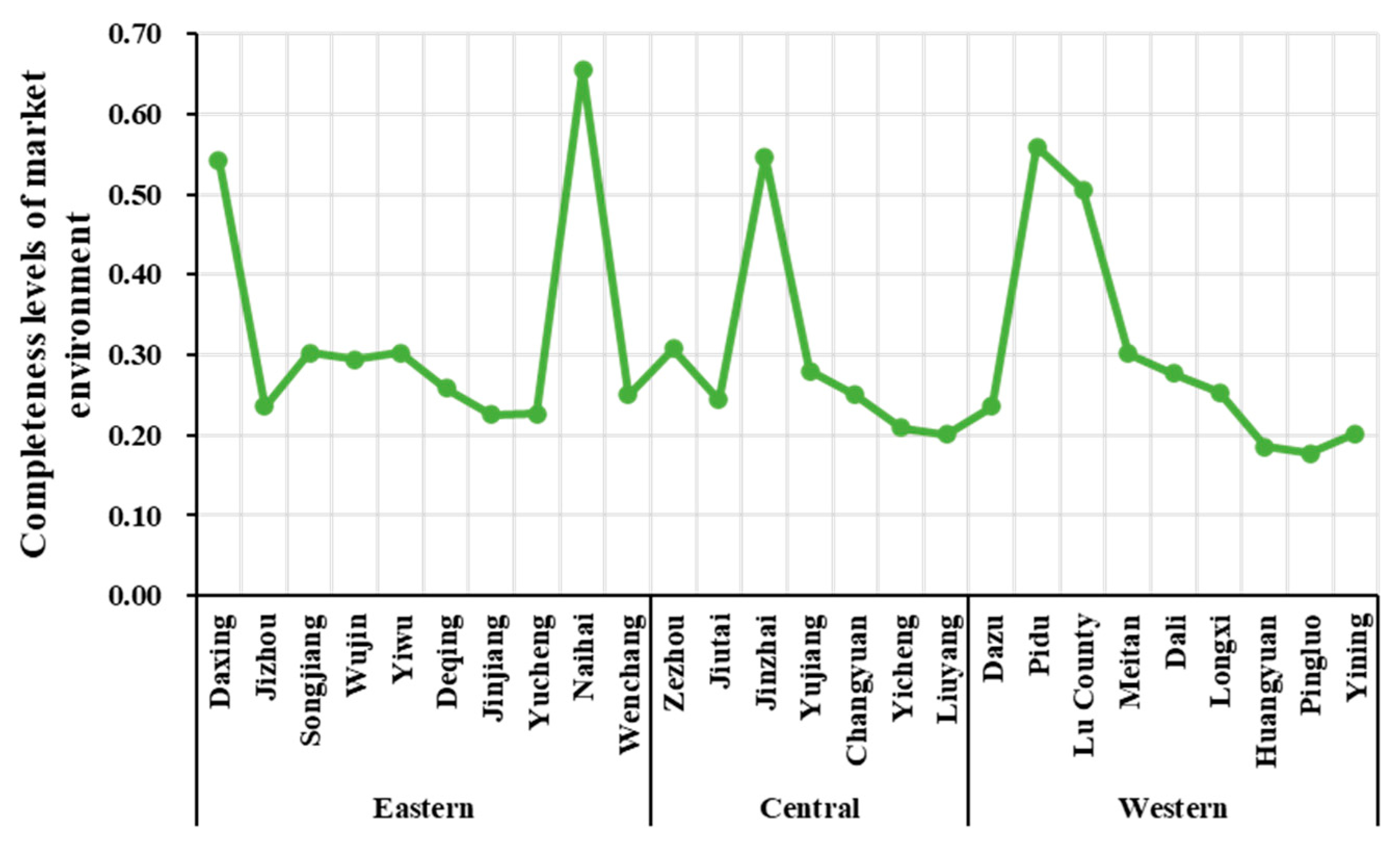

3.1.2. Market Environment

3.2. Marketization Degree

3.3. Policy Implications

4. Discussion and Conclusions

4.1. Discussion

4.2. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Lin, G.C.S.; Ho, S.P.S. The State, Land System, and Land Development Processes in Contemporary China. Ann. Assoc. Am. Geogr. 2005, 95, 411–436. [Google Scholar] [CrossRef]

- Cheng, J.; Zhao, J.; Zhu, D.; Jiang, X.; Zhang, H.; Zhang, Y. Land Marketization and Urban Innovation Capability: Evidence from China. Habitat Int. 2022, 122, 102540. [Google Scholar] [CrossRef]

- Ravallion, M.; de Walle, D.V. Land Reallocation in an Agrarian Transition. Econ. J. 2006, 116, 924–942. [Google Scholar] [CrossRef]

- Deininger, K.; Jin, S.; Adenw, B.; Gebre-Selassie, S.; Demeke, M. Market and Non-Market Transfers of Land in Ethiopia: Implications for Efficiency, Equity, and Non-Farm Development; World Bank Policy Research Working Paper No. 2992; World Bank: Washington, DC, USA, 2003. [Google Scholar]

- Deininger, K.; Zegarra, E.; Lavadenz, I. Determinants and Impacts of Rural Land Market Activity: Evidence from Nicaragua. World Dev. 2003, 31, 1385–1404. [Google Scholar] [CrossRef]

- Boucher, S.R.; Barham, B.L.; Carter, M.R. The Impact of “Market-Friendly” Reforms on Credit and Land Markets in Honduras and Nicaragua. World Dev. 2005, 33, 107–128. [Google Scholar] [CrossRef]

- Kompas, T.; Che, T.N.; Nguyen, H.T.M.; Nguyen, H.Q. Productivity, Net Returns, and Efficiency: Land and Market Reform in Vietnamese Rice Production. Land Econ. 2012, 88, 478–495. [Google Scholar] [CrossRef]

- Deininger, K.; Savastano, S.; Carletto, C. Land Fragmentation, Cropland Abandonment, and Land Market Operation in Albania. World Dev. 2012, 40, 2108–2122. [Google Scholar] [CrossRef]

- Xie, Q.; Parsa, A.R.G.; Redding, B. The Emergence of the Urban Land Market in China: Evolution, Structure, Constraints and Perspectives. Urban Stud. 2002, 39, 1375–1398. [Google Scholar] [CrossRef]

- Vyas, I.; Vyas, H.N.; Mishra, A.K. Land-based Financing of Cities in India: A Study of Bengaluru and Hyderabad and Directions for Reforms. J. Public Aff. 2022, 22, 2378. [Google Scholar] [CrossRef]

- Nguyen, T.B.; van der Krabben, E.; Musil, C.; Le, D.A. ‘Land for Infrastructure’ in Ho Chi Minh City: Land-Based Financing of Transportation Improvement. Int. Plan. Stud. 2018, 23, 310–326. [Google Scholar] [CrossRef]

- Ding, C. Land Policy Reform in China: Assessment and Prospects. Land Use Policy 2003, 20, 109–120. [Google Scholar] [CrossRef]

- Gyourko, J.; Shen, Y.; Wu, J.; Zhang, R. Land Finance in China: Analysis and Review. China Econ. Rev. 2022, 76, 101868. [Google Scholar] [CrossRef]

- Hu, F.Z.Y.; Qian, J. Land-Based Finance, Fiscal Autonomy and Land Supply for Affordable Housing in Urban China: A Prefecture-Level Analysis. Land Use Policy 2017, 69, 454–460. [Google Scholar] [CrossRef]

- Wen, L.; Butsic, V.; Stapp, J.R.; Zhang, A. What Happens to Land Price When a Rural Construction Land Market Legally Opens in China? A Spatiotemporal Analysis of Nanhai District from 2010 to 2015. China Econ. Rev. 2020, 62, 101197. [Google Scholar] [CrossRef]

- Tan, R.; Qu, F.; Heerink, N.; Mettepenningen, E. Rural to Urban Land Conversion in China—How Large Is the over-Conversion and What Are Its Welfare Implications? China Econ. Rev. 2011, 22, 474–484. [Google Scholar] [CrossRef]

- Wang, R.; Tan, R. Efficiency and Distribution of Rural Construction Land Marketization in Contemporary China. China Econ. Rev. 2020, 60, 101223. [Google Scholar] [CrossRef]

- Wen, L.; Chatalova, L.; Zhang, A. Can China’s Unified Construction Land Market Mitigate Urban Land Shortage? Evidence from Deqing and Nanhai, Eastern Coastal China. Land Use Policy 2022, 115, 105996. [Google Scholar] [CrossRef]

- Zhou, Y.; Li, X.; Liu, Y. Rural Land System Reforms in China: History, Issues, Measures and Prospects. Land Use Policy 2020, 91, 104330. [Google Scholar] [CrossRef]

- Zeng, C.; Deng, X.; Yang, J.; Cheng, Y.; Zhao, T.; Wang, P. The Exploration of Residents’ Perception of Eco-Urbanization at Community and Driving Factors in China. Cities 2022, 122, 103513. [Google Scholar] [CrossRef]

- Zhou, L.; Zhang, W.; Fang, C.; Sun, H.; Lin, J. Actors and Network in the Marketization of Rural Collectively-Owned Commercial Construction Land (RCOCCL) in China: A Pilot Case of Langfa, Beijing. Land Use Policy 2020, 99, 104990. [Google Scholar] [CrossRef]

- Chen, Z.; Zhuo, Y.; Li, G.; Xu, Z. What Drives Different Governance Modes and Marketization Performance for Collective Commercial Construction Land in Rural China? Land 2021, 10, 319. [Google Scholar] [CrossRef]

- Liu, H.; Zhou, Y. The Marketization of Rural Collective Construction Land in Northeastern China: The Mechanism Exploration. Sustainability 2021, 13, 276. [Google Scholar] [CrossRef]

- Zhang, T.; Huang, K.; Zhang, A. Choice of Rural Collective Construction Land Sales and Rental Markets at the Theoretical Framework of Williamson’s Transaction Costs: Evidence from Nanhai District, Guangdong Province, China. Sustainability 2021, 13, 8473. [Google Scholar] [CrossRef]

- Deng, M.; Zhang, A. Market Efficiency under the Arrangement of Transaction Rules of the RCCL Market from the Supply-Side Perspective. Sustainability 2020, 12, 7660. [Google Scholar] [CrossRef]

- Tan, R.; Wang, R.; Heerink, N. Liberalizing Rural-to-Urban Construction Land Transfers in China: Distribution Effects. China Econ. Rev. 2018, 60, 101147. [Google Scholar] [CrossRef]

- Wang, W. Nuanced Insights into Land Buyer Perceptions of Engaging in Rural Land Transactions from a Cost Perspective: Evidence from China’s Emerging Rural Land Market. Land Use Policy 2021, 108, 105558. [Google Scholar] [CrossRef]

- Deng, M.; Zhang, A.; Cheng, C.; Hu, C. Are Villagers Willing to Enter the Rural Collective Construction Land Market under the Arrangement of Transaction Rules?—Evidence from Ezhou, China. Land 2022, 11, 466. [Google Scholar] [CrossRef]

- Zhou, L.; Vries, W.T. de Collective Action for the Market-Based Reform of Land Element in China: The Role of Trust. Land 2022, 11, 926. [Google Scholar] [CrossRef]

- Xie, X.; Zhang, A.; Wen, L.; Bin, P. How Horizontal Integration Affects Transaction Costs of Rural Collective Construction Land Market? An Empirical Analysis in Nanhai District, Guangdong Province, China. Land Use Policy 2019, 82, 138–146. [Google Scholar] [CrossRef]

- Zhang, M.; Chen, Q.; Zhang, K.; Yang, D. Will Rural Collective-Owned Commercial Construction Land Marketization Impact Local Governments’ Interest Distribution? Evidence from Mainland China. Land 2021, 10, 209. [Google Scholar] [CrossRef]

- Zhang, W.; Wang, W.; Li, X.; Ye, F. Economic Development and Farmland Protection: An Assessment of Rewarded Land Conversion Quotas Trading in Zhejiang, China. Land Use Policy 2014, 38, 467–476. [Google Scholar] [CrossRef]

- Jiang, R.; Lin, G.C.S. Placing China’s Land Marketization: The State, Market, and the Changing Geography of Land Use in Chinese Cities. Land Use Policy 2021, 103, 105293. [Google Scholar] [CrossRef]

- Fan, X.; Qiu, S.; Sun, Y. Land Finance Dependence and Urban Land Marketization in China: The Perspective of Strategic Choice of Local Governments on Land Transfer. Land Use Policy 2020, 99, 105023. [Google Scholar] [CrossRef]

- Liu, T.; Lin, G.C.S. New Geography of Land Commodification in Chinese Cities: Uneven Landscape of Urban Land Development under Market Reforms and Globalization. Appl. Geogr. 2014, 51, 118–130. [Google Scholar] [CrossRef]

- Jiao, M.; Xu, H. How Do Collective Operating Construction Land (COCL) Transactions Affect Rural Residents’ Property Income? Evidence from Rural Deqing County, China. Land Use Policy 2022, 113, 105897. [Google Scholar] [CrossRef]

- Stoker, G. Embracing Complexity: A Framework for Exploring Governance Resources. J. Chin. Gov. 2019, 4, 91–107. [Google Scholar] [CrossRef]

- Woods, M. Researching Rural Conflicts: Hunting, Local Politics and Actor-Networks. J. Rural Stud. 1998, 14, 321–340. [Google Scholar] [CrossRef]

- Qian, Z.; Mou, Y. Level of Land Marketazation in China: Measurement and Analysis. Manag. World 2012, 7, 67–75+95. (In Chinese) [Google Scholar] [CrossRef]

- Wang, Q.; Chen, Z.; Ye, Y.; Huang, X. Analysis of the Spatiotemporal Characteristics of China’s Land Marketization Process. Resour. Sci. 2007, 1, 43–47. (In Chinese) [Google Scholar]

- Jiang, G.; Ma, W.; Dingyang, Z.; Qinglei, Z.; Ruijuan, Z. Agglomeration or Dispersion? Industrial Land-Use Pattern and Its Impacts in Rural Areas from China’s Township and Village Enterprises Perspective. J. Clean. Prod. 2017, 159, 207–219. [Google Scholar] [CrossRef]

- Kheir, N.; Portnov, B.A. Economic, Demographic and Environmental Factors Affecting Urban Land Prices in the Arab Sector in Israel. Land Use Policy 2016, 50, 518–527. [Google Scholar] [CrossRef]

- Wang, R.; Tan, R. Patterns of Rural Collective Action in Contemporary China: An Archetype Analysis of Rural Construction Land Consolidation. J. Rural Stud. 2020, 79, 286–301. [Google Scholar] [CrossRef]

- Liu, T.; Cao, G.; Yan, Y.; Wang, R.Y. Urban Land Marketization in China: Central Policy, Local Initiative, and Market Mechanism. Land Use Policy 2016, 57, 265–276. [Google Scholar] [CrossRef]

- Karita Kan Creating Land Markets for Rural Revitalization: Land Transfer, Property Rights and Gentrification in China. J. Rural Stud. 2021, 81, 68–77. [CrossRef]

- Gao, J.; Liu, Y.; Chen, J. China’s Initiatives towards Rural Land System Reform. Land Use Policy 2020, 94, 104567. [Google Scholar] [CrossRef]

- Cai, Y. Collective Ownership or Cadres’ Ownership? The Non-Agricultural Use of Farmland in China. China Q. 2003, 175, 662–680. [Google Scholar] [CrossRef]

- Yang, S.; Hu, S.; Li, W.; Zhang, C.; Song, D. Spatio-Temporal Nonstationary Effects of Impact Factors on Industrial Land Price in Industrializing Cities of China. Sustainability 2020, 12, 2792. [Google Scholar] [CrossRef]

- Wu, K.; Zhang, H. Land Use Dynamics, Built-up Land Expansion Patterns, and Driving Forces Analysis of the Fast-Growing Hangzhou Metropolitan Area, Eastern China (1978–2008). Appl. Geogr. 2012, 34, 137–145. [Google Scholar] [CrossRef]

- Zhou, T.; Tan, R.; Shu, X. Rigidity with Partial Elasticity: Local Government Adaptation under the Centralized Land Quota System in China. Land Use Policy 2022, 118, 106138. [Google Scholar] [CrossRef]

- He, C.; Zhou, Y.; Huang, Z. Fiscal Decentralization, Political Centralization, and Land Urbanization in China. Urban Geogr. 2016, 37, 436–457. [Google Scholar] [CrossRef]

- Yuan, F.; Wei, Y.D.; Xiao, W. Land Marketization, Fiscal Decentralization, and the Dynamics of Urban Land Prices in Transitional China. Land Use Policy 2019, 89, 104208. [Google Scholar] [CrossRef]

- Krusekopf, C.C. Diversity in Land-Tenure Arrangements under the Household Responsibility System in China. China Econ. Rev. 2002, 13, 297–312. [Google Scholar] [CrossRef]

- Deng, M.; Zhang, A. Effect of Transaction Rules on Enterprise Transaction Costs Based on Williamson Transaction Cost Theory in Nanhai, China. Sustainability 2020, 12, 1129. [Google Scholar] [CrossRef]

- Cai, H.; Henderson, J.V.; Zhang, Q. China’s Land Market Auctions: Evidence of Corruption? Rand J. Econ. 2013, 44, 488–521. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, S.; Wen, L. Regional Heterogeneity in China’s Rural Collectively Owned Commercialized Land Market: An Empirical Analysis from 2015–2020. Land 2023, 12, 441. https://doi.org/10.3390/land12020441

Yang S, Wen L. Regional Heterogeneity in China’s Rural Collectively Owned Commercialized Land Market: An Empirical Analysis from 2015–2020. Land. 2023; 12(2):441. https://doi.org/10.3390/land12020441

Chicago/Turabian StyleYang, Shenjie, and Lanjiao Wen. 2023. "Regional Heterogeneity in China’s Rural Collectively Owned Commercialized Land Market: An Empirical Analysis from 2015–2020" Land 12, no. 2: 441. https://doi.org/10.3390/land12020441

APA StyleYang, S., & Wen, L. (2023). Regional Heterogeneity in China’s Rural Collectively Owned Commercialized Land Market: An Empirical Analysis from 2015–2020. Land, 12(2), 441. https://doi.org/10.3390/land12020441