Abstract

Insufficient capital investment coupled with limited land resources significantly limits cultivated land use efficiency (CLUE). China’s rural credit policy system is currently growing, yet the impact of farmer-level credit on CLUE remains understudied. Therefore, this study investigated whether rural credit enhances CLUE by using the China Rural Revitalization Survey (CRRS) data. It explored the impact and mechanism of rural credit on CLUE using least squares regression and mediation models. According to our results, the average CLUE level for farmers in the study area was 0.661, which still had much room for improvement compared with Japan, which also has a large population but limited land. In addition, access to rural credit positively affected CLUE, with cultivated land scale-up and technological applications mediating the rural-credit-driven increase in CLUE. Further analyses of the rural credit allocation mode (RCAM) indicated that farmers’ use of credit for investment in agricultural production factors boosted CLUE more than non-farming allocation of credit funds. These findings suggest that the government should continue to increase support for rural credit while improving the monitoring mechanism for credit allocation to prevent rural credit de-farming from hindering CLUE improvement.

1. Introduction

The importance of cultivated land is unquestionable, especially in guaranteeing food security and sustainable development [1,2]. China’s cultivated land resources are very constrained, making up less than 10% of the world’s total farmland area. However, they support 1.4 billion people, which is one-fifth of the global population [2,3]. Over the past 40 years, China has experienced rapid urbanization and industrialization, transforming it from an agricultural country to the world’s largest industrial nation, which has led to unprecedented achievements in poverty eradication as well as increasing challenges to its cultivated land resources [4]. The problems of abandonment, quality degradation, and ecological deterioration of China’s cultivated land are becoming increasingly serious [5,6], resulting in low use efficiency of cultivated land and making it difficult to increase food production. Under the multiple pressures of war, epidemics, and increasing global food demand [7], it is urgent to change traditional attitudes and explore efficient models of cultivated land use [4], in addition to actively protecting existing cultivated land. This is crucial to ensure food security.

Research has been conducted from the perspectives of land policy and agricultural production technology to improve cultivated land use efficiency (CLUE). Scholars have argued that land policies, such as confirming rights and transferring and strengthening the market regulations of cultivated land [8,9,10], are conducive to improving CLUE. Moreover, advanced agricultural production technologies such as land preparation, green fertilization, and the application of superior seeds effectively improve CLUE [11,12]. An effective supply of agricultural capital is the basis for realizing the objectives of land policies and the application of agricultural production technologies [13,14], as agricultural capital provides the liquidity required for investment in production [15], influencing producers’ agricultural inputs. However, farmers’ poor ability to accumulate capital, stemming from the weak nature of agriculture, hinders the formation and supply of agricultural capital. The limited financial support from local governments for developing the agricultural economy in some areas exacerbates the lack of agricultural capital. Developing rural credit services could improve capital liquidity in the rural financial market [15,16], which would promote the formation of agricultural capital and reduce financial pressure on agricultural producers.

Previous studies have usually focused on the impact of rural credit on poverty eradication [17], and agricultural economic growth rather than the role it plays in improving CLUE [18]. Zeller et al. found that access to credit by households with low risk tolerance enabled growing capital-intensive crops, such as hybrid maize and tobacco, which contributed to higher household incomes and alleviated poverty [19]. De Castro and Teixeira discovered that the implementation of a rural credit program in Brazil in 1965 led to farmers purchasing numerous agricultural inputs, including fertilizers and pesticides, and significantly higher yields of crops such as soybeans and corn; this in turn gave a quick boost to economic growth in the agricultural sector [20]. Although no studies have directly investigated whether rural credit improves CLUE, some scholars have found there is a change in the farm household’s cropland output and factor allocation decisions after accessing credit. Guirkinger and Boucher found that eliminating credit constraints in Peru increased output per hectare by 26% [16]. Researchers have found that after receiving credit, farmers were more inclined to adopt high-yielding seeds and optimize their cropping structure [14,21]. Wang and Li observed a positive effect of average farmland size per laborer, size of agricultural loans, and agricultural tax exemption on the efficiency of farmland use at the prefecture and city level in China [22]. In addition, Petrick observed that access to credit increased the propensity of farmers to engage in subsistence consumption to build houses and purchase household goods [13]. This implies that credit may reduce farmers’ productive investment in cultivated land, thus constraining CLUE growth.

The existing literature provides a basis for analyzing the relationship between rural credit and CLUE. To date, scholars have not drawn general conclusions regarding the impact of the availability and allocation of rural credit on CLUE. The growing concern about the declining global per-capita cultivated land area has forced serious thought regarding the relationship between rural credit and CLUE [2]. For example, does rural credit contribute to improving CLUE, and can it still have a positive impact on the efficient use of farmland, especially in the case of rural credit de-farming transfers? Analyzing these questions is essential for the scientific establishment of effective rural credit policies to ensure sustainable food production. Therefore, an in-depth analysis of the contribution of rural credit in improving CLUE and its mechanism is provided by this study, using data from the 2020 CRRS, which is also known as the China Rural Revitalization Survey.

The remainder of the paper is structured as follows: Theories on the impact and mechanisms of rural credit on CLUE are detailed in the second part. The study area, data sources, and the basic model are presented in Section 3. The empirical analyses used to validate our theories are presented in Section 4. Section 5 presents a discussion and recommendations. Finally, conclusions are presented in Section 6.

2. Theoretical Analyses

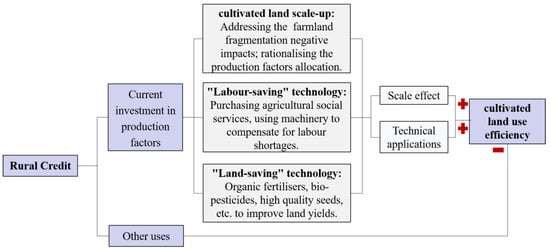

As the agents in cultivated land production activities, farmers directly influence CLUE through their allocation decisions and behavior with regard to production factors. Farm households in China rely on capital to purchase agricultural production factors as inputs to obtain agricultural outputs. Due to the natural characteristics of agricultural production, farm households may face seasonal financial constraints, leading to payment difficulties in purchasing production factors. The impact is pronounced for farm households that are more capital-dependent [23]. As a result, farmers are forced to make sub-optimal production decisions in the face of financial constraints [15]. Farmers may purchase less risky combinations of production factors or technologies, which could translate into productivity levels well below the optimum combination of inputs [17,24]. However, access to rural credit can alleviate the financial constraints of farmers to a certain extent and provide a strong incentive for farmers to increase their current investments in production factors [25]. In this way, output levels can be optimized to improve CLUE under conditions of limited cultivated land resources. Specifically, rural credit provides incentives for farmers to actively invest in purchasing farmland and technology factors and influences CLUE through cultivated land scale-up and technology application. We summarized the mechanism of rural credit impact on CLUE (Figure 1).

Figure 1.

Mechanisms by which rural credit can improve cultivated land use efficiency (CLUE).

Rural credit can increase the likelihood of farmers transferring cultivated land, facilitating its scale-up, and mitigating the negative effects of fragmentation. China faces cultivated land fragmentation [8,26], leading to irrational labor and machinery allocation and then increasing technical inefficiency and production costs [12], which reduces CLUE. Moreover, cultivated land fragmentation constrains spatial spillovers from investment in agricultural infrastructure [12], which hinders the growth in production investment and ultimately leads to lower output and efficiency. In addition, the inefficient use of cultivated land is more likely to lead to farmland abandonment [10]. Land transfer could promote centralization and large-scale operations to solve the adverse effects of fragmentation. However, farmers lack the funds to pay for land transfers when facing credit constraints [27], which discourages them from transferring. Improving rural credit availability (RCA) could provide financial support for farmers and encourage them to expand their operational scale to achieve a rational allocation between farmland and related factors by transferring farmland. CLUE might be effectively improved through large-scale operations. However, the transfer does not necessarily realize high efficiency by expanding the farmland scale if other constraints, such as production technology, are present. Farmers also need to improve their production techniques, which cannot be accomplished without the effective support of production financing.

Second, rural credit can incentivize farmers to apply "labor-saving" or "land-saving" technologies to alleviate the constraints of other production factors and change the external conditions of agricultural production. Agricultural producers are encouraged to apply “labor-saving” technologies. Agricultural labor loss quantitatively and qualitatively raises the cost of searching for and hiring workers in agriculture due to labor migration in many developing countries [8]. This may lead to a shortage of labor inputs, resulting in lower yields from land during the peak season of employment, ultimately reducing CLUE. Moreover, labor aging exacerbates farmland abandonment [26]. Aging also hinders the application of technology due to the comparative disadvantages of physical strength and perception, which is not conducive to improving CLUE. Rural credit can mitigate the inefficiencies caused by agricultural labor loss by promoting the development of the market for agricultural machinery services and investment in agricultural machinery [28]. Furthermore, agricultural machinery operation services create conditions for technical advancement conducive to efficient land use. Rural credit can also stimulate farmers to apply “land-saving” technologies to increase land output, such as replacing chemical fertilizers with organic fertilizers [29], improving varieties [30], and green control of pests and diseases [5]. Farmers have long shown fertilizer input bias due to limited capital accumulation [31], leading to low cultivated land production capacity and use efficiency. However, households with insufficient production funds may not adopt organic fertilizers, as they are more expensive than chemical fertilizers [32]. This may be why farmers in developing countries are more dependent on chemical fertilizers than in developed countries.

Thus, access to rural credit can increase CLUE if it improves farming households’ investments in land and technology and optimizes the allocation of production factors. Therefore, we proposed the following hypotheses:

Hypothesis 1:

Access to rural credit contributes to improving CLUE.

Hypothesis 2:

Rural credit improves CLUE by promoting cultivated land scale-up and technological applications.

However, farmers tend to allocate rural credit for non-agricultural production usage after acquiring it due to the lack of supervision over its use in order to fulfill financial needs in other areas [25,33]. This deprives the utilization of rural credit of the directionality for which it was designed. Petrick noted that 50% of borrowers invested less than the amount borrowed for agricultural production on Polish farms [13]. A survey of farmers in the Weibei region of Shaanxi Province, China (2000–2003) revealed that the proportion of loans invested in non-farm projects accounted for 70.93% of the total production borrowing [34]. Their study implies that rural credit generates a wealth effect that promotes consumption in the area of livelihoods. If the relief from financial constraints for farmers to purchase land and production technology is lacking, this is not conducive to the input and rational allocation of production factors that negatively affect cultivated land output levels. It even accelerates agricultural labor migration and triggers the abandonment of cultivated land. Therefore, we proposed the following hypothesis:

Hypothesis 3:

The effectiveness of rural credit in improving CLUE is affected by the allocation mode, which is unfavorable to CLUE when used for non-farm production.

3. Materials and Methods

3.1. Study Area

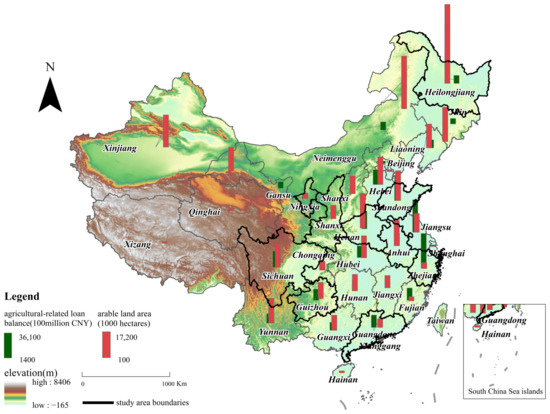

Considering the amount of agriculture-related loans, area of cultivated land, and topographical conditions in rural areas of China, this study examined 10 provinces: Guangdong, Zhejiang, Shandong, Anhui, Henan, Guizhou, Sichuan, Shaanxi, Ningxia, and Heilongjiang (Figure 2). Most of these areas are traditional agricultural provinces with a relatively flat topography and extensive cultivated land, which permits large-scale cultivation and machinery use, providing rich sample support for the study. In addition, in Zhejiang, Guangdong, Henan, Sichuan, and Shandong, the early popularization of rural financial policies and large-scale agriculture-related loans allowed more funds to be used to improve agricultural production conditions. These factors are crucial in investigating the relationship between rural credit and CLUE.

Figure 2.

Study area. Cultivated land area and farm-related loan data derived from the statistical bulletins of 10 provinces in China for 2018, 2019, and 2020. We calculated the average of these data and then used ArcGIS10.6 for specific mapping. The base map was obtained from the standard map with review number GS (2019)18231 and was downloaded from the standard map service website of the Ministry of Natural Resources of China.

3.2. Methods

3.2.1. Data Envelopment Analysis (DEA) to Measure CLUE

CLUE reflects the rational use of inputs and an appreciation of the value of cultivated land in the farming process [2,6]. Most studies in China and globally measure CLUE using the ratio of inputs to outputs in the production process [2,9,35]. Data envelopment analysis, DEA, is an important way to assess the relative efficiency of decision-making units, which are abbreviated as DMUs [36]. This method is widely used for efficiency research and analysis. Farmers often aim to maximize household returns for factor allocation. In China, this principle means maximizing output to increase returns while keeping the scale of inputs constant. Therefore, this study defined CLUE as the maximum agricultural output that can be achieved under a given input level of cultivated land resources. We measured CLUE using an output-oriented DEA model, as follows:

where and are the input and output of the farm household; is the non-negative weight of the farm household; is the efficiency value of the farm household. The input variables were cultivated land, labor, and productive capital, indicating cultivated area, family agricultural laborers, and the sum of the expenses and costs of all production stages (e.g., plowing, sowing, dousing, fertilizing, irrigating, and harvesting), respectively. The output variable was the family gross cultivation value.

3.2.2. Main and Mediating Effect Models

According to our analysis, rural credit changes the current investment in production factors, which indirectly affects CLUE. This study constructed main and mediating effect models to test our theory and estimated all the variables’ values using ordinary least squares regression with the help of stata15. The models are as follows:

where is CLUE; is the RCA; is other variables affecting CLUE of the farm household; is the investment in agricultural production factors; , , and are the coefficients to be estimated; and is the random disturbance term. The total effects model used to investigate whether RCA improves CLUE is shown in Equation (2). Equation (3) estimates the effect of the RCA on farm household investment in agricultural production factors. Equation (4) introduces RCA and agricultural factor investment to verify whether acts as an intermediary.

3.2.3. Modelling the Rural Credit Allocation Mode (RCAM) Impact on CLUE

As we pointed out in the theoretical analysis section, farmers utilizing rural credit for non-agricultural purposes squeezes capital factor inputs into the cultivated land production process, which may have a negative impact on improving CLUE. Therefore, we used the following model for farmers who receive credit:

where is CLUE of farmers who receive credit; is the RCAM; is other variables affecting CLUE, in line with Equation (2); and is a random disturbance term. All variables were estimated using OLS regression.

3.3. Data Source and Processing

Our data are derived from the 2020 CRRS, which captured agricultural and economic phenomena, such as agricultural production, rural labor force, income, and expenditure, at the village and household levels. First, sample counties were selected according to per capita GDP at the county level using the equidistant random sampling method among the 10 provinces studied. Townships (towns) and villages were randomly selected using the same sampling method. Second, a random sample of households was drawn according to the equidistant sampling method based on the roster given by the village council, and a questionnaire was used to collect information. Third, this study screened the data of farm household families with agricultural production credit needs. Finally, we excluded data where the amount of cultivated land and labor is missing, and where there is a large deviation of productive capital inputs from the output value. We obtained 1330 valid samples.

3.4. Variable Selection

The CLUE of farm households was the explanatory variable. We used Deap 2.1 (University of Queensland, St Lucia, QCL, Australia) to measure CLUE.

To examine the effectiveness of rural credit, the core explanatory variable was RCA, defined as whether farmers received loans from financial institutions for productive purposes in the last three years. To examine credit application, the core explanatory variable was RCAM, defined as whether farmers used credit for agricultural production, such as paying land rent, purchasing fertilizers, seeds, and pesticides, and building production greenhouses.

Based on the theoretical analysis, the mediating variables were selected from two dimensions: cultivated land scale-up and technological application. Cultivated land scale-up was whether farmers had cultivated land transfer in (CLTI), whereas technology application was the expenditure cost of purchasing farm machinery socialization services (PFMSS) and whether they purchased organic fertilizer (POF).

Control Variables. To prevent other factors from affecting the estimation results, we controlled for the characteristic variables in two dimensions: household and village. Specifically, these included household size (HS), labor input (LI), receipt of agricultural subsidies (AS), participation in agricultural insurance (AI), per capita disposable income (PCDI), terrain (Te), and whether the village provided production means (PM). In addition, considering the regional differences, we divided the 10 provinces into three regions, east, central, and west, according to their geographical locations, and set regional dummy variables to control for the different impacts due to regional differences. Table 1 provides the descriptive statistics for each variable.

Table 1.

Descriptive statistics.

4. Results

4.1. Estimation of CLUE

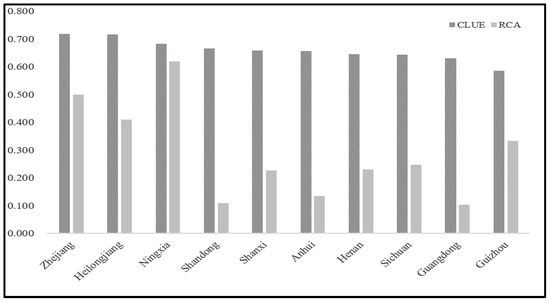

We analyzed the relationship between CLUE and RCA in the provincial and village dimensions (Figure 3 and Figure 4). In the provincial dimension, we counted the average value of sample farmers’ RCA and CLUE in terms of provinces to facilitate observing the overall situation of farmland use and credit availability in different provinces. Further, we categorized the sample farmers according to the village code in which they were located (239 villages were formed) and then counted the average level values of RCA and CLUE in the village dimension and plotted the scatterplot (Figure 4). From this, we can make a preliminary judgment on whether there is a correlation between RCA and CLUE for farmers in different sample villages. In contrast, Japan, which also has many people but little land, had a national CLUE average of 0.914 in 20212. This indicated that most sample farmers had low CLUE compared to Japan, with large disparities in CLUE between regions, indicating significant potential for improvement. Since the last century, Japan has actively promoted mechanized agricultural production and large-scale operation [37], contributing significantly to the effective use of farmland. This provides us with inspiration for improving CLUE. Second, approximately 29.8% of the sampled farmers successfully obtained rural credit, indicating that the majority of farmers had difficulty in successfully accessing rural credit. This result was similar to the findings of Kumar et al. [15], who found that 60% of Chinese households had restricted credit. Only four provinces—Zhejiang, Heilongjiang, Shandong, and Ningxia—had above-average CLUE, and among them, Zhejiang, Heilongjiang, and Ningxia had RCA above the mean value.

Figure 3.

Mean values of CLUE and RCA for 10 provinces in the study area.

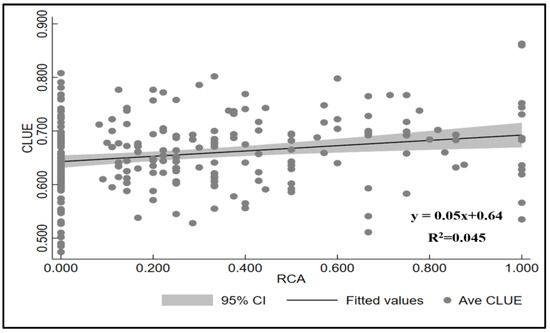

Figure 4.

Scatterplot of CLUE vs. RCA for 236 villages in the study area (goodness of fit is 0.045).

As shown in Figure 4, CLUE was positively correlated with RCA at the village level. RCA and CLUE had a positive linear relationship. This finding indicated that access to rural credit helped farmers increase CLUE. However, further econometric modeling is required to explore the relationship between the two to eliminate the confounding effects of other variables.

4.2. Impact of RCA on CLUE

Table 2 reports the effect of RCA on CLUE with the inclusion of all control variables. According to the results, the effect of RCA on CLUE was significant at the 1% level with a coefficient of 0.033. An empirical test on a sample of 1330 from 10 provinces in China demonstrated that farmers who have access to rural credit are 3.3% points more efficient in their cultivated land use than those who do not. This result was consistent with our theoretical component, suggesting that access to rural credit positively affects CLUE. However, the probability of a farmer in the study area receiving credit was low. This could be due to adverse selection. Lending institutions are more inclined to provide loans to younger families with better financial means [20]. As this group of households tends to demand larger amounts when borrowing and has a lower risk of default, lending to them is more profitable. Conversely, this may be because of a lack of suitable collateral. Most smallholder farmers have collateral that does not fulfill the collateral requirements and may forgo credit for fear of the possible risk of collateral loss if they are unable to repay the loan [15,24]. Finally, due to information asymmetry, farmers may face excessive transaction costs [16,23], affecting households’ access to credit markets.

Table 2.

OLS estimates of the impact of RCA on CLUE.

The results also indicated that LI and Te significantly affected CLUE at the 1% level. In particular, CLUE was relatively high in the plains. Poor terrain conditions tended to increase farmers’ management and machinery use costs [28], which prevents improving CLUE. The effect of LI on CLUE was significantly negative, indicating labor redundancy in some households in the current situation, leading to an irrational allocation of the labor-to-cultivated land ratio [12]. This reduced CLUE, as it was not conducive to an increase in the final output level.

4.3. Mechanism Analysis

Table 3 reports the mechanisms by which RCA affects CLUE, considering two pathways: cultivated land scale-up and technology application. The explanatory variable for Models 5–8 was CLUE; for Models 2–4, the explanatory variables were CLTI, PFMSS, and POF, respectively.

Table 3.

OLS estimates of mediating effects.

(1) Estimation results and analysis of cultivated land scale-up. According to Models 2 and 5, the effect of RCA on CLTI was significant at the 1% level and had a coefficient of 0.177, whereas the effect of CLTI on CLUE was significantly positive at the 1% level. It can be seen that access to rural credit helped drive farmers to participate in transfer to increase the farming scale, which positively affected CLUE. An important aspect of this was that cultivated land transfer led to more farmland flow to farmers with a higher agricultural production capacity but limited initial farmland resources [9], thus optimizing the allocation efficiency of farmland. Moreover, an increase in cultivated land size facilitated the rational allocation of other production factors, such as labor and machinery, thus increasing output. In addition, the size of cultivated land above a certain threshold strengthened the collateral capacity of farmers [38], increasing the likelihood of farmers’ access to rural credit and creating incentives for agricultural investment.

(2) Estimation results and analysis of technological applications. According to Models 3 and 6, access to rural credit had a positive effect on PFMSS, whereas PFMSS positively affected CLUE. Both passed the 1% significance level. Models 4 and 7 showed that the effect of rural credit on POF was significant at the 5% level, whereas that of POF on CLUE was positive and passed the 1% significance test. What these results suggest was that farmers prefer to apply technology after accessing rural credit, which positively affected CLUE. Conversely, a labor shortage created a push for farmers to purchase agricultural social services, and access to rural credit helped farmers realize their desire to purchase agricultural social services and remove the labor shortage impediment. Moreover, agricultural social services applied advanced farming techniques to production, creating a substitute for inefficient technologies. In addition, the purchase of agricultural societal services reduced the sunk costs of farmers purchasing farm machinery and the input costs of cultivated land production, which improved CLUE. Furthermore, rural credit provided farmers with stronger behavioral incentives for green production [29]. It was also important for the improvement of cultivated land quality and sustainable production. This is because the extensive use of chemical fertilizers can cause damage to the ecosystems surrounding cultivated land, whereas the use of organic fertilizers will reduce these harmful effects.

(3) Estimation results combining cultivated land scale-up and technological applications. Model 8 showed that the effects of the mediating variables were generally consistent with the previous results and passed the significance test. The impact coefficients of Model 8 were smaller than those of Models 5, 6, and 7, with the addition of a single mediator variable, suggesting that the mediator variable played only a partial mediating role.

These results indicated that rural credit enhanced farmers’ investment in production factors such as cultivated land and technology. This was consistent with previous findings [24,39]. Under imperfect market conditions, farm household production decisions were influenced by their potential to implement budgetary necessities. Nevertheless, households with access to credit could invest in production factors because of reduced budget constraints. They could then increase CLUE by promoting cultivated land scale-up and technological applications. These findings supported Hypothesis 2. This implies that access to credit increases the production endowment of farmland and other factors. The efficiency of farmland use is increased by expanding output, thus creating a substitution of capital for some under-endowed cultivated land. This finding suggests that there is an urgent need to remove the credit constraints that farmers face to expand their productive investments.

4.4. The Effect of Rural Credit Allocation on CLUE

To comprehensively assess the rural credit policy effects, this study examined both the cultivation and non-cultivation allocations. Among the 390 farming households that received rural credit, 150 households used credit for non-farm purposes, such as family home construction and children’s education. The rate of non-farm use of rural credit was as high as 38.5%, which likely had a negative impact on investment in agricultural production factors.

Table 4 reports the estimation results of the effects of credit allocation mode on CLUE. The coefficient of RCAM was 0.033 and passed the 1% significance test. This indicated that CLUE increased by 3.3% points when farmers used credit for agricultural production. This supported Hypothesis 3, indicating that rural credit cannot optimize the allocation efficiency of production factors when applied to non-farm areas, which is not conducive to increasing CLUE. Gershon Feder et al. reached a similar conclusion [25]. They found that almost one-third of the current credit is used in the area of household consumption, and that greater agricultural output is obtained if more of this credit is used for agricultural investment.

Table 4.

OLS estimates of the impact of RCAM on CLUE.

5. Discussion

5.1. Crisis and Possible Causes of Rural Credit De-Farming

Our results suggest that rural credit de-farming is a significant obstacle to effective land use. The allocation of credit funds by farmers to non-farm areas does not change the insufficient supply of capital in cultivated land production processes. An inadequate supply of agricultural capital can constrain the growth in productive investment in cultivated land use, induce low output levels, further reduce returns, and make the accumulation and regenerative capital supply insufficient, creating a vicious circle of the inefficient use of farmland and the poverty trap. This could exacerbate the displacement of agricultural labor, making cultivated land abandonment more frequent and ultimately endangering national food security. Therefore, in response to the phenomenon of low effective farmland use that may result from the diversion of rural credit for agricultural production in rural China, the role played by rural credit is limited if the policy fails to effectively guide the allocation mode of rural credit in the field.

Several possible reasons for rural credit de-farming exist. The first one is low return on investment in agriculture and high production risk [15]. Some farmers are less active in agricultural production, less dependent on cultivated land, and more inclined to use agricultural credit funds for non-farm business activities with higher returns. Second, some current farming households in poor areas have low savings capacity and face difficulties with large expenditures, such as medical care and education [40]. They apply for rural credit with relatively low interest rates in the name of agricultural production but use it for medical care, education, and other consumer purposes. Third, lending institutions lack an effective monitoring mechanism, relaxing or even abandoning the supervision of loan fund use.

5.2. Innovations and Outlooks for Future Research

In contrast to the literature on the positive contribution of rural credit to farmland production, there is less recognition that access to credit contributes to CLUE. In particular, how credit is allocated can have a differential impact on CLUE. This study makes several contributions. We analyzed the impact of RCA on CLUE from the perspective of influencing the ability to invest in production. We then constructed a theoretical analytical framework in which access to rural credit increases CLUE by improving farm household investments in production factors. Furthermore, based on a sample of 1330 micro-farming households in 10 provinces in China, we revealed that low CLUE still exists in some parts at present, as well as empirical evidence that accessing rural credit improves CLUE by expanding the size of cultivated land and applying technology. On the basis of the objective reality of the transfer of rural credit to non-farm areas, we further examined the impact of how farmers allocate rural credit on CLUE from the two dimensions of non-agricultural and agricultural use, which provided a new policy logic for improving China’s rural credit regulation mechanism. In addition, considering several input and output indicators for measuring CLUE, we adopted the statistical method of DEA to measure it. DEA applies to the efficiency evaluation problem of multiple inputs and multiple outputs [36] and uses linear programming to find the optimal "production frontier" to evaluate the CLUE of the sample farmers [41]. As setting the specific production function form in advance is unnecessary, it is superior in simplifying the calculation and reducing the error. Compared with Bing Kuang et al.’s study [2], we counted the input indicators, including the productive capital consumed in the whole process from plowing to harvesting, so that the estimated CLUE values were more in line with the real production situation of farmers.

However, this study had several limitations. Although the CRRS data describe the farmland use, output, and credit allocation modes of farm households, they ignore the time lag in the effect of credit investment. We did not measure the role of long-term investments in purchasing large machinery and education in agricultural production. For instance, credit constraints may lead to poor investment in human capital early in a person’s life cycle [15], affecting the potential for efficient farmland use. Therefore, future research should examine the effect of farmers’ credit use on long-term productive investments in CLUE through a large panel data sample. Second, different levels of farm household assets may affect rural credit availability, which in turn may have specific impacts on farm households’ cultivated land use decisions. Future studies should explore the impact of rural credit availability and allocation on CLUE at different asset levels.

5.3. Policy Implications

Although our empirical study originated from selected rural areas in China, the conclusions drawn may be relevant to other regions and even some developing countries. Farm households in many developing countries continue to derive food and household income from cultivated land. However, constrained by insufficient funds for agricultural production, general credit constraints, and non-farm credit transfers, farm households have limited agricultural inputs for cultivated land production, which, in turn, negatively affects CLUE. Our findings have important policy implications for improving CLUE in countries with insufficient capital shares in agricultural production.

First, accessing rural credit plays an important role in improving CLUE by facilitating the purchase of inputs at an optimal output level for farmers. To solve farmers’ limited credit problems, it is necessary to guide financial institutions to improve credit products and services. Governments should facilitate farmers’ access to credit by expanding their collateral range, facilitating information dissemination to reduce transaction costs, and relaxing credit standards. Moreover, farmers should be encouraged to seek credit support from financial institutions to improve external agricultural production conditions. This could meet the financing needs for expanding production capacity, equipment renovation, technological upgrading, and other purposes, as well as working capital needs for the purchase of agricultural materials.

Second, financial institutions should optimize their credit structure, direct the allocation of more credit to weak areas in agricultural production, and prevent the loss of inefficient projects. For instance, financial institutions should increase credit support to foster agricultural social service systems, promote and allocate modern agricultural technology, and construct water conservation infrastructure.

Finally, to address the rural credit de-farming risk, lending institutions should improve their monitoring mechanisms for credit usage by loan applicants to prevent credit non-farm transfers and create a truly efficient transformation of rural credit into agricultural investments. In addition, the government should improve the security system in rural areas in terms of livelihood and medical care, increase financial investment in rural education, and reduce the crowding out of credit funds for agricultural production by other economic activities.

6. Conclusions

Under the pressures of limited cultivated land resources and insufficient capital for agricultural production, improving the effective supply of agricultural capital is essential to improving CLUE. This study theoretically clarified the impact of access to rural credit on improving CLUE and its mechanism. We empirically tested a micro-sample of 1330 farm households from a survey of 10 provinces in China conducted by the CRRS in 2020 and further investigated whether RCAM affected CLUE.

The average value of CLUE was 0.661, which indicated room for improvement compared to Japan which also has a large population but limited land. CLUE exhibited significant regional differences.

Second, CLUE could be improved by access to rural credit. The analysis of the mechanisms found that rural credit changed the investment in production factors by farmers and improved CLUE by expanding farmland size and applying land-saving and labor-saving technologies.

Third, the impact of rural credit on CLUE varied according to differences in the credit allocation mode. Compared to farmers’ non-farming allocation, credit applied to agricultural production factors had a more significant effect on CLUE.

Author Contributions

Conceptualization, M.L.; methodology, M.L.; software, M.L.; validation, Y.Q. and J.Z.; formal analysis, M.L.; investigation, M.L.; resources, M.L.; data curation, M.L.; writing—original draft preparation, M.L.; writing—review and editing, D.Z.; supervision, D.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Natural Science Foundation of China (42171252), the Chinese Universities Scientific Fund, and the Foundation for Graduate Independent Innovation, China Agricultural University.

Data Availability Statement

Our data came from the 2020 China Rural Revitalization Survey (CRRS). These data can be obtained by submitting a request to the Rural Development Institute, Chinese Academy of Social Sciences.

Acknowledgments

Thanks to the Rural Development Institute, Chinese Academy of Social Sciences for the data support.

Conflicts of Interest

The authors declare no conflict of interest.

Notes

| 1 | The map came from the Ministry of Natural Resources of the People’s Republic of China in 2019. |

| 2 | The data came from the statistical information of the Ministry of Agriculture, Forestry and Fisheries of Japan in 2021. https://www.maff.go.jp/j/tokei/kekka_gaiyou/sakumotu/menseki/r3/menseki/index.html (accessed on 20 July 2023). |

References

- Su, M.; Guo, R.; Hong, W. Institutional transition and implementation path for cultivated land protection in highly urbanized regions: A case study of Shenzhen, China. Land Use Policy 2019, 81, 493–501. [Google Scholar] [CrossRef]

- Kuang, B.; Lu, X.; Zhou, M.; Chen, D. Provincial cultivated land use efficiency in China: Empirical analysis based on the SBM-DEA model with carbon emissions considered. Technol. Forecast. Soc. 2020, 151, 119874. [Google Scholar] [CrossRef]

- Huang, Z.; Du, X.; Castillo, C.S.Z. How does urbanization affect farmland protection? Evidence from China. Resour. Conserv. Recycl. 2019, 145, 139–147. [Google Scholar] [CrossRef]

- Abass, K.; Adanu, S.K.; Agyemang, S. Peri-urbanisation and loss of arable land in Kumasi Metropolis in three decades: Evidence from remote sensing image analysis. Land Use Policy 2018, 72, 470–479. [Google Scholar] [CrossRef]

- Zhang, X.; Yan, G.; He, Y.; Yu, H. Do disease and pest control outsourcing services reduce arable land abandonment? Evidence from China. Int. J. Environ. Res. Public Health 2022, 19, 11398. [Google Scholar] [CrossRef] [PubMed]

- Zhou, M.; Zhang, H.; Zhang, Z.; Sun, H. Digital financial inclusion, cultivated land transfer and cultivated land green utilization efficiency: An empirical study from China. Sustainability 2023, 15, 1569. [Google Scholar] [CrossRef]

- Hou, B.; Yu, W.; Chen, Z.; Yu, J. How does the farmland management scale affect grain losses at harvest? Analysis of mediating effect of agricultural input based on harvesting. Land 2023, 12, 557. [Google Scholar] [CrossRef]

- Tongwei, Q.; Luo, B.; Boris Choy, S.T.; Li, Y.; He, Q. Do land renting-in and its marketization increase labor input in agriculture? Evidence from rural China. Land Use Policy 2020, 99, 104820. [Google Scholar] [CrossRef]

- Fei, R.; Lin, Z.; Chunga, J. How land transfer affects agricultural land use efficiency: Evidence from China’s agricultural sector. Land Use Policy 2021, 103, 105300. [Google Scholar] [CrossRef]

- Gorgan, M.; Hartvigsen, M. Development of agricultural land markets in countries in Eastern Europe and Central Asia. Land Use Policy 2022, 120, 106257. [Google Scholar] [CrossRef]

- Jin, G.; Li, Z.; Deng, X.; Yang, J.; Chen, D.; Li, W. An analysis of spatiotemporal patterns in Chinese agricultural productivity between 2004 and 2014. Ecol. Indic. 2019, 105, 591–600. [Google Scholar] [CrossRef]

- Sui, F.; Yang, Y.; Zhao, S. Labor structure, land fragmentation, and land-use efficiency from the perspective of mediation effect: Based on a survey of garlic growers in Lanling, China. Land 2022, 11, 952. [Google Scholar] [CrossRef]

- Petrick, M. Farm investment, credit rationing, and governmentally promoted credit access in Poland: A cross-sectional analysis. Food Policy 2004, 29, 275–294. [Google Scholar] [CrossRef]

- Porgo, M.; Kuwornu, J.K.M.; Zahonogo, P.; Jatoe, J.B.D.; Egyir, I.S. Credit constraints and cropland allocation decisions in rural Burkina Faso. Land Use Policy 2018, 70, 666–674. [Google Scholar] [CrossRef]

- Kumar, C.S.; Turvey, C.G.; Kropp, J.D. The impact of credit constraints on farm households: Survey results from India and China. Appl. Econ. Perspect. Policy 2013, 35, 508–527. [Google Scholar] [CrossRef]

- Guirkinger, C.; Boucher, S.R. Credit constraints and productivity in Peruvian agriculture. Agric. Econ. 2008, 39, 295–308. [Google Scholar] [CrossRef]

- Dercon, S.; Christiaensen, L. Consumption risk, technology adoption and poverty traps: Evidence from Ethiopia. J. Dev. Econ. 2011, 96, 159–173. [Google Scholar] [CrossRef]

- Burgess, R.; Pande, R. Do rural banks matter? Evidence from the Indian social banking experiment. Am. Econ. Rev. 2005, 95, 780–795. [Google Scholar] [CrossRef]

- Zeller, M.; Diagne, A.; Mataya, C. Market access by smallholder farmers in Malawi: Implications for technology adoption, agricultural productivity and crop income. Agric. Econ. 1998, 19, 219–229. [Google Scholar] [CrossRef]

- De Castro, E.R.; Teixeira, E.C. Rural credit and agricultural supply in Brazil. Agric. Econ. 2012, 43, 293–302. [Google Scholar] [CrossRef]

- Giné, X.; Yang, D. Insurance, credit, and technology adoption: Field experimental evidence from Malawi. J. Dev. Econ. 2009, 89, 1–11. [Google Scholar] [CrossRef]

- Wang, L.; Li, H. Regional differences in cultivated land use efficiency and its influencing factors in China—Based on panel data of 281 municipalities and stochastic frontier production function approach. Geogr. Res. 2014, 33, 1995–2004. [Google Scholar]

- Fink, G.; Jack, B.K.; Masiye, F. Seasonal Liquidity, Rural Labor Markets, and Agricultural Production. Am. Econ. Rev. 2020, 110, 3351–3392. [Google Scholar] [CrossRef]

- Balana, B.B.; Mekonnen, D.; Haile, B.; Hagos, F.; Yimam, S.; Ringler, C. Demand and supply constraints of credit in smallholder farming: Evidence from Ethiopia and Tanzania. World Dev. 2022, 159, 106033. [Google Scholar] [CrossRef]

- Feder, G.; Lau, L.J.; Lin, J.Y.; Luo, X. The Relationship between Credit and Productivity in Chinese Agriculture: A Microeconomic Model of Disequilibrium. Am. J. Agr. Econ. 1990, 72, 1151–1157. [Google Scholar] [CrossRef]

- Ren, C.; Zhou, X.; Wang, C.; Guo, Y.; Diao, Y.; Shen, S.; Reis, S.; Li, W.; Xu, J.; Gu, B. Ageing threatens sustainability of smallholder farming in China. Nature 2023, 616, 96–103. [Google Scholar] [CrossRef] [PubMed]

- Du, J.; Zeng, M.; Xie, Z.; Wang, S. Power of Agricultural Credit in Farmland Abandonment: Evidence from Rural China. Land 2019, 8, 184. [Google Scholar] [CrossRef]

- Tian, Y.; Gao, Y.; Pu, C. Do agricultural productive services alleviate farmland abandonment? Evidence from China rural household panel survey data. Front. Environ. Sci. 2023, 11, 1072005. [Google Scholar] [CrossRef]

- Mei, B.; Khan, A.A.; Khan, S.U.; Ali, M.A.S.; Luo, J. An estimation of the effect of green financial policies and constraints on agriculture investment: Evidences of sustainable development achievement in Northwest China. Front. Public Health 2022, 10, 903431. [Google Scholar] [CrossRef]

- Yu, L.; Song, Y.; Wu, H.; Shi, H. Credit constraint, interlinked insurance and credit contract and farmers’ adoption of innovative seeds-field experiment of the Loess Plateau. Land 2023, 12, 357. [Google Scholar] [CrossRef]

- Wang, H.; Du, L. Agricultural credit scale and agricultural green production efficiency: A Metafrontier-Malmquist-Luenberger and panel Tobit approach. Front. Environ. Sci. 2023, 11, 1191012. [Google Scholar] [CrossRef]

- Ma, Q.; Zheng, S.; Deng, P. Impact of Internet use on farmers’ organic fertilizer application behavior under the climate change context: The role of social network. Land 2022, 11, 1601. [Google Scholar] [CrossRef]

- Von Pischke, J.D.; Adams, D.W. Fungibility and the design and evaluation of agricultural credit projects. Am. J. Agric. Econ. 1980, 62, 719–726. [Google Scholar] [CrossRef]

- Huo, X.; Qu, X. Demand and supply analysis of farmers’ capital lending in traditional agricultural regions in the west—Survey and thoughts on farmers’ capital lending in Weibei Area of Shaanxi. China Rural Econ. 2005, 8, 58–67. [Google Scholar]

- Zhang, L.; Zhu, D.; Xie, B.; Du, T.; Wang, X. Evolution of spatio-temporal pattern of cultivated land use efficiency and influencing factors in China’s main grain-producing areas—An empirical study based on 180 prefecture-level cities. Resour. Sci. 2017, 39, 608–619. [Google Scholar]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision-making units. Eur. J. Oper. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Ito, J.; Nishikori, M.; Toyoshi, M.; Feuer, H.N. The contribution of land exchange institutions and markets in countering farmland abandonment in Japan. Land Use Policy 2016, 57, 582–593. [Google Scholar] [CrossRef]

- Lin, W.; Wang, Z.; Wang, M. Agricultural land rights, factor allocation and agricultural production efficiency—An empirical analysis based on China’s labour force dynamic survey. China Rural Econ. 2018, 8, 64–82. [Google Scholar]

- Perz, S.G.; Walker, R.T.; Caldas, M.M. Beyond population and environment: Household demographic life cycles and land use allocation among small farms in the Amazon. Hum. Ecol. 2006, 34, 829–849. [Google Scholar] [CrossRef]

- Amanullah; Lakhan, G.R.; Channa, S.A.; Magsi, H.; Koondher, M.A.; Wang, J.; Channa, N.A. Credit constraints and rural farmers’ welfare in an agrarian economy. Heliyon 2020, 6, e5252. [Google Scholar] [CrossRef]

- Banker, R.B.R.; Charnes, A.C.A.; Cooper, W.C.W. Some Models for Estimating Technical and Scale Inefficiencies in Data Envelopment Analysis. Manag. Sci. 1984, 30, 1078–1092. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).